UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-09054 |

|

CREDIT SUISSE OPPORTUNITY FUNDS |

(Exact name of registrant as specified in charter) |

|

Eleven Madison Avenue, New York, New York | | 10010 |

(Address of principal executive offices) | | (Zip code) |

|

John G. Popp Credit Suisse Opportunity Funds Eleven Madison Avenue New York, New York 10010 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 325-2000 | |

|

Date of fiscal year end: | October 31st | |

|

Date of reporting period: | November 1, 2018 to October 31, 2019 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

CREDIT SUISSE FUNDS

Annual Report

October 31, 2019

n CREDIT SUISSE

FLOATING RATE HIGH INCOME FUND

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund's shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from Credit Suisse Asset Management, LLC or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper free of charge. If you hold accounts directly with the Fund, you can call 877-870-2874 to inform Credit Suisse Asset Management, LLC that you wish to continue receiving paper copies of your shareholder reports. If you hold accounts through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds advised by Credit Suisse Asset Management, LLC, or all funds held with your financial intermediary, as applicable.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by: (i) accessing the Credit Suisse Asset Management, LLC website at www.credit-suisse.com/us/funds and logging into your accounts, if you hold accounts directly with the Fund, or (ii) contacting your financial intermediary, if you hold accounts through a financial intermediary. Please note that not all financial intermediaries may offer this service.

The Fund's investment objectives, risks, charges and expenses (which should be considered carefully before investing), and more complete information about the Fund, are provided in the Prospectus, which should be read carefully before investing. You may obtain additional copies by calling 877-870-2874 or by visiting our website at www.credit-suisse.com/us/funds.

Credit Suisse Securities (USA) LLC, Distributor, is located at Eleven Madison Avenue, New York, NY 10010. Credit Suisse Funds are advised by Credit Suisse Asset Management, LLC.

Investors in the Credit Suisse Funds should be aware that they may be eligible to purchase Class I shares (where offered) directly or through certain intermediaries. Such shares are not subject to a sales charge. Investors in the Credit Suisse Funds should also be aware that they may be eligible for a reduction or waiver of the sales charge with respect to Class A or C shares (where offered). For more information, please review the relevant prospectuses or consult your financial representative.

Fund shares are not deposits or other obligations of Credit Suisse Asset Management, LLC ("Credit Suisse") or any affiliate, are not FDIC-insured and are not guaranteed by Credit Suisse or any affiliate. Fund investments are subject to investment risks, including loss of your investment.

Credit Suisse Floating Rate High Income Fund

Annual Investment Adviser's Report

October 31, 2019 (unaudited)

November 19, 2019

Dear Shareholder:

We are pleased to present this Annual Report covering the activities of the Credit Suisse Floating Rate High Income Fund (the "Fund") for the 12-month period ended October 31, 2019.

Performance Summary

11/1/2018 – 10/31/2019

Fund & Benchmark | | Performance | |

| Class I1 | | | 1.47 | % | |

| Class A1,2 | | | 1.23 | % | |

| Class C1,2 | | | 0.34 | % | |

| Credit Suisse Leveraged Loan Index3 | | | 2.61 | % | |

Performance shown for the Fund's Class A and Class C Shares does not reflect sales charges, which are a maximum of 4.75% and 1.00%, respectively.2

Market Review: A mixed period for the asset class

The 12-month period ended October 31, 2019 was a positive one for the senior secured loan asset class. The Credit Suisse Leveraged Loan Index (the "Index"), the Fund's benchmark (the "Benchmark"), returned 2.61% for the period. The discount margin for senior loans, using a three-year average life assumption, widened 114 basis points during the period to +512 basis points. Principal depreciation, however, was a large detractor, as the price of the Index decreased 2.81% to end the period at $95.22.

Along with the drop in the overall Index price, the market saw a relatively significant increase in the amount of loans trading below 90. In fact, sub-90 loans grew from 5.18% of the Index a year ago to 13.22% (by par amount) at period end. Fundamentals, however, continue to remain strong with a par-weighted default rate of 1.65%, still well below the historical average of about 3%.

From a quality point of view, the higher rated portion of the Index outperformed for the year. Split BBB posted the highest returns, at 4.76%, followed by BB loans, which returned 4.25% for the period. Split B and CCC/Split CCC rated loans underperformed, returning -1.89% and -3.90%, respectively.

As Federal Reserve policy swings shifted demand out of floating rate products, loan funds reported outflows each month, totaling -$53.4 billion for the year. Mutual fund managers have been able to raise cash for these redemptions, thanks

1

Credit Suisse Floating Rate High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2019 (unaudited)

to demand from CLO creation and light primary issuances. Gross and net CLO issuance for the period were $173.3 billion and $119.3 billion, respectively.

The period saw a significant decrease in new issue activity. According to JPMorgan, gross and net issuance were $341.9 billion and $203.8 billion, respectively — which represents respective decreases of 59% and 33.6% compared to the prior year.

Strategic Review and Outlook: Searching for pockets of opportunity

For the annual period ended October 31, 2019, the Fund underperformed the benchmark. While higher rated loans outperformed the market, lower quality assets lagged for much of the year. As rate expectations stabilize, we will look to find pockets of opportunity.

Separately, with the expectation of a potential trade deal between the United States and China, we believe the markets will likely experience continued volatility as White House rhetoric is carefully analyzed. And if political uneasiness creates another pocket of weakness, we will likely view it as an opportunity to deploy cash at lower levels.

Additionally, although CLO year-to-date issuance continues to lag 2018 by around 10%, it is about the same on a deal count basis. Since January, the average Caa basket has increased 20 basis points to 3.5%, while the average CCC basket increased 50 basis points to 3.4%, as Standard & Poor's has been more actively downgrading.

The Credit Suisse Credit Investments Group Team

John G. Popp

Thomas J. Flannery

Louis I. Farano

Wing Chan

David J. Mechlin

Senior secured floating rate loans ("Senior Loans") typically hold the most senior position in the issuer's capital structure. Senior Loans are subject to the risk that a court could subordinate a Senior Loan to presently existing or future indebtedness or take other action detrimental to the holders of Senior Loans.

2

Credit Suisse Floating Rate High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2019 (unaudited)

High yield bonds are bonds rated below BBB- by S&P or Baa3 by Moody's that are also known as "junk bonds." Such bonds entail greater risks than those found in higher- rated securities.

Additional principal risk factors for the Fund include conflict of interest risk, credit risk, foreign securities risk, interest rate risk, liquidity risk, market risk, prepayment risk and valuation risk. Before you invest, please make sure you understand the risks that apply to the Fund. As with any mutual fund, you could lose money over any period of time.

Investments in the Fund are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any government agency. For a detailed discussion of these and other risks, please refer to the Fund's Prospectus, which should be read carefully before investing.

In addition to historical information, this report contains forward-looking statements, which may concern, among other things, domestic and foreign markets, industry and economic trends and developments and government regulation, and their potential impact on the Fund's investments. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future, and their impact on the Fund, could be materially different from those projected, anticipated or implied. The Fund has no obligation to update or revise forward-looking statements.

The views of the Fund's management are as of the date of this letter and the Fund holdings described in this document are as of October 31, 2019; these views and Fund holdings may have changed subsequent to these dates. Nothing in this document is a recommendation to purchase or sell securities.

3

Credit Suisse Floating Rate High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2019 (unaudited)

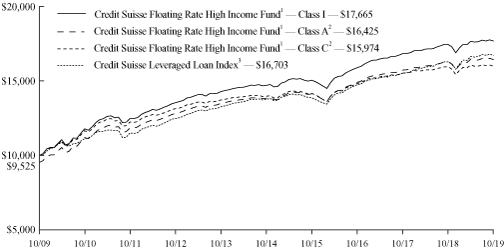

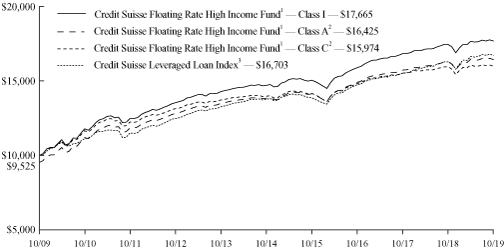

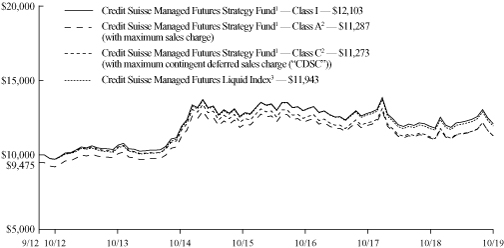

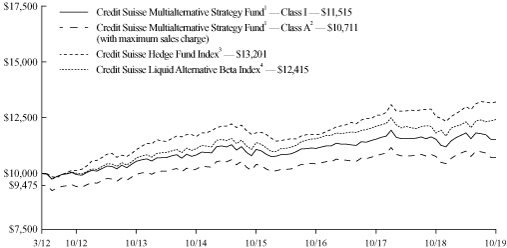

Comparison of Change in Value of $10,000 Investment in the

Credit Suisse Floating Rate High Income Fund1,2 and the

Credit Suisse Leveraged Loan Index3 for Ten Years

1 Fee waivers and/or expense reimbursements reduce expenses for the Fund, without which performance would be lower. Effective April 22, 2019, the Fund entered into a written contract to limit expenses to 0.70% of the Fund's average daily net assets for Class I shares, 0.95% of the Fund's average daily net assets for Class A shares and 1.70% of the Fund's average daily net assets for Class C shares through at least February 29, 2021. This limit excludes certain expenses, as set forth in the Fund's Prospectus.

2 Total return for the Fund's Class A shares for the reporting period, based on offering price (including maximum sales charge of 4.75%), was (3.56%). Total return for the Fund's Class C shares for the reporting period, based on redemption value including maximum contingent deferred sales charge ("CDSC") of 1.00%, was (0.62%).

3 Credit Suisse Leveraged Loan Index is an unmanaged index that is designed to mirror the investable universe of the U.S. dollar denominated institutional leveraged loan market. The index does not have transaction costs and investors cannot invest directly in the index.

4

Credit Suisse Floating Rate High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2019 (unaudited)

Average Annual Returns as of October 31, 20191

| | | 1 Year | | 5 Years | | 10 Years | |

Class I | | | 1.47 | % | | | 3.74 | % | | | 5.85 | % | |

Class A Without Sales Charge | | | 1.23 | % | | | 3.49 | % | | | 5.60 | % | |

Class A With Maximum Sales Charge | | | (3.56 | )% | | | 2.50 | % | | | 5.09 | % | |

Class C Without CDSC | | | 0.34 | % | | | 2.72 | % | | | 4.80 | % | |

Class C With CDSC | | | (0.62 | )% | | | 2.72 | % | | | 4.80 | % | |

Returns represent past performance and include change in share price and reinvestment of dividends and capital gain distributions, if any. Past performance cannot guarantee future results. The current performance of the Fund may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be more or less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance information current to the most recent month end is available at www.credit-suisse.com/us/funds.

The annual gross expense ratios are 0.78% for Class I shares, 1.03% for Class A shares and 1.78% for Class C shares. The annual net expense ratios after fee waivers and/or expense reimbursements are 0.70% for Class I shares, 0.95% for Class A shares and 1.70% for Class C shares.

1 Fee waivers and/or expense reimbursements reduce expenses for the Fund, without which performance would be lower. Effective April 22, 2019, the Fund entered into a written contract to limit expenses to 0.70% of the Fund's average daily net assets for Class I shares, 0.95% of the Fund's average daily net assets for Class A shares and 1.70% of the Fund's average daily net assets for Class C shares through at least February 29, 2021. This limit excludes certain expenses, as set forth in the Fund's Prospectus.

5

Credit Suisse Floating Rate High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2019 (unaudited)

Information About Your Fund's Expenses

As an investor of the Fund, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Fund expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Fund and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six months ended October 31, 2019.

The table illustrates your Fund's expenses in two ways:

• Actual Fund Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Fund using the Fund's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line.

• Hypothetical 5% Fund Return. This helps you to compare the Fund's ongoing expenses with those of other mutual funds using the Fund's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expenses of owning different funds.

6

Credit Suisse Floating Rate High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2019 (unaudited)

Expenses and Value for a $1,000 Investment

for the six-month period ended October 31, 2019

Actual Fund Return | | Class I | | Class A | | Class C | |

Beginning Account Value 05/01/19 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending Account Value 10/31/19 | | $ | 1,000.80 | | | $ | 998.20 | | | $ | 994.50 | | |

Expenses Paid per $1,000* | | $ | 3.53 | | | $ | 4.78 | | | $ | 8.55 | | |

Hypothetical 5% Fund Return | |

Beginning Account Value 05/01/19 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | |

Ending Account Value 10/31/19 | | $ | 1,021.68 | | | $ | 1,020.42 | | | $ | 1,016.64 | | |

Expenses Paid per $1,000* | | $ | 3.57 | | | $ | 4.84 | | | $ | 8.64 | | |

| | | Class I | | Class A | | Class C | |

Annualized Expense Ratios* | | | 0.70 | % | | | 0.95 | % | | | 1.70 | % | |

* Expenses are equal to the Fund's annualized expense ratio for each share class, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

The "Expenses Paid per $1,000" and the "Annualized Expense Ratios" in the tables are based on actual expenses paid by the Fund during the period, net of fee waivers and/or actual expense reimbursements, if applicable. If those fee waivers and/or expense reimbursements had not been in effect, the Fund's actual expenses would have been higher. Expenses do not reflect additional charges and expenses that are, or may be, imposed under the variable contracts or plans. Such charges and expenses are described in the prospectus of the insurance company separate account or in the plan documents or other informational materials supplied by plan sponsors. The Fund's expenses should be considered with these charges and expenses in evaluating the overall cost of investing in the separate account.

For more information, please refer to the Fund's Prospectus.

7

Credit Suisse Floating Rate High Income Fund

Annual Investment Adviser's Report (continued)

October 31, 2019 (unaudited)

Credit Quality Breakdown*

(% of Total Investments as of October 31, 2019)

S&P Ratings** | |

A | | | 1.4 | % | |

BBB | | | 5.4 | | |

BB | | | 27.3 | | |

B | | | 50.8 | | |

CCC | | | 10.8 | | |

NR | | | 4.0 | | |

Subtotal | | | 99.7 | | |

Equity and Other | | | 0.3 | | |

Total | | | 100.0 | % | |

* Expressed as a percentage of total investments (excluding securities lending collateral if applicable) and may vary over time.

** Credit Quality is based on ratings provided by the S&P Global Ratings Division of S&P Global Inc. ("S&P"). S&P is a main provider of ratings for credit assets classes and is widely used amongst industry participants. The NR category consists of securities that have not been rated by S&P.

8

Credit Suisse Floating Rate High Income Fund

Schedule of Investments

October 31, 2019

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| BANK LOANS (81.2%) | | | |

Advertising (0.7%) | | | |

$ | 8,707 | | | Clear Channel Outdoor Holdings, Inc.,

LIBOR 1M + 3.500%(1) | | (B+, B1) | | 08/21/26 | | | 5.286 | | | $ | 8,733,789 | | |

| | 4,368 | | | MH Sub I LLC, LIBOR 1M + 3.750%(1) | | (B, B2) | | 09/13/24 | | | 5.536 | | | | 4,268,144 | | |

| | 5,980 | | | MH Sub I LLC, LIBOR 1M + 7.500%(1) | | (CCC+, Caa2) | | 09/15/25 | | | 9.286 | | | | 5,855,407 | | |

| | | | 18,857,340 | | |

| Aerospace & Defense (0.8%) | | | |

| | 2,968 | | | Fly Funding II Sarl, LIBOR 3M + 2.000%(1) | | (BBB-, Ba2) | | 02/09/23 | | | 4.180 | | | | 2,971,992 | | |

| | 11,078 | | | Sequa Mezzanine Holdings LLC,

LIBOR 3M + 5.000%(1) | | (CCC+, B3) | | 11/28/21 | | | 7.187 | | | | 10,944,612 | | |

| | 5,237 | | | TransDigm, Inc., LIBOR 1M + 2.500%(1) | | (B+, Ba3) | | 08/22/24 | | | 4.286 | | | | 5,205,176 | | |

| | | | 19,121,780 | | |

| Air Transportation (0.6%) | | | |

| | 1,908 | | | American Airlines, Inc., LIBOR 1M + 2.000%(1) | | (BB+, Ba1) | | 10/12/21 | | | 3.939 | | | | 1,910,619 | | |

| | 12,733 | | | American Airlines, Inc., LIBOR 1M + 2.000%(1) | | (BB+, Ba1) | | 12/14/23 | | | 3.921 | | | | 12,732,704 | | |

| | | | 14,643,323 | | |

| Auto Parts & Equipment (2.7%) | | | |

| | 16,053 | | | American Axle & Manufacturing, Inc.,

LIBOR 1M + 2.250%(1) | | (BB, Ba2) | | 04/06/24 | | | 4.102 | | | | 15,324,059 | | |

| | 21,029 | | | CS Intermediate Holdco 2 LLC,

LIBOR 1M + 2.000%(1) | | (BB+, Ba2) | | 11/02/23 | | | 3.786 | | | | 20,121,762 | | |

| | 9,868 | | | Jason, Inc., LIBOR 3M + 4.500%(1),(2) | | (CCC+, Caa1) | | 06/30/21 | | | 6.516 | | | | 8,753,965 | | |

| | 2,963 | | | L&W, Inc., LIBOR 1M + 6.375%(1),(3) | | (BB-, B2) | | 05/22/25 | | | 8.161 | | | | 2,866,219 | | |

| | 8,600 | | | Panther BF Aggregator 2 LP,

LIBOR 1M + 3.500%(1) | | (B+, Ba3) | | 04/30/26 | | | 5.300 | | | | 8,503,250 | | |

| | 13,092 | | | U.S. Farathane LLC, LIBOR 1M + 3.500%(1),(3) | | (B+, B3) | | 12/23/21 | | | 5.286 | | | | 11,979,008 | | |

| | | | 67,548,263 | | |

| Automakers (0.7%) | | | |

| | 12,136 | | | TI Group Automotive Systems LLC,

EURIBOR 3M + 2.750%(1),(4) | | (BB-, B1) | | 06/30/22 | | | 3.500 | | | | 13,492,730 | | |

| | 3,811 | | | TI Group Automotive Systems LLC,

LIBOR 1M + 2.500%(1) | | (BB-, B1) | | 06/30/22 | | | 4.286 | | | | 3,785,518 | | |

| | | | 17,278,248 | | |

| Banking (0.3%) | | | |

| | 6,809 | | | Citco Funding LLC, LIBOR 1M + 2.500%(1),(3) | | (NR, Ba3) | | 09/28/23 | | | 4.286 | | | | 6,779,594 | | |

| Building & Construction (0.2%) | | | |

| | 4,234 | | | SiteOne Landscape Supply, Inc.,

LIBOR 1M + 2.750%(1) | | (BB, B2) | | 10/29/24 | | | 4.540 | | | | 4,249,389 | | |

| Building Materials (3.6%) | | | |

| | 3,950 | | | Airxcel, Inc., LIBOR 1M + 4.500%(1) | | (B, B3) | | 04/28/25 | | | 6.286 | | | | 3,747,563 | | |

| | 1,775 | | | Airxcel, Inc., LIBOR 1M + 8.750%(1),(2) | | (CCC+, Caa2) | | 04/27/26 | | | 10.536 | | | | 1,624,125 | | |

| | 15,000 | | | American Builders & Contractors Supply Co.,

Inc., LIBOR 1M + 2.250%(1) | | (BB+, B1) | | 01/15/27 | | | 3.786 | | | | 14,995,350 | | |

See Accompanying Notes to Financial Statements.

9

Credit Suisse Floating Rate High Income Fund

Schedule of Investments (continued)

October 31, 2019

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| BANK LOANS (continued) | | | |

Building Materials | | | |

$ | 7,280 | | | Floor & Decor Outlets of America, Inc.,

LIBOR 1M + 2.500%(1),(3) | | (BB-, B1) | | 09/30/23 | | | 4.290 | | | $ | 7,261,645 | | |

| | 9,431 | | | Installed Building Products, Inc.,

LIBOR 1M + 2.500%(1),(3) | | (BB+, Ba3) | | 04/15/25 | | | 4.286 | | | | 9,466,221 | | |

| | 1,958 | | | NCI Building Systems, Inc., LIBOR 1M + 3.750%(1) | | (B+, B2) | | 04/12/25 | | | 5.671 | | | | 1,897,259 | | |

| | 20,696 | | | Priso Acquisition Corp., LIBOR 1M + 3.000%(1) | | (B+, B2) | | 05/08/22 | | | 5.044 | | | | 19,695,823 | | |

| | 15,586 | | | Summit Materials Cos. I LLC,

LIBOR 1M + 2.000%(1) | | (BBB-, Ba2) | | 11/21/24 | | | 3.786 | | | | 15,637,012 | | |

| | 15,956 | | | Wilsonart LLC, LIBOR 3M + 3.250%(1) | | (B+, B2) | | 12/19/23 | | | 5.360 | | | | 15,652,188 | | |

| | | | 89,977,186 | | |

| Cable & Satellite TV (1.8%) | | | |

| | 14,409 | | | Charter Communications Operating, LLC,

LIBOR 1M +1.750%(1) | | (BBB-, Ba1) | | 04/30/25 | | | 3.580 | | | | 14,473,114 | | |

| | 21,672 | | | CSC Holdings LLC, LIBOR 1M + 2.250%(1) | | (BB, Ba3) | | 07/17/25 | | | 4.171 | | | | 21,601,702 | | |

| | 2,000 | | | Ziggo B.V., EURIBOR 3M + 3.000%(1),(4) | | (B+, B1) | | 01/31/29 | | | 3.000 | | | | 2,223,246 | | |

| | 6,408 | | | Ziggo Secured Finance Partnership,

LIBOR 1M + 2.500%(1) | | (B+, B1) | | 04/15/25 | | | 4.421 | | | | 6,340,434 | | |

| | | | 44,638,496 | | |

| Chemicals (8.3%) | | | |

| | 5,234 | | | Allnex (Luxembourg) & Cy S.C.A.,

EURIBOR 3M + 3.250%(1),(4) | | (B, B2) | | 09/13/23 | | | 3.250 | | | | 5,561,252 | | |

| | 1,839 | | | Allnex (Luxembourg) & Cy S.C.A.,

LIBOR 3M + 3.250%(1) | | (B, B2) | | 09/13/23 | | | 5.394 | | | | 1,750,155 | | |

| | 1,385 | | | Allnex U.S.A., Inc., LIBOR 3M + 3.250%(1) | | (B, B2) | | 09/13/23 | | | 5.394 | | | | 1,318,560 | | |

| | 18,485 | | | Alpha 3 B.V., LIBOR 3M + 3.000%(1) | | (B, B1) | | 01/31/24 | | | 5.104 | | | | 18,165,430 | | |

| | 9,237 | | | Ascend Performance Materials Operations LLC,

LIBOR 3M + 5.250%(1) | | (BB-, B1) | | 08/27/26 | | | 7.354 | | | | 9,277,253 | | |

| | 3,835 | | | ASP Chromaflo Dutch I B.V.,

LIBOR 1M + 3.500%(1) | | (B, B2) | | 11/20/23 | | | 5.286 | | | | 3,722,597 | | |

| | 1,907 | | | ASP Chromaflo Intermediate Holdings, Inc.,

LIBOR 1M + 8.000%(1),(2),(3) | | (CCC, Caa2) | | 11/18/24 | | | 9.786 | | | | 1,840,675 | | |

| | 2,949 | | | ASP Chromaflo Intermediate Holdings, Inc.,

LIBOR 1M + 3.500%(1) | | (B, B2) | | 11/20/23 | | | 5.286 | | | | 2,862,833 | | |

| | 18,282 | | | Axalta Coating Systems U.S. Holdings, Inc.,

LIBOR 3M + 1.750%(1) | | (BBB-, Ba1) | | 06/01/24 | | | 3.854 | | | | 18,283,974 | | |

| | 7,286 | | | CTC AcquiCo GmbH, EURIBOR 3M + 2.500%(1),(4) | | (B, B2) | | 03/07/25 | | | 2.500 | | | | 8,083,388 | | |

| | 2,646 | | | Ferro Corp., LIBOR 3M + 2.250%(1) | | (BB-, Ba3) | | 02/14/24 | | | 4.354 | | | | 2,625,395 | | |

| | 2,590 | | | Ferro Corp., LIBOR 3M + 2.250%(1) | | (BB-, Ba3) | | 02/14/24 | | | 4.354 | | | | 2,569,535 | | |

| | 1,925 | | | Flint Group GmbH, EURIBOR 3M + 3.000%(1),(4) | | (CCC+, Caa1) | | 09/07/21 | | | 3.750 | | | | 1,779,460 | | |

| | 557 | | | Flint Group GmbH, LIBOR 3M + 3.000%(1),(3) | | (CCC+, Caa1) | | 09/07/21 | | | 4.936 | | | | 446,337 | | |

| | 3,369 | | | Flint Group U.S. LLC, LIBOR 3M + 3.000%(1),(3) | | (CCC+, Caa1) | | 09/07/21 | | | 4.936 | | | | 2,699,975 | | |

| | 11,755 | | | Gemini HDPE LLC, LIBOR 3M + 2.500%(1) | | (BB, Ba2) | | 08/07/24 | | | 4.430 | | | | 11,755,061 | | |

| | 6,649 | | | Ineos U.S. Finance LLC, LIBOR 1M + 2.000%(1) | | (BB+, Ba1) | | 03/31/24 | | | 3.786 | | | | 6,590,090 | | |

| | 8,944 | | | PMHC II, Inc., LIBOR 3M + 3.500%(1) | | (CCC+, B3) | | 03/31/25 | | | 5.604 | | | | 7,272,550 | | |

See Accompanying Notes to Financial Statements.

10

Credit Suisse Floating Rate High Income Fund

Schedule of Investments (continued)

October 31, 2019

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| BANK LOANS (continued) | | | |

Chemicals | | | |

$ | 2,907 | | | PMHC II, Inc., LIBOR 3M + 7.750%(1) | | (CCC, Caa2) | | 03/30/26 | | | 9.933 | | | $ | 2,272,420 | | |

| | 16,872 | | | Polar U.S. Borrower LLC, LIBOR 3M + 4.750%(1),(3) | | (B, B2) | | 10/15/25 | | | 6.794 | | | | 15,944,512 | | |

| | 11,397 | | | PQ Corp., LIBOR 3M + 2.500%(1) | | (BB-, B1) | | 02/08/25 | | | 4.427 | | | | 11,407,074 | | |

| | 3,179 | | | Ravago Holdings America, Inc.,

LIBOR 1M + 2.750%(1),(3) | | (BB-, B2) | | 06/30/23 | | | 4.540 | | | | 3,180,795 | | |

| | 5,560 | | | Solenis Holdings LLC, LIBOR 3M + 4.000%(1) | | (B-, B2) | | 06/26/25 | | | 6.124 | | | | 5,303,301 | | |

| | 18,472 | | | Starfruit Finco B.V, LIBOR 1M + 3.250%(1) | | (B+, B1) | | 10/01/25 | | | 5.190 | | | | 18,064,703 | | |

| | 11,876 | | | Tronox Finance LLC, LIBOR 1M + 2.750%(1) | | (BB-, Ba3) | | 09/23/24 | | | 4.660 | | | | 11,788,779 | | |

| | 4,209 | | | Univar, Inc., LIBOR 1M + 2.250%(1) | | (BB+, Ba3) | | 07/01/24 | | | 4.036 | | | | 4,227,649 | | |

| | 22,517 | | | UTEX Industries, Inc., LIBOR 1M + 4.000%(1) | | (CCC, Caa1) | | 05/22/21 | | | 5.786 | | | | 17,450,883 | | |

| | 3,978 | | | Vantage Specialty Chemicals, Inc.,

LIBOR 3M + 8.250%(1),(2),(3) | | (CCC, Caa2) | | 10/27/25 | | | 10.337 | | | | 3,471,039 | | |

| | 7,132 | | | Zep, Inc., LIBOR 3M + 4.000%(1) | | (CCC+, Caa1) | | 08/12/24 | | | 6.044 | | | | 5,533,410 | | |

| | 2,250 | | | Zep, Inc., LIBOR 3M + 8.250%(1),(2) | | (CCC-, Ca) | | 08/11/25 | | | 10.354 | | | | 1,186,875 | | |

| | | | 206,435,960 | | |

| Diversified Capital Goods (1.1%) | | | |

| | 3,186 | | | Callaway Golf Co., LIBOR 3M + 4.500%(1) | | (BB-, Ba3) | | 01/02/26 | | | 6.440 | | | | 3,225,630 | | |

| | 16,133 | | | Cortes NP Acquisition Corp.,

LIBOR 3M + 4.000%(1) | | (B, B2) | | 11/30/23 | | | 5.927 | | | | 15,251,502 | | |

| | 3,419 | | | Dynacast International LLC,

LIBOR 3M + 3.250%(1),(3) | | (B-, B2) | | 01/28/22 | | | 5.354 | | | | 3,162,980 | | |

| | 3,950 | | | Electrical Components International, Inc.,

LIBOR 3M + 4.250%(1),(3) | | (B-, B2) | | 06/26/25 | | | 6.355 | | | | 3,555,000 | | |

| | 2,785 | | | Filtration Group Corp., LIBOR 1M + 3.000%(1) | | (B, B2) | | 03/29/25 | | | 4.786 | | | | 2,786,385 | | |

| | | | 27,981,497 | | |

| Electric - Generation (0.6%) | | | |

| | 14,499 | | | Brookfield WEC Holdings, Inc.,

LIBOR 1M + 3.500%(1) | | (B, B2) | | 08/01/25 | | | 5.286 | | | | 14,430,045 | | |

| Electronics (3.7%) | | | |

| | 4,205 | | | Brooks Automation, Inc., LIBOR 3M + 2.500%(1),(3) | | (BB-, Ba3) | | 10/04/24 | | | 4.460 | | | | 4,215,277 | | |

| | 2,456 | | | EXC Holdings III Corp., LIBOR 3M + 3.500%(1),(3) | | (B-, B2) | | 12/02/24 | | | 5.604 | | | | 2,416,336 | | |

| | 24,379 | | | MACOM Technology Solutions Holdings, Inc.,

LIBOR 1M + 2.250%(1) | | (B-, B3) | | 05/17/24 | | | 4.036 | | | | 21,316,050 | | |

| | 14,609 | | | Microchip Technology, Inc.,

LIBOR 1M + 2.000%(1) | | (BB+, Baa3) | | 05/29/25 | | | 3.790 | | | | 14,673,171 | | |

| | 13,780 | | | Oberthur Technologies S.A.,

LIBOR 3M + 3.750%(1) | | (B-, B3) | | 01/10/24 | | | 5.854 | | | | 13,144,474 | | |

| | 7,000 | | | Oberthur Technologies S.A.,

EURIBOR 3M + 3.750%(1),(4) | | (B-, B3) | | 01/10/24 | | | 3.750 | | | | 7,570,894 | | |

| | 13,110 | | | Seattle Spinco, Inc., LIBOR 1M + 2.500%(1) | | (BB-, B1) | | 06/21/24 | | | 4.300 | | | | 12,761,317 | | |

| | 17,259 | | | Tempo Acquisition LLC, LIBOR 1M + 3.000%(1) | | (B, B1) | | 05/01/24 | | | 4.786 | | | | 17,295,057 | | |

| | | | 93,392,576 | | |

See Accompanying Notes to Financial Statements.

11

Credit Suisse Floating Rate High Income Fund

Schedule of Investments (continued)

October 31, 2019

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| BANK LOANS (continued) | | | |

| Energy - Exploration & Production (0.9%) | | | |

$ | 6,634 | | | Lower Cadence Holdings LLC,

LIBOR 1M + 4.000%(1) | | (B, B2) | | 05/22/26 | | | 5.804 | | | $ | 6,186,360 | | |

| | 5,474 | | | PES Holdings LLC, Prime + 6.250%(1),(5) | | (NR, NR) | | 12/31/22 | | | 12.000 | | | | 4,561,299 | | |

| | 14,548 | | | PES Holdings LLC, LIBOR 3M + 6.990%(1),(5) | | (NR, NR) | | 12/31/22 | | | 13.490 | | | | 4,800,822 | | |

| | 1,163 | | | PES Holdings LLC(6),(7) | | (B+, NR) | | 04/30/20 | | | 3.000 | | | | 1,177,031 | | |

| | 2,438 | | | PES Holdings LLC, LIBOR 2M + 14.000%(1) | | (NR, NR) | | 04/30/20 | | | 15.883 | | | | 2,467,969 | | |

| | 3,967 | | | PES Holdings LLC, Prime + 9.000%(1),(2),(3),(5) | | (NR, NR) | | 12/31/22 | | | 13.750 | | | | 3,113,714 | | |

| | | | 22,307,195 | | |

| Environmental (0.7%) | | | |

| | 16,665 | | | GFL Environmental, Inc., LIBOR 1M + 3.000%(1) | | (B+, B1) | | 05/30/25 | | | 4.786 | | | | 16,633,973 | | |

| Food & Drug Retailers (0.2%) | | | |

| | 2,999 | | | L1R HB Finance Limited  ,

EURIBOR 3M + 4.250%(1),(4) | | (B, B2) | | 09/02/24 | | | 4.250 | | | | 2,180,398 | | |

| | 2,999 | | | L1R HB Finance Limited  ,

LIBOR 3M + 5.250%(1),(8) | | (B, B2) | | 09/02/24 | | | 6.015 | | | | 2,472,042 | | |

| | | | 4,652,440 | | |

| Food - Wholesale (0.9%) | | | |

| | 1,985 | | | AI Aqua Merger Sub, Inc., LIBOR 1M + 3.250%(1) | | (B-, B2) | | 12/13/23 | | | 5.036 | | | | 1,858,993 | | |

| | 2,977 | | | AI Aqua Merger Sub, Inc., LIBOR 1M + 3.250%(1) | | (B-, B2) | | 12/13/23 | | | 5.036 | | | | 2,778,114 | | |

| | 2,784 | | | AI Aqua Merger Sub, Inc.,

LIBOR 3M + 4.250%(1),(3) | | (B-, B2) | | 12/13/23 | | | 6.354 | | | | 2,631,204 | | |

| | 2,154 | | | U.S. Foods, Inc., LIBOR 1M + 2.000%(1) | | (BB+, Ba3) | | 09/13/26 | | | 3.786 | | | | 2,163,420 | | |

| | 9,005 | | | United Natural Foods, Inc., LIBOR 1M + 4.250%(1) | | (B, B3) | | 10/22/25 | | | 6.036 | | | | 7,254,452 | | |

| | 5,000 | | | Zara UK Midco Ltd.,

EURIBOR 6M + 5.750%(1),(2),(3),(4) | | (B, B2) | | 01/31/25 | | | 5.750 | | | | 5,097,128 | | |

| | | | 21,783,311 | | |

| Gaming (2.6%) | | | |

| | 19,339 | | | Caesars Resort Collection LLC,

LIBOR 1M + 2.750%(1) | | (BB, Ba3) | | 12/23/24 | | | 4.536 | | | | 19,081,207 | | |

| | 7,445 | | | CBAC Borrower LLC, LIBOR 1M + 4.000%(1) | | (B, B3) | | 07/08/24 | | | 5.786 | | | | 7,190,407 | | |

| | 11,043 | | | Eldorado Resorts LLC, LIBOR 1M + 2.250%(1) | | (BB, Ba1) | | 04/17/24 | | | 4.214 | | | | 11,044,813 | | |

| | 4,402 | | | Gateway Casinos & Entertainment Ltd.,

LIBOR 3M + 3.000%(1),(3) | | (BB-, Ba3) | | 03/13/25 | | | 5.104 | | | | 4,314,229 | | |

| | 15,000 | | | Jackpotjoy PLC, LIBOR 1M + 5.000%(1),(8) | | (B+, B1) | | 12/06/24 | | | 5.713 | | | | 19,534,406 | | |

| | 4,750 | | | MGM Growth Properties Operating

Partnership LP, LIBOR 1M + 2.000%(1) | | (BB+, Ba3) | | 03/21/25 | | | 3.786 | | | | 4,770,585 | | |

| | | | 65,935,647 | | |

| Gas Distribution (0.2%) | | | |

| | 4,477 | | | Traverse Midstream Partners LLC,

LIBOR 1M + 4.000%(1) | | (B+, B2) | | 09/27/24 | | | 5.800 | | | | 3,951,294 | | |

See Accompanying Notes to Financial Statements.

12

Credit Suisse Floating Rate High Income Fund

Schedule of Investments (continued)

October 31, 2019

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| BANK LOANS (continued) | | | |

| Health Facilities (1.4%) | | | |

$ | 11,250 | | | DaVita, Inc., LIBOR 1M + 2.250%(1) | | (BBB-, Ba1) | | 08/12/26 | | | 4.036 | | | $ | 11,292,694 | | |

| | 6,451 | | | Surgery Center Holdings, Inc.,

LIBOR 1M + 3.250%(1) | | (B-, B1) | | 09/02/24 | | | 5.040 | | | | 6,246,373 | | |

| | 2,735 | | | Western Dental Services, Inc.,

LIBOR 1M + 4.500%(1),(3) | | (B-, B3) | | 06/30/23 | | | 6.286 | | | | 2,718,051 | | |

| | 14,434 | | | Western Dental Services, Inc.,

LIBOR 1M + 5.250%(1),(3) | | (B-, B3) | | 06/30/23 | | | 7.036 | | | | 14,398,253 | | |

| | | | 34,655,371 | | |

| Health Services (2.1%) | | | |

| | 14,643 | | | Athenahealth, Inc., LIBOR 3M + 4.500%(1) | | (B, B2) | | 02/11/26 | | | 6.681 | | | | 14,551,559 | | |

| | 7,960 | | | Auris Luxembourg III Sarl, LIBOR 1M + 3.750%(1) | | (B+, B2) | | 02/27/26 | | | 5.536 | | | | 7,840,603 | | |

| | 5,379 | | | Carestream Health, Inc., LIBOR 1M + 5.750%(1) | | (B, B1) | | 02/28/21 | | | 7.536 | | | | 5,185,861 | | |

| | 3,750 | | | Radiology Partners Holdings LLC,

LIBOR 12M + 8.250%(1),(3) | | (CCC+, Caa2) | | 07/09/26 | | | 10.153 | | | | 3,656,250 | | |

| | 3,732 | | | Radiology Partners Holdings LLC,

LIBOR 6M + 4.750%(1) | | (B, B2) | | 07/09/25 | | | 6.661 | | | | 3,630,040 | | |

| | 13,562 | | | Sotera Health Holdings LLC,

LIBOR 3M + 3.000%(1) | | (B, B1) | | 05/15/22 | | | 4.927 | | | | 13,363,088 | | |

| | 798 | | | Sotera Health Holdings LLC,

LIBOR 1M + 3.500%(1) | | (B, B1) | | 05/15/22 | | | 5.427 | | | | 797,003 | | |

| | 2,885 | | | Valitas Health Services, Inc.,

LIBOR 3M + 10.000%(1),(3),(9) | | (NR, NR) | | 06/30/20 | | | 12.104 | | | | 2,855,993 | | |

| | 5,118 | | | Valitas Health Services, Inc.,

LIBOR 3M + 12.000%(1),(3),(9) | | (NR, NR) | | 06/30/20 | | | 14.104 | | | | 486,227 | | |

| | | | 52,366,624 | | |

| Hotels (1.0%) | | | |

| | 5,000 | | | Compass III Ltd., EURIBOR 6M + 4.500%(1),(4) | | (B+, B2) | | 05/07/25 | | | 4.500 | | | | 5,595,713 | | |

| | 3,000 | | | Compass IV Ltd., EURIBOR 6M + 8.000%(1),(4) | | (CCC+, Caa2) | | 04/30/26 | | | 9.000 | | | | 3,319,055 | | |

| | 5,098 | | | Playa Resorts Holding B.V., LIBOR 1M + 2.750%(1) | | (B+, B2) | | 04/29/24 | | | 4.540 | | | | 4,981,962 | | |

| | 4,757 | | | RHP Hotel Properties, LP, LIBOR 1M + 2.000%(1) | | (BB, Ba3) | | 05/11/24 | | | 3.790 | | | | 4,764,454 | | |

| | 5,308 | | | Wyndham Hotels & Resorts, Inc.,

LIBOR 1M + 1.750%(1) | | (BBB-, Baa3) | | 05/30/25 | | | 3.536 | | | | 5,338,559 | | |

| | | | 23,999,743 | | |

| Insurance Brokerage (3.4%) | | | |

| | 13,845 | | | Acrisure LLC, LIBOR 3M + 4.250%(1) | | (B, B2) | | 11/22/23 | | | 6.354 | | | | 13,632,693 | | |

| | 4,679 | | | Acrisure LLC, LIBOR 3M + 3.750%(1) | | (B, B2) | | 11/22/23 | | | 5.854 | | | | 4,564,388 | | |

| | 20,535 | | | Alliant Holdings Intermediate, LLC,

LIBOR 3M + 3.000%(1) | | (B, B2) | | 05/09/25 | | | 4.804 | | | | 20,044,079 | | |

| | 7,537 | | | AssuredPartners, Inc., LIBOR 1M + 3.500%(1) | | (B, B2) | | 10/22/24 | | | 5.286 | | | | 7,420,480 | | |

| | 16,956 | | | Hub International Ltd., LIBOR 3M + 3.000%(1) | | (B, B2) | | 04/25/25 | | | 4.940 | | | | 16,612,888 | | |

| | 7,370 | | | Hyperion Insurance Group Ltd.,

EURIBOR 1M + 3.500%(1),(4) | | (B, B2) | | 12/13/24 | | | 3.500 | | | | 8,234,231 | | |

| | 13,414 | | | NFP Corp., LIBOR 1M + 3.000%(1) | | (B, B2) | | 01/08/24 | | | 4.786 | | | | 13,042,542 | | |

| | | | 83,551,301 | | |

See Accompanying Notes to Financial Statements.

13

Credit Suisse Floating Rate High Income Fund

Schedule of Investments (continued)

October 31, 2019

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| BANK LOANS (continued) | | | |

| Investments & Misc. Financial Services (1.8%) | | | |

$ | 10,184 | | | Altisource Solutions Sarl, LIBOR 3M + 4.000%(1) | | (B+, B3) | | 04/03/24 | | | 6.104 | | | $ | 9,694,051 | | |

| | 19,055 | | | Ditech Holding Corp., Prime + 7.000%(1),(5) | | (NR, NR) | | 06/30/22 | | | 12.250 | | | | 7,776,841 | | |

| | 1,250 | | | EIG Management Company, LLC,

LIBOR 1M + 3.750%(1) | | (BB, Ba2) | | 02/22/25 | | | 5.550 | | | | 1,251,563 | | |

| | 8,950 | | | FinCo I LLC, LIBOR 1M + 2.000%(1) | | (BB, Baa3) | | 12/27/22 | | | 3.786 | | | | 8,975,510 | | |

| | 6,481 | | | Ocwen Loan Servicing LLC,

LIBOR 1M + 5.000%(1) | | (B+, B2) | | 12/07/20 | | | 6.786 | | | | 6,373,048 | | |

| | 9,768 | | | VFH Parent LLC, LIBOR 6M + 3.500%(1) | | (B+, Ba3) | | 03/01/26 | | | 6.044 | | | | 9,768,887 | | |

| | | | 43,839,900 | | |

| Machinery (1.6%) | | | |

| | 6,930 | | | Cohu, Inc., LIBOR 6M + 3.000%(1) | | (B, B2) | | 10/01/25 | | | 5.200 | | | | 6,635,475 | | |

| | 2,331 | | | CPM Holdings, Inc., LIBOR 1M + 3.750%(1) | | (B-, B2) | | 11/17/25 | | | 5.536 | | | | 2,289,367 | | |

| | 1,977 | | | CPM Holdings, Inc., LIBOR 1M + 8.250%(1),(2) | | (CCC+, Caa2) | | 11/15/26 | | | 10.036 | | | | 1,936,552 | | |

| | 6,355 | | | Doncasters Finance U.S. LLC,

LIBOR 3M + 3.750%(1),(8) | | (CCC-, Caa3) | | 04/09/20 | | | 4.750 | | | | 5,715,663 | | |

| | 3,696 | | | LTI Holdings, Inc., LIBOR 1M + 6.750%(1) | | (CCC+, Caa2) | | 09/06/26 | | | 8.536 | | | | 3,164,557 | | |

| | 13,880 | | | LTI Holdings, Inc., LIBOR 1M + 3.500%(1) | | (B-, B2) | | 09/06/25 | | | 5.286 | | | | 12,811,055 | | |

| | 8,323 | | | Welbilt, Inc., LIBOR 1M + 2.500%(1) | | (BB-, B1) | | 10/23/25 | | | 4.286 | | | | 8,271,440 | | |

| | | | 40,824,109 | | |

| Managed Care (0.4%) | | | |

| | 8,699 | | | Inovalon Holdings, Inc., LIBOR 1M + 3.500%(1) | | (B+, B2) | | 04/02/25 | | | 5.438 | | | | 8,726,466 | | |

| | 2,000 | | | MPH Acquisition Holdings LLC,

LIBOR 3M + 2.750%(1) | | (B+, B1) | | 06/07/23 | | | 4.854 | | | | 1,881,020 | | |

| | | | 10,607,486 | | |

| Media - Diversified (0.4%) | | | |

| | 6,203 | | | NEP/NCP Holdco, Inc., LIBOR 1M + 3.250%(1) | | (B+, B2) | | 10/20/25 | | | 5.036 | | | | 5,974,385 | | |

| | 5,000 | | | NEP/NCP Holdco, Inc., LIBOR 1M + 7.000%(1) | | (CCC+, Caa2) | | 10/19/26 | | | 8.786 | | | | 4,806,250 | | |

| | | | 10,780,635 | | |

| Media Content (0.5%) | | | |

| | 12,542 | | | WMG Acquisition Corp., LIBOR 1M + 2.125%(1) | | (BB-, Ba3) | | 11/01/23 | | | 3.911 | | | | 12,556,356 | | |

| Medical Products (0.8%) | | | |

| | 15,046 | | | ABB Concise Optical Group LLC,

LIBOR 6M + 5.000%(1) | | (CCC+, B3) | | 06/15/23 | | | 7.168 | | | | 14,331,310 | | |

| | 4,781 | | | Avantor, Inc., LIBOR 1M + 3.000%(1) | | (B+, Ba2) | | 11/21/24 | | | 4.786 | | | | 4,816,590 | | |

| | 223 | | | Lifescan Global Corp., LIBOR 3M + 6.000%(1) | | (B, B2) | | 10/01/24 | | | 8.056 | | | | 199,698 | | |

| | | | 19,347,598 | | |

| Metals & Mining - Excluding Steel (0.6%) | | | |

| | 14,037 | | | GrafTech Finance, Inc., LIBOR 1M + 3.500%(1),(3) | | (BB-, B1) | | 02/12/25 | | | 5.286 | | | | 13,527,971 | | |

| | 7,529 | | | Noranda Aluminum Acquisition Corp.,

Prime + 3.500%(1),(3),(5) | | (NR, NR) | | 02/28/19 | | | 8.500 | | | | 451,730 | | |

| | | | 13,979,701 | | |

See Accompanying Notes to Financial Statements.

14

Credit Suisse Floating Rate High Income Fund

Schedule of Investments (continued)

October 31, 2019

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| BANK LOANS (continued) | | | |

| Non - Electric Utilities (0.2%) | | | |

$ | 4,759 | | | BCP Raptor LLC, LIBOR 1M + 4.250%(1) | | (B, B3) | | 06/24/24 | | | 6.036 | | | $ | 4,215,112 | | |

| Oil Field Equipment & Services (0.1%) | | | |

| | 5,483 | | | Seadrill Partners Finco LLC,

LIBOR 3M + 6.000%(1) | | (CCC+, Caa2) | | 02/21/21 | | | 8.104 | | | | 2,806,108 | | |

| Oil Refining & Marketing (0.7%) | | | |

| | 2,269 | | | EG America LLC, LIBOR 3M + 8.000%(1) | | (CCC+, Caa1) | | 04/20/26 | | | 10.104 | | | | 2,147,248 | | |

| | 13,248 | | | EG Finco Ltd., EURIBOR 3M + 4.000%(1),(4) | | (B, B2) | | 02/07/25 | | | 4.000 | | | | 14,317,856 | | |

| | | | 16,465,104 | | |

| Packaging (1.7%) | | | |

| | 3,949 | | | Anchor Glass Container Corp.,

LIBOR 1M + 2.750% (1) | | (CCC+, B3) | | 12/07/23 | | | 4.729 | | | | 2,985,818 | | |

| | 6,175 | | | Anchor Glass Container Corp.,

LIBOR 1M + 7.750%(1) | | (CCC-, Caa2) | | 12/07/24 | | | 9.740 | | | | 3,500,453 | | |

| | 4,988 | | | Berry Global, Inc., LIBOR 1M + 2.500%(1) | | (BBB-, Ba2) | | 07/01/26 | | | 4.439 | | | | 5,010,168 | | |

| | 15,372 | | | Flex Acquisition Co., Inc., LIBOR 1M + 3.000%(1) | | (B, B2) | | 12/29/23 | | | 5.096 | | | | 14,553,188 | | |

| | 10,000 | | | Klockner-Pentaplast of America, Inc.,

EURIBOR 3M + 4.750%(1),(4) | | (B-, B3) | | 06/30/22 | | | 4.750 | | | | 9,042,013 | | |

| | 3,758 | | | Proampac PG Borrower LLC,

LIBOR 3M + 3.500%(1) | | (B, B3) | | 11/20/23 | | | 5.532 | | | | 3,551,709 | | |

| | 4,375 | | | Strategic Materials, Inc.,

LIBOR 1M + 7.750%(1),(2),(3) | | (CCC-, Caa3) | | 10/27/25 | | | 9.677 | | | | 3,018,750 | | |

| | | | 41,662,099 | | |

| Personal & Household Products (1.5%) | | | |

| | 6,910 | | | Comfort Holding LLC, LIBOR 1M + 4.750%(1) | | (CCC+, Caa1) | | 02/05/24 | | | 6.536 | | | | 6,894,511 | | |

| | 4,400 | | | Keter Group B.V., EURIBOR 3M + 4.250%(1),(4) | | (CCC+, Caa1) | | 10/31/23 | | | 5.250 | | | | 4,101,355 | | |

| | 22,436 | | | Serta Simmons Bedding LLC,

LIBOR 1M + 3.500%(1) | | (CCC+, Caa1) | | 11/08/23 | | | 5.405 | | | | 13,360,832 | | |

| | 6,612 | | | Serta Simmons Bedding LLC,

LIBOR 1M + 8.000%(1) | | (CCC-, Caa3) | | 11/08/24 | | | 9.846 | | | | 1,849,963 | | |

| | 12,797 | | | TricorBraun Holdings, Inc., LIBOR 3M + 3.750%(1) | | (B-, B2) | | 11/30/23 | | | 5.859 | | | | 12,528,913 | | |

| | | | 38,735,574 | | |

| Pharmaceuticals (1.8%) | | | |

| | 3,004 | | | Akorn, Inc., LIBOR 1M + 7.000%(1) | | (B-, Caa1) | | 04/16/21 | | | 8.813 | | | | 2,795,107 | | |

| | 2,171 | | | Alkermes, Inc., LIBOR 1M + 2.250%(1) | | (BB, Ba3) | | 03/23/23 | | | 4.410 | | | | 2,166,833 | | |

| | 4,656 | | | Bausch Health Companies, Inc.,

LIBOR 1M + 3.000%(1) | | (BB-, Ba2) | | 06/02/25 | | | 4.921 | | | | 4,677,303 | | |

| | 11,187 | | | Bausch Health Companies, Inc.,

LIBOR 1M + 2.750%(1) | | (BB-, Ba2) | | 11/27/25 | | | 4.671 | | | | 11,213,866 | | |

| | 16,583 | | | Endo Luxembourg Finance Co. I Sarl,

LIBOR 1M + 4.250%(1) | | (B+, B1) | | 04/29/24 | | | 6.063 | | | | 15,303,657 | | |

| | 10,223 | | | Syneos Health, Inc., LIBOR 1M + 1.500%(1),(3) | | (BB, Ba3) | | 03/25/24 | | | 3.286 | | | | 9,954,265 | | |

| | | | 46,111,031 | | |

See Accompanying Notes to Financial Statements.

15

Credit Suisse Floating Rate High Income Fund

Schedule of Investments (continued)

October 31, 2019

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| BANK LOANS (continued) | | | |

| Real Estate Development & Management (1.7%) | | | |

$ | 10,754 | | | Capital Automotive LP, LIBOR 1M + 2.500%(1) | | (B, B1) | | 03/24/24 | | | 4.290 | | | $ | 10,763,531 | | |

| | 754 | | | Capital Automotive LP, LIBOR 1M + 6.000%(1) | | (CCC+, B3) | | 03/24/25 | | | 7.790 | | | | 757,613 | | |

| | 8,873 | | | Forest City Enterprises LP, LIBOR 1M + 4.000%(1) | | (B+, B2) | | 12/07/25 | | | 5.786 | | | | 8,936,934 | | |

| | 23,000 | | | Hanjin International Corp.,

LIBOR 1M + 2.500%(1),(3) | | (B+, Ba3) | | 10/18/20 | | | 4.304 | | | | 22,942,500 | | |

| | | | 43,400,578 | | |

| Real Estate Investment Trusts (0.4%) | | | |

| | 9,260 | | | iStar, Inc., LIBOR 1M + 2.750%(1),(3) | | (BB-, Ba2) | | 06/28/23 | | | 4.671 | | | | 9,282,920 | | |

| Recreation & Travel (3.0%) | | | |

| | 14,322 | | | Alterra Mountain Co., LIBOR 1M + 3.000%(1) | | (B, B1) | | 07/31/24 | | | 4.786 | | | | 14,384,682 | | |

| | 2,154 | | | Bulldog Purchaser, Inc., LIBOR 1M + 7.750%(1),(2) | | (CCC+, Caa2) | | 09/04/26 | | | 9.536 | | | | 2,132,307 | | |

| | 10,103 | | | Bulldog Purchaser, Inc., LIBOR 1M + 3.750%(1),(3) | | (B+, B2) | | 09/05/25 | | | 5.536 | | | | 9,900,875 | | |

| | 10,583 | | | Crown Finance U.S., Inc., LIBOR 1M + 2.250%(1) | | (BB-, B1) | | 02/28/25 | | | 4.036 | | | | 10,456,705 | | |

| | 9,420 | | | Hornblower Sub LLC, LIBOR 3M + 4.500%(1) | | (B, B2) | | 04/27/25 | | | 6.604 | | | | 9,434,495 | | |

| | 813 | | | Merlin Entertainments PLC(7) | | (B+, Ba3) | | 10/16/26 | | | 0.000 | | | | 817,364 | | |

| | 6,187 | | | Merlin Entertainments PLC(7) | | (B+, Ba3) | | 10/11/26 | | | 5.260 | | | | 6,219,071 | | |

| | 3,980 | | | Richmond UK Bidco Ltd.,

LIBOR 1M + 4.250%(1),(8) | | (B, B2) | | 03/03/24 | | | 4.963 | | | | 5,018,853 | | |

| | 16,019 | | | SeaWorld Parks & Entertainment, Inc.,

LIBOR 1M + 3.000%(1) | | (B+, B2) | | 03/31/24 | | | 4.786 | | | | 15,998,990 | | |

| | | | 74,363,342 | | |

| Restaurants (1.9%) | | | |

| | 9,213 | | | 1011778 B.C. Unlimited Liability Co.,

LIBOR 1M + 2.250%(1) | | (BB, Ba2) | | 02/16/24 | | | 4.036 | | | | 9,241,310 | | |

| | 16,757 | | | Golden Nugget, Inc., LIBOR 1M + 2.750%(1) | | (B+, Ba3) | | 10/04/23 | | | 4.688 | | | | 16,746,355 | | |

| | 14,054 | | | IRB Holding Corp., LIBOR 3M + 3.250%(1) | | (B+, B2) | | 02/05/25 | | | 5.216 | | | | 13,969,013 | | |

| | 8,493 | | | K-Mac Holdings Corp., LIBOR 1M + 3.000%(1) | | (B-, B2) | | 03/14/25 | | | 4.786 | | | | 8,274,284 | | |

| | | | 48,230,962 | | |

| Software - Services (8.7%) | | | |

| | 8,716 | | | Almonde, Inc., LIBOR 3M + 3.500%(1) | | (B-, B2) | | 06/13/24 | | | 5.696 | | | | 8,351,111 | | |

| | 4,078 | | | Almonde, Inc., LIBOR 6M + 7.250%(1) | | (CCC, Caa2) | | 06/13/25 | | | 9.446 | | | | 3,829,862 | | |

| | 4,664 | | | Applied Systems, Inc., LIBOR 3M + 3.000%(1) | | (B-, B2) | | 09/19/24 | | | 5.104 | | | | 4,643,455 | | |

| | 6,948 | | | Compuware Corp., LIBOR 1M + 4.000%(1) | | (B, B2) | | 08/22/25 | | | 5.786 | | | | 6,985,121 | | |

| | 5,727 | | | Cypress Intermediate Holdings III, Inc.,

LIBOR 1M + 2.750%(1) | | (B, B2) | | 04/29/24 | | | 4.540 | | | | 5,642,988 | | |

| | 22,982 | | | Epicor Software Corp., LIBOR 1M + 3.250%(1) | | (B-, B2) | | 06/01/22 | | | 5.040 | | | | 22,939,294 | | |

| | 16,770 | | | Flexera Software LLC, LIBOR 1M + 3.500%(1) | | (B-, B1) | | 02/26/25 | | | 5.290 | | | | 16,816,139 | | |

| | 2,846 | | | Flexera Software LLC, LIBOR 1M + 7.250%(1) | | (CCC+, Caa1) | | 02/26/26 | | | 9.040 | | | | 2,853,269 | | |

| | 10,342 | | | GHX Ultimate Parent Corp.,

LIBOR 3M + 3.250%(1),(3) | | (B, B3) | | 06/28/24 | | | 5.354 | | | | 10,122,541 | | |

| | 17,272 | | | Go Daddy Operating Company LLC,

LIBOR 1M + 1.750% (1) | | (BB, Ba1) | | 02/15/24 | | | 3.536 | | | | 17,310,957 | | |

See Accompanying Notes to Financial Statements.

16

Credit Suisse Floating Rate High Income Fund

Schedule of Investments (continued)

October 31, 2019

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| BANK LOANS (continued) | | | |

Software - Services | | | |

$ | 3,867 | | | Greeneden U.S. Holdings II LLC,

EURIBOR 3M + 3.500%(1),(4) | | (B-, B2) | | 12/01/23 | | | 3.500 | | | $ | 4,311,166 | | |

| | 7,000 | | | Hyland Software, Inc., LIBOR 1M + 7.000%(1) | | (CCC, Caa1) | | 07/07/25 | | | 8.786 | | | | 7,041,580 | | |

| | 9,553 | | | Hyland Software, Inc., LIBOR 1M + 3.250%(1) | | (B-, B1) | | 07/01/24 | | | 5.036 | | | | 9,507,521 | | |

| | 5,776 | | | Infor (U.S.), Inc., EURIBOR 3M + 2.250%(1),(4) | | (B, Ba3) | | 02/01/22 | | | 3.250 | | | | 6,466,937 | | |

| | 3,986 | | | Infor (U.S.), Inc., LIBOR 3M + 2.750%(1) | | (B, Ba3) | | 02/01/22 | | | 4.854 | | | | 3,995,010 | | |

| | 13,905 | | | MA FinanceCo. LLC, LIBOR 1M + 2.250%(1) | | (BB-, B1) | | 11/19/21 | | | 4.050 | | | | 13,837,797 | | |

| | 1,958 | | | MA FinanceCo. LLC, LIBOR 1M + 2.500%(1) | | (BB-, B1) | | 06/21/24 | | | 4.300 | | | | 1,906,026 | | |

| | 1,185 | | | Mitchell International, Inc., LIBOR 1M + 7.250%(1) | | (CCC, Caa2) | | 12/01/25 | | | 9.036 | | | | 1,093,333 | | |

| | 13,689 | | | Project Alpha Intermediate Holding, Inc.,

LIBOR 3M + 3.500%(1) | | (B, B3) | | 04/26/24 | | | 5.490 | | | | 13,406,844 | | |

| | 1,511 | | | Project Alpha Intermediate Holding, Inc.,

LIBOR 3M + 4.250%(1) | | (B, B3) | | 04/26/24 | | | 6.240 | | | | 1,511,371 | | |

| | 15,696 | | | Solera LLC, LIBOR 1M + 2.750%(1) | | (B, Ba3) | | 03/03/23 | | | 4.536 | | | | 15,585,355 | | |

| | 6,616 | | | SS&C Technologies Holdings Europe Sarl,

LIBOR 1M + 2.250%(1) | | (BB+, Ba2) | | 04/16/25 | | | 4.036 | | | | 6,641,817 | | |

| | 10,149 | | | SS&C Technologies, Inc., LIBOR 1M + 2.250%(1) | | (BB+, Ba2) | | 04/16/25 | | | 4.036 | | | | 10,188,688 | | |

| | 13,195 | | | The Ultimate Software Group, Inc.,

LIBOR 1M + 3.750%(1) | | (B, B2) | | 05/04/26 | | | 5.536 | | | | 13,237,158 | | |

| | 7,765 | | | Verint Systems, Inc., LIBOR 2M + 2.000%(1) | | (BBB-, Ba1) | | 06/28/24 | | | 4.147 | | | | 7,808,770 | | |

| | | | 216,034,110 | | |

| Specialty Retail (0.5%) | | | |

| | 2,881 | | | Boing U.S. Holdco, Inc., LIBOR 3M + 7.500%(1) | | (CCC+, Caa2) | | 10/03/25 | | | 9.440 | | | | 2,747,754 | | |

| | 2,364 | | | Champ Acquisition Corp., LIBOR 3M + 5.500%(1) | | (B, B1) | | 12/19/25 | | | 7.604 | | | | 2,367,253 | | |

| | 383 | | | Mister Car Wash Holdings, Inc.(6),(7) | | (NR, B2) | | 05/14/26 | | | 3.500 | | | | 380,370 | | |

| | 7,641 | | | Mister Car Wash Holdings, Inc.,

LIBOR 3M + 3.500%(1) | | (B-, B2) | | 05/14/26 | | | 5.658 | | | | 7,588,369 | | |

| | | | 13,083,746 | | |

| Steel Producers/Products (1.8%) | | | |

| | 22,224 | | | Atkore International, Inc., LIBOR 3M + 2.750%(1) | | (BB-, B2) | | 12/22/23 | | | 4.860 | | | | 22,220,717 | | |

| | 23,665 | | | Zekelman Industries, Inc., LIBOR 1M + 2.250%(1) | | (BB-, B1) | | 06/14/21 | | | 4.073 | | | | 23,657,548 | | |

| | | | 45,878,265 | | |

| Support - Services (4.7%) | | | |

| | 1,206 | | | Allied Universal Holdco LLC(6),(7) | | (B-, B3) | | 07/10/26 | | | 2.125 | | | | 1,199,412 | | |

| | 12,184 | | | Allied Universal Holdco LLC,

LIBOR 6M + 4.250%(1) | | (B-, B3) | | 07/10/26 | | | 6.507 | | | | 12,114,064 | | |

| | 11,606 | | | Brand Energy & Infrastructure Services, Inc.,

LIBOR 3M + 4.250%(1) | | (B-, B3) | | 06/21/24 | | | 6.236 | | | | 11,294,138 | | |

| | 16,404 | | | Change Healthcare Holdings LLC,

LIBOR 1M + 2.500%(1) | | (B+, B1) | | 03/01/24 | | | 4.286 | | | | 16,327,389 | | |

| | 5,000 | | | MSX International, Inc.,

EURIBOR 3M + 4.500%(1),(2),(4) | | (B-, B2) | | 01/06/24 | | | 4.500 | | | | 5,155,282 | | |

| | 10,548 | | | PODS LLC, LIBOR 1M + 2.750%(1) | | (B+, B2) | | 12/06/24 | | | 4.671 | | | | 10,440,772 | | |

| | 6,291 | | | Sabre GLBL, Inc., LIBOR 1M + 2.000%(1) | | (BB, Ba2) | | 02/22/24 | | | 3.786 | | | | 6,310,457 | | |

See Accompanying Notes to Financial Statements.

17

Credit Suisse Floating Rate High Income Fund

Schedule of Investments (continued)

October 31, 2019

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| BANK LOANS (continued) | | | |

Support - Services | | | |

$ | 14,201 | | | SAI Global Holdings II (Australia) Pty. Ltd.,

LIBOR 3M + 4.500%(1),(2) | | (CCC, Caa1) | | 12/20/23 | | | 6.436 | | | $ | 12,639,007 | | |

| | 15,709 | | | Sedgwick Claims Management Services, Inc.,

LIBOR 1M + 3.250%(1) | | (B, B2) | | 12/31/25 | | | 5.036 | | | | 15,273,615 | | |

| | 14,152 | | | The Geo Group, Inc., LIBOR 1M + 2.000%(1) | | (BB+, Ba3) | | 03/22/24 | | | 3.790 | | | | 12,870,963 | | |

| | 7,336 | | | Tribe Buyer LLC, LIBOR 1M + 4.500%(1) | | (B-, B3) | | 02/16/24 | | | 6.300 | | | | 6,465,095 | | |

| | 6,717 | | | USS Ultimate Holdings, Inc.,

LIBOR 3M + 7.750%(1) | | (CCC+, Caa2) | | 08/25/25 | | | 9.950 | | | | 6,609,697 | | |

| | | | 116,699,891 | | |

| Tech Hardware & Equipment (0.4%) | | | |

| | 10,000 | | | CommScope, Inc., LIBOR 1M + 3.250%(1) | | (B+, Ba3) | | 04/06/26 | | | 5.036 | | | | 9,828,150 | | |

| Telecom - Wireless (1.6%) | | | |

| | 14,312 | | | SBA Senior Finance II LLC,

LIBOR 1M + 2.000%(1) | | (BB+, Ba3) | | 04/11/25 | | | 3.790 | | | | 14,363,795 | | |

| | 25,095 | | | Sprint Communications, Inc.,

LIBOR 1M + 2.500%(1) | | (BB-, Ba2) | | 02/02/24 | | | 4.313 | | | | 24,855,036 | | |

| | | | 39,218,831 | | |

| Telecom - Wireline Integrated & Services (2.6%) | | | |

| | 7,711 | | | Altice France S.A., LIBOR 1M + 3.688%(1) | | (B, B2) | | 01/31/26 | | | 5.609 | | | | 7,546,809 | | |

| | 7,664 | | | CenturyLink Inc., LIBOR 1M + 2.750%(1) | | (BBB-, Ba3) | | 01/31/25 | | | 4.536 | | | | 7,597,474 | | |

| | 1,672 | | | GTT Communications, Inc.,

LIBOR 1M + 2.750%(1) | | (B-, B2) | | 05/31/25 | | | 4.540 | | | | 1,251,642 | | |

| | 18,280 | | | Level 3 Financing, Inc., LIBOR 1M + 2.250%(1) | | (BBB-, Ba1) | | 02/22/24 | | | 4.036 | | | | 18,325,700 | | |

| | 2,487 | | | MTN Infrastructure TopCo, Inc.,

LIBOR 1M + 3.000%(1) | | (B, B2) | | 11/15/24 | | | 4.786 | | | | 2,461,455 | | |

| | 3,900 | | | Numericable Group S.A., LIBOR 1M + 2.750%(1) | | (B, B2) | | 07/31/25 | | | 4.536 | | | | 3,786,042 | | |

| | 2,487 | | | TVC Albany, Inc., LIBOR 1M + 3.500%(1) | | (B-, B2) | | 07/23/25 | | | 5.290 | | | | 2,468,781 | | |

| | 20,318 | | | Zayo Group LLC, LIBOR 1M + 2.250%(1) | | (BB, Ba2) | | 01/19/24 | | | 4.036 | | | | 20,372,737 | | |

| | | | 63,810,640 | | |

| Theaters & Entertainment (3.1%) | | | |

| | 13,203 | | | AMC Entertainment Holdings, Inc.,

LIBOR 6M + 3.000%(1) | | (BB-, Ba2) | | 04/22/26 | | | 5.230 | | | | 13,213,524 | | |

| | 10,580 | | | Metro-Goldwyn-Mayer, Inc.,

LIBOR 1M + 4.500%(1),(3) | | (B-, B2) | | 07/03/26 | | | 6.290 | | | | 10,156,394 | | |

| | 9,349 | | | NAI Entertainment Holdings LLC,

LIBOR 1M + 2.500%(1) | | (BB, B1) | | 05/08/25 | | | 4.290 | | | | 9,348,930 | | |

| | 7,000 | | | Technicolor S.A., EURIBOR 3M + 3.000%(1),(4) | | (B, B3) | | 12/06/23 | | | 3.000 | | | | 6,807,979 | | |

| | 2,903 | | | Technicolor S.A., LIBOR 3M + 2.750%(1) | | (B, B3) | | 12/06/23 | | | 4.874 | | | | 2,387,494 | | |

| | 6,500 | | | Technicolor S.A., EURIBOR 3M + 3.500%(1),(4) | | (B, B3) | | 12/06/23 | | | 3.500 | | | | 6,381,521 | | |

| | 8,414 | | | UFC Holdings, LLC, LIBOR 1M + 3.250%(1) | | (B, B2) | | 04/29/26 | | | 5.040 | | | | 8,420,412 | | |

| | 21,452 | | | William Morris Endeavor Entertainment LLC,

LIBOR 3M + 2.750%(1) | | (B, B2) | | 05/18/25 | | | 4.600 | | | | 20,777,554 | | |

| | | | 77,493,808 | | |

See Accompanying Notes to Financial Statements.

18

Credit Suisse Floating Rate High Income Fund

Schedule of Investments (continued)

October 31, 2019

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| BANK LOANS (continued) | | | |

| Transport Infrastructure/Services (0.2%) | | | |

$ | 7,024 | | | AI Mistral Holdco Ltd., LIBOR 1M + 3.000%(1) | | (B-, B2) | | 03/11/24 | | | 4.786 | | | $ | 5,548,826 | | |

| TOTAL BANK LOANS (Cost $2,125,170,927) | | | 2,019,975,478 | | |

| CORPORATE BONDS (8.9%) | | | |

| Aerospace & Defense (0.3%) | | | |

| | 7,365 | | | TransDigm, Inc., Rule 144A, Senior Secured

Notes (Callable 03/15/22 @ 103.13)(10) | | (B+, Ba3) | | 03/15/26 | | | 6.250 | | | | 7,908,169 | | |

| Auto Parts & Equipment (0.6%) | | | |

| | 6,665 | | | Cooper-Standard Automotive, Inc., Rule 144A,

Company Guaranteed Notes

(Callable 11/15/21 @ 102.81)(10) | | (B, B2) | | 11/15/26 | | | 5.625 | | | | 5,698,575 | | |

| | 1,345 | | | Panther Finance Co., Inc., Rule 144A,

Company Guaranteed Notes

(Callable 05/15/22 @ 104.25)(10) | | (B, B3) | | 05/15/27 | | | 8.500 | | | | 1,358,450 | | |

| | 7,000 | | | Panther Finance Co., Inc., Rule 144A, Senior

Secured Notes (Callable 05/15/22 @ 103.13)(10) | | (B+, Ba3) | | 05/15/26 | | | 6.250 | | | | 7,417,900 | | |

| | | | 14,474,925 | | |

| Building Materials (1.2%) | | | |

| | 23,600 | | | Omnimax International, Inc., Rule 144A, Senior

Secured Notes (Callable 11/15/19 @ 100.00)(10) | | (CCC, Caa1) | | 08/15/20 | | | 12.000 | | | | 23,216,500 | | |

| | 7,135 | | | PriSo Acquisition Corp., Rule 144A,

Senior Unsecured Notes

(Callable 12/02/19 @ 102.25)(10),(11) | | (CCC+, Caa1) | | 05/15/23 | | | 9.000 | | | | 6,573,119 | | |

| | | | 29,789,619 | | |

| Cable & Satellite TV (0.5%) | | | |

| | 2,500 | | | CSC Holdings LLC, Rule 144A,

Company Guaranteed Notes

(Callable 02/01/23 @ 102.69)(10) | | (BB, Ba3) | | 02/01/28 | | | 5.375 | | | | 2,650,000 | | |

| | 3,200 | | | CSC Holdings LLC, Rule 144A,

Company Guaranteed Notes

(Callable 05/15/21 @ 102.75)(10) | | (BB, Ba3) | | 05/15/26 | | | 5.500 | | | | 3,380,000 | | |

| | 1,000 | | | CSC Holdings LLC, Rule 144A,

Company Guaranteed Notes

(Callable 10/15/20 @ 103.31)(10) | | (BB, Ba3) | | 10/15/25 | | | 6.625 | | | | 1,067,500 | | |

| | 3,400 | | | Telenet Finance Luxembourg Notes Sarl,

Rule 144A, Senior Secured Notes

(Callable 12/01/22 @ 102.75)(10) | | (BB-, Ba3) | | 03/01/28 | | | 5.500 | | | | 3,632,900 | | |

| | 2,730 | | | Ziggo B.V., Rule 144A, Senior Secured Notes

(Callable 01/15/22 @ 102.75)(10) | | (B+, B1) | | 01/15/27 | | | 5.500 | | | | 2,893,800 | | |

| | | | 13,624,200 | | |

See Accompanying Notes to Financial Statements.

19

Credit Suisse Floating Rate High Income Fund

Schedule of Investments (continued)

October 31, 2019

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS (continued) | | | |

| Chemicals (0.2%) | | | |

$ | 4,500 | | | Atotech Alpha 2 B.V., 8.75% Cash, 9.50% PIK,

Rule 144A, Senior Unsecured Notes

(Callable 12/02/19 @ 102.00)(10),(12) | | (CCC+, Caa1) | | 06/01/23 | | | 8.750 | | | $ | 4,443,750 | | |

| | 1,390 | | | Nufarm Americas, Inc., Rule 144A,

Company Guaranteed Notes

(Callable 04/30/21 @ 102.88)(10) | | (BB-, B1) | | 04/30/26 | | | 5.750 | | | | 1,403,900 | | |

| | | | 5,847,650 | | |

| Electronics (0.3%) | | | |

| | 6,300 | | | Entegris, Inc., Rule 144A,

Company Guaranteed Notes

(Callable 11/10/20 @ 103.47)(10) | | (BB, Ba2) | | 02/10/26 | | | 4.625 | | | | 6,517,523 | | |

| Energy - Exploration & Production (0.4%) | | | |

| | 11,000 | | | W&T Offshore, Inc., Rule 144A, Secured Notes

(Callable 11/01/20 @ 104.88)(10) | | (B+, B3) | | 11/01/23 | | | 9.750 | | | | 10,367,500 | | |

| Health Services (0.3%) | | | |

| | 1,367 | | | AMN Healthcare, Inc., Rule 144A,

Company Guaranteed Notes

(Callable 12/16/19 @ 103.84)(10) | | (BB-, Ba2) | | 10/01/24 | | | 5.125 | | | | 1,421,680 | | |

| | 2,000 | | | Sotera Health Holdings LLC, Rule 144A,

Senior Unsecured Notes

(Callable 12/02/19 @ 103.25)(10) | | (CCC+, Caa2) | | 05/15/23 | | | 6.500 | | | | 2,042,500 | | |

| | 3,250 | | | Sotera Health Topco, Inc., 8.125% Cash,

8.875% PIK, Rule 144A, Senior Unsecured

Notes (Callable 12/02/19 @ 100.00)(10),(12) | | (CCC+, Caa2) | | 11/01/21 | | | 8.125 | | | | 3,241,875 | | |

| | | | 6,706,055 | | |

| Insurance Brokerage (0.2%) | | | |

| | 5,000 | | | Acrisure Finance, Inc., Rule 144A,

Senior Unsecured Notes

(Callable 11/15/20 @ 103.50)(10) | | (CCC+, Caa2) | | 11/15/25 | | | 7.000 | | | | 4,600,000 | | |

| Investments & Misc. Financial Services (0.1%) | | | |

| | 3,175 | | | Compass Group Diversified Holdings LLC,

Rule 144A, Senior Unsecured Notes

(Callable 05/01/21 @ 104.00)(10) | | (B-, B3) | | 05/01/26 | | | 8.000 | | | | 3,429,000 | | |

| Media - Diversified (0.1%) | | | |

| | 2,000 | | | National CineMedia LLC, Global Senior

Secured Notes (Callable 11/07/19 @ 101.00) | | (B+, Ba3) | | 04/15/22 | | | 6.000 | | | | 2,025,200 | | |

| | 1,000 | | | National CineMedia LLC, Global Senior

Unsecured Notes (Callable 08/15/21 @ 102.88) | | (B-, B3) | | 08/15/26 | | | 5.750 | | | | 982,500 | | |

| | | | 3,007,700 | | |

See Accompanying Notes to Financial Statements.

20

Credit Suisse Floating Rate High Income Fund

Schedule of Investments (continued)

October 31, 2019

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS (continued) | | | |

| Metals & Mining - Excluding Steel (0.9%) | | | |

$ | 4,750 | | | Cleveland-Cliffs, Inc., Rule 144A, Senior

Secured Notes (Callable 01/15/21 @ 102.44)(10) | | (BB, Ba2) | | 01/15/24 | | | 4.875 | | | $ | 4,892,500 | | |

| | 6,250 | | | Kaiser Aluminum Corp., Global Company

Guaranteed Notes (Callable 12/02/19 @ 104.41) | | (BB+, Ba3) | | 05/15/24 | | | 5.875 | | | | 6,515,625 | | |

| | 13,320 | | | Taseko Mines Ltd., Rule 144A,

Senior Secured Notes

(Callable 12/02/19 @ 104.38)(2),(10) | | (B, B3) | | 06/15/22 | | | 8.750 | | | | 11,788,200 | | |

| | | | 23,196,325 | | |

| Oil Field Equipment & Services (0.3%) | | | |

| | 7,525 | | | Pioneer Energy Services Corp., Global Company

Guaranteed Notes (Callable 12/02/19 @ 101.53) | | (CCC, Caa2) | | 03/15/22 | | | 6.125 | | | | 2,821,875 | | |

| | 7,000 | | | Shelf Drilling Holdings Ltd., Rule 144A,

Company Guaranteed Notes

(Callable 02/15/21 @ 106.19)(10) | | (B-, B3) | | 02/15/25 | | | 8.250 | | | | 5,915,000 | | |

| | | | 8,736,875 | | |

| Oil Refining & Marketing (0.2%) | | | |

| | 5,992 | | | Coffeyville Finance, Inc., Global Company

Guaranteed Notes (Callable 12/02/19 @ 101.08) | | (BB-, B1) | | 11/01/22 | | | 6.500 | | | | 6,066,900 | | |

| Packaging (0.4%) | | | |

| | 1,900 | | | Flex Acquisition Co., Inc., Rule 144A,

Senior Unsecured Notes

(Callable 01/15/20 @ 103.44)(10) | | (CCC+, Caa2) | | 01/15/25 | | | 6.875 | | | | 1,790,750 | | |

| | 7,275 | | | TriMas Corp., Rule 144A,

Company Guaranteed Notes

(Callable 10/15/20 @ 102.44)(10) | | (BB-, Ba3) | | 10/15/25 | | | 4.875 | | | | 7,415,953 | | |

| | | | 9,206,703 | | |

| Pharmaceuticals (0.5%) | | | |

| | 355 | | | Bausch Health Americas, Inc., Rule 144A,

Company Guaranteed Notes

(Callable 04/01/22 @ 104.63)(10) | | (B-, B3) | | 04/01/26 | | | 9.250 | | | | 402,488 | | |

| | 453 | | | Bausch Health Cos., Inc., Rule 144A,

Company Guaranteed Notes

(Callable 12/02/19 @ 101.47)(10) | | (B-, B3) | | 05/15/23 | | | 5.875 | | | | 461,494 | | |

| | 1,685 | | | Bausch Health Cos., Inc., Rule 144A, Senior

Secured Notes (Callable 11/01/20 @ 102.75)(10) | | (BB-, Ba2) | | 11/01/25 | | | 5.500 | | | | 1,767,161 | | |

| | 11,204 | | | Owens & Minor, Inc., Global Senior Secured

Notes (Callable 09/15/24 @ 100.00) | | (B, B2) | | 12/15/24 | | | 4.375 | | | | 8,683,100 | | |

| | | | 11,314,243 | | |

| Real Estate Investment Trusts (0.2%) | | | |

| | 5,000 | | | iStar, Inc., Senior Unsecured Notes

(Callable 12/02/19 @ 102.63) | | (BB-, Ba3) | | 09/15/22 | | | 5.250 | | | | 5,131,250 | | |

See Accompanying Notes to Financial Statements.

21

Credit Suisse Floating Rate High Income Fund

Schedule of Investments (continued)

October 31, 2019

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS (continued) | | | |

| Recreation & Travel (0.4%) | | | |

$ | 4,000 | | | Six Flags Entertainment Corp., Rule 144A,

Company Guaranteed Notes

(Callable 04/15/22 @ 102.75)(10),(11) | | (BB-, B2) | | 04/15/27 | | | 5.500 | | | $ | 4,200,000 | | |

| | 4,478 | | | Six Flags Entertainment Corp., Rule 144A,

Company Guaranteed Notes

(Callable 12/02/19 @ 103.66)(10) | | (BB-, B2) | | 07/31/24 | | | 4.875 | | | | 4,634,730 | | |

| | | | 8,834,730 | | |

| Restaurants (0.1%) | | | |

| | 3,462 | | | Golden Nugget, Inc., Rule 144A,

Senior Unsecured Notes

(Callable 12/02/19 @ 103.38)(10) | | (CCC+, B3) | | 10/15/24 | | | 6.750 | | | | 3,574,861 | | |

| Software - Services (0.3%) | | | |

| | 2,295 | | | Epicor Software Corp., Rule 144A,

Secured Notes (Callable 12/02/19 @ 100.00),

LIBOR 3M + 7.250%(1),(10) | | (CCC, Caa2) | | 06/30/23 | | | 9.350 | | | | 2,285,801 | | |

| | 5,002 | | | Solera Finance, Inc., Rule 144A,

Senior Unsecured Notes

(Callable 12/02/19 @ 107.88)(10) | | (CCC+, Caa1) | | 03/01/24 | | | 10.500 | | | | 5,258,353 | | |

| | | | 7,544,154 | | |

| Specialty Retail (0.2%) | | | |

| | 3,500 | | | Penske Automotive Group, Inc., Company

Guaranteed Notes (Callable 05/15/21 @ 102.75) | | (B+, Ba3) | | 05/15/26 | | | 5.500 | | | | 3,670,625 | | |

| | 1,000 | | | Penske Automotive Group, Inc., Company

Guaranteed Notes (Callable 12/02/19 @ 102.69) | | (B+, Ba3) | | 12/01/24 | | | 5.375 | | | | 1,030,000 | | |

| | | | 4,700,625 | | |

| Support - Services (0.1%) | | | |

| | 1,782 | | | WeWork Cos., Inc., Rule 144A, Company

Guaranteed Notes(10),(11) | | (B, NR) | | 05/01/25 | | | 7.875 | | | | 1,519,155 | | |

| Tech Hardware & Equipment (0.3%) | | | |

| | 3,000 | | | CommScope Technologies LLC, Rule 144A,

Company Guaranteed Notes

(Callable 03/15/22 @ 102.50)(10) | | (B-, B3) | | 03/15/27 | | | 5.000 | | | | 2,467,500 | | |

| | 2,750 | | | CommScope, Inc., Rule 144A,

Company Guaranteed Notes

(Callable 03/01/22 @ 104.13)(10),(11) | | (B-, B3) | | 03/01/27 | | | 8.250 | | | | 2,615,195 | | |

| | 1,920 | | | CommScope, Inc., Rule 144A, Senior Secured

Notes (Callable 03/01/22 @ 103.00)(10) | | (B+, Ba3) | | 03/01/26 | | | 6.000 | | | | 1,982,400 | | |

| | | | 7,065,095 | | |

| Telecom - Wireline Integrated & Services (0.6%) | | | |

| | 4,000 | | | Altice Financing S.A., Rule 144A,

Senior Secured Notes

(Callable 05/15/21 @ 103.75)(10) | | (B+, B2) | | 05/15/26 | | | 7.500 | | | | 4,260,000 | | |

See Accompanying Notes to Financial Statements.

22

Credit Suisse Floating Rate High Income Fund

Schedule of Investments (continued)

October 31, 2019

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| CORPORATE BONDS (continued) | | | |

Telecom - Wireline Integrated & Services | | | |

$ | 755 | | | Altice Financing S.A., Rule 144A, Senior

Secured Notes (Callable 12/02/19 @ 103.31)(10) | | (B+, B2) | | 02/15/23 | | | 6.625 | | | $ | 777,423 | | |

| | 5,000 | | | Altice France S.A., Rule 144A, Senior

Secured Notes (Callable 05/01/21 @ 103.69)(10) | | (B, B2) | | 05/01/26 | | | 7.375 | | | | 5,366,725 | | |

| | 7,000 | | | GTT Communications, Inc., Rule 144A,

Company Guaranteed Notes

(Callable 12/31/19 @ 105.91)(10),(11) | | (CCC, Caa1) | | 12/31/24 | | | 7.875 | | | | 4,112,500 | | |

| | | | 14,516,648 | | |

| Theaters & Entertainment (0.2%) | | | |

| | 775 | | | AMC Entertainment Holdings, Inc., Global

Company Guaranteed Notes

(Callable 05/15/22 @ 103.06)(11) | | (CCC+, B3) | | 05/15/27 | | | 6.125 | | | | 704,766 | | |

| | 3,800 | | | AMC Entertainment Holdings, Inc., Global

Company Guaranteed Notes

(Callable 11/15/21 @ 102.94) | | (CCC+, B3) | | 11/15/26 | | | 5.875 | | | | 3,481,750 | | |

| | | | 4,186,516 | | |

| TOTAL CORPORATE BONDS (Cost $229,874,079) | | | 221,866,421 | | |

| ASSET BACKED SECURITIES (5.4%) | | | |

| Collateralized Debt Obligations (5.4%) | | | |

| | 3,500 | | | ALM V Ltd., 2012-5A, Rule 144A,

LIBOR 3M + 5.250%(1),(10) | | (NR, Ba3) | | 10/18/27 | | | 7.253 | | | | 3,315,165 | | |

| | 5,000 | | | Ares XXXVIII CLO Ltd., 2015-38A, Rule 144A,

LIBOR 3M + 5.050%(1),(10) | | (NR, Ba3) | | 04/20/30 | | | 7.016 | | | | 4,389,941 | | |

| | 2,150 | | | Barings CLO Ltd., 2018-3A, Rule 144A,

LIBOR 3M + 2.900%(1),(10) | | (BBB-, NR) | | 07/20/29 | | | 4.866 | | | | 2,020,042 | | |

| | 2,100 | | | BlueMountain CLO Ltd., 2015-3A, Rule 144A,

LIBOR 3M + 5.400%(1),(10) | | (BB-, NR) | | 04/20/31 | | | 7.366 | | | | 1,811,571 | | |

| | 2,900 | | | Bowman Park CLO Ltd., 2014-1A, Rule 144A,

LIBOR 3M + 5.400%(1),(10) | | (BB-, NR) | | 11/23/25 | | | 7.548 | | | | 2,819,095 | | |

| | 4,316 | | | Capital Automotive LLC, 2017-1A, Rule 144A(10) | | (A+, NR) | | 04/15/47 | | | 3.870 | | | | 4,358,501 | | |

| | 2,606 | | | Capital Automotive LLC, 2017-1A, Rule 144A(10) | | (A+, NR) | | 04/15/47 | | | 4.180 | | | | 2,683,249 | | |

| | 750 | | | Carlyle Global Market Strategies CLO Ltd.,

2014-3RA, Rule 144A, LIBOR 3M + 5.400%(1),(10) | | (BB-, NR) | | 07/27/31 | | | 7.336 | | | | 610,546 | | |

| | 2,000 | | | Carlyle Global Market Strategies CLO Ltd.,

2014-5A, Rule 144A, LIBOR 3M + 3.150%(1),(10) | | (BBB-, NR) | | 07/15/31 | | | 5.151 | | | | 1,855,706 | | |

| | 1,850 | | | Carlyle Global Market Strategies CLO Ltd.,

2015-2A, Rule 144A, LIBOR 3M + 6.150%(1),(10) | | (NR, B1) | | 04/27/27 | | | 8.086 | | | | 1,716,970 | | |

| | 2,000 | | | Carlyle U.S. CLO Ltd., 2017-2A,

Rule 144A(2),(7),(10),(13) | | (NR, NR) | | 07/20/31 | | | 0.000 | | | | 1,364,404 | | |

| | 2,625 | | | CIFC Funding Ltd., 2014-1A, Rule 144A,

LIBOR 3M + 5.850%(1),(10) | | (BB-, NR) | | 01/18/31 | | | 7.853 | | | | 2,233,661 | | |

| | 4,000 | | | Crown Point CLO Ltd., 2018-4A, Rule 144A,

LIBOR 3M + 2.750%(1),(10) | | (NR, Baa3) | | 04/20/31 | | | 4.716 | | | | 3,642,661 | | |

See Accompanying Notes to Financial Statements.

23

Credit Suisse Floating Rate High Income Fund

Schedule of Investments (continued)

October 31, 2019

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| ASSET BACKED SECURITIES (continued) | | | |

Collateralized Debt Obligations | | | |

$ | 3,500 | | | Elevation CLO Ltd., 2014-2A, Rule 144A,

LIBOR 3M + 3.200%(1),(10) | | (NR, Baa3) | | 10/15/29 | | | 5.201 | | | $ | 3,286,601 | | |

| | 5,000 | | | Galaxy CLO XVIII Ltd., 2018-28A, Rule 144A,

LIBOR 3M + 3.000%(1),(10) | | (BBB-, NR) | | 07/15/31 | | | 5.001 | | | | 4,585,626 | | |

| | 5,500 | | | Gallatin CLO IX Ltd., 2018-1A, Rule 144A,

LIBOR 3M + 1.050%(1),(10) | | (NR, Aaa) | | 01/21/28 | | | 3.016 | | | | 5,489,093 | | |

| | 3,250 | | | Goldentree Loan Opportunities XI Ltd.,

2015-11A, Rule 144A, LIBOR 3M + 5.400%(1),(10) | | (NR, Ba3) | | 01/18/31 | | | 7.403 | | | | 2,919,432 | | |

| | 2,250 | | | Greywolf CLO II Ltd., 2013-1A, Rule 144A,

LIBOR 3M + 6.350%(1),(10) | | (BB-, NR) | | 10/15/29 | | | 8.351 | | | | 2,047,264 | | |

| | 1,250 | | | Greywolf CLO III Ltd., 2018-3RA, Rule 144A,

LIBOR 3M + 2.250%(1),(10) | | (A, NR) | | 10/22/28 | | | 4.203 | | | | 1,232,402 | | |

| | 2,125 | | | Greywolf CLO III Ltd., 2018-3RA, Rule 144A,

LIBOR 3M + 3.150%(1),(10) | | (BBB-, NR) | | 10/22/28 | | | 5.103 | | | | 2,089,203 | | |

| | 3,000 | | | Greywolf CLO III Ltd., 2018-3RA, Rule 144A,

LIBOR 3M + 5.500%(1),(10) | | (BB-, NR) | | 10/22/28 | | | 7.453 | | | | 2,876,488 | | |

| | 7,000 | | | Greywolf CLO IV Ltd., 2019-1A, Rule 144A,

LIBOR 3M + 2.950%(1),(10) | | (A, NR) | | 04/17/30 | | | 4.952 | | | | 6,985,587 | | |

| | 1,000 | | | Greywolf CLO IV Ltd., 2019-1A, Rule 144A,

LIBOR 3M + 3.950%(1),(10) | | (BBB-, NR) | | 04/17/30 | | | 5.952 | | | | 993,988 | | |

| | 6,000 | | | Greywolf CLO V Ltd., 2015-1A, Rule 144A,

LIBOR 3M + 2.000%(1),(10) | | (A, NR) | | 01/27/31 | | | 3.940 | | | | 5,755,290 | | |

| | 3,950 | | | Greywolf CLO V Ltd., 2015-1A, Rule 144A,

LIBOR 3M + 3.000%(1),(10) | | (BBB-, NR) | | 01/27/31 | | | 4.940 | | | | 3,672,449 | | |

| | 5,150 | | | Greywolf CLO V Ltd., 2015-1A, Rule 144A,

LIBOR 3M + 5.850%(1),(10) | | (BB-, NR) | | 01/27/31 | | | 7.790 | | | | 4,598,632 | | |

| | 2,250 | | | Greywolf CLO VI Ltd., 2018-1A, Rule 144A,

LIBOR 3M + 5.750%(1),(10) | | (BB-, NR) | | 04/26/31 | | | 7.686 | | | | 2,012,008 | | |

| | 3,000 | | | Highbridge Loan Management Ltd., 12A-2018,

Rule 144A, LIBOR 3M + 1.850%(1),(10) | | (A, NR) | | 07/18/31 | | | 3.853 | | | | 2,904,903 | | |

| | 4,500 | | | Highbridge Loan Management Ltd., 7A-2015,

Rule 144A, LIBOR 3M + 1.700%(1),(10) | | (A, NR) | | 03/15/27 | | | 3.858 | | | | 4,360,562 | | |

| | 2,500 | | | KKR CLO Ltd., 20, Rule 144A,

LIBOR 3M + 5.500%(1),(10) | | (NR, Ba3) | | 10/16/30 | | | 7.501 | | | | 2,130,821 | | |

| | 3,250 | | | KKR Financial CLO Ltd., 2013-1A, Rule 144A,

LIBOR 3M + 6.080%(1),(10) | | (NR, Ba3) | | 04/15/29 | | | 8.081 | | | | 2,757,327 | | |

| | 2,250 | | | Octagon Investment Partners 26 Ltd., 2016-1A,

Rule 144A, LIBOR 3M + 2.850%(1),(10) | | (BBB-, NR) | | 07/15/30 | | | 4.851 | | | | 2,061,259 | | |

| | 3,500 | | | Shackleton CLO Ltd., 2014-6RA, Rule 144A,

LIBOR 3M + 2.970%(1),(10) | | (NR, Baa3) | | 07/17/28 | | | 4.972 | | | | 3,365,226 | | |

| | 4,000 | | | Symphony Credit Opportunities Fund Ltd.,

2015-2A, Rule 144A, LIBOR 3M + 3.060%(1),(10) | | (NR, Baa3) | | 07/15/28 | | | 5.061 | | | | 3,858,049 | | |

| | 3,000 | | | Venture 35 CLO Ltd., 2018-35A, Rule 144A,

LIBOR 3M + 3.500%(1),(10) | | (NR, Baa3) | | 10/22/31 | | | 5.453 | | | | 2,743,849 | | |

| | 3,000 | | | Venture CLO Ltd., 2017-28AA, Rule 144A,

LIBOR 3M + 2.400%(1),(10) | | (NR, A2) | | 10/20/29 | | | 4.366 | | | | 2,935,116 | | |

See Accompanying Notes to Financial Statements.

24

Credit Suisse Floating Rate High Income Fund

Schedule of Investments (continued)

October 31, 2019

Par

(000) | |

| | Ratings†

(S&P/Moody's) | | Maturity | | Rate% | | Value | |

| ASSET BACKED SECURITIES (continued) | | | |

Collateralized Debt Obligations | | | |

$ | 1,250 | | | Venture CLO Ltd., 2018-31A, Rule 144A,

LIBOR 3M + 2.820%(1),(10) | | (NR, Baa3) | | 04/20/31 | | | 4.786 | | | $ | 1,147,028 | | |

| | 3,000 | | | Venture XIII CLO Ltd., 2013-13A, Rule 144A,

LIBOR 3M + 3.300%(1),(10) | | (NR, Baa2) | | 09/10/29 | | | 5.434 | | | | 2,867,342 | | |

| | 4,500 | | | Venture XX CLO Ltd., 2015-20A, Rule 144A,

LIBOR 3M + 1.900%(1),(10) | | (A+, NR) | | 04/15/27 | | | 3.901 | | | | 4,400,334 | | |

| | 2,250 | | | Vibrant Clo V Ltd., 2016-5A, Rule 144A,

LIBOR 3M + 2.800%(1),(10) | | (NR, A2) | | 01/20/29 | | | 4.766 | | | | 2,211,601 | | |

| | 2,150 | | | Vibrant CLO V Ltd., 2016-5A, Rule 144A,

LIBOR 3M + 7.000%(1),(10) | | (NR, Ba3) | | 01/20/29 | | | 8.966 | | | | 1,819,386 | | |