UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08194

FINANCIAL INVESTORS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Karen Gilomen, Esq., Secretary

Financial Investors Trust

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: April 30

Date of reporting period: May 1, 2017 – April 30, 2018

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

| | PAGE |

| Manager Commentary | |

| Aspen Managed Futures Strategy Fund | 1 |

| Aspen Portfolio Strategy Fund | 3 |

| Performance Update | |

| Aspen Managed Futures Strategy Fund | 5 |

| Aspen Portfolio Strategy Fund | 7 |

| Consolidated Disclosure of Fund Expenses | 9 |

| Consolidated Schedule of Investments | |

| Aspen Managed Futures Strategy Fund | 10 |

| Aspen Portfolio Strategy Fund | 12 |

| Consolidated Statements of Assets & Liabilities | 14 |

| Consolidated Statements of Operations | 16 |

| Consolidated Statements of Changes in Net Assets | |

| Aspen Managed Futures Strategy Fund | 17 |

| Aspen Portfolio Strategy Fund | 18 |

| Consolidated Financial Highlights | |

| Aspen Managed Futures Strategy Fund | 19 |

| Aspen Portfolio Strategy Fund | 21 |

| Notes to Consolidated Financial Statements | 23 |

| Report of Independent Registered Public Accounting Firm | 34 |

| Disclosure Regarding Approval of Fund Advisory Agreements | 35 |

| Additional Information | 37 |

| Trustees and Officers | 38 |

| Privacy Policy | 43 |

| Aspen Managed Futures Strategy Fund | Manager Commentary |

April 30, 2018 (Unaudited)

April 30, 2018

Performance Results

For the twelve-month period ending April 30, 2018, the Class I shares of the Aspen Managed Futures Strategy Fund (the “Fund”) posted a return of -3.13%. Per its mandate, the Fund maintained tight correlation to the Aspen Managed Futures Beta Index (“Aspen MFBI” or the “Index”). The Index uses a combination of trend and counter-trend algorithms to determine exposures to 23 futures markets. In following the Index, the Fund can take long or short positions in each of the eligible markets. A long position in a futures market will profit if the price of the futures contract rises, whereas a short position will profit if the price of the futures contract falls.

The Barclay BTOP50 Index, a managed futures benchmark, returned -0.61% over the same period. It is important to note that there are substantive differences between the Fund and this index in terms of construction. There were no significant changes to the Fund strategy during this period.

Explanation of Fund Performance

Until January of 2018, broad backdrop market volatility remained near all-time lows globally, as it had been for virtually all of 2017. While low volatility is typically not an auspicious backdrop for trend following strategies, it does not usually tend to produce significantly poor results either. The May-December period was an example of that phenomenon, as a series of relatively small monthly gains and small monthly losses for the Fund combined to produce a small end-to-end loss.

When backdrop volatility is abnormally low, occasional “events” that punctuate the markets with brief spikes of more elevated volatility can have an outsized effect on trend following performance. One such event occurred in May 2017. Heading into that month, the Fund was positioned on the short side in energy futures. But midmonth, Saudi Arabia and Russia announced a deal in principle to extend an oil output freeze for an extra nine months. Energy prices soared on the news, causing losses for the Fund in energies, and causing the trend model to reverse into long energy positions. Then in late May the official OPEC meeting occurred. Though OPEC members ratified the pre-announced deal, no further supportive measures were forthcoming. Disappointment in the markets caused energy prices to plunge once again, causing classic “V-top” losses for the Fund (i.e., losses arising from prices moving up and then down in an inverted V-shaped pattern). Largely as a consequence of this move, the Fund returned -1.51% in May.

The first several weeks of June were profitable, if uneventful. Then in the last week of the month, European Central Bank (ECB) president Mario Draghi gave a speech that markets interpreted as unexpectedly hawkish. The resulting activity could be described as a European version of the “taper tantrum” that hit the markets after similar comments by US Federal Reserve president Ben Bernanke were interpreted similarly: Both equity and fixed income markets declined rapidly as markets contemplated the consequences of potentially faster-than-expected reductions in ECB accommodation. This produced losses for Fund, albeit insufficient to eliminate the entire monthly gain. The final June fund return was +1.10%.

The entirety of the third and fourth quarters constituted a fairly uneventful and incredibly low-volatility period for investment markets. A few sustained trends developed (most notably long positions in equities and a long position in copper); others were profitable at times with occasional reversals (e.g., downtrends in fixed income, which performed well in July and reversed in August, but then resumed at the end of the year; and uptrends across most currencies, which were profitable through most of the third quarter, reversed at the end of September, and also resumed as the year ended). The result of primarily low-vol, range-bound activity was a continued series of minor monthly returns. For the months of July, August, September, October, November, and December, Fund returns were +1.63%, -1.81%, 0.76%, +0.33%, -1.31%, and +1.33%, respectively.

Long equity trends carried into 2018, where they proved profitable in the equity “melt-up” that characterized most of January. Interestingly, volatility—direct and implied—increased as the month progressed, but initially risk assets like equities and energies continued rising, and bonds lost value as interest rates rose as well (traditionally another “risk on” occurrence). The Fund was well-positioned for these movements, and returned +2.29% for the month of January.

Late in January, however, markets peaked and began a very rapid descent. In just six trading days, equity markets gave back all of their year-to-date gains and more, as did the Fund. The carnage ended in early February and recovered somewhat from there, but Fund return was -3.84% for the full month.

Notably, as we have often had occasion to mention, many other trend-following Call to Action (CTAs) (as proxied by benchmarks like the BTOP50 Index) have demonstrated significantly greater exposure to long equity futures positioning than does the Fund. The first two months of 2018 were a good example, as the BTOP50 Index returned +3.13% in January and -5.58% in February. In fact, February was the worst month for the benchmark since 2003.

After February, broad market volatility remained higher than it had been in 2017. The losses sustained by the Fund’s trend following model led to mostly defensive, internally hedged positioning for much of March and April, resulting in mostly small daily and monthly moves. March and April returns were -0.11% and -0.33%, respectively. April performance was bolstered by positive returns from the Fund’s counter-trend model, which itself was bolstered by the inclusion of the US dollar as a “long” leg (actually expressed as a flat position), making counter-trend net short foreign

| Annual Report | April 30, 2018 | 1 |

| Aspen Managed Futures Strategy Fund | Manager Commentary |

April 30, 2018 (Unaudited)

exchange overall, coinciding with a rally in the US dollar in April. However, the same phenomenon caused reversals in long currency trend positioning, which had built up due to US dollar weakness over the preceding months.

Outlook

While the sudden reversal of entrenched long equity trends and the lack of directional consensus among other risk assets produced mild losses for the Fund in the early months of 2018, the return of volatility, if it holds up, is generally a cause for optimism. Of course, volatility is always bidirectional, and the ride may continue to be wilder from here. But whereas the wild ups and downs of an elevated volatility backdrop are often detrimental to risk asset performance, they have historically tended to accumulate to positive returns for traditional trend following models like the one executed in the Fund.

The counter-trend model appears set to remain net short foreign exchange futures for the foreseeable future, portending positive returns if the latest US dollar rally continues, and losses if it reverses instead.

Sincerely,

Bryan R. Fisher

William Ware Bush

Aspen Partners, Ltd.

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please call 1-855-845-9444.

The views of Aspen Partners, Ltd. and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writers’ current views. The views expressed are those of the Fund’s adviser only, and represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned in this letter. The subject matter contained in this letter has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither Aspen Partners Ltd. nor the Fund accepts any liability for losses either direct or consequential caused by the use of this information.

The Aspen Managed Futures Strategy Fund is distributed by ALPS Distributors, Inc.

The Fund is subject to investment risks, including possible loss of the principal amount invested and therefore is not suitable for all investors. The Fund may not achieve its objectives.

Diversification does not eliminate the risk of experiencing investment losses.

Correlation - a statistical measure of how two securities or portfolios move in relation to each other.

Aspen Managed Futures Beta Index (Aspen MFBI) is constructed using a quantitative, rules-based model designed to replicate the trend following and counter-trend exposure of futures markets by allocating assets to liquid futures contracts of certain financial and commodities futures markets. The Index therefore seeks to reflect the performance of strategies and exposures common to a broad universe of futures markets, i.e., managed futures beta. The Index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor cannot invest directly in the Index.

Barclay BTOP50 Index is an index of the largest investable CTA programs as measured by assets under management. The index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor may not invest directly into the Index.

Taper tantrum - the term used to refer to the 2013 surge in U.S. Treasury yields, which resulted from the Federal Reserve’s use of tapering to gradually reduce the amount of money it was feeding into the economy.

| Aspen Portfolio Strategy Fund | Manager Commentary |

April 30, 2018 (Unaudited)

April 30, 2018

Performance Results

For the twelve-month period ending April 30, 2018, the Class I shares of the Aspen Portfolio Strategy Fund (the “Fund”) posted a return of +7.76%. Per its mandate, the Fund traded the Aspen Portfolio Strategy, which combines full exposure to US large-cap equities (the “Equity Strategy”) with full exposure to Aspen’s proprietary diversified trend following program (the “Futures Strategy”). To capture the Equity Strategy, the Fund can employ a variety of vehicles, including exchange-traded funds and futures contracts. To capture the Futures Strategy, the Fund can take long or short positions in each eligible futures market. A long position in a futures market will profit if the price of the futures contract rises, whereas a short position will profit if the price of the futures contract falls.

The S&P 500 Index, a US large-cap equity benchmark, returned +13.27%. See the following section for a description of the sources of the sub-period and full-period return differential between the Fund and the S&P 500.

Explanation of Fund Performance

Until January of 2018, broad backdrop market volatility remained near all-time lows globally. A low volatility regime is often a good backdrop for risk assets like equities, and given the return of the Equity Strategy, the period in question was no exception. Conversely, low volatility is typically not an auspicious backdrop for trend following strategies.

When backdrop volatility is abnormally low, occasional “events” that punctuate the markets with brief spikes of more elevated volatility can have an outsized effect on trend following performance. One such event occurred in May 2017. Heading into that month, the Fund was positioned on the short side in energy futures. But midmonth, Saudi Arabia and Russia announced a deal in principle to extend an oil output freeze for an extra nine months. Energy prices soared on the news, causing losses for the Fund in energies, and causing the Futures Strategy to reverse into long energy positions. Then in late May the official OPEC meeting occurred. Though OPEC members ratified the pre-announced deal, no further supportive measures were forthcoming. Disappointment in the markets caused energy prices to plunge once again, causing classic “V-top” losses for the Futures Strategy (i.e., losses arising from prices moving up and then down in an inverted V-shaped pattern). Conversely, May was a strong positive month for equities, and the Fund was able to produce a mildly positive return of +0.20% despite the losses in the Futures Strategy.

The first several weeks of June were profitable for both the Equity Strategy and the Futures Strategy. Then in the last week of the month, European Central Bank president Mario Draghi gave a speech that markets interpreted as unexpectedly hawkish. The resulting activity could be described as a European version of the “taper tantrum” that hit the markets after similar comments by US Federal Reserve president Ben Bernanke were interpreted similarly in 2013: Both equity and fixed income markets declined rapidly as markets contemplated the consequences of potentially faster-than-expected reductions in ECB accommodation. This produced losses for Fund, albeit insufficient to eliminate the entire monthly gain. The final June fund return was +0.82 %.

The entirety of the third and fourth quarters constituted a fairly uneventful and incredibly low-volatility period for investment markets. A few sustained trends developed and benefitted the Futures Strategy (most notably long positions in equities and a long position in copper); others were profitable briefly and then reversed (e.g., downtrends in fixed income, which performed well in July and reversed in August, but then resumed at the end of the year; and uptrends across most currencies, which were profitable through most of the third quarter, reversed at the end of September, and also resumed as the year ended). Over that same timeframe, the Equity Strategy continued to contribute positively and fairly consistently.

Overall Fund returns were +3.36%, -0.86%, +1.58%, +3.11%, +2.94%, and +0.77% in July, August, September, October, November, and December, respectively. (I.e., of these six months, only in August were there negative Futures Strategy returns in sufficient quantity to outrun minor positive Equity Strategy returns.)

Incredibly, the S&P 500 (which is tracked directly by the Equity Strategy) posted a positive total return for thirteen consecutive months ending in January 2018—the longest such streak in over 30 years. January was arguably the crowning achievement of the entire streak. A strong monthly gain for US and global equities, as tracked by long trends in the Futures Strategy, produced a gain of +8.50% for the Fund that month. Interestingly, volatility—direct and implied—increased as the month progressed, but initially risk assets like equities and energies continued rising, and bonds lost value as interest rates rose as well (traditionally another “risk on” occurrence).

Late in January, however, markets peaked and began a very rapid descent. In just six trading days, equity markets gave back all of their year-to-date gains and more, as did the Fund. The carnage ended in early February and recovered somewhat from there, but Fund return was -8.00% for the full month. As we’ve noted elsewhere, historically the combination of equity and trend following returns tends to reduce both the kurtosis (think “fat-tailedness”) and skewness (think “tendency for outliers to fall to one side”) of both asset classes stand-alone. The combined portfolio is more Gaussian—more “normalized”—than either stand-alone. A consequence of reducing the dangerous tail observations, though, is what mathematicians call “broad shoulders”: I.e., there are more observations of intermediate-sized volatility. The January gain and February loss are illustrative of the positive and negative “broad shoulders” of a normalized distribution.

| Annual Report | April 30, 2018 | 3 |

| Aspen Portfolio Strategy Fund | Manager Commentary |

April 30, 2018 (Unaudited)

Further losses in US equities contributed to a negative month in March, resulting in Fund returns of -2.88%. In April, losses in long currency trend positioning contributed to the Fund’s -0.49% return, as the US dollar rallied from its descent over several months prior.

Outlook

While the sudden reversal of entrenched long equity trends and the lack of directional consensus among other risk assets produced losses for both the Equity Strategy and the Futures Strategy in the early months of 2018, the return of volatility, if it holds up, is generally a cause for optimism at least for trend following strategies. Of course, volatility is always bidirectional, and the ride may continue to be wilder from here. The ideal scenario would be one in which US equities could resume their generally upward trajectory against a backdrop of sustained elevated volatility with the potential to produce tradable trends across the market spectrum. Such a scenario has not generally prevailed in the post-Great Financial Crisis years, but it was commonplace for both US equities and traditional trend following managers to post gains simultaneously in the years prior.

Sincerely,

Bryan R. Fisher

William Ware Bush

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please call 1-855-845-9444.

The views of Aspen Partners, Ltd. and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writers’ current views. The views expressed are those of the Fund’s adviser only, and represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned in this letter. The subject matter contained in this letter has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither Aspen Partners Ltd. nor the Fund accepts any liability for losses either direct or consequential caused by the use of this information.

The Aspen Portfolio Strategy Funds are distributed by ALPS Distributors, Inc.

The Fund is subject to investment risks, including possible loss of the principal amount invested and therefore is not suitable for all investors. The Fund may not achieve its objectives.

Diversification does not eliminate the risk of experiencing investment losses.

The S&P 500® Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in the Index.

Taper tantrum - the term used to refer to the 2013 surge in U.S. Treasury yields, which resulted from the Federal Reserve’s use of tapering to gradually reduce the amount of money it was feeding into the economy.

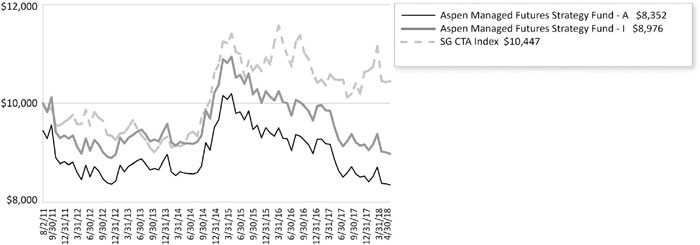

| Aspen Managed Futures Strategy Fund | Performance Update |

April 30, 2018 (Unaudited)

Annualized Total Return Performance as of April 30, 2018

| | | | | Since | Expense Ratios |

| Aspen Managed Futures Strategy Fund | 1 Year | 3 Year | 5 Year | Inception* | Total | Net(1) |

| Aspen Managed Futures Strategy Fund - Class A (NAV)(2) | -3.33% | -5.21% | -1.00% | -1.82% | 1.62% | 1.62% |

| Aspen Managed Futures Strategy Fund - Class A (MOP)(3) | -8.61% | -6.97% | -2.11% | -2.64% | 1.62% | 1.62% |

| Aspen Managed Futures Strategy Fund - Class I | -3.15% | -5.17% | -0.83% | -1.59% | 1.29% | 1.29% |

| SG CTA Index(4) | -0.26% | -1.85% | 1.58% | 0.65% | | |

| Aspen Managed Futures Beta Index(5) | -2.39% | -4.74% | -0.43% | -1.11% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-845-9444.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| * | Fund Inception date of August 2, 2011. |

| (1) | Aspen Partners, Ltd. (the “Adviser”) has agreed to waive and/or reimburse fees or expenses in order to limit total annual Fund operating expenses after fee waiver/expense reimbursements (excluding distribution and service (12b-1) fees, shareholder services fees, acquired fund fees and expenses, brokerage expenses, interest expenses, taxes and extraordinary expenses) to 1.55% of the Funds’ average daily net assets. This agreement (the “Expense Agreement”) is in effect through August 31, 2018. The Adviser will be permitted to recover, on a class-by-class basis, expenses it has borne through the Expense Agreement to the extent that the Funds’ expenses in later periods fall below the expense cap in effect at the time of waiver or reimbursement. Notwithstanding the foregoing, the Fund will not be obligated to pay any such deferred fees and expenses more than three years after the date of the waiver or reimbursement. The Expense Agreement may not be terminated or modified prior to August 31, 2018 except with the approval of the Funds’ Board of Trustees |

| (2) | Net Asset Value (NAV) is the share price without sales charges. |

| (3) | Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Funds’ maximum sales charge of 5.50%. |

| (4) | The SG CTA Index (formerly, the Newedge CTA Index) provides the market with a reliable daily performance benchmark of major commodity trading advisors (CTAs). The SG CTA Index calculates the daily rate of return for a pool of CTAs selected from the larger managers that are open to new investment. Selection of the pool of qualified CTAs used in construction of the Index will be conducted annually, with re-balancing on January 1st of each year. A committee of industry professionals has been established to monitor the methodology of the index on a regular basis. The Index is not actively managed and does not reflect any deduction for fees, expenses or taxes. An investor cannot invest directly in the Index. |

| (5) | Aspen Managed Futures Beta Index – The Managed Futures Beta Index is constructed using a quantitative, rules-based model designed to replicate the trend-following and counter-trend exposure of futures markets by allocating assets to liquid futures contracts of certain financial and commodities futures markets. The Index therefore seeks to reflect the performance of strategies and exposures common to a broad universe of futures markets, i.e., managed futures beta. The index is not actively managed and does not reflect any deductions for fees, expense or taxes. An investor may not invest directly in an index. |

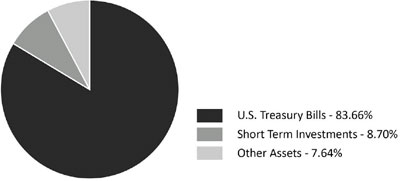

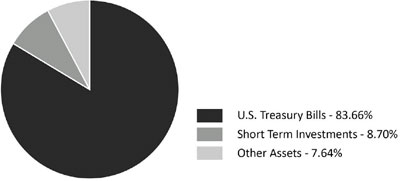

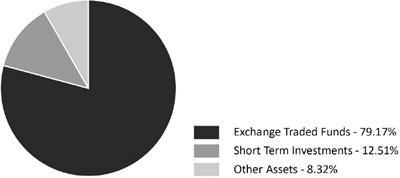

Portfolio Composition as of April 30, 2018

As a percentage of Net Assets^

| ^ | Holdings subject to change, and may not reflect the current or future position of the portfolio. |

| Annual Report | April 30, 2018 | 5 |

| Aspen Managed Futures Strategy Fund | Performance Update |

April 30, 2018 (Unaudited)

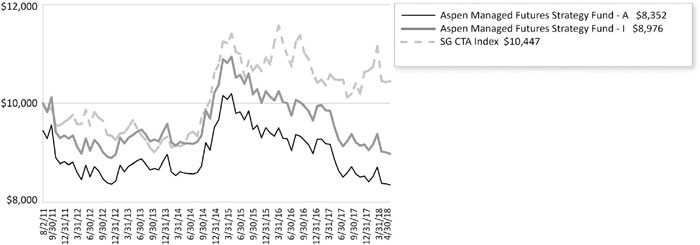

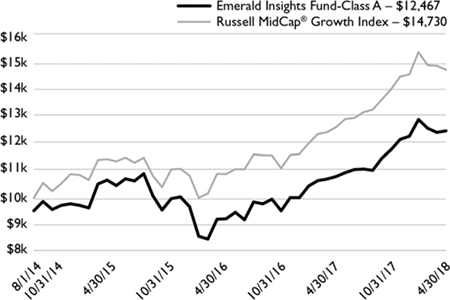

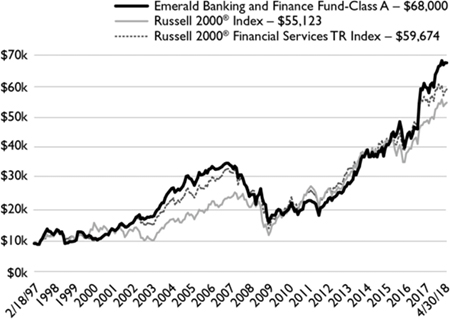

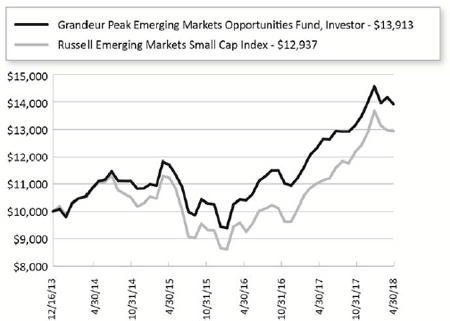

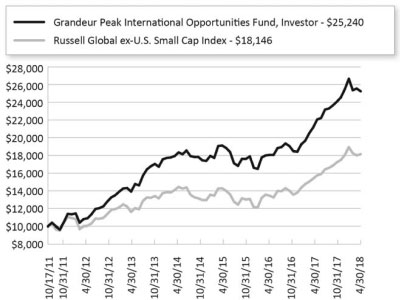

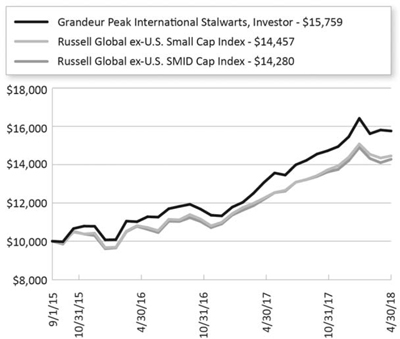

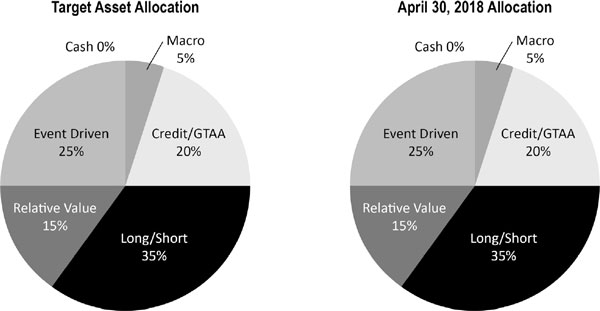

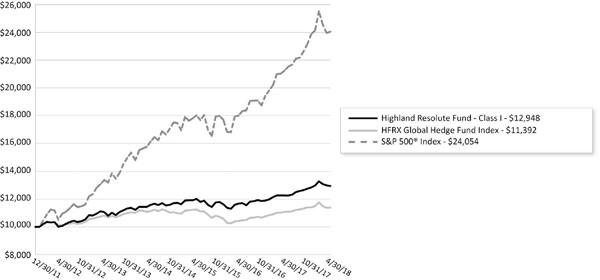

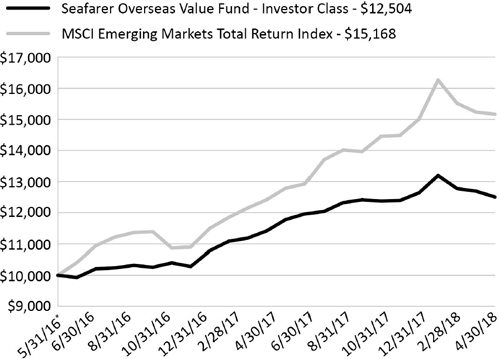

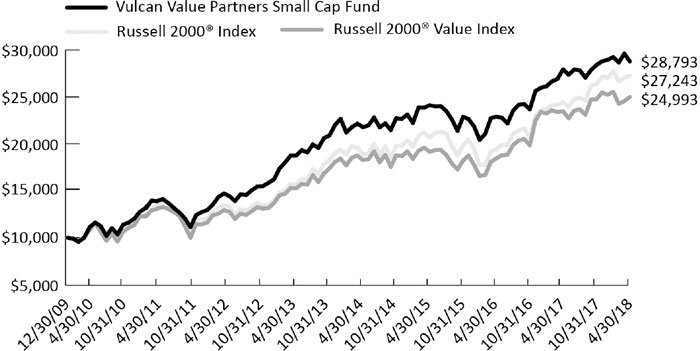

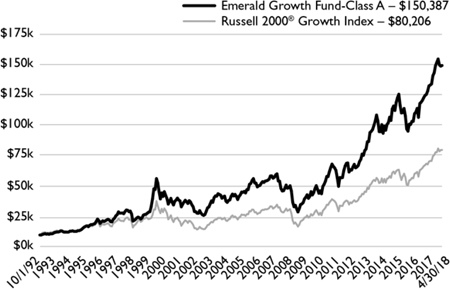

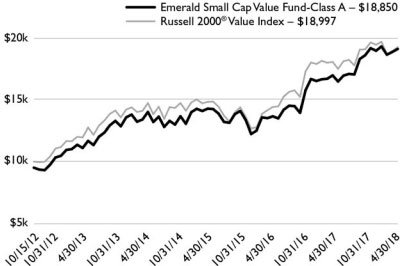

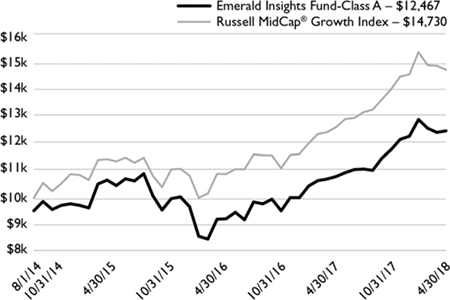

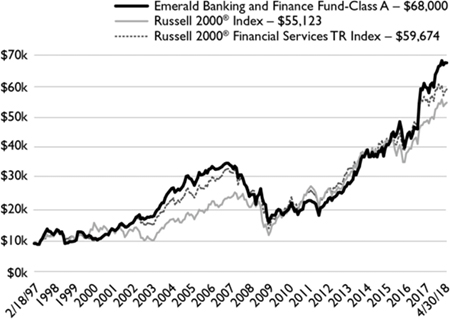

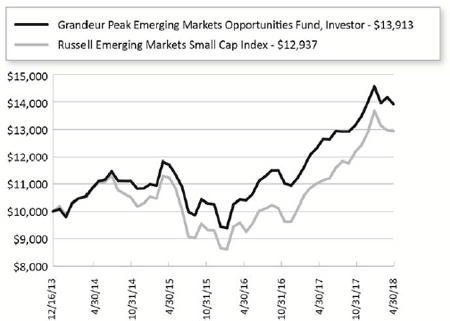

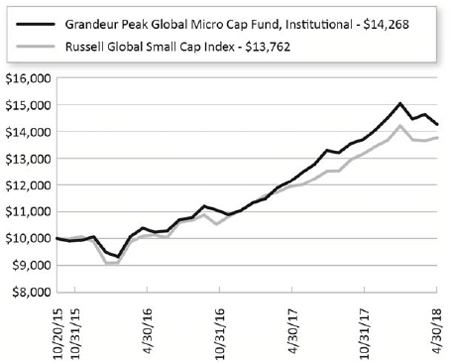

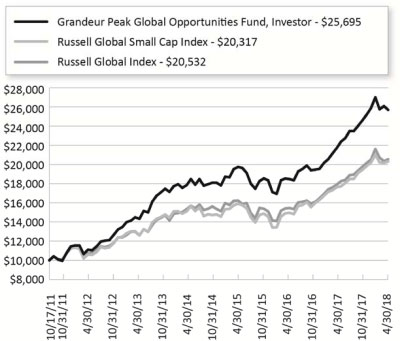

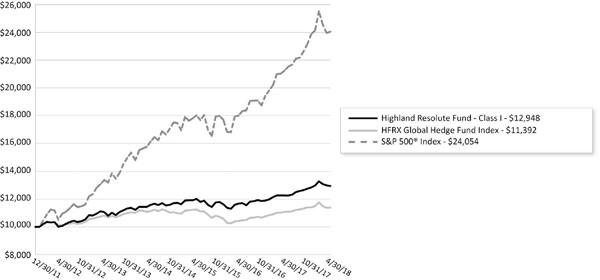

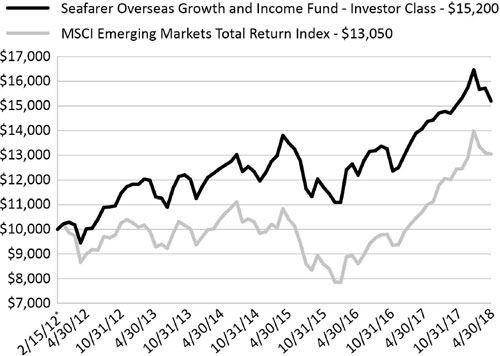

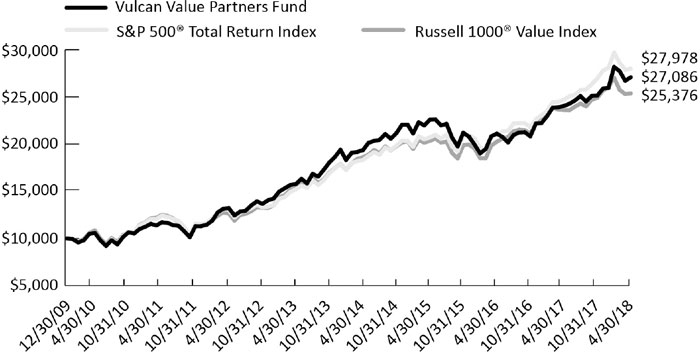

Performance of $10,000 Initial Investment (as of April 30, 2018)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

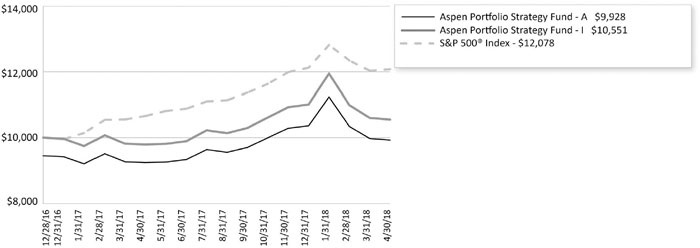

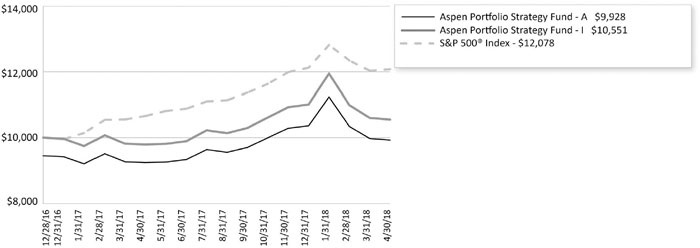

| Aspen Portfolio Strategy Fund | Performance Update |

April 30, 2018 (Unaudited)

Annualized Total Return Performance as of April 30, 2018

| | | | Expense Ratios |

| Aspen Portfolio Strategy Fund | 1 Year | Since Inception* | Gross | Net(1) |

| Aspen Portfolio Strategy Fund - Class A (NAV)(2) | 7.44% | 3.77% | 2.83% | 1.99% |

| Aspen Portfolio Strategy Fund - Class A (MOP)(3) | 1.54% | -0.54% | 2.83% | 1.99% |

| Aspen Portfolio Strategy Fund - Class I | 7.76% | 4.10% | 2.26% | 1.59% |

| S&P 500® Index(4) | 13.27% | 15.17% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-845-9444.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| * | Fund Inception date of December 28, 2016. |

| (1) | Aspen Partners, Ltd. (the “Adviser”) has agreed to waive and/or reimburse fees or expenses in order to limit total annual Fund operating expenses after fee waiver/expense reimbursements (excluding distribution and service (12b-1) fees, shareholder services fees, acquired fund fees and expenses, brokerage expenses, interest expenses, taxes and extraordinary expenses) to 1.55% of the Funds’ average daily net assets. This agreement (the “Expense Agreement”) is in effect through August 31, 2018. The Adviser will be permitted to recover, on a class-by-class basis, expenses it has borne through the Expense Agreement to the extent that the Funds’ expenses in later periods fall below the expense cap in effect at the time of waiver or reimbursement. Notwithstanding the foregoing, the Fund will not be obligated to pay any such deferred fees and expenses more than three years after the date of the waiver or reimbursement. The Expense Agreement may not be terminated or modified prior to August 31, 2018 except with the approval of the Funds’ Board of Trustees |

| (2) | Net Asset Value (NAV) is the share price without sales charges. |

| (3) | Maximum Offering Price (MOP) includes sales charges. Class A returns include effects of the Funds’ maximum sales charge of 5.50%. |

| (4) | The S&P 500® Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in the Index. |

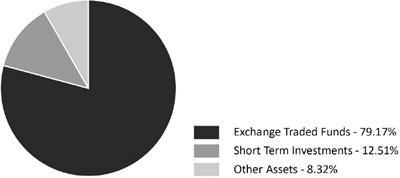

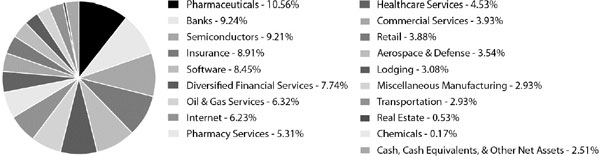

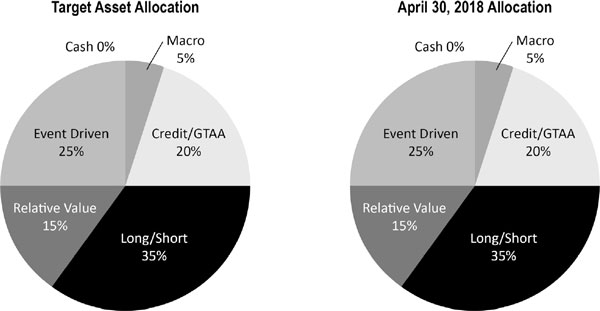

Portfolio Composition as of April 30, 2018

As a percentage of Net Assets^

| ^ | Holdings subject to change, and may not reflect the current or future position of the portfolio. |

| Annual Report | April 30, 2018 | 7 |

| Aspen Portfolio Strategy Fund | Performance Update |

April 30, 2018 (Unaudited)

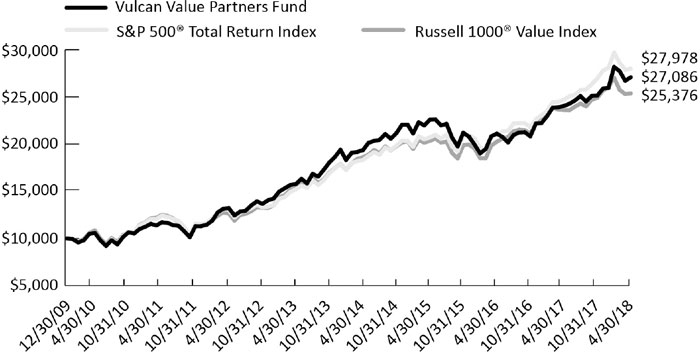

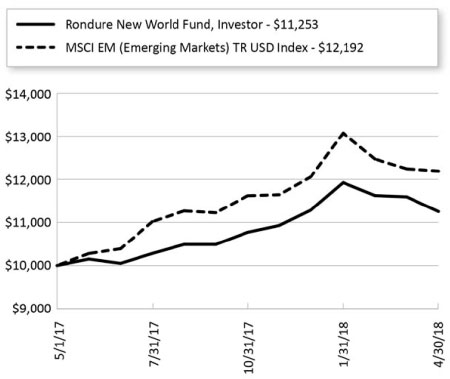

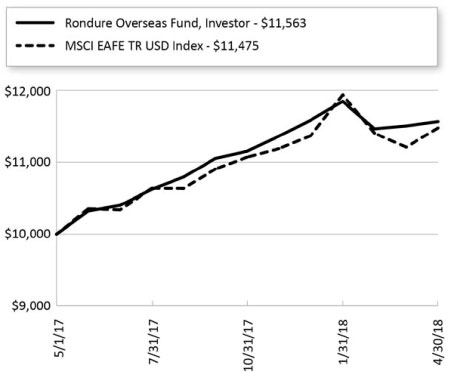

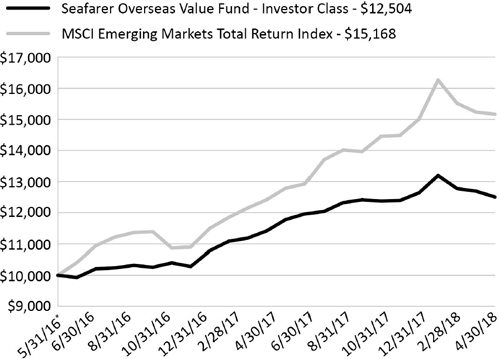

Performance of $10,000 Initial Investment (as of April 30, 2018)

Comparison of change in value of a $10,000 investment (includes applicable sales loads)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

| Aspen Funds | Consolidated Disclosure of Fund Expenses |

| April 30, 2018 (Unaudited) |

As a shareholder of the Fund, you incur two types of costs: transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; shareholder servicing fees; and other fund operating expenses. This example is intended to help you understand your ongoing costs (in dollars), of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of November 1, 2017 through April 30, 2018.

Actual Expenses The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as applicable sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning

Account Value

11/1/17 | Ending

Account Value

4/30/18 | Expense Ratio(a) | Expenses Paid

During period

11/1/17 - 4/30/18(b) |

| Aspen Managed Futures Strategy Fund | | | | |

| Class A | | | | |

| Actual | $1,000.00 | $978.80 | 1.52% | $7.46 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.26 | 1.52% | $7.60 |

| Class I | | | | |

| Actual | $1,000.00 | $979.20 | 1.45% | $7.12 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.60 | 1.45% | $7.25 |

| Aspen Portfolio Strategy Fund | | | | |

| Class A | | | | |

| Actual | $1,000.00 | $993.20 | 1.65% | $8.15 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,016.61 | 1.65% | $8.25 |

| Class I | | | | |

| Actual | $1,000.00 | $993.90 | 1.55% | $7.66 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.11 | 1.55% | $7.75 |

| (a) | The Fund's expense ratios have been based on the Fund's most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (181)/365 (to reflect the half-year period). |

| Annual Report | April 30, 2018 | 9 |

| Aspen Managed Futures Strategy Fund | Consolidated Schedule of Investments |

| | | Principal Amount/Shares | | | Value (Note 2) | |

| SHORT TERM INVESTMENTS (92.36%) | | | | | | | | |

| MONEY MARKET FUND (8.70%) | | | | | | | | |

| Dreyfus Treasury & Agency Cash Management Fund - Institutional Shares, 7-day yield, 1.537% | | | 7,721,143 | | | $ | 7,721,143 | |

| | | | | | | | | |

| U.S. TREASURY BILLS (83.66%) | | | | | | | | |

| 1.159%, 05/24/2018(a) | | $ | 5,500,000 | | | | 5,494,404 | |

| 1.126%, 06/21/2018(a) | | | 11,200,000 | | | | 11,173,344 | |

| 1.171%, 07/19/2018(a) | | | 9,000,000 | | | | 8,965,462 | |

| 1.267%, 08/16/2018(a) | | | 9,700,000 | | | | 9,646,827 | |

| 1.411%, 09/13/2018(a) | | | 13,350,000 | | | | 13,256,258 | |

| 1.548%, 10/11/2018(a) | | | 10,300,000 | | | | 10,209,409 | |

| 1.752%, 11/08/2018(a) | | | 6,550,000 | | | | 6,483,799 | |

| 1.819%, 12/06/2018(a) | | | 9,150,000 | | | | 9,048,694 | |

| | | | | | | | 74,278,197 | |

| | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | |

| (Cost $82,082,859) | | | | | | | 81,999,340 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (92.36%) | | | | | | | | |

| (Cost $82,082,859) | | | | | | $ | 81,999,340 | |

| | | | | | | | | |

| Other Assets In Excess Of Liabilities (7.64%) | | | | | | | 6,787,620 | (b) |

| | | | | | | | | |

| NET ASSETS (100.00%) | | | | | | $ | 88,786,960 | |

| (a) | Rate shown represents the bond equivalent yield to maturity at date of purchase. |

| (b) | Includes cash which is being held as collateral for futures contracts. |

See Notes to Consolidated Financial Statements.

10

| Aspen Managed Futures Strategy Fund | Consolidated Schedule of Investments |

FUTURES CONTRACTS

At April 30, 2018, the Fund had the following outstanding futures contracts:

| Description | | Position | | | Contracts | | | Expiration

Date | | Notional

Value | | | Value and

Unrealized

Appreciation | |

| Commodity Contracts | | | | | | | | | | | | | | | | | | |

| Corn Future(a) | | | Long | | | | 191 | | | 07/13/2018 | | $ | 3,827,162 | | | $ | 47,043 | |

| NY Harbor ULSD Future(a) | | | Long | | | | 41 | | | 05/31/2018 | | | 3,701,095 | | | | 44,295 | |

| Soybean Future(a) | | | Long | | | | 48 | | | 07/13/2018 | | | 2,516,400 | | | | 22,023 | |

| WTI Crude Future(a) | | | Long | | | | 55 | | | 05/22/2018 | | | 3,771,350 | | | | 5,741 | |

| Equity Contracts | | | | | | | | | | | | | | | | | | |

| FTSE 100 Index Future | | | Long | | | | 51 | | | 06/15/2018 | | | 5,237,794 | | | | 136,812 | |

| Nikkei 225 Index Future | | | Long | | | | 48 | | | 06/07/2018 | | | 5,388,000 | | | | 189,263 | |

| Foreign Currency Contracts | | | | | | | | | | | | | | | | | | |

| CHF Currency Future | | | Short | | | | 156 | | | 06/18/2018 | | | (19,757,400 | ) | | | 345,852 | |

| Euro FX Currency Future | | | Short | | | | 99 | | | 06/18/2018 | | | (15,002,213 | ) | | | 122,180 | |

| | | | | | | | | | | | | $ | (10,317,812 | ) | | $ | 913,209 | |

| Description | | Position | | | Contracts | | | Expiration

Date | | Notional

Value | | | Value and

Unrealized

Depreciation | |

| Commodity Contracts | | | | | | | | | | | | | | | | | | |

| Copper Future(a) | | | Long | | | | 16 | | | 07/27/2018 | | $ | 1,229,600 | | | $ | (33,452 | ) |

| Gold 100 Oz Future(a) | | | Long | | | | 19 | | | 06/27/2018 | | | 2,506,480 | | | | (41,482 | ) |

| Silver Future(a) | | | Long | | | | 15 | | | 07/27/2018 | | | 1,230,075 | | | | (13,249 | ) |

| Sugar No. 11 (World) Future(a) | | | Short | | | | 291 | | | 06/29/2018 | | | (3,829,560 | ) | | | (206,450 | ) |

| Equity Contracts | | | | | | | | | | | | | | | | | | |

| EURO STOXX 50 Index Future | | | Short | | | | 63 | | | 06/15/2018 | | | (2,642,978 | ) | | | (45,048 | ) |

| S&P 500 E-Mini Future | | | Long | | | | 20 | | | 06/15/2018 | | | 2,647,000 | | | | (52,396 | ) |

| Foreign Currency Contracts | | | | | | | | | | | | | | | | | | |

| Australian Dollar Currency Future | | | Long | | | | 133 | | | 06/18/2018 | | | 10,014,900 | | | | (329,975 | ) |

| Canadian Dollar Currency Future | | | Long | | | | 63 | | | 06/19/2018 | | | 4,910,220 | | | | (22,216 | ) |

| Japanese Yen Currency Future | | | Long | | | | 43 | | | 06/18/2018 | | | 4,933,175 | | | | (115,213 | ) |

| Interest Rate Contracts | | | | | | | | | | | | | | | | | | |

| Canadian 10 Year Bond Future | | | Short | | | | 147 | | | 06/20/2018 | | | (15,049,768 | ) | | | (52,456 | ) |

| Euro-Bund Future | | | Short | | | | 52 | | | 06/07/2018 | | | (9,968,113 | ) | | | (85,355 | ) |

| Long Gilt Future | | | Short | | | | 88 | | | 06/27/2018 | | | (14,811,754 | ) | | | (160,724 | ) |

| U.S. 10 Year Treasury Note Future | | | Short | | | | 125 | | | 06/20/2018 | | | (14,953,125 | ) | | | (34,417 | ) |

| | | | | | | | | | | | | $ | (33,783,848 | ) | | $ | (1,192,433 | ) |

Common Abbreviations:

FTSE - Financial Times and the London Stock Exchange

S&P - Standard and Poor's

ULSD - Ultra Low Sulfur Diesel

| (a) | Owned by an entity that is owned by the Fund and is consolidated as described in Note 1 of the Notes to the Consolidated Financial Statements. |

For Fund compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

See Notes to Consolidated Financial Statements.

| Annual Report | April 30, 2018 | 11 |

| Aspen Portfolio Strategy Fund | Consolidated Schedule of Investments |

| | | Shares | | | Value (Note 2) | |

| EXCHANGE TRADED FUNDS (79.17%) | | | | | | | | |

| SPDR® S&P 500® ETF Trust | | | 150,442 | | | $ | 39,795,140 | |

| | | | | | | | | |

| TOTAL EXCHANGE TRADED FUNDS | | | | | | | | |

| (Cost $35,492,605) | | | | | | | 39,795,140 | |

| | | | | | | | | |

| SHORT TERM INVESTMENTS (12.51%) | | | | | | | | |

| MONEY MARKET FUND (12.51%) | | | | | | | | |

| Dreyfus Treasury & Agency Cash Management Fund - Institutional Shares, 7-day yield, 1.537% | | | 6,285,392 | | | | 6,285,392 | |

| | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | |

| (Cost $6,285,392) | | | | | | | 6,285,392 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (91.68%) | | | | | | | | |

| (Cost $41,777,997) | | | | | | $ | 46,080,532 | |

| | | | | | | | | |

| Other Assets In Excess Of Liabilities (8.32%) | | | | | | | 4,181,600 | (a) |

| | | | | | | | | |

| NET ASSETS (100.00%) | | | | | | $ | 50,262,132 | |

| (a) | Includes cash which is being held as collateral for futures contracts. |

See Notes to Consolidated Financial Statements.

12

| Aspen Portfolio Strategy Fund | Consolidated Schedule of Investments |

FUTURES CONTRACTS

At April 30, 2018, the Fund had the following outstanding futures contracts:

| Description | | Position | | | Contracts | | | Expiration

Date | | Notional

Value | | | Value and

Unrealized

Appreciation | |

| Commodity Contracts | | | | | | | | | | | | | | | | | | |

| Corn Future(a) | | | Long | | | | 124 | | | 07/13/2018 | | $ | 2,484,650 | | | $ | 51,804 | |

| NY Harbor ULSD Future(a) | | | Long | | | | 27 | | | 05/31/2018 | | | 2,437,306 | | | | 35,322 | |

| Soybean Future(a) | | | Long | | | | 31 | | | 07/13/2018 | | | 1,625,175 | | | | 22,360 | |

| WTI Crude Future(a) | | | Long | | | | 35 | | | 05/22/2018 | | | 2,399,950 | | | | 26,016 | |

| Equity Contracts | | | | | | | | | | | | | | | | | | |

| FTSE 100 Index Future | | | Long | | | | 33 | | | 06/15/2018 | | | 3,389,161 | | | | 97,743 | |

| Nikkei 225 Index Future | | | Long | | | | 31 | | | 06/07/2018 | | | 3,479,750 | | | | 145,279 | |

| Foreign Currency Contracts | | | | | | | | | | | | | | | | | | |

| Australian Dollar Currency Future | | | Short | | | | 84 | | | 06/18/2018 | | | (6,325,200 | ) | | | 24,078 | |

| | | | | | | | | | | | | $ | 9,490,792 | | | $ | 402,602 | |

| Description | | Position | | | Contracts | | | Expiration

Date | | Notional

Value | | | Value and

Unrealized

Depreciation | |

| Commodity Contracts | | | | | | | | | | | | | | | | | | |

| Copper Future(a) | | | Long | | | | 10 | | | 07/27/2018 | | $ | 768,500 | | | $ | (20,033 | ) |

| Gold 100 Oz Future(a) | | | Long | | | | 12 | | | 06/27/2018 | | | 1,583,040 | | | | (33,959 | ) |

| Silver Future(a) | | | Long | | | | 9 | | | 07/27/2018 | | | 738,045 | | | | (10,199 | ) |

| Sugar No. 11 (World) Future(a) | | | Short | | | | 189 | | | 06/29/2018 | | | (2,487,240 | ) | | | (142,553 | ) |

| Equity Contracts | | | | | | | | | | | | | | | | | | |

| EURO STOXX 50 Index Future | | | Short | | | | 41 | | | 06/15/2018 | | | (1,720,034 | ) | | | (37,239 | ) |

| S&P 500 E-Mini Future | | | Long | | | | 109 | | | 06/15/2018 | | | 14,426,150 | | | | (378,684 | ) |

| Foreign Currency Contracts | | | | | | | | | | | | | | | | | | |

| Canadian Dollar Currency Future | | | Long | | | | 41 | | | 06/19/2018 | | | 3,195,540 | | | | (10,087 | ) |

| Euro FX Currency Future | | | Long | | | | 21 | | | 06/18/2018 | | | 3,182,288 | | | | (82,626 | ) |

| Japanese Yen Currency Future | | | Long | | | | 28 | | | 06/18/2018 | | | 3,212,300 | | | | (102,456 | ) |

| Interest Rate Contracts | | | | | | | | | | | | | | | | | | |

| Canadian 10 Year Bond Future | | | Short | | | | 96 | | | 06/20/2018 | | | (9,828,420 | ) | | | (25,938 | ) |

| Euro-Bund Future | | | Short | | | | 34 | | | 06/07/2018 | | | (6,517,613 | ) | | | (55,826 | ) |

| Long Gilt Future | | | Short | | | | 58 | | | 06/27/2018 | | | (9,762,292 | ) | | | (117,866 | ) |

| U.S. 10 Year Treasury Note Future | | | Short | | | | 82 | | | 06/20/2018 | | | (9,809,250 | ) | | | (17,658 | ) |

| | | | | | | | | | | | | $ | (13,018,986 | ) | | $ | (1,035,124 | ) |

Common Abbreviations:

FTSE - Financial Times and the London Stock Exchange

S&P - Standard and Poor's

ULSD - Ultra Low Sulfur Diesel

| (a) | Owned by an entity that is owned by the Fund and is consolidated as described in Note 1 of the Notes to the Consolidated Financial Statements. |

For Fund compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

See Notes to Consolidated Financial Statements.

| Annual Report | April 30, 2018 | 13 |

| Aspen Funds | Consolidated Statements of Assets & Liabilities |

| | | Aspen Managed

Futures Strategy

Fund | | | Aspen Portfolio

Strategy Fund | |

| ASSETS: | | | | | | | | |

| Investments, at value | | $ | 81,999,340 | | | $ | 46,080,532 | |

| Foreign cash due from broker for futures contracts(Cost $– and $248,168) (Note 3) | | | – | | | | 246,547 | |

| Deposit with broker for futures contracts (Note 3) | | | 7,762,766 | | | | 4,087,800 | |

| Receivable for shares sold | | | 11,726 | | | | 144,090 | |

| Interest receivable | | | 11,805 | | | | 7,152 | |

| Prepaid and other assets | | | 5,662 | | | | 10,469 | |

| Total assets | | | 89,791,299 | | | | 50,576,590 | |

| | | | | | | | | |

| LIABILITIES: | | | | | | | | |

| Foreign cash due to broker for futures contracts (Note 3) | | | 574,524 | | | | – | |

| Payable to advisor | | | 55,813 | | | | 27,199 | |

| Payable for investments purchased | | | 3 | | | | 276 | |

| Variation margin payable | | | 134,579 | | | | 201,247 | |

| Payable for shares redeemed | | | 100,079 | | | | – | |

| Payable for administration fees | | | 37,760 | | | | 27,224 | |

| Payable for distribution and service fees | | | | | | | | |

| Class A | | | 3,125 | | | | 1,884 | |

| Payable for transfer agency fees | | | 13,995 | | | | 12,377 | |

| Delegated transfer agent equivalent services fees | | | | | | | | |

| Class A | | | 157 | | | | – | |

| Class I | | | 15,819 | | | | 6,661 | |

| Payable for trustee fees and expenses | | | 1,005 | | | | 546 | |

| Payable for professional fees | | | 30,134 | | | | 25,603 | |

| Payable for chief compliance officer fees | | | 4,912 | | | | 2,669 | |

| Payable for principal financial officer fees | | | 540 | | | | 293 | |

| Payable for licensing fees | | | 18,605 | | | | – | |

| Accrued expenses and other liabilities | | | 13,289 | | | | 8,479 | |

| Total liabilities | | | 1,004,339 | | | | 314,458 | |

| NET ASSETS | | $ | 88,786,960 | | | $ | 50,262,132 | |

| | | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | | |

| | | | | | | | | |

| Paid-in capital (Note 5) | | $ | 116,680,030 | | | $ | 47,462,200 | |

| Accumulated net investment loss | | | (367,562 | ) | | | (24,568 | ) |

| Accumulated net realized loss | | | (27,176,061 | ) | | | (843,616 | ) |

| Net unrealized appreciation/(depreciation) | | | (349,447 | ) | | | 3,668,116 | |

| NET ASSETS | | $ | 88,786,960 | | | $ | 50,262,132 | |

| | | | | | | | | |

| INVESTMENTS, AT COST | | $ | 82,082,859 | | | $ | 41,777,997 | |

See Notes to Consolidated Financial Statements.

14

| Aspen Funds | Consolidated Statements of Assets & Liabilities |

| | | Aspen Managed

Futures Strategy

Fund | | | Aspen Portfolio

Strategy Fund | |

| PRICING OF SHARES: | | | | | | | | |

| Class A: | | | | | | | | |

| Net Asset Value, offering and redemption price per share | | $ | 7.85 | | | $ | 25.81 | |

| Net Assets | | $ | 3,452,141 | | | $ | 2,729,664 | |

| Shares of beneficial interest outstanding | | | 439,627 | | | | 105,747 | |

| Maximum offering price per share (NAV/0.9450), based on maximum sales charge of 5.50% of the offering price | | $ | 8.31 | | | $ | 27.31 | |

| | | | | | | | | |

| Class I: | | | | | | | | |

| Net Asset Value, offering and redemption price per share | | $ | 7.99 | | | $ | 25.87 | |

| Net Assets | | $ | 85,334,819 | | | $ | 47,532,469 | |

| Shares of beneficial interest outstanding | | | 10,676,386 | | | | 1,837,591 | |

| See Notes to Consolidated Financial Statements. |

| Annual Report | April 30, 2018 | 15 |

| Aspen Funds | Consolidated Statements of Operations |

For the Year Ended April 30, 2018

| | | Aspen Managed

Futures Strategy

Fund | | | Aspen Portfolio

Strategy Fund | |

| INVESTMENT INCOME: | | | | | | |

| Interest | | $ | 1,049,678 | | | $ | – | |

| Dividends | | | 90,544 | | | | 799,750 | |

| Total investment income | | | 1,140,222 | | | | 799,750 | |

| | | | | | | | | |

| EXPENSES: | | | | | | | | |

| Investment advisory fees (Note 6) | | | 920,192 | | | | 473,083 | |

| Investment advisory fees - subsidiary (Note 6) | | | 118,827 | | | | 13,170 | |

| Administrative fees | | | 232,293 | | | | 118,908 | |

| Distribution and service fees | | | | | | | | |

| Class A | | | 23,067 | | | | 6,059 | |

| Transfer agency fees | | | 64,288 | | | | 49,860 | |

| Delegated transfer agent equivalent services fees | | | | | | | | |

| Class A | | | 819 | | | | – | |

| Class I | | | 90,551 | | | | 28,138 | |

| Professional fees | | | 36,068 | | | | 28,003 | |

| Offering costs | | | – | | | | 48,967 | |

| Custodian fees | | | 11,454 | | | | 9,577 | |

| Trustee fees and expenses | | | 15,012 | | | | 13,573 | |

| Principal financial officer fees | | | 3,513 | | | | 1,487 | |

| Chief compliance officer fees | | | 32,012 | | | | 12,844 | |

| Licensing fees | | | 306,731 | | | | – | |

| Other | | | 64,181 | | | | 42,079 | |

| Total expenses before waiver/reimbursement | | | 1,919,008 | | | | 845,748 | |

| Waiver of investment advisory fees | | | – | | | | (93,224 | ) |

| Waiver of investment advisory fees - subsidiary (Note 6) | | | (118,827 | ) | | | (13,170 | ) |

| Total net expenses | | | 1,800,181 | | | | 739,354 | |

| NET INVESTMENT INCOME/(LOSS) | | | (659,959 | ) | | | 60,396 | |

| | | | | | | | | |

| Net realized gain/(loss) on investments | | | (53,018 | ) | | | 985 | |

| Net realized loss on futures contracts | | | (4,914,905 | ) | | | (22,118 | ) |

| Net realized gain/(loss) on foreign currency transactions | | | (253,967 | ) | | | 32,019 | |

| Total net realized gain/(loss) | | | (5,221,890 | ) | | | 10,886 | |

| Net change in unrealized appreciation of investments | | | 64,154 | | | | 3,678,102 | |

| Net change in unrealized appreciation/(depreciation) on futures contracts | | | 2,236,408 | | | | (651,297 | ) |

| Net change in unrealized depreciation on translation of assets and liabilities denominated in foreign currency transactions | | | (51,962 | ) | | | (4,306 | ) |

| Net change in unrealized appreciation | | | 2,248,600 | | | | 3,022,499 | |

| NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | | | (2,973,290 | ) | | | 3,033,385 | |

| NET INCREASE/(DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (3,633,249 | ) | | $ | 3,093,781 | |

See Notes to Consolidated Financial Statements.

16

| Aspen Managed Futures Strategy Fund | Consolidated Statements of Changes in Net Assets |

| | | For the

Year Ended

April 30, 2018 | | | For the

Year Ended

April 30, 2017 | |

| OPERATIONS: | | | | | | |

| Net investment loss | | $ | (659,959 | ) | | $ | (1,929,803 | ) |

| Net realized loss | | | (5,221,890 | ) | | | (7,661,403 | ) |

| Net change in unrealized appreciation/(depreciation) | | | 2,248,600 | | | | (7,772,050 | ) |

| Net decrease in net assets resulting from operations | | | (3,633,249 | ) | | | (17,363,256 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS (Note 4): | | | | | | | | |

| From net investment income | | | | | | | | |

| Class A | | | – | | | | (87,401 | ) |

| Class I | | | – | | | | (2,130,729 | ) |

| Net decrease in net assets from distributions | | | – | | | | (2,218,130 | ) |

| | | | | | | | | |

| SHARE TRANSACTIONS (Note 5): | | | | | | | | |

| Class A | | | | | | | | |

| Proceeds from sales of shares | | | 1,957,143 | | | | 5,709,455 | |

| Distributions reinvested | | | – | | | | 77,296 | |

| Cost of shares redeemed | | | (4,685,659 | ) | | | (18,518,215 | ) |

| Redemption fees | | | 40 | | | | 2,337 | |

| Class I | | | | | | | | |

| Proceeds from sales of shares | | | 36,658,111 | | | | 67,326,891 | |

| Distributions reinvested | | | – | | | | 1,277,264 | |

| Cost of shares redeemed | | | (142,925,441 | ) | | | (119,175,878 | ) |

| Redemption fees | | | 7,858 | | | | 9,991 | |

| Net decrease from share transactions | | | (108,987,948 | ) | | | (63,290,859 | ) |

| | | | | | | | | |

| Net decrease in net assets | | | (112,621,197 | ) | | | (82,872,245 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 201,408,157 | | | | 284,280,402 | |

| End of period* | | $ | 88,786,960 | | | $ | 201,408,157 | |

| *Includes accumulated net investment loss of: | | $ | (367,562 | ) | | $ | (592,781 | ) |

| | | | | | | | | |

| Other Information: | | | | | | | | |

| SHARE TRANSACTIONS: | | | | | | | | |

| Class A | | | | | | | | |

| Sold | | | 244,494 | | | | 657,148 | |

| Distributions reinvested | | | – | | | | 8,695 | |

| Redeemed | | | (584,494 | ) | | | (2,116,176 | ) |

| Net decrease in shares outstanding | | | (340,000 | ) | | | (1,450,333 | ) |

| | | | | | | | | |

| Class I | | | | | | | | |

| Sold | | | 4,482,058 | | | | 7,602,448 | |

| Distributions reinvested | | | – | | | | 141,447 | |

| Redeemed | | | (17,442,220 | ) | | | (13,558,549 | ) |

| Net decrease in shares outstanding | | | (12,960,162 | ) | | | (5,814,654 | ) |

See Notes to Consolidated Financial Statements.

| Annual Report | April 30, 2018 | 17 |

| Aspen Portfolio Strategy Fund | Consolidated Statements of Changes in Net Assets |

| | For the

Year Ended

April 30, 2018 | | | For the Period December 29, 2016

(Commencement) to April 30, 2017 | |

| OPERATIONS: | | | | | | |

| Net investment income/(loss) | | $ | 60,396 | | | $ | (2,905 | ) |

| Net realized gain/(loss) | | | 10,886 | | | | (1,514,647 | ) |

| Net change in unrealized appreciation | | | 3,022,499 | | | | 645,617 | |

| Net increase/(decrease) in net assets resulting from operations | | | 3,093,781 | | | | (871,935 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS (Note 4): | | | | | | | | |

| From net investment income | | | | | | | | |

| Class A | | | (10,269 | ) | | | – | |

| Class I | | | (268,936 | ) | | | – | |

| From net realized gains on investments | | | | | | | | |

| Class A | | | (34,580 | ) | | | – | |

| Class I | | | (612,820 | ) | | | – | |

| Net decrease in net assets from distributions | | | (926,605 | ) | | | – | |

| | | | | | | | | |

| SHARE TRANSACTIONS (Note 5): | | | | | | | | |

| Class A | | | | | | | | |

| Proceeds from sales of shares | | | 717,112 | | | | 4,346,888 | |

| Distributions reinvested | | | 44,794 | | | | – | |

| Cost of shares redeemed | | | (345,910 | ) | | | (2,024,348 | ) |

| Class I | | | | | | | | |

| Proceeds from sales of shares | | | 9,638,520 | | | | 42,535,105 | |

| Distributions reinvested | | | 767,869 | | | | – | |

| Cost of shares redeemed | | | (6,046,036 | ) | | | (669,987 | ) |

| Redemption fees | | | 284 | | | | 2,600 | |

| Net increase from share transactions | | | 4,776,633 | | | | 44,190,258 | |

| | | | | | | | | |

| Net increase in net assets | | | 6,943,809 | | | | 43,318,323 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 43,318,323 | | | | – | |

| End of period* | | $ | 50,262,132 | | | $ | 43,318,323 | |

| *Includes accumulated net investment income/(loss) of: | | $ | (24,568 | ) | | $ | 62,516 | |

| | | | | | | | | |

| Other Information: | | | | | | | | |

| SHARE TRANSACTIONS: | | | | | | | | |

| Class A | | | | | | | | |

| Sold | | | 27,302 | | | | 173,467 | |

| Distributions reinvested | | | 1,679 | | | | – | |

| Redeemed | | | (13,079 | ) | | | (83,622 | ) |

| Net increase in shares outstanding | | | 15,902 | | | | 89,845 | |

| | | | | | | | | |

| Class I | | | | | | | | |

| Sold | | | 361,712 | | | | 1,707,193 | |

| Distributions reinvested | | | 28,731 | | | | – | |

| Redeemed | | | (232,745 | ) | | | (27,300 | ) |

| Net increase in shares outstanding | | | 157,698 | | | | 1,679,893 | |

See Notes to Consolidated Financial Statements.

18

| Aspen Managed Futures Strategy Fund – Class A | Consolidated Financial Highlights |

For a share outstanding throughout the periods presented.

| | | For the Year Ended April 30, 2018 (a) | | For the Year Ended April 30, 2017 (a) | | For the Year Ended April 30, 2016 (a) | | For the Year Ended April 30, 2015 (a) | | For the Year Ended April 30, 2014 (a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 8.12 | | $ | 8.83 | | $ | 10.01 | | $ | 8.97 | | $ | 9.29 | |

| INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | |

| Net investment loss(b) | | | (0.06 | ) | | (0.04 | ) | | (0.12 | ) | | (0.14 | ) | | (0.16 | ) |

| Net realized and unrealized gain/(loss) on investments | | | (0.21 | ) | | (0.57 | ) | | (0.39 | ) | | 1.39 | | | (0.05 | ) |

| Total from investment operations | | | (0.27 | ) | | (0.61 | ) | | (0.51 | ) | | 1.25 | | | (0.21 | ) |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | |

| From net investment income | | | – | | | (0.10 | ) | | (0.14 | ) | | – | | | – | |

| Distributions from net realized gain on investments | | | – | | | – | | | (0.53 | ) | | (0.21 | ) | | (0.12 | ) |

| Total distributions | | | – | | | (0.10 | ) | | (0.67 | ) | | (0.21 | ) | | (0.12 | ) |

| REDEMPTION FEES ADDED TO PAID IN CAPITAL | | | 0.00 | (c) | | 0.00 | (c) | | 0.00 | (c) | | 0.00 | (c) | | 0.01 | |

| INCREASE/(DECREASE) IN NET ASSET VALUE | | | (0.27 | ) | | (0.71 | ) | | (1.18 | ) | | 1.04 | | | (0.32 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 7.85 | | $ | 8.12 | | $ | 8.83 | | $ | 10.01 | | $ | 8.97 | |

| | | | | | | | | | | | | | | | | |

| TOTAL RETURN(d) | | | (3.33 | %) | | (6.97 | %) | | (5.20 | %) | | 14.00 | % | | (2.15 | %) |

| | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | |

| Net assets, end of period (000's) | | $ | 3,452 | | $ | 6,331 | | $ | 19,682 | | $ | 23,850 | | $ | 12,914 | |

| | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | |

| Operating expenses excluding fee waivers/reimbursements | | | 1.66 | %(e) | | 1.00 | %(e) | | 1.56 | %(e) | | 1.64 | % | | 1.83 | % |

| Operating expenses including fee waivers/reimbursements | | | 1.66 | % | | 1.00 | % | | 1.56 | % | | 1.64 | % | | 1.83 | % |

| Net investment loss including fee waivers/reimbursements | | | (0.72 | %) | | (0.52 | %) | | (1.24 | %) | | (1.50 | %) | | (1.72 | %) |

| | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 0 | % | | 31 | % | | 58 | % | | 38 | % | | 90 | % |

| (a) | Per share amounts and ratios to average net assets include income and expenses of the Aspen Futures Fund Ltd. (subsidiary), exclusive of the subsidiary's management fee. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Less than $0.005 per share. |

| (d) | Total return does not reflect the effect of sales charges. |

| (e) | The ratio of operating expenses excluding fee waiver/reimbursements to average net assets is calculated excluding the waived Subsidiary management fee (see Note 6 for additional detail). The ratio inclusive of that fee would be 1.76%, 1.07% and 1.64% for the years ended April 30, 2018, April 30, 2017 and April 30, 2016, respectively. |

See Notes to Consolidated Financial Statements.

| Annual Report | April 30, 2018 | 19 |

| Aspen Managed Futures Strategy Fund – Class I | Consolidated Financial Highlights |

For a share outstanding throughout the periods presented.

| | | For the Year Ended April 30, 2018 (a) | | For the Year Ended April 30, 2017 (a) | | For the Year Ended April 30, 2016 (a) | | For the Year Ended April 30, 2015 (a) | | For the Year Ended April 30, 2014 (a) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 8.25 | | $ | 8.98 | | $ | 10.17 | | $ | 9.07 | | $ | 9.36 | |

| INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | | | | | | | | | |

| Net investment loss(b) | | | (0.04 | ) | | (0.07 | ) | | (0.09 | ) | | (0.11 | ) | | (0.11 | ) |

| Net realized and unrealized gain/(loss) on investments | | | (0.22 | ) | | (0.58 | ) | | (0.40 | ) | | 1.42 | | | (0.06 | ) |

| Total from investment operations | | | (0.26 | ) | | (0.65 | ) | | (0.49 | ) | | 1.31 | | | (0.17 | ) |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | |

| From net investment income | | | – | | | (0.08 | ) | | (0.17 | ) | | – | | | – | |

| Distributions from net realized gain on investments | | | – | | | – | | | (0.53 | ) | | (0.21 | ) | | (0.12 | ) |

| Total distributions | | | – | | | (0.08 | ) | | (0.70 | ) | | (0.21 | ) | | (0.12 | ) |

| REDEMPTION FEES ADDED TO PAID IN CAPITAL | | | 0.00 | (c) | | 0.00 | (c) | | 0.00 | (c) | | 0.00 | (c) | | 0.00 | (c) |

| INCREASE/(DECREASE) IN NET ASSET VALUE | | | (0.26 | ) | | (0.73 | ) | | (1.19 | ) | | 1.10 | | | (0.29 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 7.99 | | $ | 8.25 | | $ | 8.98 | | $ | 10.17 | | $ | 9.07 | |

| | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | (3.15 | %) | | (7.33 | %) | | (4.97 | %) | | 14.51 | % | | (1.81 | %) |

| | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | |

| Net assets, end of period (000's) | | $ | 85,335 | | $ | 195,077 | | $ | 264,598 | | $ | 242,575 | | $ | 167,258 | |

| | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | |

| Operating expenses excluding fee waivers/reimbursements | | | 1.46 | %(d) | | 1.28 | %(d) | | 1.22 | %(d) | | 1.25 | % | | 1.30 | % |

| Operating expenses including fee waivers/reimbursements | | | 1.46 | % | | 1.28 | % | | 1.22 | % | | 1.25 | % | | 1.30 | % |

| Net investment loss including fee waivers/reimbursements | | | (0.53 | %) | | (0.78 | %) | | (0.94 | %) | | (1.11 | %) | | (1.20 | %) |

| | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 0 | % | | 31 | % | | 58 | % | | 38 | % | | 90 | % |

| (a) | Per share amounts and ratios to average net assets include income and expenses of the Aspen Futures Fund Ltd. (subsidiary), exclusive of the subsidiary's management fee. |

| (b) | Per share numbers have been calculated using the average shares method. |

| (c) | Less than $0.005 per share. |

| (d) | The ratio of operating expenses excluding fee waiver/reimbursements to average net assets is calculated excluding the waived Subsidiary management fee (see Note 6 for additional detail). The ratio inclusive of that fee would be 1.56%, 1.35% and 1.30% for the years ended April 30, 2018, April 30, 2017 and April 30, 2016, respectively. |

See Notes to Consolidated Financial Statements.

20

| Aspen Portfolio Strategy Fund – Class A | Consolidated Financial Highlights |

For a share outstanding throughout the periods presented.

| | | For the

Year Ended

April 30 , 2018(a) | | | For the

Period Ended

April 30, 2017(a)(b) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 24.45 | | | $ | 25.00 | |

| INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | |

| Net investment loss(c) | | | (0.02 | )(d) | | | (0.03 | ) |

| Net realized and unrealized gain/(loss) on investments | | | 1.86 | | | | (0.52 | ) |

| Total from investment operations | | | 1.84 | | | | (0.55 | ) |

| LESS DISTRIBUTIONS: | | | | | | | | |

| From net investment income | | | (0.11 | ) | | | – | |

| Distributions from net realized gain on investments | | | (0.37 | ) | | | – | |

| Total distributions | | | (0.48 | ) | | | – | |

| INCREASE/(DECREASE) IN NET ASSET VALUE | | | 1.36 | | | | (0.55 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 25.81 | | | $ | 24.45 | |

| | | | | | | | | |

| TOTAL RETURN(e) | | | 7.44 | % | | | (2.20 | %)(f) |

| | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | |

| Net assets, end of period (000's) | | $ | 2,730 | | | $ | 2,196 | |

| | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS: | | | | | | | | |

| Operating expenses excluding fee waivers/reimbursements | | | 1.93 | %(g) | | | 2.79 | %(g)(h) |

| Operating expenses including fee waivers/reimbursements | | | 1.79 | % | | | 1.95 | %(h) |

| Net investment loss including fee waivers/reimbursements | | | (0.09 | %) | | | (0.40 | %)(h) |

| | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 0 | % | | | 0 | %(f)(i) |

| (a) | Per share amounts and ratios to average net assets include income and expenses of the Aspen Portfolio Strategy Fund Ltd. (subsidiary), exclusive of the subsidiary's management fee. |

| (b) | The Aspen Portfolio Strategy Fund is for the period from December 29, 2016 (commencement of operations) to April 30, 2017. |

| (c) | Per share numbers have been calculated using the average shares method. |

| (d) | The amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and redemptions of Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund. |

| (e) | Total return does not reflect the effect of sales charges. |

| (g) | The ratio of operating expenses excluding fee waiver/reimbursements to average net assets is calculated excluding the waived Subsidiary management fee (see Note 6 for additional detail). The ratio inclusive of that fee would be 1.96% and 2.82% for the year ended April 30, 2018 and for the period ended April 30, 2017, respectively. |

See Notes to Consolidated Financial Statements.

| Annual Report | April 30, 2018 | 21 |

| Aspen Portfolio Strategy Fund – Class I | Consolidated Financial Highlights |

For a share outstanding throughout the periods presented.

| | | For the

Year Ended

April 30, 2018(a) | | | For the

Period Ended

April 30, 2017(a)(b) | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 24.48 | | | $ | 25.00 | |

| INCOME/(LOSS) FROM OPERATIONS: | | | | | | | | |

| Net investment income(c) | | | 0.04 | | | | 0.00 | (d)(e) |

| Net realized and unrealized gain/(loss) on investments | | | 1.88 | | | | (0.52 | ) |

| Total from investment operations | | | 1.92 | | | | (0.52 | ) |

| LESS DISTRIBUTIONS: | | | | | | | | |

| From net investment income | | | (0.16 | ) | | | – | |

| Distributions from net realized gain on investments | | | (0.37 | ) | | | – | |

| Total distributions | | | (0.53 | ) | | | – | |

| REDEMPTION FEES ADDED TO PAID IN CAPITAL | | | 0.00 | (d) | | | 0.00 | (d) |

| INCREASE/(DECREASE) IN NET ASSET VALUE | | | 1.39 | | | | (0.52 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 25.87 | | | $ | 24.48 | |

| | | | | | | | | |

| TOTAL RETURN | | | 7.76 | % | | | (2.08 | %)(f) |

| | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | |

| Net assets, end of period (000's) | | $ | 47,532 | | | $ | 41,122 | |

| | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS: | | | | | | | | |

| Operating expenses excluding fee waivers/reimbursements | | | 1.75 | %(g) | | | 2.22 | %(g)(h) |

| Operating expenses including fee waivers/reimbursements | | | 1.55 | % | | | 1.55 | %(h) |

| Net investment income including fee waivers/reimbursements | | | 0.14 | % | | | 0.01 | %(h) |

| | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 0 | % | | | 0 | %(f)(i) |

| (a) | Per share amounts and ratios to average net assets include income and expenses of the Aspen Portfolio Strategy Fund Ltd. (subsidiary), exclusive of the subsidiary's management fee. |

| (b) | The Aspen Portfolio Strategy Fund is for the period from December 29, 2016 (commencement of operations) to April 30, 2017. |

| (c) | Per share numbers have been calculated using the average shares method. |

| (d) | Less than $0.005 per share. |

| (e) | The amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and redemptions of Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund. |

| (g) | The ratio of operating expenses excluding fee waiver/reimbursements to average net assets is calculated excluding the waived Subsidiary management fee (see Note 6 for additional detail). The ratio inclusive of that fee would be 1.78% and 2.25% for the year ended April 30, 2018 and for the period ended April 30, 2017, respectively. |

See Notes to Consolidated Financial Statements.

22

| Aspen Funds | Notes to Consolidated Financial Statements |

April 30, 2018

1. ORGANIZATION

Financial Investors Trust (the “Trust”), a Delaware statutory trust, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (“1940 Act”). As of October 31, 2017, the Trust consists of multiple separate portfolios or series. This annual report describes the Aspen Managed Futures Strategy Fund and the Aspen Portfolio Strategy Fund (individually a “Fund” and collectively, the “Funds”). The Aspen Managed Futures Strategy Fund seeks investment results that replicate as closely as possible, before fees and expenses, the price and yield performance of the Aspen Managed Futures Beta Index (the “MFBI” or “Index”). The Aspen Portfolio Strategy Fund seeks long-term capital appreciation. The Funds offer Class A and Class I shares.

Basis of Consolidation

Aspen Futures Fund, Ltd. (the “Aspen Fund Subsidiary”), a Cayman Islands exempted company, is a wholly owned subsidiary of the Aspen Managed Futures Strategy Fund and Aspen Portfolio Strategy Fund, Ltd. (the “Aspen Portfolio Subsidiary”), a Cayman Islands exempted company, is a wholly owned subsidiary of the Aspen Portfolio Strategy Fund. The investment objective of both the Aspen Fund Subsidiary and the Aspen Portfolio Subsidiary (collectively the “Subsidiaries”) is designed to enhance the ability of the Funds to obtain exposure to equities, financial, currency and commodities markets consistent with the limits of the U.S. federal tax law requirements applicable to registered investment companies. The Subsidiaries are subject to substantially the same investment policies and investment restrictions as the Funds. The Subsidiaries act as an investment vehicle for the Funds in order to effect certain commodity-related investments on behalf of the Funds. Investments in the Subsidiaries are expected to provide the Funds with exposure to the commodity markets within the limitations of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), and recent IRS revenue rulings, as discussed below under “Federal Income Taxes”. The Funds are the sole shareholder of the Subsidiaries pursuant to a subscription agreement dated as of August 2, 2011 for the Aspen Fund Subsidiary and December 16, 2016 for the Aspen Portfolio Subsidiary and it is intended that each Fund will remain the sole shareholder and will continue to control the Subsidiaries. Under the Articles of Association of the Subsidiaries, shares issued by the Subsidiaries confers upon a shareholder the right to wholly own and vote at general meetings of the Subsidiaries and certain rights in connection with any winding-up or repayment of capital, as well as the right to participate in the profits or assets of the Subsidiaries. Each Fund may invest up to 25% of their total assets in shares of the Subsidiaries. All investments held by the Subsidiaries are disclosed in the accounts of each Fund. As a wholly owned subsidiary of the Funds, all assets and liabilities, income and expenses of the Subsidiaries are consolidated in the financial statements and financial highlights of the Funds. All investments held by the Subsidiaries are disclosed in the accounts of the Funds. As of April 30, 2018, net assets of the Aspen Managed Futures Strategy Fund were $88,786,960, of which net assets of $15,592,443 or 17.56%, represented the Fund’s ownership of all issued shares and voting rights of the Aspen Fund Subsidiary. As of April 30, 2018, net assets of the Aspen Portfolio Strategy Fund were $50,262,132, of which $1,535,385 or 3.05%, represented the Fund's ownership of all issued shares and voting rights of the Aspen Portfolio Subsidiary.

2. SIGNIFICANT ACCOUNTING POLICIES

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Actual results could differ from those estimates. The Funds are considered an investment company for financial reporting purposes under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Codification Topic 946. The following is a summary of significant accounting policies consistently followed by the Funds and Subsidiaries in preparation of the financial statements.

Investment Valuation: The Funds generally value their securities based on market prices determined at the close of regular trading on the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern Time, on each day the NYSE is open for trading.

For equity securities and mutual funds that are traded on an exchange, the market price is usually the closing sale or official closing price on that exchange. In the case of equity securities not traded on an exchange, or if such closing prices are not otherwise available, the securities are valued at the mean of the most recent bid and ask prices on such day. Redeemable securities issued by open-end registered investment companies are valued at the investment company’s applicable net asset value, with the exception of exchange-traded open-end investment companies, which are priced as equity securities.

The market price for debt obligations is generally the price supplied by an independent third-party pricing service approved by the Board of Trustees (the “Board”), which may use a matrix, formula or other objective method that takes into consideration quotations from dealers, market transactions in comparable investments, market indices and yield curves. If vendors are unable to supply a price, or if the price supplied is deemed to be unreliable, the market price may be determined using quotations received from one or more brokers–dealers that make a market in the security.

| Annual Report | April 30, 2018 | 23 |

| Aspen Funds | Notes to Consolidated Financial Statements |

Futures contracts that are listed or traded on a national securities exchange, commodities exchange, contract market or comparable over-the-counter market, and that are freely transferable, are valued at their closing settlement price on the exchange on which they are primarily traded or based upon the current settlement price for a like instrument acquired on the day on which the instrument is being valued. A settlement price may not be used if the market makes a limit move with respect to a particular commodity.

Forward currency exchange contracts have a fair value determined by the prevailing foreign currency exchange daily rates and current foreign currency exchange forward rates. The foreign currency exchange forward rates are calculated using an automated system that estimates rates on the basis of the current day foreign currency exchange rates and forward foreign currency exchange rates supplied by a pricing service.