UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08360 |

|

GUINNESS ATKINSON FUNDS |

(Exact name of registrant as specified in charter) |

|

21550 Oxnard Street, Suite 850 Woodland Hills, CA | | 91367 |

(Address of principal executive offices) | | (Zip code) |

|

James J. Atkinson, Jr. 21550 Oxnard Street, Suite 850 Woodland Hills, CA 91367 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800-915-6566) | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2017 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

2

Guinness AtkinsonTM Funds

Annual Report

December 31, 2017

TABLE OF CONTENTS

| | 5 | | | Letter to Shareholders | |

| | 8 | | | Expense Examples | |

| | 9 | | | Alternative Energy Fund | |

| | 17 | | | Asia Focus Fund | |

| | 24 | | | Asia Pacific Dividend Builder Fund | |

| | 31 | | | China & Hong Kong Fund | |

| | 37 | | | Dividend Builder Fund | |

| | 47 | | | Global Energy Fund | |

| | 57 | | | Global Innovators Fund | |

| | 68 | | | Renminbi Yuan & Bond Fund | |

| | 74 | | | Statements of Assets and Liabilities | |

| | 76 | | | Statements of Operations | |

| | 78 | | | Statements of Changes in Net Assets | |

| | 83 | | | Financial Highlights | |

| | 92 | | | Notes to Financial Statements | |

| | 104 | | | Report of Independent Registered Public Accounting Firm | |

| | 107 | | | Trustee and Officer Information | |

| | 110 | | | Privacy Notice | |

| | 111 | | | Guinness Atkinson Funds Information | |

3

The table below provides total return data for each of the Funds over the one, three, five, ten-years and since inception periods through December 31, 2017. Also included in the table is the expense ratio data from the most recent prospectus dated May 1, 2017.

Fund (inception date) | | 1-year | | 3-year | | 5-year | | 10-year | | Since Inception | | Expense Ratio | |

Alternative Energy Fund (March 31, 2006) | | | 20.68 | % | | | -3.97 | % | | | 4.16 | % | | | -14.39 | % | | | -10.35 | % | | | 2.60 | % gross; 1.99% net† | |

Asia Focus Fund (April 29, 1996) | | | 47.10 | % | | | 12.42 | % | | | 5.35 | % | | | 1.09 | % | | | 3.86 | % | | | 2.24 | % gross; 1.98% net† | |

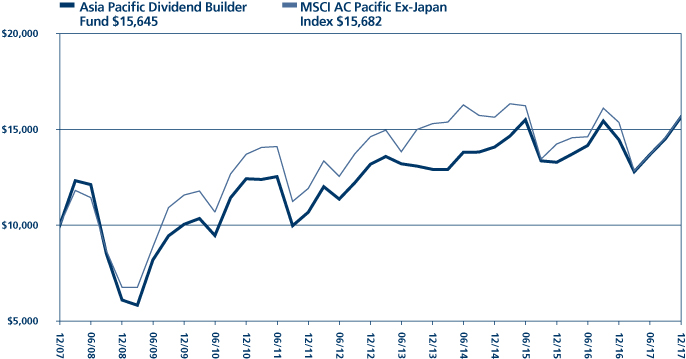

Asia Pacific Dividend Builder Fund

(March 31, 2006) | | | 36.70 | % | | | 12.37 | % | | | 8.66 | % | | | 4.69 | % | | | 6.98 | % | | | 3.14 | % gross; 1.11% net† | |

China & Hong Kong Fund (June 30, 1994) | | | 48.85 | % | | | 12.30 | % | | | 8.13 | % | | | 2.18 | % | | | 7.83 | % | | | 1.67 | %† | |

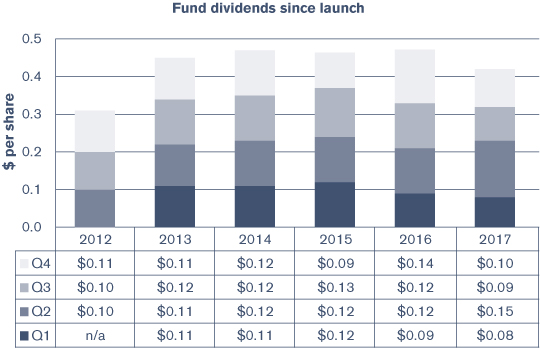

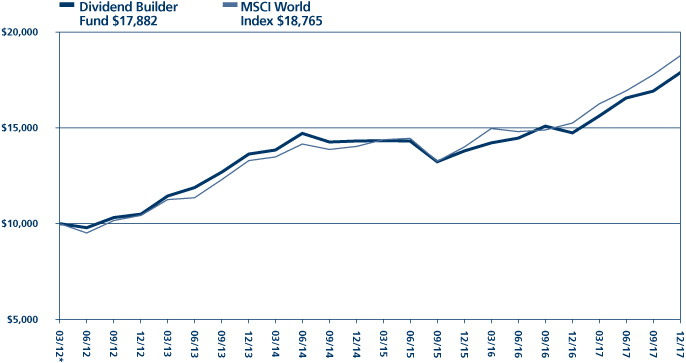

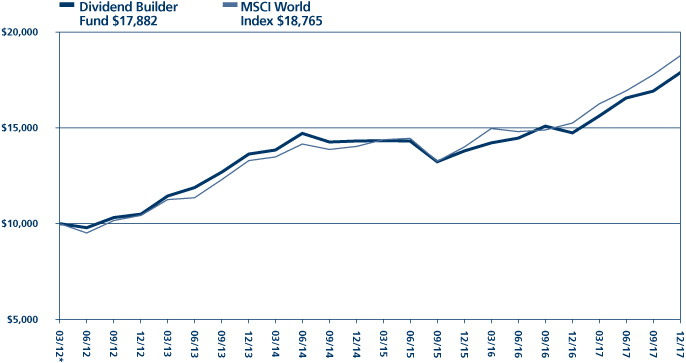

Dividend Builder Fund (March 30, 2012) | | | 21.34 | % | | | 7.70 | % | | | 11.23 | % | | | — | | | | 10.60 | % | | | 2.11 | % Gross; 0.70% net† | |

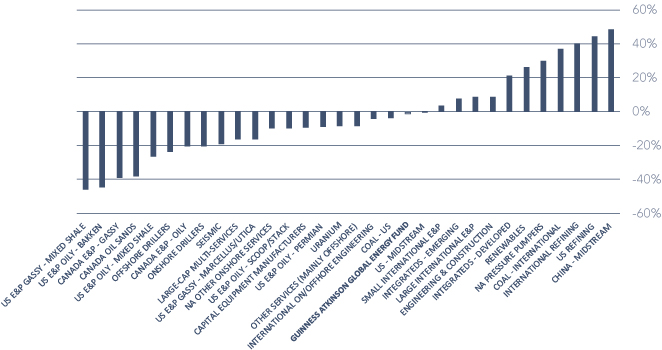

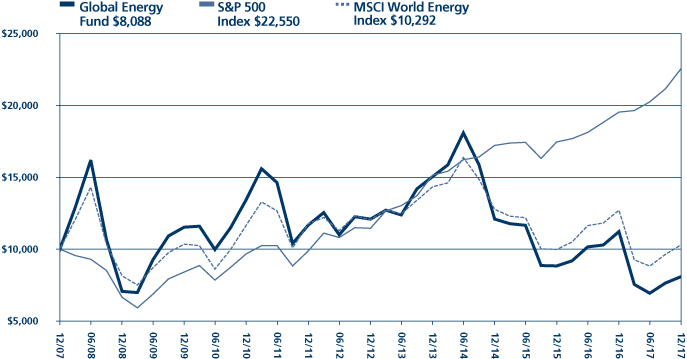

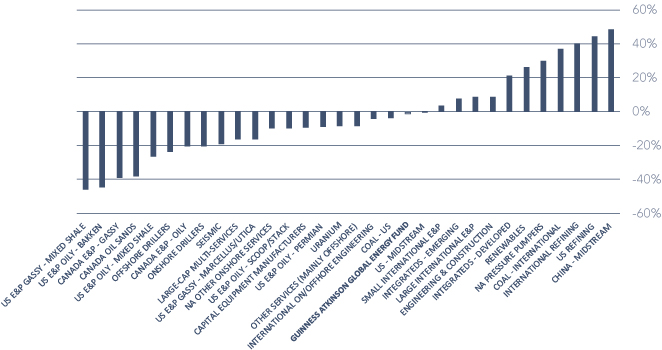

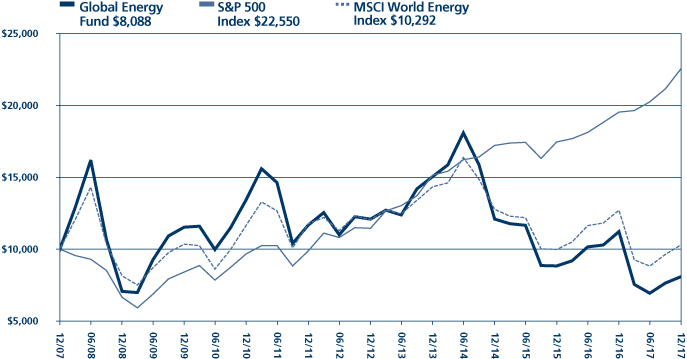

Global Energy Fund (June 30, 2004) | | | -1.06 | % | | | -2.81 | % | | | -1.69 | % | | | -2.10 | % | | | 6.82 | % | | | 1.53 | % gross; 1.45% net† | |

Global Innovators Fund Investor Class

(December 15, 1998) | | | 34.75 | % | | | 12.68 | % | | | 18.53 | % | | | 9.29 | % | | | 8.24 | % | | | 1.35 | % gross; 1.24% net† | |

Global Innovators Fund Institutional Class

(December 31, 2015) | | | 35.07 | % | | | 12.87 | % | | | 18.65 | % | | | 9.35 | % | | | 8.27 | % | | | 1.38 | % gross; 0.99% net† | |

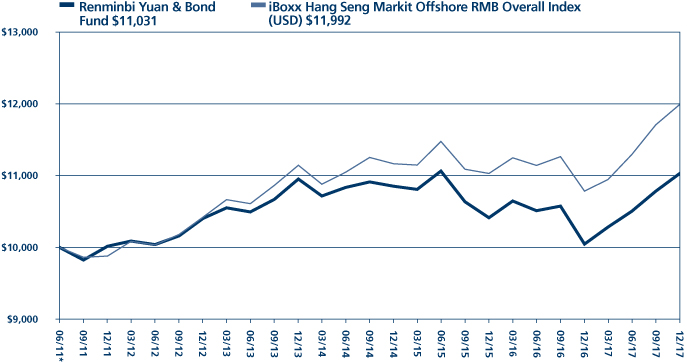

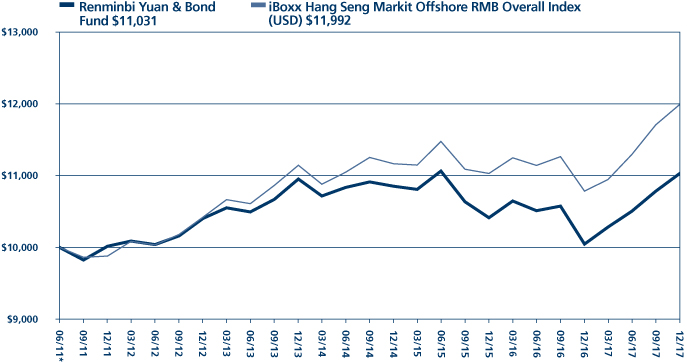

Renminbi Yuan & Bond Fund (June 30, 2011) | | | 9.79 | % | | | 0.54 | % | | | 1.17 | % | | | — | | | | 1.52 | % | | | 4.35 | % gross; 1.00% net† | |

Periods of greater than one year are average annualized returns; one year and shorter period returns are actual returns. All returns are for the periods ended December 31, 2017.

Performance data shown for the Global Innovators Fund's Institutional Class shares (GINNX) prior to its launch date on December 31, 2015 uses performance data from the Global Innovators Fund's Investor Class shares (IWIRX).

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com or calling 1-800-915-6565. The recent growth rate in the stock market has helped to produce short-term returns that are not typical. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

Each of the Asia Focus Fund, the Asia Pacific Dividend Builder Fund, the China & Hong Kong Fund, and the Renminbi Yuan & Bond Fund imposes 2% redemption fee on shares held less than 30 days. Performance data quoted does not reflect this fee. If it had, total return would be lower.

Expense ratios are from the most recent prospectus (dated May 1, 2017) and are from the most recent audited financials (period ending December 31, 2016) at the time that prospectus was completed.

†All of the Guinness Atkinson Funds, except the China & Hong Kong Fund, have an expense cap in place and the advisor is contractually obligated to cap the Funds' total expenses through June 30, 2018.

4

Dear Guinness Atkinson Funds Shareholders,

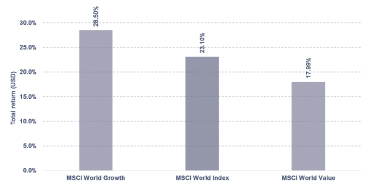

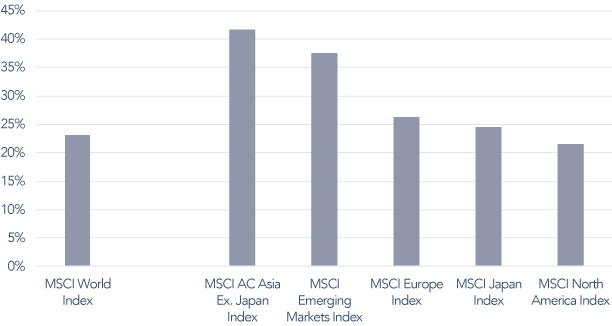

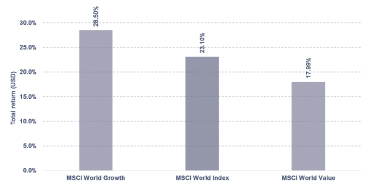

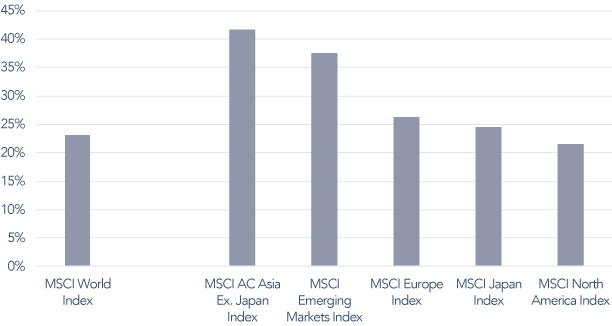

Why can't they all be like that? We're referring, of course, to the market year. There is no question 2017 was an atypical year in the markets. The MSCI World Index was up 23.10% for the year; which is in and of itself a remarkable return albeit not unprecedented. What was unprecedented was the fact that the index posted a positive total return in every single month of the year. Hence our query: why can't they all be like that? We're pleased to report that the Guinness Atkinson Funds generally had an excellent year, with seven of the eight Funds posting positive returns. The one exception was the Global Energy Fund, which as it turns out, was the top performing Guinness Atkinson Fund for 2016. The performance table on the opposite page has all the details.

The top performing Guinness Atkinson Fund for the year was the China & Hong Kong Fund, which produced a total return of 48.85% for the year. We take a particular satisfaction in this result given the large number of vocal nay-sayers which have doubted the China story since, well, since we launched the Fund in 1994. The anti-China sentiment doesn't seem to bother China in the least; the country just keeps motoring along and is now the second largest economy in the world and the fastest growing major economy in the world. While we're on the subject of China, we should mention our Renminbi Yuan & Bond Fund, which produced a total return of 9.79% in 2017. If you follow the renminbi you'll know that all of the experts were predicting a slump (or collapse even) in the renminbi the last couple of years.

Our two pan-Asia Funds, Asia Focus and Asia Pacific Dividend Builder had strong years as well, up 47.10% and 36.70% respectively.

The Global Innovators Fund continued its long run of excellent performance. For the year, the Fund had a total return of 34.75% for the Investor Class and 35.07% for the Institutional Class. This Fund will reach its 20th anniversary in December of 2018 and we know we have many shareholders that have been in this Fund since inception or shortly thereafter. We're delighted that so many have been along for the ride. Shareholders in this Fund will be pleased to know that it continues to be among the very best in its category. We don't wish to burden our readers with a lot of impressive statistics regarding the relative performance of this Fund, but we think it is important to let readers know that the Fund has been in the top decile in its Morningstar category (currently Large Blend) for trailing 10 year performance for the last 23 consecutive quarters. For the year, it finished in the top 1% in its category (1,396 funds); top 3% for three years (1,217 funds); top 1% for five years (1,079 funds); and top 7% for 10 years (800 funds). The investment thesis for this Fund is simple: We believe innovative companies outperform and the results of the Fund support this thesis.

As noted, our Global Energy Fund did not produce a positive return in 2017. This isn't too much of a surprise given the energy – particularly oil – markets in 2017. The Alternative Energy Fund produced a total return of 20.68% for the year. We've mentioned in the past that we're optimistic about the long-term prospects for alternative energy. It is our view that we're just at the point where – because of a continuation of the long-term decline in solar and wind costs – renewable energy is cost competitive with conventional energy without subsidies. We believe that reaching this tipping point will prove to be a catalyst for accelerating growth for the industry.

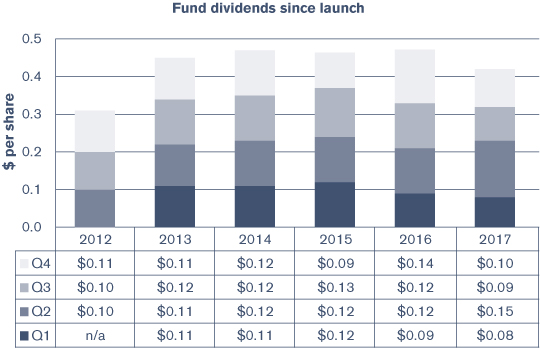

The Guinness Atkinson Dividend Builder Fund provided a total return of 21.34%. While this Fund may not be a leader in total return, we very much like its lower level of risk and its dividend orientation. Quality companies are the key ingredient in this Fund: all of the companies in the portfolio need to meet rather strict criteria to be eligible for inclusion. We believe this focus on quality, dividend-paying companies will serve this Fund well in less-buoyant markets.

Our investment team has provided a detailed commentary for each of the Guinness Atkinson Funds adjacent to each Fund's financial results.

As usual, we appreciate the confidence you have placed in us and our management team and look forward to what will hopefully be a great 2018.

We encourage you to visit gafunds.com for the latest news and announcements on the Guinness Atkinson Funds.

Sincerely, | | | |

| |

| |

Timothy Guinness | | James Atkinson | |

5

Morningstar Ratings Through December 31, 2017

Fund | | Category | | Overall | | 3-year | | 5-year | | 10-year | |

Alternative Energy | | Foreign Small/ | | 1* | | 1* | | 1* | | 1* | |

| | Mid Value | | (59 funds) | | (59 funds) | | (44 funds) | | (25 funds) | |

Asia Focus | | Pacific/Asia | | 2** | | 4**** | | 2** | | 1* | |

| | ex-Japan | | (68 funds) | | (68 funds) | | (50 funds) | | (23 funds) | |

Asia Pacific Dividend | | Pacific/Asia | | 4**** | | 4**** | | 4**** | | 3*** | |

Builder | | ex-Japan | | (68 funds) | | (68 funds) | | (50 funds) | | (23 funds) | |

China & Hong Kong | | China Region | | 2** | | 3*** | | 2** | | 2** | |

| | | | (81 funds) | | (81 funds) | | (69 funds) | | (37 funds) | |

Global Energy | | Energy Equity | | 3*** | | 3*** | | 3*** | | 3*** | |

| | | | (90 funds) | | (90 funds) | | (75 funds) | | (61 funds) | |

Global Innovators | | Large Blend | | 4**** | | 5***** | | 5***** | | 3*** | |

| | | | (1,217 funds) | | (1,217 funds) | | (1,079 funds) | | (800 funds) | |

Renminbi Yuan & Bond | | Emerging Markets | | 4**** | | 2** | | 5***** | | | |

| | Local Currency Bond | | (79 funds) | | (79 funds) | | (63 funds) | | | |

Dividend Builder | | World Stock | | 3*** | | 3*** | | 3*** | | | |

| | | | (720 funds) | | (720 funds) | | (589 funds) | | | |

Morningstar Ratings Disclosure

Global Innovators Fund ratings shown were given for Investor Class shares.

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in foreign securities, which involves greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for emerging markets countries. Non-diversified Funds' assets may be concentrated in fewer individual holdings than diversified funds. Therefore, these Funds are more exposed to individual issuer volatility than diversified funds. Investments in smaller companies involve additional risks such as limited liquidity and greater volatility. Investments in debt securities typically decrease in value when interest rates rise, which can be greater for longer-term debt securities. Investments in derivatives involve risks different from, and in certain cases, greater than the risks presented by traditional investments. Investments focused in a single geographic region may be exposed to greater risk than investments diversified among various geographies. Investments focused on the energy sector may be exposed to greater risk than an investments diversified among various sectors.

Past performance is not a guarantee of future results. The Morningstar RatingTM for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

For each fund with at least a three-year history, Morningstar calculates a Morningstar RatingTM based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund's monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars

6

and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in distribution percentages.)

©2018 Morningstar, Inc. All Rights Reserved. The information contained herein (1) is proprietary to Morningstar (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

The views in this letter were as of December 31, 2017 and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the Funds' investment methodology and do not constitute investment advice.

7

Expense Examples (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) redemption fees (applicable to the Asia Focus Fund, the Asia Pacific Dividend Builder Fund, the China & Hong Kong Fund, and the Renminbi Yuan & Bond Fund); and (2) ongoing costs, including advisory fees and other Fund expenses. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period shown and held for the entire period from July 1, 2017 to December 31, 2017.

Actual Expenses

For each Fund, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid during Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each Fund, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any redemption fees. Therefore, the second line for each Fund of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these redemption fees were included, your costs would have been higher.

| | | Beginning

Account

Value

(07/01/17) | | Ending

Account

Value

(12/31/17) | | Expenses Paid

During Period*

(07/01/17 to

12/31/17) | | Expense Ratios

During Period*

(07/01/17 to

12/31/17) | |

Guinness Atkinson Alternative Energy Fund Actual | | $ | 1,000.00 | | | $ | 1,105.50 | | | $ | 10.51 | | | | 1.98 | %† | |

Guinness Atkinson Alternative Energy Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.22 | | | $ | 10.06 | | | | 1.98 | %† | |

Guinness Atkinson Asia Focus Fund Actual | | $ | 1,000.00 | | | $ | 1,198.10 | | | $ | 10.97 | | | | 1.98 | %† | |

Guinness Atkinson Asia Focus Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.22 | | | $ | 10.06 | | | | 1.98 | %† | |

Guinness Atkinson Asia Pacific Dividend Builder Fund Actual | | $ | 1,000.00 | | | $ | 1,144.30 | | | $ | 6.05 | | | | 1.12 | %† | |

Guinness Atkinson Asia Pacific Dividend Builder Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.56 | | | $ | 5.70 | | | | 1.12 | %† | |

Guinness Atkinson China & Hong Kong Fund Actual | | $ | 1,000.00 | | | $ | 1,203.00 | | | $ | 9.22 | | | | 1.66 | % | |

Guinness Atkinson China & Hong Kong Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.84 | | | $ | 8.44 | | | | 1.66 | % | |

Guinness Atkinson Dividend Builder Fund Actual | | $ | 1,000.00 | | | $ | 1,080.10 | | | $ | 3.57 | | | | 0.68 | %† | |

Guinness Atkinson Dividend Builder Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.78 | | | $ | 3.47 | | | | 0.68 | %† | |

Guinness Atkinson Global Energy Fund Actual | | $ | 1,000.00 | | | $ | 1,166.80 | | | $ | 7.92 | | | | 1.45 | %† | |

Guinness Atkinson Global Energy Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.90 | | | $ | 7.38 | | | | 1.45 | %† | |

Guinness Atkinson Global Innovators Fund – Investor Class Actual | | $ | 1,000.00 | | | $ | 1,155.60 | | | $ | 6.74 | | | | 1.24 | %† | |

Guinness Atkinson Global Innovators Fund – Investor Class Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.95 | | | $ | 6.31 | | | | 1.24 | %† | |

Guinness Atkinson Global Innovators Fund – Institutional Class Actual | | $ | 1,000.00 | | | $ | 1,157.20 | | | $ | 5.38 | | | | 0.99 | %† | |

Guinness Atkinson Global Innovators Fund – Institutional Class

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.21 | | | $ | 5.04 | | | | 0.99 | %† | |

Guinness Atkinson Renminbi Yuan & Bond Fund Actual | | $ | 1,000.00 | | | $ | 1,050.20 | | | $ | 4.65 | | | | 0.90 | %† | |

Guinness Atkinson Renminbi Yuan & Bond Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.67 | | | $ | 4.58 | | | | 0.90 | %† | |

*Expenses are equal to the Funds' annualized expense ratio as indicated, multiplied by the average account value over the period, multiplied by the number of days in most recent fiscal half-year period (184), then divided by the number of days in the fiscal year (365) (to reflect the one-half year period).

†Net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Fund's actual expenses would have been higher.

8

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND for the period ended December 31, 2017

1. Performance

AVERAGE ANNUALIZED TOTAL RETURNS

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

Fund | | | 20.68 | % | | | -3.97 | % | | | 4.16 | % | | | -14.39 | % | |

Benchmark Indices: | |

Wilderhill Clean Energy Index (ECO) | | | 39.81 | % | | | -0.81 | % | | | 5.15 | % | | | -15.04 | % | |

Wilderhill New Energy Global Innovation Index (NEX) | | | 28.90 | % | | | 6.98 | % | | | 13.28 | % | | | -6.24 | % | |

Over 10 years, the Fund remains ahead of the ECO Index.

The Fund's gross expense ratio is 2.60% and net expense ratio is 1.99% per the Summary Prospectus dated May 3, 2017. For the Fund's current one year expense ratios, please refer to the Financial Highlights section of this report. The Advisor has contractually agreed to waive a portion of its advisory fees and/or reimburse other Fund expenses so that the Fund's ratio of expenses to average daily net assets will not exceed 1.98% (excluding Acquired Fund Fees and Expenses, interest, taxes, dividends on short positions and extraordinary expenses) through at least June 30, 2018. To the extent that the Advisor waives fees and/or reimburses expenses, it may seek repayment of a portion or all of such amounts at any time within the three fiscal years after the fiscal year in which such amounts were waived and/or reimbursed, subject to the applicable cap.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

Total returns for certain periods reflect fee limitations in effect and, in the absence of these limitations, total returns would have been lower.

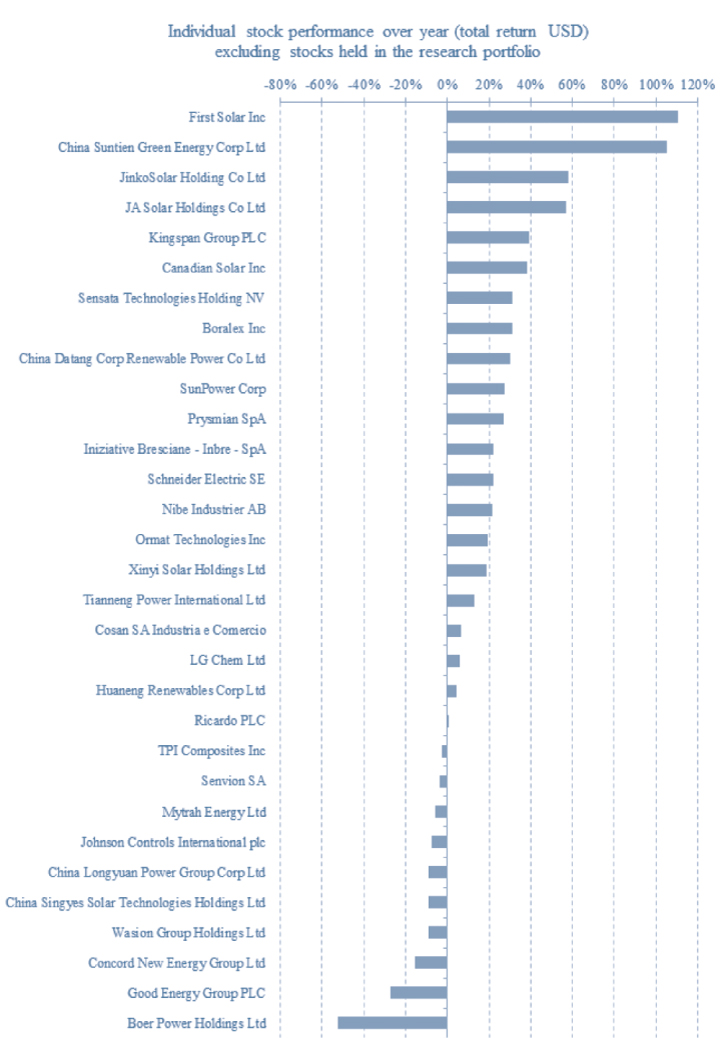

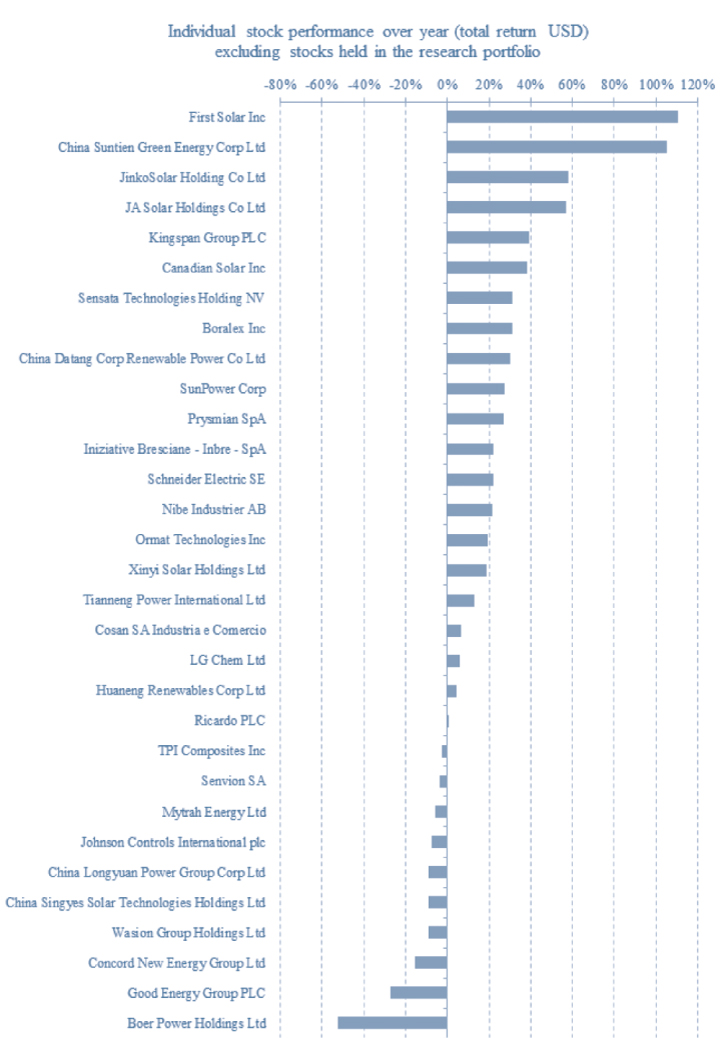

The Fund was up 20.68% in 2017. The Fund performed well throughout the year – for the first half of the year, the Fund was up 9.16% and for the second half of the year the Fund was up 10.55%. The main contributor to returns in 2017 was the solar sector. The module manufacturers largely recovered from 2016. China increased its installation targets, leading to demand for solar panels increasing by 25% year on year, when the market was expecting an increase of less than 10%. The Fund underperformed against the Wilderhill Clean Energy Index (ECO) (the "ECO Index"), which was up 18.29% for the first half of 2017 and then 18.19% for the second half of 2017. The underperformance reflected very strong index performance versus the sector and came mainly from the more speculative stocks in the ECO Index.

The best-performing subsectors in the Fund were solar, followed by hydro, geothermal, efficiency, wind and biofuels in descending order of performance. Solar had a strong year due to increased demand from China and fears of import tariffs in the US, meaning that developers were stockpiling modules, thereby stabilising prices and margins.

The Fund's one hydro holding, Italian company Iniziative Bresciane, benefitted from completion of new generating plant contributing to earnings. The Fund's one geothermal holding, Ormat Technologies, is a vertically integrated US manufacturer, developer and operator of geothermal plants. The company has successfully commissioned new plants and beat analysts' earnings expectations.

The Fund's efficiency holdings include companies involved in building efficiency, fuel efficiency, grid infrastructure, electric vehicles and batteries. These are also more exposed to global economic growth and have benefitted from strong global economy in 2017. The Fund's battery holdings fared well due to increased uptake of electric vehicles, while our grid holding benefitted from electricity grid improvements.

The Fund's wind holdings are a mixture of power producers and component manufacturers, and contributed positively to Fund performance. The Chinese wind power producers performed better due to lower wind power curtailment in China in 2017 than in 2016, while the Fund's Canadian wind power holding continued to execute its pipeline well. The biofuels sector in the Fund performed well in part because of Brazil's economic recovery.

The Fund's best performing position in 2017 was First Solar, the US-headquartered thin-film module manufacturer, closely followed by China Suntien, the Chinese photovoltaic systems installer. Both more than doubled in share price over the year. China Suntien benefitted from the surprise increase in Chinese solar demand. First Solar also benefitted from additional solar demand as well as the new tariffs the United States imposed on silicon-based solar equipment. First Solar is exempt from these import tariffs as its modules do not use silicon, even though their manufacturing locations are outside of the United States. JA Solar and JinkoSolar, two Chinese module manufacturers, were up 56.7% and 57.9%, respectively, over the year, due to increased Chinese

9

solar demand and more stable margins. The Fund's insulated panel manufacturer, Kingspan was up 39.5% due to a strong property market and demand for energy efficient building materials.

The Fund's weakest performing position, Boer Power, a Chinese distributor of energy management devices, was down 52.3% over the year as it continued to execute a major restructuring. We believe the restructuring will allow a recovery in earnings and the company's key markets remain attractive – China's distribution grid requires significant investment to deal with the influx of renewables, and particularly with the growth of rooftop solar in China this year. Good Energy, a UK-based green utility, missed expectations as a result of poor customer growth and billing system weakness. Concord New Energy suffered along with other Chinese renewable power producers as a result of delays to subsidy payments. This has been addressed and there are signs of lower generation curtailment that may support further improvements to earnings. China Singyes, a Chinese solar installer, suffered from poor prices achieved for developed sites held on its balance sheet. This part of the business has now been sold. Wasion Group, a Chinese metering provider, was down 9.1% as the Chinese government slowed its metering transition programme.

10

2. Activity

The Fund sold its position in Israel-based SolarEdge in the first quarter of 2017, due to fears of further price competition for inverters and replaced SolarEdge with Prysmian, an Italian cable manufacturing company with a global footprint. Prysmian benefits from electricity grid upgrades and expansions globally, as well as the growing market for long-distance cables. We added a position in Kingspan, an Irish insulation building materials producer to take the Fund to a full complement of 30 positions.

In the third quarter, the Fund sold its position in CEMIG, a Brazilian hydro-power utility, due to continuing concerns about the political situation in Brazil and oversupply in the Brazilian power market. The Fund acquired a position in US-based TPI Composites, a composite material provider that manufactures wind turbine blades.

In the fourth quarter, the Fund sold its position in Centrotec, a German heating and boiler installer. Sales growth had been expected after a change in law that required commercial buildings to install new boilers to meet efficiency standards. Although the growth never materialised, the Fund sold its position for roughly the same price as when it was originally introduced into the portfolio. The Fund replaced Centrotec with a position in LG Chem, a Korean chemicals and materials provider. LG Chem has reasonable valuation metrics and a leading battery business which is forecast to turn profitable in 2018. It is well placed to capitalise on the growing markets for electric vehicles and large scale stationary storage via its lithium-ion battery division.

The overall effect of these changes has been to increase the Fund's exposure to larger capitalisation companies with higher earnings visibility.

3. Portfolio Position

The Fund's largest country exposures were to China, the United States, Canada, Italy, the United Kingdom and Brazil. With China contributing half of the annual installations of wind and solar, over three-quarters of solar manufacturing capacity and over half of wind turbine manufacturing capacity, investing in China is a key part of the current investment opportunity.

On a sector basis, the Fund has been weighted between a quarter and a third in each of the energy efficiency, solar and wind sectors. The companies in other sectors, such as hydro, biofuels and geothermal, have company specific investment rationales rather than sector growth stories.

4. Outlook

Sentiment towards the alternative energy sector significantly improved over 2017. As with 2016, several tenders for power saw renewable energy undercut pricing for conventional fossil fuel plants. In emerging markets, India saw solar pricing that was lower than the price of electricity from existing coal plants. Saudi Arabia and Mexico set new records for solar, at $18/MWh and $19/MWh, respectively. In Germany, offshore wind farms to be built in 2024 forfeited per kWh subsidies in favour of the market electricity price. Although offshore wind installations in Germany have other support measures, including guaranteed and paid-for grid connections and a floor price of €0/kWh for up to six consecutive hours to protect from negative pricing, the achieved price of offshore wind has beaten most if not all expectations. Once again, renewable energy technologies are showing that they are capable of producing electricity less expensively than fossil fuel resources in an increasing number of countries. This means that the addressable market for renewables continues to increase and becomes less reliant on government support for growth.

In addition to advances in renewable energy competitiveness, batteries and electric vehicles have seen steep price decreases. With several new electric vehicle models coming to market at the same price point (with subsidies) as internal combustion engine vehicles we are confident that electric vehicles are approaching a point where they will gain significant market share. In Norway, where electric vehicles enjoy tax credits making electric cars as affordable as combustion engine vehicles, the market share of electric vehicles of new car sales reached 30% in 2016 and 39% in 2017 – up from under 1% in 2009. We expect similar growth rates for developed countries as electric vehicles become cheaper due to improvements in batteries, materials and vehicle design.

The Fund remains well positioned for growth of the alternative energy sector, and there are signs that the sector is maturing to provide investment opportunities with sustainable earnings growth. Thank you for your support.

| |

| | | |

Edward Guinness | | Samira Rudig | | | |

The Fund invests in foreign securities, which involves political, economic and currency risks, greater volatility, and differences in accounting methods. These risks are greater for emerging markets. The Fund is non-diversified, meaning

11

that its assets may be concentrated in fewer individual holdings than diversified funds. Therefore, the Fund is more exposed to individual stock volatility than diversified funds. Investments focused in a single geographic region may be exposed to greater risk and more volatility than investments diversified among various geographies. The Fund invests in smaller companies, which involves additional risks such as limited liquidity and greater volatility.

The Wilderhill Clean Energy Index (ECO) is a modified equal US dollar-weighted index of publicly traded companies whose businesses stand to benefit substantially from societal transition toward the use of cleaner energy and conservation. The Wilderhill New Energy Global Innovation Index (NEX) is a modified US dollar-weighted index of publicly traded companies, which are active in renewable and low-carbon energy, and which stand to benefit from responses to climate change and energy security concern. These indices are unmanaged, not available for investment and do not incur expenses.

KWh – kilowatt-hour

Please refer to the Schedule of Investments for details on Fund holdings. Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Guinness Atkinson Asset Management, Inc. for the period stated and is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Opinions, Fund holdings and sector allocations are subject to change at any time, and are not recommendations to buy or sell any security.

12

Growth of $10,000

Average Annual Total Return

Periods Ended December 31, 2017

| One Year | | Five Years | | Ten Years | |

| | 20.68 | % | | | 4.16 | % | | | -14.39 | % | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Total returns for certain periods reflect a fee waiver in effect and in the absence of this waiver, the total returns would be lower. Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares.

The Wilderhill New Energy Global Innovations Index (NEX) is a modified dollar weighted index of publicly traded companies, which are active in renewable and low-carbon energy, and which stand to benefit from responses to climate change and energy security concern. The Wilderhill Clean Energy Index (ECO) is a modified equal dollar weighted index comprised of publicly traded companies whose businesses stand to benefit substantially from societal transition toward the use of cleaner energy and conservation.

13

FUND HIGHLIGHTS at December 31, 2017

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND

# of Holdings in Portfolio: | | | 31 | | |

Portfolio Turnover: | | | 32.4 | % | |

% of Stocks in Top 10: | | | 33.7 | % | |

Fund Manager: | | | |

Edward Guinness | | | |

Top 10 Holdings (% of net assets) | | | | Industry Breakdown (% of net assets) | | | |

Tianneng Power International | | | 3.8 | % | | Efficiency | | | 35.7 | % | |

LG Chem Ltd. | | | 3.6 | % | | Wind | | | 30.3 | % | |

Ormat Technologies Inc. | | | 3.4 | % | | Solar | | | 22.6 | % | |

China Suntien Green Energy Corp. Ltd. - H Shares | | | 3.4 | % | | Geothermal | | | 3.4 | % | |

Senvion S.A. | | | 3.4 | % | | Biofuel | | | 3.3 | % | |

TPI Composites Inc. | | | 3.3 | % | | Hydro | | | 2.2 | % | |

Ricardo PLC | | | 3.2 | % | | | | | | | |

Boralex Inc. - Class A | | | 3.2 | % | | | | | | | |

Xinyi Solar Holdings Ltd. | | | 3.2 | % | | | | | | | |

China Datang Corp. Renewable Power Co., Ltd. - H Shares | | | 3.2 | % | | | | | | | |

14

SCHEDULE OF INVESTMENTS

at December 31, 2017

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND

Shares | | COMMON STOCKS: 97.5% | | Value | |

Biofuel: 3.3% | | | |

| | 27,600 | | | Cosan SA Industria e Comercio | | $ | 345,343 | | |

Efficiency: 35.7% | | | |

| | 1,274,000 | | | Boer Power Holdings | | | 242,277 | | |

| | 9,102 | | | Johnson Controls Inc. | | | 346,877 | | |

| | 7,970 | | | Kingspan Group PLC | | | 348,602 | | |

| | 1,000 | | | LG Chem Ltd. | | | 380,345 | | |

| | 34,235 | | | Nibe Industrier AB - B Shares | | | 328,309 | | |

| | 10,530 | | | Prysmian SpA | | | 342,864 | | |

| | 29,510 | | | Ricardo PLC | | | 353,356 | | |

| | 4,140 | | | Schneider Electric SE | | | 351,249 | | |

| | 6,800 | | | Sensata Technologies Holding* | | | 347,548 | | |

| | 388,000 | | | Tianneng Power International | | | 403,560 | | |

| | 712,000 | | | Wasion Group Holdings Ltd. | | | 348,117 | | |

| | | | | | | | 3,793,104 | | |

Geothermal: 3.4% | | | |

| | 5,659 | | | Ormat Technologies Inc. | | | 361,950 | | |

Hydro: 2.2% | | | |

| | 9,648 | | | Iniziative Bresciane - Inbre - SpA† | | | 231,523 | | |

Solar: 22.6% | | | |

| | 20,400 | | | Canadian Solar Inc.* | | | 343,944 | | |

| | 789,400 | | | China Singyes Solar Technologies Holdings Ltd. | | | 342,728 | | |

| | 5,100 | | | First Solar Inc.* | | | 344,352 | | |

| | 43,800 | | | JA Solar Holdings Co., Ltd. - ADR* | | | 326,748 | | |

| | 14,300 | | | Jinkosolar Holdings Co., - ADR* | | | 343,915 | | |

| | 41,450 | | | SunPower Corp. - Class B* | | | 349,423 | | |

| | 912,200 | | | Xinyi Solar Holdings Ltd. | | | 352,945 | | |

| | | | | | | | 2,404,055 | | |

The accompanying notes are an integral part of these financial statements.

15

Shares | | COMMON STOCKS: 97.5% (Continued) | | Value | |

Wind: 30.3% | | | |

| | 18,887 | | | Boralex Inc. - Class A | | $ | 353,098 | | |

| | 2,959,000 | | | China Datang Corp. Renewable Power Co., Ltd. - H Shares | | | 352,747 | | |

| | 453,000 | | | China Longyuan Power Group Corp. - H Shares | | | 322,701 | | |

| | 1,346,000 | | | China Suntien Green Energy Corp. Ltd. - H Shares | | | 356,644 | | |

| | 7,680,000 | | | Concord New Energy Group Ltd. | | | 338,502 | | |

| | 91,167 | | | Good Energy Group PLC† | | | 224,638 | | |

| | 1,016,000 | | | Huaneng Renewables Corp. Ltd. - H Shares | | | 345,194 | | |

| | 607,763 | | | Mytrah Energy Ltd.*† | | | 220,793 | | |

| | 28,870 | | | Senvion S.A.* | | | 356,789 | | |

| | 17,300 | | | TPI Composites Inc.* | | | 353,958 | | |

| | | | | | | | 3,225,064 | | |

| | | | | Total Common Stocks

(cost $12,454,467) | | | 10,361,039 | | |

| | | | | Total Investments in Securities

(cost $12,454,467): 97.5% | | | 10,361,039 | | |

| | | | | Other Assets less Liabilities: 2.5% | | | 267,604 | | |

| | | | | Net Assets: 100.0% | | $ | 10,628,643 | | |

* Non-income producing security.

ADR - American Depository Receipt

† The Advisor has determined these securities to be Illiquid. As of December 31, 2017, the total market value of these illiquid securities represent 6.4% of net assets.

The accompanying notes are an integral part of these financial statements.

16

GUINNESS ATKINSON ASIA FOCUS FUND for the period ended December 31, 2017

1. Performance

AVERAGE ANNUALIZED TOTAL RETURNS

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

Fund | | | 47.10 | % | | | 12.42 | % | | | 5.35 | % | | | 1.09 | % | |

Benchmark Indices: | |

MSCI AC Far East ex Japan Index | | | 42.32 | % | | | 11.20 | % | | | 8.15 | % | | | 4.63 | % | |

S&P 500 Index | | | 21.80 | % | | | 11.40 | % | | | 15.77 | % | | | 8.48 | % | |

The Fund's gross expense ratio is 2.24% and net expense ratio is 1.98% per the Summary Prospectus dated May 3, 2017. For the Fund's current one year expense ratio, please refer to the Financial Highlights section of this report. The Advisor has contractually agreed to waive a portion of its advisory fees and/or reimburse other Fund expenses so that the Fund's ratio of expenses to average daily net assets will not exceed 1.98% (excluding Acquired Fund Fees and Expenses, interest, taxes, dividends on short positions and extraordinary expenses) through at least June 30, 2018. To the extent that the Advisor waives fees and/or reimburses expenses, it may seek repayment of a portion or all of such amounts at any time within the three fiscal years after the fiscal year in which such amounts were waived and/or reimbursed, subject to the applicable cap.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

The Fund imposes a 2% redemption fee on the sale of shares held less than 30 days. Performance data quoted does not reflect this redemption fee. Total returns for certain periods reflect fee limitations in effect and, in the absence of these limitations, total returns would have been lower.

2017 has been a strong year for Asian equities and the Fund has performed well rising 47.10% compared to the MSCI AC Far East ex Japan Index, which rose 42.32%.

The best-performing sectors in 2017, as measured by the sector indices within the MSCI AC Far East ex Japan Index in USD terms, were Technology (up 64%), Health Care (up 62%), Real Estate (up 50%), and Consumer Discretionary (up 41%). The best countries were China (up 54%) and South Korea (up 46%). The overall story was accelerating profits growth driven by stronger-than-expected economic growth in China, a resurgence in Chinese domestic consumption and a significant upswing in Technology names related to consumer electronics, especially smartphones. We also note that Asian currencies strengthened 6% against the U.S. dollar (on a weighted average basis). The largest moves were the Korean won (up 13%), followed by the Malaysian ringgit and Thai baht (up 10%), and the Singapore dollar and New Taiwan dollar (each up 8%). However, perhaps the most important signal of improvement came from the Chinese yuan, which reversed the weakness of 2016 and rose 6.7%.

Chinese stocks, as measured by the MSCI China Index, have had their best year since 2009, marking a decisive reversal of the gloomy sentiment that has dominated for so many years. The stock market recovery is as much about what did not happen as what did. The 'near certain' banking sector crisis did not happen. We have long argued that debt servicing capacity, rather than the ratio of debt to Gross Domestic Product (GDP), is the most important metric when assessing the burden of debt and gauging financial stability. The recovery in heavy industrial profits and cash flows by 9% in 2016 and by a further 16% for the first 11 months of 2017 has improved matters considerably. According to our analysis of 3,000 listed companies in China the share of debt at risk (where operating profit does not cover their annual interest expense) has almost halved from 2015, from 30% to 17%. Government efforts to slow debt accumulation appear to be having an effect, according to the International Institute of Finance, with the stock of debt to GDP rising only 2% in 2017, compared to an average rise of 17% per annum from 2010 to 2016.

Technology has also been a big part of the investment story this year. In Asia, Technology features both in application and in production. These areas show the region at its most innovative. In the region's burgeoning consumer markets, the race is on for businesses to adapt to changing business methods, to adopt new technologies and to respond rapidly to developing consumer spending patterns. Online retail, e-commerce platforms and e-payments have taken off, which has caused the stock prices of the Chinese internet names especially, to surge. On the production side, the launch of the new iPhone has brought with it significant advances in production technology from phone casings, to camera lenses, through to facial recognition and screens. The resultant

17

increased performance requirements of handheld devices and the growth in Internet of Things has fed through to an upswing in demand for memory chips. There has been an increase in component prices, lifting profit forecasts throughout the supply chain.

South-East Asia (Indonesia, Malaysia, Philippines, Singapore and Thailand) has been out of favour for the past three years compared to North Asia, with only Thailand looking attractive, in our view. However, there are signs that Singapore's prospects are looking brighter. In 2017, full year economic growth came at the top end of the official forecast range at 3.5%. The main drivers have been a strong rebound in services and stronger external demand pushing up exports growth across all major categories, but especially in Pharmaceuticals/Biotech. There are expectations that improved productivity will support rising wages and hence lift domestic activity. The Monetary Authority of Singapore has been quick in the past to anticipate such turns and interest rate increases are possible. Mortgage rates have moved higher in anticipation.

The best performing stock this year by far was Geely Automobile, a Chinese car maker that owns Swedish carmaker Volvo. The company has revamped its model range with great success and is achieving new sales highs, but the excitement lies in the obvious success of its Volvo acquisition. Through this, the company looks likely to mount a serious challenge in the electric vehicle segment both in China and Europe. The weakest stock was China Minsheng Banking, which fell 2%. The second largest of China's private sector commercial banks, it is exposed to regulatory efforts to bring about lower leverage in the financial sector. The bank makes most of its money from the lending business, and with a smaller deposit franchise (as compared to the big state-owned banks) it is obliged to seek funding through the wholesale markets. The regulator is seeking not to eliminate this but to restrict the level of such funding both increasing costs and through rule-based limits. China Minsheng Bank's growth has therefore been under pressure, but the operations and capital base remain sound.

2. Portfolio Position

Compared to the MSCI AC Pacific ex Japan Index, on a sector basis the Fund is most overweight in Health Care with 12% in three names split between health care provision, equipment, and pharmaceuticals. The Fund is also 7% overweight in Consumer Discretionary and 3% overweight in Utilities, with two Thai positions. The Fund is 9% underweight in Financials, 4% underweight in Information Technology and 4% underweight Telecom Services. On a country basis, it is 7% overweight in China and 9% underweight in Hong Kong. The other notable positions are 7% overweight in Thailand and 7% underweight in Korea.

3. Outlook

Asian markets had a strong year in 2017, pushing valuations above their 10-year averages. In contrast to much of the past 10 years, however, corporate earnings have risen over the past year, giving us greater confidence in the more bullish analyst forecasts for 2018 and 2019. Market confidence has also been lifted by China's economic growth momentum and by the crisis that did not happen. The focus for the last five years has been on rising Chinese debt levels and the potential instability caused by efforts to tackle it. This year we have seen intensifying efforts to regulate banks' behaviour and this has carried on into the new year.

At the time of writing, the positive outlook hinges on continued acceleration in external demand, hope for a recovery in global capital expenditure and for Asian domestic demand to be lifted on the back of this. The risks to the outlook revolve around central bank policies in the US and Europe as they seek to wind down or reverse the years of quantitative easing, stretched valuations in developed markets and as ever, the possibility that China's economic outlook deteriorates.

Edmund Harriss

The Fund invests in foreign securities, which involves political, economic and currency risks, greater volatility, and differences in accounting methods. These risks are greater for emerging markets. The Fund is non-diversified, meaning that its assets may be concentrated in fewer individual holdings than diversified funds. Therefore, the Fund is more exposed to individual stock volatility than diversified funds. Investments focused in a single geographic region may be exposed to greater risk and more volatility than investments diversified among various geographies. The Fund invests in smaller companies, which involves additional risks such as limited liquidity and greater volatility.

The MSCI AC (All Country) Far East ex Japan Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market performance of the Far East, excluding Japan. The S&P 500 Index is a market capitalization-weighted index composed of 500 widely held common stocks of U.S. companies. These indices are unmanaged, not available for investment and do not incur expenses

18

Please refer to the Schedule of Investments for details on Fund holdings. Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Guinness Atkinson Asset Management, Inc. for the period stated and is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Opinions, Fund holdings and sector allocations are subject to change at any time, and are not recommendations to buy or sell any security.

19

Growth of $10,000

Average Annual Total Return

Periods Ended December 31, 2017

| One Year | | Five Years | | Ten Years | |

| | 47.10 | % | | | 5.35 | % | | | 1.09 | % | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Total returns for certain periods reflect a fee waiver in effect and in the absence of this waiver, the total returns would be lower. Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares. The Fund imposes a 2% redemption fee on shares held less than 30 days.

The MSCI All Country Far East Free ex-Japan Index (MSCI AC Far East Free ex-Japan Index) is a free float-adjusted, capitalization-weighted index that is designed to measure equity market performance of the Far East region excluding Japan. The index referenced in this chart is not available for investment and does not incur expenses.

20

FUND HIGHLIGHTS at December 31, 2017

GUINNESS ATKINSON ASIA FOCUS FUND

# of Holdings in Portfolio: | | | 35 | | |

Portfolio Turnover: | | | 13.2 | % | |

% of Stocks in Top 10: | | | 37.3 | % | |

Fund Manager: | | | |

Edmund Harriss | | | | | |

Top 10 Holdings (% of net assets) | | | | | | | |

Sino Biopharmaceutical Ltd. | | | 5.2 | % | | Relo Holdings, Inc. | | | 3.6 | % | |

St Shine Optical Co., Ltd. | | | 4.1 | % | | Anhui Conch Cement Co., Ltd. - H Shares | | | 3.4 | % | |

Tencent Holdings Ltd. | | | 3.8 | % | | DBS Group Holdings Ltd. | | | 3.3 | % | |

Geely Automobile Holdings Ltd. | | | 3.8 | % | | New Oriental Education & Technology Group Inc. | | | 3.3 | % | |

Hanon Systems | | | 3.6 | % | | Samsung Electronics Co., Ltd. | | | 3.2 | % | |

Industry Breakdown (% of net assets) | | | | | | | |

Commercial Banks | | | 11.8 | % | | Tobacco | | | 3.0 | % | |

Semiconductor Componets - Integrated Circuits | | | 8.2 | % | | Distribution/Wholesale | | | 3.0 | % | |

Auto/Truck Parts & Equipment | | | 6.3 | % | | Oil Components - Integrated | | | 2.9 | % | |

Electric - Generation | | | 5.5 | % | | Entertainment Software | | | 2.9 | % | |

Pharmaceuticals | | | 5.2 | % | | MRI/Medical Diagnostics Imaging | | | 2.9 | % | |

Electronic Component Miscellaneous | | | 4.8 | % | | Public Thoroughfares | | | 2.9 | % | |

Optical Supplies | | | 4.1 | % | | Property/Casualty Insurance | | | 2.7 | % | |

Internet Application Software | | | 3.8 | % | | Photo Equipment & Supplies | | | 2.3 | % | |

Auto-Cars/Light Trucks | | | 3.8 | % | | Building & Construction Production - Miscellaneous | | | 2.2 | % | |

Real Estate Management/Service | | | 3.6 | % | | Real Estate Operations/Development | | | 1.5 | % | |

Building Products - Cement/Aggregates | | | 3.4 | % | | Computers | | | 0.8 | % | |

Schools | | | 3.3 | % | | Machinery-General Industry | | | 0.6 | % | |

Electronic Components - Semiconductor | | | 3.2 | % | | | | | | | |

Metal Processors & Fabricators | | | 3.1 | % | | | | | | | |

21

SCHEDULE OF INVESTMENTS

at December 31, 2017

GUINNESS ATKINSON ASIA FOCUS FUND

Shares | | COMMON STOCKS: 97.8% | | Value | |

Australia: 2.9% | | | |

| | 32,693 | | | Sonic Healthcare Ltd. | | $ | 582,999 | | |

China: 42.2% | | | |

| | 31,000 | | | AAC Technologies Holdings Inc. | | | 553,357 | | |

| | 144,500 | | | Anhui Conch Cement Co., Ltd. - H Shares | | | 680,695 | | |

| | 610,000 | | | China Construction Bank Corp. - H Shares | | | 562,358 | | |

| | 701,000 | | | China Lesso Group Holdings Ltd. | | | 454,776 | | |

| | 152,000 | | | China Merchants Bank Co., Ltd. - H Shares | | | 604,515 | | |

| | 533,500 | | | China Minsheng Banking Corp. Ltd. - H Shares | | | 534,059 | | |

| | 220,000 | | | Geely Automobile Holdings Ltd. | | | 765,518 | | |

| | 272,000 | | | Lenovo Group Ltd. | | | 153,146 | | |

| | 1,700 | | | NetEase Inc. - ADR | | | 586,619 | | |

| | 7,100 | | | New Oriental Education & Technology Group Inc. - ADR | | | 667,400 | | |

| | 286,000 | | | PICC Property & Casualty Co., Ltd. - H Shares | | | 550,211 | | |

| | 574,000 | | | Shenzhen Expressway Co., Ltd. - H Shares | | | 582,109 | | |

| | 595,000 | | | Sino Biopharmaceutical Ltd. | | | 1,058,450 | | |

| | 14,900 | | | Tencent Holdings Ltd. | | | 774,999 | | |

| | | | | | | | 8,528,212 | | |

Hong Kong: 3.5% | | | |

| | 380,000 | | | Chen Hsong Holdings† | | | 115,085 | | |

| | 1,083,000 | | | Li & Fung Ltd. | | | 594,957 | | |

| | | | | | | | 710,042 | | |

Japan: 3.6% | | | |

| | 26,300 | | | Relo Holdings, Inc. | | | 716,460 | | |

Singapore: 3.3% | | | |

| | 36,379 | | | DBS Group Holdings Ltd. | | | 675,023 | | |

South Korea: 12.5% | | | |

| | 56,100 | | | Hanon Systems | | | 730,152 | | |

| | 2,225 | | | Hyundai Mobis Co., Ltd. | | | 545,713 | | |

| | 5,530 | | | KT&G Corp. | | | 596,277 | | |

| | 271 | | | Samsung Electronics Co., Ltd. | | | 647,070 | | |

| | | | | | | | 2,519,212 | | |

Taiwan: 17.0% | | | |

| | 57,000 | | | Catcher Technology Co., Ltd. | | | 629,700 | | |

| | 120,000 | | | Elite Material Co., Ltd. | | | 409,466 | | |

| | 3,500 | | | Largan Precision Co., Ltd. | | | 472,983 | | |

| | 135,000 | | | Novatek Microelectronics Corp. | | | 514,856 | | |

| | 2 | | | Shin Zu Shing Co., Ltd. | | | 5 | | |

| | 25,000 | | | St Shine Optical Co., Ltd. | | | 819,804 | | |

| | 75,000 | | | Taiwan Semiconductor Manufacturing Co., Ltd. | | | 577,708 | | |

| | | | | | | | 3,424,522 | | |

The accompanying notes are an integral part of these financial statements.

22

Shares | | COMMON STOCKS: 97.8% (Continued) | | Value | |

Thailand: 10.0% | | | |

| | 86,700 | | | Electricity Generating PCL/Foreign | | $ | 571,379 | | |

| | 219,200 | | | Glow Energy PCL/Foreign | | | 546,140 | | |

| | 755,000 | | | LPN Development PCL/Foreign | | | 305,838 | | |

| | 44,400 | | | PTT PCL/Foreign | | | 596,774 | | |

| | | | | | | | 2,020,131 | | |

United States: 2.8% | | | |

| | 8,900 | | | QUALCOMM Inc. | | | 569,778 | | |

| | | | | Total Common Stocks

(cost $11,307,294) | | | 19,746,379 | | |

| | | | | Total Investments in Securities

(cost $11,307,294): 97.8% | | | 19,746,379 | | |

| | | | | Other Assets less Liabilities: 2.2% | | | 450,626 | | |

| | | | | Net Assets: 100.0% | | $ | 20,197,005 | | |

ADR - American Depository Receipt

† The Advisor has determined this security to be Illiquid. As of December 31, 2017, the total market value of the illiquid security represent 0.6% of net assets.

The accompanying notes are an integral part of these financial statements.

23

GUINNESS ATKINSON ASIA PACIFIC DIVIDEND BUILDER FUND for the period ended December 31, 2017

1. Performance

AVERAGE ANNUALIZED TOTAL RETURNS

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

Fund | | | 36.70 | % | | | 12.37 | % | | | 8.66 | % | | | 4.69 | % | |

Benchmark Indices: | |

MSCI AC Pacific Ex Japan Index | | | 37.51 | % | | | 10.55 | % | | | 7.64 | % | | | 4.73 | % | |

S&P 500 Index | | | 21.80 | % | | | 11.40 | % | | | 15.77 | % | | | 8.48 | % | |

The Fund's gross expense ratio is 3.14% and net expense ratio is 1.11% per the Summary Prospectus dated May 3, 2017. For the Fund's current one year expense ratios, please refer to the Financial Highlights section of this report. The Advisor has contractually agreed to reduce its fees and/or pay Fund expenses in order to limit the Fund's total annual operating expenses to average daily net assets to 1.10% (excluding Acquired Fund Fees and Expenses, interest, taxes, dividends on short positions and extraordinary expenses) through June 30, 2018. To the extent that the Advisor absorbs expenses, it may seek repayment of a portion or all of such amounts at any time within the three fiscal years after the fiscal year in which such amounts were absorbed, subject to the applicable cap.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

The Fund imposes a 2% redemption fee on the sale of shares held less than 30 days. Performance data quoted does not reflect this redemption fee. Total returns for certain periods reflect expense limitations in effect and, in the absence of these imitations, total returns would have been lower.

2017 has been a strong year for Asian equities, with the market up 37.51% (as measured by the MSCI AC Pacific ex Japan Index in USD terms). The Fund has performed well, rising 36.70% and capturing 96% of the market rise. This was better than we might have expected because the nature of this Fund, with its focus on higher-quality dividend-paying stocks giving it a lower sensitivity (or Beta) to overall market movements.

The best-performing sectors in 2017, as measured by the sector indices within the MSCI AC Pacific ex Japan Index in USD terms, were Technology (up 64%), Health Care (up 52%), Consumer Discretionary (up 41%), and Real Estate (up 40%). The best countries were China (up 54%) and South Korea (up 46%). The overall story was accelerating profits and growth driven by stronger-than-expected economic growth in China, a resurgence in Chinese domestic consumption and a significant upswing in Technology names related to consumer electronics, especially smartphones. We also note that Asian currencies strengthened 6% against the U.S. dollar (on a weighted average basis). The largest moves were the Korean won (up 13%), followed by the Malaysian ringgit and Thai baht (each up 10%), and the Singapore dollar and New Taiwan dollar (each up 8%). However, perhaps the most important signal of improvement came from the Chinese yuan, which reversed the weakness of 2016 and rose 6.7%.

Chinese stocks, as measured by the MSCI China Index, have had their best year since 2009, marking a decisive reversal of the gloomy sentiment that has dominated for so many years. The stock market recovery is as much about what did not happen as what did. The 'near certain' banking sector crisis did not happen. We have long argued that debt servicing capacity, rather than the ratio of debt to Gross Domestic Product (GDP), is the most important metric when assessing the burden of debt and gauging financial stability. The recovery in heavy industrial profits and cash flows by 9% in 2016 and by a further 16% for the first 11 months of 2017 has improved matters considerably. According to our analysis of 3,000 listed companies in China, the share of debt at risk (where operating profit does not cover their annual interest expense) has almost halved from 2015, from 30% to 17%. Government efforts to slow debt accumulation appear to be having an effect, according to the International Institute of Finance, with the stock of debt to GDP rising only 2% in 2017, compared to an average rise of 17% per annum from 2010 to 2016.

Technology has also been a big part of the investment story this year. In Asia, Technology features both in application and in production. These areas show the region at its most innovative. In the region's burgeoning consumer markets, the race is on for businesses to adapt to changing business methods, to adopt new technologies and to respond rapidly to developing consumer spending patterns. Online retail, e-commerce platforms and e-payments have taken off, which has caused the stock prices of the

24

ASIA PACIFIC DIVIDEND BUILDER FUND

Chinese internet names especially, to surge. On the production side, the launch of the new iPhone has brought with it significant advances in production technology from phone casings, to camera lenses, through to facial recognition and screens. The resultant increased performance requirements of handheld devices and the growth in Internet of Things has fed through to an upswing in demand for memory chips. There has been an increase in component prices, lifting profit forecasts throughout the supply chain.

South-East Asia (Indonesia, Malaysia, Philippines, Singapore and Thailand) has been out of favour for the past three years compared to North Asia, with only Thailand looking attractive, in our view. However, there are signs that Singapore's prospects are looking brighter. In 2017, full year economic growth came at the top end of the official forecast range at 3.5%. The main drivers have been a strong rebound in services and stronger external demand pushing up exports growth across all major categories, but especially in Pharmaceuticals/Biotech. There are expectations that improved productivity will support rising wages and hence lift domestic activity. The Monetary Authority of Singapore has been quick in the past to anticipate such turns and interest rate increases are possible. Mortgage rates have moved higher in anticipation.

If it was exceptionally low market valuations that drove the recovery in Asian markets in 2016, it was profit growth that drove them in 2017. In aggregate, Asian markets saw profits reported in the 12-month period to 31 December 2017 rise 21% over the same period in 2016; and if commodity-heavy Australia is added to the mix, they were up over 30% in US dollar terms. Korea and Taiwan led the group, rising 43% and 19% respectively, while elsewhere (China, Thailand, Singapore) reported profits grew over 13%. Earnings for calendar year 2017 are not yet in and companies will be reporting in February through to April 2018. Forecasts for these have risen through the year and this too has propelled stock prices higher.

2. Activity

We made only one change to the portfolio following the acquisition of Belle International by a private equity firm in August. In its place we purchased Elite Material in Taiwan, a company that produces printed circuit boards used in smartphones, servers and the automotive sector. It is the largest producer of halogen-free laminates in the world which are increasingly being adopted due to their environmentally-friendly nature. We think that spending on servers is likely to continue growing at a rapid pace as cloud storage continues to boom. Additionally, consumers are becoming more data hungry, whether it is through using their mobile phone to watch high quality videos or through streaming on their PCs. As the 5G buildout is likely to begin soon, these trends will only accelerate, placing greater demand on data and therefore the servers behind them.

3. Portfolio Position

Compared to the MSCI AC Pacific ex Japan Index, the Fund is overweight by 10% in Consumer Discretionary, 7% in Real Estate, and 3% in Health Care. It is underweight by 6% in Materials, 4% in Industrials, 2% in Financials, and 1% in Information Technology. The Fund has no exposure to Telecoms and Utilities. On a country basis, it is underweight in Australia by 11%, in China by 7%, in Korea by 10%, and is overweight in Singapore by 5%, in Taiwan by 10%, and in Thailand by 8%. The Fund also holds two positions in US listed stocks, Aflac and Qualcomm, each of which derives over 50% of revenues from the region.

4. Outlook

Asian markets had a strong year in 2017, pushing valuations above their 10-year averages. In contrast to much of the past 10 years, however, corporate earnings have risen over the past year, giving us greater confidence in the more bullish analyst forecasts for 2018 and 2019. Market confidence has also been lifted by China's economic growth momentum and by the crisis that did not happen. The focus for the last five years has been on rising Chinese debt levels and the potential instability caused by efforts to tackle it. This year we have seen intensifying efforts to regulate banks' behaviour and this has carried on into the new year.

At the time of writing the positive outlook hinges on continued acceleration in external demand, hope for a recovery in global capital expenditure and for Asian domestic demand to be lifted on the back of this. The risks to the outlook revolve around central bank policies in the US and Europe as they seek to wind down or reverse the years of quantitative easing, stretched valuations in developed markets and as ever, the possibility that China's economic outlook deteriorates.

Edmund Harriss

The Fund invests in foreign securities, which will involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for emerging markets. The Fund is non-diversified, meaning its assets may be invested in fewer individual holdings than diversified funds. Therefore, the Fund is more exposed to

25

ASIA PACIFIC DIVIDEND BUILDER FUND

individual stock volatility than diversified funds. The Fund invests in smaller companies, which involves additional risks such as limited liquidity and greater volatility.

The MSCI AC Pacific Ex-Japan Index is a market capitalization weighted index that monitors the performance of stocks from the Pacific region, excluding Japan. The Standard & Poor's 500 Index is a market capitalization-weighted index composed of 500 widely held common stocks of U.S. companies. These indices are unmanaged and not available for investment, and do not incur expenses.

Please refer to the Schedule of Investments for details on Fund holdings. Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Guinness Atkinson Asset Management, Inc. for the period stated and it is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Opinions, Fund holdings and sector allocations are subject to change at any time, and are not recommendations to buy or sell any security.

26

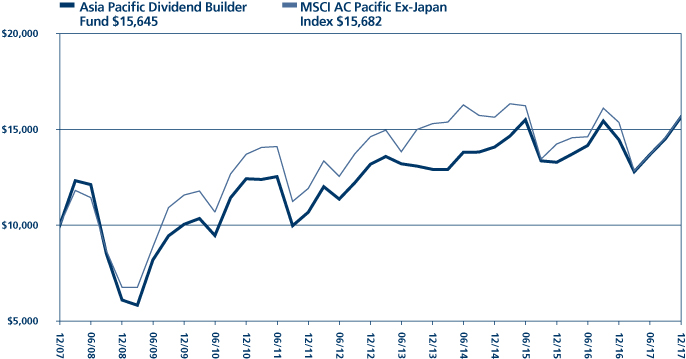

ASIA PACIFIC DIVIDEND BUILDER FUND

Growth of $10,000

Average Annual Total Return

Periods Ended December 31, 2017

| One Year | | Five Years | | Ten Years | |

| | 36.70 | % | | | 8.66 | % | | | 4.69 | % | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Total returns reflect a fee waiver in effect and in the absence of this waiver, the total returns would be lower. Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares. The Fund imposes a 2% redemption fee on shares held less than 30 days.

The MSCI All Country Pacific Free ex-Japan Index (MSCI AC Pacific ex-Japan Index) is a free float-adjusted, capitalization-weighted index that is designed to measure equity market performance in the Pacific region including Japan.

27

FUND HIGHLIGHTS at December 31, 2017

GUINNESS ATKINSON ASIA PACIFIC DIVIDEND BUILDER FUND

# of Holdings in Portfolio: | | | 36 | | |

Portfolio Turnover: | | | 47.3 | % | |

% of Stocks in Top 10: | | | 30.2 | % | |

Fund Manager: | |

Edmund Harriss | | | |

Top 10 Holdings (% of net assets) | |

St Shine Optical Co., Ltd. | | | 3.5 | % | | LPN Development PCL/Foreign | | | 2.9 | % | |

Li & Fung Ltd. | | | 3.3 | % | | DBS Group Holdings Ltd. | | | 2.9 | % | |

Hanon Systems | | | 3.1 | % | | QUALCOMM Inc. | | | 2.9 | % | |

JB Hi-Fi Ltd. | | | 3.0 | % | | Sonic Healthcare Ltd. | | | 2.9 | % | |

Luk Fook Holdings International Ltd. | | | 2.9 | % | | CapitaMall Trust - REIT | | | 2.8 | % | |

Industry Breakdown (% of net assets) | |

Commercial Banks | | | 16.4 | % | | Life/Health Insurance | | | 2.8 | % | |

Electronic Component - Miscellaneous | | | 9.9 | % | | Metal Processors & Fabricators | | | 2.8 | % | |

Semiconductor Components - Integrated Circuits | | | 7.8 | % | | REITS - Diversified | | | 2.7 | % | |

REITS - Shopping Centers | | | 5.5 | % | | Computers | | | 2.7 | % | |

Optical Supplies | | | 3.5 | % | | Investment Management/Advisor Service | | | 2.7 | % | |

Distribution/Wholesale | | | 3.3 | % | | Real Estate Management/Service | | | 2.7 | % | |

Auto/Truck Parts & Equipment | | | 3.1 | % | | Textile - Products | | | 2.7 | % | |

Retail - Consumer Electronics | | | 3.0 | % | | Retail-Apparel/Shoe | | | 2.7 | % | |

Retail - Jewelry | | | 2.9 | % | | Diversified Financial Services | | | 2.6 | % | |

Real Estate Operations/Development | | | 2.9 | % | | Shipbuilding | | | 2.5 | % | |

MRI/Medical Diagnostics Imaging | | | 2.9 | % | | Cellular Telecommunications | | | 2.5 | % | |

Tobacco | | | 2.8 | % | | Photo Equipment & Supplies | | | 2.5 | % | |

Oil Company - Integrated | | | 2.8 | % | | | | | |

28

SCHEDULE OF INVESTMENTS

at December 31, 2017

GUINNESS ATKINSON ASIA PACIFIC DIVIDEND BUILDER FUND

Shares | | COMMON STOCKS: 98.7% | | Value | |

Australia: 8.5% | | | |

| | 5,336 | | | Janus Henderson Group PLC | | $ | 205,732 | | |

| | 11,537 | | | JB Hi-Fi Ltd. | | | 224,208 | | |

| | 12,184 | | | Sonic Healthcare Ltd. | | | 217,272 | | |

| | | | | | | | 647,212 | | |

China: 20.9% | | | |

| | 10,000 | | | AAC Technologies Holdings Inc. | | | 178,502 | | |

| | 231,000 | | | China Construction Bank Corp. - H Shares | | | 212,959 | | |

| | 250,000 | | | China Lilang Ltd. | | | 201,604 | | |

| | 51,000 | | | China Merchants Bank Co., Ltd. - H Shares | | | 202,831 | | |

| | 199,400 | | | China Minsheng Banking Corp. Ltd. - H Shares | | | 199,609 | | |

| | 19,000 | | | China Mobile Ltd. | | | 193,310 | | |

| | 246,000 | | | Industrial & Commercial Bank of China Ltd. - H Shares | | | 197,854 | | |

| | 176,300 | | | Yangzijiang Shipbuilding Holdings Ltd. | | | 193,830 | | |

| | | | | | | | 1,580,499 | | |

Hong Kong: 14.3% | | | |

| | 42,000 | | | BOC Hong Kong Holdings Ltd. | | | 212,906 | | |

| | 449,000 | | | Li & Fung Ltd. | | | 246,663 | | |

| | 21,500 | | | Link REIT/The | | | 199,037 | | |

| | 51,000 | | | Luk Fook Holdings International Ltd. | | | 218,998 | | |

| | 192,000 | | | Pacific Textiles Holdings Ltd. | | | 203,029 | | |

| | | | | | | | 1,080,633 | | |

Japan: 2.7% | | | |

| | 7,500 | | | Relo Holdings Inc. | | | 204,314 | | |

Singapore: 8.5% | | | |

| | 102,500 | | | Ascendas Real Estate Investment Trust - REIT | | | 208,605 | | |

| | 134,400 | | | CapitaMall Trust - REIT | | | 214,144 | | |

| | 11,764 | | | DBS Group Holdings Ltd. | | | 218,284 | | |

| | | | | | | | 641,033 | | |

South Korea: 5.9% | | | |

| | 18,100 | | | Hanon Systems | | | 235,575 | | |

| | 1,980 | | | KT&G Corp. | | | 213,495 | | |

| | | | | | | | 449,070 | | |

Taiwan: 21.6% | | | |

| | 22,000 | | | Asustek Computer Inc. | | | 206,518 | | |

| | 19,000 | | | Catcher Technology Co., Ltd. | | | 209,900 | | |

| | 61,000 | | | Elite Material Co., Ltd. | | | 208,145 | | |

| | 57,147 | | | Hon Hai Precision Industry Co., Ltd. | | | 182,878 | | |

| | 1,400 | | | Largan Precision Co., Ltd. | | | 189,193 | | |

| | 48,000 | | | Novatek Microelectronics Corp. | | | 183,060 | | |

| | 8,000 | | | St Shine Optical Co., Ltd. | | | 262,337 | | |

| | 25,000 | | | Taiwan Semiconductor Manufacturing Co., Ltd. | | | 192,569 | | |

| | | | | | | | 1,634,600 | | |

The accompanying notes are an integral part of these financial statements.

29

Shares | | COMMON STOCKS: 98.7% (Continued) | | Value | |

Thailand: 10.7% | | | |

| | 79,800 | | | Delta Electronics Thailand PCL/Foreign | | $ | 179,227 | | |

| | 538,900 | | | LPN Development PCL/Foreign | | | 218,300 | | |

| | 15,800 | | | PTT PCL/Foreign | | | 212,365 | | |

| | 73,800 | | | Tisco Financial Group PCL/Foreign | | | 199,374 | | |

| | | | | | | | 809,266 | | |

United States: 5.6% | | | |

| | 2,400 | | | Aflac Inc. | | | 210,672 | | |

| | 3,400 | | | QUALCOMM Inc. | | | 217,668 | | |

| | | | | | | | 428,340 | | |

| | | | | Total Common Stocks

(cost $5,929,660) | | | 7,474,967 | | |

| | | | | Total Investments in Securities

(cost $5,929,660): 98.7% | | | 7,474,967 | | |

| | | | | Other Assets less Liabilities: 1.3% | | | 102,326 | | |

| | | | | Net Assets: 100.0% | | $ | 7,577,293 | | |

REIT - Real Estate Investment Trust

The accompanying notes are an integral part of these financial statements.

30

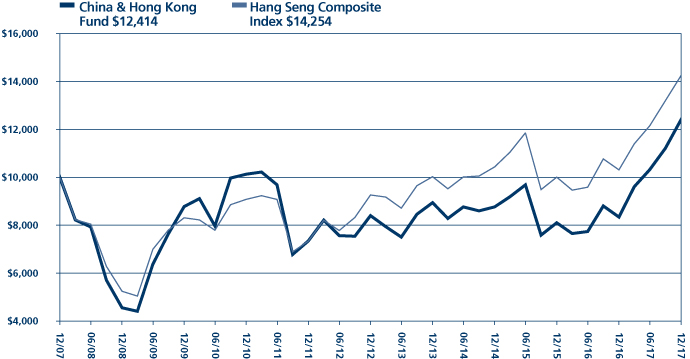

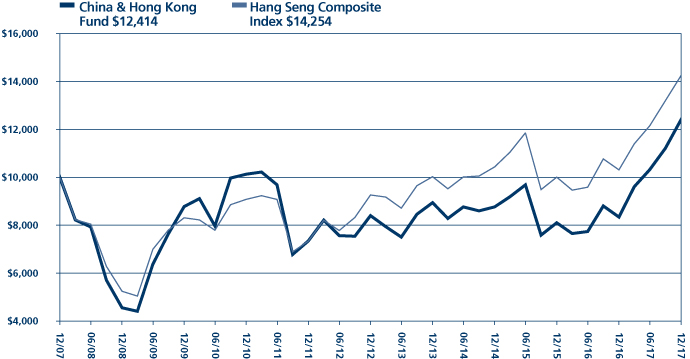

GUINNESS ATKINSON CHINA & HONG KONG FUND for the period ended December 31, 2017

1. Performance

AVERAGE ANNUALIZED TOTAL RETURNS

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

Fund | | | 48.85 | % | | | 12.30 | % | | | 8.13 | % | | | 2.18 | % | |

Benchmark Indices: | |

Hang Seng Composite Index | | | 41.91 | % | | | 11.66 | % | | | 9.39 | % | | | 3.82 | % | |

S&P 500 Index | | | 21.80 | % | | | 11.40 | % | | | 15.77 | % | | | 8.48 | % | |

The Fund's expense ratio is 1.67% per the Summary Prospectus dated May 3, 2017. For the Fund's current one year expense ratio, please refer to the Financial Highlights section of this report.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

The Fund imposes a 2% redemption fee on the sale of shares held less than 30 days. Performance data quoted does not reflect this redemption fee. Total returns for certain periods reflect fee limitations in effect and, in the absence of these limitations, total returns would have been lower.

In 2017, the Fund rose 48.85% compared to the Hang Seng Composite Index, which rose 41.91%.