As filed with the U.S. Securities and Exchange Commission on March 6, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-8352

LKCM Funds

(Exact name of registrant as specified in charter)

c/o Luther King Capital Management Corporation

301 Commerce Street, Suite 1600

Fort Worth, TX 76102

(Address of principal executive offices) (Zip code)

K&L Gates LLP

1601 K Street, NW

Washington, DC 20006

(Name and address of agent for service)

1-800-688-LKCM and1-800-423-6369

Registrant’s telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2019

Item 1. Reports to Stockholders.

LKCM

FUNDS

LKCM Small Cap Equity Fund

LKCM Small-Mid Cap Equity Fund

LKCM Equity Fund

LKCM Balanced Fund

LKCM Fixed Income Fund

LKCM International Equity Fund

Annual Report

December 31, 2019

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the LKCM Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the LKCM Funds (if you hold your Fund shares directly with the LKCM Funds) or from your financial intermediary, such as a broker-dealer or bank (if you hold your Fund shares through a financial intermediary). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you hold your Fund shares directly with the LKCM Funds, you may elect to receive shareholder reports and other communications electronically from the LKCM Funds by calling1-800-688-LKCM or, if you hold your Fund shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports on paper free of charge. If you hold your Fund shares directly with the LKCM Funds, you can inform the LKCM Funds that you wish to continue receiving paper copies of your shareholder reports by calling1-800-688-LKCM or, if you hold your Fund shares through a financial intermediary, contacting your financial intermediary. Your election to receive reports in paper will apply to all of the LKCM Funds you hold directly with LKCM Funds or all of the funds you hold through your financial intermediary, as applicable.

Dear Fellow Shareholders:

We report the following performance information for the LKCM Funds for indicated periods ended December 31, 2019:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fund | | Inception

Date | | NAV @

12/31/19 | | Net

Expense

Ratio*, ** | | Gross

Expense

Ratio** | | One Year

Total

Return

Ended

12/31/19 | | Five Year

Average

Annualized

Return

Ended

12/31/19 | | Ten Year

Average

Annualized

Return

Ended

12/31/19 | | Avg.

Annual

Total

Return

Since

Incept. |

LKCM Equity Fund - | | | | 1/3/96 | | | | $ | 29.02 | | | | | 0.81% | | | | | 0.99% | | | | | 29.85% | | | | | 10.48% | | | | | 12.41% | | | | | 8.93% | |

S&P 500® Index(1) | | | | | | | | | | | | | | | | | | | | | | | | 31.49% | | | | | 11.70% | | | | | 13.56% | | | | | 9.17% | |

LKCM Small Cap Equity Fund - | | | | 7/14/94 | | | | $ | 16.78 | | | | | 1.00% | | | | | 1.08% | | | | | 22.70% | | | | | 6.92% | | | | | 10.80% | | | | | 10.24% | |

Russell 2000® Index(2) | | | | | | | | | | | | | | | | | | | | | | | | 25.52% | | | | | 8.23% | | | | | 11.83% | | | | | 9.28% | |

LKCMSmall-Mid Cap Equity Fund - | | | | 5/2/11 | | | | $ | 9.09 | | | | | 1.00% | | | | | 1.75% | | | | | 31.05% | | | | | 8.13% | | | | | N/A | | | | | 7.24% | |

Russell 2500® Index(3) | | | | | | | | | | | | | | | | | | | | | | | | 27.77% | | | | | 8.93% | | | | | N/A | | | | | 10.12% | |

LKCM International Equity Fund - | | | | 5/1/19 | | | | $ | 10.89 | | | | | 1.00% | | | | | 1.40% | | | | | N/A | | | | | N/A | | | | | N/A | | | | | 8.97% | # |

MSCI/EAFE® Index(4) | | | | | | | | | | | | | | | | | | | | | | | | N/A | | | | | N/A | | | | | N/A | | | | | 7.98% | # |

LKCM Balanced Fund | | | | 12/30/97 | | | | $ | 24.22 | | | | | 0.80% | | | | | 1.00% | | | | | 21.85% | | | | | 8.30% | | | | | 9.52% | | | | | 6.87% | |

S&P 500® Index(1) | | | | | | | | | | | | | | | | | | | | | | | | 31.49% | | | | | 11.70% | | | | | 13.56% | | | | | 7.63% | |

Bloomberg Barclays U.S. Intermediate | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Government/Credit Bond Index(5) | | | | | | | | | | | | | | | | | | | | | | | | 6.80% | | | | | 2.57% | | | | | 3.05% | | | | | 4.47% | |

LKCM Fixed Income Fund | | | | 12/30/97 | | | | $ | 10.92 | | | | | 0.50% | | | | | 0.78% | | | | | 6.70% | | | | | 2.50% | | | | | 2.97% | | | | | 4.25% | |

Bloomberg Barclays U.S. Intermediate | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Government/Credit Bond Index(5) | | | | | | | | | | | | | | | | | | | | | | | | 6.80% | | | | | 2.57% | | | | | 3.05% | | | | | 4.47% | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. The Funds impose a 1.00% redemption fee on shares held less than 30 days. If reflected, the fee would reduce performance shown.

| * | Luther King Capital Management Corporation, the Funds’ investment adviser, has contractually agreed to waive all or a portion of its management fee and/or reimburse expenses of each Fund to maintain the expense ratios designated in the Funds’ prospectus through May 1, 2020. This expense limitation excludes interest, taxes, brokerage commissions, indirect fees and expenses related to investments in other investment companies, including money market funds, and extraordinary expenses. Investment performance, which is based on the net expense ratio, reflects fee waivers, if any, in effect during the relevant period. In the absence of such waivers, total return would be reduced. Investment performance is based upon the net expense ratio. LKCM waived management fees and/or reimbursed expenses for each Fund during the fiscal year ended December 31, 2019. |

| ** | Expense ratios above are as reported in the Funds’ current prospectus dated May 1, 2019. Expense ratios reported for other periods in the financial highlights of this report may differ. |

| # | Cumulative return for the period from May 1, 2019, the LKCM International Equity Fund’s inception date, through December 31, 2019. Short term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on returns. |

| (1) | The S&P 500® Index is an unmanaged capitalization-weighted index of 500 selected stocks that is generally considered representative of the performance of large capitalization companies in the U.S. stock market. |

| (2) | The Russell 2000® Index is an unmanaged index which measures the performance of the 2,000 smallest companies in the Russell 3000® Index. |

| (3) | The Russell 2500® Index is an unmanaged index which measures the performance of the 2,500 smallest companies in the Russell 3000® Index. |

| (4) | The Morgan Stanley Capital International Europe, Australia, Far East Index (“MSCI/EAFE Index”) is an unmanaged index composed of large-cap and mid-cap securities across 21 European and Pacific Basin countries. The MSCI/EAFE Index is a recognized international index and is weighted by market capitalization. |

| (5) | The Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index is an unmanaged market value weighted index measuring both the principal price changes of, and income provided by, the underlying universe of securities that comprise the index. Securities included in the index must meet the following criteria: fixed as opposed to variable rate; remaining maturity of one to ten years; minimum outstanding par value of $250 million; rated investment grade or higher by Moody’s Investors Service or equivalent; must be dollar denominated and non-convertible; and must be publicly issued. |

Note: The indices defined above are not available for direct investment and the index performance therefore does not include fees, expenses or taxes.

2019 Review

The longest U.S. economic expansion on record, now in its eleventh year, also remains sluggish compared to otherpost-war expansions. We believe this lack of robust growth has contributed to the longevity of the current U.S. economic expansion. We believe that in order for the economy to grow above trend, aside from the immediate aftermath of a recession, consumers, businesses, and government must employ credit to pull forward consumption. Such action often results in a cycle of rising debt burdens which typically crest just as the business cycle turns down, often driven by the Federal Reserve acting to dampen inflation by raising interest rates. In our view, the consumer, in particular, has been quite disciplined regarding leverage and savings during this expansion, which has contributed to both its moderate pace and sustainability.

However, moderate economic growth of around 2.0% per year after inflation can lead to the perception that growth is relatively fragile. Investors spent a good portion of 2019 on recession watch as traditional warning signs, such as an inverted yield curve, slowing job gains, and contracting manufacturing activity, suggested an elevated risk of a recession. Weakness in many other global economies also reinforced these perceived recessionary concerns. Fortunately, weaker economic growth amid rising trade tensions spurred policymakers

2

around the world into action as central banks lowered interest rates, reinstated quantitative easing, quickened the pace of money supply growth, and expanded fiscal spending.

The Federal Reserve then surprised markets in the first quarter of 2019 with a large and unexpected reversal in monetary policy. At the Federal Reserve’s first interest rate policy meeting of the year and only six weeks into 2019, the Federal Reserve signaled that it would refrain from further interest rate increases for the foreseeable future and suspend its balance sheet reduction at some point during the year. In our view, several factors appeared to contribute to the abrupt change in the course for monetary policy, including the decline in global equity markets following the December 2018 interest rate hike, declining inflation expectations, and the impact of trade tensions on global growth. We believe the sharp dovish tilt in monetary policy, combined with significant equity valuation compression during December 2018, set the stage for valuation expansion as monetary conditions eased and trade tensions moderated as 2019 progressed. We believe this confluence of events and other factors contributed to the strong performance of the markets during 2019, as measured by the 31.49% and 6.80% advances for the S&P 500® Index and the Bloomberg Barclays Intermediate Government/Credit Bond Index, respectively, for the year ended December 31, 2019.

Finally, the U.S. economy achieved a unique milestone as we closed the decade. We believe the history of recessions in the U.S. illustrates that they are a natural, though painful, part of the business cycle. The National Bureau of Economic Research marks the beginning of the first business cycle of record during the fourth quarter of 1854. In every decade since the 1850s, the U.S. economy has experienced a recession, which is generally defined as two consecutive quarters of contracting U.S. Gross Domestic Product (GDP). However, 2019 brought to a close the only decade over the past 165 years in which the U.S. economy did not experience a recession.

2020 Outlook

We believe the domestic economic outlook has become incrementally positive, as the slump in manufacturing appears to be bottoming, labor markets remain robust, monetary policy remains accommodative, and some political uncertainties appear to have diminished. Personal consumption represents roughly 70% of the U.S. economy, and the consumer remains healthy in our view. The U.S. economy created a surprisingly strong 266,000 new jobs in November 2019, aided in part by the return to work of 49,000 striking General Motors employees. Labor market strength also appears evident in the most recent November 2019 unemployment rate of 3.5%, the lowest since December 1969. We believe that tight labor markets are supportive of higher wages, which grew by 3.1% in November 2019 compared with a year earlier. The lowest paid U.S. workers appeared to be the recipients of the biggest raises as earnings for nonsupervisory workers grew by 3.7% from a year earlier, and this trend could continue in our view.Twenty-two states have ushered in higher minimum wage levels around the beginning of 2020. Only seven of these increases appear to relate to inflation adjustments, the balance of which are the result of state legislative actions or ballot initiatives passed by voters. We believe this will impact an estimated 6.8 million workers with increases ranging from a $0.10 per hour inflation-related adjustment in Florida to a $1.50 per hour increase in New Mexico and Washington. We believe that these strong labor conditions have helped lift consumer confidence back to recent highs.

The U.S. dollar finished 2019 little changed from the beginning of the year; however, we believe that it could face three potential headwinds over the coming year. First, rising global bond yields have generally narrowed the excess yield spread offered by owning U.S. bonds, potentially resulting in a decrease in demand for U.S. dollars by foreign investors. Second, we believe the U.S. dollar has historically been a counter-cyclical currency, meaning that it weakens as the economic growth between the U.S. and the rest of the world narrows. In our view, the heart of the European economy, Germany’s large manufacturing base, has been particularly hard hit over the past year as auto manufacturing firms, still reeling from emissions scandals, have been heavily impacted by declining auto exports to China and significant retooling costs to develop more electric vehicles. However, we believe that European economic growth, aided by recent easing of monetary policy by the European Central Bank, should stabilize and show signs of recovery in the coming years. Finally, the U.S. dollar generally is sensitive to changes in inflation expectations, which fell frommid-2018 through the early part of the fourth quarter of 2019. We believe that if inflation expectations were to lift slightly from depressed levels in light of easing monetary policy, the U.S. dollar could weaken, and any weakening in the U.S. dollar would likely help boost corporate earnings of domestic companies with foreign sales.

For 2020, the U.S. presidential election features prominently in the year ahead. As the election approaches, investors will parse unexpected developments, which likely will be rapidly reflected in market prices. One simple result could be higher volatility as November 2020 approaches, particularly if risk to the status quo is perceived to rise. Historically, the electorate has viewed the U.S. presidential election through the prism of the economy. Since Woodrow Wilson’s second term in 1916, in all twelve cases when the incumbent presidents avoided a recession two years before seeking another term, they went on to win reelection. Conversely, in the six instances when a recession occurred in the two yearrun-up to are-election year, the incumbent lost with one exception, Calvin Coolidge, who won the election in 1924 as the incumbent after the passing of President Harding.

In summary, our projected outlook for 2020 is for the economy to continue to expand around 2% in real terms, aided by easing monetary policy as well as healthy consumption which we expect to be supported by continued strength in the labor market and real wage growth. The trade tension fever may have finally broken, which we believe should be positive for business confidence, a component of capital spending plans by businesses. As always, a market correction, generally defined as a decline of approximately 10% in the value of the equity markets, could occur at any time in our view. However, we believe a bear market, generally defined as a decline of greater than 20% in the value of the equity markets, appears less likely without an accompanying recession. We believe there is a low probability of

3

this risk, absent a severe exogenous shock to the U.S. economy. The November 2020 elections will rightly capture the attention of investors, and there is considerable time for developments to occur in the interim.

LKCM Equity Fund

The LKCM Equity Fund returned 29.85% for the year ended December 31, 2019, as compared to the 31.49% return for the S&P 500® Index, the Fund’s benchmark. The Fund’s relative performance benefited from stock selection decisions, particularly in the Industrials, Consumer Discretionary and Healthcare sectors, which was partially offset by stock selection decisions in the Information Technology and Energy sectors. The Fund’s underweight position in the Information Technology sector detracted from the Fund’s relative performance, which was partially offset by the Fund not investing in the Utilities sector. We believe the Fund is well positioned with a portfolio of companies that we believe are high quality, have solid balance sheets, are reasonably valued, and otherwise meet our stringent investment criteria.

LKCM Small Cap Equity Fund

The LKCM Small Cap Equity Fund returned 22.70% for the year ending December 31, 2019, as compared to the 25.52% return for the Russell 2000® Index, the Fund’s benchmark. The Fund’s relative performance benefited from sector allocation decisions, particularly being overweight the Information Technology and Industrials sectors. Stock selection decisions in the Information Technology and Healthcare sectors detracted from the Fund’s relative performance, which were partially offset by stock selection decisions in the Financials and Consumer Staples sectors. The Fund also benefited during the year from six portfolio companies being acquired and seven portfolio companies graduating out of our small cap investment strategy due to market appreciation. We were pleased with the Fund’s performance in light of the tilt in the Fund’s investment strategy towards high quality growth-oriented companies. We continue to remain confident in our strategy of investing in companies that we believe are high quality and competitively advantaged and otherwise meet our stringent investment criteria.

LKCMSmall-Mid Cap Equity Fund

The LKCMSmall-Mid Cap Equity Fund outperformed the Russell 2500® Index, the Fund’s benchmark, for the year ended December 31, 2019, returning 31.05% as compared to the 27.77% return for the benchmark. The Fund’s relative performance benefited from sector allocation decisions, particularly being overweight the Information Technology sector and underweight the Utilities sector. The Fund’s relative performance also benefited from stock selection decisions in the Industrials, Communication Services, and Materials sectors, which was partially offset by stock selection decisions in the Healthcare and Consumer Discretionary sectors. The Fund also benefited during the year from three portfolio companies being acquired and three portfolio companies graduating out of oursmall-mid cap investment strategy due to market appreciation. We were pleased with the Fund’s performance in light of the tilt in the Fund’s investment strategy towards high quality growth-oriented companies. We continue to remain confident in our strategy of investing in companies that we believe are high quality and competitively advantaged and otherwise meet our stringent investment criteria.

LKCM Balanced Fund

The LKCM Balanced Fund returned 21.85% for the year ended December 31, 2019 versus the 31.49% return for the S&P 500® Index and the 6.80% return for the Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index. The Fund benefited from strong stock selection in the Healthcare, Industrials and Materials sectors relative to the S&P 500® Index, which was partially offset by stock selection in the Information Technology sector. The Fund’s overweight position in the Energy sector detracted from the Fund’s relative performance, which was partially offset by the Fund not investing in the Utilities sector in the equity portfolio. The Fund’s fixed income portfolio remained focused on high quality intermediate corporate bonds, which seeks to serve the dual purpose of generating income and moderating overall risk in the Fund’s portfolio. At December 31, 2019, the Fund’s holdings consisted of approximately 69.4% equity securities, 28.3% fixed income securities, and 2.3% cash and cash equivalents, which we believe has the Fund well-positioned for the upcoming year.

LKCM Fixed Income Fund

The LKCM Fixed Income Fund returned 6.70% for the year ended December 31, 2019 compared to its benchmark, the Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index, which returned 6.80% for the year ended December 31, 2019. During the year, yields declined substantially across the curve and the yield curve steepened as the Federal Reserve cut the Federal Funds rate during the second half of the year in response to slowing economic conditions. The lagged effect of cumulative monetary policy tightening that ultimately inverted the yield curve during the summer and continuing uncertainties created by escalating trade policy tensions exacerbated slowing growth around the globe and contributed to the Federal Reserve’s decision to reverse course in its monetary policy. In this environment, where longer-duration securities outperformed their shorter-duration counterparts, the Fund’s duration of approximately 3.3 years detracted from performance relative to the duration of 3.9 years for the benchmark. However, in a year characterized by sharply tighter credit spreads, corporate bonds outperformed their higher quality counterparts in the U.S. government and agency issues sector as theflight-to-quality trade reversed and lower-rated fixed income securities outperformed. As a result, the Fund’s overweight position in corporate bonds relative to the benchmark, specifically corporate bonds in theBBB-rated sector, was beneficial to the Fund’s relative performance as credit spreads tightened substantially during the year. The Fund remains largely focused onshort-to-intermediate investment grade corporate bonds with strong underlying credit fundamentals in an effort to mitigate interest rate risk and credit risk in this modest growth environment.

4

LKCM International Equity Fund

The LKCM International Equity Fund returned 8.97% for the period from May 1, 2019, the inception date of the Fund, through December 31, 2019, as compared to the 7.98% for the MSCI EAFE Index, the Fund’s benchmark. During this period, the Fund’s relative performance benefited from an underweight position in the Financials sector and overweight positions in the Industrials, Consumer Discretionary, Information Technology and Healthcare sectors, which was partially offset by an overweight position in the Consumer Staples sector and an underweight position in the Utilities sector. The Fund’s relative performance also benefited from stock selection decisions in the Industrials, Energy, Materials and Information Technology sectors, which was partially offset by stock selection decisions in the Financials, Healthcare and Consumer Discretionary sectors. We believe the Fund is well positioned to generate attractive returns for Fund shareholders through competitively advantaged companies that we believe can generate returns in excess of their cost of capital and have good opportunities for earnings growth. In addition, we believe that the Fund’s overweight positions in the Industrials and Information Technology sectors should have the Fund well positioned for an anticipated resumption of expansionary policy in response to the decline in global economic activity throughout 2019, while we believe the Fund’s underweight position in the Financials sector will likely remain in place as lower interest rates continue to pressure bank margins.

J. Luther King, Jr., CFA, CIC

January 28, 2020

The information provided herein represents the opinion of J. Luther King, Jr., CFA, CIC and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Please refer to the Schedule of Investments found on pages 16-31 of the report for more information on Fund holdings. Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any securities.

Mutual fund investing involves risk. Principal loss is possible. Past performance is not a guarantee of future results. Investments in equity securities are subject to market risks and significant fluctuations in value. Small and medium capitalization funds typically carry additional risks, since smaller companies generally have a higher risk of failure, and, historically, their stocks have experienced a greater degree of market volatility than stocks on average. Investments in debt securities typically decrease in value when interest rates rise. This risk is greater for longer-term debt securities. Investments in mortgage backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. These risks are discussed in the Funds’ summary and statutory prospectuses.

Earnings growth is not a measure of future performance.

Duration is a commonly used measure of the potential volatility of the price of a debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration.

Spread is the percentage point difference between yields of various classes of bonds compared to treasury bonds.

Yield curve is a line that plots yields (interest rates) of bonds having equal credit quality but differing maturity dates. The slope of the yield curve gives an idea of future interest rate changes and economic activity.

Bond ratings are grades given to bonds that indicate their credit quality as determined by a private independent rating service such as S&P Global. The firm evaluates a bond issuer’s financial strength, or its ability to pay a bond’s principal and interest in a timely fashion. Ratings are expressed as letters ranging from ‘AAA’, which is the highest grade, to ‘D’, which is the lowest grade. In limited situations when the rating agency has not issued a formal rating, the rating agency will classify the security as nonrated.

Investors should consider the investment objective, risks and charges and expenses of a Fund carefully before investing. Each Fund’s summary prospectus and the prospectus contain this and other information about the Fund. Investors can obtain a summary prospectus or the prospectus by calling 1-800-688-LKCM. The summary prospectus and the prospectus should be read carefully before investing in a Fund.

Quasar Distributors, LLC, distributor.

5

PERFORMANCE:

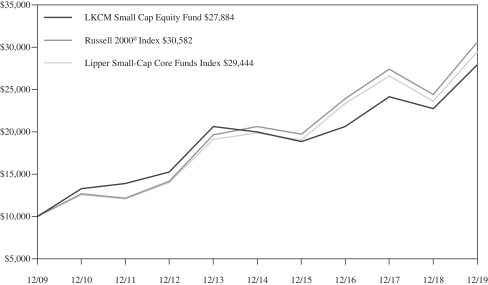

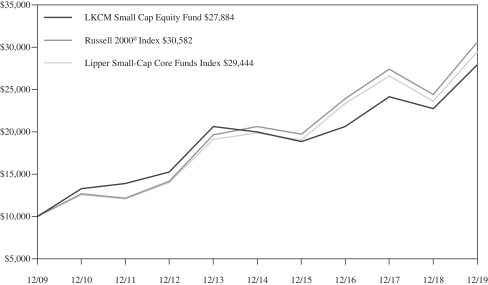

The following information illustrates the historical performance of the LKCM Small Cap Equity Fund as of December 31, 2019 compared to the Fund’s representative benchmark and peer group indices.

Performance data quoted represents past performance; past performance does not guarantee future results. The graph and table reflect the reinvestment of dividends and other distributions, if any, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. Returns would have been lower if LKCM had not waived a portion of its management fee and/or reimbursed certain expenses of the Fund. Please see Note B to the Notes to the Financial Statements for specific information regarding management fee waiver and/or expense reimbursement arrangements for the Fund.

An index is an unmanaged portfolio and does not trade or incur any expenses. The Lipper Small-Cap Core Funds Index, however, does reflect the fees and expenses borne by the funds included in that index. One can not invest in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURN (Periods Ended December 31, 2019)

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | Past

1 Year | | Past

5 Years(1) | | Past

10 Years(1) | | Since

Inception(1)(2) |

LKCM Small Cap Equity Fund | | | | 22.70% | | | | | 6.92% | | | | | 10.80% | | | | | 10.24% | |

Russell 2000® Index | | | | 25.52% | | | | | 8.23% | | | | | 11.83% | | | | | 9.28% | |

Lipper Small-Cap Core Funds Index | | | | 24.80% | | | | | 8.19% | | | | | 11.40% | | | | | 9.93% | |

A HYPOTHETICAL $10,000 INVESTMENT IN LKCM SMALL CAP EQUITY FUND

(for the ten years ended December 31, 2019)

The Russell 2000® Index is an unmanaged index consisting of the 2,000 smallest companies in the Russell 3000® Index.

The Lipper Small-Cap Core Funds Index is an unmanaged index generally considered representative of small cap core mutual funds tracked by Lipper, Inc.

6

PERFORMANCE:

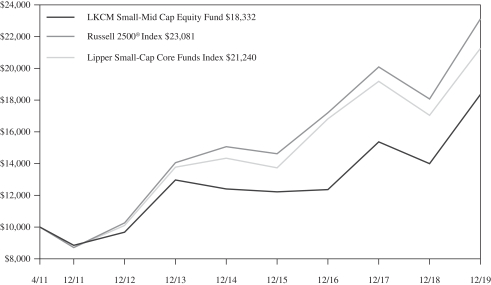

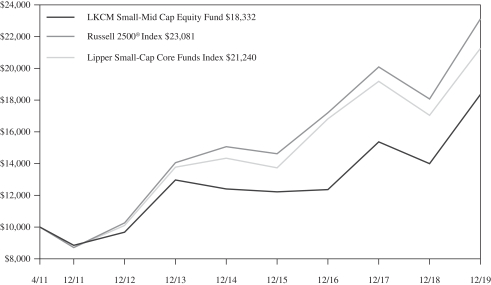

The following information illustrates the historical performance of the LKCM Small-Mid Cap Equity Fund as of December 31, 2019 compared to the Fund’s benchmark and peer group indices.

Performance data quoted represents past performance; past performance does not guarantee future results. The graph and table reflect the reinvestment of dividends and other distributions, if any, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. Returns would have been lower if LKCM had not waived a portion of its management fee and/or reimbursed certain expenses of the Fund. Please see Note B to the Notes to the Financial Statements for specific information regarding management fee waiver and/or expense reimbursement arrangements for the Fund.

An index is an unmanaged portfolio and does not trade or incur any expenses. The Lipper Small-Cap Core Funds Index, however, does reflect the fees and expenses borne by the funds included in that index. One can not invest in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURN (Periods Ended December 31, 2019)

| | | | | | | | | | | | | | | |

| | | | |

| | | Past

1 Year | | Past

5 Years(1) | | Since

Inception(1)(2) |

LKCM Small-Mid Cap Equity Fund | | | | 31.05% | | | | | 8.13% | | | | | 7.24% | |

Russell 2500® Index | | | | 27.77% | | | | | 8.93% | | | | | 10.12% | |

Lipper Small-Cap Core Funds Index | | | | 24.80% | | | | | 8.19% | | | | | 9.07% | |

A HYPOTHETICAL $10,000 INVESTMENT IN LKCM SMALL-MID CAP EQUITY FUND

(for the period from May 2, 2011 (inception date) to December 31, 2019)

The Russell 2500® Index is an unmanaged index consisting of the 2,500 smallest companies in the Russell 3000® Index.

The Lipper Small-Cap Core Funds Index is an unmanaged index generally considered representative of small cap core mutual funds tracked by Lipper, Inc.

7

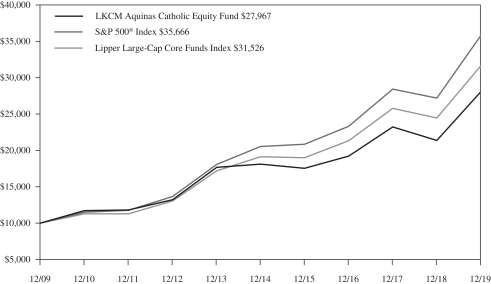

PERFORMANCE:

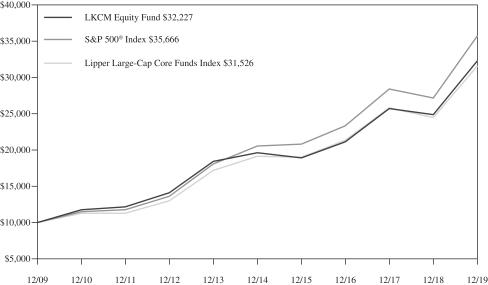

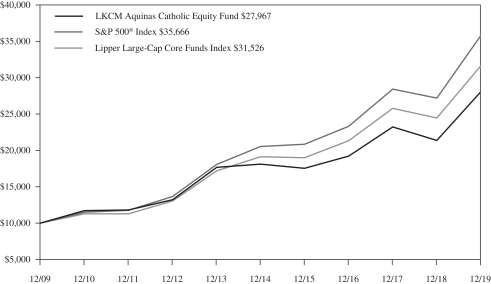

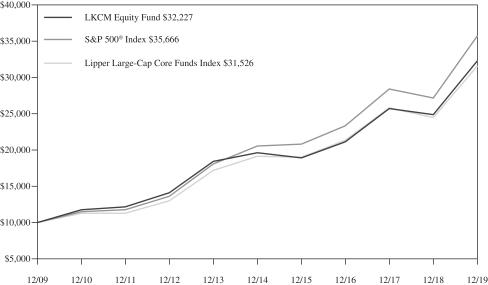

The following information illustrates the historical performance of the LKCM Equity Fund as of December 31, 2019 compared to the Fund’s benchmark and peer group indices.

Performance data quoted represents past performance; past performance does not guarantee future results. The graph and table reflect the reinvestment of dividends and other distributions, if any, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. Returns would have been lower if LKCM had not waived a portion of its management fee and/or reimbursed certain expenses of the Fund. Please see Note B to the Notes to the Financial Statements for specific information regarding management fee waiver and/or expense reimbursement arrangements for the Fund.

An index is an unmanaged portfolio and does not trade or incur any expenses. The Lipper Large-Cap Core Funds Index, however, does reflect the fees and expenses borne by the funds included in that index. One can not invest in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURN (Periods Ended December 31, 2019)

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | Past

1 Year | | Past

5 Years(1) | | Past

10 Years(1) | | Since

Inception(1)(2) |

LKCM Equity Fund | | | | 29.85% | | | | | 10.48% | | | | | 12.41% | | | | | 8.93% | |

S&P 500® Index | | | | 31.49% | | | | | 11.70% | | | | | 13.56% | | | | | 9.17% | |

Lipper Large-Cap Core Funds Index | | | | 29.00% | | | | | 10.54% | | | | | 12.17% | | | | | 8.12% | |

A HYPOTHETICAL $10,000 INVESTMENT IN LKCM EQUITY FUND

(for the ten years ended December 31, 2019)

The S&P 500® Index is an unmanaged capitalization-weighted index of 500 selected stocks that is generally considered representative of the performance of large capitalization companies in the U.S. stock market.

The Lipper Large-Cap Core Funds Index is an unmanaged index generally considered representative of large cap core mutual funds tracked by Lipper, Inc.

8

PERFORMANCE:

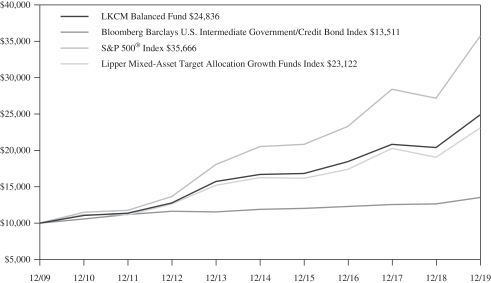

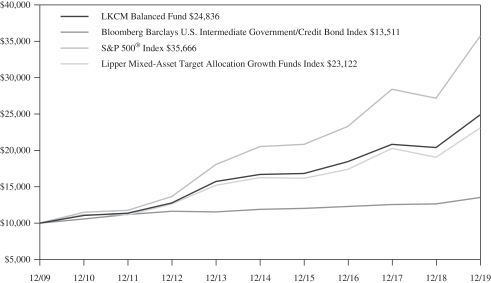

The following information illustrates the historical performance of the LKCM Balanced Fund as of December 31, 2019 compared to the Fund’s benchmark and peer group indices.

Performance data quoted represents past performance; past performance does not guarantee future results. The graph and table reflect the reinvestment of dividends and other distributions, if any, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. Returns would have been lower if LKCM had not waived a portion of its management fee and/or reimbursed certain expenses of the Fund. Please see Note B to the Notes to the Financial Statements for specific information regarding management fee waiver and/or expense reimbursement arrangements for the Fund.

An index is an unmanaged portfolio and does not trade or incur any expenses. The Lipper Mixed-Asset Target Allocation Growth Funds Index, however, does reflect the fees and expenses borne by the funds included in that index. One can not invest in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURN (Periods Ended December 31, 2019)

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | Past

1 Year | | Past

5 Years(1) | | Past

10 Years(1) | | Since

Inception(1)(2) |

LKCM Balanced Fund | | | | 21.85% | | | | | 8.30% | | | | | 9.52% | | | | | 6.87% | |

S&P 500® Index | | | | 31.49% | | | | | 11.70% | | | | | 13.56% | | | | | 7.63% | |

Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index | | | | 6.80% | | | | | 2.57% | | | | | 3.05% | | | | | 4.47% | |

Lipper Mixed-Asset Target Allocation Growth Funds Index | | | | 21.10% | | | | | 7.25% | | | | | 8.80% | | | | | 6.46% | |

A HYPOTHETICAL $10,000 INVESTMENT IN LKCM BALANCED FUND

(for the ten years ended December 31, 2019)

The S&P 500® Index is an unmanaged capitalization-weighted index of 500 selected stocks that is generally considered representative of the performance of large capitalization companies in the U.S. stock market.

The Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index is an unmanaged market value weighted index measuring both the principal price changes of, and income provided by, the underlying universe of securities that comprise the index. Securities included in the index must meet the following criteria; fixed as opposed to variable rate; remaining maturity of one to ten years;

9

minimum outstanding par value of $250 million; rated investment grade or higher by Moody’s Investors Service or equivalent; must be dollar denominated and non-convertible; and must be publicly issued.

The Lipper Mixed-Asset Target Allocation Growth Funds Index is an unmanaged index generally considered representative of mutual funds tracked by Lipper, Inc. that, by portfolio practice, maintain a mix of between 60%-80% equity securities, with the remainder invested in bonds, cash and cash equivalents.

10

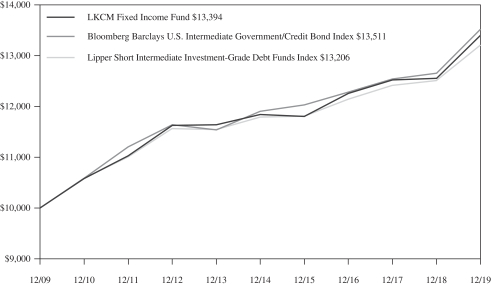

PERFORMANCE:

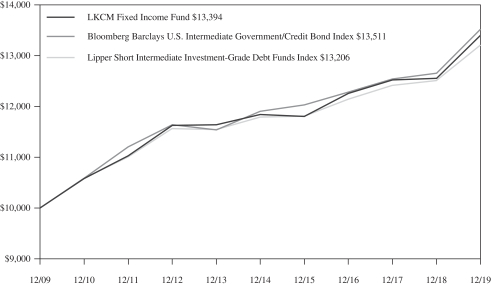

The following information illustrates the historical performance of the LKCM Fixed Income Fund as of December 31, 2019 compared to the Fund’s benchmark and peer group indices.

Performance data quoted represents past performance; past performance does not guarantee future results. The graph and table reflect the reinvestment of dividends and other distributions, if any, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. Returns would have been lower if LKCM had not waived a portion of its management fee and/or reimbursed certain expenses of the Fund. Please see Note B to the Notes to the Financial Statements for specific information regarding management fee waiver and/or expense reimbursement arrangements for the Fund.

An index is an unmanaged portfolio and does not trade or incur any expenses. The Lipper Short Intermediate Investment-Grade Debt Funds Index, however, does reflect the fees and expenses borne by the funds included in that index. One can not invest in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURN (Periods Ended December 31, 2019)

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | Past

1 Year | | Past

5 Years(1) | | Past

10 Years(1) | | Since

Inception(1)(2) |

LKCM Fixed Income Fund | | | | 6.70% | | | | | 2.50% | | | | | 2.97% | | | | | 4.25% | |

Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index | | | | 6.80% | | | | | 2.57% | | | | | 3.05% | | | | | 4.47% | |

Lipper Short Intermediate Investment-Grade Debt Funds Index | | | | 5.60% | | | | | 2.29% | | | | | 2.82% | | | | | 3.91% | |

A HYPOTHETICAL $10,000 INVESTMENT IN LKCM FIXED INCOME FUND

(for the ten years ended December 31, 2019)

The Bloomberg Barclays U.S. Intermediate Government/Credit Bond Index is an unmanaged market value weighted index measuring both the principal price changes of, and income provided by, the underlying universe of securities that comprise the index. Securities included in the index must meet the following criteria: fixed as opposed to variable rate; remaining maturity of one to ten years; minimum outstanding par value of $250 million; rated investment grade or higher by Moody’s Investors Service or equivalent; must be dollar denominated and non-convertible; and must be publicly issued.

The Lipper Short Intermediate Investment-Grade Debt Funds Index is an unmanaged index generally considered representative of short intermediate investment grade mutual funds tracked by Lipper, Inc.

11

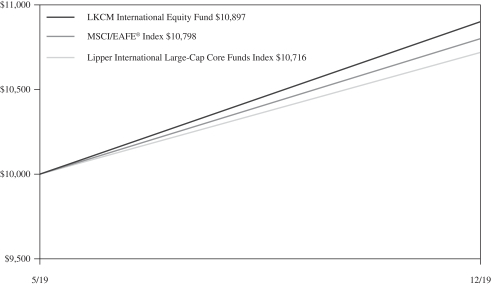

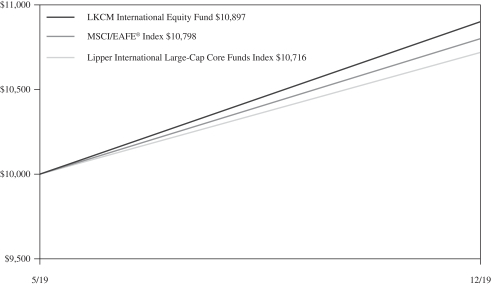

PERFORMANCE:

The following information illustrates the historical performance of the LKCM International Equity Fund as of December 31, 2019 compared to the Fund’s benchmark and peer group indices.

Performance data quoted represents past performance; past performance does not guarantee future results. The graph and table reflect the reinvestment of dividends and other distributions, if any, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. Returns would have been lower if LKCM had not waived a portion of its management fee and/or reimbursed certain expenses of the Fund. Please see Note B to the Notes to the Financial Statements for specific information regarding management fee waiver and/or expense reimbursement arrangements for the Fund.

An index is an unmanaged portfolio and does not trade or incur any expenses. The Lipper International Large-Cap Core Funds Index, however, does reflect the fees and expenses borne by the funds included in that index. One can not invest in an unmanaged index.

CUMULATIVE TOTAL RETURN (Period Ended December 31, 2019)

| | | | | |

| | |

| | | Since

Inception(1) |

LKCM International Equity Fund | | | | 8.97% | |

MSCI/EAFE® Index | | | | 7.98% | |

Lipper InternationalLarge-Cap Core Funds Index | | | | 7.16% | |

A HYPOTHETICAL $10,000 INVESTMENT IN LKCM INTERNATIONAL EQUITY FUND

(for the period from May 1, 2019 (inception date) to December 31, 2019)

The Morgan Stanley Capital International Europe, Australia, Far East Index (“MSCI/EAFE Index”) is an unmanaged index composed of large-cap and mid-cap securities across 21 European and Pacific Basin countries. The MSCI/EAFE Index is a recognized international index and is weighted by market capitalization.

The Lipper International Large-Cap Core Funds Index is an unmanaged index generally considered representative of largecap core mutual funds tracked by Lipper Inc.

12

LKCM Funds Expense Example — December 31, 2019

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including redemption fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (7/1/19-12/31/19).

ACTUAL EXPENSES

The first line of the tables below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Although the Funds charge no sales load, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC (doing business as U.S. Bank Global Fund Services), the Funds’ transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. You will be charged a redemption fee equal to 1.00% of the net amount of the redemption if you redeem your shares of the LKCM Small Cap Equity, Small-Mid Cap Equity, Equity, Balanced, Fixed Income, and International Equity Funds within 30 days of purchase, unless otherwise determined by the Funds in their discretion. To the extent the Funds invest in shares of other investment companies as part of their investment strategies, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Funds invest in addition to the expenses of the Funds. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example below includes management fees, registration fees and other expenses. However, the example below does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting principles.

HYPOTHETICAL EXAMPLES FOR COMPARISON PURPOSES

The second line of the tables below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactions costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | |

| | | LKCM Small Cap Equity Fund |

| | | Beginning

Account Value

7/1/19 | | Ending

Account Value

12/31/19 | | Expenses Paid

During Period*

7/1/19–12/31/19 |

Actual | | | $ | 1,000.00 | | | | $ | 1,027.70 | | | | $ | 5.11 | |

Hypothetical (5% return before expense) | | | $ | 1,000.00 | | | | $ | 1,020.16 | | | | $ | 5.09 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 1.00%, multiplied by the average account value over the period, multiplied by 184/365 to reflect theone-half year period. |

| | | | | | | | | | | | | | | |

| | | LKCMSmall-Mid Cap Equity Fund |

| | | Beginning

Account Value

7/1/19 | | Ending

Account Value

12/31/19 | | Expenses Paid

During Period*

7/1/19–12/31/19 |

Actual | | | $ | 1,000.00 | | | | $ | 1,055.90 | | | | $ | 5.18 | |

Hypothetical (5% return before expense) | | | $ | 1,000.00 | | | | $ | 1,020.16 | | | | $ | 5.09 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 1.00%, multiplied by the average account value over the period, multiplied by 184/365 to reflect theone-half year period. |

| | | | | | | | | | | | | | | |

| | | LKCM Equity Fund |

| | | Beginning

Account Value

7/1/19 | | Ending

Account Value

12/31/19 | | Expenses Paid

During Period*

7/1/19–12/31/19 |

Actual | | | $ | 1,000.00 | | | | $ | 1,086.60 | | | | $ | 4.21 | |

Hypothetical (5% return before expense) | | | $ | 1,000.00 | | | | $ | 1,021.17 | | | | $ | 4.08 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 0.80%, multiplied by the average account value over the period, multiplied by 184/365 to reflect theone-half year period. |

13

| | | | | | | | | | | | | | | |

| | | LKCM Balanced Fund |

| | | Beginning

Account Value

7/1/19 | | Ending

Account Value

12/31/19 | | Expenses Paid

During Period*

7/1/19–12/31/19 |

Actual | | | $ | 1,000.00 | | | | $ | 1,060.40 | | | | $ | 4.15 | |

Hypothetical (5% return before expense) | | | $ | 1,000.00 | | | | $ | 1,021.17 | | | | $ | 4.08 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 0.80%, multiplied by the average account value over the period, multiplied by 184/365 to reflect theone-half year period. |

| | | | | | | | | | | | | | | |

| | | LKCM Fixed Income Fund |

| | | Beginning

Account Value

7/1/19 | | Ending

Account Value

12/31/19 | | Expenses Paid

During Period*

7/1/19–12/31/19 |

Actual | | | $ | 1,000.00 | | | | $ | 1,017.10 | | | | $ | 2.54 | |

Hypothetical (5% return before expense) | | | $ | 1,000.00 | | | | $ | 1,022.68 | | | | $ | 2.55 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 0.50%, multiplied by the average account value over the period, multiplied by 184/365 to reflect theone-half year period. |

| | | | | | | | | | | | | | | |

| | | LKCM International Equity Fund |

| | | Beginning

Account Value

7/1/19 | | Ending

Account Value

12/31/19 | | Expenses Paid

During Period

7/1/19–12/31/19 |

Actual | | | $ | 1,000.00 | | | | $ | 1,087.50 | | | | $ | 5.26 | |

Hypothetical (5% return before expense) | | | $ | 1,000.00 | | | | $ | 1,020.16 | | | | $ | 5.09 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 1.00%, multiplied by the average account value over the period, multiplied by 184/365 to reflect theone-half year period. |

14

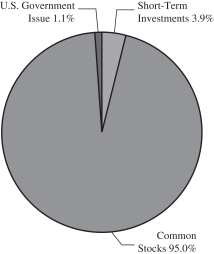

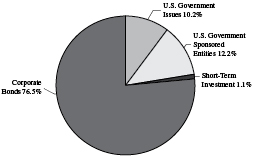

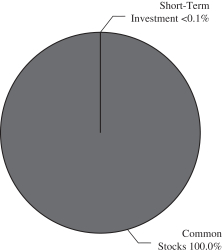

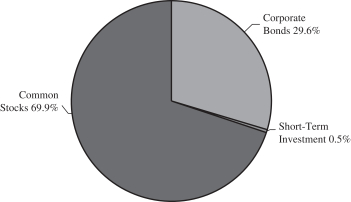

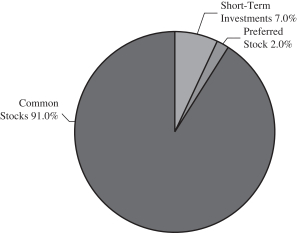

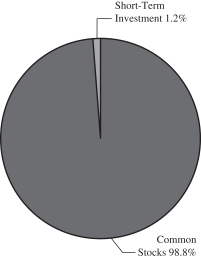

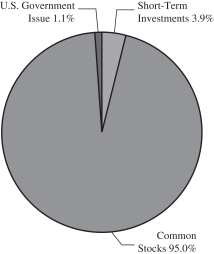

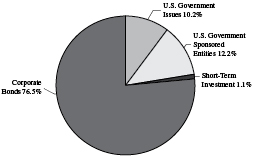

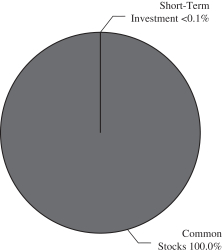

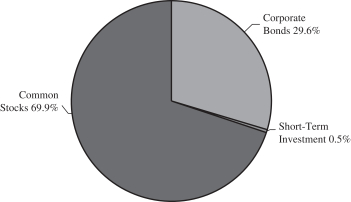

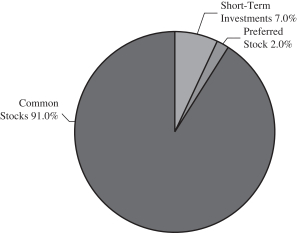

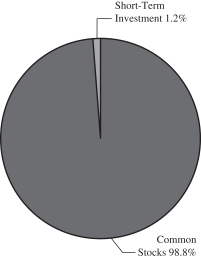

ALLOCATION OF PORTFOLIO HOLDINGS — LKCM Funds — December 31, 2019

Percentages represent market value as a percentage of total investments.

LKCM Small Cap Equity Fund

LKCM Equity Fund

LKCM Fixed Income Fund

LKCM Small-Mid Cap Equity Fund

LKCM Balanced Fund

LKCM International Equity Fund

15

|

| LKCM SMALL CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS |

| December 31, 2019 |

| | | | | | | | | | |

| COMMON STOCKS - 98.8% | | Shares | | Value |

| Aerospace & Defense - 1.5% |

Mercury Systems, Inc. (a) | | | | 39,045 | | | | $ | 2,698,400 | |

| | | | | | | | | | |

| Automobiles - 0.5% |

Thor Industries, Inc. | | | | 13,340 | | | | | 991,029 | |

| | | | | | | | | | |

| Banks - 7.7% |

BancorpSouth Bank | | | | 64,634 | | | | | 2,030,154 | |

Cadence BanCorp | | | | 98,682 | | | | | 1,789,105 | |

CBTX, Inc. | | | | 40,830 | | | | | 1,270,629 | |

Glacier Bancorp, Inc. | | | | 51,170 | | | | | 2,353,308 | |

Pinnacle Financial Partners, Inc. | | | | 36,970 | | | | | 2,366,080 | |

Seacoast Banking Corp. of Florida (a) | | | | 73,490 | | | | | 2,246,589 | |

Veritex Holdings, Inc. | | | | 64,067 | | | | | 1,866,272 | |

| | | | | | | | | | |

| | | | | | | | | 13,922,137 | |

| | | | | | | | | | |

| Biotechnology - 5.1% |

Charles River Laboratories International, Inc. (a) | | | | 12,645 | | | | | 1,931,650 | |

Emergent BioSolutions, Inc. (a) | | | | 36,770 | | | | | 1,983,742 | |

Ligand Pharmaceuticals, Inc. (a) | | | | 22,235 | | | | | 2,318,888 | |

Natera, Inc. (a) | | | | 13,590 | | | | | 457,847 | |

Neogen Corp. (a) | | | | 38,510 | | | | | 2,513,163 | |

| | | | | | | | | | |

| | | | | | | | | 9,205,290 | |

| | | | | | | | | | |

| Building Products - 6.8% |

American Woodmark Corp. (a) | | | | 23,055 | | | | | 2,409,478 | |

Builders FirstSource, Inc. (a) | | | | 132,725 | | | | | 3,372,542 | |

CSW Industrials, Inc. | | | | 39,040 | | | | | 3,006,080 | |

PGT Innovations, Inc. (a) | | | | 122,101 | | | | | 1,820,526 | |

Trex Co., Inc. (a) | | | | 19,540 | | | | | 1,756,255 | |

| | | | | | | | | | |

| | | | | | | | | 12,364,881 | |

| | | | | | | | | | |

| Chemicals - 2.5% |

Compass Minerals International, Inc. | | | | 43,230 | | | | | 2,635,301 | |

Ferro Corp. (a) | | | | 125,000 | | | | | 1,853,750 | |

Ferroglobe Representation & Warranty Insurance Trust (a)(c) | | | | 302,970 | | | | | — | |

| | | | | | | | | | |

| | | | | | | | | 4,489,051 | |

| | | | | | | | | | |

| Construction & Engineering - 1.5% |

EMCOR Group, Inc. | | | | 29,435 | | | | | 2,540,240 | |

NV5 Global, Inc. (a) | | | | 1,668 | | | | | 84,151 | |

| | | | | | | | | | |

| | | | | | | | | 2,624,391 | |

| | | | | | | | | | |

| Construction Materials - 0.5% |

Eagle Materials, Inc. | | | | 9,490 | | | | | 860,363 | |

| | | | | | | | | | |

| Consumer Finance - 0.9% |

FirstCash, Inc. | | | | 21,090 | | | | | 1,700,487 | |

| | | | | | | | | | |

| Electronic Equipment & Instruments - 0.5% |

Novanta, Inc. (a)(b) | | | | 10,400 | | | | | 919,776 | |

| | | | | | | | | | |

| Food Products - 3.4% |

Freshpet, Inc. (a) | | | | 36,590 | | | | | 2,162,103 | |

Hostess Brands, Inc. (a) | | | | 160,520 | | | | | 2,333,961 | |

J&J Snack Foods Corp. | | | | 9,150 | | | | | 1,686,070 | |

| | | | | | | | | | |

| | | | | | | | | 6,182,134 | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Health Care Equipment & Supplies - 5.1% |

Cantel Medical Corp. | | | | 13,670 | | | | $ | 969,203 | |

Cerus Corp. (a) | | | | 5,000 | | | | | 21,100 | |

Mesa Laboratories, Inc. | | | | 6,025 | | | | | 1,502,635 | |

NeoGenomics, Inc. (a) | | | | 92,520 | | | | | 2,706,210 | |

STAAR Surgical Co. (a) | | | | 81,705 | | | | | 2,873,565 | |

ViewRay, Inc. (a) | | | | 250,000 | | | | | 1,055,000 | |

| | | | | | | | | | |

| | | | | | | | | 9,127,713 | |

| | | | | | | | | | |

| Health Care Providers & Services - 7.4% |

HealthEquity, Inc. (a) | | | | 32,820 | | | | | 2,430,977 | |

Medpace Holdings, Inc. (a) | | | | 29,760 | | | | | 2,501,626 | |

Omnicell, Inc. (a) | | | | 39,775 | | | | | 3,250,413 | |

R1 RCM, Inc. (a) | | | | 225,000 | | | | | 2,920,500 | |

U.S. Physical Therapy, Inc. | | | | 19,240 | | | | | 2,200,094 | |

| | | | | | | | | | |

| | | | | | | | | 13,303,610 | |

| | | | | | | | | | |

| Health Care Technology - 1.5% |

Teladoc Health, Inc. (a) | | | | 32,990 | | | | | 2,761,923 | |

| | | | | | | | | | |

| Hotels, Restaurants & Leisure - 3.5% |

Everi Holdings, Inc. (a) | | | | 187,397 | | | | | 2,516,742 | |

Planet Fitness, Inc. - Class A (a) | | | | 23,305 | | | | | 1,740,417 | |

Wingstop, Inc. | | | | 23,465 | | | | | 2,023,387 | |

| | | | | | | | | | |

| | | | | | | | | 6,280,546 | |

| | | | | | | | | | |

| Household Durables - 1.2% |

Century Communities, Inc. (a) | | | | 82,590 | | | | | 2,258,836 | |

| | | | | | | | | | |

| Insurance - 4.8% |

Goosehead Insurance, Inc. - Class A | | | | 25,395 | | | | | 1,076,748 | |

The Hanover Insurance Group, Inc. | | | | 15,330 | | | | | 2,095,151 | |

Kinsale Capital Group, Inc. | | | | 22,590 | | | | | 2,296,499 | |

Palomar Holdings, Inc. (a) | | | | 35,875 | | | | | 1,811,329 | |

ProAssurance Corp. | | | | 39,050 | | | | | 1,411,267 | |

| | | | | | | | | | |

| | | | | | | | | 8,690,994 | |

| | | | | | | | | | |

| Internet & Catalog Retail - 0.4% |

Revolve Group, Inc. (a) | | | | 35,000 | | | | | 642,600 | |

| | | | | | | | | | |

| IT Consulting & Services - 2.8% |

Cass Information Systems, Inc. | | | | 25,680 | | | | | 1,482,763 | |

FireEye, Inc. (a) | | | | 71,865 | | | | | 1,187,929 | |

LiveRamp Holdings, Inc. (a) | | | | 48,256 | | | | | 2,319,666 | |

| | | | | | | | | | |

| | �� | | | | | | | 4,990,358 | |

| | | | | | | | | | |

| Machinery - 8.5% |

Alamo Group, Inc. | | | | 16,025 | | | | | 2,011,939 | |

Barnes Group, Inc. | | | | 23,900 | | | | | 1,480,844 | |

Colfax Corp. (a) | | | | 42,830 | | | | | 1,558,156 | |

Evoqua Water Technologies Corp. (a) | | | | 110,615 | | | | | 2,096,154 | |

John Bean Technologies Corp. | | | | 14,290 | | | | | 1,609,911 | |

Kennametal, Inc. | | | | 50,565 | | | | | 1,865,343 | |

Rexnord Corp. (a) | | | | 77,975 | | | | | 2,543,545 | |

Watts Water Technologies, Inc. - Class A | | | | 21,340 | | | | | 2,128,878 | |

| | | | | | | | | | |

| | | | | | | | | 15,294,770 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

16

|

| LKCM SMALL CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS, CONTINUED |

| December 31, 2019 |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Marine - 1.6% |

Kirby Corp. (a) | | | | 32,725 | | | | $ | 2,929,869 | |

| | | | | | | | | | |

| Media & Entertainment - 1.8% | | | | |

Nexstar Media Group, Inc. - Class A | | | | 27,625 | | | | | 3,239,031 | |

Sinclair Broadcast Group, Inc. - Class A | | | | 2,500 | | | | | 83,350 | |

| | | | | | | | | | |

| | | | | | | | | 3,322,381 | |

| | | | | | | | | | |

| Metals & Mining - 1.1% |

Carpenter Technology Corp. | | | | 40,615 | | | | | 2,021,815 | |

| | | | | | | | | | |

| Multiline Retail - 1.2% |

Ollie’s Bargain Outlet Holdings, Inc. (a) | | | | 33,460 | | | | | 2,185,273 | |

| | | | | | | | | | |

| Oil & Gas & Consumable Fuels - 2.8% |

Brigham Minerals, Inc. - Class A | | | | 96,865 | | | | | 2,076,785 | |

Magnolia Oil & Gas Corp. - Class A (a) | | | | 171,670 | | | | | 2,159,609 | |

WPX Energy, Inc. (a) | | | | 65,790 | | | | | 903,955 | |

| | | | | | | | | | |

| | | | | | | | | 5,140,349 | |

| | | | | | | | | | |

| Pharmaceuticals - 1.9% |

Horizon Therapeutics PLC (a)(b) | | | | 92,520 | | | | | 3,349,224 | |

| | | | | | | | | | |

| Real Estate Development - 1.6% |

FirstService Corp. (b) | | | | 10,030 | | | | | 933,191 | |

Newmark Group, Inc. - Class A | | | | 144,528 | | | | | 1,944,624 | |

| | | | | | | | | | |

| | | | | | | | | 2,877,815 | |

| | | | | | | | | | |

| Real Estate Investment Trusts - 2.6% |

First Industrial Realty Trust, Inc. | | | | 56,255 | | | | | 2,335,145 | |

PotlatchDeltic Corp. | | | | 54,340 | | | | | 2,351,292 | |

| | | | | | | | | | |

| | | | | | | | | 4,686,437 | |

| | | | | | | | | | |

| Software - 9.9% |

ACI Worldwide, Inc. (a) | | | | 76,645 | | | | | 2,903,696 | |

Appian Corp. (a) | | | | 55,740 | | | | | 2,129,825 | |

Fastly, Inc. - Class A (a) | | | | 42,185 | | | | | 846,653 | |

Five9, Inc. (a) | | | | 25,790 | | | | | 1,691,308 | |

Instructure, Inc. (a) | | | | 43,900 | | | | | 2,116,419 | |

LivePerson, Inc. (a) | | | | 51,805 | | | | | 1,916,785 | |

Mimecast Ltd. (a)(b) | | | | 20,425 | | | | | 886,037 | |

OneSpan Inc. (a) | | | | 84,765 | | | | | 1,451,177 | |

RealPage, Inc. (a) | | | | 27,055 | | | | | 1,454,206 | |

Talend SA - ADR (a)(b) | | | | 33,430 | | | | | 1,307,447 | |

Zuora, Inc. - Class A (a) | | | | 87,070 | | | | | 1,247,713 | |

| | | | | | | | | | |

| | | | | | | | | 17,951,266 | |

| | | | | | | | | | |

| Software & Services - 3.2% |

Alarm.com Holdings, Inc. (a) | | | | 20,510 | | | | | 881,315 | |

Cornerstone OnDemand, Inc. (a) | | | | 38,470 | | | | | 2,252,418 | |

Envestnet, Inc. (a) | | | | 32,131 | | | | | 2,237,282 | |

Yext, Inc. (a) | | | | 29,015 | | | | | 418,396 | |

| | | | | | | | | | |

| | | | | | | | | 5,789,411 | |

| | | | | | | | | | |

| Textiles, Apparel & Luxury Goods - 1.0% |

Steven Madden Ltd. | | | | 41,385 | | | | | 1,779,969 | |

| | | | | | | | | | |

| Thrifts & Mortgage Finance - 1.4% |

Home BancShares, Inc. | | | | 128,351 | | | | | 2,523,381 | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Trading Companies & Distributors - 2.6% |

Systemax, Inc. | | | | 78,723 | | | | $ | 1,980,671 | |

Textainer Group Holdings Ltd. (a)(b) | | | | 99,520 | | | | | 1,065,859 | |

Triton International Limited of Bermuda (b) | | | | 40,065 | | | | | 1,610,613 | |

| | | | | | | | | | |

| | | | | | | | | 4,657,143 | |

| | | | | | | | | | |

TOTAL COMMON STOCKS

(Cost $125,538,736) | | | | | | | | | 178,523,622 | |

| | | | | | | | | | |

| | | | | | | | | | |

| SHORT-TERM INVESTMENT - 1.1% | | | | |

| Money Market Fund - 1.1% |

Invesco Short-Term Investments Trust - Government & Agency Portfolio - Institutional Shares, 1.51% (d) | | | | 1,994,841 | | | | | 1,994,841 | |

| | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENT

(Cost $1,994,841) | | | | | 1,994,841 | |

| | | | | | | | | | |

Total Investments - 99.9%

(Cost $127,533,577) | | | | | | | | | 180,518,463 | |

Other Assets in Excess of Liabilities - 0.1% | | | | | 163,972 | |

| | | | | | | | | | |

TOTAL NET ASSETS - 100.0% | | | | | | | | $ | 180,682,435 | |

| | | | | | | | | | |

ADR American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | Security issued bynon-U.S. incorporated company. |

| (c) | Securities for which market quotations are not readily available. These securities have been valued at their fair value under procedures approved by the Fund’s Board of Trustees. Level 3 security (see Note A.1.). |

| (d) | The rate quoted is the annualizedseven-day yield of the fund at period end. |

Investments are classified by industry pursuant to the Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of Morgan Stanley Capital International, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

17

|

| LKCM SMALL-MID CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS |

| December 31, 2019 |

| | | | | | | | | | |

| COMMON STOCKS - 100.1% | | Shares | | Value |

| Aerospace & Defense - 3.3% |

Hexcel Corp. | | | | 2,555 | | | | $ | 187,307 | |

Mercury Systems, Inc. (a) | | | | 3,335 | | | | | 230,482 | |

| | | | | | | | | | |

| | | | | | | | | 417,789 | |

| | | | | | | | | | |

| Banks - 2.8% |

Cadence BanCorp | | | | 5,615 | | | | | 101,800 | |

Pinnacle Financial Partners, Inc. | | | | 3,865 | | | | | 247,360 | |

| | | | | | | | | | |

| | | | | | | | | 349,160 | |

| | | | | | | | | | |

| Biotechnology - 7.6% |

Charles River Laboratories International, Inc. (a) | | | | 1,745 | | | | | 266,566 | |

Exact Sciences Corp. (a) | | | | 2,510 | | | | | 232,125 | |

Ligand Pharmaceuticals, Inc. (a) | | | | 2,215 | | | | | 231,002 | |

Neogen Corp. (a) | | | | 3,425 | | | | | 223,516 | |

| | | | | | | | | | |

| | | | | | | | | 953,209 | |

| | | | | | | | | | |

| Building Products - 4.1% |

Builders FirstSource, Inc. (a) | | | | 13,490 | | | | | 342,781 | |

Trex Co., Inc. (a) | | | | 1,975 | | | | | 177,513 | |

| | | | | | | | | | |

| | | | | | | | | 520,294 | |

| | | | | | | | | | |

| Capital Markets - 2.0% |

LPL Financial Holdings, Inc. | | | | 2,730 | | | | | 251,843 | |

| | | | | | | | | | |

| Chemicals - 3.7% |

Compass Minerals International, Inc. | | | | 3,505 | | | | | 213,665 | |

FMC Corp. | | | | 2,525 | | | | | 252,045 | |

| | | | | | | | | | |

| | | | | | | | | 465,710 | |

| | | | | | | | | | |

| Construction & Engineering - 1.7% |

EMCOR Group, Inc. | | | | 2,445 | | | | | 211,003 | |

| | | | | | | | | | |

| Consumer Finance - 0.9% |

FirstCash, Inc. | | | | 1,455 | | | | | 117,317 | |

| | | | | | | | | | |

| Electronic Equipment & Instruments - 2.9% |

FLIR Systems, Inc. | | | | 4,195 | | | | | 218,434 | |

Trimble, Inc. (a) | | | | 3,380 | | | | | 140,912 | |

| | | | | | | | | | |

| | | | | | | | | 359,346 | |

| | | | | | | | | | |

| Food Products - 1.9% |

Freshpet, Inc. (a) | | | | 4,090 | | | | | 241,678 | |

| | | | | | | | | | |

| Health Care Equipment & Supplies - 6.7% |

Cantel Medical Corp. | | | | 2,505 | | | | | 177,604 | |

PerkinElmer, Inc. | | | | 1,555 | | | | | 150,991 | |

PRA Health Sciences, Inc. (a) | | | | 2,355 | | | | | 261,758 | |

STAAR Surgical Co. (a) | | | | 7,050 | | | | | 247,949 | |

| | | | | | | | | | |

| | | | | | | | | 838,302 | |

| | | | | | | | | | |

| Health Care Providers & Services - 3.8% |

HealthEquity, Inc. (a) | | | | 2,815 | | | | | 208,507 | |

Omnicell, Inc. (a) | | | | 3,365 | | | | | 274,988 | |

| | | | | | | | | | |

| | | | | | | | | 483,495 | |

| | | | | | | | | | |

| Health Care Technology - 2.3% |

Teladoc Health, Inc. (a) | | | | 3,405 | | | | | 285,067 | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Hotels, Restaurants & Leisure - 3.0% |

Planet Fitness, Inc. - Class A (a) | | | | 2,605 | | | | $ | 194,541 | |

Wingstop, Inc. | | | | 2,165 | | | | | 186,688 | |

| | | | | | | | | | |

| | | | | | | | | 381,229 | |

| | | | | | | | | | |

| Insurance - 2.2% |

The Hanover Insurance Group, Inc. | | | | 2,000 | | | | | 273,340 | |

| | | | | | | | | | |

| Internet Software & Services - 2.0% |

Euronet Worldwide, Inc. (a) | | | | 1,635 | | | | | 257,611 | |

| | | | | | | | | | |

| IT Consulting & Services - 1.3% |

LiveRamp Holdings, Inc. (a) | | | | 3,390 | | | | | 162,957 | |

| | | | | | | | | | |

| Leisure Equipment & Products - 2.7% |

Pool Corp. | | | | 1,595 | | | | | 338,746 | |

| | | | | | | | | | |

| Machinery - 4.7% |

Colfax Corp. (a) | | | | 3,820 | | | | | 138,972 | |

Kennametal, Inc. | | | | 5,460 | | | | | 201,419 | |

Rexnord Corp. (a) | | | | 7,585 | | | | | 247,423 | |

| | | | | | | | | | |

| | | | | | | | | 587,814 | |

| | | | | | | | | | |

| Marine - 1.9% |

Kirby Corp. (a) | | | | 2,645 | | | | | 236,807 | |

| | | | | | | | | | |

| Media & Entertainment - 4.5% |

Live Nation Entertainment, Inc. (a) | | | | 3,310 | | | | | 236,566 | |

Nexstar Media Group, Inc. - Class A | | | | 2,850 | | | | | 334,162 | |

| | | | | | | | | | |

| | | | | | | | | 570,728 | |

| | | | | | | | | | |

| Metals & Mining - 2.0% |

Reliance Steel & Aluminum Co. | | | | 2,140 | | | | | 256,286 | |

| | | | | | | | | | |

| Multiline Retail - 2.7% |

Five Below, Inc. (a) | | | | 1,170 | | | | | 149,596 | |

Ollie’s Bargain Outlet Holdings, Inc. (a) | | | | 2,855 | | | | | 186,460 | |

| | | | | | | | | | |

| | | | | | | | | 336,056 | |

| | | | | | | | | | |

| Oil & Gas & Consumable Fuels - 3.2% |

Parsley Energy, Inc. - Class A | | | | 8,000 | | | | | 151,280 | |

WPX Energy, Inc. (a) | | | | 17,970 | | | | | 246,908 | |

| | | | | | | | | | |

| | | | | | | | | 398,188 | |

| | | | | | | | | | |

| Pharmaceuticals - 2.8% |

Horizon Therapeutics PLC (a)(b) | | | | 9,700 | | | | | 351,140 | |

| | | | | | | | | | |

| Real Estate Development - 0.1% |

FirstService Corp. (b) | | | | 160 | | | | | 14,886 | |

| | | | | | | | | | |

| Real Estate Investment Trusts - 5.1% |

American Campus Communities, Inc. | | | | 3,885 | | | | | 182,711 | |

First Industrial Realty Trust, Inc. | | | | 5,760 | | | | | 239,098 | |

PotlatchDeltic Corp. | | | | 4,995 | | | | | 216,134 | |

| | | | | | | | | | |

| | | | | | | | | 637,943 | |

| | | | | | | | | | |

| Software - 7.0% |

Fair Isaac Corp. (a) | | | | 675 | | | | | 252,909 | |

Fortinet, Inc. (a) | | | | 1,210 | | | | | 129,180 | |

Guidewire Software, Inc. (a) | | | | 1,920 | | | | | 210,758 | |

Proofpoint, Inc. (a) | | | | 1,680 | | | | | 192,830 | |

The accompanying notes are an integral part of these financial statements.

18

|

| LKCM SMALL-MID CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS, CONTINUED |

| December 31, 2019 |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Software - 7.0%, Continued |

RealPage, Inc. (a) | | | | 1,885 | | | | $ | 101,319 | |

| | | | | | | | | | |

| | | | | | | | | 886,996 | |

| | | | | | | | | | |

| Software & Services - 6.6% |

Akamai Technologies, Inc. (a) | | | | 1,775 | | | | | 153,325 | |

Cornerstone OnDemand, Inc. (a) | | | | 3,555 | | | | | 208,145 | |

Coupa Software, Inc. (a) | | | | 1,790 | | | | | 261,788 | |

Envestnet, Inc. (a) | | | | 3,000 | | | | | 208,890 | |

| | | | | | | | | | |

| | | | | | | | | 832,148 | |

| | | | | | | | | | |

| Textiles, Apparel & Luxury Goods - 1.1% |

Columbia Sportswear Co. | | | | 1,360 | | | | | 136,258 | |

| | | | | | | | | | |

| Thrifts & Mortgage Finance - 1.5% |

Home BancShares, Inc. | | | | 9,455 | | | | | 185,885 | |

| | | | | | | | | | |

| Trading Companies & Distributors - 2.0% |

Watsco, Inc. | | | | 1,420 | | | | | 255,813 | |

| | | | | | | | | | |

TOTAL COMMON STOCKS

(Cost $9,078,181) | | | | | | | | | 12,595,044 | |

| | | | | | | | | | |

| | | | | | | | | | |

| SHORT-TERM INVESTMENT - 0.0% | | | | |

| Money Market Fund - 0.0% |

Invesco Short-Term Investments Trust - Government & Agency Portfolio - Institutional Shares, 1.51% (c) | | | | 4,730 | | | | | 4,730 | |

| | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENT

(Cost $4,730) | | | | | | | | | 4,730 | |

| | | | | | | | | | |

Total Investments - 100.1%

(Cost $9,082,911) | | | | | | | | | 12,599,774 | |

Liabilities in Excess of Other Assets - (0.1)% | | | | | (9,428 | ) |

| | | | | | | | | | |

TOTAL NET ASSETS - 100.0% | | | | | | | | $ | 12,590,346 | |

| | | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Security issued bynon-U.S. incorporated company. |

| (c) | The rate quoted is the annualizedseven-day yield of the fund at period end. |

Investments are classified by industry pursuant to the Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of Morgan Stanley Capital International, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

19

|

| LKCM EQUITY FUND |

| SCHEDULEOF INVESTMENTS |

| December 31, 2019 |

| | | | | | | | | | |

| COMMON STOCKS - 94.8% | | Shares | | Value |

| Aerospace & Defense - 2.5% |

Honeywell International, Inc. | | | | 52,800 | | | | $ | 9,345,600 | |

| | | | | | | | | | |

| Banks - 7.4% |

Bank of America Corp. | | | | 242,000 | | | | | 8,523,240 | |

Comerica, Inc. | | | | 149,000 | | | | | 10,690,750 | |

Cullen/Frost Bankers, Inc. | | | | 65,000 | | | | | 6,355,700 | |

Glacier Bancorp, Inc. | | | | 60,000 | | | | | 2,759,400 | |

| | | | | | | | | | |

| | | | | | | | | 28,329,090 | |

| | | | | | | | | | |

| Beverages - 3.7% |

The Coca-Cola Co. | | | | 80,000 | | | | | 4,428,000 | |

Keurig Dr Pepper, Inc. | | | | 100,000 | | | | | 2,895,000 | |

PepsiCo, Inc. | | | | 49,000 | | | | | 6,696,830 | |

| | | | | | | | | | |

| | | | | | | | | 14,019,830 | |

| | | | | | | | | | |

| Biotechnology - 1.8% |

Amgen, Inc. | | | | 28,000 | | | | | 6,749,960 | |

| | | | | | | | | | |

| Chemicals - 5.9% |

Air Products & Chemicals, Inc. | | | | 21,000 | | | | | 4,934,790 | |

Ecolab, Inc. | | | | 45,000 | | | | | 8,684,550 | |

FMC Corp. | | | | 90,000 | | | | | 8,983,800 | |

| | | | | | | | | | |

| | | | | | | | | 22,603,140 | |

| | | | | | | | | | |

| Commercial Services & Supplies - 3.5% |

Cintas Corp. | | | | 16,000 | | | | | 4,305,280 | |

Waste Connections, Inc. (b) | | | | 97,500 | | | | | 8,852,025 | |

| | | | | | | | | | |

| | | | | | | | | 13,157,305 | |

| | | | | | | | | | |

| Computers & Peripherals - 2.3% |

Apple, Inc. | | | | 30,000 | | | | | 8,809,500 | |

| | | | | | | | | | |

| Diversified Financials - 3.7% |

JPMorgan Chase & Co. | | | | 102,000 | | | | | 14,218,800 | |

| | | | | | | | | | |

| Electrical Equipment & Instruments - 4.7% |

Franklin Electric Co., Inc. | | | | 85,000 | | | | | 4,872,200 | |

Rockwell Automation, Inc. | | | | 25,000 | | | | | 5,066,750 | |

Roper Technologies, Inc. | | | | 23,000 | | | | | 8,147,290 | |

| | | | | | | | | | |

| | | | | | | | | 18,086,240 | |

| | | | | | | | | | |

| Electronic Equipment & Instruments - 2.3% |

National Instruments Corp. | | | | 55,000 | | | | | 2,328,700 | |

Trimble, Inc. (a) | | | | 150,000 | | | | | 6,253,500 | |

| | | | | | | | | | |

| | | | | | | | | 8,582,200 | |

| | | | | | | | | | |

| Food Products - 0.8% |

Mondelez International, Inc. - Class A | | | | 54,000 | | | | | 2,974,320 | |

| | | | | | | | | | |

| Health Care Equipment & Supplies - 7.8% |

Danaher Corp. | | | | 72,000 | | | | | 11,050,560 | |

PerkinElmer, Inc. | | | | 100,000 | | | | | 9,710,000 | |

Thermo Fisher Scientific, Inc. | | | | 27,200 | | | | | 8,836,464 | |

| | | | | | | | | | |

| | | | | | | | | 29,597,024 | |

| | | | | | | | | | |

| Household Products - 2.8% |

Kimberly-Clark Corp. | | | | 50,000 | | | | | 6,877,500 | |

The Procter & Gamble Co. | | | | 30,000 | | | | | 3,747,000 | |

| | | | | | | | | | |

| | | | | | | | | 10,624,500 | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Internet & Catalog Retail - 2.4% |

Amazon.com, Inc. (a) | | | | 5,000 | | | | $ | 9,239,200 | |

| | | | | | | | | | |

| IT Consulting & Services - 2.1% |

PayPal Holdings, Inc. (a) | | | | 75,000 | | | | | 8,112,750 | |

| | | | | | | | | | |

| Machinery - 6.1% |

Generac Holdings, Inc. (a) | | | | 107,000 | | | | | 10,763,130 | |

The Toro Co. | | | | 74,000 | | | | | 5,895,580 | |

Valmont Industries, Inc. | | | | 45,000 | | | | | 6,740,100 | |

| | | | | | | | | | |

| | | | | | | | | 23,398,810 | |

| | | | | | | | | | |

| Marine - 0.9% |

Kirby Corp. (a) | | | | 40,000 | | | | | 3,581,200 | |

| | | | | | | | | | |

| Media & Entertainment - 4.6% |

Alphabet, Inc. - Class A (a) | | | | 7,000 | | | | | 9,375,730 | |

Facebook, Inc. - Class A (a) | | | | 27,000 | | | | | 5,541,750 | |

Live Nation Entertainment, Inc. (a) | | | | 35,000 | | | | | 2,501,450 | |

| | | | | | | | | | |

| | | | | | | | | 17,418,930 | |

| | | | | | | | | | |

| Metals & Mining - 1.0% |

Newmont Goldcorp Corp. | | | | 90,000 | | | | | 3,910,500 | |

| | | | | | | | | | |

| Oil & Gas & Consumable Fuels - 4.9% |

Cabot Oil & Gas Corp. | | | | 190,000 | | | | | 3,307,900 | |

ConocoPhillips | | | | 91,500 | | | | | 5,950,245 | |

EOG Resources, Inc. | | | | 65,000 | | | | | 5,444,400 | |

Occidental Petroleum Corp. | | | | 100,000 | | | | | 4,121,000 | |

| | | | | | | | | | |

| | | | | | | | | 18,823,545 | |

| | | | | | | | | | |

| Personal Products - 1.6% |

The Estee Lauder Cos., Inc. - Class A | | | | 30,000 | | | | | 6,196,200 | |

| | | | | | | | | | |

| Pharmaceuticals - 5.0% |

Merck & Co., Inc. | | | | 80,000 | | | | | 7,276,000 | |

Pfizer, Inc. | | | | 115,000 | | | | | 4,505,700 | |

Zoetis, Inc. | | | | 53,500 | | | | | 7,080,725 | |

| | | | | | | | | | |

| | | | | | | | | 18,862,425 | |

| | | | | | | | | | |

| Road & Rail - 2.8% |

Kansas City Southern | | | | 40,000 | | | | | 6,126,400 | |

Union Pacific Corp. | | | | 24,000 | | | | | 4,338,960 | |

| | | | | | | | | | |

| | | | | | | | | 10,465,360 | |

| | | | | | | | | | |

| Software - 7.1% |