UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07443

Name of Registrant: | | Vanguard Whitehall Funds |

Address of Registrant: | | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

| | |

Name and address of agent for service: | | Anne E. Robinson, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: October 31

Date of reporting period: November 1, 2018—October 31, 2019

Item 1: Reports to Shareholders

Annual Report | October 31, 2019 Vanguard Selected Value Fund |

See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. |

Important information about access to shareholder reports

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com.

You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard.

Contents | |

| |

A Note From Our Chairman | 1 |

Your Fund’s Performance at a Glance | 2 |

Advisors’ Report | 3 |

About Your Fund’s Expenses | 8 |

Performance Summary | 10 |

Financial Statements | 12 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

A Note From Our Chairman

Tim Buckley

Chairman and Chief Executive Officer

Dear Shareholder,

Recent volatility in financial markets— affecting stocks, bonds, and commodities— has been a good reminder of the wise old adage, “Never keep all your eggs in one basket.” Maintaining balance and diversification in your investment portfolio can help to both limit risk and set you up for long-term success.

It’s understandable why some investors might become complacent after a long market run-up like the one that lifted stock prices, especially U.S. stock prices, in the years following the global financial crisis. But failing to rebalance regularly can leave a portfolio with a much different mix of assets than intended and, often, more risk than intended.

Balance across and diversification within asset classes are powerful tools for managing risk and achieving your investment goals. A portfolio’s allocation will determine a large portion of its long-term return and also the majority of its volatility risk. A well-diversified portfolio is less vulnerable to significant swings in the performance of any one segment of the asset classes in which it invests.

Balance and diversification will never eliminate the risk of loss, nor will they guarantee positive returns in a declining market. But they should reduce the chance that you’ll suffer disproportionate losses in one particular high-flying asset class or sector when it comes back to earth. And exposure to all key market components should give you at least some participation in the sectors that are performing best at any given time.

Vanguard is committed to helping you achieve balance and diversification in your portfolios to help meet your investment goals. We thank you for your continued loyalty.

Sincerely,

Mortimer J. Buckley

Chairman and Chief Executive Officer

November 18, 2019

1

Your Fund’s Performance at a Glance

· Vanguard Selected Value Fund returned 12.51% for the 12 months ended October 31, 2019. It outperformed its benchmark, the Russell Midcap Value Index, which returned 10.08%.

· The broad U.S. stock market, as measured by the Russell 3000 Index, climbed more than 13% for the year. Although stocks endured stretches of volatility, their performance was boosted by the Federal Reserve’s accommodative stance and corporate earnings that largely exceeded investor expectations.

· Growth stocks outperformed their value counterparts, while large- and mid-capitalization stocks surpassed small-caps.

· Returns were positive in eight of the fund’s 11 sectors. The advisors’ holdings in materials, information technology, and consumer discretionary contributed most to relative performance. Real estate, health care, and utilities were the biggest detractors.

· Over the past decade, the fund’s average annualized return trailed that of its expense-free benchmark.

Market Barometer

| | Average Annual Total Returns | |

| | Periods Ended October 31, 2019 | |

| | One Year | | Three Years | | Five Years | |

Stocks | | | | | | | |

Russell 1000 Index (Large-caps) | | 14.15% | | 14.73% | | 10.55% | |

Russell 2000 Index (Small-caps) | | 4.90 | | 10.96 | | 7.37 | |

Russell 3000 Index (Broad U.S. market) | | 13.49 | | 14.47 | | 10.31 | |

FTSE All-World ex US Index (International) | | 11.52 | | 8.21 | | 4.16 | |

| | | | | | | |

Bonds | | | | | | | |

Bloomberg Barclays U.S. Aggregate Bond Index (Broad taxable market) | | 11.51% | | 3.29% | | 3.24% | |

Bloomberg Barclays Municipal Bond Index (Broad tax-exempt market) | | 9.42 | | 3.62 | | 3.55 | |

FTSE Three-Month U.S. Treasury Bill Index | | 2.35 | | 1.57 | | 0.98 | |

| | | | | | | |

CPI | | | | | | | |

Consumer Price Index | | 1.76% | | 2.11% | | 1.62% | |

2

Advisors’ Report

For the 12 months ended October 31, 2019, Vanguard Selected Value Fund returned 12.51%, outperforming its benchmark, the Russell Midcap Value Index, which returned 10.08%. Your fund is managed by three independent advisors, a strategy that enhances the fund’s diversification by providing exposure to distinct yet complementary investment approaches. It’s not uncommon for different advisors to have different views about individual securities or the broader investment environment.

We note with sorrow the passing of Donald G. Smith, the founder, president, and co-chief investment officer of Donald Smith & Co., Inc., on October 30, 2019. Mr. Smith had been a co-portfolio manager of the portion of the fund managed by the firm since 2005, and his contributions will be missed. Jon Hartsel, CFA, co-chief investment officer and director of research for Donald Smith & Co., has been named co-portfolio manager. Mr. Hartsel will serve alongside Richard L. Greenberg, CFA, chief executive officer and co-chief investment officer of Donald Smith & Co., who has been a co-portfolio manager of the fund since 2005.

The table on page 7 lists the advisors, the amount and percentage of fund assets each manages, and brief descriptions of their investment strategies. The advisors have provided the following assessment of the investment environment during the past 12 months and the notable successes and shortfalls in their portfolios. These comments were prepared on November 19, 2019.

Barrow, Hanley, Mewhinney & Strauss, LLC

Portfolio Managers:

James P. Barrow,

Founding Director

Mark Giambrone,

Managing Director

Our portfolio strategy this fiscal year resulted in solid performance driven by favorable stock selection. Our underweight position in real estate and utilities, sectors that we believe are broadly expensive, was a minor detractor relative to the last several years.

Two of our holdings were acquired, which we believe is a testament to our strategy of buying fundamentally undervalued businesses. Longtime holding Total System Services was acquired by Global Payments, which propelled the stock to a 48% gain. Recent addition Liberty Property Trust was up 46% as strong fundamental performance was augmented by a deal, announced just before the end of the fiscal year, that the company would be acquired by Prologis.

Dollar General, the portfolio’s largest position during the 12 months, was up 45%; its growth in same-store sales and new store openings increased earnings at a double-digit pace. Our technology investments also delivered strong returns, as Microchip Technology and new holding Marvell Technology Group recovered from a sharp sell-off in late 2018.

3

Similarly, we benefited from adding to our industrial investments after that fourth-quarter sell-off by building new positions in Jacobs Engineering Group, BWX Technologies, and J.B. Hunt Transport Services, which have since recovered. Financial holdings Fidelity National Financial, Element Fleet Management, and New York Community Bancorp began the period trading at ten times or less our estimate of normalized earnings but outperformed significantly as operational execution and lower interest rates lifted sentiment.

Energy-related investments detracted most. We believe that holdings in Hess, Kosmos Energy, and Parsley Energy have world-class reserves and strong production growth potential not yet recognized by the market.

Looking forward, we are confident that an extended cycle for value stocks is overdue. Though the growth cycle over the past ten-plus years has been longer than most, it has recently decelerated as investors reassess historically extreme valuation divergences and unprofitable business models.

Pzena Investment Management, LLC

Portfolio Managers:

Richard Pzena, Managing Principal and Co-Chief Investment Officer

John Flynn, Principal

Ben Silver, CFA, CPA, Principal

In a market that favored growth and low volatility over value stocks, our value discipline disappointed.

Energy and health care holdings detracted most from portfolio performance, while positions in the financial, information technology, and industrial sectors added to results.

Mylan was the largest individual detractor amid lackluster results and a hoped-for improvement in generic drug pricing that didn’t materialize. The company recently announced a merger with Pfizer’s Upjohn, which increases Mylan’s distribution reach into Asia while providing significant cash flow from Upjohn’s off-patent drug portfolio. MEDNAX, a physician-outsourcing firm, detracted as its neonatal business remained under pressure amid lower birth rates and its anesthesia practice was pressured from payer mix (the percentage of revenue coming from private and government insurance and self-paying individuals). We exited the position as incremental research revealed increased challenges to cost reduction, widening the range of outcomes.

4

In energy, National Oilwell Varco and new position Halliburton detracted, as weak oil prices and temporary oversupply masked the fact that oil-and-gas capital spending must pick up dramatically to offset a looming shortfall in energy supply over the next several years.

Top contributors included engineering and construction company KBR and industrial conglomerate Carlisle Companies. KBR continues to generate strong organic growth in its government services segment and anticipates more revenue growth in its hydrocarbon business. Carlisle reported strong results as earnings beat consensus on higher revenue growth, better margins, and a lower tax rate.

We initiated several other new positions in addition to Halliburton, including PVH, Mohawk Industries, Baker Hughes, and Wabtec. Notable positions we sold to help fund these purchases included MEDNAX, Dover Corp., News Corp., and Franklin Resources.

Although it’s frustrating to see the continued dispersion between growth and value stocks, we point to the lessons of history. The scale of the opportunity we see in value today is second only to that of the late-1990s bubble period. The market continues to reward low-volatility stocks, which are perceived as safe, but many of these companies aren’t delivering earnings growth; in some cases, earnings-per-share growth is negative. Many of our holdings are delivering real earnings growth and returning significant amounts of capital to shareholders through dividends and buybacks, yet the market ignores them. The portfolio remains positioned in economically sensitive companies where we are finding a wide range of good businesses at compelling valuations.

Donald Smith & Co., Inc.

Portfolio Managers:

Richard L. Greenberg, CFA,

Chief Executive Officer

and Co-Chief Investment Officer

Jon Hartsel, CFA

Co-Chief Investment Officer

and Director of Research

After dipping in the fourth quarter of 2018, the market recovered strongly this year. Despite significant appreciation, our holdings are valued at a substantial discount to the market, at 106% of tangible book value and 6.6 times our estimate of normalized earnings, compared with the Standard & Poor’s 500 Index at over 1,170% of tangible book value and 17.9 times normalized earnings.

The top contributing industries were gold miners, homebuilders, and aircraft leasing/ airline holdings, but those were offset by energy and financial stocks.

5

Gold miners rose strongly (Gold Fields, +134.4%; Kinross Gold, +87.1%; Leagold Mining, +78.1%; and IAMGOLD, +9.5%) as worries over the U.S.-China trade dispute and the health of the economy sent the price of gold soaring since last year. Gold surpassed $1,500 per ounce in August, which benefited the industry.

Homebuilders Taylor Morrison (+51.5%) and Toll Brothers (+19.6%) were large contributors. Although builders under-performed through most of 2018, the industry started 2019 with a strong rally, buoyed by lower mortgage rates and optimism about the spring selling season. Many builders reported double-digit increases in third-quarter 2019 orders, and the market appears robust.

Many of the top portfolio holdings performed well. Air France (+22.8%) reported solid earnings and announced approval from its pilots’ union to expand the low-budget carrier Transavia. Aircraft lessor AerCap (+15.6%) also reported good earnings over the summer and booked higher-than-expected premiums on plane sales, which further boosted the stock. Micron Technology (+26.1%) was also a strong contributor.

Financial and insurance holdings were mixed. Unum Group (–21.5%) and Jefferies Group (–4.7%) hurt performance, but that was offset by CNA Financial (+11.5%) and MFA Financial (+22.4%). Energy holdings also detracted.

We added to our holdings in Celestica, Gold Fields, IAMGOLD, JetBlue, Jefferies Group, Taylor Morrison, and Unum Group. We trimmed our exposure in AerCap, Kinross Gold, MFA Financial, Micron Technology, Noble, and Everest Re Group. Aspen Insurance (which was taken over), Yamana Gold, Axis Capital, and Nabors Industries are no longer held in the portfolio. There were no new holdings for the fiscal year.

The largest industry weightings were airlines (24.4%), metals (22.2%), insurance (15.8%), and aircraft leasing (13.9%).

6

Vanguard Selected Value Fund Investment Advisors

| | Fund Assets Managed | | |

Investment Advisor | | % | | $ Million | | Investment Strategy |

Barrow, Hanley, Mewhinney & Strauss, LLC | | 51 | | 4,043 | | Conducts fundamental research on individual stocks exhibiting traditional value characteristics: price/earnings and price/book ratios below the market average and dividend yields above the market average. |

Pzena Investment Management, LLC | | 28 | | 2,182 | | Uses a fundamental, bottom-up, deep-value-oriented investment strategy. Seeks to buy good businesses at low prices, focusing exclusively on companies that are underperforming their historically demonstrated earnings power. |

Donald Smith & Co., Inc. | | 20 | | 1,543 | | Conducts fundamental research on the lowest price-to-tangible book value companies. Research focuses on underlying quality of book value and assets, and on long-term earnings potential. |

Cash Investments | | 1 | | 124 | | These short-term reserves are invested by Vanguard in equity index products to simulate investment in stocks. Each advisor may also maintain a cash position. |

7

About Your Fund’s Expenses

As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your fund’s costs in two ways:

· Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

· Based on hypothetical 5% yearly return. This section is intended to help you compare your fund’s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your fund’s current prospectus.

8

Six Months Ended October 31, 2019

| | Beginning | | Ending | | Expenses |

| | Account Value | | Account Value | | Paid During |

Selected Value Fund | | 4/30/2019 | | 10/31/2019 | | Period |

Based on Actual Fund Return | | $1,000.00 | | $1,036.83 | | $1.75 |

Based on Hypothetical 5% Yearly Return | | 1,000.00 | | 1,023.49 | | 1.73 |

The calculations are based on expenses incurred in the most recent six-month period. The fund’s annualized six-month expense ratio for that period is 0.34%. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period (184/365).

9

Selected Value Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

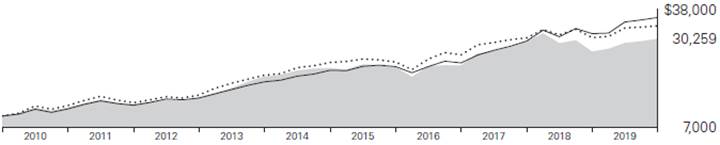

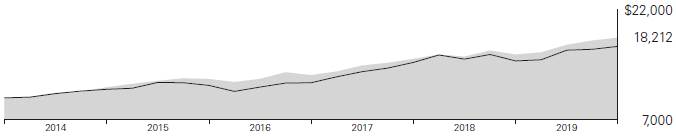

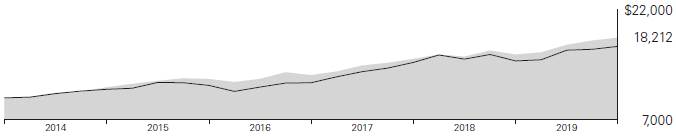

Cumulative Performance: October 31, 2009, Through October 31, 2019

Initial Investment of $10,000

| | Average Annual Total Returns | |

| | Periods Ended October 31, 2019 | |

| | | | | Final Value |

| | One | Five | Ten | of a $10,000 |

| | Year | Years | Years | Investment |

| Selected Value Fund | 12.51% | 6.03% | 11.71% | $30,259 |

| Russell Midcap Value Index | 10.08 | 6.95 | 12.90 | 33,652 |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 13.39 | 10.26 | 13.62 | 35,859 |

See Financial Highlights for dividend and capital gains information.

10

Selected Value Fund

Sector Diversification

As of October 31, 2019

Communication Services | | 1.1 | % |

Consumer Discretionary | | 17.4 | |

Consumer Staples | | 1.4 | |

Energy | | 5.6 | |

Financials | | 23.6 | |

Health Care | | 1.7 | |

Industrials | | 22.8 | |

Information Technology | | 8.3 | |

Materials | | 7.4 | |

Other | | 0.0 | |

Real Estate | | 5.7 | |

Utilities | | 5.0 | |

The table reflects the fund’s equity exposure, based on its investments in stocks and stock index futures. Any holdings in short-term reserves are excluded. Sector categories are based on the Global Industry Classification Standard (“GICS”), except for the “Other” category (if applicable), which includes securities that have not been provided a GICS classification as of the effective reporting period.

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard and Poor’s, a division of McGraw-Hill Companies, Inc. (“S&P”), and is licensed for use by Vanguard. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classification makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of its affiliates or any third party involved in making or compiling the GICS or any GICS classification have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

11

Selected Value Fund

Financial Statements

Statement of Net Assets

As of October 31, 2019

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The fund’s Form N-PORT reports are available on the SEC’s website at www.sec.gov.

| | | | | Market | |

| | | | | Value· | |

| | | Shares | | ($000) | |

Common Stocks (95.8%)1 | | | | | |

Communication Services (0.9%) | | | | | |

| Interpublic Group of Cos. Inc. | | 2,165,722 | | 47,104 | |

| Omnicom Group Inc. | | 285,382 | | 22,029 | |

| | | | | 69,133 | |

Consumer Discretionary (16.8%) | | | | | |

| Dollar General Corp. | | 848,677 | | 136,077 | |

| Aramark | | 2,751,684 | | 120,414 | |

| Wyndham Hotels & Resorts Inc. | | 2,159,554 | | 116,551 | |

| Lennar Corp. Class A | | 1,887,677 | | 112,506 | |

| Advance Auto Parts Inc. | | 681,427 | | 110,718 | |

*,2 | SeaWorld Entertainment Inc. | | 4,180,740 | | 110,455 | |

* | Taylor Morrison Home Corp. Class A | | 4,114,443 | | 103,067 | |

| Royal Caribbean Cruises Ltd. | | 909,096 | | 98,937 | |

| MGM Resorts International | | 3,341,362 | | 95,229 | |

* | Norwegian Cruise Line Holdings Ltd. | | 1,766,396 | | 89,662 | |

| Lear Corp. | | 527,126 | | 62,080 | |

| Newell Brands Inc. | | 2,571,382 | | 48,779 | |

* | Mohawk Industries Inc. | | 320,091 | | 45,895 | |

| PVH Corp. | | 398,801 | | 34,759 | |

| Gildan Activewear Inc. Class A | | 981,646 | | 25,061 | |

| Foot Locker Inc. | | 233,050 | | 10,140 | |

| Toll Brothers Inc. | | 98,920 | | 3,934 | |

| | | | | 1,324,264 | |

Consumer Staples (1.2%) | | | | | |

| Coca-Cola European Partners plc | | 1,074,654 | | 57,505 | |

| Kellogg Co. | | 337,425 | | 21,437 | |

| Spectrum Brands Holdings Inc. | | 368,061 | | 18,480 | |

| | | | | 97,422 | |

Energy (5.4%) | | | | | |

| Hess Corp. | | 1,620,619 | | 106,556 | |

| National Oilwell Varco Inc. | | 3,079,331 | | 69,655 | |

| Kosmos Energy Ltd. | | 11,038,752 | | 68,440 | |

| Halliburton Co. | | 2,416,832 | | 46,524 | |

| Parsley Energy Inc. Class A | | 2,441,953 | | 38,607 | |

| Baker Hughes Co. Class A | | 1,348,277 | | 28,853 | |

| Cenovus Energy Inc. | | 3,219,653 | | 27,335 | |

| TechnipFMC plc | | 1,277,750 | | 25,210 | |

| Murphy Oil Corp. | | 352,996 | | 7,282 | |

* | WPX Energy Inc. | | 400,879 | | 4,001 | |

*,^ | Valaris plc Class A | | 685,248 | | 2,816 | |

* | Noble Corp. plc | | 2,006,000 | | 2,467 | |

| | | | | 427,746 | |

Financials (22.8%) | | | | | |

| Axis Capital Holdings Ltd. | | 2,965,837 | | 176,260 | |

| Willis Towers Watson plc | | 712,306 | | 133,130 | |

| Unum Group | | 4,346,094 | | 119,691 | |

| Fidelity National Financial Inc. | | 2,415,213 | | 110,713 | |

| New York Community Bancorp Inc. | | 8,065,082 | | 93,958 | |

| CNA Financial Corp. | | 2,066,402 | | 92,658 | |

| Jefferies Financial Group Inc. | | 4,906,607 | | 91,606 | |

| FNB Corp. | | 6,994,255 | | 84,351 | |

| Northern Trust Corp. | | 820,725 | | 81,810 | |

| KKR & Co. Inc. Class A | | 2,750,798 | | 79,306 | |

| Regions Financial Corp. | | 4,105,725 | | 66,102 | |

| Voya Financial Inc. | | 1,218,871 | | 65,770 | |

| Element Fleet Management Corp. | | 7,337,400 | | 62,394 | |

| Fifth Third Bancorp | | 1,945,926 | | 56,588 | |

| Everest Re Group Ltd. | | 212,796 | | 54,708 | |

| KeyCorp | | 3,042,425 | | 54,672 | |

| Navient Corp. | | 3,625,053 | | 49,917 | |

| Valley National Bancorp | | 4,010,311 | | 46,439 | |

12

Selected Value Fund

| | | | | Market | |

| | | | | Value· | |

| | | Shares | | ($000) | |

| AXA Equitable Holdings Inc. | | 1,927,461 | | 41,633 | |

| CNO Financial Group Inc. | | 1,986,667 | | 31,091 | |

| Invesco Ltd. | | 1,501,950 | | 25,263 | |

| Hartford Financial Services Group Inc. | | 424,208 | | 24,214 | |

| Legg Mason Inc. | | 639,775 | | 23,838 | |

| Webster Financial Corp. | | 528,766 | | 23,319 | |

| Globe Life Inc. | | 235,908 | | 22,961 | |

| Allstate Corp. | | 211,186 | | 22,474 | |

| Hanover Insurance Group Inc. | | 167,883 | | 22,112 | |

| SLM Corp. | | 2,510,295 | | 21,187 | |

| MFA Financial Inc. | | 1,416,357 | | 10,750 | |

| Comerica Inc. | | 121,055 | | 7,919 | |

| | | | | 1,796,834 | |

Health Care (1.4%) | | | | | |

| Cardinal Health Inc. | | 1,089,555 | | 53,879 | |

* | Mylan NV | | 1,810,193 | | 34,665 | |

| McKesson Corp. | | 193,631 | | 25,753 | |

| | | | | 114,297 | |

Industrials (22.1%) | | | | | |

* | AerCap Holdings NV | | 3,700,000 | | 214,156 | |

* | Air France-KLM ADR | | 15,446,816 | | 182,427 | |

* | JetBlue Airways Corp. | | 8,354,707 | | 161,246 | |

| Stanley Black & Decker Inc. | | 924,678 | | 139,932 | |

| JB Hunt Transport Services Inc. | | 943,094 | | 110,870 | |

| Wabtec Corp. | | 1,535,739 | | 106,534 | |

| Spirit AeroSystems Holdings Inc. Class A | | 1,245,409 | | 101,899 | |

| Johnson Controls International plc | | 2,203,386 | | 95,473 | |

| Jacobs Engineering Group Inc. | | 1,012,594 | | 94,759 | |

| BWX Technologies Inc. | | 1,256,639 | | 73,011 | |

| Owens Corning | | 1,083,768 | | 66,413 | |

* | AECOM | | 1,442,899 | | 57,730 | |

| Ryder System Inc. | | 1,058,956 | | 51,497 | |

* | JELD-WEN Holding Inc. | | 2,926,689 | | 50,017 | |

| Nielsen Holdings plc | | 2,408,983 | | 48,565 | |

| Carlisle Cos. Inc. | | 285,125 | | 43,416 | |

| Actuant Corp. Class A | | 1,717,514 | | 42,543 | |

* | Avis Budget Group Inc. | | 1,403,938 | | 41,711 | |

| Snap-on Inc. | | 199,989 | | 32,532 | |

| Terex Corp. | | 1,076,438 | | 29,656 | |

| | | | | 1,744,387 | |

Information Technology (7.8%) | | | | | |

| Microchip Technology Inc. | | 1,044,751 | | 98,510 | |

* | Micron Technology Inc. | | 2,047,300 | | 97,349 | |

| Marvell Technology Group Ltd. | | 3,773,225 | | 92,029 | |

| Avnet Inc. | | 1,478,844 | | 58,503 | |

| Hewlett Packard Enterprise Co. | | 3,220,553 | | 52,849 | |

* | Anixter International Inc. | | 624,710 | | 51,695 | |

| KBR Inc. | | 1,620,427 | | 45,631 | |

* | Arrow Electronics Inc. | | 304,204 | | 24,117 | |

* | Flex Ltd. | | 1,991,393 | | 23,399 | |

| Genpact Ltd. | | 498,692 | | 19,534 | |

* | Celestica Inc. | | 2,485,719 | | 17,947 | |

| Juniper Networks Inc. | | 706,087 | | 17,525 | |

| Jabil Inc. | | 349,822 | | 12,880 | |

| | | | | 611,968 | |

Materials (7.1%) | | | | | |

| Gold Fields Ltd. ADR | | 24,378,000 | | 150,656 | |

* | Element Solutions Inc. | | 11,509,900 | | 124,997 | |

*,2 | IAMGOLD Corp. | | 31,339,433 | | 117,209 | |

* | Axalta Coating | | | | | |

| Systems Ltd. | | 3,257,639 | | 96,068 | |

* | Kinross Gold Corp. | | 12,815,632 | | 62,156 | |

* | Leagold Mining Corp. | | 6,787,563 | | 13,399 | |

| | | | | 564,485 | |

Other (0.0%) | | | | | |

* | Leagold Mining Corp | | | | | |

| Warrants Exp. | | | | | |

| 5/29/2020 | | 2,944,713 | | — | |

Real Estate (5.5%) | | | | | |

| HCP Inc. | | 3,622,821 | | 136,290 | |

| Liberty Property Trust | | 2,069,420 | | 122,241 | |

| MGM Growth Properties LLC Class A | | 3,588,359 | | 111,993 | |

| GEO Group Inc. | | 2,494,282 | | 37,963 | |

| Service Properties Trust | | 583,800 | | 14,770 | |

^ | Realogy Holdings Corp. | | 1,286,639 | | 10,139 | |

| | | | | 433,396 | |

Utilities (4.8%) | | | | | |

| Xcel Energy Inc. | | 1,952,988 | | 124,034 | |

| Edison International | | 1,943,258 | | 122,231 | |

| Pinnacle West Capital Corp. | | 914,393 | | 86,063 | |

| Avangrid Inc. | | 957,737 | | 47,935 | |

| | | | | 380,263 | |

Total Common Stocks | | | | | |

(Cost $6,270,326) | | | | 7,564,195 | |

13

Selected Value Fund

| | | | | Market | |

| | | | | Value· | |

| | | Shares | | ($000) | |

Temporary Cash Investments (4.1%)1 | | | | | |

Money Market Fund (4.0%) | | | | | |

3,4 | Vanguard Market Liquidity Fund, 1.984% | | 3,171,048 | | 317,137 | |

| | | | | | |

| | | Face | | | |

| | | Amount | | | |

| | | ($000) | | | |

U.S. Government and Agency Obligations (0.1%) | | | | | |

5 | United States Treasury Bill, 2.135%, 11/14/19 | | 2,500 | | 2,499 | |

5 | United States Treasury Bill, 2.048%, 11/21/19 | | 1,000 | | 999 | |

5 | United States Treasury Bill, 1.817%, 1/30/20 | | 1,750 | | 1,743 | |

| | | | | 5,241 | |

Total Temporary Cash Investments | | | | | |

(Cost $322,367) | | | | 322,378 | |

Total Investments (99.9%) | | | | | |

(Cost $6,592,693) | | | | 7,886,573 | |

Other Assets and Liabilities (0.1%) | | | | | |

Other Assets5 | | | | 28,630 | |

Liabilities4 | | | | (22,852 | ) |

| | | | 5,778 | |

Net Assets (100%) | | | | | |

Applicable to 286,013,340 outstanding $.001 par value shares of beneficial interest (unlimited authorization) | | 7,892,351 | |

Net Asset Value Per Share | | | | $27.59 | |

| | | | Amount | |

| | | | ($000 | ) |

Statement of Assets and Liabilities | | | | | |

Assets | | | | | |

Investments in Securities, at Value | | | | | |

Unaffiliated Issuers | | | | 7,341,772 | |

Affiliated Issuers | | | | 544,801 | |

Total Investments in Securities | | | | 7,886,573 | |

Investment in Vanguard | | | | 370 | |

Receivables for Investment Securities Sold | | | | 21,174 | |

Receivables for Accrued Income | | | | 4,121 | |

Receivables for Capital Shares Issued | | | | 2,621 | |

Other Assets5 | | | | 344 | |

Total Assets | | | | 7,915,203 | |

Liabilities | | | | | |

Payables for Investment Securities Purchased | | | | 4,614 | |

Collateral for Securities on Loan | | | | 2,518 | |

Payable to Investment Advisor | | | | 3,532 | |

Payables for Capital Shares Redeemed | | | | 5,617 | |

Payables to Vanguard | | | | 6,039 | |

Variation Margin Payable—Futures Contracts | | | | 516 | |

Other Liabilities | | | | 16 | |

Total Liabilities | | | | 22,852 | |

Net Assets | | | | 7,892,351 | |

14

Selected Value Fund

At October 31, 2019, net assets consisted of:

| | | | Amount | |

| | | | ($000 | ) |

Paid-in Capital | | | | 6,065,062 | |

Total Distributable Earnings (Loss) | | | | 1,827,289 | |

Net Assets | | | | 7,892,351 | |

· See Note A in Notes to Financial Statements.

* Non-income-producing security.

^ Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $2,167,000.

1 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect to futures investments, the fund’s effective common stock and temporary cash investment positions represent 97.4% and 2.5%, respectively, of net assets.

2 Considered an affiliated company of the fund as the fund owns more than 5% of the outstanding voting securities of such company.

3 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

4 Collateral of $2,518,000 was received for securities on loan.

5 Securities with a value of $5,241,000 and cash of $344,000 have been segregated as initial margin for open futures contracts.

ADR—American Depositary Receipt.

Derivative Financial Instruments Outstanding as of Period End |

|

Futures Contracts |

| | | | ($000) |

| | | | Value and |

| | Number of | | Unrealized |

| | Long (Short) | Notional | Appreciation |

| Expiration | Contracts | Amount | (Depreciation) |

Long Futures Contracts | | | | |

E-mini S&P 500 Index | December 2019 | 819 | 124,316 | 3,217 |

See accompanying Notes, which are an integral part of the Financial Statements.

15

Selected Value Fund

Statement of Operations

| | Year Ended | |

| | October 31, 2019 | |

| | ($000 | ) |

Investment Income | | | |

Income | | | |

Dividends—Unaffiliated Issuers1 | | 163,473 | |

Dividends—Affiliated Issuers | | 6,756 | |

Interest—Unaffiliated Issuers | | 184 | |

Interest—Affiliated Issuers | | 8,166 | |

Securities Lending—Net | | 690 | |

Total Income | | 179,269 | |

Expenses | | | |

Investment Advisory Fees—Note B | | | |

Basic Fee | | 18,250 | |

Performance Adjustment | | (4,730 | ) |

The Vanguard Group—Note C | | | |

Management and Administrative | | 11,821 | |

Marketing and Distribution | | 912 | |

Custodian Fees | | 47 | |

Auditing Fees | | 34 | |

Shareholders’ Reports | | 134 | |

Trustees’ Fees and Expenses | | 9 | |

Total Expenses | | 26,477 | |

Expenses Paid Indirectly | | (304 | ) |

Net Expenses | | 26,173 | |

Net Investment Income | | 153,096 | |

Realized Net Gain (Loss) | | | |

Investment Securities Sold—Unaffiliated Issuers | | 460,232 | |

Investment Securities Sold—Affiliated Issuers | | 3,732 | |

Futures Contracts | | 13,486 | |

Foreign Currencies | | 19 | |

Realized Net Gain (Loss) | | 477,469 | |

Change in Unrealized Appreciation (Depreciation) | | | |

Investment Securities—Unaffiliated Issuers | | 282,608 | |

Investment Securities—Affiliated Issuers | | 10,047 | |

Futures Contracts | | 8,729 | |

Change in Unrealized Appreciation (Depreciation) | | 301,384 | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | 931,949 | |

1 Dividends are net of foreign withholding taxes of $1,620,000.

See accompanying Notes, which are an integral part of the Financial Statements.

16

Selected Value Fund

Statement of Changes in Net Assets

| | Year Ended October 31, | |

| | 2019 | | 2018 | |

| | ($000 | ) | ($000 | ) |

Increase (Decrease) in Net Assets | | | | | |

Operations | | | | | |

Net Investment Income | | 153,096 | | 166,466 | |

Realized Net Gain (Loss) | | 477,469 | | 763,198 | |

Change in Unrealized Appreciation (Depreciation) | | 301,384 | | (1,822,298 | ) |

Net Increase (Decrease) in Net Assets Resulting from Operations | | 931,949 | | (892,634 | ) |

Distributions | | | | | |

Net Investment Income | | (155,280 | ) | (135,374 | ) |

Realized Capital Gain1 | | (665,160 | ) | (859,146 | ) |

Total Distributions | | (820,440 | ) | (994,520 | ) |

Capital Share Transactions | | | | | |

Issued | | 750,115 | | 1,443,090 | |

Issued in Lieu of Cash Distributions | | 757,580 | | 917,398 | |

Redeemed | | (2,537,860 | ) | (2,236,747 | ) |

Net Increase (Decrease) from Capital Share Transactions | | (1,030,165 | ) | 123,741 | |

Total Increase (Decrease) | | (918,656 | ) | (1,763,413 | ) |

Net Assets | | | | | |

Beginning of Period | | 8,811,007 | | 10,574,420 | |

End of Period | | 7,892,351 | | 8,811,007 | |

1 Includes fiscal 2019 and 2018 short-term gain distributions totaling $0 and $74,529,000, respectively. Short-term gain distributions are treated as ordinary income dividends for tax purposes.

See accompanying Notes, which are an integral part of the Financial Statements.

17

Selected Value Fund

Financial Highlights

For a Share Outstanding | | | | Year Ended October 31, | |

Throughout Each Period | | 2019 | | 2018 | | 2017 | | 2016 | | 2015 | |

Net Asset Value, Beginning of Period | | $27.38 | | $33.15 | | $27.24 | | $28.15 | | $29.49 | |

Investment Operations | | | | | | | | | | | |

Net Investment Income | | .493 | 1 | .493 | 1 | .449 | 1 | .527 | 1 | .478 | |

Net Realized and Unrealized Gain (Loss) on Investments | | 2.392 | | (3.153 | ) | 6.760 | | .030 | | (.245 | ) |

Total from Investment Operations | | 2.885 | | (2.660 | ) | 7.209 | | .557 | | .233 | |

Distributions | | | | | | | | | | | |

Dividends from Net Investment Income | | (.506 | ) | (.423 | ) | (.501 | ) | (.443 | ) | (.404 | ) |

Distributions from Realized Capital Gains | | (2.169 | ) | (2.687 | ) | (.798 | ) | (1.024 | ) | (1.169 | ) |

Total Distributions | | (2.675 | ) | (3.110 | ) | (1.299 | ) | (1.467 | ) | (1.573 | ) |

Net Asset Value, End of Period | | $27.59 | | $27.38 | | $33.15 | | $27.24 | | $28.15 | |

| | | | | | | | | | | |

Total Return2 | | 12.51% | | -9.15% | | 27.17% | | 2.20% | | 0.88% | |

| | | | | | | | | | | |

Ratios/Supplemental Data | | | | | | | | | | | |

Net Assets, End of Period (Millions) | | $7,892 | | $8,811 | | $10,574 | | $8,802 | | $9,663 | |

Ratio of Total Expenses to Average Net Assets3 | | 0.33% | | 0.36% | | 0.39% | | 0.35% | | 0.39% | |

Ratio of Net Investment Income to Average Net Assets | | 1.89% | | 1.61% | | 1.47% | | 2.00% | | 1.62% | |

Portfolio Turnover Rate | | 31% | | 31% | | 22% | | 27% | | 24% | |

1 Calculated based on average shares outstanding.

2 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

3 Includes performance-based investment advisory fee increases (decreases) of (0.06%), (0.02%), 0.00%, (0.04%), and (0.02%).

See accompanying Notes, which are an integral part of the Financial Statements.

18

Selected Value Fund

Notes to Financial Statements

Vanguard Selected Value Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services.

2. Foreign Currency: Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates obtained from an independent third party as of the fund’s pricing time on the valuation date. Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the assets or liabilities are settled in cash, at which time they are recorded as realized foreign currency gains (losses).

3. Futures Contracts: The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and has entered into clearing agreements with its clearing brokers. The clearinghouse imposes initial margin requirements to secure the fund’s performance and requires daily settlement of variation margin representing changes in the market value of each contract. Any assets pledged as initial margin for open contracts are noted in the Statement of Net Assets.

19

Selected Value Fund

Futures contracts are valued at their quoted daily settlement prices. The notional amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Assets and Liabilities as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized futures gains (losses).

During the year ended October 31, 2019, the fund’s average investments in long and short futures contracts represented 1% and 0% of net assets, respectively, based on the average of the notional amounts at each quarter-end during the period.

4. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (October 31, 2016–2019), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

5. Distributions: Distributions to shareholders are recorded on the ex-dividend date. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes.

6. Securities Lending: To earn additional income, the fund lends its securities to qualified institutional borrowers. Security loans are subject to termination by the fund at any time, and are required to be secured at all times by collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted and settled before the opening of the market on the next business day. The fund further mitigates its counterparty risk by entering into securities lending transactions only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master securities lending agreements with its counterparties. The master securities lending agreements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any loans with that borrower, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund; however, such actions may be subject to legal proceedings. While collateral mitigates counterparty risk, in the event of a default, the fund may experience delays and costs in recovering the securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability in the Statement of Assets and Liabilities for the return of the collateral, during the period the securities are on loan. Securities lending income represents fees charged to borrowers plus income earned on invested cash collateral, less expenses associated with the loan. During the term of the loan, the fund is entitled to all distributions made on or in respect of the loaned securities.

7. Credit Facility: The fund and certain other funds managed by The Vanguard Group (“Vanguard”) participate in a $4.3 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund’s regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.10% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under this facility bear interest at a rate based upon the higher of the one-month London Interbank Offered Rate, federal funds effective rate, or overnight bank funding rate plus an agreed-upon spread.

20

Selected Value Fund

The fund had no borrowings outstanding at October 31, 2019, or at any time during the period then ended.

8. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

B. The investment advisory firms Barrow, Hanley, Mewhinney & Strauss, LLC, Pzena Investment Management, LLC, and Donald Smith & Co., Inc., each provide investment advisory services to a portion of the fund for a fee calculated at an annual percentage rate of average net assets managed by the advisor. The basic fees of Barrow, Hanley, Mewhinney & Strauss, LLC, and Pzena Investment Management, LLC, are subject to quarterly adjustments based on performance relative to the Russell Midcap Value Index for the preceding three years. The basic fee of Donald Smith & Co., Inc., is subject to quarterly adjustments based on performance relative to the MSCI Investable Market 2500 Index for the preceding five years.

Vanguard manages the cash reserves of the fund as described below.

For the year ended October 31, 2019, the aggregate investment advisory fee represented an effective annual basic rate of 0.23% of the fund’s average net assets, before a net decrease of $4,730,000 (0.06%) based on performance.

C. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund corporate management, administrative, marketing, distribution, and cash management services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees. Vanguard does not require reimbursement in the current period for certain costs of operations (such as deferred compensation/benefits and risk/insurance costs); the fund’s liability for these costs of operations is included in Payables to Vanguard on the Statement of Assets and Liabilities. All other costs of operations payable to Vanguard are generally settled twice a month.

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At October 31, 2019, the fund had contributed to Vanguard capital in the amount of $370,000, representing less than 0.01% of the fund’s net assets and 0.15% of Vanguard’s capital received pursuant to the FSA. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

D. The fund has asked its investment advisors to direct certain security trades, subject to obtaining the best price and execution, to brokers who have agreed to rebate to the fund part of the commissions generated. Such rebates are used solely to reduce the fund’s management and administrative expenses. The fund’s custodian bank has also agreed to reduce its fees when the fund maintains cash on deposit in the non-interest-bearing custody account. For the year ended October 31, 2019, these arrangements reduced the fund’s management and administrative expenses by $302,000 and custodian fees by $2,000. The total expense reduction represented an effective annual rate of 0.00% of the fund’s average net assets.

21

Selected Value Fund

E. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments). Any investments valued with significant unobservable inputs are noted on the Statement of Net Assets.

The following table summarizes the market value of the fund’s investments and derivatives as of October 31, 2019, based on the inputs used to value them:

Investments | | Level 1

($000 | ) | Level 2

($000 | ) | Level 3

($000 | ) |

Common Stocks | | 7,564,195 | | — | | — | |

Temporary Cash Investments | | 317,137 | | 5,241 | | — | |

Futures Contracts—Liabilities1 | | (516 | ) | — | | — | |

Total | | 7,880,816 | | 5,241 | | — | |

1 Represents variation margin on the last day of the reporting period.

F. Permanent differences between book-basis and tax-basis components of net assets are reclassified among capital accounts in the financial statements to reflect their tax character. These reclassifications have no effect on net assets or net asset value per share. As of period end, permanent differences primarily attributable to the accounting for foreign currency transactions and distributions in connection with fund share redemptions were reclassified between the following accounts:

| | Amount ($000 | ) |

Paid-in Capital | | 62,126 | |

Total Distributable Earnings (Loss) | | (62,126 | ) |

22

Selected Value Fund

Temporary differences between book-basis and tax-basis components of total distributable earnings (loss) arise when certain items of income, gain, or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. The differences are primarily related to the tax deferral of losses on wash sales and the realization of unrealized gains or losses on certain futures contracts. As of period end, the tax-basis components of total distributable earnings (loss) are detailed in the table as follows:

| | Amount | |

| | $(000 | ) |

Undistributed Ordinary Income | | 100,008 | |

Undistributed Long-Term Gains | | 438,837 | |

Capital Loss Carryforwards (Non-expiring) | | — | |

Net Unrealized Gains (Losses) | | 1,293,797 | |

As of October 31, 2019, gross unrealized appreciation and depreciation for investments and derivatives based on cost for U.S. federal income tax purposes were as follows:

| | Amount | |

| | $(000 | ) |

Tax Cost | | 6,592,776 | |

Gross Unrealized Appreciation | | 1,918,523 | |

Gross Unrealized Depreciation | | (624,726 | ) |

Net Unrealized Appreciation (Depreciation) | | 1,293,797 | |

G. During the year ended October 31, 2019, the fund purchased $2,412,446,000 of investment securities and sold $4,078,392,000 of investment securities, other than temporary cash investments.

H. Capital shares issued and redeemed were:

| | Year Ended October 31, | |

| | 2019 | | 2018 | |

| | Shares | | Shares | |

| | (000 | ) | (000 | ) |

Issued | | 29,246 | | 46,684 | |

Issued in Lieu of Cash Distributions | | 33,010 | | 29,479 | |

Redeemed | | (98,003 | ) | (73,418 | ) |

Net Increase (Decrease) in Shares Outstanding | | (35,747 | ) | 2,745 | |

23

Selected Value Fund

I. Certain of the fund’s investments are in companies that are considered to be affiliated companies of the fund because the fund owns more than 5% of the outstanding voting securities of the company or the issuer is another member of The Vanguard Group. Transactions during the period in securities of these companies were as follows:

| | | | Current Period Transactions | | | |

| | Oct. 31, | | | | Proceeds | | Realized | | | | | | | | Oct. 31, | |

| | 2018 | | | | from | | Net | | Change in | | | | Capital Gain | | 2019 | |

| | Market | | Purchases | | Securities | | Gain | | Unrealized | | | | Distributions | | Market | |

| | Value | | at Cost | | Sold1 | | (Loss | ) | App. (Dep. | ) | Income | | Received | | Value | |

| | ($000 | ) | ($000 | ) | ($000 | ) | ($000 | ) | ($000 | ) | ($000 | ) | ($000 | ) | ($000 | ) |

IAMGOLD Corp. | | NA2 | | 54,484 | | — | | — | | 17,200 | | — | | — | | 117,209 | |

MGM Growth | | | | | | | | | | | | | | | | | |

Properties LLC | | | | | | | | | | | | | | | | | |

Class A | | 160,151 | | — | | 61,606 | | 3,673 | | 11,004 | | 6,756 | | — | | NA3 | |

SeaWorld | | | | | | | | | | | | | | | | | |

Entertainment Inc. | | — | | 128,605 | | — | | — | | (18,150 | ) | — | | — | | 110,455 | |

Vanguard Market | | | | | | | | | | | | | | | | | |

Liquidity Fund | | 448,224 | | NA4 | | NA4 | | 59 | | (7 | ) | 8,166 | | — | | 317,137 | |

Total | | 608,375 | | | | | | 3,732 | | 10,047 | | 14,922 | | — | | 544,801 | |

1 Does not include adjustments to related return of capital.

2 Not applicable—at October 31, 2018, the issuer was not an affiliated company of the fund.

3 Not applicable—at October 31, 2019, the security was still held, but issuer was no longer an affiliated company of the fund.

4 Not applicable—purchases and sales are for temporary cash investment purposes.

J. In November 2019, the board of trustees approved changes to the investment advisors of the fund. Cooke & Bieler will join Pzena Investment Management, LLC, and Donald Smith & Co., Inc., as investment advisors to the fund. Barrow, Hanley, Mewhinney & Stauss, LLC, will no longer serve as an investment advisor.

Management has determined that no other events or transactions occurred subsequent to October 31, 2019, that would require recognition or disclosure in these financial statements.

24

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Vanguard Whitehall Funds and Shareholders of Vanguard Selected Value Fund

Opinion on the Financial Statements

We have audited the accompanying statement of net assets and statement of assets and liabilities of Vanguard Selected Value Fund (one of the funds constituting Vanguard Whitehall Funds, referred to hereafter as the “Fund”) as of October 31, 2019, the related statement of operations for the year ended October 31, 2019, the statement of changes in net assets for each of the two years in the period ended October 31, 2019, including the related notes, and the financial highlights for each of the five years in the period ended October 31, 2019 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2019, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended October 31, 2019 and the financial highlights for each of the five years in the period ended October 31, 2019 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of October 31, 2019 by correspondence with the custodian and brokers and by agreement to the underlying ownership records of the transfer agent; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

December 13, 2019

We have served as the auditor of one or more investment companies in The Vanguard Group of Funds since 1975.

25

Special 2019 tax information (unaudited) for Vanguard Selected Value Fund

This information for the fiscal year ended October 31, 2019, is included pursuant to provisions of the Internal Revenue Code.

The fund distributed $712,586,000 as capital gain dividends (20% rate gain distributions) to shareholders during the fiscal year.

The fund distributed $155,280,000 of qualified dividend income to shareholders during the fiscal year.

For corporate shareholders, 75.2% of investment income (dividend income plus short-term gains, if any) qualifies for the dividends-received deduction.

26

The People Who Govern Your Fund

The trustees of your mutual fund are there to see that the fund is operated and managed in your best interests since, as a shareholder, you are a part owner of the fund. Your fund’s trustees also serve on the board of directors of The Vanguard Group, Inc., which is owned by the Vanguard funds and provides services to them.

A majority of Vanguard’s board members are independent, meaning that they have no affiliation with Vanguard or the funds they oversee, apart from the sizable personal investments they have made as private individuals. The independent board members have distinguished backgrounds in business, academia, and public service. Each of the trustees and executive officers oversees 213 Vanguard funds.

Information for each trustee and executive officer of the fund appears below. That information, as well as the Vanguard fund count, is as of the date on the cover of this fund report. The mailing address of the trustees and officers is P.O. Box 876, Valley Forge, PA 19482. More information about the trustees is in the Statement of Additional Information, which can be obtained, without charge, by contacting Vanguard at 800-662-7447, or online at vanguard.com.

Interested Trustee1

Mortimer J. Buckley

Born in 1969. Trustee since January 2018. Principal occupation(s) during the past five years and other experience: chairman of the board (January 2019– present) of Vanguard and of each of the investment companies served by Vanguard; chief executive officer (January 2018–present) of Vanguard; chief executive officer, president, and trustee (January 2018–present) of each of the investment companies served by Vanguard; president and director (2017–present) of Vanguard; and president (February 2018–present) of Vanguard Marketing Corporation. Chief investment officer (2013–2017), managing director (2002–2017), head of the Retail Investor Group (2006–2012), and chief information officer (2001–2006) of Vanguard. Chairman of the board (2011–2017) and trustee (2009–2017) of the Children’s Hospital of Philadelphia; trustee (2018–present) of The Shipley School.

Independent Trustees

Emerson U. Fullwood

Born in 1948. Trustee since January 2008. Principal occupation(s) during the past five years and other experience: executive chief staff and marketing officer for North America and corporate vice president (retired 2008) of Xerox Corporation (document management products and services). Former president of the Worldwide Channels Group, Latin America, and Worldwide Customer Service and executive chief staff officer of Developing Markets of Xerox. Executive in residence and 2009–2010 Distinguished Minett Professor at the Rochester Institute of Technology. Director of SPX FLOW, Inc. (multi-industry manufacturing). Director of the University of Rochester Medical Center, the Monroe Community College Foundation, the United Way of Rochester, North Carolina A&T University, and Roberts Wesleyan College. Trustee of the University of Rochester.

Amy Gutmann

Born in 1949. Trustee since June 2006. Principal occupation(s) during the past five years and other experience: president (2004–present) of the University of Pennsylvania. Christopher H. Browne Distinguished Professor of Political Science, School of Arts and Sciences, and professor of communication, Annenberg School for Communication, with secondary faculty appointments in the Department of Philosophy, School of Arts and Sciences, and at the Graduate School of Education, University of Pennsylvania. Trustee of the National Constitution Center.

F. Joseph Loughrey

Born in 1949. Trustee since October 2009. Principal occupation(s) during the past five years and other experience: president and chief operating officer (retired 2009) and vice chairman of the board (2008–2009) of Cummins Inc. (industrial machinery). Chairman of the board of Hillenbrand, Inc. (specialized consumer services), and the Lumina Foundation.

1 Mr. Buckley is considered an “interested person,” as defined in the Investment Company Act of 1940, because he is an officer of the Vanguard funds.

Director of the V Foundation and Oxfam America. Member of the advisory council for the College of Arts and Letters and chair of the advisory board to the Kellogg Institute for International Studies, both at the University of Notre Dame.

Mark Loughridge

Born in 1953. Trustee since March 2012. Principal occupation(s) during the past five years and other experience: senior vice president and chief financial officer (retired 2013) of IBM (information technology services). Fiduciary member of IBM’s Retirement Plan Committee (2004–2013), senior vice president and general manager (2002–2004) of IBM Global Financing, vice president and controller (1998–2002) of IBM, and a variety of other prior management roles at IBM. Member of the Council on Chicago Booth.

Scott C. Malpass

Born in 1962. Trustee since March 2012. Principal occupation(s) during the past five years and other experience: chief investment officer (1989–present) and vice president (1996–present) of the University of Notre Dame. Assistant professor of finance at the Mendoza College of Business, University of Notre Dame, and member of the Notre Dame 403(b) Investment Committee. Chairman of the board of TIFF Advisory Services, Inc. Member of the board of Catholic Investment Services, Inc. (investment advisors) and the board of superintendence of the Institute for the Works of Religion.

Deanna Mulligan

Born in 1963. Trustee since January 2018. Principal occupation(s) during the past five years and other experience: president (2010–present) and chief executive officer (2011–present) of The Guardian Life Insurance Company of America. Chief operating officer (2010–2011) and executive vice president (2008–2010) of Individual Life and Disability of The Guardian Life Insurance Company of America. Member of the board of The Guardian Life Insurance Company of America, the American Council of Life Insurers, the Partnership for New York City (business leadership), and the Committee Encouraging Corporate Philanthropy. Trustee of the Economic Club of New York and the Bruce Museum (arts and science). Member of the Advisory Council for the Stanford Graduate School of Business.

André F. Perold

Born in 1952. Trustee since December 2004. Principal occupation(s) during the past five years and other experience: George Gund Professor of Finance and Banking, Emeritus at the Harvard Business School (retired 2011). Chief investment officer and co-managing partner of HighVista Strategies (private investment firm). Board of advisors and investment committee member of the Museum of Fine Arts Boston. Board member (2018–present) of RIT Capital Partners (investment firm); investment committee member of Partners Health Care System.

Sarah Bloom Raskin

Born in 1961. Trustee since January 2018. Principal occupation(s) during the past five years and other experience: deputy secretary (2014–2017) of the United States Department of the Treasury. Governor (2010–2014) of the Federal Reserve Board. Commissioner (2007–2010) of financial regulation for the State of Maryland. Member of the board of directors (2012–2014) of Neighborhood Reinvestment Corporation. Director (2017–present) of i(x) Investments; director (2017–present) of Reserve Trust. Rubinstein Fellow (2017–present) of Duke University; trustee (2017–present) of Amherst College.

Peter F. Volanakis

Born in 1955. Trustee since July 2009. Principal occupation(s) during the past five years and other experience: president and chief operating officer (retired 2010) of Corning Incorporated (communications equipment) and director of Corning Incorporated (2000–2010) and Dow Corning (2001–2010). Director (2012) of SPX Corporation (multi-industry manufacturing). Overseer of the Amos Tuck School of Business Administration, Dartmouth College (2001–2013). Chairman of the board of trustees of Colby-Sawyer College. Member of the board of Hypertherm Inc. (industrial cutting systems, software, and consumables).

Executive Officers

John Bendl

Born in 1970. Principal occupation(s) during the past five years and other experience: principal of Vanguard. Chief financial officer (October 2019–present) of each of the investment companies served by Vanguard. Chief accounting officer, treasurer, and controller of Vanguard (2017–present). Partner (2003–2016) at KPMG (audit, tax, and advisory services).

Glenn Booraem

Born in 1967. Principal occupation(s) during the past five years and other experience: principal of Vanguard. Investment stewardship officer (2017–present), treasurer (2015–2017), controller (2010–2015), and assistant controller (2001–2010) of each of the investment companies served by Vanguard.

Christine M. Buchanan

Born in 1970. Principal occupation(s) during the past five years and other experience: principal of Vanguard. Treasurer (2017–present) of each of the investment companies served by Vanguard. Partner (2005–2017) at KPMG (audit, tax, and advisory services).

David Cermak

Born in 1960. Principal occupation(s) during the past five years and other experience: principal of Vanguard. Finance director (October 2019–present) of each of the investment companies served by Vanguard. Managing director and head (2017–present) of Vanguard Investments Singapore. Managing director and head (2017–2019) of Vanguard Investments Hong Kong. Representative director and head (2014–2017) of Vanguard Investments Japan.

Thomas J. Higgins

Born in 1957. Principal occupation(s) during the past five years and other experience: principal of Vanguard. Finance director (October 2019–present), chief financial officer (2008–2019), and treasurer (1998–2008) of each of the investment companies served by Vanguard.

Peter Mahoney

Born in 1974. Principal occupation(s) during the past five years and other experience: principal of Vanguard. Controller (2015–present) of each of the investment companies served by Vanguard. Head of International Fund Services (2008–2014) at Vanguard.

Anne E. Robinson

Born in 1970. Principal occupation(s) during the past five years and other experience: general counsel (2016–present) of Vanguard. Secretary (2016–present) of Vanguard and of each of the investment companies served by Vanguard. Managing director (2016–present) of Vanguard. Managing director and general counsel of Global Cards and Consumer Services (2014–2016) at Citigroup. Counsel (2003–2014) at American Express.

Michael Rollings

Born in 1963. Principal occupation(s) during the past five years and other experience: finance director (2017–present) and treasurer (2017) of each of the investment companies served by Vanguard. Managing director (2016–present) of Vanguard. Chief financial officer (2016–present) of Vanguard. Director (2016–present) of Vanguard Marketing Corporation. Executive vice president and chief financial officer (2006–2016) of MassMutual Financial Group.

John E. Schadl

Born in 1972. Principal occupation(s) during the past five years and other experience: principal of Vanguard. Chief compliance officer (2019–present) of Vanguard and of each of the investment companies served by Vanguard. Assistant vice president (May 2019–present) of Vanguard Marketing Corporation.

Vanguard Senior Management Team

Joseph Brennan | | Chris D. McIsaac |

Mortimer J. Buckley | | James M. Norris |

Gregory Davis | | Thomas M. Rampulla |

John James | | Karin A. Risi |

Martha G. King | | Anne E. Robinson |

John T. Marcante | | Michael Rollings |

|

|

| |

| |

| P.O. Box 2600 |

| Valley Forge, PA 19482-2600 |

Connect with Vanguard® > vanguard.com

Fund Information > 800-662-7447

Direct Investor Account Services > 800-662-2739

Institutional Investor Services > 800-523-1036

Text Telephone for People

Who Are Deaf or Hard of Hearing > 800-749-7273

This material may be used in conjunction with the offering of shares of any Vanguard fund only if preceded or accompanied by the fund’s current prospectus.

All comparative mutual fund data are from Morningstar, Inc., unless otherwise noted.

You can obtain a free copy of Vanguard’s proxy voting guidelines by visiting vanguard.com/proxyreporting or by calling Vanguard at 800-662-2739. The guidelines are also available from the SEC’s website, www.sec.gov. In addition, you may obtain a free report on how your fund voted the proxies for securities it owned during the 12 months ended June 30. To get the report, visit either vanguard.com/proxyreporting or www.sec.gov.

You can review information about your fund on the SEC’s website, and you can receive copies of this information, for a fee, by sending a request via email addressed to publicinfo@sec.gov.

Source for Bloomberg Barclays indexes: Bloomberg Index Services Limited. Copyright 2019, Bloomberg. All rights reserved.

CFA® is a registered trademark owned by CFA Institute.

| © 2019 The Vanguard Group, Inc. |

| All rights reserved. |

| Vanguard Marketing Corporation, Distributor. |

| |

| Q9340 122019 |

Annual Report | October 31, 2019 Vanguard Mid-Cap Growth Fund |

See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. |

Important information about access to shareholder reports

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com.