UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | 811-07239 |

Name of Registrant: | Vanguard Horizon Funds |

Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

Name and address of agent for service: | Heidi Stam, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000 |

Date of fiscal year end: September 30 | |

Date of reporting period: October 1, 2012 – March 31, 2013 |

Item 1: Reports to Shareholders | |

Semiannual Report | March 31, 2013

Vanguard Strategic Equity Fund

> For the six months ended March 31, 2013, Vanguard Strategic Equity Fund

returned about 18%.

> The fund outpaced its benchmark and peer-group funds.

> The strong performance was largely a result of stock selection in the consumer

discretionary, industrial, and energy sectors.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisor’s Report. | 7 |

| Fund Profile. | 9 |

| Performance Summary. | 10 |

| Financial Statements. | 11 |

| About Your Fund’s Expenses. | 24 |

| Trustees Approve Advisory Arrangement. | 26 |

| Glossary. | 27 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the

risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Our cover photograph shows rigging on the HMSSurprise, a replica of an 18th-century Royal Navy frigate. It

was featured in the 2003 movie Master and Commander: The Far Side of the World, which was based on Patrick O’Brian’s sea

novels, set amid the Napoleonic Wars. Vanguard was named for another ship of that era, the HMSVanguard, which was the

flagship of British Admiral Horatio Nelson at the Battle of the Nile.

Your Fund’s Total Returns

| |

| Six Months Ended March 31, 2013 | |

| | Total |

| | Returns |

| Vanguard Strategic Equity Fund | 18.01% |

| MSCI US Small + Mid Cap 2200 Index | 16.33 |

| Mid-Cap Core Funds Average | 15.76 |

| Mid-Cap Core Funds Average: Derived from data provided by Lipper Inc. |

| | | | |

| Your Fund’s Performance at a Glance | | | | |

| September 30, 2012, Through March 31, 2013 | | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| | Share Price | Share Price | Dividends | Gains |

| Vanguard Strategic Equity Fund | $21.02 | $24.40 | $0.350 | $0.000 |

1

Chairman’s Letter

Dear Shareholder,

During the six months ended March 31, 2013, investors’ anxieties about corporate profits, the fiscal U.S. deficit, and fresh troubles in Europe gave way to greater optimism about the strength of the U.S. economy, especially with regard to the labor and housing markets.

The improvement in market sentiment led to a shift away from safer assets toward riskier investments offering potentially higher returns, a trend that favored small-and mid-capitalization stocks more than their large-cap counterparts.

Vanguard Strategic Equity Fund returned 18.01% for the six months ended March 31, 2013, more than 1 percentage point above the return of its benchmark index (16.33%) and more than 2 percentage points ahead of the average return for peer funds (15.76%).

The fund’s gains were broad-based. Eight of ten industry sectors posted double-digit returns. In relative terms, the fund’s sectors performed roughly in line with or a little below those of the benchmark. The exceptions were consumer discretionary, industrials, and energy, where strong stock selection led to returns of more than 20% in each of the three sectors.

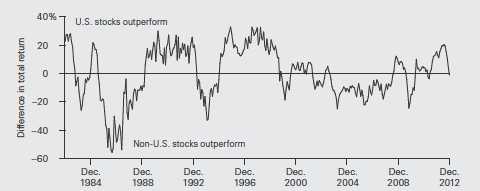

Global equity markets delivered a powerful rally

Global stocks advanced for the fifth straight month to finish the half-year ended March 31 with impressive gains. The Standard & Poor’s 500 Index closed

2

at a record high on the period’s final business day after global financial markets in recent months shrugged off the U.S. “fiscal cliff” crisis, the unsettled Italian national elections, and a controversial bailout package for Cyprus.

Peter Westaway, Vanguard’s chief European economist, said that the latest developments in Europe had been “rather bad,” but that the market had for the most part already priced in these events. “As always,” he said, “we think investors should assess their portfolios carefully and avoid making impulsive moves.”

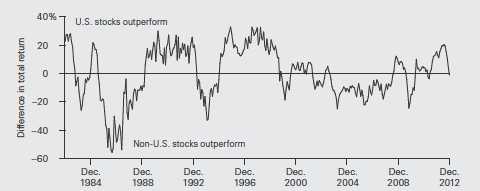

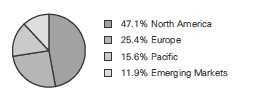

U.S. equities returned more than 11% as the economic recovery slowly built momentum, the housing market rebounded further, and the labor market improved.

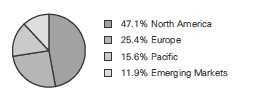

International equities were up more than 9%. Returns were about 16% in the Pacific region, where Japan’s accommodative monetary policy has helped spark the nation’s stock market, and nearly 10% in Europe. Emerging-markets stocks rose about 4%.

Bond returns barely budged as yields lingered near lows

The broad U.S. taxable bond market scraped out a minuscule gain of 0.09% for the half-year as U.S. Treasury yields remained just slightly above their all-time lows. Although the yield of the benchmark

10-year Treasury note increased during the six months and topped 2.00% at various times, it closed the period at about 1.85%. (Bond prices and yields move in opposite directions.)

| | | |

| Market Barometer | | | |

| |

| | Total Returns |

| | Periods Ended March 31, 2013 |

| | Six | One | Five Years |

| | Months | Year | (Annualized) |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 11.10% | 14.43% | 6.15% |

| Russell 2000 Index (Small-caps) | 14.48 | 16.30 | 8.24 |

| Russell 3000 Index (Broad U.S. market) | 11.35 | 14.56 | 6.32 |

| MSCI All Country World Index ex USA (International) | 9.20 | 8.36 | -0.39 |

| |

| Bonds | | | |

| Barclays U.S. Aggregate Bond Index (Broad taxable market) | 0.09% | 3.77% | 5.47% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | 0.96 | 5.25 | 6.10 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.05 | 0.08 | 0.30 |

| |

| CPI | | | |

| Consumer Price Index | 0.59% | 1.47% | 1.74% |

3

Municipal bonds returned almost 1% for the six months despite price declines in March. And returns of money market funds and savings accounts barely registered as short-term interest rates remained between 0% and 0.25%, under the Federal Reserve’s four-year-old policy.

Robert Auwaerter, head of Vanguard’s Fixed Income Group, doesn’t anticipate abrupt policy changes from the central bank. “We don’t see the Fed changing course in the near term,” he said, “and when the Fed does, we expect it’ll go slowly so as not to undo the efforts made to keep interest rates low and to stimulate the economy.”

The fund’s quantitative model found pockets of outperformance

Not all quantitative funds are the same; their investment strategies vary greatly, and so do the models they rely on to execute those strategies. As explained in more detail in the Advisor’s Report that follows, Vanguard’s Equity Investment Group, which manages this fund, uses a proprietary quantitative model to compare approximately 2,200 small- and mid-cap U.S. stocks. The aim is to single out those the model indicates are most likely to outperform over the long term because of their attractive valuations, strong balance sheets, and positive earnings momentum. The advisor counts on its choice of stocks

| | |

| Expense Ratios | | |

| Your Fund Compared With Its Peer Group | | |

| | | Peer Group |

| | Fund | Average |

| Strategic Equity Fund | 0.29% | 1.23% |

The fund expense ratio shown is from the prospectus dated January 25, 2013, and represents estimated costs for the current fiscal year. For

the six months ended March 31, 2013, the fund’s annualized expense ratio was 0.28%. The peer-group expense ratio is derived from data

provided by Lipper Inc. and captures information through year-end 2012.

Peer group: Mid-Cap Core Funds.

4

(which totaled about 420 on March 31) to outpace the benchmark without taking on additional risk through market capitalization tilts or sector bets.

The fund’s model was successful over the six-month period in generating a return for the fund that exceeded its benchmark’s by 1.68 percentage points. Quantitative analysis relating to quality (the strength of a company’s balance sheet and the sustainability of its earnings) and especially valuation (which measures the price the advisor pays for earnings and cash flows) helped identify stocks that significantly outperformed their peers in three of the benchmark’s ten sectors. A limited number of holdings among restaurants, casinos, media companies, and retailers helped the consumer discretionary sector make a big contribution to the fund’s performance. It returned about 23%, compared with about 17% for the benchmark.

The fund’s choices in industrials led to a sector return of about 32%, compared with about 26% for its counterpart in the benchmark. A few airline stocks in the portfolio soared on further consolidation in the industry, which should lead to greater pricing power and higher margins. Construction-related stocks were another bright spot.

Energy stocks returned about 23% for the fund, compared with more than 14% for the benchmark. A large part of the fund’s outperformance came from a handful of

holdings in oil and gas refining. Margins in this business traditionally tend to be quite low, but recent expansion in domestic oil production helped lower costs, which translated into higher profits.

Among the other sectors, health care and consumer staples tempered the fund’s result compared with that of the benchmark.

Low cost is key no matter how a fund is managed

Keeping costs low has been a key part of our index funds’ success—the less expensive it is for an index fund to track its benchmark, the more returns get passed on to its investors.

But the same principle—low cost—is just as important to our actively managed funds. Outperforming an index through active management has historically proven to be a challenge in itself, so the higher management fees and transaction costs associated with such funds tend to set the bar for outperforming even higher.

That’s why, regardless of a fund’s management style, at Vanguard we focus on trying to give investors the best chance for investment success by keeping our fund costs low. (You can read an analysis of the impact of costs on the performance of actively managed funds in The Case for Vanguard Active Management: Solving the Low-Cost/Top-Talent Paradox? at vanguard. com/research.)

5

The low-cost advantage doesn’t guarantee outperformance, of course. Even in those cases where an active stock fund outper-forms over long periods, it doesn’t necessarily mean that investors earned more than the index results every year—or even every decade. And investors have no way of knowing beforehand which funds will outperform.

But for those willing to accept the greater risks that come with active investing, we believe Vanguard’s low costs, along with our talented advisors, can improve the odds.

As always, thank you for entrusting your assets to Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

April 16, 2013

6

Advisor’s Report

For the six-month period ended March 31, 2013, Vanguard Strategic Equity Fund returned 18.01%, outperforming its benchmark by 1.68 percentage points.

While U.S. equities in general experienced above-average returns, the mid- and small-capitalization stocks in the fund’s benchmark, the MSCI US Small + Mid Cap 2200 Index (16.33%), outpaced larger-cap equities, as measured by the MSCI US

Large Cap 300 Index (9.46%). Performance within the benchmark was broad-based, with nine of ten sectors generating positive returns. Market returns were best in industrials, consumer staples, and financials. Telecommunication services was the sole negative performer for the semiannual period.

The returns of the two quarters were quite different. During the final quarter of 2012, the benchmark was up around 3% as investors dealt with the election results and Hurricane Sandy while contemplating the potential repercussions of the looming “fiscal cliff.” Fortunately, Congress and

President Obama finally reached an agreement early in the new year, averting the worst of the fiscal cliff, including certain tax hikes that would probably have put the anemic recovery at risk. Investor fears seemed to abate and cash came into the U.S. equity market, helping to push mid- and small-cap stocks up 13.14% for the first quarter of 2013.

Over the six months, volatility in equity returns declined relative to most of 2012—a year in which volatility was driven in large part by global macroeconomic events. Sentiment about lackluster global economic growth, European and U.S. central bank actions, and the fiscal cliff contributed significantly to market volatility during the year. While the United States is not without its problems, our modest economic recovery is expected to continue. Corporate balance sheets remain strong, there is ample liquidity in the economy, housing data continue to improve, and unemployment statistics are moving in the right direction, although at a snail’s pace.

The fluctuations in the direction of the market reinforced our conviction that attempting to time investments is not profitable. Our aim, instead, is to identify individual stocks that have characteristics that will enable them to outperform over the long run. We select stocks by using a model with five components: valuation, growth, management decisions, market sentiment, and quality. We then construct our portfolio, with the goal of minimizing exposure to risks that our research indicates do not improve returns.

Our risk-control process neutralizes our exposure to market-capitalization, volatility, and industry risks relative to our bench-mark. In our view, such risk exposures

7

are not justified by the rewards. The effect of these risk controls can be seen by analyzing the fund’s tracking error

(a measure of performance volatility relative to its benchmark). The trailing three-year tracking error of 2.3% is well within an acceptable range given the risk tolerance for this fund.

The results from our stock selection model were encouraging over the last six months as we had positive contributions from four of our five components. Our valuation measurement was our strongest performer, while the manage-ment decisions component was relatively neutral over the period.

The model’s effectiveness over the period across sectors was mixed, as we were able to produce positive stock selection results in four of the ten sectors in the benchmark, with the strongest results in consumer discretionary and industrials. Selection results were neutral in four sectors, while we underperformed in consumer staples and health care.

At the individual stock level, the largest return contributions came from overweight positions in Delta Air Lines, Virgin Media, and Western Refining. In addition, when comparing the portfolio’s performance with that of its benchmark, we benefited

from underweighting or avoiding poor-performing stocks such as Cliffs Natural Resources and Allied Nevada Gold.

Unfortunately, we could not avoid all bad performers. Overweight positions in IAC/ InterActive, Affymax, and Wellcare Health Plans were a drag on performance. Also, underweighting Netflix, United Continental, and Micron Technology hurt our overall outperformance relative to our benchmark.

We thank you for your investment and look forward to the second half of the fiscal year.

James D. Troyer, CFA

Principal and Portfolio Manager

James P. Stetler

Principal and Portfolio Manager

Michael R. Roach, CFA

Portfolio Manager

Vanguard Equity Investment Group

April 22, 2013

8

Strategic Equity Fund

Fund Profile

As of March 31, 2013

| | | |

| Portfolio Characteristics | | | |

| | | MSCI US | DJ U.S. |

| | | Small + | Total |

| | | Mid Cap | Market |

| | | 2200 | FA |

| | Fund | Index | Index |

| Number of Stocks | 420 | 2,165 | 3,586 |

| Median Market Cap | $4.2B | $4.7B | $40.0B |

| Price/Earnings Ratio | 16.2x | 23.0x | 18.1x |

| Price/Book Ratio | 2.4x | 2.2x | 2.3x |

| Return on Equity | 10.4% | 11.4% | 16.6% |

| Earnings Growth Rate | 11.6% | 8.5% | 9.6% |

| Dividend Yield | 1.4% | 1.4% | 2.0% |

| Foreign Holdings | 0.0% | 0.0% | 0.0% |

| Turnover Rate | | | |

| (Annualized) | 63% | — | — |

| Ticker Symbol | VSEQX | — | — |

| Expense Ratio1 | 0.29% | — | — |

| 30-Day SEC Yield | 1.10% | — | — |

| Short-Term Reserves | 0.4% | — | — |

| | | |

| Sector Diversification (% of equity exposure) |

| | | MSCI US | DJ U.S. |

| | | Small + | Total |

| | | Mid Cap | Market |

| | | 2200 | FA |

| | Fund | Index | Index |

| Consumer Discretionary | 15.6% | 16.2% | 12.4% |

| Consumer Staples | 4.9 | 4.5 | 9.5 |

| Energy | 6.7 | 7.1 | 10.1 |

| Financials | 20.7 | 20.4 | 17.3 |

| Health Care | 10.5 | 10.6 | 12.2 |

| Industrials | 14.3 | 14.4 | 11.1 |

| Information Technology | 15.6 | 15.1 | 17.4 |

| Materials | 5.8 | 6.0 | 3.8 |

| Telecommunication | | | |

| Services | 0.5 | 0.8 | 2.6 |

| Utilities | 5.4 | 4.9 | 3.6 |

| | |

| Volatility Measures | | |

| | MSCI US | DJ U.S. |

| | Small + | Total |

| | Mid Cap | Market |

| | 2200 | FA |

| | Index | Index |

| R-Squared | 0.99 | 0.95 |

| Beta | 1.03 | 1.18 |

| These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months. |

| | |

| Ten Largest Holdings (% of total net assets) |

| Delta Air Lines Inc. | Airlines | 1.1% |

| Western Digital Corp. | Computer Storage & | |

| | Peripherals | 1.0 |

| O'Reilly Automotive Inc. | Automotive Retail | 1.0 |

| Seagate Technology plc | Computer Storage & | |

| | Peripherals | 1.0 |

| Actavis Inc. | Pharmaceuticals | 1.0 |

| Tesoro Corp. | Oil & Gas Refining & | |

| | Marketing | 0.9 |

| Textron Inc. | Aerospace & | |

| | Defense | 0.9 |

| Triumph Group Inc. | Aerospace & | |

| | Defense | 0.9 |

| Harley-Davidson Inc. | Motorcycle | |

| | Manufacturers | 0.9 |

| ResMed Inc. | Health Care | |

| | Equipment | 0.9 |

| Top Ten | | 9.6% |

| The holdings listed exclude any temporary cash investments and equity index products. |

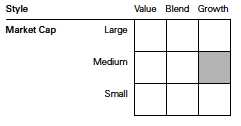

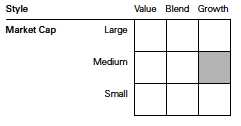

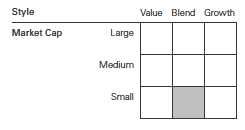

Investment Focus

1 The expense ratio shown is from the prospectus dated January 25, 2013, and represents estimated costs for the current fiscal year. For the

six months ended March 31, 2013, the annualized expense ratio was 0.28%.

9

Strategic Equity Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

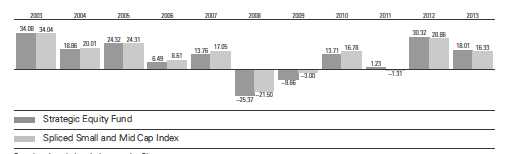

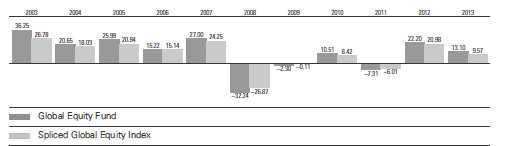

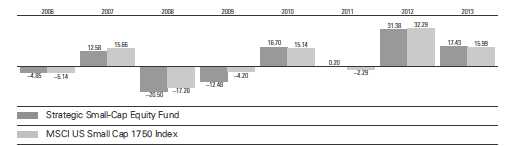

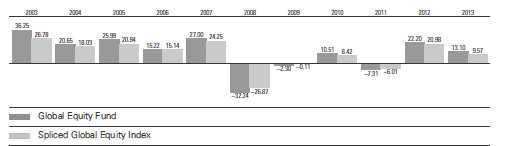

Fiscal-Year Total Returns (%): September 30, 2002, Through March 31, 2013

For a benchmark description, see the Glossary.

Note: For 2013, performance data reflect the six months ended March 31, 2013.

| | | | |

| Average Annual Total Returns: Periods Ended March 31, 2013 | | | |

| |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Strategic Equity Fund | 8/14/1995 | 18.46% | 7.34% | 10.63% |

See Financial Highlights for dividend and capital gains information.

10

Strategic Equity Fund

Financial Statements (unaudited)

Statement of Net Assets

As of March 31, 2013

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| Common Stocks (99.4%)1 | | |

| Consumer Discretionary (15.5%) | |

| * | O’ReillyAutomotive Inc. | 369,500 | 37,892 |

| | Harley-Davidson Inc. | 636,200 | 33,909 |

| | Wyndham Worldwide Corp. | 513,900 | 33,136 |

| * | PulteGroup Inc. | 1,521,500 | 30,795 |

| | Dillard’s Inc. Class A | 315,370 | 24,772 |

| | ExpediaInc. | 396,150 | 23,773 |

| | Gannett Co. Inc. | 1,036,200 | 22,662 |

| ^ | Buckle Inc. | 445,000 | 20,759 |

| | Brinker International Inc. | 516,950 | 19,463 |

| | Domino’s Pizza Inc. | 375,720 | 19,327 |

| *,^ | Coinstar Inc. | 302,190 | 17,654 |

| ^ | Regal Entertainment | | |

| | Group Class A | 1,029,900 | 17,168 |

| * | Jarden Corp. | 346,950 | 14,867 |

| ^ | Sturm Ruger & Co. Inc. | 273,700 | 13,885 |

| | Foot Locker Inc. | 400,000 | 13,696 |

| * | Conn’s Inc. | 358,900 | 12,884 |

| * | Tenneco Inc. | 277,995 | 10,928 |

| | PetSmart Inc. | 169,700 | 10,538 |

| | Sinclair Broadcast | | |

| | Group Inc. Class A | 502,640 | 10,173 |

| | Virgin Media Inc. | 203,900 | 9,985 |

| | Thor Industries Inc. | 251,500 | 9,253 |

| | Polaris Industries Inc. | 92,482 | 8,554 |

| *,^ | Smith& Wesson | | |

| | Holding Corp. | 934,500 | 8,410 |

| | American Eagle | | |

| | Outfitters Inc. | 447,600 | 8,370 |

| | Starwood Hotels & | | |

| | Resorts Worldwide Inc. | 129,400 | 8,247 |

| | PVH Corp. | 75,000 | 8,011 |

| | H&R Block Inc. | 250,300 | 7,364 |

| * | ANN Inc. | 253,400 | 7,354 |

| | Cheesecake Factory Inc. | 185,500 | 7,162 |

| | Newell Rubbermaid Inc. | 261,600 | 6,828 |

| | Genuine Parts Co. | 85,000 | 6,630 |

| * | LeapFrog Enterprises Inc. | 702,400 | 6,013 |

| | | |

| | Whirlpool Corp. | 48,900 | 5,793 |

| | Abercrombie & Fitch Co. | 123,600 | 5,710 |

| | Dana Holding Corp. | 284,500 | 5,073 |

| | Brown Shoe Co. Inc. | 312,300 | 4,997 |

| * | Grand Canyon | | |

| | Education Inc. | 180,300 | 4,578 |

| * | Jack in the Box Inc. | 128,200 | 4,434 |

| | Stage Stores Inc. | 160,900 | 4,164 |

| | Leggett & Platt Inc. | 118,200 | 3,993 |

| | NACCO Industries Inc. | | |

| | Class A | 71,600 | 3,821 |

| | Rent-A-Center Inc. | 103,400 | 3,820 |

| * | Goodyear Tire & | | |

| | Rubber Co. | 291,300 | 3,673 |

| * | Mohawk Industries Inc. | 30,900 | 3,495 |

| * | TRW Automotive | | |

| | Holdings Corp. | 60,400 | 3,322 |

| | Cracker Barrel Old | | |

| | Country Store Inc. | 40,800 | 3,299 |

| | Nordstrom Inc. | 54,400 | 3,004 |

| | Brunswick Corp. | 81,700 | 2,796 |

| * | Lamar Advertising Co. | | |

| | Class A | 53,300 | 2,591 |

| | Lear Corp. | 44,400 | 2,436 |

| * | Liberty Interactive Corp. | | |

| | Class A | 104,300 | 2,230 |

| * | Charter Communications | | |

| | Inc. Class A | 20,800 | 2,167 |

| | Service Corp. International | 128,200 | 2,145 |

| * | Hanesbrands Inc. | 46,200 | 2,105 |

| | GameStop Corp. Class A | 75,100 | 2,101 |

| | Scholastic Corp. | 78,000 | 2,079 |

| * | Red Robin Gourmet | | |

| | Burgers Inc. | 43,300 | 1,974 |

| | Cooper Tire & Rubber Co. | 74,900 | 1,922 |

| | International Game | | |

| | Technology | 115,000 | 1,897 |

| * | Marriott Vacations | | |

| | Worldwide Corp. | 41,500 | 1,781 |

11

| | | |

| Strategic Equity Fund | | |

| |

| |

| |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| | Chico’s FAS Inc. | 105,800 | 1,777 |

| | Dunkin’ Brands Group Inc. | 47,800 | 1,763 |

| * | Journal Communications | | |

| | Inc. Class A | 215,261 | 1,447 |

| ^ | Blyth Inc. | 74,600 | 1,295 |

| | OfficeMaxInc. | 69,750 | 810 |

| | | | 588,954 |

| Consumer Staples (4.9%) | | |

| * | Dean Foods Co. | 1,623,704 | 29,438 |

| | Ingredion Inc. | 328,600 | 23,764 |

| | CloroxCo. | 205,800 | 18,219 |

| | JM Smucker Co. | 147,800 | 14,656 |

| ^ | Herbalife Ltd. | 315,978 | 11,833 |

| | Energizer Holdings Inc. | 117,500 | 11,718 |

| | Safeway Inc. | 398,100 | 10,490 |

| | Universal Corp. | 157,800 | 8,843 |

| | Tyson Foods Inc. Class A | 350,000 | 8,687 |

| | Lancaster Colony Corp. | 108,519 | 8,356 |

| | Coca-Cola Enterprises Inc. | 203,500 | 7,513 |

| * | Rite Aid Corp. | 3,486,300 | 6,624 |

| ^ | SUPERVALUInc. | 1,189,400 | 5,995 |

| | Sanderson Farms Inc. | 96,900 | 5,293 |

| | Nu Skin Enterprises Inc. | | |

| | Class A | 100,900 | 4,460 |

| * | Green Mountain | | |

| | Coffee Roasters Inc. | 64,300 | 3,650 |

| *,^ | USANA Health | | |

| | Sciences Inc. | 65,700 | 3,175 |

| * | Pilgrim’s Pride Corp. | 229,900 | 2,113 |

| * | Central Garden and | | |

| | Pet Co. Class A | 60,800 | 500 |

| | | | 185,327 |

| Energy (6.7%) | | |

| | Tesoro Corp. | 611,600 | 35,809 |

| | Helmerich & Payne Inc. | 482,092 | 29,263 |

| | Western Refining Inc. | 797,400 | 28,236 |

| | Core Laboratories NV | 192,000 | 26,481 |

| | Delek US Holdings Inc. | 554,800 | 21,893 |

| * | Rosetta Resources Inc. | 311,645 | 14,828 |

| | Energy XXI Bermuda Ltd. | 531,200 | 14,459 |

| | HollyFrontier Corp. | 257,700 | 13,259 |

| | Cabot Oil & Gas Corp. | 145,000 | 9,804 |

| * | Stone Energy Corp. | 323,212 | 7,030 |

| | Rentech Inc. | 2,371,200 | 5,572 |

| * | EPLOil & Gas Inc. | 190,800 | 5,115 |

| * | Plains Exploration & | | |

| | Production Co. | 102,400 | 4,861 |

| * | ExterranHoldings Inc. | 153,600 | 4,147 |

| * | Denbury Resources Inc. | 209,800 | 3,913 |

| | Alon USA Energy Inc. | 204,900 | 3,903 |

| * | Geospace Technologies | | |

| | Corp. | 34,500 | 3,723 |

| * | Vaalco Energy Inc. | 460,100 | 3,492 |

| | | |

| * | Hornbeck Offshore | | |

| | Services Inc. | 70,000 | 3,252 |

| | Bristow Group Inc. | 34,300 | 2,262 |

| * | Ultra Petroleum Corp. | 111,400 | 2,239 |

| | Diamond Offshore | | |

| | Drilling Inc. | 29,300 | 2,038 |

| | RPC Inc. | 129,400 | 1,963 |

| * | ION Geophysical Corp. | 280,100 | 1,908 |

| | Patterson-UTI Energy Inc. | 78,200 | 1,864 |

| | Berry Petroleum Co. | | |

| | Class A | 18,800 | 870 |

| | | | 252,184 |

| Financials (20.4%) | | |

| | Huntington | | |

| | Bancshares Inc. | 4,332,800 | 32,019 |

| | Torchmark Corp. | 488,795 | 29,230 |

| | KeyCorp | 2,599,930 | 25,895 |

| *,^ | World Acceptance Corp. | 299,819 | 25,745 |

| | Discover Financial Services | 569,925 | 25,555 |

| * | Arch Capital Group Ltd. | 484,226 | 25,456 |

| | American Financial | | |

| | Group Inc. | 502,189 | 23,794 |

| | NASDAQ OMX Group Inc. | 729,200 | 23,553 |

| | Regions Financial Corp. | 2,460,300 | 20,150 |

| | Host Hotels & | | |

| | Resorts Inc. | 1,097,100 | 19,188 |

| | Assurant Inc. | 409,700 | 18,441 |

| | CapitalSource Inc. | 1,779,900 | 17,123 |

| | Kimco Realty Corp. | 759,500 | 17,013 |

| | Allied World Assurance | | |

| | Co. Holdings AG | 170,900 | 15,846 |

| | Moody’s Corp. | 290,900 | 15,511 |

| | OmegaHealthcare | | |

| | Investors Inc. | 440,600 | 13,377 |

| | Weingarten Realty | | |

| | Investors | 419,500 | 13,235 |

| | Protective Life Corp. | 349,800 | 12,523 |

| | ExtraSpace Storage Inc. | 313,540 | 12,313 |

| | Brandywine Realty Trust | 806,832 | 11,981 |

| | CBL& Associates | | |

| | Properties Inc. | 499,374 | 11,785 |

| | First Industrial | | |

| | Realty Trust Inc. | 687,825 | 11,782 |

| | East West Bancorp Inc. | 454,200 | 11,659 |

| ^ | Lexington Realty Trust | 952,700 | 11,242 |

| | EPRProperties | 215,200 | 11,201 |

| | Douglas Emmett Inc. | 448,200 | 11,174 |

| | Ryman Hospitality | | |

| | Properties | 240,500 | 11,003 |

| * | Sunstone Hotel | | |

| | Investors Inc. | 881,000 | 10,845 |

| | DCT Industrial Trust Inc. | 1,460,300 | 10,806 |

| | Regency Centers Corp. | 202,700 | 10,725 |

| * | American Capital Ltd. | 713,089 | 10,408 |

12

| | | |

| Strategic Equity Fund | | |

| |

| |

| |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| | Post Properties Inc. | 215,300 | 10,141 |

| | National Retail | | |

| | Properties Inc. | 271,100 | 9,806 |

| * | St. Joe Co. | 417,200 | 8,866 |

| | Nelnet Inc. Class A | 234,312 | 7,920 |

| * | Credit Acceptance Corp. | 62,622 | 7,649 |

| | Pennsylvania REIT | 390,400 | 7,570 |

| | Medical Properties | | |

| | Trust Inc. | 461,000 | 7,394 |

| | Bank of Hawaii Corp. | 141,900 | 7,210 |

| | Validus Holdings Ltd. | 186,600 | 6,973 |

| | Montpelier Re | | |

| | Holdings Ltd. | 244,300 | 6,364 |

| | EverestRe Group Ltd. | 47,400 | 6,155 |

| | Apartment Investment & | | |

| | Management Co. Class A | 190,200 | 5,832 |

| | Platinum Underwriters | | |

| | Holdings Ltd. | 103,000 | 5,748 |

| | Macerich Co. | 88,500 | 5,698 |

| | Primerica Inc. | 171,100 | 5,609 |

| * | Portfolio Recovery | | |

| | Associates Inc. | 42,500 | 5,394 |

| | Lincoln National Corp. | 163,300 | 5,325 |

| | Retail Properties of | | |

| | America Inc. | 345,100 | 5,107 |

| *,^ | Nationstar Mortgage | | |

| | Holdings Inc. | 138,400 | 5,107 |

| * | Howard Hughes Corp. | 58,800 | 4,928 |

| | Realty Income Corp. | 105,600 | 4,789 |

| | Umpqua Holdings Corp. | 338,000 | 4,482 |

| | Provident Financial | | |

| | Services Inc. | 293,425 | 4,481 |

| * | Texas Capital | | |

| | Bancshares Inc. | 110,600 | 4,474 |

| | Unum Group | 151,300 | 4,274 |

| * | Forest City Enterprises | | |

| | Inc. Class A | 233,800 | 4,155 |

| | Liberty Property Trust | 99,200 | 3,943 |

| | Sovran Self Storage Inc. | 59,800 | 3,857 |

| | Cathay General Bancorp | 185,510 | 3,732 |

| | Home Properties Inc. | 55,500 | 3,520 |

| | Hospitality | | |

| | Properties Trust | 125,200 | 3,436 |

| | Apollo Residential | | |

| | Mortgage Inc. | 153,400 | 3,419 |

| | PartnerRe Ltd. | 36,600 | 3,408 |

| | CNOFinancial Group Inc. | 277,200 | 3,174 |

| * | First Cash Financial | | |

| | Services Inc. | 53,200 | 3,104 |

| * | iStar Financial Inc. | 279,055 | 3,039 |

| | PrivateBancorp Inc. | 152,500 | 2,884 |

| | Axis Capital Holdings Ltd. | 64,400 | 2,680 |

| | Ramco-Gershenson | | |

| | Properties Trust | 148,300 | 2,491 |

| | | |

| * | Ocwen Financial Corp. | 60,900 | 2,309 |

| | National Penn | | |

| | Bancshares Inc. | 210,800 | 2,253 |

| | HCC Insurance Holdings Inc. | 53,400 | 2,244 |

| | STAGIndustrial Inc. | 104,300 | 2,218 |

| | Webster Financial Corp. | 90,500 | 2,196 |

| * | FlagstarBancorp Inc. | 157,100 | 2,188 |

| | Home Loan Servicing | | |

| | Solutions Ltd. | 90,900 | 2,121 |

| | RenaissanceRe | | |

| | Holdings Ltd. | 22,300 | 2,051 |

| | Corporate Office | | |

| | Properties Trust | 76,000 | 2,028 |

| | Stewart Information | | |

| | Services Corp. | 77,400 | 1,971 |

| | Federated Investors Inc. | | |

| | Class B | 83,100 | 1,967 |

| | Synovus Financial Corp. | 706,400 | 1,957 |

| | Susquehanna | | |

| | Bancshares Inc. | 157,400 | 1,957 |

| | Geo Group Inc. | 51,600 | 1,941 |

| | BOK Financial Corp. | 31,121 | 1,939 |

| | Associated Banc-Corp | 126,000 | 1,914 |

| | First American | | |

| | Financial Corp. | 73,600 | 1,882 |

| * | Popular Inc. | 65,700 | 1,814 |

| | City Holding Co. | 43,405 | 1,727 |

| | Oritani Financial Corp. | 94,900 | 1,470 |

| | CBOEHoldings Inc. | 33,900 | 1,252 |

| | Republic Bancorp Inc. | | |

| | Class A | 50,311 | 1,139 |

| | Bancfirst Corp. | 25,783 | 1,075 |

| | MFA Financial Inc. | 92,300 | 860 |

| | Camden National Corp. | 25,345 | 838 |

| | American Capital | | |

| | Agency Corp. | 21,300 | 698 |

| | XLGroup plc Class A | 21,400 | 648 |

| | | | 771,373 |

| Health Care (10.5%) | | |

| * | Actavis Inc. | 400,900 | 36,927 |

| | ResMed Inc. | 714,783 | 33,137 |

| | OmnicareInc. | 798,700 | 32,523 |

| * | Mylan Inc. | 986,300 | 28,544 |

| | AmerisourceBergen Corp. | | |

| | Class A | 420,504 | 21,635 |

| * | Regeneron | | |

| | Pharmaceuticals Inc. | 120,200 | 21,203 |

| * | Cyberonics Inc. | 375,700 | 17,587 |

| * | Pharmacyclics Inc. | 196,700 | 15,817 |

| * | Thoratec Corp. | 400,200 | 15,008 |

| * | Cubist Pharmaceuticals Inc. | 280,800 | 13,147 |

| * | Sirona Dental Systems Inc. | 171,600 | 12,652 |

| * | Magellan Health | | |

| | Services Inc. | 237,100 | 11,279 |

13

| | | | |

| Strategic Equity Fund | | | |

| |

| |

| |

| | | | | Market |

| | | | | Value |

| | | | Shares | ($000) |

| * | Charles River Laboratories | | | |

| | International Inc. | | 250,900 | 11,107 |

| * | Edwards Lifesciences Corp. | 133,700 | 10,985 |

| * | Medicines Co. | | 267,875 | 8,952 |

| *,^ | Arena Pharmaceuticals Inc. | | 844,000 | 6,929 |

| | Chemed Corp. | | 79,400 | 6,350 |

| * | Infinity Pharmaceuticals Inc. | | 114,200 | 5,535 |

| * | ABIOMED Inc. | | 294,600 | 5,500 |

| * | Life Technologies Corp. | | 85,000 | 5,494 |

| ^ | PDL BioPharma Inc. | | 732,900 | 5,358 |

| * | CareFusion Corp. | | 134,400 | 4,703 |

| | Analogic Corp. | | 58,200 | 4,599 |

| * | Bio-Reference Labs Inc. | | 170,700 | 4,435 |

| * | Vertex Pharmaceuticals Inc. | 75,000 | 4,124 |

| ^ | Questcor | | | |

| | Pharmaceuticals Inc. | | 112,400 | 3,657 |

| * | Mettler-Toledo | | | |

| | International Inc. | | 16,300 | 3,475 |

| * | Nektar Therapeutics | | 302,900 | 3,332 |

| * | Genomic Health Inc. | | 117,008 | 3,309 |

| * | ICU Medical Inc. | | 49,600 | 2,924 |

| * | Wright Medical Group Inc. | | 119,700 | 2,850 |

| * | NPS Pharmaceuticals Inc. | | 268,900 | 2,740 |

| | West Pharmaceutical | | | |

| | Services Inc. | | 41,800 | 2,714 |

| | Select Medical | | | |

| | Holdings Corp. | | 279,300 | 2,514 |

| * | PAREXEL International | | | |

| | Corp. | | 58,600 | 2,315 |

| * | Covance Inc. | | 31,000 | 2,304 |

| * | Bruker Corp. | | 119,200 | 2,277 |

| | Ensign Group Inc. | | 67,000 | 2,238 |

| * | Alkermes plc | | 92,900 | 2,203 |

| * | Tenet Healthcare Corp. | | 45,300 | 2,155 |

| * | Health Management | | | |

| | Associates Inc. Class A | | 162,800 | 2,095 |

| * | Molina Healthcare Inc. | | 58,700 | 1,812 |

| * | United Therapeutics Corp. | | 29,700 | 1,808 |

| * | Auxilium | | | |

| | Pharmaceuticals Inc. | | 92,500 | 1,598 |

| * | Gentiva Health Services Inc. | 104,400 | 1,130 |

| * | Bio-Rad Laboratories Inc. | | | |

| | Class A | | 8,200 | 1,033 |

| ^ | Spectrum | | | |

| | Pharmaceuticals Inc. | | 133,900 | 999 |

| * | SurModics Inc. | | 30,200 | 823 |

| *,^ | Affymax Inc. | | 248,400 | 345 |

| | | | | 396,180 |

| Industrials (14.2%) | | | |

| * | Delta Air Lines Inc. | 2,528,200 | 41,741 |

| | Textron Inc. | 1,176,200 | 35,062 |

| | Triumph Group Inc. | | 432,266 | 33,933 |

| | Dun & Bradstreet Corp. | | 350,600 | 29,328 |

| * | US Airways Group Inc. | 1,507,900 | 25,589 |

| | | | |

| | Cintas Corp. | | 568,900 | 25,106 |

| | Trinity Industries Inc. | | 538,200 | 24,397 |

| * | Terex Corp. | | 706,300 | 24,311 |

| | Huntington Ingalls | | | |

| | Industries Inc. | | 425,600 | 22,697 |

| | A.O. Smith Corp. | | 284,100 | 20,901 |

| * | EnerSys Inc. | | 448,557 | 20,445 |

| * | Alaska Air Group Inc. | | 298,890 | 19,117 |

| * | USG Corp. | | 679,300 | 17,961 |

| | Avery Dennison Corp. | | 262,600 | 11,310 |

| | Rockwell Collins Inc. | | 177,700 | 11,216 |

| | ADT Corp. | | 197,600 | 9,671 |

| | Lincoln Electric | | | |

| | Holdings Inc. | | 163,600 | 8,864 |

| | AMERCO | | 45,740 | 7,938 |

| | Hyster-Yale Materials | | | |

| | Handling Inc. | | 135,600 | 7,741 |

| | Steelcase Inc. Class A | | 518,400 | 7,636 |

| | Hubbell Inc. Class B | | 74,900 | 7,274 |

| * | Fortune Brands | | | |

| | Home & Security Inc. | 191,400 | 7,164 |

| * | JetBlue Airways Corp. | 1,032,600 | 7,125 |

| | Toro Co. | | 154,700 | 7,122 |

| | Robert Half | | | |

| | International Inc. | | 179,300 | 6,729 |

| * | Hertz Global Holdings Inc. | 274,000 | 6,099 |

| | Masco Corp. | | 300,000 | 6,075 |

| | L-3 Communications | | | |

| | Holdings Inc. | | 75,000 | 6,069 |

| | Equifax Inc. | | 94,600 | 5,448 |

| * | AECOM Technology Corp. | 162,600 | 5,333 |

| | ITT Corp. | | 179,300 | 5,097 |

| | Deluxe Corp. | | 122,413 | 5,068 |

| | Standex International Corp. | 76,450 | 4,222 |

| | RR Donnelley & Sons Co. | 344,200 | 4,148 |

| * | Hexcel Corp. | | 125,400 | 3,638 |

| | ExelisInc. | | 330,500 | 3,599 |

| | Pall Corp. | | 51,500 | 3,521 |

| | Lennox International Inc. | 55,000 | 3,492 |

| * | Armstrong World | | | |

| | Industries Inc. | | 58,800 | 3,286 |

| * | Taser International Inc. | 408,300 | 3,246 |

| | GATXCorp. | | 61,400 | 3,191 |

| * | General Cable Corp. | | 83,500 | 3,059 |

| | FlowserveCorp. | | 17,700 | 2,968 |

| | Mueller Industries Inc. | 48,800 | 2,601 |

| | Crane Co. | | 37,900 | 2,117 |

| | Southwest Airlines Co. | 150,000 | 2,022 |

| | Mine Safety Appliances Co. | 40,500 | 2,010 |

| | Brink’s Co. | | 70,800 | 2,001 |

| | Manitowoc Co. Inc. | | 94,500 | 1,943 |

| | Manpower Inc. | | 33,100 | 1,877 |

| | Carlisle Cos. Inc. | | 26,800 | 1,817 |

| * | Trex Co. Inc. | | 30,200 | 1,485 |

14

| | | |

| Strategic Equity Fund | | |

| |

| |

| |

| | | | Market |

| | | | Value |

| | | Shares | ($000) |

| | G&KServices Inc. Class A | 31,100 | 1,415 |

| | Mueller Water Products Inc. | |

| | Class A | 165,600 | 982 |

| | | | 538,207 |

| Information Technology (15.5%) | |

| | Western Digital Corp. | 771,900 | 38,811 |

| | Seagate Technology plc | 1,023,550 | 37,421 |

| * | Gartner Inc. | 608,991 | 33,135 |

| * | Alliance Data | | |

| | Systems Corp. | 202,200 | 32,734 |

| | Anixter International Inc. | 407,408 | 28,486 |

| * | LSI Corp. | 3,850,200 | 26,104 |

| * | Fiserv Inc. | 293,200 | 25,752 |

| * | Cadence Design | | |

| | Systems Inc. | 1,827,400 | 25,456 |

| | Maxim Integrated | | |

| | Products Inc. | 748,850 | 24,450 |

| | IAC/InterActiveCorp | 512,000 | 22,876 |

| * | CACIInternational Inc. | | |

| | Class A | 349,000 | 20,197 |

| * | CoreLogic Inc. | 626,000 | 16,188 |

| * | CommVault Systems Inc. | 192,000 | 15,740 |

| * | Avnet Inc. | 378,500 | 13,702 |

| | Lender Processing | | |

| | Services Inc. | 509,400 | 12,969 |

| * | Kulicke & Soffa | | |

| | Industries Inc. | 1,094,400 | 12,651 |

| | Avago Technologies Ltd. | | |

| | Class A | 285,600 | 10,259 |

| | MAXIMUSInc. | 113,540 | 9,080 |

| | Heartland Payment | | |

| | Systems Inc. | 268,500 | 8,852 |

| | AOL Inc. | 225,900 | 8,695 |

| * | Brocade Communications | | |

| | Systems Inc. | 1,503,200 | 8,673 |

| * | Tech Data Corp. | 182,700 | 8,333 |

| * | LinkedIn Corp. Class A | 42,100 | 7,412 |

| | DST Systems Inc. | 103,230 | 7,357 |

| * | Freescale | | |

| | Semiconductor Ltd. | 491,400 | 7,317 |

| | Jack Henry & | | |

| | Associates Inc. | 156,400 | 7,227 |

| | NVIDIA Corp. | 460,200 | 5,900 |

| * | Ingram Micro Inc. | 299,500 | 5,894 |

| * | Manhattan Associates Inc. | 79,200 | 5,884 |

| | Fidelity National Information | |

| | Services Inc. | 130,000 | 5,151 |

| * | Advanced Energy | | |

| | Industries Inc. | 276,100 | 5,053 |

| | Plantronics Inc. | 110,900 | 4,901 |

| * | Electronicsfor Imaging Inc. | 187,600 | 4,758 |

| * | Unisys Corp. | 205,900 | 4,684 |

| | Computer Sciences Corp. | 93,900 | 4,623 |

| * | Ultratech Inc. | 115,400 | 4,562 |

| | | |

| * | Acxiom Corp. | 223,200 | 4,553 |

| | Total System Services Inc. | 180,600 | 4,475 |

| * | SYNNEXCorp. | 113,274 | 4,191 |

| * | Insight Enterprises Inc. | 198,800 | 4,099 |

| * | MEMC Electronic | | |

| | Materials Inc. | 889,900 | 3,916 |

| * | Arris Group Inc. | 225,000 | 3,863 |

| * | ElectronicArts Inc. | 210,000 | 3,717 |

| *,^ | Advanced Micro | | |

| | Devices Inc. | 1,456,735 | 3,715 |

| | Amphenol Corp. Class A | 43,800 | 3,270 |

| | Mentor Graphics Corp. | 150,000 | 2,708 |

| | Harris Corp. | 53,200 | 2,465 |

| | Diebold Inc. | 75,800 | 2,298 |

| | KLA-Tencor Corp. | 39,100 | 2,062 |

| * | Vantiv Inc. Class A | 86,600 | 2,056 |

| * | Cardtronics Inc. | 74,596 | 2,048 |

| * | Aspen Technology Inc. | 61,500 | 1,986 |

| | Broadridge Financial | | |

| | Solutions Inc. | 79,000 | 1,962 |

| * | Zebra Technologies Corp. | 40,700 | 1,918 |

| * | NeuStar Inc. Class A | 41,200 | 1,917 |

| * | Integrated Device | | |

| | Technology Inc. | 249,800 | 1,866 |

| | FEI Co. | 28,300 | 1,827 |

| * | Aruba Networks Inc. | 71,900 | 1,779 |

| * | Itron Inc. | 31,500 | 1,462 |

| * | FormFactor Inc. | 267,200 | 1,256 |

| * | Flextronics | | |

| | International Ltd. | 134,670 | 910 |

| * | Quantum Corp. | 537,800 | 688 |

| | | | 588,294 |

| Materials (5.8%) | | |

| | Eastman Chemical Co. | 467,986 | 32,698 |

| | CF Industries Holdings Inc. | 170,200 | 32,401 |

| | Axiall Corp. | 474,200 | 29,476 |

| | Valspar Corp. | 389,900 | 24,271 |

| | Westlake Chemical Corp. | 143,286 | 13,397 |

| * | WR Grace & Co. | 144,800 | 11,224 |

| * | Graphic Packaging | | |

| | Holding Co. | 1,154,119 | 8,644 |

| | NewMarket Corp. | 32,822 | 8,546 |

| | Buckeye Technologies Inc. | 279,608 | 8,374 |

| | American Vanguard Corp. | 244,500 | 7,467 |

| | Schweitzer-Mauduit | | |

| | International Inc. | 128,878 | 4,992 |

| | Huntsman Corp. | 226,600 | 4,213 |

| | Kaiser Aluminum Corp. | 54,400 | 3,517 |

| | Rock Tenn Co. Class A | 36,800 | 3,415 |

| * | Headwaters Inc. | 292,100 | 3,184 |

| | Neenah Paper Inc. | 93,600 | 2,879 |

| * | Chemtura Corp. | 125,500 | 2,712 |

| | Worthington Industries Inc. | 71,500 | 2,215 |

| | Minerals Technologies Inc. | 52,600 | 2,183 |

15

| | | | |

| Strategic Equity Fund | | | |

| |

| |

| |

| | | | | Market |

| | | | | Value |

| | | | Shares | ($000) |

| | Ball Corp. | | 41,000 | 1,951 |

| | Bemis Co. Inc. | | 48,200 | 1,945 |

| | Steel Dynamics Inc. | | 121,500 | 1,928 |

| * | Owens-IllinoisInc. | | 72,300 | 1,927 |

| | Packaging Corp. of America | 42,700 | 1,916 |

| * | SunCoke Energy Inc. | | 114,600 | 1,871 |

| * | Louisiana-Pacific Corp. | 83,700 | 1,808 |

| | | | | 219,154 |

| Telecommunication Services (0.5%) | |

| * | MetroPCS | | | |

| | Communications Inc. | 1,650,287 | 17,988 |

| | Frontier | | | |

| | Communications Corp. | 478,000 | 1,902 |

| | | | | 19,890 |

| Utilities (5.4%) | | | |

| | Ameren Corp. | | 846,800 | 29,655 |

| | Pinnacle West Capital Corp. | 387,700 | 22,444 |

| | DTEEnergy Co. | | 328,050 | 22,419 |

| | Portland General Electric Co. | 687,500 | 20,852 |

| | American Water | | | |

| | Works Co. Inc. | | 466,800 | 19,344 |

| | PNM Resources Inc. | | 662,335 | 15,426 |

| | NV Energy Inc. | | 766,500 | 15,353 |

| | Southwest Gas Corp. | 271,640 | 12,892 |

| | Vectren Corp. | | 230,700 | 8,171 |

| | Wisconsin Energy Corp. | 189,500 | 8,128 |

| | Black Hills Corp. | | 110,800 | 4,880 |

| | AES Corp. | | 361,500 | 4,544 |

| | CenterPoint Energy Inc. | 172,000 | 4,121 |

| | CMS Energy Corp. | | 146,900 | 4,104 |

| | Integrys Energy Group Inc. | 46,100 | 2,681 |

| | AGL Resources Inc. | | 49,900 | 2,093 |

| | Atmos Energy Corp. | | 45,500 | 1,942 |

| | Aqua America Inc. | | 60,900 | 1,915 |

| | MGE Energy Inc. | | 25,000 | 1,386 |

| | Laclede Group Inc. | | 27,600 | 1,179 |

| | | | | 203,529 |

| Total Common Stocks | | | |

| (Cost $2,916,427) | | | 3,763,092 |

| Temporary Cash Investments (2.0%)1 | |

| Money Market Fund (1.9%) | | |

| 2,3 | Vanguard Market | | | |

| | Liquidity Fund, | | | |

| | 0.147% | 72,721,342 | 72,721 |

| | | |

| | | Face | Market |

| | | Amount | Value |

| | | ($000) | ($000) |

| U.S. Government and Agency Obligations (0.1%) |

| 4,5 | Fannie Mae | | |

| | Discount Notes, | | |

| | 0.100%, 5/8/13 | 500 | 500 |

| 5,6 | Federal Home Loan | | |

| | Bank Discount Notes, | | |

| | 0.110%, 5/15/13 | 500 | 500 |

| 5,6 | Federal Home Loan | | |

| | Bank Discount Notes, | | |

| | 0.120%, 6/5/13 | 1,000 | 1,000 |

| | | | 2,000 |

| Total Temporary Cash Investments | |

| (Cost $74,721) | | 74,721 |

| Total Investments (101.4%) | | |

| (Cost $2,991,148) | | 3,837,813 |

| Other Assets and Liabilities (-1.4%) | |

| Other Assets | | 9,578 |

| Liabilities3 | | (60,906) |

| | | | (51,328) |

| Net Assets (100%) | | |

| Applicable to 155,168,823 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 3,786,485 |

| Net Asset Value Per Share | | $24.40 |

16

Strategic Equity Fund

| |

| At March 31, 2013, net assets consisted of: |

| | Amount |

| | ($000) |

| Paid-in Capital | 3,755,305 |

| Overdistributed Net Investment Income | (1,658) |

| Accumulated Net Realized Losses | (814,009) |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | 846,665 |

| Futures Contracts | 182 |

| Net Assets | 3,786,485 |

See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Part of security position is on loan to broker-dealers. The total value of securities on loan is $34,771,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures

investments, the fund’s effective common stock and temporary cash investment positions represent 100.0% and 1.4%, respectively,

of net assets.

2 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is

the 7-day yield.

3 Includes $36,622,000 of collateral received for securities on loan.

4 The issuer was placed under federal conservatorship in September 2008; since that time, its daily operations have been managed by the

Federal Housing Finance Agency and it receives capital from the U.S. Treasury, as needed to maintain a positive net worth, in exchange

for senior preferred stock.

5 Securities with a value of $1,500,000 have been segregated as initial margin for open futures contracts.

6 The issuer operates under a congressional charter; its securities are generally neither guaranteed by the U.S. Treasury nor backed by the

full faith and credit of the U.S. government.

REIT—Real Estate Investment Trust.

See accompanying Notes, which are an integral part of the Financial Statements.

17

Strategic Equity Fund

Statement of Operations

| |

| | SixMonths Ended |

| | March 31, 2013 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends | 34,804 |

| Interest1 | 25 |

| Security Lending | 1,116 |

| Total Income | 35,945 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 704 |

| Management and Administrative | 3,774 |

| Marketing and Distribution | 250 |

| Custodian Fees | 20 |

| Shareholders’ Reports | 28 |

| Trustees’ Fees and Expenses | 3 |

| Total Expenses | 4,779 |

| Net Investment Income | 31,166 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold | 169,566 |

| Futures Contracts | 2,977 |

| Realized Net Gain (Loss) | 172,543 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | 368,863 |

| Futures Contracts | 622 |

| Change in Unrealized Appreciation (Depreciation) | 369,485 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 573,194 |

| 1 Interest income from an affiliated company of the fund was $23,000. |

See accompanying Notes, which are an integral part of the Financial Statements.

18

Strategic Equity Fund

Statement of Changes in Net Assets

| | |

| | Six Months Ended | Year Ended |

| | March 31, | September 30, |

| | 2013 | 2012 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 31,166 | 39,685 |

| Realized Net Gain (Loss) | 172,543 | 293,306 |

| Change in Unrealized Appreciation (Depreciation) | 369,485 | 477,419 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 573,194 | 810,410 |

| Distributions | | |

| Net Investment Income | (52,913) | (32,559) |

| Realized Capital Gain | — | — |

| Total Distributions | (52,913) | (32,559) |

| Capital Share Transactions | | |

| Issued | 205,029 | 237,519 |

| Issued in Lieu of Cash Distributions | 49,011 | 30,266 |

| Redeemed | (241,432) | (548,498) |

| Net Increase (Decrease) from Capital Share Transactions | 12,608 | (280,713) |

| Total Increase (Decrease) | 532,889 | 497,138 |

| Net Assets | | |

| Beginning of Period | 3,253,596 | 2,756,458 |

| End of Period1 | 3,786,485 | 3,253,596 |

| 1 Net Assets—End of Period includes undistributed (overdistributed) net investment income of ($1,658,000) and $20,089,000. |

See accompanying Notes, which are an integral part of the Financial Statements.

19

Strategic Equity Fund

Financial Highlights

| | | | | | | |

| | Six Months | | | | | |

| | | Ended | | | | | |

| For a Share Outstanding | March 31, | Year Ended September 30, |

| Throughout Each Period | | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 |

| Net Asset Value, Beginning of Period | $21.02 | $16.30 | $16.30 | $14.52 | $16.42 | $24.94 |

| Investment Operations | | | | | | | |

| Net Investment Income | | . 209 | .249 | .210 | .221 | .184 | .240 |

| Net Realized and Unrealized Gain (Loss) | | | | | | |

| on Investments | | 3.521 | 4.667 | .017 | 1.759 | (1.843) | (6.090) |

| Total from Investment Operations | | 3.730 | 4.916 | .227 | 1.980 | (1.659) | (5.850) |

| Distributions | | | | | | | |

| Dividends from Net Investment Income | (. 350) | (.196) | (. 227) | (. 200) | (. 241) | (.240) |

| Distributions from Realized Capital Gains | — | — | — | — | — | (2.430) |

| Total Distributions | | (.350) | (.196) | (. 227) | (. 200) | (. 241) | (2.670) |

| Net Asset Value, End of Period | | $24.40 | $21.02 | $16.30 | $16.30 | $14.52 | $16.42 |

| |

| Total Return1 | | 18.01% | 30.32% | 1.23% | 13.71% | -9.66% | -25.37% |

| |

| Ratios/Supplemental Data | | | | | | | |

| Net Assets, End of Period (Millions) | $3,786 | $3,254 | $2,756 | $3,103 | $3,549 | $4,822 |

| Ratio of Total Expenses to | | | | | | | |

| Average Net Assets | | 0.28% | 0.29% | 0.30% | 0.30% | 0.30% | 0.25% |

| Ratio of Net Investment Income to | | | | | | |

| Average Net Assets | | 1.56% | 1.25% | 1.09% | 1.37% | 1.47% | 1.09% |

| Portfolio Turnover Rate | | 63% | 67% | 73% | 60% | 60% | 79% |

The expense ratio, net income ratio, and turnover rate for the current period have been annualized.

1 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about

any applicable account service fees.

See accompanying Notes, which are an integral part of the Financial Statements.

20

Strategic Equity Fund

Notes to Financial Statements

Vanguard Strategic Equity Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. mutual funds. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been materially affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the board of trustees to represent fair value. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value.

Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued at their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

During the six months ended March 31, 2013, the fund’s average investments in long and short futures contracts each represented less than 1% of net assets, based on quarterly average aggregate settlement values.

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (September 30, 2009–2012), and for the period ended March 31, 2013, and has concluded that no provision for federal income tax is required in the fund’s financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

5. Security Lending: The fund may lend its securities to qualified institutional borrowers to earn additional income. Security loans are required to be secured at all times by collateral at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted on the next business day. The fund invests cash collateral received in Vanguard Market

21

Strategic Equity Fund

Liquidity Fund, and records a liability for the return of the collateral, during the period the securities are on loan. Security lending income represents fees charged to borrowers plus income earned on investing cash collateral, less expenses associated with the loan.

6. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

B. The Vanguard Group furnishes at cost corporate management, administrative, marketing, and distribution services. The costs of such services are allocated to the fund under methods approved by the board of trustees. The fund has committed to provide up to 0.40% of its net assets in capital contributions to Vanguard. At March 31, 2013, the fund had contributed capital of $462,000 to Vanguard (included in Other Assets), representing 0.01% of the fund’s net assets and 0.18% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and officers of Vanguard.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interestrates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

The following table summarizes the market value of the fund’s investments as of March 31, 2013, based on the inputs used to value them:

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investments | ($000) | ($000) | ($000) |

| Common Stocks | 3,763,092 | — | — |

| Temporary Cash Investments | 72,721 | 2,000 | — |

| Futures Contracts—Assets1 | 66 | — | — |

| Total | 3,835,879 | 2,000 | — |

| 1 Represents variation margin on the last day of the reporting period. |

D. At March 31, 2013, the aggregate settlement value of open futures contracts and the related unrealized appreciation (depreciation) were:

| | | | |

| | | | ($000) |

| | | | Aggregate | |

| | | Number of | Settlement | Unrealized |

| | | Long (Short) | Value | Appreciation |

| Futures Contracts | Expiration | Contracts | Long (Short) | (Depreciation) |

| E-mini Russell 2000 Index | June 2013 | 188 | 17,839 | 69 |

| E-mini S&P MidCap 400 Index | June 2013 | 51 | 5,870 | 113 |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized

gain (loss) for tax purposes.

22

Strategic Equity Fund

E. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

The fund’s tax-basis capital gains and losses are determined only at the end of each fiscal year. For tax purposes, at September 30, 2012, the fund had available capital losses totaling $986,991,000 to offset future net capital gains. Of this amount, $954,229,000 is subject to expiration on September 30, 2018. Capital losses of $32,762,000 realized beginning in fiscal 2012 may be carried forward indefinitely under the Regulated Investment Company Modernization Act of 2010, but must be used before any expiring loss carryforwards. The fund will use these capital losses to offset net taxable capital gains, if any, realized during the year ending September 30, 2013; should the fund realize net capital losses for the year, the losses will be added to the loss carryfor-ward balance above.

At March 31, 2013, the cost of investment securities for tax purposes was $2,991,148,000. Net unrealized appreciation of investment securities for tax purposes was $846,665,000, consisting of unrealized gains of $884,040,000 on securities that had risen in value since their purchase and $37,375,000 in unrealized losses on securities that had fallen in value since their purchase.

F. During the six months ended March 31, 2013, the fund purchased $1,068,393,000 of investment securities and sold $1,073,785,000 of investment securities, other than temporary cash investments.

G. Capital shares issued and redeemed were:

| | |

| | Six Months Ended | Year Ended |

| | March 31, 2013 | September 30, 2012 |

| | Shares | Shares |

| | (000) | (000) |

| Issued | 9,046 | 12,157 |

| Issued in Lieu of Cash Distributions | 2,331 | 1,630 |

| Redeemed | (10,981) | (28,154) |

| Net Increase (Decrease) in Shares Outstanding | 396 | (14,367) |

H. In preparing the financial statements as of March 31, 2013, management considered the impact of subsequent events for potential recognition or disclosure in these financial statements.

23

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

24

| | | |

| Six Months Ended March 31, 2013 | | | |

| | Beginning | Ending | Expenses |

| | Account Value | Account Value | Paid During |

| Strategic Equity Fund | 9/30/2012 | 3/31/2013 | Period |

| Based on Actual Fund Return | $1,000.00 | $1,180.12 | $1.52 |

| Based on Hypothetical 5% Yearly Return | 1,000.00 | 1,023.54 | 1.41 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratio for that

period is 0.28%. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account

value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most

recent 12-month period.

25

Trustees Approve Advisory Arrangement

The board of trustees of Vanguard Strategic Equity Fund has renewed the fund’s investment advisory arrangement with The Vanguard Group, Inc. (Vanguard). Vanguard—through its Equity Investment Group—serves as the investment advisor to the fund. The board determined that continuing the fund’s internalized management structure was in the best interests of the fund and its shareholders.

The board based its decision upon an evaluation of the advisor’s investment staff, portfolio manage-ment process, and performance. The trustees considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangement. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board considered the quality of the fund’s investment management services over both the short and long term, and took into account the organizational depth and stability of the advisor. The board noted that Vanguard has been managing investments for more than three decades. The Equity Investment Group adheres to a sound, disciplined investment management process; the team has considerable experience, stability, and depth.

The board concluded that Vanguard’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory arrangement.

Investment performance

The board considered the short- and long-term performance of the fund, including any periods of outperformance or underperformance relative to a benchmark index and peer group. The board concluded that the performance was such that the advisory arrangement should continue. Information about the fund’s most recent performance can be found in the Performance Summary section of this report.

Cost

The board concluded that the fund’s expense ratio was well below the average expense ratio charged by funds in its peer group and that the fund’s advisory fee rate was also well below its peer-group average. Information about the fund’s expenses appears in the About Your Fund’s Expenses section of this report as well as in the Financial Statements section.

The board does not conduct a profitability analysis of Vanguard, because of Vanguard’s unique “at-cost” structure. Unlike most other mutual fund management companies, Vanguard is owned by the funds it oversees, and produces “profits” only in the form of reduced expenses for fund shareholders.

The benefit of economies of scale

The board concluded that the fund’s at-cost arrangement with Vanguard ensures that the fund will realize economies of scale as it grows, with the cost to shareholders declining as fund assets increase.

The board will consider whether to renew the advisory arrangement again after a one-year period.

26

Glossary

30-Day SEC Yield. A fund’s 30-day SEC yield is derived using a formula specified by the U.S. Securities and Exchange Commission. Under the formula, data related to the fund’s security holdings in the previous 30 days are used to calculate the fund’s hypothetical net income for that period, which is then annualized and divided by the fund’s estimated average net assets over the calculation period. For the purposes of this calculation, a security’s income is based on its current market yield to maturity (for bonds), its actual income (for asset-backed securities), or its projected dividend yield (for stocks). Because the SEC yield represents hypothetical annualized income, it will differ—at times significantly—from the fund’s actual experience. As a result, the fund’s income distributions may be higher or lower than implied by the SEC yield.

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. For this report, beta is based on returns over the past 36 months for both the fund and the index. Note that a fund’s beta should be reviewed in conjunction with its R-squared (see definition). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Dividend Yield. Dividend income earned by stocks, expressed as a percentage of the aggregate market value (or of net asset value, for a fund). The yield is determined by dividing the amount of the annual dividends by the aggregate value (or net asset value) at the end of the period. For a fund, the dividend yield is based solely on stock holdings and does not include any income produced by other investments.

Earnings Growth Rate. The average annual rate of growth in earnings over the past five years for the stocks now in a fund.

Equity Exposure. A measure that reflects a fund’s investments in stocks and stock futures. Any holdings in short-term reserves are excluded.

Expense Ratio. A fund’s total annual operating expenses expressed as a percentage of the fund’s average net assets. The expense ratio includes management and administrative expenses, but does not include the transaction costs of buying and selling portfolio securities.

Foreign Holdings. The percentage of a fund represented by securities or depositary receipts of companies based outside the United States.

Inception Date. The date on which the assets of a fund (or one of its share classes) are first invested in accordance with the fund’s investment objective. For funds with a subscription period, the inception date is the day after that period ends. Investment performance is measured from the inception date.

Median Market Cap. An indicator of the size of companies in which a fund invests; the midpoint of market capitalization (market price x shares outstanding) of a fund’s stocks, weighted by the proportion of the fund’s assets invested in each stock. Stocks representing half of the fund’s assets have market capitalizations above the median, and the rest are below it.

Price/Book Ratio. The share price of a stock divided by its net worth, or book value, per share. For a fund, the weighted average price/book ratio of the stocks it holds.

27

Price/Earnings Ratio. The ratio of a stock’s current price to its per-share earnings over the past year. For a fund, the weighted average P/E of the stocks it holds. P/E is an indicator of market expectations about corporate prospects; the higher the P/E, the greater the expectations for a company’s future growth.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0. For this report, R-squared is based on returns over the past 36 months for both the fund and the index.

Return on Equity. The annual average rate of return generated by a company during the past five years for each dollar of shareholder’s equity (net income divided by shareholder’s equity). For a fund, the weighted average return on equity for the companies whose stocks it holds.

Short-Term Reserves. The percentage of a fund invested in highly liquid, short-term securities that can be readily converted to cash.

Turnover Rate. An indication of the fund’s trading activity. Funds with high turnover rates incur higher transaction costs and may be more likely to distribute capital gains (which may be taxable to investors). The turnover rate excludes in-kind transactions, which have minimal impact on costs.

Benchmark Information

Spliced Small and Mid Cap Index: Russell 2800 Index through May 31, 2003; MSCI US Small +

Mid Cap 2200 Index thereafter.

28

This page intentionally left blank.

This page intentionally left blank.

This page intentionally left blank.

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them on an at-cost basis.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals. The independent board members have distinguished backgrounds in business, academia, and public service. Each of the trustees and executive officers oversees 180 Vanguard funds.

The following table provides information for each trustee and executive officer of the fund. More information about the trustees is in the Statement of Additional Information, which can be obtained, without charge, by contacting Vanguard at 800-662-7447, or online at vanguard.com.

| InterestedTrustee1 | and Delphi Automotive LLP (automotive components); |

| | Senior Advisor at New Mountain Capital; Trustee of |

| F. William McNabb III | The Conference Board. |

| Born 1957. Trustee Since July 2009. Chairman of the | |

| Board. Principal Occupation(s) During the Past Five | Amy Gutmann |

| Years: Chairman of the Board of The Vanguard Group, | Born 1949. Trustee Since June 2006. Principal |

| Inc., and of each of the investment companies served | Occupation(s) During the Past Five Years: President |

| by The Vanguard Group, since January 2010; Director | of the University of Pennsylvania; Christopher H. |

| of The Vanguard Group since 2008; Chief Executive | Browne Distinguished Professor of Political Science |