UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08360 |

|

GUINNESS ATKINSON FUNDS |

(Exact name of registrant as specified in charter) |

|

21550 Oxnard Street, Suite 850

Woodland Hills, CA | | 91367 |

(Address of principal executive offices) | | (Zip code) |

|

James J. Atkinson, Jr.

21550 Oxnard Street, Suite 850

Woodland Hills, CA 91367 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800-915-6566) | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2015 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

2

Guinness AtkinsonTM Funds

Annual Report

December 31, 2015

TABLE OF CONTENTS

| | 5 | | | Letter to Shareholders | |

| | 7 | | | Expense Example | |

| | 8 | | | Alternative Energy Fund | |

| | 15 | | | Asia Focus Fund | |

| | 21 | | | Asia Pacific Dividend Builder Fund | |

| | 28 | | | China & Hong Kong Fund | |

| | 34 | | | Dividend Builder Fund | |

| | 43 | | | Global Energy Fund | |

| | 53 | | | Global Innovators Fund | |

| | 62 | | | Renminbi Yuan & Bond Fund | |

| | 69 | | | Statements of Assets and Liabilities | |

| | 70 | | | Statements of Operations | |

| | 72 | | | Statements of Changes in Net Assets | |

| | 75 | | | Financial Highlights | |

| | 83 | | | Notes to Financial Statements | |

| | 97 | | | Report of Independent Registered Public Accounting Firm | |

| | 98 | | | Trustee and Officer Information | |

| | 103 | | | Guinness Atkinson Funds Information | |

3

The table below provides total return data for each of the Funds over the one, three, five, ten year, and from inception periods through December 31, 2015. Also included in the table is the expense ratio data from the most recent prospectus dated March 23, 2015 (or as updated December 31, 2015).

Fund (inception date) | | 1-year | | 3-year | | 5-year | | 10-year | | From Inception | | Expense Ratio | |

Alternative Energy Fund (March 31, 2006) | | | -11.40 | % | | | -7.05 | % | | | -9.78 | % | | | — | | | | -12.34 | % | | | 2.06 | % gross; 2.02% net† | |

Asia Focus (April 29, 1996) | | | -11.56 | % | | | -6.82 | % | | | -6.18 | % | | | 3.27 | % | | | 1.78 | % | | | 1.92 | %† | |

Asia Pacific Dividend Builder Fund

(March 31, 2006) | | | -4.61 | % | | | 0.64 | % | | | 1.57 | % | | | — | | | | 4.14 | % | | | 3.91 | % gross; 1.98% net† | |

China & Hong Kong (June 30, 1994) | | | -7.58 | % | | | -1.20 | % | | | -4.37 | % | | | 6.44 | % | | | 6.46 | % | | | 1.53 | %† | |

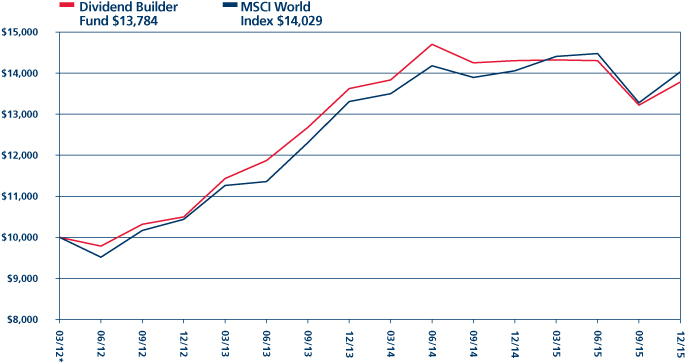

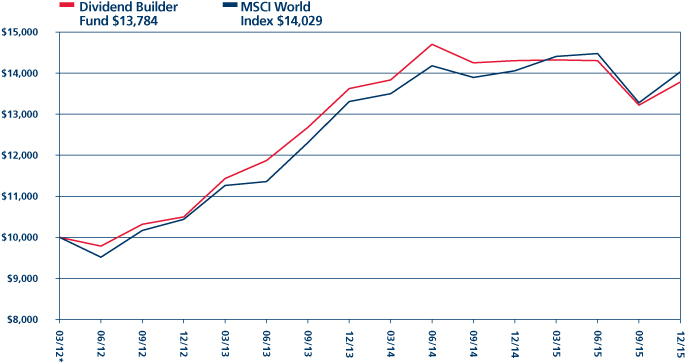

Dividend Builder Fund (March 30, 2012) | | | -3.61 | % | | | 9.54 | % | | | — | | | | — | | | | 8.92 | % | | | 2.96 | % gross; 0.68% net† | |

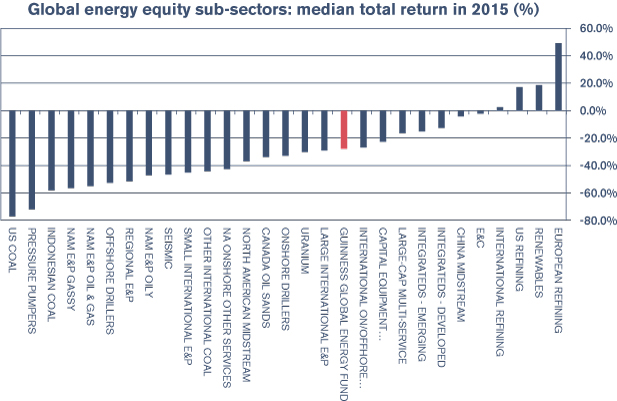

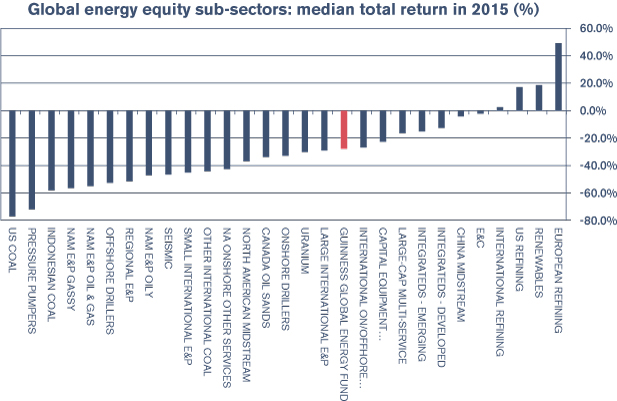

Global Energy Fund (June 30, 2004) | | | -26.97 | % | | | -9.91 | % | | | -8.06 | % | | | -0.30 | % | | | 5.93 | % | | | 1.30 | %† | |

Global Innovators Fund Investor Class

(December 15, 1998) | | | -3.04 | % | | | 16.61 | % | | | 12.19 | % | | | 9.01 | % | | | 6.78 | % | | | 1.26 | % gross; 1.24% net† | |

Global Innovators Fund Institutional Class

(December 31, 2015) | | | -3.04 | % | | | 16.61 | % | | | 12.19 | % | | | 9.01 | % | | | 6.78 | % | | | 1.10 | % gross; 0.99% net† | |

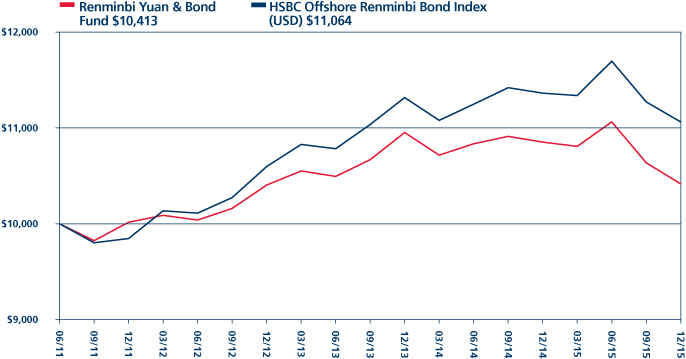

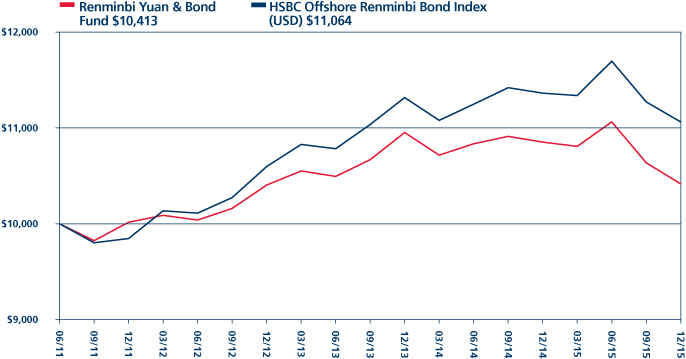

Renminbi Yuan & Bond Fund (June 30, 2011) | | | -4.05 | % | | | 0.03 | % | | | — | | | | — | | | | 0.90 | % | | | 0.95 | % gross; 0.90% net† | |

Periods of greater than one year are average annualized returns; one-year returns are actual returns. All returns are for the periods ended December 31, 2015.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Each of the Asia Focus Fund, the Asia Pacific Dividend Builder Fund, the China & Hong Kong Fund, and the Renminbi Yuan & Bond Fund imposes a 2% redemption fee on shares held less than 30 days. Performance data quoted does not reflect this fee. If it had, total return would be lower.

Expense ratios are from the most recent prospectus (dated March 23, 2015 or amended as of December 31, 2015) and are from the most recent audited financials (period ended December 31, 2014) at the time that prospectus was completed.

†All of the Guinness Atkinson Funds, except the Global Innovators Fund, have an expense cap in place and the advisor is contractually obligated to cap the Funds' total expenses at least through June 30, 2016. The Global Innovators Fund has an expense cap in place and the advisor is contractually obligated to cap the Fund's total expenses at least through June 30, 2018.

Performance data shown for the Global Innovators, Institutional Class (GINNX), prior to its launch date on December 31, 2015, uses performance data from the Global Innovators, Investor Class (IWIRX).

4

Dear Guinness Atkinson Funds Shareholders,

This last year can only be described as not good. 2015 wasn't a disaster but it clearly wasn't a great year for the markets or the Guinness Atkinson Funds. And while we're discussing bad news, we will acknowledge that 2016 has gotten off to a poor start. Last year, none of the Guinness Atkinson Funds produced a positive return. The Guinness Atkinson Fund with the weakest performance in 2015 was the Global Energy Fund, which produced a negative total return of 26.97%. The best performing of the Guinness Atkinson Funds was the Renminbi Yuan & Bond Fund, which provided a negative total return for the calendar year of 4.05%. Complete performance details and Morningstar ratings are in the table below. Despite this poor absolute performance there are some bright spots in the Guinness Atkinson Fund family.

The Global Innovators Fund continued to be a Morningstar Five Star Fund over all time periods (see table below for complete details). Both the Dividend Builder Fund and the Renminbi Yuan & Bond Fund finished the year as Morningstar Four Star Funds over all possible time periods (overall and three-years). The Asia Pacific Dividend Builder is rated Four Stars overall and over five-years. And the Alternative Energy Fund, despite being rated Three Stars overall and two stars over the five-year period, is rated Five Stars over the three-year period.

Morningstar Ratings* Through December 31, 2015

Fund | | Category | | Overall | | 3-year | | 5-year | | 10-year | |

Alternative Energy | | Energy Equity | | 3*** | | 5***** | | 2** | | | |

| | | | | (88 funds) | | (88 funds) | | (80 funds) | | | |

Asia Focus | | Pacific/Asia | | 1* | | 1* | | 1* | | 1* | |

| | | ex-Japan | | (79 funds) | | (79 funds) | | (58 funds) | | (20 funds) | |

Asia Pacific Dividend | | Pacific/Asia | | 4**** | | 3*** | | 4**** | | | |

Builder | | ex-Japan | | (79 funds) | | (79 funds) | | (58 funds) | | | |

China & Hong Kong | | China Region | | 2** | | 1* | | 1* | | 2* | |

| | | | | (75 funds) | | (75 funds) | | (64 funds) | | (35 funds) | |

Global Energy | | Energy Equity | | 3*** | | 3*** | | 3*** | | 3*** | |

| | | | | (88 funds) | | (88 funds) | | (80 funds) | | (50 funds) | |

Global Innovators | | World Stock | | 5***** | | 5***** | | 5***** | | 5***** | |

| | | | | (984 funds) | | (984 funds) | | (781 funds) | | (417 funds) | |

Renminbi Yuan & Bond | | Emerging | | 4**** | | 4**** | | | | | |

| | | Markets Bond | | (262 funds) | | (262 funds) | | | | | |

Dividend Builder | | World Stock | | 4**** | | 4**** | | | | | |

| | | | | (984 funds) | | (984 funds) | | | | | |

*Derived from a weighted average of the Fund's three-, five- and ten-year risk adjusted return measure, if applicable.

As we write this letter the markets are lower for the year and the purported reasons for the lower market include declining oil prices, a slowing Chinese economy, a plunging yuan, worries over the global economy and worries about rising interest rates. We find it odd that the markets would fret over lower oil prices. Obviously lower oil prices are a negative for our Global Energy Fund but a positive for the US economy as a whole. And the slowing growth in China is to be expected as the world's second largest economy matures. It is still among the world's fastest growing economies, which is to say, it is still growing. News reports often confuse the concept of a slower rate of growth – which is what China is experiencing – and negative growth, which is entirely different. Returning to the price of oil, we've seen oil hit all-time highs and generational lows in recent years. At both extremes, arguments are presented (rather convincingly) that the high or low price is the new normal. The price of oil tends to be extremely cyclical: high prices tend to cause lower prices and low prices tend to cause higher prices. In the short- term, supply and demand for oil seems to be inelastic. In the long-term, it tends to be very price elastic. (For our non-economist readers, the more elastic a good is, the more supply and demand adjust for changes in price.)

Regarding the "plunging" yuan, we find the attention paid to the Chinese currency by the financial press a bit surprising. First, the yuan has been among the strongest currencies over 2015. Yes, it has declined against the US dollar, but that decline has been rather modest. The yuan lost 5.69% versus the US dollar in 2015. Among major world currencies, only the Japanese yen (up 1.77%)

5

and Swiss franc (down 1.31%) performed better against the US dollar. The British pound was down 8.71%; the Australian dollar was down 14.39%, the Canadian dollar was down 18.54% and the Brazilian real was down 36.04%. The notion that the yuan has plunged or that China has devalued its currency is simply not supported by the facts. And as we noted above, the best performing Guinness Atkinson Fund for 2015 was the Renminbi Yuan & Bond Fund. (Currency data all sourced from Bloomberg.)

We understand that equity markets go up and down over time and we are in no position to argue with the market regarding its direction in 2015 or here early in 2016. But we feel we can argue about the purported reasons for the decline. Lower oil prices, a slowing of the rate of growth of the Chinese economy and a strong dollar relative to the yuan and other major currencies does not imply economic disaster. We believe the world and US economies are stronger than most believe. Might we be wrong? Of course. What will the markets do in calendar 2016? We are optimistic but we recognize this may be a tough year. Are we concerned? Should investors be concerned? One repeated theme in our annual letters is our belief in long-term investing. Volatile markets are no fun but we have tremendous faith that in the long run, the markets will move higher. The themes that underpin the Guinness Atkinson Funds are all long-term in nature as is our investment philosophy. That may seem antiquated in our 24/7 news cycle, short-attention span society but our belief in long-term thinking and investing is unchanged.

Our investment team has provided a detailed commentary for each of the Guinness Atkinson Funds adjacent to each Fund's financial results.

As usual, we appreciate the confidence you have placed in us and our management team and look forward to what will hopefully be a great 2016.

We encourage you to visit gafunds.com for the latest news and announcements on the Guinness Atkinson Funds.

Sincerely,

| |

| |

Timothy Guinness | | James Atkinson | |

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in foreign securities, which involves greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for emerging markets countries. Non-diversified Funds' assets may be concentrated in fewer individual holdings than diversified funds. Therefore, these Funds are more exposed to individual stock volatility than diversified funds. Investments in smaller companies involve additional risks such as limited liquidity and greater volatility. Investments in debt securities typically decrease in value when interest rates rise, which can be greater for longer-term debt securities. Investments in derivatives involve risks different from, and in certain cases, greater than the risks presented by traditional investments. Investments focused in a single geographic region may be exposed to greater risk than investments diversified among various geographies. Investments focused on the energy sector may be exposed to greater risk than an investments diversified among various sectors.

Morningstar Ratings Disclosure

Global Innovators Fund ratings shown were given for the Investor Class Share. Ratings for other share classes may differ.

For each fund with at least a three-year history, Morningstar calculates a Morningstar RatingTM based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund's monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in distribution percentages.)

©2016 Morningstar, Inc. All Rights Reserved. The information contained herein (1) is proprietary to Morningstar (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is not a guarantee of future results.

6

Expense Examples (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) redemption fees (applicable to the Asia Focus Fund, the Asia Pacific Dividend Builder Fund, the China & Hong Kong Fund, and the Renminbi Yuan & Bond Fund); and (2) ongoing costs, including advisory fees and other Fund expenses. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period shown and held for the entire period from July 1, 2015 to December 31, 2015.

Actual Expenses

For each Fund, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid during Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each Fund, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any redemption fees. Therefore, the second line for each Fund of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these redemption fees were included, your costs would have been higher.

| | | Beginning

Account

Value

(07/01/15) | | Ending

Account

Value

(12/31/15) | | Expenses Paid

During Period*

(07/01/15 to

12/31/15) | | Expense Ratios

During Period*

(07/01/15 to

12/31/15) | |

Guinness Atkinson Alternative Energy Fund Actual | | $ | 1,000.00 | | | $ | 860.80 | | | $ | 9.29 | | | | 1.98 | %† | |

Guinness Atkinson Alternative Energy Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.22 | | | $ | 10.06 | | | | 1.98 | %† | |

Guinness Atkinson Asia Focus Fund Actual | | $ | 1,000.00 | | | $ | 830.50 | | | $ | 9.14 | | | | 1.98 | % | |

Guinness Atkinson Asia Focus Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.22 | | | $ | 10.06 | | | | 1.98 | % | |

Guinness Atkinson Asia Pacific Dividend Builder Fund Actual | | $ | 1,000.00 | | | $ | 866.40 | | | $ | 9.31 | | | | 1.98 | %† | |

Guinness Atkinson Asia Pacific Dividend Builder Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.22 | | | $ | 10.06 | | | | 1.98 | %† | |

Guinness Atkinson China & Hong Kong Fund Actual | | $ | 1,000.00 | | | $ | 836.50 | | | $ | 7.36 | | | | 1.40 | % | |

Guinness Atkinson China & Hong Kong Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.19 | | | $ | 8.08 | | | | 1.40 | % | |

Guinness Atkinson Dividend Builder Fund Actual | | $ | 1,000.00 | | | $ | 963.90 | | | $ | 3.37 | | | | 0.68 | %† | |

Guinness Atkinson Dividend Builder Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.78 | | | $ | 3.47 | | | | 0.68 | %† | |

Guinness Atkinson Global Energy Fund Actual | | $ | 1,000.00 | | | $ | 757.40 | | | $ | 6.25 | | | | 1.32 | % | |

Guinness Atkinson Global Energy Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.10 | | | $ | 7.17 | | | | 1.32 | % | |

Guinness Atkinson Global Innovators Fund – Investor Class Actual | | $ | 1,000.00 | | | $ | 971.90 | | | $ | 6.61 | | | | 1.25 | % | |

Guinness Atkinson Global Innovators Fund – Investor Class Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.50 | | | $ | 6.77 | | | | 1.25 | % | |

Guinness Atkinson Renminbi Yuan & Bond Fund Actual | | $ | 1,000.00 | | | $ | 941.20 | | | $ | 4.40 | | | | 0.90 | %† | |

Guinness Atkinson Renminbi Yuan & Bond Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.67 | | | $ | 4.58 | | | | 0.90 | %† | |

*Expenses are equal to the Funds' annualized expense ratio as indicated, multiplied by the average account value over the period, multiplied by the number of days in most recent fiscal half-year period (184), then divided by the number of days in the fiscal year (365) (to reflect the one-half year period).

†Net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Fund's actual expenses would have been higher.

7

ALTERNATIVE ENERGY FUND for the period ended December 31, 2015

1. Performance

AVERAGE ANNUALIZED TOTAL RETURNS

| | | 1 Year

(actual) | | 3 Years | | 5 Years | | Since

Inception

(March 31, 2006) | |

Fund | | | -11.40 | % | | | 7.05 | % | | | -9.78 | % | | | -12.34 | % | |

Benchmark Indices: | |

Wilderhill New Energy Global Innovation Index | | | 1.56 | % | | | 15.65 | % | | | -1.94 | % | | | -2.94 | % | |

Wilderhill Clean Energy Index | | | -10.36 | % | | | 5.69 | % | | | -13.54 | % | | | -13.96 | % | |

MSCI World Index | | | -0.24 | % | | | 10.32 | % | | | 8.26 | % | | | 5.08 | % | |

The Fund's expense ratio is 2.06% and net expense ratio is 2.02% per the Summary Prospectus dated March 23, 2015. The Advisor has contractually agreed to waive a portion of its advisory fees and/or reimburse other Fund expenses so that the Fund's ratio of expenses to average daily net assets will not exceed 1.98% (excluding Acquired Fund Fees and Expenses, interest, taxes, dividends on short positions and extraordinary expenses) through at least June 30, 2016. To the extent that the Advisor waives fees, it may seek repayment of a portion or all of such amounts at any time within the three fiscal years after the fiscal year in which such amounts were waived and/or reimbursed, subject to the applicable cap.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

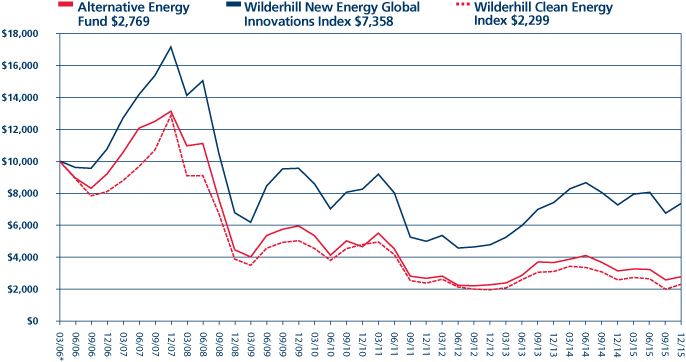

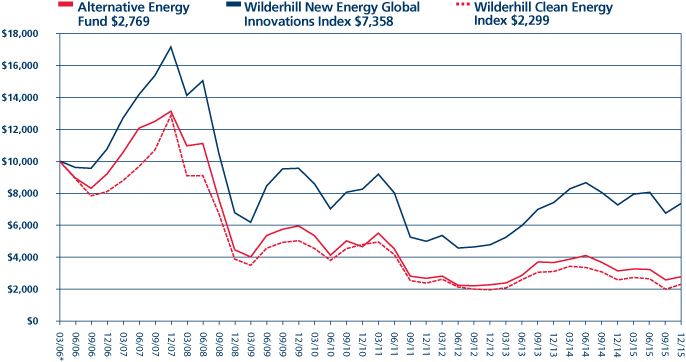

Guinness Atkinson Alternative Energy Fund was down -11.40% for 2015. This compared to a rise in the Wilderhill New Energy Global Innovation Index of 1.56% and a drop in the Wilderhill Clean Energy Index of -10.36%. The Fund suffered with the decline in the Chinese and Brazilian markets to which the Fund was more exposed than the alternative energy sector. The sector itself suffered from falling natural gas prices and deterioration in sentiment.

The main specific stock drivers of weak performance of the Fund in 2015 were two of the Fund's hydroelectric power company holdings, two of its wind holdings, and two of its solar holdings. These offset the positive performance of most of the Fund's efficiency, geothermal and solar holdings.

Stock performance of the Fund's solar holdings varied significantly. The Chinese photovoltaic module manufacturers – JA Solar, Trina Solar, Canadian Solar, Renesola and Jinkosolar – all performed well, and were up at least 10% each over 2015. Two new US solar positions, First Solar and SolarEdge, a thin-film module manufacturer and an optimiser and inverter manufacturer, respectively, performed well following the Fund's acquisition in the fourth quarter due to the extension of the US Investment Tax Credit (ITC). The Fund's microinverter holding, Enphase, a direct competitor of SolarEdge, lost significant market share but received a boost from the ITC extension. However, Enphase and SolarEdge continue to make fast progress in growing volumes and bringing costs down, so we remain confident in their future.

Unfortunately, almost all of the Fund's wind farm operator and developer holdings contributed negatively to returns, with the Chinese companies particularly affected from the uncertainty around grid constraints following the explosive growth of renewable energy in China. The poorest performer was Northern Power Systems, the Fund's only remaining wind turbine manufacturer holding, whose business has been hurt by delays in orders for its small wind turbines.

Ormat Technologies, the Fund's only current geothermal holding benefited from simplifying its ownership structure. It acquired Ormat Industries, which owned 60% of Ormat Technologies in a stock transaction that collapsed its historic holding structure, while at the same time providing better visibility on future earnings growth.

The Fund's three hydro investments performed poorly, for differing reasons. Cemig struggled with the Brazilian regulatory environment, weak hydrology, increasing debt levels and increasing interest rates. Verbund struggled with weak central European electricity pricing. Iniziative Bresciane gave back some of its gains mainly as a result of low stock liquidity.

8

Overall, this was a good year for the Fund's efficiency holdings. Wasion, the Chinese metering manufacturer, and Nibe, the global heating technology provider, both performed well, while Centrotec, the German building efficiency technology provider, underperformed.

The Fund's holding in Cosan, the Brazilian biofuels company, performed poorly as a result of the Brazilian Real, which fell 32% in 2015, and the falling oil price, although we note that only a small part of its biofuels business has direct exposure to the oil price.

Activity

The Fund sold positions in EDP Renovaveis, Acciona and Enel Green Power as they had performed well and were trading on historically high multiples. We took new positions in China Wind Power, a Chinese renewable utility, and Xinyi Solar, a manufacturer of glass for solar modules. We also increased exposure to the US solar market by taking two new positions in First Solar, a thin-film module manufacturer headquartered in the US, and SolarEdge, an inverter and optimiser manufacturer.

The position in Northern Power Systems has been frozen as a result of concerns over stock price performance. The company is a manufacturer of small wind turbines. It has been achieving strong growth but has not kept as tight control of costs as needed. The share price response reflects the illiquidity of the stock.

Outlook

The renewable energy sector had another record year for installations in 2015, peppered with good policy news from China, the United States and the UN Climate Change talks in Paris. China increased its targets for both wind and solar installations by 2020 in its 13th five-year plan (FYP) to 200 GigaWatts (GW) and 150GW, respectively.

The Obama Clean Power Plan has created a framework that should support US market growth, but we still need to see the details of individual state policy to understand its full potential. Wind and solar are likely to be prime beneficiaries, as they offer the most cost-competitive solutions today. As a year-end surprise, Congress extended the tax credits for wind and solar power to 2022.

The UN Climate talks in Paris, the 21st Conference of the Parties, gave a long-awaited affirmation from global leaders to cap the global temperature increase due to anthropogenic carbon dioxide emissions to two degrees Celsius. Although the agreement does not have an immediate impact on the renewable energy sector, the long-term impact of this agreement will likely be felt as more and more countries gradually strive to reduce the carbon footprint of their electricity sources. We are of the opinion that governments will no longer need to subsidise renewables, as these are becoming economically competitive with conventional fuels, and in the case photovoltaics (PV), take very little time to build.

The PV market grew to 57GW of annual installations, up from 45GW in 2014. We expect the following years to bring further strong growth in annual installations. The driving countries behind the growth in installations are China, the United States and Japan, while India has begun to recognise that solar offers it an attractive solution to its high energy prices and power deficit. China installed between 15 and 17GW of PV in 2015, raising its total cumulative PV capacity to 43GW. Under its 13th Five-Year Plan (FYP), the Chinese government increased its goals for PV installation to 150GW by 2020, up from 100GW, leaving 107GW to be installed in the five years including 2020. The United States gave the PV sector an early Christmas present by extending the ITC to 2022, when the market was expecting the ITC to expire by end-2016. As a result, the US is likely to install an extra 20GW of PV between 2016 and 2020. Japan remains one of the biggest PV markets, having installed approximately 13GW in 2015, although this is likely to fall over the next five years as a result of lower levels of incentives. India meanwhile increased its installations from 0.8GW in 2014 to 2.8GW in 2015. Indian Prime Minister Narendra Modi set a highly ambitious target of 100GW by 2022. We do not expect this goal to be reached, but we do expect India to increase installations to at least 5GW in 2016. India is the current home of the cheapest winning utility-scale PV bid to date. In January 2016, PV reached $64/megawatt hour (MWh) in an Indian tender for solar power.

The wind sector grew over 25% from under 50GW in 2014 to 64GW in 2015. China installed a total of 29GW in 2015, with most of its turbines being supplied by domestic manufacturers. China increased its wind target to 200GW wind by 2020 in its 13th FYP. China already has 135GW of wind at end-2015, leaving only 65GW over five years to reach the target. Wind farms in some regions of China have been plagued by curtailment due to inadequate space on the grid. Although China is working towards upgrading its grid, this may take some time to achieve. Forecasters predict that China will reach its wind target early and exceed it on the grounds of economics rather than subsidies. The United States was the second largest installer of wind turbines worldwide, with 9GW installed in 2015. Congress extended the production tax credit (PTC) for wind to 2019, and analysts expect an extra 20GW

9

to wind to be built in the US by 2020 than would have been without the tax credit. Europe remains a steady market for the wind sector, adding a further 10-12GW of onshore wind per year. Governments have had to placate nimbyism, traditional utilities and the electricity consumers who are paying for the feed-in tariffs via a levy.

In 2015, unsubsidised renewables gained traction as they were able to compete in a number of countries with fossil fuel alternatives. In Chile's October 2015 power auction that was open to all electricity generators, PV plants won with bids as low as $65/MWh. This was lower than coal, gas or wind, and reflects the new low installation costs and high levels of insulation in Chile. A wind farm in Morocco set the record for the lowest wind price at $30/MWh, compared to a local price for coal of $80/MWh.

The solar sector had a more stable year in 2015. Pricing for solar modules has declined slightly while polysilicon prices fell from over $20 per kg to around $13 per kg, which helped margins for cell and module manufacturers. There was no progress towards removing the European minimum import price (MIP) and US duties on Chinese solar modules, and the latest press releases from the EU indicate that the MIP is likely to stay in place until early 2017. Australia decided not to impose duties on Chinese solar modules. We understand that progress is being made on global trade talks to remove tariffs on sustainable technologies, but this does not appear imminent.

Alternative energy investment opportunities beyond wind and PV are judged on a case-by-case basis. Energy efficiency policy has become a key way for many European countries to reduce their overall electricity consumption. We are therefore confident that heatpumps and improved efficiency heating technologies present a good opportunity as these standards are exported from Europe.

The long term outlook for alternative energy and its related sectors remains strong. The key drivers in favour of renewable energies are: parity of renewables with traditional fuel supplies; energy security concerns; environmental issues; and climate change. We continue to position the Fund to attempt to benefit from the long term growth of the sector.

Edward Guinness Samira Rudig February 2016

The Fund invests in foreign securities, which involve political, economic and currency risks, greater volatility, and differences in accounting methods. The Fund is non-diversified meaning its assets may be concentrated in fewer individual holdings than diversified funds. Therefore, the Fund is more exposed to individual stock volatility than diversified funds. The Fund invests in smaller companies, which involve additional risks such as limited liquidity and greater volatility.

The Wilderhill New Energy Global Innovation Index (NEX) is a modified US dollar-weighted index of publicly traded companies, which are active in renewable and low-carbon energy, and which stand to benefit from responses to climate change and energy security concern. The Wilderhill Clean Energy Index (ECO) is a modified equal US dollar-weighted index of publicly traded companies whose businesses stand to benefit substantially from societal transition toward the use of cleaner energy and conservation. The MSCI World Energy Index is an unmanaged index composed of more than 1,400 stocks listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand, and the Far East. These indices are unmanaged, not available for investment and do not incur expenses.

GW - gigawatt

MWh - Megawatthour

Please refer to the Schedule of Investments for details on fund holdings. Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Guinness Atkinson Management for the period stated and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice. Opinions, fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

10

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND

Growth of $10,000

| | | Average Annual Total Return

Periods Ended December 31, 2015 | |

| | | One Year | | Five Years | | Since Inception

(03/31/06) | |

| | | | | | -11.40 | % | | | -9.78 | % | | | -12.34 | % | |

*Inception date 03/31/06.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Total returns for certain periods reflect a fee waiver in effect and in the absence of this waiver, the total returns would be lower. Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares.

The Wilderhill New Energy Global Innovations Index (NEX) is a modified US dollar-weighted index of publicly traded companies, which are active in renewable and low-carbon energy, and which stand to benefit from responses to climate change and energy security concern. The Wilderhill Clean Energy Index (ECO) is a modified equal US dollar-weighted index comprised of publicly traded companies whose businesses stand to benefit substantially from societal transition toward the use of cleaner energy and conservation.

11

FUND HIGHLIGHTS at December 31, 2015

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND

# of Holdings in Portfolio: | | 32 | |

Portfolio Turnover: | | 28.7% | |

% of Stocks in Top 10: | | 41.5% | |

Fund Manager: | | | |

Edward Guinness | | | |

Top 10 Holdings (% of net assets) | | | | Industry Breakdown (% of net assets) | | | |

Enphase Energy Inc. | | | 5.1 | % | | Solar | | | 41.9 | % | |

Solaredge Tech Inc. | | | 4.6 | % | | Wind | | | 29.4 | % | |

Good Energy Group PLC | | | 4.4 | % | | Efficiency | | | 11.1 | % | |

SunPower Corp. | | | 4.3 | % | | Hydro | | | 10.2 | % | |

Iniziative Bresciane - Inbre - SpA | | | 4.1 | % | | Biofuel | | | 3.1 | % | |

Canadian Solar Inc. | | | 3.9 | % | | Geothermal | | | 3.1 | % | |

Renesola Ltd. - ADR | | | 3.9 | % | | | | | | | |

Jinkosolar Holdings Co - ADR | | | 3.8 | % | | | | | | | |

Boralex Inc. - Class A | | | 3.8 | % | | | | | | | |

Trina Solar Ltd. - ADR | | | 3.6 | % | | | | | | | |

12

SCHEDULE OF INVESTMENTS

at December 31, 2015

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND

Shares | | COMMON STOCKS: 98.8% | | Value | |

Biofuel: 3.1% | | | |

| | 67,400 | | | Cosan SA Industria e Comercio | | $ | 426,939 | | |

Efficiency: 11.1% | | | |

| | 76,098 | | | Carmanah Technologies Corp.* | | | 312,377 | | |

| | 28,700 | | | CENTROTEC Sustainable AG | | | 412,017 | | |

| | 12,230 | | | Nibe Industrier AB - B Shares | | | 410,611 | | |

| | 360,000 | | | Wasion Group Holdings Ltd. | | | 372,483 | | |

| | | | | | | | 1,507,488 | | |

Geothermal: 3.1% | | | |

| | 11,659 | | | Ormat Technologies Inc. | | | 425,204 | | |

Hydro: 10.2% | | | |

| | 255,604 | | | Cia Energetica de Minas Gerais - ADR* | | | 383,406 | | |

| | 26,361 | | | Iniziative Bresciane - Inbre - SpA* | | | 561,211 | | |

| | 35,110 | | | Verbund AG | | | 451,013 | | |

| | | | | | | | 1,395,630 | | |

Solar: 41.9% | | | |

| | 18,400 | | | Canadian Solar Inc.* | | | 532,864 | | |

| | 628,000 | | | China Singyes Solar Technologies Holdings Ltd. | | | 448,154 | | |

| | 196,700 | | | Enphase Energy Inc.* | | | 690,417 | | |

| | 7,000 | | | First Solar Inc.* | | | 461,930 | | |

| | 46,300 | | | JA Solar Holdings Co., Ltd. - ADR* | | | 449,110 | | |

| | 18,900 | | | Jinkosolar Holdings Co - ADR* | | | 522,963 | | |

| | 311,300 | | | Renesola Ltd. - ADR* | | | 529,210 | | |

| | 22,200 | | | Solaredge Tech Inc | | | 625,374 | | |

| | 19,450 | | | SunPower Corp. - Class B* | | | 583,695 | | |

| | 44,820 | | | Trina Solar Ltd. - ADR* | | | 493,916 | | |

| | 950,000 | | | Xinyi Solar Holdings Ltd. | | | 384,898 | | |

| | | | | | | | 5,722,531 | | |

Wind: 29.4% | | | |

| | 49,987 | | | Boralex Inc. - Class A | | | 522,376 | | |

| | 3,044,000 | | | China Datang Corp. Renewable Power Co. Ltd. - H Shares | | | 380,060 | | |

| | 460,000 | | | China Longyuan Power Group Corp. - H Shares | | | 345,021 | | |

| | 2,272,000 | | | China Suntien Green Energy Corp. Ltd. - H Shares | | | 361,650 | | |

| | 6,180,000 | | | Concord New Energy Group Ltd.* | | | 368,052 | | |

| | 200,441 | | | Good Energy Group PLC | | | 605,755 | | |

| | 325,080 | | | Greentech Energy Systems* | | | 310,064 | | |

| | 1,194,000 | | | Huaneng Renewables Corp. Ltd. - H Shares | | | 354,903 | | |

| | 467,823 | | | Mytrah Energy Ltd.* | | | 310,349 | | |

| | 228,800 | | | Northern Power Systems Corp.* | | | 41,338 | | |

| | 630,608 | | | Theolia SA* | | | 404,335 | | |

| | | | | | | | 4,003,903 | | |

| | | | | Total Common Stocks

(cost $20,996,620) | | | 13,481,695 | | |

The accompanying notes are an integral part of these financial statements.

13

Shares | | WARRANTS: 0% | | Value | |

| | 946,050 | | | Theolia SA, Expiration 6/09/16, Exercise price 0.60 EUR*† | | $ | 32,900 | | |

| | | Total Warrants

(cost $0) | | | 32,900 | | |

| | | Total Investments in Securities

(cost $20,996,620): 98.8% | | | 13,514,595 | | |

| | | Other Assets less Liabilities: 1.2% | | | 129,645 | | |

| | | Net Assets: 100.0% | | $ | 13,644,240 | | |

* Non-income producing security.

† Illiquid. Illiquid securities represent 0.0% of net assets.

ADR - American Depository Receipt

The accompanying notes are an integral part of these financial statements.

14

ASIA FOCUS FUND for the period ended December 31, 2015

1. Performance

AVERAGE ANNUALIZED TOTAL RETURNS

| | | 1 Year

(actual) | | 3 Years | | 5 Years | | 10 Years | |

Fund | | | -11.56 | % | | | -6.82 | % | | | -6.18 | % | | | 3.27 | % | |

Benchmark Indices: | |

MSCI AC Far East Free Ex Japan Index | | | -9.25 | % | | | -0.79 | % | | | 0.44 | % | | | 6.49 | % | |

S&P 500 Index | | | 1.38 | % | | | 15.11 | % | | | 12.54 | % | | | 7.29 | % | |

The Fund's gross expense ratio is 1.92% per the Summary Prospectus dated March 23, 2015.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

The Fund imposes a 2% redemption fee on the sale of shares held less than 30 days. Performance data quoted does not reflect this redemption fee. Total returns for certain periods reflect fee limitations in effect and, in the absence of these limitations, total returns would have been lower.

For calendar year 2015, the Fund fell 11.56% compared to the MSCI AC Far East Free ex Japan Index, which was down 9.25%. The year was a challenging one for emerging markets although the region as a whole held up better than those whose economies are more heavily exposed to commodity prices.

The performance of China's economy and policy reform moves to the exchange rate dominated headlines in the region. The economy is expected to have grown by less than 7% in 2015 and the concentration of weakness is to be found in the heavy industrial and construction-related sectors as China seeks to lower its reliance on investment-led growth. Weaker global demand for Asian manufactured goods has also been evident in China's export numbers, which now show around 6% year-on-year growth.

Slower fixed asset investment in China has been felt domestically by those who have high debt levels to manage and externally by commodity producers. We should emphasize, however, that there has been no collapse in Chinese demand for commodities – oil demand grew by 11% in 2015, while iron ore imports into China have declined by less than 1%. While there are those who see the fall in prices as symptomatic of weak global demand, we note that it coincides with the advent of considerable new supply. Weaker exports growth from China has also been felt by regional trading partners, notably South Korea and Taiwan, and to a lesser extent, Thailand.

Currency volatility has also been a much greater factor than in prior years. The US dollar has appreciated sharply over the past twelve months against almost all currencies, which has had knock-on effects throughout the world. Countries weakened by lower commodity prices have seen their currencies fall, while those in Asia have responded to a weaker Japaneseyen and in 2015, a weaker Chinese yuan. The weaker yen is understood and accepted, since a recovery in Japan's moribund economy is seen as beneficial. By contrast, a weaker yuan is seen as fundamentally destabilizing.

In spite of Chinese worries this year, the best stock performers in the portfolio were Netease (China Internet and gaming), China Lesso (building materials), Shenzhen Expressway (China toll roads), Tencent (China Internet services) and AAC Technology (a Chinese component supplier for high end smartphones). We also saw positive contributions for Taiwanese technology hardware names, including Catcher Technology and Taiwan Semiconductor Manufacturing, as well as from Chinese financials, including PICC Property & Casualty and China Merchants Bank. The weakest stocks over the year were concentrated amongst energy names in China, Indonesia and Thailand, including Petrochina, PTT Exploration & Production and Indonesian coal producer Indo Tambangraya Megah.

2. Portfolio Position

The country allocation remained unchanged in the first half, with overweight positions in China and Hong Kong and in Thailand. The key underweight positions were Korea, Malaysia and Singapore. On a sector basis, the Fund is overweight information technology, with exposure across China, Hong Kong, Korea and Taiwan. Looking at technology sub-sectors, the exposure is split

15

between internet services, electronic equipment, technology hardware and semiconductors. During the year, there were some stock changes in the China portion of the portfolio, with the additions of NetEase, Peoples Insurance and PICC Property and Casualty in place of HSBC, SOHO China and Weichai Power.

3. Outlook

Our view remains that the Asia region offers investors a good long-term opportunity. The long-term story is one of a rising standard of living on the back of rising real wages and increasing domestic consumption. China's economy is still expected to grow 6.5% in 2016, while the rest of the region is forecast (using International Monetary Fund (IMF) data) to grow 4.1%, compared to world growth of 2.9%. Stock market valuations in Asia, in our opinion, look cheap.

There is still considerable scope for China to adjust policy in line with economic needs. Foreign exchange reserves are still substantial at $3.3 trillion, while an expected record trade surplus is likely to give an extra buffer against capital outflows, which are likely to continue. Banking sector liquidity can be augmented by the release of deposits commercial banks have been required to place with the central bank, so-called Required Reserves. These rose from 6% of China's commercial banks' deposit base in 2003 to more than 20% in response to capital inflows by the beginning of 2015.

The key to Chinese economic stability today lies in the real estate sector and so far, property sales and prices have been solid. Longer term issues are whether China can continue its transition, cut excess production capacity at a time when debt levels are still high and not fall back into renewed credit expansion. In this respect, Premier Li Keqiang has publicly ruled out the use of strong stimulus and a flood of liquidity to propel growth. He is instead pushing for new business models and economic drivers (economic transition) and for concrete steps to reduce overcapacity.

We view the recent rise in US interest rates as being a positive development. However, the outlook is by no means clear. The first move was a tentative step and the Fed minutes suggest the decision was a closer call than initially thought. The Federal Reserve has pencilled in four interest rate rises. If they pursue this regardless of external conditions, the associated monetary tightening and liquidity withdrawal could spark a mid-recovery downturn. Further rises will likely depend of rising core PCE (Personal Consumption Expenditure) inflation. That has been weak in recent years as consumers focused on paying down debt but this process may be coming to an end. Higher consumption would be a positive and welcome development for Asia.

Edmund Harriss February 2016

The Fund invests in foreign securities, which involves political, economic and currency risks, greater volatility, and differences in accounting methods. These risks are greater for emerging markets. The Fund is non-diversified, meaning that its assets may be concentrated in fewer individual holdings than diversified funds. Therefore, the Fund is more exposed to individual stock volatility than diversified funds. Investments focused in a single geographic region may be exposed to greater risk and more volatility than investments diversified among various geographies. The Fund invests in smaller companies, which involves additional risks such as limited liquidity and greater volatility.

The MSCI AC (All Country) Far East ex Japan Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market performance of the Far East, excluding Japan. The Standard & Poor's 500 Index is a market capitalization-weighted index composed of 500 widely held common stocks of U.S. companies. These indices are unmanaged, not available for investment and do not incur expenses.

Please refer to the Schedule of Investments for details on Fund holdings. Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Guinness Atkinson Asset Management, Inc. for the period stated and is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Opinions, Fund holdings and sector allocations are subject to change at any time, and are not recommendations to buy or sell any security.

16

GUINNESS ATKINSON ASIA FOCUS FUND

Growth of $10,000

| | | Average Annual Total Return

Periods Ended December 31, 2015 | |

| | | One Year | | Five Years | | Ten Years | |

| | | | | | -11.56 | % | | | -6.18 | % | | | 3.27 | % | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Total returns for certain periods reflect a fee waiver in effect and in the absence of this waiver, the total returns would be lower. Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares. The Fund imposes a 2% redemption fee on shares held less than 30 days.

The MSCI All Country Far East Free ex-Japan Index (MSCI AC Far East Free ex-Japan Index) is a free float-adjusted, capitalization-weighted index that is designed to measure equity market performance of the Far East region excluding Japan. The index referenced in this chart is not available for investment and does not incur expenses.

17

FUND HIGHLIGHTS at December 31, 2015

GUINNESS ATKINSON ASIA FOCUS FUND

# of Holdings in Portfolio: | | 36 | |

Portfolio Turnover: | | 8.6% | |

% of Stocks in Top 10: | | 41.5% | |

Fund Manager: | | | |

Edmund Harriss | | | |

Top 10 Holdings (% of net assets) | | | | | | | |

NetEase Inc. - ADR | | | 5.6 | % | | Shenzhen Expressway Co., Ltd. - H Shares | | | 4.0 | % | |

Samsung Electronics Co., Ltd. | | | 4.6 | % | | AAC Technologies Holdings Inc. | | | 4.0 | % | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | | 4.4 | % | | Hyundai Mobis Co., Ltd. | | | 3.8 | % | |

Tencent Holdings Ltd. | | | 4.1 | % | | Sohu.com Inc. | | | 3.7 | % | |

Largan Precision Co., Ltd. | | | 4.0 | % | | Catcher Technology Co., Ltd. | | | 3.3 | % | |

Industry Breakdown (% of net assets) | | | | | | | |

Commerical Banks | | | 9.3 | % | | Casino Hotels | | | 4.0 | % | |

Semiconductor Componets - Integrated Circuits | | | 7.2 | % | | Auto/Truck Parts & Equipment | | | 3.8 | % | |

Property/Casualty Insurance | | | 6.0 | % | | Web Portals/ISP | | | 3.6 | % | |

Electric - Generation | | | 5.6 | % | | Metal Processors & Fabricators | | | 3.3 | % | |

Entertainment Software | | | 5.6 | % | | Computers | | | 3.2 | % | |

Electronic Components - Semiconductor | | | 4.6 | % | | Building Products - Cement/Aggregates | | | 3.0 | % | |

Oil Components - Integrated | | | 4.5 | % | | Exchange Traded Funds (ETFs) | | | 2.9 | % | |

Internet Application Software | | | 4.1 | % | | Building & Construction Production - Miscellaneous | | | 2.7 | % | |

Auto-Cars/Light Trucks | | | 4.1 | % | | Real Estate Operations/Development | | | 2.4 | % | |

Photo Equipment & Supplies | | | 4.0 | % | | Telecommunication Services | | | 2.2 | % | |

Public Thoroughfares | | | 4.0 | % | | Distribution/Wholesale | | | 1.8 | % | |

Electronic Components - Miscellaneous | | | 4.0 | % | | Machinery - General Industry | | | 0.6 | % | |

Oil Company - Exploration & Production | | | 4.0 | % | | Coal | | | 0.3 | % | |

18

SCHEDULE OF INVESTMENTS

at December 31, 2015

GUINNESS ATKINSON ASIA FOCUS FUND

Shares | | COMMON STOCKS: 100.7% | | Value | |

China: 55.7% | | | |

| | 94,000 | | | AAC Technologies Holdings Inc. | | $ | 611,124 | | |

| | 171,000 | | | Anhui Conch Cement Co., Ltd. - H Shares | | | 455,353 | | |

| | 739,000 | | | China Construction Bank Corp. - H Shares | | | 501,688 | | |

| | 603,000 | | | China Lesso Group Holdings Ltd. | | | 418,000 | | |

| | 218,000 | | | China Merchants Bank Co., Ltd. - H Shares | | | 509,887 | | |

| | 419,000 | | | CNOOC Ltd. | | | 430,675 | | |

| | 412,000 | | | China Minsheng Banking Corp Ltd. - H Shares | | | 406,782 | | |

| | 461,500 | | | db x-trackers CSI300 Index ETF | | | 450,886 | | |

| | 278,000 | | | Dongfeng Motor Group Co., Ltd. - H Shares | | | 368,141 | | |

| | 490,000 | | | Lenovo Group Ltd. | | | 493,764 | | |

| | 4,700 | | | NetEase Inc. - ADR | | | 851,828 | | |

| | 962,000 | | | People's Insurance Company Group of China Ltd. - H Shares | | | 467,286 | | |

| | 471,000 | | | PetroChina Co Ltd. - H Shares | | | 309,802 | | |

| | 232,000 | | | PICC Property & Casualty Co., Ltd. - H Shares | | | 456,699 | | |

| | 696,000 | | | Shenzhen Expressway Co Ltd. - H Shares | | | 611,608 | | |

| | 9,800 | | | Sohu.com Inc.* | | | 560,462 | | |

| | 32,500 | | | Tencent Holdings Ltd. | | | 634,012 | | |

| | | | | | | | 8,537,997 | | |

Hong Kong: 6.3% | | | |

| | 380,000 | | | Chen Hsong Holdings | | | 89,238 | | |

| | 86,000 | | | Galaxy Entertainment Group Ltd. | | | 268,143 | | |

| | 407,000 | | | Li & Fung Ltd. | | | 274,650 | | |

| | 532,000 | | | NagaCorp Ltd. | | | 335,295 | | |

| | | | | | | | 967,326 | | |

Indonesia: 0.3% | | | |

| | 129,000 | | | Indo Tambangraya Megah PT | | | 53,224 | | |

Malaysia: 3.9% | | | |

| | 264,000 | | | DiGi.Com Bhd | | | 330,956 | | |

| | 144,000 | | | UMW Holdings Bhd | | | 262,797 | | |

| | | | | | | | 593,753 | | |

South Korea: 8.3% | | | |

| | 2,752 | | | Hyundai Mobis Co., Ltd. | | | 574,344 | | |

| | 656 | | | Samsung Electronics Co., Ltd. | | | 700,498 | | |

| | | | | | | | 1,274,842 | | |

Taiwan: 14.5% | | | |

| | 61,000 | | | Catcher Technology Co., Ltd. | | | 510,737 | | |

| | 9,000 | | | Largan Precision Co., Ltd. | | | 614,922 | | |

| | 110,000 | | | Novatek Microelectronics Corp. | | | 427,253 | | |

| | 2 | | | Shin Zu Shing Co., Ltd. | | | 8 | | |

| | 155,000 | | | Taiwan Semiconductor Manufacturing Co., Ltd. | | | 668,837 | | |

| | | | | | | | 2,221,757 | | |

The accompanying notes are an integral part of these financial statements.

19

Shares | | COMMON STOCKS: 100.7% (Continued) | | Value | |

Thailand: 11.7% | | | |

| | 99,500 | | | Electricity Generating PCL/Foreign | | $ | 416,972 | | |

| | 216,000 | | | Glow Energy PCL/Foreign | | | 444,185 | | |

| | 824,000 | | | LPN Development PCL/Foreign | | | 365,076 | | |

| | 113,198 | | | PTT Exploration & Production PCL/Foreign | | | 180,091 | | |

| | 56,700 | | | PTT PCL/Foreign | | | 384,460 | | |

| | | | | | | | 1,790,784 | | |

| | | | | Total Common Stocks

(cost $14,165,085) | | | 15,439,683 | | |

| | | | | Total Investments in Securities

(cost $14,165,085): 100.7% | | | 15,439,683 | | |

| | | | | Liabilities in Excess of Other Assets: (0.7%) | | | (103,795 | ) | |

| | | | | Net Assets: 100.0% | | $ | 15,335,888 | | |

* Non-income producing security.

ADR - American Depository Receipt

The accompanying notes are an integral part of these financial statements.

20

ASIA PACIFIC DIVIDEND BUILDER FUND for the period ended December 31, 2015

1. Performance

AVERAGE ANNUALIZED TOTAL RETURNS

| | | 1 Year

(actual) | | 3 Years | | 5 Years | | Since

Inception

(March 31, 2006) | |

Fund | | | -4.61 | % | | | 0.64 | % | | | 1.57 | % | | | 4.14 | % | |

Benchmark Indices: | |

MSCI AC Pacific Ex Japan Index | | | -8.80 | % | | | -0.59 | % | | | 0.56 | % | | | 6.04 | % | |

S&P 500 Index | | | 1.38 | % | | | 15.11 | % | | | 12.54 | % | | | 7.04 | % | |

The Fund's gross expense ratio is 3.91% and net expense ratio is 1.10% per the Summary Prospectus dated March 23, 2015, as supplemented on December 31, 2015. Prior to January 1, 2016, the Advisor has contractually agreed to waive a portion of its advisory fees and/or reimburse other Fund expenses so that the Fund's ratio of expenses to average daily net assets will not exceed 1.98% (excluding Acquired Fund Fees and Expenses, interest, taxes, dividends on short positions and extraordinary expenses) through at least June 30, 2016. To the extent that the Advisor waives fees and/or reimburses expenses, it may seek repayment of a portion or all of such amounts at any time within the three fiscal years after the fiscal year in which such amounts were waived and/or reimbursed, subject to the applicable cap.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

The Fund imposes a 2% redemption fee on the sale of shares held less than 30 days. Performance data quoted does not reflect this redemption fee. Total returns for certain periods reflect expense limitations in effect and, in the absence of these imitations, total returns would have been lower.

In 2015, Asian markets, as measured by the MSCI AC Pacific ex Japan Index, fell 8.80%. The Fund did 4.19% better than the than the index but this still meant a decline of 4.61% for the year.

In 2015 as a whole, leading stocks were Relo Holdings, Henderson Group, St Shine Optical, Pacific Textiles, AAC Technologies, KT&G, and China Lilang. All of these rose by more than 20% over the course of the year (total return in USD) and all are in different sectors including real estate, textile, technology, health care, apparel, and retail. There is also a good geographic spread with these companies based in Australia, China, Hong Kong, Korea, Japan and Taiwan. The weakest stocks were Luk Fook (jewellery retail in Hong Kong), Belle (shoe retailing in China), LPN Development (real estate in Thailand), Qualcomm (technology, US/China), PTT (energy, Thailand) and Digi.com (mobile telecom services, Malaysia), each of which fell by 25% or more.

Across the portfolio, twenty of the thirty-six holdings outperformed the market over the whole year.

Investors have had to contend with significant geopolitical and economic uncertainty in 2015; the two are inextricably linked and there is no obvious path to a solution. Lower commodity prices have been a boon to western consumers and have also come as a relief to manufacturing economies in emerging markets. But to the producers, falling prices have revealed structural weaknesses and substantially increased economic and political instability. The diverging economic fortunes of the US and the eurozone have probably the greatest ramifications because world demand growth cannot be driven by the US alone. And running alongside all of this, although overblown, is China's economic transition and deceleration.

From an Asian perspective, in 2015 we have been relieved by the fall in the price of oil and of other commodity prices. For China, it has saved over $100 billion in the import bill just from the lower prices of oil and iron ore. China's oil product demand grew over the first ten months of 2015 by 6.7% in year-on-year terms according to International Energy Agency data (IEA data). In Indonesia, Malaysia and Thailand, the lower oil price has enabled governments to abolish fuel subsidies that proved such a drain on government coffers. For export manufacturers, it has brought down the cost of raw materials and allowed wages to rise (good for consumption) without significantly damaging margins. The fall in oil prices is not a sign of weakening demand, in our view, but a problem of oversupply from the expansion of US shale production.

21

ASIA PACIFIC DIVIDEND BUILDER FUND

Stronger economic growth in the US has provided an ongoing source of demand for Asian manufactured goods in contrast to Europe but US demand is not what it was. From 2000 up to the time of the financial crisis, Chinese exports to the US grew 20% to 30% a year while export growth in Europe was even higher. This year, exports have grown about 6%. Indications are that American consumers have focused more in recent years on paying down debt than on increasing consumption. However, US strength has also brought about a sharp appreciation in the US dollar, which on a trade weighted basis is now the strongest since 2003. In Asia, the Chinese yuan fell 4% while the rest of the region's currencies (excluding Japan) were down 8.8% on a weighted average basis against the US dollar.

All of the Fund's exposure to China is through companies listed on the Hong Kong Stock Exchange, not the Chinese domestic companies that issue 'A' shares, which have been the subject of intervention by the authorities. Hong Kong Stock Exchange companies report their accounts in accordance with International Accounting Standards or the proximate standards. We look for companies whose equity value depends on the stability and strength of future operating cash flows as well as the dividends they will pay us. Analysis of companies in emerging markets has its challenges but by looking at those with long track records and operating in competitive sectors, we can increase our confidence in their ability to cope with future uncertainty. We look at companies that have earned a return on invested capital above their cost of capital for eight consecutive years: that is long enough we believe, to suggest company has a solid business.

2. Activity

There were three stock changes in 2015. At the start of the third quarter the management of Huabao International decided, after seven years, to omit its final dividend. The company justified this by highlighting the special dividend paid on top of its ordinary dividend at the interim stage and uncertain industry conditions ahead. We sold the position and purchased Aflac Inc, a US-listed health insurer that generates much of its business in Japan. The second stock change was triggered by the acquisition of iiNet, an Internet service provider in Australia, by TPG Telecom. We purchased Largan Precision, a manufacturer of high-end camera lenses, in its place. The third change was the sale of Shenzhou International (apparel) on valuation grounds. In its place we put in Belle International, a designer and retailer of footwear in China.

3. Portfolio Position

The Fund's largest country exposures were to China (30.19%), Taiwan (19.53%) and Hong Kong (13.90%). Our large weightings in these countries are an outcome of our stock selection process, rather than a 'top-down' allocation. We believe many companies in these markets are undervalued and represent attractive investment opportunities. Conversely, we have little or no allocations to other countries, for example, Indonesia or the Philippines, because the companies that meet our screening criteria in these countries have valuations that are not, at present, sufficiently attractive.

The Fund's largest sector exposures were to Financials (33.60%), Information Technology (25.11%) and Consumer Discretionary (19.42%). Again, our allocation to Financials is due to our belief that there is sufficient undervaluation present in the sector. We note that some sectors, for example, Materials, Energy and Utilities have historically had low representation in our universe – Materials and Energy are highly cyclical industries, while utility companies are often heavily regulated, and achieve lower returns.

4. Outlook

Our view remains that the Asia region offers investors a good long term opportunity. The long term story is one of a rising standard of living on the back of rising real wages and increasing domestic consumption. China's economy is still expected to grow 6.5% in 2016 while the rest of the region is forecast (using IMF data) to grow 4.1% compared to world growth of 2.9%. Stock market valuations in Asia, as we have said, look cheap.

There is still considerable scope for China to adjust policy in line with economic needs. Foreign exchange reserves are still substantial at $3.3 trillion, while an expected record trade surplus is likely to give an extra buffer against capital outflows, which are likely to continue. Banking sector liquidity can be augmented by the release of deposits commercial banks have been required to place with the central bank, so-called Required Reserves. These rose from 6% of China's commercial banks' deposit base in 2003 to more than 20% in response to capital inflows by the beginning of 2015.

The key to Chinese economic stability today lies in the real estate sector and so far, property sales and prices have been solid. Longer term issues are whether China can continue its transition, cut excess production capacity at a time when debt levels are still high and not fall back into renewed credit expansion. In this respect, Premier Li Keqiang has publicly ruled out the use of

22

ASIA PACIFIC DIVIDEND BUILDER FUND

strong stimulus and a flood of liquidity to propel growth. He is instead pushing for new business models and economic drivers (economic transition) and for concrete steps to reduce overcapacity.

We view the recent rise in US interest rates as being a positive development. However, the outlook is by no means clear. The first move was a tentative step and the Fed minutes suggest the decision was a closer call than initially thought. The Federal Reserve has pencilled in four interest rate rises. If they pursue this regardless of external conditions, the associated monetary tightening and liquidity withdrawal could spark a mid-recovery downturn. Further rises will likely depend of rising core PCE (Personal Consumption Expenditure) inflation. That has been weak in recent years as consumers focused on paying down debt, but this process may be coming to an end. Higher consumption would be a positive and welcome development for Asia.

Edmund Harriss February 2016

The Fund invests in foreign securities, which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for emerging markets. The Fund is non-diversified, meaning its assets may be concentrated in fewer individual holdings than diversified funds. Therefore, the Fund is more exposed to individual stock volatility than diversified funds. The Fund invests in smaller companies, which involves additional risks such as limited liquidity and greater volatility.

The Standard & Poor's 500 Index is a market capitalization-weighted index composed of 500 widely held common stocks of U.S. companies. The MSCI AC Pacific Ex-Japan Index is a market capitalization weighted index that monitors the performance of stocks from the Pacific region, excluding Japan. These indices are unmanaged and not available for investment, and do not incur expenses.

Please refer to the Schedule of Investments for details on Fund holdings. Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Guinness Atkinson Asset Management, Inc. for the period stated and is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Opinions, Fund holdings and sector allocations are subject to change at any time, and are not recommendations to buy or sell any security.

23

GUINNESS ATKINSON ASIA PACIFIC DIVIDEND BUILDER FUND

Growth of $10,000

| | | Average Annual Total Return

Periods Ended December 31, 2015 | |

| | | One Year | | Five Years | | Since Inception

(03/31/06) | |

| | | | | | -4.61 | % | | | 1.57 | % | | | 4.14 | % | |

*Inception date 03/31/06.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Total returns reflect a fee waiver in effect and in the absence of this waiver, the total returns would be lower. Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares. The Fund imposes a 2% redemption fee on shares held less than 30 days.

The MSCI All Country Pacific Free ex-Japan Index (MSCI AC Pacific ex-Japan Index) is a free float-adjusted, capitalization-weighted index that is designed to measure equity market performance in the Pacific region excluding Japan.

24

FUND HIGHLIGHTS at December 31, 2015

GUINNESS ATKINSON ASIA PACIFIC DIVIDEND BUILDER FUND

# of Holdings in Portfolio: | | 38 | |

Portfolio Turnover: | | 28.6% | |

% of Stocks in Top 10: | | 30.0% | |

Fund Manager: | | | |

Edmund Harriss | | | |

Top 10 Holdings (% of net assets) | | | | | | | |

Relo Holdings Inc. | | | 3.3 | % | | Yangzijiang Shipbuilding Holdings Ltd. | | | 2.9 | % | |

Largan Precision Co., Ltd. | | | 3.2 | % | | Novatek Microelectronics Corp. | | | 2.9 | % | |

Li & Fung Ltd. | | | 3.0 | % | | Delta Electronics Thailand PCL /Foreign | | | 2.9 | % | |

JB Hi-Fi Ltd. | | | 3.0 | % | | Ascendas Real Estate Investment Trust | | | 2.9 | % | |

Henderson Group PLC | | | 3.0 | % | | DiGi.Com Bhd | | | 2.9 | % | |

Industry Breakdown (% of net assets) | | | | | | | |

Commercial Banks | | | 13.8 | % | | Oil Company - Exploration & Production | | | 2.8 | % | |

Semiconductor Components - Integrated Circuits | | | 8.4 | % | | Casino Hotels | | | 2.8 | % | |

Electronic Component - Miscellaneous | | | 8.4 | % | | Textile - Products | | | 2.8 | % | |

REITS - Shopping Centers | | | 5.6 | % | | MRI/Medical Diagnostics Imaging | | | 2.8 | % | |

Retail-Apparel/Shoe | | | 5.3 | % | | Tobacco | | | 2.8 | % | |

Real Estate Management/Service | | | 3.3 | % | | Optical Supplies | | | 2.8 | % | |

Photo Equipment & Supplies | | | 3.2 | % | | Oil Company - Integrated | | | 2.7 | % | |

Distribution/Wholesale | | | 3.0 | % | | Computers | | | 2.7 | % | |

Retail - Consumer Electronics | | | 3.0 | % | | Real Estate Operations/Development | | | 2.7 | % | |

Investment Management/Advisor Service | | | 2.9 | % | | Retail - Jewelry | | | 2.7 | % | |

Shipbuilding | | | 2.9 | % | | Cellular Telecommunications | | | 2.7 | % | |

REITS - Diversified | | | 2.9 | % | | Metal Processors & Fabricators | | | 2.7 | % | |

Telecommunication Services | | | 2.8 | % | | Life/Health Insurance | | | 2.6 | % | |

25

SCHEDULE OF INVESTMENTS

at December 31, 2015

GUINNESS ATKINSON ASIA PACIFIC DIVIDEND BUILDER FUND

Shares | | COMMON STOCKS: 101.1% | | Value | |

Australia: 8.7% | | | |

| | 46,950 | | | Henderson Group PLC | | $ | 213,850 | | |

| | 15,210 | | | JB Hi-Fi Ltd. | | | 215,047 | | |

| | 15,550 | | | Sonic Healthcare Ltd. | | | 201,487 | | |

| | | | | | | | 630,384 | | |

China: 27.7% | | | |

| | 31,000 | | | AAC Technologies Holdings Inc. | | | 201,541 | | |

| | 267,000 | | | Belle International Holdings Ltd | | | 198,048 | | |

| | 294,000 | | | China Construction Bank Corp. - H Shares | | | 199,589 | | |

| | 258,000 | | | China Lilang Ltd. | | | 189,648 | | |

| | 85,000 | | | China Merchants Bank Co., Ltd. - H Shares | | | 198,809 | | |

| | 205,900 | | | China Minsheng Banking Corp. Ltd. - H Shares | | | 203,292 | | |

| | 17,500 | | | China Mobile Ltd. | | | 196,130 | | |

| | 134,000 | | | CNOOC Ltd. | | | 137,734 | | |

| | 650 | | | CNOOC Ltd. - ADR | | | 67,847 | | |

| | 334,000 | | | Industrial & Commercial Bank of China Ltd. - H Shares | | | 200,047 | | |

| | 276,100 | | | Yangzijiang Shipbuilding Holdings Ltd. | | | 213,180 | | |

| | | | | | | | 2,005,865 | | |

Hong Kong: 16.8% | | | |

| | 65,500 | | | BOC Hong Kong Holdings Ltd. | | | 198,745 | | |

| | 322,000 | | | Li & Fung Ltd. | | | 217,290 | | |

| | 34,000 | | | Link REIT/The | | | 202,838 | | |

| | 93,000 | | | Luk Fook Holdings International Ltd. | | | 196,645 | | |

| | 322,000 | | | NagaCorp Ltd. | | | 202,941 | | |

| | 131,000 | | | Pacific Textiles Holdings Ltd. | | | 201,837 | | |

| | | | | | | | 1,220,296 | | |

Japan: 3.3% | | | |

| | 2,000 | | | Relo Holdings Inc. | | | 239,960 | | |

Malaysia: 2.8% | | | |

| | 164,900 | | | DiGi.Com Bhd | | | 206,722 | | |

Singapore: 5.6% | | | |

| | 129,500 | | | Ascendas Real Estate Investment Trust - REIT | | | 207,401 | | |

| | 148,900 | | | CapitaMall Trust - REIT | | | 201,785 | | |

| | | | | | | | 409,186 | | |

South Korea: 2.8% | | | |

| | 2,260 | | | KT&G Corp. | | | 200,562 | | |

The accompanying notes are an integral part of these financial statements.

26

Shares | | COMMON STOCKS: 101.1% (Continued) | | Value | |

Taiwan: 19.7% | | | |

| | 24,000 | | | Asustek Computer Inc. | | $ | 198,006 | | |

| | 23,000 | | | Catcher Technology Co., Ltd. | | | 192,573 | | |

| | 80,134 | | | Hon Hai Precision Industry Co., Ltd. | | | 195,993 | | |

| | 3,400 | | | Largan Precision Co., Ltd. | | | 232,304 | | |

| | 54,000 | | | Novatek Microelectronics Corp. | | | 209,742 | | |

| | 10,000 | | | St Shine Optical Co., Ltd. | | | 199,760 | | |

| | 46,000 | | | Taiwan Semiconductor Manufacturing Co., Ltd. | | | 198,494 | | |

| | | | | | | | 1,426,872 | | |

Thailand: 8.3% | | | |

| | 99,100 | | | Delta Electronics Thailand PCL/Foreign | | | 208,368 | | |

| | 445,200 | | | LPN Development PCL/Foreign | | | 197,247 | | |

| | 29,300 | | | PTT PCL/Foreign | | | 198,672 | | |

| | | | | | | | 604,287 | | |

United States: 5.4% | | | |

| | 3,200 | | | Aflac Inc. | | | 191,680 | | |

| | 4,000 | | | QUALCOMM Inc. | | | 199,940 | | |

| | | | | | | | 391,620 | | |

| | | | | Total Common Stocks

(cost $7,636,000) | | | 7,335,754 | | |

| | | RIGHTS: 0.0% | | | |

| | 4,856 | | | Ascendas Real Estate Investment Trust, Rights, Strike Price 2.218 SGD (expiring 01/13/16)*^ | | | 181 | | |

| | | | | Total Rights

(cost $0) | | | 181 | | |

| | | | | Total Investments in Securities

(cost $7,636,000): 101.1% | | | 7,335,935 | | |

| | | | | Liabilities in Excess of Other Assets: (1.1%) | | | (82,390 | ) | |

| | | | | Net Assets: 100.0% | | $ | 7,253,545 | | |

* Non-income producing security.

ADR - American Depository Receipt

REIT - Real Estate Investment Trust

^ Fair value under direction of the Board of Trustees. Fair valued securities represent 0.0% of net assets.

The accompanying notes are an integral part of these financial statements.

27

CHINA & HONG KONG FUND for the period ended December 31, 2015

1. Performance

AVERAGE ANNUALIZED TOTAL RETURNS

| | | 1 Year

(actual) | | 3 Years | | 5 Years | | 10 Years | |

Fund | | | -7.58 | % | | | -1.20 | % | | | -4.37 | % | | | 6.44 | % | |

Benchmark Indices: | |

Hang Seng Composite Index | | | -4.12 | % | | | 2.57 | % | | | 1.99 | % | | | 7.86 | % | |

S&P 500 Index | | | 1.38 | % | | | 15.11 | % | | | 12.54 | % | | | 7.29 | % | |

The Fund's gross expense ratio is 1.53% per the Summary Prospectus dated March 23, 2015.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

The Fund imposes a 2% redemption fee on the sale of shares held less than 30 days. Performance data quoted does not reflect this redemption fee. Total returns for certain periods reflect fee limitations in effect and, in the absence of these limitations, total returns would have been lower.

For calendar year 2015, the Fund fell 7.58% compared to the Hang Seng Composite Index which was down 4.12%.

Stronger performance by Chinese stocks in the first half was followed by significant weakness in the second half of the year. The strength in the early part of the year followed by a resumption of policy easing by the Chinese central bank as the underlying economy slowed due to overly tight fiscal and monetary conditions at the end of 2014 and in early 2015. Chinese stocks rallied in response to liquidity injections and increased fiscal spending, but then market sentiment turned sharply negative.