UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08194

FINANCIAL INVESTORS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Karen Gilomen, Esq., Secretary

Financial Investors Trust

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: October 31

Date of reporting period: October 31, 2018

Item 1. Reports to Stockholders.

TABLE OF

CONTENTS

| Disclosure of Fund Expenses | 1 |

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund |

| Management Commentary | 6 |

| Performance Update | 8 |

| Consolidated Statement of Investments | 10 |

| Consolidated Statement of Assets and Liabilities | 15 |

| Consolidated Statement of Operations | 16 |

| Consolidated Statements of Changes in Net Assets | 17 |

| Consolidated Financial Highlights | 18 |

| ALPS | Kotak India Growth Fund | |

| Management Commentary | 22 |

| Performance Update | 24 |

| Consolidated Statement of Investments | 26 |

| Consolidated Statement of Assets and Liabilities | 28 |

| Consolidated Statement of Operations | 29 |

| Consolidated Statements of Changes in Net Assets | 30 |

| Consolidated Financial Highlights | 31 |

| ALPS | Smith Funds | |

| Management Commentary | 35 |

| Performance Update | 36 |

| Statements of Investments | 40 |

| Statements of Assets and Liabilities | 46 |

| Statements of Operations | 47 |

| Statements of Changes in Net Assets | 48 |

| Financial Highlights | 50 |

| ALPS | Red Rocks Listed Private Equity Fund | |

| Management Commentary | 58 |

| Performance Update | 60 |

| Statement of Investments | 63 |

| Statement of Assets and Liabilities | 65 |

| Statement of Operations | 66 |

| Statements of Changes in Net Assets | 67 |

| Financial Highlights | 68 |

| ALPS | WMC Research Value Fund | |

| Management Commentary | 73 |

| Performance Update | 74 |

| Statement of Investments | 76 |

| Statement of Assets and Liabilities | 80 |

| Statement of Operations | 81 |

| Statements of Changes in Net Assets | 82 |

| Financial Highlights | 83 |

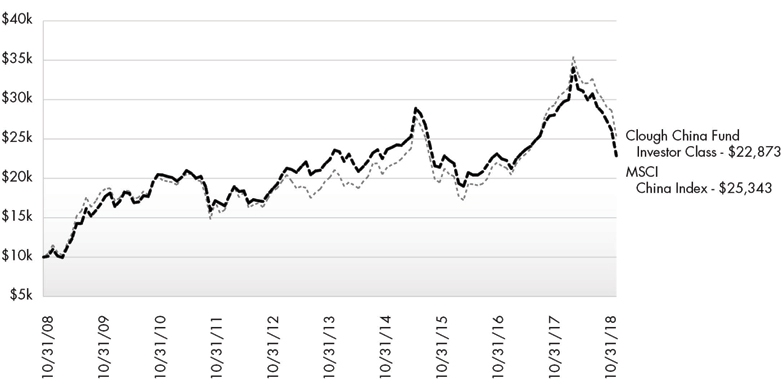

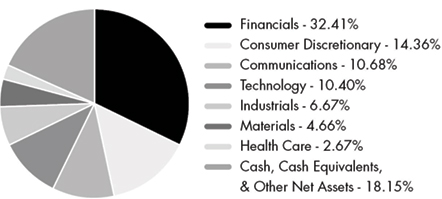

| Clough China Fund | |

| Management Commentary | 87 |

| Performance Update | 89 |

| Statement of Investments | 91 |

| Statement of Assets and Liabilities | 93 |

| Statement of Operations | 94 |

| Statements of Changes in Net Assets | 95 |

| Financial Highlights | 96 |

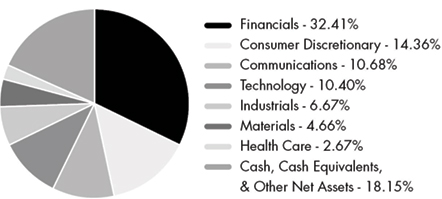

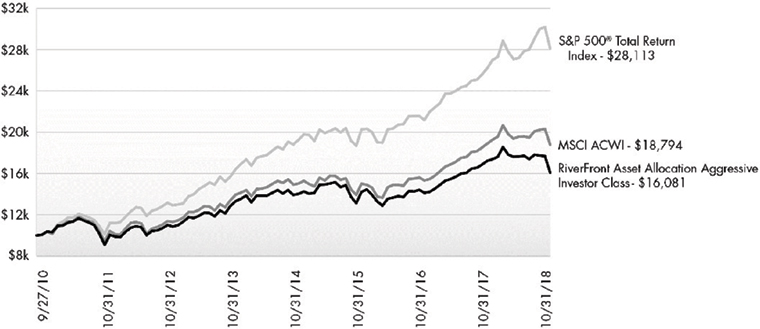

| RiverFront Global Allocation Series | |

| Management Commentary | 100 |

| Performance Update | 103 |

| Statements of Investments | 113 |

| Statements of Assets and Liabilities | 118 |

| Statements of Operations | 120 |

| Statements of Changes in Net Assets | 121 |

| Financial Highlights | 126 |

| Notes to Financial Statements | 148 |

| Report of Independent Registered Public Accounting Firm | 178 |

| Additional Information | 179 |

| Trustees and Officers | 188 |

alpsfunds.com

Disclosure of Fund Expenses

October 31, 2018 (Unaudited)

Examples. As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including applicable sales charges (loads) and redemption fees; and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, shareholder service fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on May 1, 2018 and held until October 31, 2018.

Actual Expenses. The first line under each class in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period May 1, 2018 – October 31, 2018” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line under each class in the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other mutual funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges or redemption fees. Therefore, the second line under each class in the table below is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Disclosure of Fund Expenses

October 31, 2018 (Unaudited)

| | Beginning Account Value May 1, 2018 | Ending Account Value October 31, 2018 | Expense Ratio(a) | Expenses Paid During Period May 1, 2018 - October 31, 2018(b) |

| ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund(c) | | | | |

| Investor Class | | | | |

| Actual | $1,000.00 | $932.00 | 1.39% | $6.77 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.20 | 1.39% | $7.07 |

| Class A(d) | | | | |

| Actual | $1,000.00 | $924.00 | 1.45% | $5.39 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.90 | 1.45% | $7.38 |

| Class C | | | | |

| Actual | $1,000.00 | $929.20 | 2.05% | $9.97 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,014.87 | 2.05% | $10.41 |

| Class I | | | | |

| Actual | $1,000.00 | $933.50 | 1.13% | $5.51 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.51 | 1.13% | $5.75 |

| ALPS | Kotak India Growth Fund(e) | | | | |

| Investor Class | | | | |

| Actual | $1,000.00 | $829.00 | 1.92% | $8.85 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.53 | 1.92% | $9.75 |

| Class A(d) | | | | |

| Actual | $1,000.00 | $843.20 | 2.00% | $7.12 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.12 | 2.00% | $10.16 |

| Class C | | | | |

| Actual | $1,000.00 | $825.90 | 2.60% | $11.97 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,012.10 | 2.60% | $13.19 |

| Class I | | | | |

| Actual | $1,000.00 | $829.90 | 1.60% | $7.38 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.14 | 1.60% | $8.13 |

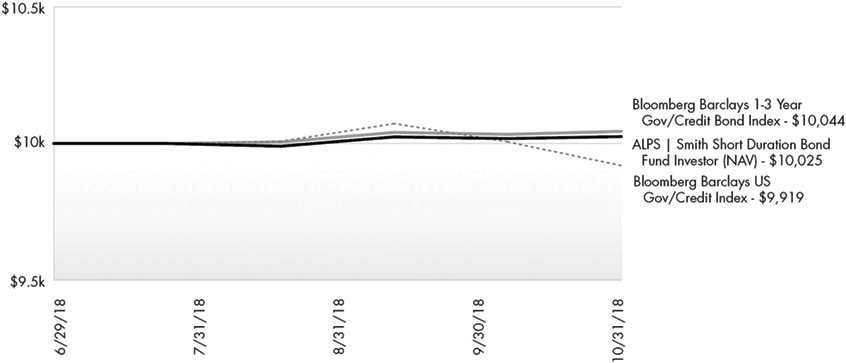

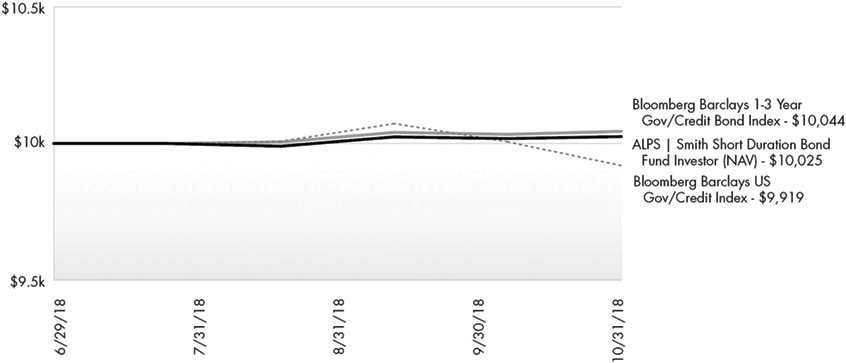

| ALPS | Smith Short Duration Bond Fund(f) | | | | |

| Investor Class | | | | |

| Actual | $1,000.00 | $1,002.50 | 0.89% | $2.98 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.72 | 0.89% | $4.53 |

| Class A | | | | |

| Actual | $1,000.00 | $1,002.70 | 0.89% | $2.98 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.72 | 0.89% | $4.53 |

| Class C | | | | |

| Actual | $1,000.00 | $1,000.90 | 1.48% | $4.95 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.74 | 1.48% | $7.53 |

| Class I | | | | |

| Actual | $1,000.00 | $1,005.00 | 0.49% | $1.64 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.74 | 0.49% | $2.50 |

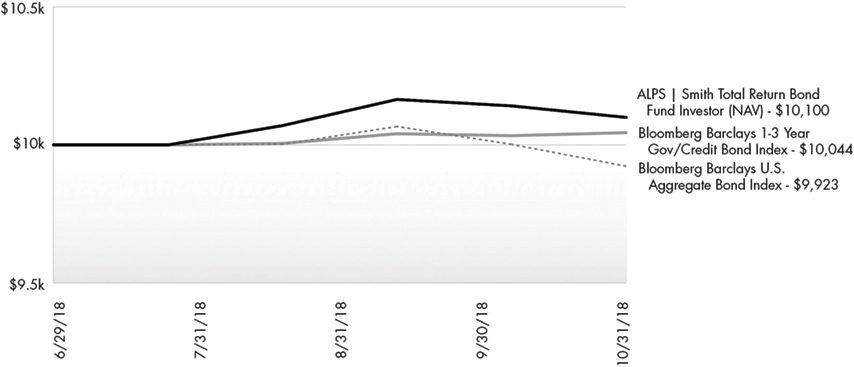

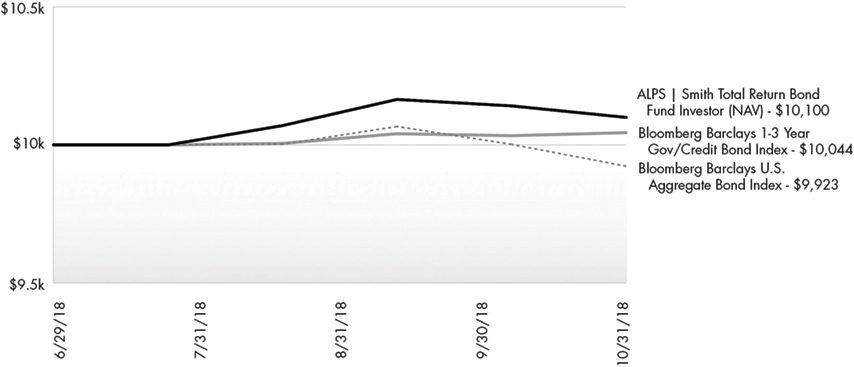

| ALPS | Smith Total Return Bond Fund(g) | | | | |

| Investor Class | | | | |

| Actual | $1,000.00 | $1,010.00 | 1.07% | $3.59 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.81 | 1.07% | $5.45 |

| Class A | | | | |

| Actual | $1,000.00 | $1,010.40 | 1.07% | $3.60 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.81 | 1.07% | $5.45 |

| Class C | | | | |

| Actual | $1,000.00 | $1,007.90 | 1.67% | $5.60 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,016.79 | 1.67% | $8.49 |

| Class I | | | | |

| Actual | $1,000.00 | $1,010.90 | 0.67% | $2.25 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.83 | 0.67% | $3.41 |

Disclosure of Fund Expenses

October 31, 2018 (Unaudited)

| | Beginning Account Value May 1, 2018 | Ending Account Value October 31, 2018 | Expense Ratio(a) | Expenses Paid During Period May 1, 2018 - October 31, 2018(b) |

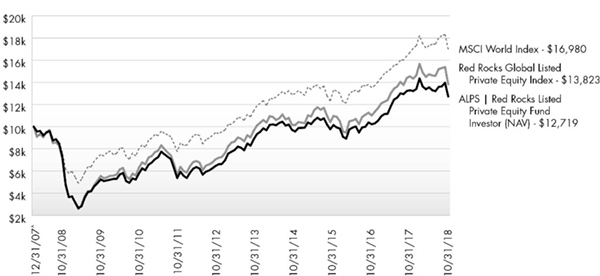

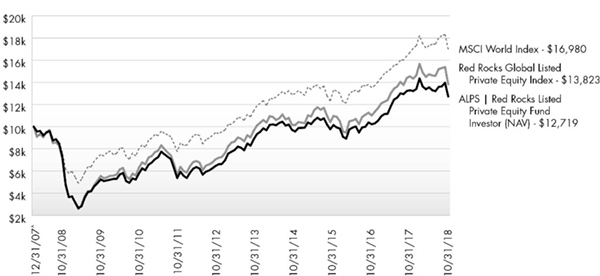

| ALPS | Red Rocks Listed Private Equity Fund | | | | |

| Investor Class | | | | |

| Actual | $1,000.00 | $939.10 | 1.42% | $6.94 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.05 | 1.42% | $7.22 |

| Class A(d) | | | | |

| Actual | $1,000.00 | $939.10 | 1.48% | $5.54 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.74 | 1.48% | $7.53 |

| Class C | | | | |

| Actual | $1,000.00 | $935.80 | 2.14% | $10.44 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,014.42 | 2.14% | $10.87 |

| Class I | | | | |

| Actual | $1,000.00 | $941.50 | 1.17% | $5.73 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.31 | 1.17% | $5.96 |

| Class R | | | | |

| Actual | $1,000.00 | $939.50 | 1.59% | $7.77 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.19 | 1.59% | $8.08 |

| ALPS | WMC Research Value Fund | | | | |

| Investor Class | | | | |

| Actual | $1,000.00 | $983.10 | 1.15% | $5.75 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.41 | 1.15% | $5.85 |

| Class A(d) | | | | |

| Actual | $1,000.00 | $956.10 | 1.15% | $4.34 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,019.41 | 1.15% | $5.85 |

| Class C | | | | |

| Actual | $1,000.00 | $979.80 | 1.90% | $9.48 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.63 | 1.90% | $9.65 |

| Class I | | | | |

| Actual | $1,000.00 | $984.60 | 0.90% | $4.50 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.67 | 0.90% | $4.58 |

| Clough China Fund | | | | |

| Investor Class | | | | |

| Actual | $1,000.00 | $763.40 | 1.95% | $8.67 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.38 | 1.95% | $9.91 |

| Class A(d) | | | | |

| Actual | $1,000.00 | $1,000.00 | 1.95% | $7.53 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,015.38 | 1.95% | $9.91 |

| Class C | | | | |

| Actual | $1,000.00 | $760.30 | 2.70% | $11.98 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,011.59 | 2.70% | $13.69 |

| Class I | | | | |

| Actual | $1,000.00 | $764.10 | 1.70% | $7.56 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,016.64 | 1.70% | $8.64 |

Disclosure of Fund Expenses

October 31, 2018 (Unaudited)

| | Beginning Account Value May 1, 2018 | Ending Account Value October 31, 2018 | Expense Ratio(a) | Expenses Paid During Period May 1, 2018 - October 31, 2018(b) |

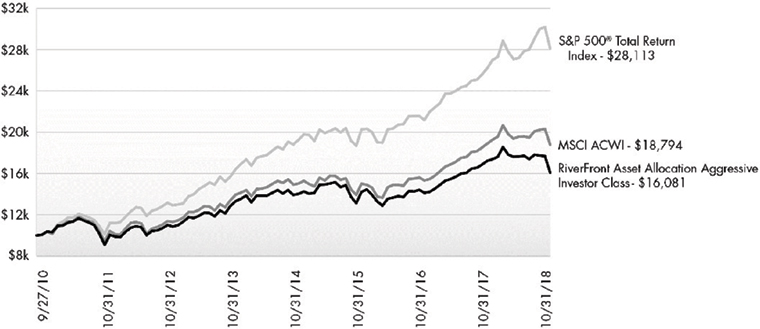

| RiverFront Asset Allocation Aggressive | | | | |

| Investor Class | | | | |

| Actual | $1,000.00 | $911.30 | 0.50% | $2.41 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.68 | 0.50% | $2.55 |

| Class A(d) | | | | |

| Actual | $1,000.00 | $887.50 | 0.50% | $1.82 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.68 | 0.50% | $2.55 |

| Class C | | | | |

| Actual | $1,000.00 | $908.00 | 1.25% | $6.01 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.90 | 1.25% | $6.36 |

| Class I | | | | |

| Actual | $1,000.00 | $912.30 | 0.25% | $1.21 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,023.95 | 0.25% | $1.28 |

| Investor Class II | | | | |

| Actual | $1,000.00 | $910.80 | 0.50% | $2.41 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.68 | 0.50% | $2.55 |

| Class L | | | | |

| Actual | $1,000.00 | $912.80 | 0.25% | $1.21 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,023.95 | 0.25% | $1.28 |

| RiverFront Asset Allocation Growth | | | | |

| Investor Class | | | | |

| Actual | $1,000.00 | $930.90 | 0.50% | $2.43 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.68 | 0.50% | $2.55 |

| Class A(d) | | | | |

| Actual | $1,000.00 | $906.00 | 0.50% | $1.84 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.68 | 0.50% | $2.55 |

| Class C | | | | |

| Actual | $1,000.00 | $927.70 | 1.25% | $6.07 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.90 | 1.25% | $6.36 |

| Class I | | | | |

| Actual | $1,000.00 | $932.10 | 0.25% | $1.22 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,023.95 | 0.25% | $1.28 |

| RiverFront Asset Allocation Growth & Income | | | | |

| Investor Class | | | | |

| Actual | $1,000.00 | $943.60 | 0.50% | $2.45 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.68 | 0.50% | $2.55 |

| Class A(d) | | | | |

| Actual | $1,000.00 | $918.70 | 0.50% | $1.85 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.68 | 0.50% | $2.55 |

| Class C | | | | |

| Actual | $1,000.00 | $939.40 | 1.25% | $6.11 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.90 | 1.25% | $6.36 |

| Class I | | | | |

| Actual | $1,000.00 | $943.90 | 0.25% | $1.22 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,023.95 | 0.25% | $1.28 |

Disclosure of Fund Expenses

October 31, 2018 (Unaudited)

| | Beginning Account Value May 1, 2018 | Ending Account Value October 31, 2018 | Expense Ratio(a) | Expenses Paid During Period May 1, 2018 - October 31, 2018(b) |

| RiverFront Asset Allocation Moderate | | | | |

| Investor Class | | | | |

| Actual | $1,000.00 | $975.50 | 0.50% | $2.49 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.68 | 0.50% | $2.55 |

| Class A(d) | | | | |

| Actual | $1,000.00 | $948.50 | 0.50% | $1.88 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.68 | 0.50% | $2.55 |

| Class C | | | | |

| Actual | $1,000.00 | $970.70 | 1.25% | $6.21 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.90 | 1.25% | $6.36 |

| Class I | | | | |

| Actual | $1,000.00 | $976.00 | 0.25% | $1.25 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,023.95 | 0.25% | $1.28 |

| RiverFront Asset Allocation Income & Growth | | | | |

| Investor Class | | | | |

| Actual | $1,000.00 | $983.10 | 0.50% | $2.50 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.68 | 0.50% | $2.55 |

| Class A(d) | | | | |

| Actual | $1,000.00 | $969.00 | 0.50% | $1.90 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,022.68 | 0.50% | $2.55 |

| Class C | | | | |

| Actual | $1,000.00 | $980.20 | 1.25% | $6.24 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,018.90 | 1.25% | $6.36 |

| Class I | | | | |

| Actual | $1,000.00 | $985.10 | 0.25% | $1.25 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,023.95 | 0.25% | $1.28 |

| (a) | Annualized, based on the Fund's most recent fiscal half year expenses. |

| (b) | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184), divided by 365. |

| (c) | Includes expenses of the CoreCommodity Management Cayman Commodity Fund Ltd. (wholly-owned subsidiary), exclusive of the subsidiary's management fee. |

| (d) | Class A commenced operations on June 12, 2018. For purposes of calculating the “Actual” figures, actual number of days from commencement of operations through October 31, 2018 were used (141 days). |

| (e) | Includes expenses of the Kotak Mauritius Portfolio (wholly-owned subsidiary). |

| (f) | ALPS | Smith Short Duration Bond Fund commenced operations on July 2, 2018. For purposes of calculating the “Actual” figures, actual number of days from commencement of operations through October 31, 2018 were used (122 days). |

| (g) | ALPS | Smith Total Return Bond Fund commenced operations on July 2, 2018. For purposes of calculating the “Actual” figures, actual number of days from commencement of operations through October 31, 2018 were used (122 days). |

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund

| Management Commentary | October 31, 2018 (Unaudited) |

The twelve month period ending on October 31, 2018 produced modestly negative returns for commodities, as measured by the diversified Bloomberg Commodities Total Return Index, down -1.73%. The ALPS | CoreCommodity CompleteCommodities® Strategy Fund (“I” Shares—“JCRIX” or the “Fund”) delivered a net positive return of +1.42% (JCRAX was -4.52% at MOP, JCRCX was down -0.50% with CDSC and JCCSX was up 1.10%).

The Fund outperformed its benchmark, the Bloomberg Commodity Index Total Return (“BCOM”), by 315 basis points during this period (measured against the performance of the “I” shares). The Fund employs a strategy that combines an actively managed portfolio of commodity futures related exposure (collateralized by U.S. Treasury Inflation Protected Securities – “TIPS”), commodity equities, and physical commodity ETF’s. At the end of October, the Fund allocated approximately 80% of its assets toward commodity futures related investments and approximately 20% of its assets in commodity equities. The Fund was more than 99% invested at the end of the period.

During the twelve-month period ending in October 2018, the Fund held sector weights which averaged approximately 41% energy, 34% agriculture, 15% industrial metals, and 10% precious metals. Within each sector, the Fund allocated differing quantities of individual commodities compared to BCOM weightings while maintaining an unleveraged, diversified portfolio.

In terms of overall weighting, the Fund's agricultural sector was relatively similar to the BCOM –34% for the Fund and 36% for BCOM. Interestingly, the Fund's greatest outperformance by sector, gross and net, occurred within agriculture. On a gross basis, the Fund’s agricultural sector outperformed the BCOM’s agricultural allocation by about 210 basis points. The Fund’s futures-related investments lost 4.6% for the year while BCOM’s agriculture sub-index total return recorded a 10.1% decline. The Fund’s allocation to agricultural producers (equities) was down -5.4% for the period, but also outperformed the BCOM agricultural sub-index. The primary driver of the outperformance on the futures side was individual weighting and selection. The Fund held a greater percentage of cotton futures relative to BCOM. Cotton prices were near the top in performance, up 15.41% for the year. We included an allocation of about 4% in cocoa futures in our agricultural sleeve. BCOM doesn’t have any cocoa futures. Cocoa prices rose by +2.86% year over year (ending in October 2018), contributing to the Fund’s outperformance. On the flip side, the Fund held less percentage weighting in both soybeans and lean hog futures than BCOM. These two components fell -19.90% and -12.43% respectively for the period. The negative performance had less impact in the Fund due to lighter weighting.

Energy prices were the best performers in the BCOM for the period. Brent North Sea crude led the way, posting a +31.59% year over year performance while West Texas Intermediate added +26.78%.The Fund held a significant overweight in this sector relative to BCOM, an average of 41% compared to 32% for BCOM. The Fund concentrated most of its overweight in petroleum and products. The Fund benefitted on a comparative basis to its benchmark, BCOM. Energy related producers (equities) did not fare as well as the futures, falling just about -100 basis

points for the year. However the combined performance of the Fund’s energy sector produced a total return of +16.8% vs. BCOM’s +18.2%. After adjusting for weighting in the total portfolio, the Fund outperformed BCOM by about 160 basis points in the energy sector.

Industrial metals provided the largest sector decline within the BCOM for the year. BCOM industrial sub-index total return moved significantly lower, down 12.8% for the twelve-month period ending in October 2018. All of the major industrial metals were down for the period. Zinc prices fell the most, down -20.03% while copper prices slipped by -15.49%. Aluminum prices traded lower, -11.18% for the year. Nickel registered a -8.40% loss. Some worries about potential slowing of global GDP growth rates kept industrial metals prices down. Also, the much anticipated infrastructure stimulus in the United States did not move forward as of the October close. The Fund held an underweight relative to BCOM in industrial metals, 15% vs. 17% for BCOM. The combined portfolio of futures and producers (equities) provided a total return of - 10.6%, about 60 basis points above BCOM industrial sub-index performance after adjusting for allocation differences.

Precious metals prices struggled during the year, declining by approximately -7.5% within the BCOM, as measured by the BCOM precious metals sub-index total return. The Fund held an underweight in this sector relative to BCOM, 10% vs 15% for the period. Gold prices went down modestly, -5.05%, while silver prices declined by -15.13%. The Fund’s combined portfolio of futures-related and commodity producer investments in precious metals declined by -11.2% compared to BCOM’s -7.5%. Adjusting for weightings in the Fund’s overall portfolio and for the whole BCOM, the difference in contribution to returns was negligible. The Fund’s precious metals allocation essentially performed in line with BCOM precious metals sub index for the period.

The US Dollar strengthened marginally during the year ending in October, +2.73% as measured by the US Dollar Index (“DXY”). Interest rates rose from about 1.60% on the US two-year Note to 2.87% by the end of October 2018. Since most commodities are priced in Dollars, commodity prices tend to be inversely related to Dollar moves. Additionally, rising interest rates may at times present headwinds to commodity price appreciation. That did not happen this time. We believe that stronger supply/demand fundamentals for many commodities overcame these potential detractors.

{The Fund’s top equity holdings at the end of October 2018 included Yara International (YAR NO) -4.82% YTD, Pilgrim’s Pride Corp (PPC US) - 43.14% YTD, Tyson Foods Inc (TSN US) -25.10% YTD, Marathon Petroleum Corporation (MPC US) +8.80% YTD, Marine Harvest NO (MHG NO) +49.06 % YTD, Holly Frontier Corp (HFC US) +33.86% YTD, Valero Energy Corp. (VLO US) +1.40% YTD, Ingredion Incorporated (INGR US) - 26.40% YTD, Kubota Corp (6326 JP) -19.00% YTD, Bunge Ltd (BG US) - 5.98% YTD }

TIPS and nominal US Treasuries are held by the fund to invest excess cash and as collateral for commodity futures related investments held in our Cayman Island subsidiary. The stated desire by the Federal Reserve to “normalize” rates and the Fed’s balance sheet has been a factor helping to move rates higher. We still believe that there may be

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund

| Management Commentary | October 31, 2018 (Unaudited) |

considerable resistance to raising rates from here. Certainly the pace of the interest rate hikes will likely be determined by the economic data, including readings on inflation. Nonetheless, we believe we may be nearing the end of what has been a significant multi-year rally in US treasury prices. As a result, we continue to invest in TIPS and nominal US Treasuries with limited duration exposure. At the end of October, our weighted average maturity was approximately 0.7 years in our TIPS and nominal US Treasury portfolio.

We strongly believe that the long term fundamental drivers of commodity demand and ultimately higher prices are still in place. Population growth is likely to remain unabated regardless of the economic environment in the US and Europe. A billion more people are likely to be added to the world population over the next decade or so. The trend of wealth distribution is tipping toward the developing world as those economies grow at faster rates relative to the slow or negative growth occurring in the developed countries. The improving global quality of life is contributing to ever increasing demand for raw materials and food. Incremental gains in disposable income in the developing nations have led to competition for the commodities needed for more complex and costly lifestyles.

While it is true that commodity prices have rallied significantly in percentage terms from the lows established in the first quarter of 2016, the absolute price levels of many commodities, including crude oil, have not gone high enough to stimulate the necessary capital expenditures to assure future supply growth to satisfy future demand. Producers need profit margins to operate, to explore for new sources, and to secure financing. Without robust capital investment, the world may essentially operate from “hand to mouth” for many key commodities. Ultimately that could lead to higher, more volatile prices if problems erupt or demand grows more than current expectations. The price cycle for many commodities seems to be shifting from favoring consumers to rewarding the producers. Commodities may become much more interesting from an investment point of view as sentiment for the asset class ascends with these potential price increases.

Bob Hyman

Portfolio Manager

CoreCommodity Management, LLC

Past performance if not indicative of future results. “Bloomberg®,” “Bloomberg Commodity IndexSM” and the names of the other indexes and sub-indexes that are part of the Bloomberg Commodity Index family are service marks of Bloomberg Finance L.P. and its affiliates. Source for all Index data: Bloomberg L.P. Commodity Sectors are represented by the applicable Bloomberg Commodity Sector Sub-Indices. This document does not constitute an offer of any commodities, securities or investment advisory services. Any such offer may be made only by means of a disclosure document or similar materials which contain a description of material terms and risks. The attribution of performance results presented above is based on gross profit and loss and does not include, among other things, investment expenses, advisory fees or other expenses incurred by the Fund. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are

considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. The economic statistics presented herein are subject to revision by the agencies that issue them. Any indices and other financial benchmarks shown are provided for illustrative purposes only, are unmanaged, reflect reinvestment of income and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. All investments are subject to risk.

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund

| Performance Update | October 31, 2018 (Unaudited) |

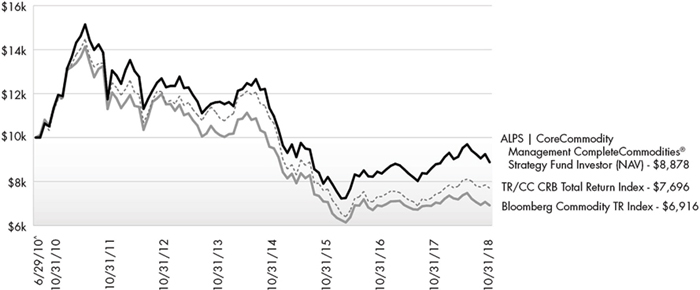

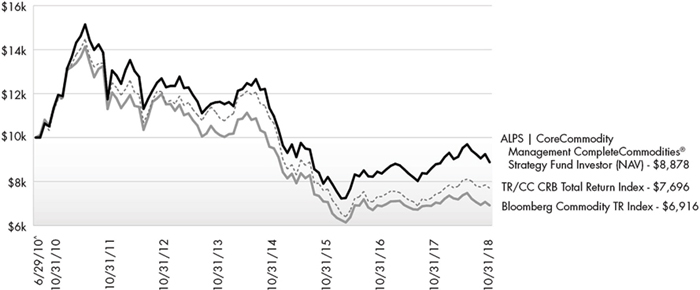

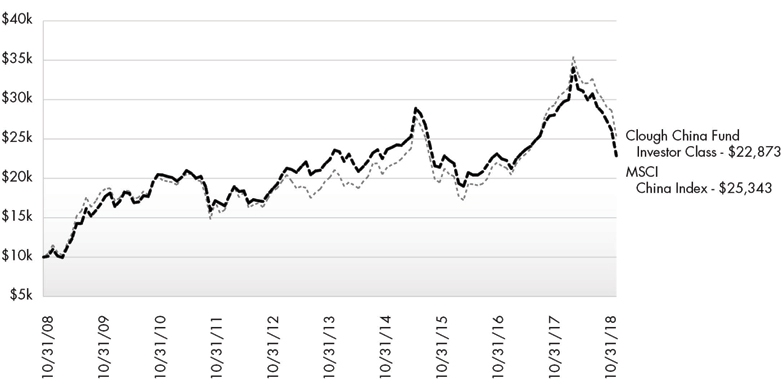

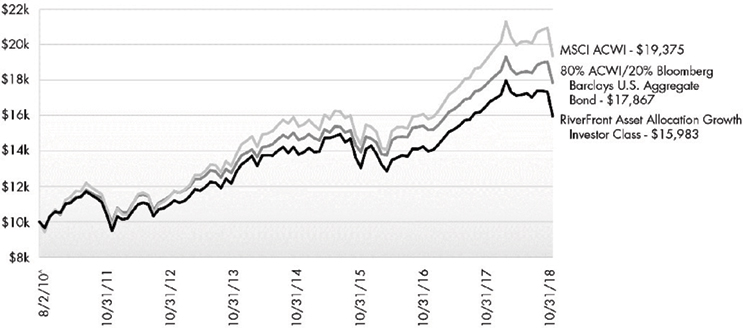

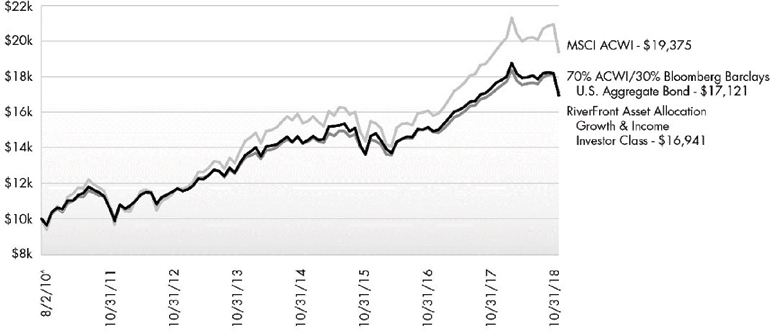

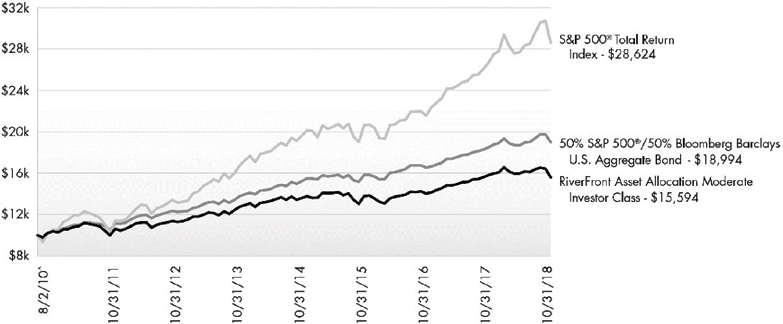

Performance of $10,000 Initial Investment (as of October 31, 2018)

Comparison of change in value of a $10,000 investment

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average Annual Total Returns (as of October 31, 2018)

| | 6 Month | 1 Year | 3 Year | 5 Year | Since Inception^ | Total Expense Ratio | What You Pay* |

| Investor# (NAV) | -6.80% | 1.23% | 2.67% | -5.24% | -1.42% | 1.47% | 1.47% |

| Class A (NAV) | -6.80% | 1.23% | 2.67% | -5.24% | -1.42% | 1.47% | 1.47% |

| Class A (MOP) | -11.92% | -4.39% | 0.73% | -6.31% | -2.08% |

| Class C (NAV) | -7.08% | 0.62% | 1.99% | -5.85% | -2.02% | 2.07% | 2.07% |

| Class C (CDSC) | -8.01% | -0.36% | 1.99% | -5.85% | -2.02% |

| Class I | -6.65% | 1.42% | 2.88% | -4.99% | -1.14% | 1.17% | 1.17% |

| TR/CC CRB Total Return Index 1 | -4.47% | 3.66% | 0.16% | -6.68% | -3.09% | | |

| Bloomberg Commodity TR Index1 | -6.18% | -1.73% | -0.69% | -7.31% | -4.32% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-866-759-5679.

Maximum Offering Price (MOP) for Class A shares includes the Fund’s maximum sales charge of 5.50%. Performance shown at NAV does not include these sales charges and would have been lower had it been taken into account. If you invest $1 million or more, either as a lump sum or through the Fund’s accumulation or letter of intent programs, you can purchase Class A shares without an initial sales charge (load). A Contingent Deferred Sales Charge (“CDSC”) of 1.00% may apply to Class C shares redeemed within the first 12 months after a purchase, and on Class A shares redeemed within the first 18 months after a purchase in excess of $1 million. The Fund imposes a 2.00% redemption fee on shares held for less than 30 days.

Performance less than 1 year is cumulative.

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund

| Performance Update | October 31, 2018 (Unaudited) |

Performance shown for Class A shares prior to June 12, 2018 reflects the historical performance of the Fund’s Investor shares, calculated using the fees and expenses of Class A shares.

| 1 | Thomson Reuters/CC CRB Total Return Index and the Bloomberg Commodity TR Index (formerly the Dow Jones-UBS Commodity Index) are unmanaged indices used as a measurement of change in commodity market conditions based on the performance of a basket of different commodities. Each index is composed of a different basket of commodities, a different weighting of the commodities in the basket, and a different re-balancing schedule. The indices are not actively managed and do not reflect any deduction for fees, expenses or taxes. An investor may not invest directly in an index. |

| ^ | Fund Inception date of June 29, 2010 for Investor Class and Classes C and I; Fund Inception date of June 12, 2018 for Class A. |

| * | What You Pay reflects the Advisor’s decision to contractually limit expenses through February 28, 2020 for Class A and February 28, 2019 for all other classes. Please see the prospectus for additional information. |

| # | Prior to December 1, 2017, Investor Class was known as Class A. |

Investments in securities of MLPs involve risks that differ from an investment in common stock. MLPs are controlled by their general partners, which generally have conflicts of interest and limited fiduciary duties to the MLP, which may permit the general partner to favor its own interests over the MLPs. The benefit you are expected to derive from the Fund’s investment in MLPs depends largely on the MLPs being treated as partnerships for federal income tax purposes. As a partnership, an MLP has no federal income tax liability at the entity level. Therefore, treatment of one or more MLPs as a corporation for federal income tax purposes could affect the Fund’s ability to meet its investment objective and would reduce the amount of cash available to pay or distribute to you. Legislative, judicial, or administrative changes and differing interpretations, possibly on a retroactive basis, could negatively impact the value of an investment in MLPs and therefore the value of your investment in the Fund.

Investing in commodity-related securities involves risk and considerations not present when investing in more conventional securities. The Fund may be more susceptible to high volatility of commodity markets.

Derivatives generally are more sensitive to changes in economic or market conditions than other types of investments; this could result in losses that significantly exceed the Fund's original investment.

The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

This Fund is not suitable for all investors, and is subject to investment risks, including possible loss of the principal amount invested.

There is no guarantee that the Fund will continue to hold any one particular security or stay invested in any one particular company. The composition of the Fund's top holdings is subject to change. Performance figures are historical and reflect the change in share price, reinvested distributions, changes in net asset value, sales charges and capital gains distributions, if any.

Not FDIC Insured – No Bank Guarantee – May Lose Value

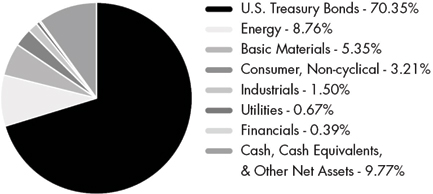

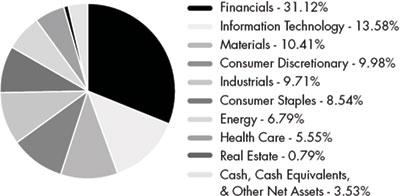

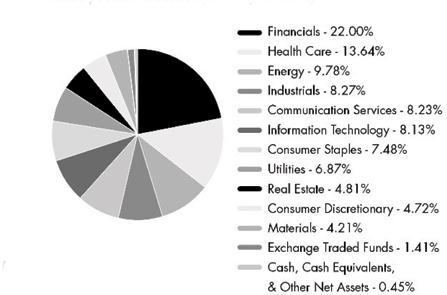

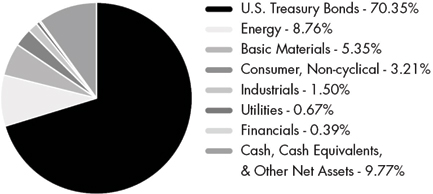

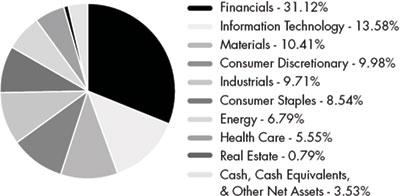

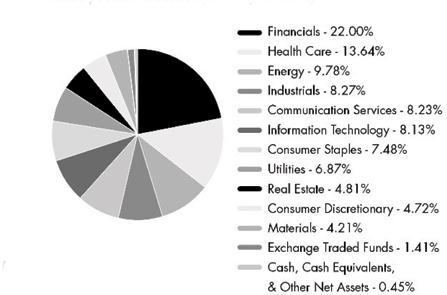

Asset Type Allocation (as a % of Net Assets)†

| Common Stock | | | 19.71 | % |

| Government Bonds | | | 70.35 | % |

| Master Limited Partnerships | | | 0.17 | % |

| Cash, Cash Equivalents and Other Net Assets | | | 9.77 | % |

| Total | | | 100.00 | % |

| † | Holdings are subject to change, and may not reflect the current or future position of the portfolio. Table presents approximate values only. |

Industry Sector Allocation (as a % of Net Assets)

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund

| Consolidated Statement of Investments | October 31, 2018 |

| | | Shares | | | Value

(Note 2) | |

| COMMON STOCKS (19.71%) | | | | | | | | |

| Argentina (0.11%) | | | | | | | | |

| Adecoagro SA(a) | | | 50,405 | | | $ | 403,240 | |

| YPF SA, Sponsored ADR(a) | | | 23,632 | | | | 354,480 | |

| | | | | | | | 757,720 | |

| | | | | | | | | |

| Australia (1.30%) | | | | | | | | |

| Beach Energy, Ltd. | | | 278,659 | | | | 347,305 | |

| BHP Billiton, Ltd. | | | 5,330 | | | | 121,575 | |

| BlueScope Steel, Ltd. | | | 5,591 | | | | 56,895 | |

| Costa Group Holdings, Ltd. | | | 27,028 | | | | 116,753 | |

| Fortescue Metals Group, Ltd. | | | 516,187 | | | | 1,462,152 | |

| GrainCorp, Ltd., Class A | | | 85,256 | | | | 497,482 | |

| Iluka Resources, Ltd. | | | 72,613 | | | | 414,452 | |

| Incitec Pivot, Ltd. | | | 328,759 | | | | 907,962 | |

| Independence Group NL | | | 176,712 | | | | 505,560 | |

| Mineral Resources, Ltd. | | | 8,685 | | | | 87,642 | |

| Nufarm, Ltd. | | | 95,715 | | | | 386,349 | |

| Oil Search, Ltd. | | | 64,472 | | | | 354,746 | |

| OZ Minerals, Ltd. | | | 133,936 | | | | 856,467 | |

| Santos, Ltd. | | | 7,201 | | | | 33,860 | |

| South32, Ltd. | | | 667,525 | | | | 1,711,202 | |

| Syrah Resources, Ltd.(a) | | | 25,375 | | | | 28,751 | |

| Washington H Soul Pattinson & Co., Ltd. | | | 1,740 | | | | 35,585 | |

| Western Areas, Ltd. | | | 156,235 | | | | 248,935 | |

| Whitehaven Coal, Ltd. | | | 165,006 | | | | 566,718 | |

| Woodside Petroleum, Ltd. | | | 18,740 | | | | 462,485 | |

| | | | | | | | 9,202,876 | |

| | | | | | | | | |

| Austria (0.05%) | | | | | | | | |

| OMV AG | | | 2,563 | | | | 142,624 | |

| voestalpine AG | | | 6,748 | | | | 239,917 | |

| | | | | | | | 382,541 | |

| | | | | | | | | |

| Brazil (0.61%) | | | | | | | | |

| BRF SA, ADR(a) | | | 131,597 | | | | 779,054 | |

| Cia de Saneamento Basico do Estado de Sao Paulo, ADR | | | 112,065 | | | | 831,522 | |

| Gerdau SA, Sponsored ADR | | | 144,950 | | | | 630,533 | |

| Petroleo Brasileiro SA, Sponsored ADR | | | 40,370 | | | | 656,013 | |

| Vale SA, Sponsored ADR | | | 91,554 | | | | 1,382,465 | |

| | | | | | | | 4,279,587 | |

| | | | | | | | | |

| Canada (0.65%) | | | | | | | | |

| Cameco Corp. | | | 45,059 | | | | 483,032 | |

| Canadian Solar, Inc.(a) | | | 19,387 | | | | 277,234 | |

| CES Energy Solutions Corp. | | | 32,100 | | | | 85,099 | |

| Enerflex, Ltd. | | | 14,300 | | | | 172,497 | |

| First Quantum Minerals, Ltd. | | | 4,500 | | | | 44,916 | |

| Hudbay Minerals, Inc. | | | 239,100 | | | | 939,001 | |

| Ivanhoe Mines, Ltd., Class A(a) | | | 113,800 | | | | 214,383 | |

| Nutrien, Ltd. | | | 17,598 | | | | 931,463 | |

| Parex Resources, Inc.(a) | | | 43,000 | | | | 626,161 | |

| Precision Drilling Corp.(a) | | | 89,606 | | | | 215,950 | |

| Secure Energy Services, Inc. | | | 42,200 | | | | 275,040 | |

| Trican Well Service, Ltd.(a) | | | 96,300 | | | | 131,672 | |

| | | Shares | | | Value (Note 2) | |

| Canada (continued) | | | | | | | | |

| Turquoise Hill Resources, Ltd.(a) | | | 121,860 | | | $ | 208,381 | |

| | | | | | | | 4,604,829 | |

| | | | | | | | | |

| Chile (0.26%) | | | | | | | | |

| Antofagasta PLC | | | 16,474 | | | | 165,256 | |

| Sociedad Quimica y Minera de Chile SA, Sponsored ADR | | | 38,571 | | | | 1,689,796 | |

| | | | | | | | 1,855,052 | |

| | | | | | | | | |

| China (0.30%) | | | | | | | | |

| CNOOC, Ltd., Sponsored ADR | | | 9,771 | | | | 1,653,743 | |

| JinkoSolar Holding Co., Ltd., ADR(a) | | | 5,556 | | | | 44,781 | |

| PetroChina Co., Ltd., ADR | | | 5,807 | | | | 421,820 | |

| | | | | | | | 2,120,344 | |

| | | | | | | | | |

| Colombia (0.02%) | | | | | | | | |

| Ecopetrol SA, Sponsored ADR | | | 5,846 | | | | 135,978 | |

| | | | | | | | | |

| Denmark (0.12%) | | | | | | | | |

| FLSmidth & Co. A/S | | | 7,311 | | | | 383,925 | |

| Vestas Wind Systems A/S | | | 7,588 | | | | 475,884 | |

| | | | | | | | 859,809 | |

| | | | | | | | | |

| Faroe Islands (0.13%) | | | | | | | | |

| Bakkafrost P/F | | | 15,902 | | | | 893,023 | |

| | | | | | | | | |

| Finland (0.10%) | | | | | | | | |

| Outokumpu OYJ | | | 122,451 | | | | 514,556 | |

| Outotec OYJ(a) | | | 43,438 | | | | 168,264 | |

| | | | | | | | 682,820 | |

| | | | | | | | | |

| France (0.13%) | | | | | | | | |

| TOTAL SA, Sponsored ADR | | | 15,485 | | | | 907,421 | |

| | | | | | | | | |

| Germany (0.19%) | | | | | | | | |

| K+S AG | | | 47,872 | | | | 893,040 | |

| Salzgitter AG | | | 10,429 | | | | 417,923 | |

| | | | | | | | 1,310,963 | |

| | | | | | | | | |

| Great Britain (1.24%) | | | | | | | | |

| Anglo American PLC | | | 18,446 | | | | 394,974 | |

| BP PLC, Sponsored ADR | | | 43,315 | | | | 1,878,571 | |

| Ensco PLC, Class A | | | 14,961 | | | | 106,822 | |

| John Wood Group PLC | | | 37,393 | | | | 341,357 | |

| Kazakhmys PLC | | | 31,933 | | | | 211,758 | |

| Noble Corp. PLC(a) | | | 74,500 | | | | 373,990 | |

| Petrofac, Ltd. | | | 12,709 | | | | 93,927 | |

| Rio Tinto PLC, Sponsored ADR | | | 30,241 | | | | 1,490,578 | |

| Severn Trent PLC | | | 21,898 | | | | 521,455 | |

| Subsea 7 SA | | | 102,954 | | | | 1,300,085 | |

| TechnipFMC PLC | | | 28,201 | | | | 741,686 | |

| Tullow Oil PLC(a) | | | 35,921 | | | | 103,674 | |

| United Utilities Group PLC | | | 129,470 | | | | 1,202,441 | |

| | | | | | | | 8,761,318 | |

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund

| Consolidated Statement of Investments | October 31, 2018 |

| | | Shares | | | Value (Note 2) | |

| India (0.02%) | | | | | | |

| Vedanta, Ltd., ADR | | | 15,717 | | | $ | 175,087 | |

| | | | | | | | | |

| Israel (0.02%) | | | | | | | | |

| SolarEdge Technologies, Inc.(a) | | | 3,393 | | | | 131,411 | |

| Tower Semiconductor, Ltd.(a) | | | 1 | | | | 9 | |

| | | | | | | | 131,420 | |

| | | | | | | | | |

| Italy (0.04%) | | | | | | | | |

| Eni SpA, Sponsored ADR | | | 8,929 | | | | 315,551 | |

| | | | | | | | | |

| Japan (1.67%) | | | | | | | | |

| Daido Steel Co., Ltd. | | | 6,200 | | | | 255,506 | |

| GS Yuasa Corp. | | | 21,600 | | | | 444,118 | |

| Hitachi Metals, Ltd. | | | 48,800 | | | | 576,077 | |

| Inpex Corp. | | | 143,333 | | | | 1,650,741 | |

| Japan Petroleum Exploration Co., Ltd. | | | 19,200 | | | | 406,852 | |

| JFE Holdings, Inc. | | | 29,300 | | | | 553,359 | |

| Kobe Steel, Ltd. | | | 60,200 | | | | 484,438 | |

| Kubota Corp. | | | 112,400 | | | | 1,775,131 | |

| Kurita Water Industries, Ltd. | | | 18,016 | | | | 444,353 | |

| Maruichi Steel Tube, Ltd. | | | 16,300 | | | | 470,935 | |

| Megmilk Snow Brand Co., Ltd. | | | 6,000 | | | | 140,488 | |

| Mitsubishi Materials Corp. | | | 17,600 | | | | 488,217 | |

| Nippon Light Metal Holdings Co., Ltd. | | | 39,000 | | | | 82,262 | |

| Nippon Suisan Kaisha, Ltd. | | | 129,600 | | | | 828,126 | |

| Nisshin Steel Co., Ltd. | | | 29,000 | | | | 379,350 | |

| OSAKA Titanium Technologies Co., Ltd. | | | 3,700 | | | | 58,008 | |

| Pacific Metals Co., Ltd. | | | 2,900 | | | | 81,344 | |

| Sakata Seed Corp. | | | 15,600 | | | | 493,570 | |

| Sumitomo Forestry Co., Ltd. | | | 20,659 | | | | 307,409 | |

| Sumitomo Metal Mining Co., Ltd. | | | 3,200 | | | | 100,962 | |

| Toho Titanium Co., Ltd. | | | 12,700 | | | | 129,549 | |

| Toho Zinc Co., Ltd. | | | 13,600 | | | | 435,113 | |

| Tokyo Steel Manufacturing Co., Ltd. | | | 73,400 | | | | 578,301 | |

| UACJ Corp. | | | 11,100 | | | | 243,278 | |

| Yamato Kogyo Co., Ltd. | | | 14,400 | | | | 379,031 | |

| | | | | | | | 11,786,518 | |

| | | | | | | | | |

| Luxembourg (0.13%) | | | | | | | | |

| APERAM SA | | | 9,087 | | | | 309,801 | |

| ArcelorMittal | | | 5,056 | | | | 126,216 | |

| Tenaris SA, ADR | | | 1,915 | | | | 55,975 | |

| Ternium SA, Sponsored ADR | | | 12,748 | | | | 405,897 | |

| | | | | | | | 897,889 | |

| | | | | | | | | |

| Netherlands (0.35%) | | | | | | | | |

| Core Laboratories N.V. | | | 5,076 | | | | 432,678 | |

| Frank's International N.V.(a) | | | 41,457 | | | | 294,345 | |

| Fugro N.V.(a) | | | 27,192 | | | | 351,109 | |

| OCI N.V.(a) | | | 15,679 | | | | 446,457 | |

| Royal Dutch Shell PLC, Class A, Sponsored ADR | | | 3,991 | | | | 252,191 | |

| Royal Dutch Shell PLC, Class B | | | 6,862 | | | | 224,977 | |

| SBM Offshore N.V. | | | 27,872 | | | | 482,377 | |

| | | | | | | | 2,484,134 | |

| | | Shares | | | Value (Note 2) | |

| Norway (1.65%) | | | | | | |

| Aker BP ASA | | | 25,870 | | | $ | 853,147 | |

| Aker Solutions ASA(a)(b) | | | 35,369 | | | | 233,282 | |

| DNO ASA | | | 266,580 | | | | 513,250 | |

| Equinor ASA | | | 48,264 | | | | 1,255,581 | |

| Leroy Seafood Group ASA | | | 124,475 | | | | 1,147,028 | |

| Marine Harvest ASA | | | 90,371 | | | | 2,186,966 | |

| Norsk Hydro ASA | | | 96,822 | | | | 502,613 | |

| Petroleum Geo-Services ASA(a) | | | 83,795 | | | | 261,828 | |

| Salmar ASA | | | 16,124 | | | | 851,168 | |

| TGS NOPEC Geophysical Co. ASA | | | 21,048 | | | | 706,361 | |

| Yara International ASA | | | 72,477 | | | | 3,118,391 | |

| | | | | | | | 11,629,615 | |

| | | | | | | | | |

| Peru (0.11%) | | | | | | | | |

| Southern Copper Corp. | | | 19,506 | | | | 747,860 | |

| | | | | | | | | |

| Singapore (0.15%) | | | | | | | | |

| Sembcorp Marine, Ltd. | | | 61,200 | | | | 70,693 | |

| Wilmar International, Ltd. | | | 445,761 | | | | 1,016,933 | |

| | | | | | | | 1,087,626 | |

| | | | | | | | | |

| South Africa (0.23%) | | | | | | | | |

| Exxaro Resources, Ltd. | | | 59,833 | | | | 612,018 | |

| Kumba Iron Ore, Ltd. | | | 15,133 | | | | 296,454 | |

| Sasol, Ltd. | | | 21,246 | | | | 697,039 | |

| | | | | | | | 1,605,511 | |

| | | | | | | | | |

| South Korea (0.03%) | | | | | | | | |

| POSCO, Sponsored ADR | | | 3,761 | | | | 216,709 | |

| | | | | | | | | |

| Spain (0.04%) | | | | | | | | |

| Acerinox SA | | | 27,354 | | | | 305,735 | |

| | | | | | | | | |

| Sweden (0.36%) | | | | | | | | |

| Boliden AB | | | 61,249 | | | | 1,399,849 | |

| Holmen AB, B Shares | | | 19,366 | | | | 443,775 | |

| Lundin Petroleum AB | | | 12,829 | | | | 391,691 | |

| SSAB AB, A Shares | | | 72,672 | | | | 290,254 | |

| | | | | | | | 2,525,569 | |

| | | | | | | | | |

| Switzerland (0.11%) | | | | | | | | |

| Bucher Industries AG | | | 594 | | | | 163,960 | |

| Ferrexpo PLC | | | 135,944 | | | | 362,992 | |

| Glencore PLC | | | 46,220 | | | | 188,372 | |

| Weatherford International PLC(a) | | | 20,498 | | | | 27,672 | |

| | | | | | | | 742,996 | |

| | | | | | | | | |

| United Kindom (0.11%) | | | | | | | | |

| CNH Industrial N.V. | | | 76,926 | | | | 799,261 | |

| | | | | | | | | |

| United States (9.48%) | | | | | | | | |

| AGCO Corp. | | | 27,270 | | | | 1,528,211 | |

| AK Steel Holding Corp.(a) | | | 135,146 | | | | 500,040 | |

| Alcoa Corp.(a) | | | 10,361 | | | | 362,531 | |

| Allegheny Technologies, Inc.(a) | | | 2,903 | | | | 75,159 | |

| American States Water Co. | | | 6,377 | | | | 390,400 | |

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund

| Consolidated Statement of Investments | October 31, 2018 |

| | | Shares | | | Value (Note 2) | |

| United States (continued) | | | | | | | | |

| American Water Works Co., Inc. | | | 1,372 | | | $ | 121,463 | |

| Anadarko Petroleum Corp. | | | 9,595 | | | | 510,454 | |

| Andersons, Inc. | | | 11,781 | | | | 424,116 | |

| Antero Resources Corp.(a) | | | 34,762 | | | | 552,368 | |

| Apache Corp. | | | 25,949 | | | | 981,651 | |

| Aqua America, Inc. | | | 27,724 | | | | 901,862 | |

| Archer-Daniels-Midland Co. | | | 23,653 | | | | 1,117,604 | |

| Baker Hughes a GE Co. | | | 13,729 | | | | 366,427 | |

| Bonanza Creek Energy, Inc.(a) | | | 9,572 | | | | 246,479 | |

| Bristow Group, Inc.(a) | | | 13,094 | | | | 144,165 | |

| Bunge, Ltd. | | | 28,517 | | | | 1,762,351 | |

| C&J Energy Services, Inc.(a) | | | 15,972 | | | | 299,954 | |

| Cabot Oil & Gas Corp. | | | 18,573 | | | | 450,024 | |

| California Resources Corp.(a) | | | 12,276 | | | | 384,730 | |

| California Water Service Group | | | 7,330 | | | | 307,860 | |

| Cal-Maine Foods, Inc. | | | 29,240 | | | | 1,423,111 | |

| Carpenter Technology Corp. | | | 11,547 | | | | 503,565 | |

| Carrizo Oil & Gas, Inc.(a) | | | 35,614 | | | | 648,531 | |

| Century Aluminum Co.(a) | | | 18,820 | | | | 149,431 | |

| CF Industries Holdings, Inc. | | | 9,620 | | | | 462,049 | |

| Chesapeake Energy Corp.(a) | | | 11,489 | | | | 40,326 | |

| Chevron Corp. | | | 9,188 | | | | 1,025,840 | |

| Cliffs Natural Resources, Inc.(a) | | | 42,406 | | | | 456,289 | |

| CNX Resources Corp.(a) | | | 13,252 | | | | 207,394 | |

| Compass Minerals International, Inc. | | | 13,897 | | | | 674,143 | |

| ConocoPhillips | | | 6,841 | | | | 478,186 | |

| Continental Resources, Inc.(a) | | | 25,931 | | | | 1,366,045 | |

| Darling Ingredients, Inc.(a) | | | 39,609 | | | | 818,322 | |

| Deere & Co. | | | 10,428 | | | | 1,412,368 | |

| Denbury Resources, Inc.(a) | | | 66,558 | | | | 229,625 | |

| Devon Energy Corp. | | | 23,480 | | | | 760,752 | |

| Diamond Offshore Drilling, Inc.(a) | | | 31,745 | | | | 450,144 | |

| Dril-Quip, Inc.(a) | | | 13,034 | | | | 554,727 | |

| Energy Recovery, Inc.(a) | | | 41,392 | | | | 310,440 | |

| EOG Resources, Inc. | | | 10,750 | | | | 1,132,405 | |

| EQT Corp. | | | 7,871 | | | | 267,378 | |

| Exterran Corp.(a) | | | 4,841 | | | | 101,128 | |

| Extraction Oil & Gas, Inc.(a) | | | 27,255 | | | | 217,767 | |

| Exxon Mobil Corp. | | | 7,125 | | | | 567,720 | |

| First Solar, Inc.(a) | | | 6,824 | | | | 285,243 | |

| FMC Corp. | | | 10,214 | | | | 797,509 | |

| Forum Energy Technologies, Inc.(a) | | | 14,276 | | | | 127,913 | |

| Freeport-McMoRan, Inc. | | | 64,970 | | | | 756,901 | |

| Fresh Del Monte Produce, Inc. | | | 9,031 | | | | 298,294 | |

| Gulfport Energy Corp.(a) | | | 35,874 | | | | 326,812 | |

| Halcon Resources Corp.(a) | | | 103,746 | | | | 344,437 | |

| Halliburton Co. | | | 13,093 | | | | 454,065 | |

| Harsco Corp.(a) | | | 20,191 | | | | 554,647 | |

| Helix Energy Solutions Group, Inc.(a) | | | 35,512 | | | | 302,562 | |

| Helmerich & Payne, Inc. | | | 4,326 | | | | 269,467 | |

| Hess Corp. | | | 1,505 | | | | 86,387 | |

| HollyFrontier Corp. | | | 28,340 | | | | 1,911,249 | |

| Ingredion, Inc. | | | 17,790 | | | | 1,799,992 | |

| Kinder Morgan, Inc. | | | 5,763 | | | | 98,086 | |

| Kosmos Energy, Ltd.(a) | | | 71,459 | | | | 463,769 | |

| Marathon Oil Corp. | | | 8,340 | | | | 158,377 | |

| Marathon Petroleum Corp. | | | 31,343 | | | | 2,208,113 | |

| | | Shares | | | Value (Note 2) | |

| United States (continued) | | | | | | | | |

| Matador Resources Co.(a) | | | 18,081 | | | $ | 521,456 | |

| McDermott International, Inc.(a) | | | 25,657 | | | | 198,329 | |

| Mosaic Co. | | | 12,802 | | | | 396,094 | |

| Murphy Oil Corp. | | | 45,632 | | | | 1,453,836 | |

| Nabors Industries, Ltd. | | | 176,847 | | | | 878,930 | |

| National Oilwell Varco, Inc. | | | 3,499 | | | | 128,763 | |

| Newfield Exploration Co.(a) | | | 30,453 | | | | 615,151 | |

| Noble Energy, Inc. | | | 28,251 | | | | 702,037 | |

| Oceaneering International, Inc.(a) | | | 47,381 | | | | 897,396 | |

| Oil States International, Inc.(a) | | | 23,227 | | | | 517,265 | |

| Patterson-UTI Energy, Inc. | | | 43,886 | | | | 730,263 | |

| PDC Energy, Inc.(a) | | | 20,568 | | | | 873,112 | |

| Phillips 66 | | | 10,779 | | | | 1,108,297 | |

| Pilgrim's Pride Corp.(a) | | | 143,550 | | | | 2,535,092 | |

| PotlatchDeltic Corp. REIT | | | 19,499 | | | | 706,839 | |

| ProPetro Holding Corp.(a) | | | 19,678 | | | | 347,317 | |

| QEP Resources, Inc.(a) | | | 56,900 | | | | 506,979 | |

| Range Resources Corp. | | | 26,273 | | | | 416,427 | |

| Rayonier, Inc. REIT | | | 30,244 | | | | 913,369 | |

| Rexnord Corp.(a) | | | 48,783 | | | | 1,307,872 | |

| Rowan Cos. PLC, Class A(a) | | | 104,809 | | | | 1,667,511 | |

| RPC, Inc. | | | 62,124 | | | | 924,405 | |

| Sanderson Farms, Inc. | | | 6,358 | | | | 625,564 | |

| Schlumberger, Ltd. | | | 8,909 | | | | 457,121 | |

| Schnitzer Steel Industries, Inc., Class A | | | 18,302 | | | | 492,324 | |

| SJW Group | | | 6,870 | | | | 417,215 | |

| Southwestern Energy Co.(a) | | | 26,093 | | | | 139,337 | |

| SRC Energy, Inc.(a) | | | 97,972 | | | | 693,642 | |

| SunCoke Energy, Inc.(a) | | | 10,819 | | | | 121,173 | |

| Superior Energy Services, Inc.(a) | | | 76,267 | | | | 597,171 | |

| TimkenSteel Corp.(a) | | | 6,351 | | | | 73,862 | |

| TPI Composites, Inc.(a) | | | 976 | | | | 24,654 | |

| Transocean, Ltd.(a) | | | 31,936 | | | | 351,615 | |

| Tyson Foods, Inc., Class A | | | 41,839 | | | | 2,506,992 | |

| United States Steel Corp. | | | 18,276 | | | | 484,862 | |

| US Silica Holdings, Inc. | | | 14,303 | | | | 200,242 | |

| Valero Energy Corp. | | | 20,330 | | | | 1,851,859 | |

| W&T Offshore, Inc.(a) | | | 98,879 | | | | 666,444 | |

| Walter Energy, Inc.(a) | | | 68,768 | | | | 76 | |

| Weyerhaeuser Co. REIT | | | 42,390 | | | | 1,128,846 | |

| WildHorse Resource Development Corp.(a) | | | 32,810 | | | | 695,900 | |

| Williams Cos., Inc. | | | 1,855 | | | | 45,132 | |

| | | | | | | | 66,850,129 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $146,217,158) | | | | | | | 139,055,891 | |

| | | | | | | | | |

| MASTER LIMITED PARTNERSHIPS (0.17%) |

| United States (0.17%) | | | | | | | | |

| Alliance Resource Partners LP | | | 29,972 | | | | 575,163 | |

| Buckeye Partners LP | | | 977 | | | | 32,055 | |

| Energy Transfer LP | | | 4,974 | | | | 77,296 | |

| Enterprise Products Partners LP | | | 10,676 | | | | 286,330 | |

| Magellan Midstream Partners LP | | | 2,054 | | | | 126,691 | |

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund

| Consolidated Statement of Investments | October 31, 2018 |

| | | Shares | | | Value (Note 2) | |

| United States (continued) | | | | | | | | |

| MPLX LP | | | 1,555 | | | $ | 52,264 | |

| Plains All American Pipeline LP | | | 3,090 | | | | 67,269 | |

| | | | | | | | 1,217,068 | |

| | | | | | | | | |

| TOTAL MASTER LIMITED PARTNERSHIPS |

| (Cost $1,628,286) | | | | | | | 1,217,068 | |

| | | | | | | | | |

| | | Principal Amount | | | | Value (Note 2) | |

| GOVERNMENT BONDS (70.35%) | | | | | | | | |

| U.S. Treasury Bonds (70.35%) | | | | | | | | |

| United States Treasury Inflation Indexed Bonds | | | | | | | | |

| 0.125%, 4/15/19(c) | | $ | 245,384,722 | | | $ | 243,261,570 | |

| 0.125%, 4/15/20(c) | | | 25,302,450 | | | | 24,869,870 | |

| United States Treasury Notes | | | | | | | | |

| 1.625%, 3/31/19 | | | 23,250,000 | | | | 23,172,803 | |

| 1.500%, 3/31/19 | | | 56,500,000 | | | | 56,288,125 | |

| 0.875%, 5/15/19 | | | 31,500,000 | | | | 31,228,682 | |

| 1.625%, 7/31/19 | | | 88,400,000 | | | | 87,762,898 | |

| 2.375%, 4/30/20 | | | 30,000,000 | | | | 29,803,125 | |

| | | | | | | | 496,387,073 | |

| TOTAL GOVERNMENT BONDS | | | | | |

| (Cost $499,589,371) | | | | 496,387,073 | |

| | | Value (Note 2) | |

| TOTAL INVESTMENTS (90.23%) | | | | |

| (Cost $647,434,815) | | $ | 636,660,032 | |

| | | | | |

| Other Assets In Excess Of Liabilities (9.77%) | | | 68,963,207 | |

| NET ASSETS - 100.00% | | $ | 705,623,239 | |

| (a) | Non-Income Producing Security. |

| (b) | Securities were purchased pursuant to Regulation S under the Securities Act of 1933, which exempts securities offered and sold outside of the United States from registration. Such securities cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from registration. These securities have been deemed liquid under guidelines approved by the Fund's Board of Trustees. As of October 31, 2018 the aggregate market value of those securities was $233,282 representing 0.033% of net assets. |

| (c) | Security, or portion of security, is being held as collateral for total return swap contracts and futures contracts aggregating a total market value of $48,109,179. |

For Fund compliance purposes, the Fund's industry and geographical classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries and regions are shown as a percent of net assets.

See Notes to Financial Statements.

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund

| Consolidated Statement of Investments | October 31, 2018 |

FUTURES CONTRACTS

| Description | | Counterparty | | Position | | | Contracts | | | Expiration Date | | Notional Amount/Fair Value (Note 2) | | | Unrealized Appreciation | |

| Coffee 'C' Future | | Morgan Stanley & Co., LLC | | Long | | | 171 | | | 11/30/18 | | $ | 7,226,888 | | | $ | 948,965 | |

| Copper Future | | Morgan Stanley & Co., LLC | | Short | | | (401) | | | 03/27/19 | | | (26,846,950 | ) | | | 1,206,658 | |

| LME Zinc Future | | Morgan Stanley & Co., LLC | | Long | | | 12 | | | 11/30/18 | | | 754,425 | | | | 29,234 | |

| Natural Gas Future | | Morgan Stanley & Co., LLC | | Long | | | 658 | | | 11/28/18 | | | 21,457,380 | | | | 1,186,361 | |

| Platinum Future | | Morgan Stanley & Co., LLC | | Long | | | 173 | | | 01/29/19 | | | 7,291,950 | | | | 110,292 | |

| Sugar #11 Future | | Morgan Stanley & Co., LLC | | Long | | | 240 | | | 02/28/19 | | | 3,545,472 | | | | 528,856 | |

| WTI Crude Future | | Morgan Stanley & Co., LLC | | Short | | | (746) | | | 11/19/18 | | | (48,721,260 | ) | | | 4,847,615 | |

| | | | | | | | | | | | | $ | (35,292,095 | ) | | $ | 8,857,981 | |

| Description | | Counterparty | | Position | | | Contracts | | | Expiration Date | | Notional Amount/Fair Value (Note 2) | | | Unrealized Depreciation | |

| Brent Crude Future | | Morgan Stanley & Co., LLC | | Long | | | 902 | | | 11/30/18 | | $ | 67,686,080 | | | $ | (3,629,884 | ) |

| Coffee Robusta Future | | Morgan Stanley & Co., LLC | | Short | | | (319) | | | 01/25/19 | | | (5,343,250 | ) | | | (592,275 | ) |

| Gold 100 Oz Future | | Morgan Stanley & Co., LLC | | Long | | | 86 | | | 12/27/18 | | | 10,449,000 | | | | (16,396 | ) |

| LME Copper Future | | Morgan Stanley & Co., LLC | | Long | | | 191 | | | 11/30/18 | | | 28,654,775 | | | | (772,092 | ) |

| LME Nickel Future | | Morgan Stanley & Co., LLC | | Long | | | 52 | | | 11/30/18 | | | 3,577,548 | | | | (309,013 | ) |

| Silver Future | | Morgan Stanley & Co., LLC | | Long | | | 217 | | | 12/27/18 | | | 15,495,970 | | | | (586,718 | ) |

| Soybean Future | | Morgan Stanley & Co., LLC | | Long | | | 258 | | | 01/14/19 | | | 10,987,575 | | | | (273,425 | ) |

| Soybean Meal Future | | Morgan Stanley & Co., LLC | | Long | | | 97 | | | 12/14/18 | | | 2,972,080 | | | | (146,307 | ) |

| | | | | | | | | | | | | $ | 134,479,778 | | | $ | (6,326,110 | ) |

TOTAL RETURN SWAP CONTRACTS(a)

| Swap Counterparty | | Reference Obligation | | Notional Amount | | | Floating Rate Paid by Fund | | Termination Date | | Value | | | Unrealized Appreciation | |

| Citigroup | | CRB 3m Fwd TR Index ** | | $ | 133,940,149 | | | USB3MTA + 24 bps* | | 9/30/19 | | $ | 133,940,657 | | | $ | 508 | |

| UBS | | CRB 3m Fwd TR Index ** | | | 73,680,577 | | | USB3MTA + 32 bps* | | 11/30/18 | | | 73,680,860 | | | | 283 | |

| Societe Generale | | CRB 3m Fwd TR Index ** | | | 72,763,784 | | | USB3MTA + 35 bps* | | 11/30/18 | | | 72,764,061 | | | | 277 | |

| Bank of America - Merrill Lynch | | CRB 3m Fwd TR Index ** | | | 168,432,685 | | | USB3MTA + 30 bps* | | 6/28/19 | | | 168,432,687 | | | | 2 | |

| | | | | $ | 448,817,195 | | | | | | | $ | 448,818,265 | | | $ | 1,070 | |

| (a) | For long positions in the total return swap, the Fund receives payments based on any positive return of the Reference Obligation less the rate paid by the Fund. The Fund makes payments on any negative return of such Reference Obligations plus the rate paid by the fund. For short positions in the total return swap, the Fund makes payments based on any positive return of the Reference Obligation less the rate paid by the Fund. The Fund receives payments on any negative return of such Reference Obligations plus the rate paid by the Fund. |

| * | United States Auction Results 3 Month Treasury Bill High Discount. Total return swap resets monthly. |

| ** | CRB - Commodity Research Bureau |

See Notes to Financial Statements.

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund

| Consolidated Statement of Assets and Liabilities | October 31, 2018 |

| ASSETS | | | |

| Investments, at value | | $ | 636,660,032 | |

| Cash | | | 64,157,735 | |

| Foreign currency, at value (Cost $294,399) | | | 292,885 | |

| Unrealized appreciation on total return swap contracts | | | 1,070 | |

| Receivable for shares sold | | | 15,538,048 | |

| Receivable for investments sold | | | 438,113 | |

| Receivable for variation margin on futures contracts | | | 187,359 | |

| Dividends and interest receivable | | | 860,699 | |

| Prepaid expenses and other assets | | | 37,482 | |

| Total Assets | | | 718,173,423 | |

| LIABILITIES | | | | |

| Payable due to broker for total return swap contracts | | | 9,133,091 | |

| Payable due to broker for futures contracts | | | 1,043,076 | |

| Payable for shares redeemed | | | 1,499,680 | |

| Investment advisory fees payable | | | 515,781 | |

| Administration and transfer agency fees payable | | | 208,149 | |

| Distribution and services fees payable | | | 36,814 | |

| Trustees' fees and expenses payable | | | 2,236 | |

| Professional fees payable | | | 42,512 | |

| Accrued expenses and other liabilities | | | 68,845 | |

| Total Liabilities | | | 12,550,184 | |

| NET ASSETS | | $ | 705,623,239 | |

| NET ASSETS CONSIST OF | | | | |

| Paid-in capital | | $ | 747,116,593 | |

| Total distributable earnings | | | (41,493,354 | ) |

| NET ASSETS | | $ | 705,623,239 | |

| INVESTMENTS, AT COST | | $ | 647,434,815 | |

| | | | | |

| PRICING OF SHARES | | | | |

| Investor Class: | | | | |

| Net Asset Value, offering and redemption price per share | | $ | 7.54 | |

| Net Assets | | $ | 48,727,793 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 6,462,445 | |

| Class A: | | | | |

| Net Asset Value, offering and redemption price per share | | $ | 7.54 | |

| Net Assets | | $ | 190,704 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 25,286 | |

| Maximum offering price per share ((NAV/0.9450), based on maximum sales charge of 5.50% of the offering price) | | $ | 7.98 | |

| Class C: | | | | |

| Net Asset Value, offering and redemption price per share(a) | | $ | 7.22 | |

| Net Assets | | $ | 9,510,027 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 1,317,054 | |

| Class I: | | | | |

| Net Asset Value, offering and redemption price per share | | $ | 7.58 | |

| Net Assets | | $ | 647,194,715 | |

| Shares of beneficial interest outstanding (unlimited number of shares, no par value common stock authorized) | | | 85,353,809 | |

| (a) | Redemption price per share may be reduced for any applicable contingent deferred sales charge. For a description of a possible sales charge, please see the Fund's Prospectus. |

See Notes to Financial Statements.

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund

| Consolidated Statement of Operations | For the Year Ended October 31, 2018 |

| INVESTMENT INCOME | | | |

| Dividends | | $ | 3,940,484 | |

| Foreign taxes withheld on dividends | | | (290,927 | ) |

| Interest and other income, net of premium amortization and accretion of discount | | | 9,179,892 | |

| Total Investment Income | | | 12,829,449 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees | | | 5,365,034 | |

| Investment advisory fees - subsidiary (Note 8) | | | 999,885 | |

| Administrative fees | | | 716,649 | |

| Transfer agency fees | | | 607,468 | |

| Distribution and service fees | | | | |

| Investor Class(a) | | | 185,454 | |

| Class A(b) | | | 126 | |

| Class C | | | 87,935 | |

| Professional fees | | | 49,072 | |

| Reports to shareholders and printing fees | | | 116,912 | |

| State registration fees | | | 64,248 | |

| Insurance fees | | | 4,018 | |

| Custody fees | | | 65,572 | |

| Trustees' fees and expenses | | | 19,525 | |

| Repayment of previously waived fees | | | | |

| Investor Class(a) | | | 6,800 | |

| Class C | | | 1,645 | |

| Class I | | | 46,891 | |

| Miscellaneous expenses | | | 24,188 | |

| Total Expenses | | | 8,361,422 | |

| Less fees waived/reimbursed by investment advisor (Note 8) | | | | |

| Waiver of investment advisory fees - subsidiary | | | (999,885 | ) |

| Class A(b) | | | (10 | ) |

| Net Expenses | | | 7,361,527 | |

| Net Investment Income | | | 5,467,922 | |

| Net realized gain on investments | | | 269,103 | |

| Net realized gain on futures contracts | | | 5,493,863 | |

| Net realized gain on total return swap contracts | | | 7,759,107 | |

| Net realized loss on foreign currency transactions | | | (29,234 | ) |

| Net Realized Gain | | | 13,492,839 | |

| Net change in unrealized depreciation on investments | | | (19,867,950 | ) |

| Net change in unrealized appreciation on futures contracts | | | 260,536 | |

| Net change in unrealized appreciation on total return swap contracts | | | 1,190 | |

| Net change in unrealized depreciation on translation of assets and liabilities denominated in foreign currencies | | | (10,426 | ) |

| Net Change in Unrealized Depreciation | | | (19,616,650 | ) |

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | (6,123,811 | ) |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (655,889 | ) |

| (a) | Prior to December 1, 2017, Investor Class was known as Class A. |

| (b) | Class A commenced operations on June 12, 2018. |

See Notes to Financial Statements.

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund

Consolidated Statements of Changes in Net Assets

| | | For the Year Ended October 31, 2018 | | | For the Year Ended October 31, 2017 | |

| OPERATIONS | | | | | | |

| Net investment income | | $ | 5,467,922 | | | $ | 287,848 | |

| Net realized gain | | | 13,492,839 | | | | 6,803,365 | |

| Net change in unrealized appreciation/(depreciation) | | | (19,616,650 | ) | | | 14,722,728 | |

| Net Increase/(Decrease) in Net Assets Resulting from Operations | | | (655,889 | ) | | | 21,813,941 | |

| | | | | | | | | |

| TOTAL DISTRIBUTIONS(a) | | | | | | | | |

| From distributable earnings | | | | | | | | |

| Investor Class(b) | | | (1,159,806 | ) | | | (15,061 | ) |

| Class C | | | (187,271 | ) | | | – | |

| Class I | | | (11,870,472 | ) | | | (491,956 | ) |

| Net Decrease in Net Assets from Distributions | | | (13,217,549 | ) | | | (507,017 | ) |

| | | | | | | | | |

| BENEFICIAL INTEREST TRANSACTIONS (NOTE 6) | | | | | | | | |

| Shares sold | | | | | | | | |

| Investor Class(b) | | | 18,832,619 | | | | 29,389,655 | |

| Class A(c) | | | 195,323 | | | | – | |

| Class C | | | 4,136,291 | | | | 3,802,844 | |

| Class I | | | 322,824,182 | | | | 213,799,975 | |

| Dividends reinvested | | | | | | | | |

| Investor Class(b) | | | 1,099,833 | | | | 12,719 | |

| Class C | | | 111,922 | | | | – | |

| Class I | | | 10,390,433 | | | | 450,481 | |

| Shares redeemed, net of redemption fees | | | | | | | | |

| Investor Class(b) | | | (18,297,033 | ) | | | (12,292,578 | ) |

| Class C | | | (2,104,665 | ) | | | (3,621,065 | ) |

| Class I | | | (155,888,526 | ) | | | (215,121,025 | ) |

| Net Increase in Net Assets Derived from Beneficial Interest Transactions | | | 181,300,379 | | | | 16,421,006 | |

| | | | | | | | | |

| Net increase in net assets | | | 167,426,941 | | | | 37,727,930 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 538,196,298 | | | | 500,468,368 | |

| End of year | | $ | 705,623,239 | | | $ | 538,196,298 | (d) |

| (a) | For the prior year ended October 31, 2017, Total Distributions consisted of Net Investment Income $507,017, and Net Realized Gains $–. |

| (b) | Prior to December 1, 2017, Investor Class was known as Class A. |

| (c) | Class A commenced operations on June 12, 2018. |

| (d) | For the prior year ended October 31, 2017, included accumulated net investment income of $11,459,725. |

See Notes to Financial Statements.

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund – Investor Class

Consolidated Financial Highlights

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

| | | For the Year Ended October 31, 2018(a) | | | For the Year Ended October 31, 2017 | | | For the Year Ended October 31, 2016 | | | For the Year Ended October 31, 2015 | | | For the Fiscal Period Ended October 31, 2014(b) | | | For the Year Ended April 30, 2014 | |

| Net asset value, beginning of period(c) | | $ | 7.64 | | | $ | 7.29 | | | $ | 7.15 | | | $ | 9.56 | | | $ | 10.87 | | | $ | 10.40 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income/(loss)(d) | | | 0.05 | | | | (0.01 | )(e) | | | (0.03 | )(e) | | | (0.09 | )(e) | | | 0.00 | (e)(f) | | | (0.06 | )(e) |

| Net realized and unrealized gain/(loss) | | | 0.04 | | | | 0.36 | | | | 0.17 | | | | (2.32 | ) | | | (1.31 | ) | | | 0.53 | |

| Total from investment operations | | | 0.09 | | | | 0.35 | | | | 0.14 | | | | (2.41 | ) | | | (1.31 | ) | | | 0.47 | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.19 | ) | | | (0.00 | )(f) | | | – | | | | – | | | | – | | | | – | |

| Total distributions | | | (0.19 | ) | | | (0.00 | )(f) | | | – | | | | – | | | | – | | | | – | |

| REDEMPTION FEES ADDED TO PAID-IN CAPITAL (NOTE 6) | | | 0.00 | (f) | | | 0.00 | (f) | | | 0.00 | (f) | | | 0.00 | (f) | | | 0.00 | (f) | | | 0.00 | (f) |

| Net increase/(decrease) in net asset value | | | (0.10 | ) | | | 0.35 | | | | 0.14 | | | | (2.41 | ) | | | (1.31 | ) | | | 0.47 | |

| Net asset value, end of year | | $ | 7.54 | | | $ | 7.64 | | | $ | 7.29 | | | $ | 7.15 | | | $ | 9.56 | | | $ | 10.87 | |

| TOTAL RETURN(g) | | | 1.23 | % | | | 4.85 | % | | | 1.96 | % | | | (25.21 | )% | | | (12.05 | )% | | | 4.52 | % |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000s) | | $ | 48,728 | | | $ | 47,845 | | | $ | 29,468 | | | $ | 30,085 | | | $ | 39,971 | | | $ | 112,562 | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements | | | 1.40 | %(h) | | | 1.38 | % | | | 1.41 | % | | | 1.47 | % | | | 1.46 | %(i) | | | 1.50 | % |

| Ratio of expenses to average net assets including fee waivers and reimbursements | | | 1.40 | % | | | 1.38 | % | | | 1.41 | % | | | 1.45 | % | | | 1.45 | %(i) | | | 1.45 | % |

| Ratio of net investment income/(loss) to average net assets | | | 0.66 | % | | | (0.10 | )% | | | (0.48 | )% | | | (1.12 | )% | | | 0.09 | %(i) | | | (0.60 | )% |

| Portfolio turnover rate(j) | | | 42 | % | | | 66 | % | | | 50 | % | | | 52 | % | | | 12 | % | | | 28 | % |

| (a) | Prior to December 1, 2017, Investor Class was known as Class A. |

| (b) | Effective May 1, 2014, the Board approved changing the fiscal year-end of the Funds from April 30 to October 31. |

| (c) | Per share amounts and ratios to average net assets include income and expenses of the CoreCommodity Management Cayman Commodity Fund Ltd. (wholly-owned subsidiary). |

| (d) | Calculated using the average shares method. |

| (e) | The per share amount does not correspond to activity reflected in the Statement of Operations due to class specific expenses during the period. |

| (f) | Less than $0.005 or ($0.005) per share. |

| (g) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown exclude any applicable sales charges. |

| (h) | The ratio of operating expenses excluding fee waiver/reimbursements to average net assets is calculated excluding the waived Subsidiary management fee (see Note 8 for additional detail). The ratio inclusive of that fee would be 1.56%. |

| (j) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund – Class A

Consolidated Financial Highlights

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

| | | For the Period June 12, 2018 (Commencement of Operations) to October 31, 2018 | |

| Net asset value, beginning of period(a) | | $ | 8.16 | |

| | | | | |

| INCOME FROM INVESTMENT OPERATIONS: | | | | |

| Net investment income(b) | | | (0.00 | )(c) |

| Net realized and unrealized loss | | | (0.62 | ) |

| Total from investment operations | | | (0.62 | ) |

| | | | | |

| Net (decrease) in net asset value | | | (0.62 | ) |

| Net asset value, end of year | | $ | 7.54 | |

| TOTAL RETURN(d) | | | (7.60 | )% |

| | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | |

| Net assets, end of year (000s) | | $ | 191 | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements | | | 1.48 | %(e)(f) |

| Ratio of expenses to average net assets including fee waivers and reimbursements | | | 1.45 | %(e) |

| Ratio of net investment loss to average net assets | | | (0.10 | %)(e) |

| Portfolio turnover rate(g) | | | 42 | % |

| (a) | Per share amounts and ratios to average net assets include income and expenses of the CoreCommodity Management Cayman Commodity Fund Ltd. (wholly-owned subsidiary). |

| (b) | Calculated using the average shares method. |

| (c) | Less than $0.005 or ($0.005) per share. |

| (d) | Total returns are for the period indicated and have not been annualized. Total returns would have been lower had certain expenses not been waived during the period. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (f) | The ratio of operating expenses excluding fee waiver/reimbursements to average net assets is calculated excluding the waived Subsidiary management fee (see Note 8 for additional detail). The ratio inclusive of that fee would be 1.64%. |

| (g) | Portfolio turnover rate for periods less than one full year have not been annualized. |

See Notes to Financial Statements.

ALPS | CoreCommodity Management CompleteCommodities® Strategy Fund – Class C

Consolidated Financial Highlights

Selected data for a share of beneficial interest outstanding throughout the periods indicated:

| | | For the Year Ended October 31, 2018 | | | For the Year Ended October 31, 2017 | | | For the Year Ended October 31, 2016 | | | For the Year Ended October 31, 2015 | | | For the Fiscal Period Ended October 31, 2014(a) | | | For the Year Ended April 30, 2014 | |

| Net asset value, beginning of period(b) | | $ | 7.36 | | | $ | 7.07 | | | $ | 6.98 | | | $ | 9.39 | | | $ | 10.71 | | | $ | 10.31 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment loss(c) | | | (0.00 | )(d)(e) | | | (0.06 | )(e) | | | (0.08 | )(e) | | | (0.14 | )(e) | | | (0.04 | )(e) | | | (0.12 | )(e) |

| Net realized and unrealized gain/(loss) | | | 0.04 | | | | 0.35 | | | | 0.17 | | | | (2.27 | ) | | | (1.28 | ) | | | 0.52 | |

| Total from investment operations | | | 0.04 | | | | 0.29 | | | | 0.09 | | | | (2.41 | ) | | | (1.32 | ) | | | 0.40 | |

| DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.18 | ) | | | – | | | | – | | | | – | | | | – | | | | – | |

| Total distributions | | | (0.18 | ) | | | – | | | | – | | | | – | | | | – | | | | – | |

| REDEMPTION FEES ADDED TO PAID-IN CAPITAL (NOTE 6) | | | – | | | | – | | | | – | | | | 0.00 | (d) | | | 0.00 | (d) | | | 0.00 | (d) |

| Net increase/(decrease) in net asset value | | | (0.14 | ) | | | 0.29 | | | | 0.09 | | | | (2.41 | ) | | | (1.32 | ) | | | 0.40 | |

| Net asset value, end of year | | $ | 7.22 | | | $ | 7.36 | | | $ | 7.07 | | | $ | 6.98 | | | $ | 9.39 | | | $ | 10.71 | |

| TOTAL RETURN(f) | | | 0.62 | % | | | 4.10 | % | | | 1.29 | % | | | (25.67 | )% | | | (12.32 | )% | | | 3.88 | % |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000s) | | $ | 9,510 | | | $ | 7,642 | | | $ | 7,260 | | | $ | 8,335 | | | $ | 12,534 | | | $ | 13,996 | |

| Ratio of expenses to average net assets excluding fee waivers and reimbursements | | | 2.05 | %(g) | | | 2.05 | % | | | 2.05 | % | | | 2.07 | % | | | 2.07 | %(h) | | | 2.10 | % |