UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08360 |

|

GUINNESS ATKINSON FUNDS |

(Exact name of registrant as specified in charter) |

|

21550 Oxnard Street, Suite 850 Woodland Hills, CA | | 91367 |

(Address of principal executive offices) | | (Zip code) |

|

James J. Atkinson, Jr. 21550 Oxnard Street, Suite 850 Woodland Hills, CA 91367 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800-915-6566) | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | December 31, 2016 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

2

Guinness AtkinsonTM Funds

Annual Report

December 31, 2016

TABLE OF CONTENTS

| | 5 | | | Letter to Shareholders | |

| | 7 | | | Expense Examples | |

| | 8 | | | Alternative Energy Fund | |

| | 15 | | | Asia Focus Fund | |

| | 22 | | | Asia Pacific Dividend Builder Fund | |

| | 29 | | | China & Hong Kong Fund | |

| | 36 | | | Dividend Builder Fund | |

| | 44 | | | Global Energy Fund | |

| | 54 | | | Global Innovators Fund | |

| | 64 | | | Renminbi Yuan & Bond Fund | |

| | 70 | | | Statements of Assets and Liabilities | |

| | 72 | | | Statements of Operations | |

| | 74 | | | Statements of Changes in Net Assets | |

| | 79 | | | Financial Highlights | |

| | 88 | | | Notes to Financial Statements | |

| | 103 | | | Report of Independent Registered Public Accounting Firm | |

| | 104 | | | Trustee and Officer Information | |

| | 107 | | | Privacy Notice | |

| | 111 | | | Guinness Atkinson Funds Information | |

3

The table below provides total return data for each of the Funds over the one, three, five, ten-years and since inception periods through December 31, 2016. Also included in the table is the expense ratio data from the most recent prospectus dated May 1, 2016 (or as updated August 22, 2016).

Fund (inception date) | | 1-year | | 3-year | | 5-year | | 10-year | | Since Inception | | Expense Ratio | |

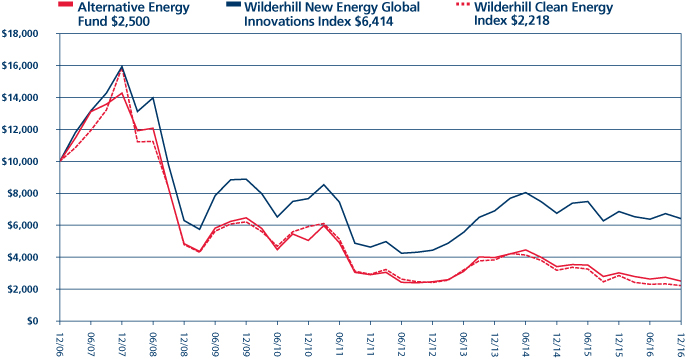

Alternative Energy Fund (March 31, 2006) | | | -17.16 | % | | | -14.32 | % | | | -2.93 | % | | | -12.95 | % | | | -12.80 | % | | | 2.31 | % gross; 1.98% net† | |

Asia Focus Fund (April 29, 1996) | | | 9.20 | % | | | -0.53 | % | | | 0.44 | % | | | 1.02 | % | | | 2.13 | % | | | 2.00 | %† | |

Asia Pacific Dividend Builder Fund

(March 31, 2006) | | | 8.81 | % | | | 4.21 | % | | | 6.48 | % | | | 3.87 | % | | | 4.57 | % | | | 3.87 | % gross; 1.10% net† | |

China & Hong Kong Fund (June 30, 1994) | | | 2.95 | % | | | -2.29 | % | | | 2.58 | % | | | 3.25 | % | | | 6.30 | % | | | 1.56 | %† | |

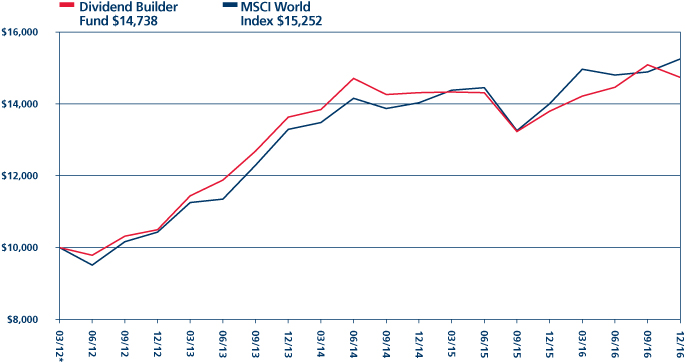

Dividend Builder Fund (March 30, 2012) | | | 6.83 | % | | | 2.63 | % | | | — | | | | — | | | | 8.48 | % | | | 1.77 | % Gross; 0.68% net† | |

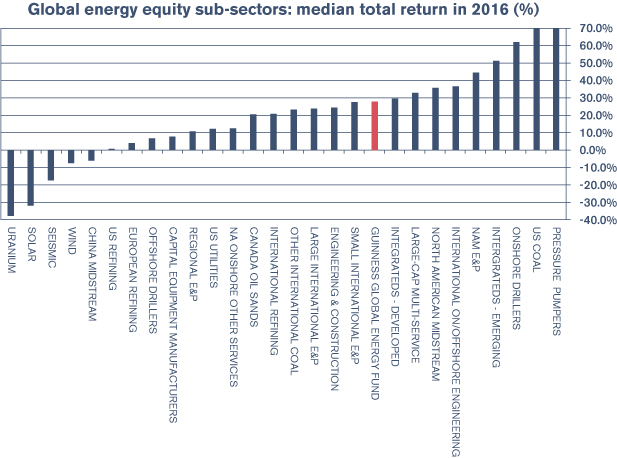

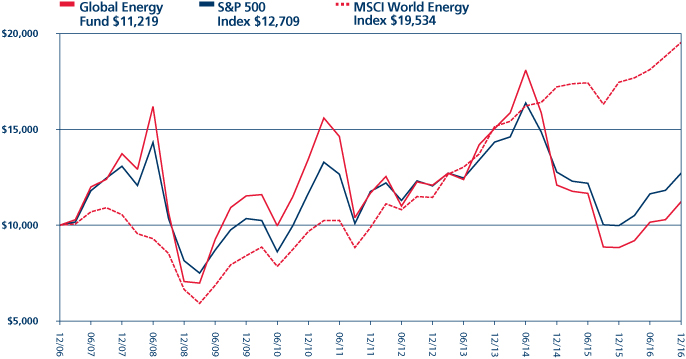

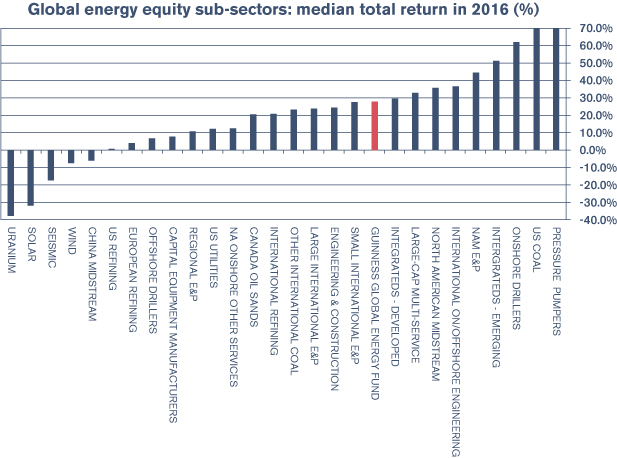

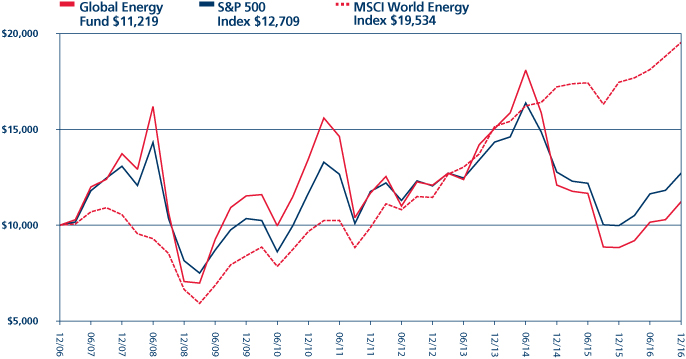

Global Energy Fund (June 30, 2004) | | | 27.04 | % | | | -9.32 | % | | | -0.79 | % | | | 1.16 | % | | | 7.48 | % | | | 1.41 | %† | |

Global Innovators Fund Investor Class

(December 15, 1998) | | | 9.51 | % | | | 6.12 | % | | | 15.80 | % | | | 8.14 | % | | | 6.93 | % | | | 1.27 | % gross; 1.24% net† | |

Global Innovators Fund Institutional Class

(December 31, 2015) | | | 9.81 | % | | | 6.22 | % | | | 15.86 | % | | | 8.17 | % | | | 6.95 | % | | | 1.07 | % gross; 0.99% net† | |

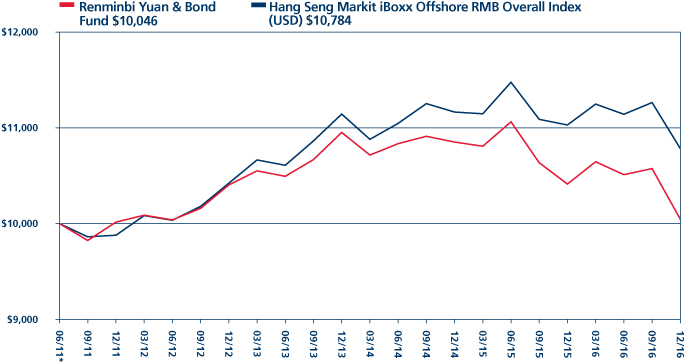

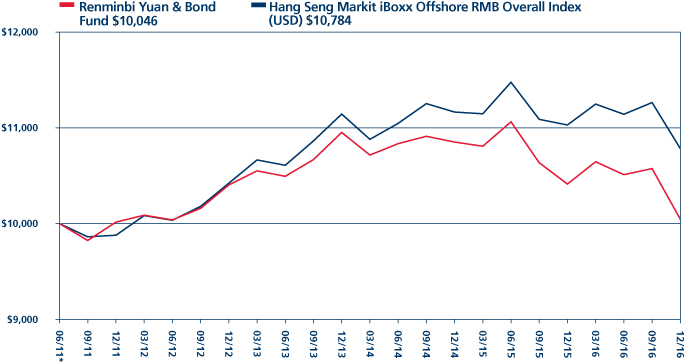

Renminbi Yuan & Bond Fund (June 30, 2011) | | | -3.52 | % | | | -2.84 | % | | | 0.06 | % | | | — | | | | 0.08 | % | | | 1.05 | % gross; 0.93% net† | |

Periods of greater than one year are average annualized returns; one year and shorter period returns are actual returns. All returns are for the periods ended December 31, 2016.

Performance data shown for the Global Innovators, Institutional Class (GINNX), prior to its inception date on December 31, 2015, uses performance data from the Global Innovators, Investor Class (IWIRX).

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Each of the Asia Focus Fund, the Asia Pacific Dividend Builder Fund, the China & Hong Kong Fund, and the Renminbi Yuan & Bond Fund imposes 2% redemption fee on shares held less than 30 days. Performance data quoted does not reflect this fee. If it had, total return would be lower.

Expense ratios are from the most recent prospectus (dated May 1, 2016 or amended as of August 22, 2016) and are from the most recent audited financials (period ended December 31, 2015) at the time that prospectus was completed.

†All of the Guinness Atkinson Funds, except the Global Innovators Fund, have an expense cap in place and the advisor is contractually obligated to cap the Funds' total expenses at least through June 30, 2017. The Global Innovators Fund has an expense cap in place and the advisor is contractually obligated to cap the Fund's total expenses at least through June 30, 2018.

4

Dear Guinness Atkinson Funds Shareholders,

Well, wasn't that interesting. We're referring to 2016, which was, in a word, interesting. You may have another, more judgmental word in mind; understood. The beginning of any year is a time for predictions. A year ago, all of the predictions we encountered didn't even come close to forecasting the many surprising things that happened in 2016. For starters, if you'll recall, 2016 began in a very bearish manner with predictions of a further collapse of the price of oil and the collapse of China and the yuan, a disaster in the stock markets and US and global economies, sharply rising interest rates and generally a bad year. In the end all of the things we were worrying about didn't come to pass. The markets, in fact, had a generally good year. Interest rates only rose fractionally, and the US and global economies generally improved nicely. The disaster prognosticators largely failed to predict the wave of populism sweeping the planet. Even if they had, the markets – at least the US markets – seem to be taking this populism craze in stride. The equity markets may be up because of, rather than in spite of, global political developments. At least for now.

For the Guinness Atkinson Funds, 2016 was a pretty good year, with six of our eight Funds producing positive results. The performance table on the facing page tells the story. Highlights for the year include the Global Energy Fund, which produced a total return of 27.04%. Not bad considering predictions of a continued collapse in the price of oil. The Global Innovators Fund added to its rather impressive long-term track record with a total return for the year of 9.51% for the Investor Class (9.81% for the Institutional Class). Our two Asian equity Funds, the Asia Pacific Dividend Builder Fund and the Asia Focus Fund, both had good years, with total returns for the year of 8.81% and 9.20%, respectively.

As mentioned, two of the Guinness Atkinson Funds had negative years. The Alternative Energy Fund turned in a total return of -17.16% while the Renminbi Yuan & Bond Fund produced a return of -3.52%. Notwithstanding the lackluster return for the Alternative Energy Fund, we are optimistic about this sector and this Fund. Much has been made of the political environment around alternative energy, but our view on alternative energy is apolitical: sustainable energy technologies have declined in price such that they are increasingly competitive with traditional energy, without subsidies. Going forward, we think, the success of alternative energy will be a function of free market economics and not government support. This isn't to say that government policy won't matter but rather that in the end, the economics will lead to the adoption of sustainable energy.

One other Fund we'd like to mention is our Dividend Builder Fund. This Fund has continued to quietly motor ahead. The 2016 total return for this Fund was 6.83% and from inception the Fund has an annualized 8.48% return. This Fund will reach its fifth anniversary at the end of March.

Morningstar Ratings Through December 31, 2016

Fund | | Category | | Overall | | 3-Year | | 5-Year | | 10-Year | |

Alternative Energy | | Energy Equity | | 2** | | 2** | | 2** | | 1* | |

| | | | | (102 funds) | | (102 funds) | | (84 funds) | | (65 funds) | |

Asia Focus | | Pacific/Asia | | 1* | | 2** | | 1* | | 1* | |

| | | ex-Japan | | (67 funds) | | (67 funds) | | (56 funds) | | (20 funds) | |

Asia Pacific Dividend | | Pacific/Asia | | 4**** | | 5***** | | 5***** | | 2** | |

Builder | | ex-Japan | | (67 funds) | | (67 funds) | | (56 funds) | | (20 funds) | |

China & Hong Kong | | China Region | | 2** | | 2** | | 2** | | 2** | |

| | | | | (93 funds) | | (93 funds) | | (78 funds) | | (38 funds) | |

Global Energy | | Energy Equity | | 3*** | | 3*** | | 3*** | | 3*** | |

| | | | | (102 funds) | | (102 funds) | | (84 funds) | | (65 funds) | |

Global Innovators | | World Stock | | 5***** | | 5***** | | 5***** | | 5***** | |

| | | | | (848 funds) | | (848 funds) | | (669 funds) | | (372 funds) | |

Renminbi Yuan & Bond | | Emerging Markets | | 5***** | | 4**** | | 5***** | | | |

| | | Local Currency Bond | | (77 funds) | | (77 funds) | | (60 funds) | | | |

Dividend Builder | | World Stock | | 3*** | | 3*** | | | | | |

| | | | | (848 funds) | | (848 funds) | | | | | |

5

Our investment team has provided a detailed commentary for each of the Guinness Atkinson Funds adjacent to each Fund's financial results.

As usual, we appreciate the confidence you have placed in us and our management team and look forward to what will hopefully be a great 2017.

We encourage you to visit gafunds.com for the latest news and announcements on the Guinness Atkinson Funds.

Sincerely,

| |

| |

Timothy Guinness | | James Atkinson | |

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in foreign securities, which involves greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for emerging markets countries. Non-diversified Funds' assets may be concentrated in fewer individual holdings than diversified funds. Therefore, these Funds are more exposed to individual stock volatility than diversified funds. Investments in smaller companies involve additional risks such as limited liquidity and greater volatility. Investments in debt securities typically decrease in value when interest rates rise, which can be greater for longer-term debt securities. Investments in derivatives involve risks different from, and in certain cases, greater than the risks presented by traditional investments. Investments focused in a single geographic region may be exposed to greater risk than investments diversified among various geographies. Investments focused on the energy sector may be exposed to greater risk than an investments diversified among various sectors.

The views in this letter were as of December 31, 2016 and may not necessarily reflect the same views on the date this letter is first published or any time thereafter. These views are intended to help shareholders in understanding the fund's investment methodology and do not constitute investment advice.

Morningstar Ratings Disclosure

Global Innovators Fund ratings shown were given for the Investor Share Class.

Past performance is not a guarantee of future results. For each fund with at least a three-year history, Morningstar calculates a Morningstar RatingTM based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund's monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. The Overall Morningstar Rating is derived from a weighted average of the Fund's three-, five- and ten-year risk adjusted return measure, if applicable. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in distribution percentages.)

©2017 Morningstar, Inc. All Rights Reserved. The information contained herein (1) is proprietary to Morningstar (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

6

Expense Examples (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) redemption fees (applicable to the Asia Focus Fund, the Asia Pacific Dividend Builder Fund, the China & Hong Kong Fund, and the Renminbi Yuan & Bond Fund); and (2) ongoing costs, including advisory fees and other Fund expenses. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period shown and held for the entire period from July 1, 2016 to December 31, 2016.

Actual Expenses

For each Fund, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid during Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each Fund, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any redemption fees. Therefore, the second line for each Fund of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these redemption fees were included, your costs would have been higher.

| | | Beginning

Account

Value

(07/01/16) | | Ending

Account

Value

(12/31/16) | | Expenses Paid

During Period*

(07/01/16 to

12/31/16) | | Expense Ratios

During Period*

(07/01/16 to

12/31/16) | |

Guinness Atkinson Alternative Energy Fund Actual | | $ | 1,000.00 | | | $ | 950.80 | | | $ | 9.71 | | | | 1.98 | %† | |

Guinness Atkinson Alternative Energy Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.18 | | | $ | 10.03 | | | | 1.98 | %† | |

Guinness Atkinson Asia Focus Fund Actual | | $ | 1,000.00 | | | $ | 1,043.40 | | | $ | 10.22 | | | | 1.98 | %† | |

Guinness Atkinson Asia Focus Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.13 | | | $ | 10.08 | | | | 1.98 | %† | |

Guinness Atkinson Asia Pacific Dividend Builder Fund Actual | | $ | 1,000.00 | | | $ | 1,020.80 | | | $ | 5.59 | | | | 1.10 | %† | |

Guinness Atkinson Asia Pacific Dividend Builder Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.61 | | | $ | 5.58 | | | | 1.10 | %† | |

Guinness Atkinson China & Hong Kong Fund Actual | | $ | 1,000.00 | | | $ | 1,078.20 | | | $ | 8.62 | | | | 1.65 | % | |

Guinness Atkinson China & Hong Kong Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,016.84 | | | $ | 8.36 | | | | 1.65 | % | |

Guinness Atkinson Dividend Builder Fund Actual | | $ | 1,000.00 | | | $ | 1,019.00 | | | $ | 3.50 | | | | 0.69 | %† | |

Guinness Atkinson Dividend Builder Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.67 | | | $ | 3.51 | | | | 0.69 | %† | |

Guinness Atkinson Global Energy Fund Actual | | $ | 1,000.00 | | | $ | 1,104.70 | | | $ | 7.67 | | | | 1.45 | %† | |

Guinness Atkinson Global Energy Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.85 | | | $ | 7.35 | | | | 1.45 | %† | |

Guinness Atkinson Global Innovators Fund – Investor Class Actual | | $ | 1,000.00 | | | $ | 1,121.50 | | | $ | 6.61 | | | | 1.24 | %† | |

Guinness Atkinson Global Innovators Fund – Investor Class Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.90 | | | $ | 6.29 | | | | 1.24 | %† | |

Guinness Atkinson Global Innovators Fund – Institutional Class Actual | | $ | 1,000.00 | | | $ | 1,123.10 | | | $ | 5.28 | | | | 0.99 | %† | |

Guinness Atkinson Global Innovators Fund – Institutional Class Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.16 | | | $ | 5.03 | | | | 0.99 | %† | |

Guinness Atkinson Renminbi Yuan & Bond Fund Actual | | $ | 1,000.00 | | | $ | 955.80 | | | $ | 4.42 | | | | 0.90 | %† | |

Guinness Atkinson Renminbi Yuan & Bond Fund Hypothetical

(5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.61 | | | $ | 4.57 | | | | 0.90 | %† | |

*Expenses are equal to the Funds' annualized expense ratio as indicated, multiplied by the average account value over the period, multiplied by the number of days in most recent fiscal half-year period (184), then divided by the number of days in the fiscal year (366) (to reflect the one-half year period).

† Net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Fund's actual expenses would have been higher.

7

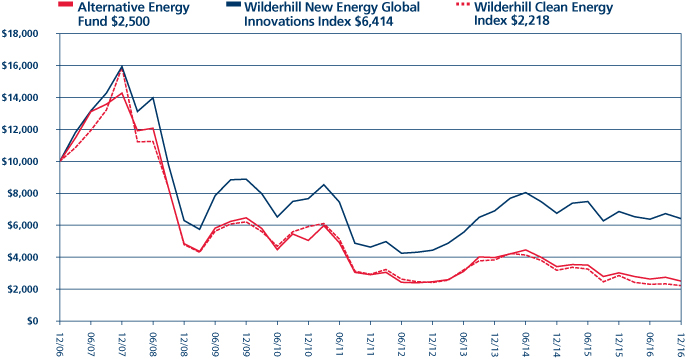

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND for the period ended December 31, 2016

1. Performance

AVERAGE ANNUAL TOTAL RETURNS

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

Fund | | | -17.16 | % | | | -14.32 | % | | | -2.93 | % | | | -12.95 | % | |

Benchmark Indices: | |

Wilderhill Clean Energy Index | | | -22.12 | % | | | -16.60 | % | | | -5.34 | % | | | -13.95 | % | |

Wilderhill New Energy Global Innovations Index | | | -6.43 | % | | | -2.41 | % | | | 6.75 | % | | | -4.21 | % | |

The Fund's gross expense ratio is 2.31% and net expense ratio is 1.98% per the Summary Prospectus dated May 3, 2016. For the Fund's current one year expense ratios, please refer to the Financial Highlights section of this report. The Advisor has contractually agreed to waive a portion of its advisory fees and/or reimburse other Fund expenses so that the Fund's ratio of expenses to average daily net assets will not exceed 1.98% (excluding Acquired Fund Fees and Expenses, interest, taxes, dividends on short positions and extraordinary expenses) through at least June 30, 2017. To the extent that the Advisor waives fees and/or reimburses expenses, it may seek repayment of a portion or all of such amounts at any time within the three fiscal years after the fiscal year in which such amounts were waived and/or reimbursed, subject to the applicable cap.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

Total returns for certain periods reflect fee limitations in effect and, in the absence of these limitations, total returns would have been lower.

The Fund ended the year down 17.16%, ahead of the benchmark which was down 22.12%. Overall the weak performance of the Fund on an absolute basis came mainly from the solar sector. Much of the Fund's outperformance versus the benchmark came during the second and third quarters as our biofuel and wind holdings rallied due to the recovery of our Chinese holdings from the downturn in January and February. In the third quarter, emerging market equities received a boost due to commodity prices and currencies recovering, driving up our Brazilian holdings and some of our Chinese holdings. In the fourth quarter, the Fund gave up some of its lead over the index as concerns around oversupply in the solar sector continued and the election of Donald Trump dampened sentiment across the alternative energy space.

Compared to the benchmark, the Fund was overweight wind and hydro, both of which worked in the Fund's favour. However, the Fund was underweight efficiency, which harmed performance and underweight solar which helped the Fund's relative performance. On an absolute level, it was almost exclusively the Fund's solar exposure that was responsible for the negative returns, with Boer Power a notable poor performer in the efficiency sector. All other sectors produced low but positive returns.

The solar sector has been beset by concerns around oversupply across the value chain, with some analysts believing that demand will not catch up with supply. We believe that the oversupply situation will be a short-to-mid-term problem, as solar installations outstripped expectations once again in 2016. The energy efficiency sector showed gains as energy savings remained important in the construction sector, investment in grid infrastructure to deal with higher intermittent energy sources increased and electric vehicles uptake increased yet another time.

Our best performing stock in the portfolio was Cosan, a Brazilian biofuel refiner and gas distributor, which benefited from the recovery of the Brazilian stock market. Our other Brazilian holding, Cemig, also performed well and has made some progress in securing the extension of its government concessions. Ormat Technologies, an Israeli-US geothermal equipment producer and project developer, and Boralex, a Canadian wind farm developer, also performed very well. Tianneng Power, the Chinese electric bicycle battery manufacturer, was our fifth best performing stock. The weakest stocks in the portfolio were solar holdings – Sunpower, Canadian Solar, SolarEdge and First Solar and Boer Power.

8

2. Activity

We made several changers to the portfolio in 2016, mainly in the first half of the year. In the first quarter, we sold our entire position in Verbund, an Austrian hydro utility, due to declining wholesale power prices in Europe. We initiated a new position in Boer Power, an energy management systems provider in China to increase our energy efficiency holdings.

In the second quarter, we sold our positions in Greentech and Futuren, one Danish and one French project developer, amid liquidity concerns and underperformance. We also sold our full position in Renesola, a photovoltaic solar module manufacturer. Renesola has significantly higher debt levels that its module manufacturing peers. We initiated new positions in Tianneng Power International, a Chinese electric bicycle battery manufacturer, Saft Groupe, a French battery manufacturer, Schneider Electric, a French energy management systems and power automations specialist and Johnson Controls, a US-based energy efficiency solutions provider and lithium-ion battery manufacturer. Total SA acquired Saft Groupe shortly after we initiated our position, meaning we had to initiate a new position soon after.

In the third quarter, we sold our position in Trina Solar, a leading Chinese module manufacturer, following the board recommendation of a management buyout offer. We replaced the position with Sensata, a controls and sensors company selling mainly to the automotive market. Sensata, aside from having a strong earnings history and trading on reasonable multiples, is likely to benefit from increased demand for its products as the automotive market focuses on fuel efficiency and electrification. The acquisition of Saft Groupe by Total closed at the beginning of the third quarter. We replaced the position with Senvion, a German wind-turbine manufacturer formerly known as RePower, which was trading at significantly lower multiples than its peers.

In the fourth quarter, we sold Enphase, a US microinverter manufacturer, due to liquidity concerns. We replaced the holding with Ricardo, an engineering consultancy for the automotive sector.

The overall effect of these changes has been to increase our exposure to the energy storage, transportation and 'smart grid' technology sectors. We believe these sectors will grow in importance with the increase in electric vehicle use and increase in intermittent electricity sources, like wind and solar, in electricity grids worldwide.

3. Portfolio Position

The Fund's largest country exposures were to China, the United States, Canada, the United Kingdom and Brazil. With China contributing half of the annual installations of wind and solar, over three-quarters of solar manufacturing capacity and over half of wind turbine manufacturing capacity, investing in China is inevitable.

On a sector basis, the Fund has been weighted between a quarter and a third in each of the energy efficiency, solar, and wind sectors. The companies in other sectors, such as hydro, biofuels and geothermal have more individual stories rather than sector-growth stories and are each less than 10% of assets.

4. Outlook

While the alternative energy sector continues to have woes, we think the overall news is exceedingly positive in terms of future volumes. Several tenders for power in 2016 showed that electricity from both wind and solar is dropping quickly in price, so much so that wind is now cheaper than gas and coal plants in most countries. Solar is cheaper than coal and gas plants in some sunny countries and is decreasing in cost faster than wind. It is possible that solar will be the cheapest form of electricity by the end of the decade. In the wind sector, one example of cost declines per unit of electricity produced is that average wind turbine output has increased 63% since 2010 due to increasing hub height and technology improvements (Bloomberg). This means that for a turbine with the same power rating that it had in 2010, the project would now produce 63% more electricity. For solar power, efficiencies of modules sold commercially have increased marginally, but the bulk of cost reduction has come from economies of scale and manufacturing efficiencies. We do not see these drivers slowing down drastically before 2020.

Complementing the increased competitiveness of the wind and solar technologies is the dramatic fall in battery prices. According to Bloomberg, lithium-ion batteries for electric vehicles fell 35% to $350/kWh in 2015 and fell a further 20% in 2016 to an average of $273/kWh. Some electric vehicle manufacturers are receiving lithium-ion batteries for $220/kWh (Bloomberg). Electric vehicle sales are set to continue increasing at around 50% per year in 2017 as battery prices decrease, making the largest cost component of electric vehicles shrink. In Norway, where electric vehicles have been given Value Added Tax (VAT) exemptions making electric cars as affordable as combustion engine vehicles, the market share of electric vehicles of new car sales reached 30% for 2016 and in January 2017 reached 37% – up from under 1% in 2009. Current global market share of electric vehicles is 0.8% of new car

9

sales. There are several electric vehicles models at the $30,000 price mark that have a range of over 200 miles on a single charge. We are confident that this is the sign of a global electric vehicle boom before the end of the decade.

As battery prices for electric vehicles continue to fall, so will prices for stationary electricity storage for grid stability, which would allow a higher amount of wind and solar technologies in the electricity grid. There have already been installations of batteries in the United States for use in assuring grid stability. Further grid automation and demand response measures other than batteries are also set to grow as the amount of renewable energy in the grid increases. Energy efficiency measures to reduce the amount of energy consumed in developed countries have proved highly successful and we have no reason to believe that this growth will stop.

Overall, we view that alternative energy has reached its economic inflection point, where it no longer requires subsidy to make economic sense. Energy storage and smarter grids, the keys to increasing the portion of renewables in the grid, are also becoming cheaper and will be in higher demand as alternative energy sources become less expensive than conventional power sources. We are waiting for sentiment to turn to recognise the volume – and therefore earnings – potential of this sector.

Edward Guinness Samira Rudig January 2017

The Fund invests in foreign securities, which involves political, economic and currency risks, greater volatility, and differences in accounting methods. These risks are greater for emerging markets. The Fund is non-diversified, meaning that its assets may be concentrated in fewer individual holdings than diversified funds. Therefore, the Fund is more exposed to individual stock volatility than diversified funds. Investments focused in a single geographic region may be exposed to greater risk and more volatility than investments diversified among various geographies. The Fund invests in smaller companies, which involves additional risks such as limited liquidity and greater volatility.

The Wilderhill New Energy Global Innovation Index (NEX) is a modified US dollar-weighted index of publicly traded companies, which are active in renewable and low-carbon energy, and which stand to benefit from responses to climate change and energy security concern. The Wilderhill Clean Energy Index (ECO) is a modified equal US dollar-weighted index of publicly traded companies whose businesses stand to benefit substantially from societal transition toward the use of cleaner energy and conservation. These indices are unmanaged, not available for investment and do not incur expenses.

KWh - kilowatt-hour

Please refer to the Schedule of Investments for details on Fund holdings. Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Guinness Atkinson Asset Management, Inc. for the period stated and is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Opinions, Fund holdings and sector allocations are subject to change at any time, and are not recommendations to buy or sell any security.

10

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND

Growth of $10,000

| | | Average Annual Total Return

Periods Ended December 31, 2016 | |

| | | One Year | | Five Years | | Ten Years | |

| | | | | | -17.16 | % | | | -2.93 | % | | | -12.95 | % | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Total returns for certain periods reflect a fee waiver in effect and in the absence of this waiver, the total returns would be lower. Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares.

The Wilderhill New Energy Global Innovations Index (NEX) is a modified dollar weighted index of publicly traded companies, which are active in renewable and low-carbon energy, and which stand to benefit from responses to climate change and energy security concern. The Wilderhill Clean Energy Index (ECO) is a modified equal dollar weighted index comprised of publicly traded companies whose businesses stand to benefit substantially from societal transition toward the use of cleaner energy and conservation. These indices are unmanaged, not available for investment and do not incur expenses.

11

FUND HIGHLIGHTS at December 31, 2016

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND

# of Holdings in Portfolio: | | 31 | |

Portfolio Turnover: | | 64.0% | |

% of Stocks in Top 10: | | 36.6% | |

Fund Manager: | | | |

Edward Guinness | | | |

Top 10 Holdings (% of net assets) | | | | Industry Breakdown (% of net assets) | | | |

Iniziative Bresciane - Inbre - SpA | | | 5.0 | % | | Efficiency | | | 29.3 | % | |

Boralex Inc - A Shares | | | 3.8 | % | | Wind | | | 29.1 | % | |

Cosan SA Industria e Comercio | | | 3.7 | % | | Solar | | | 25.5 | % | |

Concord New Energy Group Ltd. | | | 3.6 | % | | Hydro | | | 8.3 | % | |

Good Energy Group PLC | | | 3.6 | % | | Biofuel | | | 3.7 | % | |

Ricardo PLC | | | 3.4 | % | | Geothermal | | | 3.3 | % | |

Schneider Electric SE | | | 3.4 | % | | | | | | | |

Tianneng Power International | | | 3.4 | % | | | | | | | |

Nibe Industrier AB - B Shares | | | 3.4 | % | | | | | | | |

China Longyuan Power Group Corp. Ltd. - H Shares | | | 3.3 | % | | | | | | | |

12

SCHEDULE OF INVESTMENTS

at December 31, 2016

GUINNESS ATKINSON ALTERNATIVE ENERGY FUND

Shares | | COMMON STOCKS: 99.2% | | Value | |

Biofuel: 3.7% | | | |

| | 32,100 | | | Cosan SA Industria e Comercio | | $ | 376,260 | | |

Efficiency: 29.3% | | | |

| | 851,000 | | | Boer Power Holdings | | | 339,105 | | |

| | 21,070 | | | CENTROTEC Sustainable AG | | | 339,122 | | |

| | 7,402 | | | Johnson Controls Inc. | | | 304,888 | | |

| | 43,315 | | | Nibe Industrier AB - B Shares | | | 341,362 | | |

| | 29,600 | | | Ricardo PLC | | | 351,111 | | |

| | 8,100 | | | Sensata Technologies Holding* | | | 315,495 | | |

| | 5,030 | | | Schneider Electric SE | | | 350,041 | | |

| | 374,000 | | | Tianneng Power International | | | 343,398 | | |

| | 576,000 | | | Wasion Group Holdings Ltd. | | | 309,745 | | |

| | | | | | | | 2,994,267 | | |

Geothermal: 3.3% | | | |

| | 6,259 | | | Ormat Technologies Inc. | | | 335,608 | | |

Hydro: 8.3% | | | |

| | 147,404 | | | Cia Energetica de Minas Gerais - ADR | | | 336,081 | | |

| | 26,098 | | | Iniziative Bresciane - Inbre - SpA† | | | 512,629 | | |

| | | | | | | | 848,710 | | |

Solar: 25.5% | | | |

| | 26,800 | | | Canadian Solar Inc.* | | | 326,424 | | |

| | 692,400 | | | China Singyes Solar Technologies Holdings Ltd. | | | 330,373 | | |

| | 10,200 | | | First Solar Inc.* | | | 327,318 | | |

| | 69,700 | | | JA Solar Holdings Co., Ltd. - ADR* | | | 331,772 | | |

| | 21,200 | | | Jinkosolar Holdings Co., - ADR* | | | 322,876 | | |

| | 27,400 | | | Solaredge Tech Inc.* | | | 339,760 | | |

| | 46,950 | | | SunPower Corp. - Class B* | | | 310,339 | | |

| | 962,000 | | | Xinyi Solar Holdings Ltd. | | | 312,624 | | |

| | | | | | | | 2,601,486 | | |

The accompanying notes are an integral part of these financial statements.

13

Shares | | COMMON STOCKS: 99.2% (Continued) | | Value | |

Wind: 29.1% | | | |

| | 27,487 | | | Boralex Inc. - Class A | | $ | 392,043 | | |

| | 3,370,000 | | | China Datang Corp. Renewable Power Co., Ltd. - H Shares | | | 308,556 | | |

| | 437,000 | | | China Longyuan Power Group Corp. - H Shares | | | 341,508 | | |

| | 2,425,000 | | | China Suntien Green Energy Corp. Ltd. - H Shares | | | 312,722 | | |

| | 6,950,000 | | | Concord New Energy Group Ltd. | | | 362,983 | | |

| | 107,401 | | | Good Energy Group PLC† | | | 362,669 | | |

| | 1,014,000 | | | Huaneng Renewables Corp. Ltd. - H Shares | | | 329,522 | | |

| | 607,763 | | | Mytrah Energy Ltd.*† | | | 234,065 | | |

| | 170,452 | | | Northern Power Systems Corp.*† | | | 32,373 | | |

| | 22,430 | | | Senvion S.A.* | | | 288,054 | | |

| | | | | | | | 2,964,495 | | |

| | | | | Total Common Stocks

(cost $15,175,774) | | | 10,120,826 | | |

| | | | | Total Investments in Securities

(cost $15,175,774): 99.2% | | | 10,120,826 | | |

| | | | | Other Assets less Liabilities: 0.8% | | | 77,969 | | |

| | | | | Net Assets: 100.0% | | $ | 10,198,795 | | |

* Non-income producing security.

ADR - American Depository Receipt

† The Advisor has determined these securities to be illiquid. As of December 31, 2016, the total market value of these illiquid securities represent 11.2% of net assets.

The accompanying notes are an integral part of these financial statements.

14

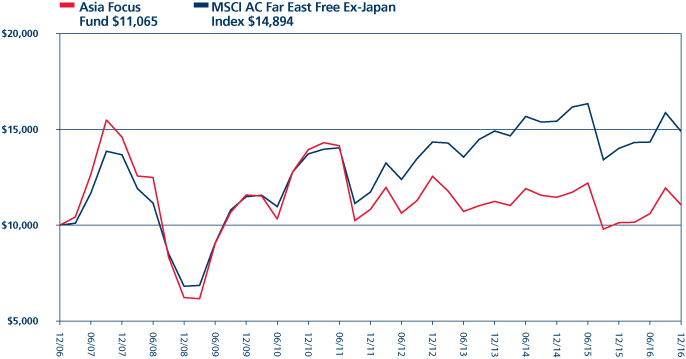

GUINNESS ATKINSON ASIA FOCUS FUND for the period ended December 31, 2016

1. Performance

AVERAGE ANNUAL TOTAL RETURNS

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

Fund | | | 9.20 | % | | | -0.53 | % | | | 0.44 | % | | | 1.02 | % | |

Benchmark Indices: | |

MSCI AC Far East Free ex-Japan Index | | | 6.30 | % | | | -0.06 | % | | | 4.91 | % | | | 4.19 | % | |

S&P 500 Index | | | 11.93 | % | | | 8.85 | % | | | 14.62 | % | | | 6.93 | % | |

The Fund's gross expense ratio is 2.00% per the Summary Prospectus dated May 3, 2016. For the Fund's current one year expense ratios, please refer to the Financial Highlights section of this report.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

The Fund imposes a 2% redemption fee on the sale of shares held less than 30 days. Performance data quoted does not reflect this redemption fee. Total returns for certain periods reflect fee limitations in effect and, in the absence of these limitations, total returns would have been lower.

The Fund ended the year up 9.20%, ahead of the benchmark up 6.30%. Much of the Fund's outperformance came during the middle of the year, as Asian markets rallied along with global emerging markets. The strength in emerging markets was particularly evident in the third quarter, as commodity prices and emerging market currencies recovered.

Despite concerns at the start of 2016 that Chinese growth would slow significantly, China's Gross Domestic Product (GDP) figures indicate robust growth in 2016, down slightly on 2015, but not the doomsday scenario some feared. Fixed asset investment has slowed but not collapsed. Higher commodity prices have begun to feed through to Producer Price Inflation, which started the year at 5.9% deflation, before recovering to end 2016 at 5.5% inflation. Stronger producer prices mean better cashflows for many of the heavy-industry state owned enterprises, particularly benefiting those companies that are struggling to meet debt repayments. Cooling measures on the property market have also begun to take effect, deflating some of the excesses that had been built up.

Commodities saw significant variations in price over the course of the year. The oil price more than doubled during the year – Brent crude touched $26.39 in January 2016, but ended the year close to a high of $55.41. Iron ore also recovered during the year, bouncing sharply in November after the US election. The victory of Donald Trump surprised many, and the resulting strength witnessed in US equity markets was also contrary to expectations. Markets quickly priced in the possibility of fiscal stimulus measures, including renewed infrastructure spending in the US.

Asian markets were less sanguine about the prospect of a Trump presidency, as fears of trade barriers and protectionist measures hit Asian stocks in November. Companies that had large exposure to export trade saw weakness during the period. Despite this volatility, some of these companies, for example, Taiwanese technology companies, ended up being some of the best performers in the Fund for the year.

Currency volatility has also been significant factor this year, as the US dollar continued to appreciate. Against this strength, the renminbi weakened by 6.50% over the course of the year. Though the People's Bank of China (PBoC) sets the currency's reference rate in relation to a basket of other currencies, many participants in the market still place considerable emphasis on the renminbi rate versus the US dollar. Other notable currency movements in the year included the Korean won weakening in the fourth quarter by 8.68%, as the political scandal involving President Park unfolded. For the region as a whole, Asian currencies depreciated by 3.38% versus the US dollar during the year (Bloomberg JP Morgan Asia Dollar Index).

Our best performing stock in the portfolio was Geely, a Chinese auto manufacturer, which saw strong domestic demand for its latest models. Several of our holdings in smartphone component manufacturers, including Largan Precision (camera lenses) and AAC Technologies (acoustic components and vibration motors), also performed well. PTT, the Thai national oil and gas company, made good gains as the oil price recovered. The weakest stocks during the year were some of our Chinese holdings, including

15

Lenovo, the computer and smartphone manufacturer, two insurers – People's Insurance Co. and PICC Property & Casualty, and Sohu.com, an internet gaming and advertising company.

2. Activity

We made a number of changes to the portfolio during 2016, the majority of which were in the first quarter. In that period, we sold our entire positions in People's Insurance Co., PetroChina, Indo Tambangraya Megah, Dongfeng Motor, Galaxy Entertainment and Sohu.com. We initiated new positions in Sino Biopharmaceutical, Relo Holdings, Geely Automobile, DBS Group, St Shine Optical, and Sonic Healthcare. Several other positions were reduced or increased to re-weight to 3% of the portfolio.

Other changes we made during the year were to sell our holdings in NagaCorp, a casino operator in Phnom Penh, Cambodia; DiGgi.com, a Malaysian mobile telecommunications provider; and UMW, an automotive manufacturer and distributor of construction, mining and agricultural equipment. We purchased new positions in KT&G, a Korean tobacco company serving domestic and export markets and New Oriental Education, a Chinese private education provider.

The overall effect of these changes has been to increase our exposure to companies that meet our definition of quality: businesses that have achieved persistently strong returns on capital, sustained over time. The other effect has been to bring the portfolio more in line with equal weighting.

3. Portfolio Position

The Fund's largest country exposures were to China, Taiwan, Thailand and Korea. We have tended to find that these countries offer good quality companies trading at attractive valuations. Conversely, we tend to find few opportunities in Indonesia, Malaysia or the Philippines, and at year-end the Fund has no exposure to those countries.

On a sector basis, the Fund has larger weighting in Information Technology, Financials and Consumer Discretionary.

4. Outlook

While growth in China has undeniably slowed, it has certainly not collapsed. We continue to believe that the 'hard landing' scenario that some fear happening in China is unlikely. The recovery in producer prices suggests that near-term stress in the heavy industry enterprises has eased, which should lead to improving earnings estimates and more positive sentiment towards the country. The steps that China is taking to resolve the build-up of bad debt in the economy seem appropriate, and we will continue to monitor the finance sector for any sign of deterioration.

Elsewhere in the region, we see infrastructure projects being a source of demand in countries such as Malaysia, which is investing in a Mass Rapid Transport project in Greater Kuala Lumpur. Government spending on infrastructure is also likely to benefit Indonesia's economy in 2017. Thailand has so far shown signs of stability following the death of King Bhumibol Adulyadej in October and we think that the operating environment for companies in the country is favourable.

Considering the region as a whole, we do not think the election of a new US President deals a fatal blow to the long-term investment case for Asia. One of the main drivers of Asian growth over the past generation has been the growth of export manufacture, and we have seen significant long-term shifts within the region (particularly in China) of companies and countries moving up the value chain in manufacturing. This shift provides the underpinning, in the form of stronger wages, for the much-heralded growth in consumption in Asia. We don't believe that these well-established patterns will disappear any time soon.

Edmund Harriss January 2017

The Fund invests in foreign securities, which involves political, economic and currency risks, greater volatility, and differences in accounting methods. These risks are greater for emerging markets. The Fund is non-diversified, meaning that its assets may be concentrated in fewer individual holdings than diversified funds. Therefore, the Fund is more exposed to individual stock volatility than diversified funds. Investments focused in a single geographic region may be exposed to greater risk and more volatility than investments diversified among various geographies. The Fund invests in smaller companies, which involves additional risks such as limited liquidity and greater volatility.

The MSCI AC (All Country) Far East ex Japan Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market performance of the Far East, excluding Japan. The Standard & Poor's 500 Index is a market

16

capitalization-weighted index composed of 500 widely held common stocks of U.S. companies. These indices are unmanaged, not available for investment and do not incur expenses. The Bloomberg JP Morgan Asia Dollar Index calculates the intraday value of Bloomberg-JPMorgan Asia Dollar Index. It is a trade and liquidity weighted index.

Please refer to the Schedule of Investments for details on Fund holdings. Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Guinness Atkinson Asset Management, Inc. for the period stated and is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Opinions, Fund holdings and sector allocations are subject to change at any time, and are not recommendations to buy or sell any security.

17

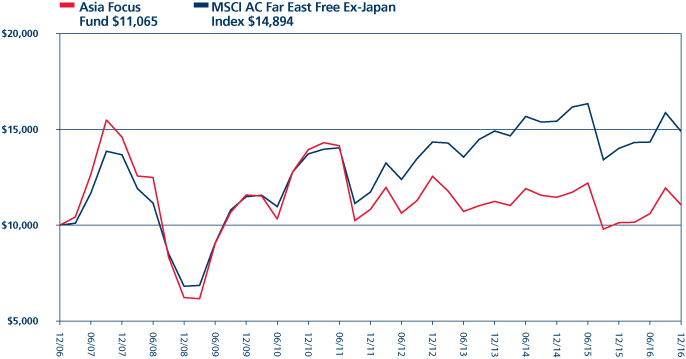

GUINNESS ATKINSON ASIA FOCUS FUND

Growth of $10,000

| | | Average Annual Total Return

Periods Ended December 31, 2016 | |

| | | One Year | | Five Years | | Ten Years | |

| | | | | | 9.20 | % | | | 0.44 | % | | | 1.02 | % | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Total returns for certain periods reflect a fee waiver in effect and in the absence of this waiver, the total returns would be lower. Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares. The Fund imposes a 2% redemption fee on shares held less than 30 days.

The MSCI All Country Far East Free ex-Japan Index (MSCI AC Far East Free ex-Japan Index) is a free float-adjusted, capitalization-weighted index that is designed to measure equity market performance of the Far East region excluding Japan. The index referenced in this chart is not available for investment and does not incur expenses.

18

FUND HIGHLIGHTS at December 31, 2016

GUINNESS ATKINSON ASIA FOCUS FUND

# of Holdings in Portfolio: | | | 34 | | |

Portfolio Turnover: | | | 38.1 | % | |

% of Stocks in Top 10: | | | 34.0 | % | |

Fund Manager: | | | |

Edmund Harriss | | | | | |

Top 10 Holdings (% of net assets) | | | | | | | |

Largan Precision Co., Ltd. | | | 3.8 | % | | Tencent Holdings Ltd. | | | 3.3 | % | |

NetEase Inc. - ADR | | | 3.6 | % | | China Merchants Bank Co., Ltd. - H Shares | | | 3.3 | % | |

LPN Development PCL /Foreign | | | 3.5 | % | | Catcher Technology Co., Ltd. | | | 3.3 | % | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | | 3.4 | % | | Glow Energy PCL /Foreign | | | 3.3 | % | |

China Construction Bank Corp. - H Shares | | | 3.3 | % | | Novatek Microelectronics Corp. | | | 3.2 | % | |

Industry Breakdown (% of net assets) | | | | | | | |

Commercial Banks | | | 12.8 | % | | Oil Company - Exploration & Production | | | 3.0 | % | |

Semiconductor Componets - Integrated Circuits | | | 6.6 | % | | Schools | | | 3.0 | % | |

Electric - Generation | | | 6.5 | % | | Computers | | | 3.0 | % | |

Auto/Truck Parts & Equipment | | | 6.1 | % | | Tobacco | | | 3.0 | % | |

Photo Equipment & Supplies | | | 3.8 | % | | Electronic Components - Semiconductor | | | 2.9 | % | |

Entertainment Software | | | 3.6 | % | | Property/Casualty Insurance | | | 2.9 | % | |

Real Estate Operations/Development | | | 3.5 | % | | Building & Construction Production - Miscellaneous | | | 2.9 | % | |

Internet Application Software | | | 3.3 | % | | Building Products - Cement/Aggregates | | | 2.8 | % | |

Metal Processors & Fabricators | | | 3.3 | % | | Distribution/Wholesale | | | 2.8 | % | |

Pharmaceuticals | | | 3.2 | % | | Real Estate Management/Service | | | 2.8 | % | |

Electronic Component Miscellaneous | | | 3.2 | % | | Public Thoroughfares | | | 2.7 | % | |

MRI/Medical Diagnostics Imaging | | | 3.1 | % | | Optical Supplies | | | 2.6 | % | |

Oil Components - Integrated | | | 3.1 | % | | Machinery - General Industry | | | 0.6 | % | |

Auto-Cars/Light Trucks | | | 3.0 | % | | | | | | | | | |

19

SCHEDULE OF INVESTMENTS

at December 31, 2016

GUINNESS ATKINSON ASIA FOCUS FUND

Shares | | COMMON STOCKS: 100.1% | | Value | |

Australia: 3.1% | | | |

| | 31,524 | | | Sonic Healthcare Ltd. | | $ | 486,835 | | |

China: 46.3% | | | |

| | 54,500 | | | AAC Technologies Holdings Inc. | | | 495,135 | | |

| | 161,500 | | | Anhui Conch Cement Co., Ltd. - H Shares | | | 439,442 | | |

| | 666,000 | | | China Construction Bank Corp. - H Shares | | | 512,737 | | |

| | 684,000 | | | China Lesso Group Holdings Ltd. | | | 443,680 | | |

| | 218,000 | | | China Merchants Bank Co., Ltd. - H Shares | | | 511,089 | | |

| | 425,000 | | | China Minsheng Banking Corp. Ltd. - H Shares | | | 454,349 | | |

| | 374,000 | | | CNOOC Ltd. | | | 467,832 | | |

| | 490,000 | | | Geely Automobile Holdings Ltd. | | | 468,231 | | |

| | 762,000 | | | Lenovo Group Ltd. | | | 461,848 | | |

| | 2,600 | | | NetEase Inc. - ADR | | | 559,884 | | |

| | 11,000 | | | New Oriental Education & Technology Group Inc.* | | | 463,100 | | |

| | 286,000 | | | PICC Property & Casualty Co., Ltd. - H Shares | | | 445,532 | | |

| | 484,000 | | | Shenzhen Expressway Co., Ltd. - H Shares | | | 413,814 | | |

| | 709,000 | | | Sino Biopharmaceutical Ltd. | | | 499,212 | | |

| | 21,000 | | | Tencent Holdings Ltd. | | | 513,728 | | |

| | | | | | | | 7,149,613 | | |

Hong Kong: 3.4% | | | |

| | 380,000 | | | Chen Hsong Holdings† | | | 94,577 | | |

| | 982,000 | | | Li & Fung Ltd. | | | 431,829 | | |

| | | | | | | | 526,406 | | |

Japan: 2.8% | | | |

| | 3,000 | | | Relo Holdings, Inc. | | | 427,636 | | |

Singapore: 3.2% | | | |

| | 41,252 | | | DBS Group Holdings | | | 493,947 | | |

South Korea: 12.0% | | | |

| | 56,000 | | | Hanon Systems | | | 477,563 | | |

| | 2,105 | | | Hyundai Mobis Co., Ltd. | | | 460,109 | | |

| | 5,530 | | | KT&G Corp. | | | 462,436 | | |

| | 301 | | | Samsung Electronics Co., Ltd. | | | 449,083 | | |

| | | | | | | | 1,849,191 | | |

Taiwan: 16.3% | | | |

| | 73,000 | | | Catcher Technology Co., Ltd. | | | 507,369 | | |

| | 5,000 | | | Largan Precision Co., Ltd. | | | 587,980 | | |

| | 152,000 | | | Novatek Microelectronics Corp. | | | 502,281 | | |

| | 2 | | | Shin Zu Shing Co., Ltd. | | | 5 | | |

| | 21,000 | | | St Shine Optical Co., Ltd. | | | 400,726 | | |

| | 93,000 | | | Taiwan Semiconductor Manufacturing Co., Ltd. | | | 523,736 | | |

| | | | | | | | 2,522,097 | | |

The accompanying notes are an integral part of these financial statements.

20

Shares | | COMMON STOCKS: 100.1% (Continued) | | Value | |

Thailand: 13.0% | | | |

| | 89,500 | | | Electricity Generating PCL/Foreign | | $ | 497,354 | | |

| | 228,000 | | | Glow Energy PCL/Foreign | | | 502,981 | | |

| | 1,579,000 | | | LPN Development PCL/Foreign | | | 533,528 | | |

| | 45,500 | | | PTT PCL/Foreign | | | 472,655 | | |

| | | | | | | | 2,006,518 | | |

| | | | | Total Common Stocks

(cost $13,126,695) | | | 15,462,243 | | |

| | | | | Total Investments in Securities

(cost $13,126,695): 100.1% | | | 15,462,243 | | |

| | | | | Liabilities in Excess of Other Assets: (0.1%) | | | (8,497 | ) | |

| | | | | Net Assets: 100.0% | | $ | 15,453,746 | | |

* Non-income producing security.

ADR - American Depository Receipt

† The Advisor has determined this security to be illiquid. As of December 31, 2016, the total market value of the illiquid security represents 0.6% of net assets.

The accompanying notes are an integral part of these financial statements.

21

GUINNESS ATKINSON ASIA PACIFIC DIVIDEND BUILDER FUND for the period ended December 31, 2016

1. Performance

AVERAGE ANNUAL TOTAL RETURNS

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

Fund | | | 8.81 | % | | | 4.21 | % | | | 6.48 | % | | | 3.87 | % | |

Benchmark Indices: | |

MSCI AC Pacific ex-Japan Index | | | 8.01 | % | | | -0.14 | % | | | 5.25 | % | | | 4.54 | % | |

S&P 500 Index | | | 11.93 | % | | | 8.85 | % | | | 14.62 | % | | | 6.93 | % | |

The Fund's gross expense ratio is 3.87% and net expense ratio is 1.10% per the Summary Prospectus dated May 3, 2016. For the Fund's current one year expense ratios, please refer to the Financial Highlights section of this report. The Advisor has contractually agreed to waive a portion of its advisory fees and/or reimburse other Fund expenses so that the Fund's ratio of expenses to average daily net assets will not exceed 1.10% (excluding Acquired Fund Fees and Expenses, interest, taxes, dividends on short positions and extraordinary expenses) through at least June 30, 2017. To the extent that the Advisor waives fees and/or reimburses expenses, it may seek repayment of a portion or all of such amounts at any time within the three fiscal years after the fiscal year in which such amounts were waived and/or reimbursed, subject to the applicable cap.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

The Fund imposes a 2% redemption fee on the sale of shares held less than 30 days. Performance data quoted does not reflect this redemption fee. Total returns for certain periods reflect expense limitations in effect and, in the absence of these imitations, total returns would have been lower.

In 2016, Asian markets, as measured by MSCI AC Pacific ex Japan Index, rose 8.01%. The Fund ended the year ahead of the benchmark, up 8.81%.

2016 can be divided into several distinct phases for Asian markets. In the first two months, China's domestic stock markets sold off heavily as newly applied circuit breakers on the Shanghai Exchange sparked fears among investors that they would find themselves locked in. The rest of the world looked at the falls and wondered if this was a sign that the Chinese economy was finally cracking under the weight of accumulated debt and excess industrial capacity. Commodities, industrial metals and oil all hit new lows.

The market began to recover in February, with a sharp rebound in March. The strong performance of the Fund paused for breath in April as our technology stocks underperformed, following lower forecasts for smartphone sales. The negative sentiment broadened, affecting higher-end consumer electronics manufacturers and component makers.

June saw the UK vote in a referendum to leave the EU – a result that surprised many, including us. Developed markets generally were weak, but Asia was notable for its relative strength and the Fund did well. Asian markets continued their strength in the third quarter, with emerging markets in particular benefitting from rising currency prices.

The final months of the year included three significant macro events. First, at the end of September the Organization of the Petroleum Exporting Countries (OPEC) agreed to an outline for cutting oil production, a reversal of its strategy that began in 2014. Second, the course of the US Presidential election was turned on its head with the election of Donald Trump accompanied by a substantial change in economic policy direction. Third, an issue in Korea surrounding allegations of influence peddling ballooned into a full blown political scandal that resulted in a vote to impeach the President.

The performance of the portfolio in 2016, as in previous years, has been characterised by individual stock performances, not by sector or country exposures. There have been individual months where stocks have moved together (Information technology in April and Thai stocks in December are examples), but over the year there has been dispersion. Amongst the 10 leading stocks, we have one energy name, two financials, one heath care, four information technology and two retailers. These have been drawn from Australia, China (including one US-listed company that derives significant revenues from China), Hong Kong, Taiwan and Thailand. The lagging stocks also have their individual characteristics. Amongst the weakest 10 we have one financial name,

22

ASIA PACIFIC DIVIDEND BUILDER FUND

two Industrial stocks, two retailers, two Information technology companies, one auto parts maker, one factory agent business and one real estate developer.

We seek to invest in businesses that have much greater control over their fortunes and have demonstrated as much by generating a return on investment above the cost of capital through good times and bad. For short periods, when markets are up very sharply, this can work against us but over time we believe that linking value to the persistence of operational cash flow generation is more sustainable and preferable to linking it to macro events that are binary in nature, that will or will not occur, and that may or may not lift share prices.

2. Activity

There were three portfolio changes in 2016. During April, we sold our position in CNOOC following the recovery in the oil price. The company's return on capital had fallen, and was not forecast to recover imminently. We replaced the company with DBS Group, a Singapore-listed diversified bank.

The second change we made, also in April, was to sell out of our position in NagaCorp, a casino operator in Cambodia. We had become increasingly concerned about the transformational expansion projects that the company was undertaking, in particular the effect that high capital expenditure (CapEx) would have on future free cash flow. In its place we purchased Tisco Financial, a financial services company specializing in car hire purchasing loans in Thailand.

The final change we made during the year was to sell DiGi.com, a mobile phone operator in Malaysia which is majority owned by Telenor of Norway. Digi had shown signs of losing growth momentum. The stock was replaced with Hanon Systems, a manufacturer of cooling and climate control systems for cars.

3. Portfolio Position

The Fund's largest country exposures were due to China, Taiwan, Thailand and Hong Kong. Our large weightings in these countries are an outcome of our stock selection process, rather than a 'top-down' allocation. We believe many companies in these markets are undervalued and represent attractive investment opportunities. Conversely, we have little or no allocations to other countries, for example, Indonesia or the Philippines, because the companies that meet our screening criteria in these countries have valuations that are not, at present, sufficiently attractive.

The Fund's largest sector exposures were due to Financials, Information Technology and Consumer Discretionary. Again, our allocations to Financials and Information Technology are due to our belief that there is sufficient undervaluation present in those sectors. We note that some sectors, for example, Materials, Energy and Utilities have historically had low representation in our universe – materials and energy are highly cyclical industries, while utility companies are often heavily regulated, and typically achieve lower returns.

4. Outlook

We see three potential consequences for Asia of the US election result: changes in trade policies, its effect on the US domestic economy and interest rates, and the potential for changes in Asia-focussed diplomatic relations. (The last of these factors seems to have taken a back seat recently in comparison to current diplomatic relations between the US and Russia.)

The potential negative impact of more restrictive trade policies on Asia was one of the main factors behind the sell-off in Asian equities, both preceding and immediately after the election. Our technology manufacturing stocks, including those in Taiwan, were among those that fell most heavily. Despite this period of weak performance, technology was one of the best performing sectors for 2016 as a whole. Yet again, this underlines the importance of selecting individual stocks for the long term over making short-term thematic bets, in our opinion.

We see it as unlikely that Trump will be able to impose tariffs on Asian countries to anything like the degree that he has suggested. Moreover, the appetite among US consumers to pay more for consumer electronics is simply not there. There is the potential for changes in tax treatment of overseas expenditure by US companies, but current policies appear to be at an early stage. Meanwhile the long-term shifts of globalisation march on.

The Trump administration's domestic policies are expected to be inflationary, which should secure or even accelerate interest rate rises by the US Federal Reserve. This is supposedly bad news for emerging markets including Asia, although as we wrote last month most countries in the Pacific region have little to fear from rate rises, having trade surpluses, low foreign debt exposure, well-capitalised banks and low inflation.

23

ASIA PACIFIC DIVIDEND BUILDER FUND

The manner in which many of the next administration's domestic policies have been proposed, although high profile, makes it difficult to judge how far and how quickly they will be enacted. The tone of the next round of US earnings reports will be instructive of whether corporate management is looking ahead with confidence of higher government spending and deregulation or caution around a higher dollar, rising interest rates, and rising stakes in trade policy. Not all of these are bad from an Asian perspective; a stronger dollar, if a result of a stronger US economy, is a good thing; greater restrictions on trade quite the opposite. US markets appear to be enjoying the relative certainty now that the election itself is over, although what this says about the factors above is impossible to say.

We believe the long-term case for investing in Asia remains unchanged:

• A quarter of the world's quality companies are in Asia. Of the 1,900 companies globally that meet our criteria for quality, 500 of them are located in Asia.

• Valuations are attractive. Asian equities trade at a substantial discount to global equities.

• Asia has historically provided a good source of diversified income. We target companies with moderate yields that are capable of growing their dividend over the long term. Companies in the portfolio have on average grown their dividends at 9.3% per annum over the past five years.

• We believe Asia economies are generating robust, sustainable growth. While a demographic tailwind has played a part in the region's success, the development of a regional manufacturing hub has helped countries to move up the value-chain by producing increasingly sophisticated goods. We see this clearly in China, but elsewhere in Asia too — Thailand's exports are becoming an increasingly important part of the supply chain. The long-term trends of globalisation seem unlikely to be halted any time soon.

2017 will doubtless bring uncertainties and surprises, as every year does. But, we believe a portfolio of attractively valued companies that have demonstrated an ability to deliver high returns on capital for eight years in a row, is well-positioned to cope with these challenges.

Edmund Harriss January 2017

The Fund invests in foreign securities, which will involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for emerging markets. The Fund is non-diversified, meaning its assets may be invested in fewer individual holdings than diversified funds. Therefore, the Fund is more exposed to individual stock volatility than diversified funds. The Fund invests in smaller companies, which involves additional risks such as limited liquidity and greater volatility.

The MSCI AC Pacific Ex-Japan Index is a market capitalization weighted index that monitors the performance of stocks from the Pacific region, excluding Japan. The Standard & Poor's 500 Index is a market capitalization-weighted index composed of 500 widely held common stocks of U.S. companies. These indices are unmanaged and not available for investment, and do not incur expenses.

Please refer to the Schedule of Investments for details on Fund holdings. Current and future portfolio holdings are subject to risk.

The information provided herein represents the opinion of Guinness Atkinson Asset Management, Inc. for the period stated and it is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Opinions, Fund holdings and sector allocations are subject to change at any time, and are not recommendations to buy or sell any security.

24

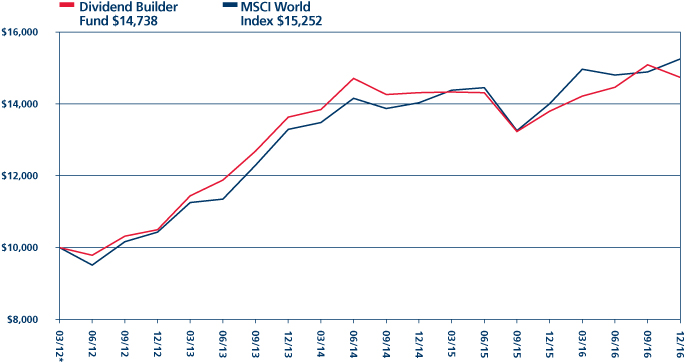

GUINNESS ATKINSON ASIA PACIFIC DIVIDEND BUILDER FUND

Growth of $10,000

| | | Average Annual Total Return

Periods Ended December 31, 2016 | |

| | | One Year | | Five Years | | Ten Years | |

| | | | | | 8.81 | % | | | 6.48 | % | | | 3.87 | % | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.gafunds.com.

Total returns reflect a fee waiver in effect and in the absence of this waiver, the total returns would be lower. Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distribution or the redemption of Fund shares. The Fund imposes a 2% redemption fee on shares held less than 30 days.

The MSCI All Country Pacific Free ex-Japan Index (MSCI AC Pacific ex-Japan Index) is a free float-adjusted, capitalization-weighted index that is designed to measure equity market performance in the Pacific region including Japan. The index referenced in this chart is not available for investment and does not incur expenses.

25

FUND HIGHLIGHTS at December 31, 2016

GUINNESS ATKINSON ASIA PACIFIC DIVIDEND BUILDER FUND

# of Holdings in Portfolio: | | | 37 | | |

Portfolio Turnover: | | | 30.9 | % | |

% of Stocks in Top 10: | | | 29.0 | % | |

Fund Manager: | | | |

Edmund Harriss | | | | | |

Top 10 Holdings (% of net assets) | | | | | | | | | | | |

LPN Development PCL /Foreign | | | 3.2 | % | | PTT PCL /Foreign | | | 2.9 | % | |

Relo Holdings Inc. | | | 3.0 | % | | Industrial & Commercial Bank of China Ltd. - H Shares | | | 2.8 | % | |

Hanon Systems | | | 2.9 | % | | China Minsheng Banking Corp. - H Shares | | | 2.8 | % | |

China Construction Bank Corp. - H Shares | | | 2.9 | % | | Henderson Group PLC | | | 2.8 | % | |

AAC Technologies Holdings Inc. | | | 2.9 | % | | Yangzijiang Shipbuilding Holdings Ltd. | | | 2.8 | % | |

Industry Breakdown (% of net assets) | | | | | | | | | | | |

Commercial Banks | | | 16.6 | % | | Photo Equipment & Supplies | | | 2.8 | % | |

Electronic Component - Miscellaneous | | | 8.3 | % | | Cellular Telecommunications | | | 2.7 | % | |

Semiconductor Components - Integrated Circuits | | | 8.1 | % | | Computers | | | 2.7 | % | |

Retail - Apparel/Shoe | | | 5.4 | % | | Retail - Consumer Electronics | | | 2.7 | % | |

REITS - Shopping Centers | | | 5.3 | % | | REITS - Diversified | | | 2.7 | % | |

Real Estate Operations/Development | | | 3.2 | % | | Optical Supplies | | | 2.7 | % | |

Real Estate Management/Service | | | 3.0 | % | | Retail - Jewelry | | | 2.7 | % | |

Diversified Financial Services | | | 2.9 | % | | MRI/Medical Diagnostics Imaging | | | 2.7 | % | |

Auto/Truck Parts & Equipment | | | 2.9 | % | | Distribution/Wholesale | | | 2.6 | % | |

Oil Company - Integrated | | | 2.9 | % | | Tobacco | | | 2.6 | % | |

Shipbuilding | | | 2.8 | % | | Life/Health Insurance | | | 2.6 | % | |

Investment Management/Advisor Service | | | 2.8 | % | | Textile - Products | | | 2.6 | % | |

Metal Processors & Fabricators | | | 2.8 | % | |

26

SCHEDULE OF INVESTMENTS

at December 31, 2016

GUINNESS ATKINSON ASIA PACIFIC DIVIDEND BUILDER FUND

Shares | | COMMON STOCKS: 99.1% | | Value | |

Australia: 8.1% | | | |

| | 82,330 | | | Henderson Group PLC | | $ | 238,248 | | |

| | 11,297 | | | JB Hi-Fi Ltd. | | | 228,596 | | |

| | 14,633 | | | Sonic Healthcare Ltd. | | | 225,982 | | |

| | | | | | | | 692,826 | | |

China: 25.2% | | | |

| | 27,000 | | | AAC Technologies Holdings Inc. | | | 245,296 | | |

| | 407,000 | | | Belle International Holdings Ltd. | | | 228,837 | | |

| | 322,000 | | | China Construction Bank Corp. - H Shares | | | 247,900 | | |

| | 410,000 | | | China Lilang Ltd. | | | 231,053 | | |

| | 101,000 | | | China Merchants Bank Co., Ltd. - H Shares | | | 236,789 | | |

| | 223,400 | | | China Minsheng Banking Corp. Ltd. - H Shares | | | 238,827 | | |

| | 22,000 | | | China Mobile Ltd. | | | 233,207 | | |

| | 402,000 | | | Industrial & Commercial Bank of China Ltd. - H Shares | | | 241,060 | | |

| | 423,600 | | | Yangzijiang Shipbuilding Holdings Ltd. | | | 238,397 | | |

| | | | | | | | 2,141,366 | | |

Hong Kong: 13.2% | | | |

| | 62,500 | | | BOC Hong Kong Holdings Ltd. | | | 223,661 | | |

| | 513,000 | | | Li & Fung Ltd. | | | 225,589 | | |

| | 35,000 | | | Link REIT/The | | | 227,481 | | |

| | 87,000 | | | Luk Fook Holdings International Ltd. | | | 227,191 | | |

| | 201,000 | | | Pacific Textiles Holdings Ltd. | | | 218,250 | | |

| | | | | | | | 1,122,172 | | |

Japan: 3.0% | | | |

| | 1,800 | | | Relo Holdings Inc. | | | 256,582 | | |

Singapore: 8.0% | | | |

| | 145,700 | | | Ascendas Real Estate Investment Trust - REIT | | | 228,387 | | |

| | 175,200 | | | CapitaMall Trust - REIT | | | 228,051 | | |

| | 18,808 | | | DBS Group Holdings | | | 225,205 | | |

| | | | | | | | 681,643 | | |

South Korea: 5.6% | | | |

| | 29,230 | | | Hanon Systems | | | 249,271 | | |

| | 2,690 | | | KT&G Corp. | | | 224,946 | | |

| | | | | | | | 474,217 | | |

Taiwan: 19.1% | | | |

| | 28,000 | | | Asustek Computer Inc. | | | 230,227 | | |

| | 34,000 | | | Catcher Technology Co., Ltd. | | | 236,309 | | |

| | 88,147 | | | Hon Hai Precision Industry Co., Ltd. | | | 230,290 | | |

| | 2,000 | | | Largan Precision Co., Ltd. | | | 235,192 | | |

| | 72,000 | | | Novatek Microelectronics Corp. | | | 237,922 | | |

| | 12,000 | | | St Shine Optical Co., Ltd. | | | 228,986 | | |

| | 40,000 | | | Taiwan Semiconductor Manufacturing Co., Ltd. | | | 225,263 | | |

| | | | | | | | 1,624,189 | | |

The accompanying notes are an integral part of these financial statements.

27

Shares | | COMMON STOCKS: 99.1% (Continued) | | Value | |

Thailand: 11.7% | | | |

| | 100,900 | | | Delta Electronics Thailand PCL/Foreign | | $ | 229,635 | | |

| | 794,500 | | | LPN Development PCL/Foreign | | | 268,453 | | |

| | 23,500 | | | PTT PCL/Foreign | | | 244,118 | | |

| | 133,900 | | | Tisco Financial Group PCL/Foreign | | | 225,282 | | |

| | 15,300 | | | Tisco Financial Group PCL/Foreign - NVDR | | | 25,742 | | |

| | | | | | | | 993,230 | | |

United States: 5.2% | | | |

| | 3,200 | | | Aflac Inc. | | | 222,720 | | |

| | 3,400 | | | QUALCOMM Inc. | | | 221,680 | | |

| | | | | | | | 444,400 | | |

| | | | | Total Common Stocks

(cost $8,487,783) | | | 8,430,625 | | |

| | | | | Total Investments in Securities

(cost $8,487,783): 99.1% | | | 8,430,625 | | |

| | | | | Other Assets less Liabilities: 0.9% | | | 73,845 | | |

| | | | | Net Assets: 100.0% | | $ | 8,504,470 | | |

NVDR - Non-Voting Depository Receipt

REIT - Real Estate Investment Trust

The accompanying notes are an integral part of these financial statements.

28

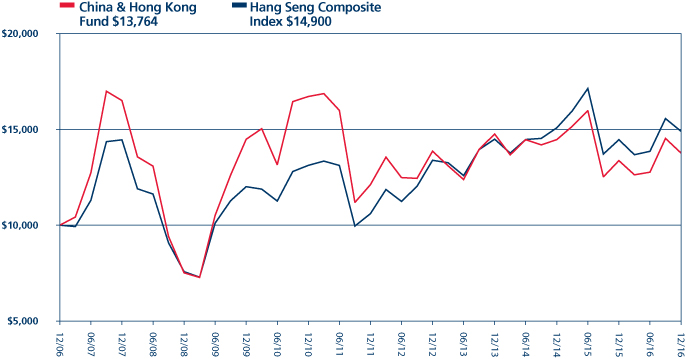

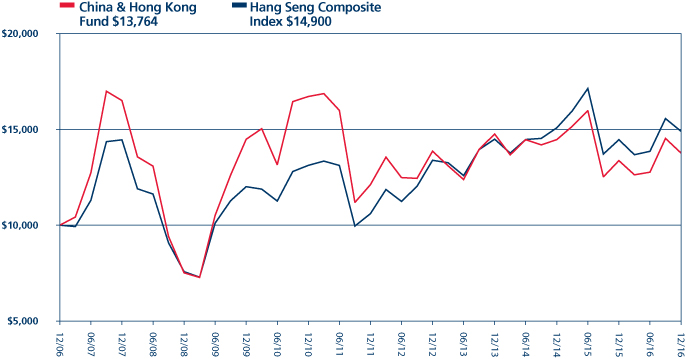

GUINNESS ATKINSON CHINA & HONG KONG FUND for the period ended December 31, 2016

1. Performance

AVERAGE ANNUAL TOTAL RETURNS

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

Fund | | | 2.95 | % | | | -2.29 | % | | | 2.58 | % | | | 3.25 | % | |

Benchmark Indices: | |

Hang Seng Composite Index | | | 3.07 | % | | | 0.93 | % | | | 7.03 | % | | | 4.02 | % | |

S&P 500 Index | | | 11.93 | % | | | 8.85 | % | | | 14.62 | % | | | 6.93 | % | |

The Fund's expense ratio is 1.56% per the Summary Prospectus dated May 3, 2016. For the Fund's current one year expense ratios, please refer to the Financial Highlights section of this report.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by visiting www.gafunds.com, or calling (800) 915-6565.

The Fund imposes a 2% redemption fee on the sale of shares held less than 30 days. Performance data quoted does not reflect this redemption fee. Total returns for certain periods reflect fee limitations in effect and, in the absence of these limitations, total returns would have been lower.

In 2016, the Fund rose 2.95% compared to the benchmark, which was up 3.07%.

The year started off with mainland markets falling sharply – Shanghai fell heavily in the first few weeks of the year and this was compounded by the unexpected weakening of the reference rate for the renminbi. Together these two events led to weaker equity markets around the world. Capital outflows continued in January and February, following on from the trend seen in the second half of 2015.