UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08194

FINANCIAL INVESTORS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Karen Gilomen, Esq., Secretary

Financial Investors Trust

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code:303-623-2577

Date of fiscal year end:April 30

Date of reporting period:April 30, 2019

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

ANNUAL REPORT

| SHAREHOLDER LETTER | 1 |

| PERFORMANCE UPDATE | 3 |

| DISCLOSURE OF FUND EXPENSES | 5 |

| PORTFOLIO OF INVESTMENTS | 6 |

| STATEMENT OF ASSETS AND LIABILITIES | 18 |

| STATEMENT OF OPERATIONS | 19 |

| STATEMENTS OF CHANGES IN NET ASSETS | 20 |

| FINANCIAL HIGHLIGHTS | 22 |

| NOTES TO FINANCIAL STATEMENTS | 24 |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 32 |

| ADDITIONAL INFORMATION | 33 |

| DISCLOSURE REGARDING APPROVAL OF FUND ADVISORY AGREEMENTS | 34 |

| TRUSTEES AND OFFICERS | 37 |

| PRIVACY POLICY | 42 |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website atwww.dgifund.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

Beginning on January 1, 2019, you may, notwithstanding the availability of shareholder reports online, elect to receive all future shareholder reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1.855.DGI.FUND (1-855-344-3863) to let the Fund know you wish to continue receiving paper copies of your shareholder reports.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling atwww.dgifund.com.

Disciplined Growth Investors’ goal is to communicate clearly and transparently with our clients and mutual fund shareholders. It is mutually beneficial when our shareholders understand how we invest, what we are currently thinking and forecasting, and the specific investment decisions we have made. Our views and opinions regarding the investment prospects of our portfolio holdings and the Fund are “forward looking statements” which may or may not be accurate over the long term. While we believe we have a reasonable basis for these forecasts and have confidence in our investment team’s views, actual results may differ materially from those we anticipate. Information provided in this report should not be considered a recommendation to purchase or sell any particular security.

You can identify forward looking statements as those including words such as “believe”, “expect”, “anticipate”, “forecast”, and similar statement. We cannot assure future performance. These forward-looking statements are made only as-of the date of this report. Following the publication of this report, we will not update any of the forward-looking statements included here.

This material must be preceded or accompanied by a prospectus. Please read the prospectus carefully before investing.

| The Disciplined Growth Investors Fund | Shareholder Letter |

April 30, 2019 (Unaudited)

Fund Performance and Asset Mix:

The DGI Fund’s fiscal year ended on April 30th. For the 2018 fiscal year (5/1/18-4/30/19), The DGI Fund returned 14.74%.

Stocks in The DGI Fund increased 19.45% and outperformed the S&P 500® Index, which increased 13.49%. The DGI Fund held 38 stocks that increased in value and 15 stocks that declined in value.

Bonds in the Fund returned 6.20%, outperforming the Barclays Government & Corporate Credit Index which gained 5.29% during the fiscal year. This represented the highest bond performance in the Fund for any fiscal year since inception (2011).

This fiscal year included a bear market during the fourth quarter of the 2018 calendar year, when the S&P 500 fell over 20% below its previous high point. The DGI Fund’s equities declined in a similar magnitude to the S&P 500. To start the 2019 calendar year, The DGI Fund rebounded and set new all-time high NAV of $21.26 on April 16th.

With 70.0% stocks and 30.0% bonds & cash as of 4/30/19, we have positioned the Fund to reflect our work which shows expected returns for the Fund’s stocks materially in excess of expected returns for bonds.

You can find additional performance information and a full list of the Fund’s holdings in this report and atwww.dgifund.com.

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please call 1.855.DGI.FUND.

Portfolio Activity:

Since we last wrote to you at the end of October, 2018, we have added two new stocks to The DGI Fund.

IPG Photonics (IPGP) is the leader in the design and production of fiber lasers, with about 70% market share. Fiber lasers are revolutionizing industrial production. This technology is displacing legacy CO2, direct diode, and other solid-state lasers in the areas of cutting, welding/brazing, and marking/engraving. As fiber lasers continue displacing traditional machine tools, they are also making inroads into several brand new applications, including additive manufacturing. Trade tensions with China caused a slowdown in sales and we took advantage of stock price weakness to make an initial investment.

Stamps.com, Inc. (STMP)enables individuals and businesses to purchase and print U.S. Postal Service-approved postage. Its success has driven most of the growth in USPS shipping over the past several years. In addition to U.S. postage, Stamps.com has expanded to enabling shipping across multiple providers (FedEx, UPS, and others). The company recently focused its attention internationally – a market it has not yet tapped and we believe holds significant potential. These two shifts caused a backlash from the USPS and the stock price declined as a result. We have nearly two decades of investment experience with Stamps.com prior to its addition to The DGI

| Annual Report | April 30, 2019 | 1 |

| The Disciplined Growth Investors Fund | Shareholder Letter |

April 30, 2019 (Unaudited)

Fund. We consider both international expansion and multiple-vendor shipping to be long-term opportunities the company has created for which the market punished the stock price in the short term. We took advantage of this situation to add the holding to The DGI Fund.

In the last six months we also added to the Fund’s existing position inMedidata Solutions (MDSO)andRealPage (RP).

Finally, we sold the remaining position in bothSeagate Technology (STX)andSynaptics (SYNA).

Sincerely,

Portfolio Manager

Disciplined Growth Investors, Inc.

Asset class-specific performance is before fees. The Fund’s single fee – the management fee – is paid from the Fund’s holding of cash. Total Fund net-of-fees performance is presented in this letter, later in this annual report, and is updated monthly on the Fund’s website,www.dgifund.com.

The views of Disciplined Growth Investors, Inc. and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writers’ current views. The views expressed are those of the Fund’s adviser only, and represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned in this letter. The subject matter contained in this letter has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither Disciplined Growth Investors, Inc. nor the Fund accepts any liability for losses either direct or consequential caused by the use of this information.

The Fund is distributed by ALPS Distributors, Inc.

The Fund is subject to investment risks, including possible loss of the principal amount invested and therefore is not suitable for all investors. The Fund may not achieve its objectives.

Diversification does not eliminate the risk of experiencing investment losses.

Fred Martin is a registered representative of ALPS Distributors, Inc. CFA Institute Marks are trademarks owned by the CFA Institute.

The S&P 500® Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in the Index.

| 2 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Performance Update |

April 30, 2019 (Unaudited)

Annualized Total Return Performance(for the period ended April 30, 2019)

| | 6 month | Calendar YTD | 1 Year | 3 Year | 5 Year | Since Inception* |

| The Disciplined Growth Investors Fund | 11.26% | 17.74% | 14.74% | 13.13% | 9.86% | 12.38% |

| S&P 500® Total Return Index(1) | 9.76% | 18.25% | 13.49% | 14.87% | 11.63% | 14.99% |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please call 1.855.DGI.FUND.

The table does not reflect the deductions of taxes a shareholder would pay on Fund distributions or redemptions of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested. Returns for periods less than 1 year are cumulative.

| * | Fund Inception date of August 12, 2011. |

| (1) | The S&P 500® Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in the Index. |

| Annual Report | April 30, 2019 | 3 |

| The Disciplined Growth Investors Fund | Performance Update |

April 30, 2019 (Unaudited)

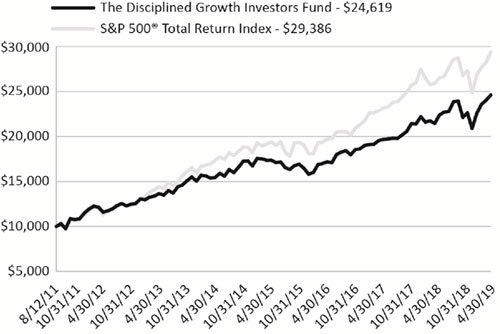

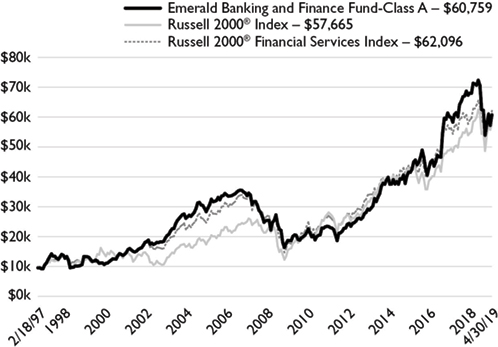

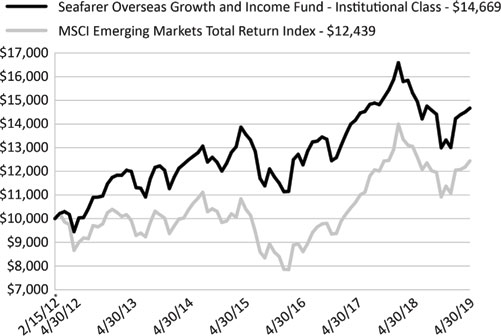

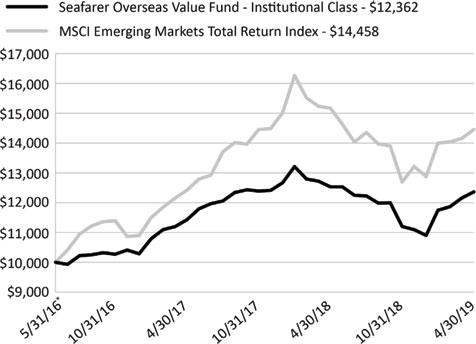

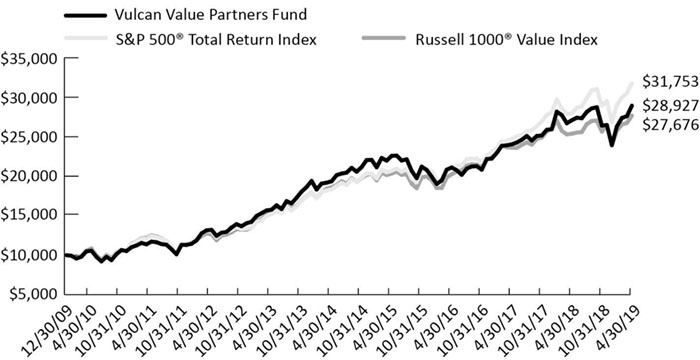

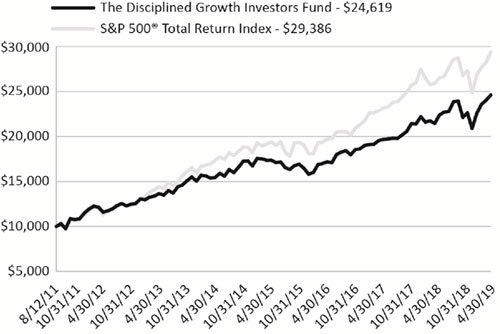

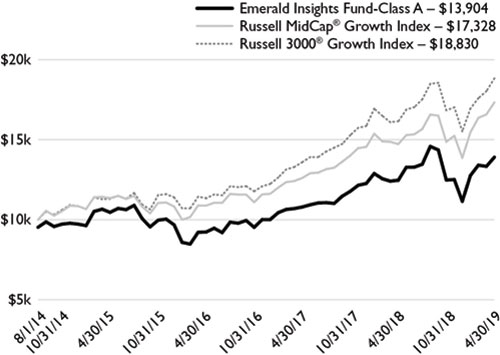

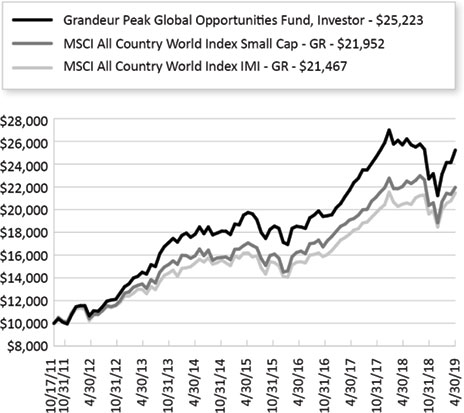

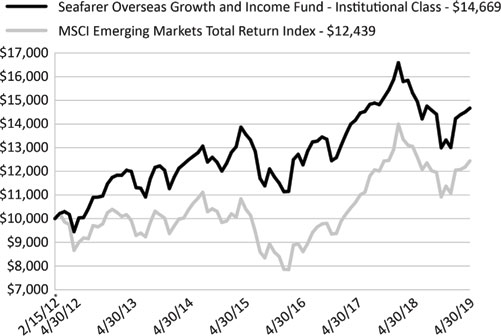

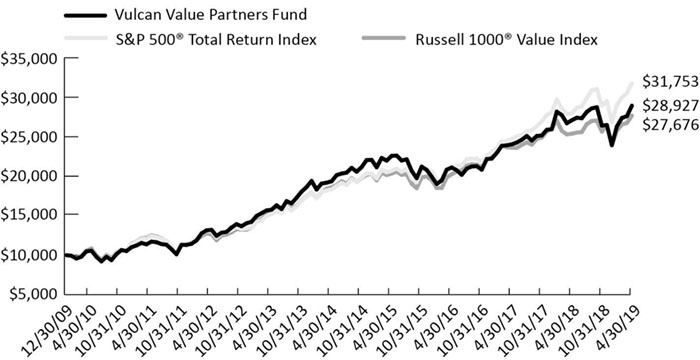

Growth of $10,000 Investment in the Fund(for the period ended April 30, 2019)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

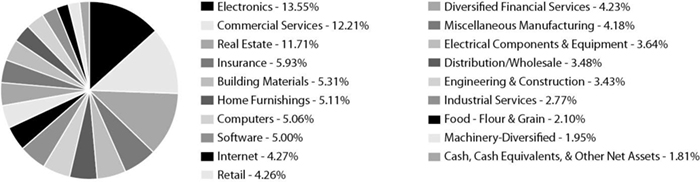

Industry Sector Allocation

(as a % of Net Assets)*

| Technology | 33.04% |

| Consumer Discretionary | 14.02% |

| Health Care | 13.19% |

| Industrials | 6.85% |

| Energy | 1.24% |

| Financials | 0.52% |

| Communications | 0.55% |

| Consumer, Cyclical | 0.71% |

| Corporate Bonds | 20.77% |

| Foreign Corporate Bonds | 0.61% |

| Foreign Government Bonds | 0.45% |

| Government & Agency Obligations | 7.40% |

| Other Assets in Excess of Liabilities | 0.65% |

Top Ten Holdings

(as a % of Net Assets)*

| Edwards Lifesciences Corp. | 4.66% |

| Ubiquiti Networks, Inc. | 3.68% |

| TJX Cos., Inc. | 3.60% |

| Align Technology, Inc. | 3.46% |

| Intuit, Inc. | 3.01% |

| U.S. Treasury Note | 2.68% |

| Middleby Corp. | 2.44% |

| FactSet Research Systems, Inc. | 2.32% |

| Intuitive Surgical, Inc. | 2.29% |

| Autodesk, Inc. | 2.24% |

| Top Ten Holdings | 30.38% |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

| 4 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Disclosure of Fund Expenses |

April 30, 2019 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other fund operating expenses. This example is intended to help you understand your ongoing costs (in dollars), of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of November 1, 2018 through April 30, 2019.

Actual Expenses The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account Value 11/1/2018 | Ending Account Value 4/30/2019 | Expense Ratio(a) | Expenses Paid During period 11/1/2018 - 4/30/2019(b) |

| Actual | $1,000.00 | $1,112.60 | 0.78% | $4.09 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.93 | 0.78% | $3.91 |

| (a) | The Fund's expense ratios have been annualized based on the Fund's most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (181)/365 (to reflect the half-year period). |

| Annual Report | April 30, 2019 | 5 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2019

| | | Shares | | | Value (Note 2) | |

| COMMON STOCKS (70.12%) | | | | | | | | |

| COMMUNICATIONS (0.55%) | | | | | | | | |

| Internet (0.55%) | | | | | | | | |

| Stamps.com, Inc.(a) | | | 15,502 | | | $ | 1,330,072 | |

| | | | | | | | | |

| TOTAL COMMUNICATIONS | | | | | | | 1,330,072 | |

| | | | | | | | | |

| CONSUMER DISCRETIONARY (14.02%) | | | | | | | | |

| Apparel & Textile Products (1.43%) | | | | | | | | |

| Ralph Lauren Corp. | | | 12,934 | | | | 1,701,856 | |

| Under Armour, Inc. , Class A(a) | | | 75,054 | | | | 1,732,997 | |

| | | | | | | | 3,434,853 | |

| | | | | | | | | |

| Automotive (1.99%) | | | | | | | | |

| Gentex Corp. | | | 141,545 | | | | 3,259,781 | |

| Gentherm, Inc.(a) | | | 35,826 | | | | 1,517,590 | |

| | | | | | | | 4,777,371 | |

| | | | | | | | | |

| Gaming, Lodging & Restaurants (2.21%) | | | | | | | | |

| Cheesecake Factory, Inc. | | | 22,470 | | | | 1,114,961 | |

| Royal Caribbean Cruises, Ltd. | | | 34,698 | | | | 4,196,376 | |

| | | | | | | | 5,311,337 | |

| | | | | | | | | |

| Leisure (0.37%) | | | | | | | | |

| TripAdvisor, Inc.(a) | | | 16,505 | | | | 878,561 | |

| | | | | | | | | |

| Passenger Transportation (1.25%) | | | | | | | | |

| JetBlue Airways Corp.(a) | | | 162,328 | | | | 3,011,184 | |

| | | | | | | | | |

| Retail - Consumer Discretionary (6.77%) | | | | | | | | |

| L Brands, Inc. | | | 68,551 | | | | 1,757,648 | |

| Nordstrom, Inc. | | | 49,463 | | | | 2,028,972 | |

| Sleep Number Corp.(a) | | | 83,681 | | | | 2,912,099 | |

| TJX Cos., Inc. | | | 157,601 | | | | 8,649,143 | |

| Urban Outfitters, Inc.(a) | | | 30,431 | | | | 904,713 | |

| | | | | | | | 16,252,575 | |

| | | | | | | | | |

| TOTAL CONSUMER DISCRETIONARY | | | | | | | 33,665,881 | |

| 6 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2019

| | | Shares | | | Value (Note 2) | |

| CONSUMER, CYCLICAL (0.71%) | | | | | | | | |

| Retail (0.71%) | | | | | | | | |

| MSC Industrial Direct Co., Inc. , Class A | | | 20,443 | | | $ | 1,710,057 | |

| | | | | | | | | |

| TOTAL CONSUMER, CYCLICAL | | | | | | | 1,710,057 | |

| | | | | | | | | |

| ENERGY (1.24%) | | | | | | | | |

| Oil, Gas & Coal (1.24%) | | | | | | | | |

| Core Laboratories NV | | | 11,350 | | | | 719,477 | |

| Southwestern Energy Co.(a) | | | 535,154 | | | | 2,113,858 | |

| Ultra Petroleum Corp.(a) | | | 337,188 | | | | 141,754 | |

| | | | | | | | 2,975,089 | |

| | | | | | | | | |

| TOTAL ENERGY | | | | | | | 2,975,089 | |

| | | | | | | | | |

| FINANCIALS (0.52%) | | | | | | | | |

| Banks (0.52%) | | | | | | | | |

| TCF Financial Corp. | | | 55,847 | | | | 1,235,894 | |

| | | | | | | | | |

| TOTAL FINANCIALS | | | | | | | 1,235,894 | |

| | | | | | | | | |

| HEALTH CARE (13.19%) | | | | | | | | |

| Medical Equipment & Devices (13.19%) | | | | | | | | |

| Align Technology, Inc.(a) | | | 25,576 | | | | 8,304,016 | |

| Edwards Lifesciences Corp.(a) | | | 63,633 | | | | 11,203,862 | |

| Intuitive Surgical, Inc.(a) | | | 10,754 | | | | 5,491,315 | |

| Myriad Genetics, Inc.(a) | | | 102,968 | | | | 3,241,432 | |

| Varian Medical Systems, Inc.(a) | | | 25,305 | | | | 3,445,782 | |

| | | | | | | | 31,686,407 | |

| | | | | | | | | |

| TOTAL HEALTH CARE | | | | | | | 31,686,407 | |

| | | | | | | | | |

| INDUSTRIALS (6.85%) | | | | | | | | |

| Electrical Equipment (0.88%) | | | | | | | | |

| Cognex Corp. | | | 41,899 | | | | 2,112,966 | |

| | | | | | | | | |

| Machinery (3.37%) | | | | | | | | |

| Graco, Inc. | | | 43,386 | | | | 2,223,533 | |

| Middleby Corp.(a) | | | 44,439 | | | | 5,871,725 | |

| | | | | | | | 8,095,258 | |

| | | | | | | | | |

| Manufactured Goods (1.20%) | | | | | | | | |

| Proto Labs, Inc.(a) | | | 26,215 | | | | 2,878,145 | |

| Annual Report | April 30, 2019 | 7 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2019

| | | Shares | | | Value (Note 2) | |

| INDUSTRIALS (continued) | | | | | | | | |

| Transportation & Logistics (1.40%) | | | | | | | | |

| Landstar System, Inc. | | | 30,964 | | | $ | 3,373,837 | |

| | | | | | | | | |

| TOTAL INDUSTRIALS | | | | | | | 16,460,206 | |

| | | | | | | | | |

| TECHNOLOGY (33.04%) | | | | | | | | |

| Design, Manufacturing & Distribution (2.07%) | | | | | | | | |

| Plexus Corp.(a) | | | 82,562 | | | | 4,968,581 | |

| | | | | | | | | |

| Hardware (10.85%) | | | | | | | | |

| Dolby Laboratories, Inc. , Class A | | | 49,970 | | | | 3,232,559 | |

| Garmin, Ltd. | | | 49,173 | | | | 4,216,093 | |

| Plantronics, Inc. | | | 53,751 | | | | 2,767,102 | |

| Super Micro Computer, Inc.(a) | | | 144,011 | | | | 3,228,727 | |

| Ubiquiti Networks, Inc. | | | 51,883 | | | | 8,843,457 | |

| ViaSat, Inc.(a) | | | 41,592 | | | | 3,777,385 | |

| | | | | | | | 26,065,323 | |

| | | | | | | | | |

| Semiconductors (3.89%) | | | | | | | | |

| IPG Photonics Corp.(a) | | | 12,927 | | | | 2,258,735 | |

| Microchip Technology, Inc. | | | 31,555 | | | | 3,152,029 | |

| Power Integrations, Inc. | | | 49,825 | | | | 3,937,171 | |

| | | | | | | | 9,347,935 | |

| | | | | | | | | |

| Software (11.72%) | | | | | | | | |

| Akamai Technologies, Inc.(a) | | | 54,292 | | | | 4,346,618 | |

| Autodesk, Inc.(a) | | | 30,216 | | | | 5,384,793 | |

| Intuit, Inc. | | | 28,810 | | | | 7,233,039 | |

| Manhattan Associates, Inc.(a) | | | 30,170 | | | | 2,034,967 | |

| Open Text Corp. | | | 137,000 | | | | 5,267,650 | |

| RealPage, Inc.(a) | | | 59,502 | | | | 3,880,125 | |

| | | | | | | | 28,147,192 | |

| 8 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2019

| | | Shares | | | Value (Note 2) | |

| TECHNOLOGY (continued) | | | | | | | | |

| Technology Services (4.51%) | | | | | | | | |

| FactSet Research Systems, Inc. | | | 20,188 | | | $ | 5,569,264 | |

| IHS Markit, Ltd.(a) | | | 27,705 | | | | 1,586,388 | |

| Medidata Solutions, Inc.(a) | | | 22,400 | | | | 2,023,616 | |

| Paychex, Inc. | | | 19,487 | | | | 1,642,949 | |

| | | | | | | | 10,822,217 | |

| | | | | | | | | |

| TOTAL TECHNOLOGY | | | | | | | 79,351,248 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $99,554,799) | | | | | | | 168,414,854 | |

| | | Principal Amount | | | Value (Note 2) | |

| CORPORATE BONDS (20.77%) | | | | | | | | |

| BASIC MATERIALS (0.30%) | | | | | | | | |

| Chemicals (0.30%) | | | | | | | | |

| DowDuPont, Inc. | | | | | | | | |

| 4.725% 11/15/2028 | | $ | 666,000 | | | | 726,770 | |

| | | | | | | | | |

| TOTAL BASIC MATERIALS | | | | | | | 726,770 | |

| | | | | | | | | |

| COMMUNICATIONS (1.28%) | | | | | | | | |

| Cable & Satellite (0.34%) | | | | | | | | |

| Comcast Corp. | | | | | | | | |

| 3.375% 08/15/2025 | | | 810,000 | | | | 823,559 | |

| | | | | | | | | |

| Entertainment Content (0.31%) | | | | | | | | |

| CBS Corp. | | | | | | | | |

| 4.000% 01/15/2026 | | | 726,000 | | | | 740,350 | |

| | | | | | | | | |

| Wireless Telecommunications Services (0.63%) | | | | | | | | |

| AT&T, Inc. | | | | | | | | |

| 4.250% 03/01/2027 | | | 741,000 | | | | 768,201 | |

| 4.450% 04/01/2024 | | | 4,000 | | | | 4,231 | |

| Verizon Communications, Inc. | | | | | | | | |

| 4.125% 03/16/2027 | | | 698,000 | | | | 736,305 | |

| | | | | | | | 1,508,737 | |

| | | | | | | | | |

| TOTAL COMMUNICATIONS | | | | | | | 3,072,646 | |

| Annual Report | April 30, 2019 | 9 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2019

| | | Principal Amount | | | Value (Note 2) | |

| CONSUMER DISCRETIONARY (1.94%) | | | | | | | | |

| Airlines (0.31%) | | | | | | | | |

| Southwest Airlines Co. | | | | | | | | |

| 3.000% 11/15/2026 | | $ | 756,000 | | | $ | 729,932 | |

| | | | | | | | | |

| Apparel & Textile Products (0.30%) | | | | | | | | |

| Cintas Corp. No 2 | | | | | | | | |

| 3.700% 04/01/2027 | | | 710,000 | | | | 728,380 | |

| | | | | | | | | |

| Restaurants (0.31%) | | | | | | | | |

| McDonald's Corp., Series MTN | | | | | | | | |

| 6.300% 03/01/2038 | | | 604,000 | | | | 751,689 | |

| | | | | | | | | |

| Retail - Consumer Discretionary (1.02%) | | | | | | | | |

| Advance Auto Parts, Inc. | | | | | | | | |

| 4.500% 12/01/2023 | | | 685,000 | | | | 718,926 | |

| Amazon.com, Inc. | | | | | | | | |

| 5.200% 12/03/2025 | | | 885,000 | | | | 1,006,506 | |

| Lowe's Cos., Inc. | | | | | | | | |

| 2.500% 04/15/2026 | | | 770,000 | | | | 731,559 | |

| | | | | | | | 2,456,991 | |

| | | | | | | | | |

| TOTAL CONSUMER DISCRETIONARY | | | | | | | 4,666,992 | |

| | | | | | | | | |

| CONSUMER STAPLES (0.62%) | | | | | | | | |

| Mass Merchants (0.32%) | | | | | | | | |

| Costco Wholesale Corp. | | | | | | | | |

| 2.750% 05/18/2024 | | | 760,000 | | | | 762,284 | |

| | | | | | | | | |

| Supermarkets & Pharmacies (0.30%) | | | | | | | | |

| CVS Health Corp. | | | | | | | | |

| 5.000% 12/01/2024 | | | 675,000 | | | | 718,511 | |

| | | | | | | | | |

| TOTAL CONSUMER STAPLES | | | | | | | 1,480,795 | |

| | | | | | | | | |

| CONSUMER, CYCLICAL (0.30%) | | | | | | | | |

| Auto Manufacturers (0.30%) | | | | | | | | |

| General Motors Financial Co., Inc. | | | | | | | | |

| 3.500% 11/07/2024 | | | 720,000 | | | | 709,599 | |

| | | | | | | | | |

| TOTAL CONSUMER, CYCLICAL | | | | | | | 709,599 | |

| 10 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2019

| | | Principal Amount | | | Value (Note 2) | |

| CONSUMER, NON-CYCLICAL (0.30%) | | | | | | | | |

| Pharmaceuticals (0.30%) | | | | | | | | |

| AbbVie, Inc. | | | | | | | | |

| 4.250% 11/14/2028 | | $ | 695,000 | | | $ | 712,477 | |

| | | | | | | | | |

| TOTAL CONSUMER, NON-CYCLICAL | | | | | | | 712,477 | |

| | | | | | | | | |

| ENERGY (2.14%) | | | | | | | | |

| Exploration & Production (0.31%) | | | | | | | | |

| Conoco Funding Co. | | | | | | | | |

| 7.250% 10/15/2031 | | | 551,000 | | | | 748,301 | |

| | | | | | | | | |

| Pipeline (1.83%) | | | | | | | | |

| Boardwalk Pipelines LP | | | | | | | | |

| 5.950% 06/01/2026 | | | 670,000 | | | | 721,950 | |

| Enbridge Energy Partners LP | | | | | | | | |

| 4.200% 09/15/2021 | | | 4,000 | | | | 4,106 | |

| 5.875% 10/15/2025 | | | 643,000 | | | | 729,163 | |

| Enterprise Products Operating LLC | | | | | | | | |

| 3.950% 02/15/2027 | | | 710,000 | | | | 737,063 | |

| MPLX LP | | | | | | | | |

| 4.125% 03/01/2027 | | | 748,000 | | | | 756,954 | |

| ONEOK Partners LP | | | | | | | | |

| 4.900% 03/15/2025 | | | 680,000 | | | | 725,157 | |

| Williams Cos., Inc. | | | | | | | | |

| 3.750% 06/15/2027 | | | 718,000 | | | | 718,668 | |

| | | | | | | | 4,393,061 | |

| | | | | | | | | |

| TOTAL ENERGY | | | | | | | 5,141,362 | |

| | | | | | | | | |

| FINANCIALS (3.95%) | | | | | | | | |

| Banks (1.50%) | | | | | | | | |

| Bank of America Corp., Series L | | | | | | | | |

| 4.183% 11/25/2027 | | | 715,000 | | | | 732,248 | |

| BB&T Corp., Series MTN | | | | | | | | |

| 3.875% 03/19/2029 | | | 695,000 | | | | 709,038 | |

| JPMorgan Chase & Co. | | | | | | | | |

| 4.125% 12/15/2026 | | | 690,000 | | | | 714,355 | |

| Morgan Stanley, Series GMTN | | | | | | | | |

| 3.700% 10/23/2024 | | | 690,000 | | | | 709,000 | |

| Wells Fargo & Co., Series GMTN | | | | | | | | |

| 4.300% 07/22/2027 | | | 710,000 | | | | 737,436 | |

| | | | | | | | 3,602,077 | |

| Annual Report | April 30, 2019 | 11 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2019

| | | Principal Amount | | | Value (Note 2) | |

| FINANCIALS (continued) | | | | | | | | |

| Consumer Finance (0.30%) | | | | | | | | |

| American Express Co. | | | | | | | | |

| 3.625% 12/05/2024 | | $ | 708,000 | | | $ | 730,476 | |

| | | | | | | | | |

| Diversified Banks (0.62%) | | | | | | | | |

| Citigroup, Inc. | | | | | | | | |

| 4.300% 11/20/2026 | | | 720,000 | | | | 744,082 | |

| US Bancorp, Series MTN | | | | | | | | |

| 3.100% 04/27/2026 | | | 739,000 | | | | 734,829 | |

| | | | | | | | 1,478,911 | |

| | | | | | | | | |

| Financial Services (0.60%) | | | | | | | | |

| National Rural Utilities Cooperative Finance Corp. | | | | | | | | |

| 2.950% 02/07/2024 | | | 707,000 | | | | 712,334 | |

| Northern Trust Corp. | | | | | | | | |

| 3.950% 10/30/2025 | | | 693,000 | | | | 732,019 | |

| | | | | | | | 1,444,353 | |

| | | | | | | | | |

| Life Insurance (0.31%) | | | | | | | | |

| MetLife, Inc. | | | | | | | | |

| 3.600% 11/13/2025 | | | 710,000 | | | | 737,116 | |

| | | | | | | | | |

| Property & Casualty Insurance (0.31%) | | | | | | | | |

| American International Group, Inc. | | | | | | | | |

| 3.750% 07/10/2025 | | | 740,000 | | | | 749,401 | |

| | | | | | | | | |

| Real Estate (0.31%) | | | | | | | | |

| Welltower, Inc. | | | | | | | | |

| 4.250% 04/01/2026 | | | 712,000 | | | | 737,276 | |

| | | | | | | | | |

| TOTAL FINANCIALS | | | | | | | 9,479,610 | |

| | | | | | | | | |

| HEALTH CARE (0.91%) | | | | | | | | |

| Managed Care (0.60%) | | | | | | | | |

| Anthem, Inc. | | | | | | | | |

| 3.650% 12/01/2027 | | | 731,000 | | | | 725,334 | |

| UnitedHealth Group, Inc. | | | | | | | | |

| 3.750% 07/15/2025 | | | 691,000 | | | | 718,982 | |

| | | | | | | | 1,444,316 | |

| 12 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2019

| | | Principal Amount | | | Value (Note 2) | |

| HEALTH CARE (continued) | | | | | | | | |

| Pharmaceuticals (0.31%) | | | | | | | | |

| Johnson & Johnson | | | | | | | | |

| 5.850% 07/15/2038 | | $ | 572,000 | | | $ | 737,974 | |

| | | | | | | | | |

| TOTAL HEALTH CARE | | | | | | | 2,182,290 | |

| | | | | | | | | |

| INDUSTRIALS (3.40%) | | | | | | | | |

| Aerospace & Defense (0.88%) | | | | | | | | |

| Lockheed Martin Corp. | | | | | | | | |

| 3.100% 01/15/2023 | | | 680,000 | | | | 687,456 | |

| Rockwell Collins, Inc. | | | | | | | | |

| 3.500% 03/15/2027 | | | 730,000 | | | | 723,216 | |

| United Technologies Corp. | | | | | | | | |

| 3.950% 08/16/2025 | | | 680,000 | | | | 710,425 | |

| | | | | | | | 2,121,097 | |

| | | | | | | | | |

| Commercial Services & Supplies (0.31%) | | | | | | | | |

| Waste Management, Inc. | | | | | | | | |

| 3.150% 11/15/2027 | | | 745,000 | | | | 741,205 | |

| | | | | | | | | |

| Electrical Equipment Manufacturing (0.29%) | | | | | | | | |

| General Electric Co., Series MTN | | | | | | | | |

| 5.875% 01/14/2038 | | | 653,000 | | | | 706,520 | |

| | | | | | | | | |

| Engineering & Construction (0.31%) | | | | | | | | |

| Fluor Corp. | | | | | | | | |

| 4.250% 09/15/2028 | | | 725,000 | | | | 736,147 | |

| | | | | | | | | |

| Railroad (0.69%) | | | | | | | | |

| Burlington Northern Santa Fe LLC | | | | | | | | |

| 3.000% 03/15/2023 | | | 2,000 | | | | 2,022 | |

| 3.400% 09/01/2024 | | | 875,000 | | | | 901,494 | |

| Union Pacific Corp. | | | | | | | | |

| 3.250% 08/15/2025 | | | 735,000 | | | | 744,903 | |

| | | | | | | | 1,648,419 | |

| | | | | | | | | |

| Transportation (0.31%) | | | | | | | | |

| FedEx Corp. | | | | | | | | |

| 3.300% 03/15/2027 | | | 756,000 | | | | 752,880 | |

| | | | | | | | | |

| Transportation & Logistics (0.30%) | | | | | | | | |

| United Parcel Service, Inc. | | | | | | | | |

| 6.200% 01/15/2038 | | | 558,000 | | | | 726,131 | |

| Annual Report | April 30, 2019 | 13 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2019

| | | Principal Amount | | | Value (Note 2) | |

| INDUSTRIALS (continued) | | | | | | | | |

| Waste & Environmental Services & Equipment (0.31%) | | | | | | | | |

| Republic Services, Inc. | | | | | | | | |

| 3.375% 11/15/2027 | | $ | 735,000 | | | $ | 737,631 | |

| 5.500% 09/15/2019 | | | 1,000 | | | | 1,010 | |

| | | | | | | | 738,641 | |

| | | | | | | | | |

| TOTAL INDUSTRIALS | | | | | | | 8,171,040 | |

| | | | | | | | | |

| INFORMATION TECHNOLOGY (0.30%) | | | | | | | | |

| Semiconductors (0.30%) | | | | | | | | |

| Analog Devices, Inc. | | | | | | | | |

| 3.900% 12/15/2025 | | | 711,000 | | | | 730,541 | |

| | | | | | | | | |

| TOTAL INFORMATION TECHNOLOGY | | | | | | | 730,541 | |

| | | | | | | | | |

| UTILITIES (5.33%) | | | | | | | | |

| Electric (0.30%) | | | | | | | | |

| American Electric Power Co., Inc. | | | | | | | | |

| 3.200% 11/13/2027 | | | 731,000 | | | | 715,665 | |

| | | | | | | | | |

| Utilities (5.03%) | | | | | | | | |

| Black Hills Corp. | | | | | | | | |

| 3.150% 01/15/2027 | | | 700,000 | | | | 675,449 | |

| CenterPoint Energy, Inc. | | | | | | | | |

| 3.850% 02/01/2024 | | | 700,000 | | | | 718,133 | |

| CMS Energy Corp. | | | | | | | | |

| 3.000% 05/15/2026 | | | 760,000 | | | | 740,138 | |

| Dominion Energy, Inc., Series B | | | | | | | | |

| 2.750% 09/15/2022 | | | 695,000 | | | | 690,935 | |

| DTE Energy Co., Series C | | | | | | | | |

| 3.500% 06/01/2024 | | | 715,000 | | | | 724,978 | |

| Duke Energy Corp. | | | | | | | | |

| 3.950% 10/15/2023 | | | 690,000 | | | | 717,029 | |

| Edison International | | | | | | | | |

| 2.400% 09/15/2022 | | | 745,000 | | | | 708,654 | |

| Interstate Power & Light Co. | | | | | | | | |

| 3.400% 08/15/2025 | | | 723,000 | | | | 725,887 | |

| ITC Holdings Corp. | | | | | | | | |

| 4.050% 07/01/2023 | | | 540,000 | | | | 552,041 | |

| NiSource, Inc. | | | | | | | | |

| 3.850% 02/15/2023 | | | 695,000 | | | | 709,829 | |

| Potomac Electric Power Co. | | | | | | | | |

| 3.600% 03/15/2024 | | | 698,000 | | | | 718,459 | |

| 14 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2019

| | | Principal Amount | | | Value (Note 2) | |

| UTILITIES (continued) | | | | | | | | |

| Utilities (continued) | | | | | | | | |

| PPL Capital Funding, Inc. | | | | | | | | |

| 3.100% 05/15/2026 | | $ | 820,000 | | | $ | 792,805 | |

| PSEG Power LLC | | | | | | | | |

| 4.300% 11/15/2023 | | | 675,000 | | | | 701,633 | |

| Puget Energy, Inc. | | | | | | | | |

| 3.650% 05/15/2025 | | | 725,000 | | | | 724,268 | |

| Sempra Energy | | | | | | | | |

| 2.875% 10/01/2022 | | | 720,000 | | | | 715,455 | |

| Virginia Electric & Power Co., Series A | | | | | | | | |

| 3.800% 04/01/2028 | | | 710,000 | | | | 737,987 | |

| Wisconsin Electric Power Co. | | | | | | | | |

| 3.100% 06/01/2025 | | | 735,000 | | | | 734,775 | |

| | | | | | | | 12,088,455 | |

| | | | | | | | | |

| TOTAL UTILITIES | | | | | | | 12,804,120 | |

| | | | | | | | | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $49,117,331) | | | | | | | 49,878,242 | |

| | | | | | | | | |

| FOREIGN CORPORATE BONDS (0.61%) | | | | | | | | |

| ENERGY (0.31%) | | | | | | | | |

| Pipeline (0.31%) | | | | | | | | |

| TransCanada PipeLines, Ltd. | | | | | | | | |

| 7.250% 08/15/2038 | | | 572,000 | | | | 748,875 | |

| | | | | | | | | |

| TOTAL ENERGY | | | | | | | 748,875 | |

| | | | | | | | | |

| INDUSTRIALS (0.30%) | | | | | | | | |

| Electrical Equipment Manufacturing (0.30%) | | | | | | | | |

| Tyco Electronics Group SA | | | | | | | | |

| 3.500% 02/03/2022 | | | 708,000 | | | | 719,209 | |

| | | | | | | | | |

| TOTAL INDUSTRIALS | | | | | | | 719,209 | |

| | | | | | | | | |

| TOTAL FOREIGN CORPORATE BONDS | | | | | | | | |

| (Cost $1,458,884) | | | | | | | 1,468,084 | |

| | | | | | | | | |

| FOREIGN GOVERNMENT BONDS (0.45%) | | | | | | | | |

| Corp Andina de Fomento | | | | | | | | |

| 8.125% 06/04/2019 | | | 375,000 | | | | 376,721 | |

| Annual Report | April 30, 2019 | 15 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2019

| | | Principal Amount | | | Value (Note 2) | |

| FOREIGN GOVERNMENT BONDS (continued) | | | | | | | | |

| Province of Quebec Canada, Series NN | | | | | | | | |

| 7.125% 02/09/2024 | | $ | 590,000 | | | $ | 706,507 | |

| | | | | | | | 1,083,228 | |

| | | | | | | | | |

| TOTAL FOREIGN GOVERNMENT BONDS | | | | | | | | |

| (Cost $1,071,689) | | | | | | | 1,083,228 | |

| | | | | | | | | |

| GOVERNMENT & AGENCY OBLIGATIONS (7.40%) | | | | | | | | |

| U.S. Treasury Bonds | | | | | | | | |

| 1.500% 08/15/2026 | | | 689,000 | | | | 646,987 | |

| 2.875% 05/15/2028 | | | 2,000,000 | | | | 2,063,008 | |

| 6.500% 11/15/2026 | | | 77,000 | | | | 98,542 | |

| U.S. Treasury Notes | | | | | | | | |

| 0.875% 07/31/2019 | | | 4,100,000 | | | | 4,083,926 | |

| 1.250% 01/31/2020 | | | 6,500,000 | | | | 6,443,379 | |

| 1.500% 04/15/2020 | | | 4,470,000 | | | | 4,432,983 | |

| | | | | | | | | |

| TOTAL GOVERNMENT & AGENCY OBLIGATIONS | | | | | | | | |

| (Cost $17,705,723) | | | | | | | 17,768,825 | |

| | | Yield | | Shares | | | Value (Note 2) | |

| SHORT TERM INVESTMENTS (0.67%) | | | | | | | | | | | |

| MONEY MARKET FUND (0.67%) | | | | | | | | | | | |

| Fidelity Investments Money Market Government Portfolio - Class I | | | 2.303 | %(b) | | 1,616,569 | | | | 1,616,569 | |

| | | | | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | | | | |

| (Cost $1,616,569) | | | | | | | | | | 1,616,569 | |

| | | | | | | | | | | | |

| TOTAL INVESTMENTS (100.02%) | | | | | | | | | | | |

| (Cost $170,524,995) | | | | | | | | | $ | 240,229,802 | |

| | | | | | | | | | | | |

| Liabilities In Excess Of Other Assets (-0.02%) | | | | | | | | | | (58,278 | ) |

| | | | | | | | | | | | |

| NET ASSETS (100.00%) | | | | | | | | | $ | 240,171,524 | |

| (a) | Non-Income Producing Security. |

| (b) | Represents the 7-day yield. |

For Fund compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group

| 16 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2019

indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percent of net assets.

See Notes to Financial Statements.

| Annual Report | April 30, 2019 | 17 |

| The Disciplined Growth Investors Fund | Statement of Assets and Liabilities |

April 30, 2019

| ASSETS | | |

| Investments, at value | | $ | 240,229,802 | |

| Receivable for shares sold | | | 70,314 | |

| Dividends and interest receivable | | | 631,854 | |

| Total assets | | | 240,931,970 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for investments purchased | | | 350,377 | |

| Payable for shares redeemed | | | 256,800 | |

| Payable to adviser | | | 153,269 | |

| Total liabilities | | | 760,446 | |

| NET ASSETS | | $ | 240,171,524 | |

| | | | | |

| NET ASSETS CONSIST OF | | | | |

| Paid-in capital (Note 5) | | $ | 167,397,042 | |

| Distributable Earnings | | | 72,774,482 | |

| NET ASSETS | | $ | 240,171,524 | |

| | | | | |

| INVESTMENTS, AT COST | | $ | 170,524,995 | |

| | | | | |

| PRICING OF SHARES | | | | |

| Net Asset Value, offering and redemption price per share | | $ | 21.15 | |

| Shares of beneficial interest outstanding | | | 11,353,354 | |

See Notes to Financial Statements.

| 18 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Statement of Operations |

| | | For the Year Ended April 30, 2019 |

| INVESTMENT INCOME | | | | |

| Dividends | | $ | 1,397,637 | |

| Foreign taxes withheld | | | (16,143 | ) |

| Interest | | | 2,117,957 | |

| Total investment income | | | 3,499,451 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees (Note 6) | | | 1,732,520 | |

| Total expenses | | | 1,732,520 | |

| NET INVESTMENT INCOME | | | 1,766,931 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | | |

| Net realized gain on investments | | | 7,977,814 | |

| Net change in unrealized appreciation on investments | | | 21,055,807 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 29,033,621 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 30,800,552 | |

See Notes to Financial Statements.

| Annual Report | April 30, 2019 | 19 |

| The Disciplined Growth Investors Fund | Statements of Changes in Net Assets |

| | | For the Year Ended April 30, 2019 | | For the Year Ended April 30, 2018 |

| OPERATIONS | | | | |

| Net investment income | | $ | 1,766,931 | | | $ | 1,179,799 | |

| Net realized gain | | | 7,977,814 | | | | 5,834,973 | |

| Net change in unrealized appreciation | | | 21,055,807 | | | | 9,802,428 | |

| Net increase in net assets resulting from operations | | | 30,800,552 | | | | 16,817,200 | |

| | | | | | | | | |

| DISTRIBUTIONS (Note 3) | | | | | | | | |

| Total distributions to shareholders(a) | | | (7,508,119 | ) | | | (8,118,741 | ) |

| Net decrease in net assets from distributions | | | (7,508,119 | ) | | | (8,118,741 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS (Note 5) | | | | | | | | |

| Proceeds from sales of shares | | | 20,768,296 | | | | 50,597,596 | |

| Issued to shareholders in reinvestment of distributions | | | 7,471,582 | | | | 8,084,564 | |

| Cost of shares redeemed, net of redemption fees | | | (15,429,264 | ) | | | (23,086,274 | ) |

| Net increase from capital share transactions | | | 12,810,614 | | | | 35,595,886 | |

| | | | | | | | | |

| Net increase in net assets | | | 36,103,047 | | | | 44,294,345 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 204,068,477 | | | | 159,774,132 | |

| End of period | | $ | 240,171,524 | | | $ | 204,068,477 | (b) |

| | | | | | | | | |

| OTHER INFORMATION | | | | | | | | |

| Share Transactions | | | | | | | | |

| Issued | | | 1,042,174 | | | | 2,685,263 | |

| Issued to shareholders in reinvestment of distributions | | | 410,272 | | | | 428,168 | |

| Redeemed | | | (770,890 | ) | | | (1,218,824 | ) |

| Net increase in share transactions | | | 681,556 | | | | 1,894,607 | |

| (a) | For the prior year ended April 30, 2018, Total Distributions consisted of Net Investment Income of $1,134,526, and Net Realized Gains of $6,984,215. |

| (b) | For the prior year ended April 30, 2018, included accumulated net investment income of $76,473. |

See Notes to Financial Statements.

| 20 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

Page Intentionally Left Blank

The Disciplined Growth Investors Fund

| NET ASSET VALUE, BEGINNING OF PERIOD |

| |

| INCOME FROM OPERATIONS |

| Net investment income(a) |

| Net realized and unrealized gain/(loss) on investments |

| Total from investment operations |

| |

| DISTRIBUTIONS |

| From net investment income |

| From net realized gain on investments |

| Total distributions |

| |

| REDEMPTION FEES ADDED TO PAID-IN CAPITAL |

| INCREASE/(DECREASE) IN NET ASSET VALUE |

| NET ASSET VALUE, END OF PERIOD |

| |

| TOTAL RETURN |

| |

| RATIOS AND SUPPLEMENTAL DATA |

| Net assets, end of period (000's) |

| |

| RATIOS TO AVERAGE NET ASSETS |

| Expenses |

| Net investment income |

| |

| PORTFOLIO TURNOVER RATE |

| (a) | Per share numbers have been calculated using the average shares method. |

| (b) | In 2018 the Fund's total return consists of a voluntary reimbursement by the advisor for a realized investment loss. Excluding this item, total return would not have been impacted. |

See Notes to Financial Statements.

| 22 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

Financial Highlights

For a share outstanding during the periods presented

For the Year Ended April 30, 2019 | | For the Year Ended April 30, 2018 | | For the Year Ended April 30, 2017 | | For the Year Ended April 30, 2016 | | For the Year Ended April 30, 2015 |

| $ | 19.12 | | | $ | 18.20 | | | $ | 15.96 | | | $ | 16.75 | | | $ | 15.02 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | 0.16 | | | | 0.12 | | | | 0.09 | | | | 0.09 | | | | 0.10 | |

| | 2.55 | | | | 1.64 | | | | 2.29 | | | | (0.44 | ) | | | 1.83 | |

| | 2.71 | | | | 1.76 | | | | 2.38 | | | | (0.35 | ) | | | 1.93 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | (0.12 | ) | | | (0.12 | ) | | | (0.09 | ) | | | (0.10 | ) | | | (0.09 | ) |

| | (0.56 | ) | | | (0.72 | ) | | | (0.05 | ) | | | (0.34 | ) | | | (0.11 | ) |

| | (0.68 | ) | | | (0.84 | ) | | | (0.14 | ) | | | (0.44 | ) | | | (0.20 | ) |

| | | | | | | | | | | | | | | | | | | |

| | – | | | | – | | | | – | | | | – | | | | – | |

| | 2.03 | | | | 0.92 | | | | 2.24 | | | | (0.79 | ) | | | 1.73 | |

| $ | 21.15 | | | $ | 19.12 | | | $ | 18.20 | | | $ | 15.96 | | | $ | 16.75 | |

| | | | | | | | | | | | | | | | | | | |

| | 14.74 | % | | | 9.75 | %(b) | | | 14.96 | % | | | (2.05 | %) | | | 12.87 | % |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| $ | 240,172 | | | $ | 204,068 | | | $ | 159,774 | | | $ | 119,857 | | | $ | 113,342 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | 0.78 | % | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % |

| | 0.80 | % | | | 0.64 | % | | | 0.50 | % | | | 0.59 | % | | | 0.61 | % |

| | | | | | | | | | | | | | | | | | | |

| | 22 | % | | | 18 | % | | | 16 | % | | | 13 | % | | | 14 | % |

| Annual Report | April 30, 2019 | 23 |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

April 30, 2019

1. ORGANIZATION

Financial Investors Trust (the “Trust”), a Delaware statutory trust, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (“1940 Act”). The Trust consists of multiple separate portfolios or series. This annual report describes The Disciplined Growth Investors Fund (the “Fund”). The Fund seeks long-term capital growth and as a secondary objective, modest income with reasonable risk.

2. SIGNIFICANT ACCOUNTING POLICIES

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Actual results could differ from those estimates. The Fund is considered an investment company for financial reporting purposes under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Codification Topic 946. The following is a summary of significant accounting policies consistently followed by the Fund in preparation of its financial statements.

Investment Valuation: The Fund generally values its securities based on market prices determined at the close of regular trading on the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern Time, on each day the NYSE is open for trading.

For equity securities and mutual funds that are traded on an exchange, the market price is usually the closing sale or official closing price on that exchange. In the case of equity securities not traded on an exchange, or if such closing prices are not otherwise available, the securities are valued at the mean of the most recent bid and ask prices on such day. Redeemable securities issued by open-end registered investment companies are valued at the investment company’s applicable net asset value, with the exception of exchange-traded open-end investment companies, which are priced as equity securities.

The market price for debt obligations is generally the price supplied by an independent third-party pricing service approved by the Board of Trustees (the “Board”), which may use a matrix, formula or other objective method that takes into consideration quotations from dealers, market transactions in comparable investments, market indices and yield curves. If vendors are unable to supply a price, or if the price supplied is deemed to be unreliable, the market price may be determined using quotations received from one or more broker–dealers that make a market in the security. Fixed-income obligations, excluding municipal securities, having a remaining maturity of greater than 60 days, are typically valued at the mean between the evaluated bid and ask prices formulated by an independent pricing service. Corporate Bonds, U.S. Government & Agency, and U.S. Treasury Bonds & Notes are valued using market models that consider trade data, quotations from dealers and active market makers, relevant yield curve and spread data, creditworthiness, trade data or market information on comparable securities, and other relevant security specific information. Publicly traded Foreign Government Debt securities and Foreign Corporate Bonds are typically

| 24 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

April 30, 2019

traded internationally in the over-the-counter market and are valued at the mean between the bid and asked prices as of the close of business of that market. Mortgage-related and asset-backed securities are valued based on models that consider trade data, prepayment and default projections, benchmark yield and spread data and estimated cash flows of each tranche of the issuer. Publicly traded foreign government debt securities are typically traded internationally in the over-the-counter market and are valued at the mean between the bid and asked prices as of the close of business of that market.

When such prices or quotations are not available, or when Disciplined Growth Investors, Inc. (the “Adviser”) believes that they are unreliable, securities may be priced using fair value procedures approved by the Board.

Fair Value Measurements: The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

| Annual Report | April 30, 2019 | 25 |

The Disciplined Growth Investors Fund | Notes to Financial Statements |

April 30, 2019

The following is a summary of each input used to value the Fund as of April 30, 2019:

| Investments in Securities at Value | | Level 1 -

Unadjusted

Quoted Prices | | | Level 2 - Other

Significant

Observable Inputs | | | Level 3 -

Significant Unobservable Inputs | | | Total | |

| Common Stocks(a) | | $ | 168,414,854 | | | $ | – | | | $ | – | | | $ | 168,414,854 | |

| Corporate Bonds(a) | | | – | | | | 49,878,242 | | | | – | | | | 49,878,242 | |

| Foreign Corporate Bonds(a) | | | – | | | | 1,468,084 | | | | – | | | | 1,468,084 | |

| Foreign Government Bonds | | | – | | | | 1,083,228 | | | | – | | | | 1,083,228 | |

| Government & Agency Obligations | | | – | | | | 17,768,825 | | | | – | | | | 17,768,825 | |

| Short Term Investments | | | 1,616,569 | | | | – | | | | – | | | | 1,616,569 | |

| TOTAL | | $ | 170,031,423 | | | $ | 70,198,379 | | | $ | – | | | $ | 240,229,802 | |

| (a) | For detailed descriptions of the underlying industries, see the accompanying Portfolio of Investments. |

The following is a reconciliation of the investments in which significant unobservable inputs (Level 3) were used in determining fair value:

Investments

in Securities

at Value | | Balance

as of

04/30/2018 | | Return of

Capital | | Realized

Gain/(Loss) | | Change in

Unrealized

Appreciation/

(Depreciation) | | Purchases | | Sales

Proceeds | | Transfer

in and/or

(out) of

Level 3 | | Balance

as of

04/30/2019 | | Net change

in unrealized

appreciation/

(depreciation)

attributable to

Level 3

investments

held at

04/30/2019 |

| Common Stocks | | $ | 41,846 | | | $ | – | | | $ | – | | | $ | 224,254 | | | $ | – | | | $ | (266,100 | ) | | $ | – | | | $ | – | | | $ | – | |

| Total | | $ | 41,846 | | | $ | – | | | $ | – | | | $ | 224,254 | | | $ | – | | | $ | (266,100 | ) | | $ | – | | | $ | – | | | $ | – | |

Net change in unrealized appreciation/depreciation on Level 3 securities is included on the Statement of Operations under Net change in unrealized appreciation on investments.

Investment Transactions and Investment Income: Investment transactions are accounted for on the date the investments are purchased or sold (trade date). Realized gains and losses from investment transactions are reported on an identified cost basis, which is the same basis the Fund uses for federal income tax purposes. Interest income, which includes accretion of discounts, is accrued and recorded as earned. Dividend income is recognized on the ex-dividend date or for certain foreign securities, as soon as information is available to the Fund.

Trust Expenses: Some expenses of the Trust can be directly attributed to the Fund. Expenses which cannot be directly attributed to the Fund are apportioned among all funds in the Trust based on average net assets of each fund.

Fund Expenses: Expenses that are specific to the Fund are charged directly to the Fund.

| 26 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

April 30, 2019

Federal Income Taxes: The Fund complies with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and intends to distribute substantially all of their net taxable income and net capital gains, if any, each year so that it will not be subject to excise tax on undistributed income and gains. The Fund is not subject to income taxes to the extent such distributions are made.

As of and during the year ended April 30, 2019, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Distributions to Shareholders: The Fund normally pays dividends, if any, quarterly and distributes capital gains, if any, on an annual basis. Income dividend distributions are derived from dividends and other income the Fund receives from its investments, including short term capital gains. Long term capital gain distributions are derived from gains realized when the Fund sells a security it has owned for more than a year. The Fund may make additional distributions and dividends at other times if the portfolio manager believes doing so may be necessary for the Fund to avoid or reduce taxes.

3. TAX BASIS INFORMATION

Reclassifications:As of April 30, 2019, permanent differences in book and tax accounting were reclassified. These differences had no effect on net assets.

The reclassifications as of April 30, 2019 were as follows:

| Fund | | | Paid-in Capital | | | | Distributable earnings | |

| The Disciplined Growth Investors Fund | | $ | – | | | $ | – | |

Tax Basis of Investments: As of April 30, 2019, the aggregate cost of investments, gross unrealized appreciation/ (depreciation) and net unrealized appreciation for Federal tax purposes was as follows:

| | | The Disciplined

Growth Investors

Fund |

| Gross appreciation (excess of value over tax cost) | | $ | 76,062,855 | |

| Gross depreciation (excess of tax cost over value) | | | (6,358,048 | ) |

| Net unrealized appreciation | | $ | 69,704,807 | |

| Cost of investments for income tax purposes | | $ | 170,524,995 | |

| Annual Report | April 30, 2019 | 27 |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

April 30, 2019

Components of Earnings:As of April 30, 2019, components of distributable earnings were as follows:

| Undistributed ordinary income | | $ | 53,895 | |

| Accumulated capital gains | | | 3,021,472 | |

| Net unrealized appreciation on investments | | | 69,704,807 | |

| Other cumulative effect of timing differences | | | (5,692 | ) |

| Total | | $ | 72,774,482 | |

Tax Basis of Distributions to Shareholders: The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain was recorded by the Fund.

The tax character of distributions paid during the year ended April 30, 2019, were as follows:

| | | Ordinary Income | | Long-Term Capital Gain |

| The Disciplined Growth Investors Fund | | $ | 1,871,972 | | | $ | 5,636,147 | |

The tax character of distributions paid during the year ended April 30, 2018, were as follows:

| | | Ordinary Income | | Long-Term Capital Gain |

| The Disciplined Growth Investors Fund | | $ | 1,182,759 | | | $ | 6,935,982 | |

4. SECURITIES TRANSACTIONS

During the year ended April 30, 2019, equity holdings were transferred in-kind into the Fund. The intent of the transfers was to save on equity transaction costs both for the new shareholders at the institution they transferred from and for the Fund on the addition of assets. The assets of two separate accounts were transferred-in-kind into the Fund in the amount of $1,191,807.

The cost of purchases and proceeds from sales of securities (excluding short-term securities, transfers-in-kind, and U.S. Government Obligations) during the year ended April 30, 2019, were as follows:

| Fund | | Purchases of

Securities | | Proceeds From Sales of Securities |

| The Disciplined Growth Investors Fund | | $ | 43,140,201 | | | $ | 38,917,154 | |

| 28 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

April 30, 2019

Investment transactions in U.S. Government Obligations (excluding transfers-in-kind) during the year ended April 30, 2019 were as follows:

| Fund | | Purchases of Securities | | | Proceeds From Sales of Securities |

| The Disciplined Growth Investors Fund | | $ | 18,057,775 | | | $ | 7,894,211 | |

5. SHARES OF BENEFICIAL INTEREST

The capitalization of the Trust consists of an unlimited number of shares of beneficial interest with no par value per share. Holders of the shares of the Fund of the Trust have one vote for each share held and a proportionate fraction of a vote for each fractional share. All shares issued and outstanding are fully paid and are transferable and redeemable at the option of the shareholder. Purchasers of the shares do not have any obligation to make payments to the Trust or its creditors (other than the purchase price for the shares or make contributions to the Trust or its creditors solely by reason of the purchasers’ ownership of the shares. Shares have no pre-emptive rights.

Prior to September 1, 2015, shares redeemed within 90 days of purchase may have incurred a 2% short-term redemption fee deducted from the redemption amount. Effective September 1, 2015, the Fund no longer imposes redemption fees. For the year ended April 30, 2019 and April 30, 2018, the Fund did not receive any redemption fees.

6. MANAGEMENT AND RELATED-PARTY TRANSACTIONS

The Adviser, subject to the authority of the Board, is responsible for the overall management and administration of the Fund’s business affairs. The Adviser manages the investments of the Fund in accordance with the Fund’s investment objective, policies and limitations and investment guidelines established jointly by the Adviser and the Trustees. Pursuant to the Advisory Agreement, the Fund pays the Adviser a unitary management fee for the services and facilities it provides payable on a monthly basis at the annual rate of 0.78% of the Fund’s average daily net assets. The management fee is paid on a monthly basis.

Out of the unitary management fee, the Adviser pays substantially all expenses of the Fund, including the cost of transfer agency, custody, fund administration, bookkeeping and pricing services, legal, audit and other services, except for interest expenses, brokerage expenses, taxes and extraordinary expenses not incurred in the ordinary course of the Fund’s business. Also included are Trustee fees which were $6,484 for the year ended April 30, 2019.

Fund Administrator Fees and Expenses

ALPS Fund Services, Inc. (“ALPS”) serves as administrator to the Fund. Pursuant to an Administration Agreement, ALPS provides operational services to the Fund including, but not limited to, fund accounting and fund administration and generally assists in the Fund’s operations. Officers of the Trust are employees of ALPS. The Fund’s administration fee is accrued on a daily basis and paid monthly. The Administrator is also reimbursed for certain out-of-pocket expenses. The administrative fee and out-of-pocket expenses are included in the unitary management fee paid to the Adviser.

| Annual Report | April 30, 2019 | 29 |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

April 30, 2019

Transfer Agent

ALPS serves as transfer, dividend paying and shareholder servicing agent for the Fund. ALPS receives an annual minimum fee, a fee based upon the number of shareholder accounts, and is also reimbursed for certain out-of-pocket expenses. The fee and out-of-pocket expenses are included in the unitary management fee paid to the Adviser.

Compliance Services

ALPS provides services that assist the Trust’s chief compliance officer in monitoring and testing the policies and procedures of the Trust in conjunction with requirements under Rule 38a-1 under the 1940 Act and receives an annual base fee. ALPS is reimbursed for certain out-of-pocket expenses. The fee and out-of-pocket expenses are included in the unitary management fee paid to the Adviser.

Principal Financial Officer

ALPS receives an annual fee for providing principal financial officer services to the Fund. The fee is included in the unitary management fee paid to the Adviser.

Distributor

ALPS Distributors, Inc. (“ADI” or the “Distributor”) (an affiliate of ALPS) acts as the distributor of the Fund’s shares pursuant to a Distribution Agreement with the Trust. Shares are sold on a continuous basis by ADI as agent for the Fund, and ADI has agreed to use its best efforts to solicit orders for the sale of the Fund’s shares, although it is not obliged to sell any particular amount of shares. ADI is not entitled to any compensation for its services as Distributor. ADI is registered as a broker-dealer with the Securities and Exchange Commission.

7. INDEMNIFICATIONS

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that may contain general indemnification clauses, which may permit indemnification to the extent permissible under applicable law. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

8. RECENT ACCOUNTING PRONOUNCEMENTS

On October 4, 2018, the SEC amended Regulation S-X to require certain financial statement disclosure requirements to conform them to U.S. GAAP for investment companies. Effective November 4, 2018, the Fund adopted disclosure requirement changes for Regulation S-X and these changes are reflected throughout this report. The Fund’s adoption of those amendments, effective with the financial statements prepared as of April 30, 2019, had no effect on the Fund’s net assets or results of operations.

In August 2018, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2018-13, which changes the fair value measurement disclosure requirements of FASB Accounting Standards Codification Topic 820, Fair Value Measurement. The update to Topic 820 includes new, eliminated, and modified disclosure requirements. ASU 2018-13 is effective for fiscal years beginning after December 15, 2019, including interim periods. Early adoption is

| 30 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

April 30, 2019

permitted for any eliminated or modified disclosures. The Fund early adopted effective with the financial statements prepared as of April 30, 2019, and they had no effect on the Fund’s net assets or results of operations.

9. SUBSEQUENT EVENTS

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued.

| Annual Report | April 30, 2019 | 31 |

| The Disciplined Growth Investors Fund | Report of Independent Registered

Public Accounting Firm |

To the shareholders and the Board of Trustees of Financial Investors Trust:

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of The Disciplined Growth Investors Fund (the “Fund’), one of the funds constituting the Financial Investors Trust, as of April 30, 2019, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of The Disciplined Growth Investors Fund of Financial Investors Trust as of April 30, 2019, and the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of April 30, 2019, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

DELOITTE & TOUCHE LLP

Denver, Colorado

June 25, 2019

We have served as the auditor of one or more investment companies advised by Disciplined Growth Investors, Inc. since 2012.

| 32 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Additional Information |

April 30, 2019 (Unaudited)

1. FUND HOLDINGS

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year within 60 days after the end of the period. Copies of the Fund’s previously filed Form N-Qs are available without charge on the SEC website at http://www.sec.gov.

2. FUND PROXY VOTING POLICIES, PROCEDURES AND SUMMARIES

The Fund’s policies and procedures used in determining how to vote proxies and information regarding how the Fund voted proxies relating to portfolio securities during the most recent prior 12-month period ending June 30 are available without charge, (1) upon request, by calling (toll-free) 855-DGI-Fund and (2) on the SEC’s website at http://www.sec.gov.

3. TAX DESIGNATIONS

The Fund designates the following for federal income tax purposes for distributions made during the calendar year ended December 31, 2018:

| Dividend Received Deduction | 51.55% |

| Qualified Dividend Income | 72.38% |

Pursuant to Section 852(b)(3) of the Internal Revenue Code, the Disciplined Growth Investors Fund designated $5,636,147 as long-term capital gain dividends.

In early 2019, if applicable, shareholders of record received this information for the distributions paid to them by the Fund during the calendar year 2018 via Form 1099. The Fund will notify shareholders in early 2020 of amounts paid to them by the Fund, if any, during the calendar year 2019.

| Annual Report | April 30, 2019 | 33 |

| The Disciplined Growth Investors Fund | Disclosure Regarding Approval of

Fund Advisory Agreements |

April 30, 2019 (Unaudited)

On December 11, 2018, the Trustees met in person to discuss, among other things, the approval of the Investment Advisory Agreement between Disciplined Growth Investors, Inc. (“DGI”) and the Trust, with respect to The Disciplined Growth Investors Fund (the “DGI Fund”), in accordance with Section 15(c) of the 1940 Act. In renewing and approving the Investment Advisory Agreement with DGI, the Trustees, including the Independent Trustees, considered the following factors with respect to the DGI Fund:

Nature, Extent, and Quality of the Services under the Investment Advisory Agreement: The Trustees received and considered information regarding the nature, extent, and quality of services to be provided to the DGI Fund under the Investment Advisory Agreement. The Trustees reviewed certain background materials supplied by DGI in its presentation, including its Form ADV.

The Trustees reviewed and considered DGI’s investment advisory personnel, its history as an asset manager, and its performance and the amount of assets currently under management by DGI. The Trustees also reviewed the research and decision-making processes utilized by DGI, including the methods adopted to seek to achieve compliance with the investment objectives, policies, and restrictions of the DGI Fund.

The Trustees considered the background and experience of DGI’s management in connection with the DGI Fund, including reviewing the qualifications, backgrounds, and responsibilities of the management team primarily responsible for the day-to-day portfolio management of the DGI Fund and the extent of the resources devoted to research and analysis of actual and potential investments.

The Trustees also reviewed, among other things, DGI’s insider trading policies and procedures and its Code of Ethics.