UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-1735 |

|

FPA NEW INCOME, INC. |

(Exact name of registrant as specified in charter) |

|

11601 WILSHIRE BLVD., SUITE 1200, LOS ANGELES, CALIFORNIA | | 90025 |

(Address of principal executive offices) | | (Zip code) |

|

J. RICHARD ATWOOD, 11601 WILSHIRE BLVD., SUITE 1200, LOS ANGELES, CALIFORNIA 90025 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 310-473-0225 | |

|

Date of fiscal year end: | SEPTEMBER 30 | |

|

Date of reporting period: | SEPTEMBER 30, 2014 | |

| | | | | | | | | |

Item 1. Report to Stockholders.

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Dear Fellow Shareholders:

This Annual Report covers the year ended September 30, 2014. Your Fund's net asset value (NAV) closed at $10.24. During the fiscal year, your Fund paid four income dividends totaling $0.36. There were no capital gains distributions.

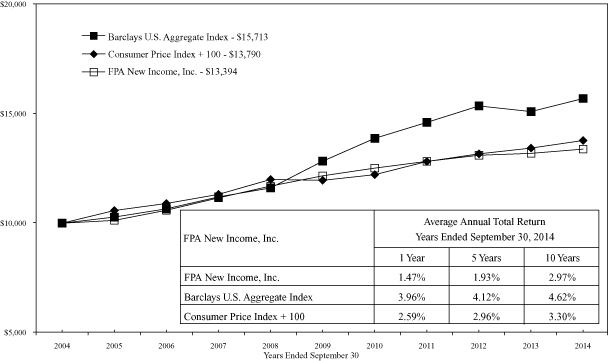

The following table shows the average annual total return for several different periods ended on September 30, 2014 for the Fund and comparative indices of securities prices.

| | | Periods Ended September 30, 2014 | |

| | | 1 Year | | 5 Years | | 10 Years | | 15 Years | | 20 Years | | 7/11/1984

Inception | |

FPA New Income | | | 1.47 | % | | | 1.93 | % | | | 2.97 | % | | | 4.35 | % | | | 5.13 | % | | | 7.54 | % | |

Barclays U.S. Aggregate Bond Index | | | 3.96 | % | | | 4.12 | % | | | 4.62 | % | | | 5.57 | % | | | 6.13 | % | | | 7.88 | % | |

Consumer Price Index + 100

Basis Points | | | 2.59 | % | | | 2.96 | % | | | 3.30 | % | | | 3.37 | % | | | 3.38 | % | | | N/A | | |

The Fund continues to perform in line with our expectations. Our emphasis on high-quality, short-duration bonds led to our year-to-date return of 1.27% through September 30, 2014 versus 4.10% for the Barclays U.S. Aggregate Bond Index and 2.06% for the CPI + 100. For the second half of the fiscal year, your Fund's return was 0.68%, 2.21% for the Barclays Index and 1.34% for the CPI + 100.

Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown. This data represents past performance, and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment may be worth more or less than its original cost. Current month-end performance data can be obtained by visiting the website at www.fpafunds.com or by calling toll-free, 1-800-982-4372. Information regarding the Fund's expense ratio and redemption fees can be found on pages 44 and 48.

Portfolio Commentary

During the past quarter the Fund appreciated 0.10%, roughly in line with the Barclays U.S. Aggregate Bond Index return of 0.17%.We were pleased with our risk-adjusted performance during the quarter, as we captured about 60% of the Index's return while only taking on ~20% of the interest rate risk (as measured by duration).

Performance from a sector perspective was primarily driven by the holdings of asset backed securities1 (ABS) with the equipment segment doing very well followed by the automobile loan-backed securities. The collateralized mortgage obligation2 (CMO) holdings exhibited mixed results with the agency backed principal and interest securities producing a negative return, while the non-agency-backed securities and interest-only securities providing positive returns. The portfolio's agency mortgage pools also contributed positively to returns. The commercial mortgage backed securities3 (CMBS) returns continue to be driven by the GNMA Project Loan

1 Asset-backed securities are bonds or notes backed by assets.

2 Collateralized mortgage obligations are mortgage-backed bonds that separate mortgage pools into different maturity classes.

3 Commercial mortgage backed securities are securities backed by commercial mortgages rather than residential mortgages.

1

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS (Continued)

Interest Only securities. The portfolio's corporate bond holdings had a more difficult time during the quarter and were a small detractor from performance.

Portfolio Activity

We continue to look at investment opportunities across multiple sectors of the bond market. In our view the bond market is still exhibiting a skewed risk/return profile, with risk being too large. The investment characteristics of bonds we find attractive remain similar to what we have pursued over the past twelve months. Specifically we have added to the shorter automobile loan backed ABS bonds, along with other types of ABS bonds. Within the single family mortgage sector of the market, bonds or pools backed by seasoned 15-year agency backed mortgage loans are our preferred area of interest. Within the CMBS portion of the market we are still able to periodically accumulate GNMA Project Loan Interest Only securities. The high yield corporate segment of the portfolio has been active during the quarter. Many of the bonds purchased a little over a year ago that were callable did in fact get called. However, with the high yield market experiencing some difficulty, we were able to re-deploy that capital into attractive callable high yield bonds and keep the same level of allocation to high yield corporate bonds as in the previous quarter. Allocation to other sectors has remained stable over the past quarter.

The profile of the portfolio did not change dramatically over the quarter as there was little movement in either domestic investment grade yields or inflation expectations. Our duration increased from 1.25 to 1.36 while our yield-to-worst4 increased from 1.85 to 2.02.

A Note About the Recent Dividend Payment

The FPA New Income's distribution was $0.05 this quarter, which was less than the $0.07-$0.08 range in prior quarters for a number of reasons:

• The amortization of the notional amount of all our interest only securities increased, and given a general reduction in our exposure to this sector, the resulting income for the quarter was reduced.

• Over the past three months, the amount of prepayment penalties received from our GNMA Project Loan Interest Only securities declined.

• Lastly, new investments in the "high quality" portion of the portfolio have been generating somewhat lower yields than those owned previously and, though yielding more than the money market investments they replaced, have not been held long enough to make a significant difference to our total income for the quarter.

Market Commentary

3 Ds: Deflation, Default, and Devaluation

Lombard Street Research, a London-based economic research organization, recently discussed their view for how a developed economy might deal with excess debt resulting from the financial crisis. They call it the 3 Ds: deflation, default, and devaluation. So how are the United States, Europe and Japan graded against the 3 Ds?

4 Yield to worst is the lowest possible yield on a callable bond. As of September 30, 2014, the SEC yield was 2.23%. This calculation begins with the Fund's dividend payments for the last 30 days, subtracts Fund expenses and uses this number to estimate your returns for a year. The SEC yield is based on the price of the Fund at the beginning of the month. The income yield stated here reflects prospective data and thus assumes payments collected by the Fund may fluctuate.

2

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS (Continued)

United States

Inflation in the U.S. over the past six years has averaged 1.6% compared to a 2.8% average over the past 30 years. Consumer spending which is a primary driver of demand, has not pushed inflation upwards, evidenced by the Unadjusted Retail Sales Total reported by the U.S. Census Bureau which increased by 2.9% annually over the past six years versus a 3.8% annual increase over the past 30 years. Concurrently, the Federal Government ran a substantial deficit of almost 10% of nominal GDP in fiscal year 2009 declining to an estimated 2.9% in fiscal year 2014. This resulted in a deflationary underpinning to the economy.

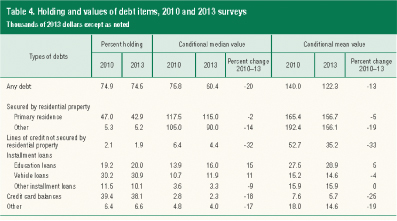

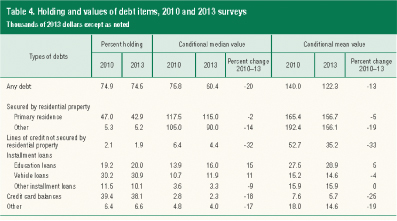

Default and debt repayment by the consumer sector has been very pronounced over the past six years. The table below from the Federal Reserve Bank 2013 Survey of Consumer Finance illustrates this point.

Source: Federal Reserve Bank

The amount of debt held by households measured either by median or mean declined from 2010 to 2013. The same is true for secured debt, whether primary residence or other. The median level of student loan debt increased, as did loans against a vehicle. Both of these data points are not a surprise. Of note is the percentage of households surveyed that reported primary resident debt decline due to the decline in the percentage of households that own a home.

3

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS (Continued)

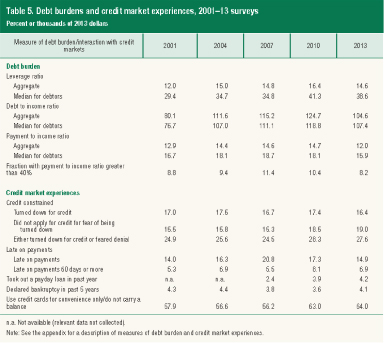

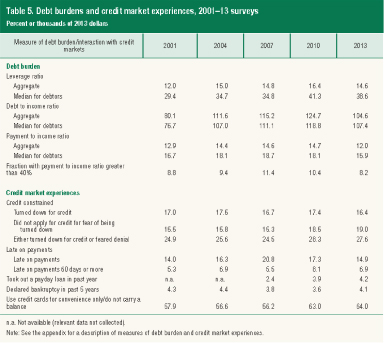

The following chart from the same survey shows the change in the household balance sheet and income statement as it relates to leverage and ability to service the debt outstanding.

Source: Federal Reserve Bank

The amount of leverage on the household balance sheet declined slightly over the past three years, as illustrated by the leverage ratio declining from 41.3% in 2010 to 38.6% in 2013. However, it is still elevated when compared to the survey periods 2001, 2004, and 2007. The payment-to-income ratio has declined as well due to the Fed Zero Interest Rate Policy (ZIRP) and Quantitative Easing (QE) and is at the lowest level for any of the survey periods. The number of households reporting late payments has declined with the overall group declining close to the level experienced in the 2001 survey, and the 60-day or more late payment group declining back to the 2004 level. Finally, the percent of households that do not carry a balance on their credit card is at the highest level of any period reported. This data indicates a stronger financial position for the household portion of the economy. This reduction of debt and improvement in the balance sheet and income statement of U.S.

4

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS (Continued)

households is a solid contributing factor to the slower retail sales growth and inflation outlined under the first "D" deflation.

As for devaluation, if we look at the U.S. Dollar Spot Index5 going back six years, the index averaged 80.3, which represents its value at the beginning and the end of the time period from 10/1/08-6/30/14. During that time period the value has ranged within +/-10% of the average. Beginning in the third quarter 2014, the index has appreciated by approximately 7%.

Overall the U.S. economy has done fairly well with the 3 "D's" and as a result its prospects for growth going forward have improved. This is one of the factors that leads us to believe that the shape of the Treasury yield curve may likely change from its current very steep shape (short rates significantly lower than long term rates) to a flatter configuration (short rates much closer to the level of longer term interest rates).

Europe and Japan

What about Europe and Japan? We can summarize their situation as follows. Deflation has been a long-term problem in Japan. In Europe deflation has been more acute with the region's CPI declining from about 3% a few years ago to the latest measurement of 0.3%. Both regions continue to be highly levered as measured by government debt to GDP with Japan at approximately 226% and the levels in Europe for the countries such as Greece, Spain, and Italy being higher today than when the Greek debt crisis occurred several years ago. As for currency devaluation, in both Japan and Europe changes have occurred in a fairly dramatic fashion. In Japan the yen has declined by about 40% since the announcement of the huge quantitative easing program, which achieved the stated objective of currency devaluation. Europe too has just recently experienced currency devaluation, as the region's economy has lurched closer to another recession.

So how may this impact the U.S. bond market and how we deploy capital? The table below shows the difference in yield for a Japanese government bond, a German government bond, and a U.S. Treasury as of 9/30/2014.

Country | | 5-Year Maturity | | 10-Year Maturity | |

United States | | | 1.76 | % | | | 2.49 | % | |

France | | | 0.33 | % | | | 1.28 | % | |

Germany | | | 0.15 | % | | | 0.95 | % | |

Japan | | | 0.17 | % | | | 0.53 | % | |

Source: Bloomberg

There is a significant incentive for an investor in those countries to take capital and buy a U.S. Treasury for additional yield (assuming U.S. inflation remains muted). This capital may also find our stock and credit markets more attractive given the U.S.'s better growth prospects. A strengthening dollar combined with the prospects of households having more disposable income could cause the U.S. economy to be stronger in 2015 than 2014. The result is that risk assets may continue to be highly valued and that some of the flattening of the yield curve we expect could come from longer maturity Treasury yields either declining or, if the Fed starts raising rates, increasing at a slower rate than previous periods of the Fed raising rates.

5 A measure of the value of the U.S. dollar relative to the majority of its most significant trading partners.

5

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS (Continued)

A Lesson Learned

Investing is not always about celebrating success. Though we try very hard to avoid it, sometimes mistakes happen. We strive to give our investors as much transparency as possible about our process, both good and bad. In that vein, we have never been shy about acknowledging our errors and we will do so again here. Discussing mistakes is an exercise in introspection that helps us (and our clients) become better investors. The following is a topic we had previously discussed during our Q3 2013 webcast.

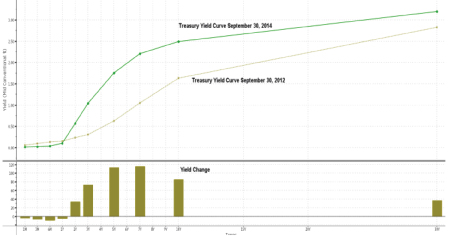

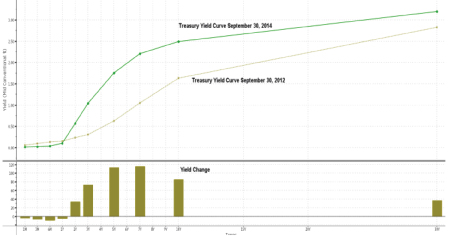

In the fourth quarter of 2012, the yield curve looked much different than it looks today. The chart below compares the yield curve as of September 30, 2012 to the yield curve as of September 30, 2014.

Source: Bloomberg

At the beginning of Q3 2012, the 10-year Treasury yield was 1.63%, off of a recent multi-year low of 1.39%. In the midst of the Federal Reserve's quantitative easing program, before the word "taper" had ever been muttered, we were concerned about a sustained period of extremely low rates (a so called "Japan Scenario") and the implications that such a rate environment could have on our portfolio.

A significant portion of our portfolio was comprised of agency mortgage bonds that were priced at a premium. When interest rates are low, borrowers have an incentive to refinance debt at a lower interest rate. Prepayments of principal (whether via refinancing or housing turnover) are punitive for premium bonds because they result in a loss of the premium.

To address the risk of low rates reducing the return on our premium holdings via brisk refinancing activity, we searched for investments that might provide some upside to the portfolio in a protracted low interest rate environment. Working within the constraints of our investment guidelines, our search led us to an investment in CMO support bonds that were priced at a discount to par. Our thesis was that low rates would lead to greater

6

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS (Continued)

refinancing activity, which, for a discount bond, is a good outcome because we would capture the discount quickly, and thereby enhance the return.

Two elements were necessary to make this investment work. First, buying a discount priced bond necessitated buying a support bond. Support bonds are riskier because principal payments could be redirected to other bonds (and away from our investment) in the event that prepayment activity is slow which extends the bond's average life.

To mitigate the risk of slow prepayment activity, the other necessary element was collateral that is conducive to fast prepayment speeds. We specified high credit quality jumbo borrowers with low indebtedness. The premise in specifying this particular collateral was that these borrowers have multiple options available to them in terms of creating potential prepayment events for our bonds. Also, residing in California, these borrowers also tend to exhibit greater housing turnover that leads to a prepayment event. As such, even in a rising interest rate environment, we would have expected these borrowers to prepay faster than a typical borrower.

Our error came in how we specified this collateral. We had specified average criteria — average FICO6, average loan-to-value, etc. When the collateral arrived, although the averages met our specifications, the distribution around the averages was not consistent with the borrower profile we were targeting. (Going forward we will specify our distribution preference in addition to our average criteria.) For example, we requested a specific average debt-to-income ratio. The average debt-to-income ratio for the loans that we received was consistent with the average but the pool of loans was comprised of a broad distribution of high debt-to-income ratio loans and low debt-to-income ratio loans rather than a tight cluster of loans around the average. As a result, while on average, our borrowers should have been able to easily refinance their loans, that average borrower did not actually exist in our loan pool. In reality, we had a large number of borrowers whose debt-to-income ratio was high enough that they had limited financing options.

Due to this skewed loan distribution, when interest rates rose during 2013, our borrowers no longer had an incentive to refinance their loans because they could not refinance at a lower rate. This lack of refinancing incentive was expected. However, the other elements that we thought would mitigate slowing prepayment speeds (i.e., the high quality borrower) did not exist as we had expected. Consequently, these bonds exhibited extremely slow prepayment speeds. Due to the aforementioned structural features of the bonds that redirected principal payments away from the bonds when prepayment speeds slowed, these bonds experienced a significant extension in weighted average life. The increase in weighted average life led to a significant decline in price.

Seeing no prospect for prepayment speeds on these bonds to increase meaningfully and persistently, and a poor risk/reward profile even after they declined in price, we sold these bonds during the third quarter. The good news is that, consistent with our risk management process, we purposely limited the portfolio's exposure to this investment. Our total exposure to these bonds represented approximately at 2% at time of purchase and 1.5% of the portfolio as of June 30, 2014. We sold these bonds at an average holding period loss of approximately 7.6% versus the price at which we owned the bonds as of June 30, 2014 and an average holding period loss of approximately 12% since the time of the investment in December 2012. Due to the small position size, the investment had an approximate 11 basis point negative impact on the Fund's return in Q3 2014.

This investment reinforced important investment practices we know well including: mind the details and weigh upside versus downside. This investment also reinforced the value of our disciplined risk management

6 A type of credit score that makes up a substantial portion of the credit report that lenders use to assess an applicant's credit risk and whether to extend a loan. FICO is an acronym for the Fair Isaac Corporation, the creators of the FICO score.

7

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS (Continued)

process. Despite the best analysis, mistakes can happen. These mistakes have been rare for us and we have been able to rely on our disciplined approach to risk management to minimize the negative impact to performance.

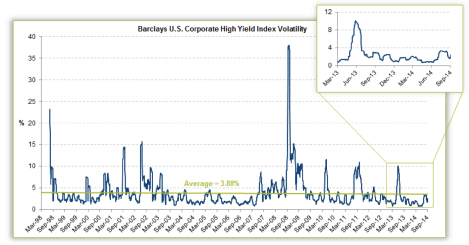

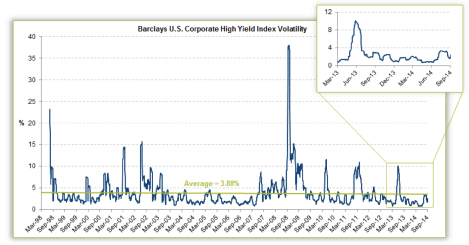

You Ain't Seen Nothin' Yet

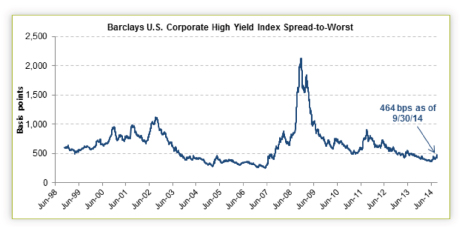

In our 2Q 2014 commentary, we speculated that excess liquidity in the financial markets had lulled credit investors into an imprudent state of complacency. That reversed itself recently as volatility returned to the high yield market during this recent quarter. The Barclays U.S. Corporate High Yield Index lost 1.9% during the quarter, the first quarterly loss since the "taper tantrum-inspired" downturn in the 3Q 2013. Spread-to-worst7 for the index widened over 90 basis points to 464 bps, and yield-to-worst widened to 6.1% from 4.9% at the end of 2Q 2014. The main drivers for poor performance were outflows from the asset class, coupled with a continued robust new issue calendar and the inability of investment banks to absorb inventory in a time of market stress.

Source: Barclays

7 Spread-to-Worst: the difference in overall returns between two different classes of securities, or returns from the same class, but different representative securities.

8

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS (Continued)

Source: Barclays

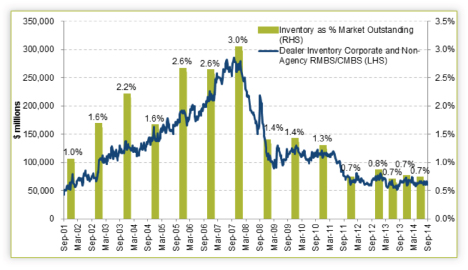

Redemptions for open-end high yield mutual funds8 were $22.7 billion (7% of average assets under management during the quarter), the heaviest outflow for any quarter recorded by Morningstar. Concurrent with these heavy redemptions, the new issue calendar in the high yield market was extensive in September 2014, with $44 billion of new deals priced.

Further, bank capital market trading departments have decreased their inventory of corporate bonds quite significantly since the financial crisis, which has hampered their ability to act as shock absorbers for the market when outflows occur. Since late 2011, primary dealer inventory of corporate and non-agency mortgage bonds9 has consistently been below 1% of the total market outstanding10. Inventory as a percentage of the overall market has decreased significantly from prior years, when it ranged between 1-3% of the market. Given changes to regulatory capital requirements and other regulations, we do not expect inventory levels to be restored to former levels.

8 High yield mutual funds invest primarily in high paying bonds with a lower credit rating than investment-grade corporate bonds, Treasury bonds and municipal bonds.

9 Federal Reserve Bank of New York primary dealer inventory data

10 Total market outstanding data according to SIFMA

9

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS (Continued)

Source: Federal Reserve Bank of New York primary dealer inventory, total market outstanding data according to SIFMA

Despite the recent increase in spreads and volatility, we remain cautious in our outlook for the high yield and leveraged loan markets. A massive amount of capital has been deployed in this area over the last few years as the Fed's unusually accommodative monetary policy has driven investors further out on the risk spectrum. As we approach the curtailment of central bank securities purchases and a potential increase in short-term interest rates, it is possible that the proportion of assets allocated to riskier credit investments could normalize.

The FPA New Income corporate credit portfolio has been small (10% of assets) and structured with an extremely short duration relative to the market for some time now, as potential returns in the high yield market have been insufficient to compensate investors adequately for the interest rate and credit risk inherent in the asset class. This posture helped to insulate us from most of the pain suffered in the high yield market this past quarter, although the corporate portfolio did suffer a very modest loss during the period. We intend to remain defensive in our positioning until valuation improves. Even after the recent sell-off, high yield valuations still appear rich. We believe our shorter duration corporate portfolio is likely to generate returns slightly below the overall high yield market11 over the next three years if the market remains in an abnormal environment, with tighter than average high yield spreads and low interest rates, while shielding investors from the negative impact of rising interest rates should credit markets normalize.

11 Using the Barclays U.S. Corporate High Yield Index as a proxy.

10

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS (Continued)

Conclusion

We continue to construct the portfolio in a matter that allows us to deploy capital in a marketplace that may be starting to take on characteristics that are different from the past 6 years. We think having a nimble and flexible portfolio as well as limiting areas of risk until valuations become more attractive is paramount if we are to achieve our goals. We diligently investigate all areas of the bond market looking for opportunities that have the potential to achieve a positive total return in a twelve-month period and, over the long-term, achieve a return that is in excess of CPI plus 100 basis points.

We thank you for your continued confidence and support.

Respectfully submitted,

Thomas H. Atteberry

Chief Executive Officer and Portfolio Manager

October 23, 2014

The discussion of Fund investments represents the views of the Fund's managers at the time of this report and is subject to change without notice. References to individual securities are for informational purposes only and should not be construed as recommendations to purchase or sell individual securities.

11

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS (Continued)

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on current management expectations, they are considered "forward-looking statements" which may or may not be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be construed as a recommendation to purchase or sell any particular security.

12

FPA NEW INCOME, INC.

HISTORICAL PERFORMANCE

(Unaudited)

Change in Value of a $10,000 Investment in FPA New Income, Inc. vs. Barclays U.S. Aggregate Index and Consumer Price Index + 100 Basis Points from October 1, 2004 to September 30, 2014

Past performance is not indicative of future performance. The Barclays U.S. Aggregate Bond Index is a broad-based unmanaged composite of four major subindexes: U.S. Government Index; U.S. Credit Index; U.S. Mortgage-Backed Securities Index; and U.S. Asset-Backed Securities Index. The index holds investment-quality bonds. The Consumer Price Index is an unmanaged index representing the rate of inflation of U.S. consumer prices as determined by the US Department of Labor Statistics. The performance of the Fund and of the Averages is computed on a total return basis which includes reinvestment of all distributions.

Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown. This data represents past performance, and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment it may be worth more or less than its original cost. Current month-end performance data can be obtained by visiting the website at www.fpafunds.com or by calling toll-free, 1-800-982-4372. Information regarding the Fund's expense ratio and redemption fees can be found on pages 44 and 48.

The Prospectus details the Fund's objective and policies, charges, and other matters of interest to prospective investors. Please read the prospectus carefully before investing. The Prospectus may be obtained by visiting the website at www.fpafunds.com, by email at crm@fpafunds.com, toll-free by calling 1-800-982-4372 or by contacting the Fund in writing.

13

FPA NEW INCOME, INC.

PORTFOLIO SUMMARY

September 30, 2014 (Unaudited)

Bonds & Debentures | | | | | 97.7 | % | |

Commercial Mortgage-Backed | |

Agency Stripped | | | 7.7 | % | | | | | |

Non-Agency | | | 5.5 | % | | | | | |

Agency | | | 1.8 | % | | | | | |

Residential Mortgage-Backed | |

Agency Pool Fixed Rate | | | 6.3 | % | | | | | |

Agency Collateralized Mortgage

Obligation | | | 16.7 | % | | | | | |

Non-Agency Collateralized

Mortgage Obligation | | | 6.9 | % | | | | | |

Agency Stripped | | | 1.7 | % | | | | | |

Agency Pool Adjustable Rate | | | 0.0 | % | | | | | |

Asset-Backed | |

Auto | | | 27.1 | % | | | | | |

Other | | | 8.7 | % | | | | | |

U.S. Treasuries | | | 5.1 | % | | | | | |

Corporate | | | 7.8 | % | | | | | |

Corporate Bank Debt | | | 2.4 | % | | | | | |

Short-Term Investments | | | | | 3.5 | % | |

Other Assets and Liabilities, net | | | | | (1.2 | )% | |

Net Assets | | | | | 100.0 | % | |

MAJOR PORTFOLIO CHANGES

For the Six Months Ended September 30, 2014

(Unaudited)

NET PURCHASES | |

| | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | |

STRU RB-5918 AD (1) | | | 2.5000 | | | 10/15/2024 | | $ | 130,745,525 | | |

U.S Treasury Note (1) | | | 0.0089 | | | 4/30/2016 | | $ | 100,000,000 | | |

Reynolds Group Issuer LLC (1) | | | 7.8750 | | | 8/15/2019 | | $ | 71,081,000 | | |

U.S Treasury Note (1) | | | 2.3750 | | | 2/28/2015 | | $ | 65,000,000 | | |

Nissan Auto Lease Trust 2013-A A3 | | | 0.6100 | | | 4/15/2016 | | $ | 64,363,000 | | |

AmeriCredit Automobile Receivables Trust 2012-4 A3 (1) | | | 0.6700 | | | 6/8/2017 | | $ | 57,082,481 | | |

Sunset Mortgage Loan Company 2014-NPL-1 A (1) | | | 3.2282 | | | 8/16/2044 | | $ | 54,945,555 | | |

Everest ACQ LLC / Finance | | | 6.8750 | | | 5/1/2019 | | $ | 56,439,000 | | |

Santander Drive Auto Receivables Trust 2013-2 A3 (1) | | | 0.7000 | | | 9/15/2017 | | $ | 54,591,885 | | |

Ford Credit Auto Trust 2013-A A3 (1) | | | 0.5500 | | | 7/15/2017 | | $ | 52,352,795 | | |

14

FPA NEW INCOME, INC.

MAJOR PORTFOLIO CHANGES (Continued)

For the Six Months Ended September 30, 2014

(Unaudited)

NET SALES | |

| | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | |

JP Morgan Mortgage Trust 2013-1 CL 2A2 (2) | | | 2.5000 | | | 3/1/2043 | | $ | 37,837,917 | | |

U.S Treasury Note (2) | | | 0.1250 | | | 7/31/2014 | | $ | 38,000,000 | | |

Sequoia Mortgage Trust 2013-2 A1 (2) | | | 1.8740 | | | 2/17/2043 | | $ | 43,618,780 | | |

Federal National Mortgage Association 2013-6 CL TA (2) | | | 1.5000 | | | 1/25/2043 | | $ | 46,851,435 | | |

Nielsen Finance LLC Co. (2) | | | 7.7500 | | | 10/15/2018 | | $ | 51,409,000 | | |

CARDS II TR 2012-4A A (2) | | | 0.6050 | | | 9/15/2017 | | $ | 75,000,000 | | |

U.S Treasury Note (2) | | | 1.0000 | | | 5/15/2014 | | $ | 110,000,000 | | |

U.S Treasury Note (2) | | | 2.6250 | | | 7/31/2014 | | $ | 168,000,000 | | |

U.S Treasury Note (2) | | | 2.6250 | | | 6/30/2014 | | $ | 193,000,000 | | |

U.S Treasury Note (2) | | | 2.3750 | | | 8/31/2014 | | $ | 193,000,000 | | |

(1) Indicates new commitment to portfolio

(2) Indicates elimination from portfolio

15

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS

September 30, 2014

BONDS & DEBENTURES | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

COMMERCIAL MORTGAGE-BACKED SECURITIES

AGENCY STRIPPED — 7.7% | | | |

Government National Mortgage Association | |

2004-10 | | | 0.0000 | | | 1/16/44 | | $ | 17,966,525 | | | $ | 180 | | |

2002-56 | | | 0.0425 | | | 6/16/42 | | | 214,637 | | | | 337 | | |

2010-18 | | | 0.1160 | | | 1/16/50 | | | 56,373,857 | | | | 1,304,491 | | |

2011-10 | | | 0.1213 | | | 12/16/45 | | | 69,494,571 | | | | 1,783,926 | | |

2009-119 | | | 0.1370 | | | 12/16/49 | | | 90,702,539 | | | | 1,973,687 | | |

2010-63 | | | 0.1740 | | | 5/16/50 | | | 42,521,588 | | | | 885,299 | | |

2011-6 | | | 0.2839 | | | 10/16/52 | | | 165,979,760 | | | | 4,189,329 | | |

2008-24 | | | 0.2934 | | | 11/16/47 | | | 10,067,949 | | | | 205,386 | | |

2008-8 | | | 0.3194 | | | 11/16/47 | | | 28,209,326 | | | | 621,734 | | |

2009-71 | | | 0.3234 | | | 7/16/49 | | | 49,380,651 | | | | 1,151,557 | | |

2008-45 | | | 0.3443 | | | 2/16/48 | | | 18,829,142 | | | | 394,282 | | |

2007-77 | | | 0.3738 | | | 11/16/47 | | | 49,719,556 | | | | 1,593,512 | | |

2009-86 | | | 0.3792 | | | 9/16/49 | | | 61,704,146 | | | | 1,472,261 | | |

| 2010-148 IX | | | 0.4079 | | | 10/16/52 | | | 54,420,656 | | | | 1,922,682 | | |

2009-49 | | | 0.4213 | | | 6/16/49 | | | 28,488,666 | | | | 842,980 | | |

2005-9 | | | 0.4466 | | | 1/16/45 | | | 5,393,686 | | | | 115,910 | | |

2010-49 | | | 0.4630 | | | 2/16/50 | | | 75,094,160 | | | | 1,837,554 | | |

2009-105 | | | 0.4949 | | | 11/16/49 | | | 35,877,629 | | | | 1,326,755 | | |

| 2011-64 IX | | | 0.5127 | | | 10/16/44 | | | 59,661,321 | | | | 2,817,208 | | |

2009-60 | | | 0.5220 | | | 7/16/49 | | | 57,636,318 | | | | 1,568,861 | | |

2013-72 | | | 0.5269 | | | 11/16/47 | | | 535,741,397 | | | | 30,800,844 | | |

2004-43 | | | 0.5449 | | | 6/16/44 | | | 39,707,119 | | | | 953,368 | | |

2004-108 | | | 0.5623 | | | 12/16/44 | | | 14,548,230 | | | | 346,102 | | |

2011-16 | | | 0.6120 | | | 9/16/46 | | | 95,344,648 | | | | 3,916,758 | | |

2008-48 | | | 0.6153 | | | 4/16/48 | | | 13,874,530 | | | | 542,078 | | |

2013-35 | | | 0.6556 | | | 1/16/53 | | | 358,441,159 | | | | 21,293,054 | | |

| 2010-161 IA | | | 0.6664 | | | 12/16/50 | | | 237,608,862 | | | | 7,567,842 | | |

2008-92 | | | 0.6696 | | | 10/16/48 | | | 41,988,960 | | | | 1,797,547 | | |

2006-55 | | | 0.6812 | | | 8/16/46 | | | 22,286,161 | | | | 846,428 | | |

2010-28 | | | 0.7208 | | | 3/16/50 | | | 82,702,994 | | | | 2,651,458 | | |

2013-7 | | | 0.7464 | | | 5/16/53 | | | 366,535,056 | | | | 24,975,112 | | |

2008-78 | | | 0.7552 | | | 7/16/48 | | | 11,767,212 | | | | 585,772 | | |

2009-4 | | | 0.7717 | | | 1/16/49 | | | 34,470,084 | | | | 1,437,747 | | |

2010-123 | | | 0.8014 | | | 9/16/50 | | | 60,108,120 | | | | 2,635,140 | | |

2014-120 | | | 0.8170 | | | 4/16/56 | | | 74,894,848 | | | | 4,980,470 | | |

2013-29 | | | 0.8307 | | | 5/16/53 | | | 125,798,609 | | | | 8,435,388 | | |

2012-35 | | | 0.8596 | | | 11/16/52 | | | 129,059,948 | | | | 7,509,714 | | |

2009-30 | | | 0.8690 | | | 3/16/49 | | | 12,639,014 | | | | 555,106 | | |

16

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2014

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

2006-30 | | | 0.8932 | | | 5/16/46 | | $ | 4,892,297 | | | $ | 323,625 | | |

2013-1 | | | 0.9123 | | | 2/16/54 | | | 138,475,091 | | | | 10,938,258 | | |

2014-88 | | | 0.9199 | | | 3/16/55 | | | 228,497,887 | | | | 16,224,195 | | |

2013-80 | | | 0.9207 | | | 3/16/52 | | | 64,228,946 | | | | 5,170,469 | | |

2012-9 | | | 0.9208 | | | 11/16/52 | | | 167,594,803 | | | | 15,229,340 | | |

2012-131 | | | 0.9241 | | | 2/16/53 | | | 111,066,522 | | | | 8,650,616 | | |

2011-49 | | | 0.9243 | | | 4/16/45 | | | 69,829,176 | | | | 3,239,375 | | |

2014-138 | | | 0.9322 | | | 4/16/56 | | | 38,650,000 | | | | 2,987,003 | | |

2013-125 | | | 0.9456 | | | 10/16/54 | | | 26,751,292 | | | | 1,523,689 | | |

2013-13 | | | 0.9461 | | | 7/16/47 | | | 106,522,934 | | | | 7,117,138 | | |

2012-150 | | | 0.9609 | | | 11/16/52 | | | 97,183,383 | | | | 7,337,170 | | |

| 2011-78 IX | | | 0.9628 | | | 8/16/46 | | | 118,816,595 | | | | 6,315,102 | | |

2012-45 | | | 0.9638 | | | 4/16/53 | | | 33,859,887 | | | | 2,398,401 | | |

2012-95 | | | 0.9804 | | | 2/16/53 | | | 149,355,440 | | | | 11,644,542 | | |

2013-30 | | | 0.9818 | | | 9/16/53 | | | 229,532,029 | | | | 16,612,472 | | |

2011-165 | | | 0.9822 | | | 10/16/51 | | | 230,361,748 | | | | 11,522,695 | | |

2014-135 | | | 0.9859 | | | 1/16/56 | | | 290,505,000 | | | | 22,381,522 | | |

2014-110 | | | 1.0090 | | | 1/16/57 | | | 57,912,558 | | | | 5,157,519 | | |

2012-58 | | | 1.0109 | | | 1/16/55 | | | 229,956,902 | | | | 17,101,895 | | |

2012-79 | | | 1.0179 | | | 3/16/53 | | | 143,350,201 | | | | 10,169,263 | | |

2012-25 | | | 1.0428 | | | 8/16/52 | | | 115,363,945 | | | | 7,437,202 | | |

2013-61 | | | 1.0460 | | | 5/16/53 | | | 157,047,463 | | | | 11,635,772 | | |

2012-85 | | | 1.0481 | | | 9/16/52 | | | 120,044,095 | | | | 9,071,792 | | |

2011-143 | | | 1.0554 | | | 4/16/53 | | | 92,458,464 | | | | 11,571,177 | | |

2013-45 | | | 1.0643 | | | 12/26/53 | | | 124,167,636 | | | | 7,918,679 | | |

2011-120 | | | 1.0801 | | | 12/16/43 | | | 112,275,323 | | | | 11,458,819 | | |

2011-164 | | | 1.1193 | | | 4/16/46 | | | 159,916,569 | | | | 9,574,205 | | |

| 2011-92 IX | | | 1.1245 | | | 11/16/44 | | | 31,461,155 | | | | 2,002,503 | | |

2011-149 | | | 1.1642 | | | 10/16/46 | | | 76,055,800 | | | | 5,706,467 | | |

2012-4 | | | 1.1691 | | | 5/16/52 | | | 226,338,862 | | | | 13,008,464 | | |

2014-28 | | | 1.1969 | | | 10/16/54 | | | 113,259,408 | | | | 10,080,438 | | |

2014-49 | | | 1.3588 | | | 8/16/54 | | | 173,689,056 | | | | 16,417,176 | | |

TOTAL AGENCY STRIPPED | | | | $ | 445,764,842 | | |

NON-AGENCY — 5.5% | | | |

A10 Securitization 2013-2 A† | | | 2.6000 | | | 11/15/27 | | $ | 11,574,950 | | | $ | 11,584,211 | | |

Citigroup Commercial Mortgage Trust | |

| 2007-FL3A B† | | | 0.3236 | | | 4/15/22 | | | 440,933 | | | | 439,402 | | |

| 2007-FL3A C† | | | 0.3636 | | | 4/15/22 | | | 546,612 | | | | 543,787 | | |

| 2007-FL3A D† | | | 0.4036 | | | 4/15/22 | | | 361,447 | | | | 359,577 | | |

| 2007-FL3A E† | | | 0.4536 | | | 4/15/22 | | | 413,082 | | | | 409,873 | | |

17

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2014

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

COMM Mortgage Trust 2013-RIA4 A2† | | | 6.0000 | | | 11/27/28 | | $ | 12,099,500 | | | $ | 11,753,254 | | |

Credit Suisse Mortgage Trust | |

| 2007-TF2A A3† | | | 0.4236 | | | 4/15/22 | | | 33,454,106 | | | | 33,324,763 | | |

| 2007-TF2A B† | | | 0.5036 | | | 4/15/22 | | | 401,000 | | | | 394,269 | | |

Del Coronado Trust 2013-HDMZ CL M† | | | 5.1550 | | | 3/15/18 | | | 9,299,000 | | | | 9,325,047 | | |

Lehman Brothers Floating Rate

Commercial 2007-LLFA F† | | | 1.1536 | | | 6/15/22 | | | 6,269,144 | | | | 6,068,469 | | |

Monty Parent Issuer LLC | |

| 2013-LTR1 A† | | | 3.4700 | | | 11/20/28 | | | 6,860,204 | | | | 6,866,317 | | |

| 2013-LTR1 B† | | | 4.2500 | | | 11/20/28 | | | 16,757,956 | | | | 16,757,822 | | |

Motel 6 Trust | |

| 2012-MTL6 D† | | | 3.7812 | | | 10/5/25 | | | 37,663,000 | | | | 37,539,514 | | |

| 2012-MTL6 E† | | | 4.2743 | | | 10/5/25 | | | 10,061,000 | | | | 9,728,606 | | |

Ores NPL LLC | |

| 2014-LV3 CL A† | | | 3.0000 | | | 3/27/24 | | | 15,012,072 | | | | 15,013,267 | | |

| 2013-LV2 CL A† | | | 3.0810 | | | 9/25/25 | | | 16,448,314 | | | | 16,441,065 | | |

| 2014-LV3 CL B† | | | 6.0000 | | | 3/27/24 | | | 47,419,000 | | | | 47,378,039 | | |

Rialto Real Estate Fund LP | |

| 2014-LT6 CL A† | | | 2.7500 | | | 9/15/24 | | | 7,221,000 | | | | 7,174,825 | | |

| 2014-LT5 CL A† | | | 2.8500 | | | 5/15/24 | | | 8,569,231 | | | | 8,570,654 | | |

| 2014-LT6 CL B† | | | 5.4860 | | | 9/15/24 | | | 9,457,000 | | | | 9,532,830 | | |

Starwood Commercial Mortgage Trust

2013-FV1 CL B† | | | 2.1540 | | | 8/11/28 | | | 18,051,000 | | | | 18,052,847 | | |

Sunset Mortgage Loan Company

2014-NPL-1 A† | | | 3.2282 | | | 8/16/44 | | | 54,945,555 | | | | 54,966,742 | | |

TOTAL NON-AGENCY | | | | $ | 322,225,180 | | |

AGENCY — 1.8% | | | |

Government National Mortgage Association | |

| 2012-22 CL AB | | | 1.6610 | | | 3/16/33 | | $ | 4,953,211 | | | $ | 4,951,973 | | |

| 2011-49 CL AB | | | 2.8000 | | | 1/16/34 | | | 21,550,948 | | | | 21,849,860 | | |

| 2011-120 CL A | | | 3.8984 | | | 8/16/33 | | | 35,324,543 | | | | 36,223,906 | | |

| 2011-143 CL AB | | | 3.9394 | | | 3/16/33 | | | 37,435,872 | | | | 38,388,241 | | |

TOTAL AGENCY | | | | $ | 101,413,980 | | |

18

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2014

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

RESIDENTIAL MORTGAGE-BACKED SECURITIES

AGENCY POOL FIXED RATE MORTGAGES — 6.3% | |

Federal Home Loan Mortgage Corporation | |

E01305 | | | 4.5000 | | | 12/1/17 | | $ | 38,356 | | | $ | 40,447 | | |

E01304 | | | 4.5000 | | | 1/1/18 | | | 59,339 | | | | 62,573 | | |

E01489 | | | 4.5000 | | | 11/1/18 | | | 3,498,495 | | | | 3,689,135 | | |

G11657 | | | 4.5000 | | | 12/1/18 | | | 430,261 | | | | 453,707 | | |

255227 | | | 4.5000 | | | 5/1/19 | | | 1,117,145 | | | | 1,181,031 | | |

E01641 | | | 4.5000 | | | 5/1/19 | | | 210,941 | | | | 222,468 | | |

E01653 | | | 4.5000 | | | 6/1/19 | | | 420,388 | | | | 443,633 | | |

J11204 | | | 4.5000 | | | 11/1/19 | | | 4,317,409 | | | | 4,564,624 | | |

G11712 | | | 4.5000 | | | 7/1/20 | | | 430,601 | | | | 456,693 | | |

P60959 | | | 4.5000 | | | 9/1/20 | | | 2,487,592 | | | | 2,612,593 | | |

G11772 | | | 4.5000 | | | 9/1/20 | | | 412,249 | | | | 437,853 | | |

G15110 | | | 4.5000 | | | 8/1/25 | | | 4,596,002 | | | | 4,871,848 | | |

G15169 | | | 4.5000 | | | 9/1/26 | | | 16,345,504 | | | | 17,390,949 | | |

G13812 | | | 5.0000 | | | 12/1/20 | | | 6,172,841 | | | | 6,517,471 | | |

G15036 | | | 5.0000 | | | 6/1/24 | | | 25,120,464 | | | | 26,747,117 | | |

G15173 | | | 5.0000 | | | 6/1/26 | | | 16,073,015 | | | | 17,183,964 | | |

G12400 | | | 5.5000 | | | 11/1/16 | | | 156,144 | | | | 161,954 | | |

G12730 | | | 5.5000 | | | 7/1/17 | | | 25,436 | | | | 26,682 | | |

G12829 | | | 5.5000 | | | 10/1/17 | | | 22,012 | | | | 23,149 | | |

G11397 | | | 5.5000 | | | 3/1/18 | | | 94,253 | | | | 99,589 | | |

G11684 | | | 5.5000 | | | 12/1/18 | | | 214,646 | | | | 226,270 | | |

G11632 | | | 5.5000 | | | 9/1/19 | | | 3,703,431 | | | | 3,958,229 | | |

G12339 | | | 5.5000 | | | 10/1/20 | | | 510,642 | | | | 548,881 | | |

G14187 | | | 5.5000 | | | 12/1/20 | | | 11,049,802 | | | | 11,827,045 | | |

G13774 | | | 5.5000 | | | 12/1/20 | | | 512,476 | | | | 547,372 | | |

J01270 | | | 5.5000 | | | 2/1/21 | | | 179,696 | | | | 193,778 | | |

G13353 | | | 5.5000 | | | 3/1/21 | | | 1,480,130 | | | | 1,585,804 | | |

G12393 | | | 5.5000 | | | 10/1/21 | | | 335,053 | | | | 361,487 | | |

G14178 | | | 5.5000 | | | 7/1/22 | | | 1,535,805 | | | | 1,651,910 | | |

G15037 | | | 5.5000 | | | 12/1/24 | | | 9,947,162 | | | | 10,673,338 | | |

G14979 | | | 5.5000 | | | 12/1/24 | | | 1,507,406 | | | | 1,622,707 | | |

G14830 | | | 5.5000 | | | 12/1/24 | | | 4,862,290 | | | | 5,253,766 | | |

G12139 | | | 6.5000 | | | 9/1/19 | | | 712,498 | | | | 743,506 | | |

A26942 | | | 6.5000 | | | 9/1/34 | | | 615,545 | | | | 701,173 | | |

G08107 | | | 6.5000 | | | 1/1/36 | | | 1,675,177 | | | | 1,907,307 | | |

P50543 | | | 6.5000 | | | 4/1/37 | | | 141,792 | | | | 155,273 | | |

19

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2014

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

Federal National Mortgage Association | |

745278 | | | 4.5000 | | | 6/1/19 | | $ | 2,861,965 | | | $ | 3,025,634 | | |

725609 | | | 4.5000 | | | 7/1/19 | | | 994,621 | | | | 1,051,501 | | |

725792 | | | 4.5000 | | | 8/1/19 | | | 6,262,546 | | | | 6,620,685 | | |

MA0358 | | | 4.5000 | | | 3/1/20 | | | 456,563 | | | | 482,673 | | |

MA0419 | | | 4.5000 | | | 5/1/20 | | | 708,004 | | | | 748,493 | | |

745181 | | | 4.5000 | | | 11/1/20 | | | 482,617 | | | | 512,363 | | |

AA0905 | | | 4.5000 | | | 1/1/21 | | | 2,465,289 | | | | 2,610,816 | | |

995321 | | | 4.5000 | | | 12/1/21 | | | 322,220 | | | | 343,423 | | |

889531 | | | 4.5000 | | | 5/1/22 | | | 113,699 | | | | 120,705 | | |

254907 | | | 5.0000 | | | 10/1/18 | | | 262,018 | | | | 277,876 | | |

995756 | | | 5.0000 | | | 12/1/18 | | | 6,392,272 | | | | 6,773,443 | | |

AL5252 | | | 5.0000 | | | 4/1/19 | | | 2,050,273 | | | | 2,161,909 | | |

745387 | | | 5.0000 | | | 4/1/19 | | | 502,693 | | | | 534,530 | | |

735660 | | | 5.0000 | | | 6/1/20 | | | 271,677 | | | | 291,361 | | |

AE0126 | | | 5.0000 | | | 6/1/20 | | | 9,117,933 | | | | 9,669,112 | | |

310097 | | | 5.0000 | | | 10/1/20 | | | 2,211,369 | | | | 2,334,084 | | |

995861 | | | 5.0000 | | | 1/1/21 | | | 7,080,562 | | | | 7,503,342 | | |

888104 | | | 5.0000 | | | 5/1/21 | | | 160,209 | | | | 171,444 | | |

AE0314 | | | 5.0000 | | | 8/1/21 | | | 37,493,105 | | | | 39,832,847 | | |

890185 | | | 5.0000 | | | 10/1/21 | | | 1,989,657 | | | | 2,143,987 | | |

890083 | | | 5.0000 | | | 12/1/21 | | | 3,610,381 | | | | 3,826,246 | | |

AL5656 | | | 5.0000 | | | 9/1/25 | | | 2,568,522 | | | | 2,751,452 | | |

AL5764 | | | 5.0000 | | | 9/1/25 | | | 18,504,336 | | | | 19,802,362 | | |

AE0792 | | | 5.0000 | | | 1/1/26 | | | 7,004,476 | | | | 7,430,208 | | |

AL4056 | | | 5.0000 | | | 6/1/26 | | | 20,891,123 | | | | 22,485,225 | | |

257100 | | | 5.5000 | | | 1/1/18 | | | 624,281 | | | | 662,424 | | |

745500 | | | 5.5000 | | | 12/1/18 | | | 4,501,227 | | | | 4,788,090 | | |

995284 | | | 5.5000 | | | 3/1/20 | | | 5,249,261 | | | | 5,581,644 | | |

889318 | | | 5.5000 | | | 7/1/20 | | | 6,091,477 | | | | 6,485,169 | | |

AE0237 | | | 5.5000 | | | 11/1/23 | | | 6,339,086 | | | | 6,746,182 | | |

AL5812 | | | 5.5000 | | | 5/1/25 | | | 18,354,110 | | | | 19,607,246 | | |

AL4433 | | | 5.5000 | | | 9/1/25 | | | 5,092,943 | | | | 5,494,270 | | |

AL4901 | | | 5.5000 | | | 9/1/25 | | | 9,171,649 | | | | 9,830,894 | | |

735439 | | | 6.0000 | | | 9/1/19 | | | 1,164,461 | | | | 1,231,824 | | |

745832 | | | 6.0000 | | | 4/1/21 | | | 15,307,857 | | | | 16,323,074 | | |

AD0951 | | | 6.0000 | | | 12/1/21 | | | 6,085,439 | | | | 6,522,496 | | |

AL0294 | | | 6.0000 | | | 10/1/22 | | | 306,296 | | | | 332,846 | | |

890225 | | | 6.0000 | | | 5/1/23 | | | 5,626,641 | | | | 6,024,782 | | |

725951 | | | 7.5000 | | | 8/1/17 | | | 54,644 | | | | 57,239 | | |

323282 | | | 7.5000 | | | 7/1/28 | | | 315,456 | | | | 356,655 | | |

20

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2014

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

Government National Mortgage Association | |

782281 | | | 6.0000 | | | 3/15/23 | | $ | 3,239,207 | | | $ | 3,538,686 | | |

TOTAL AGENCY POOL FIXED RATE

MORTGAGES | | | | $ | 366,234,568 | | |

AGENCY COLLATERALIZED

MORTGAGE OBLIGATION — 16.7% | | | |

Federal Home Loan Mortgage Corporation | |

| 3818 CL HA | | | 1.5000 | | | 1/15/18 | | $ | 6,252,613 | | | $ | 6,319,312 | | |

| 4350 CL CA | | | 2.0000 | | | 10/15/19 | | | 42,394,692 | | | | 43,170,303 | | |

| 4351 CL GA | | | 2.0000 | | | 11/15/19 | | | 30,546,234 | | | | 31,085,958 | | |

| 3711 CL AD | | | 2.5000 | | | 8/15/23 | | | 284,970 | | | | 289,017 | | |

STRU RB-5918 AD | | | 2.5000 | | | 10/15/24 | | | 130,745,525 | | | | 133,850,731 | | |

| 3825 CL AB | | | 3.0000 | | | 8/15/20 | | | 781,922 | | | | 809,078 | | |

| 2634 CL CI | | | 3.0000 | | | 2/15/23 | | | 51,991 | | | | 52,802 | | |

| 3829 CL CD | | | 3.0000 | | | 8/15/24 | | | 1,695,180 | | | | 1,725,388 | | |

| 2809 CL UC | | | 4.0000 | | | 6/15/19 | | | 620,266 | | | | 652,979 | | |

| 3806 CL AB | | | 4.0000 | | | 2/15/23 | | | 732,605 | | | | 734,751 | | |

| 3625 CL AJ | | | 4.0000 | | | 3/15/23 | | | 81,932 | | | | 82,369 | | |

| 2990 CL TD | | | 4.0000 | | | 5/15/35 | | | 90,940 | | | | 94,592 | | |

| 3992 CL H | | | 4.0000 | | | 6/15/36 | | | 172,757 | | | | 176,769 | | |

| 3986 CL P | | | 4.0000 | | | 3/15/39 | | | 429,699 | | | | 444,625 | | |

| 4088 CL LE | | | 4.0000 | | | 10/15/40 | | | 13,023,450 | | | | 13,524,270 | | |

| 2877 CL WA | | | 4.2500 | | | 10/15/34 | | | 498,628 | | | | 499,640 | | |

| 3578 CL AM | | | 4.5000 | | | 9/15/16 | | | 1,641,715 | | | | 1,683,874 | | |

| 2614 CL BY | | | 4.5000 | | | 5/15/18 | | | 1,720,127 | | | | 1,809,431 | | |

| 2645 CL BY | | | 4.5000 | | | 7/15/18 | | | 345,764 | | | | 363,141 | | |

| 2656 CL PE | | | 4.5000 | | | 7/15/18 | | | 687,486 | | | | 724,074 | | |

| 2694 CL AN | | | 4.5000 | | | 7/15/18 | | | 3,078,224 | | | | 3,247,722 | | |

| 2885 CL DX | | | 4.5000 | | | 11/15/19 | | | 9,766,998 | | | | 10,346,883 | | |

| 3271 CL TB | | | 4.5000 | | | 11/15/19 | | | 5,836,529 | | | | 6,187,781 | | |

| 2900 CL PC | | | 4.5000 | | | 12/15/19 | | | 5,705,654 | | | | 6,039,543 | | |

| 2930 CL KT | | | 4.5000 | | | 2/15/20 | | | 1,588,484 | | | | 1,684,441 | | |

| 2995 CL JK | | | 4.5000 | | | 6/15/20 | | | 2,069,938 | | | | 2,186,237 | | |

| 3969 CL MP | | | 4.5000 | | | 4/15/39 | | | 157,426 | | | | 165,047 | | |

| 3939 CL D | | | 4.5000 | | | 9/15/41 | | | 2,799,569 | | | | 2,969,380 | | |

| 2509 CL CB | | | 5.0000 | | | 10/15/17 | | | 1,989,296 | | | | 2,079,332 | | |

| 2568 CL XD | | | 5.0000 | | | 2/15/18 | | | 488,380 | | | | 515,392 | | |

| 2747 CL DX | | | 5.0000 | | | 2/15/19 | | | 4,092,710 | | | | 4,338,068 | | |

| 3852 CL HA | | | 5.0000 | | | 12/15/21 | | | 7,580,879 | | | | 8,106,461 | | |

| 2494 CL CF | | | 5.5000 | | | 9/15/17 | | | 2,069,046 | | | | 2,182,740 | | |

21

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2014

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

| 2503 CL B | | | 5.5000 | | | 9/15/17 | | $ | 2,014,836 | | | $ | 2,112,213 | | |

| 3808 CL BQ | | | 5.5000 | | | 8/15/25 | | | 7,931,885 | | | | 8,402,801 | | |

| 3806 CL JB | | | 5.5000 | | | 2/15/26 | | | 4,137,928 | | | | 4,519,156 | | |

| 3855 CL HQ | | | 5.5000 | | | 2/15/26 | | | 4,234,000 | | | | 4,525,002 | | |

| 2453 CL BD | | | 6.0000 | | | 5/15/17 | | | 614,810 | | | | 648,306 | | |

| 3926 CL GP | | | 6.0000 | | | 8/15/25 | | | 4,460,077 | | | | 4,664,483 | | |

| 3614 CL DY | | | 6.0000 | | | 1/15/32 | | | 8,918,488 | | | | 9,881,417 | | |

Federal National Mortgage Association | |

| 2013-64 CL TZ | | | 1.5000 | | | 3/25/42 | | | 1,895,176 | | | | 1,881,171 | | |

| 2013-30 CL CA | | | 1.5000 | | | 4/25/43 | | | 25,755,610 | | | | 24,954,675 | | |

| 2013-30 CL JA | | | 1.5000 | | | 4/25/43 | | | 18,135,148 | | | | 17,531,743 | | |

| 2013-66 CL JA | | | 2.2500 | | | 7/25/43 | | | 73,715,779 | | | | 74,575,106 | | |

| 2010-83 CL AH | | | 2.5000 | | | 11/25/18 | | | 1,851,086 | | | | 1,900,368 | | |

| 2011-125 GE | | | 2.5000 | | | 12/25/41 | | | 51,434,508 | | | | 51,137,237 | | |

| 2012-73 CL JB | | | 3.5000 | | | 1/25/42 | | | 35,966,398 | | | | 37,736,106 | | |

| 2012-8 CL LE | | | 3.5000 | | | 2/25/42 | | | 34,616,988 | | | | 36,319,289 | | |

| 2012-26 CL ME | | | 3.5000 | | | 3/25/42 | | | 45,856,499 | | | | 48,111,529 | | |

| 2012-41 CL LB | | | 3.5000 | | | 4/25/42 | | | 43,050,138 | | | | 45,168,652 | | |

| 2012-48 CL MB | | | 3.5000 | | | 5/25/42 | | | 42,084,654 | | | | 44,153,544 | | |

| 2012-117 CL AD | | | 3.5000 | | | 10/25/42 | | | 65,672,461 | | | | 68,336,306 | | |

| 2013-112 CL WA | | | 3.5000 | | | 2/25/43 | | | 43,735,906 | | | | 45,161,308 | | |

| 2003-128 CL NG | | | 4.0000 | | | 1/25/19 | | | 399,837 | | | | 419,830 | | |

| 2004-7 CL JK | | | 4.0000 | | | 2/25/19 | | | 3,448,892 | | | | 3,619,663 | | |

| 2008-15 CL JM | | | 4.0000 | | | 2/25/19 | | | 69,738 | | | | 70,632 | | |

| 2008-18 CL MD | | | 4.0000 | | | 3/25/19 | | | 811,637 | | | | 851,422 | | |

| 2011-67 CL EA | | | 4.0000 | | | 7/25/21 | | | 15,974,017 | | | | 16,815,528 | | |

| 2009-31 CL A | | | 4.0000 | | | 2/25/24 | | | 401,182 | | | | 420,315 | | |

| 2009-76 CL MA | | | 4.0000 | | | 9/25/24 | | | 1,074,956 | | | | 1,117,140 | | |

| 2012-95 CL AB | | | 4.0000 | | | 11/25/40 | | | 7,108,647 | | | | 7,273,453 | | |

| 2014-39 CL MA | | | 4.0000 | | | 8/25/42 | | | 12,064,016 | | | | 12,567,046 | | |

| 2014-1 CL DA | | | 4.0000 | | | 6/25/43 | | | 11,449,051 | | | | 11,953,302 | | |

| 2009-70 CL NU | | | 4.2500 | | | 8/25/19 | | | 5,292,772 | | | | 5,544,602 | | |

| 2004-90 -CL GA | | | 4.3500 | | | 3/25/34 | | | 998,406 | | | | 1,011,066 | | |

| 2003-30 CL HW | | | 4.5000 | | | 4/25/18 | | | 662,830 | | | | 697,116 | | |

| 2003-92 CL HP | | | 4.5000 | | | 9/25/18 | | | 8,539,309 | | | | 9,016,426 | | |

| 2008-40 CL KA | | | 4.5000 | | | 10/25/18 | | | 1,196,185 | | | | 1,247,426 | | |

| 2008-18 CL NB | | | 4.5000 | | | 5/25/20 | | | 2,031,320 | | | | 2,132,445 | | |

| 2008-59 CL KB | | | 4.5000 | | | 7/25/23 | | | 4,163,484 | | | | 4,400,720 | | |

| 2011-7 CL PA | | | 4.5000 | | | 10/25/39 | | | 493,926 | | | | 511,899 | | |

| 2012-40 CL GC | | | 4.5000 | | | 12/25/40 | | | 6,114,195 | | | | 6,296,297 | | |

| 2012-67 CL PB | | | 4.5000 | | | 12/25/40 | | | 9,613,092 | | | | 10,020,111 | | |

22

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2014

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

| 2011-148 CL PB | | | 4.5000 | | | 12/25/41 | | $ | 7,839,113 | | | $ | 8,363,328 | | |

| 2002-74 CL PE | | | 5.0000 | | | 11/25/17 | | | 672,169 | | | | 706,379 | | |

| 2003-24 -CL PD | | | 5.0000 | | | 4/25/18 | | | 2,437,947 | | | | 2,571,864 | | |

| 2003-97 CL CA | | | 5.0000 | | | 10/25/18 | | | 15,356,978 | | | | 16,329,833 | | |

| 2008-77 CL DA | | | 5.0000 | | | 4/25/23 | | | 2,100,071 | | | | 2,167,840 | | |

| 2005-26 CL G | | | 5.0000 | | | 6/25/32 | | | 81,540 | | | | 82,311 | | |

| 2010-39 CL PL | | | 5.0000 | | | 10/25/32 | | | 1,748,290 | | | | 1,773,168 | | |

| 2004-60 CL LB | | | 5.0000 | | | 4/25/34 | | | 7,653,644 | | | | 8,268,614 | | |

| 2014-2 CL MC | | | 5.0000 | | | 3/25/42 | | | 5,461,171 | | | | 5,833,524 | | |

| 2003-W17 CL 1A5 | | | 5.3500 | | | 8/25/33 | | | 1,204,986 | | | | 1,207,806 | | |

| 2011-19 CL WB | | | 5.5000 | | | 10/25/18 | | | 5,862,725 | | | | 6,252,479 | | |

| 2009-116 CL PA | | | 5.5000 | | | 4/25/24 | | | 3,167,684 | | | | 3,273,675 | | |

| 2002-9 CL PC | | | 6.0000 | | | 3/25/17 | | | 1,907,467 | | | | 2,000,094 | | |

TOTAL AGENCY COLLATERALIZED

MORTGAGE OBLIGATION | | | | $ | 974,679,897 | | |

NON-AGENCY COLLATERALIZED

MORTGAGE OBLIGATION — 6.9% | | | |

Bayview Opportunity Master Fund Trust | |

| 2013-13NP CL A† | | | 3.7210 | | | 6/28/33 | | $ | 7,149,851 | | | $ | 7,126,006 | | |

| 2014-20NP CL A† | | | 3.7210 | | | 8/28/44 | | | 250,000 | | | | 252,004 | | |

| 2012-4NR2 CL A† | | | 3.9496 | | | 1/28/34 | | | 5,723,606 | | | | 5,701,984 | | |

| 2013-14NP CL A† | | | 4.2130 | | | 8/28/33 | | | 18,078,163 | | | | 18,134,581 | | |

| 2013-4RPL CL A† | | | 4.4583 | | | 7/28/18 | | | 1,354,999 | | | | 1,357,783 | | |

Citicorp Mortgage Securities Inc.

2005-5 CL 2A3 | | | 5.0000 | | | 8/25/20 | | | 159,585 | | | | 163,899 | | |

Citigroup Mortgage Loan Trust Inc.

2014-A A | | | 4.0000 | | | 1/1/35 | | | 26,237,206 | | | | 27,046,364 | | |

Credit Suisse Mortgage Trust | |

| 2013-6 1A1† | | | 2.5000 | | | 7/25/28 | | | 85,747,762 | | | | 84,514,966 | | |

| 2006-C5 A3 | | | 5.3110 | | | 12/15/39 | | | 25,045,000 | | | | 26,706,703 | | |

Normandy Mortgage Loan Trust

2013-NPL3 A† | | | 4.9486 | | | 9/16/43 | | | 33,584,416 | | | | 33,534,039 | | |

Riverview HECM Trust 2007-1 CL A† | | | 0.6100 | | | 5/25/47 | | | 34,187,471 | | | | 30,012,155 | | |

Sequoia Mortgage Trust 2012-1 1A1 | | | 2.8650 | | | 1/25/42 | | | 6,031,012 | | | | 5,962,072 | | |

Stanwich Mortgage Loan Trust Series | |

| 2009-2 A†,* | | | 11.2093 | | | 2/15/49 | | | 352,665 | | | | 157,712 | | |

| 2010-1 A†,* | | | 27.9270 | | | 9/15/47 | | | 660,818 | | | | 334,242 | | |

| 2010-2 A†,* | | | 15.6747 | | | 2/28/57 | | | 3,327,766 | | | | 1,677,860 | | |

| 2010-3 A†,* | | | 24.6244 | | | 7/31/38 | | | 2,067,249 | | | | 1,034,245 | | |

| 2010-4 A†,* | | | 0.0000 | | | 8/31/49 | | | 2,784,093 | | | | 1,405,967 | | |

23

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2014

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

| 2011-1 A†,* | | | 2.9596 | | | 8/15/50 | | $ | 4,195,764 | | | $ | 2,212,968 | | |

| 2011-2 A†,* | | | 0.0000 | | | 9/15/50 | | | 2,874,505 | | | | 1,538,447 | | |

| 2012-NPL4 CL A† | | | 2.9814 | | | 10/15/42 | | | 3,773,416 | | | | 3,771,210 | | |

| 2013-NPL1 CL A† | | | 2.9814 | | | 2/16/43 | | | 16,235,871 | | | | 16,295,875 | | |

| 2013-NPL2 CL A† | | | 3.2282 | | | 4/16/59 | | | 34,568,992 | | | | 34,568,957 | | |

Truman Capital Mortgage Loan Trust | |

| 2014-NPL3 A1† | | | 3.1250 | | | 4/25/53 | | | 8,647,000 | | | | 8,612,412 | | |

| 2014-NPL2 A1† | | | 3.1250 | | | 6/25/54 | | | 8,723,000 | | | | 8,679,027 | | |

US Residential Opportunity Fund Trust

2014-4A† | | | 3.4656 | | | 3/25/34 | | | 7,105,137 | | | | 7,128,583 | | |

Vericrest Opportunity Loan Transferee | |

| 2014-NPL4 A1† | | | 3.1250 | | | 4/24/54 | | | 43,082,021 | | | | 42,976,875 | | |

| 2014-NPL3 A1† | | | 3.2500 | | | 11/25/53 | | | 10,919,819 | | | | 10,965,043 | | |

| 2014-NPL1 A1† | | | 3.6250 | | | 10/27/53 | | | 7,619,568 | | | | 7,626,557 | | |

| 2014-NPL2 A1† | | | 3.6250 | | | 11/25/53 | | | 9,607,845 | | | | 9,631,864 | | |

Wells Fargo Mortgage-Backed Securities Trust

2006-5 2A1 | | | 5.2500 | | | 4/25/21 | | | 5,374,092 | | | | 5,422,243 | | |

TOTAL NON-AGENCY COLLATERALIZED

MORTGAGE OBLIGATION | | | | $ | 404,552,643 | | |

AGENCY STRIPPED SECURITIES — 1.7%

PRINCIPAL ONLY | | | |

Federal Home Loan Mortgage

Corporation 217 | | | 0.0000 | | | 1/1/32 | | $ | 436,939 | | | $ | 401,081 | | |

INTEREST ONLY | | | |

Federal Home Loan Mortgage Corporation | |

| 3714 TI | | | 2.2500 | | | 8/15/15 | | $ | 33,417,779 | | | $ | 571,685 | | |

| 3935 LI | | | 3.0000 | | | 10/15/21 | | | 6,058,574 | | | | 483,295 | | |

| 3948 AI | | | 3.0000 | | | 10/15/21 | | | 7,527,484 | | | | 589,553 | | |

| 3956 KI | | | 3.0000 | | | 11/15/21 | | | 16,428,403 | | | | 1,369,575 | | |

| 3968 AI | | | 3.0000 | | | 12/15/21 | | | 6,223,143 | | | | 523,170 | | |

| 3992 OI | | | 3.0000 | | | 1/15/22 | | | 4,920,144 | | | | 401,246 | | |

| 3994 AI | | | 3.0000 | | | 2/15/22 | | | 11,712,250 | | | | 1,006,039 | | |

| 3994 EI | | | 3.0000 | | | 2/15/22 | | | 11,228,161 | | | | 968,565 | | |

| 3998 KI | | | 3.0000 | | | 11/15/26 | | | 19,896,758 | | | | 2,291,774 | | |

| 4100 EI | | | 3.0000 | | | 8/15/27 | | | 92,012,373 | | | | 11,228,896 | | |

| 3706 AI | | | 3.5000 | | | 7/15/20 | | | 8,058,609 | | | | 407,418 | | |

| 3722 AI | | | 3.5000 | | | 9/15/20 | | | 10,497,161 | | | | 829,960 | | |

| 3735 AI | | | 3.5000 | | | 10/15/20 | | | 4,981,888 | | | | 411,754 | | |

24

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2014

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

| 3874 DI | | | 3.5000 | | | 10/15/20 | | $ | 8,541,525 | | | $ | 499,951 | | |

| 3893 DI | | | 3.5000 | | | 10/15/20 | | | 6,344,846 | | | | 378,374 | | |

| 3753 CI | | | 3.5000 | | | 11/15/20 | | | 2,350,782 | | | | 197,050 | | |

| 3755 AI | | | 3.5000 | | | 11/15/20 | | | 9,467,837 | | | | 780,991 | | |

| 3760 KI | | | 3.5000 | | | 11/15/20 | | | 7,479,859 | | | | 578,488 | | |

| 3784 BI | | | 3.5000 | | | 1/15/21 | | | 6,333,877 | | | | 533,904 | | |

| 3874 BI | | | 3.5000 | | | 6/15/21 | | | 5,341,092 | | | | 468,729 | | |

| 3893 BI | | | 3.5000 | | | 7/15/21 | | | 4,598,006 | | | | 410,558 | | |

| 3909 KI | | | 3.5000 | | | 7/15/21 | | | 3,965,312 | | | | 351,986 | | |

| 3938 IO | | | 3.5000 | | | 10/15/21 | | | 27,316,961 | | | | 2,502,193 | | |

| 3778 GI | | | 3.5000 | | | 6/15/24 | | | 5,046,531 | | | | 366,799 | | |

| 3854 GI | | | 3.5000 | | | 11/15/24 | | | 3,598,613 | | | | 189,640 | | |

| 3852 YI | | | 3.5000 | | | 3/15/25 | | | 12,267,225 | | | | 867,218 | | |

| 3763 NI | | | 3.5000 | | | 5/15/25 | | | 4,298,497 | | | | 395,965 | | |

| 3904 QI | | | 3.5000 | | | 5/15/25 | | | 4,611,828 | | | | 392,063 | | |

| 3909 UI | | | 3.5000 | | | 8/15/25 | | | 7,275,237 | | | | 568,119 | | |

| 3904 NI | | | 3.5000 | | | 8/15/26 | | | 9,928,345 | | | | 1,311,188 | | |

| 3930 AI | | | 3.5000 | | | 9/15/26 | | | 12,785,210 | | | | 1,764,548 | | |

| 4018 AI | | | 3.5000 | | | 3/15/27 | | | 22,172,695 | | | | 2,806,318 | | |

| 3684 CI | | | 4.5000 | | | 8/15/24 | | | 24,426,017 | | | | 2,392,091 | | |

| 3917 AI | | | 4.5000 | | | 7/15/26 | | | 35,694,434 | | | | 4,907,903 | | |

| 3636 IO | | | 5.0000 | | | 11/15/18 | | | 23,030,091 | | | | 1,541,655 | | |

217 | | | 6.5000 | | | 1/1/32 | | | 420,726 | | | | 92,114 | | |

Federal National Mortgage Association | |

| 2011-88 BI | | | 3.0000 | | | 11/25/20 | | | 3,816,847 | | | | 204,381 | | |

| 2011-141 EI | | | 3.0000 | | | 7/25/21 | | | 16,439,287 | | | | 1,153,571 | | |

| 2012-8 TI | | | 3.0000 | | | 10/25/21 | | | 7,690,056 | | | | 606,107 | | |

| 2011-113 GI | | | 3.0000 | | | 11/25/21 | | | 7,391,354 | | | | 583,074 | | |

| 2011-129 AI | | | 3.0000 | | | 12/25/21 | | | 10,117,117 | | | | 820,409 | | |

| 2012-8 UI | | | 3.0000 | | | 12/25/21 | | | 24,702,709 | | | | 2,025,753 | | |

| 2011-137 AI | | | 3.0000 | | | 1/25/22 | | | 13,202,352 | | | | 1,051,190 | | |

| 2011-138 IG | | | 3.0000 | | | 1/25/22 | | | 15,866,628 | | | | 1,320,370 | | |

| 2011-145 IO | | | 3.0000 | | | 1/25/22 | | | 20,649,576 | | | | 1,737,664 | | |

| 2012-78 AI | | | 3.0000 | | | 2/25/22 | | | 12,371,299 | | | | 891,807 | | |

| 2012-23 IA | | | 3.0000 | | | 3/25/22 | | | 9,390,512 | | | | 776,625 | | |

| 2012-32 AI | | | 3.0000 | | | 4/25/22 | | | 15,347,604 | | | | 1,291,383 | | |

| 2012-53 CI | | | 3.0000 | | | 5/25/22 | | | 23,550,460 | | | | 2,000,098 | | |

| 2012-147 AI | | | 3.0000 | | | 10/25/27 | | | 33,959,542 | | | | 4,249,116 | | |

| 2012-145 DI | | | 3.0000 | | | 1/25/28 | | | 18,674,164 | | | | 2,365,415 | | |

| 2012-149 CI | | | 3.0000 | | | 1/25/28 | | | 49,758,395 | | | | 6,267,025 | | |

| 2010-128 LI | | | 3.5000 | | | 11/25/20 | | | 12,009,072 | | | | 925,452 | | |

25

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2014

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

| 2011-75 BI | | | 3.5000 | | | 11/25/20 | | $ | 6,399,899 | | | $ | 375,435 | | |

| 2011-78 LI | | | 3.5000 | | | 11/25/20 | | | 16,751,094 | | | | 931,701 | | |

| 2010-145 BI | | | 3.5000 | | | 12/25/20 | | | 6,094,560 | | | | 514,217 | | |

| 2011-61 BI | | | 3.5000 | | | 7/25/21 | | | 5,274,544 | | | | 474,371 | | |

| 2011-66 QI | | | 3.5000 | | | 7/25/21 | | | 9,194,031 | | | | 827,116 | | |

| 2010-104 CI | | | 3.5000 | | | 10/25/21 | | | 15,747,908 | | | | 1,413,753 | | |

| 2011-104 DI | | | 3.5000 | | | 10/25/21 | | | 26,331,886 | | | | 2,290,205 | | |

| 2011-110 AI | | | 3.5000 | | | 11/25/21 | | | 11,050,295 | | | | 960,734 | | |

| 2011-118 IC | | | 3.5000 | | | 11/25/21 | | | 29,016,560 | | | | 2,612,326 | | |

| 2011-125 DI | | | 3.5000 | | | 12/25/21 | | | 20,483,588 | | | | 1,883,728 | | |

| 2011-143 MI | | | 3.5000 | | | 1/25/22 | | | 8,442,246 | | | | 711,382 | | |

| 2012-2 MI | | | 3.5000 | | | 2/25/22 | | | 12,608,363 | | | | 1,203,231 | | |

| 2010-137 BI | | | 3.5000 | | | 2/25/24 | | | 4,422,149 | | | | 240,996 | | |

| 2010-135 DI | | | 3.5000 | | | 4/25/24 | | | 9,574,596 | | | | 615,466 | | |

| 2011-75 AI | | | 3.5000 | | | 1/25/25 | | | 18,076,429 | | | | 1,299,334 | | |

| 2011-66 BI | | | 3.5000 | | | 3/25/25 | | | 2,203,248 | | | | 136,656 | | |

| 2011-80 KI | | | 3.5000 | | | 4/25/25 | | | 9,375,003 | | | | 755,160 | | |

| 2011-67 CI | | | 3.5000 | | | 8/25/25 | | | 4,608,673 | | | | 427,564 | | |

| 2011-22 IC | | | 3.5000 | | | 12/25/25 | | | 9,080,578 | | | | 1,001,845 | | |

| 2011-101 EI | | | 3.5000 | | | 10/25/26 | | | 20,111,049 | | | | 2,618,247 | | |

| 2011-69 TI | | | 4.0000 | | | 5/25/20 | | | 5,967,768 | | | | 362,918 | | |

| 2010-89 LI | | | 4.0000 | | | 8/25/20 | | | 9,453,295 | | | | 776,627 | | |

| 2010-104 CI | | | 4.0000 | | | 9/25/20 | | | 4,143,455 | | | | 339,716 | | |

| 2011-67 EI | | | 4.0000 | | | 7/25/21 | | | 10,390,270 | | | | 811,610 | | |

| 2010-110 IH | | | 4.5000 | | | 10/25/18 | | | 11,229,556 | | | | 794,088 | | |

| 2009-70 IN | | | 4.5000 | | | 8/25/19 | | | 15,849,032 | | | | 988,865 | | |

| 2008-15 JI | | | 4.5000 | | | 6/25/22 | | | 2,730,316 | | | | 77,889 | | |

| 2010-114 CI | | | 5.0000 | | | 4/25/18 | | | 14,110,229 | | | | 955,292 | | |

2010-30 | | | 5.0000 | | | 8/25/18 | | | 5,827,247 | | | | 414,250 | | |

| 2003-64 XI | | | 5.0000 | | | 7/25/33 | | | 1,199,004 | | | | 193,952 | | |

TOTAL AGENCY STRIPPED | | | | $ | 101,059,970 | | |

AGENCY POOL ADJUSTABLE RATE

MORTGAGES — 0.0% | | | |

Federal National Mortgage Association 865963 | | | 2.2980 | | | 3/1/36 | | $ | 2,065,162 | | | $ | 2,202,578 | | |

ASSET-BACKED SECURITIES

AUTO — 27.1% | | | |

Ally Auto Receivables Trust 2012-1 B | |

| 2012-SN1 A4 | | | 0.7000 | | | 12/21/15 | | $ | 22,500,000 | | | $ | 22,517,069 | | |

26

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2014

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

| 2012-SN1 A3 | | | 0.7200 | | | 8/20/15 | | $ | 6,296,132 | | | $ | 6,303,353 | | |

| 2012-1 B | | | 1.8400 | | | 11/15/16 | | | 8,666,000 | | | | 8,713,666 | | |

American Credit Acceptance Receivables | |

| 2014-1 A† | | | 1.1400 | | | 3/12/18 | | | 3,515,179 | | | | 3,517,486 | | |

| 2013-2 A | | | 1.3200 | | | 2/15/17 | | | 675,459 | | | | 676,540 | | |

| 2014-2 A† | | | 1.3900 | | | 10/10/17 | | | 9,387,034 | | | | 9,377,936 | | |

AmeriCredit Automobile Receivables Trust | |

| 2013-2 A2 | | | 0.5300 | | | 11/8/16 | | | 11,150,268 | | | | 11,152,293 | | |

| 2014-1 A2 | | | 0.5700 | | | 6/8/17 | | | 44,721,951 | | | | 44,695,686 | | |

| 2013-1 A3 | | | 0.6100 | | | 10/10/17 | | | 1,588,000 | | | | 1,586,954 | | |

| 2012-5 A3 | | | 0.6200 | | | 6/8/17 | | | 907,113 | | | | 907,462 | | |

| 2013-1 A2† | | | 0.6300 | | | 6/8/16 | | | 1,199,860 | | | | 1,199,862 | | |

| 2014-3 A2A | | | 0.6400 | | | 4/9/18 | | | 45,000,000 | | | | 44,999,136 | | |

| 2013-2 A3 | | | 0.6500 | | | 12/8/17 | | | 18,477,000 | | | | 18,480,396 | | |

| 2012-4 A3 | | | 0.6700 | | | 6/8/17 | | | 57,082,481 | | | | 57,113,215 | | |

| 2013-4 A2 | | | 0.7400 | | | 11/8/16 | | | 23,641,480 | | | | 23,656,112 | | |

| 2013-4 A3 | | | 0.9600 | | | 4/9/18 | | | 8,314,000 | | | | 8,329,637 | | |

| 2013-3 B | | | 1.5800 | | | 9/10/18 | | | 5,024,000 | | | | 5,045,160 | | |

| 2013-4 B | | | 1.6600 | | | 9/10/18 | | | 90,000 | | | | 90,346 | | |

| 2012-5 C | | | 1.6900 | | | 11/8/18 | | | 14,140,000 | | | | 14,211,852 | | |

| 2012-1 B | | | 1.7300 | | | 2/8/17 | | | 2,000,000 | | | | 2,005,324 | | |

| 2011-4 B | | | 2.2600 | | | 9/8/16 | | | 5,170,805 | | | | 5,181,799 | | |

| 2012-3 C | | | 2.4200 | | | 5/8/18 | | | 1,650,000 | | | | 1,677,517 | | |

| 2012-2 C | | | 2.6400 | | | 10/10/17 | | | 4,893,000 | | | | 4,979,402 | | |

| 2012-1 C | | | 2.6700 | | | 1/8/18 | | | 2,371,000 | | | | 2,407,473 | | |

| 2011-3 C | | | 2.8600 | | | 1/9/17 | | | 3,000,000 | | | | 3,023,802 | | |

| 2012-3 D | | | 3.0300 | | | 7/9/18 | | | 24,856,000 | | | | 25,555,033 | | |

| 2011-4 C | | | 3.0800 | | | 7/10/17 | | | 225,000 | | | | 228,219 | | |

| 2011-2 C | | | 3.1900 | | | 10/12/16 | | | 6,222,799 | | | | 6,270,216 | | |

| 2010-3 C | | | 3.3400 | | | 4/8/16 | | | 2,459,159 | | | | 2,473,602 | | |

| 2012-1 D | | | 4.7200 | | | 3/8/18 | | | 8,891,000 | | | | 9,311,370 | | |

| 2010-3 D | | | 4.9800 | | | 1/8/18 | | | 13,735,000 | | | | 14,259,952 | | |

BMW Vehicle Lease Trust 2014-1 A2 | | | 0.4500 | | | 3/21/16 | | | 21,453,000 | | | | 21,445,858 | | |

California Republic Auto Receivables Trust

2013-2 A2 | | | 1.2300 | | | 3/15/19 | | | 15,927,909 | | | | 15,982,088 | | |

Capital Auto Receivables Asset Trust | |

| 2013-1 A3 | | | 0.7900 | | | 6/20/17 | | | 3,345,000 | | | | 3,347,648 | | |

| 2013-4 A2 | | | 0.8500 | | | 2/21/17 | | | 6,750,000 | | | | 6,761,841 | | |

Credit Acceptance Auto Loan Trust | |

| 2014-2A B† | | | 2.6700 | | | 9/15/22 | | | 8,639,000 | | | | 8,637,732 | | |

| 2012-1A B† | | | 3.1200 | | | 3/16/20 | | | 4,500,000 | | | | 4,548,875 | | |

27

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2014

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

Carmax Auto Owner Trust | |

| 2014-1 A2 | | | 0.4700 | | | 2/15/17 | | $ | 36,376,650 | | | $ | 36,387,716 | | |

| 2012-3 A3 | | | 0.5200 | | | 7/17/17 | | | 21,491,316 | | | | 21,492,880 | | |

| 2014-2 A2 | | | 0.7400 | | | 4/17/17 | | | 40,571,000 | | | | 40,560,865 | | |

DT Auto Owner Trust | |

| 2014-1A A† | | | 0.6600 | | | 7/17/17 | | | 1,728,597 | | | | 1,728,589 | | |

| 2014-2A A1† | | | 0.8300 | | | 8/15/17 | | | 10,588,172 | | | | 10,584,864 | | |

| 2014-1A B† | | | 1.4300 | | | 3/15/18 | | | 5,730,000 | | | | 5,742,484 | | |

| 2014-2A B† | | | 1.6400 | | | 4/16/18 | | | 8,474,000 | | | | 8,465,986 | | |

| 2013-2A B† | | | 1.7800 | | | 6/15/17 | | | 9,548,000 | | | | 9,595,576 | | |

Enterprise Fleet Financing LLC | |

| 2012-2 A2† | | | 0.7200 | | | 4/20/18 | | | 5,820,906 | | | | 5,824,259 | | |

| 2014-2 A2† | | | 1.0500 | | | 3/20/20 | | | 2,500,000 | | | | 2,495,720 | | |

Exeter Automobile Receivables Trust 2013-2A A | |

| 2014-2A A† | | | 1.0600 | | | 8/15/18 | | | 8,734,584 | | | | 8,720,344 | | |

| 2014-1A A† | | | 1.2900 | | | 5/15/18 | | | 30,147,341 | | | | 30,202,046 | | |

| 2013-2A A† | | | 1.4900 | | | 11/15/17 | | | 14,981,756 | | | | 15,031,929 | | |

Fifth Third Auto Trust | |

| 2014-1 A1 | | | 0.2000 | | | 3/16/15 | | | 1,033,356 | | | | 1,033,342 | | |

| 2014-1 A2 | | | 0.4600 | | | 8/15/16 | | | 42,380,000 | | | | 42,392,659 | | |

First Investors Auto Owner Trust | |

| 2014-1A A2† | | | 0.8000 | | | 2/15/18 | | | 4,434,996 | | | | 4,433,584 | | |

| 2014-2A A2† | | | 0.8600 | | | 8/15/18 | | | 22,500,000 | | | | 22,471,799 | | |

| 2013-3A A2† | | | 0.8900 | | | 9/15/17 | | | 4,328,288 | | | | 4,332,279 | | |

| 2014-1A A3† | | | 1.4900 | | | 1/15/20 | | | 9,500,000 | | | | 9,501,422 | | |

Ford Credit Auto Lease Trust 2013-A A3 | | | 0.6000 | | | 3/15/16 | | | 39,425,377 | | | | 39,451,409 | | |

Ford Credit Auto Trust 2013-A A3 | | | 0.5500 | | | 7/15/17 | | | 52,352,795 | | | | 52,354,894 | | |

GE Equipment Transportation LLC

2012-1 A3 | | | 0.9900 | | | 11/23/15 | | | 21,659 | | | | 21,664 | | |

Honda Auto Receivables Owner Trust | |

| 2014-1 A1 | | | 0.1900 | | | 3/23/15 | | | 5,953,275 | | | | 5,952,928 | | |

| 2014-2 A2 | | | 0.3900 | | | 9/19/16 | | | 25,376,000 | | | | 25,364,078 | | |

| 2014-1 A2 | | | 0.4100 | | | 8/22/16 | | | 42,000,000 | | | | 41,987,224 | | |

| 2014-B A2 | | | 0.4400 | | | 2/15/17 | | | 44,090,000 | | | | 44,071,923 | | |

| 2011-2 A4 | | | 1.5500 | | | 8/18/17 | | | 2,993,622 | | | | 2,994,023 | | |

Hyundai Auto Receivables Trust | |

| 2014-B A1 | | | 0.1800 | | | 5/15/15 | | | 2,687,351 | | | | 2,687,077 | | |

| 2012-C A4 | | | 0.7300 | | | 6/15/18 | | | 500,000 | | | | 500,345 | | |

Mercedes-Benz Auto Lease | |

| 2014-A A2A | | | 0.4800 | | | 6/15/16 | | | 47,197,000 | | | | 47,190,463 | | |

| 2013 A A3 | | | 0.5900 | | | 2/15/16 | | | 28,903,000 | | | | 28,917,148 | | |

28

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2014

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |

Nissan Auto Lease Trust | |

| 2013-A A2A | | | 0.4500 | | | 9/15/15 | | $ | 79,993 | | | $ | 80,001 | | |

| 2013-A A3 | | | 0.6100 | | | 4/15/16 | | | 64,363,000 | | | | 64,403,394 | | |

Prestige Automobile Receivables Trust | |

| 2014-1A A2† | | | 0.9700 | | | 3/15/18 | | | 14,663,673 | | | | 14,649,678 | | |

| 2012-1 B | | | 1.0900 | | | 2/15/18 | | | 3,855,000 | | | | 3,912,650 | | |

| 2013-1A A2† | | | 1.0900 | | | 2/15/18 | | | 9,870,369 | | | | 9,882,942 | | |

| 2013-1A A3 | | | 1.3300 | | | 5/15/19 | | | 4,625,000 | | | | 4,629,131 | | |

| 2014-1A A3† | | | 1.5200 | | | 4/15/20 | | | 17,250,000 | | | | 17,187,222 | | |

Porsche Financial Auto Securitization

2014-1 A2† | | | 0.3800 | | | 9/23/16 | | | 40,666,000 | | | | 40,658,700 | | |

Santander Drive Auto Receivables Trust | |

| 2014-3 A2A | | | 0.5400 | | | 8/15/17 | | | 17,167,000 | | | | 17,159,845 | | |

| 2013-3 A2 | | | 0.5500 | | | 9/15/16 | | | 4,989,297 | | | | 4,989,902 | | |

| 2013-1 A3 | | | 0.6200 | | | 6/15/17 | | | 30,909,932 | | | | 30,917,258 | | |

| 2013-5 A2A | | | 0.6400 | | | 4/17/17 | | | 15,014,465 | | | | 15,020,311 | | |

| 2014-1 A2A | | | 0.6600 | | | 7/17/17 | | | 20,177,886 | | | | 20,184,225 | | |

| 2014-4 A2A | | | 0.6700 | | | 1/16/18 | | | 43,174,000 | | | | 43,173,763 | | |

| 2013-2 A3 | | | 0.7000 | | | 9/15/17 | | | 54,591,885 | | | | 54,622,156 | | |

| 2013-3 A3 | | | 0.7000 | | | 10/16/17 | | | 6,031,000 | | | | 6,034,745 | | |

| 2014-2 A2A | | | 0.7500 | | | 8/15/17 | | | 28,700,000 | | | | 28,688,187 | | |

| 2014-1 A3 | | | 0.8700 | | | 1/16/18 | | | 19,425,000 | | | | 19,442,875 | | |

| 2013-4 A2 | | | 0.8900 | | | 9/15/16 | | | 736,512 | | | | 736,813 | | |

| 2012-4 A3 | | | 1.0400 | | | 8/15/16 | | | 706,018 | | | | 706,161 | | |

| 2013-1 B | | | 1.1600 | | | 1/15/19 | | | 3,570,000 | | | | 3,573,899 | | |

| 2012-AA B | | | 1.2100 | | | 10/16/17 | | | 17,943,000 | | | | 17,984,335 | | |

| 2012-6 B | | | 1.3300 | | | 5/15/17 | | | 21,788,000 | | | | 21,832,160 | | |

| 2013-5 B | | | 1.5500 | | | 10/15/18 | | | 17,165,000 | | | | 17,233,754 | | |

| 2014-1 B | | | 1.5900 | | | 10/15/18 | | | 5,460,000 | | | | 5,473,332 | | |

| 2012-3 B | | | 1.9400 | | | 12/15/16 | | | 3,521,290 | | | | 3,531,786 | | |

| 2013-4 B | | | 2.1600 | | | 1/15/20 | | | 4,218,000 | | | | 4,283,661 | | |

| 2012-3 D | | | 3.6400 | | | 5/15/18 | | | 32,352,000 | | | | 33,524,737 | | |

Toyota Auto Receivable Owner Trust

2014-A A3 | | | 0.6700 | | | 12/15/17 | | | 35,000,000 | | | | 34,926,119 | | |

VFC LLC | |

| 2014-2 A† | | | 2.7500 | | | 7/20/30 | | | 8,392,913 | | | | 8,393,261 | | |

| 2014-2 B† | | | 5.5000 | | | 7/20/30 | | | 6,185,000 | | | | 6,178,961 | | |

Volkswagen Auto Loan Enhanced Trust

2013-1 A2 | | | 0.3700 | | | 1/20/16 | | | 4,172,235 | | | | 4,172,652 | | |

Wheels SPV LLC | |

| 2014-1A A1† | | | 0.2400 | | | 5/20/15 | | | 8,078,727 | | | | 8,078,898 | | |

29

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2014

BONDS & DEBENTURES — Continued | | Coupon

Rate (%) | | Maturity

Date | | Principal

Amount | | Fair

Value | |