UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-1735 |

|

FPA NEW INCOME, INC. |

(Exact name of registrant as specified in charter) |

|

11400 WEST OLYMPIC BLVD., SUITE 1200, LOS ANGELES, CALIFORNIA | | 90064 |

(Address of principal executive offices) | | (Zip code) |

|

J. RICHARD ATWOOD, 11400 WEST OLYMPIC BLVD., SUITE 1200, LOS ANGELES, CALIFORNIA 90064 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 310-473-0225 | |

|

Date of fiscal year end: | SEPTEMBER 30 | |

|

Date of reporting period: | SEPTEMBER 30, 2013 | |

| | | | | | | | | |

Item 1. Report to Stockholders.

Distributor:

UMB DISTRIBUTION SERVICES, LLC

803 West Michigan Street

Milwaukee, Wisconsin 53233

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Dear Fellow Shareholders:

This Annual Report covers the year ended September 30, 2013. Your Fund's net asset value (NAV) closed at $10.45. During the fiscal year, your Fund paid four income dividends totaling $0.32. There were no capital gains distributions.

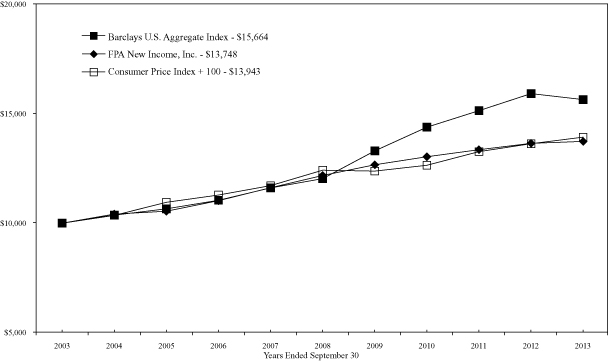

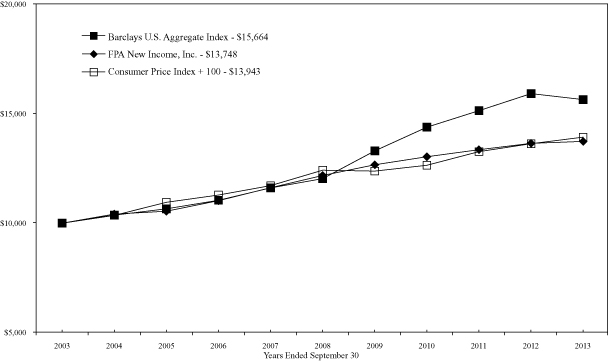

The following table shows the average annual total return for several different periods ended on September 30, 2013 for the Fund and comparative indices of securities prices.

| | | Periods Ended September 30, 2013 | |

| | | 1 Year | | 5 Years | | 10 Years | | 15 Years | | 20 Years | | 25 Years | | 6/30/1984

Inception | |

FPA New Income (NAV) | | | 0.66 | % | | | 2.44 | % | | | 3.23 | % | | | 4.51 | % | | | 5.14 | % | | | 6.48 | % | | | 7.82 | % | |

Barclays U.S. Aggregate

Bond Index | | | (1.68 | )% | | | 5.41 | % | | | 4.59 | % | | | 5.27 | % | | | 5.75 | % | | | 6.86 | % | | | 8.01 | % | |

Consumer Price Index + 100

Basis Points | | | 2.01 | % | | | 2.34 | % | | | 3.38 | % | | | 3.43 | % | | | 3.43 | % | | | 3.73 | % | | | 3.85 | % | |

The Fund continues to perform in line with our expectations. Our emphasis on high-quality, short-duration bonds led to our year-to-date return of 0.47% through September 30, 2013 versus -1.89% for the Barclays U.S. Aggregate Bond Index and 1.96% for the CPI + 100. For the second half of the fiscal year, your Fund's return was -0.09%, -1.77% for the Barclays Index and 1.20% for the CPI + 100.

Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. This data represents past performance and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment may be worth more or less than its original cost. Current month-end performance data can be obtained by visiting the website at www.fpafunds.com or by calling toll-free, 1-800-982-4372. Information regarding the Fund's expense ratio and redemption fees can be found on pages 31 and 34.

Portfolio Commentary

The third quarter, while challenging from a portfolio management perspective, has been positive in at least a few regards. The rise in interest rates not only reminded investors that the timing of rising rates is often unpredictable (more on that below), it puts to rest the belief that the Federal Reserve has "everything under control." In addition, for those shareholders who have been with us over the past few years, while we have delivered positive, albeit modest, returns, we hope you have renewed appreciation for our disciplined investment process. We appreciate your confidence in our process as demonstrated by the inflows we have experienced the past few months, as some other fixed-income managers have faced substantial redemptions. We attribute this to the Fund's performance and that we have successfully communicated our strategy, aligning shareholder expectations for the bumpy road ahead.

The unpredictability of interest rate movements is often taken for granted, until it is not. Since 1940, rates have risen 1% or more over any consecutive 12 month period about 11% of the time (97 out of 872 rolling 12 month periods). Investors might suspect most of those periods occurred during the rising rate period from 1940-1982. Instead it turns out that nearly half of the rising interest rate periods (43 out of the 97) occurred during the bond bull market from 1982-2013. Instead of trying to guess which way rates are headed, we hope to replicate our past success by positioning the portfolio to maximize returns for each unit of risk assumed, consistent with our goals.

1

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS (Continued)

Portfolio Activity

Our third-quarter activity report looks back to the second quarter as backdrop. In May and June, we implemented changes in the portfolio's exposure with particular emphasis on corporate credit with S&P credit rating equivalents of A or less. All told, we more than doubled the allocation to corporate credit (and increased the A-rated or less component by one-third). Our current corporate credit exposure is approximately 8%. Motivating our actions was a market sell-off in credit driven by an increase in Treasury yields. "Tapering talk" by the Federal Reserve concerning its Treasury and mortgage purchases spurred the significant liquidations from the fixed income segment of the mutual funds market. Our second quarter shareholder conference call addressed this event in detail. We explained our view that the market was over-reacting, and re-positioned the portfolio to take advantage of this anomaly.

Third quarter transactions focused on further reducing interest rate risk while continuing to take advantage of uncertainty in credit markets to optimize our exposure in that area. In the high quality segment, we sold 15-year amortization single-family mortgage pools. The portfolio's mortgage pool holdings are now all 10-year amortization loans. These proceeds were redeployed into securities backed by sub-prime auto loans with average lives of less than 1.5 years and credit enhancement that result in quality ratings ranging from AA and above. This segment of the Asset Backed Securities market sold off in the summer, providing us with an opportunity to receive very attractive yields for the average life. The effect of this swap is a further reduction of the risk posed by rising interest rates.

We further optimized the credit component by selling bonds maturing in 2-3 years and replacing them with bonds that mature in 3-5 years at more attractive yields. We also shifted from bank debt to callable bonds with similar maturity characteristics and an enhanced yield profile.

In light of the above highlighted changes, yield to worst1 and effective duration of the Fund's portfolio over the past six months can be summarized as follows:

| | 3/31/2013 | | 6/30/2013 | | 9/30/2013 | |

Effective Duration | | | 1.59 years | | | | 2.00 years | | | | 1.93 years | | |

Yield to Worst | | | 2.24 | % | | | 2.51 | % | | | 2.37 | % | |

Performance Details (six months)

The last six months have been challenging for fixed income portfolio managers and the value of looking at your downside risk first was paramount. The Fund's performance was mixed during this period. Within the Collateralized Mortgage Obligations (CMO2) portion of the portfolio we had two sectors that were positive in total return and two that were negative. The Interest Only (IO) securities did very well during this rising interest rate period. Our allocation to the short duration bonds backed by non-performing mortgage loans also contributed to the performance given that the returns of that investment are not driven by changes in interest rates, but rather by resolution of the default through modification or disposition of the home. On the negative side, our holdings of 30-year amortization jumbo conforming loans produced a negative return during the period. We constructed a bond that would perform well in a falling interest rate environment and counteract the underperformance that

1 Yield to worst is the lowest possible yield on a callable bond. As of September 30, 2013, SEC yield for FPA New Income Fund was 3.16%.

2 CMO is Collateralized Mortgage Obligation. It is a mortgage-backed, investment-grade bond that separates mortgage pools into different maturity classes.

2

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS (Continued)

would occur in our IO holdings in that type of scenario. However, these bonds performed even worse than we expected when interest rates rose. The other area of underperformance came from our holdings of bonds backed by 30-year relocation mortgage loans. While these bonds reacted negatively to the increase in the yield of the 10-year Treasury, we are comfortable that from a structural perspective they remain short duration bonds. This is due to the nature of the bonds where, as the loans age, the borrower will be transferred to another location and thus pays off the loan. The bond's cash flow structure is such that it receives all principal and interest payments first before others in the securitization and will only have an average life of around 3 years if it performs as expected. To date, the bonds are on track for just such an average life.

While the CMO portion of the portfolio had its challenges, the corporate holdings did very well providing solid positive performance for the period. This area was the largest contributor to overall portfolio performance over the past six months. The Commercial Mortgage-Backed Securities (CMBS3) sector of the portfolio was also a positive contributor.

Market Outlook: U.S. Fiscal Policy Cast Adrift, Year by Year

The Presidential and Congressional elections of 2012 did not appreciably revamp the political landscape. Just as prior to the election, Congress remains split between a Republican House and a Democratic Senate and Presidency. One distinct change has been the President's approval rating, which dropped from 57% to 44% since the election, according to recent Gallup presidential approval ratings. 2013 was a prime moment for all parties to unite behind creating a long-term sustainable fiscal policy for the country. Instead, we arrived at the last week of the fiscal year with the parties unable to pass a budget for 2014 or settle on a debt plan, so the government temporarily shut down. Thus, the nation lurches from one short-term fix to another while uncertainty prevails. An illustration of the uncertainty (and of Congress's inability to compromise) is the fact that while the House of Representatives has passed budgets in 2010, 2011, and 2012, the Senate has neither ratified those budgets nor passed one of its own. Those years' only real achievement from a fiscal perspective was a partial revenue solution through an increase in the individual tax rates, and the re-establishment of the full social security withholding tax. This has helped to reduce the annual Federal deficit from over one trillion dollars to an estimated $642 billion this year (according to the Congressional Budget Office).

2014 is an election year for one third of the Senate and the entire House. Both sides are deeply determined that only their ideas will work and that the other side is evil. For this reason, we anticipate nothing in 2014 in the way of true compromise. Rather, each side will pound away on its public relations plan hoping to convince the electorate that their solutions are uniquely correct. The upshot: until the first Tuesday in November 2014, nothing permanent will be put in place. What's more, as the sides drift further from the middle, compromise becomes that much more difficult. Polarized America: The Dance of Ideology and Unequal Riches by Nolan McCarty, Keith T. Poole, and Howard Rosenthal (The MIT Press: 2008) examines Congressional voting patterns since 1879 and concludes that not since the end of the Civil War has Congress been as polarized as it is today.

2015 is probably the first potential year for a compromise in our fiscal policy plan, however this depends on the 2014 election result. If Democrats gain control of the House they would dominate the legislative process and implement their vision of the fiscal future. If 2009 and 2010 is any indication (Democrats controlled both houses of Congress and the Presidency), results may be mixed. The only major legislation was the Affordable

3 CMBS is Commercial Mortgage Backed Security. It is a mortgage-backed security backed by commercial mortgages rather than residential mortgages.

3

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS (Continued)

Care Act which at this writing is encountering implementation difficulties. If Republicans remain in control of the House and gain control of the Senate it would then fall to the President to compromise. To date, those two sides have not worked very well together. For these reasons neither outcome bodes well, in our view, for a long-term solution. If politics remain as polarized as now, we see more reason to doubt a better outcome.

That brings us to 2016, the next presidential election. Because the incumbent cannot run, it's highly uncertain who will be the presidential candidates — from either political party. We expect nothing in the way of a long-term fiscal solution during the election process. That means the next solid opportunity for the Federal government to find a solution that incorporates spending and taxes is 2017.

What we therefore anticipate is a continuation of short-term fixes, uncertain long-term spending policy, tax policy and regulatory policy for the coming three and one-quarter years. Similarly, we believe the Federal debt will continue to rise, the debt-to-GDP4 ratio will increase, and continued sluggish growth is likely. Federal Reserve monetary policy could continue to attempt to counteract this fiscal policy uncertainty with a very accommodative stance via ZIRP (zero interest rate policy) and QE (quantitative easing).

How has the lack of a long-term fiscal solution manifested itself in the broader economy? We have commented in the past on employment growth, household wealth and wage growth. How have the actions of the Federal government impacted these areas? The Fed's QE policy, as we have repeatedly pointed out, aims at increasing asset prices in hopes that wealthier households will spend more, resulting in increased corporate revenue and earnings feeding back to higher asset prices, i.e., Fed Chairman Bernanke's so-called virtuous cycle. With GDP growth levels flat to down over the past three years, it seems that this stimulus has yet to kick in. We contend that the wealthiest 25% of households have benefited from this policy but the middle 50% have not. Why is that? Three major indicators lead us to conclude that the middle class has not participated in the virtuous cycle of employment growth, wage growth/income growth, and net worth.

First, while the reported unemployment rate has declined from a peak of 10% in November 2009 to 7.3% as of August 2013, the labor participation rate has also declined from 65% to 63.2%. Part-time employment remains at an elevated level considering that the recession ended more than three years ago. This is the slowest employment growth during an economic expansion since the end of World War II.

Second, incomes have not kept up with inflation. Median household income at year end 2012 was $51,017 compared to $55,627 at the end of 2007.

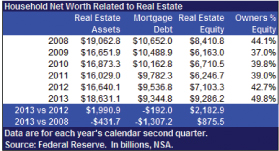

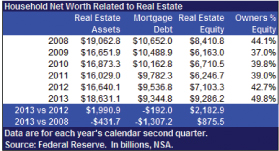

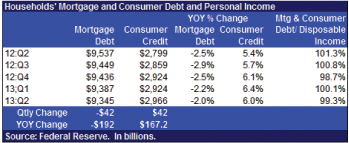

This contrasts with the third point — household net worth being at an all-time high. The major contributor here is the rise in housing prices over the past two years by about 13% on a national level, according to the Federal Housing Finance Agency. The rise in the S&P 5005 of 33.8% over the past two years contributed as well. Both items fall on the asset side of the wealth equation and skew in favor of wealthier households. On the liability side of the ledger, household debt has declined since the beginning of 2008. The bulk of this decline has come from a decline in mortgage debt by $1.3 trillion with credit card debt declining as well. Counteracting these two elements of debt is the expansion of student loan debt by over $527 billion since the beginning of 2009. The

4 GDP is the Gross Domestic Product, which is the total market value of all final goods and services produced in a country in a given year, equal to total consumer, investment and government spending, plus the value of exports, minus the value of imports.

5 S&P 500 Index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. The index focuses on the large-cap segment of the market, with over 80% coverage of U.S. equities, but is also considered a proxy for the total market. These indices do not reflect any commissions or fees which would be incurred by an investor purchasing the stocks it represents. The performance of the Fund and of the indices is computed on a total return basis which includes reinvestment of all distributions. It is not possible to invest in an index.

4

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS (Continued)

chart below from Stone & McCarthy Research Associates uses the latest Federal Reserve flow of funds data to illustrate how the combination of a decline in mortgage debt and increase in real estate assets has contributed heavily to the increase in household wealth.

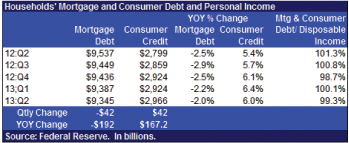

Whereas the mortgage component has been a positive contributor, non-mortgage consumer debt has increased, limiting the growth in household wealth as the data from the same Federal Reserve Flow of Funds data shows.

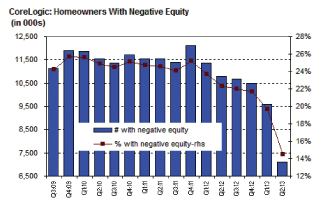

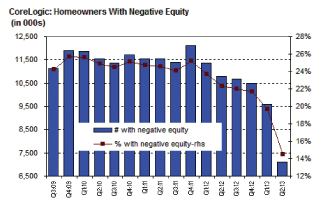

One other debt item, while still small, has started to reemerge in the past year: cash out refinancing. With house prices recovering, fewer households are underwater on their mortgages. At its peak, about 25% of households owed more on their homes than their houses were worth. Today, that percentage has fallen to around

5

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS (Continued)

14.5%. The chart below using the Core Logic data from a recent Stone & McCarthy Research Associates report illustrates this dramatic change in negative equity.

Combine this decline with the 30-year fixed mortgage rate at its lowest level in history and it is not surprising to see this type of refinance option reappear. Using data compiled by Federal Home Loan Mortgage Corporation (FHLMC) from second quarter of 2012, 12% of all their refinance loans were classified as cash out. One year later, that percentage increased to 15%.

What is emerging, in our view, is a household that may be borrowing to maintain a lifestyle or supplement what current income cannot provide. Dare we recall that this kind of activity by consumers pre-dated the last recession? The new borrowing, by the way, is not being provided by the private sector but through the government, either via student loan programs or federally guaranteed mortgages. Without government sponsorship we suspect there would be substantially less of this type of borrowing. The failure of fiscal policy to craft a long-term solution to the government's financial situation is a significant driver of the economy's inability to grow at a pace sufficient to create employment opportunities that, in turn, would allow middle class households to increase their standard of living.

Investors face a Treasury yield curve that is steep by historical standards. That is, the difference in yield between short maturity and long maturity bonds is quite large. As an example, over the past 60 years the median difference in yield between a 1-year maturity Treasury note and a 10-year Treasury note has been 0.84%. At the end of this quarter the yield spread stood at 2.54%. Real GDP for the same period increased at a median level of 3.1% but today is only growing at a 2.5% rate. The median unemployment rate has been 5.7% over the same 60-year period but today stands at 7.3%. These subpar outcomes are occurring at a time when total debt-to-GDP

6

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS (Continued)

is at an elevated level. That is, the economy is highly levered but its growth is less robust than in the past. Without either an increase in growth or a reduction in debt, we believe the longer term outcome is worrisome. At some point, the Federal Government needs to step forward and put a long-term fiscal policy plan in place that will lead to better growth and smaller debt as a percentage of GDP. Unfortunately, for the reasons noted earlier, we fear that objective will not be achievable until 2017 at the earliest.

Path forward for portfolio

So, in this exceedingly uncertain environment, how have we acted to deploy capital? In 2009 we established the following criteria for the type of fixed income security that we felt would perform well in this type of environment. Four years later, these criteria still guide our screening process for the portfolio. We seek opportunities in securities with the following characteristics:

• Secured by an asset that is critical to the business or individual

• Have ability to accurately value the collateral asset

• Have a first lien on the asset

• Issuer/borrower has capital at risk

• Five year or less average life or maturity

We have found securities meeting these criteria primarily in the structured products portion of the bond market, specifically bonds backed by automobile loans, commercial insurance premiums, shipping containers, single family mortgages and commercial property mortgages. That is why our portfolio allocation to structured product securities is at historically high levels. Barring a significant change in yields, we continue to manage the portfolio to an effective duration of 1-2 years. From a quality perspective, a maximum of 20-25% of the portfolio will be A-rated and below. The investment team feels confident that through diligent research and execution we can continue to meet these criteria and meet our desired objectives.

Why the third quarter dividend?

The portfolio was able to declare a 12-cent dividend this quarter. The Fund's exposure to interest-only securities was approximately 13%. The rapid rise in both the 5-year and 10-year Treasuries over the quarter had a profound negative impact on the ability of mortgage borrowers to refinance their loans. This resulted in the prepayment speeds on these mortgages declining a significant amount. Thus, the stream of income produced by these interest-only securities was higher than previously experienced. From an accounting perspective, the Fund must amortize down the notional amount of the interest-only security over an estimated average life. This amortization offsets the income generated by the security. During the quarter, this amortization was diminished by the increase in interest rates and decline in refinancing activity. We expect that this is more of a one-time event and that the dividend rate will return to level more in line with that of the recent past.

In closing, we are proud to announce the addition of another professional to our team, Nazanin Pajoom. Nazanin has a double undergraduate degree from the University of California, Berkeley in computer science and electrical engineering, and currently she is obtaining a Masters degree in financial engineering from the University of Southern California this fall. She also spent some time working for Texas Instruments. Her primary role for the team will be to efficiently organize our portfolio analytical data, the financial information on all or our securitized product holdings, and assist in mining that data for prime investment opportunities and financial performance.

7

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS (Continued)

On behalf of the entire FPA fixed-income team, we thank you for the continued trust that you place in us to preserve and prudently grow your capital.

Respectfully submitted,

Thomas H. Atteberry

Chief Executive Officer and Portfolio Manager

October 21, 2013

The discussion of Fund investments represents the views of the Fund's managers at the time of this report and is subject to change without notice. References to individual securities are for informational purposes only and should not be construed as recommendations to purchase or sell individual securities.

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on current management expectations, they are considered "forward-looking statements" which may or may not be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be construed as a recommendation to purchase or sell any particular security.

8

FPA NEW INCOME, INC.

HISTORICAL PERFORMANCE

(Unaudited)

Change in Value of a $10,000 Investment in FPA New Income, Inc. vs. Barclays U.S. Aggregate Index and Consumer Price Index + 100 Basis Points from October 1, 2003 to September 30, 2013

Past performance is not indicative of future performance. The Barclays U.S. Aggregate Bond Index a broad-based unmanaged composite of four major subindexes: U.S. Government Index; U.S. Credit Index; U.S. Mortgage-Backed Securities Index; and U.S. Asset-Backed Securities Index. The index holds investment quality bonds. The Consumer Price Index is an unmanaged index representing the rate of inflation of U.S. consumer prices as determined by the US Department of Labor Statistics. The performance of the Fund and of the Averages is computed on a total return basis which includes reinvestment of all distributions.

Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. This data represents past performance and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment may be worth more or less than its original cost. Current month-end performance data can be obtained by visiting the website at www.fpafunds.com or by calling toll-free, 1-800-982-4372. Information regarding the Fund's expense ratio and redemption fees can be found on pages 31 and 34.

The Prospectus details the Fund's objective and policies, sales charges, and other matters of interest to prospective investors. Please read the prospectus carefully before investing. The Prospectus may be obtained by visiting the website at www.fpafunds.com, by email at crm@fpafunds.com, toll-free by calling 1-800-982-4372 or by contacting the Fund in writing.

9

FPA NEW INCOME, INC.

PORTFOLIO SUMMARY

September 30, 2013 (Unaudited)

Bonds & Debentures | | | | | 96.5 | % | |

Commercial Mortgage-Backed | |

Agency Stripped | | | 10.3 | % | | | | | |

Non-Agency | | | 3.8 | % | | | | | |

Agency | | | 3.0 | % | | | | | |

Residential Mortgage-Backed | |

Agency Pool Fixed Rate | | | 11.7 | % | | | | | |

Agency Collateralized Mortgage

Obligation | | | 21.1 | % | | | | | |

Non-Agency Collateralized

Mortgage Obligation | | | 10.8 | % | | | | | |

Agency Stripped | | | 2.8 | % | | | | | |

Agency Pool Adjustable Rate | | | 0.0 | % | | | | | |

Asset-Backed | |

Auto | | | 6.1 | % | | | | | |

Other | | | 6.5 | % | | | | | |

U.S. Treasuries | | | 12.9 | % | | | | | |

Corporate | | | 5.2 | % | | | | | |

Corporate Bank Debt | | | 2.3 | % | | | | | |

Short-Term Investments | | | | | 4.1 | % | |

Other Assets and Liabilities, net | | | | | 0.6 | % | |

Net Assets | | | | | 100.0 | % | |

MAJOR PORTFOLIO CHANGES

For the Six Months Ended September 30, 2013

NET PURCHASES | |

| Bonds & Debentures | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | |

U.S Treasury Note (1) | | | 0.2500 | | | 3/31/14 | | $ | 150,000,000 | | |

Credit Suisse Mortgage Trust 2013-6 1A1(1) | | | 2.5000 | | | 8/25/43 | | $ | 95,566,180 | | |

Federal National Mortgage Association 2013-66 CL JA (1) | | | 2.2500 | | | 7/25/43 | | $ | 81,331,693 | | |

U.S Treasury Note (1) | | | 0.2500 | | | 4/30/14 | | $ | 75,000,000 | | |

U.S Treasury Note (1) | | | 0.7500 | | | 12/15/13 | | $ | 75,000,000 | | |

U.S Treasury Note (1) | | | 1.8750 | | | 2/28/14 | | $ | 75,000,000 | | |

U.S Treasury Note (1) | | | 1.2500 | | | 3/15/14 | | $ | 70,000,000 | | |

Federal National Mortgage Association 2011-125 GE (1) | | | 2.5000 | | | 12/25/41 | | $ | 60,102,740 | | |

NET SALES | |

| Bonds & Debentures | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | |

U.S Treasury Note (2) | | | 3.1250 | | | 8/31/13 | | $ | 180,000,000 | | |

Federal National Mortgage Association AB7141 (2) | | | 2.5000 | | | 12/1/27 | | $ | 60,825,073 | | |

U.S Treasury Note (2) | | | 3.1250 | | | 9/30/13 | | $ | 50,000,000 | | |

U.S Treasury Note (2) | | | 0.3750 | | | 7/31/13 | | $ | 50,000,000 | | |

(1) Indicates new commitment to portfolio

(2) Indicates elimination from portfolio

10

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS

September 30, 2013

BONDS & DEBENTURES | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

COMMERCIAL MORTGAGE-BACKED

SECURITIES AGENCY STRIPPED — 10.3% | | | |

Government National Mortgage Association | |

2002-56 | | | 0.0425 | | | 06/16/2042 | | $ | 277,174 | | | $ | 452 | | |

2004-10 | | | 0.0802 | | | 1/16/2044 | | | 44,746,968 | | | | 25,953 | | |

2008-45 | | | 0.1573 | | | 2/16/2048 | | | 41,971,874 | | | | 718,978 | | |

2010-63 | | | 0.2012 | | | 5/16/2050 | | | 44,704,489 | | | | 1,201,210 | | |

2010-18 | | | 0.2320 | | | 1/16/2050 | | | 63,911,647 | | | | 1,917,349 | | |

2008-48 | | | 0.2557 | | | 4/16/2048 | | | 20,798,695 | | | | 701,956 | | |

2009-119 | | | 0.3138 | | | 12/16/2049 | | | 118,799,909 | | | | 3,628,149 | | |

2006-30 | | | 0.3407 | | | 5/16/2046 | | | 12,038,972 | | | | 491,792 | | |

2004-43 | | | 0.3421 | | | 6/16/2044 | | | 52,476,724 | | | | 1,054,782 | | |

2008-24 | | | 0.3448 | | | 11/16/2047 | | | 17,847,958 | | | | 457,979 | | |

2008-8 | | | 0.3454 | | | 11/16/2047 | | | 38,938,035 | | | | 997,203 | | |

2011-10 | | | 0.3873 | | | 12/16/2045 | | | 84,208,029 | | | | 2,885,809 | | |

2005-9 | | | 0.3960 | | | 1/16/2045 | | | 8,808,213 | | | | 181,714 | | |

2006-55 | | | 0.4050 | | | 8/16/2046 | | | 38,161,796 | | | | 1,173,475 | | |

2007-77 | | | 0.4092 | | | 11/16/2047 | | | 56,227,291 | | | | 1,926,347 | | |

2008-78 | | | 0.4959 | | | 7/16/2048 | | | 23,870,680 | | | | 1,011,878 | | |

2009-105 | | | 0.5007 | | | 11/16/2049 | | | 36,190,563 | | | | 1,490,689 | | |

2013-72 | | | 0.5263 | | | 11/16/2047 | | | 546,296,767 | | | | 34,652,861 | | |

2004-108 | | | 0.5778 | | | 12/16/2044 | | | 19,463,830 | | | | 515,986 | | |

2010-49 | | | 0.5831 | | | 2/16/2050 | | | 81,330,838 | | | | 2,615,600 | | |

2009-86 | | | 0.5928 | | | 9/16/2049 | | | 71,109,224 | | | | 2,288,295 | | |

2008-92 | | | 0.6005 | | | 10/16/2048 | | | 50,681,019 | | | | 2,201,583 | | |

2013-35 | | | 0.6542 | | | 1/16/2053 | | | 365,841,024 | | | | 24,260,016 | | |

| 2010-161 IA | | | 0.6810 | | | 12/16/2050 | | | 241,354,420 | | | | 9,086,994 | | |

2010-28 | | | 0.7364 | | | 3/1/2050 | | | 83,900,716 | | | | 3,106,844 | | |

2013-7 | | | 0.7391 | | | 5/16/2053 | | | 132,452,409 | | | | 9,963,176 | | |

2011-6 | | | 0.7652 | | | 10/16/2052 | | | 211,580,926 | | | | 8,992,189 | | |

2009-4 | | | 0.7857 | | | 1/16/2049 | | | 51,123,501 | | | | 2,036,249 | | |

2010-123 | | | 0.8103 | | | 9/16/2050 | | | 61,748,085 | | | | 3,045,416 | | |

| 2011-64 IX | | | 0.8221 | | | 10/16/2044 | | | 73,774,279 | | | | 4,207,347 | | |

2009-49 | | | 0.8258 | | | 6/16/2049 | | | 53,276,012 | | | | 2,086,821 | | |

2013-29 | | | 0.8279 | | | 5/16/2053 | | | 129,044,398 | | | | 9,542,949 | | |

2012-125 | | | 0.8547 | | | 2/16/2053 | | | 205,124,650 | | | | 15,120,476 | | |

2009-60 | | | 0.8575 | | | 7/16/2049 | | | 83,091,743 | | | | 3,149,177 | | |

2012-112 | | | 0.8690 | | | 10/16/2053 | | | 476,776,948 | | | | 33,614,253 | | |

2012-100 | | | 0.8902 | | | 2/16/2053 | | | 156,950,441 | | | | 11,447,651 | | |

2013-1 | | | 0.9093 | | | 2/16/2054 | | | 141,007,182 | | | | 12,207,753 | | |

2013-80 | | | 0.9192 | | | 3/16/2052 | | | 65,398,058 | | | | 5,645,468 | | |

11

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2013

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

2012-131 | | | 0.9269 | | | 2/16/2053 | | $ | 113,448,486 | | | $ | 9,636,439 | | |

2009-30 | | | 0.9292 | | | 3/16/2049 | | | 14,268,714 | | | | 722,140 | | |

2009-71 | | | 0.9406 | | | 7/16/2049 | | | 77,811,656 | | | | 2,717,183 | | |

2013-13 | | | 0.9457 | | | 7/16/2047 | | | 108,387,964 | | | | 7,878,439 | | |

2013-125 | | | 0.9534 | | | 10/16/2054 | | | 27,020,587 | | | | 1,669,310 | | |

2012-150 | | | 0.9536 | | | 11/16/2052 | | | 100,687,726 | | | | 8,217,750 | | |

2011-16 | | | 0.9617 | | | 9/16/2046 | | | 115,699,214 | | | | 6,210,734 | | |

2013-30 | | | 0.9859 | | | 9/16/2053 | | | 234,264,611 | | | | 18,534,641 | | |

2012-9 | | | 1.0144 | | | 11/16/2052 | | | 176,222,919 | | | | 18,447,015 | | |

2012-114 | | | 1.0303 | | | 1/16/2053 | | | 172,065,141 | | | | 16,265,111 | | |

2012-58 | | | 1.0312 | | | 1/16/2055 | | | 235,893,476 | | | | 19,442,340 | | |

2012-35 | | | 1.0332 | | | 11/16/2052 | | | 150,327,231 | | | | 10,943,898 | | |

2012-95 | | | 1.0397 | | | 2/16/2053 | | | 146,400,436 | | | | 12,446,262 | | |

2013-61 | | | 1.0457 | | | 5/16/2053 | | | 160,066,517 | | | | 12,896,335 | | |

2011-49 | | | 1.0479 | | | 4/16/2045 | | | 78,415,470 | | | | 4,396,756 | | |

2012-79 | | | 1.0505 | | | 3/16/2053 | | | 147,735,703 | | | | 11,758,285 | | |

2011-165 | | | 1.0565 | | | 10/16/2051 | | | 253,317,058 | | | | 14,388,409 | | |

2012-45 | | | 1.0640 | | | 4/16/2053 | | | 35,237,029 | | | | 2,845,989 | | |

2012-85 | | | 1.0679 | | | 9/16/2053 | | | 123,713,018 | | | | 10,629,324 | | |

2013-45 | | | 1.0774 | | | 12/16/2040 | | | 128,105,547 | | | | 9,023,973 | | |

2011-143 | | | 1.0918 | | | 4/16/2053 | | | 98,749,671 | | | | 14,226,865 | | |

2012-25 | | | 1.0959 | | | 8/16/2052 | | | 122,228,194 | | | | 9,005,077 | | |

| 2010-148 IX | | | 1.1133 | | | 10/16/2052 | | | 70,303,253 | | | | 4,004,473 | | |

2011-120 | | | 1.1384 | | | 12/16/2043 | | | 120,303,149 | | | | 14,228,253 | | |

| 2011-78 IX | | | 1.2147 | | | 8/16/2046 | | | 161,094,087 | | | | 10,535,553 | | |

2011-149 | | | 1.2287 | | | 10/16/2046 | | | 143,584,672 | | | | 11,195,297 | | |

2011-164 | | | 1.3458 | | | 4/16/2046 | | | 174,466,971 | | | | 12,095,795 | | |

| 2011-92 IX | | | 1.3714 | | | 11/16/2044 | | | 35,074,741 | | | | 2,584,307 | | |

2012-4 | | | 1.4934 | | | 5/16/2052 | | | 277,566,733 | | | | 20,732,126 | | |

TOTAL AGENCY STRIPPED | | | | $517,330,898 | |

NON-AGENCY — 3.8% | | | |

Banc of America Large Loan 2010-HLTN† | | | 2.4820 | | | 11/15/2015 | | $ | 15,362,803 | | | $ | 15,371,867 | | |

Del Coronado Trust 2013-HDMZ CL M† | | | 5.1830 | | | 3/15/2018 | | | 6,823,000 | | | | 6,853,530 | | |

GS Mortgage Securities Corporation II

2007-EOP A3† | | | 1.4563 | | | 3/6/2020 | | | 15,803,078 | | | | 15,810,822 | | |

JP Morgan Clearing Corporation

2011-FL1 MH† | | | 4.4720 | | | 7/15/2028 | | | 20,000,000 | | | | 19,706,600 | | |

Lehman Brothers Floating Rate Commercial

2007-LLFA F† | | | 1.1823 | | | 6/15/2022 | | | 12,924,000 | | | | 12,323,034 | | |

12

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2013

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

LSTAR Commercial Mortgage Trust

2001-1 A† | | | 3.9129 | | | 7/25/2017 | | $ | 3,653,466 | | | $ | 3,683,278 | | |

Motel 6 Trust | |

| 2012-MTL6 D† | | | 3.7812 | | | 10/5/2017 | | | 37,033,000 | | | | 36,700,084 | | |

| 2012-MTL6 E† | | | 4.2743 | | | 10/5/2017 | | | 10,061,000 | | | | 9,695,659 | | |

Ores NPL LLC 2013-LV2 CL A† | | | 3.0810 | | | 9/25/2025 | | | 29,794,444 | | | | 29,803,382 | | |

RREF 2012 LT1 LLC 2013-LT2 CL A† | | | 2.8331 | | | 5/22/2028 | | | 17,007,818 | | | | 17,007,818 | | |

Starwood Commercial Mortgage Trust

2013-FV1 CL B† | | | 2.1819 | | | 8/11/2028 | | | 18,051,000 | | | | 18,067,607 | | |

Washington Mutual Commercial Mortgage

Series Trust 2007-SL2 CL A † | | | 5.4268 | | | 12/27/2049 | | | 8,326,062 | | | | 8,292,674 | | |

TOTAL NON-AGENCY | | | | $193,316,355 | |

AGENCY — 3.0% | | | |

Government National Mortgage Association | |

| 2012-22 CL AB | | | 1.6610 | | | 2/1/2026 | | $ | 7,121,734 | | | $ | 7,120,262 | | |

| 2011-49 CL AB | | | 2.8000 | | | 4/16/2034 | | | 28,026,623 | | | | 28,484,578 | | |

| 2009-49 CL B | | | 3.4360 | | | 6/16/2034 | | | 2,936 | | | | 2,935 | | |

| 2011-120 CL A | | | 3.9284 | | | 8/16/2033 | | | 43,227,684 | | | | 44,489,932 | | |

| 2007-12 CL A | | | 3.9570 | | | 6/16/2031 | | | 26,492 | | | | 26,498 | | |

| 2011-143 CL AB | | | 3.9739 | | | 3/16/2033 | | | 45,287,674 | | | | 46,616,867 | | |

| 2007-34 CL B | | | 4.5790 | | | 12/16/2031 | | | 13,284,909 | | | | 13,385,182 | | |

| 2007-75 CL B | | | 5.0548 | | | 3/16/2036 | | | 91,700 | | | | 91,821 | | |

| 2006-8 CL C | | | 5.3130 | | | 2/16/2036 | | | 10,334,467 | | | | 10,546,944 | | |

TOTAL AGENCY | | | | $150,765,019 | |

RESIDENTIAL MORTGAGE-BACKED

SECURITIES AGENCY POOL FIXED RATE

MORTGAGES — 11.7% | | | |

Federal Home Loan Mortgage Corporation | |

J18815 | | | 3.0000 | | | 4/1/2022 | | $ | 22,396,369 | | | $ | 23,356,089 | | |

J19188 | | | 3.0000 | | | 5/1/2022 | | | 19,095,092 | | | | 19,937,216 | | |

G14462 | | | 3.0000 | | | 5/1/2022 | | | 16,633,256 | | | | 17,205,675 | | |

J19459 | | | 3.0000 | | | 6/1/2022 | | | 17,623,000 | | | | 18,400,202 | | |

J12954 | | | 3.5000 | | | 9/1/2020 | | | 4,199,990 | | | | 4,454,635 | | |

J13919 | | | 3.5000 | | | 12/1/2020 | | | 23,903,819 | | | | 25,251,210 | | |

G14025 | | | 4.0000 | | | 12/1/2025 | | | 25,158,217 | | | | 26,766,330 | | |

J11204 | | | 4.5000 | | | 11/1/2019 | | | 6,253,710 | | | | 6,657,137 | | |

E01322 | | | 5.0000 | | | 3/1/2018 | | | 5,791,656 | | | | 6,150,970 | | |

G13091 | | | 5.0000 | | | 6/1/2018 | | | 2,728,840 | | | | 2,909,899 | | |

13

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2013

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

E01642 | | | 5.0000 | | | 5/1/2019 | | $ | 4,102,927 | | | $ | 4,375,156 | | |

G13812 | | | 5.0000 | | | 12/1/2020 | | | 9,466,127 | | | | 10,094,205 | | |

G14187 | | | 5.5000 | | | 12/1/2020 | | | 15,902,661 | | | | 17,036,839 | | |

G12139 | | | 6.5000 | | | 9/1/2019 | | | 1,333,261 | | | | 1,364,766 | | |

A26942 | | | 6.5000 | | | 9/1/2034 | | | 632,907 | | | | 701,596 | | |

G08107 | | | 6.5000 | | | 1/1/2036 | | | 2,398,253 | | | | 2,659,759 | | |

P50543 | | | 6.5000 | | | 4/1/2037 | | | 144,135 | | | | 159,967 | | |

Federal National Mortgage Association | |

890429 | | | 3.0000 | | | 5/1/2022 | | | 43,399,051 | | | | 45,397,781 | | |

AP4062 | | | 3.0000 | | | 8/1/2022 | | | 30,065,195 | | | | 31,506,211 | | |

MA0629 | | | 3.5000 | | | 1/1/2021 | | | 47,987,714 | | | | 50,827,613 | | |

MA0905 | | | 3.5000 | | | 11/1/2021 | | | 14,695,040 | | | | 15,564,688 | | |

MA0989 | | | 3.5000 | | | 2/1/2022 | | | 40,602,570 | | | | 43,190,984 | | |

MA1019 | | | 3.5000 | | | 3/1/2022 | | | 43,123,395 | | | | 45,702,377 | | |

932433 | | | 4.0000 | | | 1/1/2020 | | | 876,620 | | | | 932,654 | | |

AA0905 | | | 4.5000 | | | 1/1/2021 | | | 3,550,435 | | | | 3,772,728 | | |

995756 | | | 5.0000 | | | 12/1/2018 | | | 9,827,973 | | | | 10,464,924 | | |

735453 | | | 5.0000 | | | 12/1/2019 | | | 5,251,681 | | | | 5,592,200 | | |

AE0126 | | | 5.0000 | | | 6/1/2020 | | | 13,355,240 | | | | 14,222,529 | | |

995861 | | | 5.0000 | | | 1/1/2021 | | | 10,803,315 | | | | 11,504,450 | | |

890122 | | | 5.0000 | | | 11/1/2021 | | | 4,949,362 | | | | 5,230,882 | | |

890083 | | | 5.0000 | | | 12/1/2021 | | | 5,477,693 | | | | 5,833,688 | | |

AE0792 | | | 5.0000 | | | 1/1/2026 | | | 10,125,130 | | | | 10,781,441 | | |

257100 | | | 5.5000 | | | 1/1/2018 | | | 972,514 | | | | 1,023,843 | | |

745500 | | | 5.5000 | | | 12/1/2018 | | | 7,319,422 | | | | 7,830,830 | | |

995327 | | | 5.5000 | | | 12/1/2019 | | | 2,513,950 | | | | 2,701,365 | | |

735521 | | | 5.5000 | | | 3/1/2020 | | | 4,495,036 | | | | 4,828,298 | | |

995284 | | | 5.5000 | | | 3/1/2020 | | | 9,046,418 | | | | 9,665,464 | | |

889318 | | | 5.5000 | | | 7/1/2020 | | | 9,165,253 | | | | 9,754,762 | | |

889069 | | | 5.5000 | | | 1/1/2021 | | | 8,497,854 | | | | 9,116,073 | | |

AE0237 | | | 5.5000 | | | 11/1/2023 | | | 10,246,539 | | | | 10,980,908 | | |

AD0951 | | | 6.0000 | | | 4/1/2021 | | | 9,703,130 | | | | 10,463,370 | | |

745832 | | | 6.0000 | | | 4/1/2021 | | | 18,034,982 | | | | 19,419,347 | | |

890225 | | | 6.0000 | | | 5/1/2023 | | | 9,561,083 | | | | 10,294,992 | | |

323282 | | | 7.5000 | | | 7/1/2028 | | | 365,041 | | | | 420,462 | | |

Government National Mortgage Association | |

782281 | | | 6.0000 | | | 3/15/2023 | | | 4,094,188 | | | | 4,489,693 | | |

TOTAL AGENCY POOL FIXED RATE

MORTGAGES | | | | $588,996,208 | |

14

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2013

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

AGENCY COLLATERALIZED MORTGAGE

OBLIGATION — 21.1% | | | |

Federal Home Loan Bank | |

I7-2014 1 | | | 5.3400 | | | 3/20/2014 | | $ | 14,829,177 | | | $ | 15,122,646 | | |

00-0986 | | | 5.7390 | | | 7/20/2014 | | | 11,338,881 | | | | 11,737,556 | | |

Federal Home Loan Mortgage Corporation | |

| 4097 CL PB | | | 1.7500 | | | 11/15/2040 | | | 22,744,314 | | | | 21,739,334 | | |

| 4151 CL YU | | | 2.0000 | | | 1/15/2043 | | | 25,111,153 | | | | 22,538,573 | | |

| 4125 CL NA | | | 2.5000 | | | 4/15/2042 | | | 26,396,148 | | | | 24,002,809 | | |

| 4141 CL CK | | | 2.5000 | | | 12/15/2042 | | | 3,673,963 | | | | 3,328,012 | | |

| 4144 CL BY | | | 2.5000 | | | 12/15/2042 | | | 23,217,334 | | | | 21,068,535 | | |

| 4153 CL KP | | | 2.5000 | | | 1/15/2043 | | | 22,249,404 | | | | 20,384,394 | | |

| 3829 CL CD | | | 3.0000 | | | 8/15/2024 | | | 3,239,488 | | | | 3,304,634 | | |

| 3806 CL AB | | | 4.0000 | | | 2/15/2023 | | | 4,586,648 | | | | 4,641,550 | | |

| 2869 CL JA | | | 4.0000 | | | 4/15/2034 | | | 382,611 | | | | 384,681 | | |

| 3992 CL H | | | 4.0000 | | | 6/15/2036 | | | 192,404 | | | | 196,700 | | |

| 3877 CL EL | | | 4.0000 | | | 8/15/2038 | | | 8,227,125 | | | | 8,263,982 | | |

| 4088 CL LE | | | 4.0000 | | | 10/15/2040 | | | 16,411,297 | | | | 17,016,669 | | |

| 2877 CL WA | | | 4.2500 | | | 10/15/2034 | | | 3,260,037 | | | | 3,310,274 | | |

| 3578 CL AM | | | 4.5000 | | | 9/15/2016 | | | 3,325,063 | | | | 3,460,726 | | |

| 2914 CL JQ | | | 4.5000 | | | 5/15/2019 | | | 1,059,008 | | | | 1,067,332 | | |

| 3439 CL AC | | | 4.5000 | | | 4/15/2022 | | | 3,289,140 | | | | 3,327,426 | | |

| 3939 CL D | | | 4.5000 | | | 9/15/2041 | | | 3,377,137 | | | | 3,563,989 | | |

| 2509 CL CB | | | 5.0000 | | | 10/15/2017 | | | 3,229,045 | | | | 3,385,395 | | |

| 2602 CL ET | | | 5.0000 | | | 11/15/2017 | | | 365,424 | | | | 366,100 | | |

| 2747 CL DX | | | 5.0000 | | | 2/15/2019 | | | 6,172,416 | | | | 6,626,212 | | |

| 3852 CL HA | | | 5.0000 | | | 12/15/2021 | | | 10,796,359 | | | | 11,548,217 | | |

| 3285 CL LC | | | 5.0000 | | | 8/15/2025 | | | 106,822 | | | | 106,807 | | |

| 2494 CL CF | | | 5.5000 | | | 9/15/2017 | | | 3,459,370 | | | | 3,687,758 | | |

| 2503 CL B | | | 5.5000 | | | 9/15/2017 | | | 3,426,757 | | | | 3,616,908 | | |

| 3808 CL BQ | | | 5.5000 | | | 8/15/2025 | | | 11,357,413 | | | | 12,086,332 | | |

| 3806 CL JB | | | 5.5000 | | | 2/15/2026 | | | 5,276,621 | | | | 5,794,785 | | |

| 3855 CL HQ | | | 5.5000 | | | 2/15/2026 | | | 5,811,474 | | | | 6,235,072 | | |

| 3926 CL GP | | | 6.0000 | | | 8/15/2025 | | | 6,140,605 | | | | 6,490,251 | | |

| 3614 CL DY | | | 6.0000 | | | 1/15/2032 | | | 11,353,648 | | | | 12,588,471 | | |

Federal National Mortgage Association | |

| 2013-64 CL TA | | | 1.5000 | | | 5/1/2032 | | | 13,015,402 | | | | 12,537,268 | | |

| 2013-42 CL QC | | | 1.5000 | | | 5/25/2033 | | | 32,989,100 | | | | 32,247,195 | | |

| 2013-64 CL TZ | | | 1.5000 | | | 3/25/2042 | | | 1,936,716 | | | | 1,927,517 | | |

| 2013-6 CL TA | | | 1.5000 | | | 1/25/2043 | | | 51,961,187 | | | | 50,270,230 | | |

| 2013-30 CL JA | | | 1.5000 | | | 4/25/2043 | | | 20,119,450 | | | | 18,305,696 | | |

15

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2013

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

| 2013-30 CL CA | | | 1.5000 | | | 4/25/2043 | | $ | 30,712,000 | | | $ | 28,129,155 | | |

| 2013-66 CL JA | | | 2.2500 | | | 7/25/2043 | | | 81,331,693 | | | | 80,657,185 | | |

| 2011-125 GE | | | 2.5000 | | | 12/25/2041 | | | 60,102,740 | | | | 59,086,451 | | |

| 2011-110 BH | | | 3.0000 | | | 10/25/2041 | | | 3,561,950 | | | | 3,575,252 | | |

| 2012-73 CL JB | | | 3.5000 | | | 1/25/2042 | | | 41,711,139 | | | | 43,513,039 | | |

| 2012-8 CL LE | | | 3.5000 | | | 2/25/2042 | | | 39,230,993 | | | | 40,923,088 | | |

| 2012-26 CL ME | | | 3.5000 | | | 3/25/2042 | | | 55,605,339 | | | | 57,991,737 | | |

| 2012-41 CL LB | | | 3.5000 | | | 4/25/2042 | | | 51,252,771 | | | | 53,491,215 | | |

| 2012-48 CL MB | | | 3.5000 | | | 5/25/2042 | | | 49,998,080 | | | | 52,136,288 | | |

| 2012-117 CL AD | | | 3.5000 | | | 10/25/2042 | | | 67,816,414 | | | | 70,157,749 | | |

| 2009-68 KA | | | 3.7500 | | | 11/25/2022 | | | 226,245 | | | | 226,535 | | |

| 2011-67 CL EA | | | 4.0000 | | | 7/25/2021 | | | 22,890,914 | | | | 24,182,419 | | |

| 2011-89 CL H | | | 4.0000 | | | 10/25/2038 | | | 3,629,894 | | | | 3,634,648 | | |

| 2011-27 CL JQ | | | 4.0000 | | | 9/25/2039 | | | 15,564,997 | | | | 16,176,135 | | |

| 2012-95 CL AB | | | 4.0000 | | | 11/25/2040 | | | 9,172,475 | | | | 9,382,305 | | |

| 2012-78 CL PA | | | 4.0000 | | | 8/25/2041 | | | 15,066,420 | | | | 15,803,771 | | |

| 2012-97 CL MA | | | 4.0000 | | | 10/25/2041 | | | 12,202,182 | | | | 12,605,211 | | |

| 2012-81 CL Q | | | 4.0000 | | | 8/25/2042 | | | 10,148,060 | | | | 10,619,524 | | |

| 2009-70 CL NU | | | 4.2500 | | | 8/25/2019 | | | 8,115,939 | | | | 8,498,930 | | |

| 2004-90 -CL GA | | | 4.3500 | | | 3/25/2034 | | | 3,180,046 | | | | 3,247,717 | | |

| 2012-67 CL PB | | | 4.5000 | | | 6/1/2027 | | | 11,697,621 | | | | 12,146,693 | | |

| 2012-40 CL GC | | | 4.5000 | | | 12/25/2040 | | | 8,278,635 | | | | 8,553,072 | | |

| 2012-102 CL PA | | | 4.5000 | | | 3/25/2041 | | | 15,311,451 | | | | 16,071,175 | | |

| 2011-148 CL PB | | | 4.5000 | | | 12/25/2041 | | | 9,624,660 | | | | 10,258,768 | | |

| 2003-24 -CL PD | | | 5.0000 | | | 4/25/2018 | | | 3,828,235 | | | | 4,051,459 | | |

| 2008-77 CL DA | | | 5.0000 | | | 4/25/2023 | | | 3,868,419 | | | | 4,036,231 | | |

| 2010-39 CL PL | | | 5.0000 | | | 10/25/2032 | | | 3,975,410 | | | | 4,086,602 | | |

| 2004-60 CL LB | | | 5.0000 | | | 4/25/2034 | | | 10,156,709 | | | | 11,109,916 | | |

| 2003-W17 CL 1A5 | | | 5.3500 | | | 8/25/2033 | | | 3,722,314 | | | | 3,811,314 | | |

| 2011-19 CL WB | | | 5.5000 | | | 10/25/2018 | | | 8,773,359 | | | | 9,458,120 | | |

| 2009-116 CL PA | | | 5.5000 | | | 4/25/2024 | | | 5,347,701 | | | | 5,611,877 | | |

| 2002-9 CL PC | | | 6.0000 | | | 3/25/2017 | | | 3,410,715 | | | | 3,608,843 | | |

TOTAL AGENCY COLLATERALIZED

MORTGAGE OBLIGATION | | | | $1,063,122,460 | |

NON-AGENCY COLLATERALIZED

MORTGAGE OBLIGATION — 10.8% | | | |

Bayview Opportunity Master Fund Trust | |

| 2012-4NPL CL A† | | | 3.4747 | | | 7/28/2032 | | $ | 4,093,175 | | | $ | 4,098,414 | | |

| 2013-2RPL CL A† | | | 3.4721 | | | 3/28/2016 | | | 7,612,372 | | | | 7,464,685 | | |

| 2013-4RPL CL A† | | | 4.4583 | | | 7/28/2018 | | | 22,843,184 | | | | 22,830,250 | | |

16

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2013

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

| 2013-13NP CL A† | | | 3.7210 | | | 6/28/2033 | | $ | 13,653,327 | | | $ | 13,322,234 | | |

| 2013-14NP CL A† | | | 4.2130 | | | 8/28/2033 | | | 33,915,959 | | | | 33,831,169 | | |

Citicorp Mortgage Securities Inc.

2005-5 CL 2A3 | | | 5.0000 | | | 8/25/2020 | | | 238,117 | | | | 242,237 | | |

Credit Suisse Mortgage Trust 2013-6 1A1† | | | 2.5000 | | | 8/25/2043 | | | 95,566,180 | | | | 93,901,054 | | |

JP Morgan Mortgage Trust 2013-1 CL 2A2† | | | 2.5000 | | | 3/1/2043 | | | 40,690,798 | | | | 39,480,442 | | |

Normandy Mortgage Loan Trust 2013-NPL3 A† | | | 4.9486 | | | 9/16/2043 | | | 35,972,832 | | | | 35,972,832 | | |

Riverview HECM Trust 2007-1 CL A† | | | 0.6000 | | | 5/25/2047 | | | 38,992,864 | | | | 34,976,209 | | |

Sequoia Mortgage Trust | |

| 2013-2 A1 | | | 1.8740 | | | 2/17/2043 | | | 45,622,751 | | | | 42,970,701 | | |

| 2012-1 A1 | | | 2.8650 | | | 1/25/2042 | | | 9,303,549 | | | | 9,209,574 | | |

Stanwich Mortgage Loan Trust Series | |

| 2009-2 A†,* | | | 2.1892 | | | 2/15/2049 | | | 586,046 | | | | 262,080 | | |

| 2010-1 A†,* | | | 1.2897 | | | 9/15/2047 | | | 880,919 | | | | 445,569 | | |

| 2010-2 A†,* | | | 7.5851 | | | 2/28/2057 | | | 4,583,691 | | | | 2,311,097 | | |

| 2010-3 A†,* | | | 1.3103 | | | 7/31/2038 | | | 2,690,006 | | | | 1,345,810 | | |

| 2010-4 A†,* | | | 1.0254 | | | 8/31/2049 | | | 3,217,029 | | | | 1,503,318 | | |

| 2011-1 A†,* | | | 3.8944 | | | 6/30/2039 | | | 5,481,452 | | | | 2,891,077 | | |

| 2011-2 A†,* | | | 2.8890 | | | 9/15/2050 | | | 3,547,404 | | | | 1,898,585 | | |

| 2012-NPL4 CL A† | | | 2.9814 | | | 10/15/2042 | | | 15,624,648 | | | | 15,643,057 | | |

| 2012-NPL5 CL A† | | | 2.9814 | | | 10/16/2042 | | | 32,410,724 | | | | 32,433,408 | | |

| 2013-NPL1 CL A† | | | 2.9814 | | | 2/16/2043 | | | 40,345,388 | | | | 40,448,470 | | |

| 2013-NPL2 CL A† | | | 3.2282 | | | 4/16/2059 | | | 41,900,648 | | | | 41,502,592 | | |

Vericrest Opportunity Loan Transferee | |

| 2012-NL2A A1† | | | 2.4871 | | | 2/25/2052 | | | 10,375,142 | | | | 10,344,120 | | |

| 2012-NL3A A† | | | 2.7344 | | | 11/25/2060 | | | 20,983,534 | | | | 21,024,120 | | |

| 2013-1A A† | | | 3.1049 | | | 11/25/2050 | | | 7,156,995 | | | | 7,162,721 | | |

| 2013-3A A † | | | 3.2216 | | | 5/27/2053 | | | 16,151,455 | | | | 15,844,595 | | |

VRPL 2012-RP3A CL AI† | | | 3.4747 | | | 11/27/2017 | | | 2,505,275 | | | | 2,510,379 | | |

Wells Fargo Mortgage-Backed Securities Trust

2006-5 2A1 | | | 5.2500 | | | 4/25/2021 | | | 7,555,574 | | | | 7,703,437 | | |

TOTAL NON-AGENCY COLLATERALIZED

MORTGAGE OBLIGATION | | | | $543,574,236 | |

AGENCY STRIPPED — 2.8% | | | |

PRINCIPAL ONLY SECURITIES | | | |

Federal Home Loan Mortgage

Corporation 217 | | | 6.5000 | | | 1/1/2032 | | $ | 561,400 | | | $ | 516,883 | | |

17

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2013

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

INTEREST ONLY SECURITIES | | | |

Federal Home Loan Mortgage Corporation | |

| 3714 TI | | | 2.2500 | | | 8/15/2015 | | $ | 48,337,268 | | | $ | 1,517,534 | | |

| 3935 LI | | | 3.0000 | | | 10/15/2021 | | | 7,567,587 | | | | 623,541 | | |

| 3948 AI | | | 3.0000 | | | 10/15/2021 | | | 9,489,414 | | | | 740,364 | | |

| 3956 KI | | | 3.0000 | | | 11/15/2021 | | | 21,236,696 | | | | 1,919,581 | | |

| 3968 AI | | | 3.0000 | | | 12/15/2021 | | | 7,991,172 | | | | 726,921 | | |

| 3992 OI | | | 3.0000 | | | 1/15/2022 | | | 6,318,332 | | | | 578,834 | | |

| 3994 EI | | | 3.0000 | | | 2/15/2022 | | | 13,891,899 | | | | 1,280,241 | | |

| 3998 KI | | | 3.0000 | | | 11/15/2026 | | | 22,805,182 | | | | 2,570,199 | | |

| 3994 AI | | | 3.0000 | | | 2/1/2027 | | | 14,735,925 | | | | 1,351,579 | | |

| 4100 EI | | | 3.0000 | | | 8/15/2027 | | | 105,851,690 | | | | 13,135,570 | | |

| 3706 AI | | | 3.5000 | | | 7/15/2020 | | | 11,895,538 | | | | 692,535 | | |

| 3722 AI | | | 3.5000 | | | 9/15/2020 | | | 14,127,338 | | | | 1,248,321 | | |

| 3735 AI | | | 3.5000 | | | 10/15/2020 | | | 6,716,509 | | | | 618,819 | | |

| 3874 DI | | | 3.5000 | | | 10/15/2020 | | | 12,139,108 | | | | 853,843 | | |

| 3893 DI | | | 3.5000 | | | 10/15/2020 | | | 8,660,725 | | | | 616,342 | | |

| 3753 CI | | | 3.5000 | | | 11/15/2020 | | | 3,100,484 | | | | 298,123 | | |

| 3755 AI | | | 3.5000 | | | 11/15/2020 | | | 12,656,927 | | | | 1,169,706 | | |

| 3760 KI | | | 3.5000 | | | 11/15/2020 | | | 10,382,012 | | | | 849,465 | | |

| 3784 BI | | | 3.5000 | | | 1/15/2021 | | | 8,451,095 | | | | 829,562 | | |

| 3874 BI | | | 3.5000 | | | 6/15/2021 | | | 7,075,827 | | | | 697,283 | | |

| 3893 BI | | | 3.5000 | | | 7/15/2021 | | | 5,848,693 | | | | 557,666 | | |

| 3909 KI | | | 3.5000 | | | 7/15/2021 | | | 5,216,501 | | | | 497,724 | | |

| 3938 IO | | | 3.5000 | | | 10/15/2021 | | | 35,381,296 | | | | 3,559,698 | | |

| 3778 GI | | | 3.5000 | | | 6/15/2024 | | | 6,526,500 | | | | 563,755 | | |

| 3854 GI | | | 3.5000 | | | 11/15/2024 | | | 5,081,338 | | | | 283,106 | | |

| 3852 YI | | | 3.5000 | | | 3/15/2025 | | | 17,071,558 | | | | 1,228,667 | | |

| 3763 NI | | | 3.5000 | | | 5/15/2025 | | | 5,445,981 | | | | 478,772 | | |

| 3904 QI | | | 3.5000 | | | 5/15/2025 | | | 5,883,508 | | | | 453,637 | | |

| 3909 UI | | | 3.5000 | | | 8/15/2025 | | | 9,467,097 | | | | 650,358 | | |

| 3904 NI | | | 3.5000 | | | 8/15/2026 | | | 11,959,859 | | | | 1,413,588 | | |

| 3930 AI | | | 3.5000 | | | 9/15/2026 | | | 15,167,714 | | | | 2,376,512 | | |

| 4018 AI | | | 3.5000 | | | 3/15/2027 | | | 26,737,985 | | | | 3,926,051 | | |

| 3684 CI | | | 4.5000 | | | 8/15/2024 | | | 32,327,603 | | | | 3,397,812 | | |

| 3917 AI | | | 4.5000 | | | 7/15/2026 | | | 44,798,494 | | | | 6,298,776 | | |

217 | | | 6.5000 | | | 1/1/2032 | | | 540,569 | | | | 103,848 | | |

Federal National Mortgage Association | |

| 2011-88 BI | | | 3.0000 | | | 11/25/2020 | | | 5,347,748 | | | | 331,100 | | |

| 2011-141 EI | | | 3.0000 | | | 7/25/2021 | | | 21,541,285 | | | | 1,714,908 | | |

| 2012-8 TI | | | 3.0000 | | | 10/25/2021 | | | 10,011,351 | | | | 795,378 | | |

18

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2013

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

| 2011-113 GI | | | 3.0000 | | | 11/25/2021 | | $ | 9,622,483 | | | $ | 765,448 | | |

| 2011-129 AI | | | 3.0000 | | | 12/25/2021 | | | 12,943,337 | | | | 1,094,188 | | |

| 2012-8 UI | | | 3.0000 | | | 12/25/2021 | | | 31,304,971 | | | | 2,532,297 | | |

| 2011-137 AI | | | 3.0000 | | | 1/25/2022 | | | 17,043,399 | | | | 1,413,818 | | |

| 2011-138 IG | | | 3.0000 | | | 1/25/2022 | | | 19,796,641 | | | | 1,753,925 | | |

2011-145 | | | 3.0000 | | | 1/25/2022 | | | 26,296,278 | | | | 2,198,316 | | |

| 2012-78 AI | | | 3.0000 | | | 2/25/2022 | | | 16,114,973 | | | | 1,301,581 | | |

| 2012-23 IA | | | 3.0000 | | | 3/25/2022 | | | 11,881,961 | | | | 1,055,690 | | |

| 2012-32 AI | | | 3.0000 | | | 4/25/2022 | | | 19,191,641 | | | | 1,734,028 | | |

| 2012-53 CI | | | 3.0000 | | | 5/25/2022 | | | 29,541,410 | | | | 2,694,321 | | |

| 2012-147 CL AI | | | 3.0000 | | | 10/25/2027 | | | 38,635,335 | | | | 4,874,419 | | |

| 2012-145 CL DI | | | 3.0000 | | | 1/25/2028 | | | 21,132,464 | | | | 2,623,841 | | |

| 2012-149 CL CI | | | 3.0000 | | | 1/25/2028 | | | 56,898,585 | | | | 6,998,793 | | |

| 2010-128 LI | | | 3.5000 | | | 11/25/2020 | | | 16,574,223 | | | | 1,430,878 | | |

| 2011-75 BI | | | 3.5000 | | | 11/25/2020 | | | 9,240,473 | | | | 735,452 | | |

| 2011-78 LI | | | 3.5000 | | | 11/25/2020 | | | 23,372,397 | | | | 1,776,347 | | |

| 2010-145 BI | | | 3.5000 | | | 12/25/2020 | | | 8,163,602 | | | | 741,455 | | |

| 2011-61 BI | | | 3.5000 | | | 7/25/2021 | | | 6,917,232 | | | | 702,304 | | |

| 2011-66 QI | | | 3.5000 | | | 7/25/2021 | | | 12,138,302 | | | | 1,151,638 | | |

| 2010-104 CI | | | 3.5000 | | | 10/25/2021 | | | 20,504,447 | | | | 1,973,660 | | |

| 2011-104 DI | | | 3.5000 | | | 10/25/2021 | | | 34,727,659 | | | | 3,216,813 | | |

| 2011-110 AI | | | 3.5000 | | | 11/25/2021 | | | 14,712,166 | | | | 1,395,634 | | |

| 2011-118 IC | | | 3.5000 | | | 11/25/2021 | | | 38,201,941 | | | | 3,747,714 | | |

| 2011-125 DI | | | 3.5000 | | | 12/25/2021 | | | 26,469,291 | | | | 2,668,192 | | |

| 2011-143 MI | | | 3.5000 | | | 1/25/2022 | | | 11,308,526 | | | | 1,018,077 | | |

| 2012-2 MI | | | 3.5000 | | | 2/25/2022 | | | 16,654,565 | | | | 1,745,625 | | |

| 2010-137 BI | | | 3.5000 | | | 2/25/2024 | | | 6,211,249 | | | | 381,001 | | |

| 2010-135 DI | | | 3.5000 | | | 4/25/2024 | | | 12,661,621 | | | | 883,249 | | |

| 2011-75 AI | | | 3.5000 | | | 1/25/2025 | | | 23,250,948 | | | | 1,565,112 | | |

| 2011-66 BI | | | 3.5000 | | | 3/25/2025 | | | 2,963,930 | | | | 163,541 | | |

| 2011-80 KI | | | 3.5000 | | | 4/25/2025 | | | 12,026,008 | | | | 1,061,441 | | |

| 2011-67 CI | | | 3.5000 | | | 8/25/2025 | | | 5,737,275 | | | | 518,902 | | |

| 2011-22 IC | | | 3.5000 | | | 12/25/2025 | | | 11,199,514 | | | | 1,411,348 | | |

| 2011-101 EI | | | 3.5000 | | | 10/25/2026 | | | 24,311,659 | | | | 3,465,527 | | |

| 2011-69 TI | | | 4.0000 | | | 5/25/2020 | | | 8,800,026 | | | | 680,488 | | |

| 2010-89 LI | | | 4.0000 | | | 8/25/2020 | | | 13,383,251 | | | | 1,244,265 | | |

| 2010-104 CI | | | 4.0000 | | | 9/25/2020 | | | 5,998,565 | | | | 563,086 | | |

| 2011-67 EI | | | 4.0000 | | | 7/25/2021 | | | 14,925,184 | | | | 1,370,081 | | |

| 2012-148 CL AI | | | 4.0000 | | | 1/25/2028 | | | 33,725,124 | | | | 4,755,367 | | |

| 2010-110 IH | | | 4.5000 | | | 10/25/2018 | | | 16,689,348 | | | | 1,433,734 | | |

| 2009-70 IN | | | 4.5000 | | | 8/25/2019 | | | 24,302,915 | | | | 1,757,611 | | |

19

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2013

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

| 2008-15 JI | | | 4.5000 | | | 6/25/2022 | | $ | 5,630,425 | | | $ | 249,847 | | |

2010-114 | | | 5.0000 | | | 4/25/2018 | | | 22,156,866 | | | | 1,837,695 | | |

2010-30 | | | 5.0000 | | | 5/25/2018 | | | 8,948,389 | | | | 672,899 | | |

| 2003-64 XI | | | 5.0000 | | | 7/25/2033 | | | 1,586,280 | | | | 346,474 | | |

TOTAL AGENCY STRIPPED | | | | $139,172,724 | |

AGENCY POOL ADJUSTABLE RATE

MORTGAGES — 0.0% | | | |

Federal National Mortgage Association 865963 | | | 2.5290 | | | 3/1/2036 | | $ | 2,331,881 | | | $ | 2,456,194 | | |

ASSET-BACKED SECURITIES | | | |

AUTO — 6.1% | | | |

AmeriCredit Automobile Receivables Trust | |

| 2010-1 C | | | 5.1900 | | | 8/17/2015 | | $ | 2,149,333 | | | $ | 2,187,419 | | |

| 2010-2 D | | | 6.2400 | | | 6/8/2016 | | | 6,990,000 | | | | 7,279,106 | | |

| 2010-3 C | | | 3.3400 | | | 4/8/2016 | | | 4,993,000 | | | | 5,097,634 | | |

| 2010-3 D | | | 4.9800 | | | 1/8/2018 | | | 13,735,000 | | | | 14,429,716 | | |

| 2011-1 B | | | 2.1900 | | | 2/8/2016 | | | 6,197,000 | | | | 6,230,795 | | |

| 2011-2 C | | | 3.1900 | | | 10/8/2016 | | | 8,580,000 | | | | 8,784,633 | | |

| 2011-4 B | | | 2.2600 | | | 9/8/2016 | | | 7,952,000 | | | | 8,048,614 | | |

| 2013-1 A2† | | | 0.4900 | | | 6/8/2016 | | | 31,101,049 | | | | 31,076,694 | | |

| 2013-2 A2 | | | 0.5300 | | | 11/8/2016 | | | 23,386,000 | | | | 23,384,239 | | |

| 2013-4 A2 | | | 0.7400 | | | 11/8/2016 | | | 48,087,000 | | | | 48,103,071 | | |

Credit Acceptance Auto Loan Trust 2012-1A B† | | | 3.1200 | | | 3/16/2020 | | | 4,500,000 | | | | 4,552,871 | | |

DT Auto Owner Trust | |

| 2012-2A B† | | | 1.8500 | | | 4/17/2017 | | | 7,352,000 | | | | 7,365,090 | | |

| 2012-2A B† | | | 1.7800 | | | 6/15/2017 | | | 9,548,000 | | | | 9,547,405 | | |

Exeter Automobile Receivables Trust

2013-2A A† | | | 1.4960 | | | 11/15/2017 | | | 34,000,000 | | | | 33,999,881 | | |

Prestige Automobile Receivables Trust

2013-1A A2† | | | 1.0900 | | | 2/15/2018 | | | 14,246,378 | | | | 14,251,847 | | |

Santander Drive Auto Receivables Trust | |

| 2011-4 A2 | | | 1.3700 | | | 3/15/2015 | | | 5,181 | | | | 5,183 | | |

| 2012-1 A2 | | | 1.2500 | | | 4/15/2015 | | | 1,042,353 | | | | 1,043,270 | | |

| 2012-3 A3 | | | 1.0800 | | | 4/15/2016 | | | 3,790,000 | | | | 3,797,699 | | |

| 2012-4 A3 | | | 1.0400 | | | 8/15/2016 | | | 7,157,000 | | | | 7,179,511 | | |

| 2012-6 A2 | | | 0.4700 | | | 9/15/2015 | | | 33,019,213 | | | | 33,003,195 | | |

| 2013-1 A2 | | | 0.4800 | | | 2/16/2016 | | | 10,623,838 | | | | 10,618,404 | | |

| 2013-3 A2 | | | 0.5500 | | | 9/15/2016 | | | 5,432,000 | | | | 5,423,961 | | |

20

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2013

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

Westlake Automobile Receivables Trust

2013-1A A1† | | | 0.5500 | | | 10/15/2014 | | $ | 20,135,000 | | | $ | 20,135,201 | | |

TOTAL ASSET-BACKED

SECURITIES-AUTO | | | | $305,545,439 | |

ASSET-BACKED SECURITIES-OTHER — 6.5% | | | |

Beacon Container Finance LLC 2012-1A A† | | | 3.7200 | | | 9/20/2022 | | $ | 9,573,187 | | | $ | 9,691,616 | | |

CLI Funding LLC | |

| 2011-2A CL A† | | | 4.9400 | | | 10/18/2026 | | | 20,314,610 | | | | 20,417,694 | | |

| 2012-1A † | | | 4.2100 | | | 12/18/2022 | | | 43,629,975 | | | | 44,639,573 | | |

Cronos Containers Program | |

| 2011-1A† | | | 4.9400 | | | 11/18/2021 | | | 14,230,417 | | | | 14,346,822 | | |

| 2012-2A A† | | | 3.8100 | | | 9/18/2027 | | | 30,533,399 | | | | 31,014,153 | | |

Global Tower Partners Acquisition Partners† | | | 4.7040 | | | 5/15/2018 | | | 15,981,000 | | | | 15,301,648 | | |

HFG HEALTHCO-4 LLC 2011-1A A† | | | 2.4321 | | | 6/2/2017 | | | 16,552,000 | | | | 16,800,280 | | |

Insite Issuer LLC† | | | 8.5950 | | | 8/15/2043 | | | 11,613,000 | | | | 11,613,000 | | |

MMAF Equipment Finance LLC 2013-AA A2† | | | 0.6900 | | | 5/9/2016 | | | 20,656,000 | | | | 20,657,886 | | |

PFS Financing Corpation | |

| 2011-BA A† | | | 1.6823 | | | 10/17/2016 | | | 4,710,000 | | | | 4,749,005 | | |

| 2011-BA B† | | | 2.4323 | | | 10/17/2016 | | | 4,000,000 | | | | 4,008,318 | | |

Panhandle-Plains Student Finance Corp

2001-1 CL A2 | | | 2.2900 | | | 12/1/2031 | | | 5,900,000 | | | | 5,811,500 | | |

Progresso Receivables Funding I LLC

2013-A CL A† | | | 4.0000 | | | 7/9/2018 | | | 14,984,000 | | | | 14,909,080 | | |

Global SC Finance SRL 2012-1A CL A† | | | 4.1100 | | | 7/17/2027 | | | 9,482,583 | | | | 9,576,555 | | |

Store Master Funding LLC 2012-1A CLA† | | | 5.7700 | | | 8/20/2042 | | | 16,986,804 | | | | 17,365,440 | | |

TAL Advantage LLC | |

| 2006-1A† | | | 0.3700 | | | 4/20/2021 | | | 11,883,333 | | | | 11,598,371 | | |

| 2011-1A A† | | | 4.6000 | | | 1/20/2021 | | | 3,205,400 | | | | 3,235,370 | | |

Textainer Marine Containers Ltd 2012-1A A† | | | 4.2100 | | | 4/15/2027 | | | 14,884,358 | | | | 15,113,546 | | |

Triton Container Finance LLC 2006-1A† | | | 4.2100 | | | 5/14/2027 | | | 6,733,133 | | | | 6,820,933 | | |

Unison Ground Lease Fund† | | | 5.7800 | | | 3/16/2020 | | | 10,932,000 | | | | 10,590,657 | | |

Unison Ground Lease Fund† | | | 6.2680 | | | 3/16/2020 | | | 3,768,000 | | | | 3,715,964 | | |

Unison Ground Lease Fund† | | | 9.5220 | | | 4/15/2020 | | | 19,600,000 | | | | 22,235,024 | | |

WCP Issuer LLC 2013-1 CL B† | | | 6.6570 | | | 8/15/2020 | | | 15,347,000 | | | | 14,901,937 | | |

TOTAL ASSET-BACKED SECURITIES | | | | $329,114,372 | |

U.S. TREASURY SECURITIES — 12.9% | | | |

U.S Treasury Note | | | 0.2500 | | | 1/31/2014 | | $ | 50,000,000 | | | $ | 50,035,645 | | |

U.S Treasury Note | | | 0.2500 | | | 3/31/2014 | | | 150,000,000 | | | | 150,139,890 | | |

21

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2013

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

U.S Treasury Note | | | 0.2500 | | | 4/30/2014 | | $ | 75,000,000 | | | $ | 75,076,170 | | |

U.S Treasury Note | | | 0.7500 | | | 12/15/2013 | | | 75,000,000 | | | | 75,108,398 | | |

U.S Treasury Note | | | 1.0000 | | | 1/15/2014 | | | 50,000,000 | | | | 50,138,915 | | |

U.S Treasury Note | | | 1.0000 | | | 5/15/2014 | | | 50,000,000 | | | | 50,283,935 | | |

U.S Treasury Note | | | 1.2500 | | | 3/15/2014 | | | 70,000,000 | | | | 70,380,079 | | |

U.S Treasury Note | | | 1.7500 | | | 3/31/2014 | | | 50,000,000 | | | | 50,419,920 | | |

U.S Treasury Note | | | 1.8750 | | | 2/28/2014 | | | 75,000,000 | | | | 75,565,800 | | |

TOTAL U.S. TREASURY SECURITIES | | | | $647,148,752 | |

CORPORATE BONDS & DEBENTURES — 5.2% | | | |

Boart Longyear Management Pty Ltd† | | | 10.0000 | | | 10/1/2018 | | $ | 21,104,000 | | | $ | 21,473,320 | | |

British Airways plc † | | | 5.6250 | | | 6/20/2020 | | | 8,375,000 | | | | 8,500,625 | | |

Continental Airlines Company | |

| 1997-1 1A | | | 7.4610 | | | 4/1/2015 | | | 796,692 | | | | 797,688 | | |

2000-1 | | | 8.3880 | | | 11/1/2020 | | | 8,298,611 | | | | 8,665,409 | | |

Delta Airlines | |

| 2012-1B† | | | 6.8750 | | | 5/7/2019 | | | 2,238,662 | | | | 2,344,998 | | |

N671US† | | | 7.5000 | | | 9/15/2020 | | | 18,935,837 | | | | 18,935,837 | | |

Fidelity National Information Services | | | 7.8750 | | | 7/15/2020 | | | 14,162,000 | | | | 15,690,248 | | |

HD Supply Inc. | | | 8.1250 | | | 4/15/2019 | | | 43,314,000 | | | | 47,970,255 | | |

Lease Air Trust | |

| 2012 A1† | | | 6.7500 | | | 4/25/2016 | | | 23,357,917 | | | | 23,357,917 | | |

| 2012 A2† | | | 6.7500 | | | 4/25/2016 | | | 3,730,312 | | | | 3,739,637 | | |

Nielsen Finance LLC Co. | | | 7.7500 | | | 10/15/2018 | | | 35,780,000 | | | | 38,821,300 | | |

Northwest Airlines | |

| 1999-2 B | | | 7.9500 | | | 9/1/2016 | | | 5,627,092 | | | | 5,978,785 | | |

| 1999-2 C | | | 8.3040 | | | 9/1/2019 | | | 8,254,799 | | | | 8,450,850 | | |

| 2000-1 G | | | 7.1500 | | | 10/1/2020 | | | 19,613,564 | | | | 20,398,107 | | |

US Airways PT Trust | |

| 1998-1B | | | 7.3500 | | | 7/30/2019 | | | 8,842,272 | | | | 9,273,333 | | |

| 1998-1C | | | 6.8200 | | | 1/30/2016 | | | 28,949,725 | | | | 28,225,982 | | |

TOTAL CORPORATE BONDS &

DEBENTURES | | | | $262,624,291 | |

CORPORATE BANK DEBT — 2.3% | | | |

Emdeon Term Loan BL0979577† | | | 3.7500 | | | 11/2/2018 | | $ | 16,517,602 | | | $ | 16,517,106 | | |

Kar Auction Services Term Loan BL095302† | | | 3.7500 | | | 5/18/2017 | | | 14,543,166 | | | | 14,552,474 | | |

La Frontera Generation Term Loan B† | | | 4.5000 | | | 9/30/2020 | | | 32,154,000 | | | | 32,173,292 | | |

Nielsen Finance LLC Term Loan LN 284932† | | | 2.3932 | | | 5/1/2016 | | | 11,714,063 | | | | 11,742,879 | | |

22

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2013

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

OCI Beaumont LLC | |

Term Loan B1† | | | 6.2500 | | | 8/20/2019 | | $ | 7,633,264 | | | $ | 7,643,569 | | |

Term Loan B2† | | | 6.2500 | | | 8/20/2019 | | | 14,350,536 | | | | 14,369,909 | | |

Toys R Us Property Term Loan† | | | 6.0000 | | | 8/21/2019 | | | 16,426,000 | | | | 16,289,500 | | |

TOTAL CORPORATE BANK DEBT | | | | $113,288,729 | |

TOTAL INVESTMENT SECURITIES — 96.5%

(Cost $4,924,467,717) | | | | $4,856,455,677 | |

SHORT-TERM INVESTMENTS — 4.1%

(Cost $204,959,940) | |

Exxon Mobil Corporation | | | 0.0400 | | | 10/7/2013 | | $ | 50,000,000 | | | $ | 49,999,667 | | |

Exxon Mobil Corporation | | | 0.0400 | | | 10/10/2013 | | | 51,870,000 | | | | 51,869,481 | | |

General Electric Company | | | 0.0300 | | | 10/1/2013 | | | 53,091,000 | | | | 53,091,000 | | |

Toyota Motor Credit Corporation | | | 0.0500 | | | 10/4/2013 | | | 50,000,000 | | | | 49,999,792 | | |

TOTAL SHORT-TERM INVESTMENTS | | | | $204,959,940 | |

TOTAL INVESTMENTS — 100.6%

(Cost $5,129,427,657) | | | | $5,061,415,617 | |

Other assets and liabilities, net — (0.6)% | | | | (28,848,238) | |

TOTAL NET ASSETS — 100.0% | | | | $5,032,567,379 | |

* These securities have been valued in good faith under policies adopted by authority of the Board of Directors in accordance with the Fund's fair value procedures. These securities constituted 0.2% of total net assets at September 30, 2013

† Restricted securities. These restricted securities constituted 25.85% of total net assets at September 30, 2013, most of which are considered liquid by the Adviser. These securities are not registered and may not be sold to the public. There are legal and/or contractual restrictions on resale. The Fund does not have the right to demand that such securities be registered. The values of these securities are determined by valuations provided by pricing services, brokers, dealers, market makers, or in good faith under policies adopted by authority of the Fund's Board of Directors.

23

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES

September 30, 2013

Issuer | | Acquisition

Date (s) | | Cost | | Fair

Value | | Fair

Value as a %

of Net Assets | |

Banc of America Large Loan

2010-HLTN | | 11/15/12 | | $ | 15,348,401 | | | $ | 15,371,867 | | | | 0.31 | % | |

Del Coronado Trust

2013-HDMZ CL M | | 4/1/13 | | | 6,840,058 | | | | 6,853,530 | | | | 0.14 | % | |

GS Mortgage Securities Corporation II

2007-EOP A3 | | 10/21/11, 12/5/11,

1/13/12 | | | 15,544,164 | | | | 15,810,822 | | | | 0.31 | % | |

JP Morgan Clearing Corporation

2011-FL1 MH | | 12/14/11 | | | 19,300,000 | | | | 19,706,600 | | | | 0.39 | % | |

Lehman Brothers Floating Rate

Commercial 2007-LLFA F | | 2/8/13 | | | 12,213,180 | | | | 12,323,034 | | | | 0.24 | % | |

LSTAR Commercial Mortgage Trust

2001-1 A | | 6/23/11 | | | 3,654,551 | | | | 3,683,278 | | | | 0.07 | % | |

Motel 6 Trust 2012-MTL6 D | | 11/2/12, 3/12/13,

3/14/13 | | | 37,118,870 | | | | 36,700,084 | | | | 0.73 | % | |

Motel 6 Trust 2012-MTL6 E | | 11/2/12 | | | 10,060,970 | | | | 9,695,659 | | | | 0.19 | % | |

Ores NPL LLC 2013-LV2 CL A | | 8/9/13 | | | 29,794,444 | | | | 29,803,382 | | | | 0.59 | % | |

RREF 2012 LT1 LLC 2013-LT2 CL A | | 3/20/13 | | | 17,007,804 | | | | 17,007,818 | | | | 0.34 | % | |

Starwood Commercial Mortgage Trust

2013-FV1 CL B | | 7/30/13 | | | 18,051,000 | | | | 18,067,607 | | | | 0.36 | % | |

Washington Mutual Commercial

Mortgage Series Trust

2007-SL2 CL A | | 5/22/09, 9/22/11,

2/29/12 | | | 4,736,407 | | | | 8,292,674 | | | | 0.16 | % | |

Bayview Opportunity Master Fund Trust

2012-4NPL CL A | | 9/7/12 | | | 4,093,174 | | | | 4,098,414 | | | | 0.08 | % | |

Bayview Opportunity Master Fund Trust

2013-2RPL CL A | | 4/11/13 | | | 7,612,371 | | | | 7,464,685 | | | | 0.15 | % | |

Bayview Opportunity Master Fund Trust

2013-4RPL CL A | | 8/9/13 | | | 22,843,184 | | | | 22,830,250 | | | | 0.45 | % | |

Bayview Opportunity Master Fund Trust

2013-13NP CL A | | 6/10/13 | | | 13,653,327 | | | | 13,322,234 | | | | 0.26 | % | |

Bayview Opportunity Master Fund Trust

2013-14NP CL A | | 7/24/13 | | | 33,915,959 | | | | 33,831,169 | | | | 0.67 | % | |

Credit Suisse Mortgage Trust

2013-6 1A1 | | 7/26/13 | | | 93,177,025 | | | | 93,901,054 | | | | 1.87 | % | |

JP Morgan Mortgage Trust

2013-1 CL 2A2 | | 3/25/13 | | | 41,369,949 | | | | 39,480,442 | | | | 0.78 | % | |

Normandy Mortgage Loan Trust

2013-NPL3 A | | 8/28/13 | | | 35,972,832 | | | | 35,972,832 | | | | 0.71 | % | |

Riverview HECM Trust 2007-1 CL A | | 1/9/13 | | | 35,483,507 | | | | 34,976,209 | | | | 0.69 | % | |

24

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES

(Continued)

September 30, 2013

Issuer | | Acquisition

Date (s) | | Cost | | Fair

Value | | Fair

Value as a %

of Net Assets | |

Stanwich Mortgage Loan Trust Series

2009-2 A | | 9/22/11 | | $ | 260,289 | | | $ | 262,080 | | | | 0.01 | % | |

Stanwich Mortgage Loan Trust Series

2010-1 A | | 4/22/2010, 9/22/11 | | | 370,956 | | | | 445,569 | | | | 0.01 | % | |

Stanwich Mortgage Loan Trust Series

2010-2 A | | 5/21/2010, 9/22/11 | | | 2,347,211 | | | | 2,311,097 | | | | 0.05 | % | |

Stanwich Mortgage Loan Trust Series

2010-3 A | | 6/2/2010, 9/22/11 | | | 1,125,080 | | | | 1,345,810 | | | | 0.03 | % | |

Stanwich Mortgage Loan Trust Series

2010-4 A | | 8/4/2010, 9/22/11 | | | 1,497,930 | | | | 1,503,318 | | | | 0.03 | % | |

Stanwich Mortgage Loan Trust Series

2011-1 A | | 5/10/2011, 9/22/11 | | | 2,524,355 | | | | 2,891,077 | | | | 0.06 | % | |

Stanwich Mortgage Loan Trust Series

2011-2 A† | | 6/10/2011, 9/22/11 | | | 1,350,372 | | | | 1,898,585 | | | | 0.04 | % | |

Stanwich Mortgage Loan Trust Series

2012-NPL4 CL A | | 9/24/12 | | | 15,624,648 | | | | 15,643,057 | | | | 0.31 | % | |

Stanwich Mortgage Loan Trust Series

2012-NPL5 CL A | | 11/5/12, 11/20/12,

3/12/13 | | | 32,440,241 | | | | 32,433,408 | | | | 0.64 | % | |

Stanwich Mortgage Loan Trust Series

2013-NPL1 CL A | | 2/15/13 | | | 40,344,080 | | | | 40,448,470 | | | | 0.80 | % | |

Stanwich Mortgage Loan Trust Series

2013-NPL2 CL A | | 5/31/13 | | | 41,900,648 | | | | 41,502,592 | | | | 0.82 | % | |

Vericrest Opportunity Loan Transferee

2012-NL2A A1 | | 9/14/12, 10/16/12 | | | 10,381,510 | | | | 10,344,120 | | | | 0.21 | % | |

Vericrest Opportunity Loan Transferee

2012-NL3A A | | 11/15/12, 2/12/13 | | | 20,990,386 | | | | 21,024,120 | | | | 0.42 | % | |

Vericrest Opportunity Loan Transferee

2013-1A A | | 1/18/13 | | | 7,156,995 | | | | 7,162,721 | | | | 0.14 | % | |

Vericrest Opportunity Loan Transferee

2013-3A A | | 5/9/2013,

8/29/2013 | | | 16,000,823 | | | | 15,844,595 | | | | 0.31 | % | |

VRPL 2012-RP3A CL AI | | 11/16/12 | | | 2,505,270 | | | | 2,510,379 | | | | 0.05 | % | |

AmeriCredit Automobile Receivables

Trust 2013-1 A2 | | 1/15/13 | | | 31,100,023 | | | | 31,076,694 | | | | 0.62 | % | |

Credit Acceptance Auto Loan Trust

2012-1A B | | 3/22/12 | | | 4,499,265 | | | | 4,552,871 | | | | 0.09 | % | |

DT Auto Owner Trust 2012-2A B | | 7/17/12 | | | 7,351,623 | | | | 7,365,090 | | | | 0.15 | % | |

DT Auto Owner Trust 2012-2A B | | 9/17/13 | | | 9,547,310 | | | | 9,547,405 | | | | 0.19 | % | |

Exeter Automobile Receivables Trust

2013-2A A | | 9/11/13 | | | 33,999,541 | | | | 33,999,881 | | | | 0.68 | % | |

25

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES

(Continued)

September 30, 2013

Issuer | | Acquisition

Date (s) | | Cost | | Fair

Value | | Fair

Value as a %

of Net Assets | |

Prestige Automobile Receivables Trust

2013-1A A2 | | 8/27/13 | | $ | 14,248,604 | | | $ | 14,251,847 | | | | 0.28 | % | |

Westlake Automobile Receivables Trust

2013-1A A1 | | 9/18/13 | | | 20,135,000 | | | | 20,135,201 | | | | 0.40 | % | |