UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | 811-07443 |

Name of Registrant: | Vanguard Whitehall Funds |

Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

Name and address of agent for service: | Heidi Stam, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000 |

Date of fiscal year end: October 31 |

Date of reporting period: November 1, 2014 – October 31, 2015 |

Item 1: Reports to Shareholders |

Annual Report | October 31, 2015

Vanguard Selected Value Fund

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles, grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds. Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisors’ Report. | 8 |

| Fund Profile. | 13 |

| Performance Summary. | 14 |

| Financial Statements. | 16 |

| Your Fund’s After-Tax Returns. | 28 |

| About Your Fund’s Expenses. | 29 |

| Glossary. | 31 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice.

Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the

risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Pictured is a sailing block on the Brilliant, a 1932 schooner docked in Mystic, Connecticut. A type of pulley, the

sailing block helps coordinate the setting of the sails. At Vanguard, the intricate coordination of technology and people allows

us to help millions of clients around the world reach their financial goals.

Your Fund’s Total Returns

| |

| Fiscal Year Ended October 31, 2015 | |

| | Total |

| | Returns |

| Vanguard Selected Value Fund | 0.88% |

| Russell Midcap Value Index | 0.47 |

| Mid-Cap Value Funds Average | 0.92 |

| Mid-Cap Value Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

| | | | |

| Your Fund’s Performance at a Glance | | | | |

| October 31, 2014, Through October 31, 2015 | | | | |

| |

| | | | Distributions Per Share |

| | Starting | Ending | | |

| | Share | Share | Income | Capital |

| | Price | Price | Dividends | Gains |

| Vanguard Selected Value Fund | $29.49 | $28.15 | $0.404 | $1.169 |

1

Chairman’s Letter

Dear Shareholder,

Compared with the previous few years, U.S. stock returns were generally restrained for the 12 months ended October 31, 2015. Neither mid-capitalization nor value stocks, which are the focus of Vanguard Selected Value Fund, measured up to the broad market. The fund returned close to 1%, a bit better than its benchmark, the Russell Midcap Value Index, and about the same as the average return of its mid-cap value peers.

The fund and its benchmark traveled very different routes to reach those results. Selected Value far outdistanced its benchmark in the consumer discretionary, consumer staples, and health care sectors, but lagged in financials, energy, and information technology. Selected Value’s cash position, about 6% as of the end of the period, weighed slightly on returns. (The advisors have the flexibility to hold cash when they cannot find attractive stocks that meet their strict valuation criteria.)

If you hold shares in a taxable account, you may wish to review the table and discussion on after-tax returns for the fiscal year that appear later in this report.

On a separate note, I’d like to recognize Vanguard Selected Value Fund’s tenth anniversary with advisor Donald Smith & Co., Inc., and portfolio managers Don Smith and Rich Greenberg. The fund launched in 1996 and Donald and his namesake firm, along with Richard, began advising it in 2005.

2

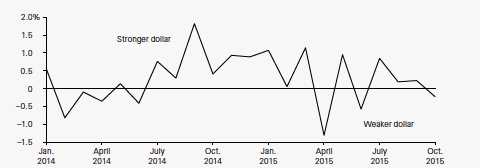

U.S. stock market fluctuated on its way to modest returns

The broad U.S. stock market returned more than 4% for the fiscal year ended October 31. Stocks generally climbed during the first nine months before dropping sharply in August and September. Fears surfaced in late summer that slower economic growth in China would spread across the globe.

In October, however, stocks rallied as the Federal Reserve maintained its historically low short-term interest rates. Central banks in Europe and Asia also signaled or implemented additional stimulus measures to counter sluggish growth and low inflation. Corporate earnings, although generally lower than in the past couple of years, mostly exceeded expectations.

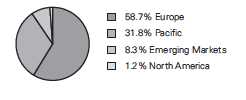

The strength of the U.S. dollar against foreign currencies contributed to a return of about –4% for international stocks. Returns for the developed markets of the Pacific region and Europe were essentially flat. Stocks tumbled in emerging markets, where concerns about China seemed to weigh most heavily.

| | | |

| Market Barometer | | | |

| |

| | Average Annual Total Returns |

| | Periods Ended October 31, 2015 |

| | One | Three | Five |

| | Year | Years | Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 4.86% | 16.28% | 14.32% |

| Russell 2000 Index (Small-caps) | 0.34 | 13.90 | 12.06 |

| Russell 3000 Index (Broad U.S. market) | 4.49 | 16.09 | 14.14 |

| FTSE All-World ex US Index (International) | -3.83 | 5.20 | 2.99 |

| |

| Bonds | | | |

| Barclays U.S. Aggregate Bond Index (Broad taxable market) | 1.96% | 1.65% | 3.03% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | 2.87 | 2.91 | 4.28 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.02 | 0.02 | 0.04 |

| |

| CPI | | | |

| Consumer Price Index | 0.17% | 0.93% | 1.69% |

3

The consumer sectors soared; financials and energy soured

Selected Value’s three advisors––Barrow, Hanley, Mewhinney & Strauss, Donald Smith & Co., and Pzena Investment Management––manage their respective portions of the fund separately.

They all have extensive experience as value-oriented investors and rely on deep research to find stocks of companies that, in their view, haven’t been adequately recognized or rewarded by the markets. They make a solid commitment when they invest in a stock, tucking it firmly into the portfolio until its fundamentals change or it no longer meets their strict criteria.

The fund performed well in the consumer discretionary and consumer staples sectors. Its consumer discretionary stocks returned about 24%, almost four times as much as their benchmark counterparts. Several apparel companies led the way, helped by cruise lines and auto parts firms. Outperformance was even more striking in consumer staples: Returns in this lightly held sector approached 60% and lifted the fund’s overall results, while the benchmark’s holdings returned 10%.

Health care is not a mainstay of the fund, as it isn’t traditionally considered a source of value-oriented stocks. For this fiscal year, however, Selected Value got a

| | |

| Expense Ratios | | |

| Your Fund Compared With Its Peer Group | | |

| |

| | | Peer Group |

| | Fund | Average |

| Selected Value Fund | 0.44% | 1.29% |

The fund expense ratio shown is from the prospectus dated February 25, 2015, and represents estimated costs for the current fiscal year. For

the fiscal year ended October 31, 2015, the fund’s expense ratio was 0.39%. The peer-group expense ratio is derived from data provided by

Lipper, a Thomson Reuters Company, and captures information through year-end 2014.

Peer group: Mid-Cap Value Funds.

4

boost from its holdings in the health care providers and services segment. Its technology stocks returned less than 2%, lagging the benchmark by nearly 5 percentage points. Strong results from IT services firms offset poor results from semiconductor companies.

The fund recorded negative returns in five of the nine industry sectors it had exposure to. Most dramatic was the troubled energy sector, where low oil prices plagued most of the industry. The fund’s holdings returned about –50%, while their benchmark counterparts returned –37%.

Financials, which at almost 30% of assets is the fund’s largest sector weighting, returned about –3%, behind the benchmark’s return of almost 5%. Selected Value’s consumer finance firms and REITs (real estate investment trusts) had the most difficulties; its multiline insurance and asset management segments also hit rough patches.

You can find more information on the fund’s positioning and performance in the Advisors’ Report that follows this letter.

| |

| Total Returns | |

| Ten Years Ended October 31, 2015 | |

| | Average |

| | Annual Return |

| Selected Value Fund | 8.63% |

| Russell Midcap Value Index | 8.39 |

| Mid-Cap Value Funds Average | 7.52 |

| Mid-Cap Value Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be

lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our

website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so

an investor’s shares, when sold, could be worth more or less than their original cost.

5

|

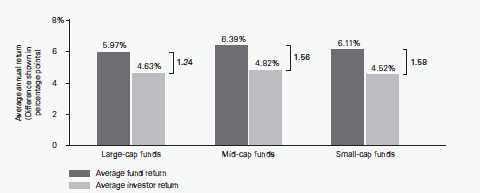

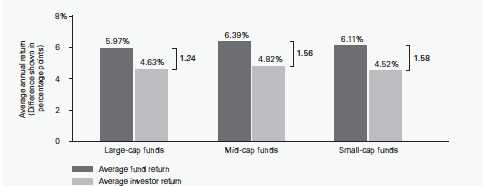

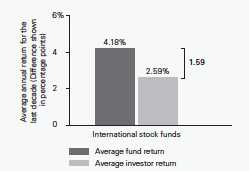

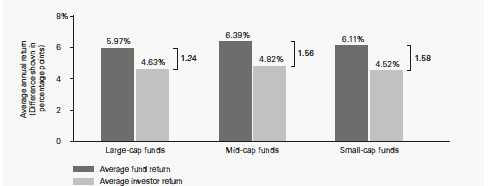

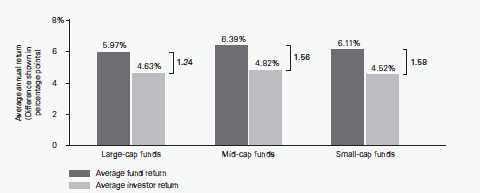

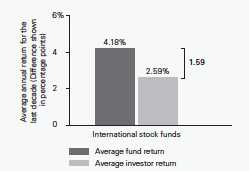

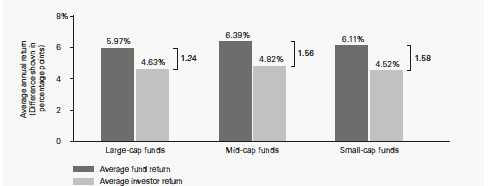

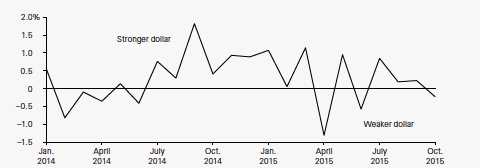

| Staying the course can help you stay closer to your fund’s return |

| |

| When stock markets are highly volatile, as in recent months, it’s tempting to run for cover. |

| But the price of panic can be high. |

| |

| A rough measure of what can be lost from attempts to time the market is the difference |

| between the returns produced by a fund and the returns earned by the fund’s investors. |

| |

| The results shown in your fund’s Performance Summary later in this report are its time- |

| weighted returns—the average annual returns investors would have earned if they had |

| invested a lump sum in the fund at the start of the period and reinvested any distributions |

| they received. Their actual returns, however, depend on whether they subsequently bought |

| or sold any shares. There’s often a gap between this dollar-weighted return for investors and |

| the fund’s time-weighted return, as shown below. |

| |

| Many sensible investment behaviors can contribute to the difference in returns, but industry |

| cash flow data suggest that one important factor is the generally counterproductive effort to |

| buy and sell at the “right” time. Keeping your emotions in check can help narrow the gap. |

| |

| Mutual fund returns and investor returns over the last decade |

| Notes: Data are as of September 30, 2015. The average fund returns and average investor returns are from Morningstar. The average fund |

| returns are the average of the funds’ time-weighted returns in each category. The average investor returns assume that the growth of a |

| fund’s total net assets for a given period is driven by market returns and investor cash flow. To calculate investor return, a fund’s change |

| in assets for the period is discounted by the return of the fund to isolate how much of the asset growth was driven by cash flow. A model, |

| similar to an internal rate-of-return calculation, is then used to calculate a constant growth rate that links the beginning total net assets |

| and periodic cash flows to the ending total net assets. Amounts may not add up exactly because of rounding. |

| Sources: Vanguard and Morningstar, Inc. |

6

Dips and detours are common as fund strives for strong returns

The advisors’ patient approach, along with a relatively concentrated portfolio, results in a collection of stocks that looks significantly different than those held by the benchmark. At times, the advisors’ conviction and enduring investment process can result in short-term underperformance, an occurrence that can be frustrating but is sometimes necessary for the fund to achieve its desired long-term outcome.

For the ten years ended October 31, Selected Value Fund produced an average annual return of 8.63%. Its benchmark (which bears no expenses) returned 8.39% over the same period; its peer group, 7.52%.

Selected Value is served well by the advisors’ experience, skill, and knowledge, and by its low costs, which allow you to keep more of the fund’s return.

A dose of discipline is crucial when markets become volatile

The developments over the past few months remind us that nobody can control the direction of the markets or reliably predict where they’ll go in the short term. However, investors can control how they react to unstable and turbulent markets.

During periods of market adversity, it’s more important than ever to keep sight of one of Vanguard’s key principles: Maintain perspective and long-term discipline. Whether you’re investing for yourself or on behalf of clients, your success is affected greatly by how you respond—or don’t respond—during turbulent markets. (You can read Vanguard’s Principles for Investing Success at vanguard.com/research.)

As I’ve written in the past, the best course for long-term investors is generally to ignore daily market moves and not make decisions based on emotion. This is also a good time to evaluate your portfolio and make sure your asset allocation is aligned with your time horizon, goals, and risk tolerance.

The markets are unpredictable and often confounding. Keeping your long-term plans clearly in focus can help you weather these periodic storms.

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

November 17, 2015

7

Advisors’ Report

For the fiscal year ended October 31, 2015, Vanguard Selected Value Fund returned 0.88%. Your fund is managed by three independent advisors. This provides exposure to distinct yet complementary investment approaches, enhancing the fund’s diversification. It is not uncommon for different advisors to have different views about individual securities or the broader investment environment.

The advisors, the percentage and amount of fund assets each manages, and a brief description of their investment strategies are presented in the table below. The advisors have also prepared a discussion of the investment environment that existed during the fiscal period and of how portfolio positioning reflects this assessment. (Please note that the Pzena Investment Management discussion refers to industry sectors as defined by Russell classifications, rather than by the Global Industry Classification Standard used elsewhere in this report.) These comments were prepared on November 19, 2015.

| | | |

| Vanguard Selected Value Fund Investment Advisors | |

| |

| | Fund Assets Managed | |

| Investment Advisor | % | $ Million | Investment Strategy |

| Barrow, Hanley, Mewhinney & | 63 | 6,133 | Conducts fundamental research on individual stocks |

| Strauss, LLC | | | exhibiting traditional value characteristics: |

| | | | price/earnings and price/book ratios below the market |

| | | | average and dividend yields above the market average. |

| Donald Smith & Co., Inc. | 21 | 2,066 | Conducts fundamental research on the lowest |

| | | | price-to-tangible book value companies. Research |

| | | | focuses on underlying quality of book value and assets, |

| | | | and on long-term earnings potential. |

| Pzena Investment Management, | 13 | 1,300 | Uses a fundamental, bottom-up, deep-value-oriented |

| LLC | | | investment strategy. Seeks to buy good businesses at |

| | | | low prices, focusing exclusively on companies that are |

| | | | underperforming their historically demonstrated |

| | | | earnings power. |

| Cash Investments | 3 | 164 | These short-term reserves are invested by Vanguard in |

| | | | equity index products to simulate investment in stocks. |

| | | | Each advisor may also maintain a cash position. |

8

Barrow, Hanley, Mewhinney &

Strauss, LLC

Portfolio Managers:

James P. Barrow,

Executive Director

Mark Giambrone,

Managing Director

Stocks advanced moderately in the last 12 months as the market struggled to balance improving economic data with the prospects for rising interest rates and the strong dollar. This type of environment often produces solid results for value stocks with high dividend yields, and our return was better than that of the market. Because we have positioned our portfolio in anticipation of continued modest economic data and the rising rates that should follow, our largest positions are in the financial sector, where higher rates will mean higher profits, and in those sectors that thrive during economic uplifts, such as industrials and consumer discretionary.

We continue to benefit from a pickup in merger and acquisition (M&A) activity, with take-outs of two of our holdings announced during the period. Our positioning in health care has been especially fruitful, as Omnicare and Cigna were targeted for acquisition during the past year. If we are finding good companies with attractive valuations and cash flow, and the market

doesn’t recognize this, we consider it a proof statement of the efficacy of our process to then see a financial or strategic buyer come along. We expect to continue to see additional activity over time, as First Niagara Financial Group and New York Community Bancorp were also involved in M&A activity after the end of the fiscal year.

Our financial holdings detracted meaningfully from returns, mainly because of continued low interest rates. We have been underweighted in REITs (real estate investment trusts) and overweighted in companies focused on lending. REITs have done well, as their valuations rise on low interest rates, while lending-center companies have suffered, as they need rate increases to improve margins. Thus, low interest rates have hindered returns over the last few years. If economic data remain good, however, we expect that rising rates will help returns.

We are underweighted in information technology, utilities, materials, and, as noted above, REITs. We believe that traditional yield plays like utilities and REITs have had substantial runs because of the continued low interest rate environment and now have very little room for valuation upside or meaningful yield relative to their own histories. We also see considerable risk to their valuation levels should interest rates rise.

9

Donald Smith & Co., Inc.

Portfolio Managers:

Donald G. Smith, President

and Chief Investment Officer

Richard L. Greenberg, CFA,

Senior Vice President

The portfolio continues to meet our criteria of owning a concentrated selection of low price-to-tangible book value stocks with attractive long-term earnings potential. It currently sells at 95% of tangible book value and 7.6 times our estimate of normalized earnings. In contrast, the Standard & Poor’s 500 Index sells at over 5 times tangible book value and 16 times normalized earnings.

During the last year, the portfolio’s largest detractor by far was Micron Technology, which declined 50% over the past year after a spectacular run that saw its stock rise 400% from the beginning of 2013. Slackening demand for personal computers led to pricing weakness in PC DRAM (dynamic random access memory), a product that accounts for over 20% of Micron’s sales. We still believe that the memory industry has undergone a structural change, shrinking to only a handful of competitors, and that the magnitude of industry pricing downturns will be less steep than in past cycles. The interest shown by a Chinese company in buying Micron highlights the inherent value of the company’s assets and technology.

Commodity stocks––namely, energy and precious metals––were the other large losers for the portfolio; their decline mirrored that of oil and gold prices.

WPX Energy (–64.1%) and Yamana Gold (–43.8%) detracted most. Commodity companies constitute over 40% of the lowest price/book value decile, and they account for the majority of the poor performance of the decile over the last year. Thanks to our long-standing caution over oil prices, we have been underweighted in energy stocks relative to this decile, preferring gas-oriented companies; any exposure to this area, however, has hurt performance. On the positive side, JetBlue Airways (+115.2%) benefited from both lower oil prices and internal profit enhancement actions, as did Royal Caribbean Cruises (+47.0%).

We sold our positions in Peabody Energy and Exelon. We purchased Aspen Insurance Holdings, a reinsurance and insurance company, at about book value. Meeting its stated goal of an 11% return on equity in 2015 would likely drive the stock to a premium to book value. Aspen is a prime takeover target; in 2014, the company rejected an offer from Endurance at a substantial premium to book value. We purchased MFA Financial, a mortgage REIT, at 89% of tangible book value. The stock yields 11.4%, and the company is one of the mortgage REITs least vulnerable to rising interest rates.

10

Our largest position is in AerCap. The stock sells at approximately book value, below fair market value, and 7 times current earnings. We expect the company to be able to restart its stock buyback program by first quarter 2016. Insurance is the largest industry weighting. On average, our insurance holdings sell at about book value and 11 times earnings. Other large weightings include airlines/ aircraft leasing and technology.

We believe that rising interest rates that result from strengthening worldwide economies would generally benefit the portfolio. Insurers would earn more on their investments, while technology and commodity companies would be helped by stronger demand. Until this growth is evident, it is possible that investors will continue to seek safe havens in the narrow universe of large-cap growth companies—though we believe their high valuations make these stocks anything but safe. In this uncertain environment, we are comforted by the generally strong balance sheets and cash flows exhibited by most of our holdings; the fact that over one-half of our holdings have active stock buyback programs is evidence of strong balance sheets, as well as managements’ belief in the undervaluation of their assets.

Pzena Investment Management, LLC

Portfolio Managers:

Richard S. Pzena, Founder,

Chief Executive Officer, and

Co-Chief Investment Officer

Manoj Tandon, Principal,

Co-Director of Research

Eli Rabinowich, Principal

Stocks were generally strong in the first half of the year, only to reverse most of their gains in the second half. As a result, the Russell Midcap Value Index, the fund’s benchmark, was up slightly in a year where investor behavior was influenced by oil prices, which declined sharply, and anticipation of a rise in the short-term interest rate. Over the past year, our portfolio benefited from stock selection in the materials and processing, technology, and financial services sectors. These results were slightly offset by positioning in producer durables and consumer staples.

Strong results were spread broadly across the portfolio. The largest individual contributor was ON Semiconductor Corporation, which performed well in a year that featured strong design wins, market share gains in the automotive and computing space, and positive guidance for 2017 targets.

11

Our managed health care holdings performed well, led by Cigna and Aetna. HMOs were up as investors gained comfort with the sustainability of earnings growth after the implementation of the Affordable Care Act, and on better-than-expected medical cost trends. Cigna’s shares further increased on the takeover offer by Anthem. Within financials, property and casualty insurance holdings performed well, led by Progressive, which benefited from strong results as net premiums written grew by 16%. Owens Corning, a roofing and insulation manufacturer, issued strong results and above-consensus guidance, resulting in a solid 12-month return. The business continued to show revenue growth and margin improvement amid a recovery in new residential construction.

The largest detractors were Murphy Oil and Superior Energy Services, reflecting the depressed oil prices. We continue to

believe that Murphy Oil has a solid mix of assets and a balance sheet that can withstand a prolonged period of low oil prices. Superior Energy also has a strong balance sheet and is well positioned to participate in an eventual rebound in capital spending by energy companies. We took advantage of the weakness to add to our positions. Another top detractor was producer durable holding Terex. Its price fell because of the firm’s exposure to the oil and gas sector (margins in the aerial work platform division were weaker than expected), and because its merger partner, Konecranes, issued a profit warning.

Overall, the portfolio continues to consist of companies that we believe are of high quality. Our largest exposure is to the insurance, advertising, and technology segments, where we believe valuations are attractive.

12

Selected Value Fund

Fund Profile

As of October 31, 2015

| | | |

| Portfolio Characteristics | | |

| | | | DJ |

| | | | U.S. |

| | | Russell | Total |

| | | Midcap | Market |

| | | Value | FA |

| | Fund | Index | Index |

| Number of Stocks | 123 | 558 | 3,971 |

| Median Market Cap | $9.9B | $10.3B | $51.0B |

| Price/Earnings Ratio | 16.8x | 22.4x | 21.9x |

| Price/Book Ratio | 1.7x | 1.7x | 2.7x |

| Return on Equity | 13.5% | 10.2% | 17.2% |

| Earnings Growth | | | |

| Rate | 9.4% | 6.7% | 9.9% |

| Dividend Yield | 2.2% | 2.3% | 2.0% |

| Foreign Holdings | 8.1% | 0.0% | 0.0% |

| Turnover Rate | 24% | — | — |

| Ticker Symbol | VASVX | — | — |

| Expense Ratio1 | 0.44% | — | — |

| 30-Day SEC Yield | 1.47% | — | — |

| Short-Term | | | |

| Reserves | 5.5% | — | — |

| | | |

| Sector Diversification (% of equity exposure) |

| | | Russell | DJ |

| | | Midcap | U.S. Total |

| | | Value | Market |

| | Fund | Index | FA Index |

| Consumer | | | |

| Discretionary | 18.0% | 8.4% | 13.7% |

| Consumer Staples | 3.6 | 3.9 | 8.5 |

| Energy | 5.0 | 9.2 | 6.5 |

| Financials | 28.8 | 33.3 | 17.9 |

| Health Care | 6.7 | 5.9 | 14.2 |

| Industrials | 20.4 | 9.8 | 10.7 |

| Information | | | |

| Technology | 8.6 | 9.9 | 20.1 |

| Materials | 4.8 | 6.3 | 3.3 |

| Telecommunication | | | |

| Services | 0.1 | 1.6 | 2.1 |

| Utilities | 4.0 | 11.7 | 3.0 |

| | |

| Volatility Measures | | |

| | Russell | DJ |

| | Midcap | U.S. Total |

| | Value | Market |

| | Index | FA Index |

| R-Squared | 0.86 | 0.90 |

| Beta | 0.96 | 0.98 |

| These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months. |

| | |

| Ten Largest Holdings (% of total net assets) |

| Royal Caribbean Cruises | Hotels, Resorts & | |

| Ltd. | Cruise Lines | 3.2% |

| Reynolds American Inc. | Tobacco | 3.0 |

| Hanesbrands Inc. | Apparel, Accessories | |

| | & Luxury Goods | 2.8 |

| Stanley Black & Decker | | |

| Inc. | Industrial Machinery | 2.5 |

| Total System Services | Data Processing & | |

| Inc. | Outsourced Services | 2.5 |

| Owens Corning | Building Products | 2.5 |

| Cigna Corp. | Managed Health | |

| | Care | 2.3 |

| Delphi Automotive plc | Auto Parts & | |

| | Equipment | 2.3 |

| Cardinal Health Inc. | Health Care | |

| | Distributors | 2.1 |

| Norwegian Cruise Line | Hotels, Resorts & | |

| Holdings Ltd. | Cruise Lines | 1.9 |

| Top Ten | | 25.1% |

| The holdings listed exclude any temporary cash investments and equity index products. |

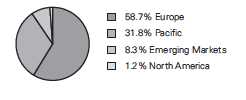

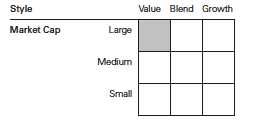

Investment Focus

1 The expense ratio shown is from the prospectus dated February 25, 2015, and represents estimated costs for the current fiscal year. For the fiscal

year ended October 31, 2015, the expense ratio was 0.39%.

13

Selected Value Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

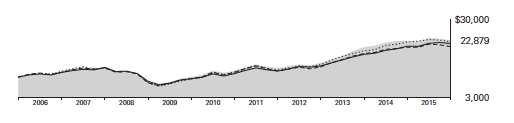

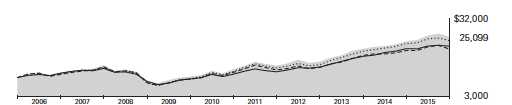

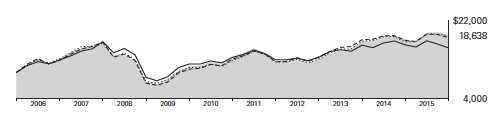

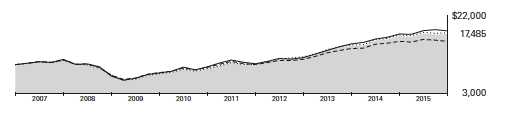

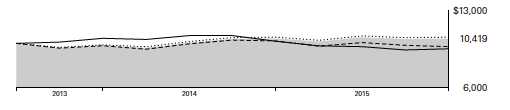

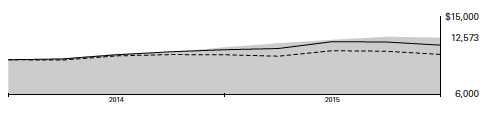

Cumulative Performance: October 31, 2005, Through October 31, 2015

Initial Investment of $10,000

| | | | | |

| | | Average Annual Total Returns | |

| | | Periods Ended October 31, 2015 | |

| | | | | | Final Value |

| | | One | Five | Ten | of a $10,000 |

| | | Year | Years | Years | Investment |

| | Selected Value Fund* | 0.88% | 13.35% | 8.63% | $22,879 |

| •••••••• | Russell Midcap Value Index | 0.47 | 13.64 | 8.39 | 22,388 |

| – – – – | Mid-Cap Value Funds Average | 0.92 | 12.15 | 7.52 | 20,654 |

| | Dow Jones U.S. Total Stock Market | | | | |

| | Float Adjusted Index | 4.40 | 14.11 | 8.07 | 21,735 |

| Mid-Cap Value Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

See Financial Highlights for dividend and capital gains information.

14

Selected Value Fund

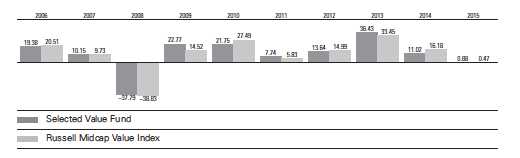

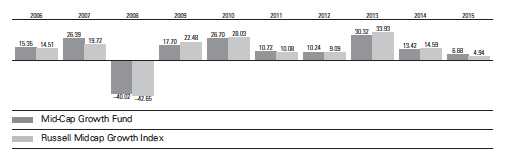

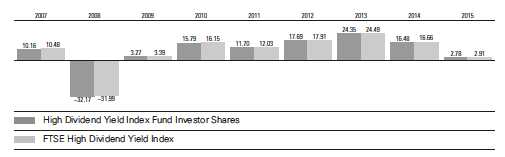

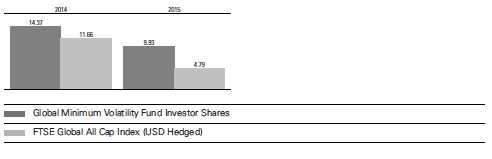

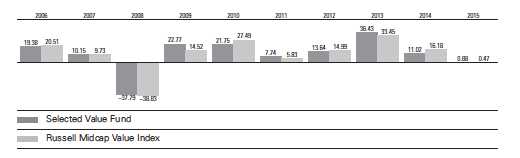

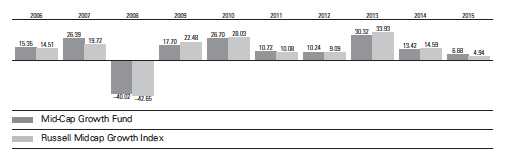

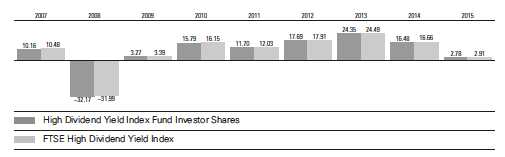

Fiscal-Year Total Returns (%): October 31, 2005, Through October 31, 2015

Average Annual Total Returns: Periods Ended September 30, 2015

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Selected Value Fund | 2/15/1996 | -4.25% | 12.65% | 7.54% |

15

Selected Value Fund

Financial Statements

Statement of Net Assets

As of October 31, 2015

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| Common Stocks (93.3%)1 | | |

| Consumer Discretionary (16.9%) | |

| | Royal Caribbean Cruises | | |

| | Ltd. | 3,167,345 | 311,508 |

| | Hanesbrands Inc. | 8,348,700 | 266,658 |

| | Delphi Automotive plc | 2,714,000 | 225,778 |

| * | Norwegian Cruise Line | | |

| | Holdings Ltd. | 2,864,200 | 182,220 |

| | L Brands Inc. | 1,889,800 | 181,383 |

| | Whirlpool Corp. | 1,018,900 | 163,167 |

| 2 | SeaWorld Entertainment | | |

| | Inc. | 5,141,400 | 102,468 |

| | Interpublic Group of Cos. | | |

| | Inc. | 1,881,994 | 43,154 |

| | Omnicom Group Inc. | 533,025 | 39,934 |

| | News Corp. Class A | 2,298,100 | 35,391 |

| | Dana Holding Corp. | 1,489,275 | 25,020 |

| | Staples Inc. | 1,802,725 | 23,417 |

| | Meredith Corp. | 394,800 | 18,564 |

| | News Corp. Class B | 643,700 | 9,964 |

| | | | 1,628,626 |

| Consumer Staples (3.2%) | | |

| | Reynolds American Inc. | 6,063,476 | 292,987 |

| | Kellogg Co. | 296,600 | 20,916 |

| | | | 313,903 |

| Energy (4.6%) | | |

| | Golar LNG Ltd. | 4,370,308 | 126,783 |

| | PBF Energy Inc. Class A | 2,275,752 | 77,375 |

| * | WPX Energy Inc. | 6,469,194 | 44,379 |

| ^ | Noble Corp. plc | 3,160,316 | 42,569 |

| | Murphy Oil Corp. | 892,850 | 25,384 |

| *,^ | Seadrill Ltd. | 3,301,300 | 21,359 |

| | Superior Energy Services | | |

| | Inc. | 1,481,750 | 20,982 |

| | Cenovus Energy Inc. | 1,359,400 | 20,269 |

| | Apache Corp. | 424,625 | 20,013 |

| | Rowan Cos. plc Class A | 730,525 | 14,377 |

| | Baker Hughes Inc. | 222,550 | 11,724 |

| | Nabors Industries Ltd. | 885,000 | 8,885 |

| | | |

| | Valero Energy Corp. | 106,000 | 6,987 |

| | Tidewater Inc. | 556,400 | 6,871 |

| ^ | Paragon Offshore plc | 870,105 | 209 |

| | | | 448,166 |

| Financials (27.0%) | | |

| | Discover Financial | | |

| | Services | 3,217,300 | 180,877 |

| | XL Group plc Class A | 4,603,630 | 175,306 |

| | Capital One Financial | | |

| | Corp. | 2,207,600 | 174,180 |

| | Fifth Third Bancorp | 8,598,775 | 163,807 |

| | Ameriprise Financial Inc. | 1,314,700 | 151,664 |

| | New York Community | | |

| | Bancorp Inc. | 9,056,200 | 149,608 |

| | Unum Group | 4,292,805 | 148,746 |

| | Willis Group Holdings plc | 2,974,975 | 132,714 |

| | Host Hotels & Resorts | | |

| | Inc. | 7,130,600 | 123,573 |

| | Navient Corp. | 8,676,447 | 114,442 |

| | People’s United Financial | | |

| | Inc. | 6,554,600 | 104,546 |

| | CNA Financial Corp. | 2,259,996 | 82,625 |

| | Everest Re Group Ltd. | 429,037 | 76,356 |

| | First Niagara Financial | | |

| | Group Inc. | 6,784,200 | 70,217 |

| | Validus Holdings Ltd. | 1,557,005 | 68,975 |

| | Corporate Office | | |

| | Properties Trust | 2,812,800 | 64,694 |

| | Valley National Bancorp | 6,006,800 | 63,071 |

| * | Element Financial Corp. | 4,215,200 | 54,511 |

| | Lamar Advertising Co. | | |

| | Class A | 752,150 | 42,444 |

| | Axis Capital Holdings Ltd. | 690,000 | 37,260 |

| | Progressive Corp. | 1,072,450 | 35,530 |

| | Torchmark Corp. | 598,608 | 34,725 |

| * | SLM Corp. | 4,507,900 | 31,826 |

| | Aspen Insurance Holdings | | |

| | Ltd. | 649,830 | 31,588 |

| | Franklin Resources Inc. | 653,100 | 26,620 |

16

Selected Value Fund

| | | |

| | | | Market |

| | | | Value• |

| | | Shares | ($000) |

| | American National | | |

| | Insurance Co. | 254,722 | 26,308 |

| | Voya Financial Inc. | 627,465 | 25,456 |

| | Webster Financial Corp. | 583,775 | 21,658 |

| | Legg Mason Inc. | 439,100 | 19,650 |

| | Regions Financial Corp. | 2,088,100 | 19,524 |

| | Comerica Inc. | 438,450 | 19,029 |

| | Hospitality Properties | | |

| | Trust | 583,800 | 15,669 |

| | Invesco Ltd. | 465,650 | 15,446 |

| | Hartford Financial Services | |

| | Group Inc. | 313,800 | 14,516 |

| | Endurance Specialty | | |

| | Holdings Ltd. | 219,125 | 13,833 |

| | EPR Properties | 239,975 | 13,633 |

| | Synovus Financial Corp. | 420,221 | 13,292 |

| | Allstate Corp. | 207,575 | 12,845 |

| | KeyCorp | 916,525 | 11,383 |

| | MFA Financial Inc. | 1,600,100 | 11,073 |

| | Assurant Inc. | 80,045 | 6,526 |

| | Primerica Inc. | 96,553 | 4,599 |

| * | Genworth Financial Inc. | | |

| | Class A | 914,500 | 4,280 |

| | Citizens Financial Group | | |

| | Inc. | 151,150 | 3,673 |

| | | | 2,612,298 |

| Health Care (6.1%) | | |

| | Cigna Corp. | 1,689,957 | 226,522 |

| | Cardinal Health Inc. | 2,448,100 | 201,234 |

| | St. Jude Medical Inc. | 2,276,100 | 145,238 |

| | Aetna Inc. | 109,575 | 12,577 |

| | | | 585,571 |

| Industrials (19.2%) | | |

| | Stanley Black & Decker | | |

| | Inc. | 2,310,375 | 244,854 |

| | Owens Corning | 5,268,572 | 239,878 |

| * | AerCap Holdings NV | 4,273,188 | 177,337 |

| * | JetBlue Airways Corp. | 6,138,340 | 152,476 |

| * | Spirit AeroSystems | | |

| | Holdings Inc. Class A | 2,421,507 | 127,710 |

| | Eaton Corp. plc | 2,283,000 | 127,643 |

| | Tyco International plc | 3,124,100 | 113,842 |

| ^ | CNH Industrial NV | 16,692,100 | 113,339 |

| | KBR Inc. | 5,925,975 | 109,275 |

| *,2 | SPX FLOW Inc. | 2,496,500 | 84,631 |

| | Xylem Inc. | 2,091,600 | 76,155 |

| | Ryder System Inc. | 954,800 | 68,536 |

| *,^ | Air France-KLM ADR | 7,538,085 | 54,915 |

| | Joy Global Inc. | 2,192,800 | 37,672 |

| * | AECOM | 1,122,860 | 33,091 |

| | Parker-Hannifin Corp. | 272,375 | 28,518 |

| | Terex Corp. | 1,250,765 | 25,090 |

| | Dover Corp. | 310,525 | 20,007 |

| | Actuant Corp. Class A | 840,675 | 19,168 |

| | | | 1,854,137 |

| | | | |

| Information Technology (7.8%) | |

| | Total System Services | | |

| | Inc. | | 4,661,479 | 244,495 |

| | Ingram Micro Inc. | | 5,098,784 | 151,842 |

| * | Micron Technology Inc. | 8,980,588 | 148,718 |

| | Hewlett-Packard Co. | 1,416,150 | 38,179 |

| | Avnet Inc. | | 738,866 | 33,567 |

| * | ON Semiconductor Corp. | 2,880,421 | 31,685 |

| * | Flextronics International | | |

| | Ltd. | | 2,423,850 | 27,608 |

| * | Celestica Inc. | | 2,206,793 | 24,760 |

| * | Genpact Ltd. | | 760,452 | 18,844 |

| | Jabil Circuit Inc. | | 553,840 | 12,727 |

| * | Arrow Electronics Inc. | 227,954 | 12,535 |

| | CDW Corp. | | 173,790 | 7,767 |

| | | | | 752,727 |

| Materials (4.5%) | | | |

| | CRH plc ADR | | 5,655,100 | 154,724 |

| | FMC Corp. | | 2,696,300 | 109,766 |

| * | Kinross Gold Corp. | | 49,757,791 | 100,013 |

| | Yamana Gold Inc. | | | |

| | (New York Shares) | 24,088,851 | 52,755 |

| * | New Gold Inc. | | 4,949,152 | 12,125 |

| * | Coeur Mining Inc. | | 825,000 | 2,227 |

| | | | | 431,610 |

| Other (0.3%) | | | |

| ^,3 | Vanguard Mid-Cap Value | | |

| | ETF | | 334,800 | 29,626 |

| |

| Utilities (3.7%) | | | |

| | Pinnacle West Capital | | |

| | Corp. | | 2,203,500 | 139,944 |

| | Xcel Energy Inc. | | 3,348,437 | 119,305 |

| | CenterPoint Energy Inc. | 2,234,617 | 41,452 |

| | Edison International | 438,475 | 26,537 |

| | PG&E Corp. | | 262,800 | 14,034 |

| | NRG Energy Inc. | | 796,234 | 10,263 |

| | Exelon Corp. | | 333,668 | 9,316 |

| | | | | 360,851 |

| Total Common Stocks | | |

| (Cost $7,211,152) | | | 9,017,515 |

| Temporary Cash Investments (7.4%)1 | |

| Money Market Fund (7.3%) | | |

| 4,5 | Vanguard Market | | | |

| | Liquidity Fund, | | | |

| | 0.207% | 708,714,719 | 708,715 |

17

Selected Value Fund

| | |

| | Face | Market |

| | Amount | Value• |

| | ($000) | ($000) |

| U.S. Government and Agency Obligations (0.1%) |

| 6,7 Federal Home Loan | | |

| Bank Discount Notes, | | |

| 0.208%, 12/9/15 | 8,000 | 7,999 |

| Total Temporary Cash Investments | |

| (Cost $716,713) | | 716,714 |

| Total Investments (100.7%) | | |

| (Cost $7,927,865) | | 9,734,229 |

| |

| | | Amount |

| | | ($000) |

| Other Assets and Liabilities (-0.7%) | |

| Other Assets | | |

| Investment in Vanguard | | 835 |

| Receivables for Investment Securities Sold 91,560 |

| Receivables for Accrued Income | 8,074 |

| Receivables for Capital Shares Issued | 4,676 |

| Other Assets | | 192 |

| Total Other Assets | | 105,337 |

| Liabilities | | |

| Payables for Investment Securities | |

| Purchased | | (94,811) |

| Collateral for Securities on Loan | (61,521) |

| Payables to Investment Advisor | (4,859) |

| Payables for Capital Shares Redeemed | (3,845) |

| Payables to Vanguard | | (10,811) |

| Other Liabilities | | (373) |

| Total Liabilities | | (176,220) |

| Net Assets (100%) | | |

| Applicable to 343,231,365 outstanding | |

| $.001 par value shares of beneficial | |

| interest (unlimited authorization) | 9,663,346 |

| Net Asset Value Per Share | | $28.15 |

| |

| At October 31, 2015, net assets consisted of: |

| | Amount |

| | ($000) |

| Paid-in Capital | 7,402,921 |

| Undistributed Net Investment Income | 106,036 |

| Accumulated Net Realized Gains | 341,870 |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | 1,806,364 |

| Futures Contracts | 6,155 |

| Net Assets | 9,663,346 |

• See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $57,913,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures

investments, the fund’s effective common stock and temporary cash investment positions represent 94.7% and 6.0%, respectively,

of net assets.

2 Considered an affiliated company of the fund as the fund owns more than 5% of the outstanding voting securities of such company.

3 Considered an affiliated company of the fund as the issuer is another member of The Vanguard Group.

4 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the

7-day yield.

5 Includes $61,521,000 of collateral received for securities on loan.

6 The issuer operates under a congressional charter; its securities are generally neither guaranteed by the U.S. Treasury nor backed by the

full faith and credit of the U.S. government.

7 Securities with a value of $6,299,000 have been segregated as initial margin for open futures contracts.

ADR—American Depositary Receipt.

See accompanying Notes, which are an integral part of the Financial Statements.

18

Selected Value Fund

Statement of Operations

| |

| | Year Ended |

| | October 31, 2015 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends1 | 200,674 |

| Interest | 1,200 |

| Securities Lending | 833 |

| Total Income | 202,707 |

| Expenses | |

| Investment Advisory Fees—Note B | |

| Basic Fee | 21,513 |

| Performance Adjustment | (1,625) |

| The Vanguard Group—Note C | |

| Management and Administrative | 16,562 |

| Marketing and Distribution | 2,261 |

| Custodian Fees | 104 |

| Auditing Fees | 34 |

| Shareholders’ Reports | 182 |

| Trustees’ Fees and Expenses | 16 |

| Total Expenses | 39,047 |

| Expenses Paid Indirectly | (130) |

| Net Expenses | 38,917 |

| Net Investment Income | 163,790 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold | 377,949 |

| Futures Contracts | 1,807 |

| Foreign Currencies | (34) |

| Realized Net Gain (Loss) | 379,722 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities | (449,907) |

| Futures Contracts | 5,317 |

| Change in Unrealized Appreciation (Depreciation) | (444,590) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 98,922 |

| 1 Dividends are net of foreign withholding taxes of $212,000. |

See accompanying Notes, which are an integral part of the Financial Statements.

19

Selected Value Fund

Statement of Changes in Net Assets

| | |

| | Year Ended October 31, |

| | 2015 | 2014 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 163,790 | 136,639 |

| Realized Net Gain (Loss) | 379,722 | 447,397 |

| Change in Unrealized Appreciation (Depreciation) | (444,590) | 260,276 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 98,922 | 844,312 |

| Distributions | | |

| Net Investment Income | (138,609) | (86,230) |

| Realized Capital Gain1 | (401,073) | (318,790) |

| Total Distributions | (539,682) | (405,020) |

| Capital Share Transactions | | |

| Issued | 1,787,330 | 3,609,195 |

| Issued in Lieu of Cash Distributions | 496,488 | 371,698 |

| Redeemed | (2,333,003) | (1,285,461) |

| Net Increase (Decrease) from Capital Share Transactions | (49,185) | 2,695,432 |

| Total Increase (Decrease) | (489,945) | 3,134,724 |

| Net Assets | | |

| Beginning of Period | 10,153,291 | 7,018,567 |

| End of Period2 | 9,663,346 | 10,153,291 |

| 1 Includes fiscal 2015 and 2014 short-term gain distributions totaling $33,623,000 and $0, respectively. Short-term gain distributions are treated as ordinary income dividends for tax purposes. |

| 2 Net Assets—End of Period includes undistributed (overdistributed) net investment income of $106,036,000 and $96,293,000. |

See accompanying Notes, which are an integral part of the Financial Statements.

20

Selected Value Fund

Financial Highlights

| | | | | |

| For a Share Outstanding | Year Ended October 31, |

| Throughout Each Period | 2015 | 2014 | 2013 | 2012 | 2011 |

| Net Asset Value, Beginning of Period | $29.49 | $28.07 | $21.01 | $18.81 | $17.73 |

| Investment Operations | | | | | |

| Net Investment Income | . 478 | .415 | .395 | .405 | .334 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | (. 245) | 2.555 | 7.105 | 2.122 | 1.037 |

| Total from Investment Operations | . 233 | 2.970 | 7.500 | 2.527 | 1.371 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (.404) | (.330) | (.440) | (. 327) | (.291) |

| Distributions from Realized Capital Gains | (1.169) | (1.220) | — | — | — |

| Total Distributions | (1.573) | (1.550) | (.440) | (. 327) | (.291) |

| Net Asset Value, End of Period | $28.15 | $29.49 | $28.07 | $21.01 | $18.81 |

| |

| Total Return1 | 0.88% | 11.02% | 36.43% | 13.64% | 7.74% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $9,663 | $10,153 | $7,019 | $4,337 | $3,956 |

| Ratio of Total Expenses to Average Net Assets2 | 0.39% | 0.41% | 0.43% | 0.38% | 0.45% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 1.62% | 1.53% | 1.70% | 2.00% | 1.74% |

| Portfolio Turnover Rate | 24% | 18% | 27% | 18% | 25% |

| 1 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees. |

| 2 Includes performance-based investment advisory fee increases (decreases) of (0.02%), 0.01%, 0.02%, (0.03%), and 0.04%. |

See accompanying Notes, which are an integral part of the Financial Statements.

21

Selected Value Fund

Notes to Financial Statements

Vanguard Selected Value Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments acquired over 60 days to maturity are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services. Other temporary cash investments are valued at amortized cost, which approximates market value.

2. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and has entered into clearing agreements with its clearing brokers. The clearinghouse imposes initial margin requirements to secure the fund’s performance and requires daily settlement of variation margin representing changes in the market value of each contract.

Futures contracts are valued at their quoted daily settlement prices. The aggregate settlement values of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

During the year ended October 31, 2015, the fund’s average investments in long and short futures contracts represented 2% and 0% of net assets, respectively, based on the average of aggregate settlement values at each quarter-end during the period.

22

Selected Value Fund

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (October 31, 2012–2015), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

4. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

5. Securities Lending: To earn additional income, the fund lends its securities to qualified institutional borrowers. Security loans are required to be secured at all times by collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted and settled on the next business day. The fund further mitigates its counterparty risk by entering into securities lending transactions only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master securities lending agreements with its counterparties. The master securities lending agreements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any loans with that borrower, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund; however, such actions may be subject to legal proceedings. While collateral mitigates counterparty risk, in the absence of a default the fund may experience delays and costs in recovering the securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability in the Statement of Net Assets for the return of the collateral, during the period the securities are on loan. Securities lending income represents fees charged to borrowers plus income earned on invested cash collateral, less expenses associated with the loan.

6. Credit Facility: The fund and certain other funds managed by The Vanguard Group (“Vanguard”) participate in a $3 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund’s regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.06% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under this facility bear interest at a rate equal to the higher of the federal funds rate or LIBOR reference rate plus an agreed-upon spread.

The fund had no borrowings outstanding at October 31, 2015, or at any time during the period then ended.

7. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

23

Selected Value Fund

B. The investment advisory firms Barrow, Hanley, Mewhinney & Strauss, LLC, Donald Smith & Co., Inc., and Pzena Investment Management, LLC, each provide investment advisory services to a portion of the fund for a fee calculated at an annual percentage rate of average net assets managed by the advisor. The basic fee of Barrow, Hanley, Mewhinney & Strauss, LLC, is subject to quarterly adjustments based on performance relative to the Russell Midcap Value Index for the preceding three years. The basic fee of Donald Smith & Co., Inc., is subject to quarterly adjustments based on performance relative to the MSCI Investable Market 2500 Index for the preceding five years. The basic fee of Pzena Investment Management, LLC, is subject to quarterly adjustments based on performance relative to the Russell Midcap Value Index since April 30, 2014.

Vanguard manages the cash reserves of the fund as described below.

For the year ended October 31, 2015, the aggregate investment advisory fee represented an effective annual basic rate of 0.21% of the fund’s average net assets, before a decrease of $1,625,000 (0.02%) based on performance.

C. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund corporate management, administrative, marketing, distribution and cash management services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees. Vanguard does not require reimbursement in the current period for certain costs of operations (such as deferred compensation/benefits and risk/insurance costs); the fund’s liability for these costs of operations is included in Payables to Vanguard on the Statement of Net Assets.

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At October 31, 2015, the fund had contributed to Vanguard capital in the amount of $835,000, representing 0.01% of the fund’s net assets and 0.33% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

D. The fund has asked its investment advisors to direct certain security trades, subject to obtaining the best price and execution, to brokers who have agreed to rebate to the fund part of the commissions generated. Such rebates are used solely to reduce the fund’s management and administrative expenses. For the year ended October 31, 2015, these arrangements reduced the fund’s expenses by $130,000 (an annual rate of 0.00% of average net assets).

E. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

24

Selected Value Fund

The following table summarizes the market value of the fund’s investments as of October 31, 2015, based on the inputs used to value them:

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investments | ($000) | ($000) | ($000) |

| Common Stocks | 9,017,515 | — | — |

| Temporary Cash Investments | 708,715 | 7,999 | — |

| Futures Contracts—Assets1 | 10 | — | — |

| Futures Contracts—Liabilities1 | (373) | — | — |

| Total | 9,725,867 | 7,999 | — |

| 1 Represents variation margin on the last day of the reporting period. |

F. At October 31, 2015, the aggregate settlement value of open futures contracts and the related unrealized appreciation (depreciation) were:

| | | | |

| | | | | ($000) |

| | | | Aggregate | |

| | | Number of | Settlement | Unrealized |

| | | Long (Short) | Value | Appreciation |

| Futures Contracts | Expiration | Contracts | Long (Short) | (Depreciation) |

| S&P 500 Index | December 2015 | 144 | 74,653 | 4,665 |

| E-mini S&P MidCap 400 Index | December 2015 | 336 | 48,431 | 1,417 |

| E-mini S&P 500 Index | December 2015 | 67 | 6,947 | 50 |

| E-mini Russell 2000 Index | December 2015 | 26 | 3,012 | 23 |

| | | | | 6,155 |

Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized gain (loss) for tax purposes.

G. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or loss are recognized in different periods for financial statement and tax purposes. These differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

During the year ended October 31, 2015, the fund realized net foreign currency losses of $34,000, which decreased distributable net income for tax purposes; accordingly, such losses have been reclassified from accumulated net realized gains to undistributed net investment income.

The fund used a tax accounting practice to treat a portion of the price of capital shares redeemed during the year as distributions from net investment income and realized capital gains. Accordingly, the fund has reclassified $15,404,000 from undistributed net investment income, and $35,902,000 from accumulated net realized gains, to paid-in capital.

For tax purposes, at October 31, 2015, the fund had $145,261,000 of ordinary income and $318,665,000 of long-term capital gains available for distribution.

25

Selected Value Fund

At October 31, 2015, the cost of investment securities for tax purposes was $7,927,865,000. Net unrealized appreciation of investment securities for tax purposes was $1,806,364,000, consisting of unrealized gains of $2,728,478,000 on securities that had risen in value since their purchase and $922,114,000 in unrealized losses on securities that had fallen in value since their purchase.

H. During the year ended October 31, 2015, the fund purchased $2,223,146,000 of investment securities and sold $2,328,198,000 of investment securities, other than temporary cash investments.

I. Capital shares issued and redeemed were:

| | |

| | Year Ended October 31, |

| | 2015 | 2014 |

| | Shares | Shares |

| | (000) | (000) |

| Issued | 62,441 | 125,298 |

| Issued in Lieu of Cash Distributions | 17,943 | 13,610 |

| Redeemed | (81,402) | (44,653) |

| Net Increase (Decrease) in Shares Outstanding | (1,018) | 94,255 |

J. Certain of the fund’s investments are in companies that are considered to be affiliated companies of the fund because the fund owns more than 5% of the outstanding voting securities of the company or the issuer is another member of Vanguard. Transactions during the period in securities of these companies were as follows:

| | | | | | |

| | | Current Period Transactions | |

| | Oct. 31, | | Proceeds | | | Oct. 31, |

| | 2014 | | from | | Capital Gain | 2015 |

| | Market | Purchases | Securities | | Distributions | Market |

| | Value | at Cost | Sold1 | Income | Received | Value |

| | ($000) | ($000) | ($000) | ($000) | ($000) | ($000) |

| SeaWorld Entertainment Inc. | 101,339 | — | 2,423 | 4,398 | — | 102,468 |

| SPX FLOW Inc. | — | 39,492 | — | — | — | 84,631 |

| Vanguard Market Liquidity Fund | 942,982 | NA2 | NA 2 | 1,185 | — | 708,715 |

| Vanguard Mid-Cap Value ETF | 29,436 | — | — | 901 | — | 29,626 |

| Total | 1,073,757 | | | 6,484 | — | 925,440 |

| 1 Includes net realized gain (loss) on affiliated investment securities sold of $1,108,000. |

| 2 Not applicable—purchases and sales are for temporary cash investment purposes. |

K. Management has determined that no material events or transactions occurred subsequent to October 31, 2015, that would require recognition or disclosure in these financial statements.

26

Report of Independent Registered

Public Accounting Firm

To the Board of Trustees of Vanguard Whitehall Funds and the Shareholders of Vanguard Selected Value Fund: In our opinion, the accompanying statement of net assets and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Vanguard Selected Value Fund (constituting a separate portfolio of Vanguard Whitehall Funds, hereafter referred to as the “Fund”) at October 31, 2015, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2015 by correspondence with the custodian and brokers, by agreement to the underlying ownership records of the transfer agent and the application of alternative auditing procedures where securities purchased had not been received, provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

December 10, 2015

Special 2015 tax information (unaudited) for Vanguard Selected Value Fund

This information for the fiscal year ended October 31, 2015, is included pursuant to provisions of

the Internal Revenue Code.

The fund distributed $400,319,000 as capital gain dividends (20% rate gain distributions) to

shareholders during the fiscal year.

For nonresident alien shareholders, 100% of short-term capital gain dividends distributed by the

fund are qualified short-term capital gains.

The fund distributed $156,930,000 of qualified dividend income to shareholders during the fiscal year.

For corporate shareholders, 73.7% of investment income (dividend income plus short-term gains,

if any) qualifies for the dividends-received deduction.

27

Your Fund’s After-Tax Returns

This table presents returns for your fund both before and after taxes. The after-tax returns are shown in two ways: (1) assuming that an investor owned the fund during the entire period and paid taxes on the fund’s distributions, and (2) assuming that an investor paid taxes on the fund’s distributions and sold all shares at the end of each period.

Calculations are based on the highest individual federal income tax and capital gains tax rates in effect at the times of the distributions and the hypothetical sales. State and local taxes were not considered. After-tax returns reflect any qualified dividend income, using actual prior-year figures and estimates for 2015. (In the example, returns after the sale of fund shares may be higher than those assuming no sale. This occurs when the sale would have produced a capital loss. The calculation assumes that the investor received a tax deduction for the loss.) Please note that your actual after-tax returns will depend on your tax situation and may differ from those shown. Also note that if you own the fund in a tax-deferred account, such as an individual retirement account or a 401(k) plan, this information does not apply to you. Such accounts are not subject to current taxes.

Finally, keep in mind that a fund’s performance—whether before or after taxes—does not guarantee future results.

| | | |

| Average Annual Total Returns: Selected Value Fund | | | |

| Periods Ended October 31, 2015 | | | |

| | One | Five | Ten |

| | Year | Years | Years |

| Returns Before Taxes | 0.88% | 13.35% | 8.63% |

| Returns After Taxes on Distributions | -0.44 | 12.58 | 7.76 |

| Returns After Taxes on Distributions and Sale of Fund Shares | 1.50 | 10.69 | 6.95 |

28

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

• Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund‘s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

• Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

29

| | | |

| Six Months Ended October 31, 2015 | | | |

| | Beginning | Ending | Expenses |

| | Account Value | Account Value | Paid During |

| Selected Value Fund | 4/30/2015 | 10/31/2015 | Period |

| Based on Actual Fund Return | $1,000.00 | $968.02 | $1.98 |

| Based on Hypothetical 5% Yearly Return | 1,000.00 | 1,023.19 | 2.04 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratio for that

period is 0.40%. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account

value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most

recent 12-month period (184/365).

30

Glossary

30-Day SEC Yield. A fund’s 30-day SEC yield is derived using a formula specified by the U.S. Securities and Exchange Commission. Under the formula, data related to the fund’s security holdings in the previous 30 days are used to calculate the fund’s hypothetical net income for that period, which is then annualized and divided by the fund’s estimated average net assets over the calculation period. For the purposes of this calculation, a security’s income is based on its current market yield to maturity (for bonds), its actual income (for asset-backed securities), or its projected dividend yield (for stocks). Because the SEC yield represents hypothetical annualized income, it will differ—at times significantly—from the fund’s actual experience. As a result, the fund’s income distributions may be higher or lower than implied by the SEC yield.

Beta. A measure of the magnitude of a fund’s past share-price fluctuations in relation to the ups and downs of a given market index. The index is assigned a beta of 1.00. Compared with a given index, a fund with a beta of 1.20 typically would have seen its share price rise or fall by 12% when the index rose or fell by 10%. For this report, beta is based on returns over the past 36 months for both the fund and the index. Note that a fund’s beta should be reviewed in conjunction with its R-squared (see definition). The lower the R-squared, the less correlation there is between the fund and the index, and the less reliable beta is as an indicator of volatility.

Dividend Yield. Dividend income earned by stocks, expressed as a percentage of the aggregate market value (or of net asset value, for a fund). The yield is determined by dividing the amount of the annual dividends by the aggregate value (or net asset value) at the end of the period. For a fund, the dividend yield is based solely on stock holdings and does not include any income produced by other investments.

Earnings Growth Rate. The average annual rate of growth in earnings over the past five years for the stocks now in a fund.

Equity Exposure. A measure that reflects a fund’s investments in stocks and stock futures. Any holdings in short-term reserves are excluded.

Expense Ratio. A fund’s total annual operating expenses expressed as a percentage of the fund’s average net assets. The expense ratio includes management and administrative expenses, but does not include the transaction costs of buying and selling portfolio securities.

Foreign Holdings. The percentage of a fund represented by securities or depositary receipts of companies based outside the United States.

Inception Date. The date on which the assets of a fund (or one of its share classes) are first invested in accordance with the fund’s investment objective. For funds with a subscription period, the inception date is the day after that period ends. Investment performance is measured from the inception date.

Median Market Cap. An indicator of the size of companies in which a fund invests; the midpoint of market capitalization (market price x shares outstanding) of a fund’s stocks, weighted by the proportion of the fund’s assets invested in each stock. Stocks representing half of the fund’s assets have market capitalizations above the median, and the rest are below it.

Price/Book Ratio. The share price of a stock divided by its net worth, or book value, per share. For a fund, the weighted average price/book ratio of the stocks it holds.

31

Price/Earnings Ratio. The ratio of a stock’s current price to its per-share earnings over the past year. For a fund, the weighted average P/E of the stocks it holds. P/E is an indicator of market expectations about corporate prospects; the higher the P/E, the greater the expectations for a company’s future growth.

R-Squared. A measure of how much of a fund’s past returns can be explained by the returns from the market in general, as measured by a given index. If a fund’s total returns were precisely synchronized with an index’s returns, its R-squared would be 1.00. If the fund’s returns bore no relationship to the index’s returns, its R-squared would be 0. For this report, R-squared is based on returns over the past 36 months for both the fund and the index.

Return on Equity. The annual average rate of return generated by a company during the past five years for each dollar of shareholder’s equity (net income divided by shareholder’s equity). For a fund, the weighted average return on equity for the companies whose stocks it holds.

Short-Term Reserves. The percentage of a fund invested in highly liquid, short-term securities that can be readily converted to cash.

Turnover Rate. An indication of the fund’s trading activity. Funds with high turnover rates incur higher transaction costs and may be more likely to distribute capital gains (which may be taxable to investors). The turnover rate excludes in-kind transactions, which have minimal impact on costs.

32

This page intentionally left blank.

This page intentionally left blank.

This page intentionally left blank.

The People Who Govern Your Fund