|

SEMI-ANNUAL REPORT MARCH 31, 2013 |

APRIL 2013

DEAR SHAREHOLDER: Enclosed is your semi-annual report for The Marsico Investment Fund, encompassing the six-month fiscal period from October 1, 2012 to March 31, 2013. The purpose of this report is to provide a review of the Marsico Funds’ six-month investment results by discussing what we believe were the main areas that impacted performance – including the macroeconomic environment, sector and industry positioning, and individual stock selection – as compared to the Funds’ performance benchmark indexes. For updated information regarding the market environment and the Funds’ overall investment postures and performance, please refer to the Funds’ most recent monthly fact sheets and quarterly investment updates, which are available under the name of each Fund on the Funds’ website at www.marsicofunds.com. |

| | KEY FUND STATISTICS | 2 | |

| | MARKET ENVIRONMENT | 5 | |

| | | | |

| | |

| | Investment Review | 6 | |

| | Fund Overview | 9 | |

| | Schedule of Investments | 10 | |

| | | | |

| | |

| | Investment Review | 6 | |

| | Fund Overview | 11 | |

| | Schedule of Investments | 12 | |

| | | | |

| | MARSICO 21st CENTURY FUND |

| | Investment Review | 14 | |

| | Fund Overview | 16 | |

| | Schedule of Investments | 17 | |

| | | | |

| | MARSICO INTERNATIONAL OPPORTUNITIES FUND |

| | Investment Review | 19 | |

| | Fund Overview | 21 | |

| | Schedule of Investments | 22 | |

| | | | |

| | MARSICO FLEXIBLE CAPITAL FUND |

| | Investment Review | 24 | |

| | Fund Overview | 26 | |

| | Schedule of Investments | 27 | |

| | | | |

| | |

| | Investment Review | 29 | |

| | Fund Overview | 31 | |

| | Schedule of Investments | 32 | |

| | | | |

| | FINANCIAL STATEMENTS | 34 | |

| | NOTES TO FINANCIAL STATEMENTS | 44 | |

| | EXPENSE EXAMPLE | 53 | |

| | CONSIDERATION OF INVESTMENT ADVISORY AGREEMENTS | 54 | |

| | OTHER INFORMATION | 57 | |

| |

| KEY FUND STATISTICS (UNAUDITED) |

| |

Marsico Focus Fund | Marsico Growth Fund | Marsico 21st Century Fund |

| MFOCX | MGRIX | MXXIX |

| For additional disclosures, please see page 9. | For additional disclosures, please see page 11. | For additional disclosures, please see page 16. |

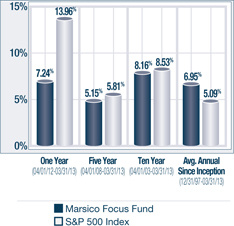

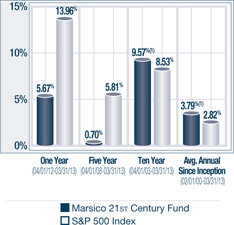

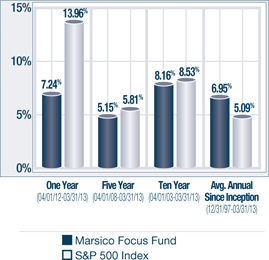

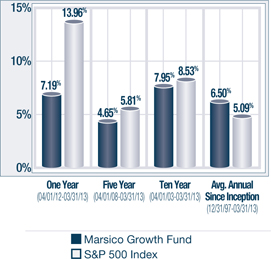

PERFORMANCE COMPARISON(1) | PERFORMANCE COMPARISON(1) | PERFORMANCE COMPARISON(1) |

| | |

TOTAL ANNUAL OPERATING

EXPENSES* 1.34% | TOTAL ANNUAL OPERATING

EXPENSES* 1.35% | TOTAL ANNUAL OPERATING

EXPENSES* 1.42% |

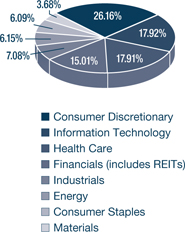

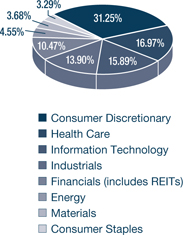

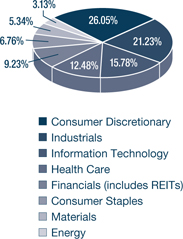

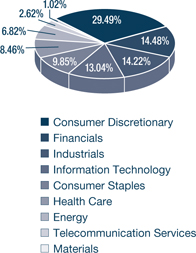

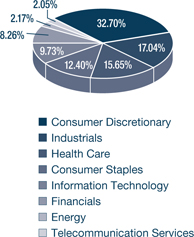

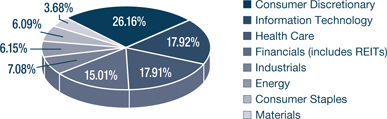

SECTOR ALLOCATION(2) | SECTOR ALLOCATION(2) | SECTOR ALLOCATION(2) |

| | |

| TOP FIVE HOLDINGS | TOP FIVE HOLDINGS | TOP FIVE HOLDINGS |

| GILEAD SCIENCES, INC. | 5.71% | GILEAD SCIENCES, INC. | 5.25% | BIOGEN IDEC INC. | 3.77% |

| BIOGEN IDEC INC. | 5.43% | BRISTOL-MYERS SQUIBB COMPANY | 4.38% | GILEAD SCIENCES, INC. | 3.72% |

| BRISTOL-MYERS SQUIBB COMPANY | 4.72% | BIOGEN IDEC INC. | 4.29% | MONSANTO COMPANY | 3.42% |

| VISA, INC. - CL. A | 4.42% | EBAY, INC. | 4.27% | LOWE'S COMPANIES, INC. | 3.26% |

| EBAY, INC. | 4.35% | GOOGLE, INC. - CL. A | 3.12% | PRECISION CASTPARTS CORP. | 3.06% |

For additional disclosures about the Marsico Funds, please see page 4. The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

| |

| KEY FUND STATISTICS (UNAUDITED) |

| |

Marsico International Opportunities Fund | Marsico Flexible Capital Fund | Marsico Global Fund |

| MIOFX | MFCFX | MGLBX |

| For additional disclosures, please see page 21. | For additional disclosures, please see page 26. | For additional disclosures, please see page 31. |

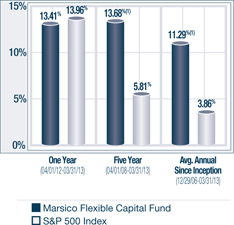

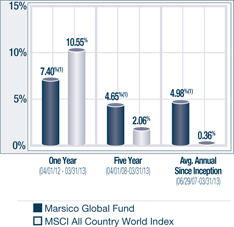

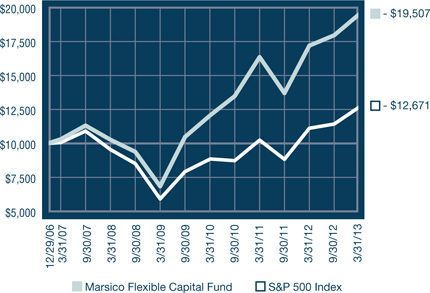

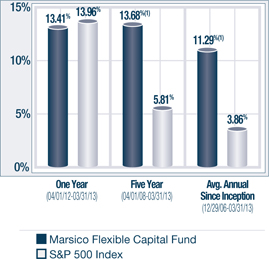

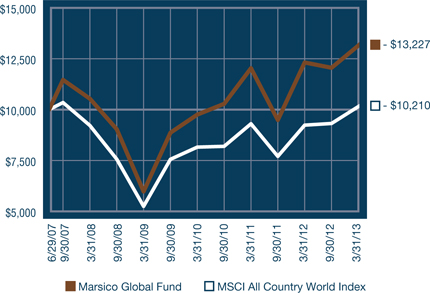

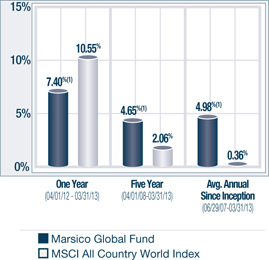

PERFORMANCE COMPARISON(1) | PERFORMANCE COMPARISON(1) | PERFORMANCE COMPARISON(1) |

| | |

TOTAL ANNUAL OPERATING

EXPENSES* 1.65% NET EXPENSES*† 1.60% | TOTAL ANNUAL OPERATING

EXPENSES* 1.44% | TOTAL ANNUAL OPERATING

EXPENSES* 1.71% NET EXPENSES*† 1.61% |

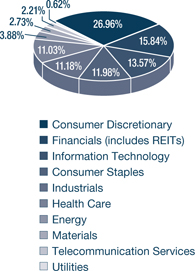

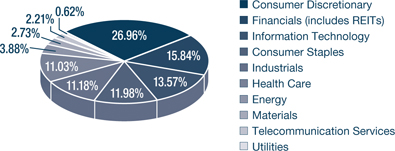

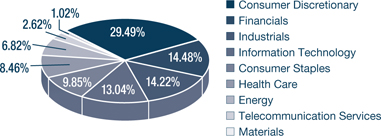

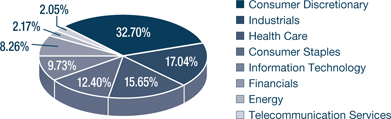

SECTOR ALLOCATION(2) | SECTOR ALLOCATION(2) | SECTOR ALLOCATION(2) |

| | |

| TOP FIVE HOLDINGS | TOP FIVE HOLDINGS | TOP FIVE HOLDINGS |

| LIBERTY GLOBAL, INC. SERIES C | 3.25% | LIBERTY GLOBAL, INC. SERIES C | 4.39% | ROCHE HOLDING AG | 4.95% |

| ROCHE HOLDING AG | 2.99% | AUTOZONE, INC. | 4.08% | ROLLS-ROYCE HOLDINGS PLC | 4.58% |

| NESTLÉ S.A. | 2.93% | LOWE'S COMPANIES, INC. | 3.95% | BIOGEN IDEC INC. | 3.90% |

| DIAGEO PLC | 2.73% | MONDELEZ INTERNATIONAL, INC. - CL. A | 3.76% | EBAY, INC. | 3.76% |

| TELECITY GROUP PLC | 2.72% | UNITED RENTALS, INC. | 2.97% | GOOGLE, INC. - CL. A | 3.62% |

Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com. A redemption fee may be imposed on redemptions or exchanges of Fund shares held for 30 days or less.

| |

| KEY FUND STATISTICS (UNAUDITED) |

| |

ADDITIONAL DISCLOSURES ABOUT THE MARSICO FUNDS

| * | The Total Annual Operating Expenses and Net Expenses are reflective of the information disclosed in the Funds’ Prospectus dated February 1, 2013. The information may differ from the expense ratios disclosed in this report. |

| † | Marsico Capital Management, LLC (the “Adviser”) has entered into a written expense limitation and fee waiver agreement under which it has agreed to limit the total expenses of each of the International Opportunities Fund and the Global Fund (excluding interest, taxes, acquired fund fees and expenses, litigation, brokerage and extraordinary expenses) to an annual rate of 1.60% of each Fund’s average net assets until January 31, 2014. This expense limitation and fee waiver agreement may be terminated by the Adviser at any time after January 31, 2014, upon 15 days prior notice to the Fund and its administrator. The Adviser may recoup from a Fund fees previously waived or expenses previously reimbursed by the Adviser with respect to that Fund pursuant to this agreement (or a previous expense limitation agreement) if such reimbursement does not cause the Fund to exceed the expense limitation currently in effect and the reimbursement is made within three years after the year in which the Adviser waived the fee or reimbursed the expense. |

| (1) | The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com. A redemption fee may be imposed on redemptions or exchanges of Fund shares held for 30 days or less. |

| | The performance included in the chart does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares. |

| | All indices are unmanaged and investors cannot invest directly in an index. |

| | The performance returns for the 21st Century Fund (for the period prior to March 31, 2004), the International Opportunities Fund (for the period prior to September 30, 2004 and from October 2011 through March 2013), the Flexible Capital Fund (for the period prior to February 1, 2011), and the Global Fund (for the period prior to January 1, 2009, from April 2009 through May 2009 and from January 2012 through March 2013) reflect a fee waiver in effect; in the absence of such a waiver, the returns would be reduced. The performance returns for the 21st Century Fund (for the period beginning April 2004 through January 2005), the International Opportunities Fund (for the period beginning October 2004 through December 2005), and the Global Fund (for the one-month period June 2009) would have been higher but for the reimbursement of fees waived previously. |

| (2) | Sector weightings represent the percentage of the respective Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

MARKET ENVIRONMENT: OCTOBER 2012 – MARCH 2013 (UNAUDITED)

Equities markets were able to surmount policy-related uncertainty and responded favorably to a variety of stabilizing and improving economic data and ultra-accommodative central bank policy around the globe. Stocks posted solid gains for the six-month fiscal period ended March 31, 2013, albeit with considerable intra-period volatility.

US equities were pressured by a tightly-contested, contentious Presidential election and worries regarding the “fiscal cliff” tax increases and spending cut machinations in Washington. However, those negative forces were counterbalanced by a number of solid corporate earnings reports and generally improving economic data. The market was buoyed by optimism that the US housing recovery is entrenched and that employers are starting to hire again. The S&P 500 Index ended the period at 1,569, eclipsing its previous nominal high of 1,565 set on October 9, 2007. At March 31, 2013, the index had recouped its entire decline associated with the financial crisis and recession, and ended up 132% (on a price return basis) since the low of 677 reached on March 9, 2009.

Central bank intervention remained at the forefront. Federal Reserve Chairman Ben Bernanke and European Central Bank President Mario Draghi made it clear that they continue to support accommodative monetary policies. Based on the significant increase in assets on central bank balance sheets, it appears that many of the world’s central bankers have joined the fight against deflation. The newest entrant to the fray, the Bank of Japan, vowed to double its holdings of government bonds and double the amount of yen circulating in the economy. Such policy moves, in our view, seemed to overshadow troubles such as Cyprus’s banking crisis, an inconclusive Italian election and continued political discord in Washington.

As depicted in the table below, developed market equities posted strong returns for the six-month period ended March 31, 2013, while emerging markets experienced muted gains:

Index Name(1) | Universe of Equities Represented | Six-Month

Total Return |

| US | | |

| S&P 500 | US large-capitalization equities | +10.19% |

| Russell 3000 | US publicly-traded equities of all sizes | +11.35% |

| Russell 2000 | US small-capitalization equities | +14.48% |

| Russell Mid-Cap | US medium-capitalization equities | +16.21% |

Index Name(1) | Universe of Equities Represented | Six-Month

Total Return |

| INTERNATIONAL | |

| MSCI EAFE (US$) | Equities in developed international equity markets, including Japan, Western Europe, and Australasia | +12.04% |

| MSCI Emerging Markets (US$) | Equities in developing international equity markets, including China, India, Eastern Europe, and Latin America | +3.86% |

| MSCI ACWI (US$) | Equities in the global developed and emerging markets | +9.57% |

In terms of the underlying dynamics of US equity market performance, small- and mid-capitalization stocks outperformed large-capitalization stocks.

In emerging markets, concerns regarding slower growth and rising inflation resulted in relatively weak performance. China’s industrial production showed signs of slowing during the period, leading investors to question the direction of the Chinese economy going forward. India’s economy appeared to be on track to register its slowest growth rate in more than a decade. Brazil, meanwhile, has been challenged by rising inflation and high levels of consumer debt.

From a currency perspective, a number of major foreign currencies experienced sizeable fluctuations. One of the most notable was the weakening of the Japanese yen. Newly-elected Japanese officials took steps to weaken the yen in an effort to help stimulate Japan’s economy. The euro generally strengthened intra-period before moving lower as compared to the US dollar during the last two months of the reporting period. The US dollar, meanwhile, moved higher as compared to major world currencies during the late-stages of the reporting period. An appreciating US dollar dampened returns of US investors in foreign securities.

THE MARSICO INVESTMENT TEAM

| (1) | All indices are unmanaged and investors cannot invest directly in an index. |

INVESTMENT REVIEW BY TOM MARSICO AND CORALIE WITTER (UNAUDITED)

The Marsico Focus Fund and the Marsico Growth Fund generated total returns of +9.65% and +8.51%, respectively, for the six-month fiscal period ended March 31, 2013. While the Funds posted strong gains, both Funds’ performance lagged their benchmark index, the S&P 500 Index, which had a total return of +10.19% for the six-month period ended March 31, 2013. Please see the Funds’ Overviews for more detailed information about each Fund’s longer-term performance for various periods ended March 31, 2013.

The performance data for the Funds quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.(1)

This review highlights Fund performance over a six-month fiscal period. Shareholders should keep in mind that the Funds are intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our views on all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Funds may not necessarily hold these securities or investments today. Please see the accompanying Schedules of Investments for the percentage of each Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period.

The Focus Fund is non-diversified and may hold fewer securities than a diversified fund because it is permitted to invest a greater percentage of its assets in a smaller number of securities. Holding fewer securities increases the risk that the value of the Fund could go down because of the poor performance of a single investment. The Funds and the stocks and markets in which they invest are subject to general risks that include periods of turbulence, instability, decline, and cyclical change, and that investors may continue to avoid investments in equity securities generally. Please see the Prospectus for more information.

The Focus Fund and the Growth Fund often invest in similar growth companies. Their performance may differ at times, however, because of a variety of factors. Among other factors, the Focus Fund is a non-diversified mutual fund that may invest in a more concentrated portfolio and may hold the securities of fewer issuers than the Growth Fund. As a result, the Focus Fund may hold some securities that are different from those held by the Growth Fund, and may be more exposed to individual stock volatility than the Growth Fund or other mutual funds that invest in a larger number of securities.

FOCUS FUND

The Marsico Focus Fund moderately underperformed the S&P 500 Index for the six-month fiscal period ended March 31, 2013. Stock selection in the Consumer Discretionary and Financials sectors, as defined under the Global Industry Classification Standard (“GICS”)(2), constituted primary detractors from performance.

Several of the Fund’s primary performance detractors included positions in “value proposition” retailers such as Dollar General Corporation (-15% prior to being sold) and The TJX Companies, Inc. (+5%) whose returns did not keep up with the +14% return of the S&P 500 Index Consumer Discretionary sector. Retailing companies, especially those with a globally-oriented business model, were challenged by the potential impact of slowing economic activity levels in general and more subdued consumer discretionary spending in particular. Other laggards within the sector included restaurant companies Chipotle Mexican Grill, Inc. (+3%) and McDonald’s Corporation (+10%).

The collective return of the Fund’s Financials positions, +10%, lagged the +18% return of the S&P 500 Index Financials sector. U.S. Bancorp (-3%) declined prior to being sold from the Fund. An underweight allocation to the strong-performing sector further hampered performance results.

Certain individual holdings adversely impacted results, including Mead Johnson Nutrition Company (-19%), Express Scripts Holding Company (-15%) and VMware, Inc. – Cl. A (-20%). All three positions posted double-digit negative returns and were sold from the Fund during the period.

The Fund’s performance was aided by stock selection and overweight allocation to the Health Care sector. The Fund’s Health Care positions posted a collective return of +23% and significantly surpassed the +16% return of the respective benchmark index sector. A number of the Fund’s pharmaceuticals and biotechnology holdings generated strong returns including Gilead Sciences, Inc. (+47%), Biogen Idec Inc. (+29%), Celgene Corporation (+25%) and Bristol-Myers Squibb Company (+24%). The Fund further benefitted from having an overweight allocation to Health Care, as it was a strong-performing sector of the S&P 500 Index.

Stock selection in the Information Technology and Materials sectors also buoyed the Fund’s results. Apple, Inc. was the largest constituent of the S&P 500 Index and was also a significant holding in the Fund early in the reporting period. The Fund began selling Apple in the second half of 2012 and sold completely out of the stock in January 2013. Though Apple declined -27% prior to being sold from the Fund, the Fund’s performance benefitted from selling Apple before further stock price declines. We felt Apple’s product pipeline was lacking a major catalyst and, perhaps more importantly, believed that the company may not have recurring revenues. Financial transaction processor Visa, Inc. – Cl. A (+27%) was another leading contributor to Fund performance in the Information Technology sector. Within Materials, agricultural materials company Monsanto Company (+17%) was a strong performer as it benefitted from increased use of its US corn and soybean products, as well as strong performance in its international seeds business.

From a sector allocation standpoint, the Fund benefitted from having a significant overweight allocation to the strong-performing Consumer Discretionary sector while refraining from investments in the Telecommunication Services sector, which was a weak-performing sector of the S&P 500 Index.

During the period, the Fund reduced its exposure to the Information Technology and Consumer Discretionary sectors while increasing its allocations to the Financials, Energy, Industrials, Health Care and Consumer Staples sectors.

GROWTH FUND

The Marsico Growth Fund underperformed the S&P 500 Index and shared several of the Focus Fund’s performance attributes for the six-month fiscal period ended March 31, 2013.

The Growth Fund’s Financials holdings posted an aggregate return of +7% and lagged the +18% return of the S&P 500 Index Financials sector. Financials was the strongest-performing sector of the benchmark index, and the Fund’s underweight allocation to the sector further detracted from performance.

Stock selection in the Consumer Discretionary and Energy sectors was also weak. Discount retailer Dollar General Corporation (-16% prior to being sold) and athletic apparel company lululemon athletica, inc. (-15%) posted disappointing returns. National Oilwell Varco, Inc., a provider of equipment for oil and gas drilling and production, slid -17% and was sold from the Fund.

Other individual holdings also weighed on results, including software firm VMware, Inc. – Cl. A (-38%), pharmacy benefit company Express Scripts Holding Company (-15%) and nutritional products company Mead Johnson Nutrition Company (-18%). All three positions were sold from the Fund prior to period-end.

At times during the period, the Growth Fund held a slightly elevated level of cash. The uninvested cash weighed on performance to some degree as the equity market posted gains. (The Fund’s benchmark index holds no cash.)

There were several positive performance factors for the Fund. Stock selection in the Materials and Health Care sectors contributed to Fund results. Within Materials, specialty chemical firm LyondellBasell Industries N.V. – Cl. A (+30%) and agricultural materials company Monsanto Company (+17%) were strong performers. LyondellBasell’s ethylene margins increased during the period, driven by lower feedstock costs in the US, as ethane supply continued to outpace demand. Monsanto benefitted from increased use of its US corn and soybean products, as well as strong performance in its international seeds business. Leading Health Care holdings included drug companies Gilead Sciences, Inc. (+46%), Biogen Idec Inc. (+29%) and Bristol-Myers Squibb Company (+23%).

Like the Focus Fund, the Growth Fund was aided by having a significant portion of its net assets invested in the strong-performing Consumer Discretionary sector while refraining from investments in the weak-performing Telecommunication Services sector. Also similar to the Focus Fund, the Growth Fund benefitted from selling its position in Apple, Inc. (-23%) during the period.

Other individual holdings making meaningful positive contributions to performance included media company CBS Corporation – Cl. B (+30%) and financial transaction processor Visa, Inc. – Cl. A (+27%).

During the period, the Fund increased its exposure to the Industrials, Health Care and Financials sectors while paring back its exposure to the Information Technology, Energy, Consumer Discretionary and Consumer Staples sectors.

Fiscal Period-End Investment Posture

As of March 31, 2013, the Focus Fund’s and the Growth Fund’s largest sector allocations included Consumer Discretionary, Information Technology, Health Care, Financials and Industrials. The Funds had no exposure to the Utilities and Telecommunication Services sectors.

Sincerely,

THOMAS F. MARSICO

CORALIE T. WITTER, CFA

PORTFOLIO MANAGERS

| (1) | Total returns are based on net change in net asset value assuming reinvestment of distributions. A redemption fee of 2% may be imposed on redemptions or exchanges of Fund shares owned for 30 days or less. Please see the Prospectus for more information. |

| (2) | Regarding GICS data cited throughout this report, the Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s (“S&P”) and is licensed for use by Marsico Capital Management, LLC (“MCM”). Neither MSCI, S&P, nor MCM or any third party involved in compiling GICS makes any express or implied warranties or representations with respect to such standard or classification (or the results from use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any such standard or classification. MSCI, S&P, MCM, and any of their affiliates or third parties involved in compiling GICS shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. |

March 31, 2013 (Unaudited)

The Focus Fund invests primarily in the common stocks of large companies, normally a core position of 20–30 common stocks that are selected for their long-term growth potential.

| TOTAL ANNUAL OPERATING EXPENSES* 1.34% | NET ASSETS $871,592,681 | NET ASSET VALUE PER SHARE $19.32 |

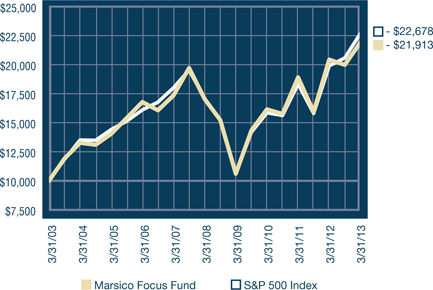

GROWTH OF $10,000(1) | PERFORMANCE COMPARISON |

| |

SECTOR ALLOCATION(2) | TOP FIVE HOLDINGS |

| | |

| GILEAD SCIENCES, INC. | 5.71% |

| BIOGEN IDEC INC. | 5.43% |

| BRISTOL-MYERS SQUIBB COMPANY | 4.72% |

| VISA, INC. - CL. A | 4.42% |

| EBAY, INC. | 4.35% |

| | |

| * | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ Prospectus dated February 1, 2013 and may differ from the expense ratio disclosed in this report. |

| | The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com. A redemption fee may be imposed on redemptions or exchanges of Fund shares held for 30 days or less. |

| | The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares. |

| | All indices are unmanaged and investors cannot invest directly in an index. |

| (1) | This chart assumes an initial investment of $10,000 made on March 31, 2003. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

| (2) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

MARSICO FOCUS FUND

SCHEDULE OF INVESTMENTS

March 31, 2013 (Unaudited)

| | | Number of Shares | | | Value | | | Percent of Net Assets | |

| COMMON STOCKS | | | | | | | | | |

| Aerospace & Defense | | | | | | | | | |

| Precision Castparts Corp. | | | 150,564 | | | $ | 28,549,946 | | | | 3.28 | % |

| | | | | | | | | | | | | |

| Apparel Retail | | | | | | | | | | | | |

| The TJX Companies, Inc. | | | 574,973 | | | | 26,879,988 | | | | 3.08 | |

| | | | | | | | | | | | | |

| Automotive Retail | | | | | | | | | | | | |

| AutoZone, Inc.* | | | 55,311 | | | | 21,945,745 | | | | 2.52 | |

| | | | | | | | | | | | | |

| Biotechnology | | | | | | | | | | | | |

| Biogen Idec Inc.* | | | 245,240 | | | | 47,309,249 | | | | 5.43 | |

| Celgene Corporation* | | | 116,575 | | | | 13,512,208 | | | | 1.55 | |

| Gilead Sciences, Inc.* | | | 1,016,944 | | | | 49,759,070 | | | | 5.71 | |

| | | | | | | | 110,580,527 | | | | 12.69 | |

| Brewers | | | | | | | | | | | | |

| Anheuser-Busch InBev N.V. Spon. ADR | | | 266,562 | | | | 26,536,247 | | | | 3.04 | |

| | | | | | | | | | | | | |

| Cable & Satellite | | | | | | | | | | | | |

| Comcast Corporation - Cl. A | | | 441,004 | | | | 18,526,578 | | | | 2.13 | |

| | | | | | | | | | | | | |

| Casinos & Gaming | | | | | | | | | | | | |

| Wynn Resorts Ltd. | | | 217,591 | | | | 27,233,690 | | | | 3.12 | |

| | | | | | | | | | | | | |

| Construction & Farm Machinery & Heavy Trucks | | | | | |

| Cummins, Inc. | | | 98,289 | | | | 11,382,849 | | | | 1.31 | |

| | | | | | | | | | | | | |

| Consumer Finance | | | | | | | | | | | | |

| American Express Company | | | 363,355 | | | | 24,511,928 | | | | 2.81 | |

| | | | | | | | | | | | | |

| Data Processing & Outsourced Services | | | | | |

| Visa, Inc. - Cl. A | | | 227,000 | | | | 38,553,680 | | | | 4.42 | |

| | | | | | | | | | | | | |

| Diversified Banks | | | | | | | | | | | | |

| Wells Fargo & Company | | | 946,455 | | | | 35,009,370 | | | | 4.02 | |

| | | | | | | | | | | | | |

| Fertilizers & Agricultural Chemicals | | | | | |

| Monsanto Company | | | 302,461 | | | | 31,948,955 | | | | 3.67 | |

| | | | | | | | | | | | | |

| Footwear | | | | | | | | | | | | |

| NIKE, Inc. - Cl. B | | | 436,622 | | | | 25,765,064 | | | | 2.96 | |

| | | | | | | | | | | | | |

| Health Care Equipment | | | | | | | | | | | | |

| Intuitive Surgical, Inc.* | | | 7,527 | | | | 3,697,187 | | | | 0.42 | |

| | | | | | | | | | | | | |

| Home Improvement Retail | | | | | | | | | | | | |

| Lowe's Companies, Inc. | | | 494,938 | | | | 18,768,049 | | | | 2.15 | |

| The Home Depot, Inc. | | | 444,615 | | | | 31,025,235 | | | | 3.56 | |

| | | | | | | | 49,793,284 | | | | 5.71 | |

| Hypermarkets & Super Centers | | | | | | | | | |

| Wal-Mart Stores, Inc. | | | 351,257 | | | | 26,284,561 | | | | 3.02 | |

| | | | | | | | | | | | | |

| Internet Software & Services | | | | | | | | | |

| eBay, Inc.* | | | 699,257 | | | | 37,913,715 | | | | 4.35 | |

| Equinix, Inc.* | | | 78,272 | | | | 16,931,016 | | | | 1.94 | |

| Google, Inc. - Cl. A* | | | 46,233 | | | | 36,710,389 | | | | 4.21 | |

| | | | | | | | 91,555,120 | | | | 10.50 | |

| IT Consulting & Other Services | | | | | | | | | |

| Accenture plc - Cl. A | | | 334,085 | | | | 25,380,437 | | | | 2.91 | |

| | | | | | | | | | | | | |

COMMON STOCKS (continued) | | | | | | | | | |

| Multi-Line Insurance | | | | | | | | | | | | |

| American International Group, Inc.* | | | 688,069 | | | $ | 26,710,839 | | | | 3.06 | % |

| | | | | | | | | | | | | |

| Oil & Gas Equipment & Services | | | | | | | | | |

| Schlumberger Ltd. | | | 272,215 | | | | 20,386,181 | | | | 2.34 | |

| | | | | | | | | | | | | |

| Oil & Gas Storage & Transportation | | | | | | | | | |

| Kinder Morgan, Inc. | | | 852,915 | | | | 32,990,752 | | | | 3.79 | |

| | | | | | | | | | | | | |

| Other Diversified Financial Services | | | | | | | | | |

| Citigroup, Inc. | | | 609,120 | | | | 26,947,469 | | | | 3.09 | |

| | | | | | | | | | | | | |

| Pharmaceuticals | | | | | | | | | | | | |

| Bristol-Myers Squibb Company | | | 998,277 | | | | 41,119,030 | | | | 4.72 | |

| | | | | | | | | | | | | |

| Railroads | | | | | | | | | | | | |

| Union Pacific Corporation | | | 151,075 | | | | 21,514,591 | | | | 2.47 | |

| | | | | | | | | | | | | |

| Restaurants | | | | | | | | | | | | |

| Chipotle Mexican Grill, Inc.* | | | 55,490 | | | | 18,082,526 | | | | 2.07 | |

| McDonald's Corporation | | | 184,082 | | | | 18,351,135 | | | | 2.11 | |

| Starbucks Corporation | | | 358,008 | | | | 20,392,136 | | | | 2.34 | |

| | | | | | | | 56,825,797 | | | | 6.52 | |

| Specialized REITs | | | | | | | | | | | | |

| American Tower Corporation - Cl. A | | | 222,424 | | | | 17,108,854 | | | | 1.96 | |

| | | | | | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | | | | | |

| (Cost $652,228,700) | | | | | | | 867,738,669 | | | | 99.56 | |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS | | | | | | | | | |

| State Street Institutional U.S. Government Money Market Fund, 0.039% | | | 11,546,751 | | | | 11,546,751 | | | | 1.32 | |

| | | | | | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | |

| (Cost $11,546,751) | | | | | | | 11,546,751 | | | | 1.32 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS | | | | | | | | | | | | |

| (Cost $663,775,451) | | | | | | | 879,285,420 | | | | 100.88 | |

| | | | | | | | | | | | | |

| Liabilities, Less Cash and Other Assets | | | | | | | (7,692,739 | ) | | | (0.88 | ) |

| | | | | | | | | | | | | |

| NET ASSETS | | | | | | $ | 871,592,681 | | | | 100.00 | % |

| | See notes to financial statements. |

March 31, 2013 (Unaudited)

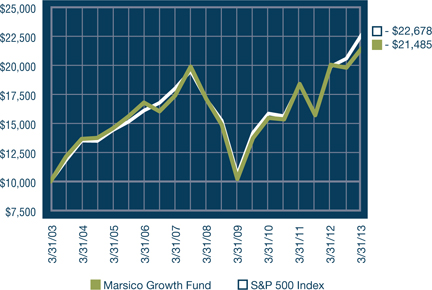

The Growth Fund invests primarily in the common stocks of large companies that are selected for their long-term growth potential. The Growth Fund will normally hold a core position of between 35 and 50 common stocks.

| TOTAL ANNUAL OPERATING EXPENSES* 1.35% | NET ASSETS $653,031,284 | NET ASSET VALUE PER SHARE $22.46 |

GROWTH OF $10,000(1) | PERFORMANCE COMPARISON |

| |

SECTOR ALLOCATION(2) | TOP FIVE HOLDINGS |

| | |

| GILEAD SCIENCES, INC. | 5.25% |

| BRISTOL-MYERS SQUIBB COMPANY | 4.38% |

| BIOGEN IDEC INC. | 4.29% |

| EBAY, INC. | 4.27% |

| GOOGLE, INC. - CL. A | 3.12% |

| | |

| * | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ Prospectus dated February 1, 2013 and may differ from the expense ratio disclosed in this report. |

| | The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com. A redemption fee may be imposed on redemptions or exchanges of Fund shares held for 30 days or less. |

| | The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares. |

| | All indices are unmanaged and investors cannot invest directly in an index. |

| (1) | This chart assumes an initial investment of $10,000 made on March 31, 2003. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

| (2) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

MARSICO GROWTH FUND

SCHEDULE OF INVESTMENTS

March 31, 2013 (Unaudited)

| | | Number of Shares | | | Value | | | Percent of Net Assets | |

| COMMON STOCKS | | | | | | | | | |

| Aerospace & Defense | | | | | | | | | |

| Precision Castparts Corp. | | | 77,888 | | | $ | 14,769,123 | | | | 2.26 | % |

| Rolls-Royce Holdings PLC* | | | 427,643 | | | | 7,342,537 | | | | 1.13 | |

| | | | | | | | 22,111,660 | | | | 3.39 | |

| Apparel Retail | | | | | | | | | | | | |

| The TJX Companies, Inc. | | | 281,547 | | | | 13,162,322 | | | | 2.02 | |

| | | | | | | | | | | | | |

| Apparel, Accessories & Luxury Goods | | | | | |

| lululemon athletica, inc.* | | | 116,485 | | | | 7,262,840 | | | | 1.11 | |

| | | | | | | | | | | | | |

| Application Software | | | | | | | | | | | | |

| Intuit, Inc. | | | 95,373 | | | | 6,261,237 | | | | 0.96 | |

| | | | | | | | | | | | | |

| Automotive Retail | | | | | | | | | | | | |

| AutoZone, Inc.* | | | 44,947 | | | | 17,833,621 | | | | 2.73 | |

| | | | | | | | | | | | | |

| Biotechnology | | | | | | | | | | | | |

| Biogen Idec Inc.* | | | 145,058 | | | | 27,983,139 | | | | 4.29 | |

| Celgene Corporation* | | | 85,840 | | | | 9,949,714 | | | | 1.52 | |

| Gilead Sciences, Inc.* | | | 700,285 | | | | 34,264,945 | | | | 5.25 | |

| | | | | | | | 72,197,798 | | | | 11.06 | |

| Brewers | | | | | | | | | | | | |

| Anheuser-Busch InBev N.V. Spon. ADR | | | 78,765 | | | | 7,841,056 | | | | 1.20 | |

| | | | | | | | | | | | | |

| Broadcasting | | | | | | | | | | | | |

| CBS Corporation - Cl. B | | | 411,964 | | | | 19,234,599 | | | | 2.95 | |

| | | | | | | | | | | | | |

| Cable & Satellite | | | | | | | | | | | | |

| Comcast Corporation - Cl. A | | | 329,546 | | | | 13,844,227 | | | | 2.12 | |

| Liberty Global, Inc. - Cl. A* | | | 125,329 | | | | 9,199,149 | | | | 1.41 | |

| | | | | | | | 23,043,376 | | | | 3.53 | |

| Casinos & Gaming | | | | | | | | | | | | |

| Wynn Resorts Ltd. | | | 130,017 | | | | 16,272,928 | | | | 2.49 | |

| | | | | | | | | | | | | |

| Commodity Chemicals | | | | | | | | | | | | |

| LyondellBasell Industries N.V. - Cl. A | | | 75,661 | | | | 4,788,585 | | | | 0.73 | |

| | | | | | | | | | | | | |

| Communications Equipment | | | | | | | | | |

| Motorola Solutions, Inc. | | | 76,668 | | | | 4,909,052 | | | | 0.75 | |

| QUALCOMM, Inc. | | | 98,215 | | | | 6,575,494 | | | | 1.01 | |

| | | | | | | | 11,484,546 | | | | 1.76 | |

| Construction & Farm Machinery & Heavy Trucks | | | | | |

| Cummins, Inc. | | | 56,301 | | | | 6,520,219 | | | | 1.00 | |

| | | | | | | | | | | | | |

| Consumer Finance | | | | | | | | | | | | |

| American Express Company | | | 197,892 | | | | 13,349,794 | | | | 2.04 | |

| | | | | | | | | | | | | |

| Data Processing & Outsourced Services | | | | | |

| Visa, Inc. - Cl. A | | | 102,075 | | | | 17,336,418 | | | | 2.65 | |

| | | | | | | | | | | | | |

| Diversified Banks | | | | | | | | | | | | |

| Wells Fargo & Company | | | 541,975 | | | | 20,047,655 | | | | 3.07 | |

| | | | | | | | | | | | | |

| Fertilizers & Agricultural Chemicals | | | | | | | | | |

| Monsanto Company | | | 175,773 | | | | 18,566,902 | | | | 2.84 | |

| | | | | | | | | | | | | |

| Footwear | | | | | | | | | | | | |

| NIKE, Inc. - Cl. B | | | 233,956 | | | | 13,805,744 | | | | 2.11 | |

| | | | | | | | | | | | | |

COMMON STOCKS (continued) | | | | | | | | | |

| Health Care Equipment | | | | | | | | | | | | |

| Intuitive Surgical, Inc.* | | | 14,293 | | | $ | 7,020,579 | | | | 1.08 | % |

| | | | | | | | | | | | | |

| Home Improvement Retail | | | | | | | | | | | | |

| Lowe's Companies, Inc. | | | 492,129 | | | | 18,661,532 | | | | 2.86 | |

| The Home Depot, Inc. | | | 187,003 | | | | 13,049,069 | | | | 2.00 | |

| | | | | | | | 31,710,601 | | | | 4.86 | |

| Hotels, Resorts & Cruise Lines | | | | | | | | | |

| Starwood Hotels & Resorts Worldwide, Inc. | | | 231,561 | | | | 14,757,383 | | | | 2.26 | |

| | | | | | | | | | | | | |

| Hypermarkets & Super Centers | | | | | | | | | |

| Wal-Mart Stores, Inc. | | | 174,391 | | | | 13,049,679 | | | | 2.00 | |

| | | | | | | | | | | | | |

| Industrial Conglomerates | | | | | | | | | | | | |

| Danaher Corporation | | | 123,084 | | | | 7,649,671 | | | | 1.17 | |

| | | | | | | | | | | | | |

| Industrial Machinery | | | | | | | | | | | | |

| Pentair Ltd. | | | 299,921 | | | | 15,820,833 | | | | 2.42 | |

| | | | | | | | | | | | | |

| Internet Retail | | | | | | | | | | | | |

| priceline.com, Inc.* | | | 11,568 | | | | 7,957,974 | | | | 1.22 | |

| | | | | | | | | | | | | |

| Internet Software & Services | | | | | | | | | |

| eBay, Inc.* | | | 514,327 | | | | 27,886,810 | | | | 4.27 | |

| Equinix, Inc.* | | | 52,158 | | | | 11,282,297 | | | | 1.73 | |

| Google, Inc. - Cl. A* | | | 25,679 | | | | 20,389,896 | | | | 3.12 | |

| | | | | | | | 59,559,003 | | | | 9.12 | |

| IT Consulting & Other Services | | | | | | | | | |

| Accenture plc - Cl. A | | | 83,069 | | | | 6,310,752 | | | | 0.97 | |

| | | | | | | | | | | | | |

| Multi-Line Insurance | | | | | | | | | | | | |

| American International Group, Inc.* | | | 96,338 | | | | 3,739,841 | | | | 0.57 | |

| | | | | | | | | | | | | |

| Oil & Gas Equipment & Services | | | | | | | | | |

| Schlumberger Ltd. | | | 255,774 | | | | 19,154,915 | | | | 2.93 | |

| | | | | | | | | | | | | |

| Oil & Gas Storage & Transportation | | | | | | | | | |

| Kinder Morgan, Inc. | | | 251,768 | | | | 9,738,386 | | | | 1.49 | |

| | | | | | | | | | | | | |

| Other Diversified Financial Services | | | | | | | | | |

| Citigroup, Inc. | | | 397,648 | | | | 17,591,947 | | | | 2.69 | |

| | | | | | | | | | | | | |

| Pharmaceuticals | | | | | | | | | | | | |

| Bristol-Myers Squibb Company | | | 694,422 | | | | 28,603,242 | | | | 4.38 | |

| | | | | | | | | | | | | |

| Railroads | | | | | | | | | | | | |

| CSX Corporation | | | 262,260 | | | | 6,459,464 | | | | 0.99 | |

| Union Pacific Corporation | | | 93,442 | | | | 13,307,075 | | | | 2.04 | |

| | | | | | | | 19,766,539 | | | | 3.03 | |

| Restaurants | | | | | | | | | | | | |

| Chipotle Mexican Grill, Inc.* | | | 19,619 | | | | 6,393,244 | | | | 0.98 | |

| McDonald's Corporation | | | 163,804 | | | | 16,329,621 | | | | 2.50 | |

| Starbucks Corporation | | | 188,513 | | | | 10,737,700 | | | | 1.64 | |

| | | | | | | | 33,460,565 | | | | 5.12 | |

| Specialized REITs | | | | | | | | | | | | |

| American Tower Corporation - Cl. A | | | 153,386 | | | | 11,798,451 | | | | 1.81 | |

| | See notes to financial statements. |

| | | | Number of Shares | | | | Value | | | | Percent of Net Assets | |

COMMON STOCKS (continued) | | | | | | | | | |

| Trading Companies & Distributors | | | | | | | | | |

| United Rentals, Inc.* | | | 63,023 | | | $ | 3,464,374 | | | | 0.53 | % |

| W.W. Grainger, Inc. | | | 57,592 | | | | 12,957,048 | | | | 1.98 | |

| | | | | | | | 16,421,422 | | | | 2.51 | |

| | | | | | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | | | | | |

| (Cost $482,224,779) | | | | | | | 635,233,083 | | | | 97.27 | |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS | | | | | | | | | |

| State Street Institutional Treasury Money Market Fund, 0.000% | | | 19,192,790 | | | | 19,192,790 | | | | 2.94 | |

| | | | | | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | |

| (Cost $19,192,790) | | | | | | | 19,192,790 | | | | 2.94 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS | | | | | | | | | | | | |

| (Cost $501,417,569) | | | | | | | 654,425,873 | | | | 100.21 | |

| | | | | | | | | | | | | |

| Liabilities, Less Cash and Other Assets | | | | | | | (1,394,589 | ) | | | (0.21 | ) |

| | | | | | | | | | | | | |

| NET ASSETS | | | | | | $ | 653,031,284 | | | | 100.00 | % |

| | See notes to financial statements. |

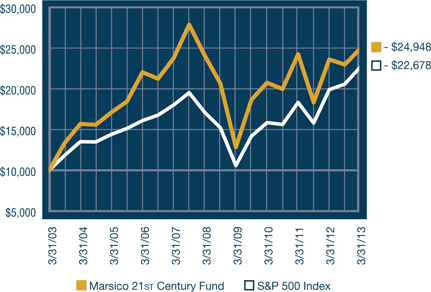

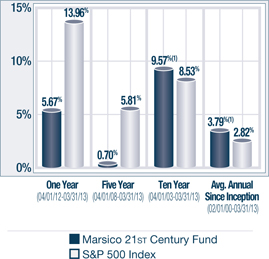

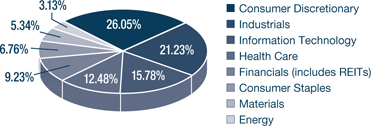

INVESTMENT REVIEW BY BRANDON GEISLER (UNAUDITED)

The Marsico 21st Century Fund posted a return of +8.57% for the six-month fiscal period ended March 31, 2013. The Fund underperformed the S&P 500 Index, the Fund’s benchmark index, which had a total return of +10.19% over the same time period. For comparison, the Russell 3000 Index, a proxy for the performance of all publicly-traded US equity securities including smaller capitalization companies (which may be a useful representation of the Fund’s ability to invest across the entire market capitalization spectrum), had a total return of +11.35%. Please see the Fund Overview for more detailed information about the Fund’s longer-term performance for various time periods ended March 31, 2013.

The performance data for the Fund quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.(1)

This review highlights Fund performance over a six-month fiscal period. Shareholders should keep in mind that the Fund is intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our views on all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Fund may not necessarily hold these securities or investments today. Please see the accompanying Schedule of Investments for the percentage of the Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period. The Fund and the stocks and markets in which it invests are subject to general risks that include periods of turbulence, instability, decline, and cyclical change, and that investors may continue to avoid investments in equity securities generally. Please see the Prospectus for more information.

Stock selection in several sectors contributed to the Fund’s underperformance versus its benchmark index. The Fund’s Financials holdings gained +6% in aggregate; however, that return did not keep pace with the +18% return of the S&P 500 Index Financials sector returns. Two banks, Capital One Financial Corporation (-3%) and The PNC Financial Services Group, Inc. (-16%), were primary detractors within the sector. The Fund sold its position in PNC Financial Services during the period. As Financials was a strong-performing sector of the benchmark index, the Fund’s performance was also hurt by having an underweight allocation to the sector.

Several of the Fund’s Information Technology positions posted weak returns. Enterprise technology company Fusion-io, Inc. slid -36% and was sold from the Fund. Software companies VMware, Inc. – Cl. A (-31% prior to being sold) and Red Hat, Inc. (-11%) also sustained double-digit stock price declines.

Stock selection in Energy and Consumer Discretionary detracted from performance. Energy firm National Oilwell Varco, Inc. declined -17% prior to being sold from the Fund. In Consumer Discretionary, retailers Ulta Salon, Cosmetics & Fragrance, Inc. (-17% prior to being sold) and Ross Stores, Inc. (-6%) posted negative returns.

The Fund benefitted from stock selection and an overweight allocation to the Industrials sector. Capital goods companies Precision Castparts Corp. (+16%) and WESCO International, Inc. (+30% prior to being sold) and railroad operator Genesee & Wyoming, Inc. – Cl. A (+35%) each experienced strong stock price appreciation. Industrials was a strong-performing sector of the S&P 500 Index with a return of +15%, and the Fund did well by having approximately double the exposure to the Industrials sector as compared to the benchmark index for a portion of the period.

Fund results also were aided by stock selection in the Materials, Health Care and Consumer Staples sectors. Within Materials, specialty chemical company LyondellBasell Industries N.V. – Cl. A (+30%) was a material positive contributor. Leading Health Care holdings included Gilead Sciences, Inc. (+31%) and Biogen Idec Inc. (+30%). Green Mountain Coffee Roasters, Inc., a Consumer Staples holding, rose +24%.

During the reporting period, the Fund increased its allocations to the Industrials, Consumer Staples and Consumer Discretionary sectors. Allocations to the Information Technology, Energy and Financials sectors were reduced.

Fiscal Period-End Investment Posture

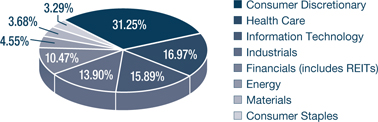

As of March 31, 2013, the Fund’s primary economic sector allocations included Consumer Discretionary, Industrials, Information Technology and Health Care. The Fund had no investments in the Utilities and Telecommunication Services sectors.

Sincerely,

BRANDON A. GEISLER

PORTFOLIO MANAGER

| (1) | Total returns are based on net change in net asset value assuming reinvestment of distributions. For the period prior to March 31, 2004, the performance returns for the 21st Century Fund reflect a fee waiver in effect; in the absence of such a waiver, the returns would have been reduced. For the period beginning April 2004 through January 2005, performance returns for the 21st Century Fund would have been higher but for the reimbursement of fees waived previously. A redemption fee of 2% may be imposed on redemptions or exchanges of Fund shares owned for 30 days or less. Please see the Prospectus for more information. |

| |

21st CENTURY FUND OVERVIEW |

| |

March 31, 2013 (Unaudited)

The 21st Century Fund invests primarily in common stocks that are selected for their long-term growth potential. The Fund may invest in companies of any size, and will normally hold a core position of between 35 and 50 common stocks.

| TOTAL ANNUAL OPERATING EXPENSES* 1.42% | NET ASSETS $301,155,781 | NET ASSET VALUE PER SHARE $15.46 |

GROWTH OF $10,000(1)(2) | PERFORMANCE COMPARISON |

| |

SECTOR ALLOCATION(3) | TOP FIVE HOLDINGS |

| | |

| BIOGEN IDEC INC. | 3.77% |

| GILEAD SCIENCES, INC. | 3.72% |

| MONSANTO COMPANY | 3.42% |

| LOWE'S COMPANIES, INC. | 3.26% |

| PRECISION CASTPARTS CORP. | 3.06% |

| | |

| * | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ Prospectus dated February 1, 2013 and may differ from the expense ratio disclosed in this report. |

| | The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com. A redemption fee may be imposed on redemptions or exchanges of Fund shares held for 30 days or less. |

| | The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares. |

| | All indices are unmanaged and investors cannot invest directly in an index. |

| (1) | The performance returns for the 21st Century Fund (for the period prior to March 31, 2004) reflect a fee waiver in effect; in the absence of such a waiver, the returns would be reduced. For the period beginning April 2004 through January 2005, performance returns for the 21st Century Fund would be higher but for the reimbursement of fees waived previously. |

| (2) | This chart assumes an initial investment of $10,000 made on March 31, 2003. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

| (3) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

MARSICO 21st CENTURY FUND

SCHEDULE OF INVESTMENTS

March 31, 2013 (Unaudited)

| | | Number of Shares | | | Value | | | Percent of Net Assets | |

| COMMON STOCKS | | | | | | | | | |

| Aerospace & Defense | | | | | | | | | |

| Precision Castparts Corp. | | | 48,675 | | | $ | 9,229,753 | | | | 3.06 | % |

| TransDigm, Inc. | | | 44,518 | | | | 6,807,693 | | | | 2.26 | |

| | | | | | | | 16,037,446 | | | | 5.32 | |

| Apparel Retail | | | | | | | | | | | | |

| Foot Locker, Inc. | | | 69,058 | | | | 2,364,546 | | | | 0.78 | |

| Ross Stores, Inc. | | | 84,430 | | | | 5,118,147 | | | | 1.70 | |

| | | | | | | | 7,482,693 | | | | 2.48 | |

| Apparel, Accessories & Luxury Goods | | | | | |

| Ralph Lauren Corporation - Cl. A | | | 25,684 | | | | 4,348,558 | | | | 1.44 | |

| | | | | | | | | | | | | |

| Application Software | | | | | | | | | | | | |

| salesforce.com, inc.* | | | 20,477 | | | | 3,661,902 | | | | 1.22 | |

| | | | | | | | | | | | | |

| Automobile Manufacturers | | | | | | | | | | | | |

| Tesla Motors, Inc.* | | | 77,529 | | | | 2,937,574 | | | | 0.97 | |

| | | | | | | | | | | | | |

| Automotive Retail | | | | | | | | | | | | |

| Monro Muffler Brake, Inc. | | | 39,002 | | | | 1,548,769 | | | | 0.51 | |

| | | | | | | | | | | | | |

| Biotechnology | | | | | | | | | | | | |

| Alkermes PLC* | | | 167,908 | | | | 3,981,099 | | | | 1.32 | |

| Biogen Idec Inc.* | | | 58,735 | | | | 11,330,569 | | | | 3.77 | |

| BioMarin Pharmaceutical, Inc.* | | | 36,870 | | | | 2,295,526 | | | | 0.76 | |

| Gilead Sciences, Inc.* | | | 228,949 | | | | 11,202,474 | | | | 3.72 | |

| | | | | | | | 28,809,668 | | | | 9.57 | |

| Cable & Satellite | | | | | | | | | | | | |

| Liberty Global, Inc. Series C* | | | 51,255 | | | | 3,517,631 | | | | 1.17 | |

| | | | | | | | | | | | | |

| Casinos & Gaming | | | | | | | | | | | | |

| Wynn Resorts Ltd. | | | 60,136 | | | | 7,526,622 | | | | 2.50 | |

| | | | | | | | | | | | | |

| Commodity Chemicals | | | | | | | | | | | | |

| LyondellBasell Industries N.V. - Cl. A | | | 90,993 | | | | 5,758,947 | | | | 1.91 | |

| | | | | | | | | | | | | |

| Construction & Farm Machinery & Heavy Trucks | | | | | |

| Cummins, Inc. | | | 41,022 | | | | 4,750,758 | | | | 1.58 | |

| | | | | | | | | | | | | |

| Consumer Finance | | | | | | | | | | | | |

| Capital One Financial Corporation | | | 55,205 | | | | 3,033,515 | | | | 1.01 | |

| | | | | | | | | | | | | |

| Data Processing & Outsourced Services | | | | | |

| FleetCor Technologies, Inc.* | | | 53,623 | | | | 4,111,276 | | | | 1.36 | |

| MasterCard, Inc. - Cl. A | | | 14,625 | | | | 7,914,026 | | | | 2.63 | |

| | | | | | | | 12,025,302 | | | | 3.99 | |

| Distillers & Vintners | | | | | | | | | | | | |

| Constellation Brands, Inc. - Cl. A* | | | 95,995 | | | | 4,573,202 | | | | 1.52 | |

| | | | | | | | | | | | | |

| Diversified Support Services | | | | | | | | | |

| Copart, Inc.* | | | 83,289 | | | | 2,855,147 | | | | 0.95 | |

| | | | | | | | | | | | | |

| Fertilizers & Agricultural Chemicals | | | | | | | | | |

| Monsanto Company | | | 97,584 | | | | 10,307,798 | | | | 3.42 | |

| | | | | | | | | | | | | |

| General Merchandise Stores | | | | | | | | | |

| Dollar Tree, Inc.* | | | 154,450 | | | | 7,480,013 | | | | 2.48 | |

| | | | | | | | | | | | | |

COMMON STOCKS (continued) | | | | | | | | | |

| Health Care Equipment | | | | | | | | | | | | |

| Hologic, Inc.* | | | 164,116 | | | $ | 3,709,022 | | | | 1.23 | % |

| Intuitive Surgical, Inc.* | | | 10,237 | | | | 5,028,312 | | | | 1.67 | |

| | | | | | | | 8,737,334 | | | | 2.90 | |

| Home Improvement Retail | | | | | | | | | | | | |

| Lowe's Companies, Inc. | | | 258,667 | | | | 9,808,653 | | | | 3.26 | |

| | | | | | | | | | | | | |

| Hotels, Resorts & Cruise Lines | | | | | | | | | |

| Norwegian Cruise Line Holdings Ltd.* | | | 61,805 | | | | 1,832,518 | | | | 0.61 | |

| | | | | | | | | | | | | |

| Household Products | | | | | | | | | | | | |

| Church & Dwight Company, Inc. | | | 49,188 | | | | 3,179,020 | | | | 1.06 | |

| | | | | | | | | | | | | |

| Industrial Machinery | | | | | | | | | | | | |

| Pentair Ltd. | | | 129,076 | | | | 6,808,759 | | | | 2.26 | |

| | | | | | | | | | | | | |

| Internet Retail | | | | | | | | | | | | |

| Expedia, Inc. | | | 31,261 | | | | 1,875,973 | | | | 0.62 | |

| | | | | | | | | | | | | |

| Internet Software & Services | | | | | | | | | |

| Equinix, Inc.* | | | 27,971 | | | | 6,050,407 | | | | 2.01 | |

| Facebook, Inc. - Cl. A* | | | 100,842 | | | | 2,579,538 | | | | 0.86 | |

| Google, Inc. - Cl. A* | | | 11,047 | | | | 8,771,650 | | | | 2.91 | |

| VeriSign, Inc.* | | | 68,836 | | | | 3,254,566 | | | | 1.08 | |

| Yahoo!, Inc.* | | | 65,623 | | | | 1,544,109 | | | | 0.51 | |

| | | | | | | | 22,200,270 | | | | 7.37 | |

| Investment Banking & Brokerage | | | | | | | | | |

| Morgan Stanley | | | 95,107 | | | | 2,090,452 | | | | 0.69 | |

| | | | | | | | | | | | | |

| IT Consulting & Other Services | | | | | | | | | |

| Accenture plc - Cl. A | | | 65,322 | | | | 4,962,512 | | | | 1.65 | |

| | | | | | | | | | | | | |

| Movies & Entertainment | | | | | | | | | | | | |

| Viacom, Inc. - Cl. B | | | 114,555 | | | | 7,053,151 | | | | 2.34 | |

| | | | | | | | | | | | | |

| Oil & Gas Equipment & Services | | | | | | | | | |

| Halliburton Company | | | 74,071 | | | | 2,993,209 | | | | 1.00 | |

| Schlumberger Ltd. | | | 85,732 | | | | 6,420,470 | | | | 2.13 | |

| | | | | | | | 9,413,679 | | | | 3.13 | |

| Other Diversified Financial Services | | | | | | | | | |

| Citigroup, Inc. | | | 177,546 | | | | 7,854,635 | | | | 2.61 | |

| | | | | | | | | | | | | |

| Packaged Foods & Meats | | | | | | | | | | | | |

| Green Mountain Coffee Roasters, Inc.* | | | 83,548 | | | | 4,742,184 | | | | 1.58 | |

| Mondelez International, Inc. - Cl. A | | | 217,344 | | | | 6,652,900 | | | | 2.21 | |

| Pinnacle Foods, Inc.* | | | 53,496 | | | | 1,188,146 | | | | 0.39 | |

| | | | | | | | 12,583,230 | | | | 4.18 | |

| Railroads | | | | | | | | | | | | |

| Genesee & Wyoming, Inc. - Cl. A* | | | 67,296 | | | | 6,265,931 | | | | 2.08 | |

| | | | | | | | | | | | | |

| Regional Banks | | | | | | | | | | | | |

| BankUnited, Inc. | | | 115,829 | | | | 2,967,539 | | | | 0.99 | |

| City National Corporation | | | 67,008 | | | | 3,947,441 | | | | 1.31 | |

| Columbia Banking System, Inc. | | | 72,872 | | | | 1,601,727 | | | | 0.53 | |

| | | | | | | | 8,516,707 | | | | 2.83 | |

| Research & Consulting Services | | | | | | | | | |

| IHS, Inc. - Cl. A* | | | 54,030 | | | | 5,658,021 | | | | 1.88 | |

| Nielsen Holdings N.V. | | | 171,157 | | | | 6,130,844 | | | | 2.03 | |

| | | | | | | | 11,788,865 | | | | 3.91 | |

| | See notes to financial statements. |

MARSICO 21st CENTURY FUND

SCHEDULE OF INVESTMENTS (continued)

March 31, 2013 (Unaudited)

| | | | Number of Shares | | | | Value | | | | Percent of Net Assets | |

COMMON STOCKS (continued) | | | | | | | | | |

| Restaurants | | | | | | | | | | | | |

| Chipotle Mexican Grill, Inc.* | | | 14,539 | | | $ | 4,737,824 | | | | 1.57 | % |

| Dunkin' Brands Group, Inc. | | | 145,178 | | | | 5,354,164 | | | | 1.78 | |

| McDonald's Corporation | | | 90,526 | | | | 9,024,537 | | | | 3.00 | |

| | | | | | | | 19,116,525 | | | | 6.35 | |

| Specialized REITs | | | | | | | | | | | | |

| American Tower Corporation - Cl. A | | | 81,329 | | | | 6,255,827 | | | | 2.08 | |

| | | | | | | | | | | | | |

| Specialty Stores | | | | | | | | | | | | |

| Tractor Supply Company | | | 36,602 | | | | 3,811,366 | | | | 1.27 | |

| | | | | | | | | | | | | |

| Systems Software | | | | | | | | | | | | |

| Red Hat, Inc.* | | | 90,879 | | | | 4,594,842 | | | | 1.53 | |

| | | | | | | | | | | | | |

| Trading Companies & Distributors | | | | | | | | | |

| MRC Global, Inc.* | | | 166,281 | | | | 5,475,633 | | | | 1.82 | |

| United Rentals, Inc.* | | | 55,574 | | | | 3,054,903 | | | | 1.01 | |

| W.W. Grainger, Inc. | | | 30,344 | | | | 6,826,793 | | | | 2.27 | |

| | | | | | | | 15,357,329 | | | | 5.10 | |

| TOTAL COMMON STOCKS | | | | | | | | | | | | |

| (Cost $229,594,852) | | | | | | | 300,763,123 | | | | 99.87 | |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS | | | | | | | | | |

| State Street Institutional Treasury Money Market Fund, 0.000% | | | 4,125,273 | | | | 4,125,273 | | | | 1.37 | |

| | | | | | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | |

| (Cost $4,125,273) | | | | | | | 4,125,273 | | | | 1.37 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS | | | | | | | | | | | | |

| (Cost $233,720,125) | | | | | | | 304,888,396 | | | | 101.24 | |

| | | | | | | | | | | | | |

| Liabilities, Less Cash and Other Assets | | | | | | | (3,732,615 | ) | | | (1.24 | ) |

| | | | | | | | | | | | | |

| NET ASSETS | | | | | | $ | 301,155,781 | | | | 100.00 | % |

| | See notes to financial statements. |

| |

| INTERNATIONAL OPPORTUNITIES FUND |

| |

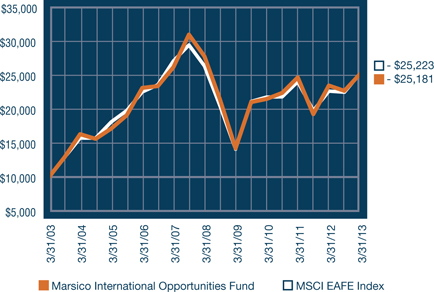

INVESTMENT REVIEW BY JIM GENDELMAN AND MUNISH MALHOTRA (UNAUDITED)

The Marsico International Opportunities Fund posted a total return of (US$) +10.88% for the six-month fiscal period ended March 31, 2013. The Fund underperformed the MSCI EAFE Index, which we consider to be the Fund’s benchmark index and which had a total return of (US$) +12.04%. Please see the Fund Overview for more detailed information about the Fund’s longer-term performance for various time periods ended March 31, 2013.

The performance data for the Fund quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.(1)

This review highlights Fund performance over a six-month fiscal period. Shareholders should keep in mind that the Fund is intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our views on all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Fund may not necessarily hold these securities or investments today. Please see the accompanying Schedule of Investments for the percentage of the Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period.

Foreign investments present additional risks due to currency fluctuations, economic and political factors, lower liquidity, differences in securities regulations and accounting standards, possible changes in taxation, limited public information, and other factors. In addition, the Fund and the stocks and markets in which it invests are subject to other general risks that include periods of turbulence, instability, decline, and cyclical change, and that investors may continue to avoid investments in equity securities generally. Please see the Prospectus for more information.

The Fund’s underperformance versus its benchmark index was primarily attributable to stock selection in several sectors. Several of the Fund’s Information Technology holdings posted weak returns and accounted for some of the shortfall relative to the benchmark index. Chinese Internet services company Baidu, Inc. Spon. ADR (-27%), Japanese ecommerce company DeNA Co., Ltd. (-16%) and imaging products company HOYA CORPORATION (-15% prior to being sold) each registered sizeable stock price declines.

Stock selection and an underweight allocation to the Financials sector also impaired performance. Financials was a strong-performing sector of the MSCI EAFE Index with a return of +17%. The Fund’s performance was penalized by being significantly underweight the sector as compared to the benchmark index. Additionally, several of the Fund’s Financials positions struggled, most notably Brazilian real estate company BR Malls Participacoes S.A. (-11%).

Several of the Fund’s holdings in the Energy and Telecommunication Services sectors declined sharply. Oil and gas exploration company Tullow Oil PLC (-17%) and mobile phone operator Millicom International Cellular S.A. (-17% prior to being sold) each had a material, negative effect on performance results.

While some of the Fund’s holdings in the Consumer Discretionary and Health Care sectors posted positive absolute returns, their results significantly lagged the overall return of the benchmark index. Japanese ecommerce retailer Rakuten, Inc. gained just 0.01% and detracted from relative performance. In Health Care, Perrigo Company, manufacturer of store-branded over-the-counter medications, garnered a return of +2% and significantly lagged the +14% return of the MSCI EAFE Index Health Care sector.

The Fund’s sector allocations generally aided performance as compared to the benchmark index. Consumer Discretionary and Information Technology were strong-performing sectors of the MSCI EAFE Index, and the Fund did well by having a significant portion of its net assets invested in the sectors. The Fund’s performance was also buoyed by having few investments in Utilities, Energy and Materials, as these were some of the weakest-performing sectors of the benchmark index.

The Fund benefitted from strong performance by a few of its individual holdings. Semiconductor company ARM Holdings PLC (+48%), specialty chemicals company LyondellBasell Industries N.V. – Cl. A (+31%) and German media company Kabel Deutschland Holding AG (+35%) were among the Fund’s top-performing individual holdings.

| |

| INTERNATIONAL OPPORTUNITIES FUND |

| |

Although active currency management is not a central facet of the Fund’s investment process, currency fluctuations may at times affect the Fund’s performance. The Fund did well by having less exposure to securities denominated in the weaker Japanese yen than its benchmark index. The Fund also benefitted from having some exposure to companies whose securities are denominated in the US dollar, as the US dollar appreciated during the period.

During the period, the Fund increased its allocation to companies in the Consumer Discretionary and Industrials sectors while reducing its exposure to the Information Technology and Telecommunication Services sectors.

Fiscal Period-End Investment Posture

As of March 31, 2013, the Fund’s primary economic sector allocations included Consumer Discretionary, Financials and Information Technology.

In terms of country allocations, the Fund’s most significant weightings, excluding short-term investments, at period-end were the United Kingdom, Japan and Switzerland. Country-level weightings generally should be considered a residual of the Fund’s stock selection process rather than a major, proactive facet of its investment strategy.

Sincerely,

JAMES G. GENDELMAN

MUNISH MALHOTRA, CFA

PORTFOLIO MANAGERS

| (1) | Total returns are based on net change in net asset value assuming reinvestment of distributions. For the period prior to September 30, 2004 and from October 2011 through March 2013, the performance returns for the International Opportunities Fund reflect a fee waiver in effect; in the absence of such a waiver, the returns would have been reduced. For the period beginning October 2004 through December 2005, performance returns for the International Opportunities Fund would have been higher but for the reimbursement of fees waived previously. A redemption fee of 2% may be imposed on redemptions or exchanges of Fund shares owned for 30 days or less. Please see the Prospectus for more information. |

| |

| INTERNATIONAL OPPORTUNITIES FUND OVERVIEW |

| |

March 31, 2013 (Unaudited)

The International Opportunities Fund invests primarily in common stocks of foreign companies that are selected for their long-term growth potential. The Fund may invest in companies of any size throughout the world. It normally invests in the securities of issuers that are economically tied to one or more foreign countries, and expects to be invested in various issuers or securities that together have ties to at least four different foreign countries. Some issuers or securities in the Fund’s portfolio may be based in or economically tied to the United States. The Fund may hold an unlimited number of common stocks.

TOTAL ANNUAL OPERATING EXPENSES* 1.65% NET EXPENSES*† 1.60% | NET ASSETS $118,988,472 | NET ASSET VALUE PER SHARE $13.86 |

GROWTH OF $10,000(1)(2) | PERFORMANCE COMPARISON |

| |

SECTOR ALLOCATION(3) | TOP FIVE HOLDINGS |

| | |

| LIBERTY GLOBAL, INC. SERIES C | 3.25% |

| ROCHE HOLDING AG | 2.99% |

| NESTLÉ S.A. | 2.93% |

| DIAGEO PLC | 2.73% |

| TELECITY GROUP PLC | 2.72% |

| | |

| * | The Total Annual Operating Expenses and Net Expenses are reflective of the information disclosed in the Funds’ Prospectus dated February 1, 2013 and may differ from the expense ratios disclosed in this report. |

| † | Marsico Capital Management, LLC (the “Adviser”) has entered into a written expense limitation and fee waiver agreement under which it has agreed to limit the total expenses of the International Opportunities Fund (excluding interest, taxes, acquired fund fees and expenses, litigation, brokerage and extraordinary expenses) to an annual rate of 1.60% of the Fund’s average net assets until January 31, 2014. This expense limitation and fee waiver agreement may be terminated by the Adviser at any time after January 31, 2014, upon 15 days prior notice to the Fund and its administrator. The Adviser may recoup from the Fund fees previously waived or expenses previously reimbursed by the Adviser with respect to the Fund pursuant to this agreement (or a previous expense limitation agreement) if such reimbursement does not cause the Fund to exceed the expense limitation currently in effect and the reimbursement is made within three years after the year in which the Adviser waived the fee or reimbursed the expense. |

| | The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com. A redemption fee may be imposed on redemptions or exchanges of Fund shares held for 30 days or less. |

| | The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares. |

| | All indices are unmanaged and investors cannot invest directly in an index. |

| (1) | The performance returns for the International Opportunities Fund (for the period prior to September 30, 2004 and from October 2011 through March 2013) reflect a fee waiver in effect; in the absence of such a waiver, the returns would be reduced. For the period beginning October 2004 through December 2005, performance returns for the International Opportunities Fund would be higher but for the reimbursement of fees waived previously. |

| (2) | This chart assumes an initial investment of $10,000 made on March 31, 2003. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

| (3) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

| | The MSCI EAFE Index tracks the stocks of about 1,000 companies in Europe, Australasia, and the Far East (EAFE). |

MARSICO INTERNATIONAL OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

March 31, 2013 (Unaudited)

| | | Number of Shares | | | Value | | | Percent of Net Assets | |

| COMMON STOCKS | | | | | | | | | |

| Aerospace & Defense | | | | | | | | | |

| Rolls-Royce Holdings PLC* | | | 161,008 | | | $ | 2,764,472 | | | | 2.32 | % |

| | | | | | | | | | | | | |

| Alternative Carriers | | | | | | | | | | | | |

| Ziggo N.V. | | | 71,688 | | | | 2,521,093 | | | | 2.12 | |

| | | | | | | | | | | | | |

| Apparel, Accessories & Luxury Goods | | | | | |

| Adidas A.G. | | | 22,505 | | | | 2,334,961 | | | | 1.96 | |

| Swatch Group AG | | | 3,169 | | | | 1,842,714 | | | | 1.55 | |

| | | | | | | | 4,177,675 | | | | 3.51 | |

| Automobile Manufacturers | | | | | | | | | | | | |

| Bayerische Motoren Werke AG | | | 29,363 | | | | 2,533,480 | | | | 2.13 | |

| Honda Motor Co., Ltd. | | | 63,200 | | | | 2,416,954 | | | | 2.03 | |

| Hyundai Motor Company | | | 9,322 | | | | 1,872,611 | | | | 1.57 | |

| | | | | | | | 6,823,045 | | | | 5.73 | |

| Brewers | | | | | | | | | | | | |

| Anheuser-Busch InBev N.V. | | | 32,505 | | | | 3,218,742 | | | | 2.71 | |

| | | | | | | | | | | | | |

| Cable & Satellite | | | | | | | | | | | | |

| British Sky Broadcasting Group PLC | | | 239,943 | | | | 3,219,253 | | | | 2.71 | |

| Kabel Deutschland Holding AG | | | 26,050 | | | | 2,403,571 | | | | 2.02 | |

| Liberty Global, Inc. Series C* | | | 56,376 | | | | 3,869,085 | | | | 3.25 | |

| Naspers Ltd. - Cl. N | | | 23,676 | | | | 1,474,971 | | | | 1.24 | |

| | | | | | | | 10,966,880 | | | | 9.22 | |

| Commodity Chemicals | | | | | | | | | | | | |

| LyondellBasell Industries N.V. - Cl. A | | | 49,150 | | | | 3,110,704 | | | | 2.61 | |

| | | | | | | | | | | | | |

| Computer Storage & Peripherals | | | | | | | | | |

| Seagate Technology PLC | | | 51,998 | | | | 1,901,047 | | | | 1.60 | |

| | | | | | | | | | | | | |

| Construction & Farm Machinery & Heavy Trucks | | | | | |

| Komatsu Ltd. | | | 57,600 | | | | 1,366,344 | | | | 1.15 | |

| | | | | | | | | | | | | |

| Department Stores | | | | | | | | | | | | |

| Next PLC | | | 20,392 | | | | 1,352,788 | | | | 1.14 | |

| | | | | | | | | | | | | |

| Distillers & Vintners | | | | | | | | | | | | |

| Diageo PLC | | | 103,169 | | | | 3,252,772 | | | | 2.73 | |

| Pernod-Ricard S.A. | | | 10,582 | | | | 1,318,610 | | | | 1.11 | |

| | | | | | | | 4,571,382 | | | | 3.84 | |

| Diversified Banks | | | | | | | | | | | | |

| Barclays PLC | | | 369,948 | | | | 1,636,605 | | | | 1.37 | |

| BNP Paribas | | | 31,541 | | | | 1,618,851 | | | | 1.36 | |

| Mizuho Financial Group, Inc. | | | 1,069,700 | | | | 2,284,057 | | | | 1.92 | |

| Standard Chartered PLC | | | 89,550 | | | | 2,317,897 | | | | 1.95 | |

| | | | | | | | 7,857,410 | | | | 6.60 | |

| Diversified Capital Markets | | | | | | | | | |

| UBS A.G. | | | 106,935 | | | | 1,639,002 | | | | 1.38 | |

| | | | | | | | | | | | | |

| Electrical Components & Equipment | | | | | | | | | |

| Schneider Electric S.A. | | | 21,549 | | | | 1,574,488 | | | | 1.32 | |

| | | | | | | | | | | | | |

| Gas Utilities | | | | | | | | | | | | |

| ENN Energy Holdings Ltd. | | | 128,000 | | | | 705,747 | | | | 0.59 | |

| | | | | | | | | | | | | |

| Health Care Services | | | | | | | | | | | | |

| Fresenius S.E. & Company KGaA | | | 14,502 | | | | 1,789,973 | | | | 1.50 | |

| | | | | | | | | | | | | |

COMMON STOCKS (continued) | | | | | | | | | |

| Hotels, Resorts & Cruise Lines | | | | | | | | | |

| InterContinental Hotels Group PLC | | | 90,892 | | | $ | 2,771,784 | | | | 2.33 | % |

| | | | | | | | | | | | | |

| Industrial Machinery | | | | | | | | | | | | |

| FANUC Corporation | | | 12,500 | | | | 1,910,820 | | | | 1.61 | |

| | | | | | | | | | | | | |

| Internet Retail | | | | | | | | | | | | |

| Rakuten, Inc. | | | 228,900 | | | | 2,336,781 | | | | 1.96 | |

| | | | | | | | | | | | | |

| Internet Software & Services | | | | | | | | | |

| Baidu, Inc. Spon. ADR* | | | 13,408 | | | | 1,175,882 | | | | 0.99 | |

| DeNA Co., Ltd. | | | 69,900 | | | | 1,900,929 | | | | 1.60 | |

| MercadoLibre, Inc. | | | 13,000 | | | | 1,255,280 | | | | 1.05 | |

| Telecity Group PLC | | | 235,451 | | | | 3,232,325 | | | | 2.72 | |

| Yandex N.V. - Cl. A* | | | 107,634 | | | | 2,488,498 | | | | 2.09 | |

| | | | | | | | 10,052,914 | | | | 8.45 | |

| IT Consulting & Other Services | | | | | | | | | |

| Accenture plc - Cl. A | | | 16,162 | | | | 1,227,827 | | | | 1.03 | |

| | | | | | | | | | | | | |

| Life & Health Insurance | | | | | | | | | | | | |

| AIA Group Ltd. | | | 703,800 | | | | 3,073,580 | | | | 2.58 | |

| | | | | | | | | | | | | |

| Movies & Entertainment | | | | | | | | | | | | |

| Imax Corporation* | | | 44,024 | | | | 1,176,762 | | | | 0.99 | |

| | | | | | | | | | | | | |

| Oil & Gas Drilling | | | | | | | | | | | | |

| Seadrill Ltd. | | | 36,995 | | | | 1,340,897 | | | | 1.13 | |

| | | | | | | | | | | | | |

| Oil & Gas Exploration & Production | | | | | | | | | |

| CNOOC Ltd. | | | 680,800 | | | | 1,306,777 | | | | 1.10 | |

| Tullow Oil PLC | | | 94,978 | | | | 1,776,509 | | | | 1.49 | |

| | | | | | | | 3,083,286 | | | | 2.59 | |

| Packaged Foods & Meats | | | | | | | | | | | | |

| Danone S.A. | | | 34,191 | | | | 2,378,971 | | | | 2.00 | |

| Nestlé S.A. | | | 48,193 | | | | 3,485,146 | | | | 2.93 | |

| | | | | | | | 5,864,117 | | | | 4.93 | |

| Pharmaceuticals | | | | | | | | | | | | |

| Novo Nordisk A/S - B Shares | | | 10,678 | | | | 1,734,872 | | | | 1.46 | |

| Perrigo Company | | | 21,828 | | | | 2,591,638 | | | | 2.18 | |

| Roche Holding AG | | | 15,298 | | | | 3,561,422 | | | | 2.99 | |

| Shire PLC | | | 94,865 | | | | 2,888,618 | | | | 2.43 | |

| | | | | | | | 10,776,550 | | | | 9.06 | |

| Railroads | | | | | | | | | | | | |

| Canadian National Railway Company | | | 25,460 | | | | 2,553,638 | | | | 2.15 | |

| Canadian Pacific Railway Ltd. | | | 5,425 | | | | 696,756 | | | | 0.58 | |

| | | | | | | | 3,250,394 | | | | 2.73 | |