UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07739

Harding, Loevner Funds, Inc.

(Exact name of registrant as specified in charter)

400 Crossing Boulevard

Fourth Floor

Bridgewater, NJ 08807

(Address of principal executive offices) (Zip code)

Owen T. Meacham

The Northern Trust Company

50 South LaSalle Street

Chicago, IL 60603

With a copy to:

Stephen H. Bier, Esq.

Dechert LLP

1095 Avenue of the Americas

New York, NY 10036

(Name and address of agent for service)

Registrant’s telephone number, including area code: (877) 435-8105

Date of fiscal year end: 10/31

Date of reporting period: 10/31/2014

Item 1. Reports to Stockholders.

About the Adviser

Harding Loevner Funds

Global equity investing for institutions is Harding Loevner’s exclusive focus. Through Harding Loevner Funds it offers five distinct global strategies based on its quality-and-growth investment philosophy. It seeks to purchase shares of growing, financially strong, well-managed companies at favorable prices. Harding Loevner manages each of the Funds’ Portfolios according to a disciplined, research-based investment process. It identifies companies with sustainable competitive advantages and assesses the durability of their earnings growth by conducting in-depth fundamental research into global industries. In constructing portfolios, Harding Loevner diversifies carefully to limit risk.

Receive Investor Materials Electronically

Shareholders may sign up for electronic delivery of investor materials. By doing so, you will receive the information faster and help us reduce the impact on the environment of providing these materials. To enroll in electronic delivery,

| | 1. | Go to http://www.icsdelivery.com |

| | 2. | Select the first letter of your brokerage firm’s name. |

| | 3. | From the list that follows, select your brokerage firm. If your brokerage firm is not listed, electronic delivery may not be available. Please contact your brokerage firm. |

| | 4. | Complete the information requested, including the e-mail address where you would like to receive notifications for electronic documents. |

Your information will be kept confidential and will not be used for any purpose other than electronic delivery. If you change your mind, you can cancel electronic delivery at any time and revert to physical delivery of your materials. Just go to http://www.icsdelivery.com, perform the first three steps above, and follow the instructions for cancelling electronic delivery. If you have any questions, please contact your brokerage firm.

Table of Contents

| | |

Harding, Loevner Funds, Inc. c/o Northern Trust Attn: Funds Center C5S 801 South Canal Street Chicago, IL 60607 Phone: (877) 435-8105 Fax: (312) 267-3657 www.hardingloevnerfunds.com | | Must be preceded or accompanied by a current Prospectus. Quasar Distributors, LLC, Distributor |

Global Equity Portfolio

Portfolio Managers

| | |

Peter Baughan, CFA Co-Lead Portfolio Manager Ferrill Roll, CFA Co-Lead Portfolio Manager Christopher Mack, CFA Portfolio Manager Alexander Walsh, CFA Portfolio Manager | | |

Performance Summary

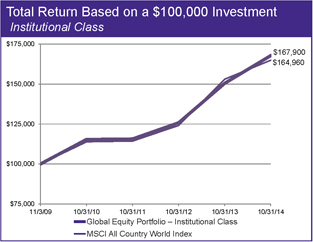

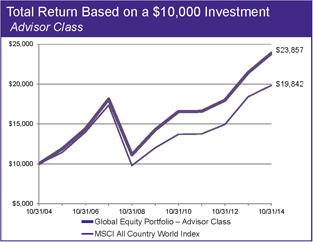

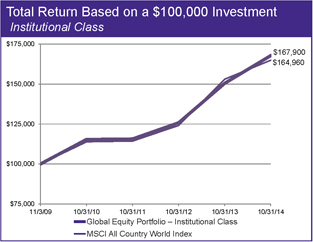

The Global Equity Portfolio – Institutional Class rose 11.47% and the Advisor Class gained 11.19% (net of fees and expenses) in the fiscal year ended October 31, 2014. The Portfolio’s benchmark, the MSCI All Country World Index, rose 7.78% (net of source taxes) in this period.

Market Review

Global stock markets achieved solid returns in US dollars in the fiscal year just ended, but were punctuated by a significant correction in January/February, and a deeper one in September/October. The winter correction was centered on concerns about a number of Emerging Market (EM) economies and rising conflict in Ukraine; in autumn, investor fears arose that developed economies, especially in Western Europe, could slip into deflation and recession. Tensions between Russia and NATO countries remained elevated over Ukraine, with further sanctions enacted by the EU and the US apparently leading to curtailed gas supplies to a number of neighboring countries, interpreted by some as a harbinger of a difficult winter. US-led attacks on the “Islamic State” forces in Iraq and Syria escalated, while the US persuaded more countries to join the bombing and logistical efforts. Plentiful liquidity, however, kept markets afloat, not least by encouraging corporate M&A activity alongside buoyant new equity (IPO) issues.

European economic data continues to reflect very sluggish activity, and inflation statistics, in particular, are falling steadily toward zero, alarming monetary authorities and underpinning the demand for bonds despite their record-low yields. That is in contrast to Japan, where Abenomics continues to deliver on its promise of generating inflation, if not yet on its goal of stimulating real economic growth. US growth data has been more consistently positive, with employment gaining ground and thus adding pressure on the US Federal Reserve to end its quantitative easing and eventually raise interest rates. The contrast of gathering economic momentum in the US with ongoing slack in European and other economies has led to starkly divergent expectations regarding monetary policies in the two regions, which has been encouraged by European Central Bank (ECB) President Mario Draghi’s push to expand the ECB’s balance sheet as well as by comments from various Fed officials. Those expectations and comments, in turn, fostered US dollar strength against all other currencies, resulting in sharp movements

| | | | |

| Fund Facts at October 31, 2014 |

Total Net Assets | | | | $813.4 million |

Sales Charge | | | | None |

Number of Holdings | | | | 71 |

Turnover (5 Yr. Average) | | | | 30% |

Redemption Fee | | | | 2% first 90 days |

Dividend Policy | | | | Annual |

| | | Institutional Class | | Advisor Class |

Ticker | | HLMVX | | HLMGX |

CUSIP | | 412295602 | | 412295206 |

Inception Date | | 11/3/2009 | | 12/1/1996 |

Minimum Investment* | | $100,000 | | $5,000 |

Net Expense Ratio | | 0.95%† | | 1.20%‡ |

Gross Expense Ratio | | 0.96% | | 1.22% |

*Lower minimums available through certain brokerage firms. †Shown net of Harding Loevner’s contractual agreement, through February 28, 2015, to waive its management fee to the extent necessary to cap the Portfolio’s total operating expenses. ‡The Net Expense Ratio is operating below the contractual agreement, which is in effect until February 28, 2015. The Net Expense Ratio is as of October 31, 2014. The Gross Expense Ratio is as of the Prospectus, dated February 28, 2014.

in exchange rates, and helping the US stock market to recover fully from the latest correction and reach all-time-high levels for the S&P 500 Index, making it far and away the best-performing major equity market in US dollar terms in the year.

Within EMs, falling commodity prices combined with the strong dollar to dim export prospects, especially for countries whose exchange rates are tied, even informally, to the US currency. Political uncertainties in several countries, notably Brazil and Russia, combined with currency and commodity export weakness to dampen enthusiasm for stock markets. In Brazil’s case, the polls regarding this fall’s presidential election swung wildly, and took the stock market first up, and then down, with them. On the other hand, China has benefited from a backdrop of reform and control on the part of President Xi Jinping, with investors believing—for the moment, at least—that the government will be able to manage the ongoing slowdown in capital investment, and therefore economic growth, without triggering a bad debt cascade in the teetering shadow market for high-yield “wealth management” products.

Currency effects had significant impacts on market returns, with the strong dollar subtracting from local currency returns outside the US for dollar-based investors, and conversely flattering the home currency returns on US investments from abroad.

Performance Attribution

The Portfolio outperformed the Index in the fiscal year through a combination of strong stock selection and good sector allocation decisions. Financials were helped by rebounds in EM banks in India, along with Wells Fargo in the US, which benefited from better cost containment and hopes of higher US interest rates, while JPMorgan and Lazard enjoyed bolstered revenues from M&A advisory. In Health Care, the Portfolio benefitted from two holdings, Allergan and Shire, whose current business is strong and whose pipelines are promising—both attracting corporate suitors. Within Materials, Sigma-Aldrich soared after agreeing

1

Institutional Class HLMVX

Advisor Class HLMGX

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Performance | |

| Average Annualized Total Returns (%) | | | | |

| at September 30, 2014 | | | | | | | | | | | | | | | | | | | | at October 31, 2014 | | | | |

| | | | | | | | | | | | |

| | | Inception

Date | | | 1 year | | | 3 years | | | 5 years | | | 10 years | | | Since

Inception* | | | 1 year | | | 3 years | | | 5 years | | | 10 years | | | Since

Inception* | |

Global Equity Portfolio – Inst. Class | | | 11/3/09 | | | | 12.15 | | | | 16.00 | | | | – | | | | – | | | | 10.64 | | | | 11.47 | | | | 13.22 | | | | – | | | | – | | | | 10.94 | |

| | | | | | | | | | | | |

Global Equity Portfolio – Advisor Class | | | 12/1/96 | | | | 11.87 | | | | 15.68 | | | | 10.10 | | | | 9.19 | | | | 6.72 | | | | 11.19 | | | | 12.90 | | | | 10.85 | | | | 9.08 | | | | 6.82 | |

| | | | | | | | | | | | |

MSCI All Country World Index† | | | | | | | 11.33 | | | | 16.62 | | | | 10.08 | | | | 7.28 | | | | 10.58 | | | | 7.78 | | | | 12.99 | | | | 10.57 | | | | 7.09 | | | | 10.55 | |

*The since inception return of the MSCI All Country World Index is since 11/3/09; †The inception date of the Index is 1/1/01.

Performance data quoted represent past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (877) 435-8105 or visiting www.hardingloevnerfunds.com. The Portfolio imposes a 2% redemption fee on shares held 90 days or less. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

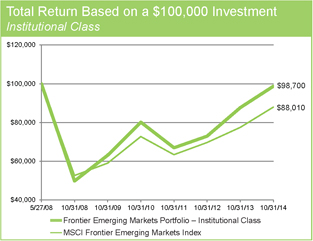

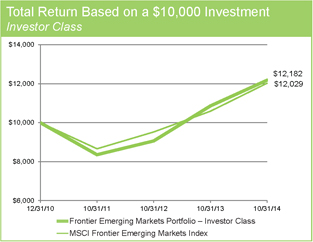

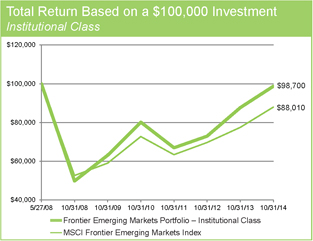

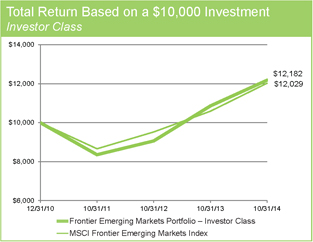

The charts below illustrate the hypothetical return of an investment made in the corresponding share classes. Investment return reflects voluntary fee waivers in effect. Absent such waivers, total return would be reduced. The performance provided in the table above and charts below do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

to be acquired by Germany’s Merck. Offsetting this were some poor stocks within the IT sector, including eBay, ARM Holdings, and Trimble Navigation.

Viewed by geography, the good relative performance shows up mostly as good stock picking, with positive stock selection in all regions, including the best performing region, the US, where in addition to good stocks, the Portfolio has large holdings.

Perspectives

More than five years have elapsed since global equity markets turned positive from the depths of the Global Financial Crisis. In that time, the MSCI All Country World Index has delivered a total US dollar return of more than 160%, not least due to the vigorous efforts of central banks to supply liquidity that is more than ample to unfreeze markets and facilitate the repair of the most leveraged balance sheets in the global economy, including in particular those of financial institutions, governments, and mortgaged homeowners. The Fed has just ended its quantitative easing and has resumed discussing openly the eventuality of raising interest rates toward some more “normal” level. Markets, which a year ago took fright at the very hint of this, have adjusted to the prospect this summer with a remarkable degree of equanimity, currency markets aside. That, we hope, is a sign that such repair as has taken place over the past five years will suffice to allow the US economy to tran-

sit gracefully to a less-experimental monetary policy. Recent data depict robust growth, with small business sentiment at a six-year high, job vacancies surging, car sales at an eight-year high, and US consumer credit expanding the most in over a decade.1

That moment of normalization is not to be shared by other major economies. The lurch toward deflation in Europe has spooked even such an orthodox monetary stalwart as the Bundesbank, whose chief economist told us a few weeks ago that “there is a clear intellectual case for engaging in unorthodox measures to combat cyclical deflationary forces”—a statement that we’d never dreamed of hearing in Frankfurt.2 The President of the ECB aims to deliver such unorthodox policy, attempting to increase the balance sheet of the ECB by a trillion euros by lending to banks via long-term repurchase agreements (TLTRO), as well as by buying covered mortgage bonds and other asset-backed securities, in an effort to stimulate both the demand for (by lowering the price) and supply of (by releasing capital tied up in such assets on bank balance sheets) credit in the euro zone. Combined with continued mandated capital raising and restructuring within the European banking sector, these moves are meant to create in those economies some lending momentum where it has been lacking.

1 JPMorgan Cazenove, Global Equity Research, September 2014.

2 Harding Loevner Analyst Meeting, Frankfurt, September 18, 2014.

2

Global Equity Portfolio continued

The very idea that reflation, modest quantitative easing, and recapitalized banks may now be a reality in Europe is a departure for our thinking. With both Japan and the ECB picking up the baton of monetary stimulus, there may well be ample liquidity keeping a spring in the step of equity markets worldwide, even as the Fed pulls out of the race to less-than-zero interest rates. Some are making the case that global stock prices will rise to record heights in a new leg of the bull market that is based on accelerating earnings (a pull-through effect from the US’s economic growth), alongside plentiful M&A, which is itself the result of growing management confidence combined with continued availability of very low-cost financing.

We are not so sure. For one, we have many times pointed out the low correlation between economic growth rate and stock prices. It may well be that the rising stock markets of the past few years were discounting the stronger economic—and corporate earnings—growth that is now upon us, with little additional growth left for markets to reflect. And those discount rates? They are heading higher, at least in the US, if the Fed’s own projections of short-term interest rates prove to be accurate and prove to have their usual effect on longer-term interest rates. Those higher discount rates should have an offsetting (i.e., negative) impact on stock prices even as corporate earnings rise.

That is if everything goes according to plan. But little thought has been given to Chair Janet Yellen’s public statements that the Fed should be tolerant of rising inflation as long as labor markets retain slack, as interpreted by her and the Fed staff, who are focused on wage increases, which have been lagging the general US recovery. And rising inflation has, in the past, had very negative effects on the multiples that investors are willing to pay for earnings, even nominally rising earnings.

We also note the growing market enthusiasm for IPOs and privately held startup-stage companies which continued once again this quarter, punctuated by the US$25 billion IPO of Alibaba, the largest new equity offering in history—and that laurel won despite the twist of this being primarily a cross-border effort, with mostly US and other offshore funds being tapped for a primarily Chinese internet business, connected through a murkily-governed legal structure. The market for privately held technology startups is strong, even frothy, with the dollar value of venture capital investment approaching

| | | | | | | | |

| Geographical Weightings (%) at October 31, 2014 | |

| Institutional and Advisor Classes | |

| Country/Region | | | Portfolio | | | | Benchmark | 1 |

Canada | | | 0.0 | | | | 3.6 | |

| | | |

Emerging Markets | | | 10.1 | | | | 10.8 | |

| | | |

Europe EMU | | | 8.5 | | �� | | 10.3 | |

| | | |

Europe ex-EMU | | | 11.9 | | | | 12.3 | |

| | | |

Japan | | | 8.8 | | | | 7.3 | |

| | | |

Middle East | | | 0.0 | | | | 0.2 | |

| | | |

Pacific ex-Japan | | | 3.9 | | | | 4.4 | |

| | | |

United States | | | 54.4 | | | | 51.1 | |

| | | |

Frontier Markets2 | | | 0.0 | | | | – | |

| | | |

Cash | | | 2.4 | | | | – | |

1MSCI All Country World Index; 2Includes countries with less-developed markets outside the Index.

| | | | | | | | |

| Sector Weightings (%) at October 31, 2014 | |

| Institutional and Advisor Classes | |

| Sector | | | Portfolio | | | | Benchmark | 1 |

Consumer Discretionary | | | 11.6 | | | | 11.5 | |

| | | |

Consumer Staples | | | 9.7 | | | | 9.7 | |

| | | |

Energy | | | 5.4 | | | | 8.9 | |

| | | |

Financials | | | 18.5 | | | | 21.8 | |

| | | |

Health Care | | | 16.1 | | | | 11.5 | |

| | | |

Industrials | | | 7.5 | | | | 10.4 | |

| | | |

Information Technology | | | 21.3 | | | | 13.4 | |

| | | |

Materials | | | 6.1 | | | | 5.5 | |

| | | |

Telecom Services | | | 1.4 | | | | 3.9 | |

| | | |

Utilities | | | 0.0 | | | | 3.4 | |

| | | |

Cash | | | 2.4 | | | | – | |

1MSCI All Country World Index.

levels not seen since the year 2000, the peak of the last technology and telecom bubble. Such phenomena are symptoms of strong risk appetites on the part of investors and entrepreneurs alike. Their ebullience is being echoed in the growing number of merger and acquisition announcements, reflecting increased confidence of public company managements—although that confidence has yet to be reflected in more than a modest recovery in capital expenditures. Our worry is that, in past market cycles, by the time all players—investors, venture capitalists, and company managers—have grown uniformly confident, the game is already in its late innings. Often, a hot IPO market is a signal that the best valuations have already been attained.

As a result, we are not abandoning our carefully balanced view that we have insufficient visibility into the future to take either a more pro-cyclical stance or a less optimistic one. And, as always, we remain focused on durable profit growth, rather than cyclical recovery or the next takeover target. We believe that the high quality of the businesses in which we invest should offer relative stock price resilience in markets that are more hostile than the ones we have faced over the past 68 months. We feel fortunate to have kept pace with what have been, in actuality, torrid returns over that time.

Portfolio Structure

We are still assessing the Portfolio implications of aggressive monetary stimulus and a healing banking system in Europe. We have generally avoided investments in the euro zone Financials sector over the past few years of recovering global stock markets, for the simple reason that we found it hard to articulate a growth argument for all but an exceptional few of the financial businesses that we examined there. That may change if the putative quantitative easing will eventually have the desired effect of rekindling economic momentum in Europe—a condition on which the jury is decidedly out. Certainly we heard managements make arguments that sounded like growth arguments when we met a number of companies on a recent trip to Europe. The US experience with cleaning up and recapitalizing its banking system is causing us to rethink euro zone Financials, but so far we have taken no action on that front. What is clear is that the euro zone should not implode without putting up a (monetary) fight. That is likely to be good for multinationals based there, thanks to the competitiveness corollary from the

3

Institutional Class HLMVX

Advisor Class HLMGX

weaker euro. As a counterpoint, US multinationals should at least face the headwind of weaker translation of their overseas earnings. It may also be good for EMs, which benefit from more liquidity creation and exported capital in search of higher yields.

We were asked recently to comment on how we manage geopolitical risks in the Portfolio. While some observers think that political risks are on the rise, we think only the media coverage of such risks is more prominent, putting them more top of mind, whereas the risks themselves have been there for the prudent analyst to see all along. Seeing risks does not, however, equate to an ability to predict outcomes. Against adverse political events the only reliable defense is geographical diversification. In this respect, we believe our investment style leaves us well defended, even beyond the explicit care we take to see that our holdings are not overly concentrated in particular countries or regions. One indicator of the strength of a company’s business model is that it has succeeded so well in its home market that to continue to grow it had to expand its franchise to other countries. Multinational companies, not dependent on any single country for their production, sales, or profits, face fewer existential threats from political risks. So, for example, when investors began this summer to worry about the potential dissolution of the United Kingdom, we were able to reassure ourselves that our UK-based companies, all multinational companies with the most domestically oriented of them garnering just 13% of its revenues from the UK, and the average garnering on the order of 7%, faced no crisis.3

The risks of investing in Russia in the present, post-Crimea era, are apparent to all: potential further economic sanctions from the West, possible capital controls by the Russian government that obstruct repatriation of investment, or even expropriation. Yet, because Russian stock prices reflect these widely appreciated risks, we believe that shares of certain high-quality Russian companies (specifically discount food retailer Magnit and internet search provider Yandex, holdings that we accumulated this year) are currently attractive, offering the potential for high returns that, critically, have little correlation with the global market and, in particular, with the expected return from the rest of our Portfolio, whose both systematic and idiosyncratic, company-specific risks are largely independent of the course of political developments in Russia. Thus does the context of a globally-diversified Portfolio permit us the opportunity to pursue highly attractive—and, taken on their own, highly risky—opportunities in the appropriate amounts.

We hold a similar opinion about investments in Japan, a country where growth companies have been rare to find, but the benefits to the Portfolio of finding them have been great, due to the low correlation of Japanese stocks with those traded in US or European markets. Thus we have worked assiduously to identify Japanese companies that meet our quality and growth criteria, even when we had little enthusiasm for the demographically challenged, poorly governed, low-return group of companies we found there for many years—and the hot-money, inflationary-minded ones we see today. As in the UK, most of our holdings in Japan have tended to be multinationals, that is, companies that have gone beyond Japan’s borders in pursuit of growth that was so hard to find domestically. Increasingly, though, we are also identifying companies that,

3Capital IQ; Analyst Estimates. Based upon the International Equity Strategy model portfolio.

| | | | | | | | | | |

| Ten Largest Holdings at October 31, 2014 | |

| Institutional and Advisor Classes | |

| Company | | | Sector | | | Country | | | % | |

Nike | | | Cons Discretionary | | | US | | | 2.9 | |

| | | | |

Schlumberger | | | Energy | | | US | | | 2.7 | |

| | | | |

Nestlé | | | Cons Staples | | | Switzerland | | | 2.5 | |

| | | | |

Roper | | | Industrials | | | US | | | 2.4 | |

| | | | |

eBay | | | Info Technology | | | US | | | 2.3 | |

| | | | |

Allergan | | | Health Care | | | US | | | 2.3 | |

| | | | |

Microsoft | | | Info Technology | | | US | | | 2.2 | |

| | | | |

Google | | | Info Technology | | | US | | | 2.2 | |

| | | | |

MasterCard | | | Info Technology | | | US | | | 2.2 | |

| | | | |

AIA Group | | | Financials | | | Hong Kong | | | 2.1 | |

through the mechanism of technology, are growing domestically by disrupting old, established but inefficient industry patterns. ABC-MART, for example, is side-stepping the entire wholesale middleman industry structure of retailing in Japan, integrating its own supply chain of domestic and low-cost Asian shoe manufactures to source its inventory. MonotaRO, the affiliate of US-based WW Grainger, has taken the catalog business of supplying consumable maintenance and safety items to small- and medium-sized businesses, and built a much more efficient e-commerce platform for ordering and fulfillment, creating efficiencies for customers that traditional wholesalers and catalog retailers just cannot match.

We have maintained large holdings in the IT sector, even though our stock selection within the sector has been uneven over the past couple of years. We like the strong net cash position that most companies in the sector maintain alongside their high margins and returns, and their focus on pursuing growth prospects. But in an environment of increasing cyclical optimism, we value the traditional resilience the IT stocks have shown in periods of rising interest rates, a corollary to the operating leverage they enjoy when capital spending appetite in the economy surges, given the central role that technology plays in expansion plans of nearly all enterprises. Nevertheless, all the money being invested by venture capitalists in new companies will engender more competition for many of our current holdings in established companies. And that doesn’t even include the rivalry already evident in companies trying to enter one another’s businesses. Just recently, Apple revealed its plans to enter the electronic payments space, where we have several investments, including MasterCard, American Express, and eBay. One result is that eBay has announced plans to spin out its online payments business PayPal, in order for it to compete more effectively as an independent entity, a move that the stock market applauded.

Please read the separate disclosure page for important information, including the risks of investing in the Portfolio.

4

International Equity Portfolio

Portfolio Managers

| | |

Ferrill Roll, CFA Co-Lead Portfolio Manager Alexander Walsh, CFA Co-Lead Portfolio Manager Peter Baughan, CFA Portfolio Manager Bryan Lloyd, CFA Portfolio Manager Andrew West, CFA Portfolio Manager | | |

Performance Summary

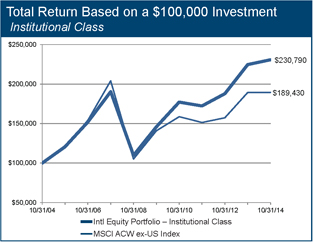

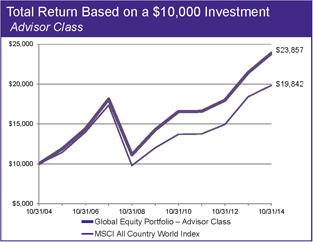

The International Equity Portfolio – Institutional Class rose 2.65% and the Investor Class gained 2.36% (net of fees and expenses) in the fiscal year ended October 31, 2014. The Portfolio’s benchmark, the MSCI All Country World ex-US Index, rose 0.05% (net of source taxes) in this period.

Market Review

Global stock markets achieved solid, single-digit returns measured in their own local currency in the fiscal year just ended, but the decline of nearly all currencies against the dollar meant that, for US-dollar-based investors, returns were barely above zero for the year. Markets experienced a significant correction in January/February, and a deeper one in September/October. The winter correction was centered on concerns about a number of Emerging Market (EM) economies and rising conflict in Ukraine; in autumn, investor fears arose that developed economies, especially in Western Europe, could slip into deflation and recession. Tensions between Russia and NATO countries remained elevated over Ukraine, with further sanctions enacted by the EU and the US apparently leading to curtailed gas supplies to a number of neighboring countries, interpreted by some as a harbinger of a difficult winter. US-led attacks on the “Islamic State” forces in Iraq and Syria escalated, while the US persuaded more countries to join the bombing and logistical efforts. Plentiful liquidity, however, kept markets afloat, not least by encouraging corporate M&A activity alongside buoyant new equity (IPO) issues.

European economic data continues to reflect very sluggish activity, and inflation statistics, in particular, are falling steadily toward zero, alarming monetary authorities and underpinning the demand for bonds despite their record-low yields. That is in contrast to Japan, where Abenomics continues to deliver on its promise of generating inflation, if not yet on its goal of stimulating real economic growth. US growth data has been more consistently positive, with employment gaining ground and thus adding pressure on the US Federal Reserve to end its quantitative easing and eventually raise interest rates. The contrast of gathering economic momentum in the US with ongoing slack in European and other economies has led to starkly divergent expectations regarding monetary policies in the two regions, which has been encouraged by European Central

| | | | |

| Fund Facts at October 31, 2014 |

Total Net Assets | | | | $4,262.5 million |

Sales Charge | | | | None |

Number of Holdings | | | | 54 |

Turnover (5 Yr. Average) | | | | 19% |

Redemption Fee | | | | 2% first 90 days |

Dividend Policy | | | | Annual |

| | | Institutional Class | | Investor Class |

Ticker | | HLMIX | | HLMNX |

CUSIP | | 412295107 | | 412295503 |

Inception Date | | 5/11/1994 | | 9/30/2005 |

Minimum Investment* | | $100,000 | | $5,000 |

Net Expense Ratio† | | 0.87% | | 1.17% |

Gross Expense Ratio | | 0.87% | | 1.20% |

*Lower minimums available through certain brokerage firms. †The Net Expense Ratio is operating below the contractual agreement, which is in effect until February 28, 2015. The Net Expense Ratio is as of October 31, 2014. The Gross Expense Ratio is as of the Prospectus, dated February 28, 2014.

Bank (ECB) President Mario Draghi’s push to expand the ECB’s balance sheet as well as by comments from various Fed officials. Those expectations and comments, in turn, fostered US dollar strength against all other currencies, resulting in sharp movements in exchange rates, and helping the US stock market to recover fully from the latest correction and reach all-time-high levels for the S&P 500 Index, making it far and away the best-performing major equity market in US dollar terms in the year.

Within EMs, falling commodity prices combined with the strong dollar to dim export prospects, especially for countries whose exchange rates are tied, even informally, to the US currency. Political uncertainties in several countries, notably Brazil and Russia, combined with currency and commodity export weakness to dampen enthusiasm for stock markets. In Brazil’s case, the polls regarding this fall’s presidential election swung wildly, and took the stock market first up, and then down, with them. On the other hand, China has benefited from a backdrop of reform and control on the part of President Xi Jinping, with investors believing—for the moment, at least—that the government will be able to manage the ongoing slowdown in capital investment, and therefore economic growth, without triggering a bad debt cascade in the teetering shadow market for high-yield “wealth management” products.

Performance Attribution

The Portfolio outperformed the Index in the fiscal year through a combination of good stock selection and positive sector allocation decisions. Within Financials, we benefited from rebounds in certain EM banks, especially in Brazil (Itau Unibanco) and India (ICICI Bank), and also from Hong Kong Exchanges. Our emphasis on the strongly performing Health Care and Information Technology sectors also helped relative performance. Offsetting these effects were poor stocks within Consumer Discretionary, especially Sands China, which struggled with slowing gaming revenues in Macau, and Swatch Group, whose watch sales reflected dampened demand in China for luxury goods in the current environment of anti-corruption campaigns.

5

Institutional Class HLMIX

Investor Class HLMNX

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Performance | |

| Average Annualized Total Returns (%) | | | | |

| at September 30, 2014 | | | | | | | | | | | | | | | | | | | | at October 31, 2014 | | | | |

| | | | | | | | | | | | |

| | | Inception Date | | | 1 year | | | 3 years | | | 5 years | | | 10 years | | | Since Inception* | | | 1 year | | | 3 years | | | 5 years | | | 10 years | | | Since Inception* | |

Intl Equity Portfolio – Institutional Class | | | 5/11/94 | | | | 4.34 | | | | 13.20 | | | | 9.05 | | | | 8.89 | | | | 6.22 | | | | 2.65 | | | | 10.21 | | | | 9.61 | | | | 8.72 | | | | 6.28 | |

| | | | | | | | | | | | |

Intl Equity Portfolio – Investor Class | | | 9/30/05 | | | | 4.05 | | | | 12.81 | | | | 8.69 | | | | – | | | | 6.40 | | | | 2.36 | | | | 9.82 | | | | 9.26 | | | | – | | | | 6.55 | |

| | | | | | | | | | | | |

MSCI ACW ex-US Index† | | | | | | | 4.76 | | | | 11.79 | | | | 6.04 | | | | 7.07 | | | | 4.92 | | | | 0.05 | | | | 7.77 | | | | 6.09 | | | | 6.60 | | | | 4.75 | |

*The since inception return of the MSCI ACW ex-US Index is since 9/30/05. †The inception date of the Index is 1/1/01.

Performance data quoted represent past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (877) 435-8105 or visiting www.hardingloevnerfunds.com. The Portfolio imposes a 2% redemption fee on shares held 90 days or less. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

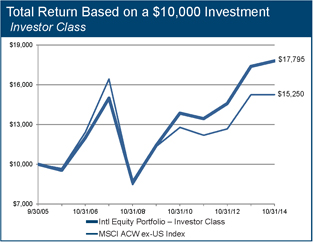

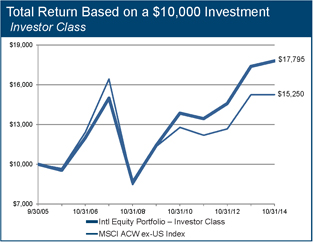

The charts below illustrate the hypothetical return of an investment made in the corresponding share classes. Investment return reflects voluntary fee waivers in effect. Absent such waivers, total return would be reduced. The performance provided in the table above and charts below do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

Viewed by geography, the good relative performance shows up mostly as good stock picking, especially in EMs. In addition to the EM banks, South African telecommunications firm MTN Group helped performance as investors reappraised their revenue growth and better free cash flow generation. Europe ex-EMU was the only region where Portfolio returns lagged the Index, hurt by Swatch Group, integrated oil and gas producer BG Group, semiconductor chip design specialist ARM Holdings, and Tesco (now sold).

Perspectives

More than five years have elapsed since global equity markets turned positive from the depths of the Global Financial Crisis. In that time, the MSCI All Country World ex-US Index has delivered a total US dollar return of more than 120%, not least due to the vigorous efforts of central banks to supply liquidity that is more than ample to unfreeze markets and facilitate the repair of the most leveraged balance sheets in the global economy, including in particular those of financial institutions, governments, and mortgaged homeowners. The Fed has just ended its quantitative easing and has resumed discussing openly the eventuality of raising interest rates toward some more “normal” level. Markets, which a year ago took fright at the very hint of this, have adjusted to the prospect this summer with a remarkable degree of equanimity, currency markets aside. That, we hope, is a sign that such repair as has taken place

over the past five years will suffice to allow the US economy to transit gracefully to a less-experimental monetary policy. Recent data depict robust growth, with small business sentiment at a six-year high, job vacancies surging, car sales at an eight-year high, and US consumer credit expanding the most in over a decade.1

That moment of normalization is not to be shared by other major economies. The lurch toward deflation in Europe has spooked even such an orthodox monetary stalwart as the Bundesbank, whose chief economist told us a few weeks ago that “there is a clear intellectual case for engaging in unorthodox measures to combat cyclical deflationary forces”—a statement that we’d never dreamed of hearing in Frankfurt.2 The President of the ECB aims to deliver such unorthodox policy, attempting to increase the balance sheet of the ECB by a trillion euros by lending to banks via long-term repurchase agreements (TLTRO), as well as by buying covered mortgage bonds and other asset-backed securities, in an effort to stimulate both the demand for (by lowering the price) and supply of (by releasing capital tied up in such assets on bank balance sheets) credit in the euro zone. Combined with continued mandated capital raising and restructuring within the European banking sector, these moves are meant to create in those economies some lending momentum where it has been lacking.

1 JPMorgan Cazenove, Global Equity Research, September 2014.

2 Harding Loevner Analyst Meeting, Frankfurt, September 18, 2014.

6

International Equity Portfolio continued

The very idea that reflation, modest quantitative easing, and recapitalized banks may now be a reality in Europe is a departure for our thinking. With both Japan and the ECB picking up the baton of monetary stimulus, there may well be ample liquidity keeping a spring in the step of equity markets worldwide, even as the Fed pulls out of the race to less-than-zero interest rates. Some are making the case that global stock prices will rise to record heights in a new leg of the bull market that is based on accelerating earnings (a pull-through effect from the US’s economic growth), alongside plentiful M&A, which is itself the result of growing management confidence combined with continued availability of very low-cost financing.

We are not so sure. For one, we have many times pointed out the low correlation between economic growth rate and stock prices. It may well be that the rising stock markets of the past few years were discounting the stronger economic—and corporate earnings—growth that is now upon us, with little additional growth left for markets to reflect. And those discount rates? They are heading higher, at least in the US, if the Fed’s own projections of short-term interest rates prove to be accurate and prove to have their usual effect on longer-term interest rates. Those higher discount rates should have an offsetting (i.e., negative) impact on stock prices even as corporate earnings rise.

That is if everything goes according to plan. But little thought has been given to Chair Janet Yellen’s public statements that the Fed should be tolerant of rising inflation as long as labor markets retain slack, as interpreted by her and the Fed staff, who are focused on wage increases, which have been lagging the general US recovery. And rising inflation has, in the past, had very negative effects on the multiples that investors are willing to pay for earnings, even nominally rising earnings.

We also note the growing market enthusiasm for IPOs and privately held startup-stage companies which continued once again this quarter, punctuated by the US$25 billion IPO of Alibaba, the largest new equity offering in history—and that laurel won despite the twist of this being primarily a cross-border effort, with mostly US and other offshore funds being tapped for a primarily Chinese internet business, connected through a murkily-governed legal structure. The market for privately held technology startups is strong,

| | | | | | | | |

| Geographical Weightings (%) at October 31, 2014 | |

| Institutional and Investor Classes | |

| Country/Region | | | Portfolio | | | | Benchmark | 1 |

Canada | | | 4.6 | | | | 7.5 | |

| | | |

Emerging Markets | | | 16.2 | | | | 22.2 | |

| | | |

Europe EMU | | | 27.1 | | | | 21.0 | |

| | | |

Europe ex-EMU | | | 21.1 | | | | 25.1 | |

| | | |

Japan | | | 14.2 | | | | 14.8 | |

| | | |

Middle East | | | 0.0 | | | | 0.4 | |

| | | |

Pacific ex-Japan | | | 10.0 | | | | 9.0 | |

| | | |

Frontier Markets2 | | | 0.0 | | | | – | |

| | | |

Other3 | | | 4.3 | | | | – | |

| | | |

Cash | | | 2.5 | | | | – | |

1MSCI All Country World ex-US Index; 2Includes countries with less-developed markets outside the Index; 3Includes countries with developed markets outside the Index where some holdings are incorporated.

| | | | | | | | |

| Sector Weightings (%) at October 31, 2014 | |

| Institutional and Investor Classes | |

| Sector | | | Portfolio | | | | Benchmark | 1 |

Consumer Discretionary | | | 9.0 | | | | 10.7 | |

| | | |

Consumer Staples | | | 13.9 | | | | 9.9 | |

| | | |

Energy | | | 7.2 | | | | 8.5 | |

| | | |

Financials | | | 19.4 | | | | 27.5 | |

| | | |

Health Care | | | 13.5 | | | | 8.6 | |

| | | |

Industrials | | | 11.8 | | | | 10.8 | |

| | | |

Information Technology | | | 14.0 | | | | 7.1 | |

| | | |

Materials | | | 5.9 | | | | 7.8 | |

| | | |

Telecom Services | | | 2.0 | | | | 5.5 | |

| | | |

Utilities | | | 0.8 | | | | 3.6 | |

| | | |

Cash | | | 2.5 | | | | – | |

1MSCI All Country World ex-US Index.

even frothy, with the dollar value of venture capital investment approaching levels not seen since the year 2000, the peak of the last technology and telecom bubble. Such phenomena are symptoms of strong risk appetites on the part of investors and entrepreneurs alike. Their ebullience is being echoed in the growing number of merger and acquisition announcements, reflecting increased confidence of public company managements—although that confidence has yet to be reflected in more than a modest recovery in capital expenditures. Our worry is that, in past market cycles, by the time all players—investors, venture capitalists, and company managers—have grown uniformly confident, the game is already in its late innings. Often, a hot IPO market is a signal that the best valuations have already been attained.

As a result, we are not abandoning our carefully balanced view that we have insufficient visibility into the future to take either a more pro-cyclical stance or a less optimistic one. And, as always, we remain focused on durable profit growth, rather than cyclical recovery or the next takeover target. We believe that the high quality of the businesses in which we invest should offer relative stock price resilience in markets that are more hostile than the ones we have faced over the past 68 months. We feel fortunate to have kept pace with what have been, in actuality, torrid returns over that time.

Portfolio Structure

We are still assessing the Portfolio implications of aggressive monetary stimulus and a healing banking system in Europe. We have had limited investments in the financial sector in the euro zone over the past few years of recovery in global stock markets (only Spanish multinational BBVA and capital-rich Allianz), for the simple reason that we found it hard to articulate a growth argument for all but an exceptional few of the financial businesses that we examined there. That may change if the putative quantitative easing will eventually have the desired effect of rekindling economic momentum in Europe—a condition on which the jury is decidedly out. Certainly we heard managements make arguments that sounded like growth arguments when we met a number of companies on a recent trip to Europe. The US experience with cleaning up and recapitalizing its banking system is causing us to rethink euro zone Financials, but so far we have taken no further action on that front.

7

Institutional Class HLMIX

Investor Class HLMNX

What is clear is that the euro zone should not implode without putting up a (monetary) fight. That is likely to be good for multinationals based there, thanks to the competitiveness corollary from the weaker euro. As a counterpoint, US multinationals should at least face the headwind of weaker translation of their overseas earnings. It may also be good for EMs, which benefit from more liquidity creation and exported capital in search of higher yields.

We were asked recently to comment on how we manage geopolitical risks in the Portfolio. While some observers think that political risks are on the rise, we think only the media coverage of such risks is more prominent, putting them more top of mind, whereas the risks themselves have been there for the prudent analyst to see all along. Seeing risks does not, however, equate to an ability to predict outcomes. Against adverse political events the only reliable defense is geographical diversification. In this respect, we believe our investment style leaves us well defended, even beyond the explicit care we take to see that our holdings are not overly concentrated in particular countries or regions. One indicator of the strength of a company’s business model is that it has succeeded so well in its home market that to continue to grow it had to expand its franchise to other countries. Multinational companies, not dependent on any single country for their production, sales, or profits, face fewer existential threats from political risks. So, for example, when investors began this summer to worry about the potential dissolution of the United Kingdom, we were able to reassure ourselves that our UK-based companies, all multinational companies with the most domestically oriented of them garnering just 17% of its revenues from the UK, and the average garnering on the order of 10%, faced no crisis.3

Diversification aspects also inform our investments in Japan, a country where growth companies have been rare to find but the benefits to the Portfolio of finding them have been great, due to the low correlation of Japanese stocks with those traded in US or European markets. Thus we have worked assiduously to identify Japanese companies that meet our quality and growth criteria, even when we had little enthusiasm for the demographically challenged, poorly governed, low-return group of companies we found there for many years—and the hot-money, inflationary-minded ones we see today. As in the UK, most of our holdings in Japan have tended to be multinationals, that is, companies that have gone beyond Japan’s borders in pursuit of growth that was so hard to find domestically. Increasingly, though, we are also identifying companies that, through the mechanism of technology, are growing domestically by disrupting old, established, but inefficient industry patterns. One example of this is MonotaRO, the affiliate of US-based WW Grainger, which has taken the catalog business of supplying consumable maintenance and safety items to small- and medium-sized businesses, and built a much more efficient e-commerce platform for ordering and fulfillment, creating efficiencies for customers that traditional wholesalers and catalog retailers just cannot match.

We have maintained significant holdings in the IT sector, even though our stock selection within the sector has been mixed over the past couple of years. We like the strong net cash position that most companies in the sector maintain alongside their high margins and returns, and their focus on pursuing growth prospects. But in an environment of increasing cyclical optimism, we value the

3 Capital IQ; Analyst Estimates. Based upon the International Equity Strategy model portfolio.

| | | | | | | | | | | | |

| Ten Largest Holdings at October 31, 2014 | |

| Institutional and Investor Classes | |

| Company | | | Sector | | | | Country | | | | % | |

Nestlé | | | Cons Staples | | | | Switzerland | | | | 3.8 | |

| | | | |

Dassault Systemes | | | Info Technology | | | | France | | | | 3.7 | |

| | | | |

AIA Group | | | Financials | | | | Hong Kong | | | | 3.5 | |

| | | | |

Roche Holding | | | Health Care | | | | Switzerland | | | | 3.1 | |

| | | | |

ICICI Bank | | | Financials | | | | India | | | | 3.1 | |

| | | | |

WPP | | | Cons Discretionary | | | | UK | | | | 2.9 | |

| | | | |

Air Liquide | | | Materials | | | | France | | | | 2.8 | |

| | | | |

Allianz | | | Financials | | | | Germany | | | | 2.7 | |

| | | | |

Unicharm | | | Cons Staples | | | | Japan | | | | 2.6 | |

| | | | |

Fanuc | | | Industrials | | | | Japan | | | | 2.5 | |

traditional resilience the IT stocks have shown in periods of rising interest rates, a corollary to the operating leverage they enjoy when capital spending appetite in the economy surges, given the central role that technology plays in expansion plans of nearly all enterprises. Nevertheless, all the money being invested by venture capitalists in new companies will engender more competition for many of our current holdings in established companies. Those established businesses will need to respond, in some cases by buying into the next generation of technology that threatens their position, as enterprise resource planning software maker SAP did in September with the acquisition of Concur, a provider of cloud-based expense management software.

Finally, within EMs, volatility continues to be the rule of the day, often due to political changes that have greater impact on the environment for corporate profits than they normally might in developed countries. Such was the case in Brazil, where rising chances of President Dilma Rousseff losing the elections to a less interventionist candidate sent shares of all stocks soaring at first, but, as those chances receded, the gains were lost. Likewise, it is no accident that a German luxury marque, a Swiss watchmaker, and a Macau-based casino operator all saw shares underperform as anti-corruption measures were ratcheted up another notch in China: BMW, Swatch Group, and Sands China are all, in part, beneficiaries of conspicuous consumption in China, a cultural pattern that today is suffering from its association with corrupt officials and their associates and families. On the other hand, Indian Prime Minister Narendra Modi’s installation in office has led to a reappraisal of that country’s ability to rationalize regulatory, bureaucratic, and legal hurdles to commercial or even government-led economic activity and investment, which markets have continued to reward, not least in the share price of financial services group ICICI Bank, which may stand to benefit from improved loan performance in the infrastructure sector, and from faster generalized growth in financing economic activity.

Please read the separate disclosure page for important information, including the risks of investing in the Portfolio.

8

International Small Companies Portfolio

Portfolio Managers

| | |

| | from left: Josephine Lewis Co-Portfolio Manager Jafar Rizvi, CFA Co-Portfolio Manager |

Performance Summary

The International Small Companies Portfolio – Institutional Class rose 2.28% and the Investor Class gained 1.97% (net of fees and expenses) in the fiscal year ended October 31, 2014. The Portfolio’s benchmark, the MSCI All Country World ex-US Small Cap Index (the Index), declined 0.99% (net of source taxes) in this period.

Market Review

The Index gained nearly 5% in the first half of the fiscal year, but then suffered its steepest six-month decline since the summer of 2012. The Index returns by sector this year were widely dispersed, with Energy (down 18%) and Materials (down 7%) falling the most. Oil and commodity prices declined sharply in the second half of the year and the International Monetary Fund’s (IMF) recent revision of its 2014 global growth outlook down to 3% seems to signify weak demand for energy and commodities in the near term. Telecom Services was the best performing sector, returning 12%. As discussed in our April 2014 Semi-Annual Report, we believe the surge in performance by small cap companies in this sector is attributable in part to a shifting regulatory environment that has created favorable operating dynamics for smaller companies, as many governments have recognized the need for allowing greater competition in telecom markets. By contrast, in the primarily large-cap MSCI All Country World ex-US Index, the Telecom Services sector rose just 4%.

By geography, the European Monetary Union (EMU) was the Index’s worst-performing region, falling 5%. Emerging Markets (EMs) had the best performance, returning 4% overall. There was a high dispersion of returns in the region, however, with the largest extremes found among the larger EMs, including the BRIC countries (Brazil, Russia, India, and China). Russia dropped 33% as its continued involvement in the conflict between Ukraine and separatists in eastern Ukraine—and the sanctions imposed by the US and European countries in response—weighed on both the country’s stock market and currency. In Brazil, the reelection of President Dilma Rousseff was viewed among investors as unfavorable to the economy and the country’s market declined 20% as a result. In contrast, India soared 68% due to optimism surrounding the newly elected Prime Minister, Narendra Modi. This optimism is generally shared by us, as detailed later in this letter. Finally, China gained 10%; it seems the country has benefited from the reforms and controls being instituted under the leadership of President Xi Jinping. Investors seem to believe—for the moment, at least—that the government will be able to successfully manage China’s ongoing slowdown in capital investment (and, therefore, in economic growth) without triggering a severe debt crisis.

| | | | |

| Fund Facts at October 31, 2014 |

Total Net Assets | | | | $91.5 million |

Sales Charge | | | | None |

Number of Holdings | | | | 94 |

Turnover (5 Yr. Average) | | | | 33% |

Redemption Fee | | | | 2% first 90 days |

Dividend Policy | | | | Annual |

| | | Institutional Class | | Investor Class |

Ticker | | HLMRX | | HLMSX |

CUSIP | | 412295875 | | 412295883 |

Inception Date | | 6/30/2011 | | 3/26/2007 |

Minimum Investment* | | $100,000 | | $5,000 |

Net Expense Ratio† | | 1.30% | | 1.55% |

Gross Expense Ratio | | 1.68% | | 1.99% |

*Lower minimums available through certain brokerage firms. †Shown net of Harding Loevner’s contractual agreement, through February 28, 2015, to waive its management fee to the extent necessary to cap the Portfolio’s total operating expenses. The Net Expense Ratio is as of October 31, 2014. The Gross Expense Ratio is as of the Prospectus, dated February 28, 2014.

The strong performance of the US dollar this year had a significant impact on returns—the Index was up about 7% in local currency terms. The dollar appreciated about 12% against the yen, 8% against the euro, and also strengthened relative to most emerging market currencies.

The behavior of currencies was a reflection of the contrasting economic data for the United States versus other regions. In the US, the IMF forecasts GDP should grow about 2% this year, and unemployment has fallen to below 6% for the first time since 2008. Meanwhile, in the euro zone, GDP is estimated to grow less than 1% this year, and unemployment is in the double digits.1 There are also fears the region could be falling into a deflationary spiral. In September, Mario Draghi, the President of the European Central Bank (ECB), announced the ECB will work to combat deflation by implementing a form of quantitative easing.

Performance Attribution

Strong stock selection in the Information Technology and Financials sectors contributed most to the Portfolio’s returns relative to the Index. Shares of the Swedish enterprise resource-planning software company IFS outperformed as it continued to see strong growth across its licenses, maintenance, and consulting divisions. Within Financials, Kenya’s Equity Bank reported higher profits because of strong increases in fee income along with a healthy decline in non-performing loans. Our underweights in the weak Energy and Materials sectors also helped performance.

Poor stock selection in the Consumer Staples and Consumer Discretionary sectors detracted most from performance. Singapore-based packaged food maker Super Group reported disappointing earnings growth due to weak sales and higher raw material costs. Shares of Italian fashion discounter YOOX fell as the company missed earnings expectations. We continue to believe the company will benefit from its profitable partnerships with luxury fashion brands and the long-term growth opportunities for its web-based business strategy.

1 International Monetary Fund, World Economic Outlook: Legacies, Clouds, Uncertainties (October 2014).

9

Institutional Class HLMRX

Investor Class HLMSX

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Performance | | | | | |

| Average Annualized Total Returns (%) | | | | | | | |

| at September 30, 2014 | | | | | | | | | | | | | | | | | at October 31, 2014 | | | | |

| | | | | | | | | | |

| | | Inception

Date | | | 1 year | | | 3 years | | | 5 years | | | Since

Inception* | | | 1 year | | | 3 years | | | 5 years | | | Since

Inception* | |

Intl Small Companies Portfolio – Institutional Class | | | 6/30/11 | | | | 5.72 | | | | 16.16 | | | | – | | | | 6.76 | | | | 2.28 | | | | 12.80 | | | | – | | | | 6.42 | |

| | | | | | | | | | |

Intl Small Companies Portfolio – Investor Class | | | 3/26/07 | | | | 5.48 | | | | 15.89 | | | | 11.33 | | | | 6.04 | | | | 1.97 | | | | 12.54 | | | | 11.10 | | | | 5.89 | |

| | | | | | | | | | |

MSCI ACW ex-US Small Cap Index† | | | | | | | 4.54 | | | | 12.48 | | | | 8.32 | | | | 4.06 | | | | -0.99 | | | | 8.61 | | | | 8.03 | | | | 3.21 | |

* The since inception return of the MSCI ACW ex-US Small Cap Index is since 6/30/11. †The inception date of the Index is 6/1/07.

Performance data quoted represent past performance; past performance does not predict future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Portfolio may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (877) 435-8105 or visiting www.hardingloevnerfunds.com. The Portfolio imposes a 2% redemption fee on shares held 90 days or less. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

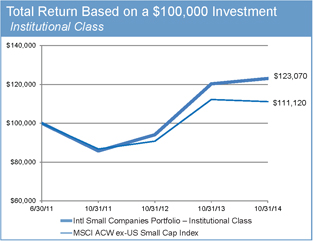

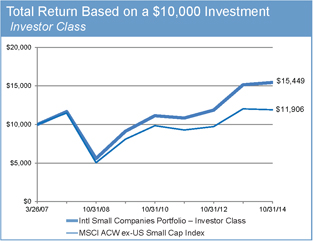

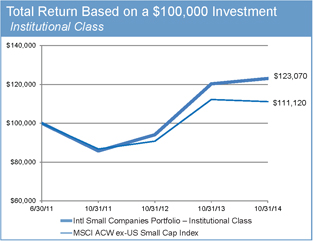

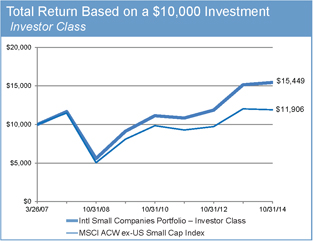

The charts below illustrate the hypothetical return of an investment made in the corresponding share classes. Investment return reflects voluntary fee waivers in effect. Absent such waivers, total return would be reduced. The performance provided in the table above and charts below do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

Viewed by region, most of our positive relative performance came from good stock selection, especially in European markets outside the EMU. In the UK, engineering and construction company Kentz accepted a favorable takeover offer from Canadian engineering services firm SNC Lavalin. Our Japanese holdings also helped, with especially good performance by noodle company and restaurant operator Hiday Hidaka. The company currently has about 300 restaurants, but in 2013 opened a new noodle factory that can support 600 restaurants, allowing the company to expand more broadly across Tokyo. We underperformed in the EMU because of poor stock picks in Italy (YOOX) and Spain. Spanish railway operator CAF underperformed as its Mexican projects were put on hold due to payment delays by customers.

Investment Perspectives

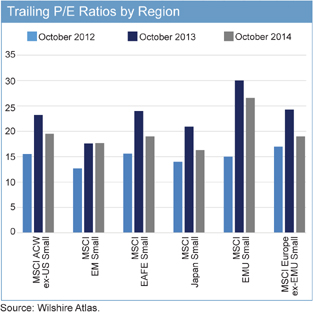

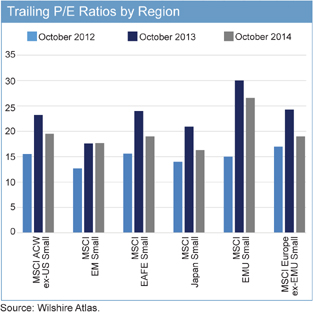

Over the past three fiscal years, the Index has posted a total return (net of source taxes) of over 28% through October 31, 2014. Given this solid performance, we would like to provide some perspective on current market valuations in the international small companies’ universe. Our primary method for determining valuations is to forecast a company’s long-term cash flows and discount them to the present day. However, price-to-earnings (P/E) ratios provide a useful shorthand for reviewing overall valuation trends. The following chart provides the average P/E ratios for

different regions within the Index, specifically EMs, developed markets (represented by the EAFE Small Cap Index), Japan, the EMU, and Europe ex-EMU.

10

International Small Companies Portfolio continued

As the chart indicates, valuations were not uniform across our investment universe at the end of the fiscal year. While P/E ratios broadly have declined since the end of 2013, they continue to be relatively rich in the euro zone, while valuations for international small companies in Japan, Europe ex-EMU and EMs appear more attractive. However, the low P/E ratio for stocks in Japan must be viewed in the context of the country’s relatively slow growth outlook. Prime Minister Shinzo Abe continues to struggle with balancing Japan’s fiscal deficits, and the government’s recent consumption tax hike has stymied growth. Similarly, while valuation ratios in the Europe ex-EMU region have come down, the pace of growth in the UK (the region’s largest economy, representing over 60% of the region’s market cap in the Index) slowed in the third quarter of calendar year 2014. Although the UK is in a better position than the rest of Europe, it is not immune to the economic woes facing the rest of the continent. P/E ratios for EM stocks, on the other hand, do look more attractive given the forecasts of relatively high economic growth for the region.

Our investment process does not focus on share price when beginning research on a company. Rather, we first spend our time identifying and verifying a company’s quality and growth characteristics, including evaluating its competitive position in its industry and the sustainability of this position over the long term. Only after we have confirmed that a company meets our criteria will we then emphasize valuation and strive to invest only when shares are attractively priced. Emerging and frontier markets have been especially fruitful for the Portfolio recently due to the combination of high-quality, growing companies available and reasonable share prices. As detailed in the next section, we made new investments this year in China and India. We think long-term opportunities for small companies in developing countries should be supported by investments in infrastructure, rising per-capita wealth, and increasing demand for diverse products and services.

Portfolio Highlights

China and India

Structural change is afoot in China, as its leaders seek to shift the economy from blistering growth based on exports toward sustainable growth supported by a strong domestic economy. Part of the government’s sustainability initiative has been an increased focus on controlling the country’s rampant pollution problem. Hong Kong-listed smart-meter manufacturer Wasion Group Holdings should be a beneficiary of this trend. Wasion is a market leader in the production of energy meters that are crucial for the efficient operation of large-scale “smart” energy grids, the data-driven, automated energy distribution systems used by utility companies to improve energy efficiency. China’s annual US$3 billion smart-grid market is the largest in the world. Currently, 60% of the meters in China are “smart,” but we believe that by 2020 all meters in China will be smart.

We also purchased shares of Shenzhou International Group—one of the world’s largest vertically integrated knitwear manufacturers—based in Ningbo, China. The company produces apparel for some of the globe’s most prominent textile and apparel companies, including Adidas, Uniqlo, Nike, and Puma. Producing the technical fibers used in these companies’ products can be complex, but Shenzhou meets the highest international quality standards. The process of producing textiles has historically required polluting large quantities of fresh water, but Shenzhou has been an innovator

| | | | | | | | |

| Sector Weightings (%) at October 31, 2014 | |

| Institutional and Investor Classes | |

| Sector | | | Portfolio | | | | Benchmark | 1 |

| | | |

Consumer Discretionary | | | 12.6 | | | | 17.1 | |

| | | |

Consumer Staples | | | 12.0 | | | | 6.2 | |

| | | |

Energy | | | 1.4 | | | | 4.9 | |

| | | |

Financials | | | 13.1 | | | | 21.2 | |

| | | |

Health Care | | | 10.7 | | | | 6.1 | |

| | | |

Industrials | | | 24.4 | | | | 19.7 | |

| | | |

Information Technology | | | 13.5 | | | | 10.6 | |

| | | |

Materials | | | 3.8 | | | | 10.5 | |

| | | |

Telecom Services | | | 3.5 | | | | 1.2 | |

| | | |

Utilities | | | 1.6 | | | | 2.5 | |

| | | |

Cash | | | 3.4 | | | | – | |

1MSCI All Country World ex-US Small Cap Index.

| | | | | | | | |

| Geographical Weightings (%) at October 31, 2014 | |

| Institutional and Investor Classes | |

| Country/Region | | | Portfolio | | | | Benchmark | 1 |

| | | |

Canada | | | 0.9 | | | | 8.6 | |

| | | |

Emerging Markets | | | 24.2 | | | | 22.5 | |

| | | |

Europe EMU | | | 23.1 | | | | 15.4 | |

| | | |

Europe ex-EMU | | | 18.5 | | | | 23.9 | |

| | | |

Japan | | | 16.0 | | | | 19.7 | |

| | | |

Middle East | | | 0.0 | | | | 0.7 | |

| | | |

Pacific ex-Japan | | | 9.2 | | | | 9.2 | |

| | | |

Frontier Markets2 | | | 3.1 | | | | – | |

| | | |

Other3 | | | 1.6 | | | | – | |

| | | |

Cash | | | 3.4 | | | | – | |

1MSCI All Country World ex-US Small Cap Index; 2Includes countries with less-developed markets outside the Index; 3Includes countries with developed markets outside the Index where some holdings are incorporated.

at developing sustainable manufacturing methods. We think the company’s efforts to limit pollution are a competitive advantage, as the Chinese government’s increasingly strict environmental standards should make it more difficult for less-sophisticated manufacturers to successfully compete in the textile industry.

Our third recent investment in China was AirTac, which produces pneumatic equipment used in manufacturing processes. This company is listed in Taiwan, but virtually all of its facilities are in China. The company has a large share of the the low- to mid-priced segment of the industry, giving it economies of scale that allow AirTac to offer lower costs compared to its competitors in China. AirTac also offers a uniquely large catalogue of over 90,000 different products, which is a competitive advantage in an industry where precise model specification is extremely important. We believe AirTac will be able to build on its advantages to enter new global markets (such as Japan), as well as gain from China’s long-term focus on industrial automation.

This year we made our first investment in India, a country that offers small companies significant opportunities but also operating

11

Institutional Class HLMRX

Investor Class HLMSX

challenges, including an underdeveloped infrastructure and overly bureaucratic government institutions. We are optimistic, however, that the election of Prime Minister Narendra Modi in May this year will help move the country toward greater regulatory efficiency and economic growth. Max India is a distinctive financial services company that focuses on life insurance; most of its competitors in India are financial conglomerates pursuing a variety of businesses including banking and wealth management. Max India is also notable for the relatively high productivity of its agents, its financial strength, and the successful track record of management. We believe the company should benefit from the long-term growth of India’s life insurance industry, which continues to have low market penetration. The amount spent per capita on premiums in India is less than half the overall average in emerging and frontier markets.2

Mergers and Acquisitions

The amount of mergers and acquisitions (M&A) activity globally has increased significantly in 2014 compared to recent years.3 This rising trend may be due to the modest growth prospects in many parts of the world—causing more companies to seek growth through acquisitions—as well as the high levels of cash on corporate balance sheets. Management teams also may be increasingly aware that the prevailing low-interest-rate environment allowing them to borrow cheaply for acquisitions will not last forever. The Portfolio has participated in this M&A surge, with holdings across a variety of industries becoming acquisition targets during the fiscal year, including Kentz (engineering and construction consulting), Goodpack (shipping crate leasing), SAI Global (business information services), and Vacon (industrial equipment).

We believe our Portfolio companies are favorable acquisition candidates due to their strong competitive positions in niche markets and healthy balance sheets. Finland-based Vacon, for instance, is the world’s only publically traded company specializing in the manufacture of AC drives used to control the speed and power of electric motors. This market is growing fast due partly to manufacturers’ increasing emphasis on industrial automation. Danfoss, a privately held multi-national based in Denmark, recognized Vacon’s recent share-price weakness as an opportunity to expand its own market position and offered a 20% premium to the average volume-weighted price of the past three months, which was roughly 15% above our estimate of the company’s fair value.

Our Portfolio companies have been on the other side of M&A transactions over the past 12 months as well. Academic research has shown that companies completing acquisitions often find their purchases generate lower returns than originally envisioned, causing their share prices to underperform as a result. We recognize that our Portfolio companies are not immune to this syndrome. However, we have also found that businesses that meet our high-quality criteria generally have been relatively strong capital allocators. In our research, we consider it particularly important to identify companies led by skillful managements with the ability to make successful strategic acquisitions to expand into new markets and enhance their companies’ long-term growth and return potential.

2Swiss Re, “World Insurance in 2012: Progressing on the Long and Winding Road to Recovery,” Sigma 3 (2013).

3Ed Hammond, “M&A Deals in 2014 Eclipse Levels in Past 5 Years,” Financial Times (September 30, 2014).

| | | | | | | | |

| Ten Largest Holdings at October 31, 2014 | |

| Institutional and Investor Classes | |

| Company | | Sector | | Country | | | % | |

Bechtle | | Info Technology | | Germany | | | 2.1 | |

| | | | |

Hiday Hidaka | | Cons Discretionary | | Japan | | | 2.1 | |

| | | | |

Synergy Health | | Health Care | | UK | | | 2.0 | |

| | | | |

Equity Bank | | Financials | | Kenya | | | 2.0 | |

| | | | |

Grafton Group | | Industrials | | UK | | | 1.9 | |

| | | | |

Industrial & Financial Systems | | Info Technology | | Sweden | | | 1.9 | |

| | | | |

Anadolu Hayat Emeklilik | | Financials | | Turkey | | | 1.8 | |

| | | | |

Wasion Group Holdings | | Info Technology | | China | | | 1.8 | |

| | | | |

Misumi Group | | Industrials | | Japan | | | 1.8 | |

| | | | |

Bank of Georgia | | Financials | | UK | | | 1.7 | |

We think one such example is pawnshop operator First Cash Financial, which has successfully sustained its growth in part by acquiring independent pawnshops to expand in the US and Mexico. The company also invests in new stores, which usually become profitable after the second year of operation. First Cash serves primarily the unbanked by offering short-term micro loans (usually with durations of only one month) to borrowers, who provide valuables such as jewelry or merchandise as collateral. Borrowers who default on loans lose their collateral, but do not face collection agencies or an impact on their credit ratings. About 70% of loans are fully repaid. First Cash is based in Texas; however, over 50% of its revenues are generated in Mexico, where it has 241 stores. Mexico is a favorable environment for the pawn shop model because 70% of the population is unbanked or under-banked, creating loan demand.4 The company has successfully grown revenue and earnings before interest and taxes at 15% annually over the past five years.

Another acquirer this year was Ingenico, a French-based electronic payment specialist and the world’s largest seller of point-of-sale (POS) terminals. The market for POS terminals is becoming saturated and, thus, increasingly reliant on replacement cycles for growth. Ingenico has responded by making acquisitions that supplement its hardware business and move the company into faster growth markets. In early 2013, Ingenico purchased Ogone, which is focused on preventing fraud in web transactions. And, in September, Ingenico finalized the acquisition of GlobalCollect, which offers merchants a payment platform software that allows them to optimize their cross-border ecommerce distribution. We value Ingenico’s operating track-record—it has grown income at 25% per year over the last five years—and its management’s continued ability to invest in new markets for future growth.

4First Cash Financial Services, “Investor Presentation” (September 2014).

Please read the separate disclosure page for important information, including the risks of investing in the Portfolio.

12

Emerging Markets

Portfolio Managers

| | |

G. Rusty Johnson, CFA Co-Lead Portfolio Manager Craig Shaw, CFA Co-Lead Portfolio Manager Scott Crawshaw Portfolio Manager Richard Schmidt, CFA Portfolio Manager | | |

The Institutional Emerging Markets Portfolio (Class I and Class II) and the Emerging Markets Portfolio – Advisor Class (collectively, the “Portfolios”) are both managed in strict accordance with the Emerging Markets Strategy Model Portfolio. The Portfolios, therefore, have highly similar holdings and characteristics. We have provided a single commentary to cover both Portfolios. The specific performance and characteristics of each are presented separately in the tables that follow.

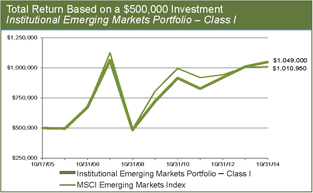

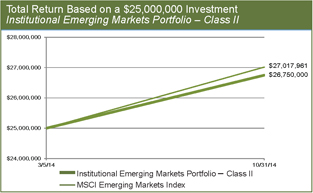

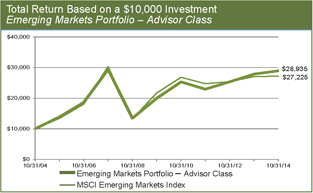

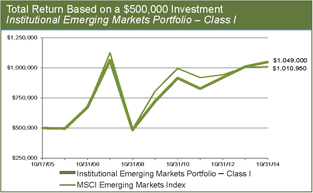

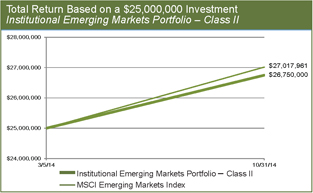

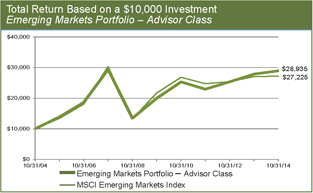

Performance Summary

The Institutional Emerging Markets Portfolio – Class I rose 3.80% and the Emerging Markets Portfolio – Advisor Class gained 3.79% (net of fees and expenses) in the fiscal year ended October 31, 2014. The Portfolios’ benchmark, the MSCI Emerging Markets Index (the “Index”), rose 0.64% (net of source taxes) in this period. The Institutional Emerging Markets Portfolio – Class II, which incepted in March 2014, has gained 7.00% (net of fees and expenses) since inception through October 31, 2014; the Index rose 8.07% (net of source taxes) in this period.

Market Review

Though a 0.6% return for the Index over twelve months may strike EM investors as some type of market paralysis, this muted return is noteworthy in that the MSCI Emerging Markets Index bettered Developed Markets (DMs) over this period after several years of underperformance: the MSCI EAFE Index lost 0.6% in the trailing twelve months. The tide shifted in March, and the 2Q14 calendar quarter (April 1st to June 30th) represented the first quarter in which EMs outperformed DMs since the third calendar quarter of 2012.

The macro backdrop has improved with economic variables across many EMs taking a more positive trajectory, a testament to some proactive steps made by policy makers. Specifically, current account deficits improved over the first half of 2014 in four of the “Fragile Five:” Turkey, India, Indonesia, and South Africa. Finally, “taper talk�� was of little influence on market returns this year. We believe that after the broad market impact of the taper tantrum of 2013, most of the negativity stemming from this influence has been seen already.

There was wide dispersion in returns across the largest countries: Brazil and South Korea lost 9% and 7%, respectively, while China gained 7% and Taiwan was up nearly 11%. Overall, EM currencies were a modest drag on returns for dollar-based investors, though the Chinese renminbi, the Korean won, and the Taiwanese dollar fared better than many of their peers, at least partially due to stronger macroeconomic fundamentals in these countries. The Indian election in

| | | | | | |

| Portfolio Facts at October 31, 2014 |

Sales Charge | | | | | | None |

Number of Holdings | | | | | | 79 |

Redemption Fee | | | | | | 2% first 90 days |

Dividend Policy | | | | | | Annual |

| | | Institutional | | | | Advisor |

Portfolio Assets | | $1,715.7M | | | | $2,545.5M |

Turnover (5 Yr. Average) | | 35% | | | | 30% |