| OMB APPROVAL |

OMB Number: 3235-0570 Expires: September 30, 2007 Estimated average burden hours per response: 19.4 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08415

Evergreen Fixed Income Trust

_____________________________________________________________

(Exact name of registrant as specified in charter)

200 Berkeley Street Boston, Massachusetts 02116

_____________________________________________________________

(Address of principal executive offices) (Zip code)

Michael H. Koonce, Esq. 200 Berkeley Street Boston, Massachusetts 02116

____________________________________________________________

(Name and address of agent for service)

Registrant's telephone number, including area code: (617) 210-3200

Date of fiscal year end: Registrant is making a semi-annual filing for five of its series, Evergreen High Yield Bond Fund, Evergreen Institutional Mortgage Portfolio Fund, Evergreen U.S. Government Fund, Evergreen Diversified Bond Fund and Evergreen Strategic Income Fund, for the six months ended October 31, 2006. These five series have an April 30 fiscal year end.

Date of reporting period: October 31, 2006

Item 1 - Reports to Stockholders.

Evergreen High Yield Bond Fund

| table of contents |

| 1 | | LETTER TO SHAREHOLDERS |

| 6 | | FUND AT A GLANCE |

| 8 | | ABOUT YOUR FUND’S EXPENSES |

| 9 | | FINANCIAL HIGHLIGHTS |

| 13 | | SCHEDULE OF INVESTMENTS |

| 21 | | STATEMENT OF ASSETS AND LIABILITIES |

| 22 | | STATEMENT OF OPERATIONS |

| 23 | | STATEMENTS OF CHANGES IN NET ASSETS |

| 24 | | NOTES TO FINANCIAL STATEMENTS |

| 31 | | ADDITIONAL INFORMATION |

| 40 | | TRUSTEES AND OFFICERS |

This semiannual report must be preceded or accompanied by a prospectus of the Evergreen fund contained herein. The prospectus contains more complete information, including fees and expenses, and should be read carefully before investing or sending money.

The fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q will be available on the SEC’s Web site at http://www.sec.gov. In addition, the fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 800.SEC.0330.

A description of the fund’s proxy voting policies and procedures, as well as information regarding how the fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available by visiting our Web site at EvergreenInvestments.com or by visiting the SEC’s Web site at http://www.sec.gov. The fund’s proxy voting policies and procedures are also available without charge, upon request, by calling 800.343.2898.

| Mutual Funds: | | | | |

| NOT FDIC INSURED | | MAY LOSE VALUE | | NOT BANK GUARANTEED |

Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC.

Copyright 2006, Evergreen Investment Management Company, LLC.

Evergreen Investment Management Company, LLC is a subsidiary of Wachovia Corporation

and is an affiliate of Wachovia Corporation’s other Broker Dealer subsidiaries.

Evergreen mutual funds are distributed by Evergreen Investment Services, Inc.

200 Berkeley Street, Boston, MA 02116

LETTER TO SHAREHOLDERS

December 2006

Dennis H. Ferro

President and Chief Executive Officer

Dear Shareholder:

We are pleased to provide the semi-annual report for the Evergreen High Yield Bond Fund, covering the six-month period ended October 31, 2006.

Domestic capital markets, both equity and fixed income, faced a wide range of sometimes inconsistent influences during the past six months. In the first two months of the period, investors worried about rapidly rising oil and commodity prices and the effects of the Federal Reserve Board’s persistent efforts to raise short-term interest rates to slow the economy. However, in the final four months, declining oil and commodity prices offered more encouragement to investors willing to take on risk, especially after the Federal Reserve paused in its cycle of credit tightening. Throughout the period, investors warily watched for signs that specific pockets of weakness might lead to a deceleration of growth in the general economy.

Evidence of economic deceleration did appear in the second and third quarters of 2006 — a year which began with a particularly robust rise in Gross Domestic Product (GDP) of more than 5% in the first quarter. GDP growth then slowed to annualized rates of approximately 2.5% and an estimated 2.2% in the second and third quarters, respectively, with weakening most evident in the housing and automotive industries. Yet healthy

1

LETTER TO SHAREHOLDERS continued

growth levels in personal consumption and business investment enabled demand to grow at more historically average rates, enabling the overall economy to absorb the problems in the housing and automobile areas. In addition, energy prices fell dramatically in the waning months of the fiscal period, boosting consumer confidence and raising hopes for lower inflation in the months ahead. However, officials at the Federal Reserve indicated they continued to be concerned about the possibility of rising inflationary pressures.

Over the six-month period, the domestic fixed income market delivered generally positive results, with high-yield corporate debt maintaining a performance edge over investment grade securities, including government bonds.

In managing Evergreen’s fixed income funds, managers focused on interest rate changes, particularly in higher-grade portfolios including the Evergreen Institutional Mortgage Portfolio, the Evergreen U.S. Government Fund and the Evergreen Core Bond Fund. The teams managing the Evergreen High Yield Bond Fund and the Evergreen Select High Yield Bond Fund paid particularly close attention to credit analysis, analyzing factors such as cash flow and corporations’ abilities to meet their debt obligations. Managers of more diversified funds, including the Evergreen Diversified Bond Fund and the Evergreen Strategic Income Fund, also considered factors such as interest rate expectations and yield spreads in making allocations to different sectors within the fixed income market.

2

LETTER TO SHAREHOLDERS continued

As always, we encourage investors to maintain diversified investment portfolios, including allocations to fixed income funds, in pursuit of their long-term investment goals.

Please visit our Web site, EvergreenInvestments.com, for more information about our funds and other investment products available to you. Thank you for your continued support of Evergreen Investments.

Sincerely,

Dennis H. Ferro

President and Chief Executive Officer

Evergreen Investment Company, Inc.

Notice to Shareholders:

Effective October 1, 2006, Tattersall Advisory Group, Inc., an indirect, wholly-owned subsidiary of Wachovia, became the investment sub-advisor to the Fund and is paid by EIMC for its services to the Fund.

Special Notice to Shareholders:

Please visit our Web site at EvergreenInvestments.com for a statement from President and Chief Executive Officer, Dennis Ferro, addressing NASD actions involving Evergreen Investment Services, Inc. (EIS), Evergreen’s mutual fund distributor or statements from Dennis Ferro and Chairman of the Board of the Evergreen funds, Michael S. Scofield, addressing SEC actions involving the Evergreen funds.

3

Notification of Investment Strategy Change:

Effective February 1, 2007, the Fund may, but will not necessarily, use a variety of derivative instruments, such as futures contracts, options, and swaps, including, for example, index futures, Treasury futures, Eurodollar futures, interest rate swap agreements, credit default swaps, and total return swaps. The Fund may use derivatives both for hedging and non-hedging purposes, including for purposes of enhancing returns. The Fund’s use of derivative instruments involves risks different from, or possibly greater than, the risks associated with other types of investments. For example, the use of derivatives involves the risk of loss due to the failure of another party to the contract (typically referred to as a “counterparty”) to make required payments or otherwise to comply with the contract’s terms. Derivative transactions can create investment leverage and may be highly volatile and may be illiquid or difficult to price. Derivatives are highly specialized instruments, and involve the risk that an investment adviser may not accurately predict the performance of a derivative under all market conditions. When the Fund uses a derivative instrument, it could lose more than the principal amount invested. The various derivative instruments that the Fund may use may change from time to time as new derivative products become available to the Fund. More information about derivatives and the risks associated with them can be found in the Fund’s prospectus and statement of additional information, which may be obtained by calling 1.800.343.2898 or visiting our website at EvergreenInvestments.com.

4

Notice to Shareholders:

| The Fund’s prospectus has been amended to make the following change to the Fund’s short-term trading policy effective April 2, 2007: |

| |

| | To limit the negative effects of short-term trading on the Fund, the Fund��s Board of Trustees has adopted certain restrictions on trading by investors. If an investor redeems more than $5,000 (including redemptions that are a part of an exchange transaction) from an Evergreen Fund, that investor is “blocked” from purchasing shares of the Fund (including purchases that are a part of an exchange transaction) for 30 calendar days after the redemption. The short- term trading policy does not apply to: |

| |

| | | Money market funds; |

| |

| | | Evergreen Institutional Enhanced Income Fund; Evergreen Adjustable Rate Fund; and Evergreen Ultra Short Opportunities Fund; |

| |

| | | Systematic investments or exchanges where Evergreen or the financial intermediary maintaining the shareholder account identifies to Evergreen the transaction as a systematic redemption or purchase at the time of the transaction; |

| |

| | | Rebalancing transactions within certain asset allocation or “wrap” programs where Evergreen or the financial intermediary is able to identify the transaction as part of a firm-approved asset allocation program; |

| |

| | | Purchases by a “fund of funds” into the underlying fund vehicle and purchases by 529 Plans: |

| |

| | | Certain transactions involving participants in employer-sponsored retirement plans, including: participant withdrawals due to mandatory distributions, rollovers and hardships; withdrawals of shares acquired by participants through payroll deductions; and, shares acquired or sold by a participant in connection with plan loans; and |

| |

| | | Purchases below $5,000 (including purchases that are a part of an exchange transaction). |

| |

| | There are certain limitations on the Fund’s ability to detect and prevent short- term trading. For example, while the Fund has access to trading information relating to investors who trade and hold their shares directly with the Fund, the Fund may not have immediate access to such information for investors who trade through financial intermediaries such as broker dealers and financial advisors or through retirement plans. Certain financial intermediaries and retirement plans hold their shares or those of their clients through omnibus accounts maintained with the Fund. The Fund may be unable to compel financial intermediaries to apply the Fund’s short-term trading policy described above. The Fund reserves the right, in its sole discretion, to allow financial intermediaries to apply alternative short-term trading policies. The Fund will use reasonable diligence to confirm that such intermediary is applying the Fund’s short-term trading policy or an acceptable alternative. Consult the disclosure provided by your financial intermediary for any alternative short-term trading policies that may apply to your account. It is possible that excessive short-term trading or trading in violation of the Fund’s trading restrictions may occur despite the Fund’s efforts to prevent them. |

| |

| Effective April 2, 2007, the “Reinstatement Privileges” described in the Fund’s prospectus are eliminated. |

| |

5

FUND AT A GLANCE

as of October 31, 2006

MANAGEMENT TEAM

Investment Advisor:

• Evergreen Investment Management Company, LLC

Sub-Advisor:

• Tattersall Advisory Group, Inc.

Portfolio Manager:

• Gary Pzegeo, CFA

CURRENT INVESTMENT STYLE

Source: Morningstar, Inc.

Morningstar’s style box is based on a portfolio date as of 9/30/2006.

The Fixed income style box placement is based on a fund’s average effective maturity or duration and the average credit rating of the bond portfolio.

PERFORMANCE AND RETURNS

Portfolio inception date: 9/11/1935

| | | Class A | | Class B | | Class C | | Class I |

| Class inception date | | 1/20/1998 | | 9/11/1935 | | 1/21/1998 | | 4/14/1998 |

|

| Nasdaq symbol | | EKHAX | | EKHBX | | EKHCX | | EKHYX |

|

| 6-month return with sales charge | | -1.69% | | -1.99% | | 1.99% | | N/A |

|

| 6-month return w/o sales charge | | 3.36% | | 2.99% | | 2.99% | | 3.51% |

|

| Average annual return* | | | | | | | | |

|

| 1-year with sales charge | | 2.49% | | 1.71% | | 5.71% | | N/A |

|

| 1-year w/o sales charge | | 7.46% | | 6.71% | | 6.71% | | 7.77% |

|

| 5-year | | 7.69% | | 7.69% | | 7.98% | | 9.06% |

|

| 10-year | | 5.52% | | 5.36% | | 5.36% | | 6.27% |

|

| Maximum sales charge | | 4.75% | | 5.00% | | 1.00% | | N/A |

| | | Front-end | | CDSC | | CDSC | | |

|

* Adjusted for maximum applicable sales charge, unless noted.

Past performance is no guarantee of future results. The performance quoted represents past performance and current performance may be lower or higher. The investment return and principal value of an investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance information current to the most recent month-end for Classes A, B, C or I, please go to EvergreenInvestments.com/fundperformance. The performance of each class may vary based on differences in loads, fees and expenses paid by the shareholders investing in each class. Performance includes the reinvestment of income dividends and capital gain distributions. Performance shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Historical performance shown for Classes A, C and I prior to their inception is based on the performance of Class B, the original class offered. The historical returns for Classes A and I have not been adjusted to reflect the effect of each class’ 12b-1 fee. These fees are 0.30% for Class A and 1.00% for Classes B and C. Class I does not pay a 12b-1 fee. If these fees had been reflected, returns for Classes A and I would have been higher.

The advisor is reimbursing a portion of the 12b-1 fee for Class A. Had the fee not been reimbursed, returns for Class A would have been lower. Returns reflect expense limits previously in effect for all classes, without which returns would have been lower.

6

FUND AT A GLANCE continued

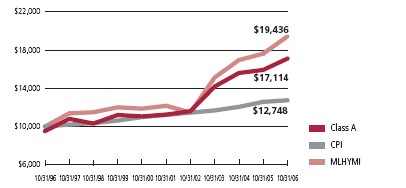

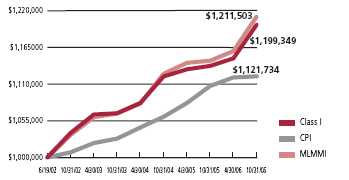

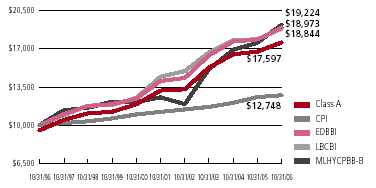

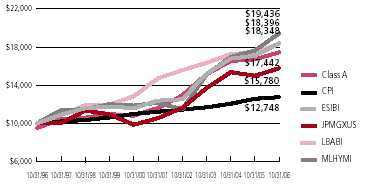

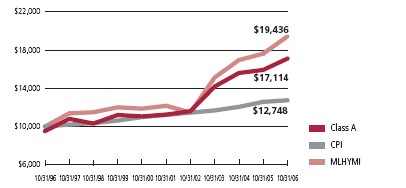

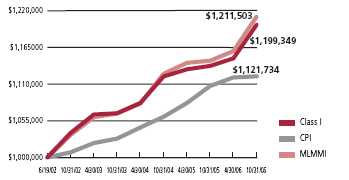

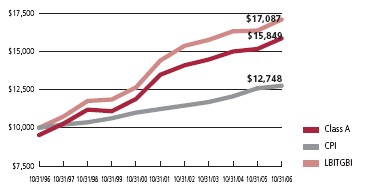

LONG-TERM GROWTH

Comparison of a $10,000 investment in the Evergreen High Yield Bond Fund Class A shares versus a similar investment in the Merrill Lynch High Yield Master Index† (MLHYMI) and the Consumer Price Index (CPI).

The MLHYMI is an unmanaged market index and does not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses or any taxes. The CPI is a commonly used measure of inflation and does not represent an investment return. It is not possible to invest directly in an index.

Class I shares are only offered in the following manner: (1) to investment advisory clients of Evergreen Investment Management Company, LLC (or its advisory affiliates) when purchased by such advisor(s) on behalf of its clients, (2) through arrangements entered into on behalf of the Evergreen funds with certain financial services firms, (3) to certain institutional investors and (4) to persons who owned Class Y shares in registered name in an Evergreen fund on or before December 31, 1994 or who owned shares of any SouthTrust fund in registered name as of March 18, 2005 or shares of Vestaur Securities Fund as of May 20, 2005.

Class I shares are only available to institutional shareholders with a minimum of $1 million investment, which may be waived in certain situations.

The fund’s investment objective may be changed without a vote of the fund’s shareholders.

Foreign investments may contain more risk due to the inherent risks associated with changing political climates, foreign market instability and foreign currency fluctuations.

Derivatives involve additional risks including interest rate risk, credit risk, the risk of improper valuation and the risk of non-correlation to the relevant instruments they are designed to hedge or to closely track.

High yield, lower-rated bonds may contain more risk due to the increased possibility of default.

The return of principal is not guaranteed due to fluctuation in the fund’s NAV caused by changes in the price of individual bonds held by the fund and the buying and selling of bonds by the fund. Bond funds have the same inflation, interest rate and credit risks as individual bonds. Generally, the value of bond funds rise when prevailing interest rates fall, and fall when interest rates rise.

† Copyright 2006. Merrill Lynch, Pierce, Fenner & Smith Incorporated. All rights reserved.

All data is as of October 31, 2006, and subject to change.

7

ABOUT YOUR FUND’S EXPENSES

The Example below is intended to describe the fees and expenses borne by shareholders and the impact of those costs on your investment.

Example

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads), redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2006 to October 31, 2006.

The example illustrates your fund’s costs in two ways:

- Actual expenses

The section in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class, in the column entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. - Hypothetical example for comparison purposes

The section in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the section in the table under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning | | Ending | | |

| | | Account | | Account | | Expenses |

| | | Value | | Value | | Paid During |

| | | 5/1/2006 | | 10/31/2006 | | Period* |

|

| Actual | | | | | | |

| Class A | | $ 1,000.00 | | $ 1,033.63 | | $ 5.43 |

| Class B | | $ 1,000.00 | | $ 1,029.91 | | $ 9.16 |

| Class C | | $ 1,000.00 | | $ 1,029.91 | | $ 9.16 |

| Class I | | $ 1,000.00 | | $ 1,035.09 | | $ 4.05 |

| Hypothetical | | | | | | |

| (5% return | | | | | | |

| before expenses) | | | | | | |

| Class A | | $ 1,000.00 | | $ 1,019.86 | | $ 5.40 |

| Class B | | $ 1,000.00 | | $ 1,016.18 | | $ 9.10 |

| Class C | | $ 1,000.00 | | $ 1,016.18 | | $ 9.10 |

| Class I | | $ 1,000.00 | | $ 1,021.22 | | $ 4.02 |

|

* For each class of the Fund, expenses are equal to the annualized expense ratio of each class (1.06% for Class A, 1.79% for Class B, 1.79% for Class C and 0.79% for Class I), multiplied by the average account value over the period, multiplied by 184 / 365 days.

8

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

| | | | | | | | | | | | | |

| | | Six Months Ended | | Year Ended April 30, |

| | October 31, 2006 | |

|

| CLASS A | | (unaudited) | | 2006 | | 2005 | | 2004 | | 2003 | | 20021 |

|

| Net asset value, beginning of period | | $ 3.31 | | $ 3.32 | | $ 3.43 | | $ 3.30 | | $ 3.29 | | $ 3.39 |

|

| Income from investment operations | | | | | | | | | | | | |

| Net investment income (loss) | | 0.12 | | 0.23 | | 0.24 | | 0.25 | | 0.272 | | 0.27 |

Net realized and unrealized gains

or losses on investments | | (0.01) | | 0 | | (0.10) | | 0.14 | | 0.01 | | (0.09) |

| |

|

| Total from investment operations | | 0.11 | | 0.23 | | 0.14 | | 0.39 | | 0.28 | | 0.18 |

|

| Distributions to shareholders from | | | | | | | | | | | | |

| Net investment income | | (0.12) | | (0.24) | | (0.25) | | (0.26) | | (0.27) | | (0.28) |

|

| Net asset value, end of period | | $ 3.30 | | $ 3.31 | | $ 3.32 | | $ 3.43 | | $ 3.30 | | $ 3.29 |

|

| Total return3 | | 3.36% | | 7.01% | | 4.14% | | 12.25% | | 9.42% | | 5.77% |

|

| Ratios and supplemental data | | | | | | | | | | | | |

| Net assets, end of period (thousands) | | $352,463 | | $388,523 | | $467,714 | | $530,526 | | $484,346 | | $321,830 |

| Ratios to average net assets | | | | | | | | | | | | |

| Expenses including waivers/reimbursements | | | | | | | | | | | | |

| but excluding expense reductions | | 1.06%4 | | 1.04% | | 1.04% | | 1.01% | | 1.11% | | 1.19% |

| Expenses excluding waivers/reimbursements | | | | | | | | | | | | |

| and expense reductions | | 1.09%4 | | 1.05% | | 1.04% | | 1.02% | | 1.11% | | 1.21% |

| Net investment income (loss) | | 7.02%4 | | 6.95% | | 7.16% | | 7.42% | | 8.70% | | 8.27% |

| Portfolio turnover rate | | 29% | | 67% | | 65% | | 71% | | 80% | | 138% |

|

1 As required, effective May 1, 2001, the Fund has adopted the provisions of the AICPA Audit and Accounting Guide, Audits of Investment Companies, and began amortizing premium on its fixed-income securities . The effects of this change for the year ended April 30, 2002 were a decrease in net investmen t income per share of $0.00; an increase in net realized gains or losses per share of $0.00; and a decrease to the ratio of net investment income to average net assets of 0.13%.

2 Net investment income (loss) per share is based on average shares outstanding during the period.

3 Excluding applicable sales charges

4 Annualized

See Notes to Financial Statements

9

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

| | | | | | | | | | | | | |

| | | Six Months Ended | | Year Ended April 30, |

| | October 31, 2006 | |

|

| CLASS B | | (unaudited) | | 2006 | | 2005 | | 2004 | | 2003 | | 20021 |

|

| Net asset value, beginning of period | | $ 3.31 | | $ 3.32 | | $ 3.43 | | $ 3.30 | | $ 3.29 | | $ 3.39 |

|

| Income from investment operations | | | | | | | | | | | | |

| Net investment income (loss) | | 0.10 | | 0.212 | | 0.22 | | 0.232 | | 0.252 | | 0.242 |

Net realized and unrealized gains

or losses on investments | | 0 | | (0.01)3 | | (0.10) | | 0.14 | | 0.01 | | (0.08) |

| |

|

| Total from investment operations | | 0.10 | | 0.20 | | 0.12 | | 0.37 | | 0.26 | | 0.16 |

|

| Distributions to shareholders from | | | | | | | | | | | | |

| Net investment income | | (0.11) | | (0.21) | | (0.23) | | (0.24) | | (0.25) | | (0.26) |

|

| Net asset value, end of period | | $ 3.30 | | $ 3.31 | | $ 3.32 | | $ 3.43 | | $ 3.30 | | $ 3.29 |

|

| Total return3 | | 2.99% | | 6.27% | | 3.42% | | 11.46% | | 8.61% | | 4.98% |

|

| Ratios and supplemental data | | | | | | | | | | | | |

| Net assets, end of period (thousands) | | $159,001 | | $176,663 | | $211,950 | | $247,741 | | $173,002 | | $54,537 |

| Ratios to average net assets | | | | | | | | | | | | |

| Expenses including waivers/reimbursements | | | | | | | | | | | | |

| but excluding expense reductions | | 1.79%4 | | 1.75% | | 1.74% | | 1.72% | | 1.84% | | 1.92% |

| Expenses excluding waivers/reimbursements | | | | | | | | | | | | |

| and expense reductions | | 1.79%4 | | 1.75% | | 1.74% | | 1.72% | | 1.84% | | 1.95% |

| Net investment income (loss) | | 6.30%4 | | 6.25% | | 6.46% | | 6.71% | | 7.99% | | 7.49% |

| Portfolio turnover rate | | 29% | | 67% | | 65% | | 71% | | 80% | | 138% |

|

1 As required, effective May 1, 2001, the Fund has adopted the provisions of the AICPA Audit and Accounting Guide, Audits of Investment Companies, and began amortizing premium on its fixed-income securities . The effects of this change for the year ended April 30, 2002 were a decrease in net investmen t income per share of $0.01; an increase in net realized gains or losses per share of $0.01; and a decrease to the ratio of net investment income to average net assets of 0.13%.

2 Net investment income (loss) per share is based on average shares outstanding during the period.

3 Excluding applicable sales charges

4 Annualized

See Notes to Financial Statements

10

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

| | | | | | | | | | | | | |

| | | Six Months Ended | | Year Ended April 30, |

| | October 31, 2006 | |

|

| CLASS C | | (unaudited) | | 2006 | | 2005 | | 2004 | | 2003 | | 20021 |

|

| Net asset value, beginning of period | | $ 3.31 | | $ 3.32 | | $ 3.43 | | $ 3.30 | | $ 3.29 | | $ 3.39 |

|

| Income from investment operations | | | | | | | | | | | | |

| Net investment income (loss) | | 0.10 | | 0.21 | | 0.22 | | 0.23 | | 0.252 | | 0.26 |

Net realized and unrealized gains

or losses on investments | | 0 | | (0.01)3 | | (0.10) | | 0.14 | | 0.01 | | (0.10) |

| |

|

| Total from investment operations | | 0.10 | | 0.20 | | 0.12 | | 0.37 | | 0.26 | | 0.16 |

|

| Distributions to shareholders from | | | | | | | | | | | | |

| Net investment income | | (0.11) | | (0.21) | | (0.23) | | (0.24) | | (0.25) | | (0.26) |

|

| Net asset value, end of period | | $ 3.30 | | $ 3.31 | | $ 3.32 | | $ 3.43 | | $ 3.30 | | $ 3.29 |

|

| Total return4 | | 2.99% | | 6.27% | | 3.42% | | 11.46% | | 8.61% | | 4.98% |

|

| Ratios and supplemental data | | | | | | | | | | | | |

| Net assets, end of period (thousands) | | $175,707 | | $201,975 | | $281,810 | | $381,525 | | $290,914 | | $105,753 |

| Ratios to average net assets | | | | | | | | | | | | |

| Expenses including waivers/reimbursements | | | | | | | | | | | | |

| but excluding expense reductions | | 1.79%5 | | 1.75% | | 1.74% | | 1.72% | | 1.85% | | 1.93% |

| Expenses excluding waivers/reimbursements | | | | | | | | | | | | |

| and expense reductions | | 1.79%5 | | 1.75% | | 1.74% | | 1.72% | | 1.85% | | 1.95% |

| Net investment income (loss) | | 6.30%5 | | 6.25% | | 6.47% | | 6.72% | | 7.98% | | 7.52% |

| Portfolio turnover rate | | 29% | | 67% | | 65% | | 71% | | 80% | | 138% |

|

1 As required, effective May 1, 2001, the Fund has adopted the provisions of the AICPA Audit and Accounting Guide, Audits of Investment Companies, and began amortizing premium on its fixed-income securities . The effects of this change for the year ended April 30, 2002 were a decrease in net investmen t income per share of $0.00; an increase in net realized gains or losses per share of $0.00; and a decrease to the ratio of net investment income to average net assets of 0.13%.

2 Net investment income (loss) per share is based on average shares outstanding during the period.

3 The per share net realized and unrealized gains or losses is not in accord with the net realized and unrealized gains or losses for the period due to the timing of sales and redemptions of Fund shares in relation to fluctuating market values for the portfolio .

4 Excluding applicable sales charges

5 Annualized

See Notes to Financial Statements

11

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

| | | | | | | | | | | | | |

| | | Six Months Ended | | Year Ended April 30, |

| | October 31, 2006 | |

|

| CLASS I1 | | (unaudited) | | 2006 | | 2005 | | 2004 | | 2003 | | 20022 |

|

| Net asset value, beginning of period | | $ 3.31 | | $ 3.32 | | $ 3.43 | | $ 3.30 | | $ 3.29 | | $ 3.39 |

|

| Income from investment operations | | | | | | | | | | | | |

| Net investment income (loss) | | 0.12 | | 0.24 | | 0.26 | | 0.26 | | 0.283 | | 0.29 |

Net realized and unrealized gains

or losses on investments | | (0.01) | | 0 | | (0.11) | | 0.14 | | 0.01 | | (0.10) |

| |

|

| Total from investment operations | | 0.11 | | 0.24 | | 0.15 | | 0.40 | | 0.29 | | 0.19 |

|

| Distributions to shareholders from | | | | | | | | | | | | |

| Net investment income | | (0.12) | | (0.25) | | (0.26) | | (0.27) | | (0.28) | | (0.29) |

|

| Net asset value, end of period | | $ 3.30 | | $ 3.31 | | $ 3.32 | | $ 3.43 | | $ 3.30 | | $ 3.29 |

|

| Total return | | 3.51% | | 7.33% | | 4.45% | | 12.58% | | 9.69% | | 6.04% |

|

| Ratios and supplemental data | | | | | | | | | | | | |

| Net assets, end of period (thousands) | | $43,336 | | $50,365 | | $60,412 | | $37,894 | | $49,370 | | $10,011 |

| Ratios to average net assets | | | | | | | | | | | | |

| Expenses including waivers/reimbursements | | | | | | | | | | | | |

| but excluding expense reductions | | 0.79%4 | | 0.75% | | 0.74% | | 0.72% | | 0.84% | | 0.92% |

| Expenses excluding waivers/reimbursements | | | | | | | | | | | | |

| and expense reductions | | 0.79%4 | | 0.75% | | 0.74% | | 0.72% | | 0.84% | | 0.94% |

| Net investment income (loss) | | 7.29%4 | | 7.23% | | 7.46% | | 7.73% | | 9.05% | | 8.53% |

| Portfolio turnover rate | | 29% | | 67% | | 65% | | 71% | | 80% | | 138% |

|

1 Effective at the close of business on May 11, 2001, Class Y shares were renamed as Class I shares.

2 As required, effective May 1, 2001, the Fund has adopted the provisions of the AICPA Audit and Accounting Guide, Audits of Investment Companies, and began amortizing premium on its fixed-income securities . The effects of this change for the year ended April 30, 2002 were a decrease in net investmen t income per share of $0.00; an increase in net realized gains or losses per share of $0.00; and a decrease to the ratio of net investment income to average net assets of 0.13%.

3 Net investment income (loss) per share is based on average shares outstanding during the period.

4 Annualized

See Notes to Financial Statements

12

SCHEDULE OF INVESTMENTS

October 31, 2006 (unaudited)

| | | Principal | | |

| | | Amount | | Value |

|

| CORPORATE BONDS 86.1% | | | | |

| CONSUMER DISCRETIONARY 24.2% | | | | |

| Auto Components 2.2% | | | | |

| Accuride Corp., 8.50%, 02/01/2015 | | $ 4,750,000 | | $ 4,631,250 |

| American Axle & Manufacturing Holdings, Inc., 5.25%, 02/11/2014 (p) | | 10,000,000 | | 8,425,000 |

| ArvinMeritor, Inc., 6.80%, 02/15/2009 | | 543,000 | | 524,674 |

| Goodyear Tire & Rubber Co., 9.00%, 07/01/2015 (p) | | 2,000,000 | | 2,032,500 |

| |

|

| | | | | 15,613,424 |

| |

|

| Automobiles 1.2% | | | | |

| Ford Motor Co.: | | | | |

| 5.80%, 01/12/2009 | | 1,225,000 | | 1,170,658 |

| 7.45%, 07/16/2031 (p) | | 3,000,000 | | 2,366,250 |

| General Motors Corp., 8.375%, 07/15/2033 (p) | | 6,000,000 | | 5,370,000 |

| |

|

| | | | | 8,906,908 |

| |

|

| Diversified Consumer Services 1.5% | | | | |

| Education Management Corp., 8.75%, 06/01/2014 144A | | 2,100,000 | | 2,163,000 |

| Service Corporation International, 8.00%, 06/15/2017 144A | | 9,000,000 | | 8,730,000 |

| |

|

| | | | | 10,893,000 |

| |

|

| Hotels, Restaurants & Leisure 4.2% | | | | |

| Festival Fun Parks, LLC, 10.875%, 04/15/2014 | | 3,750,000 | | 3,703,125 |

| Inn of the Mountain Gods Resort & Casino, 12.00%, 11/15/2010 (p) | | 7,000,000 | | 7,525,000 |

| Isle of Capri Casinos, Inc., 7.00%, 03/01/2014 | | 5,500,000 | | 5,307,500 |

| Las Vegas Sands Corp., 6.375%, 02/15/2015 (p) | | 4,070,000 | | 3,846,150 |

| Mandalay Resort Group, Ser. B, 10.25%, 08/01/2007 | | 6,000,000 | | 6,202,500 |

| Pokagon Gaming Authority, 10.375%, 06/15/2014 144A | | 3,800,000 | | 4,094,500 |

| |

|

| | | | | 30,678,775 |

| |

|

| Household Durables 1.1% | | | | |

| Jarden Corp., 9.75%, 05/01/2012 (p) | | 3,570,000 | | 3,793,125 |

| Libbey, Inc., FRN, 12.44%, 06/01/2011 144A | | 4,000,000 | | 4,260,000 |

| |

|

| | | | | 8,053,125 |

| |

|

| Media 8.3% | | | | |

| Cablevision Systems Corp., Ser. B, 8.00%, 04/15/2012 | | 7,521,000 | | 7,342,376 |

| CCH I, LLC, 11.00%, 10/01/2015 | | 4,700,000 | | 4,553,125 |

| Cinemark USA, Inc., 9.00%, 02/01/2013 | | 2,440,000 | | 2,552,850 |

| Dex Media East, LLC, 9.875%, 11/15/2009 | | 6,000,000 | | 6,337,500 |

| Houghton Mifflin Co.: | | | | |

| 8.25%, 02/01/2011 | | 5,000,000 | | 5,175,000 |

| FRN, 12.03%, 05/15/2011 144A | | 5,000,000 | | 5,300,000 |

| Lamar Media Corp., 6.625%, 08/15/2015 | | 8,675,000 | | 8,393,063 |

| Mediacom Broadband, LLC, 8.50%, 10/15/2015 144A | | 3,000,000 | | 3,011,250 |

| Mediacom Communications Corp., 9.50%, 01/15/2013 (p) | | 11,250,000 | | 11,601,562 |

| Paxson Communications Corp., FRN, 11.62%, 01/15/2013 144A | | 5,500,000 | | 5,534,375 |

| Sirius Satellite Radio, Inc., 9.625%, 08/01/2013 (p) | | 1,068,000 | | 1,046,640 |

| |

|

| | | | | 60,847,741 |

| |

|

See Notes to Financial Statements

13

SCHEDULE OF INVESTMENTS continued

October 31, 2006 (unaudited)

| | | Principal | | |

| | | Amount | | Value |

|

| CORPORATE BONDS continued | | | | |

| CONSUMER DISCRETIONARY continued | | | | |

| Multi-line Retail 0.5% | | | | |

| Neiman Marcus Group, Inc., 9.00%, 10/15/2015 | | $ 3,500,000 | | $ 3,771,250 |

| |

|

| Specialty Retail 3.2% | | | | |

| Baker & Taylor, Inc., 11.50%, 07/01/2013 144A | | 4,500,000 | | 4,522,500 |

| Linens ‘n Things, Inc., 11.00%, 01/15/2014 (p) | | 4,000,000 | | 3,940,000 |

| Michaels Stores, Inc.: | | | | |

| 10.00%, 11/01/2014 144A | | 2,500,000 | | 2,515,625 |

| 11.375%, 11/01/2016 144A (p) | | 1,850,000 | | 1,861,563 |

| Payless ShoeSource, Inc., 8.25%, 08/01/2013 | | 6,500,000 | | 6,662,500 |

| United Auto Group, Inc., 9.625%, 03/15/2012 | | 3,650,000 | | 3,864,437 |

| |

|

| | | | | 23,366,625 |

| |

|

| Textiles, Apparel & Luxury Goods 2.0% | | | | |

| Levi Strauss & Co., 9.75%, 01/15/2015 (p) | | 3,650,000 | | 3,887,250 |

| Oxford Industries, Inc., 8.875%, 06/01/2011 | | 4,000,000 | | 4,125,000 |

| Unifi, Inc., 11.50%, 05/15/2014 144A | | 3,500,000 | | 3,307,500 |

| Warnaco Group, Inc., 8.875%, 06/15/2013 | | 3,000,000 | | 3,150,000 |

| |

|

| | | | | 14,469,750 |

| |

|

| ENERGY 13.0% | | | | |

| Energy Equipment & Services 2.1% | | | | |

| Dresser-Rand Group, Inc., 7.375%, 11/01/2014 | | 4,154,000 | | 4,128,037 |

| GulfMark Offshore, Inc., 7.75%, 07/15/2014 (p) | | 3,025,000 | | 3,055,250 |

| Hornbeck Offshore Services, Inc., Ser. B, 6.125%, 12/01/2014 | | 5,575,000 | | 5,219,594 |

| Parker Drilling Co., 9.625%, 10/01/2013 (p) | | 2,830,000 | | 3,091,775 |

| |

|

| | | | | 15,494,656 |

| |

|

| Oil, Gas & Consumable Fuels 10.9% | | | | |

| ANR Pipeline Co., 8.875%, 03/15/2010 | | 1,650,000 | | 1,741,563 |

| Chesapeake Energy Corp., 6.875%, 01/15/2016 | | 9,145,000 | | 9,122,138 |

| Clayton Williams Energy, Inc., 7.75%, 08/01/2013 | | 5,450,000 | | 5,054,875 |

| El Paso Corp.: | | | | |

| 7.75%, 06/01/2013 | | 7,755,000 | | 7,987,650 |

| 7.875%, 06/15/2012 (p) | | 10,000,000 | | 10,475,000 |

| Encore Acquisition Co., 6.25%, 04/15/2014 | | 9,250,000 | | 8,648,750 |

| Exco Resources, Inc., 7.25%, 01/15/2011 | | 8,650,000 | | 8,368,875 |

| Overseas Shipholding Group, Inc., 8.25%, 03/15/2013 | | 4,400,000 | | 4,642,000 |

| Peabody Energy Corp.: | | | | |

| 5.875%, 04/15/2016 | | 4,275,000 | | 4,039,875 |

| 6.875%, 03/15/2013 | | 2,380,000 | | 2,427,600 |

| Plains Exploration & Production Co.: | | | | |

| 7.125%, 06/15/2014 | | 1,445,000 | | 1,556,988 |

| 8.75%, 07/01/2012 (p) | | 2,730,000 | | 2,914,275 |

| Targa Resources, Inc., 8.50%, 11/01/2013 144A | | 4,500,000 | | 4,511,250 |

| Williams Cos., 8.125%, 03/15/2012 (p) | | 7,250,000 | | 7,811,875 |

| |

|

| | | | | 79,302,714 |

| |

|

See Notes to Financial Statements

14

SCHEDULE OF INVESTMENTS continued

October 31, 2006 (unaudited)

| | | | | Principal | | |

| | | | | Amount | | Value |

|

| CORPORATE BONDS continued | | | | |

| FINANCIALS 9.0% | | | | | | |

| Consumer Finance 5.9% | | | | |

| CCH II Capital Corp., 10.25%, 09/15/2010 | | $ 8,250,000 | | $ 8,559,375 |

| Ford Motor Credit Co., 5.70%, 01/15/2010 (p) | | 3,350,000 | | 3,104,572 |

| General Motors Acceptance Corp., 6.875%, 08/28/2012 | | 11,275,000 | | 11,318,657 |

| NXP Funding, LLC, 7.875%, 10/15/2014 144A | | 5,500,000 | | 5,610,000 |

| Qwest Capital Funding, Inc., 6.50%, 11/15/2018 | | 10,500,000 | | 9,660,000 |

| Terra Capital, Inc., 11.50%, 06/01/2010 | | 4,750,000 | | 5,177,500 |

| |

|

| | | | | | | 43,430,104 |

| |

|

| Real Estate Investment Trusts 3.1% | | | | |

| Host Marriott Corp.: | | | | | | |

| Ser. G, 9.25%, 10/01/2007 | | 4,000,000 | | 4,140,000 |

| Ser. J, 7.125%, 11/01/2013 | | 4,000,000 | | 4,065,000 |

| Omega Healthcare Investors, Inc.: | | | | |

| 7.00%, 04/01/2014 | | 4,450,000 | | 4,477,812 |

| 7.00%, 01/15/2016 | | 3,850,000 | | 3,854,813 |

| Thornburg Mortgage, Inc., 8.00%, 05/15/2013 | | 6,325,000 | | 6,261,750 |

| |

|

| | | | | | | 22,799,375 |

| |

|

| HEALTH CARE 0.9% | | | | |

| Health Care Providers & Services 0.9% | | | | |

| HCA, Inc., 6.375%, 01/15/2015 | | 5,955,000 | | 4,778,888 |

| HealthSouth Corp., 10.75%, 06/15/2016 144A (p) | | 2,000,000 | | 2,060,000 |

| |

|

| | | | | | | 6,838,888 |

| |

|

| INDUSTRIALS 8.1% | | | | |

| Aerospace & Defense 0.7% | | | | |

| DRS Technologies, Inc., 7.625%, 02/01/2018 | | 5,000,000 | | 5,137,500 |

| |

|

| Air Freight & Logistics 0.9% | | | | |

| PHI, Inc., 7.125%, 04/15/2013 144A | | 7,000,000 | | 6,650,000 |

| |

|

| Commercial Services & Supplies 0.5% | | | | |

| West Corp., 11.00%, 10/15/2016 144A | | 3,750,000 | | 3,778,125 |

| |

|

| Machinery 2.8% | | | | | | |

| Case New Holland, Inc., 9.25%, 08/01/2011 | | 3,650,000 | | 3,891,812 |

| Commercial Vehicle Group, Inc., 8.00%, 07/01/2013 | | 5,120,000 | | 4,992,000 |

| ITT Corp., 7.375%, 11/15/2015 | | 4,395,000 | | 4,460,925 |

| RBS Global, Inc.: | | | | | | |

| 9.50%, 08/01/2014 144A | | 4,750,000 | | 4,940,000 |

| 11.75%, 08/01/2016 144A | | 1,900,000 | | 1,985,500 |

| |

|

| | | | | | | 20,270,237 |

| |

|

| Marine 0.7% | | | | | | |

| Horizon Lines, LLC, Sr. Disc. Note, Step Bond, 0.00%, 04/01/2013 † | | 5,303,000 | | 4,812,473 |

| |

|

| Road & Rail 1.3% | | | | | | |

| Avis Rent-A-Car, Inc., 7.75%, 05/15/2016 144A | | 9,500,000 | | 9,310,000 |

| |

|

See Notes to Financial Statements

15

SCHEDULE OF INVESTMENTS continued

October 31, 2006 (unaudited)

| | | Principal | | |

| | | Amount | | Value |

|

| CORPORATE BONDS continued | | | | |

| INDUSTRIALS continued | | | | |

| Trading Companies & Distributors 1.2% | | | | |

| Ashtead Group plc, 9.00%, 08/15/2016 144A | | $ 4,500,000 | | $ 4,758,750 |

| United Rentals, Inc., 7.00%, 02/15/2014 (p) | | 4,500,000 | | 4,331,250 |

| |

|

| | | | | 9,090,000 |

| |

|

| INFORMATION TECHNOLOGY 3.2% | | | | |

| Electronic Equipment & Instruments 0.3% | | | | |

| Compucom Systems, Inc., 12.00%, 11/01/2014 144A | | 2,500,000 | | 2,528,125 |

| |

|

| IT Services 1.4% | | | | |

| iPayment, Inc., 9.75%, 05/15/2014 144A | | 2,850,000 | | 2,942,625 |

| SunGard Data Systems, Inc., 9.125%, 08/15/2013 | | 7,400,000 | | 7,714,500 |

| |

|

| | | | | 10,657,125 |

| |

|

| Semiconductors & Semiconductor Equipment 0.3% | | | | |

| Spansion, LLC, 11.25%, 01/15/2016 144A (p) | | 1,850,000 | | 1,933,250 |

| |

|

| Software 1.2% | | | | |

| Activant Solutions, Inc., 9.50%, 05/01/2016 144A | | 3,800,000 | | 3,553,000 |

| UGS Capital Corp. II, 10.38%, 06/01/2011 144A | | 4,750,000 | | 4,928,125 |

| |

|

| | | | | 8,481,125 |

| |

|

| MATERIALS 11.7% | | | | |

| Chemicals 4.6% | | | | |

| Hexion Specialty Chemicals, Inc., 9.75%, 11/15/2014 144A # | | 3,500,000 | | 3,508,750 |

| Huntsman International, LLC: | | | | |

| 8.375%, 01/01/2015 144A (p) | | 4,000,000 | | 3,970,000 |

| 11.50%, 07/15/2012 | | 6,105,000 | | 6,944,437 |

| Lyondell Chemical Co., 10.50%, 06/01/2013 | | 11,600,000 | | 12,818,000 |

| Tronox Worldwide, LLC, 9.50%, 12/01/2012 (p) | | 6,150,000 | | 6,380,625 |

| |

|

| | | | | 33,621,812 |

| |

|

| Containers & Packaging 3.2% | | | | |

| Berry Plastics Corp., 8.875%, 09/15/2014 144A | | 4,000,000 | | 4,060,000 |

| Crown Americas, Inc., 7.75%, 11/15/2015 (p) | | 8,000,000 | | 8,250,000 |

| Owens-Brockway Glass Containers, Inc., 6.75%, 12/01/2014 (p) | | 6,500,000 | | 6,272,500 |

| Smurfit-Stone Container Corp., 8.375%, 07/01/2012 | | 4,500,000 | | 4,410,000 |

| |

|

| | | | | 22,992,500 |

| |

|

| Metals & Mining 2.5% | | | | |

| Freeport-McMoRan Copper & Gold, Inc., 6.875%, 02/01/2014 (p) | | 7,050,000 | | 7,050,000 |

| United States Steel Corp., 10.75%, 08/01/2008 (p) | | 10,526,000 | | 11,394,395 |

| |

|

| | | | | 18,444,395 |

| |

|

| Paper & Forest Products 1.4% | | | | |

| Bowater, Inc., 6.50%, 06/15/2013 (p) | | 3,000,000 | | 2,677,500 |

| Verso Paper Holdings, LLC: | | | | |

| 9.125%, 08/01/2014 144A | | 2,250,000 | | 2,295,000 |

| 11.375%, 08/01/2016 144A (p) | | 5,250,000 | | 5,355,000 |

| |

|

| | | | | 10,327,500 |

| |

|

See Notes to Financial Statements

16

SCHEDULE OF INVESTMENTS continued

October 31, 2006 (unaudited)

| | | Principal | | |

| | | Amount | | Value |

|

| CORPORATE BONDS continued | | | | |

| TELECOMMUNICATION SERVICES 6.7% | | | | |

| Diversified Telecommunication Services 2.6% | | | | |

| Consolidated Communications, Inc., 9.75%, 04/01/2012 | | $ 4,579,000 | | $ 4,876,635 |

| Level 3 Communications, Inc., 6.375%, 10/15/2015 | | 8,625,000 | | 8,538,750 |

| Qwest Communications International, Inc., 7.875%, 09/01/2011 | | 5,425,000 | | 5,770,844 |

| |

|

| | | | | 19,186,229 |

| |

|

| Wireless Telecommunication Services 4.1% | | | | |

| Centennial Communications Corp.: | | | | |

| 8.125%, 02/01/2014 (p) | | 4,750,000 | | 4,779,687 |

| 10.00%, 01/01/2013 (p) | | 4,800,000 | | 5,004,000 |

| Cricket Communications, Inc., 9.375%, 11/01/2014 144A (p) | | 3,500,000 | | 3,587,500 |

| Dobson Communications Corp., 8.875%, 10/01/2013 (p) | | 3,850,000 | | 3,869,250 |

| Horizon PCS, Inc., 11.375%, 07/15/2012 | | 3,655,000 | | 4,121,012 |

| Metropcs Wireless, Inc., 9.25%, 11/01/2014 144A # | | 3,200,000 | | 3,244,000 |

| Rural Cellular Corp.: | | | | |

| 8.25%, 03/15/2012 (p) | | 1,170,000 | | 1,209,488 |

| 9.75%, 01/15/2010 (p) | | 3,750,000 | | 3,815,625 |

| |

|

| | | | | 29,630,562 |

| |

|

| UTILITIES 9.3% | | | | |

| Electric Utilities 4.2% | | | | |

| Mirant North America, LLC, 7.375%, 12/31/2013 | | 6,575,000 | | 6,681,844 |

| NRG Energy, Inc., 7.375%, 02/01/2016 | | 13,675,000 | | 13,863,031 |

| Reliant Energy, Inc., 6.75%, 12/15/2014 | | 10,250,000 | | 9,827,187 |

| |

|

| | | | | 30,372,062 |

| |

|

| Gas Utilities 1.1% | | | | |

| SEMCO Energy, Inc.: | | | | |

| 7.125%, 05/15/2008 | | 3,500,000 | | 3,504,690 |

| 7.75%, 05/15/2013 | | 4,500,000 | | 4,531,856 |

| |

|

| | | | | 8,036,546 |

| |

|

| Independent Power Producers & Energy Traders 4.0% | | | | |

| AES Corp., 7.75%, 03/01/2014 (p) | | 8,460,000 | | 8,904,150 |

| Dynegy, Inc., 8.375%, 05/01/2016 (p) | | 12,250,000 | | 12,648,125 |

| Orion Power Holdings, Inc., 12.00%, 05/01/2010 | | 5,100,000 | | 5,814,000 |

| Tenaska, Inc., 7.00%, 06/30/2021 144A | | 2,083,779 | | 2,073,012 |

| |

|

| | | | | 29,439,287 |

| |

|

| Total Corporate Bonds (cost $623,094,574) | | | | 629,165,188 |

| |

|

| YANKEE OBLIGATIONS - CORPORATE 6.7% | | | | |

| CONSUMER DISCRETIONARY 1.5% | | | | |

| Media 1.5% | | | | |

| IMAX Corp., 9.625%, 12/01/2010 (p) | | 7,800,000 | | 7,293,000 |

| National Cable plc, 9.125%, 08/15/2016 | | 3,800,000 | | 4,013,750 |

| |

|

| | | | | 11,306,750 |

| |

|

See Notes to Financial Statements

17

SCHEDULE OF INVESTMENTS continued

October 31, 2006 (unaudited)

| | | Principal | | |

| | | Amount | | Value |

|

| YANKEE OBLIGATIONS - CORPORATE continued | | | | |

| FINANCIALS 0.7% | | | | |

| Diversified Financial Services 0.7% | | | | |

| Ship Finance International, Ltd., 8.50%, 12/15/2013 | | $ 4,915,000 | | $ 4,816,700 |

| |

|

| MATERIALS 2.0% | | | | |

| Chemicals 0.7% | | | | |

| Ineos Group Holdings plc, 8.50%, 02/15/2016 144A | | 5,000,000 | | 4,837,500 |

| |

|

| Metals & Mining 0.8% | | | | |

| Novelis, Inc., FRN, 8.25%, 02/15/2015 144A | | 5,940,000 | | 5,702,400 |

| |

|

| Paper & Forest Products 0.5% | | | | |

| Abitibi-Consolidated, Inc., 8.375%, 04/01/2015 (p) | | 4,250,000 | | 3,724,063 |

| |

|

| TELECOMMUNICATION SERVICES 2.5% | | | | |

| Diversified Telecommunication Services 0.7% | | | | |

| Nordic Telecom Holdings Co., 8.875%, 05/01/2016 144A | | 4,750,000 | | 4,999,375 |

| |

|

| Wireless Telecommunication Services 1.8% | | | | |

| Intelsat, Ltd.: | | | | |

| 9.25%, 06/15/2016 144A | | 3,500,000 | | 3,753,750 |

| 11.25%, 06/15/2016 144A | | 2,600,000 | | 2,843,750 |

| Rogers Wireless, Inc.: | | | | |

| 6.375%, 03/01/2014 (p) | | 2,790,000 | | 2,803,950 |

| 9.625%, 05/01/2011 | | 3,475,000 | | 3,952,812 |

| |

|

| | | | | 13,354,262 |

| |

|

| Total Yankee Obligations - Corporate (cost $48,332,149) | | | | 48,741,050 |

| | |

|

|

| | | Shares | | Value |

|

| COMMON STOCKS 1.0% | | | | |

| CONSUMER DISCRETIONARY 0.2% | | | | |

| Media 0.2% | | | | |

| Charter Communications, Inc., Class A * (p) | | 425,000 | | 977,500 |

| Comcast Corp., Class A * (p) | | 17,500 | | 711,725 |

| |

|

| | | | | 1,689,225 |

| |

|

| MATERIALS 0.5% | | | | |

| Chemicals 0.2% | | | | |

| Huntsman Corp. * + | | 88,065 | | 1,520,882 |

| |

|

| Containers & Packaging 0.3% | | | | |

| Smurfit-Stone Container Corp. * (p) | | 185,000 | | 1,972,100 |

| |

|

| UTILITIES 0.3% | | | | |

| Electric Utilities 0.3% | | | | |

| Mirant Corp. * | | 80,000 | | 2,365,600 |

| |

|

| Total Common Stocks (cost $6,306,723) | | | | 7,547,807 |

| |

|

See Notes to Financial Statements

18

SCHEDULE OF INVESTMENTS continued

October 31, 2006 (unaudited)

| | | | | | | Shares | | Value |

|

| WARRANTS 0.0% | | | | | | | | |

| CONSUMER DISCRETIONARY 0.0% | | | | |

| Media 0.0% | | | | | | | | |

| Metricom, Inc., Expiring 02/15/2010 * (h) + | | 1,500 | | $ 0 |

| |

|

| FINANCIALS 0.0% | | | | | | | | |

| Diversified Financial Services 0.0% | | | | |

| Asat Finance, LLC, Expiring 11/01/2006 * 144A (h) + | | 4,000 | | 0 |

| |

|

| Total Warrants (cost $558,090) | | | | 0 |

| | |

|

|

| | | | | | | Principal | | |

| | | | | | | Amount | | Value |

|

| DEBT OBLIGATIONS 2.5% | | | | | | |

| Blue Grass Energy Corp. Loan, FRN, 10.33%, 12/30/2013 | | $ 7,000,000 | | 7,071,680 |

| Commonwealth Brands, Inc. Loan, 7.75%, 12/01/2035 | | 4,451,938 | | 4,472,906 |

| Georgia-Pacific Corp. Loan, 8.39%, 12/23/2013 | | 5,000,000 | | 5,057,450 |

| HealthSouth Corp. Loan, 8.58%, 01/16/2011 | | 1,995,000 | | 2,001,065 |

| |

|

| Total Debt Obligations (cost $18,453,671) | | | | 18,603,101 |

| | |

|

|

| | | | | | | Shares | | Value |

|

| SHORT-TERM INVESTMENTS 20.9% | | | | |

| MUTUAL FUND SHARES 20.9% | | | | |

| Evergreen Institutional Money Market Fund ø ## | | 17,759,437 | | 17,759,437 |

| Navigator Prime Portfolio (pp) | | | | 134,644,303 | | 134,644,303 |

| |

|

| Total Short-Term Investments (cost $152,403,740) | | | | 152,403,740 |

| |

|

| Total Investments (cost $849,148,947) 117.2% | | | | 856,460,886 |

| Other Assets and Liabilities (17.2%) | | | | (125,954,221) |

| |

|

| Net Assets 100.0% | | | | | | | | $ 730,506,665 |

| |

|

| (p) | | All or a portion of this security is on loan. |

| 144A | | Security that may be sold to qualified institutional buyers under Rule 144A of the Securities Act of 1933, as amended. |

| | | This security has been determined to be liquid under guidelines established by the Board of Trustees, unless otherwise |

| | | noted. |

| † | | Security initially issued in zero coupon form which converts to coupon form at a specified rate and date. An effective |

| | | interest rate is applied to recognize interest income daily for the bond. This rate is based on total expected interest to |

| | | be earned over the life of the bond which consists of the aggregate coupon-interest payments and discount at |

| | | acquisition. The rate shown is the stated rate at the current period end. |

| # | | When-issued or delayed delivery security |

| * | | Non-income producing security |

| + | | Security is deemed illiquid and is valued using market quotations when readily available. |

| (h) | | Security is valued at fair value as determined by the investment advisor in good faith, according to procedures approved |

| | | by the Board of Trustees. |

| ø | | Evergreen Investment Management Company, LLC is the investment advisor to both the Fund and the money market |

| | | fund. |

| ## | | All or a portion of this security has been segregated for when-issued or delayed delivery securities. |

| (pp) | | Represents investment of cash collateral received from securities on loan. |

See Notes to Financial Statements

19

SCHEDULE OF INVESTMENTS continued

October 31, 2006 (unaudited)

| Summary of Abbreviations | | | |

| FRN Floating Rate Note | | | |

| |

| The following table shows the percent of total investments (excluding equity positions and collateral from securities on loan) by |

| credit quality based on Moody’s and Standard & Poor’s ratings as of October 31, 2006: |

| AAA | | 2.0% | |

| BBB | | 0.6% | |

| BB | | 24.2% | |

| B | | 60.1% | |

| CCC | | 13.1% | |

| |

| |

| | | 100.0% | |

| | |

| |

| |

| The following table shows the percent of total investments (excluding equity positions and collateral from securities on loan) |

| based on effective maturity as of October 31, 2006: |

| Less than 1 year | | 3.5% | |

| 1 to 3 year(s) | | 2.3% | |

| 3 to 5 years | | 13.6% | |

| 5 to 10 years | | 75.6% | |

| 10 to 20 years | | 3.9% | |

| 20 to 30 years | | 1.1% | |

| |

| |

| | | 100.0% | |

| | |

| |

See Notes to Financial Statements

20

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2006 (unaudited)

| Assets | | |

| Investments in securities, at value (cost $831,389,510) including $132,029,271 of | | |

| securities loaned | | $ 838,701,449 |

| Investments in affiliated money market fund, at value (cost $17,759,437) | | 17,759,437 |

|

| Total investments | | 856,460,886 |

| Receivable for securities sold | | 2,399,764 |

| Receivable for Fund shares sold | | 260,636 |

| Interest receivable | | 16,433,092 |

| Receivable for securities lending income | | 19,567 |

| Prepaid expenses and other assets | | 146,279 |

|

| Total assets | | 875,720,224 |

|

| Liabilities | | |

| Dividends payable | | 1,770,962 |

| Payable for securities purchased | | 6,705,756 |

| Payable for Fund shares redeemed | | 1,970,004 |

| Payable for securities on loan | | 134,644,303 |

| Advisory fee payable | | 8,651 |

| Distribution Plan expenses payable | | 160 |

| Due to other related parties | | 2,259 |

| Accrued expenses and other liabilities | | 111,464 |

|

| Total liabilities | | 145,213,559 |

|

| Net assets | | $ 730,506,665 |

|

| Net assets represented by | | |

| Paid-in capital | | $ 866,368,385 |

| Overdistributed net investment income | | (4,843,694) |

| Accumulated net realized losses on investments | | (138,329,965) |

| Net unrealized gains on investments | | 7,311,939 |

|

| Total net assets | | $ 730,506,665 |

|

| Net assets consists of | | |

| Class A | | $ 352,463,011 |

| Class B | | 159,000,875 |

| Class C | | 175,706,545 |

| Class I | | 43,336,234 |

|

| Total net assets | | $ 730,506,665 |

|

| Shares outstanding (unlimited number of shares authorized) | | |

| Class A | | 106,725,104 |

| Class B | | 48,145,170 |

| Class C | | 53,204,033 |

| Class I | | 13,122,698 |

|

| Net asset value per share | | |

| Class A | | $ 3.30 |

| Class A — Offering price (based on sales charge of 4.75%) | | $ 3.46 |

| Class B | | $ 3.30 |

| Class C | | $ 3.30 |

| Class I | | $ 3.30 |

|

See Notes to Financial Statements

21

STATEMENT OF OPERATIONS

Six Months Ended October 31, 2006 (unaudited)

| Investment income | | |

| Interest (net of foreign withholding taxes of $838) | | $ 29,826,764 |

| Income from affiliate | | 820,451 |

| Securities lending | | 309,271 |

| Dividends | | 27,000 |

|

| Total investment income | | 30,983,486 |

|

| Expenses | | |

| Advisory fee | | 1,643,481 |

| Distribution Plan expenses | | |

| Class A | | 550,396 |

| Class B | | 831,897 |

| Class C | | 932,808 |

| Administrative services fee | | 381,824 |

| Transfer agent fees | | 756,674 |

| Trustees’ fees and expenses | | 5,436 |

| Printing and postage expenses | | 44,765 |

| Custodian and accounting fees | | 111,112 |

| Registration and filing fees | | 58,085 |

| Professional fees | | 17,198 |

| Other | | 11,545 |

|

| Total expenses | | 5,345,221 |

| Less: Expense reductions | | (18,268) |

| Expense reimbursements | | (51,447) |

|

| Net expenses | | 5,275,506 |

|

| Net investment income | | 25,707,980 |

|

| Net realized gains on investments | | 1,527,235 |

| Net change in unrealized gains or losses on investments | | (4,866,028) |

|

| Net realized and unrealized gains or losses on investments | | (3,338,793) |

|

| Net increase in net assets resulting from operations | | $ 22,369,187 |

|

See Notes to Financial Statements

22

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | | |

| | | October 31, 2006 | | Year Ended |

| | | (unaudited) | | April 30, 2006 |

|

| Operations | | | | | | | | |

| Net investment income | | $ 25,707,980 | | $ 62,351,931 |

| Net realized gains or losses on | | | | | | | | |

| investments | | | | 1,527,235 | | | | (8,091,668) |

| Net change in unrealized gains or | | | | | | | | |

| losses on investments | | | | (4,866,028) | | | | 9,546,925 |

|

| Net increase in net assets resulting | | | | | | | | |

| from operations | | | | 22,369,187 | | | | 63,807,188 |

|

| Distributions to shareholders from | | | | | | | | |

| Net investment income | | | | | | | | |

| Class A | | | | (13,170,929) | | | | (31,245,428) |

| Class B | | | | (5,371,656) | | | | (12,543,324) |

| Class C | | | | (6,032,093) | | | | (15,403,177) |

| Class I | | | | (1,743,791) | | | | (4,575,274) |

|

| Total distributions to shareholders | | | | (26,318,469) | | | | (63,767,203) |

|

| | | Shares | | | | Shares | | |

| Capital share transactions | | | | | | | | |

| Proceeds from shares sold | | | | | | | | |

| Class A | | 4,849,764 | | 15,848,811 | | 24,776,857 | | 83,068,682 |

| Class B | | 1,497,016 | | 4,890,331 | | 4,135,694 | | 13,808,738 |

| Class C | | 1,970,393 | | 6,436,634 | | 4,431,167 | | 14,748,116 |

| Class I | | 1,311,609 | | 4,294,589 | | 9,285,824 | | 31,101,831 |

|

| | | | | 31,470,365 | | | | 142,727,367 |

|

| Net asset value of shares issued in | | | | | | | | |

| reinvestment of distributions | | | | | | | | |

| Class A | | 2,680,240 | | 8,754,936 | | 6,413,132 | | 21,422,043 |

| Class B | | 778,753 | | 2,543,768 | | 1,806,924 | | 6,033,111 |

| Class C | | 947,437 | | 3,094,720 | | 2,451,404 | | 8,188,773 |

| Class I | | 240,109 | | 784,311 | | 494,768 | | 1,650,619 |

|

| | | | | 15,177,735 | | | | 37,294,546 |

|

| Automatic conversion of Class B | | | | | | | | |

| shares to Class A shares | | | | | | | | |

| Class A | | 418,845 | | 1,371,678 | | 1,188,644 | | 3,971,959 |

| Class B | | (418,845) | | (1,371,678) | | (1,188,644) | | (3,971,959) |

|

| | | | | 0 | | | | 0 |

|

| Payment for shares redeemed | | | | | | | | |

| Class A | | (18,429,685) | | (60,195,508) | | (56,163,187) | | (187,595,502) |

| Class B | | (7,008,417) | | (22,899,325) | | (15,347,963) | | (51,155,220) |

| Class C | | (10,646,807) | | (34,766,661) | | (30,896,580) | | (102,833,318) |

| Class I | | (3,622,492) | | (11,857,030) | | (12,796,893) | | (42,836,974) |

|

| | | | | (129,718,524) | | | | (384,421,014) |

|

| Net decrease in net assets resulting | | | | | | | | |

| from capital share transactions | | | | (83,070,424) | | | | (204,399,101) |

|

| Total decrease in net assets | | | | (87,019,706) | | | | (204,359,116) |

| Net assets | | | | | | | | |

| Beginning of period | | | | 817,526,371 | | | | 1,021,885,487 |

|

| End of period | | $ 730,506,665 | | $ 817,526,371 |

|

| Overdistributed net investment income | | $ (4,843,694) | | $ (1,742,300) |

|

See Notes to Financial Statements

23

NOTES TO FINANCIAL STATEMENTS (unaudited)

1. ORGANIZATION

Evergreen High Yield Bond Fund (the “Fund”) is a diversified series of Evergreen Fixed Income Trust (the “Trust”), a Delaware statutory trust organized on September 18, 1997. The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”).

The Fund offers Class A, Class B, Class C and Class I shares. Class A shares are sold with a front-end sales charge. However, Class A share investments of $1 million or more are not subject to a front-end sales charge but will be subject to a contingent deferred sales charge of 1.00% upon redemption within one year. Class B shares are sold without a front-end sales charge but are subject to a contingent deferred sales charge that is payable upon redemption and decreases depending on how long the shares have been held. Class C shares are sold without a front-end sales charge but are subject to a contingent deferred sales charge that is payable upon redemption within one year. Class I shares are sold without a front-end sales charge or contingent deferred sales charge. Each class of shares, except Class I shares, pays an ongoing distribution fee.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with generally accepted accounting principles in the United States of America, which require management to make estimates and assumptions that affect amounts reported herein. Actual results could differ from these estimates.

a. Valuation of investments

Portfolio debt securities acquired with more than 60 days to maturity are fair valued using matrix pricing methods determined by an independent pricing service which takes into consideration such factors as similar security prices, yields, maturities, liquidity and ratings. Securities for which valuations are not readily available from an independent pricing service may be valued by brokers which use prices provided by market makers or estimates of market value obtained from yield data relating to investments or securities with similar characteristics.

Listed equity securities are usually valued at the last sales price or official closing price on the national securities exchange where the securities are principally traded.

Foreign securities traded on an established exchange are valued at the last sales price on the exchange where the security is primarily traded. If there has been no sale, the securities are valued at the mean between bid and asked prices. Foreign securities may be valued at fair value according to procedures approved by the Board of Trustees if the closing price is not reflective of current market values due to trading or events occurring in the foreign markets between the close of the established exchange and the valuation time of the Fund. In addition, substantial changes in values in the U.S. markets subsequent to the close of a foreign market may also affect the values of securities traded in the foreign market. The value of foreign securities may be adjusted if such movements in the U.S. market exceed a specified threshold.

24

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

Short-term securities with remaining maturities of 60 days or less at the time of purchase are valued at amortized cost, which approximates market value.

Investments in other mutual funds are valued at net asset value. Securities for which market quotations are not readily available or not reflective of current market value are valued at fair value as determined by the investment advisor in good faith, according to procedures approved by the Board of Trustees.

b. Foreign currency translation

All assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of portfolio securities and income items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not separately account for that portion of the results of operations resulting from changes in foreign exchange rates on investments and the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gains or losses on investments.

c. When-issued and delayed delivery transactions

The Fund records when-issued or delayed delivery securities as of trade date and maintains security positions such that sufficient liquid assets will be available to make payment for the securities purchased. Securities purchased on a when-issued or delayed delivery basis are marked-to-market daily and begin earning interest on the settlement date. Losses may occur on these transactions due to changes in market conditions or the failure of counterparties to perform under the contract.

d. Securities lending

The Fund may lend its securities to certain qualified brokers in order to earn additional income. The Fund receives compensation in the form of fees or interest earned on the investment of any cash collateral received. The Fund also continues to receive interest and dividends on the securities loaned. The Fund receives collateral in the form of cash or securities with a market value at least equal to the market value of the securities on loan, including accrued interest. In the event of default or bankruptcy by the borrower, the Fund could experience delays and costs in recovering the loaned securities or in gaining access to the collateral. The Fund has the right under the lending agreement to recover the securities from the borrower on demand.

e. Security transactions and investment income

Security transactions are recorded on trade date. Realized gains and losses are computed using the specific cost of the security sold. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums. Dividend income is recorded on the ex-dividend date. Foreign income and capital gains realized on some securities may be subject to foreign taxes, which are accrued as applicable.

25

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

f. Federal taxes

The Fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income, including any net capital gains (which have already been offset by available capital loss carryovers). Accordingly, no provision for federal taxes is required.

g. Distributions

Distributions to shareholders from net investment income are accrued daily and paid monthly. Distributions from net realized gains, if any, are recorded on the ex-dividend date. Such distributions are determined in conformity with income tax regulations, which may differ from generally accepted accounting principles.

h. Class allocations

Income, common expenses and realized and unrealized gains and losses are allocated to the classes based on the relative net assets of each class. Distribution fees, if any, are calculated daily at the class level based on the appropriate net assets of each class and the specific expense rates applicable to each class.

3. ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Evergreen Investment Management Company, LLC (“EIMC”), an indirect, wholly-owned subsidiary of Wachovia Corporation (“Wachovia”), is the investment advisor to the Fund and is paid a fee at an annual rate of 2% of the Fund’s gross investment income plus an amount determined by applying percentage rates to the average daily net assets of the Fund, starting at 0.31% and declining to 0.16% as average daily net assets increase.

Effective October 1, 2006, Tattersall Advisory Group, Inc. (“TAG”), an indirect, wholly-owned subsidiary of Wachovia, became the investment sub-advisor to the Fund and is paid by EIMC for its services to the Fund.

From time to time, EIMC may voluntarily or contractually waive its fee and/or reimburse expenses in order to limit operating expenses. During the six months ended October 31, 2006, EIMC reimbursed Distribution Plan expenses (see Note 4) relating to Class A shares in the amount of $51,447.

The Fund may invest in Evergreen-managed money market funds, which are also advised by EIMC. Income earned on these investments is included in income from affiliate on the Statement of Operations.

Evergreen Investment Services, Inc. (“EIS”), an indirect, wholly-owned subsidiary of Wachovia, is the administrator to the Fund. As administrator, EIS provides the Fund with facilities, equipment and personnel and is paid an annual rate determined by applying percentage rates to the aggregate average daily net assets of the Evergreen funds (excluding money market funds and Evergreen Institutional Enhanced Income Fund), starting at 0.10% and declining to 0.05% as the aggregate average daily net assets of the Evergreen funds (excluding money market funds and Evergreen Institutional Enhanced Income Fund) increase.

26

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

Evergreen Service Company, LLC (“ESC”), an indirect, wholly-owned subsidiary of Wachovia, is the transfer and dividend disbursing agent for the Fund. ESC receives account fees that vary based on the type of account held by the shareholders in the Fund. For the six months ended October 31, 2006, the transfer agent fees were equivalent to an annual rate of 0.20% of the Fund’s average daily net assets.

4. DISTRIBUTION PLANS

EIS also serves as distributor of the Fund’s shares. The Fund has adopted Distribution Plans, as allowed by Rule 12b-1 of the 1940 Act, for each class of shares, except Class I. Under the Distribution Plans, distribution fees are paid at an annual rate of 0.30% of the average daily net assets for Class A shares and 1.00% of the average daily net assets for each of Class B and Class C shares.

For the six months ended October 31, 2006, EIS received $12,138 from the sale of Class A shares and $275,009 and $1,156 in contingent deferred sales charges from redemptions of Class B and Class C shares, respectively.

5. SECURITIES TRANSACTIONS

Cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were $212,696,472 and $282,072,374, respectively, for the six months ended October 31, 2006.

During the six months ended October 31, 2006, the Fund loaned securities to certain brokers. At October 31, 2006, the value of securities on loan and the value of collateral (including accrued interest) amounted to $132,029,271 and $134,644,303, respectively.

On October 31, 2006, the aggregate cost of securities for federal income tax purposes was $849,184,902. The gross unrealized appreciation and depreciation on securities based on tax cost was $19,107,554 and $11,831,570, respectively, with a net unrealized appreciation of $7,275,984.

As of April 30, 2006, the Fund had $132,422,905 in capital loss carryovers for federal income tax purposes expiring as follows:

| Expiration |

|

| 2008 | | 2009 | | 2010 | | 2011 | | 2014 |

|

| $19,168,229 | | $38,451,200 | | $57,513,490 | | $15,936,101 | | $1,353,885 |

|

For income tax purposes, capital losses incurred after October 31 within the Fund’s fiscal year are deemed to arise on the first business day of the following fiscal year. As of April 30, 2006, the Fund incurred and elected to defer post-October losses of $7,422,177.

27

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

6. INTERFUND LENDING

Pursuant to an Exemptive Order issued by the SEC, the Fund may participate in an interfund lending program with certain funds in the Evergreen fund family. This program allows the Fund to borrow from, or lend money to, other participating funds. During the six months ended October 31, 2006, the Fund did not participate in the interfund lending program.

7. EXPENSE REDUCTIONS

Through expense offset arrangements with ESC and the Fund’s custodian, a portion of fund expenses has been reduced.

8. DEFERRED TRUSTEES’ FEES

Each Trustee of the Fund may defer any or all compensation related to performance of their duties as Trustees. The Trustees’ deferred balances are allocated to deferral accounts, which are included in the accrued expenses for the Fund. The investment performance of the deferral accounts is based on the investment performance of certain Evergreen funds. Any gains earned or losses incurred in the deferral accounts are reported in the Fund’s Trustees’ fees and expenses. At the election of the Trustees, the deferral account will be paid either in one lump sum or in quarterly installments for up to ten years.

9. FINANCING AGREEMENT

The Fund and certain other Evergreen funds share in an unsecured revolving credit commitment for temporary and emergency purposes, including the funding of redemptions, as permitted by each participating fund’s borrowing restrictions. Borrowings under this facility bear interest at 0.50% per annum above the Federal Funds rate. All of the participating funds are charged an annual commitment fee on the unused balance, which is allocated pro rata. The credit facility is for $100 million with an annual commitment fee of 0.08% . Prior to July 3, 2006, the credit facility was for $150 million with an annual commitment fee of 0.09% . During the six months ended October 31, 2006, the Fund had no borrowings.

10. CONCENTRATION OF RISK

The Fund may invest a substantial portion of its assets in an industry or sector and, therefore, may be more affected by changes in that industry or sector than would be a comparable mutual fund that is not heavily weighted in any industry or sector.

11. REGULATORY MATTERS AND LEGAL PROCEEDINGS

Since September 2003, governmental and self-regulatory authorities have instituted numerous ongoing investigations of various practices in the mutual fund industry, including investigations relating to revenue sharing, market-timing, late trading and record retention, among other things. The investigations cover investment advisors, distributors and transfer agents to mutual funds, as well as other firms. EIMC, EIS and ESC (collectively, “Evergreen”) have received subpoenas and other requests for documents and testimony relating to these investigations, are endeavoring to comply with those requests, and are cooperating with the investigations. Evergreen is continuing

28

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

its own internal review of policies, practices, procedures and personnel, and is taking remedial action where appropriate.