UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08748 |

|

Wanger Advisors Trust |

(Exact name of registrant as specified in charter) |

|

227 W. Monroe Street Suite 3000 Chicago, IL | | 60606 |

(Address of principal executive offices) | | (Zip code) |

|

Mary C. Moynihan Perkins Coie LLP 700 13th Street, NW Suite 600 Washington, DC 20005 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 312-634-9200 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2013 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Wanger International

2013 Semiannual Report

Not FDIC insured • No bank guarantee • May lose value

Columbia Wanger Asset Management, LLC (CWAM) is one of the leading global small- and mid-cap equity managers in the United States with over 40 years of small- and mid-cap investment experience. As of June 30, 2013, CWAM managed $34.9 billion in assets. CWAM is the investment manager to Wanger USA, Wanger International, Wanger Select and Wanger International Select (together, the Columbia Wanger Funds) and the Columbia Acorn Family of Funds.

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus, which contains this and other important information about the Fund, contact your financial adviser, insurance company, qualified pension or retirement plan sponsor or call 1-888-4-WANGER. Read the prospectus carefully before investing.

An important note: Columbia Wanger Funds are available for purchase through variable annuity contracts and variable life insurance policies offered by the separate accounts of participating insurance companies and qualified pension or retirement plans.

Shares of the Fund may not be purchased or sold directly by individual owners of variable annuity contracts and/or variable life insurance policies (collectively, Contracts) or participants in qualified retirement or other plans (collectively, Qualified Plans). If you are the owner of a Contract or a participant in a Qualified Plan, please refer to the prospectus that describes your Contract or Qualified Plan for information about minimum investment requirements and how to purchase and redeem shares of the Fund.

The views expressed in "Health Care in the United States" and in the Performance Review reflect the current views of the respective authors. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict so actual outcomes and results may differ significantly from those stated. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Wanger Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Wanger Fund. References to specific company securities should not be construed as a recommendation or investment advice.

Wanger International

2013 Semiannual Report

Table of Contents

| | 2 | | | Understanding Your Expenses | |

| | 3 | | | Health Care in the United States | |

| | 6 | | | Performance Review | |

| | 8 | | | Statement of Investments | |

| | 19 | | | Statement of Assets and Liabilities | |

| | 19 | | | Statement of Operations | |

| | 20 | | | Statement of Changes in Net Assets | |

| | 21 | | | Financial Highlights | |

| | 22 | | | Notes to Financial Statements | |

| | 25 | | | Board Approval of the Advisory Agreement | |

Wanger International 2013 Semiannual Report

Understanding Your Expenses

As an investor, you incur two types of costs. There are transaction costs, which may include redemption fees or exchange fees charged under your contract or qualified plan. There are also ongoing costs, which generally include management fees and other Fund expenses. Lastly, there may be additional fees or charges imposed by the insurance company that sponsors your variable annuity and/or variable life insurance product. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your Fund's expenses

To illustrate the ongoing costs, we have provided an example and calculated the expenses paid by investors in the Fund during the period. The actual and hypothetical information in the table below is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the Fund's actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the Actual column. The amount listed in the "Hypothetical" column assumes a 5% annual rate of return before expenses (which is not the Fund's actual return) and then applies the Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See "Compare with other funds" below for details on how to use the hypothetical data.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing cost of investing in a fund only and do not reflect any transaction costs, such as redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of investing in different funds. If transaction costs were included in these calculations, your costs would be higher.

January 1, 2013 - June 30, 2013

| | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid during

period ($) | | Fund's annualized

expense ratio (%)* | |

| | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | | |

Wanger International | | | 1,000.00 | | | | 1,000.00 | | | | 1,057.70 | | | | 1,019.32 | | | | 5.35 | | | | 5.25 | | | | 1.06 | | |

*Expenses paid during the period are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, then multiplied by the number of days in the Fund's most recent fiscal half-year and divided by 365.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the Fund. Expenses paid during the period do not include any insurance charges imposed by your insurance company's separate account.

2

Wanger International 2013 Semiannual Report

Health Care in the United States

Critics of the U.S. health care system note that the World Health Organization (WHO) ranked the United States thirtieth in the world in life expectancy1 despite the fact that the United States spends more money per capita on health care than any other country. They argue that health care in the United States is inferior to health care in many other developed countries.

Scott W. Atlas's book, In Excellent Health, Setting the Record Straight on America's Health Care,2 analyzes the consequences of poor lifestyle choices made by many Americans and how the U.S. health care system operates compared to health care systems elsewhere. His book cites numerous studies indicating the U.S. health care system does a great job addressing the health concerns of Americans and is likely the best system in the world.

Life Expectancy

The United States is much more violent and accident-prone than other developed countries. Homicide rates in the United States are ten times that of the United Kingdom and five times that of Canada.3 Death rates from transportation accidents in the United States are 250% that of the United Kingdom and 160% that of Canada.4 Murder and accidents account for the majority of deaths among young adults in the United States,5 and deaths at young ages substantially impact life expectancies.

Robert Ohsfeldt's and John Schneider's book, The Business of Health,6 attempts to quantify the impact of fatal injuries on life expectancy. Using linear regression, they calculate that after standardizing for fatal injuries alone, the United States would edge out Switzerland by 0.3 years and have the highest life expectancy of any country in the world.7

Other studies indicate that violence and accidents account for much, but not all, of the life expectancy shortfall in the United States. A National Academy of Sciences panel addressing cross-national health differences issued a paper that indicated 57% of the life expectancy gap for

males under age 50 and 38% for females under 50 is explained by higher violence and accidents in the United States.8

The United States has a much higher incidence of obesity than other developed countries. Atlas notes that in 2010 34% of people in the United States were obese compared to 15% in Canada, 17% in Western Europe and about 24% in the United Kingdom.9 The Organization for Economic Cooperation and Development (OECD) estimates that obesity reduces life spans by up to eight to ten years.10 Sadly, the worst is yet to come for the United States, as obesity rates have increased and there appears to be a 25-year time lag between becoming obese and suffering premature death.11

Cigarette use in the United States is down substantially; smoking rates are now lower than most other OECD countries.12 However, studies have found a time lag of roughly 25 to 30 years between smoking and lung cancer mortality.13 The United States had the highest rate of smoking in the developed world from the 1930s to the mid-1980s and, according to a 2007 study, 53% of Americans were current or former smokers, compared to 43% of Western Europeans.14 Clearly the United States' legacy of smoking continues to impact health. The Surgeon General estimates that cigarette smoking causes 443,000 deaths in the United States yearly, nearly one-fifth of all deaths.15

With respect to neonatal mortality, Atlas writes that the United States has stringent reporting requirements and definitions. Birth registrations in the United States are done by hospitals and health care professionals, while many other countries rely on reporting by families or surveys.16 In the United States, a live birth is tabulated should a newborn breathe, have a beating heart, move voluntary muscles or show any other evidence of life.17 According to WHO, countries representing only 13% of births worldwide had reliable data meeting this definition.18

Elsewhere, definitions for live births vary greatly. Some countries consider births as live only if 28 weeks gestation was achieved, if a baby is 30 centimeters long, or if a baby survives 24 hours.19 Otherwise, the baby is classified as stillborn and is not considered an infant mortality. Atlas states, "... considering that roughly half of all U.S. infant mortality occurs in the first twenty-four hours, the single criterion of omitting deaths within the first twenty-four hours by many European nations generates their falsely superior infant mortality rates."20

Data from 2004 indicated that the United States had 12% of births classified as preterm (under 32 weeks gestation), a rate 50% to 100% higher than most European countries.21 These figures are impacted by the fact the United States has more multiple gestation pregnancies. Since the early 1980s, the incidence of triplets in the United States has more than tripled to over 140 births per 100,000.22 Atlas notes that in 2007, 17% of twins and 40% of triplets in the United States were associated with fertility treatments.

The United States health care system should be applauded for its efforts to save premature babies rather than write them off as stillborn, as many other countries do. Except for a very limited number of abusive cases, fertility treatment should be considered a virtue of the U.S. health care system. Yet, coupled with superior record keeping, these efforts depress the country's life expectancy ranking.

Diagnosis, Treatment and Outcomes

The Centers for Disease Control and Prevention (CDC) lists heart disease as the top killer in the United States, accounting for 25% of deaths, followed by cancer at 23%, and stroke a distant third at 6%.23 Rather than judge a health care system on reported life expectancy, Atlas assesses health care quality in the United States based on actual medical care, especially diagnosis and treatment of important diseases, using objective data.

3

Wanger International 2013 Semiannual Report

Atlas notes the challenges facing the health care system due to the poor lifestyle choices of many Americans. The CDC estimates that 80% of diabetes, heart disease and stroke, and 40% of cancer, could be eliminated through reduction in obesity and smoking.24 The rate of diabetes in the United States is typically 33% to 100% higher than other developed countries.25 A 2007 study indicated that 12% of Americans over age 50 were diagnosed with cancer, compared to only 5% in a composite of 10 European countries.26

Atlas cites data showing more timely diagnosis and treatment in the United States as compared to other countries. He writes that, "... prolonged wait times are commonly found in health systems with government-controlled nationalized health insurance."27 Numerous countries with single payer systems had to create policies to address prolonged wait times, including Canada, England, Italy, Sweden and Spain.

The United States is among the world's leaders in per capita computerized tomography (CT) and magnetic resonance imaging (MRI) scanners,28 which are crucial to accurately diagnosing leading fatal diseases and guiding lower risk and more effective treatments. In the United States, referring doctors book CT and MRI appointments within days. In other countries, people wait. In 2010, the average wait time in Canada for a CT scan was 4 weeks and for an MRI, 10 weeks.29 A 2011 study in the United Kingdom indicated thousands of people waited over six weeks for an MRI scan. With respect to breast cancer biopsies, another survey indicated that only 1% of U.S. patients waited three weeks or more while 44% of Canadian and 20% of U.K. patients waited that long.30

Treatment of diseases also tends to be very timely in the United States. One study indicated that no elective (non-emergency) cardiac bypass patients in the United States were known to have waited more than three months, while 47% in Canada and 89% in the United Kingdom waited at least that long.31

Furthermore, treatments in the United States tend to be aggressive. A 2009 paper written by

University of Pennsylvania professor Samuel Preston and doctoral candidate Jessica Ho states that 88% of Americans with high cholesterol are being medicated versus 62% of Europeans. Likewise a higher percentage of Americans over age 50 with heart disease receive medication. Among those with hypertension in the United States, 66% were being successfully treated, versus 25% to 49% in other countries.32

With respect to cancer, Preston and Ho cite studies showing that the United States tends to have the highest percentage of screenings for breast, cervical, prostate and colon cancer.33 If cancer is detected, Americans tend to receive more surgery, chemotherapy and advanced cancer drugs. A 2008 study calculated five-year survival rates for breast, colorectal and prostate cancers. Patients in the United States lead the world with a 74% survival rate. Second-best Canada came in at 71% and the United Kingdom was a laggard at 52%.

Atlas adds that new oncology drugs are most often approved and first used in the United States.34 Some 80% of worldwide medical innovation originates in the United States and, since the mid-1970s, U.S. scientists have won more than half of Nobel Prize awards in medicine and physiology.

The statistics are clear. Sick Americans are more likely to receive timely and aggressive health care than citizens of other countries. Atlas writes, "Availability of state-of-the-art medical technology, timely access to specialists, the most effective screening, the shortest wait times for life-changing surgeries, the newest, most effective drugs for more accurate, safer diagnosis and for the most advanced treatment are all superior in the United States."35

Many people appear to agree. In 2008, a McKinsey & Company study estimated that up to 85,000 patients sought in-patient treatment outside their home country. Of that number, 87% traveled to the United States for advanced medical technology, better quality care or quicker access to care. In contrast, critics of the U.S.

health care system don't appear to be traveling to Cuba for treatment. Based on the facts, I agree with Atlas.

Health Care Economics and Investment Implications

Atlas states that the, "... only real crisis in America's health care today is the unsustainable and increasing burden of health care costs..."36 and recommends free market reforms. Health care costs are not the topic of this essay, but world-class health care clearly is expensive, and costs in the United States are exacerbated by detrimental lifestyle choices. I also believe that poor government policies result in few incentives for cost restraint.

Columbia Wanger Asset Management, the investment manager of the Columbia Wanger Funds, strives to provide Columbia Wanger Fund investors with investments in health care companies that are pursuing breakthrough drugs and devices, with the potential to transform treatment of serious and poorly managed diseases. For example, in pivotal studies Seattle Genetics' drug Adcetris delivered 80% response rates in advanced Hodgkin's lymphoma patients who had exhausted all other treatment options.37 In addition, we seek to invest in companies with products and services that we believe increase the cost effectiveness of health care delivery. We attempt to avoid investing in health care companies that may be more likely to be subject to cost cuts or price controls.

Charles P. McQuaid

President and Chief Investment Officer

Columbia Wanger Asset Management, LLC

4

Wanger International 2013 Semiannual Report

The information and data provided in this analysis are derived from sources that we deem to be reliable and accurate. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict so actual outcomes and results may differ significantly from the views expressed. The views/opinions expressed here are those of the author and not of the Wanger Advisors Trust Board, are subject to change at any time based upon economic, market or other conditions, may differ from views expressed by other Columbia Management associates and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Wanger Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Wanger Fund.

1 Atlas, Scott W., In Excellent Health, Setting the Record Straight on American's Heath Care, (Stanford, California, Hoover Institution Press), p. 2.

2 Ibid.

3 Ohsfeldt, Robert L., and Schneider, John E., The Business of Health, The Role of Competition, Markets, and Regulation, (Washington, D.C., The AEI Press), p. 19.

4 Atlas, Scott W., op. cit., p. 28.

5 Ibid., p. 28.

6 Ohsfeldt, Robert L., and Schneider, John E., op. cit.

7 Ibid., p. 22.

8 Steven H. Woolf and Laudan Aron, Editors; Panel on Understanding Cross-National Health Differences Among High-Income Countries; Committee on Population; Division of Behavioral and Social Sciences and Education; National Research Council; Board on Population Health and Public Health Practice; Institute of Medicine, www.nap.edu.

9 Atlas, Scott W., op. cit., p. 105.

10 Ibid., p. 31.

11 Ibid., p. 107.

12 Ibid., p. 40.

13 Ibid., p. 41.

14 Ibid., p. 111.

15 Ibid., p. 108.

16 Ibid., p. 60.

17 Ibid., p. 67.

18 Ibid., p. 71.

19 Ibid., p. 68.

20 Ibid., p. 70.

21 Ibid., p. 73.

22 Ibid., p. 89.

23 Ibid., p. 119.

24 Ibid., p. 103.

25 Ibid., p. 113.

26 Preston, Samuel H., and Ho, Jessica Y., "Low Life Expectancy in the United States: Is the Health Care System at Fault?" University of Pennsylvania Scholarly Commons Working Paper Series, July 1, 2009, p. 4, http://repository.upenn.edu/psc_working_papers/13/. Accessed July 24, 2013.

27 Atlas, Scott W., op. cit., p. 159.

28 Ibid., p. 192-193.

29 Ibid., p. 194.

30 Ibid., p. 175.

31 Ibid., p. 187.

32 Preston, Samuel H., and Ho, Jessica Y., op. cit., p. 6.

33 Ibid., p. 3.

34 Atlas, Scott W., op. cit., p. 222.

35 Ibid., p. 233.

36 Ibid., p. 245.

37 Seattle Genetics is held in the following Columbia Wanger Funds: Wanger USA, 1.2%; Wanger Select, 1.3%.

5

Wanger International 2013 Semiannual Report

Performance Review Wanger International

| |

| |

Louis J. Mendes III

Co-Portfolio Manager | | Christopher J. Olson

Co-Portfolio Manager | |

Performance data shown represents past performance and is not a guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data shown. Please visit columbiamanagement.com for most recent month-end performance updates.

Wanger International gained 5.77% for the semiannual period ended June 30, 2013, outperforming the 1.95% return of its primary benchmark, the S&P Global Ex-U.S. Between $500M and $5B Index. For comparison, the large-cap, developed market MSCI EAFE Index (Net) rose 4.10% during the period.

Many bond markets experienced a sharp rise in mid-term interest rates following the mid-May remarks by U.S. Federal Reserve Bank Chairman Ben Bernanke that the Fed could "take a step down in our pace of purchase" of bonds, an unconventional practice that has supported low interest rates through the present financial crisis. How the Fed will manage this policy shift is of critical importance to investors globally, since many risk assets are priced off of U.S. government bonds. While Bernanke's remarks are grounded in signs of a normalizing U.S. economy—ostensibly good news—10-year bond rates rose on average 100 basis points in the ensuing weeks, which triggered a sell-off in international equities as investors discounted the impact more expensive money would have on economic activity and asset values in diverse markets. While the outlook for the U.S. economy may be brightening, things still appear grim in many parts of the world. In June, fears of stagflation in Brazil sent over one million people into the streets demanding more accountability from a government whose popularity has reached historic lows. Slowing economic growth in China upset already weak commodity markets and sent resources shares tumbling in the second quarter of 2013. Japanese stocks also took a breather in the second quarter as the initial euphoria of "Abenomics" began to fade following two prior quarters of sharply rising markets. Despite the ebb and flow of sentiment, many of the Fund's holdings have continued to post growth in earnings.

Up 111%, the Fund's top performer in the semiannual period was Start Today, a Japanese online apparel retailer. The company has successfully managed costs to return to strong profitability after a rough 2012, during which its shares declined roughly 60%. Siam Makro, a Thai-based cash and carry retailer of goods and produce, rose 76% following a takeover bid from fellow Thai retailer CP-ALL. In recent years, Thailand has had a strong domestic economy as government policies and foreign investment have continued to increase the purchasing power of the rising middle class outside of urban Bangkok. Taiwan's St. Shine Optical, the world's leading manufacturer of daily disposable contact lenses, rose 69% with continued

expansion of its overseas presence, and increasing penetration of daily-wear contact lenses, which have become more affordable with rising regional incomes.

Commodity-related holdings, namely in energy and basic materials, came under pressure as anxiety about the macroeconomic outlook rose. Coal miner Mongolian Mining fell 62% during the six-month period on disappointing volume throughput to China as logistic improvements continue to be delayed. Brazilian gold miner Beadell Resources and Australia's Regis Resources each fell over 50% in the first six months of 2013 as gold prices dropped over 25%. Imtech, a Dutch technical installation and maintenance services provider, was down 68%. It became clear that an earnings-dilutive rights issue was in the offing, following the news of fraud in its German and Polish operations. In Korea, Samsung Engineering fell 49% as the outlook for earnings declined amidst weakening overseas construction orders. We opted to sell the Fund's position in this stock.

Considerable uncertainties mar the international landscape. We expect continued high volatility in the second half of the year. We believe that, while unsettling, volatility provides opportunities to buy good companies at attractive prices.

International investing involves special risks, including foreign taxation, currency risks, risks associated with possible differences in financial standards, operational and settlement risks and other risks associated with future political and economic developments. Stocks of small- and mid-cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies. Investing in emerging markets may involve greater risks than investing in more developed countries. In addition, concentration of investments in a single region may result in greater volatility.

Portfolio holdings are subject to change periodically and may not be representative of current holdings.

Fund's Positions in Mentioned Holdings

As a percentage of net assets, as of 6/30/13

St. Shine Optical | | | 0.8 | % | |

Start Today | | | 0.8 | | |

Beadell Resources | | | 0.3 | | |

Regis Resources | | | 0.2 | | |

Imtech | | | 0.2 | | |

Mongolian Mining | | | 0.2 | | |

6

Wanger International 2013 Semiannual Report

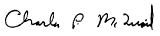

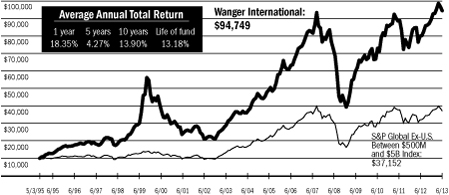

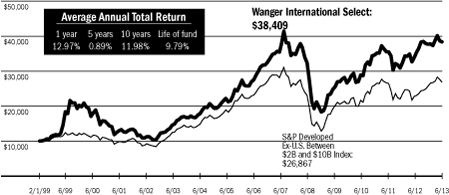

Growth of a $10,000 Investment in Wanger International

May 3, 1995 (inception date) through June 30, 2013

Performance data shown represents past performance and is not a guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data shown. Performance results reflect any fee waivers or reimbursements of Fund expenses by the investment manager and/or any of its affiliates. Absent these fee waivers and/or expense reimbursement arrangements, performance results would have been lower. For daily and most recent month-end performance updates, please call 1-888-4-WANGER.

This graph compares the results of $10,000 invested in Wanger International on May 3, 1995 (the date the Fund began operations) through June 30, 2013, to the S&P Global Ex-U.S. Between $500M and $5B Index with dividends and capital gains reinvested. Although the index is provided for use in assessing the Fund's performance, the Fund's holdings may differ significantly from those in the index.

Top 10 Holdings

As a percentage of net assets, as of 6/30/13

1. Far Eastone Telecom (Taiwan)

Taiwan's Third Largest Mobile Operator | | | 1.4

| % | |

2. Coronation Fund Managers (South Africa)

South African Fund Manager | | | 1.1

| | |

3. Hexagon (Sweden)

Design, Measurement & Visualization Software & Equipment | | | 1.1

| | |

4. Melco Crown Entertainment — ADR* (Hong Kong)

Macau Casino Operator | | | 1.1

| | |

5. CCL Industries (Canada)

Largest Global Label Converter | | | 1.0

| | |

6. Partners Group (Switzerland)

Private Markets Asset Management | | | 1.0

| | |

7. Eurofins Scientific (France)

Food, Pharmaceuticals & Materials Screening & Testing | | | 0.9

| | |

8. Neopost (France)

Postage Meter Machines | | | 0.9

| | |

9. Taiwan Mobile (Taiwan)

Taiwan's Second Largest Mobile Operator | | | 0.9

| | |

10. Aalberts Industries (Netherlands)

Flow Control & Heat Treatment | | | 0.9

| | |

* ADR = American Depository Receipts

Top 5 Countries

As a percentage of net assets, as of 6/30/13

Japan | | | 20.9 | % | |

United Kingdom | | | 9.7 | | |

Taiwan | | | 7.0 | | |

Hong Kong | | | 4.9 | | |

South Africa | | | 4.1 | | |

Results as of June 30, 2013

| | 2nd quarter* | | Year to date* | | 1 year | | 5 years | | 10 years | |

Wanger International | | | -1.08 | % | | | 5.77 | % | | | 18.35 | % | | | 4.27 | % | | | 13.90 | % | |

S&P Global Ex-U.S.

Between $500M and

$5B Index** | | | -3.46 | | | | 1.95 | | | | 15.91 | | | | 2.88 | | | | 12.36 | | |

MSCI EAFE Index (Net) | | | -0.98 | | | | 4.10 | | | | 18.62 | | | | -0.63 | | | | 7.67 | | |

Lipper Variable

Underlying International

Growth Funds Index | | | -1.78 | | | | 2.16 | | | | 15.59 | | | | 0.02 | | | | 7.88 | | |

*Not annualized.

**The Fund's primary benchmark.

NAV as of 6/30/13: $30.10

Performance numbers reflect all Fund expenses but do not include any fees and expenses imposed under your variable annuity or life insurance policy or qualified pension or retirement plan. If performance included the effect of these additional charges, it would be lower.

The Fund's annual operating expense ratio of 1.07% is stated as of the Fund's prospectus dated May 1, 2013, and differences in expense ratios disclosed elsewhere in this report may result from including fee waivers and expense reimbursements as well as different time periods used in calculating the ratios.

All results shown assume reinvestment of distributions.

The S&P Global Ex-U.S. Between $500M and $5B Index is a subset of the broad market selected by the index sponsor representing the mid- and small-cap developed and emerging markets, excluding the United States. The MSCI Europe, Australasia, Far East (EAFE) Index (Net) is a capitalization-weighted index that tracks the total return of common stocks in 22 developed-market countries within Europe, Australasia and the Far East. The returns of the MSCI EAFE Index (Net) are presented net of the withholding tax rate applicable to foreign non-resident institutional investors in the foreign companies included in the index who do not benefit from double taxation treaties. The performance of the MSCI EAFE Index (Net) is provided to show how the Fund's performance compares to a widely recognized broad-based index of foreign market performance. The Lipper Variable Underlying International Growth Funds Index is an equally weighted representation of the 30 largest variable insurance underlying funds in the Lipper Variable Underlying International Growth Funds Classification, and shows how the Fund's performance compares with returns of an index of funds with similar investment objectives. Indexes are not managed and do not incur fees or expenses. It is not possible to invest directly in an index.

Lipper Inc., a widely respected data provider in the industry, calculates an average total return (assuming reinvestment of distributions) for mutual funds with investment objectives similar to those of the Fund.

Portfolio characteristics and holdings are subject to change periodically and may not be representative of current characteristics and holdings.

7

Wanger International 2013 Semiannual Report

Statement of Investments (Unaudited), June 30, 2013

Number of

Shares | | | | Value | |

| | | Equities – 97.7% | |

| | | Asia – 46.7% | |

| | | Japan – 20.9% | |

| 292,000

| | | Start Today

Online Japanese Apparel Retailer | | $ | 5,717,824

| | |

| 514,600

| | | Wacom

Computer Graphic Illustration Devices | | | 5,688,398

| | |

| 443,589

| | | Kansai Paint

Paint Producer in Japan, India, China & Southeast Asia | | | 5,662,483

| | |

| 255,000

| | | NGK Spark Plug

Automobile Parts | | | 5,103,796

| | |

| 1,339,000

| | | Seven Bank

ATM Processing Services | | | 4,853,989

| | |

| 4,220

| | | Orix JREIT

Diversified Real Estate Investment Trust | | | 4,816,670

| | |

| 339,900

| | | Kuraray

Special Resin, Fine Chemical, Fibers & Textures | | | 4,763,767

| | |

| 125,000

| | | Hoshizaki Electric

Commercial Kitchen Equipment | | | 4,003,054

| | |

| 30,299

| | | Nakanishi

Dental Tools & Machinery | | | 3,862,053

| | |

| 238,000

| | | Japan Airport Terminal

Airport Terminal Operator at Haneda | | | 3,766,951

| | |

| 88,541

| | | Kintetsu World Express

Airfreight Logistics | | | 3,543,005

| | |

| 149,000

| | | Glory

Currency Handling Systems & Related Equipment | | | 3,495,770

| | |

| 143,300

| | | Ariake Japan

Manufacturer of Soup/Sauce Extracts for

Business-to-business Use | | | 3,489,591

| | |

| 190,400

| | | Park24

Parking Lot Operator | | | 3,454,242

| | |

| 830

| | | Kenedix Realty Investment

Tokyo Mid-size Office Real Estate Investment Trust | | | 3,304,040

| | |

| 170,000

| | | Daiseki (a)

Waste Disposal & Recycling | | | 2,974,003

| | |

| 220,500

| | | Ushio

Industrial Light Sources | | | 2,911,421

| | |

| 22,000

| | | Hirose Electric

Electrical Connectors | | | 2,897,624

| | |

| 234,000

| | | NGK Insulators

Ceramic Products for Auto, Power & Electronics | | | 2,891,671

| | |

| 62,000

| | | Sanrio

Character Goods & Licensing | | | 2,876,044

| | |

Number of

Shares | | | | Value | |

| 141,039

| | | Nihon Parkerizing

Metal Surface Treatment Agents & Processing Service | | $ | 2,792,999

| | |

| 77,000

| | | Benesse

Education Service Provider | | | 2,777,924

| | |

| 59,536

| | | Miraca Holdings

Outsourced Lab Testing, Diagnostic Equipment & Reagents | | | 2,735,854

| | |

| 39,300

| | | Disco

Semiconductor Dicing & Grinding Equipment | | | 2,710,634

| | |

| 206,500

| | | Nippon Kayaku (a)

Functional Chemicals, Pharmaceuticals &

Auto Safety Systems | | | 2,572,738

| | |

| 140,000

| | | Suruga Bank

Regional Bank | | | 2,538,827

| | |

| 121,000

| | | Nabtesco

Machinery Components | | | 2,512,294

| | |

| 35,000

| | | Rinnai

Gas Appliances for Household & Commercial Use | | | 2,488,695

| | |

| 35,100

| | | FP Corporation

Disposable Food Trays & Containers | | | 2,433,624

| | |

| 250

| | | Industrial & Infrastructure Fund

Industrial Real Estate Investment Trust in Japan | | | 2,431,418

| | |

| 280

| | | Nippon Prologis REIT

Logistics Real Estate Investment Trust in Japan | | | 2,429,631

| | |

| 58,000

| | | Itochu Techno-Science

IT Network Equipment Sales & Services | | | 2,400,948

| | |

| 72,000

| | | Toyo Suisan Kaisha

Instant Noodle Manufacturer | | | 2,395,637

| | |

| 65,500

| | | Hamamatsu Photonics

Optical Sensors for Medical & Industrial Applications | | | 2,365,417

| | |

| 166,000

| | | Doshisha

Wholesaler | | | 2,364,333

| | |

| 1,070

| | | Advance Residence Investment

Residential REIT | | | 2,319,745

| | |

| 370

| | | Mori Hills REIT Investment

Tokyo Centric Diversified Real Estate Investment Trust | | | 2,310,592

| | |

| 54,000

| | | Familymart

Convenience Store Operator | | | 2,304,096

| | |

| 51,500

| | | Santen Pharmaceutical

Specialty Pharma (Ophthalmic Medicine) | | | 2,228,652

| | |

| 109,100

| | | Aica Kogyo

Laminated Sheets, Building Materials &

Chemical Adhesives | | | 2,186,773

| | |

| 72,300

| | | Omron

Electric Components for Factory Automation | | | 2,155,481

| | |

See accompanying notes to financial statements.

8

Wanger International 2013 Semiannual Report

Statement of Investments (Unaudited), June 30, 2013

Number of

Shares | | | | Value | |

| | | Japan – 20.9% (cont) | |

| 48,711

| | | Ain Pharmaciez

Dispensing Pharmacy/Drugstore Operator | | $ | 2,099,612

| | |

| 360

| | | Global One Real Estate

Office Real Estate Investment Trust | | | 2,091,463

| | |

| 133,900

| | | OSG

Consumable Cutting Tools | | | 2,003,206

| | |

| 80,000

| | | Icom

Two Way Radio Communication Equipment | | | 1,940,519

| | |

| 197,000

| | | Asahi Diamond Industrial

Consumable Diamond Tools | | | 1,862,077

| | |

| 21,000

| | | Shimano

Bicycle Components & Fishing Tackle | | | 1,788,882

| | |

| 200,900

| | | Sintokogio

Automated Casting Machines, Surface Treatment

System & Consumables | | | 1,660,851

| | |

| 45,500

| | | Milbon

Manufacturer of Hair Products for Business-to-business Use | | | 1,604,271

| | |

| 155,000

| | | Lifenet Insurance (a) (b)

Online Life Insurance Company in Japan | | | 1,265,423

| | |

| 23,800

| | | Horiba

Test & Measurement Instruments | | | 868,051

| | |

| 34,600

| | | MonotaRO (a)

Online MRO (Maintenance, Repair, Operations) Goods

Distributor in Japan | | | 842,437

| | |

| | | | 149,559,500 | | |

| | | Taiwan – 7.0% | |

| 3,714,000

| | | Far Eastone Telecom

Taiwan's Third Largest Mobile Operator | | | 9,953,914

| | |

| 1,671,000

| | | Taiwan Mobile

Taiwan's Second Largest Mobile Operator | | | 6,583,164

| | |

| 224,000

| | | St. Shine Optical

World's Leading Disposable Contact Lens OEM (Original

Equipment Manufacturer) | | | 5,790,303

| | |

| 2,115,000

| | | CTCI Corp

International Engineering Firm | | | 3,835,911

| | |

| 717,000

| | | Delta Electronics

Industrial Automation, Switching Power Supplies &

Passive Components | | | 3,256,243

| | |

| 1,249,000

| | | Taiwan Hon Chuan

Beverage Packaging (Bottles, Caps, Labels) Manufacturer | | | 2,914,612

| | |

| 603,000

| | | Advantech

Industrial PC & Components | | | 2,859,993

| | |

Number of

Shares | | | | Value | |

| 140,000

| | | Ginko International

Largest Contact Lens Maker in China | | $ | 2,346,037

| | |

| 680,000

| | | Flexium Interconnect

Flexible Printed Circuit for Mobile Electronics | | | 2,310,184

| | |

| 612,000

| | | Lung Yen

Funeral Services & Columbaria | | | 1,987,842

| | |

| 262,000

| | | President Chain Store

Taiwan's Number One Convenience Chain Store Operator | | | 1,712,647

| | |

| 894,000

| | | Lite-On Technology

Mobile Device, LED & IT Component Supplier | | | 1,562,675

| | |

| 298,000

| | | PC Home

Taiwanese Internet Retail Company | | | 1,553,938

| | |

| 543,181

| | | Chipbond

Semiconductor Back-end Packaging Services | | | 1,321,751

| | |

| 695,000

| | | Chroma Ate

Automatic Test Systems, Testing & Measurement

Instruments | | | 1,176,137

| | |

| 404,000

| | | CHC Healthcare

Medical Device Distributor | | | 1,069,383

| | |

| | | | 50,234,734 | | |

| | | Hong Kong – 4.9% | |

| 340,000

| | | Melco Crown Entertainment – ADR (b)

Macau Casino Operator | | | 7,602,400

| | |

| 753,000

| | | AAC Technologies

Miniature Acoustic Components | | | 4,224,687

| | |

| 1,531,750

| | | L'Occitane International

Skin Care & Cosmetics Producer | | | 4,114,770

| | |

| 1,746,000

| | | Lifestyle International

Mid to High-end Department Store Operator in

Hong Kong & China | | | 3,644,230

| | |

| 1,835,000

| | | Melco International

Macau Casino Operator | | | 3,443,084

| | |

| 2,888,000

| | | Sa Sa International

Cosmetics Retailer | | | 2,851,958

| | |

| 3,600,000

| | | Mapletree Greater China

Commercial Trust (b)

Retail & Office Property Landlord | | | 2,675,693

| | |

| 917,800

| | | MGM China Holdings

Macau Casino Operator | | | 2,435,526

| | |

| 1,700,000

| | | Vitasoy International

Well Known Hong Kong Soy Food Brand

Reinventing Brand | | | 2,046,360

| | |

| 162,300

| | | ASM Pacific

Semi Backend & Surface Mounting Equipment | | | 1,781,690

| | |

| | | | 34,820,398 | | |

See accompanying notes to financial statements.

9

Wanger International 2013 Semiannual Report

Statement of Investments (Unaudited), June 30, 2013

Number of

Shares | | | | Value | |

| | | Singapore – 2.8% | |

| 3,850,000

| | | Mapletree Commercial Trust

Retail & Office Property Landlord | | $ | 3,588,018

| | |

| 3,000,000

| | | Mapletree Logistics Trust

Industrial Property Landlord | | | 2,600,109

| | |

| 2,500,000

| | | Mapletree Industrial Trust

Industrial Property Landlord | | | 2,598,079

| | |

| 1,851,000

| | | CDL Hospitality Trust

Hotel Owner/Operator | | | 2,476,842

| | |

| 1,239,000

| | | Ascendas REIT

Industrial Property Landlord | | | 2,171,328

| | |

| 323,000

| | | Singapore Exchange

Singapore Equity & Derivatives Market Operator | | | 1,785,349

| | |

| 473,000

| | | Super Group

Instant Food & Beverages in Southeast Asia | | | 1,659,512

| | |

| 1,233,000

| | | Goodpack Limited

International Bulk Container Leasing | | | 1,527,266

| | |

| 473,000

| | | Petra Foods

Cocoa Processor & Chocolate Manufacturer | | | 1,412,156

| | |

| | | | 19,818,659 | | |

| | | Korea – 2.7% | |

| 76,570

| | | Coway

Household Appliance Rental Service Provider | | | 3,720,862

| | |

| 148,377

| | | Paradise Co

Korean 'Foreigner Only' Casino Operator | | | 2,994,929

| | |

| 46,952

| | | Kepco Plant Service & Engineering

Power Plant & Grid Maintenance | | | 2,137,821

| | |

| 40,000

| | | LS Industrial Systems

Manufacturer of Electrical & Automation Equipment | | | 1,998,998

| | |

| 6,865

| | | KCC

Paint & Housing Material Manufacturer | | | 1,962,503

| | |

| 1,495

| | | Lotte Chilsung Beverage

Beverages & Liquor Manufacturer | | | 1,800,465

| | |

| 89,014

| | | iMarketKorea

Procurement, Distribution of MRO (Maintenance, Repair,

Operations) Goods | | | 1,715,005

| | |

| 65,350

| | | Handsome

High-end Apparel Company | | | 1,656,840

| | |

| 74,000

| | | Nexen Tire

Tire Manufacturer | | | 1,052,067

| | |

| 14,260

| | | BS Financial Group

Regional Bank in Busan (Korea's Second Largest City) | | | 179,447

| | |

| | | | 19,218,937 | | |

Number of

Shares | | | | Value | |

| | | India – 2.2% | |

| 32,877

| | | Asian Paints

India's Largest Paint Company | | $ | 2,558,332

| | |

| 185,000

| | | United Breweries

India's Largest Brewer | | | 2,247,503

| | |

| 277,000

| | | Yes Bank

Commercial Banking in India | | | 2,141,297

| | |

| 91,100

| | | Colgate Palmolive India

Consumer Products in Oral Care | | | 2,081,059

| | |

| 694,809

| | | Adani Ports & Special Economic Zone

Indian West Coast Shipping Port | | | 1,754,243

| | |

| 1,217,418

| | | Redington India

Supply Chain Solutions for IT & Mobile Handsets in

Emerging Markets | | | 1,469,813

| | |

| 556,967

| | | Bharti Infratel

Communication Towers | | | 1,424,164

| | |

| 8,620

| | | Bosch

Automotive Parts | | | 1,308,568

| | |

| 12,300

| | | TTK Prestige

Branded Cooking Equipment | | | 651,686

| | |

| 199,131

| | | SKIL Ports and Logistics (b)

Indian Container Port Project | | | 298,325

| | |

| | | | 15,934,990 | | |

| | | Indonesia – 1.8% | |

| 5,367,900

| | | Tower Bersama Infrastructure (b)

Communications Towers | | | 2,803,150

| | |

| 3,249,542

| | | Archipelago Resources (b)

Gold Mining Projects in Indonesia, Vietnam &

the Philippines | | | 2,335,279

| | |

| 23,000,000

| | | Ace Indonesia

Home Improvement Retailer | | | 1,710,651

| | |

| 509,000

| | | Mayora Indah

Consumer Branded Food Manufacturer | | | 1,542,547

| | |

| 4,035,391

| | | Surya Citra Media

Free to Air TV Station in Indonesia | | | 1,107,455

| | |

| 945,500

| | | Matahari Department Store (b)

Largest Department Store Chain in Indonesia | | | 1,105,563

| | |

| 4,681,000

| | | MNC Skyvision (b)

Largest Satellite Pay TV Operator in Indonesia | | | 1,104,040

| | |

| 1,589,500

| | | Arwana Citramulia

Ceramic Tiles for Home Decoration | | | 511,580

| | |

| 636,500

| | | Mitra Adiperkasa

Operator of Department Store & Specialty Retail Stores | | | 446,875

| | |

See accompanying notes to financial statements.

10

Wanger International 2013 Semiannual Report

Statement of Investments (Unaudited), June 30, 2013

Number of

Shares | | | | Value | |

| | | Indonesia – 1.8% (cont) | |

| 780,500

| | | Southern Arc Minerals (b)

Gold & Copper Exploration in Indonesia | | $ | 89,056

| | |

| | | | 12,756,196 | | |

| | | China – 1.4% | |

| 209,348

| | | WuXi PharmaTech — ADR (b)

Largest Contract Research Organization

Business in China | | | 4,396,308

| | |

| 1,640,000

| | | Want Want

Chinese Branded Consumer Food Company | | | 2,298,694

| | |

| 19,000,000

| | | RexLot Holdings

Lottery Equipment Supplier in China | | | 1,246,006

| | |

| 3,002,000

| | | AMVIG Holdings

Chinese Tobacco Packaging Material Supplier | | | 1,161,158

| | |

| 136,000

| | | Biostime

Pediatric Nutrition & Baby Care Products Provider | | | 760,523

| | |

| 435,000

| | | Digital China

IT Distribution & Systems Integration Services | | | 517,069

| | |

| | | | 10,379,758 | | |

| | | Thailand – 1.1% | |

| 9,174,600

| | | Home Product Center

Home Improvement Retailer | | | 3,387,702

| | |

| 400,000

| | | Airports of Thailand

Airport Operator of Thailand | | | 2,161,669

| | |

| 882,000

| | | Robinson's Department Store

Mass-market Department Store Operator in Thailand | | | 1,723,725

| | |

| 924,300

| | | Samui Airport Property Fund

Thai Airport Operator | | | 523,335

| | |

| | | | 7,796,431 | | |

| | | Philippines – 0.9% | |

| 6,165,000

| | | SM Prime Holdings

Shopping Mall Operator | | | 2,315,950

| | |

| 777,540

| | | Int'l Container Terminal

Container Handling Terminals & Port Management | | | 1,558,525

| | |

| 1,795,000

| | | Manila Water Company

Water Utility Company in Philippines | | | 1,344,880

| | |

| 5,500,000

| | | Melco Crown (Philippines) Resorts (b)

Integrated Resort Operator in Manila | | | 1,056,713

| | |

| | | | 6,276,068 | | |

Number of

Shares | | | | Value | |

| | | Cambodia – 0.6% | |

| 5,774,000

| | | Nagacorp

Casino/Entertainment Complex in Cambodia | | $ | 4,487,842

| | |

| | | Mongolia – 0.4% | |

| | 118,952 | | | Turquoise Hill Resources (a) (b) | | | 705,772 | | |

| 108,951

| | | Turquoise Hill Resources (a) (b) (c)

Copper Mine Project in Mongolia | | | 646,079

| | |

| 7,204,500

| | | Mongolian Mining (b)

Coking Coal Mining in Mongolia | | | 1,336,578

| | |

| | | | 2,688,429 | | |

| | | | | Total Asia | | | 333,971,942 | | |

| | | Europe – 31.5% | |

| | | United Kingdom – 9.7% | |

| 448,000

| | | Jardine Lloyd Thompson Group

International Business Insurance Broker | | | 6,205,356

| | |

| 2,000,000

| | | Charles Taylor

Insurance Services | | | 5,718,770

| | |

| 350,000

| | | Telecity

European Data Center Provider | | | 5,393,523

| | |

| 110,920

| | | Spirax Sarco

Steam Systems for Manufacturing & Process Industries | | | 4,545,925

| | |

| 92,700

| | | Whitbread

The UK's Leading Hotelier & Coffee Shop | | | 4,312,373

| | |

| 353,326

| | | Domino's Pizza UK & Ireland

Pizza Delivery in UK, Ireland & Germany | | | 3,601,921

| | |

| 113,000

| | | Rightmove

Internet Real Estate Listings | | | 3,582,445

| | |

| 317,959

| | | WH Smith (a)

Newsprint, Books & General Stationery Retailer | | | 3,472,359

| | |

| 356,000

| | | Shaftesbury

London Prime Retail Real Estate Investment Trust | | | 3,225,596

| | |

| 270,000

| | | Smith & Nephew

Medical Equipment & Supplies | | | 3,023,962

| | |

| 78,000

| | | CRODA

Oleochemicals & Industrial Chemicals | | | 2,941,388

| | |

| 572,355

| | | BBA Aviation

Aviation Support Services | | | 2,437,634

| | |

| 347,000

| | | Abcam

Online Sales of Antibodies | | | 2,393,435

| | |

See accompanying notes to financial statements.

11

Wanger International 2013 Semiannual Report

Statement of Investments (Unaudited), June 30, 2013

Number of

Shares | | | | Value | |

| | | United Kingdom – 9.7% (cont) | |

| 715,966

| | | Elementis

Clay-based Additives | | $ | 2,389,042

| | |

| 451,000

| | | Halford's

The UK's Leading Retailer for Leisure Goods & Auto Parts | | | 2,169,127

| | |

| 3,455,000

| | | Cable and Wireless

Leading Telecoms Service Provider in the Caribbean | | | 2,150,718

| | |

| 80,731

| | | Aggreko

Temporary Power & Temperature Control Services | | | 2,017,829

| | |

| 117,771

| | | Babcock International

Public Sector Outsourcer | | | 1,977,482

| | |

| 831,000

| | | Smiths News

Newspaper & Magazine Distributor | | | 1,911,662

| | |

| 274,715

| | | PureCircle (a) (b)

Natural Sweeteners | | | 1,462,397

| | |

| 48,186

| | | Fidessa Group

Software for Financial Trading Systems | | | 1,413,230

| | |

| 31,000

| | | Intertek Group

Testing, Inspection & Certification Services | | | 1,377,999

| | |

| 189,615

| | | Ocado (a) (b)

Leading Online Grocery Retailer | | | 860,282

| | |

| 36,815

| | | Tullow Oil

Oil & Gas Producer | | | 560,428

| | |

| 5,708

| | | Telecom Plus

UK Multi Utility | | | 108,346

| | |

| | | | 69,253,229 | | |

| | | Netherlands – 3.5% | |

| 291,319

| | | Aalberts Industries

Flow Control & Heat Treatment | | | 6,510,913

| | |

| 145,741

| | | UNIT4

Business Software Development | | | 4,723,461

| | |

| 113,383

| | | TKH Group

Dutch Industrial Conglomerate | | | 2,915,475

| | |

| 51,818

| | | Fugro

Subsea Oilfield Services | | | 2,815,600

| | |

| 98,582

| | | Arcadis

Engineering Consultants | | | 2,654,553

| | |

| 14,197

| | | Core Labs

Oil & Gas Reservoir Consulting | | | 2,153,117

| | |

| 27,926

| | | Vopak

World's Largest Operator of Petroleum & Chemical

Storage Terminals | | | 1,648,288

| | |

Number of

Shares | | | | Value | |

| 207,240

| | | Imtech (a) (b)

Technical Installation & Maintenance | | $ | 1,525,500

| | |

| | | | 24,946,907 | | |

| | | France – 3.2% | |

| 32,020

| | | Eurofins Scientific (b)

Food, Pharmaceuticals & Materials Screening & Testing | | | 6,756,949

| | |

| 100,921

| | | Neopost

Postage Meter Machines | | | 6,682,153

| | |

| 44,200

| | | Gemalto (a)

Digital Security Solutions | | | 4,001,989

| | |

| 30,533

| | | Norbert Dentressangle

Leading European Logistics & Transport Group | | | 2,483,954

| | |

| 96,450

| | | Saft

Niche Battery Manufacturer | | | 2,291,754

| | |

| 220,933

| | | Hi-Media (b)

Online Advertiser in Europe | | | 480,526

| | |

| | | | 22,697,325 | | |

| | | Switzerland – 2.9% | |

| 25,741

| | | Partners Group

Private Markets Asset Management | | | 6,967,544

| | |

| 20,880

| | | Geberit

Plumbing Supplies | | | 5,172,470

| | |

| 1,505

| | | Sika

Chemicals for Construction & Industrial Applications | | | 3,891,537

| | |

| 22,965

| | | Dufry Group (b)

Operates Airport Duty Free & Duty Paid Shops | | | 2,781,903

| | |

| 37,840

| | | Zehnder

Radiators & Heat Recovery Ventilation Systems | | | 1,686,585

| | |

| | | | 20,500,039 | | |

| | | Germany – 2.7% | |

| 183,492

| | | Wirecard

Online Payment Processing & Risk Management | | | 4,992,808

| | |

| 14,270

| | | Rational

Commercial Ovens | | | 4,777,346

| | |

| 68,400

| | | NORMA Group

Clamps for Automotive & Industrial Applications | | | 2,473,788

| | |

| 213,000

| | | TAG Immobilien

Owner of Residential Properties in Germany | | | 2,321,552

| | |

| 47,000

| | | Elringklinger (a)

Automobile Components | | | 1,566,231

| | |

See accompanying notes to financial statements.

12

Wanger International 2013 Semiannual Report

Statement of Investments (Unaudited), June 30, 2013

Number of

Shares | | | | Value | |

| | | Germany – 2.7% (cont) | |

| 57,879

| | | Aurelius

European Turnaround Investor | | $ | 1,390,743

| | |

| 11,343

| | | Pfeiffer Vacuum

Vacuum Pumps | | | 1,174,599

| | |

| 26,200

| | | Deutsche Beteiligungs

Private Equity Investment Management | | | 630,276

| | |

| | | | 19,327,343 | | |

| | | Sweden – 2.1% | |

| 289,727

| | | Hexagon

Design, Measurement & Visualization

Software & Equipment | | | 7,744,803

| | |

| 399,345

| | | Sweco

Engineering Consultants | | | 4,540,651

| | |

| 83,593

| | | Unibet

European Online Gaming Operator | | | 2,798,441

| | |

| | | | 15,083,895 | | |

| | | Denmark – 1.8% | |

| 169,677

| | | SimCorp

Software for Investment Managers | | | 5,043,189

| | |

| 128,911

| | | Novozymes

Industrial Enzymes | | | 4,129,047

| | |

| 102,481

| | | Jyske Bank (b)

Danish Bank | | | 3,854,718

| | |

| | | | 13,026,954 | | |

| | | Italy – 0.9% | |

| 351,999

| | | Pirelli (a)

Global Tire Supplier | | | 4,069,158

| | |

| 833,343

| | | Geox (a)

Apparel & Shoe Maker | | | 2,071,373

| | |

| | | | 6,140,531 | | |

| | | Finland – 0.8% | |

| 56,294

| | | Vacon

Leading Independent Manufacturer of Variable Speed

Alternating Current Drives | | | 3,733,364

| | |

| 106,000

| | | Tikkurila

Decorative & Industrial Paint in Scandinavia & Central &

Eastern Europe | | | 2,392,275

| | |

| | | | 6,125,639 | | |

Number of

Shares | | | | Value | |

| | | Norway – 0.7% | |

| 324,911

| | | Atea

Leading Nordic IT Hardware/Software Reseller &

Installation Company | | $ | 3,276,202

| | |

| 90,000

| | | Subsea 7 (b)

Offshore Subsea Contractor | | | 1,577,947

| | |

| | | | 4,854,149 | | |

| | | Spain – 0.6% | |

| 587,190

| | | Dia

Leading Hard Discounter in Spain, Latin America &

the Eastern Mediterranean | | | 4,435,793

| | |

| | | Russia – 0.6% | |

| 112,297

| | | Yandex (b)

Search Engine for Russian & Turkish Languages | | | 3,102,766

| | |

| 43,200

| | | QIWI — ADR

Electronic Payments Network Serving Russia &

the Commonwealth of Independent States | | | 1,002,240

| | |

| | | | 4,105,006 | | |

| | | Iceland – 0.5% | |

| | 2,644,101 | | | Marel (d) | | | 1,891,740 | | |

| 1,700,000

| | | Marel (d)

Largest Manufacturer of Poultry & Fish Processing

Equipment | | | 1,798,506

| | |

| | | | 3,690,246 | | |

| | | Kazakhstan – 0.5% | |

| 494,896

| | | Halyk Savings Bank of Kazakhstan - GDR

Largest Retail Bank & Insurer in Kazakhstan | | | 3,652,333

| | |

| | | Belgium – 0.4% | |

| 42,233

| | | EVS Broadcast Equipment

Digital Live Mobile Production Software & Systems | | | 2,928,071

| | |

| | | Portugal – 0.3% | |

| 854,881

| | | Redes Energéticas Nacionais

Portuguese Power Transmission & Gas Transportation | | | 2,451,400

| | |

| | | Turkey – 0.3% | |

| 130,830

| | | Bizim Toptan

Cash & Carry Stores in Turkey | | | 2,129,964

| | |

| | | | | Total Europe | | | 225,348,824 | | |

See accompanying notes to financial statements.

13

Wanger International 2013 Semiannual Report

Statement of Investments (Unaudited), June 30, 2013

Number of

Shares | | | | Value | |

| | | Other Countries – 14.0% | |

| | | South Africa – 4.1% | |

| 1,278,520

| | | Coronation Fund Managers

South African Fund Manager | | $ | 8,116,614

| | |

| 83,713

| | | Naspers

Media in Africa, China, Russia & Other Emerging Markets | | | 6,178,997

| | |

| 1,872,183

| | | Rand Merchant Insurance

Directly Sold Property & Casualty Insurance;

Holdings in Other Insurers | | | 4,767,359

| | |

| 218,654

| | | Massmart Holdings

General Merchandise, Food & Home Improvement Stores;

Wal-Mart Subsidiary | | | 3,966,056

| | |

| 254,433

| | | Mr. Price

South African Retailer of Apparel, Household &

Sporting Goods | | | 3,468,107

| | |

| 835,245

| | | Northam Platinum (b)

Platinum Mining in South Africa | | | 2,697,175

| | |

| | | | 29,194,308 | | |

| | | Canada – 3.8% | |

| 120,663

| | | CCL Industries (b)

Largest Global Label Converter | | | 7,443,773

| | |

| 106,322

| | �� | ShawCor

Oil & Gas Pipeline Products | | | 4,201,524

| | |

| 313,128

| | | CAE

Flight Simulator Equipment & Training Centers | | | 3,248,290

| | |

| 62,856

| | | Onex Capital

Private Equity | | | 2,852,038

| | |

| | 158,516 | | | DeeThree Exploration (b) (e) | | | 1,122,589 | | |

| 119,569

| | | DeeThree Exploration (b)

Canadian Oil & Gas Producer | | | 864,053

| | |

| 58,433

| | | AG Growth

Leading Manufacturer of Augers & Grain

Handling Equipment | | | 1,896,836

| | |

| 65,101

| | | Black Diamond Group

Provides Accommodations/Equipment for Oil Sands

Development | | | 1,383,481

| | |

| 90,834

| | | Alliance Grain Traders

Global Leader in Pulse Processing & Distribution | | | 1,265,302

| | |

| 202,168

| | | Horizon North Logistics (a)

Diversified Oil Services Offering in Northern Canada | | | 1,220,659

| | |

| 26,123

| | | Baytex

Oil & Gas Producer in Canada | | | 941,392

| | |

Number of

Shares | | | | Value | |

| 53,000

| | | Athabasca Oil Sands (b)

Oil Sands & Unconventional Oil Development | | $ | 328,069

| | |

| 195,271

| | | Pan Orient

Asian Oil & Gas Explorer | | | 302,645

| | |

| 42,800

| | | Crew Energy (b)

Canadian Oil & Gas Producer | | | 210,805

| | |

| 35,542

| | | Americas Petrogas (a) (b)

Oil & Gas Exploration in Argentina, Potash in Peru | | | 30,077

| | |

| | | | 27,311,533 | | |

| | | United States – 2.8% | |

| 124,722

| | | Textainer Group Holdings (a)

Top International Container Leasor | | | 4,794,314

| | |

| 91,616

| | | Atwood Oceanics (b)

Offshore Drilling Contractor | | | 4,768,613

| | |

| 96,600

| | | Rowan (b)

Contract Offshore Driller | | | 3,291,162

| | |

| 57,853

| | | FMC Technologies (b)

Oil & Gas Well Head Manufacturer | | | 3,221,255

| | |

| 43,084

| | | Hornbeck Offshore (b)

Supply Vessel Operator in U.S. Gulf of Mexico | | | 2,304,994

| | |

| 41,979

| | | World Fuel Services

Global Fuel Broker | | | 1,678,320

| | |

| | | | 20,058,658 | | |

| | | Australia – 2.6% | |

| 1,089,000

| | | Challenger Financial

Largest Annuity Provider | | | 3,971,065

| | |

| 3,658,000

| | | Commonwealth Property Office Fund

Australia Prime Office Real Estate Investment Trust | | | 3,666,096

| | |

| 571,000

| | | IAG

General Insurance Provider | | | 2,834,273

| | |

| 780,001

| | | SAI Global

Publishing, Certification & Compliance Services | | | 2,583,865

| | |

| 251,000

| | | Domino's Pizza Enterprises

Domino's Pizza Operator in Australia/New Zealand &

France/Benelux | | | 2,566,279

| | |

| 651,000

| | | Regis Resources (b)

Gold Mining in Australia | | | 1,723,286

| | |

| 94,269

| | | Austbrokers

Local Australian Small Business Insurance Broker | | | 935,240

| | |

| | | | 18,280,104 | | |

See accompanying notes to financial statements.

14

Wanger International 2013 Semiannual Report

Statement of Investments (Unaudited), June 30, 2013

Number of

Shares | | | | Value | |

| | | Israel – 0.7% | |

| 302,685

| | | Israel Chemicals

Producer of Potash, Phosphates, Bromine &

Specialty Chemicals | | $ | 2,972,498

| | |

| 78,000

| | | Caesarstone (b)

Quartz Countertops | | | 2,123,940

| | |

| | | | 5,096,438 | | |

| | | | | Total Other Countries | | | 99,941,041 | | |

| | | Latin America – 5.5% | |

| | | Brazil – 2.2% | |

| 320,000

| | | Localiza Rent A Car

Car Rental | | | 4,524,615

| | |

| 5,037,276

| | | Beadell Resources (b)

Gold Mining in Brazil | | | 2,350,101

| | |

| 173,209

| | | Arcos Dorados (a)

McDonald's Master Franchise for Latin America | | | 2,023,081

| | |

| 130,000

| | | Multiplus

Loyalty Program Operator in Brazil | | | 1,920,855

| | |

| 461,400

| | | Odontoprev

Dental Insurance | | | 1,900,314

| | |

| 100,000

| | | Linx

Retail Management Software in Brazil | | | 1,673,427

| | |

| 111,800

| | | Mills Estruturas e Servicos de

Engenharia

Civil Engineering & Construction | | | 1,515,151

| | |

| | | | 15,907,544 | | |

| | | Mexico – 1.8% | |

| 1,722,600

| | | Genomma Lab Internacional (b)

Develops, Markets & Distributes Consumer Products | | | 3,402,007

| | |

| 28,000

| | | Grupo Aeroportuario del Sureste – ADR

Mexican Airport Operator | | | 3,114,720

| | |

| 600,222

| | | Gruma (b)

Tortilla Producer & Distributor | | | 2,728,398

| | |

| 816,000

| | | Bolsa Mexicana de Valores

Mexico's Stock Exchange | | | 2,029,066

| | |

| 641,824

| | | Qualitas

Leading Auto Insurer in Mexico & Central America | | | 1,535,529

| | |

| | | | 12,809,720 | | |

Number of

Shares | | | | Value | |

| | | Chile – 0.6% | |

| 65,995

| | | Sociedad Quimica y Minera

de Chile — ADR

Producer of Specialty Fertilizers, Lithium & Iodine | | $ | 2,666,198

| | |

| 2,300,000

| | | Grupo Hites

Mass Retailer for the Lower Income Strata | | | 1,806,771

| | |

| | | | 4,472,969 | | |

| | | Uruguay – 0.3% | |

| 230,870

| | | Union Agriculture Group (b) (e) (f)

Farmland Operator in Uruguay | | | 2,389,504

| | |

| | | Colombia – 0.3% | |

| 1,503,000

| | | Isagen (b)

Leading Colombian Electricity Provider | | | 2,013,975

| | |

| | | Guatemala – 0.3% | |

| 132,362

| | | Tahoe Resources (b)

Silver Project in Guatemala | | | 1,876,502

| | |

| | | Argentina – —% | |

| 459,000

| | | Madalena Ventures (b)

Oil & Gas Exploration in Argentina | | | 122,202

| | |

| | | | | Total Latin America | | | 39,592,416 | | |

Total Equities

(Cost: $525,131,728) – 97.7% | | | 698,854,223 | (g) | |

Short-Term Investments – 1.4% | | | |

| 6,773,346

| | | JPMorgan U.S. Government

Money Market Fund, Capital Shares

(7 day yield of 0.01%) | | | 6,773,346 | | |

| 3,334,246

| | | JPMorgan U.S. Government

Money Market Fund, Agency Shares

(7 day yield of 0.01%) | | | 3,334,246 | | |

Total Short-Term Investments

(Cost: $10,107,592) – 1.4% | | | 10,107,592 | | |

See accompanying notes to financial statements.

15

Wanger International 2013 Semiannual Report

Statement of Investments (Unaudited), June 30, 2013

Number of

Shares | | | | Value | |

Securities Lending Collateral – 2.0% | |

| 14,168,673

| | | Dreyfus Government Cash

Management Fund,

Institutional Shares

(7 day yield of 0.01%) (h) | | $ | 14,168,673 | | |

Total Securities Lending Collateral

(Cost: $14,168,673) | | | 14,168,673 | | |

Total Investments

(Cost: $549,407,993) (i) – 101.1% | | | 723,130,488 | | |

Obligation to Return Collateral for

Securities Loaned – (2.0)% | | | (14,168,673 | ) | |

Cash and Other Assets Less Liabilities – 0.9% | | | 6,398,936 | | |

Net Assets – 100.0% | | $ | 715,360,751 | | |

ADR = American Depositary Receipts

GDR = Global Depositary Receipts

REIT = Real Estate Investment Trust

Notes to Statement of Investments

(a) All or a portion of this security was on loan at June 30, 2013. The total market value of securities on loan at June 30, 2013 was $13,479,204.

(b) Non-income producing security.

(c) Security is traded on a U.S. exchange.

(d) The common stock equity holdings of Marel are stated separately on the Statement of Investments due to the application of the onshore or offshore foreign currency exchange rate. The appropriate exchange rate is applied to each purchased security lot based on the applicable registration obtained from Marel's regulatory governing body, the Icelandic Central Bank.

(e) Denotes a restricted security, which is subject to restrictions on resale under federal securities laws. These securities are valued at fair value determined in good faith under consistently applied procedures established by the Board of Trustees. At June 30, 2013, the market value of these securities amounted to $3,512,093, which represented 0.49% of total net assets. Additional information on these securities is as follows:

Security | | Acquisition

Dates | |

Shares | |

Cost | |

Value | |

Union Agriculture Group | | 12/8/10-

6/27/12 | | | 230,870 | | | $ | 2,649,999 | | | $ | 2,389,504 | | |

DeeThree Exploration | | 9/7/10 | | | 158,516 | | | | 413,939 | | | | 1,122,589 | | |

| | | | | | | $ | 3,063,938 | | | $ | 3,512,093 | | |

(f) Illiquid security.

(g) On June 30, 2013, the Fund's total investments were denominated in currencies as follows:

Currency | | Value | | Percentage

of Net Assets | |

Japanese Yen | | $ | 149,559,500 | | | | 20.9 | | |

Euro | | | 86,899,892 | | | | 12.2 | | |

British Pound | | | 71,886,833 | | | | 10.0 | | |

United States Dollar | | | 54,931,345 | | | | 7.7 | | |

Taiwan Dollar | | | 50,234,734 | | | | 7.0 | | |

Hong Kong Dollar | | | 36,350,175 | | | | 5.1 | | |

Other currencies less than

5% of total net assets | | | 248,991,744 | | | | 34.8 | | |

Total Equities | | $ | 698,854,223 | | | | 97.7 | | |

(h) Investment made with cash collateral received from securities lending activity.

(i) At June 30, 2013, for federal income tax purposes, the cost of investments was $549,407,993 and net unrealized appreciation was $173,722,495 consisting of gross unrealized appreciation of $209,309,639 and gross unrealized depreciation of $35,587,144.

Fair Value Measurements

Various inputs are used in determining the value of the Fund's investments, following the input prioritization hierarchy established by accounting principles generally accepted in the United States of America (GAAP). These inputs are summarized in the three broad levels listed below:

• Level 1 – quoted prices in active markets for identical securities

• Level 2 – prices determined using other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk and others)

• Level 3 – prices determined using significant unobservable inputs where quoted prices or observable inputs are unavailable or less reliable (including management's own assumptions about the factors market participants would use in pricing an investment)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Examples of the types of securities in which the Fund would typically invest and how they are classified within this hierarchy are as follows. Typical Level 1 securities include exchange traded domestic equities, mutual funds whose NAVs are published each day and exchange traded foreign equities that are not statistically fair valued. Typical Level 2 securities include exchange traded foreign equities that are statistically fair valued, forward foreign currency exchange contracts and short-term investments valued at amortized cost. Additionally, securities fair valued by the Valuation Committee (the Committee) of the Fund's Board of Trustees (the Board) that rely on significant observable inputs are also included in Level 2. Typical Level 3 securities include any security fair valued by the Committee that relies on significant unobservable inputs.

Under the direction of the Board, the Committee is responsible for carrying out the valuation procedures approved by the Board.

The Committee meets as necessary, and no less frequently than quarterly, to determine fair values for securities for which market quotations are not readily available or for which the investment manager believes that available market quotations are unreliable, to review the appropriateness of the Trust's Portfolio Pricing Policy and the pricing procedures of the investment manager (the Policies), and to review the continuing

See accompanying notes to financial statements.

16

Wanger International 2013 Semiannual Report

Statement of Investments (Unaudited), June 30, 2013

appropriateness of the current value of any security subject to the Policies. The Policies address, among other things: circumstances under which market quotations will be deemed readily available; selection of third party pricing vendors; appropriate pricing methodologies; events that require fair valuation and fair value techniques; and circumstances under which securities will be deemed to pose a potential for stale pricing, including when securities are illiquid, restricted, or in default. The Committee may also meet to discuss additional valuation matters, which may include review of back-testing results, review of time-sensitive information or approval of other valuation related actions, and to review the appropriateness of the Policies.

For investments categorized as Level 3, the significant unobservable inputs used in the fair value measurement of the Funds' securities may include: (i) data specific to the issuer or comparable issuers, (ii) general market or specific sector news and (iii) quoted prices and specific or similar security transactions. The Committee considers this data and any changes from prior periods in order to assess the reasonableness of observable and unobservable inputs, any assumptions or internal models used to value those securities and changes in fair value. Significant changes in any of these factors could result in lower or higher fair value measurements. Various factors impact the frequency of monitoring (which may occur as often as daily), however the Committee may determine that changes to inputs, assumptions and models are not required with the same frequency.

The following table summarizes the inputs used, as of June 30, 2013, in valuing the Fund's assets:

Investment Type | |

Quoted Prices

(Level 1) | | Other

Significant

Observable

Inputs

(Level 2) | |

Significant

Unobservable

Inputs

(Level 3) | |

Total | |

Equities | |

Asia | | $ | 13,439,615 | | | $ | 320,532,327 | | | $ | — | | | $ | 333,971,942 | | |

Europe | | | 6,258,123 | | | | 219,090,701 | | | | — | | | | 225,348,824 | | |

Other Countries | | | 48,371,542 | | | | 51,569,499 | | | | — | | | | 99,941,041 | | |

Latin America | | | 34,852,811 | | | | 2,350,101 | | | | 2,389,504 | | | | 39,592,416 | | |

Total Equities | | | 102,922,091 | | | | 593,542,628 | | | | 2,389,504 | | | | 698,854,223 | | |

Total Short-Term