UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08748 |

|

Wanger Advisors Trust |

(Exact name of registrant as specified in charter) |

|

227 W. Monroe Street Suite 3000 Chicago, IL | | 60606 |

(Address of principal executive offices) | | (Zip code) |

|

Paul B. Goucher, Esq. Columbia Management Investment Advisers, LLC 100 Park Avenue New York, New York 10017 |

|

P. Zachary Egan Columbia Acorn Trust 227 West Monroe Street, Suite 3000 Chicago, Illinois 60606 |

|

Mary C. Moynihan Perkins Coie LLP 700 13th Street, NW Suite 600 Washington, DC 20005 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (312) 634-9200 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2015 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

SEMIANNUAL REPORT

June 30, 2015

COLUMBIA WANGER FUNDS

Managed by Columbia Wanger Asset Management, LLC

WANGER INTERNATIONAL

Wanger International

2015 Semiannual Report

Table of Contents

| | 1 | | | Understanding Your Expenses | |

| | 2 | | | Battery Technology and its Implications | |

| | 4 | | | Performance Review | |

| | 6 | | | Statement of Investments | |

| | 16 | | | Statement of Assets and Liabilities | |

| | 16 | | | Statement of Operations | |

| | 17 | | | Statement of Changes in Net Assets | |

| | 18 | | | Financial Highlights | |

| | 19 | | | Notes to Financial Statements | |

| | 22 | | | Board Approval of the Advisory Agreement | |

| | 24 | | | Results of Special Meeting of Shareholders | |

Columbia Wanger Asset Management, LLC (CWAM) is one of the leading global small- and mid-cap equity managers in the United States with over 40 years of small- and mid-cap investment experience. As of June 30, 2015, CWAM managed $27 billion in assets. CWAM is the investment manager to Wanger USA, Wanger International, Wanger Select and Wanger International Select (together, the Columbia Wanger Funds) and the Columbia Acorn Family of Funds.

An important note: Columbia Wanger Funds are available only through variable annuity contracts and variable life insurance policies issued by participating insurance companies or certain eligible retirement plans. Columbia Wanger Funds are not offered directly to the public and are not available in all contracts, policies or plans. Contact your financial advisor or insurance representative for more information. Columbia Wanger Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and are managed by CWAM.

Investors should carefully consider investment objectives, risks and expenses of the Fund before investing. For variable fund and variable contract prospectuses, which contain this and other important information, including the fees and expenses imposed under your contract, investors should contact their financial advisor or insurance representative. Read the prospectuses for the Fund and your variable contract carefully before investing.

The views expressed in "Battery Technology and its Implications" and in the Performance Review reflect the current views of the respective authors. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Wanger Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Wanger Fund. References to specific company securities should not be construed as a recommendation or investment advice.

A Comment on Trading Volumes

Market conditions are always changing and vary by country and industry sector, and investing in international markets involves unique risks. In the wake of the 2007-2009 financial crisis, trading volumes in both emerging and developed international markets declined significantly and have stayed at generally reduced levels since then. Although it is difficult to accurately assess trends in trading volumes in foreign markets, because some amount of activity has migrated to alternative trading venues, a reduction in trading volumes poses challenges to the Fund. This is particularly so because the Fund focuses on small- and mid-cap companies that usually have lower trading volumes and often takes sizeable positions in portfolio companies. As a result of lower trading volumes, it may take longer to buy or sell securities, which can exacerbate the Fund's exposure to volatile markets. The Fund may also be limited in its ability to execute favorable trades in portfolio securities in response to changes in company prices and fundamentals. If the Fund is forced to sell securities to meet redemption requests or other cash needs, or in the case of an event affecting liquidity in a particular market or markets, it may be forced to dispose of those securities under disadvantageous circumstances and at a loss. As the Fund grows in size, these considerations take on increasing significance and may adversely impact performance.

Wanger International 2015 Semiannual Report

Understanding Your Expenses

As a shareholder, you incur three types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees and other expenses for Wanger International (the Fund). Lastly, there may be additional fees or charges imposed by the insurance company that sponsors your variable annuity and/or variable life insurance product. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your Fund's expenses

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in the Fund during the period. The actual and hypothetical information in the table below is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the Fund's actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the Actual column. The amount listed in the "Hypothetical" column assumes a 5% annual rate of return before expenses (which is not the Fund's actual return) and then applies the Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See "Compare with other funds" below for details on how to use the hypothetical data.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing cost of investing in a fund only and do not reflect any transaction costs, such as sales charges, redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

January 1, 2015 – June 30, 2015

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid during

period ($) | | Fund's annualized

expense ratio (%)* | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | | |

Wanger International | | | 1,000.00 | | | | 1,000.00 | | | | 1,051.60 | | | | 1,019.44 | | | | 5.49 | | | | 5.41 | | | | 1.08 | | |

* Expenses paid during the period are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, then multiplied by the number of days in the Fund's most recent fiscal half-year and divided by 365.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the Fund. Expenses paid during the period do not include any insurance charges imposed by your insurance company's separate account. The hypothetical example provided is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds whose shareholders may incur transaction costs.

1

Wanger International 2015 Semiannual Report

Battery Technology and its Implications

Battery History

Alessandro Volta was a professor of physics at the University of Pavia in Italy at a time of great debate about electricity. He was also a skilled maker of scientific instruments, including machines that could generate an electrostatic charge. After reading a paper noting a torpedo fish could create electric shocks, and proposing that the process creating the charge could be imitated, Volta created the undisputed first battery.1 As described in a paper he wrote in March 1800, the battery consisted of a column of zinc and copper discs separated by brine-soaked cardboard.2

Within months, others were making variations of Volta's battery and improved versions were developed. The batteries were largely used in laboratory equipment, often to enable electrolysis, which resulted in scientific discoveries such as the separation of water into oxygen and hydrogen, as well as discoveries of other elements including sodium and magnesium.3 For several decades, electroplating of metal appears to have been the primary commercial use of batteries.4

All batteries have anode and cathode electrodes as well as an acid or alkaline electrolyte, which facilitates movement of electricity between the electrodes. Components in existing batteries have been refined over time and often later replaced by new materials. In 1839, Sir William Robert Grove, a Welsh judge and physical scientist, made a version utilizing zinc in sulfuric acid and platinum in nitric acid, which produced a then-powerful charge of 1.8 volts but emitted poisonous nitric oxide gas. In the 1850s, German chemist Robert Bunsen created a much cheaper version of Grove's battery by substituting carbon for platinum.5

Telegraphs were developed in the 1830s and 1840s, and became widespread after inventor Samuel Morse's 1844 Washington, D.C. to Baltimore link. That initial line used huge Grove batteries at both ends plus 150-pound Grove batteries at relay points in between. Within 30 years there were 650,000 land miles of telegraph cable6 and, since telegraphs then needed battery powered relays every few miles to boost their signals, commercial demand for batteries boomed. Telegraph office batteries initially needed regular care on strict schedules. The electrodes had to be cleaned or replaced, and the electrolyte needed replenishing.7

The first practical rechargeable battery was developed in 18598 by French physicist Gaston Planté using lead because it was readily available, cheap and amenable to recharging.9 The next battery breakthrough came in 1866 when French engineer Georges Leclanché created a simple, cheap battery consisting of a glass jar with manganese dioxide and zinc electrodes, a small bar of carbon, and an ammonium chloride electrolyte, which was then a common household chemical (sal ammoniac) used in cleaning and baking. This was the first battery not to use acid and, when discharged, replacing the sal ammoniac would revitalize it. Millions were produced for telegraphs, doorbells and telephones, though the battery was good only for intermittent use.10

German chemist Carl Gassner in 1887 patented his "dry cell" battery, consisting of a zinc can as the anode, ammonium chloride and plaster of paris as a dry electrolyte and carbon as the cathode. Producing a steady 1.5 volts, this was apparently the first battery requiring no maintenance. This compact six-inch long battery was durable and was mass-produced to power alarm clocks and bicycle lights.11

Batteries powered many of the first cars. The 1894 Electrobat had 1,500 pounds of lead-acid batteries.12 Of the 4,200 automobiles sold in the United States in the year 1900, battery powered cars were the most popular, followed by steam powered cars. Fewer than 1,000 were powered by gasoline.13

American inventor and businessman Thomas Edison was a proponent of battery-powered cars, and was determined to create a new rechargeable battery with triple the capacity of the lead-acid battery.14 His team experimented with hundreds of different compounds for a better automotive battery. When chided about failed experiments, he said, "No, I didn't fail. I discovered 24,999 ways that the storage battery does not work."15 Ultimately he developed a battery with nickel and iron electrodes and a potassium-based electrolyte that outperformed existing lead-acid batteries by 233%.16 But it was expensive and gasoline-powered cars dominated once the automatic starter (as opposed to a crank) became ubiquitous.

In the 1950s, inventor Samuel Ruben created the alkaline manganese battery in a new AAA size, and licensed it to Mallory, which later became Duracell. That battery was popular in

Kodak flash cameras. Canadian-American chemist Lewis Urry of Eveready invented the modern alkaline battery in 1959.17 His primary innovation was to use powdered zinc, which has dramatically more surface area than solid zinc. Labelled the Energizer, it had 40 times the capacity of the then-ubiquitous zinc-carbon battery.18

As power-hungry portable electronics took off after 1980, the quest for high energy, rechargeable batteries intensified. Nickel-cadmium batteries were invented, but had a "memory effect," which reduced capacity if recharged before depletion, and contained toxic cadmium. Nickel-metal-hydride batteries were also developed, powering cell phones and the first hybrid cars. These batteries had high capacity for the time, but tended to self-discharge when not in use.

Lithium Batteries

Chemists were long aware of lithium's potential in batteries. Lithium is the lightest metal, has half the density of water and, pound per pound, a lithium battery should be able to produce 30 times the energy of a lead-acid battery. However, lithium is too volatile to exist by itself in nature. It will burn or explode when exposed to air and pure lithium must be stored in oil to prevent it from reacting.

Exxon had a venture capital division that recruited British chemist Stanley Whittingham in the 1970s to pursue development of lithium batteries. Whittingham created a coin-sized battery with a lithium-aluminum alloy and a sulfide electrode. The first rechargeable lithium battery was used in a solar-powered watch shipped in 1977. But larger batteries ignited in Exxon's laboratories, and Exxon later exited the business and sold its patents. 19

John Goodenough achieved the breakthrough in lithium batteries. A University of Chicago Ph.D. working at Oxford, he experimented with metal oxides, which could be charged and discharged at higher voltages than sulfides. He also realized that as lithium ions migrate from a sulfide-based cathode, sections of the cathode tend to hollow out and collapse, reducing the ability of the battery to be recharged. Metal oxides in the cathode, in effect, reinforce its structure.

In 1980, Goodenough's team announced the lithium-cobalt-oxide battery.20 His belief in oxides proved correct, as the battery produced about 4 volts versus the 2.4 volts Whittingham

2

Wanger International 2015 Semiannual Report

achieved.21 "It was the first lithium-ion cathode with the capacity to power both compact and relatively large devices...far superior to anything on the market," said author Steve Levine in his recently published book, The Powerhouse.22 Yet because the battery was unusual, no companies in Europe or the Americas licensed it.

South African Ph.D. Mike Thackeray joined Goodenough during a stint at Oxford and helped invent a nickel-manganese-cobalt (NMC) cathode in place of Goodenough's lithium-cobalt-oxide. The NMC version has less safety risk than Goodenough's first lithium battery and theoretically should provide more energy.23 A version of this battery is used in the Chevrolet Volt.

Battery research funding diminished in the United States during the 1980s, a period of low oil prices and excitement about superconductivity. In Japan, however, battery research continued in earnest. After a decade of work, Japanese researcher Akira Yoshino combined Goodenough's lithium-cobalt-oxide cathode with a carbon anode and, in 1991, Sony shipped a resulting lithium-ion battery for small electronic devices. Later, Sony changed the anode to graphite, which was benign and better absorbed lithium ions, resulting in more power for longer periods. The Sony batteries were wildly successful, spurring knockoffs as well as additional lithium battery research.24

Electric Cars and Other Uses for Batteries

Improving performance and dropping costs have enabled much more sophisticated portable electronics but the biggest potential market for batteries is in automobiles. Thomas Edison said that the internal combustion engine would be a bridge between generations of battery powered cars, and he yet could be proven right (albeit late).25

The basic physics problem confronting battery powered vehicles is the energy density of gasoline versus batteries. A kilogram of gasoline contains about 12,700 watt hours of energy,26 while lithium batteries currently used in automobiles have energy densities ranging from 155 to 233 watt hours per kilogram.27 However, electric motors are over 90% efficient, three times that of gasoline engines,28 and electric vehicles can recapture up to half of energy expended through regenerative breaking,29 reducing the effective energy density gap somewhat.

Another key use for improved batteries is within the electric grid. Renewable power from solar and wind is by nature intermittent, and higher capacity, lower cost batteries will allow the adoption of more renewable energy. As battery performance improves and costs fall, expect to see more electric automobiles and renewable energy.

Potential Breakthroughs

In his book, Levine describes the inventions of various forms of lithium batteries and Argonne National Laboratory's successful effort to win funding as The Joint Center for Energy Storage Research. Argonne's goal is another battery breakthrough, achieving five times the performance at one-fifth the cost in five years. The Joint Center is looking beyond lithium. Argonne's senior scientist George Crabtree notes that new concepts, such as use of materials with double ions, use of reactions on the electrode surface instead of inside them and liquid electrodes, are worth exploring.

Investment Implications

Predicting which battery technology will succeed and which battery companies will profit is extremely difficult and risky. I've been on numerous battery technology wild goose chases, and can vaguely recall talking to Argonne researchers back in the late 1970s. The Columbia Wanger Funds' shareholders have instead benefited from investing downstream, in companies that prospered from improved battery technology. For example, domestic funds had profitable investments in cell phone service providers as the industry consolidated years ago, and more recently in cell tower companies.

Charles P. McQuaid

Portfolio Manager, Analyst and Advisor

Columbia Wanger Asset Management, LLC

The information and data provided in this analysis are derived from sources that we deem to be reliable and accurate. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict so actual outcomes and results may differ significantly from the views expressed. The views/opinions expressed here are those of the author and not of the Wanger Advisors Trust Board, are subject to change at any time based upon economic, market or other conditions, may differ from views expressed by other Columbia Management associates and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Wanger Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Wanger Fund.

1 In 1936 in Eastern Iraq, archeologist Wilhelm Koenig found a five- by three-inch broken clay jar that held a rolled sheet of copper and an iron rod. It dated back to between 200 BC and 200 AD. Koenig realized that with an acid or alkaline liquid, the device would be a functioning battery. Several similar jars have since been found. Google "Baghdad battery" to pursue the mystery and controversy.

2 Seth Fletcher, Bottled Lightning: Superbatteries, Electric Cars, and the New Lithium Economy (New York, Hill and Wang, 2011), p. 11.

3 Henry Schlesinger, The Battery: How Portable Power Sparked a Technological Revolution (New York, HarperCollins, 2010), p. 77.

4 Ibid., p. 50, 65.

5 Ibid., p. 96.

6 Ibid., p. 110, 130.

7 Ibid., p. 139.

8 Fletcher, op. cit., p. 13.

9 Schlesinger, op. cit., p. 145.

10 Ibid., p. 142-143.

11 Ibid., p. 179.

12 Ibid., p. 174.

13 Jim Motavalli, High Voltage: The Fast Track To Plug In the Auto Industry (New York, Rodale, 2011), p. xii.

14 Fletcher, op. cit., p. 14.

15 Schlesinger, op. cit., p. 174.

16 Fletcher, op. cit., 15.

17 NNDB website: nndb.com/people/004/000206383. Accessed April 2, 2015.

18 Schlesinger, op. cit., p. 250.

19 Steve Levine, The Powerhouse: Inside the Invention of a Battery to Save the World (New York, Viking, 2015), p. 21.

20 Ibid., p. 25.

21 Fletcher, op. cit., p. 44.

22 Levine, op. cit., p. 25.

23 Ibid., p. 41-44.

24 Ibid., p. 35.

25 Schlesinger, op. cit., p. 174.

26 Hypertextbook website: hypertextbook.com/facts/2003/ArthurGolnik.shtml. Accessed April 1, 2015.

27 Luke Ottaway, "What Makes Tesla's Batteries So Great?" Torque News, October 19, 2014, on website at: torquenews.com/2250/what-makes-tesla-s-batteries-so-great. Accessed April 3, 2015.

28 Tobias Fleiter and Wolfgang Eichhammer, "Energy efficiency in electric motor systems: Technology, saving potentials and policy options for developing countries," Working Paper 11/2011 published by United Nations Industrial Development Organization, p. 5, unido.org. Accessed April 21, 2015.

29 Source: ProEv Inc. article titled, "Regenerative Braking Efficiency," 2015.

3

Wanger International 2015 Semiannual Report

Performance Review Wanger International

| |

| |

Louis J. Mendes

Co-Portfolio Manager | | Christopher J. Olson

Co-Portfolio Manager | |

Performance data shown represents past performance and is not a guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data shown. Please visit columbiathreadneedle.com/us for most recent month-end performance updates.

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. International investing involves certain risks and volatility due to potential political, economic or currency instabilities and different, potentially less stringent, financial and accounting standards than those generally applicable to U.S. issuers. Risks are enhanced for emerging market issuers. Investments in small- and mid-cap companies involve risks and volatility and possible illiquidity greater than investments in larger, more established companies. Please also see "A Comment on Trading Volumes" on the inside cover of this report.

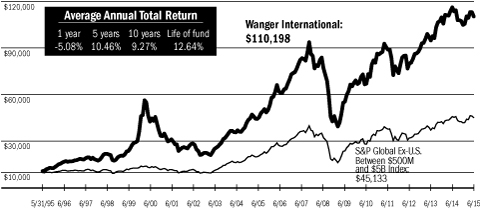

Wanger International gained 5.16% in the first half of 2015. This compares to the 7.97% gain of the Fund's primary benchmark, the S&P Global ex-U.S. Between $500M and $5B® Index, for the same period.

The majority of the Fund's underperformance for the half year was the result of weak relative performance in Asia, excluding Japan, which comprised roughly 27% of both the Fund and the benchmark. The strong rally in Chinese domestic shares (described in more detail below) helped lift China-related shares listed in Hong Kong in the benchmark nearly 25%, and the Fund's China-related holdings did not keep pace. In Hong Kong itself, Fund holdings continued to be negatively impacted by weak domestic demand in consumer stocks, as well as the continued decline in the Macau gaming sector. Elsewhere in Asia, underperformance in Korea was primarily due to the Fund's lack of holdings in the health care sector, which rallied over 100% on positive news regarding drug approvals. On the upside, in Japan, where the Fund's weight roughly matched that of the benchmark, good stock selection helped Fund stocks outperform the benchmark during the period.

Although the principal Chinese stock exchanges in Shanghai and Shenzen are by regulation inaccessible to most non-Chinese investors, including the Fund, this so-called "A-share market" is the world's second largest equity market, calculated in U.S. dollars.* In the 12 months ended June 30, 2015, the Shanghai A and Shenzen A share indexes rose 109% and 125%, respectively, inclusive of a major correction in June. The rally has captured the imagination of millions of new domestic Chinese investors who have rushed to open brokerage accounts and speculate in the market. Margin lending reached record highs in June, representing an estimated 12% of the free-float market capitalization of marginable stocks, according to Reuters. The launch in November 2014 of the "Shanghai-Hong Kong Connect," a partnership between the Hong Kong and Shanghai exchanges that allows traders registered on each exchange to invest in stocks on the other, was thought to be the global investors' gateway into the China A-share market. In fact, it has resulted to date in large amounts of money flowing from Chinese investors into shares listed on the Hong Kong exchange, significantly bolstering that market.

Given this market environment, Wanger International's underweight in China-related shares has hurt relative performance, but we have been skeptical of the hype around the Shanghai-Hong Kong Connect and the rapid rise in speculation by Chinese investors, which we believe warrant caution for global investors like the Fund. We continue to be cautious about allocating capital in the region, although we have recently initiated some new positions there, as discussed below. The Chinese political leadership has been engaged for some time in a very public

project to transform its large economy from one that has been almost solely export-oriented and investment-led, into one more focused on its internal market and meeting the needs of the Chinese consumer and citizen. This re-orientation is necessitated by an economic growth imperative in light of industrial capacity overinvestment and increasing demands for an enhanced quality of life. In recent months, some elements of a policy framework designed to address these goals have become clearer, which we believe create some attractive opportunities for long-term investors like the Fund. In particular, we like the prospects for entrepreneurial Chinese companies focused on health care, certain types of infrastructure development, and meeting the goals of evolving environmental regulation.

Consistent with this view, we have recently increased the Fund's exposure to China, although it remains slightly underweight compared to the benchmark. We initiated positions in China Everbright International, a municipal waste-to-energy operating facility, and SIIC Environment, a municipal water treatment operator, both of which will benefit from efforts to clean up a highly polluted environment after years of heavy industrial growth. Another new position, Phoenix Healthcare Group, has been winning contracts to manage public hospitals, and through modern organizational and information systems, it is increasing health care delivery standards while turning around loss-making, former state-managed operations. At June 30, the Fund's exposure to China (through Hong Kong-listed, Singapore-listed and U.S.-listed shares) was approximately 6%, compared to 3% at December 31, 2014.

During the first half of 2015, there was significant world focus and dramatic headlines about the potential exit of Greece from the eurozone and the possible impact. While a Greek exit from the common euro currency cannot be ruled out, we think that it is an unlikely outcome and one that entails little contagion risk for the rest of Europe because of the way the debt is held. Whatever the outcome, we do not believe it would portend a broader dissolution of the eurozone. Consequently, we have not modified the Fund's portfolio to anticipate this scenario. We remain overweight in Europe relative to the benchmark by approximately three percentage points.

* Data source: the World Federation of Exchanges.

Fund's Positions in Mentioned Holdings

As a percentage of net assets, as of 6/30/15

China Everbright International | | | 0.6 | % | |

SIIC Environment | | | 0.3 | | |

Phoenix Healthcare Group | | | 0.2 | | |

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security. Top holdings exclude short-term holdings and cash, if applicable.

4

Wanger International 2015 Semiannual Report

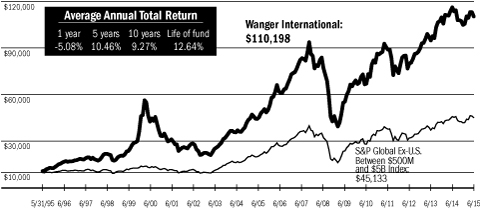

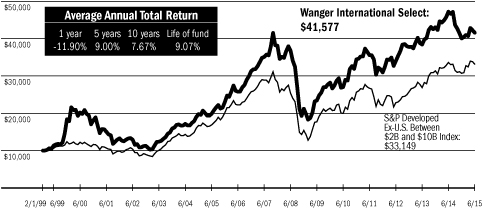

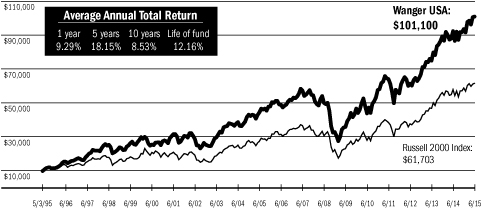

Growth of a $10,000 Investment in Wanger International

May 3, 1995 (inception date) through June 30, 2015

Performance data shown represents past performance and is not a guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data shown. Performance results reflect any fee waivers or reimbursements of Fund expenses by the investment adviser and/or any of its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results would have been lower. For most recent month-end performance updates, please visit columbiathreadneedle.com/us.

This graph compares the results of $10,000 invested in Wanger International on May 3, 1995 (the date the Fund began operations) through June 30, 2015, to the S&P Global Ex-U.S. Between $500M and $5B Index with dividends and capital gains reinvested. Although the index is provided for use in assessing the Fund's performance, the Fund's holdings may differ significantly from those in the index.

Top 10 Holdings

As a percentage of net assets, as of 6/30/15

1. Charles Taylor (United Kingdom)

Insurance Services | | | 1.5

| % | |

2. Coronation Fund Managers (South Africa)

South African Fund Manager | | | 1.2

| | |

3. SimCorp (Denmark)

Software for Investment Managers | | | 1.0

| | |

4. CCL Industries (Canada)

Global Label Converter | | | 1.0

| | |

5. Zee Entertainment Enterprises (India)

Indian Programmer of Pay Television Content | | | 1.0

| | |

6. Distribuidora Internacional de Alimentación (Spain)

Discount Retailer in Spain & Latin America | | | 1.0

| | |

7. Spotless (Australia)

Facility Management & Catering Company | | | 0.9

| | |

8. Spirax Sarco (United Kingdom)

Steam Systems for Manufacturing & Process Industries | | | 0.9

| | |

9. Singapore Exchange (Singapore)

Singapore Equity & Derivatives Market Operator | | | 0.8

| | |

10. Partners Group (Switzerland)

Private Markets Asset Management | | | 0.8

| | |

Top 5 Countries

As a percentage of net assets, as of 6/30/15

Japan | | | 21.5 | % | |

United Kingdom | | | 11.3 | | |

Taiwan | | | 5.3 | | |

China | | | 5.1 | | |

Canada | | | 4.5 | | |

Results as of June 30, 2015

| | 2nd quarter* | | Year to date* | | 1 year | | 5 years | | 10 years | |

Wanger International | | | 0.83 | % | | | 5.16 | % | | | -5.08 | % | | | 10.46 | % | | | 9.27 | % | |

S&P Global Ex-U.S.

Between $500M

and $5B Index** | | | 2.91 | | | | 7.97 | | | | -1.52 | | | | 9.91 | | | | 8.20 | | |

MSCI EAFE Index (Net) | | | 0.62 | | | | 5.52 | | | | -4.22 | | | | 9.54 | | | | 5.12 | | |

NAV as of 6/30/15: $27.86

* Not annualized.

** The Fund's primary benchmark.

Performance numbers reflect all Fund expenses but do not include any fees and expenses imposed under your variable annuity contract or life insurance policy or qualified pension or retirement plan. If performance numbers included the effect of these additional charges, they would be lower.

The Fund's annual operating expense ratio of 1.05% is stated as of the Fund's prospectus dated May 1, 2015, and differences in expense ratios disclosed elsewhere in this report may result from including fee waivers and/or expense reimbursements as well as different time periods used in calculating the ratios.

All results shown assume reinvestment of distributions.

The S&P Global Ex-U.S. Between $500M and $5B Index is a subset of the broad market selected by the index sponsor representing the mid- and small-cap developed and emerging markets, excluding the United States. The MSCI Europe, Australasia, Far East (EAFE) Index (Net) is a capitalization-weighted index that tracks the total return of common stocks in 21 developed-market countries within Europe, Australasia and the Far East. The returns of the MSCI EAFE Index (Net) are presented net of the withholding tax rate applicable to foreign non-resident institutional investors in the foreign companies included in the index who do not benefit from double taxation treaties. The performance of the MSCI EAFE Index (Net) is provided to show how the Fund's performance compares to a widely recognized broad-based index of foreign market performance. Indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

Portfolio characteristics and holdings are subject to change periodically and may not be representative of current characteristics and holdings.

5

Wanger International 2015 Semiannual Report

Statement of Investments (Unaudited), June 30, 2015

Number of

Shares | | | | Value | |

| | | | | Equities – 96.7% | | | |

| | | Asia – 48.4% | |

| | | Japan – 21.5% | |

| | 202,000 | | | NGK Insulators

Ceramic Products for Auto, Power & Electronics | | $ | 5,197,676

| | |

| | 252,100 | | | Aeon Mall

Suburban Shopping Mall Developer, Owner & Operator | | | 4,720,767

| | |

| | 153,000 | | | Glory

Currency Handling Systems & Related Equipment | | | 4,526,383

| | |

| | 88,400 | | | FamilyMart

Convenience Store Operator | | | 4,065,088

| | |

| | 305,000 | | | Ushio

Industrial Light Sources | | | 3,970,070

| | |

| | 2,400 | | | Orix JREIT

Diversified REIT | | | 3,456,764

| | |

| | 123,300 | | | NGK Spark Plug

Automobile Parts | | | 3,414,693

| | |

| | 78,000 | | | JIN (a)

Eyeglasses Retailer | | | 3,362,122

| | |

| | 414,000 | | | NOF

Specialty Chemicals, Life Science & Rocket Fuels | | | 3,321,387

| | |

| | 23,150 | | | Hirose Electric

Electrical Connectors | | | 3,316,902

| | |

| | 118,000 | | | Aeon Financial Service

Diversified Consumer-related Finance Company in Japan | | | 3,273,855

| | |

| | 856,000 | | | Aozora Bank

Commercial Bank | | | 3,229,700

| | |

| | 105,000 | | | Recruit Holdings

Recruitment & Media Services | | | 3,201,898

| | |

| | 224,000 | | | Santen Pharmaceutical

Specialty Pharma (Ophthalmic Medicine) | | | 3,169,315

| | |

| | 65,100 | | | Kintetsu World Express

Airfreight Logistics | | | 2,921,535

| | |

| | 71,240 | | | Ariake Japan

Commercial Soup & Sauce Extracts | | | 2,915,351

| | |

| | 592,000 | | | IHI

Industrial Conglomerates | | | 2,756,455

| | |

| | 55,500 | | | Ezaki Glico

Confectionary, Ice Cream & Dairy Products | | | 2,756,286

| | |

| | 254,000 | | | Nippon Kayaku

Functional Chemicals, Pharmaceuticals & Auto Safety

Systems | | | 2,738,440

| | |

| | 121,700 | | | OSG

Consumable Cutting Tools | | | 2,608,744

| | |

Number of

Shares | | | | Value | |

| | 122,800 | | | Tamron

Camera Lenses | | $ | 2,591,606

| | |

| | 515 | | | Kenedix Office Investment

Tokyo Mid-size Office REIT | | | 2,579,548

| | |

| | 229,500 | | | Moshi Moshi Hotline

Call Center Operator | | | 2,567,895

| | |

| | 56,400 | | | OBIC

Computer Software | | | 2,514,466

| | |

| | 46,000 | | | Japan Airport Terminal

Airport Terminal Operator at Haneda | | | 2,503,576

| | |

| | 53,400 | | | Otsuka

One-stop IT Services & Office Supplies Provider | | | 2,492,799

| | |

| | 142,000 | | | Park24

Parking Lot Operator | | | 2,430,966

| | |

| | 28,900 | | | Disco

Semiconductor Dicing & Grinding Equipment | | | 2,389,128

| | |

| | 134,700 | | | Doshisha

Consumer Goods Wholesaler | | | 2,388,519

| | |

| | 166,200 | | | Misumi Group

Industrial Components Distributor | | | 2,359,493

| | |

| | 107,000 | | | Suruga Bank

Regional Bank | | | 2,292,061

| | |

| | 127,000 | | | Toto

Toilets & Bathroom Fittings | | | 2,289,033

| | |

| | 95,100 | | | Aica Kogyo

Laminated Sheets, Building Materials & Chemical

Adhesives | | | 2,209,066

| | |

| | 78,000 | | | Nippon Paint Holdings

Paints for Automotive, Decorative & Industrial Usage | | | 2,198,088

| | |

| | 140,589 | | | Kansai Paint

Paint Producer in Japan, India, China & Southeast Asia | | | 2,178,174

| | |

| | 85,000 | | | Nabtesco

Machinery Components | | | 2,132,118

| | |

| | 26,900 | | | Rinnai

Gas Appliances for Home & Commercial Use | | | 2,118,244

| | |

| | 100,000 | | | Stanley Electric

Automobile Lighting & LED Equipment | | | 2,082,682

| | |

| | 82,700 | | | Benesse

Education Service Provider | | | 2,073,240

| | |

| | 106,000 | | | Daiseki

Waste Disposal & Recycling | | | 2,050,454

| | |

| | 69,300 | | | Hamamatsu Photonics

Optical Sensors for Medical & Industrial Applications | | | 2,043,458

| | |

See accompanying notes to financial statements.

6

Wanger International 2015 Semiannual Report

Statement of Investments (Unaudited), June 30, 2015

Number of

Shares | | | | Value | |

| | | Japan – 21.5% (cont) | |

| | 57,800 | | | Kaken Pharmaceutical

Pharmaceutical & Agrochemical Producer | | $ | 2,017,884

| | |

| | 212,000 | | | Dowa Holdings

Environmental/Recycling, Nonferrous Metals, Electric

Material & Metal Processing | | | 2,003,449

| | |

| | 1,000 | | | Japan Retail Fund

Retail REIT in Japan | | | 1,999,689

| | |

| | 176,800 | | | Asahi Diamond Industrial

Consumable Diamond Tools | | | 1,991,908

| | |

| | 432 | | | Industrial & Infrastructure Fund

Industrial REIT in Japan | | | 1,950,723

| | |

| | 47,800 | | | Nakanishi

Dental Tools & Machinery | | | 1,888,536

| | |

| | 32,000 | | | Hoshizaki Electric

Commercial Kitchen Equipment | | | 1,882,223

| | |

| | 58,520 | | | Milbon

Hair Products for Salons | | | 1,862,143

| | |

| | 27,500 | | | Hikari Tsushin

Office IT/Mobiles/Insurance Distribution | | | 1,853,445

| | |

| | 126,000 | | | Nippon Shokubai

Producer of Acrylic Acid & Super Absorbent Polymers

Used in Disposable Diapers | | | 1,723,560

| | |

| | 64,900 | | | Icom

Two Way Radio Communication Equipment | | | 1,634,452

| | |

| | 153,166 | | | Nihon Parkerizing

Metal Surface Treatment Chemicals & Processing Service | | | 1,553,633

| | |

| | 30,000 | | | MonotaRO

Online Maintenance, Repair & Operations Goods

Distributor in Japan | | | 1,316,931

| | |

| | 8,900 | | | Asahi Intecc

Medical Guidewires for Surgery | | | 609,751

| | |

| | 6,100 | | | Cocokara Fine

Drugstores | | | 209,840

| | |

| | | | 141,906,212 | | |

| | | Taiwan – 5.3% | |

| | 698,000 | | | President Chain Store

Convenience Chain Store Operator in Taiwan | | | 4,907,252

| | |

| | 33,000 | | | Largan Precision

Mobile Device Camera Lenses & Modules | | | 3,766,977

| | |

| | 2,279,000 | | | Vanguard International Semiconductor

Semiconductor Foundry | | | 3,636,888

| | |

Number of

Shares | | | | Value | |

| | 689,000 | | | Novatek Microelectronics

Display Related Integrated Circuit Designer | | $ | 3,323,308

| | |

| | 1,300,000 | | | Far EasTone Telecom

Mobile Operator in Taiwan | | | 3,142,396

| | |

| | 538,000 | | | Delta Electronics

Industrial Automation, Switching Power Supplies &

Passive Components | | | 2,752,338

| | |

| | 161,156 | | | PChome Online

Taiwanese Internet Retail Company | | | 2,660,227

| | |

| | 164,000 | | | St. Shine Optical

Disposable Contact Lens Original Equipment Manufacturer | | | 2,606,888

| | |

| | 159,500 | | | Ginko International

Contact Lens Maker in China | | | 2,004,726

| | |

| | 259,349 | | | Advantech

Industrial PC & Components | | | 1,780,779

| | |

| | 1,395,803 | | | Lite-On Technology

Mobile Device, LED & PC Server Component Supplier | | | 1,637,602

| | |

| | 128,000 | | | Voltronic Power

Uninterruptible Power Supply Products | | | 1,613,217

| | |

| | 69,000 | | | Silergy

Chinese Provider of Analog & Mixed Digital Integrated

Circuits | | | 710,715

| | |

| | 260,000 | | | Chroma Ate

Automatic Test Systems, Testing & Measurement

Instruments | | | 574,618

| | |

| | | | 35,117,931 | | |

| | | China – 5.1% | |

| | 2,250,000 | | | CAR Inc (b)

Consolidator of Chinese Auto Rental Sector | | | 4,781,743

| | |

| | 2,300,000 | | | China Everbright International

Municipal Waste Operator | | | 4,119,296

| | |

| | 7,180,000 | | | Sihuan Pharmaceuticals (c)

Chinese Generic Drug Manufacturer | | | 3,243,045

| | |

| | 65,000 | | | WuXi PharmaTech – ADR (b)

Contract Research Organization in China | | | 2,746,900

| | |

| | 48,039 | | | BitAuto – ADR (b)

Automotive Information Website for Buyers & Dealers | | | 2,452,391

| | |

| | 8,500,000 | | | Jiangnan Group

Cable & Wire Manufacturer | | | 2,442,243

| | |

| | 2,814,000 | | | Chongqing Rural Commercial Bank

Rural Commercial Bank | | | 2,250,835

| | |

See accompanying notes to financial statements.

7

Wanger International 2015 Semiannual Report

Statement of Investments (Unaudited), June 30, 2015

Number of

Shares | | | | Value | |

| | | China – 5.1% (cont) | |

| | 636,000 | | | Shanghai Industrial

Shanghai State Owned Enterprise | | $ | 2,153,376

| | |

| | 1,208,000 | | | TravelSky Technology

Chinese Air Travel Transaction Processor | | | 1,776,989

| | |

| | 3,300,000 | | | AMVIG Holdings

Chinese Tobacco Packaging Material Supplier | | | 1,702,885

| | |

| | 844,000 | | | Phoenix Healthcare Group

Private Hospital Management Group | | | 1,605,440

| | |

| | 3,446,000 | | | NewOcean Energy

Southern China Liquefied Petroleum Gas Distributor | | | 1,599,490

| | |

| | 1,370,000 | | | Sino Biopharmaceutical

Pharmaceutical Developer | | | 1,588,339

| | |

| | 32,000 | | | 51job – ADR (a) (b)

Integrated Human Resource Services | | | 1,063,680

| | |

| | | | 33,526,652 | | |

| | | Korea – 3.9% | |

| | 18,071 | | | CJ Corp

Holding Company of Korean Consumer Conglomerate | | | 4,787,623

| | |

| | 40,055 | | | KT&G

Tobacco & Ginseng Products | | | 3,407,790

| | |

| | 12,500 | | | Nongshim

Instant Noodles, Snacks & Bottled Water | | | 3,250,666

| | |

| | 245,695 | | | CJ Hellovision

Cable TV, Broadband & Mobile Virtual Network Operator | | | 2,818,939

| | |

| | 95,855 | | | LF Corp

Apparel Design & Retail | | | 2,600,181

| | |

| | 5,437 | | | KCC

Paint & Housing Material Manufacturer | | | 2,392,428

| | |

| | 41,784 | | | LS Industrial Systems

Electrical & Automation Equipment | | | 1,709,421

| | |

| | 63,234 | | | Hyundai Marine & Fire Insurance

Property & Casualty Insurance | | | 1,670,349

| | |

| | 103,500 | | | Cheil Worldwide (b)

Advertising | | | 1,602,231

| | |

| | 42,115 | | | Grand Korea Leisure

'Foreigner Only' Casino Group in Korea | | | 1,174,214

| | |

| | 3,643 | | | Koh Young Technology

Inspection Systems for Printed Circuit Boards | | | 134,080

| | |

| | | | 25,547,922 | | |

Number of

Shares | | | | Value | |

| | | India – 3.2% | |

| | 1,150,794 | | | Zee Entertainment Enterprises

Indian Programmer of Pay Television Content | | $ | 6,642,042

| | |

| | 533,178 | | | Bharti Infratel

Communications Towers | | | 3,742,628

| | |

| | 118,525 | | | Container Corporation of India

Railway Cargo Services | | | 3,117,419

| | |

| | 512,888 | | | Adani Ports & Special Economic Zone

Indian West Coast Shipping Port | | | 2,475,392

| | |

| | 76,280 | | | Colgate Palmolive India

Consumer Products in Oral Care | | | 2,441,281

| | |

| | 158,970 | | | United Breweries

Indian Brewer | | | 2,327,596

| | |

| | 43,941 | | | Amara Raja

Indian Maker of Auto & Industrial Batteries, Mostly

for the Replacement Market | | | 608,400

| | |

| | | | 21,354,758 | | |

| | | Singapore – 2.8% | |

| | 950,000 | | | Singapore Exchange

Singapore Equity & Derivatives Market Operator | | | 5,518,691

| | |

| | 4,500,000 | | | Mapletree Commercial Trust

Retail & Office Property Landlord | | | 4,893,652

| | |

| | 707,000 | | | Petra Foods

Chocolate Manufacturer in Southeast Asia | | | 1,837,250

| | |

| | 12,462,300 | | | SIIC Environment (b)

Waste Water Treatment Operator | | | 1,802,941

| | |

| | 1,905,500 | | | China Everbright Water (b)

Waste Water Treatment Operator | | | 1,394,226

| | |

| | 879,888 | | | Mapletree Industrial Trust

Industrial Property Landlord | | | 1,019,266

| | |

| | 1,160,934 | | | Mapletree Logistics Trust

Industrial Property Landlord | | | 974,017

| | |

| | 685,890 | | | CDL Hospitality Trust

Hotel Owner Operator | | | 830,086

| | |

| | | | 18,270,129 | | |

| | | Hong Kong – 2.1% | |

| | 5,316,000 | | | Mapletree Greater China Commercial

Trust

Retail & Office Property Landlord | | | 4,024,301

| | |

| | 900,000 | | | Samsonite International

Mass Market Luggage & Travel Accessories | | | 3,107,317

| | |

See accompanying notes to financial statements.

8

Wanger International 2015 Semiannual Report

Statement of Investments (Unaudited), June 30, 2015

Number of

Shares | | | | Value | |

| | | Hong Kong – 2.1% (cont) | |

| | 96,000 | | | Melco Crown Entertainment – ADR (a)

Macau Casino Operator | | $ | 1,884,480

| | |

| | 1,200,000 | | | Melco International

Macau Casino Operator | | | 1,694,196

| | |

| | 942,000 | | | Vitasoy International

Hong Kong Soy Food Brand | | | 1,604,118

| | |

| | 648,500 | | | Lifestyle International

Mid- to High-end Department Store Operator in

Hong Kong & China | | | 1,203,040

| | |

| | | | 13,517,452 | | |

| | | Indonesia – 1.5% | |

| | 2,028,900 | | | Matahari Department Store

Department Store Chain in Indonesia | | | 2,514,614

| | |

| | 2,580,000 | | | Tower Bersama Infrastructure

Communications Towers | | | 1,785,149

| | |

| | 4,169,000 | | | Link Net (b)

Fixed Broadband & Cable TV Service Provider | | | 1,586,925

| | |

| | 26,000,000 | | | Ace Indonesia

Home Improvement Retailer | | | 1,256,504

| | |

| | 5,185,021 | | | Surya Citra Media

Free to Air TV Station in Indonesia | | | 1,115,887

| | |

| | 18,253,400 | | | Arwana Citramulia

Ceramic Tiles for Home Decoration | | | 725,618

| | |

| | 340,117 | | | Mayora Indah

Consumer Branded Food Manufacturer | | | 662,880

| | |

| | 4,860,000 | | | MNC Sky Vision (b)

Satellite Pay TV Operator in Indonesia | | | 528,558

| | |

| | | | 10,176,135 | | |

| | | Philippines – 1.1% | |

| | 2,967,000 | | | Puregold Price Club

Supermarket Operator in the Philippines | | | 2,433,426

| | |

| | 493,000 | | | Universal Robina

Branded Consumer Food Manufacturer in the Philippines | | | 2,119,806

| | |

| | 1,136,000 | | | Robinsons Retail Holdings

Multi-format Retailer in the Philippines | | | 1,875,697

| | |

| | 7,468,300 | | | Melco Crown (Philippines) Resorts (b)

Integrated Resort Operator in Manila | | | 847,661

| | |

| | | | 7,276,590 | | |

Number of

Shares | | | | Value | |

| | | Thailand – 1.0% | |

| | 366,900 | | | Airports of Thailand

Airport Operator of Thailand | | $ | 3,284,116

| | |

| | 9,669,944 | | | Home Product Center

Home Improvement Retailer | | | 1,929,066

| | |

| | 1,264,400 | | | Robinson Department Store

Department Store Operator in Thailand | | | 1,672,770

| | |

| | | | 6,885,952 | | |

| | | Cambodia – 0.5% | |

| | 4,600,000 | | | Nagacorp

Casino & Entertainment Complex in Cambodia | | | 3,386,603

| | |

| | | Malaysia – 0.4% | |

| | 3,493,000 | | | 7-Eleven Malaysia Holdings

Exclusive 7-Eleven Franchisor for Malaysia | | | 1,481,262

| | |

| | 1,590,000 | | | Astro Malaysia Holdings

Pay TV Operator in Malaysia | | | 1,297,545

| | |

| | | | 2,778,807 | | |

| | | | | Total Asia | | | 319,745,143 | | |

| | | Europe – 31.6% | |

| | | United Kingdom – 11.3% | |

| | 2,857,142 | | | Charles Taylor

Insurance Services | | | 9,876,425

| | |

| | 105,487 | | | Spirax Sarco

Steam Systems for Manufacturing & Process Industries | | | 5,623,777

| | |

| | 223,482 | | | WH Smith

Newsprint, Books & General Stationery Retailer | | | 5,365,512

| | |

| | 86,000 | | | Rightmove

Internet Real Estate Listings | | | 4,428,128

| | |

| | 3,800,000 | | | Cable and Wireless

Telecommunications Service Provider in the Caribbean | | | 3,976,519

| | |

| | 169,852 | | | Aggreko

Temporary Power & Temperature Control Services | | | 3,840,402

| | |

| | 402,000 | | | Halfords

UK Retailer of Leisure Goods & Auto Parts | | | 3,335,072

| | |

| | 190,000 | | | Jardine Lloyd Thompson Group

International Business Insurance Broker | | | 3,116,731

| | |

| | 739,000 | | | Regus

Rental of Office Space in Full Service Business Centers | | | 3,032,933

| | |

| | 242,000 | | | Halma

Health & Safety Sensor Technology | | | 2,897,448

| | |

See accompanying notes to financial statements.

9

Wanger International 2015 Semiannual Report

Statement of Investments (Unaudited), June 30, 2015

Number of

Shares | | | | Value | |

| | | United Kingdom – 11.3% (cont) | |

| | 80,669 | | | Fidessa Group

Software for Financial Trading Systems | | $ | 2,883,589

| | |

| | 396,510 | | | Ocado (b)

Online Grocery Retailer | | | 2,778,030

| | |

| | 636,765 | | | Polypipe

Manufacturer of Plastic Piping & Fittings | | | 2,716,403

| | |

| | 221,860 | | | Domino's Pizza UK & Ireland

Pizza Delivery in the UK, Ireland & Germany | | | 2,708,602

| | |

| | 1,210,014 | | | Connect Group

Newspaper & Magazine Distributor | | | 2,695,000

| | |

| | 2,958,000 | | | Assura

UK Primary Health Care Property Developer | | | 2,544,647

| | |

| | 290,000 | | | Abcam

Online Sales of Antibodies | | | 2,360,332

| | |

| | 76,450 | | | AVEVA

Engineering Software | | | 2,171,807

| | |

| | 474,031 | | | Elementis

Specialty Chemicals | | | 1,911,211

| | |

| | 110,000 | | | Babcock International

Public Sector Outsourcer | | | 1,866,645

| | |

| | 262,952 | | | PureCircle (a) (b)

Natural Sweeteners | | | 1,673,311

| | |

| | 120,000 | | | Shaftesbury

London Prime Retail REIT | | | 1,636,614

| | |

| | 80,000 | | | Smith & Nephew

Medical Equipment & Supplies | | | 1,350,018

| | |

| | | | 74,789,156 | | |

| | | Sweden – 3.4% | |

| | 142,417 | | | Hexagon

Design, Measurement & Visualization Software &

Equipment | | | 5,160,777

| | |

| | 81,762 | | | Unibet

European Online Gaming Operator | | | 4,980,767

| | |

| | 245,094 | | | Sweco (a)

Engineering Consultants | | | 3,215,254

| | |

| | 98,000 | | | Modern Times Group (a)

Nordic TV Broadcaster | | | 2,629,143

| | |

| | 81,106 | | | Swedish Match

Swedish Snus | | | 2,307,013

| | |

Number of

Shares | | | | Value | |

| | 87,076 | | | Mekonomen

Nordic Integrated Wholesaler/Retailer of Automotive

Parts & Service | | $ | 2,127,046

| | |

| | 103,000 | | | Recipharm (a)

Contract Development Manufacturing Organization | | | 1,925,849

| | |

| | | | 22,345,849 | | |

| | | Germany – 3.2% | |

| | 52,205 | | | MTU Aero Engines

Airplane Engine Components & Services | | | 4,910,395

| | |

| | 115,940 | | | Wirecard (a)

Online Payment Processing & Risk Management | | | 4,439,932

| | |

| | 10,049 | | | Rational

Commercial Ovens | | | 3,690,869

| | |

| | 66,899 | | | NORMA Group

Clamps for Automotive & Industrial Applications | | | 3,381,935

| | |

| | 66,899 | | | Aurelius

European Turnaround Investor | | | 2,859,859

| | |

| | 74,647 | | | Elringklinger

Automobile Components | | | 2,006,855

| | |

| | | | 21,289,845 | | |

| | | Denmark – 2.5% | |

| | 169,227 | | | SimCorp

Software for Investment Managers | | | 6,739,341

| | |

| | 110,724 | | | Novozymes

Industrial Enzymes | | | 5,263,274

| | |

| | 59,000 | | | William Demant Holding (b)

Manufacture & Distribution of Hearing Aids &

Diagnostic Equipment | | | 4,500,889

| | |

| | | | 16,503,504 | | |

| | | Netherlands – 2.4% | |

| | 181,144 | | | Aalberts Industries

Flow Control & Heat Treatment | | | 5,379,903

| | |

| | 60,905 | | | Vopak

Operator of Petroleum & Chemical Storage Terminals | | | 3,073,490

| | |

| | 27,708 | | | Gemalto

Digital Security Solutions | | | 2,467,513

| | |

| | 103,000 | | | Brunel

Temporary Specialist & Energy Staffing | | | 2,043,391

| | |

| | 70,843 | | | Arcadis

Engineering Consultants | | | 1,948,419

| | |

See accompanying notes to financial statements.

10

Wanger International 2015 Semiannual Report

Statement of Investments (Unaudited), June 30, 2015

Number of

Shares | | | | Value | |

| | | Netherlands – 2.4% (cont) | |

| | 9,960 | | | Core Labs (a)

Oil & Gas Reservoir Consulting | | $ | 1,135,838

| | |

| | | | 16,048,554 | | |

| | | Spain – 2.1% | |

| | 868,718 | | | Distribuidora Internacional de

Alimentación

Discount Retailer in Spain & Latin America | | | 6,634,156

| | |

| | 573,279 | | | Prosegur

Security Guards | | | 3,144,470

| | |

| | 32,000 | | | Viscofan

Sausage Casings Maker | | | 1,935,379

| | |

| | 45,000 | | | Bolsas y Mercados Españoles

Spanish Stock Markets | | | 1,820,103

| | |

| | | | 13,534,108 | | |

| | | France – 2.0% | |

| | 110,602 | | | Neopost

Postage Meter Machines | | | 4,758,941

| | |

| | 123,000 | | | Eutelsat

Fixed Satellite Services | | | 3,969,812

| | |

| | 62,163 | | | Saft

Niche Battery Manufacturer | | | 2,425,584

| | |

| | 7,000 | | | Eurofins Scientific

Food, Pharmaceuticals & Materials Screening & Testing | | | 2,131,258

| | |

| | | | 13,285,595 | | |

| | | Switzerland – 1.6% | |

| | 18,384 | | | Partners Group

Private Markets Asset Management | | | 5,495,832

| | |

| | 9,763 | | | Geberit

Plumbing Systems | | | 3,254,855

| | |

| | 6,011 | | | INFICON

Gas Detection Instruments | | | 2,054,136

| | |

| | | | 10,804,823 | | |

| | | Finland – 1.2% | |

| | 140,445 | | | Tikkurila

Decorative & Industrial Paint in Scandinavia,

Central & Eastern Europe | | | 2,791,733

| | |

| | 91,921 | | | Konecranes

Manufacture & Service of Industrial Cranes &

Port Handling Equipment | | | 2,677,753

| | |

Number of

Shares | | | | Value | |

| | 651,561 | | | Sponda

Office, Retail & Logistics Properties | | $ | 2,404,359

| | |

| | | | 7,873,845 | | |

| | | Norway – 0.7% | |

| | 295,609 | | | Orkla

Food & Brands, Aluminum, Chemicals Conglomerate | | | 2,326,279

| | |

| | 219,301 | | | Atea

Nordic IT Hardware/Software Reseller & Integrator | | | 1,957,932

| | |

| | | | 4,284,211 | | |

| | | Kazakhstan – 0.6% | |

| | 432,778 | | | Halyk Savings Bank of Kazakhstan – GDR

Retail Bank & Insurer in Kazakhstan | | | 3,678,613

| | |

| | | Italy – 0.4% | |

| | 39,000 | | | Industria Macchine Automatiche

Food & Drugs Packaging & Machinery | | | 1,817,428

| | |

| | 353,023 | | | Hera

Northern Italian Utility | | | 883,165

| | |

| | | | 2,700,593 | | |

| | | Belgium – 0.2% | |

| | 40,001 | | | EVS Broadcast Equipment

Digital Live Mobile Production Software & Systems | | | 1,159,473

| | |

| | | | | Total Europe | | | 208,298,169 | | |

| | | Other Countries – 13.8% | |

| | | Canada – 4.5% | |

| | 54,928 | | | CCL Industries

Global Label Converter | | | 6,737,366

| | |

| | 77,000 | | | Vermilion Energy (a)

Canadian Exploration & Production Company | | | 3,325,981

| | |

| | 268,267 | | | CAE

Flight Simulator Equipment & Training Centers | | | 3,193,859

| | |

| | 89,849 | | | ShawCor

Oil & Gas Pipeline Products | | | 2,632,166

| | |

| | 190,995 | | | Rona

Canadian Home Improvement Retailer | | | 2,321,300

| | |

| | 41,250 | | | Onex Capital

Private Equity | | | 2,282,456

| | |

| | 86,000 | | | PrairieSky Royalty

Canadian Owner of Oil & Gas Mineral Interests | | | 2,168,247

| | |

See accompanying notes to financial statements.

11

Wanger International 2015 Semiannual Report

Statement of Investments (Unaudited), June 30, 2015

Number of

Shares | | | | Value | |

| | | Canada – 4.5% (cont) | |

| | 62,000 | | | Keyera (a)

Integrated Supply of Hydrocarbon Processing,

Transport & Storage | | $ | 2,069,976

| | |

| | 116,310 | | | Baytex (a)

Oil & Gas Producer in Canada | | | 1,809,370

| | |

| | 44,612 | | | Ag Growth

Manufacturer of Augers & Grain Handling Equipment | | | 1,672,682

| | |

| | 221,245 | | | Boulder Energy (b)

Canadian Exploration & Production | | | 1,470,243

| | |

| | 52,833 | | | Granite Oil

Canadian Oil & Gas Producer | | | 266,070

| | |

| | | | 29,949,716 | | |

| | | Australia – 3.2% | |

| | 3,680,000 | | | Spotless

Facility Management & Catering Company | | | 5,923,721

| | |

| | 181,870 | | | Domino's Pizza Enterprises

Domino's Pizza Operator in Australia & New Zealand | | | 4,994,364

| | |

| | 360,000 | | | Amcor

Global Leader in Flexible & Rigid Packaging | | | 3,804,301

| | |

| | 450,000 | | | Challenger Financial

Annuity Provider in Australia | | | 2,332,617

| | |

| | 450,000 | | | IAG

General Insurance Provider | | | 1,934,719

| | |

| | 340,000 | | | Estia Health (b)

Residential Aged Care Operator | | | 1,573,962

| | |

| | 90,000 | | | Austbrokers

Local Australian Small Business Insurance Broker | | | 624,956

| | |

| | | | 21,188,640 | | |

| | | South Africa – 2.6% | |

| | 1,150,421 | | | Coronation Fund Managers

South African Fund Manager | | | 7,792,717

| | |

| | 1,425,860 | | | Rand Merchant Insurance

Directly Sold Property & Casualty Insurance;

Holdings in other Insurers | | | 4,977,501

| | |

| | 729,169 | | | Northam Platinum (b)

Platinum Mining in South Africa | | | 2,412,982

| | |

| | 11,714 | | | Naspers

Media in Africa, China, Russia & other Emerging Markets | | | 1,824,596

| | |

| | | | 17,007,796 | | |

Number of

Shares | | | | Value | |

| | | United States – 1.2% | |

| | 30,000 | | | Cimarex Energy

Oil & Gas Producer in Texas, New Mexico & Oklahoma | | $ | 3,309,300

| | |

| | 82,000 | | | Bladex

Latin American Trade Financing House | | | 2,638,760

| | |

| | 53,234 | | | Hornbeck Offshore (a) (b)

Supply Vessel Operator in Gulf of Mexico | | | 1,092,894

| | |

| | 37,757 | | | Textainer Group Holdings (a)

Top International Container Leasor | | | 982,059

| | |

| | | | 8,023,013 | | |

| | | New Zealand – 1.0% | |

| | 908,808 | | | Auckland International Airport

Auckland Airport Operator | | | 3,041,681

| | |

| | 667,250 | | | Sky City Entertainment

Casino & Entertainment Complex | | | 1,898,460

| | |

| | 352,549 | | | Ryman Healthcare

Retirement Village Operator | | | 1,892,141

| | |

| | | | 6,832,282 | | |

| | | Israel – 0.7% | |

| | 66,562 | | | Caesarstone

Quartz Countertops | | | 4,562,159

| | |

| | | Egypt – 0.6% | |

| | 502,189 | | | Commercial International Bank of Egypt

Private Universal Bank in Egypt | | | 3,684,417

| | |

| | | | | Total Other Countries | | | 91,248,023 | | |

| | | Latin America – 2.9% | |

| | | Brazil – 1.0% | |

| | 300,000 | | | Localiza Rent A Car

Car Rental | | | 2,969,991

| | |

| | 570,570 | | | Odontoprev

Dental Insurance | | | 1,987,480

| | |

| | 120,000 | | | Linx

Retail Management Software in Brazil | | | 1,858,416

| | |

| | | | 6,815,887 | | |

| | | Mexico – 0.8% | |

| | 23,830 | | | Grupo Aeroportuario del Sureste – ADR

Mexican Airport Operator | | | 3,380,762

| | |

| | 1,121,000 | | | Qualitas (b)

Auto Insurer in Mexico & Central America | | | 1,855,079

| | |

| | | | 5,235,841 | | |

See accompanying notes to financial statements.

12

Wanger International 2015 Semiannual Report

Statement of Investments (Unaudited), June 30, 2015

Number of

Shares | | | | Value | |

| | | Colombia – 0.3% | |

| | 2,046,229 | | | Isagen

Colombian Electricity Provider | | $ | 2,183,511

| | |

| | | Uruguay – 0.3% | |

| | 230,870 | | | Union Agriculture Group (b) (c) (d)

Farmland Operator in Uruguay | | | 2,179,413

| | |

| | | Guatemala – 0.3% | |

| | 136,877 | | | Tahoe Resources

Silver & Gold Projects in Guatemala & Peru | | | 1,659,182

| | |

| | | Chile – 0.2% | |

| | 86,000 | | | Sociedad Quimica y Minera de

Chile – ADR

Producer of Specialty Fertilizers, Lithium & Iodine | | | 1,377,720

| | |

| | | | | Total Latin America | | | 19,451,554 | | |

Total Equities

(Cost: $507,756,753) – 96.7% | | | 638,742,889 | (e) | |

Short-Term Investments – 2.5% | | | |

| | 16,386,757 | | | JPMorgan U.S. Government Money

Market Fund, IM Shares

(7 day yield of 0.01%) | | | 16,386,757 | | |

Total Short-Term Investments

(Cost: $16,386,757) – 2.5% | | | 16,386,757 | | |

Securities Lending Collateral – 2.7% | | | |

| | 17,824,988 | | | Dreyfus Government Cash

Management Fund, Institutional Shares

(7 day yield of 0.01%) (f) | | | 17,824,988 | | |

Total Securities Lending Collateral

(Cost: $17,824,988) – 2.7% | | | 17,824,988 | | |

Total Investments

(Cost: $541,968,498) (g) – 101.9% | | | 672,954,634 | | |

Obligation to Return Collateral for

Securities Loaned – (2.7)% | | | (17,824,988 | ) | |

Cash and Other Assets Less Liabilities – 0.8% | | | 5,087,961 | | |

Net Assets – 100.0% | | $ | 660,217,607 | | |

ADR = American Depositary Receipts

GDR = Global Depositary Receipts

REIT = Real Estate Investment Trust

Notes to Statement of Investments

(a) All or a portion of this security was on loan at June 30, 2015. The total market value of securities on loan at June 30, 2015 was $16,988,175.

(b) Non-income producing security.

(c) Illiquid security.

(d) Denotes a restricted security, which is subject to restrictions on resale under federal securities laws. This security is valued at fair value determined in good faith under consistently applied procedures established by the Fund's Board of Trustees. At June 30, 2015, the market value of this security amounted to $2,179,413, which represented 0.33% of total net assets. Additional information on this security is as follows:

Security | | Acquisition

Dates | | Shares/

Units | | Cost | | Value | |

Union Agriculture Group | | 12/8/10-

6/27/12 | | | 230,870 | | | $ | 2,649,999 | | | $ | 2,179,413 | | |

(e) On June 30, 2015, the Fund's total equity investments were denominated in currencies as follows:

Currency | | Value | | Percentage of

Net Assets | |

Japanese Yen | | $ | 141,906,212 | | | | 21.5 | | |

British Pound | | | 74,789,156 | | | | 11.3 | | |

Euro | | | 74,756,174 | | | | 11.3 | | |

Hong Kong Dollar | | | 38,258,955 | | | | 5.8 | | |

Taiwan Dollar | | | 35,117,931 | | | | 5.3 | | |

Other currencies less

than 5% of total net assets | | | 273,914,461 | | | | 41.5 | | |

Total Equities | | $ | 638,742,889 | | | | 96.7 | | |

(f) Investment made with cash collateral received from securities lending activity.

(g) At June 30, 2015, for federal income tax purposes, the cost of investments was approximately $541,968,498 and net unrealized appreciation was $130,986,136 consisting of gross unrealized appreciation of $164,328,920 and gross unrealized depreciation of $33,342,784.

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments, following the input prioritization hierarchy established by accounting principles generally accepted in the United States of America (GAAP). These inputs are summarized in the three broad levels listed below:

• Level 1 – quoted prices in active markets for identical securities

• Level 2 – prices determined using other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk and others)

• Level 3 – prices determined using significant unobservable inputs where quoted prices or observable inputs are unavailable or less reliable (including management's own assumptions about the factors market participants would use in pricing an investment)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

See accompanying notes to financial statements.

13

Wanger International 2015 Semiannual Report

Statement of Investments (Unaudited), June 30, 2015

Examples of the types of securities in which the Fund would typically invest and how they are classified within this hierarchy are as follows. Typical Level 1 securities include exchange traded domestic equities, mutual funds whose NAVs are published each day and exchange traded foreign equities that are not statistically fair valued. Typical Level 2 securities include exchange traded foreign equities that are statistically fair valued, forward foreign currency exchange contracts and short-term investments valued at amortized cost. Additionally, securities fair valued by CWAM's Valuation Committee (the Committee) that rely on significant observable inputs are also included in Level 2. Typical Level 3 securities include any security fair valued by the Committee that relies on significant unobservable inputs.

The Committee is responsible for applying the Trust's Portfolio Pricing Policy and the CWAM pricing procedures (the Policies), which are approved by and subject to the oversight of the Board.

The Committee meets as necessary, and no less frequently than quarterly, to determine fair values for securities for which market quotations are not readily available or for which the investment manager believes that available market quotations are unreliable. The Committee also reviews the continuing appropriateness of the Policies. In circumstances where a security has been fair valued, the Committee will also review the continuing appropriateness of the current value of the security. The Policies address, among other things: circumstances under which market quotations will be deemed readily available; selection of third party pricing vendors; appropriate pricing methodologies; events that require fair valuation and fair value techniques; circumstances under which securities will be deemed to pose a potential for stale pricing, including when securities are illiquid, restricted, or in default; and certain delegations of authority to determine fair values to the Fund's investment manager. The Committee may also meet to discuss additional valuation matters, which may include review of back-testing results, review of time-sensitive information or approval of other valuation related actions, and to review the appropriateness of the Policies.

For investments categorized as Level 3, the significant unobservable inputs used in the fair value measurement of the Fund's securities may include: (i) data specific to the issuer or comparable issuers, (ii) general market or specific sector news and (iii) quoted prices and specific or similar security transactions. The Committee considers this data and any changes from prior periods in order to assess the reasonableness of observable and unobservable inputs, any assumptions or internal models used to value those securities and changes in fair value. Significant changes in any of these factors could result in lower or higher fair value measurements. Various factors impact the frequency of monitoring (which may occur as often as daily), however the Committee may determine that changes to inputs, assumptions and models are not required with the same frequency.

The following table summarizes the inputs used, as of June 30, 2015, in valuing the Fund's assets:

Investment Type | |

Quoted Prices

(Level 1) | | Other

Significant

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | | Total | |

Equities | |

Asia | | $ | 8,147,451 | | | $ | 308,354,647 | | | $ | 3,243,045 | | | $ | 319,745,143 | | |

Europe | | | 1,135,838 | | | | 207,162,331 | | | | — | | | | 208,298,169 | | |

Other Countries | | | 42,534,888 | | | | 48,713,135 | | | | — | | | | 91,248,023 | | |

Latin America | | | 17,272,141 | | | | — | | | | 2,179,413 | | | | 19,451,554 | | |

Total Equities | | | 69,090,318 | | | | 564,230,113 | | | | 5,422,458 | | | | 638,742,889 | | |

Total Short-Term

Investments | | | 16,386,757 | | | | — | | | | — | | | | 16,386,757 | | |

Total Securities

Lending Collateral | | | 17,824,988 | | | | — | | | | — | | | | 17,824,988 | | |

Total Investments | | $ | 103,302,063 | | | $ | 564,230,113 | | | $ | 5,422,458 | | | $ | 672,954,634 | | |

The Fund's assets assigned to the Level 2 input category are generally valued using a market approach, in which a security's value is determined through its correlation to prices and information from observable market transactions for similar or identical assets. Foreign equities are generally valued at the last sale price on the foreign exchange or market on which they trade. The Fund may use a statistical fair valuation model, in accordance with the policy adopted by the Board, provided by an independent third party to value securities principally traded in foreign markets in order to adjust for possible stale pricing that may occur between the close of the foreign exchanges and the time for valuation. These models take into account available market data including intraday index, ADR, and ETF movements.

There were no transfers of financial assets between Levels 1 and 2 during the period.

The Fund does not hold any significant investments (greater than one percent of net assets) categorized as Level 3.

Financial assets were transferred from Level 2 to Level 3 as trading halted during the period. As a result, as of period end, the Committee determined to value the security(s) under consistently applied procedures established by and under the general supervision of the Board.

The following table shows transfers between Level 2 and Level 3 of the fair value hierarchy:

Transfers In | | Transfers Out | |

| Level 2 | | Level 3 | | Level 2 | | Level 3 | |

| $ | — | | | $ | 4,496,473 | | | $ | 4,496,473 | | | $ | — | | |

Transfers in and/or out of Level 3 are determined based on the fair value at the beginning of the period for security positions held throughout the period.