UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-1735 |

|

FPA NEW INCOME, INC. |

(Exact name of registrant as specified in charter) |

|

11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA | | 90025 |

(Address of principal executive offices) | | (Zip code) |

|

(Name and Address of Agent for Service) | Copy to: |

| |

J. RICHARD ATWOOD, PRESIDENT FPA NEW INCOME, INC. 11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA 90025 | MARK D. PERLOW, ESQ. DECHERT LLP ONE BUSH STREET, STE. 1600 SAN FRANCISCO, CA 94104 |

|

Registrant’s telephone number, including area code: | (310) 473-0225 | |

|

Date of fiscal year end: | September 30 | |

|

Date of reporting period: | September 30, 2017 | |

| | | | | | | | | |

Item 1: Report to Shareholders.

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Dear Shareholders:

FPA New Income, Inc. (the "Fund") had a total return of 1.01% in the third quarter of 2017 and a total return of 2.58% for the trailing 12 months.

As of June 30, the portfolio had a yield-to-worst1 of 2.67% and an effective duration2 of 1.49 years. The Treasury yield curve continued to flatten in the third quarter, with meaningfully higher yields for maturities up to three years, smaller yield increases in five- to 10-year maturities and a de minimis increase in the 30-year Treasury yield. Credit spreads continued to compress across both high quality and credit assets, resulting in fewer attractive investment opportunities. The portfolio's credit sensitive holdings decreased slightly to 11.5% for the period, compared to 12.1% on June 30. We remain cautious about credit risk, while seeking opportunities to extend the portfolio's duration as rates allow.

Portfolio Attribution

Fiscal Year 2017 (10/1/16-9/30/17)

The largest contributors to performance were corporate bonds and bank debt, led by price appreciation of our energy and metals and mining investments. The second-and third-largest contributors to performance were asset-backed securities (ABS) backed by auto loans and Collateralized Loan Obligations (CLOs), with the return on both stemming primarily from coupon return.

The largest detractors from performance were interest-only agency mortgage bonds, which decreased in price as a result of rising interest rates over the past 12 months. The short remaining life of these bonds' underlying mortgages makes the prepayment speed insensitive to changes in interest rates, thereby creating positive duration. We largely exited this investment during the year. The second-largest detractors from performance were our longer maturity Treasury notes (the average maturity was approximately 2.7 years as of the end of the quarter), which decreased in price as a result of rising interest rates.

Third Quarter 2017

The largest contributors to performance were corporate bonds and bank debt, led by our metals and mining investment, which increased in value following the completion of the issuer's restructuring. The second- and third-largest contributors to performance were GNMA project loan interest-only bonds and Collateralized Loan Obligations (CLOs). Both were driven by coupon return.

There were no meaningful detractors from performance.

1 Yield-to-worst is the lowest possible yield that can be received on a bond without the issuer actually defaulting. It does not represent the yield that an investor should expect to receive. As of September 30, 2017, the SEC yield was 2.58%. This yield figure reflects the theoretical income that a bond portfolio would generate, including dividends and interest, during the period after deducting the Fund's expenses for the period (but excluding any fee waivers). The Fund's actual net earnings for a given period under generally accepted accounting principles may differ from this standardized yield. The SEC yield is expressed as an annual percentage based on the price of the Fund at the beginning of the month.

2 Duration is a measure of the sensitivity of the price (the value of principal) of a fixed-income investment to a change in interest rates.

1

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

Portfolio Activity

The table below shows the change in portfolio allocations for the third quarter compared to the second:

Sector | | % Portfolio

9/30/2017 | | % Portfolio

6/30/2017 | |

ABS | | | 53.0 | % | | | 54.7 | % | |

Mortgage Backed (CMO3) | | | 9.7 | % | | | 13.6 | % | |

Stripped Mortgage-backed | | | 8.1 | % | | | 8.9 | % | |

Corporate | | | 7.4 | % | | | 6.2 | % | |

Cash and equivalents | | | 10.5 | % | | | 6.9 | % | |

CMBS4 | | | 3.8 | % | | | 3.4 | % | |

Mortgage Pass-through | | | 2.6 | % | | | 3.2 | % | |

U.S. Treasury | | | 4.8 | % | | | 3.0 | % | |

Municipal | | | 0.1 | % | | | 0.1 | % | |

Total | | | 100 | % | | | 100 | % | |

Yield-to-worst | | | 2.67 | % | | | 2.71 | % | |

Duration (years) | | | 1.49 | | | | 1.54 | | |

Average Life (years) | | | 1.77 | | | | 1.88 | | |

Our ABS holdings decreased during the quarter due to amortization and the maturity of existing positions, but the decline was partially offset by additions to our auto ABS, CLO and insurance premium finance holdings. Investments in Mortgage Backed (CMO) bonds decreased primarily due to sales of existing agency relocation mortgage bonds and the amortization of bonds backed by non-performing residential mortgages. As credit spreads decreased during the quarter, we sold certain of our high-quality relocation bonds after their price increased to the point where they no longer offered enough yield relative to the duration. The exposure to Stripped Mortgage Backed bonds decreased as we sold GNMA project loan interest-only bonds whose prospective return profiles were no longer attractive. Notwithstanding the expensive market for credit investments, we were able to find a few attractive investments in corporate bank debt and bonds, which slightly increased our exposure to corporates during the quarter.

In general, given the available opportunities in the market, we have had more success finding attractive credit investments in bank debt versus high yield. Bank debt has higher seniority and better structural protections, which enhance the margin of safety5 as appropriate for the available return. Finally, with respect to notable changes in exposures, our U.S. Treasury bond exposure increased as higher Treasury rates allowed us to buy two-year Treasury notes at a yield that compensates for the duration risk. As credits continued to tighten this quarter, it was challenging to find attractive new investment opportunities. We made some purchases during the quarter,

3 Collateralized mortgage obligations are mortgage-backed bonds that separate mortgage pools into different maturity classes.

4 Commercial mortgage backed securities are securities backed by commercial mortgages rather than residential mortgages.

5 Margin of safety is a principle of investing in which an investor only purchases securities when the market price is significantly below its intrinsic value. In other words, when market price is significantly below your estimation of the intrinsic value, the difference is the margin of safety. This difference allows an investment to be made with minimal downside risk.

2

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

but uninvested cash from amortization and maturities of existing positions increased the portfolio's cash and cash equivalents at the end of the quarter.

Market Commentary

This summer marked the 50th anniversary of the "Summer of Love," when an estimated 100,000 baby boomers descended on San Francisco's Haight Ashbury neighborhood to celebrate the new counterculture of being hippies (or flower children). Investors seem to be commemorating the anniversary by spreading their love throughout the capital markets — to bonds, credit, stocks and, in a nod to San Francisco, to FAANG (Facebook, Apple, Amazon, Netflix and Google).

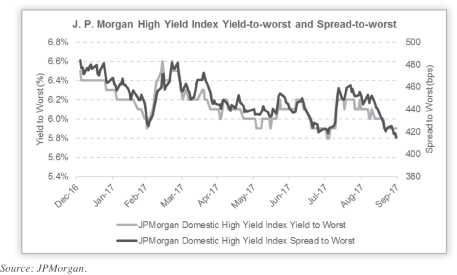

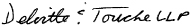

With so much love going around, fixed income markets — in all forms — are expensive. Everywhere we look, we find lower spreads and, thus, less compensation for the risk of short-term mark-to-market price movements (i.e., duration risk) and/or the risk of permanent loss of capital. As we said last quarter, high-quality bond spreads are low and trending lower. Likewise, in the credit market, the spread on high-yield bonds continues to narrow. The JPMorgan Domestic High Yield Index reached a new low in spread for 2017, and is close to the low in yield-to-worst, as shown below.

3

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

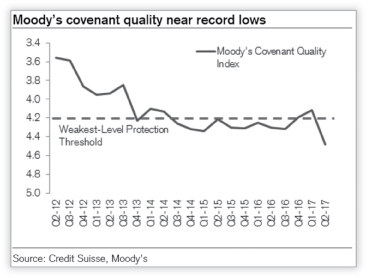

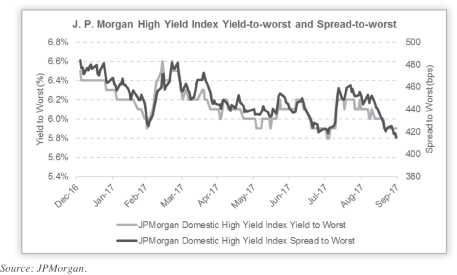

Yet at the same time that bonds are more expensive (i.e., yields are lower), the quality of what one can buy is going down, as evidenced by weaker investor protections in high-yield bond covenants (see chart below).

Narrow spreads pose a challenge and limit investment opportunities. Our exposure to credit (which we measure as anything rated BBB+ or lower) was little changed in the third quarter. The Fund's credit exposure has decreased from 17.6% of the portfolio to 11.5% over the past year because the expensive market is making it difficult to find compelling investments. We do find the occasional interesting idea, but without cheaper valuations it is difficult to see our credit exposure changing meaningfully in the near term. As a result, the bulk of the portfolio's capital has been redeployed toward high quality, less credit sensitive investments.

Despite the exuberance in the market, as with that magical event in 1967, not everything is as rosy as it seems. Washington has stumbled on the legislative front, hampered by political infighting and a twice-failed attempt to repeal and replace the Affordable Care Act. While President Trump has struggled to move his agenda through the legislative process, it appears that he can at least move markets. Every move in bond prices seems to be driven by his tweets and pronouncements. In fact, that may explain many of the changes in Treasury rates over the past few weeks and months.

Indeed, in the latest market-moving announcement, President Trump introduced a framework for reform of both personal and corporate income taxes. The president and his advisors say this reform will spread love to both the middle class and corporate America, but not to the wealthy. While on the surface this would appear to be a positive for many, it has a potential negative side as well. If enacted, it would be the first time in U.S. history that the federal government sought to use fiscal policy to stimulate the economy following nine years of economic expansion and when the unemployment rate is less than 4.5%. Given that fiscal policy stimulus is typically enacted when the economy is in poor shape, doing it under the economic backdrop outlined above creates the possibility of at least a transitory increase in economic activity that could result in higher inflation. At the same time, this potential increase in inflation would come as Treasury rates and credit spreads are still near their historical lows, introducing historically high duration risk into the market. This situation creates the potential for

4

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

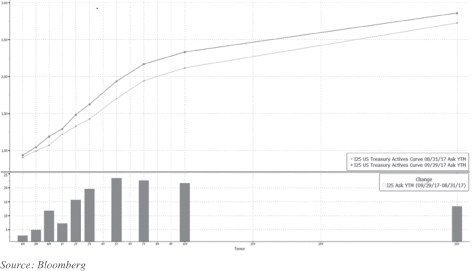

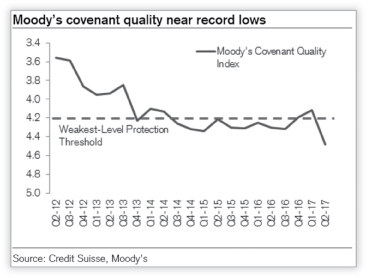

a dramatic increase in interest rates, which could cause mark-to-market problems for a significant percentage of fixed income investors. Whether, and in what form, the president and Congress can enact the stimulus remains to be seen. However, we believe that higher Treasury rates over the past few weeks (as shown below), suggests that the market expects something to materialize.

Meanwhile, we believe that the Federal Reserve will be spreading less love to borrowers (but more love to savers). The Fed has determined that it is time to further tighten monetary policy, and it plans to do so notwithstanding the fact that inflation still has not consistently stayed at or above the Fed's inflation target of 2%. On Sept. 20, the Federal Reserve formally announced its plan for Quantitative Tightening (QT). Starting Oct. 1, the Fed will reduce the reinvestment of its maturing Treasuries and agency mortgages by $10 billion per month. Previously, the Fed had been reinvesting 100% of maturities each month. Over time, the Fed will reduce its reinvestment by $50 billion per month, a figure that's in line with what we outlined in our Q2 2017 market commentary. This announcement comes at the same time that the future of the Federal Reserve's analytical framework for monetary policy is increasingly uncertain. Federal Reserve Chair Janet Yellen's reappointment is in doubt, Vice Chairman Stanley Fischer has resigned, and other board seats are still vacant. New appointees with different views could take the Fed in a new direction or abandon existing policies.

With so many uncertainties, we see a lot of interest rate risk. Could the president's fiscal stimulus package be the catalyst that changes the inflation equation? Could fiscal stimulus in combination with QT drive rates higher? We see no value in speculating. What we care about is whether we are compensated enough in case such an event occurs. As it relates to long duration bonds, we are not.

With valuations stretched, it is paramount that we stay focused on executing our investment strategy in a way that protects your (and our) capital from permanent or temporary capital loss. As such, we continue to lean toward short-duration, high-quality investments while selectively investing in credit where the risk versus reward is appealing.

We are excited to announce that joining us in this effort is a new member of our team, Ryan Taylor. Ryan possesses all of the qualities we look for. He has a strong background in credit investing, and importantly, he

5

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

employs his skills with an absolute return mindset. Ryan will work alongside our colleagues, Joe Choi and Prakash Gopinath, to scour the market for credit investments, whether they are in structured product, corporate or any other form.

We thank you for your continued support and we continue to work diligently to maintain your trust.

Respectfully submitted,

Thomas H. Atteberry

Portfolio Manager

Abhijeet Patwardhan

Portfolio Manager

October 2017

6

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

The discussions of Fund investments represent the views of the Fund's managers at the time of this report and are subject to change without notice. References to individual securities are for informational purposes only and should not be construed as recommendations to purchase or sell individual securities.

FUND RISKS

Investments in mutual funds carry risks and investors may lose principal value. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The funds may purchase foreign securities which are subject to interest rate, currency exchange rate, economic and political risks: this may be enhanced when investing in emerging markets. The securities of smaller, less well-known companies can be more volatile than those of larger companies. The return of principal in a bond fund is not guaranteed. Bond funds have the same issuer, interest rate, inflation and credit risks that are associated with underlying bonds owned by the fund. Lower rated bonds, convertible securities and other types of debt obligations involve greater risks than higher rated bonds. Mortgage securities and collateralized mortgage obligations (CMOs) are subject to prepayment risk and the risk of default on the underlying mortgages or other assets; derivatives may increase volatility. High yield securities can be volatile and subject to much higher instances of default.

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on our current expectations, they are considered "forward-looking statements" which may or may not prove to be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be construed as a recommendation to purchase or sell any particular security.

7

FPA NEW INCOME, INC.

HISTORICAL PERFORMANCE

(Unaudited)

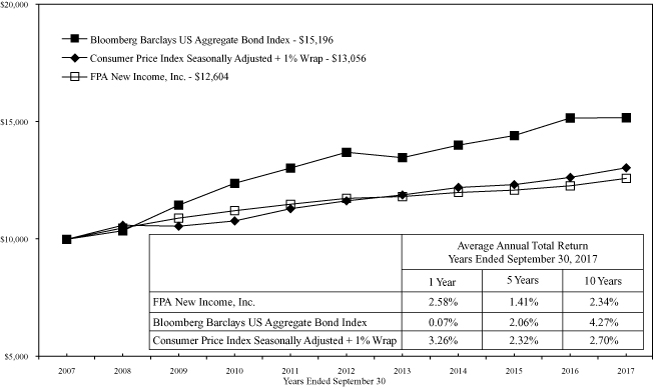

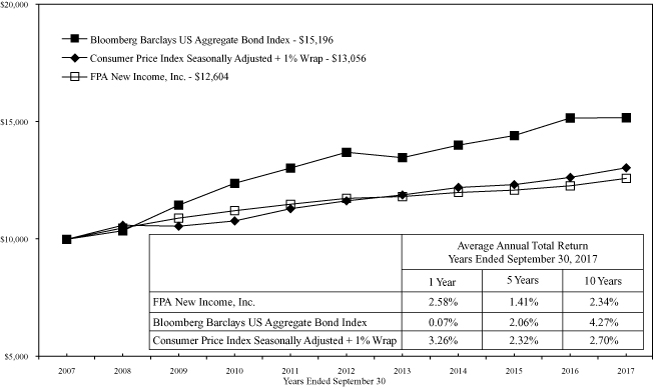

Change in Value of a $10,000 Investment in FPA New Income, Inc. vs. Barclays U.S. Aggregate Index and Consumer Price Index + 100 Basis Points from October 1, 2007 to September 30, 2017

Past performance is not indicative of future performance. The Barclays U.S. Aggregate Bond Index a broad-based unmanaged composite of four major subindexes: U.S. Government Index; U.S. Credit Index; U.S. Mortgage-Backed Securities Index; and U.S. Asset-Backed Securities Index. The index holds investment quality bonds. The Consumer Price Index is an unmanaged index representing the rate of inflation of U.S. consumer prices as determined by the US Department of Labor Statistics. The performance of the Fund and of the Averages is computed on a total return basis which includes reinvestment of all distributions.

Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown. This data represents past performance, and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment it may be worth more or less than its original cost. Current month-end performance data can be obtained by visiting the website at ww.fpafunds.com or by calling toll-free, 1-800-982-4372. Information regarding the Fund's expense ratio and redemption fees can be found on pages 38 and 42.

The Prospectus details the Fund's objective and policies, charges, and other matters of interest to prospective investors. Please read the prospectus carefully before investing. The Prospectus may be obtained by visiting the website at www.fpafunds.com, by email at crm@fpafunds.com, toll-free by calling 1-800-982-4372 or by contacting the Fund in writing.

8

FPA NEW INCOME, INC.

PORTFOLIO SUMMARY

September 30, 2017

Common Stocks | | | 0.1 | % | |

Industrials | | | 0.1 | % | |

Bonds & Debentures | | | 99.5 | % | |

Asset-Backed Securities | | | 53.0 | % | |

U.S. Treasuries | | | 14.9 | % | |

Residential Mortgage-Backed Securities | | | 12.3 | % | |

Commercial Mortgage-Backed Securities | | | 11.9 | % | |

Corporate Bank Debt | | | 4.4 | % | |

Corporate Bonds & Notes | | | 2.9 | % | |

Municipals | | | 0.1 | % | |

Short-term Investments | | | 0.9 | % | |

Other Assets And Liabilities, Net | | | (0.5 | )% | |

Net Assets | | | 100.0 | % | |

9

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS

September 30, 2017

COMMON STOCK — 0.1% | | Shares or

Principal

Amount | | Fair

Value | |

INDUSTRIALS — 0.1% | |

Boart Longyear Ltd.* (Cost $630,347) | | | 261,407,903 | | | $ | 5,126,208 | | |

BONDS & DEBENTURES | |

COMMERCIAL MORTGAGE-BACKED SECURITIES — 11.9% | |

AGENCY— 0.0% | |

Government National Mortgage Association 2013-55 A — 1.317% 5/16/2034 | | $ | 433,512 | | | $ | 430,771 | | |

Government National Mortgage Association 2012-2 A — 1.862% 6/16/2031 | | | 527,372 | | | | 527,017 | | |

Government National Mortgage Association 2011-49 A — 2.45% 7/16/2038 | | | 692,279 | | | | 692,346 | | |

Government National Mortgage Association 2010-148 AC — 7.00% 12/16/2050@ | | | 53,969 | | | | 54,991 | | |

| | | $ | 1,705,125 | | |

AGENCY STRIPPED — 8.1% | |

Government National Mortgage Association 2004-10 IO — 0.00% 1/16/2044@ | | $ | 9,438,606 | | | $ | 21 | | |

Government National Mortgage Association 2002-56 IO — 0.043% 6/16/2042@ | | | 27,351 | | | | 36 | | |

Government National Mortgage Association 2009-119 IO — 0.105% 12/16/2049@ | | | 13,943,044 | | | | 129,853 | | |

Government National Mortgage Association 2009-105 IO — 0.165% 11/16/2049@ | | | 10,699,307 | | | | 85,587 | | |

Government National Mortgage Association 2009-71 IO — 0.26% 7/16/2049@ | | | 3,332,376 | | | | 50,658 | | |

Government National Mortgage Association 2012-45 IO — 0.325% 4/16/2053@ | | | 17,681,254 | | | | 469,853 | | |

Government National Mortgage Association 2008-8 IO — 0.349% 11/16/2047@ | | | 11,630,383 | | | | 92,723 | | |

Government National Mortgage Association 2009-49 IO — 0.383% 6/16/2049@ | | | 12,002,459 | | | | 146,233 | | |

Government National Mortgage Association 2009-4 IO — 0.39% 1/16/2049@ | | | 3,008,585 | | | | 56,515 | | |

Government National Mortgage Association 2009-86 IO — 0.397% 10/16/2049@ | | | 21,856,060 | | | | 262,893 | | |

Government National Mortgage Association 2012-125 IO — 0.413% 2/16/2053@ | | | 80,658,551 | | | | 2,405,383 | | |

Government National Mortgage Association 2005-9 IO — 0.451% 1/16/2045@ | | | 2,547,341 | | | | 28,538 | | |

Government National Mortgage Association 2007-77 IO — 0.486% 11/16/2047@ | | | 27,590,936 | | | | 483,261 | | |

Government National Mortgage Association 2009-60 IO — 0.508% 6/16/2049@ | | | 7,243,678 | | | | 76,263 | | |

Government National Mortgage Association 2011-165 IO — 0.581% 10/16/2051@ | | | 134,102,232 | | | | 2,686,644 | | |

Government National Mortgage Association 2009-30 IO — 0.613% 3/16/2049@ | | | 7,866,067 | | | | 254,920 | | |

Government National Mortgage Association 2010-123 IO — 0.646% 9/16/2050@ | | | 7,799,791 | | | | 172,522 | | |

Government National Mortgage Association 2008-24 IO — 0.652% 11/16/2047@ | | | 1,836,203 | | | | 25,408 | | |

Government National Mortgage Association 2014-157 IO — 0.657% 5/16/2055@ | | | 161,137,193 | | | | 7,668,342 | | |

Government National Mortgage Association 2008-45 IO — 0.67% 2/16/2048@ | | | 2,657,235 | | | | 18,685 | | |

Government National Mortgage Association 2012-25 IO — 0.706% 8/16/2052@ | | | 114,401,214 | | | | 3,689,805 | | |

Government National Mortgage Association 2013-45 IO — 0.715% 12/16/2053@ | | | 78,676,060 | | | | 2,668,574 | | |

Government National Mortgage Association 2004-43 IO — 0.726% 6/16/2044@ | | | 14,471,431 | | | | 194,003 | | |

Government National Mortgage Association 2012-58 IO — 0.73% 2/16/2053@ | | | 229,712,582 | | | | 8,796,407 | | |

Government National Mortgage Association 2012-150 IO — 0.748% 11/16/2052@ | | | 77,170,512 | | | | 3,730,747 | | |

Government National Mortgage Association 2015-41 IO — 0.756% 9/16/2056@ | | | 47,772,814 | | | | 2,844,838 | | |

Government National Mortgage Association 2014-138 IO — 0.762% 4/16/2056@ | | | 25,665,223 | | | | 1,318,702 | | |

Government National Mortgage Association 2015-86 IO — 0.773% 5/16/2052@ | | | 72,562,529 | | | | 4,111,712 | | |

Government National Mortgage Association 2013-63 IO — 0.777% 9/16/2051@ | | | 73,819,387 | | | | 3,745,426 | | |

Government National Mortgage Association 2013-125 IO — 0.78% 10/16/2054@ | | | 22,953,787 | | | | 922,403 | | |

Government National Mortgage Association 2013-13 IO — 0.783% 7/16/2047@ | | | 107,090,968 | | | | 4,893,982 | | |

Government National Mortgage Association 2014-164 IO — 0.801% 1/16/2056@ | | | 293,658,683 | | | | 15,164,329 | | |

Government National Mortgage Association 2012-79 IO — 0.803% 3/16/2053@ | | | 149,645,550 | | | | 6,391,511 | | |

Government National Mortgage Association 2012-114 IO — 0.811% 1/16/2053@ | | | 52,729,520 | | | | 2,971,430 | | |

10

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2017

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

Government National Mortgage Association 2014-77 IO — 0.823% 12/16/2047@ | | $ | 65,233,322 | | | $ | 3,195,148 | | |

Government National Mortgage Association 2014-153 IO — 0.825% 4/16/2056@ | | | 239,059,874 | | | | 14,056,242 | | |

Government National Mortgage Association 2015-47 IO — 0.83% 10/16/2056@ | | | 192,121,399 | | | | 11,952,007 | | |

Government National Mortgage Association 2014-135 IO — 0.835% 1/16/2056@ | | | 317,955,644 | | | | 17,137,205 | | |

Government National Mortgage Association 2014-110 IO — 0.84% 1/16/2057@ | | | 79,478,895 | | | | 5,149,366 | | |

Government National Mortgage Association 2014-175 IO — 0.848% 4/16/2056@ | | | 233,034,774 | | | | 13,928,232 | | |

Government National Mortgage Association 2015-7 IO — 0.876% 1/16/2057@ | | | 20,277,026 | | | | 1,264,419 | | |

Government National Mortgage Association 2015-101 IO — 0.879% 3/16/2052@ | | | 178,133,026 | | | | 10,528,072 | | |

Government National Mortgage Association 2015-19 IO — 0.879% 1/16/2057@ | | | 121,870,042 | | | | 8,058,047 | | |

Government National Mortgage Association 2008-92 IO — 0.881% 10/16/2048@ | | | 21,523,626 | | | | 371,321 | | |

Government National Mortgage Association 2006-55 IO — 0.915% 8/16/2046@ | | | 8,664,223 | | | | 32,597 | | |

Government National Mortgage Association 2014-187 IO — 0.932% 5/16/2056@ | | | 227,885,819 | | | | 14,482,736 | | |

Government National Mortgage Association 2015-169 IO — 0.939% 7/16/2057@ | | | 232,537,568 | | | | 16,842,184 | | |

Government National Mortgage Association 2015-128 IO — 0.946% 12/16/2056@ | | | 208,618,434 | | | | 13,486,598 | | |

Government National Mortgage Association 2015-160 IO — 0.956% 1/16/2056@ | | | 269,429,385 | | | | 17,621,355 | | |

Government National Mortgage Association 2008-48 IO — 0.957% 4/16/2048@ | | | 10,112,724 | | | | 180,437 | | |

Government National Mortgage Association 2012-53 IO — 0.958% 3/16/2047@ | | | 85,362,592 | | | | 4,012,759 | | |

Government National Mortgage Association 2015-150 IO — 0.966% 9/16/2057@ | | | 256,050,116 | | | | 19,274,659 | | |

Government National Mortgage Association 2015-114 IO — 0.968% 3/15/2057@ | | | 170,381,999 | | | | 10,465,919 | | |

Government National Mortgage Association 2016-45 IO — 1.004% 2/16/2058@ | | | 133,062,669 | | | | 9,903,894 | | |

Government National Mortgage Association 2016-34 IO — 1.007% 1/16/2058@ | | | 224,876,217 | | | | 16,584,464 | | |

Government National Mortgage Association 2016-65 IO — 1.009% 1/16/2058@ | | | 248,120,298 | | | | 18,649,913 | | |

Government National Mortgage Association 2015-108 IO — 1.035% 10/16/2056@ | | | 43,017,121 | | | | 2,909,226 | | |

Government National Mortgage Association 2016-125 IO — 1.064% 12/16/2057@ | | | 141,490,859 | | | | 11,252,584 | | |

Government National Mortgage Association 2016-106 IO — 1.069% 9/16/2058@ | | | 274,406,781 | | | | 22,744,974 | | |

Government National Mortgage Association 2016-85 IO — 1.121% 3/16/2057@ | | | 163,312,410 | | | | 13,320,266 | | |

Government National Mortgage Association 2016-119 IO — 1.126% 4/16/2058@ | | | 406,030,945 | | | | 33,178,413 | | |

Government National Mortgage Association 2016-67 IO — 1.166% 7/16/2057@ | | | 122,375,602 | | | | 9,776,611 | | |

Government National Mortgage Association 2016-94 IO — 1.17% 12/16/2057@ | | | 220,654,897 | | | | 18,382,142 | | |

Government National Mortgage Association 2004-108 IO — 1.265% 12/16/2044@ | | | 1,259,801 | | | | 65 | | |

Government National Mortgage Association 2006-30 IO — 2.299% 5/16/2046@ | | | 1,263,785 | | | | 7,805 | | |

| | | $ | 415,307,867 | | |

NON-AGENCY — 3.8% | |

A10 Term Asset Financing LLC 2017-1A A1FX — 2.34% 3/15/2036**,†† | | $ | 17,639,000 | | | $ | 17,649,124 | | |

A10 Term Asset Financing LLC 2016-1 A1 — 2.42% 3/15/2035** | | | 5,607,609 | | | | 5,589,408 | | |

Aventura Mall Trust M 2013-AVM A — 3.867% 12/5/2032**,@ | | | 25,142,000 | | | | 26,124,587 | | |

Bear Stearns Commercial Mortgage Securities Trust

2005-PWR7 B — 5.214% 2/11/2041@ | | | 5,302,421 | | | | 5,301,885 | | |

Citigroup Commercial Mortgage Trust

2006-C4 B — 6.25% 3/15/2049@ | | | 2,809,433 | | | | 2,810,725 | | |

COMM Mortgage Trust

2014-FL5 B, 1M LIBOR + 2.150% — 3.384% 10/15/2031**,@ | | | 12,720,000 | | | | 12,698,431 | | |

COMM Mortgage Trust

2014-FL5 C, 1M LIBOR + 2.150% — 3.384% 10/15/2031**,@ | | | 8,240,000 | | | | 8,063,460 | | |

Credit Suisse Commercial Mortgage Trust Series

2016-MFF E, 1M LIBOR + 6.000% — 7.234% 11/15/2033**,@ | | | 30,398,000 | | | | 30,550,127 | | |

11

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2017

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

JP Morgan Chase Commercial Mortgage Securities Trust

2010-C1 A3 — 5.058% 6/15/2043** | | $ | 7,277,000 | | | $ | 7,759,364 | | |

Latitude Management Real Estate Capital

2016-CRE2 A, 1M LIBOR + 1.700% — 2.936% 11/24/2031**,@,†† | | | 16,735,000 | | | | 16,902,350 | | |

Morgan Stanley Capital I Trust 2006-HQ9 D — 5.862% 7/12/2044@ | | | 7,920,327 | | | | 7,944,790 | | |

Ores NPL LLC 2014-LV3 B — 6.00% 3/27/2024** | | | 21,506,144 | | | | 21,525,566 | | |

Rialto Capital Management LLC 2014-LT5 B — 5.00% 5/15/2024** | | | 1,538,980 | | | | 1,537,663 | | |

Rialto Real Estate Fund LP 2015-LT7 B — 5.071% 12/25/2032** | | | 16,642,256 | | | | 16,629,471 | | |

SCG Trust 2013-SRP1 AJ, 1M LIBOR + 1.950% — 3.427% 11/15/2026**,@ | | | 14,152,000 | | | | 14,099,106 | | |

| | | $ | 195,186,057 | | |

| TOTAL COMMERICAL MORTGAGE-BACKED SECURITIES (Cost $659,466,426) | | $ | 612,199,049 | | |

RESIDENTIAL MORTGAGE-BACKED SECURITIES — 12.3% | |

AGENCY COLLATERALIZED MORTGAGE OBLIGATION — 4.4% | |

Federal Home Loan Mortgage Corporation 2809 UC — 4.00% 6/15/2019 | | $ | 88,020 | | | $ | 88,893 | | |

Federal Home Loan Mortgage Corporation 3957 BV — 4.00% 10/15/2029 | | | 445,182 | | | | 445,981 | | |

Federal Home Loan Mortgage Corporation 2990 TD — 4.00% 5/15/2035 | | | 12,389 | | | | 12,557 | | |

Federal Home Loan Mortgage Corporation 2614 BY — 4.50% 5/15/2018 | | | 119,854 | | | | 120,778 | | |

Federal Home Loan Mortgage Corporation 2645 BY — 4.50% 7/15/2018 | | | 27,473 | | | | 27,666 | | |

Federal Home Loan Mortgage Corporation 2649 AN — 4.50% 7/15/2018 | | | 301,163 | | | | 303,635 | | |

Federal Home Loan Mortgage Corporation 2656 PE — 4.50% 7/15/2018 | | | 54,305 | | | | 54,742 | | |

Federal Home Loan Mortgage Corporation 2568 XD — 5.00% 2/15/2018 | | | 24,271 | | | | 24,391 | | |

Federal National Mortgage Association 2012-117 DA — 1.50% 12/25/2039 | | | 2,819,822 | | | | 2,754,791 | | |

Federal National Mortgage Association 2014-80 GD — 2.00% 2/25/2042 | | | 25,765,977 | | | | 25,552,849 | | |

Federal National Mortgage Association 2017-16 JA — 3.00% 2/25/2043 | | | 32,215,744 | | | | 32,758,151 | | |

Federal National Mortgage Association 2016-104 QA — 3.00% 11/25/2043 | | | 48,511,727 | | | | 49,250,755 | | |

Federal National Mortgage Association 2017-15 DA — 3.00% 12/25/2044 | | | 23,922,983 | | | | 24,285,244 | | |

Federal National Mortgage Association 2017-45 KD — 3.50% 2/25/2044 | | | 21,957,619 | | | | 22,627,276 | | |

Federal National Mortgage Association 2017-52 KC — 3.50% 4/25/2044 | | | 21,414,540 | | | | 22,078,477 | | |

Federal National Mortgage Association 2017-59 DC — 3.50% 5/25/2044 | | | 31,565,842 | | | | 32,548,786 | | |

Federal National Mortgage Association 2003-128 NG — 4.00% 1/25/2019 | | | 41,925 | | | | 42,277 | | |

Federal National Mortgage Association 2004-7 JK — 4.00% 2/25/2019 | | | 352,638 | | | | 355,355 | | |

Federal National Mortgage Association 2008-18 MD — 4.00% 3/25/2019 | | | 99,016 | | | | 99,838 | | |

Federal National Mortgage Association 2004-76 CL — 4.00% 10/25/2019 | | | 96,055 | | | | 96,854 | | |

Federal National Mortgage Association 2009-76 MA — 4.00% 9/25/2024 | | | 46,132 | | | | 46,556 | | |

Federal National Mortgage Association 2011-113 NE — 4.00% 3/25/2040 | | | 973,922 | | | | 981,398 | | |

Federal National Mortgage Association 2012-95 AB — 4.00% 11/25/2040 | | | 560,037 | | | | 563,659 | | |

Federal National Mortgage Association 2009-70 NU — 4.25% 8/25/2019 | | | 440,607 | | | | 443,075 | | |

Federal National Mortgage Association 2003-30 HW — 4.50% 4/25/2018 | | | 37,845 | | | | 38,032 | | |

Federal National Mortgage Association 2008-18 NB — 4.50% 5/25/2020 | | | 137,377 | | | | 138,308 | | |

Federal National Mortgage Association 2011-7 PA — 4.50% 10/25/2039 | | | 44,216 | | | | 44,437 | | |

Federal National Mortgage Association 2012-40 GC — 4.50% 12/25/2040 | | | 1,778,713 | | | | 1,820,671 | | |

Federal National Mortgage Association 2012-67 PB — 4.50% 12/25/2040 | | | 1,760,745 | | | | 1,780,382 | | |

Federal National Mortgage Association 2002-74 PE — 5.00% 11/25/2017 | | | 2,394 | | | | 2,393 | | |

Federal National Mortgage Association 2003-24 PD — 5.00% 4/25/2018 | | | 119,033 | | | | 119,627 | | |

12

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2017

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

Federal National Mortgage Association 2003-46 BG — 5.00% 6/25/2018 | | $ | 143,181 | | | $ | 144,127 | | |

Federal National Mortgage Association 2004-60 LB — 5.00% 4/25/2034 | | | 2,902,853 | | | | 3,055,547 | | |

Federal National Mortgage Association 2011-19 WB — 5.50% 10/25/2018 | | | 652,337 | | | | 659,669 | | |

| | | $ | 223,367,177 | | |

AGENCY POOL ADJUSTABLE RATE — 0.0% | |

Federal National Mortgage Association

865963, 12M USD LIBOR + 1.725% — 3.445% 3/1/2036@ | | $ | 975,680 | | | $ | 1,021,031 | | |

AGENCY POOL FIXED RATE — 2.6% | |

Federal Home Loan Mortgage Corporation J24941 — 2.00% 8/1/2023 | | $ | 3,539,076 | | | $ | 3,536,592 | | |

Federal Home Loan Mortgage Corporation G15139 — 4.50% 6/1/2019 | | | 157,376 | | | | 159,848 | | |

Federal Home Loan Mortgage Corporation P60959 — 4.50% 9/1/2020 | | | 281,039 | | | | 283,259 | | |

Federal Home Loan Mortgage Corporation G14030 — 4.50% 12/1/2020 | | | 207,565 | | | | 212,951 | | |

Federal Home Loan Mortgage Corporation G15169 — 4.50% 9/1/2026 | | | 4,067,489 | | | | 4,206,426 | | |

Federal Home Loan Mortgage Corporation G15272 — 4.50% 9/1/2026 | | | 3,968,485 | | | | 4,065,758 | | |

Federal Home Loan Mortgage Corporation G15875 — 4.50% 9/1/2026 | | | 4,997,022 | | | | 5,182,340 | | |

Federal Home Loan Mortgage Corporation G18056 — 5.00% 6/1/2020 | | | 306,290 | | | | 315,775 | | |

Federal Home Loan Mortgage Corporation G13812 — 5.00% 12/1/2020 | | | 980,397 | | | | 1,006,873 | | |

Federal Home Loan Mortgage Corporation G15036 — 5.00% 6/1/2024 | | | 3,340,839 | | | | 3,421,636 | | |

Federal Home Loan Mortgage Corporation G13667 — 5.00% 8/1/2024 | | | 187,931 | | | | 196,461 | | |

Federal Home Loan Mortgage Corporation G15435 — 5.00% 11/1/2024 | | | 7,539,429 | | | | 7,755,696 | | |

Federal Home Loan Mortgage Corporation G15173 — 5.00% 6/1/2026 | | | 2,829,253 | | | | 2,906,135 | | |

Federal Home Loan Mortgage Corporation G15407 — 5.00% 6/1/2026 | | | 4,499,182 | | | | 4,734,565 | | |

Federal Home Loan Mortgage Corporation G15874 — 5.00% 6/1/2026 | | | 2,192,715 | | | | 2,256,179 | | |

Federal Home Loan Mortgage Corporation G12829 — 5.50% 10/1/2017 | | | 226 | | | | 226 | | |

Federal Home Loan Mortgage Corporation G14187 — 5.50% 12/1/2020 | | | 2,158,685 | | | | 2,211,417 | | |

Federal Home Loan Mortgage Corporation J01270 — 5.50% 2/1/2021 | | | 67,519 | | | | 70,569 | | |

Federal Home Loan Mortgage Corporation G14035 — 5.50% 12/1/2021 | | | 228,012 | | | | 237,594 | | |

Federal Home Loan Mortgage Corporation G15230 — 5.50% 12/1/2024 | | | 5,444,503 | | | | 5,650,418 | | |

Federal Home Loan Mortgage Corporation G15458 — 5.50% 12/1/2024 | | | 876,879 | | | | 924,407 | | |

Federal Home Loan Mortgage Corporation G14460 — 6.00% 1/1/2024 | | | 374,150 | | | | 396,220 | | |

Federal Home Loan Mortgage Corporation G12139 — 6.50% 9/1/2019 | | | 499 | | | | 499 | | |

Federal Home Loan Mortgage Corporation P50543 — 6.50% 4/1/2037 | | | 70,842 | | | | 73,454 | | |

Federal National Mortgage Association AB6251 — 2.00% 9/1/2022 | | | 706,705 | | | | 706,478 | | |

Federal National Mortgage Association AB7515 — 2.00% 1/1/2023 | | | 367,747 | | | | 367,434 | | |

Federal National Mortgage Association MA1502 — 2.50% 7/1/2023 | | | 34,044,896 | | | | 34,504,965 | | |

Federal National Mortgage Association AA4546 — 4.00% 5/1/2024 | | | 1,210,214 | | | | 1,265,494 | | |

Federal National Mortgage Association AL5956 — 4.00% 5/1/2027 | | | 1,232,823 | | | | 1,290,130 | | |

Federal National Mortgage Association 254906 — 4.50% 10/1/2018 | | | 85,813 | | | | 86,669 | | |

Federal National Mortgage Association 255547 — 4.50% 1/1/2020 | | | 47,435 | | | | 48,465 | | |

Federal National Mortgage Association MA0323 — 4.50% 2/1/2020 | | | 163,583 | | | | 166,311 | | |

Federal National Mortgage Association MA0358 — 4.50% 3/1/2020 | | | 97,923 | | | | 100,031 | | |

Federal National Mortgage Association MA0419 — 4.50% 5/1/2020 | | | 172,985 | | | | 177,256 | | |

Federal National Mortgage Association AL6725 — 4.50% 9/1/2020 | | | 1,811,245 | | | | 1,841,177 | | |

Federal National Mortgage Association 735920 — 4.50% 10/1/2020 | | | 45,285 | | | | 46,398 | | |

Federal National Mortgage Association 995158 — 4.50% 12/1/2020 | | | 82,397 | | | | 84,774 | | |

Federal National Mortgage Association 889531 — 4.50% 5/1/2022 | | | 29,839 | | | | 30,608 | | |

13

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2017

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

Federal National Mortgage Association AL6212 — 4.50% 1/1/2027 | | $ | 4,301,710 | | | $ | 4,380,672 | | |

Federal National Mortgage Association AE0126 — 5.00% 6/1/2020 | | | 3,424,798 | | | | 3,504,087 | | |

Federal National Mortgage Association 310097 — 5.00% 10/1/2020 | | | 136,990 | | | | 138,167 | | |

Federal National Mortgage Association AE0792 — 5.00% 12/1/2020 | | | 938,877 | | | | 961,194 | | |

Federal National Mortgage Association AE0314 — 5.00% 8/1/2021 | | | 5,206,341 | | | | 5,298,897 | | |

Federal National Mortgage Association AD0285 — 5.00% 9/1/2022 | | | 559,377 | | | | 580,222 | | |

Federal National Mortgage Association AE0812 — 5.00% 7/1/2025 | | | 1,124,141 | | | | 1,152,902 | | |

Federal National Mortgage Association AL5764 — 5.00% 9/1/2025 | | | 3,773,070 | | | | 3,870,376 | | |

Federal National Mortgage Association AL6798 — 5.00% 9/1/2025 | | | 4,458,870 | | | | 4,545,603 | | |

Federal National Mortgage Association AL4056 — 5.00% 6/1/2026 | | | 4,847,953 | | | | 5,017,586 | | |

Federal National Mortgage Association 257100 — 5.50% 1/1/2018 | | | 18,135 | | | | 18,155 | | |

Federal National Mortgage Association 745500 — 5.50% 12/1/2018 | | | 122,727 | | | | 123,538 | | |

Federal National Mortgage Association 745119 — 5.50% 12/1/2019 | | | 1,357,092 | | | | 1,389,257 | | |

Federal National Mortgage Association 995284 — 5.50% 3/1/2020 | | | 22,371 | | | | 22,416 | | |

Federal National Mortgage Association 745190 — 5.50% 6/1/2020 | | | 28,086 | | | | 28,272 | | |

Federal National Mortgage Association 889318 — 5.50% 7/1/2020 | | | 764,688 | | | | 781,163 | | |

Federal National Mortgage Association 745749 — 5.50% 3/1/2021 | | | 161,271 | | | | 167,837 | | |

Federal National Mortgage Association AL5867 — 5.50% 8/1/2023 | | | 686,066 | | | | 702,741 | | |

Federal National Mortgage Association AE0237 — 5.50% 11/1/2023 | | | 604,870 | | | | 620,379 | | |

Federal National Mortgage Association AL5812 — 5.50% 5/1/2025 | | | 2,792,149 | | | | 2,865,709 | | |

Federal National Mortgage Association AL0471 — 5.50% 7/1/2025 | | | 161,659 | | | | 171,889 | | |

Federal National Mortgage Association AL4433 — 5.50% 9/1/2025 | | | 1,262,019 | | | | 1,329,028 | | |

Federal National Mortgage Association AL4901 — 5.50% 9/1/2025 | | | 1,560,414 | | | | 1,617,602 | | |

Federal National Mortgage Association 735439 — 6.00% 9/1/2019 | | | 55,971 | | | | 57,475 | | |

Federal National Mortgage Association 745238 — 6.00% 12/1/2020 | | | 234,250 | | | | 240,036 | | |

Federal National Mortgage Association 745832 — 6.00% 4/1/2021 | | | 1,800,719 | | | | 1,869,857 | | |

Federal National Mortgage Association AD0951 — 6.00% 12/1/2021 | | | 869,873 | | | | 909,441 | | |

Federal National Mortgage Association AL0294 — 6.00% 10/1/2022 | | | 86,018 | | | | 91,311 | | |

Federal National Mortgage Association 890225 — 6.00% 5/1/2023 | | | 801,246 | | | | 852,065 | | |

Federal National Mortgage Association 890403 — 6.00% 5/1/2023 | | | 475,794 | | | | 491,201 | | |

Government National Mortgage Association 782281 — 6.00% 3/15/2023 | | | 1,205,289 | | | | 1,287,789 | | |

| | | $ | 135,608,355 | | |

AGENCY STRIPPED — 0.0% | |

Federal Home Loan Mortgage Corporation 217 PO — 0.00% 1/1/2032@@@ | | $ | 216,819 | | | $ | 196,305 | | |

Federal Home Loan Mortgage Corporation 3763 NI — 3.50% 5/15/2025 | | | 1,963,172 | | | | 135,319 | | |

Federal Home Loan Mortgage Corporation 3917 AI — 4.50% 7/15/2026 | | | 14,929,416 | | | | 1,400,435 | | |

Federal Home Loan Mortgage Corporation 217 IO — 6.50% 1/1/2032 | | | 208,773 | | | | 49,088 | | |

Federal National Mortgage Association 2010-137 BI — 3.50% 2/25/2024 | | | 237,964 | | | | 703 | | |

Federal National Mortgage Association 2011-66 BI — 3.50% 3/25/2025 | | | 262,543 | | | | 2,718 | | |

Federal National Mortgage Association 2010-25 NI — 5.00% 3/25/2025 | | | 299,031 | | | | 11,052 | | |

Federal National Mortgage Association 2003-64 XI — 5.00% 7/25/2033 | | | 599,944 | | | | 109,853 | | |

| | | $ | 1,905,473 | | |

14

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2017

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

NON-AGENCY COLLATERALIZED MORTGAGE OBLIGATION — 5.3% | |

BCAP LLC Trust 2010-RR8 2A6 — 2.754% 11/26/2036**,@ | | $ | 971,947 | | | $ | 969,581 | | |

Citicorp Mortgage Securities REMIC Pass-Through Certificates Trust Series

2005-5 2A3 — 5.00% 8/25/2020 | | | 48,910 | | | | 49,404 | | |

Citigroup Mortgage Loan Trust, Inc. 2014-A A — 4.00% 1/25/2035**,@ | | | 10,629,262 | | | | 10,972,160 | | |

Credit Suisse Mortgage Trust Series 2010-9R 1A4 — 3.75% 8/27/2037** | | | 25,425 | | | | 25,376 | | |

Nationstar HECM Loan Trust 2016-3A A — 2.013% 8/25/2026** | | | 1,896,758 | | | | 1,921,138 | | |

Nationstar HECM Loan Trust 2017-2A A1 — 2.038% 9/25/2027**,@,†† | | | 12,528,000 | | | | 12,528,000 | | |

Nationstar HECM Loan Trust 2017-2A M1 — 2.815% 9/25/2027**,@,†† | | | 12,184,000 | | | | 12,184,000 | | |

Nomura Resecuritization Trust 2016-1R 3A1 — 5.00% 9/28/2036**,@ | | | 5,923,880 | | | | 6,111,580 | | |

RiverView HECM Trust

2007-1 A, 1 year Treasury + 0.500% — 1.817% 5/25/2047**,@ | | | 25,657,611 | | | | 21,512,239 | | |

Stanwich Mortgage Loan Trust Series 2010-3 A — 0.00% 7/31/2038**,@,†† | | | 545,075 | | | | 272,701 | | |

Stanwich Mortgage Loan Trust Series 2011-2 A — 0.00% 9/15/2050**,@,†† | | | 806,632 | | | | 431,713 | | |

Stanwich Mortgage Loan Trust Series 2011-1 A — 0.192% 8/15/2050**,@,†† | | | 771,910 | | | | 407,128 | | |

Stanwich Mortgage Loan Trust Series 2009-2 A — 0.472% 2/15/2049**,@,†† | | | 57,563 | | | | 25,742 | | |

Stanwich Mortgage Loan Trust Series 2010-2 A — 1.005% 2/28/2057**,@,†† | | | 920,261 | | | | 463,995 | | |

Stanwich Mortgage Loan Trust Series 2010-1 A — 1.069% 9/30/2047**,@,†† | | | 230,722 | | | | 116,699 | | |

Stanwich Mortgage Loan Trust Series 2010-4 A — 1.78% 8/31/2049**,@,†† | | | 473,758 | | | | 239,248 | | |

Sunset Mortgage Loan Co. LLC 2015-NPL1 A — 4.459% 9/18/2045**,@@ | | | 9,841,257 | | | | 9,939,036 | | |

Towd Point Mortgage Trust 2016-3 A1 — 2.25% 4/25/2056**,@ | | | 22,959,408 | | | | 22,830,691 | | |

Towd Point Mortgage Trust 2015-1 AES — 3.00% 10/25/2053**,@ | | | 25,033,738 | | | | 25,270,787 | | |

Towd Point Mortgage Trust 2015-2 1A1 — 3.25% 11/25/2060**,@ | | | 35,117,879 | | | | 35,741,984 | | |

Towd Point Mortgage Trust 2015-4 A1 — 3.50% 4/25/2055**,@ | | | 31,925,051 | | | | 32,561,359 | | |

Towd Point Mortgage Trust 2015-2 2A1 — 3.75% 11/25/2057**,@ | | | 27,559,319 | | | | 28,216,964 | | |

VOLT XL LLC 2015-NP14 A1 — 4.375% 11/27/2045**,@@ | | | 14,425,896 | | | | 14,437,969 | | |

VOLT XXV LLC 2015-NPL8 A1 — 3.50% 6/26/2045**,@@ | | | 22,236,690 | | | | 22,244,108 | | |

VOLT XXXVIII LLC 2015-NP12 A1 — 3.875% 9/25/2045**,@@ | | | 11,903,687 | | | | 11,910,021 | | |

| | | $ | 271,383,623 | | |

| TOTAL RESIDENTIAL MORTGAGE-BACKED SECURITIES (Cost $635,302,945) | | $ | 633,285,659 | | |

ASSET-BACKED SECURITIES — 53.0% | |

AUTO — 17.8% | |

Ally Auto Receivables Trust 2015-1 A3 — 1.39% 9/16/2019 | | $ | 12,281,943 | | | $ | 12,277,737 | | |

Ally Auto Receivables Trust 2017-1 B — 2.35% 3/15/2022 | | | 3,743,000 | | | | 3,735,812 | | |

Ally Auto Receivables Trust 2017-1 C — 2.48% 5/16/2022 | | | 7,059,000 | | | | 7,049,352 | | |

AmeriCredit Automobile Receivables Trust 2014-2 B — 1.60% 7/8/2019 | | | 615,105 | | | | 615,145 | | |

AmeriCredit Automobile Receivables Trust 2014-1 B — 1.68% 7/8/2019 | | | 63,693 | | | | 63,695 | | |

AmeriCredit Automobile Receivables Trust 2015-2 B — 1.82% 7/8/2020 | | | 6,678,000 | | | | 6,680,959 | | |

AmeriCredit Automobile Receivables Trust 2014-3 B — 1.92% 11/8/2019 | | | 10,560,770 | | | | 10,566,041 | | |

AmeriCredit Automobile Receivables Trust 2015-3 B — 2.08% 9/8/2020 | | | 19,000,000 | | | | 19,053,909 | | |

AmeriCredit Automobile Receivables Trust 2015-4 B — 2.11% 1/8/2021 | | | 28,000,000 | | | | 28,037,058 | | |

AmeriCredit Automobile Receivables Trust 2013-5 C — 2.29% 11/8/2019 | | | 1,441,506 | | | | 1,442,675 | | |

AmeriCredit Automobile Receivables Trust 2013-3 C — 2.38% 6/10/2019 | | | 177,641 | | | | 177,652 | | |

AmeriCredit Automobile Receivables Trust 2015-1 C — 2.51% 1/8/2021 | | | 1,727,000 | | | | 1,739,039 | | |

15

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2017

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

AmeriCredit Automobile Receivables Trust 2017-1 C — 2.71% 8/18/2022 | | $ | 7,547,000 | | | $ | 7,560,020 | | |

BMW Vehicle Lease Trust 2017-1 A4 — 2.18% 6/22/2020 | | | 18,527,000 | | | | 18,579,696 | | |

California Republic Auto Receivables Trust 2013-2 A2 — 1.23% 3/15/2019 | | | 255,480 | | | | 255,444 | | |

Capital Auto Receivables Asset Trust 2016-3 A3 — 1.54% 8/20/2020 | | | 9,410,000 | | | | 9,399,291 | | |

Capital Auto Receivables Asset Trust 2015-2 A3 — 1.73% 9/20/2019 | | | 29,993,612 | | | | 30,018,653 | | |

Capital Auto Receivables Asset Trust 2014-3 A4 — 1.83% 4/22/2019 | | | 4,575,862 | | | | 4,577,413 | | |

Capital Auto Receivables Asset Trust 2013-4 C — 2.67% 2/20/2019 | | | 1,093,029 | | | | 1,093,697 | | |

Capital Auto Receivables Asset Trust 2016-1 B — 2.67% 12/21/2020 | | | 4,211,000 | | | | 4,236,250 | | |

Credit Acceptance Auto Loan Trust 2015-1A A — 2.00% 7/15/2022** | | | 488,485 | | | | 488,616 | | |

Credit Acceptance Auto Loan Trust 2016-2A A — 2.42% 11/15/2023** | | | 9,956,000 | | | | 9,995,301 | | |

Credit Acceptance Auto Loan Trust 2017-2A A — 2.55% 2/17/2026** | | | 50,778,000 | | | | 50,733,960 | | |

Credit Acceptance Auto Loan Trust 2015-1A B — 2.61% 1/17/2023** | | | 3,160,000 | | | | 3,164,376 | | |

Credit Acceptance Auto Loan Trust 2014-2A B — 2.67% 9/15/2022** | | | 7,204,672 | | | | 7,205,879 | | |

Credit Acceptance Auto Loan Trust 2016-3A B — 2.94% 10/15/2024** | | | 20,626,000 | | | | 20,669,851 | | |

Credit Acceptance Auto Loan Trust 2015-2A B — 3.04% 8/15/2023** | | | 27,401,000 | | | | 27,608,009 | | |

Credit Acceptance Auto Loan Trust 2016-2A B — 3.18% 5/15/2024** | | | 22,937,000 | | | | 23,087,997 | | |

Credit Acceptance Auto Loan Trust 2016-3A C — 3.60% 4/15/2025** | | | 12,661,000 | | | | 12,758,369 | | |

Credit Acceptance Auto Loan Trust 2015-2A C — 3.76% 2/15/2024** | | | 550,000 | | | | 556,121 | | |

DT Auto Owner Trust 2016-4A B — 2.02% 8/17/2020** | | | 13,677,000 | | | | 13,655,533 | | |

DT Auto Owner Trust 2015-3A B — 2.46% 11/15/2019** | | | 5,379,779 | | | | 5,381,123 | | |

DT Auto Owner Trust 2017-1A C — 2.70% 11/15/2022** | | | 18,717,000 | | | | 18,711,245 | | |

DT Auto Owner Trust 2016-2A B — 2.92% 5/15/2020** | | | 4,606,782 | | | | 4,613,593 | | |

Exeter Automobile Receivables Trust 2016-3A A — 1.84% 11/16/2020** | | | 12,315,527 | | | | 12,280,297 | | |

Exeter Automobile Receivables Trust 2017-1A B — 3.00% 12/15/2021** | | | 8,763,000 | | | | 8,772,879 | | |

First Investors Auto Owner Trust 2016-2A A2 — 1.87% 11/15/2021** | | | 5,514,000 | | | | 5,502,207 | | |

First Investors Auto Owner Trust 2016-1A A2 — 2.26% 4/15/2021** | | | 16,653,000 | | | | 16,679,876 | | |

First Investors Auto Owner Trust 2015-2A A2 — 2.28% 9/15/2021** | | | 16,556,000 | | | | 16,584,438 | | |

First Investors Auto Owner Trust 2017-1A B — 2.67% 4/17/2023** | | | 4,126,000 | | | | 4,124,598 | | |

First Investors Auto Owner Trust 2015-2A B — 2.75% 9/15/2021** | | | 4,443,000 | | | | 4,445,655 | | |

First Investors Auto Owner Trust 2017-1A C — 2.95% 4/17/2023** | | | 8,149,000 | | | | 8,152,934 | | |

GM Financial Automobile Leasing Trust 2016-3 C — 2.38% 5/20/2020 | | | 7,768,000 | | | | 7,750,023 | | |

GM Financial Automobile Leasing Trust 2017-2 B — 2.43% 6/21/2021 | | | 22,240,000 | | | | 22,145,080 | | |

GM Financial Automobile Leasing Trust 2017-1 B — 2.48% 8/20/2020 | | | 6,027,000 | | | | 6,047,506 | | |

GM Financial Automobile Leasing Trust 2017-1 C — 2.74% 8/20/2020 | | | 21,903,000 | | | | 21,927,538 | | |

GM Financial Automobile Leasing Trust 2017-2 C — 2.84% 6/21/2021 | | | 3,750,000 | | | | 3,735,332 | | |

Honda Auto Receivables Owner Trust 2015-2 A3 — 1.04% 2/21/2019 | | | 11,651,242 | | | | 11,639,015 | | |

Hyundai Auto Lease Securitization Trust 2016-C B — 1.86% 5/17/2021** | | | 13,264,000 | | | | 13,170,100 | | |

Nissan Auto Lease Trust 2017-A A3 — 1.91% 4/15/2020 | | | 21,315,000 | | | | 21,327,962 | | |

Prestige Auto Receivables Trust 2015-1 A3 — 1.53% 2/15/2021** | | | 4,120,775 | | | | 4,120,056 | | |

Prestige Auto Receivables Trust 2016-1A A3 — 1.99% 6/15/2020** | | | 7,917,000 | | | | 7,926,674 | | |

Prestige Auto Receivables Trust 2015-1 B — 2.04% 4/15/2021** | | | 10,395,000 | | | | 10,403,463 | | |

Prestige Auto Receivables Trust 2016-2A B — 2.19% 11/15/2022** | | | 25,223,000 | | | | 25,073,776 | | |

Prestige Auto Receivables Trust 2017-1A B — 2.39% 5/16/2022** | | | 12,040,000 | | | | 11,973,106 | | |

Prestige Auto Receivables Trust 2017-1A C — 2.81% 1/17/2023** | | | 30,214,000 | | | | 30,304,313 | | |

Prestige Auto Receivables Trust 2016-2A C — 2.88% 11/15/2022** | | | 12,327,000 | | | | 12,378,889 | | |

Santander Drive Auto Receivables Trust 2016-2 A3 — 1.56% 5/15/2020 | | | 12,350,144 | | | | 12,349,807 | | |

Santander Drive Auto Receivables Trust 2013-3 C — 1.81% 4/15/2019 | | | 75,819 | | | | 75,820 | | |

Santander Drive Auto Receivables Trust 2015-2 B — 1.83% 1/15/2020 | | | 1,067,930 | | | | 1,068,329 | | |

16

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2017

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

Santander Drive Auto Receivables Trust 2015-5 B — 1.96% 5/15/2020 | | $ | 36,741,982 | | | $ | 36,722,961 | | |

Santander Drive Auto Receivables Trust 2015-1 B — 1.97% 11/15/2019 | | | 2,190,695 | | | | 2,191,032 | | |

Santander Drive Auto Receivables Trust 2015-3 B — 2.07% 4/15/2020 | | | 14,404,580 | | | | 14,418,195 | | |

Santander Drive Auto Receivables Trust 2017-3 B — 2.19% 3/15/2022 | | | 30,359,000 | | | | 30,260,585 | | |

Santander Drive Auto Receivables Trust 2014-2 C — 2.33% 11/15/2019 | | | 3,944,327 | | | | 3,952,368 | | |

Santander Drive Auto Receivables Trust 2015-1 C — 2.57% 4/15/2021 | | | 9,270,000 | | | | 9,308,948 | | |

Santander Drive Auto Receivables Trust 2017-1 C — 2.58% 5/16/2022 | | | 7,621,000 | | | | 7,608,454 | | |

Santander Drive Auto Receivables Trust 2014-4 C — 2.60% 11/16/2020 | | | 11,427,463 | | | | 11,468,747 | | |

Santander Drive Auto Receivables Trust 2016-2 C — 2.66% 11/15/2021 | | | 4,882,000 | | | | 4,920,392 | | |

Santander Drive Auto Receivables Trust 2013-5 D — 2.73% 10/15/2019 | | | 16,422,000 | | | | 16,518,957 | | |

Santander Drive Auto Receivables Trust 2014-2 D — 2.76% 2/18/2020 | | | 8,332,000 | | | | 8,389,169 | | |

Santander Drive Auto Receivables Trust 2017-2 C — 2.79% 8/15/2022 | | | 12,325,000 | | | | 12,359,320 | | |

Santander Drive Auto Receivables Trust 2013-4 C — 3.25% 1/15/2020 | | | 97,968 | | | | 98,036 | | |

Westlake Automobile Receivables Trust 2015-3A B — 2.21% 5/17/2021** | | | 13,009,089 | | | | 13,010,680 | | |

Westlake Automobile Receivables Trust 2015-1A C — 2.29% 11/16/2020** | | | 207,617 | | | | 207,747 | | |

Westlake Automobile Receivables Trust 2015-2A C — 2.45% 1/15/2021** | | | 441,689 | | | | 441,931 | | |

Westlake Automobile Receivables Trust 2016-3A C — 2.46% 1/18/2022** | | | 19,575,000 | | | | 19,492,938 | | |

Westlake Automobile Receivables Trust 2017-1A C — 2.70% 10/17/2022** | | | 11,439,000 | | | | 11,482,349 | | |

Westlake Automobile Receivables Trust 2015-3A C — 3.05% 5/17/2021** | | | 550,000 | | | | 551,086 | | |

World Omni Automobile Lease Securitization Trust 2015-A A4 — 1.73% 12/15/2020 | | | 15,000,000 | | | | 15,008,797 | | |

World Omni Automobile Lease Securitization Trust 2015-A B — 1.94% 12/15/2020 | | | 12,350,000 | | | | 12,349,433 | | |

World Omni Automobile Lease Securitization Trust 2017-A A4 — 2.32% 8/15/2022 | | | 5,473,000 | | | | 5,479,116 | | |

World Omni Automobile Lease Securitization Trust 2017-A B — 2.48% 8/15/2022 | | | 10,102,000 | | | | 10,114,099 | | |

| | | $ | 912,104,524 | | |

COLLATERALIZED LOAN OBLIGATION — 14.0% | |

Adams Mill CLO Ltd. 2014-1A B2R — 3.35% 7/15/2026** | | $ | 8,136,000 | | | $ | 8,087,688 | | |

Black Diamond CLO Ltd.

2014-1A A1R, 3M USD LIBOR + 1.150% — 2.454% 10/17/2026**,@ | | | 33,585,000 | | | | 33,672,758 | | |

BlueMountain CLO Ltd. 2013-4A — 3.36% 4/15/2025** | | | 8,598,000 | | | | 8,614,353 | | |

Cerberus Loan Funding XVIII LP

2017-1A A, 3M USD LIBOR + 1.750% — 3.054% 4/15/2027**,@ | | | 42,107,000 | | | | 42,156,686 | | |

Cerberus Onshore II CLO-2 LLC

2014-1A A, 3M USD LIBOR + 1.900% — 3.204% 10/15/2023**,@ | | | 941,905 | | | | 942,029 | | |

Cerberus Onshore II CLO-2 LLC

2014-1A B, 3M USD LIBOR + 2.700% — 4.004% 10/15/2023**,@ | | | 6,612,000 | | | | 6,612,840 | | |

CIFC Funding 2013-III Ltd. 2013-3A A2BR — 3.40% 10/24/2025** | | | 6,498,000 | | | | 6,509,924 | | |

CIFC Funding 2013-IV Ltd. 2013-4A A2R — 2.72% 11/27/2024** | | | 14,822,000 | | | | 14,843,848 | | |

Elm Trust 2016-1A A2 — 4.163% 6/20/2025** | | | 13,183,000 | | | | 13,463,139 | | |

Flagship VII Ltd. 2013-7A A2R — 2.70% 1/20/2026** | | | 17,551,000 | | | | 17,574,466 | | |

Fortress Credit Opportunities III CLO LP

2014-3A A1TR, 3M USD LIBOR + 1.650% — 2.953% 4/28/2026**,@ | | | 48,830,000 | | | | 48,942,309 | | |

Fortress Credit Opportunities III CLO LP

2014-3A DR, 3M USD LIBOR + 4.100% — 5.403% 4/28/2026**,@ | | | 8,143,000 | | | | 8,189,106 | | |

Fortress Credit Opportunities V CLO Ltd.

2014-5A A1FR — 3.40% 10/15/2026** | | | 25,265,000 | | | | 25,282,054 | | |

Fortress Credit Opportunities V CLO Ltd.

2014-5A A2R — 3.75% 10/15/2026** | | | 6,584,000 | | | | 6,566,822 | | |

17

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2017

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

Fortress Credit Opportunities VII CLO, Ltd.

2016-7I E, 3M USD LIBOR + 7.490% — 8.81% 12/15/2028@ | | $ | 20,895,000 | | | $ | 21,012,430 | | |

Halcyon Loan Advisors Funding,

3M USD LIBOR + 1.100% — 2.413% 10/22/2025**,@ | | | 18,450,000 | | | | 18,459,631 | | |

ICG US CLO Ltd. 2014-3A A1BR — 2.97% 1/25/2027** | | | 34,490,000 | | | | 34,526,801 | | |

Jamestown CLO III Ltd. 2013-3A A1BR — 2.753% 1/15/2026** | | | 16,675,000 | | | | 16,694,110 | | |

MidOcean Credit CLO I

2012-1A A2R, 3M USD LIBOR + 2.500% — 3.804% 1/15/2024**,@ | | | 18,780,000 | | | | 18,882,426 | | |

Nelder Grove CLO Ltd. 2014-1A AFR — 3.00% 8/28/2026** | | | 7,465,000 | | | | 7,497,264 | | |

NewMark Capital Funding CLO, Ltd. 2014-2A AFR — 3.077% 6/30/2026** | | | 5,750,000 | | | | 5,775,495 | | |

NewMark Capital Funding CLO, Ltd. 2014-2A BFR — 3.669% 6/30/2026** | | | 10,199,000 | | | | 10,247,557 | | |

Northwoods Capital X Ltd. 2013-10A A2R — 2.649% 11/4/2025** | | | 29,490,000 | | | | 29,451,103 | | |

Northwoods Capital X Ltd. 2013-10A B2R — 3.442% 11/4/2025** | | | 4,000,000 | | | | 4,007,020 | | |

Oaktree CLO Ltd. 2014-2A A1BR — 2.953% 10/20/2026** | | | 10,752,000 | | | | 10,797,051 | | |

Ocean Trails CLO V 2014-5A C2R — 4.70% 10/13/2026** | | | 6,814,000 | | | | 6,888,259 | | |

OHA Loan Funding LLC 2014-1A A2R — 2.95% 10/20/2026** | | | 20,832,000 | | | | 20,843,208 | | |

Peaks CLO 1, Ltd.

2014-1A C, 3M USD LIBOR + 3.500% — 4.804% 6/15/2026**,@ | | | 12,077,000 | | | | 12,079,029 | | |

Peaks CLO, 1 Ltd.

2014-1A A, 3M USD LIBOR + 1.750% — 3.054% 6/15/2026**,@ | | | 31,573,000 | | | | 31,610,824 | | |

Saranac CLO II Ltd.

2014-2A A2, 3M USD LIBOR + 1.750% — 3.066% 2/20/2025**,@ | | | 11,720,000 | | | | 11,741,166 | | |

Saranac CLO II Ltd.

2014-2A B, 3M USD LIBOR + 2.050% — 3.366% 2/20/2025**,@ | | | 3,750,000 | | | | 3,764,089 | | |

Senior Credit Fund SPV LLC 2016-1A — 3.033% 12/19/2025†† | | | 34,234,000 | | | | 34,278,504 | | |

Silvermore CLO Ltd., 3M USD LIBOR + 1.170% — 2.485% 5/15/2026**,@ | | | 24,974,259 | | | | 24,973,984 | | |

Symphony CLO XII Ltd. 2013-12A B2R — 3.50% 10/15/2025** | | | 15,800,000 | | | | 15,824,664 | | |

Telos CLO

2013-3A AR, 3M USD LIBOR + 1.300% — 2.571% 7/17/2026**,@ | | | 17,353,000 | | | | 17,352,531 | | |

Telos CLO

2013-3A BR, 3M USD LIBOR + 2.000% — 3.271% 7/17/2026**,@ | | | 20,644,000 | | | | 20,643,381 | | |

Telos CLO, Ltd.

2014-5A A, 3M USD LIBOR + 1.550% — 2.854% 4/17/2025**,@ | | | 31,420,000 | | | | 31,564,343 | | |

Washington Mill CLO Ltd. 2014-1A A2R — 2.90% 4/20/2026** | | | 8,859,000 | | | | 8,882,166 | | |

Washington Mill CLO Ltd. 2014-1A B2R — 3.60% 4/20/2026** | | | 11,052,000 | | | | 11,090,185 | | |

West CLO Ltd. 2013-1A A1BR — 2.745% 11/7/2025** | | | 27,181,000 | | | | 27,199,945 | | |

West CLO Ltd. 2013-1A A2BR — 3.393% 11/7/2025** | | | 12,780,000 | | | | 12,800,601 | | |

Zais CLO 2 Ltd. 2014-2A A1BR — 2.92% 7/25/2026** | | | 6,979,000 | | | | 7,006,016 | | |

| | | $ | 717,351,805 | | |

CREDIT CARD — 3.6% | |

Cabela's Credit Card Master Note Trust 2016-1 A1 — 1.78% 6/15/2022 | | $ | 51,561,000 | | | $ | 51,433,727 | | |

Capital One Multi-Asset Execution Trust 2016-A6 A6 — 1.82% 9/15/2022 | | | 38,371,000 | | | | 38,354,888 | | |

Capital One Multi-Asset Execution Trust 2017-A1 A1 — 2.00% 1/17/2023 | | | 48,839,000 | | | | 48,980,462 | | |

Discover Card Execution Note Trust 2014-A4 A4 — 2.12% 12/15/2021 | | | 42,672,000 | | | | 42,906,568 | | |

Synchrony Credit Card Master Note Trust 2016-3 B — 1.91% 9/15/2022 | | | 3,847,000 | | | | 3,820,061 | | |

| | | $ | 185,495,706 | | |

18

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2017

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

EQUIPMENT — 8.8% | |

ARI Fleet Lease Trust 2015-A A2 — 1.11% 11/15/2018** | | $ | 3,446,057 | | | $ | 3,443,629 | | |

ARI Fleet Lease Trust 2016-A A2 — 1.82% 7/15/2024** | | | 12,780,337 | | | | 12,786,422 | | |

Ascentium Equipment Receivables LLC 2015-2A B — 2.62% 12/10/2019** | | | 4,102,000 | | | | 4,106,839 | | |

Ascentium Equipment Receivables Trust 2016-1A A2 — 1.75% 11/13/2018** | | | 326,633 | | | | 326,631 | | |

Avis Budget Rental Car Funding AESOP LLC 2014-2A A — 2.50% 2/20/2021** | | | 6,084,000 | | | | 6,096,274 | | |

Avis Budget Rental Car Funding AESOP LLC 2015-1A A — 2.50% 7/20/2021** | | | 48,498,000 | | | | 48,368,292 | | |

Avis Budget Rental Car Funding AESOP LLC 2015-2A A — 2.63% 12/20/2021** | | | 22,566,000 | | | | 22,551,161 | | |

CCG Receivables Trust 2015-1 A2 — 1.46% 11/14/2018** | | | 4,038,980 | | | | 4,035,448 | | |

Chesapeake Funding II LLC 2016-2A A1 — 1.88% 6/15/2028** | | | 25,004,414 | | | | 25,009,175 | | |

Chesapeake Funding II LLC 2016-1A A1 — 2.11% 3/15/2028** | | | 25,469,876 | | | | 25,527,415 | | |

Coinstar Funding LLC Series 2017-1A A2 — 5.216% 4/25/2047** | | | 8,403,938 | | | | 8,713,616 | | |

Enterprise Fleet Financing LLC 2014-2 A2 — 1.05% 3/20/2020** | | | 674,410 | | | | 674,215 | | |

Enterprise Fleet Financing LLC 2015-2 A2 — 1.59% 2/22/2021** | | | 20,357,302 | | | | 20,342,317 | | |

Enterprise Fleet Financing LLC 2016-2 A2 — 1.74% 2/22/2022** | | | 15,342,898 | | | | 15,325,045 | | |

Enterprise Fleet Financing LLC 2017-2 A2 — 1.97% 1/20/2023** | | | 14,450,000 | | | | 14,441,024 | | |

Enterprise Fleet Financing LLC 2017-1 A3 — 2.60% 7/20/2022** | | | 9,453,000 | | | | 9,549,099 | | |

GreatAmerica Leasing Receivables Funding LLC Series

2017-1 A4 — 2.36% 1/20/2023** | | | 6,562,000 | | | | 6,548,020 | | |

GreatAmerica Leasing Receivables Funding LLC Series

2017-1 C — 2.89% 1/22/2024** | | | 2,609,000 | | | | 2,604,205 | | |

Hertz Fleet Lease Funding LP 2016-1 A2 — 1.96% 4/10/2030** | | | 18,366,911 | | | | 18,334,178 | | |

Hertz Fleet Lease Funding LP 2017-1 A2 — 2.13% 4/10/2031** | | | 20,226,000 | | | | 20,212,192 | | |

Leaf Receivables Funding 12 LLC 2017-1 A3 — 2.07% 8/15/2020**,†† | | | 7,553,000 | | | | 7,542,380 | | |

Leaf Receivables Funding 12 LLC 2017-1 A4 — 2.43% 7/15/2021**,†† | | | 5,552,000 | | | | 5,542,029 | | |

NextGear Floorplan Master Owner Trust 2015-2A A — 2.38% 10/15/2020** | | | 10,000,000 | | | | 10,040,765 | | |

NextGear Floorplan Master Owner Trust 2017-1A A2 — 2.54% 4/18/2022** | | | 22,933,000 | | | | 22,881,155 | | |

Prop Series 2017-1A — 5.30% 3/15/2042†† | | | 38,879,747 | | | | 39,307,424 | | |

Verizon Owner Trust 2016-2A A — 1.68% 5/20/2021** | | | 8,830,000 | | | | 8,795,884 | | |

Verizon Owner Trust 2017-2A A — 1.92% 12/20/2021** | | | 26,369,000 | | | | 26,341,953 | | |

Verizon Owner Trust 2017-2A B — 2.22% 12/20/2021** | | | 24,047,000 | | | | 23,921,234 | | |

Verizon Owner Trust 2017-1A B — 2.45% 9/20/2021** | | | 33,682,000 | | | | 33,832,521 | | |

Volvo Financial Equipment LLC Series 2017-1A A4 — 2.21% 11/15/2021** | | | 5,916,000 | | | | 5,907,189 | | |

| | | $ | 453,107,731 | | |

OTHER — 8.8% | |

InSite Issuer LLC — 8.595% 8/15/2020**,†† | | $ | 12,001,000 | | | $ | 12,827,789 | | |

MMAF Equipment Finance LLC 2013-AA A4 — 1.68% 5/11/2020** | | | 6,502,141 | | | | 6,504,925 | | |

New Residential Advance Receivables Trust

2015-ON1 2016-T4 AT4 — 3.107% 12/15/2050**,†† | | | 50,294,000 | | | | 50,485,620 | | |

New Residential Advance Receivables Trust Advance Receivables Backed

2016-T1 AT1 — 2.751% 6/15/2049** | | | 16,005,500 | | | | 15,909,467 | | |

New Residential Advance Receivables Trust Advance Receivables Backed Notes

2016-T2 AT2 — 2.575% 10/15/2049** | | | 50,834,000 | | | | 50,450,834 | | |

New Residential Advance Receivables Trust Advance Receivables Backed Notes

2017-T1 AT1 — 3.214% 2/15/2051**,†† | | | 46,789,000 | | | | 47,042,128 | | |

Ocwen Master Advance Receivables Trust

2017-T1 AT1 — 2.499% 9/15/2048**,†† | | | 4,566,000 | | | | 4,566,000 | | |

19

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2017

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

Ocwen Master Advance Receivables Trust

2016-T1 AT1 — 2.521% 8/17/2048** | | $ | 51,028,000 | | | $ | 50,948,269 | | |

Oportun Funding III LLC 2016-B A — 3.69% 7/8/2021** | | | 10,122,000 | | | | 10,129,810 | | |

Oportun Funding IV LLC 2016-C A — 3.28% 11/8/2021** | | | 9,739,000 | | | | 9,674,025 | | |

Panhandle-Plains Student Finance Corporation

2001-1 A2 — 2.735% 12/1/2031††,@ | | | 5,500,000 | | | | 5,465,625 | | |

PFS Financing Corp. 2016-BA A — 1.87% 10/15/2021** | | | 3,481,000 | | | | 3,454,250 | | |

PFS Financing Corp. 2017-BA A2 — 2.22% 7/15/2022** | | | 22,038,000 | | | | 22,032,252 | | |

PFS Financing Corp. 2017-BA B — 2.57% 7/15/2022** | | | 7,305,000 | | | | 7,303,817 | | |

PFS Financing Corporation

2014-BA A, 1M LIBOR + 0.600% — 1.834% 10/15/2019**,@ | | | 33,006,000 | | | | 33,048,264 | | |

PFS Financing Corporation

2015-AA A, 1M LIBOR + 0.620% — 1.854% 4/15/2020**,@ | | | 29,100,000 | | | | 29,132,138 | | |

PFS Financing Corporation

2015-AA B, 1M LIBOR + 0.900% — 2.127% 4/15/2020**,@ | | | 500,000 | | | | 497,960 | | |

PFS Financing Corporation

2016-A A, 1M LIBOR + 1.200% — 2.434% 2/18/2020**,@ | | | 57,776,000 | | | | 57,989,165 | | |

Unison Ground Lease Funding LLC 2013-1 B — 5.78% 3/15/2020**,†† | | | 10,932,000 | | | | 10,853,598 | | |

Unison Ground Lease Funding LLC 2013-2 B — 6.268% 3/15/2020** | | | 3,768,000 | | | | 3,521,305 | | |

WCP ISSUER LLC 2013-1 B — 6.657% 8/15/2020**,†† | | | 15,000,000 | | | | 15,526,222 | | |

Wheels SPV 2 LLC 2015-1A A2 — 1.27% 4/22/2024** | | | 3,684,038 | | | | 3,680,818 | | |

| | | $ | 451,044,281 | | |

| TOTAL ASSET-BACKED SECURITIES (Cost $2,715,134,608) | | $ | 2,719,104,047 | | |

CORPORATE BONDS & NOTES — 2.9% | |

BASIC MATERIALS — 1.0% | |

PT Boart Longyear Management Pty Ltd.

PIK, 10.00% Cash or 12.00% PIK — 10.00% 12/31/2022 | | $ | 57,655,626 | | | $ | 50,052,290 | | |

CONSUMER, CYCLICAL — 0.4% | |

Northwest Airlines 1999-2 Class C Pass Through Trust — 8.304% 9/1/2010†† | | $ | 17,800,245 | | | $ | 6,630,591 | | |

Northwest Airlines 2000-1 Class G Pass Through Trust — 7.15% 10/1/2019 | | | 8,533,852 | | | | 8,960,545 | | |

US Airways 1998-1B Pass Through Trust — 7.35% 1/30/2018 | | | 3,780,561 | | | | 3,740,487 | | |

US Airways 1998-1C Pass Through Trust — 6.82% 1/30/2019†† | | | 2,362,334 | | | | 7,890 | | |

US Airways 1999-1C Pass Through Trust — 7.96% 1/20/2018†† | | | 4,341,206 | | | | 1,534,616 | | |

Continental Airlines 2000-1 Class B Pass Through Trust — 8.388% 11/1/2020 | | | 2,510 | | | | 2,825 | | |

| | | $ | 20,876,954 | | |

CONSUMER, NON-CYCLICAL — 0.1% | |

StoneMor Partners LP / Cornerstone Family Services of West Virginia

Subsidiary — 7.875% 6/1/2021 | | $ | 6,282,000 | | | $ | 6,030,720 | | |

ENERGY — 0.2% | |

PHI, Inc. — 5.25% 3/15/2019 | | $ | 11,499,000 | | | $ | 11,182,778 | | |

20

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2017

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

FINANCIAL — 0.4% | |

N671US Trust — 7.50% 9/15/2020**,†† | | $ | 8,045,244 | | | $ | 8,065,357 | | |

Berkshire Hathaway Finance Corporation,

3M USD LIBOR + 0.260% — 1.575% 8/15/2019@ | | | 12,753,000 | | | | 12,796,644 | | |

| | | $ | 20,862,001 | | |

INDUSTRIAL — 0.3% | |

Air 2 US — 8.027% 10/1/2019** | | $ | 2,669,437 | | | $ | 2,751,189 | | |

Air 2 US — 10.127% 10/1/2020**,†† | | | 39,258,228 | | | | 9,814,557 | | |

| | | $ | 12,565,746 | | |

TECHNOLOGY — 0.5% | |

Apple, Inc. — 1.90% 2/7/2020 | | $ | 25,563,000 | | | $ | 25,647,969 | | |

| TOTAL CORPORATE BONDS & NOTES (Cost $165,591,591) | | $ | 147,218,458 | | |

CORPORATE BANK DEBT — 4.4% | |

ACCTL2, 3M LIBOR + 4.75% — 6.06% 7/28/2023††,**,@ | | $ | 19,235,053 | | | $ | 19,235,053 | | |

ACCTL2, Prime + 3.75% — 8.00% 7/28/2023††,**,@ | | | 48,532 | | | | 48,532 | | |

Authentic Brands TL 2L, 3M LIBOR + 7.75% — 9.075% 9/26/2025**,@ | | | 5,049,000 | | | | 5,086,868 | | |

Boart Longyear Management Pty Ltd TL — 10.00% Cash or

11.00% PIK 10/23/2020**,@ | | | 4,022,120 | | | | 3,861,838 | | |

Intelsat Jackson Holding SA, 3M LIBOR + 2.75% — 4.07% 6/30/2019**,@ | | | 25,972,703 | | | | 25,883,357 | | |

Internap Corp. TL 1L, 3M LIBOR + 7.00% — 8.24% 4/3/2022**,@ | | | 11,500,000 | | | | 11,586,250 | | |

Logix Holding Co. LLC TL 1L — 2.87% 7/17/2024**,@ | | | 11,707,000 | | | | 11,756,286 | | |

MB1LTL, 1M LIBOR + 5.00% — 6.24% 11/30/2022††,**,@ | | | 26,388,519 | | | | 26,482,462 | | |

MB1LDDTL, 1M LIBOR + 2.26% — 2.33% 12/2/2022††,** | | | 2,307,601 | | | | 8,215 | | |

MB2LTL, 1M LIBOR + 9.25% — 10.49% 11/30/2023††,**,@ | | | 6,816,000 | | | | 6,813,069 | | |

OTGDDTL, 1.00% — 1.00% 8/26/2021††,** | | | 780,000 | | | | 21,450 | | |

| OTGTL, 2M LIBOR + 8.50% — 9.77% 8/26/2021††,**,@ | | | 1,033,500 | | | | 1,041,251 | | |

OTGTL 3M LIBOR + 8.50% — 9.77% 8/26/2021††,**,@ | | | 20,106,500 | | | | 20,257,299 | | |

SDTL, 3M LIBOR + 6.00% — 7.33% 12/22/2021††,**,@ | | | 13,855,250 | | | | 13,872,569 | | |

Sears Roebuck Acceptance Corp. TL, 3M LIBOR + 4.50% — 5.74% 6/30/2018**,@ | | | 19,928,573 | | | | 19,679,466 | | |

Xplornet Communications Inc. TL-B 1L,

3M LIBOR + 4.75% — 7.56% 9/9/2021**,@ | | | 39,396,447 | | | | 39,667,495 | | |

ZW1L, 3M LIBOR + 5.00% — 6.32% 11/17/2022††,**,@ | | | 13,527,775 | | | | 13,544,685 | | |

ZW2L, 3M LIBOR + 9.00% — 10.314% 11/17/2023††,**,@ | | | 4,870,000 | | | | 4,863,913 | | |

| TOTAL CORPORATE BANK DEBT (Cost $221,182,353) | | $ | 223,710,058 | | |

MUNICIPALS — 0.1% | |

Wayne County GO, (TXBL-NTS), — 4.25% 12/1/2018 (Cost $4,387,000) | | $ | 4,387,000 | | | $ | 4,419,376 | | |

U.S. TREASURIES — 14.9% | |

U.S. Treasury Notes — 0.75% 10/31/2017 | | $ | 35,000,000 | | | $ | 34,987,694 | | |

U.S. Treasury Notes — 1.875% 10/31/2017 | | | 10,000,000 | | | | 10,004,297 | | |

U.S. Treasury Notes — 0.875% 11/15/2017 | | | 10,000,000 | | | | 9,997,852 | | |

21

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2017

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

U.S. Treasury Notes — 4.25% 11/15/2017 | | $ | 29,450,000 | | | $ | 29,559,286 | | |

U.S. Treasury Notes — 0.875% 11/30/2017 | | | 60,000,000 | | | | 59,977,734 | | |

U.S. Treasury Notes — 1.00% 12/15/2017 | | | 100,843,000 | | | | 100,837,091 | | |

U.S. Treasury Notes — 2.625% 1/31/2018 | | | 90,000,000 | | | | 90,427,149 | | |

| U.S. Treasury Notes — 0.75% 2/28/2018 | | | 90,000,000 | | | | 89,841,798 | | |

U.S. Treasury Notes — 0.75% 3/31/2018 | | | 90,000,000 | | | | 89,783,793 | | |

U.S. Treasury Notes — 1.375% 1/15/2020 | | | 99,363,000 | | | | 99,004,965 | | |

U.S. Treasury Notes — 1.375% 8/31/2020 | | | 114,135,000 | | | | 113,315,146 | | |

U.S. Treasury Notes — 1.375% 10/31/2020 | | | 34,456,000 | | | | 34,159,461 | | |

| TOTAL U.S. TREASURIES (Cost $763,979,466) | | $ | 761,896,266 | | |

| TOTAL BONDS & DEBENTURES — 99.5% (Cost $5,165,044,389) | | $ | 5,101,832,913 | | |

| TOTAL INVESTMENT SECURITIES — 99.6% (Cost $5,165,674,736) | | $ | 5,106,959,121 | | |

SHORT-TERM INVESTMENTS — 0.9% | |

State Street Bank Repurchase Agreement — 0.12% 10/2/2017 | |

(Dated 09/29/2017, repurchase price of $46,301,463, collateralized by

$46,515,000 principal amount U.S. Treasury Notes — 2.25% 2024,

fair value $47,227,331) | | $ | 46,301,000 | | | $ | 46,301,000 | | |

| TOTAL SHORT-TERM INVESTMENTS (Cost $46,301,000) | | $ | 46,301,000 | | |

| TOTAL INVESTMENTS — 100.5% (Cost $5,211,975,736) | | $ | 5,153,260,121 | | |

Other Assets and Liabilities, net — (0.5)% | | | (27,827,501 | ) | |

NET ASSETS — 100.0% | | $ | 5,125,432,620 | | |

* Non-income producing security.

@ Variable/Floating Rate Security — The rate shown is based on the latest available information as of September 30, 2017. For Senior Loan Notes, the rate shown may represent a weighted average interest rate. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description.

** Restricted securities. These restricted securities constituted 51.74% of total net assets at September 30, 2017, most of which are considered liquid by the Adviser. These securities are not registered and may not be sold to the public. There are legal and/or contractual restrictions on resale. The Fund does not have the right to demand that such securities be registered. The values of these securities are determined by valuations provided by pricing services, brokers, dealers, market makers, or in good faith under policies adopted by authority of the Fund's Board of Directors.

†† These securities have been valued in good faith under policies adopted by authority of the Board of Director in accordance with the Fund's fair value procedures. These securities constituted 8.33% of total net assets at September 30, 2017.

@@@ Zero coupon bond. Coupon amount represents effective yield to maturity.

@@ Step Coupon — Coupon rate increases in increments to maturity. Rate disclosed is as of September 30, 2017.

See accompanying Notes to Financial Statements.

22

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS —

RESTRICTED SECURITIES

September 30, 2017

Issuer | | Acquisition

Date(s) | |

Cost | | Fair

Value | | Fair Value

as a % of

Net Assets | |

A10 Term Asset

Financing LLC 2017-1A A1FX

2.34% 3/15/2036 | | 8/8/2017 | | $ | 17,636,777 | | | $ | 17,649,124 | | | | 0.34 | % | |

A10 Term Asset

Financing LLC 2016-1 A1

2.42% 3/15/2035 | | 5/19/2016 | | | 5,607,071 | | | | 5,589,408 | | | | 0.11 | % | |

ACCTL2, 3M LIBOR +4.75% —

6.06% 7/28/2013 | | 9/19/2016 | | | 19,071,790 | | | | 19,235,053 | | | | 0.38% | | |

ACCTL2, Prime +3.75% — 8.00%

7/28/2013 | | 9/19/2016 | | | 48,120 | | | | 48,532 | | | | 0.00% | | |

ARI Fleet Lease Trust 2016-A A2

1.82% 7/15/2024 | | 2/17/2016 | | | 12,779,542 | | | | 12,786,422 | | | | 0.25 | % | |

ARI Fleet Lease Trust 2015-A A2

1.11% 11/15/2018

| | 4/15/2015,

7/20/2015,

3/11/2016,

3/18/2016 | | | 3,444,027 | | | | 3,443,629 | | | | 0.07 | % | |

Adams Mill CLO Ltd. 2014-1A B2R

3.35% 7/15/2026 | | 6/23/2017 | | | 8,136,000 | | | | 8,087,688 | | | | 0.16 | % | |

Air 2 US 10.127% 10/1/2020 | | 7/24/2014, 8/22/2014,

2/12/2015 | | | 9,396,339 | | | | 9,814,557 | | | | 0.19 | % | |

Air 2 US 8.027% 10/1/2019 | | 7/1/2014, 10/27/2014 | | | 2,795,914 | | | | 2,751,189 | | | | 0.05 | % | |

Ascentium Equipment

Receivables LLC 2015-2A B

2.62% 12/10/2019 | | 2/18/2016 | | | 4,093,020 | | | | 4,106,839 | | | | 0.08 | % | |

Ascentium Equipment

Receivables Trust 2016-1A A2

1.75% 11/13/2018 | | 4/18/2016 | | | 326,629 | | | | 326,631 | | | | 0.01 | % | |

Authentic Brands TL 2L,

1M LIBOR + 7.75% — 9.075%

9/26/2025 | | 9/26/2017 | | | 5,011,133 | | | | 5,086,868 | | | | 0.10 | % | |

Aventura Mall Trust M 2013-AVM A

3.867% 12/5/2032

| | 9/20/2017,

9/21/2017,

9/21/2017,

9/27/2017,

9/28/2017 | | | 26,214,366 | | | | 26,124,587 | | | | 0.51 | % | |

Avis Budget Rental Car

Funding AESOP LLC 2015-1A A

2.50% 7/20/2021 | | 2/22/2017, 3/13/2017 | | | 48,363,698 | | | | 48,368,292 | | | | 0.94 | % | |

Avis Budget Rental Car

Funding AESOP LLC 2015-2A A

2.63% 12/20/2021 | | 1/31/2017, 3/8/2017,

3/13/2017 | | | 22,499,648 | | | | 22,551,161 | | | | 0.44 | % | |

23

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS —

RESTRICTED SECURITIES

(Continued)

September 30, 2017

Issuer | | Acquisition

Date(s) | |

Cost | | Fair

Value | | Fair Value

as a % of

Net Assets | |

Avis Budget Rental Car

Funding AESOP LLC 2014-2A A