UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-01735 |

|

FPA NEW INCOME, INC. |

(Exact name of registrant as specified in charter) |

|

11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA | | 90025 |

(Address of principal executive offices) | | (Zip code) |

|

(Name and Address of Agent for Service) J. RICHARD ATWOOD, PRESIDENT FPA NEW INCOME, INC. 11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA 90025 | Copy to: MARK D. PERLOW, ESQ. DECHERT LLP ONE BUSH STREET, STE. 1600 SAN FRANCISCO, CA 94104 |

|

Registrant’s telephone number, including area code: | (310) 473-0225 | |

|

Date of fiscal year end: | September 30 | |

|

Date of reporting period: | September 30, 2018 | |

| | | | | | | | | |

Item 1: Report to Shareholders.

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

Dear Shareholders:

FPA New Income, Inc. (the "Fund") had a total net return of 0.40% in the third quarter of 2018, 1.47% year-to-date, and 1.91% for the fiscal year ended September 30, 2018.

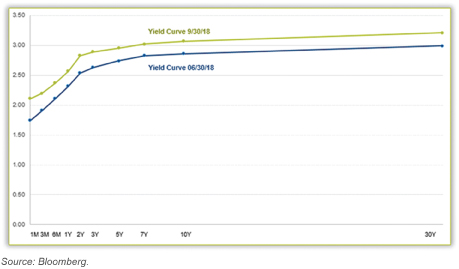

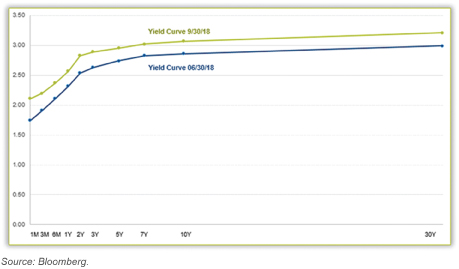

As of Sept. 30, the portfolio had a yield-to-worst1 of 3.82% and an effective duration2 of 1.77 years. Treasury yields rose meaningfully during the third quarter, particularly in the front-end of the yield curve (0-3 year maturities) causing the yield curve to flatten further. Higher Treasury yields allowed us to add more duration at lower prices in the high-quality portion of the portfolio (investments rated A- or higher). With credit spreads compressed versus the prior quarter and prior year, the portfolio's credit-sensitive holdings (investments rated less than A-) decreased to 7.2%, compared to 8.2% on June 30, 2018 and 11.5% on Sept. 30, 2017, as attractively priced credit investments remain difficult to find. Because of our efforts to add more duration to the portfolio in this rising interest rate environment, cash and equivalents decreased to 3.5% of the Fund, down from 8.2% at the end of the second quarter.

The Fund has performed well in comparison to commonly used industry benchmarks. The Bloomberg Barclays U.S. Aggregate Bond 1-3 year Index, with a 1.93 year duration, returned 0.34% this quarter and 0.42% year-to-date, while the Bloomberg Barclays U.S. Aggregate Bond index, with a 6.03-year duration, returned 0.02% this quarter and lost 1.60% year-to-date. The outperformance of the Fund versus the index was partially driven by our absolute value-oriented approach to duration, which includes eschewing speculative bets on interest rates and seeking to own more duration when we believe the upside versus downside is attractive.

Portfolio Attribution3

Third Quarter 2018

The largest contributors to performance during the quarter were collateralized loan obligations (CLO's). The majority of these bonds have floating-rate coupons. With interest rates rising, the coupon returns on these bonds offset a small decline in price. The second- and third-largest contributors to performance were asset-backed securities (ABS) backed by auto loans and ABS backed by equipment loans and leases, respectively. In both cases, the return on these bonds was predominantly due to coupon returns; the prices of the auto loan ABS were

1 Yield-to-worst is the lowest possible yield that can be received on a bond without the issuer defaulting. It does not represent the yield that an investor should expect to receive. As of September 30, 2018, the SEC yield was 3.11%. The SEC yield figure reflects the theoretical income that a bond portfolio would generate, including dividends and interest, during the period after deducting the Fund's expenses for the period (but excluding any fee waivers). The Fund's actual net earnings for a given period under generally accepted accounting principles may differ from this standardized yield. The SEC yield is expressed as an annual percentage based on the price of the Fund at the beginning of the month. The SEC yield reflects prospective data and thus assumes payments collected by the fund may fluctuate.

2 Duration is a measure of the sensitivity of the price (the value of principal) of a fixed-income investment to a change in interest rates.

3 Contributors and detractors are presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. This information is not a recommendation for a specific security or sector and these securities/sectors may not be in the Fund at the time you receive this report. The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. A copy of the methodology used and a list of every sector's contribution to the overall Fund's performance during the quarter is available by contacting FPA at crm@fpa.com. The portfolio holdings as of the most recent quarter-end may be obtained at www.fpa.com. Past performance is no guarantee, nor is it indicative, of future results. Please see Important Disclosures at the end of this commentary.

1

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

essentially unchanged and the prices of the equipment ABS were down slightly, as lower spreads mitigated most of the impact of rising Treasury rates.

There were no meaningful detractors from performance during the quarter.

Fiscal Year 2018 (10/1/17-9/30/18)

The largest contributors to performance for the fiscal year ended Sept. 30 were corporate bonds and bank debt, with much of that return coming from price appreciation and coupon on a metals and mining-related investment. The rest came mostly from coupons on other corporate bond and bank debt investments, which offset an overall small price decline on those investments. The second-largest contributor to performance for the fiscal year were CLO's, owing predominantly to coupon return. The third-largest contributor to performance were GNMA project loan interest only bonds whose return stemmed from a combination of coupon payments, prepayment penalties and higher prices as lower spreads offset rising interest rates.

The only detractors from performance were long Treasury bonds, where prices declined due to rising interest rates.

Portfolio Activity4

The table below shows the portfolio's exposures as of Sept. 30, 2018 compared to June 30, 2018 and Sept. 30, 2017:

| Sector | | % Portfolio

9/30/2018 | | % Portfolio

6/30/2018 | | % Portfolio

9/30/2017 | | Change 6/30/18

to 9/30/18 (bps)5 | |

ABS | | | 54.0 | % | | | 52.6 | % | | | 53.0 | % | | | 140 | | |

Mortgage Backed (CMO6) | | | 12.9 | % | | | 13.4 | % | | | 9.7 | % | | | -50 | | |

Stripped Mortgage-backed | | | 4.3 | % | | | 4.8 | % | | | 8.1 | % | | | -50 | | |

Corporate | | | 6.0 | % | | | 6.8 | % | | | 7.4 | % | | | -80 | | |

CMBS7 | | | 3.7 | % | | | 4.1 | % | | | 10.5 | % | | | -40 | | |

Mortgage Pass-through | | | 10.7 | % | | | 5.2 | % | | | 3.8 | % | | | 550 | | |

U.S. Treasury | | | 4.9 | % | | | 4.9 | % | | | 2.6 | % | | | 0 | | |

Cash and equivalents | | | 3.5 | % | | | 8.2 | % | | | 4.8 | % | | | -470 | | |

Total | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | | | |

Yield-to-worst | | | 3.82 | % | | | 3.42 | % | | | 2.67 | % | | | 40 | | |

Effective Duration (years) | | | 1.77 | | | | 1.64 | | | | 1.49 | | | | 0.13 | | |

Average Life (years) | | | 2.31 | | | | 2.12 | | | | 1.77 | | | | 0.19 | | |

Not much has changed in the past three months in regard to the market and our investment approach. Since the second quarter, the market has continued in the same direction it has been heading for much of the year: interest rates are higher, the yield curve is flatter and credit is more expensive.

4 Portfolio composition will change due to ongoing management of the fund.

5 Change in basis points, except for effective duration and average life, which represents the change in years.

6 Collateralized mortgage obligations ("CMO") are mortgage-backed bonds that separate mortgage pools into different maturity classes.

7 Commercial mortgage-backed securities ("CMBS") are securities backed by commercial mortgages rather than residential mortgages.

2

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

As a result, nothing has changed since the last quarter in how we execute our investment activity: We are adding duration in high-quality bonds and upgrading the credit quality of the portfolio.

On the duration front, as always, we try to buy bonds that we expect will produce a positive total return if yields rise by 100 bps over a 12-month period, and we look for the longest bonds that will meet that hurdle. Today, with rates meaningfully higher during the quarter, this approach allows us to buy high-quality bonds that have a duration of three to four years. The spread on high-quality non-agency securities (i.e., ABS, CMBS and non-agency RMBS rated A- or higher) continues to narrow, which decreases the yield we are giving up by owning agency mortgages that have better collateral and better liquidity. Moreover, increasingly, our ideal duration does not overlap with the high-quality duration available in ABS and other non-agency investments which oftentimes is either too short or too long for us. Under those circumstances, the agency mortgage market is generally the best way for us to buy the duration we seek. During the third quarter, we invested 13% of the portfolio in high-quality bonds that have an average duration of approximately 2.8 years, of which approximately half was invested in agency mortgage pools with an average duration of 3.4 years. Consequently, the Fund's mortgage pass-through exposure increased by 550 basis points (bps) since June 30, 2018.

The Fund's ABS exposure also increased due to new investments in prime auto loan ABS, which were partially offset by amortization and maturities of our existing prime auto and subprime auto loan ABS. The Fund's CMO holdings decreased as a result of amortization of existing bonds and the sale of an agency CMO backed by relocation mortgages that had become too expensive to own. These reductions were partially offset by

3

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

new investments in non-agency CMOs backed by re-performing mortgages. The Stripped Mortgage-Backed holdings, which primarily represents our holdings of GNMA project loan interest-only bonds, decreased due to the sale of one existing position and the amortization of others. As discussed in prior commentaries, we periodically sell our GNMA project loan interest-only bonds if prepayment activity degrades the expected future return profile of the bonds. The Fund's corporate investments decreased due to the maturity of a bank debt investment. Finally, we took advantage of cheaper prices caused by higher yields to slightly increase the Fund's position in Treasuries during the quarter.

In the credit market, we see no substantive changes with respect to the price of risk. If anything, spreads are lower meaning that investors, whether in high-grade bonds or high-yield, are being paid less to take on credit risk. In response, we continue to upgrade the portfolio's credit quality in two ways. First, in our high-quality investments, we have been investing relatively more capital in agency mortgages and less capital in non-agency securities (as described above). Notwithstanding our view that the ABS we buy include little risk of permanent capital impairment, they do not have the additional protection of the implicit government guarantee that agency mortgages carry. Importantly, we buy agency mortgages based on the quality of the loans, not because of the implicit guarantee (though that is certainly worth something). Second, we have decreased the portfolio's exposure to credit sensitive issuers (which we define as investments rated BBB+ or lower). With the high-yield index spread hovering near all-time lows (and near pre-financial crisis levels), we have struggled to find investments with an attractive risk-versus-return profile. As such, we have been allowing existing investments to mature while we continue to sift through the market and stockpile ideas for the future. The portfolio's credit exposure stands at 7.2% as of the end of the third quarter, down from 8.2% at the end of the second quarter and 11.5% a year ago.

Overall, in the third quarter we were very active capitalizing on a cheaper market for duration. That's in keeping with our investment strategy, which focuses on preserving capital in an expensive market and recycling capital into cheaper bonds when prices are more attractive. The activity resulted in the Fund's cash and equivalents decreasing significantly to 3.5% as of Sept. 30, down from 8.2% at the end of the second quarter.

Market Commentary

Over the past several years, investors have asked us why we have such a significant exposure to structured product investments, and to sub-prime automobile loan securitizations in particular. In our quarterly conference calls and during our biannual investor day presentations, we have discussed specific aspects of this portion of the portfolio. Here we provide some historical context on why we are comfortable investing in those assets.

Our broad knowledge of consumer credit started in 2002 with our investments in Conseco, Inc. At the time, the portfolio manager of the Fund, Bob Rodriguez, wrote that Conseco was his "worst investment failure." While in the end we had a small gain on the investment, the bigger gain was in the form of institutional knowledge that we acquired regarding consumer credit underwriting, repayment behavior and loan servicing. We leveraged this knowledge in 2005, when we sold Alt-A mortgage bonds that exhibited early default patterns we had seen before in Conseco's manufactured housing loan securitizations. Our Conseco experience continued to pay dividends five years later, when our research prompted us to write a March 2007 special commentary that detailed the then-looming mortgage crisis.

4

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

Over the past several years, this experience with subprime consumer credit has enabled us to invest in securitizations of non-performing residential mortgages, subprime auto loan ABS and re-performing mortgage loan securitizations (now 7% of the portfolio). In sum, our investment mistake of 2002 helped us identify one of the largest financial excesses in recorded history and has provided multiple investment opportunities for us since 2010.

In closing, the strict adherence to our investment discipline is resulting in a limited set of new investments in the portfolio. In our opinion, the economy is nearing the end of a very long upward cycle and there is a higher probability of it experiencing a slowdown over the next several years. In today's expensive market, this warrants higher-quality investments to protect our capital and position the Fund for the investment cycle that may follow.

Respectfully submitted,

Thomas H. Atteberry

Portfolio Manager

Abhijeet Patwardhan

Portfolio Manager

October 2018

5

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

Important Disclosures

Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. This data represents past performance and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment it may be worth more or less than its original cost. Current month-end performance data, which may be higher or lower than the performance data quoted, may be obtained at www.fpa.com or by calling toll-free, 1-800-982-4372.

You should consider the Fund's investment objectives, risks, and charges and expenses carefully before you invest. The Prospectus details the Fund's objective and policies, charges, and other matters of interest to the prospective investor. Please read this Prospectus carefully before investing. The Prospectus may be obtained by visiting the website at www.fpa.com, by email at crm@fpa.com, toll-free by calling 1-800-982-4372 or by contacting the Fund in writing.

The views expressed herein and any forward-looking statements are as of the date of the publication and are those of the portfolio management team. Future events or results may vary significantly from those expressed and are subject to change at any time in response to changing circumstances and industry developments. This information and data has been prepared from sources believed reliable, but the accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data.

Portfolio composition will change due to ongoing management of the Fund. References to individual securities are for informational purposes only and should not be construed as recommendations by the Fund, the portfolio managers, the Adviser, or the Distributor. It should not be assumed that future investments will be profitable or will equal the performance of the security examples discussed. The portfolio holdings as of the most recent quarter-end may be obtained at www.fpa.com.

Investments in mutual funds carry risks and investors may lose principal value. Capital markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The Fund may purchase foreign securities, which are subject to interest rate, currency exchange rate, economic and political risks; this may be enhanced when investing in emerging markets. The securities of smaller, less well-known companies can be more volatile than those of larger companies.

The return of principal in a bond fund is not guaranteed. Bond funds have the same issuer, interest rate, inflation and credit risks that are associated with underlying bonds owned by the Fund. Lower rated bonds, convertible securities and other types of debt obligations involve greater risks than higher rated bonds.

Interest rate risk is the risk that when interest rates go up, the value of fixed income securities, such as bonds, typically go down and investors may lose principal value. Credit risk is the risk of loss of principal due to the issuer's failure to repay a loan. Generally, the lower the quality rating of a security, the greater the risk that the issuer will fail to pay interest fully and return principal in a timely manner. If an issuer defaults the security may lose some or all of its value.

Mortgage securities and collateralized mortgage obligations (CMOs) are subject to prepayment risk and the risk of default on the underlying mortgages or other assets; such derivatives may increase volatility. Convertible securities are generally not investment grade and are subject to greater credit risk than higher-rated investments. High yield securities can be volatile and subject to much higher instances of default.

Value style investing presents the risk that the holdings or securities may never reach their full market value because the market fails to recognize what the portfolio management team considers the true business

6

FPA NEW INCOME, INC.

LETTER TO SHAREHOLDERS

(Continued)

value or because the portfolio management team has misjudged those values. In addition, value style investing may fall out of favor and underperform growth or other styles of investing during given periods.

Portfolio composition will change due to ongoing management of the fund. References to individual securities are for informational purposes only and should not be construed as recommendations by the Fund, the Adviser, or the portfolio managers.

Index / Benchmark Definitions

Comparison to any index is for illustrative purposes only and should not be relied upon as a fully accurate measure of comparison. The Fund will be less diversified than the indices noted herein, and may hold non-index securities or securities that are not comparable to those contained in an index. Indices will hold positions that are not within the Fund's investment strategy. Indices are unmanaged, do not reflect any commissions or fees which would be incurred by an investor purchasing the underlying securities. Investors cannot invest directly in an index.

Bloomberg Barclays Aggregate Index provides a measure of the performance of the U.S. investment grade bonds market, which includes investment grade U.S. Government bonds, investment grade corporate bonds, mortgage pass-through securities and asset-backed securities that are publicly offered for sale in the United States. The securities in the Index must have at least 1 year remaining in maturity. In addition, the securities must be denominated in U.S. dollars and must be fixed rate, nonconvertible, and taxable.

Bloomberg Barclays Aggregate 1-3 Year Index provides a measure of the performance of the U.S. investment grade bonds market, which includes investment grade U.S. Government bonds, investment grade corporate bonds, mortgage pass-through securities and asset-backed securities that are publicly offered for sale in the United States. The securities in the Index must have a remaining maturity of 1 to 3 years. In addition, the securities must be denominated in U.S. dollars and must be fixed rate, nonconvertible, and taxable.

The Consumer Price Index (CPI) is an unmanaged index representing the rate of the inflation of U.S. consumer prices as determined by the U.S. Department of Labor Statistics. The CPI is presented to illustrate the Fund's purchasing power against changes in the prices of goods as opposed to a benchmark, which is used to compare the Fund's performance. There can be no guarantee that the CPI will reflect the exact level of inflation at any given time.

7

FPA NEW INCOME, INC.

HISTORICAL PERFORMANCE

(Unaudited)

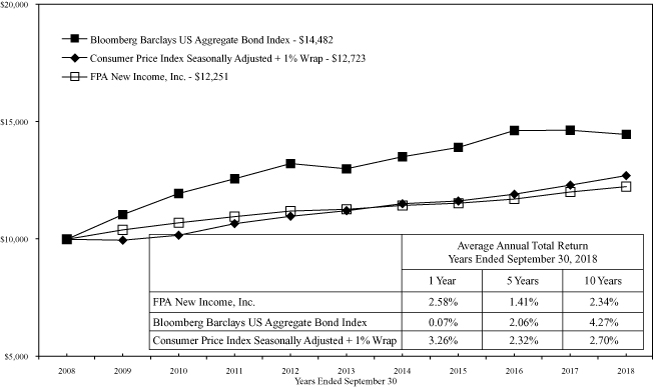

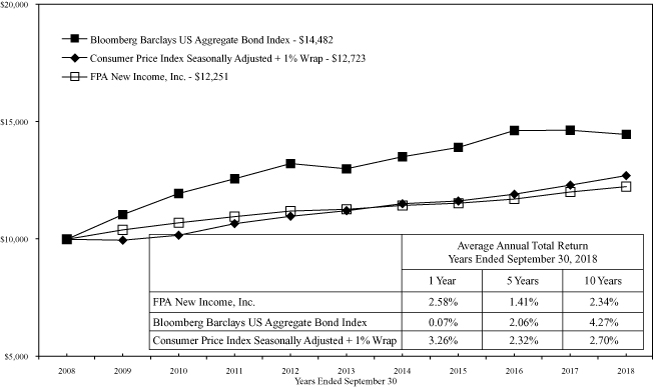

Change in Value of a $10,000 Investment in FPA New Income, Inc. vs. Barclays U.S. Aggregate Index and Consumer Price Index + 100 Basis Points from October 1, 2008 to September 30, 2018

Past performance is not indicative of future performance. The Barclays U.S. Aggregate Bond Index a broad-based unmanaged composite of four major subindexes: U.S. Government Index; U.S. Credit Index; U.S. Mortgage-Backed Securities Index; and U.S. Asset-Backed Securities Index. The index holds investment quality bonds. The Consumer Price Index is an unmanaged index representing the rate of inflation of U.S. consumer prices as determined by the US Department of Labor Statistics. The performance of the Fund and of the Averages is computed on a total return basis which includes reinvestment of all distributions.

Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown. This data represents past performance, and investors should understand that investment returns and principal values fluctuate, so that when you redeem your investment it may be worth more or less than its original cost. Current month-end performance data can be obtained by visiting the website at www.fpa.com or by calling toll-free, 1-800-982-4372. Information regarding the Fund's expense ratio and redemption fees can be found on page 30.

The Prospectus details the Fund's objective and policies, charges, and other matters of interest to prospective investors. Please read the prospectus carefully before investing. The Prospectus may be obtained by visiting the website at www.fpa.com, by email at crm@fpa.com, toll-free by calling 1-800-982-4372 or by contacting the Fund in writing.

8

FPA NEW INCOME, INC.

PORTFOLIO SUMMARY

September 30, 2018

Common Stocks | | | | | | | 0.0 | %* | |

Industrials | | | 0.0 | %* | | | | | |

Bonds & Debentures | | | | | | | 101.7 | % | |

Asset-Backed Securities | | | 53.9 | % | | | | | |

Residential Mortgage-Backed Securities | | | 23.6 | % | | | | | |

U.S. Treasuries | | | 10.2 | % | | | | | |

Commercial Mortgage-Backed Securities | | | 8.0 | % | | | | | |

Corporate Bonds & Notes | | | 3.7 | % | | | | | |

Corporate Bank Debt | | | 2.3 | % | | | | | |

Short-term Investments | | | | | | | 0.2 | % | |

Other Assets And Liabilities, Net | | | | | | | (1.9 | )% | |

Net Assets | | | | | 100.0 | % | |

* Less than 0.05%

9

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS

September 30, 2018

COMMON STOCK — 0.0% | | Shares or

Principal

Amount | | Fair

Value | |

INDUSTRIALS — 0.0% | |

Boart Longyear Ltd.(a) (Cost $630,347) | | | 261,407,903 | | | $ | 1,133,752 | | |

BONDS & DEBENTURES | |

COMMERCIAL MORTGAGE-BACKED SECURITIES — 8.0% | |

AGENCY — 0.0% | |

Government National Mortgage Association 2013-55 A —

1.317% 5/16/2034 | | $ | 383,186 | | | $ | 378,008 | | |

Government National Mortgage Association 2011-49 A —

2.45% 7/16/2038 | | | 89,980 | | | | 89,802 | | |

Government National Mortgage Association 2010-148 AC —

7.00% 12/16/2050(b) | | | 30,048 | | | | 30,251 | | |

| | | $ | 498,061 | | |

AGENCY STRIPPED — 4.3% | |

Government National Mortgage Association 2004-10 IO —

0.00% 1/16/2044(b) | | $ | 7,157,564 | | | $ | 16 | | |

Government National Mortgage Association 2012-45 IO —

0.022% 4/16/2053(b) | | | 11,346,786 | | | | 194,921 | | |

Government National Mortgage Association 2002-56 IO —

0.043% 6/16/2042(b) | | | 17,821 | | | | 22 | | |

Government National Mortgage Association 2009-119 IO —

0.105% 12/16/2049(b) | | | 13,695,343 | | | | 104,157 | | |

Government National Mortgage Association 2009-86 IO —

0.106% 10/16/2049(b) | | | 16,207,873 | | | | 132,527 | | |

Government National Mortgage Association 2009-105 IO —

0.166% 11/16/2049(b) | | | 10,475,434 | | | | 74,167 | | |

Government National Mortgage Association 2009-71 IO —

0.262% 7/16/2049(b) | | | 3,239,566 | | | | 41,349 | | |

Government National Mortgage Association 2008-8 IO —

0.357% 11/16/2047(b) | | | 7,791,283 | | | | 48,223 | | |

Government National Mortgage Association 2009-49 IO —

0.36% 6/16/2049(b) | | | 10,721,748 | | | | 102,809 | | |

Government National Mortgage Association 2012-125 IO —

0.37% 2/16/2053(b) | | | 71,246,691 | | | | 1,850,590 | | |

Government National Mortgage Association 2009-4 IO —

0.39% 1/16/2049(b) | | | 2,905,437 | | | | 47,960 | | |

Government National Mortgage Association 2009-60 IO —

0.509% 6/16/2049(b) | | | 7,107,988 | | | | 69,172 | | |

Government National Mortgage Association 2010-123 IO —

0.522% 9/16/2050(b) | | | 6,383,938 | | | | 110,565 | | |

10

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2018

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

Government National Mortgage Association 2007-77 IO —

0.538% 11/16/2047(b) | | $ | 21,500,541 | | | $ | 326,378 | | |

Government National Mortgage Association 2012-25 IO —

0.551% 8/16/2052(b) | | | 87,617,770 | | | | 1,896,040 | | |

Government National Mortgage Association 2005-9 IO —

0.556% 1/16/2045(b) | | | 1,454,090 | | | | 13,436 | | |

Government National Mortgage Association 2009-30 IO —

0.57% 3/16/2049(b) | | | 5,121,569 | | | | 138,188 | | |

Government National Mortgage Association 2008-24 IO —

0.594% 11/16/2047(b) | | | 453,477 | | | | 3,747 | | |

Government National Mortgage Association 2013-45 IO —

0.655% 12/16/2053(b) | | | 70,725,278 | | | | 1,752,629 | | |

Government National Mortgage Association 2014-157 IO —

0.663% 5/16/2055(b) | | | 152,193,849 | | | | 6,376,253 | | |

Government National Mortgage Association 2015-41 IO —

0.671% 9/16/2056(b) | | | 37,390,988 | | | | 1,821,637 | | |

Government National Mortgage Association 2012-58 IO —

0.702% 2/16/2053(b) | | | 219,166,970 | | | | 6,817,189 | | |

Government National Mortgage Association 2012-150 IO —

0.721% 11/16/2052(b) | | | 73,054,585 | | | | 3,018,732 | | |

Government National Mortgage Association 2004-43 IO —

0.743% 6/16/2044(b) | | | 12,495,880 | | | | 152,045 | | |

Government National Mortgage Association 2014-138 IO —

0.745% 4/16/2056(b) | | | 29,510,486 | | | | 1,475,554 | | |

Government National Mortgage Association 2012-79 IO —

0.751% 3/16/2053(b) | | | 135,240,085 | | | | 4,809,164 | | |

Government National Mortgage Association 2013-125 IO —

0.762% 10/16/2054(b) | | | 22,249,478 | | | | 809,069 | | |

Government National Mortgage Association 2015-86 IO —

0.771% 5/16/2052(b) | | | 71,242,836 | | | | 3,661,789 | | |

Government National Mortgage Association 2014-110 IO —

0.773% 1/16/2057(b) | | | 73,262,949 | | | | 3,903,142 | | |

Government National Mortgage Association 2015-19 IO —

0.773% 1/16/2057(b) | | | 91,406,774 | | | | 5,037,519 | | |

Government National Mortgage Association 2014-77 IO —

0.785% 12/16/2047(b) | | | 59,156,092 | | | | 2,523,090 | | |

Government National Mortgage Association 2012-114 IO —

0.786% 1/16/2053(b) | | | 50,167,401 | | | | 2,439,942 | | |

Government National Mortgage Association 2014-153 IO —

0.788% 4/16/2056(b) | | | 211,414,132 | | | | 11,006,791 | | |

11

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2018

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

Government National Mortgage Association 2015-7 IO —

0.789% 1/16/2057(b) | | $ | 15,761,004 | | | $ | 854,434 | | |

Government National Mortgage Association 2014-164 IO —

0.807% 1/16/2056(b) | | | 273,120,563 | | | | 12,919,832 | | |

Government National Mortgage Association 2015-47 IO —

0.825% 10/16/2056(b) | | | 172,105,586 | | | | 9,588,312 | | |

Government National Mortgage Association 2014-175 IO —

0.828% 4/16/2056(b) | | | 209,356,492 | | | | 10,896,126 | | |

Government National Mortgage Association 2014-135 IO —

0.832% 1/16/2056(b) | | | 310,812,592 | | | | 15,562,666 | | |

Government National Mortgage Association 2015-101 IO —

0.836% 3/16/2052(b) | | | 161,550,010 | | | | 8,377,967 | | |

Government National Mortgage Association 2008-45 IO —

0.85% 2/16/2048(b) | | | 2,621,206 | | | | 5,191 | | |

Government National Mortgage Association 2014-187 IO —

0.892% 5/16/2056(b) | | | 196,536,481 | | | | 10,982,970 | | |

Government National Mortgage Association 2006-55 IO —

0.912% 8/16/2046(b) | | | 8,426,743 | | | | 22,659 | | |

Government National Mortgage Association 2015-169 IO —

0.925% 7/16/2057(b) | | | 224,416,953 | | | | 14,429,539 | | |

Government National Mortgage Association 2012-53 IO —

0.93% 3/16/2047(b) | | | 58,976,225 | | | | 2,297,047 | | |

Government National Mortgage Association 2015-114 IO —

0.94% 3/15/2057(b) | | | 160,396,069 | | | | 9,293,845 | | |

Government National Mortgage Association 2015-108 IO —

0.941% 10/16/2056(b) | | | 36,360,007 | | | | 2,152,342 | | |

Government National Mortgage Association 2015-150 IO —

0.942% 9/16/2057(b) | | | 226,495,921 | | | | 15,037,902 | | |

Government National Mortgage Association 2015-128 IO —

0.943% 12/16/2056(b) | | | 205,178,939 | | | | 11,835,788 | | |

Government National Mortgage Association 2015-160 IO —

0.945% 1/16/2056(b) | | | 252,839,171 | | | | 15,522,909 | | |

Government National Mortgage Association 2008-48 IO —

0.968% 4/16/2048(b) | | | 8,857,344 | | | | 129,679 | | |

Government National Mortgage Association 2016-65 IO —

1.003% 1/16/2058(b) | | | 242,492,641 | | | | 17,966,377 | | |

Government National Mortgage Association 2016-106 IO —

1.031% 9/16/2058(b) | | | 241,060,678 | | | | 18,448,735 | | |

Government National Mortgage Association 2016-125 IO —

1.062% 12/16/2057(b) | | | 138,458,709 | | | | 10,695,201 | | |

12

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2018

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

Government National Mortgage Association 2008-92 IO —

1.162% 10/16/2048(b) | | $ | 12,537,991 | | | $ | 147,245 | | |

Government National Mortgage Association 2004-108 IO —

1.935% 12/16/2044(b) | | | 410,402 | | | | 4,044 | | |

Government National Mortgage Association 2006-30 IO —

2.298% 5/16/2046(b) | | | 884,151 | | | | 10,444 | | |

| | | $ | 247,940,066 | | |

NON-AGENCY — 3.7% | |

A10 Term Asset Financing LLC 2017-1A A1FX — 2.34% 3/15/2036(c) | | $ | 11,813,758 | | | $ | 11,776,601 | | |

Aventura Mall Trust M 2013-AVM A — 3.867% 12/5/2032(b)(c) | | | 37,676,000 | | | | 38,196,486 | | |

Bear Stearns Commercial Mortgage Securities Trust 2005-PWR7 B —

5.214% 2/11/2041(b) | | | 4,903,354 | | | | 4,917,365 | | |

Citigroup Commercial Mortgage Trust 2006-C4 B — 6.395% 3/15/2049(b) | | | 41,972 | | | | 42,017 | | |

COMM Mortgage Trust 2014-FL5 B, 1M LIBOR + 2.150% —

3.449% 10/15/2031(b)(c) | | | 1,045,238 | | | | 1,046,362 | | |

COMM Mortgage Trust 2014-FL5 C, 1M LIBOR + 2.150% —

3.449% 10/15/2031(b)(c) | | | 8,240,000 | | | | 8,201,127 | | |

Credit Suisse Commercial Mortgage Trust Series 2016-MFF E,

1M LIBOR + 6.000% — 8.158% 11/15/2033(b)(c) | | | 34,144,000 | | | | 34,155,957 | | |

DBUBS Mortgage Trust 2011-LC2A A4 — 4.537% 7/10/2044(c) | | | 44,683,605 | | | | 45,843,421 | | |

JP Morgan Chase Commercial Mortgage Securities Trust 2010-C1 A3 —

5.058% 6/15/2043(c) | | | 7,277,000 | | | | 7,474,177 | | |

Latitude Management Real Estate Capita 2016-CRE2 A,

1M LIBOR + 1.700% — 2.696% 11/24/2031(b)(c) | | | 16,735,000 | | | | 16,818,642 | | |

OBP Depositor LLC Trust P 2010-OBP A — 4.646% 7/15/2045(c) | | | 4,000,000 | | | | 4,099,516 | | |

Wells Fargo Commercial Mortgage Trust 2015-C26 A2 —

2.663% 2/15/2048 | | | 7,857,000 | | | | 7,824,701 | | |

WFRBS Commercial Mortgage Trust 2013-UBS1 A3 —

3.591% 3/15/2046 | | | 30,472,000 | | | | 30,732,843 | | |

| | | $ | 211,129,215 | | |

TOTAL COMMERICAL MORTGAGE-BACKED SECURITIES

(Cost $515,626,127) | | $ | 459,567,342 | | |

RESIDENTIAL MORTGAGE-BACKED SECURITIES — 23.6% | |

AGENCY COLLATERALIZED MORTGAGE OBLIGATION — 4.8% | |

Federal Home Loan Mortgage Corporation 4170 QE — 2.00% 5/15/2032 | | $ | 1,970,448 | | | $ | 1,914,082 | | |

Federal Home Loan Mortgage Corporation 3979 HD — 2.50% 12/15/2026 | | | 3,248,975 | | | | 3,193,421 | | |

Federal Home Loan Mortgage Corporation 4304 DA — 2.50% 1/15/2027 | | | 1,176,379 | | | | 1,155,439 | | |

13

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2018

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

Federal Home Loan Mortgage Corporation 4010 DE — 2.50% 2/15/2027 | | $ | 3,877,361 | | | $ | 3,813,925 | | |

Federal Home Loan Mortgage Corporation 3914 MA — 3.00% 6/15/2026 | | | 2,416,352 | | | | 2,401,794 | | |

Federal Home Loan Mortgage Corporation 4297 CA — 3.00% 12/15/2030 | | | 4,232,085 | | | | 4,202,063 | | |

Federal Home Loan Mortgage Corporation 4664 TA — 3.00% 9/15/2037 | | | 6,634,573 | | | | 6,588,694 | | |

Federal Home Loan Mortgage Corporation 4504 DN — 3.00% 10/15/2040 | | | 13,924,004 | | | | 13,799,270 | | |

Federal Home Loan Mortgage Corporation 3862 MB — 3.50% 5/15/2026 | | | 18,776,000 | | | | 18,906,409 | | |

Federal Home Loan Mortgage Corporation 2809 UC — 4.00% 6/15/2019 | | | 7,844 | | | | 7,855 | | |

Federal Home Loan Mortgage Corporation 2990 TD — 4.00% 5/15/2035 | | | 2,523 | | | | 2,526 | | |

Federal Home Loan Mortgage Corporation 3828 VE — 4.50% 1/15/2024 | | | 1,081,276 | | | | 1,115,365 | | |

Federal Home Loan Mortgage Corporation 4395 NT — 4.50% 7/15/2026 | | | 10,150,144 | | | | 10,422,879 | | |

Federal National Mortgage Association 2012-117 DA — 1.50% 12/25/2039 | | | 1,477,014 | | | | 1,400,272 | | |

Federal National Mortgage Association 2014-80 GD — 2.00% 2/25/2042 | | | 19,012,766 | | | | 18,394,950 | | |

Federal National Mortgage Association 2014-21 ED — 2.25% 4/25/2029 | | | 880,030 | | | | 862,338 | | |

Federal National Mortgage Association 2013-135 KM — 2.50% 3/25/2028 | | | 1,855,080 | | | | 1,822,116 | | |

Federal National Mortgage Association 2017-30 G — 3.00% 7/25/2040 | | | 10,508,914 | | | | 10,337,409 | | |

Federal National Mortgage Association 2013-93 PJ — 3.00% 7/25/2042 | | | 2,162,424 | | | | 2,136,615 | | |

Federal National Mortgage Association 2017-16 JA — 3.00% 2/25/2043 | | | 27,466,398 | | | | 27,161,958 | | |

Federal National Mortgage Association 2018-16 HA — 3.00% 7/25/2043 | | | 25,120,068 | | | | 24,767,945 | | |

Federal National Mortgage Association 2017-15 DA — 3.00% 12/25/2044 | | | 19,326,400 | | | | 18,793,225 | | |

Federal National Mortgage Association 2011-98 VE — 3.50% 6/25/2026 | | | 13,625,000 | | | | 13,617,112 | | |

Federal National Mortgage Association 2011-80 KB — 3.50% 8/25/2026 | | | 13,526,000 | | | | 13,611,594 | | |

Federal National Mortgage Association 2017-45 KD — 3.50% 2/25/2044 | | | 19,384,998 | | | | 19,243,714 | | |

Federal National Mortgage Association 2017-52 KC — 3.50% 4/25/2044 | | | 19,918,706 | | | | 19,769,488 | | |

Federal National Mortgage Association 2017-59 DC — 3.50% 5/25/2044 | | | 27,657,474 | | | | 27,454,253 | | |

Federal National Mortgage Association 2003-128 NG — 4.00% 1/25/2019 | | | 48 | | | | 48 | | |

Federal National Mortgage Association 2004-7 JK — 4.00% 2/25/2019 | | | 1,919 | | | | 1,918 | | |

Federal National Mortgage Association 2008-18 MD — 4.00% 3/25/2019 | | | 5,197 | | | | 5,197 | | |

Federal National Mortgage Association 2004-76 CL — 4.00% 10/25/2019 | | | 472 | | | | 472 | | |

Federal National Mortgage Association 2009-76 MA — 4.00% 9/25/2024 | | | 7,385 | | | | 7,399 | | |

Federal National Mortgage Association 2011-113 NE — 4.00% 3/25/2040 | | | 426,550 | | | | 426,932 | | |

Federal National Mortgage Association 2012-95 AB — 4.00% 11/25/2040 | | | 138,304 | | | | 138,573 | | |

Federal National Mortgage Association 2009-70 NU — 4.25% 8/25/2019 | | | 7,340 | | | | 7,336 | | |

Federal National Mortgage Association 2008-18 NB — 4.50% 5/25/2020 | | | 3,455 | | | | 3,456 | | |

Federal National Mortgage Association 2012-40 GC — 4.50% 12/25/2040 | | | 1,251,263 | | | | 1,263,057 | | |

Federal National Mortgage Association 2012-67 PB — 4.50% 12/25/2040 | | | 1,052,364 | | | | 1,049,086 | | |

Federal National Mortgage Association 2004-60 LB — 5.00% 4/25/2034 | | | 1,935,168 | | | | 1,981,975 | | |

Federal National Mortgage Association 2010-43 MK — 5.50% 5/25/2040 | | | 2,174,870 | | | | 2,292,905 | | |

| | | $ | 274,075,065 | | |

14

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2018

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

AGENCY POOL ADJUSTABLE RATE — 0.0% | |

Federal National Mortgage Association 865963,

12M USD LIBOR + 1.705% — 3.716% 3/1/2036(b) | | $ | 728,805 | | | $ | 758,861 | | |

AGENCY POOL FIXED RATE — 10.7% | |

Federal Home Loan Mortgage Corporation J24941 — 2.00% 8/1/2023 | | $ | 2,631,030 | | | $ | 2,553,660 | | |

Federal Home Loan Mortgage Corporation J16678 — 3.00% 9/1/2026 | | | 5,551,491 | | | | 5,500,779 | | |

Federal Home Loan Mortgage Corporation J17544 — 3.00% 12/1/2026 | | | 7,872,567 | | | | 7,800,653 | | |

Federal Home Loan Mortgage Corporation G16406 — 3.00% 1/1/2028 | | | 24,026,570 | | | | 23,769,551 | | |

Federal Home Loan Mortgage Corporation G16478 — 3.00% 5/1/2030 | | | 33,610,516 | | | | 33,271,981 | | |

Federal Home Loan Mortgage Corporation G16592 — 3.00% 2/1/2032 | | | 19,296,383 | | | | 19,089,964 | | |

Federal Home Loan Mortgage Corporation G16473 — 3.50% 1/1/2028 | | | 39,070,148 | | | | 39,337,923 | | |

Federal Home Loan Mortgage Corporation J26472 — 3.50% 11/1/2028 | | | 8,055,240 | | | | 8,116,742 | | |

Federal Home Loan Mortgage Corporation G15139 — 4.50% 6/1/2019 | | | 43,542 | | | | 43,686 | | |

Federal Home Loan Mortgage Corporation P60959 — 4.50% 9/1/2020 | | | 75,301 | | | | 75,331 | | |

Federal Home Loan Mortgage Corporation G14030 — 4.50% 12/1/2020 | | | 101,662 | | | | 102,666 | | |

Federal Home Loan Mortgage Corporation G15169 — 4.50% 9/1/2026 | | | 2,080,193 | | | | 2,117,045 | | |

Federal Home Loan Mortgage Corporation G15272 — 4.50% 9/1/2026 | | | 1,606,768 | | | | 1,627,037 | | |

Federal Home Loan Mortgage Corporation G15875 — 4.50% 9/1/2026 | | | 3,142,432 | | | | 3,208,797 | | |

Federal Home Loan Mortgage Corporation G18056 — 5.00% 6/1/2020 | | | 157,261 | | | | 159,224 | | |

Federal Home Loan Mortgage Corporation G13812 — 5.00% 12/1/2020 | | | 319,685 | | | | 322,773 | | |

Federal Home Loan Mortgage Corporation G15036 — 5.00% 6/1/2024 | | | 1,458,997 | | | | 1,481,059 | | |

Federal Home Loan Mortgage Corporation G13667 — 5.00% 8/1/2024 | | | 113,692 | | | | 116,147 | | |

Federal Home Loan Mortgage Corporation G15435 — 5.00% 11/1/2024 | | | 3,399,432 | | | | 3,440,588 | | |

Federal Home Loan Mortgage Corporation G15173 — 5.00% 6/1/2026 | | | 1,155,470 | | | | 1,173,474 | | |

Federal Home Loan Mortgage Corporation G15407 — 5.00% 6/1/2026 | | | 2,874,421 | | | | 2,957,267 | | |

Federal Home Loan Mortgage Corporation G15874 — 5.00% 6/1/2026 | | | 992,154 | | | | 1,004,687 | | |

Federal Home Loan Mortgage Corporation G14187 — 5.50% 12/1/2020 | | | 617,433 | | | | 622,388 | | |

Federal Home Loan Mortgage Corporation J01270 — 5.50% 2/1/2021 | | | 35,157 | | | | 35,889 | | |

Federal Home Loan Mortgage Corporation G14035 — 5.50% 12/1/2021 | | | 120,968 | | | | 123,405 | | |

Federal Home Loan Mortgage Corporation G15230 — 5.50% 12/1/2024 | | | 2,709,022 | | | | 2,773,384 | | |

Federal Home Loan Mortgage Corporation G15458 — 5.50% 12/1/2024 | | | 549,885 | | | | 565,973 | | |

Federal Home Loan Mortgage Corporation G14460 — 6.00% 1/1/2024 | | | 221,003 | | | | 228,037 | | |

Federal Home Loan Mortgage Corporation G12139 — 6.50% 9/1/2019 | | | 6 | | | | 6 | | |

Federal National Mortgage Association AB6251 — 2.00% 9/1/2022 | | | 477,448 | | | | 465,889 | | |

Federal National Mortgage Association AB7515 — 2.00% 1/1/2023 | | | 277,958 | | | | 270,298 | | |

Federal National Mortgage Association MA1502 — 2.50% 7/1/2023 | | | 24,092,637 | | | | 23,723,764 | | |

Federal National Mortgage Association AR6882 — 2.50% 2/1/2028 | | | 4,025,797 | | | | 3,925,039 | | |

Federal National Mortgage Association BM4386 — 2.50% 8/1/2030 | | | 15,835,332 | | | | 15,439,005 | | |

Federal National Mortgage Association MA2726 — 3.00% 8/1/2026 | | | 3,887,808 | | | | 3,863,988 | | |

15

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2018

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

Federal National Mortgage Association AJ6973 — 3.00% 11/1/2026 | | $ | 1,900,676 | | | $ | 1,887,842 | | |

Federal National Mortgage Association AJ9387 — 3.00% 12/1/2026 | | | 951,465 | | | | 945,041 | | |

Federal National Mortgage Association AU3826 — 3.00% 12/1/2026 | | | 27,572,575 | | | | 27,394,195 | | |

Federal National Mortgage Association AL1345 — 3.00% 2/1/2027 | | | 1,755,458 | | | | 1,743,605 | | |

Federal National Mortgage Association AB4673 — 3.00% 3/1/2027 | | | 1,906,426 | | | | 1,891,766 | | |

Federal National Mortgage Association AK9467 — 3.00% 3/1/2027 | | | 2,014,609 | | | | 2,001,007 | | |

Federal National Mortgage Association AL3458 — 3.00% 5/1/2028 | | | 39,706,147 | | | | 39,376,014 | | |

Federal National Mortgage Association AL4693 — 3.00% 8/1/2028 | | | 1,705,560 | | | | 1,694,044 | | |

Federal National Mortgage Association AU6681 — 3.00% 9/1/2028 | | | 16,533,635 | | | | 16,396,168 | | |

Federal National Mortgage Association AU6682 — 3.00% 9/1/2028 | | | 83,278,470 | | | | 82,586,060 | | |

Federal National Mortgage Association 890837 — 3.00% 10/1/2028 | | | 20,126,916 | | | | 19,972,153 | | |

Federal National Mortgage Association BM3539 — 3.00% 10/1/2030 | | | 40,328,264 | | | | 39,992,958 | | |

Federal National Mortgage Association BM4536 — 3.00% 8/1/2031 | | | 57,894,000 | | | | 57,412,646 | | |

Federal National Mortgage Association AB1940 — 3.50% 12/1/2025 | | | 2,160,204 | | | | 2,174,907 | | |

Federal National Mortgage Association MA3075 — 3.50% 7/1/2027 | | | 34,101,181 | | | | 34,430,810 | | |

Federal National Mortgage Association MA3132 — 3.50% 9/1/2027 | | | 7,645,111 | | | | 7,719,010 | | |

Federal National Mortgage Association MA3251 — 3.50% 1/1/2028 | | | 9,271,284 | | | | 9,358,004 | | |

Federal National Mortgage Association MA3321 — 3.50% 3/1/2028 | | | 5,313,412 | | | | 5,363,112 | | |

Federal National Mortgage Association CA1631 — 3.50% 10/1/2028 | | | 8,731,543 | | | | 8,791,386 | | |

Federal National Mortgage Association BM1231 — 3.50% 11/1/2031 | | | 18,404,716 | | | | 18,536,607 | | |

Federal National Mortgage Association AA4546 — 4.00% 5/1/2024 | | | 829,830 | | | | 846,633 | | |

Federal National Mortgage Association AL5956 — 4.00% 5/1/2027 | | | 913,988 | | | | 932,495 | | |

Federal National Mortgage Association 254906 — 4.50% 10/1/2018 | | | 241 | | | | 241 | | |

Federal National Mortgage Association 255547 — 4.50% 1/1/2020 | | | 18,901 | | | | 19,008 | | |

Federal National Mortgage Association MA0323 — 4.50% 2/1/2020 | | | 58,917 | | | | 59,271 | | |

Federal National Mortgage Association MA0358 — 4.50% 3/1/2020 | | | 40,400 | | | | 40,663 | | |

Federal National Mortgage Association MA0419 — 4.50% 5/1/2020 | | | 73,455 | | | | 74,021 | | |

Federal National Mortgage Association AL6725 — 4.50% 9/1/2020 | | | 460,845 | | | | 462,277 | | |

Federal National Mortgage Association 735920 — 4.50% 10/1/2020 | | | 20,828 | | | | 21,001 | | |

Federal National Mortgage Association 995158 — 4.50% 12/1/2020 | | | 42,240 | | | | 42,642 | | |

Federal National Mortgage Association 889531 — 4.50% 5/1/2022 | | | 14,592 | | | | 14,722 | | |

Federal National Mortgage Association AL6212 — 4.50% 1/1/2027 | | | 1,220,045 | | | | 1,227,156 | | |

Federal National Mortgage Association AE0126 — 5.00% 6/1/2020 | | | 1,068,221 | | | | 1,100,367 | | |

Federal National Mortgage Association 310097 — 5.00% 10/1/2020 | | | 4,965 | | | | 5,013 | | |

Federal National Mortgage Association AE0792 — 5.00% 12/1/2020 | | | 332,536 | | | | 342,543 | | |

Federal National Mortgage Association AE0314 — 5.00% 8/1/2021 | | | 1,278,992 | | | | 1,288,701 | | |

Federal National Mortgage Association AD0285 — 5.00% 9/1/2022 | | | 292,847 | | | | 297,121 | | |

Federal National Mortgage Association AE0812 — 5.00% 7/1/2025 | | | 414,316 | | | | 418,825 | | |

Federal National Mortgage Association AL5764 — 5.00% 9/1/2025 | | | 1,442,165 | | | | 1,458,521 | | |

16

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2018

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

Federal National Mortgage Association AL6798 — 5.00% 9/1/2025 | | $ | 1,207,578 | | | $ | 1,220,963 | | |

Federal National Mortgage Association AL4056 — 5.00% 6/1/2026 | | | 2,520,049 | | | | 2,570,298 | | |

Federal National Mortgage Association 745500 — 5.50% 12/1/2018 | | | 54 | | | | 54 | | |

Federal National Mortgage Association 745119 — 5.50% 12/1/2019 | | | 436,636 | | | | 439,707 | | |

Federal National Mortgage Association 995284 — 5.50% 3/1/2020 | | | 213 | | | | 213 | | |

Federal National Mortgage Association 745190 — 5.50% 6/1/2020 | | | 171 | | | | 172 | | |

Federal National Mortgage Association 889318 — 5.50% 7/1/2020 | | | 196,893 | | | | 198,067 | | |

Federal National Mortgage Association 745749 — 5.50% 3/1/2021 | | | 85,056 | | | | 86,507 | | |

Federal National Mortgage Association AL5867 — 5.50% 8/1/2023 | | | 202,221 | | | | 205,509 | | |

Federal National Mortgage Association AE0237 — 5.50% 11/1/2023 | | | 225,936 | | | | 227,618 | | |

Federal National Mortgage Association AL5812 — 5.50% 5/1/2025 | | | 1,009,785 | | | | 1,023,554 | | |

Federal National Mortgage Association AL0471 — 5.50% 7/1/2025 | | | 110,571 | | | | 114,427 | | |

Federal National Mortgage Association AL4433 — 5.50% 9/1/2025 | | | 788,776 | | | | 810,586 | | |

Federal National Mortgage Association AL4901 — 5.50% 9/1/2025 | | | 888,725 | | | | 911,143 | | |

Federal National Mortgage Association 735439 — 6.00% 9/1/2019 | | | 13,289 | | | | 13,401 | | |

Federal National Mortgage Association 745238 — 6.00% 12/1/2020 | | | 79,986 | | | | 80,986 | | |

Federal National Mortgage Association 745832 — 6.00% 4/1/2021 | | | 893,838 | | | | 911,456 | | |

Federal National Mortgage Association AD0951 — 6.00% 12/1/2021 | | | 470,227 | | | | 479,155 | | |

Federal National Mortgage Association AL0294 — 6.00% 10/1/2022 | | | 53,962 | | | | 55,781 | | |

Federal National Mortgage Association 890225 — 6.00% 5/1/2023 | | | 474,862 | | | | 486,610 | | |

Federal National Mortgage Association 890403 — 6.00% 5/1/2023 | | | 196,735 | | | | 200,325 | | |

Government National Mortgage Association 782281 — 6.00% 3/15/2023 | | | 854,122 | | | | 885,232 | | |

| | | $ | 608,548,419 | | |

AGENCY STRIPPED — 0.0% | |

Federal Home Loan Mortgage Corporation 217 PO — 0.00% 1/1/2032(d) | | $ | 189,011 | | | $ | 163,713 | | |

Federal Home Loan Mortgage Corporation 3763 NI — 3.50% 5/15/2025 | | | 1,348,470 | | | | 77,996 | | |

Federal Home Loan Mortgage Corporation 3917 AI — 4.50% 7/15/2026 | | | 10,706,910 | | | | 859,761 | | |

Federal Home Loan Mortgage Corporation 217 IO — 6.50% 1/1/2032 | | | 181,997 | | | | 43,835 | | |

Federal National Mortgage Association 2010-25 NI — 5.00% 3/25/2025 | | | 106,772 | | | | 2,769 | | |

Federal National Mortgage Association 2003-64 XI — 5.00% 7/25/2033 | | | 536,410 | | | | 107,767 | | |

| | | $ | 1,255,841 | | |

NON-AGENCY COLLATERALIZED MORTGAGE OBLIGATION — 8.1% | |

CIM Trust 2017-7 A, VRN — 3.00% 4/25/2057(b)(c) | | $ | 29,631,687 | | | $ | 29,331,592 | | |

CIM Trust 2018-R3 A1, VRN — 5.00% 12/25/2057(b)(c) | | | 50,654,639 | | | | 52,017,897 | | |

Citicorp Mortgage Securities REMIC Pass-Through

Certificates Trust Series 2005-5 2A3 — 5.00% 8/25/2020 | | | 24,554 | | | | 24,689 | | |

Citigroup Mortgage Loan Trust, Inc. 2014-A A — 4.00% 1/25/2035(b)(c) | | | 9,322,652 | | | | 9,367,955 | | |

Finance of America Structured Securities Trust 2017-HB1 A —

2.321% 11/25/2027(b)(c) | | | 8,740,472 | | | | 8,729,564 | | |

17

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2018

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

Finance of America Structured Securities Trust 2017-HB1 M1 —

2.84% 11/25/2027(b)(c) | | $ | 15,065,000 | | | $ | 14,922,033 | | |

Mill City Mortgage Loan Trust 2018-2 A1, VRN — 3.50% 5/25/2058(b)(c) | | | 47,512,828 | | | | 47,197,937 | | |

Mill City Mortgage Loan Trust 2018-3 A1, VRN — 3.50% 8/25/2058(b)(c) | | | 23,661,000 | | | | 23,429,193 | | |

Nationstar HECM Loan Trust 2017-2A A1 — 2.038% 9/25/2027(b)(c) | | | 5,956,628 | | | | 5,913,817 | | |

Nationstar HECM Loan Trust 2017-2A M1 — 2.815% 9/25/2027(b)(c) | | | 12,414,000 | | | | 12,355,815 | | |

Nationstar HECM Loan Trust 2018-2A M1, VRN —

3.552% 7/25/2028(b)(c) | | | 8,281,000 | | | | 8,256,240 | | |

Nomura Resecuritization Trust 2016-1R 3A1 — 5.00% 9/28/2036(b)(c) | | | 4,637,899 | | | | 4,688,845 | | |

Stanwich Mortgage Loan Trust Series 2010-1 A —

0.00% 9/30/2047(b)(c)(e)(f) | | | 10,734 | | | | 5,429 | | |

Stanwich Mortgage Loan Trust Series 2011-1 A —

0.00% 8/15/2050(b)(c)(e)(f) | | | 133,069 | | | | 70,184 | | |

Stanwich Mortgage Loan Trust Series 2011-2 A —

0.00% 9/15/2050(b)(c)(e)(f) | | | 288,419 | | | | 154,363 | | |

Stanwich Mortgage Loan Trust Series 2010-2 A —

0.944% 2/28/2057(b)(c)(e)(f) | | | 250,870 | | | | 126,489 | | |

Stanwich Mortgage Loan Trust Series 2010-4 A —

1.101% 8/31/2049(b)(c)(e)(f) | | | 87,647 | | | | 44,262 | | |

Towd Point Mortgage Trust 2016-3 A1 — 2.25% 4/25/2056(b)(c) | | | 17,057,081 | | | | 16,606,762 | | |

Towd Point Mortgage Trust 2015-1 AES — 3.00% 10/25/2053(b)(c) | | | 15,507,757 | | | | 15,367,925 | | |

Towd Point Mortgage Trust 2018-1 A1, VRN — 3.00% 1/25/2058(b)(c) | | | 35,196,038 | | | | 34,534,325 | | |

Towd Point Mortgage Trust 2018-2 A1, VRN — 3.25% 3/25/2058(b)(c) | | | 52,038,965 | | | | 51,327,379 | | |

Towd Point Mortgage Trust 2018-5 A1A, VRN — 3.25% 8/25/2058(b)(c) | | | 56,995,000 | | | | 56,244,017 | | |

Towd Point Mortgage Trust 2015-2 1A1 — 3.25% 11/25/2060(b)(c) | | | 25,994,037 | | | | 25,705,098 | | |

Towd Point Mortgage Trust 2015-4 A1 — 3.50% 4/25/2055(b)(c) | | | 26,023,696 | | | | 25,906,750 | | |

Towd Point Mortgage Trust 2015-2 2A1 — 3.75% 11/25/2057(b)(c) | | | 18,155,907 | | | | 18,144,197 | | |

| | | $ | 460,472,757 | | |

TOTAL RESIDENTIAL MORTGAGE-BACKED SECURITIES

(Cost $1,360,095,791) | | $ | 1,345,110,943 | | |

ASSET-BACKED SECURITIES — 53.9% | |

AUTO — 16.4% | |

Ally Auto Receivables Trust 2017-1 B — 2.35% 3/15/2022 | | $ | 3,743,000 | | | $ | 3,669,508 | | |

Ally Auto Receivables Trust 2017-1 C — 2.48% 5/16/2022 | | | 7,059,000 | | | | 6,934,423 | | |

American Credit Acceptance Receivables Trust 2017-4 B —

2.61% 5/10/2021(c) | | | 8,389,000 | | | | 8,378,340 | | |

AmeriCredit Automobile Receivables Trust 2017-4 A3 — 2.04% 7/18/2022 | | | 15,618,000 | | | | 15,392,284 | | |

18

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2018

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

AmeriCredit Automobile Receivables Trust 2015-4 B — 2.11% 1/8/2021 | | $ | 28,000,000 | | | $ | 27,955,315 | | |

AmeriCredit Automobile Receivables Trust 2015-1 C — 2.51% 1/8/2021 | | | 1,472,009 | | | | 1,471,040 | | |

AmeriCredit Automobile Receivables Trust 2017-1 C — 2.71% 8/18/2022 | | | 7,547,000 | | | | 7,430,071 | | |

BMW Vehicle Lease Trust 2017-1 A4 — 2.18% 6/22/2020 | | | 18,527,000 | | | | 18,400,272 | | |

BMW Vehicle Lease Trust 2017-2 A4 — 2.19% 3/22/2021 | | | 9,547,000 | | | | 9,418,193 | | |

Capital Auto Receivables Asset Trust 2016-1 B — 2.67% 12/21/2020 | | | 4,211,000 | | | | 4,199,738 | | |

CarMax Auto Owner Trust 2017-4 A3 — 2.11% 10/17/2022 | | | 8,680,000 | | | | 8,546,361 | | |

CarMax Auto Owner Trust 2018-1 A3 — 2.48% 11/15/2022 | | | 18,879,000 | | | | 18,651,553 | | |

CarMax Auto Owner Trust 2018-2 A3 — 2.98% 1/17/2023 | | | 22,185,000 | | | | 22,105,385 | | |

Credit Acceptance Auto Loan Trust 2017-2A A — 2.55% 2/17/2026(c) | | | 50,778,000 | | | | 50,299,148 | | |

Credit Acceptance Auto Loan Trust 2017-3A A — 2.65% 6/15/2026(c) | | | 17,185,000 | | | | 16,987,379 | | |

Credit Acceptance Auto Loan Trust 2016-3A B — 2.94% 10/15/2024(c) | | | 20,626,000 | | | | 20,372,820 | | |

Credit Acceptance Auto Loan Trust 2016-2A B — 3.18% 5/15/2024(c) | | | 22,937,000 | | | | 22,933,651 | | |

Credit Acceptance Auto Loan Trust 2017-3A B — 3.21% 8/17/2026(c) | | | 36,312,000 | | | | 35,657,698 | | |

Credit Acceptance Auto Loan Trust 2015-2A C — 3.76% 2/15/2024(c) | | | 550,000 | | | | 550,526 | | |

DT Auto Owner Trust 2017-4A B — 2.44% 1/15/2021(c) | | | 10,627,000 | | | | 10,594,024 | | |

DT Auto Owner Trust 2017-1A C — 2.70% 11/15/2022(c) | | | 18,717,000 | | | | 18,682,074 | | |

DT Auto Owner Trust 2017-4A C — 2.86% 7/17/2023(c) | | | 9,173,000 | | | | 9,132,771 | | |

Exeter Automobile Receivables Trust 2018-1A B — 2.75% 4/15/2022(c) | | | 10,910,000 | | | | 10,814,267 | | |

Exeter Automobile Receivables Trust 2017-1A B — 3.00% 12/15/2021(c) | | | 8,763,000 | | | | 8,745,233 | | |

First Investors Auto Owner Trust 2016-2A A2 — 1.87% 11/15/2021(c) | | | 5,514,000 | | | | 5,481,389 | | |

First Investors Auto Owner Trust 2017-1A B — 2.67% 4/17/2023(c) | | | 4,126,000 | | | | 4,079,681 | | |

First Investors Auto Owner Trust 2015-2A B — 2.75% 9/15/2021(c) | | | 4,443,000 | | | | 4,435,426 | | |

First Investors Auto Owner Trust 2017-1A C — 2.95% 4/17/2023(c) | | | 8,149,000 | | | | 7,983,807 | | |

GM Financial Automobile Leasing Trust 2016-3 C — 2.38% 5/20/2020 | | | 7,768,000 | | | | 7,731,076 | | |

GM Financial Automobile Leasing Trust 2017-2 B — 2.43% 6/21/2021 | | | 22,240,000 | | | | 21,985,897 | | |

GM Financial Automobile Leasing Trust 2017-1 B — 2.48% 8/20/2020 | | | 6,027,000 | | | | 5,976,955 | | |

GM Financial Automobile Leasing Trust 2018-1 A4 — 2.68% 12/20/2021 | | | 15,683,000 | | | | 15,531,523 | | |

GM Financial Automobile Leasing Trust 2017-1 C — 2.74% 8/20/2020 | | | 21,903,000 | | | | 21,719,315 | | |

GM Financial Automobile Leasing Trust 2017-2 C — 2.84% 6/21/2021 | | | 3,750,000 | | | | 3,714,129 | | |

Honda Auto Receivables Owner Trust 2018-1I A4 — 2.78% 5/15/2024 | | | 37,474,000 | | | | 37,153,282 | | |

Hyundai Auto Lease Securitization Trust 2016-C B — 1.86% 5/17/2021(c) | | | 13,264,000 | | | | 13,187,159 | | |

Hyundai Auto Lease Securitization Trust 2017-C A4 — 2.21% 9/15/2021(c) | | | 10,294,000 | | | | 10,158,803 | | |

Hyundai Auto Lease Securitization Trust 2018-A A4 — 2.89% 3/15/2022(c) | | | 23,522,000 | | | | 23,361,387 | | |

Hyundai Auto Receivables Trust 2018-A A4 — 2.94% 6/17/2024 | | | 27,022,000 | | | | 26,820,859 | | |

Mercedes-Benz Auto Lease Trust 2018-A A4 — 2.51% 10/16/2023 | | | 6,293,000 | | | | 6,228,857 | | |

Mercedes-Benz Auto Receivables Trust 2018-1 A4 — 3.15% 10/15/2024 | | | 23,979,000 | | | | 23,928,896 | | |

Nissan Auto Lease Trust 2017-A A3 — 1.91% 4/15/2020 | | | 21,315,000 | | | | 21,191,177 | | |

Nissan Auto Lease Trust 2017-B A4 — 2.17% 12/15/2021 | | | 11,287,000 | | | | 11,145,394 | | |

Nissan Auto Receivables Owner Trust 2018-A A3 — 2.65% 5/16/2022 | | | 27,017,000 | | | | 26,833,414 | | |

19

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2018

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

Nissan Auto Receivables Owner Trust 2018-B A4 — 3.16% 12/16/2024 | | $ | 26,545,000 | | | $ | 26,422,559 | | |

Prestige Auto Receivables Trust 2016-2A B — 2.19% 11/15/2022(c) | | | 25,223,000 | | | | 25,104,096 | | |

Prestige Auto Receivables Trust 2017-1A B — 2.39% 5/16/2022(c) | | | 12,040,000 | | | | 11,880,312 | | |

Prestige Auto Receivables Trust 2017-1A C — 2.81% 1/17/2023(c) | | | 30,628,000 | | | | 30,008,169 | | |

Prestige Auto Receivables Trust 2016-2A C — 2.88% 11/15/2022(c) | | | 12,327,000 | | | | 12,249,043 | | |

Santander Drive Auto Receivables Trust 2017-3 B — 2.19% 3/15/2022 | | | 30,359,000 | | | | 30,067,384 | | |

Santander Drive Auto Receivables Trust 2017-1 C — 2.58% 5/16/2022 | | | 7,621,000 | | | | 7,570,776 | | |

Santander Drive Auto Receivables Trust 2018-1 B — 2.63% 7/15/2022 | | | 18,461,000 | | | | 18,354,198 | | |

Santander Drive Auto Receivables Trust 2016-2 C — 2.66% 11/15/2021 | | | 4,882,000 | | | | 4,869,606 | | |

Santander Drive Auto Receivables Trust 2017-2 C — 2.79% 8/15/2022 | | | 12,325,000 | | | | 12,250,601 | | |

Westlake Automobile Receivables Trust 2016-3A C — 2.46% 1/18/2022(c) | | | 19,575,000 | | | | 19,519,869 | | |

Westlake Automobile Receivables Trust 2017-1A C — 2.70% 10/17/2022(c) | | | 11,439,000 | | | | 11,394,657 | | |

Westlake Automobile Receivables Trust 2018-1A C — 2.92% 5/15/2023(c) | | | 12,377,000 | | | | 12,257,277 | | |

World Omni Auto Receivables Trust 2018-A A3 — 2.50% 4/17/2023 | | | 31,343,000 | | | | 30,931,770 | | |

World Omni Automobile Lease Securitization Trust 2017-A A4 —

2.32% 8/15/2022 | | | 5,473,000 | | | | 5,424,483 | | |

World Omni Automobile Lease Securitization Trust 2017-A B —

2.48% 8/15/2022 | | | 10,102,000 | | | | 10,002,344 | | |

World Omni Automobile Lease Securitization Trust 2018-B B —

3.43% 3/15/2024 | | | 11,060,000 | | | | 11,057,393 | | |

| | | $ | 935,335,037 | | |

COLLATERALIZED LOAN OBLIGATION — 12.2% | |

Adams Mill CLO Ltd. 2014-1A B2R — 3.35% 7/15/2026(c) | | $ | 8,136,000 | | | $ | 8,008,411 | | |

B&M CLO Ltd. 2014-1A A2R, FRN — 3.939% 4/16/2026(b)(c) | | | 12,309,000 | | | | 12,315,339 | | |

Black Diamond CLO Ltd. 2014-1A A1R, 3M USD

LIBOR + 1.150% — 3.486% 10/17/2026(b)(c) | | | 34,610,000 | | | | 34,583,177 | | |

BlueMountain CLO Ltd. 2013-4A — 3.36% 4/15/2025(c) | | | 8,598,000 | | | | 8,605,515 | | |

Cerberus Loan Funding XVIII LP 2017-1A A, 3M USD

LIBOR + 1.750% — 4.089% 4/15/2027(b)(c) | | | 43,407,000 | | | | 43,411,731 | | |

Cerberus Loan Funding XXI LP 2017-4A A, FRN —

3.789% 10/15/2027(b)(c) | | | 34,672,000 | | | | 34,673,595 | | |

Elm Trust 2016-1A A2 — 4.163% 6/20/2025(c) | | | 13,183,000 | | | | 13,096,259 | | |

Flagship VII Ltd. 2013-7A A2R — 2.70% 1/20/2026(c) | | | 10,774,671 | | | | 10,672,689 | | |

Fortress Credit Opportunities IX CLO Ltd. 2017-9A A1T, FRN —

3.864% 11/15/2029(b)(c) | | | 25,867,000 | | | | 25,907,792 | | |

Fortress Credit Opportunities IX CLO Ltd. 2017-9A E, FRN —

9.564% 11/15/2029(b)(c) | | | 12,722,000 | | | | 12,433,770 | | |

Fortress Credit Opportunities VII CLO, Ltd. 2016-7I E,

3M USD LIBOR + 7.490% — 9.824% 12/15/2028(b) | | | 20,895,000 | | | | 20,915,999 | | |

20

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2018

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

Halcyon Loan Advisors Funding 2015-3A A1R,

3M USD LIBOR + 0.90% — 3.233% 10/18/2027(b)(c) | | $ | 43,913,000 | | | $ | 43,847,262 | | |

Halcyon Loan Advisors Funding 2015-1A AR,

FRN — 3.268% 4/20/2027(b)(c) | | | 50,214,000 | | | | 50,182,717 | | |

Halcyon Loan Advisors Funding 2014-3A AR,

3M USD LIBOR + 1.100% — 3.447% 10/22/2025(b)(c) | | | 18,450,000 | | | | 18,451,568 | | |

Ivy Hill Middle Market Credit Fund VII Ltd. — 3.583% 7/18/2030(b)(c)(e) | | | 25,985,000 | | | | 25,959,015 | | |

Ivy Hill Middle Market Credit Fund VII Ltd. 7A AR, FRN —

3.878% 10/20/2029(b)(c) | | | 7,180,000 | | | | 7,174,931 | | |

NewMark Capital Funding CLO, Ltd. 2014-2A AFR —

3.077% 6/30/2026(c) | | | 5,169,726 | | | | 5,116,462 | | |

NewMark Capital Funding CLO, Ltd. 2014-2A BFR —

3.669% 6/30/2026(c) | | | 10,199,000 | | | | 10,192,218 | | |

Oaktree CLO Ltd. 2014-2A A1BR — 2.953% 10/20/2026(c) | | | 10,752,000 | | | | 10,595,451 | | |

Ocean Trails CLO V 2014-5A C2R — 4.70% 10/13/2026(c) | | | 6,814,000 | | | | 6,811,772 | | |

Saranac CLO III Ltd. 2014-3A ALR, FRN — 3.466% 6/22/2030(b)(c) | | | 26,117,000 | | | | 26,116,896 | | |

Senior Credit Fund SPV LLC 2016-1A — 3.033% 12/19/2025(e) | | | 34,234,000 | | | | 34,234,000 | | |

Silvermore CLO Ltd. 2014-1A A1R, 3M USD LIBOR + 1.170% —

3.484% 5/15/2026(b)(c) | | | 22,399,076 | | | | 22,404,295 | | |

Symphony CLO XII Ltd. 2013-12A B2R — 3.389% 10/15/2025(c) | | | 15,800,000 | | | | 15,799,795 | | |

Telos CLO 2013-3A AR, 3M USD LIBOR + 1.300% —

3.636% 7/17/2026(b)(c) | | | 23,124,000 | | | | 23,202,807 | | |

Telos CLO 2013-3A BR, 3M USD LIBOR + 2.000% —

4.336% 7/17/2026(b)(c) | | | 20,644,000 | | | | 20,646,870 | | |

Telos CLO Ltd. 2014-5A A1R, FRN — 3.286% 4/17/2028(b)(c) | | | 31,772,000 | | | | 31,737,241 | | |

THL Credit Wind River CLO Ltd. 2016-1A AR, FRN —

3.398% 7/15/2028(b) | | | 27,723,000 | | | | 27,722,695 | | |

VCO CLO LLC 2018-1A A, FRN — 3.942% 7/20/2030(b)(c) | | | 26,176,000 | | | | 26,174,744 | | |

Wellfleet CLO Ltd. 2016-1A AR, FRN — 3.258% 4/20/2028(b)(c) | | | 26,029,000 | | | | 25,837,270 | | |

West CLO Ltd. 2014-2A A1BR — 2.724% 1/16/2027(c) | | | 8,977,000 | | | | 8,782,199 | | |

West CLO Ltd. 2013-1A A1BR — 2.745% 11/7/2025(c) | | | 11,274,245 | | | | 11,194,784 | | |

West CLO Ltd. 2013-1A A2BR — 3.393% 11/7/2025(c) | | | 12,780,000 | | | | 12,773,853 | | |

Zais CLO 2 Ltd. 2014-2A A1BR — 2.92% 7/25/2026(c) | | | 6,979,000 | | | | 6,875,487 | | |

| | | $ | 696,458,609 | | |

CREDIT CARD — 5.5% | |

American Express Credit Account Master Trust 2017-6 B —

2.20% 5/15/2023 | | $ | 39,998,000 | | | $ | 39,138,475 | | |

Cabela's Credit Card Master Note Trust 2016-1 A1 — 1.78% 6/15/2022 | | | 51,561,000 | | | | 51,176,938 | | |

Capital One Multi-Asset Execution Trust 2016-A6 A6 — 1.82% 9/15/2022 | | | 38,371,000 | | | | 37,913,541 | | |

Capital One Multi-Asset Execution Trust 2017-A1 A1 — 2.00% 1/17/2023 | | | 48,839,000 | | | | 48,159,713 | | |

21

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2018

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

Discover Card Execution Note Trust 2014-A4 A4 — 2.12% 12/15/2021 | | $ | 42,672,000 | | | $ | 42,480,445 | | |

Golden Credit Card Trust 2018-1A A — 2.62% 1/15/2023(c) | | | 31,898,000 | | | | 31,466,809 | | |

Synchrony Card Issuance Trust 2018-A1 A1 — 3.38% 9/15/2024 | | | 56,107,000 | | | | 56,107,000 | | |

Synchrony Credit Card Master Note Trust 2016-3 B — 1.91% 9/15/2022 | | | 3,847,000 | | | | 3,805,196 | | |

| | | $ | 310,248,117 | | |

EQUIPMENT — 12.4% | |

ARI Fleet Lease Trust 2018-A A3 — 2.84% 10/15/2026(c) | | $ | 13,874,000 | | | $ | 13,717,191 | | |

Ascentium Equipment Receivables Trust 2017-2A A3 —

2.31% 12/10/2021(c) | | | 11,128,000 | | | | 10,918,899 | | |

Avis Budget Rental Car Funding AESOP LLC 2014-2A A —

2.50% 2/20/2021(c) | | | 6,084,000 | | | | 6,036,344 | | |

Avis Budget Rental Car Funding AESOP LLC 2015-1A A —

2.50% 7/20/2021(c) | | | 48,498,000 | | | | 47,838,151 | | |

Avis Budget Rental Car Funding AESOP LLC 2015-2A A —

2.63% 12/20/2021(c) | | | 22,566,000 | | | | 22,223,383 | | |

CCG Receivables Trust 2018-1 A2 — 2.50% 6/16/2025(c) | | | 14,750,000 | | | | 14,665,247 | | |

Chesapeake Funding II LLC 2016-1A A1 — 2.11% 3/15/2028(c) | | | 11,613,556 | | | | 11,584,313 | | |

Chesapeake Funding II LLC 2017-4A A1 — 2.12% 11/15/2029(c) | | | 25,384,955 | | | | 25,076,756 | | |

Coinstar Funding LLC Series 2017-1A A2 — 5.216% 4/25/2047(c) | | | 8,319,688 | | | | 8,420,192 | | |

Dell Equipment Finance Trust 2017-2 A3 — 2.19% 10/24/2022(c) | | | 6,888,000 | | | | 6,814,107 | | |

Enterprise Fleet Financing LLC 2016-2 A2 — 1.74% 2/22/2022(c) | | | 7,047,264 | | | | 7,023,009 | | |

Enterprise Fleet Financing LLC 2017-2 A2 — 1.97% 1/20/2023(c) | | | 11,775,981 | | | | 11,695,191 | | |

Enterprise Fleet Financing LLC 2017-3 A2 — 2.13% 5/22/2023(c) | | | 17,098,100 | | | | 16,945,961 | | |

Enterprise Fleet Financing LLC 2017-2 A3 — 2.22% 1/20/2023(c) | | | 23,511,000 | | | | 23,046,394 | | |

Enterprise Fleet Financing LLC 2017-1 A3 — 2.60% 7/20/2022(c) | | | 9,453,000 | | | | 9,365,956 | | |

GreatAmerica Leasing Receivables Funding LLC Series 2017-1 A4 —

2.36% 1/20/2023(c) | | | 6,562,000 | | | | 6,478,189 | | |

GreatAmerica Leasing Receivables Funding LLC Series 2018-1 A4 —

2.83% 6/17/2024(c) | | | 8,531,000 | | | | 8,409,457 | | |

GreatAmerica Leasing Receivables Funding LLC Series 2017-1 C —

2.89% 1/22/2024(c) | | | 2,609,000 | | | | 2,569,704 | | |

Hertz Fleet Lease Funding LP 2016-1 A2 — 1.96% 4/10/2030(c) | | | 9,443,464 | | | | 9,412,338 | | |

Hertz Fleet Lease Funding LP 2017-1 A2 — 2.13% 4/10/2031(c) | | | 17,370,680 | | | | 17,266,656 | | |

Hertz Fleet Lease Funding LP 2018-1 A2 — 3.23% 5/10/2032(c) | | | 16,932,000 | | | | 16,922,091 | | |

John Deere Owner Trust 2018-B A4 — 3.23% 6/16/2025 | | | 26,892,000 | | | | 26,757,330 | | |

John Deere Owner Trust 2018 2018-A A4 — 2.91% 1/15/2025 | | | 24,403,000 | | | | 24,183,100 | | |

Kubota Credit Owner Trust 2018-1A A3 — 3.10% 8/15/2022(c) | | | 41,604,000 | | | | 41,496,404 | | |

MMAF Equipment Finance LLC 2017-B A3 — 2.21% 10/17/2022(c) | | | 19,410,000 | | | | 19,064,302 | | |

NextGear Floorplan Master Owner Trust 2017-1A A2 —

2.54% 4/18/2022(c) | | | 22,933,000 | | | | 22,696,375 | | |

22

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2018

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

NextGear Floorplan Master Owner Trust 2017-2A B —

3.02% 10/17/2022(c) | | $ | 20,252,000 | | | $ | 19,991,697 | | |

NextGear Floorplan Master Owner Trust 2018-1A A2 —

3.22% 2/15/2023(c) | | | 12,191,000 | | | | 12,105,233 | | |

Prop Series 2017-1A — 5.30% 3/15/2042(e) | | | 34,288,960 | | | | 33,758,225 | | |

Verizon Owner Trust 2016-2A A — 1.68% 5/20/2021(c) | | | 8,830,000 | | | | 8,768,578 | | |

Verizon Owner Trust 2017-2A A — 1.92% 12/20/2021(c) | | | 26,369,000 | | | | 26,027,176 | | |

Verizon Owner Trust 2017-3A A1A — 2.06% 4/20/2022(c) | | | 20,678,000 | | | | 20,362,880 | | |

Verizon Owner Trust 2017-2A B — 2.22% 12/20/2021(c) | | | 24,047,000 | | | | 23,552,755 | | |

Verizon Owner Trust 2017-3A B — 2.38% 4/20/2022(c) | | | 19,491,000 | | | | 19,130,953 | | |

Verizon Owner Trust 2017-1A B — 2.45% 9/20/2021(c) | | | 33,682,000 | | | | 33,220,725 | | |

Verizon Owner Trust 2018-1A B — 3.05% 9/20/2022(c) | | | 24,178,000 | | | | 23,952,871 | | |

Volvo Financial Equipment LLC Series 2017-1A A4 —

2.21% 11/15/2021(c) | | | 5,916,000 | | | | 5,817,897 | | |

Volvo Financial Equipment LLC Series 2018-1A A3 —

2.54% 2/15/2022(c) | | | 40,054,000 | | | | 39,688,235 | | |

Wheels SPV 2 LLC 2018-1A A3 — 3.24% 4/20/2027(c) | | | 12,559,000 | | | | 12,510,820 | | |

| | | $ | 709,515,085 | | |

OTHER — 7.4% | |

Conn Funding II LP 2017-B B — 4.52% 4/15/2021(c) | | $ | 7,765,000 | | | $ | 7,805,857 | | |

InSite Issuer LLC — 8.595% 8/15/2043(c)(e) | | | 12,001,000 | | | | 12,814,927 | | |

New Residential Advance Receivables Trust 2015-ON1 2016-T4 AT4 —

3.107% 12/15/2050(c) | | | 50,294,000 | | | | 49,821,221 | | |

New Residential Advance Receivables Trust Advance

Receivables Backed Notes 2016-T2 AT2 — 2.575% 10/15/2049(c) | | | 25,417,000 | | | | 25,200,307 | | |

New Residential Advance Receivables Trust Advance

Receivables Backed Notes 2017-T1 AT1 — 3.214% 2/15/2051(c) | | | 46,789,000 | | | | 46,309,155 | | |

New Residential Mortgage LLC 2018-FNT1 A — 3.61% 5/25/2023(c) | | | 31,301,565 | | | | 31,120,442 | | |

New Residential Mortgage LLC 2018-FNT2 A — 3.79% 7/25/2054(c) | | | 38,441,900 | | | | 38,358,547 | | |

NRZ Excess Spread-Collateralized Notes Series 2018-PLS1 A —

3.193% 1/25/2023(c) | | | 15,222,658 | | | | 15,083,890 | | |

NRZ Excess Spread-Collateralized Notes Series 2018-PLS2 A —

3.265% 2/25/2023(c) | | | 17,196,331 | | | | 17,048,119 | | |

Panhandle-Plains Student Finance Corporation 2001-1 A2 —

3.17% 12/1/2031(e) | | | 3,900,000 | | | | 3,875,625 | | |

PFS Financing Corp. 2017-D A — 2.40% 10/17/2022(c) | | | 16,752,000 | | | | 16,425,731 | | |

PFS Financing Corp. 2017-D B — 2.74% 10/17/2022(c) | | | 7,798,000 | | | | 7,648,944 | | |

PFS Financing Corp. 2018-B A — 2.89% 2/15/2023(c) | | | 28,232,000 | | | | 27,910,853 | | |

PFS Financing Corp. 2018-B B — 3.08% 2/15/2023(c) | | | 7,809,000 | | | | 7,707,467 | | |

PFS Financing Corp. 2018-D A — 3.19% 4/17/2023(c) | | | 34,868,000 | | | | 34,657,610 | | |

23

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2018

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

PFS Financing Corp. 2018-D B — 3.45% 4/17/2023(c) | | $ | 17,375,000 | | | $ | 17,223,652 | | |

PFS Financing Corporation 2016-BA A — 1.87% 10/15/2021(c) | | | 3,481,000 | | | | 3,438,207 | | |

PFS Financing Corporation 2017-BA A2 — 2.22% 7/15/2022(c) | | | 22,038,000 | | | | 21,597,725 | | |

PFS Financing Corporation 2017-BA B — 2.57% 7/15/2022(c) | | | 7,305,000 | | | | 7,170,831 | | |

Unison Ground Lease Funding LLC 2013-1 B — 5.78% 3/15/2043(c)(e) | | | 10,932,000 | | | | 10,849,373 | | |

Unison Ground Lease Funding LLC 2013-2 B — 6.268% 3/15/2043(c) | | | 3,768,000 | | | | 3,741,247 | | |

WCP ISSUER LLC 2013-1 B — 6.657% 8/15/2043(c)(e) | | | 15,000,000 | | | | 15,519,479 | | |

| | | $ | 421,329,209 | | |

| TOTAL ASSET-BACKED SECURITIES (Cost $3,093,739,556) | | $ | 3,072,886,057 | | |

CORPORATE BONDS & NOTES — 3.7% | |

BASIC MATERIALS — 1.0% | |

PT Boart Longyear Management Pty Ltd.

PIK, 10.00% Cash or 12.00% PIK — 10.00% 12/31/2022 | | $ | 63,661,002 | | | $ | 58,394,355 | | |

COMMUNICATIONS — 0.5% | |

Cisco Systems, Inc. — 2.45% 6/15/2020 | | $ | 26,664,000 | | | $ | 26,444,675 | | |

CONSUMER, CYCLICAL — 0.1% | |

Northwest Airlines 1999-2 Class C Pass Through Trust —

8.304% 9/1/2010(e) | | $ | 14,816,524 | | | $ | 2,592,892 | | |

Northwest Airlines 2000-1 Class G Pass Through Trust — 7.15% 4/1/2021 | | | 4,685,438 | | | | 4,688,249 | | |

US Airways 1999-1C Pass Through Trust — 7.96% 7/20/2019(e) | | | 3,790,184 | | | | 625,380 | | |

Continental Airlines 2000-1 Class B Pass Through Trust —

8.388% 5/1/2022 | | | 2,510 | | | | 2,751 | | |

| | | $ | 7,909,272 | | |

CONSUMER, NON-CYCLICAL — 0.4% | |

StoneMor Partners LP / Cornerstone Family Services of West Virginia

Subsidiary — 7.875% 6/1/2021 | | $ | 22,958,000 | | | $ | 21,307,894 | | |

ENERGY — 0.8% | |

PHI, Inc. — 5.25% 3/15/2019 | | $ | 46,715,000 | | | $ | 44,612,825 | | |

FINANCIAL — 0.2% | |

Berkshire Hathaway Finance Corporation,

3M USD LIBOR + 0.260% — 2.574% 8/15/2019(b) | | $ | 12,753,000 | | | $ | 12,782,108 | | |

24

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2018

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

INDUSTRIAL — 0.2% | |

Air 2 US — 8.027% 10/1/2020(c) | | $ | 1,230,726 | | | $ | 1,248,418 | | |

Air 2 US — 10.127% 10/1/2020(c)(e) | | | 39,258,228 | | | | 7,459,063 | | |

| | | $ | 8,707,481 | | |

TECHNOLOGY — 0.5% | |

Apple, Inc. — 1.90% 2/7/2020 | | $ | 29,017,000 | | | $ | 28,654,714 | | |

Oracle Corporation — 3.875% 7/15/2020 | | | 839,000 | | | | 852,684 | | |

| | | $ | 29,507,398 | | |

| TOTAL CORPORATE BONDS & NOTES (Cost $231,942,564) | | $ | 209,666,008 | | |

CORPORATE BANK DEBT — 2.3% | |

ABG Intermediate Holdings 2 LLC,

3M USD LIBOR + 7.750% — 9.992% 9/29/2025(b)(g) | | $ | 12,468,384 | | | $ | 12,483,969 | | |

Boart Longyear Management Pty Ltd TL, 10.000%

Cash or 11.000% PIK — 11.000% 10/23/2020(b)(g) | | | 4,367,047 | | | | 4,280,492 | | |

JC Penney Corporation, Inc., 1M USD LIBOR + 4.250% —

6.567% 6/23/2023(b)(g) | | | 20,492,161 | | | | 18,781,066 | | |

Logix Holding Co. LLC TL 1L, 1M USD LIBOR + 5.750% —

7.992% 12/22/2024(b)(g) | | | 11,150,918 | | | | 11,123,040 | | |

MB2LTL, 6M USD LIBOR + 9.250% — 11.750% 11/30/2023(b)(e)(g) | | | 6,816,000 | | | | 6,850,080 | | |

OTGDDTL — 1.00% 8/23/2021(b)(e)(f)(g) | | | 224,051 | | | | 5,525 | | |

OTGTL, 8/23/2021(b)(e)(g) | |

2M USD LIBOR + 9.000% — 11.334% | | | 9,985,000 | | | | 10,031,530 | | |

3M USD LIBOR + 9.000% — 11.338% | | | 15,363,949 | | | | 15,435,545 | | |

SDTL, 11/22/2021(b)(e)(g) | |

1M USD LIBOR + 4.500% — 6.742% | | | 6,078,935 | | | | 6,064,771 | | |

6M USD LIBOR + 4.500% — 7.001% | | | 6,883,500 | | | | 6,867,462 | | |

Xplornet Communication, Inc., 3M USD LIBOR 4.000% —

6.334% 9/9/2021(b)(g) | | | 21,635,095 | | | | 21,725,530 | | |

ZW1L, 3M USD LIBOR + 5.00% — 7.34% 11/16/2022(b)(e)(g) | | | 13,382,879 | | | | 13,399,608 | | |

ZW2L, 3M USD LIBOR + 9.00% — 11.312% 11/16/2023(b)(e)(g) | | | 4,870,000 | | | | 4,930,875 | | |

| TOTAL CORPORATE BANK DEBT (Cost $131,854,144) | | $ | 131,979,493 | | |

25

FPA NEW INCOME, INC.

PORTFOLIO OF INVESTMENTS (Continued)

September 30, 2018

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair

Value | |

U.S. TREASURIES — 10.2% | |

U.S. Treasury Bills — 1.946% 10/4/2018(d) | | $ | 112,080,000 | | | $ | 112,060,946 | | |

U.S. Treasury Bills — 2.075% 10/11/2018(d) | | | 3,300,000 | | | | 3,298,121 | | |

U.S. Treasury Bills — 1.979% 10/25/2018(d) | | | 111,563,000 | | | | 111,407,928 | | |

U.S. Treasury Notes — 1.25% 11/30/2018 | | | 72,750,000 | | | | 72,630,646 | | |

U.S. Treasury Notes — 2.00% 11/15/2021 | | | 96,363,000 | | | | 93,809,381 | | |

U.S. Treasury Notes — 1.875% 1/31/2022 | | | 97,388,000 | | | | 94,206,694 | | |

U.S. Treasury Notes — 2.00% 2/15/2022 | | | 97,082,000 | | | | 94,277,097 | | |

| TOTAL U.S. TREASURIES (Cost $582,432,314) | | $ | 581,690,813 | | |