UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08194

FINANCIAL INVESTORS TRUST

(Exact name of Registrant as specified in charter)

1290 Broadway, Suite 1000, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Karen Gilomen, Esq., Secretary

Financial Investors Trust

1290 Broadway, Suite 1000

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code:303-623-2577

Date of fiscal year end:April 30

Date of reporting period:October 31, 2019

Item 1.Reports to Stockholders.

TABLE OF CONTENTS

SEMI-ANNUAL REPORT

| SHAREHOLDER LETTER | 1 |

| PERFORMANCE UPDATE | 4 |

| DISCLOSURE OF FUND EXPENSES | 6 |

| PORTFOLIO OF INVESTMENTS | 7 |

| STATEMENT OF ASSETS AND LIABILITIES | 18 |

| STATEMENT OF OPERATIONS | 19 |

| STATEMENTS OF CHANGES IN NET ASSETS | 20 |

| FINANCIAL HIGHLIGHTS | 22 |

| NOTES TO FINANCIAL STATEMENTS | 24 |

| ADDITIONAL INFORMATION | 30 |

| PRIVACY POLICY | 31 |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website atwww.dgifund.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may, notwithstanding the availability of shareholder reports online, elect to receive all future shareholder reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1.855.DGI. FUND (1-855-344-3863) to let the Fund know you wish to continue receiving paper copies of your shareholder reports.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling atwww.dgifund.com.

Disciplined Growth Investors’ goal is to communicate clearly and transparently with our clients and mutual fund shareholders. It is mutually beneficial when our shareholders understand how we invest, what we are currently thinking and forecasting, and the specific investment decisions we have made. Our views and opinions regarding the investment prospects of our portfolio holdings and the Fund are “forward looking statements” which may or may not be accurate over the long term. While we believe we have a reasonable basis for these forecasts and have confidence in our investment team’s views, actual results may differ materially from those we anticipate. Information provided in this report should not be considered a recommendation to purchase or sell any particular security.

You can identify forward looking statements as those including words such as “believe”, “expect”, “anticipate”, “forecast”, and similar statement. We cannot assure future performance. These forward-looking statements are made only as-of the date of this report. Following the publication of this report, we will not update any of the forward-looking statements included here.

This material must be preceded or accompanied by a prospectus. Please read the prospectus carefully before investing.

| OCTOBER 31, 2019 | DGINV.COM |

| The Disciplined Growth Investors Fund | Shareholder Letter |

October 31, 2019 (Unaudited)

Fund Performance and Asset Mix:

The Disciplined Growth Investors Fund's (the "DGI Fund") fiscal year runs from May 1stto April 30th. For the 2019 fiscal year-to-date (5/1/19-10/31/19), The DGI Fund returned 0.95%. Stocks in the Fund decreased by 0.53% and bonds increased 5.52%.

Stocks in The DGI Fund underperformed the S&P 500® index, which increased 4.16%. The DGI Fund held 21 stocks that increased in value and 32 stocks that declined in value. The ten largest equity holdings in The DGI Fund combined to add 0.53% to the Fund’s total performance.

The Fund’s bond portfolio also underperformed the Barclays Intermediate Government & Corporate Credit index1, which gained 6.50% during the fiscal year-to-date.

Looking at different time periods, especially in the short term, can make market growth and Fund performance appear to vary wildly. 2019 is a good example. For the calendar year-to-date (January 1stthrough October 31st), The DGI Fund has increased 18.86% and the S&P 500 has increased 23.16%. Most of that increase took place in the first four months of the year. That leaves the fiscal year-to-date returns reflected in this report to be much more modest, especially considering the month of May was the worst performing month of the year so far.

We point this out as an example of the fickle manner with which the market can treat investors in the short term. We do not believe anyone can invest around these short term fluctuations or predict them accurately and repeatedly. We are focused on the long term ability of the companies in the portfolio to execute and the potential of those companies’ stocks for long term performance. With 69.4% stocks and 30.6% bonds & cash as of 10/31/19, we have positioned the Fund to reflect this long-term view and research, which shows expected returns for the Fund’s stocks materially in excess of expected returns for bonds.

You can find additional performance information and a full list of the Fund’s holdings in this Semi Annual report and atwww.dgifund.com.

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please call 1.855.DGI.FUND.

Portfolio Activity:

Since we last wrote to you last (April 30th), we added three new stocks to The DGI Fund, sold the remaining position in one, and one portfolio holding was acquired by another company.

New Stocks:

Pure Storage (PSTG) has pioneered the development of innovative computer storage for larger organizations. These storage systems are made of solid-state arrays, a new technology that has important advantages over existing disk-based storage solutions. Pure Storage’s systems provides customers with not only a simple solution and superior performance, but offers it at a lower overall cost and provides industry-leading customer service. The stock price has come under pressure recently on fears of competition, allowing us to buy into the company at what we see as an attractive price.

| Semi-Annual Report | October 31, 2019 | 1 |

| The Disciplined Growth Investors Fund | Shareholder Letter |

October 31, 2019 (Unaudited)

Cabot Oil & Gas (COG) is an exploration and production (E&P) company with all of its focus on the most productive and economic natural gas region in the United States: The Marcellus Shale in Northeast Pennsylvania. Cabot is currently the fourth largest producer of natural gas in the U.S. and one of the few energy companies that currently generates positive free cash flow2& pays a dividend (despite historically low natural gas prices). We were given an opportunity to take an initial position in Cabot because the company decided to make a long-term strategic decision at the expense of short-term results, which Wall Street did not like because the decision delayed this year’s expected gas production totals.

Deluxe Corporation (DLX) is known for its very profitable, but declining, legacy check business. Over the last several years, the company has been adding new digital capabilities which it expects to be able to sell to its existing customer base of 4.8 million small businesses and 4600 financial institutions. We see this customer base as a strategic competitive advantage for Deluxe given the trusted partnerships the company forms with its clients. Deluxe also recently hired a new CEO who has extensive experience developing and growing businesses in these markets.

Complete Sales:

L Brands (LB) is the business behind the well-known Victoria’s Secret and Bath & Body Works brands. While it had a history of successfully developing these brands, recent missteps by management, significant market share losses at Victoria’s Secret, and evidence of a deteriorating internal culture ultimately caused us to sell our entire position in the company.

Acquisitions:

Medidata Solutions (MDSO) was acquired by the French technology company Dassault Systemes in June for $5.8 billion ($92.25 per share). While the acquisition will officially close later this calendar year, the two sides have agreed to all the terms, and we do not anticipate any regulatory or legal issues to prevent completion of the acquisition. The purchase price represents a 23% premium to Medidata’s valuation a few days prior to announcement of the acquisition.

Portfolio Construction Update:

We have updated the market cap range we consider to be Mid Cap equities to $1 billion to $15 billion. The previous upper limit we employed was $10 billion. This reflects what we believe to be a long-term increase in the upper limit of market cap size for companies that otherwise have the characteristics we look for in Mid Cap growth companies. This market cap range limitation applies only to the size of companies we typically consider to be new investment candidates for the Fund. We will continue to hold a position in companies whose market cap has exceeded $15 billion (or falls below $1 billion) based on our ongoing assessment of those companies’ individual risk profiles and expected returns. Prior to this change, we had not made a change to our definition of a Mid Cap company since the Fund’s inception.

Sincerely,

Portfolio Manager

Disciplined Growth Investors, Inc.

| 1 | The Barclay’s Government & Corporate Credit index includes both corporate (publicly-issued, fixed-rate, nonconvertible, investment grade, dollar-denominated, SEC-registered, corporate |

| 2 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Shareholder Letter |

October 31, 2019 (Unaudited)

| | | dept.) and government (Treasury Bond index, Agency Bond index, 1-3 Year Government index, and the 20+-Year treasury) indexes, including bonds with maturities up to ten years. |

| 2 | For our purposes, defined here as operating cash flow less capital expenditures (CapEx). Operating Cash Flow is a measure of the amount of cash generated by a company's normal business operations. CapEx comprises money spent by a business or organization on acquiring or maintaining fixed assets, such as land, buildings, and equipment. |

Asset class-specific performance is before fees. The Fund’s single fee – the management fee – is paid from the Fund’s holding of cash. Total Fund net-of-fees performance is presented in this letter, later in this annual report, and is updated monthly on the Fund’s website,www.dgifund.com.

The views of Disciplined Growth Investors, Inc. and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writers’ current views.

The views expressed are those of the Fund’s adviser only, and represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned in this letter. The subject matter contained in this letter has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither Disciplined Growth Investors, Inc. nor the Fund accepts any liability for losses either direct or consequential caused by the use of this information.

The Fund is distributed by ALPS Distributors, Inc.

The Fund is subject to investment risks, including possible loss of the principal amount invested and therefore is not suitable for all investors. The Fund may not achieve its objectives.

Diversification does not eliminate the risk of experiencing investment losses.

Fred Martin is a registered representative of ALPS Distributors, Inc. CFA Institute Marks are trademarks owned by the CFA Institute.

The S&P 500®Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in the Index.

| Semi-Annual Report | October 31, 2019 | 3 |

| The Disciplined Growth Investors Fund | Performance Update |

October 31, 2019 (Unaudited)

Annualized Total Return Performance(for the period ended October 31, 2019)

| | 6 month | Calendar YTD | 1 Year | 3 Year | 5 Year | Since Inception* |

| The Disciplined Growth Investors Fund | 0.95% | 18.86% | 12.31% | 11.41% | 8.42% | 11.71% |

| S&P 500® Total Return Index(1) | 4.16% | 23.16% | 14.33% | 14.91% | 10.78% | 14.58% |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please call 1.855.DGI.FUND.

The table does not reflect the deductions of taxes a shareholder would pay on Fund distributions or redemptions of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| * | Fund Inception date of August 12, 2011. |

| (1) | The S&P 500®Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in the Index. |

| 4 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Performance Update |

October 31, 2019 (Unaudited)

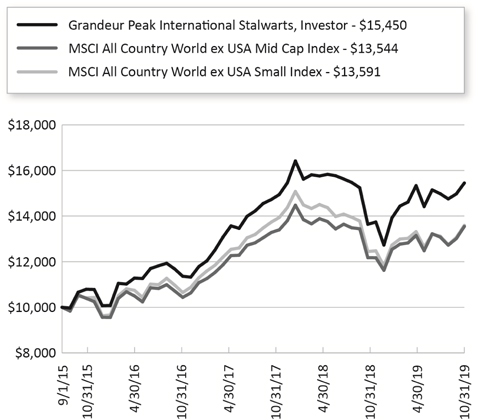

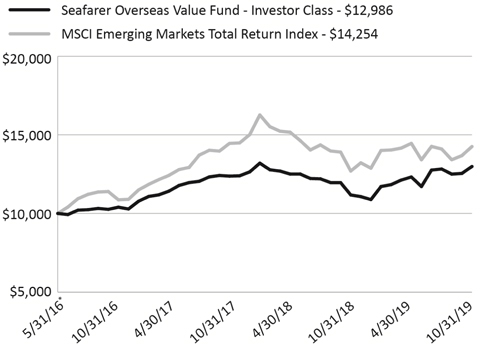

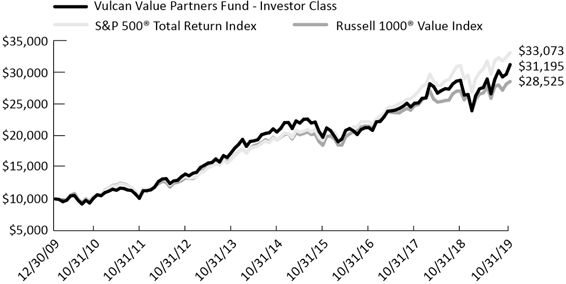

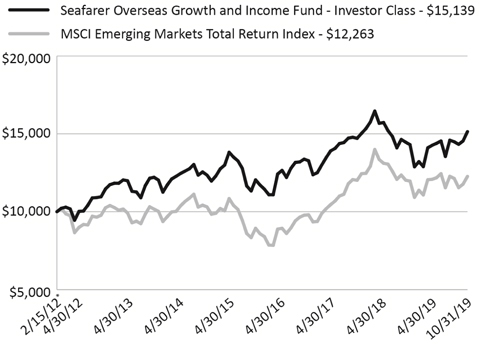

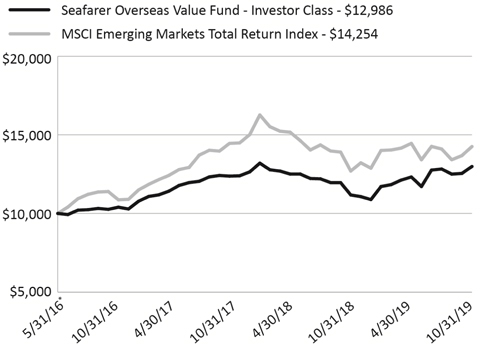

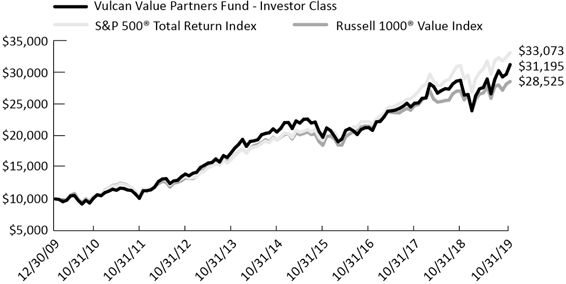

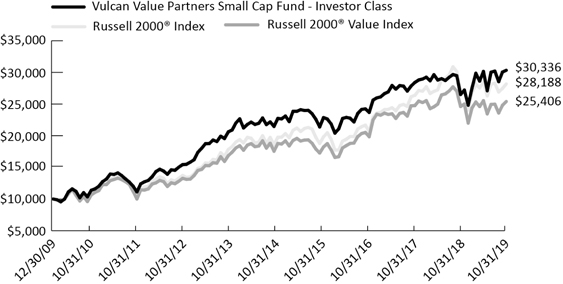

Growth of $10,000 Investment in the Fund(for the period ended October 31, 2019)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

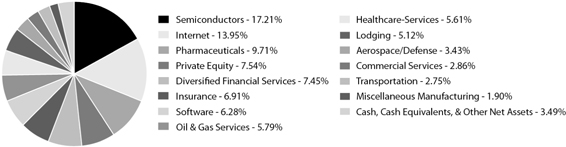

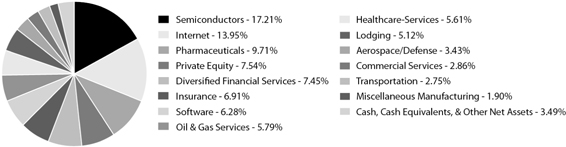

Industry Sector Allocation

(as a % of Net Assets)*

| Technology | | | 31.54 | % |

| Consumer Discretionary | | | 13.88 | % |

| Health Care | | | 11.61 | % |

| Industrials | | | 7.09 | % |

| Energy | | | 1.73 | % |

| Communications | | | 1.55 | % |

| Financials | | | 1.40 | % |

| Consumer, Cyclical | | | 0.61 | % |

| Corporate Bonds | | | 21.74 | % |

| Foreign Corporate Bonds | | | 0.64 | % |

| Foreign Government Bonds | | | 0.31 | % |

| Government & Agency Obligations | | | 6.83 | % |

| Other Assets in Excess of Liabilities | | | 1.07 | % |

Top Ten Holdings

(as a % of Net Assets)*

| Edwards Lifesciences Corp. | | | 3.85 | % |

| TJX Cos., Inc. | | | 3.73 | % |

| Intuit, Inc. | | | 3.04 | % |

| Ubiquiti, Inc. | | | 2.69 | % |

| Align Technology, Inc. | | | 2.65 | % |

| Plexus Corp. | | | 2.50 | % |

| Intuitive Surgical, Inc. | | | 2.44 | % |

| Open Text Corp. | | | 2.26 | % |

| Middleby Corp. | | | 2.21 | % |

| FactSet Research Systems, Inc. | | | 1.96 | % |

| Top Ten Holdings | | | 27.33 | % |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

| Semi-Annual Report | October 31, 2019 | 5 |

| The Disciplined Growth Investors Fund | Disclosure of Fund Expenses |

October 31, 2019 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other fund operating expenses. This example is intended to help you understand your ongoing costs (in dollars), of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of May 1, 2019 through October 31, 2019.

Actual ExpensesThe first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison PurposesThe second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account Value 5/1/2019 | Ending Account Value 10/31/2019 | Expense Ratio(a) | Expenses Paid During period 5/1/2019 - 10/31/2019(b) |

| Actual | $1,000.00 | $1,009.50 | 0.78% | $ 3.94 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,021.22 | 0.78% | $ 3.96 |

| (a) | The Fund's expense ratios have been annualized based on the Fund's most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184)/366 (to reflect the half-year period). |

| 6 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

October 31, 2019 (Unaudited)

| | | Shares | | | Value (Note 2) | |

| COMMON STOCKS (69.41%) | | | | | | | | |

| COMMUNICATIONS (1.55%) | | | | | | | | |

| Media (1.55%) | | | | | | | | |

| Stamps.com, Inc.(a) | | | 36,943 | | | $ | 3,119,098 | |

| TripAdvisor, Inc.(a) | | | 16,505 | | | | 666,802 | |

| | | | | | | | 3,785,900 | |

| | | | | | | | | |

| TOTAL COMMUNICATIONS | | | | | | | 3,785,900 | |

| | | | | | | | | |

| CONSUMER DISCRETIONARY (13.88%) | | | | | | | | |

| Apparel & Textile Products (1.15%) | | | | | | | | |

| Ralph Lauren Corp. | | | 12,934 | | | | 1,242,440 | |

| Under Armour, Inc. , Class A(a) | | | 75,054 | | | | 1,549,865 | |

| | | | | | | | 2,792,305 | |

| | | | | | | | | |

| Automotive Manufacturing (2.24%) | | | | | | | | |

| Gentex Corp. | | | 141,545 | | | | 3,970,337 | |

| Gentherm, Inc.(a) | | | 35,826 | | | | 1,496,452 | |

| | | | | | | | 5,466,789 | |

| | | | | | | | | |

| Gaming, Lodging & Restaurants (1.93%) | | | | | | | | |

| Cheesecake Factory, Inc. | | | 22,470 | | | | 939,021 | |

| Royal Caribbean Cruises, Ltd. | | | 34,698 | | | | 3,776,184 | |

| | | | | | | | 4,715,205 | |

| | | | | | | | | |

| Passenger Transportation (1.77%) | | | | | | | | |

| JetBlue Airways Corp.(a) | | | 222,898 | | | | 4,301,931 | |

| | | | | | | | | |

| Retail - Consumer Discretionary (6.79%) | | | | | | | | |

| Nordstrom, Inc. | | | 71,346 | | | | 2,561,321 | |

| Sleep Number Corp.(a) | | | 83,681 | | | | 4,026,730 | |

| TJX Cos., Inc. | | | 157,601 | | | | 9,085,698 | |

| Urban Outfitters, Inc.(a) | | | 30,431 | | | | 873,370 | |

| | | | | | | | 16,547,119 | |

| | | | | | | | | |

| TOTAL CONSUMER DISCRETIONARY | | | | | | | 33,823,349 | |

| | | | | | | | | |

| CONSUMER, CYCLICAL (0.62%) | | | | | | | | |

| Retail (0.62%) | | | | | | | | |

| MSC Industrial Direct Co., Inc. , Class A | | | 20,443 | | | | 1,496,632 | |

| | | | | | | | | |

| TOTAL CONSUMER, CYCLICAL | | | | | | | 1,496,632 | |

| Semi-Annual Report | October 31, 2019 | 7 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

October 31, 2019 (Unaudited)

| | | Shares | | | Value (Note 2) | |

| ENERGY (1.73%) | | | | | | |

| Oil, Gas & Coal (1.73%) | | | | | | |

| Cabot Oil & Gas Corp. | | | 96,226 | | | $ | 1,793,653 | |

| Core Laboratories NV | | | 28,475 | | | | 1,254,039 | |

| Southwestern Energy Co.(a) | | | 535,154 | | | | 1,097,066 | |

| Ultra Petroleum Corp.(a) | | | 337,188 | | | | 67,437 | |

| | | | | | | | 4,212,195 | |

| | | | | | | | | |

| TOTAL ENERGY | | | | | | | 4,212,195 | |

| | | | | | | | | |

| FINANCIALS (1.40%) | | | | | | | | |

| Banking (0.46%) | | | | | | | | |

| TCF Financial Corp. | | | 28,375 | | | | 1,123,366 | |

| | | | | | | | | |

| Specialty Finance (0.94%) | | | | | | | | |

| Deluxe Corp. | | | 44,206 | | | | 2,291,197 | |

| | | | | | | | | |

| TOTAL FINANCIALS | | | | | | | 3,414,563 | |

| | | | | | | | | |

| HEALTH CARE (11.61%) | | | | | | | | |

| Medical Equipment & Devices Manufacturing (11.61%) | | | | | | | | |

| Align Technology, Inc.(a) | | | 25,576 | | | | 6,452,569 | |

| Edwards Lifesciences Corp.(a) | | | 39,356 | | | | 9,381,683 | |

| Intuitive Surgical, Inc.(a) | | | 10,754 | | | | 5,946,424 | |

| Myriad Genetics, Inc.(a) | | | 102,968 | | | | 3,466,933 | |

| Varian Medical Systems, Inc.(a) | | | 25,305 | | | | 3,057,097 | |

| | | | | | | | 28,304,706 | |

| | | | | | | | | |

| TOTAL HEALTH CARE | | | | | | | 28,304,706 | |

| | | | | | | | | |

| INDUSTRIALS (7.08%) | | | | | | | | |

| Electrical Equipment Manufacturing (1.59%) | | | | | | | | |

| Cognex Corp. | | | 75,310 | | | | 3,877,712 | |

| | | | | | | | | |

| Machinery Manufacturing (3.01%) | | | | | | | | |

| Graco, Inc. | | | 43,386 | | | | 1,961,047 | |

| Middleby Corp.(a) | | | 44,439 | | | | 5,374,897 | |

| | | | | | | | 7,335,944 | |

| Manufactured Goods (1.04%) | | | | | | | | |

| Proto Labs, Inc.(a) | | | 26,215 | | | | 2,542,068 | |

| 8 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

October 31, 2019 (Unaudited)

| | | Shares | | | Value (Note 2) | |

| INDUSTRIALS (continued) | | | | | | |

| Transportation & Logistics (1.44%) | | | | | | |

| Landstar System, Inc. | | | 30,964 | | | $ | 3,503,577 | |

| | | | | | | | | |

| TOTAL INDUSTRIALS | | | | | | | 17,259,301 | |

| | | | | | | | | |

| TECHNOLOGY (31.54%) | | | | | | | | |

| Design, Manufacturing & Distribution (2.50%) | | | | | | | | |

| Plexus Corp.(a) | | | 82,562 | | | | 6,104,634 | |

| | | | | | | | | |

| Hardware (10.64%) | | | | | | | | |

| Dolby Laboratories, Inc. , Class A | | | 67,768 | | | | 4,359,515 | |

| Garmin, Ltd. | | | 49,173 | | | | 4,609,969 | |

| Plantronics, Inc. | | | 59,136 | | | | 2,331,141 | |

| Pure Storage, Inc. , Class A(a) | | | 113,655 | | | | 2,211,726 | |

| Super Micro Computer, Inc.(a) | | | 144,011 | | | | 2,978,148 | |

| Ubiquiti, Inc. | | | 51,883 | | | | 6,567,869 | |

| ViaSat, Inc.(a) | | | 41,592 | | | | 2,863,193 | |

| | | | | | | | 25,921,561 | |

| | | | | | | | | |

| Semiconductors (3.80%) | | | | | | | | |

| IPG Photonics Corp.(a) | | | 12,927 | | | | 1,735,837 | |

| Microchip Technology, Inc. | | | 31,555 | | | | 2,975,321 | |

| Power Integrations, Inc. | | | 49,825 | | | | 4,539,556 | |

| | | | | | | | 9,250,714 | |

| | | | | | | | | |

| Software (11.17%) | | | | | | | | |

| Akamai Technologies, Inc.(a) | | | 54,292 | | | | 4,696,258 | |

| Autodesk, Inc.(a) | | | 30,216 | | | | 4,452,630 | |

| Intuit, Inc. | | | 28,810 | | | | 7,418,575 | |

| Manhattan Associates, Inc.(a) | | | 20,701 | | | | 1,551,540 | |

| Open Text Corp. | | | 137,000 | | | | 5,515,620 | |

| RealPage, Inc.(a) | | | 59,502 | | | | 3,602,846 | |

| | | | | | | | 27,237,469 | |

| Semi-Annual Report | October 31, 2019 | 9 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

October 31, 2019 (Unaudited)

| | | Shares | | | Value (Note 2) | |

| TECHNOLOGY (continued) | | | | | | |

| Technology Services (3.43%) | | | | | | |

| FactSet Research Systems, Inc. | | | 18,888 | | | $ | 4,788,486 | |

| IHS Markit, Ltd.(a) | | | 27,705 | | | | 1,939,904 | |

| Paychex, Inc. | | | 19,487 | | | | 1,629,893 | |

| | | | | | | | 8,358,283 | |

| | | | | | | | | |

| TOTAL TECHNOLOGY | | | | | | | 76,872,661 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $105,224,871) | | | | | | | 169,169,307 | |

| | | Principal Amount | | | Value (Note 2) | |

| CORPORATE BONDS (21.74%) | | | | | | |

| COMMUNICATIONS (1.33%) | | | | | | |

| Cable & Satellite (0.35%) | | | | | | |

| Comcast Corp. | | | | | | |

| 3.375% 08/15/2025 | | $ | 810,000 | | | | 863,657 | |

| | | | | | | | | |

| Entertainment Content (0.32%) | | | | | | | | |

| CBS Corp. | | | | | | | | |

| 4.000% 01/15/2026 | | | 726,000 | | | | 778,811 | |

| | | | | | | | | |

| Wireless Telecommunications Services (0.66%) | | | | | | | | |

| AT&T, Inc. | | | | | | | | |

| 4.250% 03/01/2027 | | | 741,000 | | | | 814,495 | |

| 4.450% 04/01/2024 | | | 4,000 | | | | 4,339 | |

| Verizon Communications, Inc. | | | | | | | | |

| 4.125% 03/16/2027 | | | 698,000 | | | | 778,438 | |

| | | | | | | | 1,597,272 | |

| | | | | | | | | |

| TOTAL COMMUNICATIONS | | | | | | | 3,239,740 | |

| | | | | | | | | |

| CONSUMER DISCRETIONARY (2.34%) | | | | | | | | |

| Airlines (0.32%) | | | | | | | | |

| Southwest Airlines Co. | | | | | | | | |

| 3.000% 11/15/2026 | | | 756,000 | | | | 775,874 | |

| | | | | | | | | |

| Automobiles Manufacturing (0.31%) | | | | | | | | |

| General Motors Financial Co., Inc. | | | | | | | | |

| 5.250% 03/01/2026 | | | 695,000 | | | | 754,563 | |

| 10 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

October 31, 2019 (Unaudited)

| | | Principal Amount | | | Value (Note 2) | |

| CONSUMER DISCRETIONARY (continued) | | | | | | |

| Consumer Services (0.32%) | | | | | | |

| Cintas Corp. No 2 | | | | | | |

| 3.700% 04/01/2027 | | $ | 710,000 | | | $ | 777,075 | |

| | | | | | | | | |

| Restaurants (0.33%) | | | | | | | | |

| McDonald's Corp., Series MTN | | | | | | | | |

| 6.300% 03/01/2038 | | | 604,000 | | | | 824,184 | |

| | | | | | | | | |

| Retail - Consumer Discretionary (1.06%) | | | | | | | | |

| Advance Auto Parts, Inc. | | | | | | | | |

| 4.500% 12/01/2023 | | | 685,000 | | | | 739,203 | |

| Amazon.com, Inc. | | | | | | | | |

| 5.200% 12/03/2025 | | | 885,000 | | | | 1,042,117 | |

| Lowe's Cos., Inc. | | | | | | | | |

| 3.650% 04/05/2029 | | | 742,000 | | | | 799,089 | |

| | | | | | | | 2,580,409 | |

| | | | | | | | | |

| TOTAL CONSUMER DISCRETIONARY | | | | | | | 5,712,105 | |

| | | | | | | | | |

| CONSUMER STAPLES (0.32%) | | | | | | | | |

| Mass Merchants (0.32%) | | | | | | | | |

| Costco Wholesale Corp. | | | | | | | | |

| 2.750% 05/18/2024 | | | 760,000 | | | | 789,558 | |

| | | | | | | | | |

| TOTAL CONSUMER STAPLES | | | | | | | 789,558 | |

| | | | | | | | | |

| CONSUMER, NON-CYCLICAL (0.62%) | | | | | | | | |

| Pharmaceuticals (0.62%) | | | | | | | | |

| AbbVie, Inc. | | | | | | | | |

| 4.250% 11/14/2028 | | | 695,000 | | | | 755,988 | |

| CVS Health Corp. | | | | | | | | |

| 4.300% 03/25/2028 | | | 685,000 | | | | 744,198 | |

| | | | | | | | 1,500,186 | |

| | | | | | | | | |

| TOTAL CONSUMER, NON-CYCLICAL | | | | | | | 1,500,186 | |

| | | | | | | | | |

| ENERGY (2.19%) | | | | | | | | |

| Exploration & Production (0.32%) | | | | | | | | |

| Conoco Funding Co. | | | | | | | | |

| 7.250% 10/15/2031 | | | 551,000 | | | | 784,064 | |

| Semi-Annual Report | October 31, 2019 | 11 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

October 31, 2019 (Unaudited)

| | | Principal Amount | | | Value (Note 2) | |

| ENERGY (continued) | | | | | | |

| Pipeline (1.87%) | | | | | | |

| Boardwalk Pipelines LP | | | | | | |

| 5.950% 06/01/2026 | | $ | 670,000 | | | $ | 751,656 | |

| Enbridge Energy Partners LP | | | | | | | | |

| 4.200% 09/15/2021 | | | 4,000 | | | | 4,137 | |

| 5.875% 10/15/2025 | | | 643,000 | | | | 748,627 | |

| Enterprise Products Operating LLC | | | | | | | | |

| 3.950% 02/15/2027 | | | 710,000 | | | | 768,379 | |

| MPLX LP | | | | | | | | |

| 4.125% 03/01/2027 | | | 748,000 | | | | 786,182 | |

| ONEOK, Inc. | | | | | | | | |

| 4.550% 07/15/2028 | | | 694,000 | | | | 755,996 | |

| Williams Cos., Inc. | | | | | | | | |

| 3.750% 06/15/2027 | | | 718,000 | | | | 748,185 | |

| | | | | | | | 4,563,162 | |

| | | | | | | | | |

| TOTAL ENERGY | | | | | | | 5,347,226 | |

| | | | | | | | | |

| FINANCIALS (4.08%) | | | | | | | | |

| Banks (0.95%) | | | | | | | | |

| BB&T Corp., Series MTN | | | | | | | | |

| 3.875% 03/19/2029 | | | 695,000 | | | | 757,302 | |

| US Bancorp, Series MTN | | | | | | | | |

| 3.100% 04/27/2026 | | | 739,000 | | | | 774,606 | |

| Wells Fargo & Co., Series GMTN | | | | | | | | |

| 4.300% 07/22/2027 | | | 710,000 | | | | 777,024 | |

| | | | | | | | 2,308,932 | |

| | | | | | | | | |

| Consumer Finance (0.31%) | | | | | | | | |

| American Express Co. | | | | | | | | |

| 3.625% 12/05/2024 | | | 708,000 | | | | 751,901 | |

| | | | | | | | | |

| Diversified Banks (0.95%) | | | | | | | | |

| Bank of America Corp., Series L | | | | | | | | |

| 4.183% 11/25/2027 | | | 715,000 | | | | 775,097 | |

| Citigroup, Inc. | | | | | | | | |

| 4.300% 11/20/2026 | | | 720,000 | | | | 781,306 | |

| JPMorgan Chase & Co. | | | | | | | | |

| 4.125% 12/15/2026 | | | 690,000 | | | | 754,331 | |

| | | | | | | | 2,310,734 | |

| | | | | | | | | |

| Financial Services (0.61%) | | | | | | | | |

| Morgan Stanley, Series GMTN | | | | | | | | |

| 3.700% 10/23/2024 | | | 690,000 | | | | 734,148 | |

| 12 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

October 31, 2019 (Unaudited)

| | | Principal Amount | | | Value (Note 2) | |

| FINANCIALS (continued) | | | | | | | | |

| Financial Services (continued) | | | | | | | | |

| Northern Trust Corp. | | | | | | | | |

| 3.950% 10/30/2025 | | $ | 693,000 | | | $ | 758,773 | |

| | | | | | | | 1,492,921 | |

| Life Insurance (0.31%) | | | | | | | | |

| Principal Financial Group, Inc. | | | | | | | | |

| 3.100% 11/15/2026 | | | 726,000 | | | | 753,881 | |

| | | | | | | | | |

| Property & Casualty Insurance (0.32%) | | | | | | | | |

| American International Group, Inc. | | | | | | | | |

| 4.250% 03/15/2029 | | | 700,000 | | | | 775,865 | |

| | | | | | | | | |

| Real Estate (0.63%) | | | | | | | | |

| Simon Property Group LP | | | | | | | | |

| 3.250% 11/30/2026 | | | 728,000 | | | | 767,545 | |

| Welltower, Inc. | | | | | | | | |

| 4.250% 04/01/2026 | | | 712,000 | | | | 778,728 | |

| | | | | | | | 1,546,273 | |

| | | | | | | | | |

| TOTAL FINANCIALS | | | | | | | 9,940,507 | |

| | | | | | | | | |

| HEALTH CARE (0.96%) | | | | | | | | |

| Managed Care (0.62%) | | | | | | | | |

| Anthem, Inc. | | | | | | | | |

| 3.650% 12/01/2027 | | | 731,000 | | | | 773,919 | |

| UnitedHealth Group, Inc. | | | | | | | | |

| 3.750% 07/15/2025 | | | 691,000 | | | | 750,032 | |

| | | | | | | | 1,523,951 | |

| | | | | | | | | |

| Pharmaceuticals (0.34%) | | | | | | | | |

| Johnson & Johnson | | | | | | | | |

| 5.850% 07/15/2038 | | | 572,000 | | | | 817,638 | |

| | | | | | | | | |

| TOTAL HEALTH CARE | | | | | | | 2,341,589 | |

| | | | | | | | | |

| INDUSTRIALS (3.52%) | | | | | | | | |

| Aerospace & Defense (0.92%) | | | | | | | | |

| Lockheed Martin Corp. | | | | | | | | |

| 3.100% 01/15/2023 | | | 680,000 | | | | 705,038 | |

| Rockwell Collins, Inc. | | | | | | | | |

| 3.500% 03/15/2027 | | | 730,000 | | | | 781,542 | |

| Semi-Annual Report | October 31, 2019 | 13 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

October 31, 2019 (Unaudited)

| | | Principal Amount | | | Value (Note 2) | |

| INDUSTRIALS (continued) | | | | | | |

| Aerospace & Defense (continued) | | | | | | |

| United Technologies Corp. | | | | | | |

| 3.950% 08/16/2025 | | $ | 680,000 | | | $ | 744,967 | |

| | | | | | | | 2,231,547 | |

| | | | | | | | | |

| Electrical Equipment Manufacturing (0.32%) | | | | | | | | |

| General Electric Co., Series MTN | | | | | | | | |

| 5.875% 01/14/2038 | | | 653,000 | | | | 782,218 | |

| | | | | | | | | |

| Engineering & Construction (0.29%) | | | | | | | | |

| Fluor Corp. | | | | | | | | |

| 4.250% 09/15/2028 | | | 725,000 | | | | 718,883 | |

| | | | | | | | | |

| Railroad (0.70%) | | | | | | | | |

| Burlington Northern Santa Fe LLC | | | | | | | | |

| 3.000% 03/15/2023 | | | 2,000 | | | | 2,065 | |

| 3.400% 09/01/2024 | | | 875,000 | | | | 931,692 | |

| Union Pacific Corp. | | | | | | | | |

| 3.250% 08/15/2025 | | | 735,000 | | | | 775,831 | |

| | | | | | | | 1,709,588 | |

| | | | | | | | | |

| Transportation & Logistics (0.64%) | | | | | | | | |

| FedEx Corp. | | | | | | | | |

| 3.300% 03/15/2027 | | | 756,000 | | | | 782,013 | |

| United Parcel Service, Inc. | | | | | | | | |

| 6.200% 01/15/2038 | | | 558,000 | | | | 777,633 | |

| | | | | | | | 1,559,646 | |

| | | | | | | | | |

| Waste & Environment Services & Equipment (0.65%) | | | | | | | | |

| Republic Services, Inc. | | | | | | | | |

| 3.375% 11/15/2027 | | | 735,000 | | | | 784,962 | |

| Waste Management, Inc. | | | | | | | | |

| 3.150% 11/15/2027 | | | 745,000 | | | | 787,309 | |

| | | | | | | | 1,572,271 | |

| | | | | | | | | |

| TOTAL INDUSTRIALS | | | | | | | 8,574,153 | |

| 14 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

October 31, 2019 (Unaudited)

| | | Principal Amount | | | Value (Note 2) | |

| MATERIALS (0.31%) | | | | | | |

| Chemicals (0.31%) | | | | | | |

| DuPont de Nemours, Inc. | | | | | | |

| 4.725% 11/15/2028 | | $ | 666,000 | | | $ | 760,008 | |

| | | | | | | | | |

| TOTAL MATERIALS | | | | | | | 760,008 | |

| | | | | | | | | |

| TECHNOLOGY (0.32%) | | | | | | | | |

| Semiconductors (0.32%) | | | | | | | | |

| Analog Devices, Inc. | | | | | | | | |

| 3.900% 12/15/2025 | | | 711,000 | | | | 767,885 | |

| | | | | | | | | |

| TOTAL TECHNOLOGY | | | | | | | 767,885 | |

| | | | | | | | | |

| UTILITIES (5.75%) | | | | | | | | |

| Utilities (5.75%) | | | | | | | | |

| Ameren Corp. | | | | | | | | |

| 2.500% 09/15/2024 | | | 690,000 | | | | 695,497 | |

| American Electric Power Co., Inc. | | | | | | | | |

| 3.200% 11/13/2027 | | | 731,000 | | | | 770,107 | |

| Black Hills Corp. | | | | | | | | |

| 3.150% 01/15/2027 | | | 700,000 | | | | 710,669 | |

| CenterPoint Energy, Inc. | | | | | | | | |

| 3.850% 02/01/2024 | | | 700,000 | | | | 741,945 | |

| CMS Energy Corp. | | | | | | | | |

| 3.000% 05/15/2026 | | | 760,000 | | | | 782,612 | |

| Dominion Energy, Inc., Series B | | | | | | | | |

| 2.750% 09/15/2022 | | | 695,000 | | | | 707,190 | |

| DTE Energy Co., Series C | | | | | | | | |

| 3.500% 06/01/2024 | | | 715,000 | | | | 748,101 | |

| Duke Energy Corp. | | | | | | | | |

| 3.950% 10/15/2023 | | | 690,000 | | | | 733,506 | |

| Edison International | | | | | | | | |

| 2.400% 09/15/2022 | | | 745,000 | | | | 728,307 | |

| Interstate Power & Light Co. | | | | | | | | |

| 3.400% 08/15/2025 | | | 723,000 | | | | 758,632 | |

| ITC Holdings Corp. | | | | | | | | |

| 4.050% 07/01/2023 | | | 540,000 | | | | 568,257 | |

| NiSource, Inc. | | | | | | | | |

| 3.850% 02/15/2023 | | | 695,000 | | | | 724,790 | |

| Potomac Electric Power Co. | | | | | | | | |

| 3.600% 03/15/2024 | | | 698,000 | | | | 741,956 | |

| PPL Capital Funding, Inc. | | | | | | | | |

| 3.100% 05/15/2026 | | | 820,000 | | | | 840,870 | |

| Semi-Annual Report | October 31, 2019 | 15 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

October 31, 2019 (Unaudited)

| | | Principal Amount | | | Value (Note 2) | |

| UTILITIES (continued) | | | | | | |

| Utilities (continued) | | | | | | |

| PSEG Power LLC | | | | | | |

| 4.300% 11/15/2023 | | $ | 675,000 | | | $ | 718,326 | |

| Puget Energy, Inc. | | | | | | | | |

| 3.650% 05/15/2025 | | | 725,000 | | | | 755,061 | |

| Sempra Energy | | | | | | | | |

| 2.875% 10/01/2022 | | | 720,000 | | | | 734,774 | |

| Virginia Electric & Power Co., Series A | | | | | | | | |

| 3.800% 04/01/2028 | | | 710,000 | | | | 782,154 | |

| Wisconsin Electric Power Co. | | | | | | | | |

| 3.100% 06/01/2025 | | | 735,000 | | | | 768,230 | |

| | | | | | | | 14,010,984 | |

| | | | | | | | | |

| TOTAL UTILITIES | | | | | | | 14,010,984 | |

| | | | | | | | | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $49,954,468) | | | | | | | 52,983,941 | |

| | | | | | | | | |

| FOREIGN CORPORATE BONDS (0.64%) | | | | | | | | |

| ENERGY (0.33%) | | | | | | | | |

| Pipeline (0.33%) | | | | | | | | |

| TransCanada PipeLines, Ltd. | | | | | | | | |

| 7.250% 08/15/2038 | | | 572,000 | | | | 813,285 | |

| | | | | | | | | |

| TOTAL ENERGY | | | | | | | 813,285 | |

| | | | | | | | | |

| FINANCIALS (0.31%) | | | | | | | | |

| Diversified Banks (0.31%) | | | | | | | | |

| Royal Bank of Canada, Series GMTN | | | | | | | | |

| 2.550% 07/16/2024 | | | 746,000 | | | | 757,571 | |

| | | | | | | | | |

| TOTAL FINANCIALS | | | | | | | 757,571 | |

| | | | | | | | | |

| TOTAL FOREIGN CORPORATE BONDS | | | | | | | | |

| (Cost $1,488,801) | | | | | | | 1,570,856 | |

| | | | | | | | | |

| FOREIGN GOVERNMENT BONDS (0.31%) | | | | | | | | |

| Corp Andina de Fomento | | | | | | | | |

| 4.375% 06/15/2022 | | | 712,000 | | | | 751,018 | |

| | | | | | | | | |

| TOTAL FOREIGN GOVERNMENT BONDS | | | | | | | | |

| (Cost $742,930) | | | | | | | 751,018 | |

| 16 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

October 31, 2019 (Unaudited)

| | | Principal Amount | | | Value (Note 2) | |

| GOVERNMENT & AGENCY OBLIGATIONS (6.82%) | | | | | | |

| U.S. Treasury Bonds | | | | | | |

| 1.500% 08/15/2026 | | $ | 689,000 | | | $ | 684,452 | |

| 2.875% 05/15/2028 | | | 2,000,000 | | | | 2,194,219 | |

| 6.500% 11/15/2026 | | | 77,000 | | | | 102,129 | |

| U.S. Treasury Notes | | | | | | | | |

| 1.250% 01/31/2020 | | | 4,500,000 | | | | 4,496,748 | |

| 1.375% 09/15/2020 | | | 1,150,000 | | | | 1,148,001 | |

| 1.375% 01/31/2021 | | | 3,550,000 | | | | 3,541,125 | |

| 1.500% 04/15/2020 | | | 4,470,000 | | | | 4,468,865 | |

| | | | | | | | | |

| TOTAL GOVERNMENT & AGENCY OBLIGATIONS | | | | | | | | |

| (Cost $16,375,447) | | | | | | | 16,635,539 | |

| | | Yield | | | Shares | | | Value (Note 2) | |

| SHORT TERM INVESTMENTS (0.89%) | | | | | | | | | | | | |

| (0.89%) | | | | | | | | | | | | |

| Fidelity Investments Money Market Government Portfolio - Class I | | | 1.736 | %(b) | | | 2,163,609 | | | | 2,163,609 | |

| | | | | | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $2,163,609) | | | | | | | | | | | 2,163,609 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS (99.81%) | | | | | | | | | | | | |

| (Cost $175,950,126) | | | | | | | | | | $ | 243,274,270 | |

| | | | | | | | | | | | | |

| Other Assets In Excess Of Liabilities (0.19%) | | | | | | | | | | | 456,266 | |

| | | | | | | | | | | | | |

| NET ASSETS (100.00%) | | | | | | | | | | $ | 243,730,536 | |

| (a) | Non-Income Producing Security. |

| (b) | Represents the 7-day yield. |

For Fund compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percent of net assets.

See Notes to Financial Statements.

| Semi-Annual Report | October 31, 2019 | 17 |

| The Disciplined Growth Investors Fund | Statement of Assets and Liabilities |

October 31, 2019 (Unaudited)

| ASSETS | | | |

| Investments, at value | | $ | 243,274,270 | |

| Receivable for shares sold | | | 25 | |

| Dividends and interest receivable | | | 627,373 | |

| Total assets | | | 243,901,668 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for shares redeemed | | | 14,000 | |

| Payable to adviser | | | 157,132 | |

| Total liabilities | | | 171,132 | |

| NET ASSETS | | $ | 243,730,536 | |

| | | | | |

| NET ASSETS CONSIST OF | | | | |

| Paid-in capital (Note 5) | | $ | 169,592,852 | |

| Distributable Earnings | | | 74,137,684 | |

| NET ASSETS | | $ | 243,730,536 | |

| | | | | |

| INVESTMENTS, AT COST | | $ | 175,950,126 | |

| | | | | |

| PRICING OF SHARES | | | | |

| Net Asset Value, offering and redemption price per share | | $ | 21.27 | |

| Shares of beneficial interest outstanding | | | 11,460,248 | |

See Notes to Financial Statements.

| 18 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Statement of Operations |

| | | For the Six Months Ended October 31, 2019 (Unaudited) | |

| INVESTMENT INCOME | | | |

| Dividends | | $ | 705,638 | |

| Foreign taxes withheld | | | (11,874 | ) |

| Interest | | | 1,152,822 | |

| Total investment income | | | 1,846,586 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees (Note 6) | | | 920,281 | |

| Total expenses | | | 920,281 | |

| NET INVESTMENT INCOME | | | 926,305 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN/LOSS ON INVESTMENTS | | | | |

| Net realized gain on investments | | | 3,701,404 | |

| Net change in unrealized depreciation on investments | | | (2,380,663 | ) |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 1,320,741 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 2,247,046 | |

See Notes to Financial Statements.

| Semi-Annual Report | October 31, 2019 | 19 |

| The Disciplined Growth Investors Fund | Statements of Changes in Net Assets |

| | | For the Six Months Ended October 31, 2019 (Unaudited) | | | For the Year Ended April 30, 2019 | |

| OPERATIONS | | | | | | |

| Net investment income | | $ | 926,305 | | | $ | 1,766,931 | |

| Net realized gain | | | 3,701,404 | | | | 7,977,814 | |

| Net change in unrealized appreciation/(depreciation) | | | (2,380,663 | ) | | | 21,055,807 | |

| Net increase in net assets resulting from operations | | | 2,247,046 | | | | 30,800,552 | |

| | | | | | | | | |

| DISTRIBUTIONS (Note 3) | | | | | | | | |

| Total distributions to shareholders | | | (883,844 | ) | | | (7,508,119 | ) |

| Net decrease in net assets from distributions | | | (883,844 | ) | | | (7,508,119 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS (Note 5) | | | | | | | | |

| Proceeds from sales of shares | | | 5,316,088 | | | | 20,768,296 | |

| Issued to shareholders in reinvestment of distributions | | | 876,683 | | | | 7,471,582 | |

| Cost of shares redeemed | | | (3,996,961 | ) | | | (15,429,264 | ) |

| Net increase from capital share transactions | | | 2,195,810 | | | | 12,810,614 | |

| | | | | | | | | |

| Net increase in net assets | | | 3,559,012 | | | | 36,103,047 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 240,171,524 | | | | 204,068,477 | |

| End of period | | $ | 243,730,536 | | | $ | 240,171,524 | |

| | | | | | | | | |

| OTHER INFORMATION | | | | | | | | |

| Share Transactions | | | | | | | | |

| Issued | | | 258,705 | | | | 1,042,174 | |

| Issued to shareholders in reinvestment of distributions | | | 42,628 | | | | 410,272 | |

| Redeemed | | | (194,439 | ) | | | (770,890 | ) |

| Net increase in share transactions | | | 106,894 | | | | 681,556 | |

See Notes to Financial Statements.

| 20 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

Page Intentionally Left Blank

| The Disciplined Growth Investors Fund |

| NET ASSET VALUE, BEGINNING OF PERIOD | |

| | |

| INCOME FROM OPERATIONS | |

| Net investment income(a) | |

| Net realized and unrealized gain/(loss) on investments | |

| Total from investment operations | |

| | |

| DISTRIBUTIONS | |

| From net investment income | |

| From net realized gain on investments | |

| Total distributions | |

| | |

| REDEMPTION FEES ADDED TO PAID-IN CAPITAL | |

| INCREASE/(DECREASE) IN NET ASSET VALUE | |

| NET ASSET VALUE, END OF PERIOD | |

| | |

| TOTAL RETURN | |

| | |

| RATIOS AND SUPPLEMENTAL DATA | |

| Net assets, end of period (000's) | |

| | |

| RATIOS TO AVERAGE NET ASSETS | |

| Expenses | |

| Net investment income | |

| | |

| PORTFOLIO TURNOVER RATE | |

| (a) | Per share numbers have been calculated using the average shares method. |

| (c) | In 2018 the Fund's total return consists of a voluntary reimbursement by the advisor for a realized investment loss. Excluding this item, total return would not have been impacted. |

See Notes to Financial Statements.

| 22 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

For a share outstanding during the periods presented

| For the Six Months Ended October 31, 2019 (Unaudited) | | | For the Year Ended April 30, 2019 | | | For the Year Ended April 30, 2018 | | | For the Year Ended April 30, 2017 | | | For the Year Ended April 30, 2016 | | | For the Year Ended April 30, 2015 | |

| $ | 21.15 | | | $ | 19.12 | | | $ | 18.20 | | | $ | 15.96 | | | $ | 16.75 | | | $ | 15.02 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 0.08 | | | | 0.16 | | | | 0.12 | | | | 0.09 | | | | 0.09 | | | | 0.10 | |

| | 0.12 | | | | 2.55 | | | | 1.64 | | | | 2.29 | | | | (0.44 | ) | | | 1.83 | |

| | 0.20 | | | | 2.71 | | | | 1.76 | | | | 2.38 | | | | (0.35 | ) | | | 1.93 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | (0.08 | ) | | | (0.12 | ) | | | (0.12 | ) | | | (0.09 | ) | | | (0.10 | ) | | | (0.09 | ) |

| | – | | | | (0.56 | ) | | | (0.72 | ) | | | (0.05 | ) | | | (0.34 | ) | | | (0.11 | ) |

| | (0.08 | ) | | | (0.68 | ) | | | (0.84 | ) | | | (0.14 | ) | | | (0.44 | ) | | | (0.20 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

| | – | | | | – | | | | – | | | | – | | | | – | | | | – | |

| | 0.12 | | | | 2.03 | | | | 0.92 | | | | 2.24 | | | | (0.79 | ) | | | 1.73 | |

| $ | 21.27 | | | $ | 21.15 | | | $ | 19.12 | | | $ | 18.20 | | | $ | 15.96 | | | $ | 16.75 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 0.95 | %(b) | | | 14.74 | % | | | 9.75 | %(c) | | | 14.96 | % | | | (2.05 | %) | | | 12.87 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| $ | 243,731 | | | $ | 240,172 | | | $ | 204,068 | | | $ | 159,774 | | | $ | 119,857 | | | $ | 113,342 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 0.78 | %(d) | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % |

| | 0.79 | %(d) | | | 0.80 | % | | | 0.64 | % | | | 0.50 | % | | | 0.59 | % | | | 0.61 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 10 | %(b) | | | 22 | % | | | 18 | % | | | 16 | % | | | 13 | % | | | 14 | % |

| Semi-Annual Report | October 31, 2019 | 23 |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

October 31, 2019 (Unaudited)

1. ORGANIZATION

Financial Investors Trust (the “Trust”), a Delaware statutory trust, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (“1940 Act”). The Trust consists of multiple separate portfolios or series. This semi-annual report describes The Disciplined Growth Investors Fund (the “Fund”). The Fund seeks long-term capital growth and as a secondary objective, modest income with reasonable risk.

2. SIGNIFICANT ACCOUNTING POLICIES

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Actual results could differ from those estimates. The Fund is considered an investment company for financial reporting purposes under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Codification Topic 946. The following is a summary of significant accounting policies consistently followed by the Fund in preparation of its financial statements.

Investment Valuation:The Fund generally values its securities based on market prices determined at the close of regular trading on the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern Time, on each day the NYSE is open for trading.

For equity securities and mutual funds that are traded on an exchange, the market price is usually the closing sale or official closing price on that exchange. In the case of equity securities not traded on an exchange, or if such closing prices are not otherwise available, the securities are valued at the mean of the most recent bid and ask prices on such day. Redeemable securities issued by open-end registered investment companies are valued at the investment company’s applicable net asset value, with the exception of exchange-traded open-end investment companies, which are priced as equity securities.

The market price for debt obligations is generally the price supplied by an independent third-party pricing service approved by the Board of Trustees of the Trust (the “Board” or the “Trustees”), which may use a matrix, formula or other objective method that takes into consideration quotations from dealers, market transactions in comparable investments, market indices and yield curves. If vendors are unable to supply a price, or if the price supplied is deemed to be unreliable, the market price may be determined using quotations received from one or more broker–dealers that make a market in the security. Fixed-income obligations, excluding municipal securities, having a remaining maturity of greater than 60 days, are typically valued at the mean between the evaluated bid and ask prices formulated by an independent pricing service. Corporate Bonds, U.S. Government & Agency, and U.S. Treasury Bonds & Notes are valued using market models that consider trade data, quotations from dealers and active market makers, relevant yield curve and spread data, creditworthiness, trade data or market information on comparable securities, and other relevant security specific information. Publicly traded Foreign Government Debt securities and Foreign Corporate Bonds are

| 24 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

October 31, 2019 (Unaudited)

typically traded internationally in the over-the-counter market and are valued at the mean between the bid and asked prices as of the close of business of that market. Mortgage-related and asset-backed securities are valued based on models that consider trade data, prepayment and default projections, benchmark yield and spread data and estimated cash flows of each tranche of the issuer. Publicly traded foreign government debt securities are typically traded internationally in the over-the-counter market and are valued at the mean between the bid and asked prices as of the close of business of that market.

When such prices or quotations are not available, or when Disciplined Growth Investors, Inc. (the “Adviser”) believes that they are unreliable, securities may be priced using fair value procedures approved by the Board.

Fair Value Measurements:The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

| Semi-Annual Report | October 31, 2019 | 25 |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

October 31, 2019 (Unaudited)

The following is a summary of each input used to value the Fund as of October 31, 2019:

| Investments in Securities at Value | | Level 1 - Unadjusted Quoted Prices | | | Level 2 - Other Significant Observable Inputs | | | Level 3 - Significant Unobservable Inputs | | | Total | |

| Common Stocks(a) | | $ | 169,169,307 | | | $ | – | | | $ | – | | | $ | 169,169,307 | |

| Corporate Bonds(a) | | | – | | | | 52,983,941 | | | | – | | | | 52,983,941 | |

| Foreign Corporate Bonds(a) | | | – | | | | 1,570,856 | | | | – | | | | 1,570,856 | |

| Foreign Government Bonds | | | – | | | | 751,018 | | | | – | | | | 751,018 | |

| Government & Agency Obligations | | | – | | | | 16,635,539 | | | | – | | | | 16,635,539 | |

| Short Term Investments | | | 2,163,609 | | | | – | | | | – | | | | 2,163,609 | |

| TOTAL | | $ | 171,332,916 | | | $ | 71,941,354 | | | $ | – | | | $ | 243,274,270 | |

| (a) | For detailed descriptions of the underlying industries, see the accompanying Portfolio of Investments. |

For the six months ended October 31, 2019, the Fund did not have any securities that used significant unobservable inputs (Level 3) in determining fair value.

Investment Transactions and Investment Income:Investment transactions are accounted for on the date the investments are purchased or sold (trade date). Realized gains and losses from investment transactions are reported on an identified cost basis, which is the same basis the Fund uses for federal income tax purposes. Interest income, which includes accretion of discounts, is accrued and recorded as earned. Dividend income is recognized on the ex-dividend date or for certain foreign securities, as soon as information is available to the Fund.

Trust Expenses:Some expenses of the Trust can be directly attributed to the Fund. Expenses which cannot be directly attributed to the Fund are apportioned among all funds in the Trust based on average net assets of each fund.

Fund Expenses:Expenses that are specific to the Fund are charged directly to the Fund.

Federal Income Taxes:The Fund complies with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and intends to distribute substantially all of their net taxable income and net capital gains, if any, each year so that it will not be subject to excise tax on undistributed income and gains. The Fund is not subject to income taxes to the extent such distributions are made.

As of and during the six months ended October 31, 2019, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

| 26 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

October 31, 2019 (Unaudited)

Distributions to Shareholders:The Fund normally pays dividends, if any, quarterly and distributes capital gains, if any, on an annual basis. Income dividend distributions are derived from dividends and other income the Fund receives from its investments, including short term capital gains. Long term capital gain distributions are derived from gains realized when the Fund sells a security it has owned for more than a year. The Fund may make additional distributions and dividends at other times if the portfolio manager believes doing so may be necessary for the Fund to avoid or reduce taxes.

3. TAX BASIS INFORMATION

Tax Basis of Investments:As of October 31, 2019, the aggregate cost of investments, gross unrealized appreciation/ (depreciation) and net unrealized appreciation for Federal tax purposes was as follows:

| | | The Disciplined Growth Investors Fund | |

| Gross appreciation(excess of value over tax cost) | | $ | 74,661,020 | |

| Gross depreciation (excess of tax cost over value) | | | (7,336,876 | ) |

| Net unrealized appreciation | | $ | 67,324,144 | |

| Cost of investments for income tax purposes | | $ | 175,950,126 | |

Tax Basis of Distributions to Shareholders:The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain was recorded by the Fund.

The tax character of distributions paid during the year ended April 30, 2019, were as follows:

| | | Ordinary Income | | | Long-Term Capital Gain | |

| The Disciplined Growth Investors Fund | | $ | 1,871,972 | | | $ | 5,636,147 | |

The amounts and characteristics of tax basis distributions and composition of distributable earnings/(accumulated losses) are finalized at fiscal year-end. Accordingly, tax basis balances have not been determined as of October 31, 2019.

| Semi-Annual Report | October 31, 2019 | 27 |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

October 31, 2019 (Unaudited)

4. SECURITIES TRANSACTIONS

The Fund utilizes transfer in-kind transactions with the intent of saving on equity transaction costs for new shareholders at the institution they transferred from and for the Fund on the addition of assets. During the six months ended October 31, 2019, no assets were transferred in-kind.

The cost of purchases and proceeds from sales of securities (excluding short-term securities, transfers-in-kind, and U.S. Government Obligations) during the six months ended October 31, 2019, were as follows:

| Fund | | Purchases of Securities | | | Proceeds From Sales of Securities | |

| The Disciplined Growth Investors Fund | | $ | 19,426,355 | | | $ | 16,859,291 | |

Investment transactions in U.S. Government Obligations (excluding transfers-in-kind) during the six months ended October 31, 2019 were as follows:

| Fund | | Purchases of Securities | | | Proceeds From Sales of Securities | |

| The Disciplined Growth Investors Fund | | $ | 4,685,748 | | | $ | 6,092,934 | |

5. SHARES OF BENEFICIAL INTEREST

The capitalization of the Trust consists of an unlimited number of shares of beneficial interest with no par value per share. Holders of the shares of the Fund of the Trust have one vote for each share held and a proportionate fraction of a vote for each fractional share. All shares issued and outstanding are fully paid and are transferable and redeemable at the option of the shareholder. Purchasers of the shares do not have any obligation to make payments to the Trust or its creditors (other than the purchase price for the shares or make contributions to the Trust or its creditors solely by reason of the purchasers’ ownership of the shares. Shares have no pre-emptive rights.

6. MANAGEMENT AND RELATED-PARTY TRANSACTIONS

The Adviser, subject to the authority of the Board, is responsible for the overall management and administration of the Fund’s business affairs. The Adviser manages the investments of the Fund in accordance with the Fund’s investment objective, policies and limitations and investment guidelines established jointly by the Adviser and the Trustees. Pursuant to the Advisory Agreement, the Fund pays the Adviser a unitary management fee for the services and facilities it provides payable on a monthly basis at the annual rate of 0.78% of the Fund’s average daily net assets. The management fee is paid on a monthly basis.

Out of the unitary management fee, the Adviser pays substantially all expenses of the Fund, including the cost of transfer agency, custody, fund administration, bookkeeping and pricing services, legal, audit and other services, except for interest expenses, brokerage expenses, taxes and extraordinary expenses not incurred in the ordinary course of the Fund’s business. Also included are Trustee fees which were $4,375 for the six months ended October 31, 2019.

| 28 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

October 31, 2019 (Unaudited)

Fund Administrator Fees and Expenses

ALPS Fund Services, Inc. (“ALPS”) serves as administrator to the Fund. Pursuant to an Administration Agreement, ALPS provides operational services to the Fund including, but not limited to, fund accounting and fund administration and generally assists in the Fund’s operations. Officers of the Trust are employees of ALPS. The Fund’s administration fee is accrued on a daily basis and paid monthly. The Administrator is also reimbursed for certain out-of-pocket expenses. The administrative fee and out-of-pocket expenses are included in the unitary management fee paid to the Adviser.

Transfer Agent

ALPS serves as transfer, dividend paying and shareholder servicing agent for the Fund. ALPS receives an annual minimum fee, a fee based upon the number of shareholder accounts, and is also reimbursed for certain out-of-pocket expenses. The fee and out-of-pocket expenses are included in the unitary management fee paid to the Adviser.

Compliance Services

ALPS provides services that assist the Trust’s chief compliance officer in monitoring and testing the policies and procedures of the Trust in conjunction with requirements under Rule 38a-1 under the 1940 Act and receives an annual base fee. ALPS is reimbursed for certain out-of-pocket expenses. The fee and out-of-pocket expenses are included in the unitary management fee paid to the Adviser.

Principal Financial Officer

ALPS receives an annual fee for providing principal financial officer services to the Fund. The fee is included in the unitary management fee paid to the Adviser.

Distributor

ALPS Distributors, Inc. (“ADI” or the “Distributor”) (an affiliate of ALPS) acts as the distributor of the Fund’s shares pursuant to a Distribution Agreement with the Trust. Shares are sold on a continuous basis by ADI as agent for the Fund, and ADI has agreed to use its best efforts to solicit orders for the sale of the Fund’s shares, although it is not obliged to sell any particular amount of shares. ADI is not entitled to any compensation for its services as Distributor. ADI is registered as a broker-dealer with the Securities and Exchange Commission.

7. INDEMNIFICATIONS

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that may contain general indemnification clauses, which may permit indemnification to the extent permissible under applicable law. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

8. SUBSEQUENT EVENTS

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued.

| Semi-Annual Report | October 31, 2019 | 29 |

| The Disciplined Growth Investors Fund | Additional Information |

October 31, 2019 (Unaudited)

1. FUND HOLDINGS

The Fund’s portfolio holdings are made available semi-annually in shareholder reports within 60 days after the close of the period for which the report is being made, as required by federal securities laws. The Fund also files monthly portfolio holdings on Form N-PORT on a quarterly basis, with the schedule of portfolio holdings filed on Form N-PORT for the third month of the Fund’s fiscal quarter made publicly available 60 days after the end of the Fund’s fiscal quarter.

2. FUND PROXY VOTING POLICIES, PROCEDURES AND SUMMARIES

The Fund’s policies and procedures used in determining how to vote proxies and information regarding how the Fund voted proxies relating to portfolio securities during the most recent prior 12-month period ending June 30 are available without charge, (1) upon request, by calling (toll-free) 855-DGI-Fund and (2) on the SEC’s website at http://www.sec.gov.

| 30 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Privacy Policy |

| WHO WE ARE | |

| Who is providing this notice? | The Disciplined Growth Investors Fund |

| WHAT WE DO | |

| How does the Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. |

How does the Fund collect my personal information? | We collect your personal information, for example, when you • open an account • provide account information or give us your contact information • make a wire transfer or deposit money |

Why can’t I limit all sharing? | Federal law gives you the right to limit only • sharing for affiliates’ everyday business purposes-information about your creditworthiness • affiliates from using your information to market to you • sharing for non-affiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

| DEFINITIONS | |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. |

Non-affiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies. ��� The Fund does not share with non-affiliates so they can market to you. |

| Joint marketing | A formal agreement between non-affiliated financial companies that together market financial products or services to you. • The Fund does not jointly market. |

| Semi-Annual Report | October 31, 2019 | 31 |

| The Disciplined Growth Investors Fund | Privacy Policy |

| FACTS | WHAT DOES THE FUND DO WITH YOUR PERSONAL INFORMATION? |

| WHY? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| WHAT? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: |

| | • Social Security number and account transactions • Account balances and transaction history • Wire transfer instructions |

| HOW? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons the Fund chooses to share; and whether you can limit this sharing. |

| REASONS WE CAN SHARE YOUR PERSONAL INFORMATION | DOES THE FUND SHARE: | CAN YOU LIMIT THIS SHARING? |

For our everyday business purposes –

such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

For our marketing purposes –

to offer our products and services to you | No | We do not share. |

| For joint marketing with other financial companies | No | We do not share. |

For our affiliates’ everyday business purposes –

information about your transactions and experiences | Yes | No |

For our affiliates’ everyday business purposes –

information about your creditworthiness | No | We do not share. |

| For non-affiliates to market to you | No | We do not share. |

| 32 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Privacy Policy |

| OTHER IMPORTANT INFORMATION |

| California Residents | If your account has a California home address, your personal information will not be disclosed to nonaffiliated third parties except as permitted by applicable California law, and we will limit sharing such personal information with our affiliates to comply with California privacy laws that apply to us. |

| Vermont Residents | The State of Vermont requires financial institutions to obtain your consent prior to sharing personal information that they collect about you with affiliated companies and nonaffiliated third parties other than in certain limited circumstances. Except as permitted by law, we will not share personal information we collect about you with nonaffiliated third parties or other affiliated companies unless you provide us with your written consent to share such information. |

| Semi-Annual Report | October 31, 2019 | 33 |

THIS MATERIAL MUST BE PRECEDED OR ACCOMPANIED BY A PROSPECTUS.

THE DISCIPLINED GROWTH INVESTORS FUND IS DISTRIBUTED BY ALPS DISTRIBUTORS, INC.

TABLE OF CONTENTS

| Manager Commentary | |

| Emerald Growth Fund | 1 |

| Emerald Small Cap Value Fund | 6 |

| Emerald Insights Fund | 12 |

| Emerald Banking and Finance Fund | 17 |

| Disclosure of Fund Expenses | 23 |

| Schedule of Investments | |

| Emerald Growth Fund | 25 |

| Emerald Small Cap Value Fund | 27 |

| Emerald Insights Fund | 29 |

| Emerald Banking and Finance Fund | 31 |

| Statements of Assets and Liabilities | 33 |

| Statements of Operations | 34 |

| Statements of Changes in Net Assets | |

| Emerald Growth Fund | 35 |

| Emerald Small Cap Value Fund | 37 |

| Emerald Insights Fund | 39 |

| Emerald Banking and Finance Fund | 41 |

| Financial Highlights | |

| Emerald Growth Fund | 43 |

| Emerald Small Cap Value Fund | 47 |

| Emerald Insights Fund | 51 |

| Emerald Banking and Finance Fund | 55 |

| Notes to Financial Statements | 59 |

| Additional Information | 67 |

| Privacy Policy | 68 |

| Emerald Growth Fund | Manager Commentary |

| | October 31, 2019 (Unaudited) |

October 31, 2019

Dear Shareholders:

Investment Results:

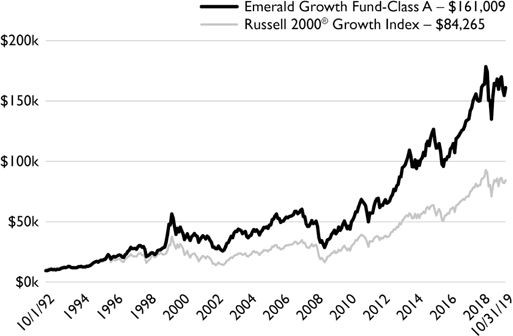

The performance of the Emerald Growth Fund’s Class A shares (without sales load), for the six months ended October 31, 2019, declined by -4.23%, trailing the Russell 2000® Growth Index which declined by -1.73%.

Performance data quoted represents past performance. Past performance does not guarantee future results.

The market had a lot to contend with during the course of the last six months as trade tensions with China escalated, bond yields rallied, then retreated and rallied again, the 2yr-10yr yield curve inverted then steepened, downward revisions to global and domestic economic and earnings growth, fluctuating opinions on the pace at which the Federal Reserve (the “Fed”) will lower interest rates and the necessity of the cuts, ongoing social unrest in Hong Kong and last but not least the late September announcement of a Democratic led impeachment inquiry of President Trump.