As filed with the U.S. Securities and Exchange Commission on February 28, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-8352

LKCM Funds

(Exact name of registrant as specified in charter)

c/o Luther King Capital Management Corporation

301 Commerce Street, Suite 1600

Fort Worth, TX 76102

(Address of principal executive offices) (Zip code)

K&L Gates LLP

1601 K Street, NW

Washington, DC 20006

(Name and address of agent for service)

1-800-688-LKCM and1-800-423-6369

Registrant’s telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2018

Item 1. Reports to Stockholders.

LKCM

FUNDS

LKCM Small Cap Equity Fund

LKCM Small-Mid Cap Equity Fund

LKCM Equity Fund

LKCM Balanced Fund

LKCM Fixed Income Fund

Annual Report

December 31, 2018

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the LKCM Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the LKCM Funds (if you hold your Fund shares directly with the LKCM Funds) or from your financial intermediary, such as a broker-dealer or bank (if you hold your Fund shares through a financial intermediary). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you hold your Fund shares directly with the LKCM Funds, you may elect to receive shareholder reports and other communications electronically from the LKCM Funds by calling1-800-688-LKCM or, if you hold your Fund shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports on paper free of charge. If you hold your Fund shares directly with the LKCM Funds, you can inform the LKCM Funds that you wish to continue receiving paper copies of your shareholder reports by calling1-800-688-LKCM or, if you hold your Fund shares through a financial intermediary, contacting your financial intermediary. Your election to receive reports in paper will apply to all of the LKCM Funds you hold directly with LKCM Funds or all of the funds you hold through your financial intermediary, as applicable.

Dear Fellow Shareholders:

We report the following performance information for the LKCM Funds for indicated periods ended December 31, 2018:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Funds | | Inception

Dates | | NAV @

12/31/18 | | Net

Expense

Ratio*, ** | | Gross

Expense

Ratio** | | One Year

Total

Return

Ended

12/31/18 | | Five Year

Average

Annualized

Return

Ended

12/31/18 | | Ten Year

Average

Annualized

Return

Ended

12/31/18 | | Avg.

Annual

Total

Return

Since

Incept. |

LKCM Equity Fund | | | | 1/3/96 | | | | $ | 23.34 | | | | | 0.81% | | | | | 1.00% | | | | | -3.28% | | | | | 6.17% | | | | | 12.17% | | | | | 8.10% | |

S&P 500® Index1 | | | | | | | | | | | | | | | | | | | | | | | | -4.38% | | | | | 8.49% | | | | | 13.12% | | | | | 8.29% | |

LKCM Small Cap Equity Fund | | | | 7/14/94 | | | | $ | 14.39 | | | | | 1.00% | | | | | 1.10% | | | | | -5.70% | | | | | 1.98% | | | | | 11.61% | | | | | 9.75% | |

Russell 2000® Index2 | | | | | | | | | | | | | | | | | | | | | | | | -11.01% | | | | | 4.41% | | | | | 11.97% | | | | | 8.67% | |

LKCMSmall-Mid Cap Equity Fund | | | | 5/2/11 | | | | $ | 7.92 | | | | | 1.00% | | | | | 1.76% | | | | | -8.89% | | | | | 1.52% | | | | | N/A | | | | | 4.47% | |

Russell 2500® Index3 | | | | | | | | | | | | | | | | | | | | | | | | -10.00% | | | | | 5.15% | | | | | N/A | | | | | 8.01% | |

LKCM Balanced Fund | | | | 12/30/97 | | | | $ | 21.07 | | | | | 0.80% | | | | | 1.02% | | | | | -2.15% | | | | | 5.32% | | | | | 9.62% | | | | | 6.21% | |

S&P 500® Index1 | | | | | | | | | | | | | | | | | | | | | | | | -4.38% | | | | | 8.49% | | | | | 13.12% | | | | | 6.61% | |

Bloomberg Barclays U.S. Intermediate | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Government/Credit Bond Index4 | | | | | | | | | | | | | | | | | | | | | | | | 0.88% | | | | | 1.86% | | | | | 2.90% | | | | | 4.36% | |

LKCM Fixed Income Fund | | | | 12/30/97 | | | | $ | 10.47 | | | | | 0.50% | | | | | 0.80% | | | | | 0.26% | | | | | 1.53% | | | | | 3.35% | | | | | 4.14% | |

Bloomberg Barclays U.S. Intermediate | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Government/Credit Bond Index4 | | | | | | | | | | | | | | | | | | | | | | | | 0.88% | | | | | 1.86% | | | | | 2.90% | | | | | 4.36% | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. The Funds impose a 1.00% redemption fee on shares held less than 30 days. If reflected, the fee would reduce performance shown.

| * | Luther King Capital Management Corporation, the Funds’ investment adviser, has contractually agreed to waive all or a portion of its management fee and/or reimburse expenses of each Fund to maintain the expense ratios designated in the Funds’ prospectus through May 1, 2019. This expense limitation excludes interest, taxes, brokerage commissions, indirect fees and expenses related to investments in other investment companies, including money market funds, and extraordinary expenses. Investment performance reflects fee waivers, if any, in effect during the relevant period. In the absence of such waivers, total return would be reduced. Investment performance is based upon the net expense ratio. LKCM waived management fees and/or reimbursed expenses for each Fund during the year ended December 31, 2018. |

| ** | Expense ratios above are as reported in the Funds’ current prospectus dated May 1, 2018. Expense ratios reported for other periods in the financial highlights of this report may differ. |

| (1) | The S&P 500® Index is an unmanaged capitalization-weighted index of 500 selected stocks that is generally considered representative of the performance of large capitalization companies in the U.S. stock market. |

| (2) | The Russell 2000® Index is an unmanaged index which measures the performance of the 2,000 smallest companies in the Russell 3000® Index. |

| (3) | The Russell 2500® Index is an unmanaged index which measures the performance of the 2,500 smallest companies in the Russell 3000® Index. |

| (4) | The Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index is an unmanaged market value weighted index measuring both the principal price changes of, and income provided by, the underlying universe of securities that comprise the index. Securities included in the index must meet the following criteria: fixed as opposed to variable rate; remaining maturity of one to ten years; minimum outstanding par value of $250 million; rated investment grade or higher by Moody’s Investors Service or equivalent; must be dollar denominated and non-convertible; and must be publicly issued. |

Note: The indices defined above are not available for direct investment and the index performance therefore does not include fees, expenses or taxes.

2018 Review

The S&P 500® Index declined 4.38% for the year ended December 31, 2018, marking its first calendar year decline since 2008. The string of nine consecutive years of positive returns tied the 1991–1999 period as the longest streak of positive returns for the S&P 500® Index since 1936. During 2018, the S&P 500® Index experienced two market corrections, which are generally defined as a decline of greater than 10%. The first market correction occurred during the first quarter of 2018. The S&P 500® Index rose sharply in January as investor optimism for stronger corporate profit growth, aided by newly lowered corporate tax rates, helped boost stock prices. However, this enthusiasm appeared undermined in early February 2018 over concern that accelerating wages could cause the Federal Reserve to hasten the pace of monetary tightening and increase the probability of a recession, which resulted in the S&P 500® Index recording its first market correction in almost two years.

The S&P 500® Index then rallied in the second quarter of 2018 as weaker first quarter consumption data reversed with retail sales growing 6% year-over-year and the unemployment rate falling to 3.8%, its lowest reading since 1969. During the third quarter of 2018, the S&P 500® Index continued to rally and posted a 7.7% gain, which included the peak for the S&P 500® Index for the year on September 20, 2018. The S&P 500® Index declined 18.9% from this peak through the low on Christmas Eve, with approximately 57% of the constituents of the S&P 500® Index down more than 20% from their52-week highs. Both developed and emerging international equity markets indices reported even weaker returns than domestic equity indices for 2018, especially in U.S. dollar terms as the U.S. dollar strengthened against most currencies in 2018.

2

The decline in the equity markets during the last quarter of 2018 was similar to the drawdown in early 2016 when concerns about a weakening Chinese economy roiled global markets. At the time, the domestic economy appeared to be teetering on the brink of a recession, which prompted the Federal Reserve to postpone interest rate hikes. In contrast, the Federal Reserve increased its target Federal Funds interest rate a fourth time in 2018 just as concerns of slowing economic growth—both domestically and abroad—began to intensify. As a result, the S&P 500® Index declined 9.0% during December 2018, its worst December performance since 1931.

2019 Outlook

Our baseline expectation for 2019 is for lower economic growth compared to 2018, which we believe will be driven by anticipated slowing global growth, tighter monetary policy, and a weakening manufacturing outlook. However, we believe the odds of a recession in 2019 remain low based on our belief that the underpinnings of the economy, such as employment, credit availability, capital expenditures, and consumer spending, all appear to remain supportive of economic expansion. In sum, we anticipate good, but not great, economic growth during the year. Capital markets are typically forward looking and often amplify anticipated changes in economic activity through corporate earnings estimates and price/earnings multiples. As a result, we believe the downshift in market expectations for real economic growth from 3.0% year-over-year to a more modest rate of around 2.0–2.5% for 2019 is part of what caused a decline in capital markets during the fourth quarter of 2018. Moreover, we believe that asset allocation shifts, many computer driven, occurred as fixed income instruments with higher yields provided an attractive alternative to volatile stocks during that time.

During 2018, exceptionally strong corporate earnings growth, which was fueled in part by lower corporate tax rates, was offset by significant price/earnings multiple compression. The compression in the S&P 500® Index price/earnings multiple throughout 2018 appears to track the level of price/earnings multiple compression during the period of 2004–2006, the last prolonged period of Federal Reserve monetary tightening. Accordingly, we believe market participants priced in a full Federal Reserve tightening cycle in 2018. Despite slowing international and domestic economic growth, we remain constructive on domestic equity markets for 2019. We believe it is rare for the domestic equity markets to decline in two or three consecutive years, as this has occurred only twice since World War II: 1973–1974 and 2000–2002. We believe the capital markets are likely to continue to display characteristics of a late cycle economy. However, we believe the fundamental underpinnings of the economy continue to point to the current expansion becoming the longest in modern history.

LKCM Equity Fund

The LKCM Equity Fund outperformed the S&P 500® Index, the Fund’s benchmark, for the year ended December 31, 2018, declining 3.28% as compared to the 4.38% decline for the benchmark. For 2018, stock selection for the Fund was strong and contributed to outperformance relative to the benchmark, while sector allocation decisions detracted from the Fund’s relative performance. Stock selection in the Healthcare, Industrials, Information Technology, Consumer Staples, Energy and Financials sectors all contributed to the Fund’s relative performance, which was partially offset by stock selection in the Consumer Discretionary sector. The Fund’s overweight positions in the Industrials and Materials sectors detracted from the Fund’s relative performance, which was partially offset by an underweight position in the Communications sector. We believe the Fund is well positioned with a portfolio of companies that we believe are high quality, have solid balance sheets, are reasonably valued, and otherwise meet our stringent investment criteria.

LKCM Fixed Income Fund

The LKCM Fixed Income Fund advanced 0.26% for the year ended December 31, 2018 compared to its benchmark, the Bloomberg Barclays Intermediate Government/Credit Bond Index, which advanced 0.88% for the year ended December 31, 2018. During the year, yields rose across the curve and the yield curve flattened substantially as the Federal Reserve continued to tighten monetary policy by increasing the Federal Funds rate and continuing to reduce its balance sheet. In this environment, where shorter-duration securities outperformed their longer-duration counterparts, the Fund’s duration of 3.1 years was additive to performance relative to the duration of 3.9 years for the benchmark. However, in a year characterized by markedly increased volatility, U.S. government and agency issues outperformed their lower quality counterparts in the corporate bond sector as theflight-to-quality trade gained momentum especially as the year came to a close. As a result, the Fund’s overweight position in corporate bonds relative to the benchmark, specifically corporate bonds in theBBB-rated space, was the primary detractor from the Fund’s relative performance as credit spreads widened substantially. The Fund remains largely focused onshort-to-intermediate investment grade corporate bonds with strong underlying credit fundamentals in an effort to mitigate interest rate risk and credit risk in this modest growth environment.

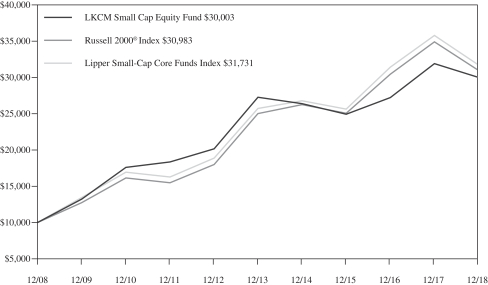

LKCM Small Cap Equity Fund

The LKCM Small Cap Equity Fund outperformed the Russell 2000® Index, the Fund’s benchmark, for the year ended December 31, 2018, declining 5.70% as compared to the 11.01% decline for the benchmark. For 2018, stock selection in the Information Technology, Consumer Discretionary and Healthcare sectors all contributed to the Fund’s relative performance, which was partially offset by stock selection in the Industrials, Materials and Financials sectors. The Fund’s overweight position in the Information Technology sector also contributed to the Fund’s relative performance, which was offset by an overweight position in the Industrials sector and an underweight position in the Healthcare sector. The Fund also benefited during the year from five portfolio companies being acquired and five portfolio companies graduating out of our small cap investment strategy due to market appreciation. Despite the market pullback in the fourth quarter of 2018, we believe the Fund continues to be positioned for growth (overweighting the Information Technology

3

and Industrials sectors) and higher interest rates (underweighting the Real Estate and Utilities sectors). We continue to remain confident in our strategy of investing in companies that we believe are high quality and competitively advantaged and otherwise meet our stringent investment criteria.

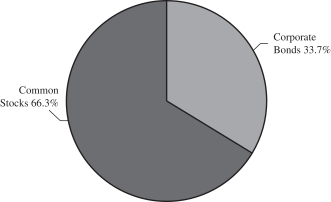

LKCM Balanced Fund

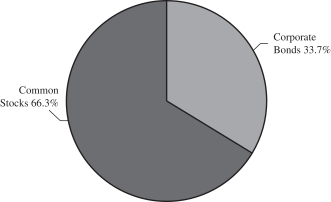

The LKCM Balanced Fund declined 2.15% for the year ended December 31, 2018 versus the 4.38% decline for the S&P 500® Index and the 0.88% return for the Bloomberg Barclays Intermediate Government/Credit Bond Index, the Fund’s benchmark indices. For 2018, the Fund’s equity portfolio outperformed the S&P 500® Index, and the Fund’s fixed income portfolio outperformed the Bloomberg Barclays Intermediate Government/Credit Bond Index. The Fund benefited from strong stock selection in the Industrials, Healthcare and Consumer Staples sectors relative to the S&P 500® Index, which was partially offset by stock selection in the Financials and Consumer Discretionary sectors. The Fund’s fixed income portfolio remained focused on high quality intermediate corporate bonds, which we believe was especially beneficial for the Fund during the market decline in the fourth quarter of 2018. At December 31, 2018, the Fund’s holdings consisted of approximately 65.8% equity securities, 33.6% fixed income securities, and 0.6% cash and cash equivalents, which we believe has the Fund well-positioned for 2019.

LKCMSmall-Mid Cap Equity Fund

The LKCMSmall-Mid Cap Equity Fund outperformed the Russell 2500® Index, the Fund’s benchmark, for the year ended December 31, 2018, declining 8.89% as compared to the 10.00% decline for the benchmark. For 2018, stock selection in the Information Technology, Healthcare and Communication Services sectors all contributed to the Fund’s relative performance, which was partially offset by stock selection in the Materials, Financials and Industrials sectors. The Fund’s overweight position in the Information Technology sector also contributed to the Fund’s relative performance, which was offset by overweight positions in the Industrials and Energy sectors and an underweight position in the Real Estate sector. Despite the market pullback in the fourth quarter of 2018, the Fund continues to be tilted towards growth companies (overweighting the Healthcare sector), positioned for economic growth (overweighting the Information Technology and Industrials sectors) and higher interest rates (underweighting the Real Estate and Utilities sectors). We continue to remain confident in our strategy of investing in companies that we believe are high quality and competitively advantaged and otherwise meet our stringent investment criteria.

J. Luther King, Jr., CFA, CIC

February 1, 2019

The information provided herein represents the opinion of J. Luther King, Jr., CFA, CIC and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Please refer to the Schedule of Investments found on pages 14-26 of the report for more information on Fund holdings. Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any securities.

Mutual fund investing involves risk. Principal loss is possible. Past performance is not a guarantee of future results. Small and medium capitalization funds typically carry additional risks, since smaller companies generally have a higher risk of failure, and, historically, their stocks have experienced a greater degree of market volatility than stocks on average. Investments in debt securities typically decrease in value when interest rates rise. This risk is greater for longer-term debt securities. Investments in mortgage backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. These risks are discussed in the Funds’ summary and statutory prospectuses.

Earnings growth is not a measure of future performance.

Duration is a commonly used measure of the potential volatility of the price of a debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration.

Spread is the percentage point difference between yields of various classes of bonds compared to treasury bonds.

Price/earnings ratio is the market price of a company share divided by the earnings per share of the company.

Investors should consider the investment objective, risks and charges and expenses of a Fund carefully before investing. Each Fund’s summary prospectus and the prospectus contain this and other information about the Fund. Investors can obtain a summary prospectus or the prospectus by calling 1-800-688-LKCM. The summary prospectus and the prospectus should be read carefully before investing in a Fund.

Quasar Distributors, LLC, distributor.

4

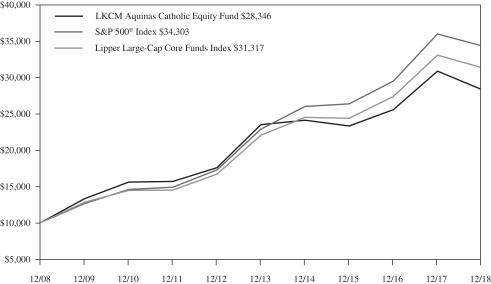

PERFORMANCE:

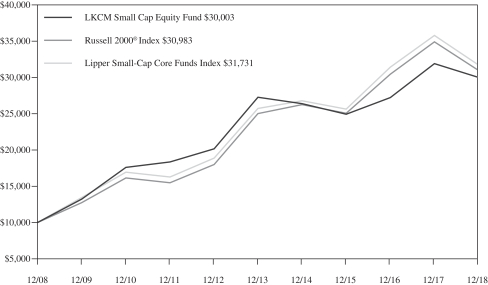

The following information illustrates the historical performance of the LKCM Small Cap Equity Fund as of December 31, 2018 compared to the Fund’s representative benchmark and peer group indices.

Performance data quoted represents past performance; past performance does not guarantee future results. The graph and table reflect the reinvestment of dividends and other distributions, if any, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. Returns would have been lower if LKCM had not waived a portion of its management fee and/or reimbursed certain expenses of the Fund. Please see Note B to the Notes to the Financial Statements for specific information regarding management fee waiver and/or expense reimbursement arrangements for the Fund.

An index is an unmanaged portfolio and does not trade or incur any expenses. The Lipper Small-Cap Core Funds Index, however, does reflect the fees and expenses borne by the funds included in that index. One can not invest in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURN (Periods Ended December 31, 2018)

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | Past

1 Year | | Past

5 Years(1) | | Past

10 Years(1) | | Since

Inception(1)(2) |

LKCM Small Cap Equity Fund | | | | -5.70% | | | | | 1.98% | | | | | 11.61% | | | | | 9.75% | |

Russell 2000® Index | | | | -11.01% | | | | | 4.41% | | | | | 11.97% | | | | | 8.67% | |

Lipper Small-Cap Core Funds Index | | | | -11.19% | | | | | 4.33% | | | | | 12.24% | | | | | 9.43% | |

A HYPOTHETICAL $10,000 INVESTMENT IN LKCM SMALL CAP EQUITY FUND

(for the ten years ended December 31, 2018)

The Russell 2000® Index is an unmanaged index consisting of the 2,000 smallest companies in the Russell 3000® Index.

The Lipper Small-Cap Core Funds Index is an unmanaged index generally considered representative of small cap core mutual funds tracked by Lipper, Inc.

5

PERFORMANCE:

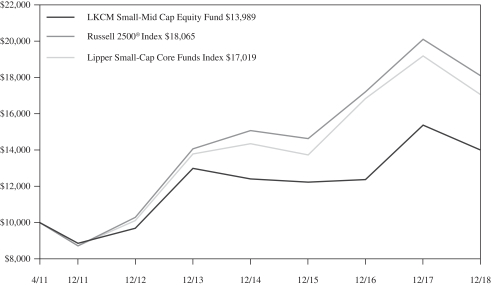

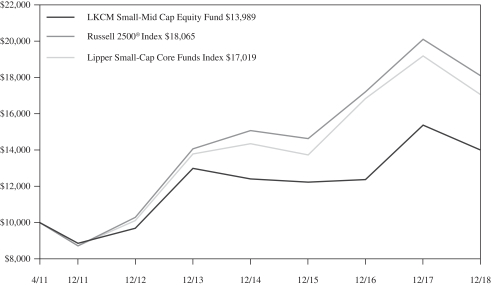

The following information illustrates the historical performance of the LKCM Small-Mid Cap Equity Fund as of December 31, 2018 compared to the Fund’s benchmark and peer group indices.

Performance data quoted represents past performance; past performance does not guarantee future results. The graph and table reflect the reinvestment of dividends and other distributions, if any, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. Returns would have been lower if LKCM had not waived a portion of its management fee and/or reimbursed certain expenses of the Fund. Please see Note B to the Notes to the Financial Statements for specific information regarding management fee waiver and/or expense reimbursement arrangements for the Fund.

An index is an unmanaged portfolio and does not trade or incur any expenses. The Lipper Small-Cap Core Funds Index, however, does reflect the fees and expenses borne by the funds included in that index. One can not invest in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURN (Periods Ended December 31, 2018)

| | | | | | | | | | | | | | | |

| | | | |

| | | Past

1 Year | | Past

5 Years(1) | | Since

Inception(1)(2) |

LKCM Small-Mid Cap Equity Fund | | | | -8.89% | | | | | 1.52% | | | | | 4.47% | |

Russell 2500® Index | | | | -10.00% | | | | | 5.15% | | | | | 8.01% | |

Lipper Small-Cap Core Funds Index | | | | -11.19% | | | | | 4.33% | | | | | 7.17% | |

A HYPOTHETICAL $10,000 INVESTMENT IN LKCM SMALL-MID CAP EQUITY FUND

(for the period from May 2, 2011 to December 31, 2018)

The Russell 2500® Index is an unmanaged index consisting of the 2,500 smallest companies in the Russell 3000® Index.

The Lipper Small-Cap Core Funds Index is an unmanaged index generally considered representative of small cap core mutual funds tracked by Lipper, Inc.

6

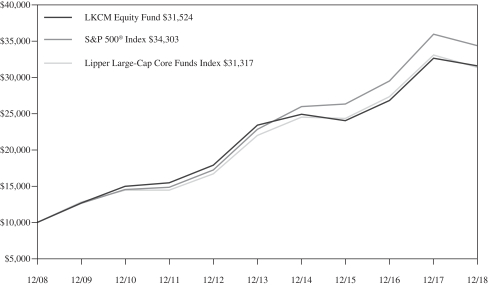

PERFORMANCE:

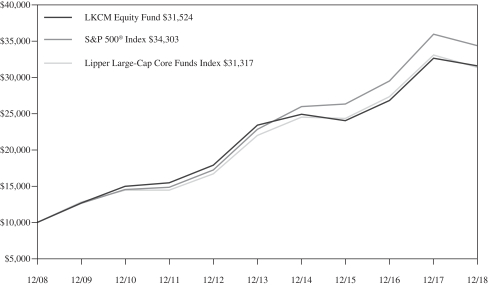

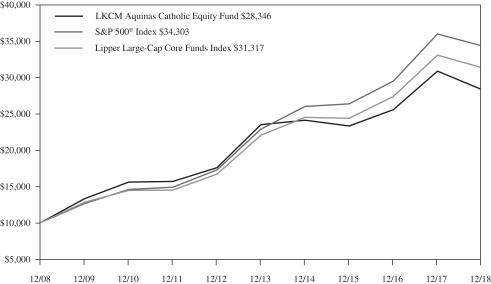

The following information illustrates the historical performance of the LKCM Equity Fund as of December 31, 2018 compared to the Fund’s benchmark and peer group indices.

Performance data quoted represents past performance; past performance does not guarantee future results. The graph and table reflect the reinvestment of dividends and other distributions, if any, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. Returns would have been lower if LKCM had not waived a portion of its management fee and/or reimbursed certain expenses of the Fund. Please see Note B to the Notes to the Financial Statements for specific information regarding management fee waiver and/or expense reimbursement arrangements for the Fund.

An index is an unmanaged portfolio and does not trade or incur any expenses. The Lipper Large-Cap Core Funds Index, however, does reflect the fees and expenses borne by the funds included in that index. One can not invest in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURN (Periods Ended December 31, 2018)

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | Past

1 Year | | Past

5 Years(1) | | Past

10 Years(1) | | Since

Inception(1)(2) |

LKCM Equity Fund | | | | -3.28% | | | | | 6.17% | | | | | 12.17% | | | | | 8.10% | |

S&P 500® Index | | | | -4.38% | | | | | 8.49% | | | | | 13.12% | | | | | 8.29% | |

Lipper Large-Cap Core Funds Index | | | | -5.13% | | | | | 7.33% | | | | | 12.09% | | | | | 7.32% | |

A HYPOTHETICAL $10,000 INVESTMENT IN LKCM EQUITY FUND

(for the ten years ended December 31, 2018)

The S&P 500® Index is an unmanaged capitalization-weighted index of 500 selected stocks that is generally considered representative of the performance of large capitalization companies in the U.S. stock market.

The Lipper Large-Cap Core Funds Index is an unmanaged index generally considered representative of large cap core mutual funds tracked by Lipper, Inc.

7

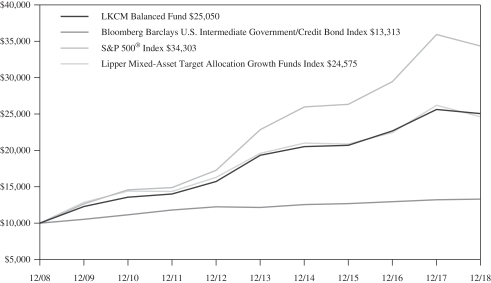

PERFORMANCE:

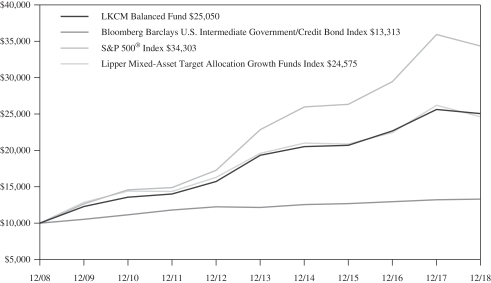

The following information illustrates the historical performance of the LKCM Balanced Fund as of December 31, 2018 compared to the Fund’s benchmark and peer group indices.

Performance data quoted represents past performance; past performance does not guarantee future results. The graph and table reflect the reinvestment of dividends and other distributions, if any, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. Returns would have been lower if LKCM had not waived a portion of its management fee and/or reimbursed certain expenses of the Fund. Please see Note B to the Notes to the Financial Statements for specific information regarding management fee waiver and/or expense reimbursement arrangements for the Fund.

An index is an unmanaged portfolio and does not trade or incur any expenses. The Lipper Mixed-Asset Target Allocation Growth Funds Index, however, does reflect the fees and expenses borne by the funds included in that index. One can not invest in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURN (Periods Ended December 31, 2018)

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | Past

1 Year | | Past

5 Years(1) | | Past

10 Years(1) | | Since

Inception(1)(2) |

LKCM Balanced Fund | | | | -2.15% | | | | | 5.32% | | | | | 9.62% | | | | | 6.21% | |

S&P 500® Index | | | | -4.38% | | | | | 8.49% | | | | | 13.12% | | | | | 6.61% | |

Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index | | | | 0.88% | | | | | 1.86% | | | | | 2.90% | | | | | 4.36% | |

Lipper Mixed-Asset Target Allocation Growth Funds Index | | | | -6.11% | | | | | 4.63% | | | | | 9.26% | | | | | 5.81% | |

A HYPOTHETICAL $10,000 INVESTMENT IN LKCM BALANCED FUND

(for the ten years ended December 31, 2018)

The Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index is an unmanaged market value weighted index measuring both the principal price changes of, and income provided by, the underlying universe of securities that comprise the index. Securities included in the index must meet the following criteria; fixed as opposed to variable rate; remaining maturity of one to ten years; minimum outstanding par value of $250 million; rated investment grade or higher by Moody’s Investors Service or equivalent; must be dollar denominated and non-convertible; and must be publicly issued.

8

The Lipper Mixed-Asset Target Allocation Growth Funds Index is an unmanaged index generally considered representative of mutual funds tracked by Lipper, Inc. that, by portfolio practice, maintain a mix of between 60%-80% equity securities, with the remainder invested in bonds, cash and cash equivalents.

The S&P 500® Index is an unmanaged capitalization-weighted index of 500 selected stocks that is generally considered representative of the performance of large capitalization companies in the U.S. stock market.

9

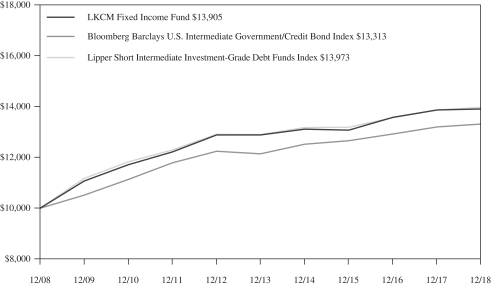

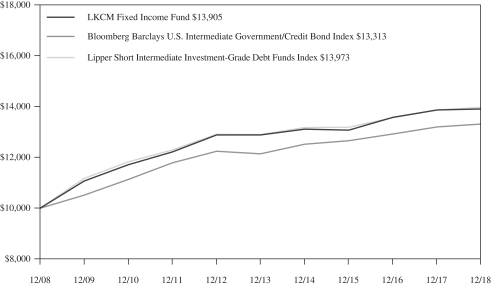

PERFORMANCE:

The following information illustrates the historical performance of the LKCM Fixed Income Fund as of December 31, 2018 compared to the Fund’s benchmark and peer group indices.

Performance data quoted represents past performance; past performance does not guarantee future results. The graph and table reflect the reinvestment of dividends and other distributions, if any, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. Returns would have been lower if LKCM had not waived a portion of its management fee and/or reimbursed certain expenses of the Fund. Please see Note B to the Notes to the Financial Statements for specific information regarding management fee waiver and/or expense reimbursement arrangements for the Fund.

An index is an unmanaged portfolio and does not trade or incur any expenses. The Lipper Short Intermediate Investment-Grade Debt Funds Index, however, does reflect the fees and expenses borne by the funds included in that index. One can not invest in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURN (Periods Ended December 31, 2018)

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | Past

1 Year | | Past

5 Years(1) | | Past

10 Years(1) | | Since

Inception(1)(2) |

LKCM Fixed Income Fund | | | | 0.26% | | | | | 1.53% | | | | | 3.35% | | | | | 4.14% | |

Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index | | | | 0.88% | | | | | 1.86% | | | | | 2.90% | | | | | 4.36% | |

Lipper Short Intermediate Investment-Grade Debt Funds Index | | | | 0.74% | | | | | 1.62% | | | | | 3.40% | | | | | 3.85% | |

A HYPOTHETICAL $10,000 INVESTMENT IN LKCM FIXED INCOME FUND

(for the ten years ended December 31, 2018)

The Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index is an unmanaged market value weighted index measuring both the principal price changes of, and income provided by, the underlying universe of securities that comprise the index. Securities included in the index must meet the following criteria: fixed as opposed to variable rate; remaining maturity of one to ten years; minimum outstanding par value of $250 million; rated investment grade or higher by Moody’s Investors Service or equivalent; must be dollar denominated and non-convertible; and must be publicly issued.

The Lipper Short Intermediate Investment-Grade Debt Funds Index is an unmanaged index generally considered representative of short intermediate investment grade mutual funds tracked by Lipper, Inc.

10

LKCM Funds Expense Example — December 31, 2018

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including redemption fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (7/1/18-12/31/18).

ACTUAL EXPENSES

The first line of the tables below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Although the Funds charge no sales load, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services, the Funds’ transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. You will be charged a redemption fee equal to 1.00% of the net amount of the redemption if you redeem your shares of the LKCM Small Cap Equity, Small-Mid Cap Equity, Equity, Balanced and Fixed Income Funds within 30 days of purchase, unless otherwise determined by the Funds in their discretion. To the extent the Funds invest in shares of other investment companies as part of their investment strategies, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Funds invest in addition to the expenses of the Funds. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example below includes management fees, registration fees and other expenses. However, the example below does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting principles.

HYPOTHETICAL EXAMPLES FOR COMPARISON PURPOSES

The second line of the tables below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactions costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | |

| | | LKCM Small Cap Equity Fund |

| | | Beginning

Account Value

7/1/18 | | Ending

Account Value

12/31/18 | | Expenses Paid

During Period*

7/1/18–12/31/18 |

Actual . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | | | $ | 1,000.00 | | | | $ | 853.60 | | | | $ | 4.67 | |

Hypothetical (5% return before expense) . . . . . . | | | $ | 1,000.00 | | | | $ | 1,020.16 | | | | $ | 5.09 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 1.00%, multiplied by the average account value over the period, multiplied by 184/365 to reflect theone-half year period. |

| | | | | | | | | | | | | | | |

| | | LKCMSmall-Mid Cap Equity Fund |

| | | Beginning

Account Value

7/1/18 | | Ending

Account Value

12/31/18 | | Expenses Paid

During Period*

7/1/18–12/31/18 |

Actual . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | | | $ | 1,000.00 | | | | $ | 859.90 | | | | $ | 4.69 | |

Hypothetical (5% return before expense) . . . . . . | | | $ | 1,000.00 | | | | $ | 1,020.16 | | | | $ | 5.09 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 1.00%, multiplied by the average account value over the period, multiplied by 184/365 to reflect theone-half year period. |

| | | | | | | | | | | | | | | |

| | | LKCM Equity Fund |

| | | Beginning

Account Value

7/1/18 | | Ending

Account Value

12/31/18 | | Expenses Paid

During Period*

7/1/18–12/31/18 |

Actual . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | | | $ | 1,000.00 | | | | $ | 919.50 | | | | $ | 3.87 | |

Hypothetical (5% return before expense) . . . . . . | | | $ | 1,000.00 | | | | $ | 1,021.17 | | | | $ | 4.08 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 0.80%, multiplied by the average account value over the period, multiplied by 184/365 to reflect theone-half year period. |

11

| | | | | | | | | | | | | | | |

| | | LKCM Balanced Fund |

| | | Beginning

Account Value

7/1/18 | | Ending

Account Value

12/31/18 | | Expenses Paid

During Period*

7/1/18–12/31/18 |

Actual . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | | | $ | 1,000.00 | | | | $ | 962.20 | | | | $ | 3.96 | |

Hypothetical (5% return before expense) . . . . . . | | | $ | 1,000.00 | | | | $ | 1,021.17 | | | | $ | 4.08 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 0.80%, multiplied by the average account value over the period, multiplied by 184/365 to reflect theone-half year period. |

| | | | | | | | | | | | | | | |

| | | LKCM Fixed Income Fund |

| | | Beginning

Account Value

7/1/18 | | Ending

Account Value

12/31/18 | | Expenses Paid

During Period*

7/1/18–12/31/18 |

Actual . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | | | $ | 1,000.00 | | | | $ | 1,010.90 | | | | $ | 2.53 | |

Hypothetical (5% return before expense) . . . . . . | | | $ | 1,000.00 | | | | $ | 1,022.68 | | | | $ | 2.55 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 0.50%, multiplied by the average account value over the period, multiplied by 184/365 to reflect theone-half year period. |

12

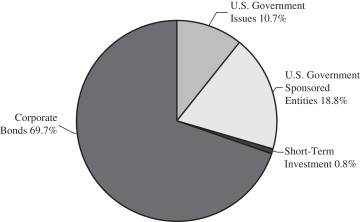

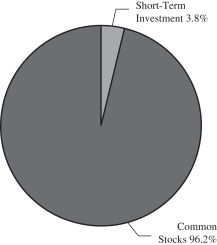

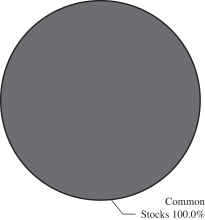

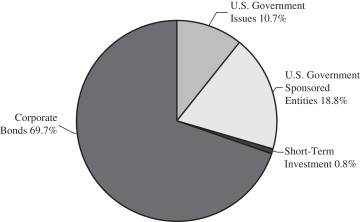

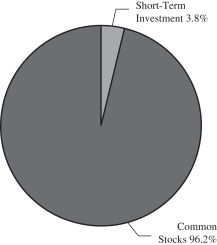

ALLOCATION OF PORTFOLIO HOLDINGS — LKCM Funds — December 31, 2018

Percentages represent market value as a percentage of total investments.

LKCM Small Cap Equity Fund

LKCM Equity Fund

LKCM Fixed Income Fund

LKCM Small-Mid Cap Equity Fund

LKCM Balanced Fund

13

|

| LKCM SMALL CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS |

| December 31, 2018 |

| | | | | | | | | | |

| COMMON STOCKS - 99.8% | | Shares | | Value |

| Aerospace & Defense - 1.8% |

Mercury Systems, Inc. (a) | | | | 60,020 | | | | $ | 2,838,346 | |

| | | | | | | | | | |

| Banks - 9.9% |

BancorpSouth Bank | | | | 84,154 | | | | | 2,199,786 | |

Cadence BanCorporation | | | | 111,625 | | | | | 1,873,067 | |

CBTX, Inc. | | | | 45,440 | | | | | 1,335,936 | |

Glacier Bancorp, Inc. | | | | 47,645 | | | | | 1,887,695 | |

Green Bancorp, Inc. | | | | 89,060 | | | | | 1,526,488 | |

LegacyTexas Financial Group, Inc. | | | | 50,575 | | | | | 1,622,952 | |

Pinnacle Financial Partners, Inc. | | | | 37,230 | | | | | 1,716,303 | |

Seacoast Banking Corp of Florida (a) | | | | 83,040 | | | | | 2,160,701 | |

Texas Capital Bancshares, Inc. (a) | | | | 30,950 | | | | | 1,581,235 | |

| | | | | | | | | | |

| | | | | | | | | 15,904,163 | |

| | | | | | | | | | |

| Biotechnology - 4.7% |

Charles River Laboratories International, Inc. (a) | | | | 27,555 | | | | | 3,118,675 | |

Ligand Pharmaceuticals Incorporated (a) | | | | 14,280 | | | | | 1,937,796 | |

Neogen Corporation (a) | | | | 43,080 | | | | | 2,455,560 | |

| | | | | | | | | | |

| | | | | | | | | 7,512,031 | |

| | | | | | | | | | |

| Building Products - 4.4% |

American Woodmark Corporation (a) | | | | 14,070 | | | | | 783,418 | |

Builders FirstSource, Inc. (a) | | | | 134,795 | | | | | 1,470,613 | |

CSW Industrials, Inc. (a) | | | | 43,690 | | | | | 2,112,412 | |

PGT, Inc. (a) | | | | 111,121 | | | | | 1,761,268 | |

Trex Company, Inc. (a) | | | | 16,315 | | | | | 968,458 | |

| | | | | | | | | | |

| | | | | | | | | 7,096,169 | |

| | | | | | | | | | |

| Capital Markets - 0.5% |

BGC Partners Inc. - Class A | | | | 155,710 | | | | | 805,021 | |

| | | | | | | | | | |

| Chemicals - 0.9% |

Ferro Corporation (a) | | | | 87,485 | | | | | 1,371,765 | |

| | | | | | | | | | |

| Commercial Services & Supplies - 1.7% |

Healthcare Services Group, Inc. | | | | 66,735 | | | | | 2,681,412 | |

| | | | | | | | | | |

| Construction & Engineering - 1.4% |

EMCOR Group, Inc. | | | | 22,130 | | | | | 1,320,940 | |

NV5 Global, Inc. (a) | | | | 16,020 | | | | | 970,011 | |

| | | | | | | | | | |

| | | | | | | | | 2,290,951 | |

| | | | | | | | | | |

| Consumer Finance - 1.6% |

FirstCash, Inc. | | | | 34,450 | | | | | 2,492,457 | |

| | | | | | | | | | |

| Electronic Equipment & Instruments - 2.3% |

Littelfuse, Inc. | | | | 8,510 | | | | | 1,459,295 | |

Mesa Laboratories, Inc. | | | | 10,690 | | | | | 2,227,689 | |

| | | | | | | | | | |

| | | | | | | | | 3,686,984 | |

| | | | | | | | | | |

| Energy Equipment & Services - 0.7% |

Mammoth Energy Services, Inc. | | | | 63,855 | | | | | 1,148,113 | |

| | | | | | | | | | |

| Food Products - 2.4% |

Freshpet, Inc. (a) | | | | 29,345 | | | | | 943,735 | |

Hostess Brands, Inc. (a) | | | | 173,690 | | | | | 1,900,169 | |

J&J Snack Foods Corp. | | | | 7,370 | | | | | 1,065,628 | |

| | | | | | | | | | |

| | | | | | | | | 3,909,532 | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Health Care Equipment & Supplies - 4.7% |

Cantel Medical Corp. | | | | 32,335 | | | | $ | 2,407,341 | |

LeMaitre Vascular, Inc. | | | | 10,835 | | | | | 256,139 | |

STAAR Surgical Co. (a) | | | | 121,390 | | | | | 3,873,555 | |

ViewRay Inc. (a) | | | | 174,680 | | | | | 1,060,308 | |

| | | | | | | | | | |

| | | | | | | | | 7,597,343 | |

| | | | | | | | | | |

| Health Care Providers & Services - 5.6% |

HealthEquity, Inc. (a) | | | | 46,865 | | | | | 2,795,497 | |

Omnicell, Inc. (a) | | | | 41,815 | | | | | 2,560,751 | |

R1 RCM Inc. (a) | | | | 192,640 | | | | | 1,531,488 | |

U.S. Physical Therapy, Inc. | | | | 20,645 | | | | | 2,113,016 | |

| | | | | | | | | | |

| | | | | | | | | 9,000,752 | |

| | | | | | | | | | |

| Health Care Technology - 0.5% |

Teladoc Health, Inc. (a) | | | | 17,650 | | | | | 874,911 | |

| | | | | | | | | | |

| Hotels, Restaurants & Leisure - 3.0% |

Planet Fitness, Inc. - Class A (a) | | | | 50,950 | | | | | 2,731,939 | |

Wingstop Inc. | | | | 31,990 | | | | | 2,053,438 | |

| | | | | | | | | | |

| | | | | | | | | 4,785,377 | |

| | | | | | | | | | |

| Household Durables - 0.3% |

Century Communities, Inc. (a) | | | | 25,000 | | | | | 431,500 | |

| | | | | | | | | | |

| Insurance - 1.0% |

Kinsale Capital Group, Inc. | | | | 15,310 | | | | | 850,624 | |

Trupanion, Inc. (a) | | | | 26,535 | | | | | 675,581 | |

| | | | | | | | | | |

| | | | | | | | | 1,526,205 | |

| | | | | | | | | | |

| Internet & Catalog Retail - 1.8% |

Nutrisystem, Inc. | | | | 67,035 | | | | | 2,941,496 | |

| | | | | | | | | | |

| Internet Software & Services - 1.0% |

Euronet Worldwide, Inc. (a) | | | | 16,405 | | | | | 1,679,544 | |

| | | | | | | | | | |

| IT Consulting & Services - 4.2% |

Cass Information Systems, Inc. | | | | 28,830 | | | | | 1,525,684 | |

Everi Holdings, Inc. (a) | | | | 116,280 | | | | | 598,842 | |

FireEye, Inc. (a) | | | | 114,145 | | | | | 1,850,290 | |

LiveRamp Holdings, Inc. (a) | | | | 71,521 | | | | | 2,762,856 | |

| | | | | | | | | | |

| | | | | | | | | 6,737,672 | |

| | | | | | | | | | |

| Leisure Equipment & Products - 0.6% |

Pool Corporation | | | | 6,150 | | | | | 914,197 | |

| | | | | | | | | | |

| Machinery - 5.6% |

Actuant Corporation - Class A | | | | 37,240 | | | | | 781,668 | |

Barnes Group Inc. | | | | 26,185 | | | | | 1,404,040 | |

John Bean Technologies Corporation | | | | 11,630 | | | | | 835,150 | |

Kennametal Inc. | | | | 73,195 | | | | | 2,435,930 | |

Lindsay Corporation | | | | 7,560 | | | | | 727,650 | |

Rexnord Corporation (a) | | | | 64,070 | | | | | 1,470,406 | |

Watts Water Technologies, Inc. - Class A | | | | 20,465 | | | | | 1,320,606 | |

| | | | | | | | | | |

| | | | | | | | | 8,975,450 | |

| | | | | | | | | | |

| Marine - 1.6% | | | | |

Kirby Corporation (a) | | | | 39,180 | | | | | 2,639,165 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

14

|

| LKCM SMALL CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS, CONTINUED |

| December 31, 2018 |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Media & Entertainment - 1.8% | | | | |

comScore, Inc. (a) | | | | 41,440 | | | | $ | 597,979 | |

Nexstar Media Group, Inc. - Class A | | | | 28,400 | | | | | 2,233,376 | |

| | | | | | | | | | |

| | | | | | | | | 2,831,355 | |

| | | | | | | | | | |

| Metals & Mining - 0.9% | | |

Carpenter Technology Corporation | | | | 40,390 | | | | | 1,438,288 | |

| | | | | | | | | | |

| Multiline Retail - 1.8% | | |

Ollie’s Bargain Outlet Holdings, Inc. (a) | | | | 43,390 | | | | | 2,885,869 | |

| | | | | | | | | | |

| Oil & Gas & Consumable Fuels - 1.5% |

Magnolia Oil & Gas Corp. (a) | | | | 122,870 | | | | | 1,377,373 | |

Oasis Petroleum Inc. (a) | | | | 126,230 | | | | | 698,052 | |

SRC Energy, Inc. (a) | | | | 75,000 | | | | | 352,500 | |

| | | | | | | | | | |

| | | | | | | | | 2,427,925 | |

| | | | | | | | | | |

| Pharmaceuticals - 0.5% | | |

Cambrex Corp. (a) | | | | 22,659 | | | | | 855,604 | |

| | | | | | | | | | |

| Real Estate Development - 0.4% |

Newmark Group, Inc. | | | | 72,233 | | | | | 579,309 | |

| | | | | | | | | | |

| Real Estate Investment Trusts - 3.9% |

First Industrial Realty Trust, Inc. | | | | 64,015 | | | | | 1,847,473 | |

Life Storage, Inc. | | | | 19,075 | | | | | 1,773,784 | |

Tanger Factory Outlet Centers, Inc. | | | | 62,585 | | | | | 1,265,469 | |

Tier REIT, Inc. | | | | 64,175 | | | | | 1,323,930 | |

| | | | | | | | | | |

| | | | | | | | | 6,210,656 | |

| | | | | | | | | | |

| Retailing - 0.9% | | |

Stamps.com Inc. (a) | | | | 8,775 | | | | | 1,365,741 | |

| | | | | | | | | | |

| Road & Rail - 1.3% | | |

Genesee & Wyoming Inc. - Class A (a) | | | | 27,525 | | | | | 2,037,400 | |

| | | | | | | | | | |

| Software - 4.4% | | |

ACI Worldwide, Inc. (a) | | | | 86,610 | | | | | 2,396,499 | |

Fair Isaac Corporation (a) | | | | 7,570 | | | | | 1,415,590 | |

OneSpan Inc. (a) | | | | 96,470 | | | | | 1,249,286 | |

RealPage, Inc. (a) | | | | 40,500 | | | | | 1,951,695 | |

| | | | | | | | | | |

| | | | | | | | | 7,013,070 | |

| | | | | | | | | | |

| Software & Services - 11.8% |

Alarm.com Holdings, Inc. (a) | | | | 57,770 | | | | | 2,996,530 | |

Box, Inc. - Class A (a) | | | | 46,405 | | | | | 783,316 | |

Carbonite, Inc. (a) | | | | 66,700 | | | | | 1,684,842 | |

Cornerstone OnDemand, Inc. (a) | | | | 48,025 | | | | | 2,421,901 | |

Coupa Software, Inc. (a) | | | | 67,190 | | | | | 4,223,563 | |

Envestnet, Inc. (a) | | | | 35,166 | | | | | 1,729,816 | |

LogMeIn, Inc. | | | | 13,030 | | | | | 1,062,857 | |

The Trade Desk, Inc. - Class A (a) | | | | 23,865 | | | | | 2,769,772 | |

Twilio Inc. - Class A (a) | | | | 14,695 | | | | | 1,312,263 | |

| | | | | | | | | | |

| | | | | | | | | 18,984,860 | |

| | | | | | | | | | |

| Textiles, Apparel & Luxury Goods - 3.2% |

Columbia Sportswear Company | | | | 21,251 | | | | | 1,786,996 | |

Steven Madden Ltd. | | | | 52,035 | | | | | 1,574,579 | |

Oxford Industries, Inc. | | | | 25,615 | | | | | 1,819,690 | |

| | | | | | | | | | |

| | | | | | | | | 5,181,265 | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Thrifts & Mortgage Finance - 2.0% |

Banc of California, Inc. | | | | 90,515 | | | | $ | 1,204,755 | |

Home BancShares Inc. | | | | 118,721 | | | | | 1,939,901 | |

| | | | | | | | | | |

| | | | | | | | | 3,144,656 | |

| | | | | | | | | | |

| Trading Companies & Distributors - 3.2% |

DXP Enterprises, Inc. (a) | | | | 42,070 | | | | | 1,171,229 | |

MSC Industrial Direct Co., Inc. - Class A | | | | 13,285 | | | | | 1,021,882 | |

Systemax, Inc. | | | | 29,610 | | | | | 707,383 | |

Textainer Group Holdings Ltd. (a)(b) | | | | 51,370 | | | | | 511,645 | |

Triton International Limited of Bermuda (b) | | | | 56,315 | | | | | 1,749,707 | |

| | | | | | | | | | |

| | | | | | | | | 5,161,846 | |

| | | | | | | | | | |

TOTAL COMMON STOCKS

(Cost $131,591,748) | | | | | | | | | 159,958,400 | |

| | | | | | | | | | |

Total Investments - 99.8%

(Cost $131,591,748) | | | | | | | | | 159,958,400 | |

Other Assets in Excess of Liabilities - 0.2% | | | | | 363,723 | |

| | | | | | | | | | |

TOTAL NET ASSETS - 100.0% | | | | | | | | $ | 160,322,123 | |

| | | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Security issued bynon-U.S. incorporated company. |

Investments are classified by industry pursuant to the Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of Morgan Stanley Capital International, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

15

|

| LKCMSMALL-MID CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS |

| December 31, 2018 |

| | | | | | | | | | |

| COMMON STOCKS - 96.5% | | Shares | | Value |

| Aerospace & Defense - 6.3% | | |

HEICO Corporation | | | | 4,253 | | | | $ | 329,522 | |

Hexcel Corporation | | | | 1,750 | | | | | 100,345 | |

Mercury Systems, Inc. (a) | | | | 7,020 | | | | | 331,976 | |

| | | | | | | | | | |

| | | | | | | | | 761,843 | |

| | | | | | | | | | |

| Banks - 4.1% | | |

LegacyTexas Financial Group, Inc. | | | | 7,940 | | | | | 254,795 | |

Pinnacle Financial Partners, Inc. | | | | 3,070 | | | | | 141,527 | |

SVB Financial Group (a) | | | | 560 | | | | | 106,355 | |

| | | | | | | | | | |

| | | | | | | | | 502,677 | |

| | | | | | | | | | |

| Biotechnology - 5.8% | | |

Charles River Laboratories International, Inc. (a) | | | | 2,195 | | | | | 248,430 | |

Exact Sciences Corp. (a) | | | | 3,460 | | | | | 218,326 | |

Ligand Pharmaceuticals Incorporated (a) | | | | 1,200 | | | | | 162,840 | |

Neogen Corporation (a) | | | | 1,340 | | | | | 76,380 | |

| | | | | | | | | | |

| | | | | | | | | 705,976 | |

| | | | | | | | | | |

| Building Products - 0.3% | | |

Builders FirstSource, Inc. (a) | | | | 3,000 | | | | | 32,730 | |

| | | | | | | | | | |

| Capital Markets - 1.1% | | |

SEI Investments Company | | | | 2,890 | | | | | 133,518 | |

| | | | | | | | | | |

| Chemicals - 1.3% | | |

CF Industries Holdings, Inc. | | | | 3,765 | | | | | 163,815 | |

| | | | | | | | | | |

| Commercial Services & Supplies - 2.5% | | |

Healthcare Services Group, Inc. | | | | 7,529 | | | | | 302,515 | |

| | | | | | | | | | |

| Consumer Finance - 2.6% | | |

FirstCash, Inc. | | | | 4,360 | | | | | 315,446 | |

| | | | | | | | | | |

| Diversified Financials - 1.9% | | |

MSCI Inc. | | | | 1,545 | | | | | 227,779 | |

| | | | | | | | | | |

| Electronic Equipment & Instruments - 4.7% | | |

FLIR Systems, Inc. | | | | 6,020 | | | | | 262,111 | |

Trimble Inc. (a) | | | | 9,305 | | | | | 306,227 | |

| | | | | | | | | | |

| | | | | | | | | 568,338 | |

| | | | | | | | | | |

| Health Care Equipment & Supplies - 7.5% | | |

Cantel Medical Corp. | | | | 2,875 | | | | | 214,043 | |

PerkinElmer, Inc. | | | | 2,965 | | | | | 232,901 | |

PRA Health Sciences, Inc. (a) | | | | 2,505 | | | | | 230,360 | |

STAAR Surgical Co. (a) | | | | 7,180 | | | | | 229,114 | |

| | | | | | | | | | |

| | | | | | | | | 906,418 | |

| | | | | | | | | | |

| Health Care Providers & Services - 4.2% | | |

HealthEquity, Inc. (a) | | | | 4,520 | | | | | 269,618 | |

Omnicell, Inc. (a) | | | | 4,010 | | | | | 245,572 | |

| | | | | | | | | | |

| | | | | | | | | 515,190 | |

| | | | | | | | | | |

| Internet Software & Services - 1.4% | | |

Euronet Worldwide, Inc. (a) | | | | 1,655 | | | | | 169,439 | |

| | | | | | | | | | |

| IT Consulting & Services - 2.2% | | |

LiveRamp Holdings, Inc. (a) | | | | 6,820 | | | | | 263,457 | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Leisure Equipment & Products - 2.4% | | |

Pool Corporation | | | | 1,965 | | | | $ | 292,097 | |

| | | | | | | | | | |

| Machinery - 3.1% | | |

Kennametal Inc. | | | | 3,810 | | | | | 126,797 | |

Rexnord Corporation (a) | | | | 10,765 | | | | | 247,057 | |

| | | | | | | | | | |

| | | | | | | | | 373,854 | |

| | | | | | | | | | |

| Marine - 1.6% | | |

Kirby Corporation (a) | | | | 2,970 | | | | | 200,059 | |

| | | | | | | | | | |

| Media & Entertainment - 2.4% | | |

Nexstar Media Group, Inc. - Class A | | | | 3,650 | | | | | 287,036 | |

| | | | | | | | | | |

| Metals & Mining - 1.2% | | |

Reliance Steel & Aluminum Co. | | | | 2,065 | | | | | 146,966 | |

| | | | | | | | | | |

| Multiline Retail - 2.5% | | |

Ollie’s Bargain Outlet Holdings, Inc. (a) | | | | 4,550 | | | | | 302,621 | |

| | | | | | | | | | |

| Oil & Gas & Consumable Fuels - 2.1% | | |

WPX Energy Inc. (a) | | | | 22,505 | | | | | 255,432 | |

| | | | | | | | | | |

| Real Estate Investment Trusts - 6.2% | | |

American Campus Communities, Inc. | | | | 6,020 | | | | | 249,168 | |

First Industrial Realty Trust, Inc. | | | | 6,950 | | | | | 200,577 | |

Life Storage, Inc. | | | | 1,965 | | | | | 182,725 | |

Tanger Factory Outlet Centers, Inc. | | | | 6,330 | | | | | 127,993 | |

| | | | | | | | | | |

| | | | | | | | | 760,463 | |

| | | | | | | | | | |

| Road & Rail - 1.4% | | |

Genesee & Wyoming Inc. - Class A (a) | | | | 2,315 | | | | | 171,356 | |

| | | | | | | | | | |

| Software - 9.5% | | |

Fair Isaac Corporation (a) | | | | 890 | | | | | 166,430 | |

Fortinet Inc. (a) | | | | 5,210 | | | | | 366,941 | |

Guidewire Software Inc. (a) | | | | 1,940 | | | | | 155,646 | |

Proofpoint, Inc. (a) | | | | 3,090 | | | | | 258,973 | |

RealPage, Inc. (a) | | | | 4,300 | | | | | 207,217 | |

| | | | | | | | | | |

| | | | | | | | | 1,155,207 | |

| | | | | | | | | | |

| Software & Services - 9.2% | | |

Akamai Technologies, Inc. (a) | | | | 3,765 | | | | | 229,966 | |

Coupa Software, Inc. (a) | | | | 3,750 | | | | | 235,725 | |

Envestnet, Inc. (a) | | | | 4,065 | | | | | 199,957 | |

Twilio Inc. - Class A (a) | | | | 5,125 | | | | | 457,663 | |

| | | | | | | | | | |

| | | | | | | | | 1,123,311 | |

| | | | | | | | | | |

| Specialty Retail - 1.4% | | |

Tiffany & Co. | | | | 2,170 | | | | | 174,707 | |

| | | | | | | | | | |

| Textiles, Apparel & Luxury Goods - 2.6% | | |

Columbia Sportswear Company | | | | 1,925 | | | | | 161,873 | |

Michael Kors Holdings Ltd. (a)(b) | | | | 4,025 | | | | | 152,628 | |

| | | | | | | | | | |

| | | | | | | | | 314,501 | |

| | | | | | | | | | |

| Thrifts & Mortgage Finance - 1.3% | | |

Home BancShares Inc. | | | | 9,915 | | | | | 162,011 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

16

|

| LKCMSMALL-MID CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS, CONTINUED |

| December 31, 2018 |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Trading Companies & Distributors - 3.7% | | |

Triton International Limited of Bermuda (b) | | | | 4,460 | | | | $ | 138,572 | |

Watsco, Inc. | | | | 2,230 | | | | | 310,282 | |

| | | | | | | | | | |

| | | | | | | | | 448,854 | |

| | | | | | | | | | |

TOTAL COMMON STOCKS

(Cost $9,827,747) | | | | | | | | | 11,737,616 | |

| | | | | | | | | | |

| | | | | | | | | | |

| SHORT-TERM INVESTMENT - 3.8% | | | | |

| Money Market Fund - 3.8% | | | | |

Invesco Short-Term Investments Trust-Government & Agency Portfolio - Institutional Shares, 2.30% (c) | | | | 463,416 | | | | | 463,416 | |

| | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENT

(Cost $463,416) | | | | | | | | | 463,416 | |

| | | | | | | | | | |

Total Investments - 100.3%

(Cost $10,291,163) | | | | | 12,201,032 | |

Liabilities in Excess of Other Assets - (0.3)% | | | | | (38,817 | ) |

| | | | | | | | | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 12,162,215 | |

| | | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Security issued by non-U.S. incorporated company. |

| (c) | The rate quoted is the annualized seven-day yield of the fund at period end. |

Investments are classified by industry pursuant to the Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of Morgan Stanley Capital International, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

17

|

| LKCM EQUITY FUND |

| SCHEDULEOF INVESTMENTS |

| December 31, 2018 |

| | | | | | | | | | |

| COMMON STOCKS - 97.3% | | Shares | | Value |

| Aerospace & Defense - 2.6% | | |

Honeywell International Inc. | | | | 60,000 | | | | $ | 7,927,200 | |

| | | | | | | | | | |

| Banks - 8.5% | | | | |

Bank of America Corporation | | | | 385,000 | | | | | 9,486,400 | |

Comerica Incorporated | | | | 126,000 | | | | | 8,654,940 | |

Cullen/Frost Bankers, Inc. | | | | 65,000 | | | | | 5,716,100 | |

Glacier Bancorp, Inc. | | | | 60,000 | | | | | 2,377,200 | |

| | | | | | | | | | |

| | | | | | | | | 26,234,640 | |

| | | | | | | | | | |

| Beverages - 3.0% | | | | |

The Coca-Cola Company | | | | 80,000 | | | | | 3,788,000 | |

PepsiCo, Inc. | | | | 49,000 | | | | | 5,413,520 | |

| | | | | | | | | | |

| | | | | | | | | 9,201,520 | |

| | | | | | | | | | |

| Biotechnology - 2.5% | | | | |

Amgen Inc. | | | | 40,000 | | | | | 7,786,800 | |

| | | | | | | | | | |

| Chemicals - 5.2% | | | | |

DowDuPont Inc. | | | | 100,000 | | | | | 5,348,000 | |

Ecolab Inc. | | | | 30,000 | | | | | 4,420,500 | |

FMC Corporation | | | | 85,000 | | | | | 6,286,600 | |

| | | | | | | | | | |

| | | | | | | | | 16,055,100 | |

| | | | | | | | | | |

| Commercial Services & Supplies - 3.4% | | |

Cintas Corporation | | | | 20,000 | | | | | 3,359,800 | |

Waste Connections, Inc. (b) | | | | 97,500 | | | | | 7,239,375 | |

| | | | | | | | | | |

| | | | | | | | | 10,599,175 | |

| | | | | | | | | | |

| Computers & Peripherals - 2.1% | | | | |

Apple Inc. | | | | 40,000 | | | | | 6,309,600 | |

| | | | | | | | | | |

| Diversified Financials - 3.2% | | | | |

JPMorgan Chase & Co. | | | | 102,000 | | | | | 9,957,240 | |

| | | | | | | | | | |

| Electrical Equipment & Instruments - 7.7% | | |

Emerson Electric Co. | | | | 170,000 | | | | | 10,157,500 | |

Franklin Electric Co., Inc. | | | | 85,000 | | | | | 3,644,800 | |

Rockwell Automation, Inc. | | | | 25,000 | | | | | 3,762,000 | |

Roper Technologies, Inc. | | | | 23,000 | | | | | 6,129,960 | |

| | | | | | | | | | |

| | | | | | | | | 23,694,260 | |

| | | | | | | | | | |

| Electronic Equipment & Instruments - 2.4% | | |

National Instruments Corporation | | | | 55,000 | | | | | 2,495,900 | |

Trimble Inc. (a) | | | | 150,000 | | | | | 4,936,500 | |

| | | | | | | | | | |

| | | | | | | | | 7,432,400 | |

| | | | | | | | | | |

| Health Care Equipment & Supplies - 7.2% | | |

Danaher Corporation | | | | 75,000 | | | | | 7,734,000 | |

PerkinElmer, Inc. | | | | 100,000 | | | | | 7,855,000 | |

Thermo Fisher Scientific Inc. | | | | 30,000 | | | | | 6,713,700 | |

| | | | | | | | | | |

| | | | | | | | | 22,302,700 | |

| | | | | | | | | | |

| Household Durables - 0.3% | | | | |

Roku, Inc. (a) | | | | 30,000 | | | | | 919,200 | |

| | | | | | | | | | |

| Household Products - 1.9% | | | | |

Kimberly-Clark Corporation | | | | 50,000 | | | | | 5,697,000 | |

| | | | | | | | | | |

| Internet & Catalog Retail - 2.4% | | | | |

Amazon.com, Inc. (a) | �� | | | 5,000 | | | | | 7,509,850 | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| IT Consulting & Services - 2.1% | | | | |

PayPal Holdings, Inc. (a) | | | | 75,000 | | | | $ | 6,306,750 | |

| | | | | | | | | | |

| Machinery - 4.8% | | | | |

Generac Holdings, Inc. (a) | | | | 115,000 | | | | | 5,715,500 | |

The Toro Company | | | | 74,000 | | | | | 4,135,120 | |

Valmont Industries, Inc. | | | | 45,000 | | | | | 4,992,750 | |

| | | | | | | | | | |

| | | | | | | | | 14,843,370 | |

| | | | | | | | | | |

| Marine - 1.1% | | | | |

Kirby Corporation (a) | | | | 50,000 | | | | | 3,368,000 | |

| | | | | | | | | | |

| Media & Entertainment - 3.5% | | | | |

Alphabet, Inc. - Class A (a) | | | | 7,000 | | | | | 7,314,720 | |

Facebook, Inc. - Class A (a) | | | | 27,000 | | | | | 3,539,430 | |

| | | | | | | | | | |

| | | | | | | | | 10,854,150 | |

| | | | | | | | | | |

| Oil & Gas & Consumable Fuels - 6.9% | | |

Cabot Oil & Gas Corporation | | | | 190,000 | | | | | 4,246,500 | |

ConocoPhillips | | | | 62,000 | | | | | 3,865,700 | |

EOG Resources, Inc. | | | | 65,000 | | | | | 5,668,650 | |

Occidental Petroleum Corporation | | | | 124,000 | | | | | 7,611,120 | |

| | | | | | | | | | |

| | | | | | | | | 21,391,970 | |

| | | | | | | | | | |

| Personal Products - 1.3% | | | | |

The Estee Lauder Companies Inc.- Class A | | | | 30,000 | | | | | 3,903,000 | |

| | | | | | | | | | |

| Pharmaceuticals - 6.7% | | | | |

Johnson & Johnson | | | | 38,000 | | | | | 4,903,900 | |

Merck & Co., Inc. | | | | 80,000 | | | | | 6,112,800 | |

Pfizer Inc. | | | | 115,000 | | | | | 5,019,750 | |

Zoetis Inc. | | | | 53,500 | | | | | 4,576,390 | |

| | | | | | | | | | |

| | | | | | | | | 20,612,840 | |

| | | | | | | | | | |

| Road & Rail - 2.3% | | | | |

Kansas City Southern | | | | 40,000 | | | | | 3,818,000 | |

Union Pacific Corporation | | | | 24,000 | | | | | 3,317,520 | |

| | | | | | | | | | |

| | | | | | | | | 7,135,520 | |

| | | | | | | | | | |

| Software - 6.0% | | | | |

Adobe Inc. (a) | | | | 30,000 | | | | | 6,787,200 | |

Microsoft Corporation | | | | 100,000 | | | | | 10,157,000 | |

RealPage, Inc. (a) | | | | 35,000 | | | | | 1,686,650 | |

| | | | | | | | | | |

| | | | | | | | | 18,630,850 | |

| | | | | | | | | | |

| Software & Services - 4.9% | | | | |

Akamai Technologies, Inc. (a) | | | | 90,000 | | | | | 5,497,200 | |

Alarm.com Holdings, Inc. (a) | | | | 67,000 | | | | | 3,475,290 | |

Envestnet, Inc. (a) | | | | 65,000 | | | | | 3,197,350 | |

LogMeIn, Inc. | | | | 35,000 | | | | | 2,854,950 | |

| | | | | | | | | | |

| | | | | | | | | 15,024,790 | |

| | | | | | | | | | |

| Specialty Retail - 3.0% | | | | |

The Home Depot, Inc. | | | | 40,000 | | | | | 6,872,800 | |

Tiffany & Co. | | | | 30,000 | | | | | 2,415,300 | |

| | | | | | | | | | |

| | | | | | | | | 9,288,100 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

18

|

| LKCM EQUITY FUND |

| SCHEDULEOF INVESTMENTS, CONTINUED |

| December 31, 2018 |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Textiles, Apparel & Luxury Goods - 2.3% | | |

VF Corporation | | | | 100,000 | | | | $ | 7,134,000 | |

| | | | | | | | | | |

TOTAL COMMON STOCKS

(Cost $190,671,748) | | | | | | | | | 300,120,025 | |

| | | | | | | | | | |

| | | | | | | | | | |

| U.S. GOVERNMENT ISSUE - 3.2% | | Principal

Amount | | |

| U.S. Treasury Note - 3.2% | | | | |

1.500%, 05/31/2019 | | | $ | 10,000,000 | | | | | 9,959,766 | |

| | | | | | | | | | |

TOTAL U.S. GOVERNMENT ISSUE

(Cost $9,966,486) | | | | | 9,959,766 | |

| | | | | | | | | | |

Total Investments - 100.5%

(Cost $200,638,234) | | | | | | | | | 310,079,791 | |

Liabilities in Excess of Other Assets - (0.5)% | | | | | (1,413,226 | ) |

| | | | | | | | | | |

TOTAL NET ASSETS - 100.0% | | | | | | | | $ | 308,666,565 | |

| | | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Security issued bynon-U.S. incorporated company. |

Investments are classified by industry pursuant to the Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of Morgan Stanley Capital International, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

19

|

| LKCM BALANCED FUND |

| SCHEDULEOF INVESTMENTS |

| December 31, 2018 |

| | | | | | | | | | |

| COMMON STOCKS - 61.9% | | Shares | | Value |

| Aerospace & Defense - 0.8% | | | | |

Honeywell International Inc. | | | | 5,100 | | | | $ | 673,812 | |

| | | | | | | | | | |

| Banks - 4.4% | | | | |

Bank of America Corporation | | | | 38,500 | | | | | 948,640 | |

Comerica Incorporated | | | | 11,300 | | | | | 776,197 | |

Cullen/Frost Bankers, Inc. | | | | 7,300 | | | | | 641,962 | |

SunTrust Banks, Inc. | | | | 14,600 | | | | | 736,424 | |

Zions Bancorporation | | | | 17,500 | | | | | 712,950 | |

| | | | | | | | | | |

| | | | | | | | | 3,816,173 | |

| | | | | | | | | | |

| Beverages - 1.8% | | | | |

The Coca-Cola Company | | | | 17,600 | | | | | 833,360 | |

PepsiCo, Inc. | | | | 6,700 | | | | | 740,216 | |

| | | | | | | | | | |

| | | | | | | | | 1,573,576 | |

| | | | | | | | | | |

| Biotechnology - 0.9% | | | | |

Charles River Laboratories International, Inc. (a) | | | | 6,800 | | | | | 769,624 | |

| | | | | | | | | | |

| Chemicals - 5.3% | | | | |

Air Products and Chemicals, Inc. | | | | 5,100 | | | | | 816,255 | |

DowDuPont Inc. | | | | 16,076 | | | | | 859,745 | |

Ecolab Inc. | | | | 4,800 | | | | | 707,280 | |

FMC Corporation | | | | 12,200 | | | | | 902,312 | |

GCP Applied Technologies Inc. (a) | | | | 16,000 | | | | | 392,800 | |

Linde Plc (b) | | | | 5,500 | | | | | 858,220 | |

| | | | | | | | | | |

| | | | | | | | | 4,536,612 | |

| | | | | | | | | | |

| Commercial Services & Supplies - 1.4% | | | | |

Cintas Corporation | | | | 4,000 | | | | | 671,960 | |

Waste Management, Inc. | | | | 5,900 | | | | | 525,041 | |

| | | | | | | | | | |

| | | | | | | | | 1,197,001 | |

| | | | | | | | | | |

| Computers & Peripherals - 1.3% | | | | |

Apple Inc. | | | | 7,150 | | | | | 1,127,841 | |

| | | | | | | | | | |

| Construction Materials - 0.8% | | | | |

Martin Marietta Materials, Inc. | | | | 4,100 | | | | | 704,667 | |

| | | | | | | | | | |

| Containers & Packaging - 0.5% | | | | |

Ball Corporation | | | | 8,800 | | | | | 404,624 | |

| | | | | | | | | | |

| Diversified Financials - 2.0% | | | | |

JPMorgan Chase & Co. | | | | 9,000 | | | | | 878,580 | |

Moody’s Corporation | | | | 6,000 | | | | | 840,240 | |

| | | | | | | | | | |

| | | | | | | | | 1,718,820 | |

| | | | | | | | | | |

| Diversified Telecommunication Services - 1.7% |

AT&T Inc. | | | | 26,739 | | | | | 763,131 | |

Verizon Communications Inc. | | | | 12,141 | | | | | 682,567 | |

| | | | | | | | | | |

| | | | | | | | | 1,445,698 | |

| | | | | | | | | | |

| Electrical Equipment & Instruments - 0.8% | | | | |

Rockwell Automation, Inc. | | | | 4,500 | | | | | 677,160 | |

| | | | | | | | | | |

| Electronic Equipment & Instruments - 2.2% | | | | |

FLIR Systems, Inc. | | | | 11,200 | | | | | 487,648 | |

National Instruments Corporation | | | | 15,800 | | | | | 717,004 | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Electronic Equipment & Instruments - 2.2%, Continued |

Trimble Inc. (a) | | | | 22,200 | | | | $ | 730,602 | |

| | | | | | | | | | |

| | | | | | | | | 1,935,254 | |

| | | | | | | | | | |

| Food & Drug Retailing - 1.5% | | | | |

Walgreens Boots Alliance, Inc. | | | | 7,500 | | | | | 512,475 | |

Walmart, Inc. | | | | 8,100 | | | | | 754,515 | |

| | | | | | | | | | |

| | | | | | | | | 1,266,990 | |

| | | | | | | | | | |

| Food Products - 0.9% | | | | |

Mondelez International Inc. - Class A | | | | 19,800 | | | | | 792,594 | |

| | | | | | | | | | |

| Health Care Equipment & Supplies - 4.5% | | | | |

Becton, Dickinson & Company | | | | 3,000 | | | | | 675,960 | |

Danaher Corporation | | | | 8,800 | | | | | 907,456 | |

Medtronic, Inc. (b) | | | | 7,600 | | | | | 691,296 | |

PerkinElmer, Inc. | | | | 10,100 | | | | | 793,355 | |

Thermo Fisher Scientific, Inc. | | | | 3,700 | | | | | 828,023 | |

| | | | | | | | | | |

| | | | | | | | | 3,896,090 | |

| | | | | | | | | | |

| Household Products - 2.0% | | | | |

Colgate-Palmolive Company | | | | 11,600 | | | | | 690,432 | |

Kimberly-Clark Corporation | | | | 6,600 | | | | | 752,004 | |

The Procter & Gamble Company | | | | 3,500 | | | | | 321,720 | |

| | | | | | | | | | |

| | | | | | | | | 1,764,156 | |

| | | | | | | | | | |

| Internet & Catalog Retail - 1.2% | | | | |

Amazon.com, Inc. (a) | | | | 700 | | | | | 1,051,379 | |

| | | | | | | | | | |

| IT Consulting & Services - 2.0% | | | | |

PayPal Holdings, Inc. (a) | | | | 11,400 | | | | | 958,626 | |

Visa Inc. - Class A | | | | 5,600 | | | | | 738,864 | |

| | | | | | | | | | |

| | | | | | | | | 1,697,490 | |

| | | | | | | | | | |

| Machinery - 1.5% | | | | |

Fortive Corporation | | | | 10,100 | | | | | 683,366 | |

Stanley Black & Decker, Inc. | | | | 5,400 | | | | | 646,596 | |

| | | | | | | | | | |

| | | | | | | | | 1,329,962 | |

| | | | | | | | | | |

| Marine - 0.7% | | | | |

Kirby Corporation (a) | | | | 9,000 | | | | | 606,240 | |

| | | | | | | | | | |

| Media & Entertainment - 2.2% | | | | |

Alphabet, Inc. - Class C (a) | | | | 625 | | | | | 647,256 | |

Alphabet, Inc. - Class A (a) | | | | 250 | | | | | 261,240 | |

CBS Corporation - Class B | | | | 3,600 | | | | | 157,392 | |

The Walt Disney Company | | | | 7,500 | | | | | 822,375 | |

| | | | | | | | | | |

| | | | | | | | | 1,888,263 | |

| | | | | | | | | | |

| Oil & Gas & Consumable Fuels - 5.0% | | | | |

Anadarko Petroleum Corporation | | | | 9,500 | | | | | 416,480 | |

Cabot Oil & Gas Corporation | | | | 25,900 | | | | | 578,865 | |

Chevron Corporation | | | | 5,795 | | | | | 630,438 | |

ConocoPhillips | | | | 11,400 | | | | | 710,790 | |

EOG Resources, Inc. | | | | 7,100 | | | | | 619,191 | |

Exxon Mobil Corporation | | | | 4,633 | | | | | 315,924 | |

Pioneer Natural Resources Company | | | | 4,100 | | | | | 539,232 | |

WPX Energy Inc. (a) | | | | 41,000 | | | | | 465,350 | |

| | | | | | | | | | |

| | | | | | | | | 4,276,270 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

20

|

| LKCM BALANCED FUND |

| SCHEDULEOF INVESTMENTS, CONTINUED |

| December 31, 2018 |

| | | | | | | | | | |

| COMMON STOCKS | |

Shares | |

Value |

| Pharmaceuticals - 5.2% | | | | |

Abbott Laboratories | | | | 12,300 | | | | $ | 889,659 | |

AbbVie Inc. | | | | 9,000 | | | | | 829,710 | |

Merck & Co., Inc. | | | | 9,800 | | | | | 748,818 | |

Pfizer Inc. | | | | 17,100 | | | | | 746,415 | |

Zoetis Inc. | | | | 14,400 | | | | | 1,231,776 | |

| | | | | | | | | | |

| | | | | | | | | 4,446,378 | |

| | | | | | | | | | |

| Real Estate Investment Trusts - 0.7% | | | | |

American Tower Corporation | | | | 3,800 | | | | | 601,122 | |

| | | | | | | | | | |

| Road & Rail - 0.7% | | | | |

Union Pacific Corp. | | | | 4,100 | | | | | 566,743 | |

| | | | | | | | | | |

| Software - 5.1% | | | | |

Adobe Inc. (a) | | | | 3,500 | | | | | 791,840 | |

Microsoft Corporation | | | | 11,000 | | | | | 1,117,270 | |