UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811- 09101 |

| |

| Exact name of registrant as specified in charter: | | Prudential Investment Portfolios 9 |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 17th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 10/31/2019 |

| |

| Date of reporting period: | | 10/31/2019 |

Item 1 – Reports to Stockholders

PGIM ABSOLUTE RETURN BOND FUND

ANNUAL REPORT

OCTOBER 31, 2019

COMING SOON: PAPERLESS SHAREHOLDER REPORTS

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (pgiminvestments.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-225-1852 or by sending an email request to PGIM Investments at shareholderreports@pgim.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary or follow instructions included with this notice to elect to continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-800-225-1852 or send an email request to shareholderreports@pgim.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

To enroll in e-delivery, go to pgiminvestments.com/edelivery

|

Objective:To seek positive returns over the long term, regardless of market

conditions |

Highlights(unaudited)

| • | | The Fund outperformed the ICE BofAML US Dollar 3-Month Deposit Offered Rate Constant Maturity Index over the reporting period, highlighted by strong duration positioning, sector allocation, security selection, and yield curve positioning. Currency selection hurt performance. |

| • | | In sector allocation, positions in high yield bonds, collateralized loan obligations, and emerging markets debt were positive contributors. Security selection was a strong contributor to performance, led by positioning in sovereign and high yield bonds,non-agency mortgages, and commercial mortgage-backed securities. |

| • | | Although overall security selection contributed to the Fund’s performance, positioning in interest-rate swaps, CLOs, and Treasuries limited results. |

| • | | Within corporates, security selection in the upstream-energy and aerospace & defense sectors hurt performance. Detractors in upstream-energy included overweights in Antero Resources and Frontera Energy. Within aerospace & defense, a position in Bombardier was negative. |

| • | | An overweight to Argentina was the largest detractor from performance. |

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Mutual funds are distributed by Prudential Investment Management Services LLC (PIMS), member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PIMS and PGIM are Prudential Financial companies.© 2019 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| | |

| 2 | | Visit our website at pgiminvestments.com |

Table of Contents

| | | | |

| PGIM Absolute Return Bond Fund | | | 3 | |

This Page Intentionally Left Blank

Letter from the President

Dear Shareholder:

We hope you find the annual report for the PGIM Absolute Return Bond Fund informative and useful. The report covers performance for the12-month period that ended October 31, 2019.

While the US economy remained healthy, with rising corporate profits and strong job growth, the Federal Reserve cut interest rates three times in the latter half of the period. The cuts were a proactive attempt by the Fed to extend the longest domestic economic expansion on record as growth in many regions weakened. China in particular showed signs of slowing amid trade tensions with the US, and turmoil in the United Kingdom continued as it negotiates an exit from the European Union.

The interest-rate cuts helped boost the performance of stocks globally. For the period overall, large-cap US equities along with stocks in developed and emerging foreign markets all rose by double digits. Small-cap US stocks posted a single-digit gain. This positive performance came despite significant volatility early in the period. Equities plunged at the end of 2018 on concerns about China’s economy, a potential global trade war, higher interest rates, and worries that profit growth might slow. Stocks reversed course early in 2019, rising sharply after the Fed moderated its position on additional rate hikes for the remainder of the year.

The overall US bond market posted strong returns during the period on a significant rally in interest rates that saw the 10-year US Treasury yield decline from over 3% to under 2%. Investment-grade corporate bonds led the way with a double-digit gain, while corporate high yield and municipal bonds each had a return in the high single digits. Globally, bonds in developed markets delivered strong returns, and emerging markets debt rose by double digits.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. PGIM is a top-10 global investment manager with more than $1 trillion in assets under management. This scale and investment expertise allow us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM Absolute Return Bond Fund

December 16, 2019

| | | | |

| PGIM Absolute Return Bond Fund | | | 5 | |

Your Fund’s Performance(unaudited)

Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website atpgiminvestments.com or by calling (800) 225-1852.

| | | | | | | | | | |

| |

| | | Average Annual Total Returns as of 10/31/19

(with sales charges) | |

| | | One Year (%) | | Five Years (%) | | | Since Inception (%) | |

| Class A | | 1.30 | | | 2.38 | | | | 2.40 (3/30/11) | |

| Class C | | 2.81 | | | 2.27 | | | | 2.03 (3/30/11) | |

| Class Z | | 5.00 | | | 3.32 | | | | 3.07 (3/30/11) | |

| Class R6 | | 4.94 | | | 3.34 | | | | 3.10 (3/30/11) | |

| ICE BofAML US Dollar 3-Month Deposit Offered Rate Constant Maturity Index | |

| | 2.68 | | | 1.27 | | | | 0.88 | |

| Bloomberg Barclays US Aggregate Bond Index | |

| | | 11.51 | | | 3.24 | | | | 3.57 | |

| | | | | | | | | | |

| |

| | | Average Annual Total Returns as of 10/31/19

(without sales charges) | |

| | | One Year (%) | | Five Years (%) | | | Since Inception (%) | |

| Class A | | 4.71 | | | 3.06 | | | | 2.80 (3/30/11) | |

| Class C | | 3.80 | | | 2.27 | | | | 2.03 (3/30/11) | |

| Class Z | | 5.00 | | | 3.32 | | | | 3.07 (3/30/11) | |

| Class R6 | | 4.94 | | | 3.34 | | | | 3.10 (3/30/11) | |

| ICE BofAML US Dollar 3-Month Deposit Offered Rate Constant Maturity Index | | | | | |

| | 2.68 | | | 1.27 | | | | 0.88 | |

| Bloomberg Barclays US Aggregate Bond Index | | | | | | | | | | |

| | | 11.51 | | | 3.24 | | | | 3.57 | |

| | |

| 6 | | Visit our website at pgiminvestments.com |

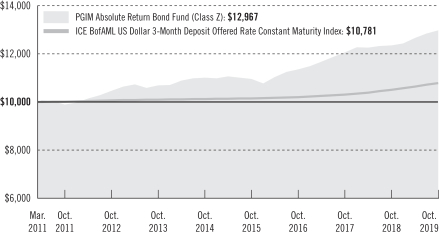

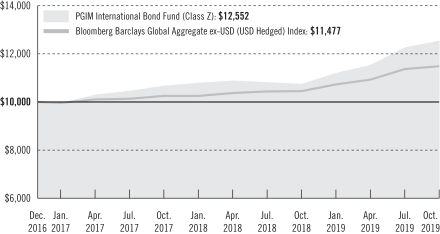

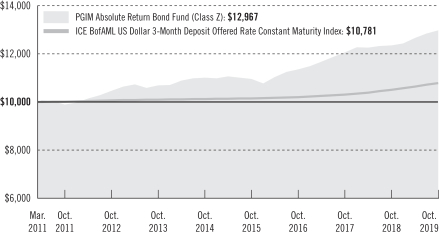

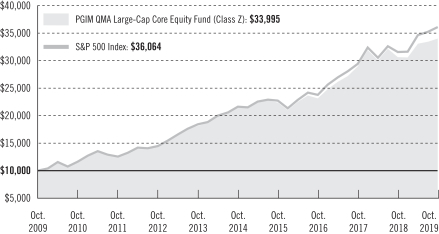

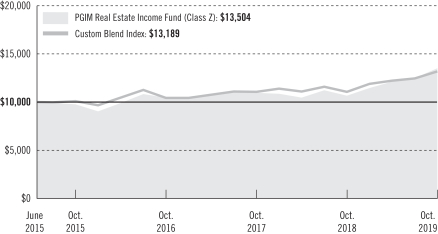

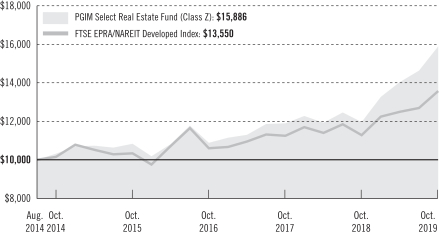

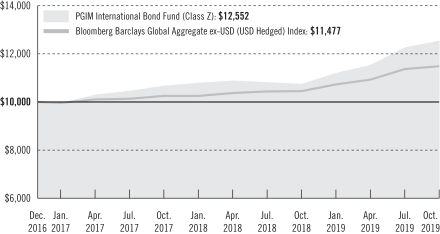

Growth of a $10,000 Investment(unaudited)

The graph compares a $10,000 investment in the Fund’s Class Z shares with a similar investment in the ICE BofAML US Dollar 3-Month Deposit Offered Rate Constant Maturity Index by portraying the initial account values at the commencement of operations for Class Z shares (March 30, 2011) and the account values at the end of the current fiscal year (October 31, 2019) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends and distributions were reinvested. The line graph provides information for Class Z shares only. As indicated in the tables provided earlier, performance for other share classes will vary due to the differing charges and expenses applicable to each share class (as indicated in the following paragraphs). Without waiver of fees and/or expense reimbursements, if any, the Fund’s returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graph include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Source: PGIM Investments LLC and Lipper Inc.

Since Inception returns are provided since the Fund has less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the closest month-end to the Fund’s inception date.

| | | | |

| PGIM Absolute Return Bond Fund | | | 7 | |

Your Fund’s Performance(continued)

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares. The average annual total returns take into account applicable sales charges, which are described for each share class in the table below.

| | | | | | | | |

| | | | | |

| | | Class A | | Class C | | Class Z | | Class R6 |

| Maximum initial sales charge | | For purchases on or after July 15, 2019: 3.25% of the public offering price. For purchases prior to July 15, 2019: 4.50% of the public offering price | | None | | None | | None |

| Contingent deferred sales charge (CDSC) (as a percentage of the lower of the original purchase price or the net asset value at redemption) | | For purchases on or after July 15, 2019: 1.00% on sales of $500,000 or more made within 12 months of purchase. For purchases prior to July 15, 2019: 1.00% on sales of $1 million or more made within 12 months of purchase. | | 1.00% on sales made within 12 months of purchase | | None | | None |

Annual distribution and service

(12b-1) fees (shown as a percentage of average daily net assets) | | 0.25%

| | 1.00% | | None | | None |

Benchmark Definitions

ICE BofAML US Dollar 3-Month Deposit Offered Rate Constant Maturity Index—The ICE BofAML US Dollar3-Month Deposit Offered Rate Constant Maturity Index is an unmanaged index that tracks the performance of a synthetic asset paying LIBOR to a stated maturity. The Index is based on the assumed purchase at par of a synthetic instrument having exactly its stated maturity and with a coupon equal to that current day fixing rate. That issue is assumed to be sold the following business day (priced at a yield equal to the current day fixing rate) and rolled into a new instrument.

Bloomberg Barclays US Aggregate Bond Index—The Bloomberg Barclays US Aggregate Bond Index is unmanaged and represents securities that are taxable and dollar denominated. It covers the US investment-grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

Investors cannot invest directly in an index or average. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes.

| | |

| 8 | | Visit our website at pgiminvestments.com |

| | | | | | |

| | |

| Distributions and Yields as of 10/31/19 | | | | |

| | Total Distributions

Paid for

12 Months ($) | | SEC 30-Day

Subsidized

Yield* (%) | | SEC30-Day

Unsubsidized

Yield** (%) |

| Class A | | 0.53 | | 3.04 | | 3.04 |

| Class C | | 0.46 | | 2.41 | | 2.41 |

| Class Z | | 0.56 | | 3.42 | | 3.39 |

| Class R6 | | 0.57 | | 3.45 | | 3.47 |

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

| | | | |

| |

| Credit Quality expressed as a percentage of total investments as of 10/31/19 (%) | | | |

| AAA | | | 21.1 | |

| AA | | | 7.4 | |

| A | | | 4.9 | |

| BBB | | | 13.1 | |

| BB | | | 18.0 | |

| B | | | 14.8 | |

| CCC | | | 1.3 | |

| CC | | | 0.1 | |

| C | | | 0.1 | |

| Not Rated | | | 3.3 | |

| Cash/Cash Equivalents | | | 15.9 | |

| Total Investments | | | 100.0 | |

Source: PGIM Fixed Income

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by a NRSRO. Credit ratings are subject to change.

| | | | |

| PGIM Absolute Return Bond Fund | | | 9 | |

Strategy and Performance Overview

How did the Fund Perform?

ThePGIM Absolute Return Bond Fund’s Class Z shares returned 5.00% in the12-month reporting period that ended October 31, 2019, outperforming the 2.68% return of the ICE BofAML US Dollar 3-Month Deposit Offered Rate Constant Maturity Index (the Index).

What were the market conditions?

| • | | The fourth quarter of 2018 represented a major shift in market sentiment across global asset classes. Interest rates peaked in early October and aggressively rallied as Brexit worries, fears of an escalating trade war, weaker economic data, and a hawkish Federal Reserve (Fed) punished risk assets, sending developed-market interest rates to yearly lows. As the fourth quarter concluded, the yield on10-year German government bunds and Japanese government bonds (JGBs) plummeted to depths not seen in years, while the10-year US Treasury note yield ended the quarter just above its low from early in 2018. Additionally, after beginning the quarter higher, the yield on Italy’s10-year BTP government bond declined below 3% for the first time since September 2018 as Italy slowly moved its 2019 budget target closer to the European Commission’s suggestion. With signs of slowing global growth, the fourth quarter also brought the potential for further headwinds as Democrats won control of the US House of Representatives—thus mitigating the probability of further fiscal stimulus as a “fiscal cliff” approaches in 2020—and trade tensions with China intensified. Against this macro backdrop, Fed Chairman Jerome Powell and Vice Chairman Richard Clarida struck a more balanced tone prior to December’s Federal Open Market Committee (FOMC) meeting. In addition to the expected25-basis point (bp) hike in its nominal federal funds target range, the FOMC decreased its median projection for additional hikes going forward by 25 bps. (One basis point is 0.01%.) |

| • | | As the fourth quarter of 2018 concluded, the global economy and markets were on the ropes. Spreads were rising sharply, equity markets were falling, and the prospects for global growth seemed in serious jeopardy. Global real gross domestic product (GDP) growth in the first quarter of 2019 sagged to 3%, its weakest performance sincemid-2016. The slowdown was broad-based and included the US, United Kingdom, Canada, China, Turkey, and Poland. In addition, global trade growth retreated, and other key measures of activity also showed weakness. |

| • | | The 2019 second-quarter collapse in developed-market government bond yields seemingly confirmed a trend of mounting economic disappointment where growth and inflation simply remain too low. As the G3 (United States, European Union, and Japan) rate markets fell for the third consecutive quarter and pointed to the need for more central bank accommodation, the actual tipping points for the G3 institutions varied: The European Central Bank (ECB) was struck by the market’s drop in inflation expectations, while the Fed and Bank of Japan (BOJ) moved to easing biases asUS-China trade |

| | |

| 10 | | Visit our website at pgiminvestments.com |

| | tensions flared. Although no G3 central bank actually moved rates, the ECB and the Fed certainly appeared poised to act over the balance of the year, if not in the third quarter. WhileUS-China trade tensions led to a pronounced hiccup in the risk markets in May 2019, these markets recovered byquarter-end, leaving returns for equities and riskier fixed income sectors in positive territory and even stronger year to date thanks to a banner first quarter. The return bounty certainly belied what many considered to be low levels of yields and spreads at the beginning of the year. |

| • | | Positive total returns continued to accrue across the fixed income sectors in the third quarter, leading to someeye-popping double-digit gains in 2019 through the end of the reporting period. Yet, if bonds have managed to thrive in the current environment of economic and policy uncertainty, one only needs to recall a year earlier—the fourth quarter of 2018—for a reminder of how quickly market sentiment can change. Developed-market rates took another leg down in the third quarter of 2019 as central banks collectively eased policies to counter signs of mounting global economic weakness and uncertainty. It was the second consecutive quarter of double-digit basis point declines for US and German10-year yields (down 35 bps and 25 bps to 1.67% and –0.57%, respectively), while the Japanese10-year yield also fell deeper into negative territory (down 10 bps to –0.22%). |

| • | | In October 2019, the trend of global monetary easing continued unabated, while some of the downside risks to the global outlook seemed to have lessened. In particular, risks of a hard Brexit seemed on the decline, and there seemed to be some intention for reaching some kind of an interim deal in theUS-China trade war, although many of the more complex issues seemed to be excluded from the discussions. Although the global manufacturing sector and trade volumes remained in the doldrums, continued (albeit easing) resilience in the service sector prevented a sharper deceleration in global growth. Case in point: US real GDP growth eased only a tad to 1.9% in the third quarter (year over year), and euro-area growth came in at 1.1%, both somewhat better than expected. As was widely expected, the Fed cut its target range for the federal funds rate another 25 bp to1.50%-1.75% at its meeting on October29-30, 2019, citing the global backdrop and below-target inflation as reasons for the easing. It was the Fed’s third rate cut in 2019, effectively and quickly unwinding the lion’s share of last year’s 100 bps of hikes. Also as expected, the Fed appeared to shift to await-and-see mode, indicating that it will continue to “assess” the appropriate policy path going forward, which is a change from its stance in September that it “will act” as appropriate to sustain the expansion. |

What worked?

| • | | The Fund outperformed the Index over the reporting period, highlighted by strong duration positioning, sector allocation, security selection, and yield curve positioning. Currency selection hurt performance. The Index does not include any bonds but closely |

| | | | |

| PGIM Absolute Return Bond Fund | | | 11 | |

Strategy and Performance Overview(continued)

| | tracks the Bank of America Merrill Lynch US Dollar LIBOR3-Month Constant Maturity Index (LIBOR), the most widely used benchmark for short-term interest rates. |

| • | | The Fund employs an absolute return strategy that seeks to mitigate (or even eliminate) interest-rate risk when appropriate. During the period, the Fund’s strategy to manage duration was a significant contributor to performance. Duration is a measure of the interest-rate sensitivity of a bond portfolio or debt securities that is expressed as a number of years. The Fund’s long-duration positioning added to performance, asUS-dollar (USD) rates were lower during the period. The Fund’s active duration positioning ranged from 0.4 years short to 1.2 years long during the period, ending it at the middle end of the range at +0.3 years. |

| • | | In sector allocation, positions in high yield bonds, collateralized loan obligations (CLOs), and emerging markets debt were positive contributors. |

| • | | Security selection was a strong contributor to performance, led by positioning in sovereign and high yield bonds,non-agency mortgages, and commercial mortgage-backed securities (CMBS). |

| • | | Corporate positioning in the building materials & home construction sector and the foreignnon-corporates sector added value. Within building materials & home construction, overweights toWilliam Lyon Homes andBeazer Homes USA were positive. Contributors in foreignnon-corporates included positions in Greece and Ukraine. |

| • | | Also contributing positively was the Fund’s yield curve flattener positioning as the curve flattened over the period. |

What didn’t work?

| • | | Although overall security selection contributed to the Fund’s performance, positioning in interest-rate swaps, CLOs, and Treasuries limited results. |

| • | | Within corporates, security selection in the upstream-energy and aerospace & defense sectors hurt performance. Detractors in upstream-energy included overweights inAntero Resources Corp. andFrontera Energy Corp. Within aerospace & defense, a position inBombardier Inc. was negative. |

| • | | An overweight to Argentina was the largest detractor from performance. |

| • | | The Fund occasionally features a modest notional exposure tonon-USD currencies across a diversified basket of currencies in faster-growing emerging and developed countries. The Fund’s foreign-exchange currency market (FX) positioning hurt performance, with positions in the Norwegian krone, South African rand, and euro among the largest detractors. |

| | |

| 12 | | Visit our website at pgiminvestments.com |

Did the Fund use derivatives?

The Fund uses derivatives when they facilitate implementation of the overall investment approach. During the reporting period, the Fund used interest-rate futures, options, and swaps to help manage duration positioning and yield curve exposure. Over the period, futures and swaps hurt performance while options added value. Credit default swaps and credit default swap index (CDX) positions were used to either add risk exposure to certain issuers or to hedge credit risk imposed by certain issuers. Overall, credit derivative exposure added value during the period. In addition, the Fund traded foreign-exchange derivatives, which had a negative impact on performance during the period.

Current outlook

| • | | PGIM Fixed Income’s base case assumes that the Fed will pause from adjusting rates for the foreseeable future as the impact of its rate cuts in 2019 continues to filter through the economy and the FOMC takes time to assess developments across the global economy. |

| • | | PGIM Fixed Income maintains its positive view of fundamentals in the credit sectors of fixed income. As of the end of the reporting period, the Fund was overweight structured products, which include CMBS, CLOs, and asset-backed securities (ABS); emerging market debt; and high yield bonds. Within CMBS, PGIM Fixed Income continues to find value in high-quality securities ofnew-issue conduit deals. In ABS, the Fund is maintaining anup-in-quality focus (with some exceptions) as capital stack/issuer valuations remain compressed. PGIM Fixed Income is constructive on US high yield and continues to like independent power producers and US consumer-related names. PGIM Fixed Income remains cautious on commodities but is looking at unique opportunities in natural gas and health care. Within investment-grade corporates, as we enter the later stage of the credit cycle, PGIM Fixed Income continues to favor better-quality financials and electric utilities over industrials. |

| | | | |

| PGIM Absolute Return Bond Fund | | | 13 | |

Fees and Expenses(unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemptions, as applicable, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses, as applicable. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 held through the six-month period ended October 31, 2019. The example is for illustrative purposes only; you should consult the Prospectus for information on initial and subsequent minimum investment requirements.

Actual Expenses

The first line for each share class in the table on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The Fund’s transfer agent may charge additional fees to holders of certain accounts that are not included in the expenses shown in the table on the following page. These fees apply to individual retirement accounts (IRAs) and Section 403(b) accounts. As of the close of the six-month period covered by the table, IRA fees included an annual maintenance fee of $15 per account (subject to a maximum annual maintenance fee of $25 for all accounts held by the same shareholder). Section 403(b) accounts are charged an annual $25 fiduciary maintenance fee. Some of the fees may vary in amount, or may be waived, based on your total account balance or the number of PGIM funds, including the Fund, that you own. You should consider the additional fees that were charged to your Fund account over the six-month period when you estimate the total ongoing expenses paid over the period

| | |

| 14 | | Visit our website at pgiminvestments.com |

and the impact of these fees on your ending account value, as these additional expenses are not reflected in the information provided in the expense table. Additional fees have the effect of reducing investment returns.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads). Therefore, the second line for each share class in the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | |

PGIM Absolute

Return Bond Fund | | Beginning Account

Value

May 1, 2019 | | | Ending Account

Value

October 31, 2019 | | | Annualized

Expense Ratio

Based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

| Class A | | Actual | | $ | 1,000.00 | | | $ | 1,023.70 | | | | 1.03 | % | | $ | 5.25 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,020.01 | | | | 1.03 | % | | $ | 5.24 | |

| Class C | | Actual | | $ | 1,000.00 | | | $ | 1,018.80 | | | | 1.79 | % | | $ | 9.11 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,016.18 | | | | 1.79 | % | | $ | 9.10 | |

| Class Z | | Actual | | $ | 1,000.00 | | | $ | 1,024.20 | | | | 0.73 | % | | $ | 3.72 | |

| | Hypothetical | | $ | 1,000.00 | | | $ | 1,021.53 | | | | 0.73 | % | | $ | 3.72 | |

| Class R6 | | Actual | | $ | 1,000.00 | | | $ | 1,024.40 | | | | 0.70 | % | | $ | 3.57 | |

| | | Hypothetical | | $ | 1,000.00 | | | $ | 1,021.68 | | | | 0.70 | % | | $ | 3.57 | |

*Fund expenses (net of fee waivers or subsidies, if any) for each share class are equal to the annualized expense ratio for each share class (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended October 31, 2019, and divided by the 365 days in the Fund’s fiscal year ended October 31, 2019 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

| | | | |

| PGIM Absolute Return Bond Fund | | | 15 | |

Schedule of Investments

as of October 31, 2019

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

LONG-TERM INVESTMENTS 89.2% | | | | | | | | | | | | | | | | |

| | | | |

ASSET-BACKED SECURITIES 28.5% | | | | | | | | | | | | | | | | |

| | | | |

Automobiles 0.5% | | | | | | | | | | | | | | | | |

OneMain Direct Auto Receivables Trust, | | | | | | | | | | | | | | | | |

Series 2017-02A, Class E, 144A | | | 4.740 | % | | | 11/14/25 | | | | 1,200 | | | $ | 1,219,882 | |

Series 2019-01A, Class A, 144A | | | 3.630 | | | | 09/14/27 | | | | 8,300 | | | | 8,645,599 | |

Series 2019-01A, Class B, 144A | | | 3.950 | | | | 11/14/28 | | | | 1,700 | | | | 1,786,434 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 11,651,915 | |

| | | | |

Collateralized Loan Obligations 19.7% | | | | | | | | | | | | | | | | |

Anchorage Capital CLO Ltd. (Cayman Islands),

Series 2015-06A, Class AR, 144A, 3 Month LIBOR + 1.270%

(Cap N/A, Floor 0.000%) | | | 3.271 | (c) | | | 07/15/30 | | | | 1,750 | | | | 1,741,369 | |

ArrowMark Colorado Holdings (Cayman Islands),

Series 2017-06A, Class A1, 144A, 3 Month LIBOR + 1.280%

(Cap N/A, Floor 0.000%) | | | 3.281 | (c) | | | 07/15/29 | | | | 2,500 | | | | 2,496,959 | |

Atlas Senior Loan Fund Ltd. (Cayman Islands),

| | | | | | | | | | | | | | | | |

Series 2014-01A, Class AR2, 144A, 3 Month LIBOR + 1.260%

(Cap N/A, Floor 0.000%) | | | 3.261 | (c) | | | 07/16/29 | | | | 2,000 | | | | 1,997,367 | |

Series 2017-08A, Class A, 144A, 3 Month LIBOR + 1.300%

(Cap N/A, Floor 0.000%) | | | 3.301 | (c) | | | 01/16/30 | | | | 4,500 | | | | 4,491,620 | |

Bain Capital Credit CLO Ltd. (Cayman Islands),

Series 2018-01A, Class A1, 144A, 3 Month LIBOR + 0.960%

(Cap N/A, Floor 0.000%) | | | 2.894 | (c) | | | 04/23/31 | | | | 5,000 | | | | 4,927,790 | |

Battalion CLO Ltd. (Cayman Islands),

Series 2015-08A, Class A1R, 144A, 3 Month LIBOR + 1.340%

(Cap N/A, Floor 0.000%) | | | 3.343 | (c) | | | 07/18/30 | | | | 2,000 | | | | 1,995,948 | |

Benefit Street Partners CLO Ltd. (Cayman Islands),

| | | | | | | | | | | | | | | | |

Series 2013-IIA, Class A1R, 144A, 3 Month LIBOR + 1.250%

(Cap N/A, Floor 0.000%) | | | 3.251 | (c) | | | 07/15/29 | | | | 3,500 | | | | 3,490,449 | |

Series 2017-12A, Class A1, 144A, 3 Month LIBOR + 1.250%

(Cap N/A, Floor 0.000%) | | | 3.251 | (c) | | | 10/15/30 | | | | 9,250 | | | | 9,206,516 | |

Brookside Mill CLO Ltd. (Cayman Islands),

Series 2013-01A, Class BR, 144A, 3 Month LIBOR + 1.350%

(Cap N/A, Floor 0.000%) | | | 3.352 | (c) | | | 01/17/28 | | | | 4,000 | | | | 3,912,502 | |

Carlyle US CLO Ltd. (Cayman Islands),

Series 2017-02A, Class A1B, 144A, 3 Month LIBOR + 1.220%

(Cap N/A, Floor 0.000%) | | | 3.186 | (c) | | | 07/20/31 | | | | 3,000 | | | | 2,984,300 | |

Catamaran CLO Ltd. (Cayman Islands),

Series 2014-01A, Class A1AR, 144A, 3 Month LIBOR + 1.260%

(Cap N/A, Floor 0.000%) | | | 3.213 | (c) | | | 04/22/30 | | | | 10,500 | | | | 10,439,778 | |

See Notes to Financial Statements.

| | | | |

| PGIM Absolute Return Bond Fund | | | 17 | |

Schedule of Investments (continued)

as of October 31, 2019

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Collateralized Loan Obligations (cont’d.) | | | | | | | | | | | | | | | | |

CIFC Funding Ltd. (Cayman Islands),

Series 2015-01A, Class ARR, 144A, 3 Month LIBOR + 1.110% (Cap N/A, Floor 1.110%) | | | 3.063 | %(c) | | | 01/22/31 | | | | 8,000 | | | $ | 7,944,216 | |

Elevation CLO Ltd. (Cayman Islands),

Series 2017-07A, Class A, 144A, 3 Month LIBOR + 1.220% (Cap N/A, Floor 0.000%) | | | 3.221 | (c) | | | 07/15/30 | | | | 4,000 | | | | 3,972,993 | |

Ellington CLO Ltd. (Cayman Islands),

Series 2017-02A, Class A, 144A, 3 Month LIBOR + 1.700% (Cap N/A, Floor 1.700%) | | | 3.858 | (c) | | | 02/15/29 | | | | 20,000 | | | | 20,044,176 | |

Highbridge Loan Management Ltd. (Cayman Islands),

Series 2015-06A, Class A1R, 144A, 3 Month LIBOR + 1.000% (Cap N/A, Floor 0.000%) | | | 3.287 | (c) | | | 02/05/31 | | | | 15,250 | | | | 15,131,068 | |

ICG US CLO Ltd. (Cayman Islands),

Series 2017-02A, Class A1, 144A, 3 Month LIBOR + 1.280% (Cap N/A, Floor 0.000%) | | | 3.214 | (c) | | | 10/23/29 | | | | 3,000 | | | | 2,987,280 | |

Jamestown CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | | | |

Series 2019-01A, Class A1, 144A, 3 Month LIBOR + 1.470% (Cap N/A, Floor 1.470%) | | | 3.436 | (c) | | | 04/20/32 | | | | 14,750 | | | | 14,692,333 | |

Series 2019-01A, Class A2, 144A, 3 Month LIBOR + 2.150% (Cap N/A, Floor 2.150%) | | | 4.116 | (c) | | | 04/20/32 | | | | 17,000 | | | | 16,952,556 | |

KKR CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | | | |

Series 11, Class AR, 144A, 3 Month LIBOR + 1.180% (Cap N/A, Floor 0.000%) | | | 3.181 | (c) | | | 01/15/31 | | | | 8,000 | | | | 7,949,370 | |

Series 18, Class A, 144A, 3 Month LIBOR + 1.270% (Cap N/A, Floor 0.000%) | | | 3.273 | (c) | | | 07/18/30 | | | | 8,000 | | | | 7,973,498 | |

KVK CLO Ltd. (Cayman Islands),

Series 2018-01A, Class B, 144A, 3 Month LIBOR + 1.650% (Cap N/A, Floor 0.000%) | | | 3.786 | (c) | | | 05/20/29 | | | | 18,000 | | | | 17,742,866 | |

MidOcean Credit CLO (Cayman Islands), | | | | | | | | | | | | | | | | |

Series 2014-03A, Class A1R, 144A, 3 Month LIBOR + 1.120% (Cap N/A, Floor 1.120%) | | | 3.086 | (c) | | | 04/21/31 | | | | 7,500 | | | | 7,379,320 | |

Series 2014-03A, Class BR, 144A, 3 Month LIBOR + 1.800% (Cap N/A, Floor 1.800%) | | | 3.766 | (c) | | | 04/21/31 | | | | 18,000 | | | | 17,831,057 | |

Mountain View CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | | | |

Series 2015-09A, Class A2R, 144A, 3 Month LIBOR + 1.780% (Cap N/A, Floor 0.000%) | | | 3.781 | (c) | | | 07/15/31 | | | | 22,500 | | | | 22,246,378 | |

Series 2017-02A, Class A, 144A, 3 Month LIBOR + 1.210% (Cap N/A, Floor 0.000%) | | | 3.211 | (c) | | | 01/16/31 | | | | 8,000 | | | | 7,912,183 | |

Series 2019-01A, Class B, 144A, 3 Month LIBOR + 2.000% (Cap N/A, Floor 2.000%) | | | 4.009 | (c) | | | 04/15/29 | | | | 10,000 | | | | 9,959,273 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Collateralized Loan Obligations (cont’d.) | | | | | | | | | | | | | | | | |

OCP CLO Ltd. (Cayman Islands),

Series 2017-13A, Class A1A, 144A, 3 Month LIBOR + 1.260% (Cap N/A, Floor 0.000%) | | | 3.261 | %(c) | | | 07/15/30 | | | | 5,750 | | | $ | 5,733,335 | |

OZLM Ltd. (Cayman Islands), | | | | | | | | | | | | | | | | |

Series 2014-06A, Class A2AS, 144A, 3 Month LIBOR + 1.750% (Cap N/A, Floor 0.000%) | | | 3.752 | (c) | | | 04/17/31 | | | | 4,000 | | | | 3,959,232 | |

Series 2015-11A, Class A1R, 144A, 3 Month LIBOR + 1.250% (Cap N/A, Floor 0.000%) | | | 3.186 | (c) | | | 10/30/30 | | | | 3,000 | | | | 2,984,237 | |

Series 2016-15A, Class A1, 144A, 3 Month LIBOR + 1.490% (Cap N/A, Floor 0.000%) | | | 3.456 | (c) | | | 01/20/29 | | | | 22,750 | | | | 22,722,909 | |

Series 2018-20A, Class A2, 144A, 3 Month LIBOR + 1.650% (Cap N/A, Floor 0.000%) | | | 3.616 | (c) | | | 04/20/31 | | | | 3,000 | | | | 2,949,570 | |

Palmer Square CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | | | |

Series 2014-01A, Class A1R2, 144A, 3 Month LIBOR + 1.130% (Cap N/A, Floor 1.130%) | | | 3.132 | (c) | | | 01/17/31 | | | | 10,000 | | | | 9,946,395 | |

Series 2015-02A, Class A1AR, 144A, 3 Month LIBOR + 1.270% (Cap N/A, Floor 0.000%) | | | 3.236 | (c) | | | 07/20/30 | | | | 5,750 | | | | 5,728,508 | |

Series 2018-02A, Class A1A, 144A, 3 Month LIBOR + 1.100% (Cap N/A, Floor 0.000%) | | | 3.101 | (c) | | | 07/16/31 | | | | 12,000 | | | | 11,896,345 | |

Regatta Funding Ltd. (Cayman Islands),

Series 2017-01A, Class A, 144A, 3 Month LIBOR + 1.250% (Cap N/A, Floor 0.000%) | | | 3.252 | (c) | | | 10/17/30 | | | | 4,750 | | | | 4,721,234 | |

Romark CLO Ltd. (Cayman Islands),

Series 2018-02A, Class A1, 144A, 3 Month LIBOR + 1.175% (Cap N/A, Floor 1.175%) | | | 3.115 | (c) | | | 07/25/31 | | | | 5,000 | | | | 4,944,276 | |

Romark WM-R Ltd. (Cayman Islands),

Series 2018-01A, Class A1, 144A, 3 Month LIBOR + 1.030% (Cap N/A, Floor 0.000%) | | | 2.996 | (c) | | | 04/20/31 | | | | 1,500 | | | | 1,475,426 | |

Shackleton CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | | | |

Series 2014-05RA, Class B, 144A, 3 Month LIBOR + 1.700% (Cap N/A, Floor 0.000%) | | | 3.909 | (c) | | | 05/07/31 | | | | 12,500 | | | | 12,326,564 | |

Series 2017-11A, Class A, 144A, 3 Month LIBOR + 1.270%

(Cap N/A, Floor 0.000%) | | | 3.428 | (c) | | | 08/15/30 | | | | 2,500 | | | | 2,503,495 | |

Sound Point CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | | | |

Series 2016-02A, Class AR, 144A, 3 Month LIBOR + 1.290% (Cap N/A, Floor 1.290%) | | | 3.256 | (c) | | | 10/20/28 | | | | 14,750 | | | | 14,733,928 | |

Series 2017-02A, Class A, 144A, 3 Month LIBOR + 1.280%

(Cap N/A, Floor 0.000%) | | | 3.220 | (c) | | | 07/25/30 | | | | 8,500 | | | | 8,463,433 | |

Series 2017-03A, Class A1B, 144A, 3 Month LIBOR + 1.220% (Cap N/A, Floor 0.000%) | | | 3.186 | (c) | | | 10/20/30 | | | | 8,750 | | | | 8,700,356 | |

See Notes to Financial Statements.

| | | | |

| PGIM Absolute Return Bond Fund | | | 19 | |

Schedule of Investments(continued)

as of October 31, 2019

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Collateralized Loan Obligations (cont’d.) | | | | | | | | | | | | | | | | |

Strata CLO Ltd. (Cayman Islands),

Series 2018-01A, Class A, 144A, 3 Month LIBOR + 1.590% (Cap N/A, Floor 1.590%) | | | 3.591 | %(c) | | | 01/15/31 | | | | 19,000 | | | $ | 18,817,583 | |

TICP CLO Ltd. (Cayman Islands),

Series 2017-07A, Class AS, 144A, 3 Month LIBOR + 1.230% (Cap N/A, Floor 1.230%) | | | 3.231 | (c) | | | 07/15/29 | | | | 5,500 | | | | 5,488,510 | |

Trinitas CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | | | |

Series 2015-03A, Class BR, 144A, 3 Month LIBOR + 1.400% (Cap N/A, Floor 0.000%) | | | 3.401 | (c) | | | 07/15/27 | | | | 12,880 | | | | 12,735,144 | |

Series 2017-07A, Class A, 144A, 3 Month LIBOR + 1.210% (Cap N/A, Floor 0.000%) | | | 3.150 | (c) | | | 01/25/31 | | | | 4,500 | | | | 4,451,504 | |

Series 2017-07A, Class B, 144A, 3 Month LIBOR + 1.600% (Cap N/A, Floor 0.000%) | | | 3.540 | (c) | | | 01/25/31 | | | | 3,000 | | | | 2,940,582 | |

Tryon Park CLO Ltd. (Cayman Islands),

Series 2013-01A, Class A2R, 144A, 3 Month LIBOR + 1.500% (Cap N/A, Floor 0.000%) | | | 3.501 | (c) | | | 04/15/29 | | | | 4,000 | | | | 3,937,106 | |

Venture CLO Ltd. (Cayman Islands),

Series 2015-21A, Class AR, 144A, 3 Month LIBOR + 0.880% (Cap N/A, Floor 0.000%) | | | 2.881 | (c) | | | 07/15/27 | | | | 7,196 | | | | 7,176,002 | |

Voya CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | | | |

Series 2013-01A, Class A1AR, 144A, 3 Month LIBOR + 1.210% (Cap N/A, Floor 0.000%) | | | 3.211 | (c) | | | 10/15/30 | | | | 2,750 | | | | 2,738,327 | |

Series 2015-01A, Class A1R, 144A, 3 Month LIBOR + 0.900% (Cap N/A, Floor 0.900%) | | | 2.903 | (c) | | | 01/18/29 | | | | 9,000 | | | | 8,936,236 | |

Wellfleet CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | | | |

Series 2017-02A, Class A1, 144A, 3 Month LIBOR + 1.250% (Cap N/A, Floor 0.000%) | | | 3.216 | (c) | | | 10/20/29 | | | | 7,000 | | | | 6,982,648 | |

Series 2017-03A, Class A1, 144A, 3 Month LIBOR + 1.150% (Cap N/A, Floor 1.150%) | | | 3.152 | (c) | | | 01/17/31 | | | | 10,500 | | | | 10,384,993 | |

York CLO Ltd. (Cayman Islands),

Series 2015-01A, Class AR, 144A, 3 Month LIBOR + 1.150% (Cap N/A, Floor 0.000%) | | | 3.103 | (c) | | | 01/22/31 | | | | 3,000 | | | | 2,980,321 | |

Zais CLO Ltd. (Cayman Islands), | | | | | | | | | | | | | | | | |

Series 2015-03A, Class A2R, 144A, 3 Month LIBOR + 2.190% (Cap N/A, Floor 0.000%) | | | 4.191 | (c) | | | 07/15/31 | | | | 12,800 | | | | 12,426,839 | |

Series 2017-01A, Class A1, 144A, 3 Month LIBOR + 1.370% (Cap N/A, Floor 0.000%) | | | 3.371 | (c) | | | 07/15/29 | | | | 8,750 | | | | 8,692,677 | |

Series 2017-02A, Class A, 144A, 3 Month LIBOR + 1.290% (Cap N/A, Floor 0.000%) | | | 3.291 | (c) | | | 04/15/30 | | | | 4,750 | | | | 4,687,212 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 465,568,092 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Consumer Loans 1.7% | | | | | | | | | | | | | | | | |

Lendmark Funding Trust, | | | | | | | | | | | | | | | | |

Series 2017-02A, Class C, 144A | | | 4.330 | % | | | 05/20/26 | | | | 700 | | | $ | 701,159 | |

Series 2018-02A, Class A, 144A | | | 4.230 | | | | 04/20/27 | | | | 3,200 | | | | 3,301,101 | |

OneMain Financial Issuance Trust, | | | | | | | | | | | | | | | | |

Series 2017-01A, Class A2, 144A, 1 Month LIBOR + 0.800% (Cap N/A, Floor 0.000%) | | | 2.714 | (c) | | | 09/14/32 | | | | 4,197 | | | | 4,199,412 | |

Series 2017-01A, Class C, 144A | | | 3.350 | | | | 09/14/32 | | | | 700 | | | | 704,063 | |

Oportun Funding LLC, | | | | | | | | | | | | | | | | |

Series 2017-B, Class B, 144A | | | 4.260 | | | | 10/10/23 | | | | 7,500 | | | | 7,561,150 | |

Series 2018-B, Class A, 144A | | | 3.910 | | | | 07/08/24 | | | | 2,050 | | | | 2,082,160 | |

Series 2018-B, Class B, 144A | | | 4.500 | | | | 07/08/24 | | | | 500 | | | | 508,063 | |

Series 2018-B, Class C, 144A | | | 5.430 | | | | 07/08/24 | | | | 1,000 | | | | 1,012,609 | |

Series 2018-C, Class A, 144A | | | 4.100 | | | | 10/08/24 | | | | 3,200 | | | | 3,281,171 | |

Series 2018-C, Class B, 144A | | | 4.590 | | | | 10/08/24 | | | | 1,300 | | | | 1,332,214 | |

Series 2018-C, Class C, 144A | | | 5.520 | | | | 10/08/24 | | | | 2,000 | | | | 2,055,151 | |

Series 2018-D, Class A, 144A | | | 4.150 | | | | 12/09/24 | | | | 2,300 | | | | 2,362,920 | |

Series 2018-D, Class B, 144A | | | 4.830 | | | | 12/09/24 | | | | 1,200 | | | | 1,229,866 | |

Series 2019-A, Class B, 144A | | | 3.870 | | | | 08/08/25 | | | | 4,860 | | | | 4,896,374 | |

PNMAC GMSR Issuer Trust, | | | | | | | | | | | | | | | | |

Series 2018-GT01, Class A, 144A, 1 Month LIBOR + 2.850% (Cap N/A, Floor 2.850%) | | | 4.673 | (c) | | | 02/25/23 | | | | 1,650 | | | | 1,660,208 | |

Series 2018-GT02, Class A, 144A, 1 Month LIBOR + 2.650% (Cap N/A, Floor 0.000%) | | | 4.473 | (c) | | | 08/25/25 | | | | 3,400 | | | | 3,411,789 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 40,299,410 | |

| | | | |

Home Equity Loans 1.0% | | | | | | | | | | | | | | | | |

ABFC Trust,

Series 2004-OPT05, Class A1, 1 Month LIBOR + 0.700% (Cap N/A, Floor 0.350%) | | | 2.523 | (c) | | | 06/25/34 | | | | 1,077 | | | | 1,072,274 | |

Accredited Mortgage Loan Trust,

Series 2004-03, Class 2A2, 1 Month LIBOR + 1.200% (Cap 13.000%, Floor 0.600%) | | | 3.023 | (c) | | | 10/25/34 | | | | 2,393 | | | | 2,434,540 | |

Argent Securities, Inc., Asset-Backed Pass-Through Certificates, | | | | | | | | | | | | | | | | |

Series 2003-W05, Class M1, 1 Month LIBOR + 1.050% (Cap N/A, Floor 0.700%) | | | 2.873 | (c) | | | 10/25/33 | | | | 18 | | | | 18,124 | |

Series 2004-W06, Class AF | | | 4.123 | | | | 05/25/34 | | | | 176 | | | | 185,708 | |

Series 2004-W06, Class AV5, 1 Month LIBOR + 0.800% (Cap N/A, Floor 0.400%) | | | 2.623 | (c) | | | 05/25/34 | | | | 577 | | | | 569,102 | |

Asset-Backed Securities Corp. Home Equity Loan Trust,

Series 2003-HE06, Class A2, 1 Month LIBOR + 0.680%

(Cap N/A, Floor 0.340%) | | | 2.503 | (c) | | | 11/25/33 | | | | 1,758 | | | | 1,727,749 | |

See Notes to Financial Statements.

| | | | |

| PGIM Absolute Return Bond Fund | | | 21 | |

Schedule of Investments(continued)

as of October 31, 2019

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Home Equity Loans (cont’d.) | | | | | | | | | | | | | | | | |

Asset-Backed Securities Corp. Home Equity Loan Trust, (cont’d.) | | | | | | | | | | | | | | | | |

Series 2003-HE06, Class A3B, 1 Month LIBOR + 0.960% (Cap N/A, Floor 0.480%) | | | 2.783 | %(c) | | | 11/25/33 | | | | 3,546 | | | $ | 3,488,164 | |

Bear Stearns Asset-Backed Securities Trust, | | | | | | | | | | | | | | | | |

Series 2002-02, Class A1, 1 Month LIBOR + 0.660% (Cap 11.000%, Floor 0.330%) | | | 2.483 | (c) | | | 10/25/32 | | | | 700 | | | | 702,823 | |

Series 2003-03, Class A2, 1 Month LIBOR + 1.180% (Cap 11.000%, Floor 0.590%) | | | 3.003 | (c) | | | 06/25/43 | | | | 98 | | | | 99,138 | |

Series 2003-HE01, Class M1, 1 Month LIBOR + 1.095% (Cap N/A, Floor 0.730%) | | | 2.918 | (c) | | | 01/25/34 | | | | 2,418 | | | | 2,490,634 | |

Series 2004-HE11, Class M2, 1 Month LIBOR + 1.575% (Cap N/A, Floor 1.050%) | | | 3.398 | (c) | | | 12/25/34 | | | | 2,075 | | | | 2,097,727 | |

Home Equity Asset Trust,

Series 2004-07, Class A2, 1 Month LIBOR + 0.840%

(Cap N/A, Floor 0.420%) | | | 2.663 | (c) | | | 01/25/35 | | | | 1,051 | | | | 1,070,407 | |

MASTR Asset-Backed Securities Trust,

Series 2003-WMC02, Class M2, 1 Month LIBOR + 2.475% (Cap N/A, Floor 1.650%) | | | 4.298 | (c) | | | 08/25/33 | | | | 912 | | | | 949,430 | |

Merrill Lynch Mortgage Investors Trust,

Series 2002-HE01, Class A1, 1 Month LIBOR + 1.000%

(Cap N/A, Floor 0.500%) | | | 2.823 | (c) | | | 08/25/32 | | | | 2,360 | | | | 2,354,165 | |

Morgan Stanley ABS Capital I, Inc. Trust, | | | | | | | | | | | | | | | | |

Series 2003-HE03, Class M1, 1 Month LIBOR + 1.020% (Cap N/A, Floor 0.680%) | | | 2.843 | (c) | | | 10/25/33 | | | | 2,107 | | | | 2,111,129 | |

Series 2003-NC08, Class M1, 1 Month LIBOR + 1.050% (Cap N/A, Floor 0.700%) | | | 2.873 | (c) | | | 09/25/33 | | | | 504 | | | | 504,473 | |

Series 2003-NC10, Class M1, 1 Month LIBOR + 1.020% (Cap N/A, Floor 0.680%) | | | 2.843 | (c) | | | 10/25/33 | | | | 561 | | | | 557,624 | |

Series 2004-HE05, Class M1, 1 Month LIBOR + 0.945% (Cap N/A, Floor 0.630%) | | | 2.768 | (c) | | | 06/25/34 | | | | 670 | | | | 674,045 | |

RASC Trust,

Series 2005-KS11, Class M1, 1 Month LIBOR + 0.400% (Cap 14.000%, Floor 0.400%) | | | 2.223 | (c) | | | 12/25/35 | | | | 194 | | | | 193,936 | |

Securitized Asset-Backed Receivables LLC Trust,

Series 2004-NC01, Class M1, 1 Month LIBOR + 0.780% (Cap N/A, Floor 0.520%) | | | 2.603 | (c) | | | 02/25/34 | | | | 925 | | | | 925,123 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 24,226,315 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | |

| | | | |

Other 0.1% | | | | | | | | | | | | | | | | |

PNMAC FMSR Issuer Trust,

Series 2018-FT01, Class A, 144A, 1 Month LIBOR + 2.350%

(Cap N/A, Floor 0.000%) | | | 4.173 | %(c) | | | 04/25/23 | | | | 3,200 | | | $ | 3,163,472 | |

| | | | |

Residential Mortgage-Backed Securities 3.2% | | | | | | | | | | | | | | | | |

Chase Funding Trust Series, | | | | | | | | | | | | | | | | |

Series 2002-03, Class 2A1, 1 Month LIBOR + 0.640% (Cap N/A, Floor 0.320%) | | | 2.463 | (c) | | | 08/25/32 | | | | 312 | | | | 307,308 | |

Series 2003-04, Class 1A5 | | | 5.142 | | | | 05/25/33 | | | | 603 | | | | 621,287 | |

Citigroup Mortgage Loan Trust, Inc., | | | | | | | | | | | | | | | | |

Series 2005-OPT01, Class M1, 1 Month LIBOR + 0.630% (Cap N/A, Floor 0.420%) | | | 2.453 | (c) | | | 02/25/35 | | | | 273 | | | | 271,609 | |

Series 2005-WF01, Class A5 | | | 5.010 | (cc) | | | 11/25/34 | | | | 8 | | | | 8,559 | |

Countrywide Asset-Backed Certificates, | | | | | | | | | | | | | | | | |

Series 2003-BC04, Class M1, 1 Month LIBOR + 1.050% (Cap N/A, Floor 0.700%) | | | 2.873 | (c) | | | 07/25/33 | | | | 711 | | | | 711,934 | |

Series 2004-03, Class 1A, 1 Month LIBOR + 0.420% (Cap N/A, Floor 0.210%) | | | 2.243 | (c) | | | 08/25/34 | | | | 7,769 | | | | 7,534,495 | |

Series 2004-BC04, Class M1, 1 Month LIBOR + 1.050% (Cap N/A, Floor 0.700%) | | | 2.873 | (c) | | | 11/25/34 | | | | 450 | | | | 451,217 | |

Credit Suisse Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2016-RPL01, Class A1, 144A, 1 Month LIBOR + 3.150% (Cap N/A, Floor 3.150%) | | | 5.182 | (c) | | | 12/26/46 | | | | 3,830 | | | | 3,843,139 | |

Series 2018-RPL08, Class A1, 144A | | | 4.125 | (cc) | | | 07/25/58 | | | | 7,685 | | | | 7,756,933 | |

Credit-Based Asset Servicing & Securitization LLC, | | | | | | | | | | | | | | | | |

Series 2003-CB03, Class AF1 | | | 3.379 | | | | 12/25/32 | | | | 117 | | | | 118,629 | |

Series 2003-CB05, Class M1, 1 Month LIBOR + 1.020% (Cap N/A, Floor 0.680%) | | | 2.843 | (c) | | | 11/25/33 | | | | 640 | | | | 636,056 | |

CWABS, Inc., Asset-Backed Certificates,

Series 2004-01, Class M1, 1 Month LIBOR + 0.750%

(Cap N/A, Floor 0.500%) | | | 2.573 | (c) | | | 03/25/34 | | | | 83 | | | | 83,570 | |

Finance America Mortgage Loan Trust,

Series 2003-01, Class M1, 1 Month LIBOR + 1.050%

(Cap N/A, Floor 0.700%) | | | 2.873 | (c) | | | 09/25/33 | | | | 1,665 | | | | 1,646,518 | |

First Franklin Mortgage Loan Trust,

Series 2004-FF05, Class A2, 1 Month LIBOR + 0.760%

(Cap N/A, Floor 0.530%) | | | 2.583 | (c) | | | 08/25/34 | | | | 747 | | | | 746,435 | |

Fremont Home Loan Trust,

Series 2004-04, Class M1, 1 Month LIBOR + 0.795%

(Cap N/A, Floor 0.530%) | | | 2.618 | (c) | | | 03/25/35 | | | | 2,476 | | | | 2,461,824 | |

See Notes to Financial Statements.

| | | | |

| PGIM Absolute Return Bond Fund | | | 23 | |

Schedule of Investments(continued)

as of October 31, 2019

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Residential Mortgage-Backed Securities (cont’d.) | | | | | | | | | | | | | | | | | | | | |

GSAMP Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2003-HE02, Class A1A, 144A, 1 Month LIBOR + 0.600%

(Cap N/A, Floor 0.300%) | | | 2.423 | %(c) | | | 08/25/33 | | | | | | | | 600 | | | $ | 591,118 | |

Series 2004-AR01, Class A2B, 1 Month LIBOR + 1.200%

(Cap N/A, Floor 0.600%) | | | 3.023 | (c) | | | 06/25/34 | | | | | | | | 1,323 | | | | 1,327,191 | |

Series 2004-NC02, Class A1B, 1 Month LIBOR + 0.900%

(Cap N/A, Floor 0.450%) | | | 2.723 | (c) | | | 10/25/34 | | | | | | | | 1,787 | | | | 1,750,232 | |

JPMorgan Mortgage Acquisition Corp.,

Series 2005-OPT02, Class M1, 1 Month LIBOR + 0.430%

(Cap N/A, Floor 0.430%) | | | 2.253 | (c) | | | 12/25/35 | | | | | | | | 7 | | | | 7,265 | |

Long Beach Mortgage Loan Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2003-04, Class AV1, 1 Month LIBOR + 0.620%

(Cap N/A, Floor 0.310%) | | | 2.443 | (c) | | | 08/25/33 | | | | | | | | 1,351 | | | | 1,363,266 | |

Series 2004-02, Class A1, 1 Month LIBOR + 0.440%

(Cap N/A, Floor 0.220%) | | | 2.263 | (c) | | | 06/25/34 | | | | | | | | 925 | | | | 908,191 | |

Morgan Stanley ABS Capital I, Inc. Trust,

Series 2004-NC05, Class M1, 1 Month LIBOR + 0.900%

(Cap N/A, Floor 0.600%) | | | 2.723 | (c) | | | 05/25/34 | | | | | | | | 232 | | | | 229,596 | |

Park Place Securities, Inc., Asset-Backed Pass-Through Certificates,

Series 2005-WCH01, Class M3, 1 Month LIBOR + 0.840%

(Cap N/A, Floor 0.560%) | | | 2.663 | (c) | | | 01/25/36 | | | | | | | | 234 | | | | 234,154 | |

Specialty Underwriting & Residential Finance Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2003-BC04, Class M1, 1 Month LIBOR + 0.900%

(Cap N/A, Floor 0.600%) | | | 2.723 | (c) | | | 11/25/34 | | | | | | | | 1,088 | | | | 1,076,438 | |

Series 2004-BC02, Class M1, 1 Month LIBOR + 0.825%

(Cap N/A, Floor 0.550%) | | | 2.648 | (c) | | | 05/25/35 | | | | | | | | 1,693 | | | | 1,697,323 | |

Structured Asset Investment Loan Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2004-BNC01, Class A2, 1 Month LIBOR + 1.000%

(Cap N/A, Floor 0.500%) | | | 2.823 | (c) | | | 09/25/34 | | | | | | | | 2,908 | | | | 2,918,895 | |

Series 2005-03, Class M2, 1 Month LIBOR + 0.660%

(Cap N/A, Floor 0.440%) | | | 2.483 | (c) | | | 04/25/35 | | | | | | | | 510 | | | | 510,315 | |

TFS (Spain),

Series 2018-03, Class A1, 1 Month EURIBOR + 2.900% | | | 2.900 | (c) | | | 03/16/23 | | | | EUR | | | | 12,056 | | | | 13,419,391 | |

Towd Point Mortgage Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2017-04, Class A1, 144A | | | 2.750 | (cc) | | | 06/25/57 | | | | | | | | 1,985 | | | | 2,008,346 | |

Series 2018-02, Class A1, 144A | | | 3.250 | (cc) | | | 03/25/58 | | | | | | | | 12,536 | | | | 12,814,833 | |

Series 2018-03, Class A1, 144A | | | 3.750 | (cc) | | | 05/25/58 | | | | | | | | 7,670 | | | | 7,968,981 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 76,025,048 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | | |

ASSET-BACKED SECURITIES (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Student Loans 2.3% | | | | | | | | | | | | | | | | | | | | |

Laurel Road Prime Student Loan Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2018-D, Class A, 144A | | | 0.000 | %(cc) | | | 11/25/43 | | | | | | | | 10,256 | | | $ | 10,656,599 | |

Series 2019-A, Class R, 144A | | | 0.000 | | | | 10/25/48 | | | | | | | | 8,200 | | | | 577,712 | |

SLM Student Loan Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2004-02X, Class A6, 3 Month EURIBOR + 0.550%

(Cap N/A, Floor 0.000%) | | | 0.148 | (c) | | | 07/25/39 | | | | EUR | | | | 7,950 | | | | 8,587,811 | |

Series 2007-02, Class B, 3 Month LIBOR + 0.170%

(Cap N/A, Floor 0.000%) | | | 2.110 | (c) | | | 07/25/25 | | | | | | | | 11,503 | | | | 10,452,208 | |

SoFi Alternative Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2019-B, Class PT, 144A | | | — | (p) | | | 12/15/45 | | | | | | | | 11,176 | | | | 11,572,982 | |

Series 2019-D, Class 1PT, 144A | | | 2.460 | (cc) | | | 01/16/46 | | | | | | | | 12,100 | | | | 12,499,532 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 54,346,844 | |

| | | | | | | | | | | | | | | | | | | | |

TOTAL ASSET-BACKED SECURITIES

(cost $675,297,511) | | | | | | | | | | | | | | | | | | | 675,281,096 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

BANK LOANS 2.2% | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Chemicals 0.1% | | | | | | | | | | | | | | | | | | | | |

Avantor, Inc. (United Kingdom),

Initial B-2 Euro Term Loan, 1 Month EURIBOR + 3.250% | | | 3.250 | (c) | | | 11/21/24 | | | | EUR | | | | 526 | | | | 593,414 | |

Starfruit Finco BV (Netherlands), | | | | | | | | | | | | | | | | | | | | |

Initial Dollar Term Loan, 1 Month LIBOR + 3.250% | | | 5.190 | (c) | | | 10/01/25 | | | | | | | | 485 | | | | 472,403 | |

Initial Euro Term Loan, 3 Month EURIBOR + 3.750% | | | 3.750 | (c) | | | 10/01/25 | | | | EUR | | | | 1,580 | | | | 1,757,219 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 2,823,036 | |

| | | | | |

Computers 0.1% | | | | | | | | | | | | | | | | | | | | |

McAfee LLC, | | | | | | | | | | | | | | | | | | | | |

Second Lien Initial Loan, 1 Month LIBOR + 8.500% | | | 10.305 | (c) | | | 09/29/25 | | | | | | | | 1,706 | | | �� | 1,711,937 | |

Term B USD Loan, 1 Month LIBOR + 3.750% | | | 5.555 | (c) | | | 09/30/24 | | | | | | | | 1,171 | | | | 1,169,794 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 2,881,731 | |

| | | | | |

Foods 0.2% | | | | | | | | | | | | | | | | | | | | |

Sigma Bidco BV (Netherlands),

Facility B-4 Loan, 1 Month GBP LIBOR + 4.000% | | | 4.714 | (c) | | | 07/02/25 | | | | GBP | | | | 3,700 | | | | 4,660,993 | |

| | | | | |

Healthcare-Products 0.1% | | | | | | | | | | | | | | | | | | | | |

Ceva Sante Animale SA (United Kingdom),

Term Loan, 3 Month EURIBOR + 4.750% | | | 4.750 | (c) | | | 04/13/26 | | | | EUR | | | | 2,125 | | | | 2,376,783 | |

See Notes to Financial Statements.

| | | | |

| PGIM Absolute Return Bond Fund | | | 25 | |

Schedule of Investments(continued)

as of October 31, 2019

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | | |

BANK LOANS (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Household Products/Wares 0.2% | | | | | | | | | | | | | | | | | | | | |

Diamond BC BV,

Initial Euro Term Loan, 1 - 3 Month EURIBOR + 3.250% | | | 3.250 | %(c) | | | 09/06/24 | | | | EUR | | | | 4,226 | | | $ | 4,454,123 | |

| | | | | |

Leisure Time 0.2% | | | | | | | | | | | | | | | | | | | | |

HNVR Holdco Ltd. (United Kingdom),

Facility C, 6 Month EURIBOR + 4.500% | | | 4.500 | (c) | | | 09/12/25 | | | | EUR | | | | 2,525 | | | | 2,816,133 | |

Richmond UK Bidco Ltd. (United Kingdom),

Facility B, 1 Month GBP LIBOR + 4.250% | | | 4.963 | (c) | | | 03/03/24 | | | | GBP | | | | 358 | | | | 447,087 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 3,263,220 | |

| | | | | |

Pharmaceuticals 0.1% | | | | | | | | | | | | | | | | | | | | |

Nidda Healthcare Holding AG (Germany),

Facility C GBP, 3 Month GBP LIBOR + 4.500% | | | 5.264 | (c) | | | 08/21/24 | | | | GBP | | | | 1,700 | | | | 2,205,766 | |

| | | | | |

Retail 0.9% | | | | | | | | | | | | | | | | | | | | |

BBD Bidco Ltd. (United Kingdom),

Term Loan | | | — | (p) | | | 09/30/26 | | | | | | | | 2,400 | | | | 3,121,794 | |

EG America LLC (United Kingdom),

Second Lien Facility (USD), 3 Month LIBOR + 8.000% | | | 10.104 | (c) | | | 04/20/26 | | | | | | | | 746 | | | | 704,592 | |

EG Finco Ltd. (United Kingdom), | | | | | | | | | | | | | | | | | | | | |

Second Lien Term Loan, 1 - 3 Month EURIBOR + 7.750%^ | | | 8.750 | (c) | | | 04/20/26 | | | | EUR | | | | 421 | | | | 464,890 | |

Term B, 3 Month GBP LIBOR + 4.750% | | | 5.508 | (c) | | | 02/06/25 | | | | GBP | | | | 1,108 | | | | 1,373,806 | |

Term B-1, 3 Month EURIBOR + 4.000% | | | 4.000 | (c) | | | 02/07/25 | | | | EUR | | | | 2,442 | | | | 2,627,156 | |

Stonegate Pub Co. Ltd.,

Term Loan^ | | | — | (p) | | | 10/31/27 | | | | GBP | | | | 10,900 | | | | 13,836,929 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 22,129,167 | |

| | | | | |

Telecommunications 0.3% | | | | | | | | | | | | | | | | | | | | |

Sprint Communications, Inc.,

Initial Term Loan, 1 Month LIBOR + 2.500% | | | 4.313 | (c) | | | 02/02/24 | | | | | | | | 3,940 | | | | 3,891,794 | |

West Corp.,

Initial Term B Loan, 1 - 3 Month LIBOR + 4.000% | | | 5.857 | (c) | | | 10/10/24 | | | | | | | | 2,743 | | | | 2,283,565 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 6,175,359 | |

| | | | | | | | | | | | | | | | | | | | |

TOTAL BANK LOANS

(cost $51,533,702) | | | | | | | | | | | | | | | | | | | 50,970,178 | |

| | | | | | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES 8.4% | | | | | | | | | | | | | | | | |

20 Times Square Trust, | | | | | | | | | | | | | | | | |

Series 2018-20TS, Class G, 144A | | | 3.100 | %(cc) | | | 05/15/35 | | | | 2,700 | | | $ | 2,618,087 | |

Series 2018-20TS, Class H, 144A | | | 3.100 | (cc) | | | 05/15/35 | | | | 2,700 | | | | 2,571,209 | |

BBCMS Mortgage Trust,

Series 2018-TALL, Class D, 144A, 1 Month LIBOR + 1.449% (Cap N/A, Floor 1.449%) | | | 3.362 | (c) | | | 03/15/37 | | | | 11,875 | | | | 11,867,596 | |

BX Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2018-IND, Class G, 144A, 1 Month LIBOR + 2.050% (Cap N/A, Floor 2.050%) | | | 3.964 | (c) | | | 11/15/35 | | | | 2,929 | | | | 2,941,943 | |

Series 2019-XL, Class J, 144A, 1 Month LIBOR + 2.650% (Cap N/A, Floor 2.650%) | | | 4.650 | (c) | | | 10/15/36 | | | | 14,650 | | | | 14,677,634 | |

COMM Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2012-CR01, Class XA, IO | | | 1.858 | (cc) | | | 05/15/45 | | | | 11,016 | | | | 428,954 | |

Series 2015-LC19, Class XB, IO, 144A | | | 0.262 | (cc) | | | 02/10/48 | | | | 123,049 | | | | 1,622,586 | |

Credit Suisse Mortgage Capital Certificates,

Series 2019-ICE04, Class F, 144A, 1 Month LIBOR + 2.650% (Cap N/A, Floor 2.650%) | | | 4.564 | (c) | | | 05/15/36 | | | | 15,000 | | | | 15,075,263 | |

Credit Suisse Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2017-LSTK, Class D, 144A | | | 3.331 | (cc) | | | 04/05/33 | | | | 6,850 | | | | 6,849,034 | |

Series 2017-LSTK, Class E, 144A | | | 3.331 | (cc) | | | 04/05/33 | | | | 12,575 | | | | 12,512,873 | |

CSAIL Commercial Mortgage Trust,

Series 2018-CX11, Class A3 | | | 4.095 | | | | 04/15/51 | | | | 9,000 | | | | 9,743,714 | |

DBGS Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2018-BIOD, Class E, 144A, 1 Month LIBOR + 1.700% (Cap N/A, Floor 1.700%) | | | 3.614 | (c) | | | 05/15/35 | | | | 3,365 | | | | 3,377,431 | |

Series 2018-BIOD, Class F, 144A, 1 Month LIBOR + 2.000% (Cap N/A, Floor 2.000%) | | | 3.914 | (c) | | | 05/15/35 | | | | 12,994 | | | | 13,056,389 | |

DBWF Mortgage Trust,

Series 2016-85T, Class E, 144A | | | 3.808 | (cc) | | | 12/10/36 | | | | 15,500 | | | | 15,499,003 | |

FHLMC Multifamily Structured Pass-Through Certificates, | | | | | | | | | | | | | | | | |

Series K007, Class X1, IO | | | 1.030 | (cc) | | | 04/25/20 | | | | 3,081 | | | | 5,375 | |

Series K008, Class X1, IO | | | 1.480 | (cc) | | | 06/25/20 | | | | 17,229 | | | | 94,328 | |

Series K010, Class X1, IO | | | 0.129 | (cc) | | | 10/25/20 | | | | 17,401 | | | | 19,646 | |

Series K018, Class X1, IO | | | 1.306 | (cc) | | | 01/25/22 | | | | 14,587 | | | | 325,444 | |

Series K020, Class X1, IO | | | 1.393 | (cc) | | | 05/25/22 | | | | 19,344 | | | | 578,134 | |

Series K021, Class X1, IO | | | 1.428 | (cc) | | | 06/25/22 | | | | 3,986 | | | | 128,283 | |

Series K025, Class X1, IO | | | 0.823 | (cc) | | | 10/25/22 | | | | 87,200 | | | | 1,873,522 | |

Series K055, Class X1, IO | | | 1.365 | (cc) | | | 03/25/26 | | | | 22,918 | | | | 1,699,063 | |

Series K066, Class X1, IO | | | 0.752 | (cc) | | | 06/25/27 | | | | 235,124 | | | | 11,720,580 | |

Series KC02, Class X1, IO | | | 0.374 | (cc) | | | 03/25/24 | | | | 142,181 | | | | 2,240,103 | |

GS Mortgage Securities Corp.,

Series 2013-GC10, Class XB, IO, 144A | | | 0.482 | (cc) | | | 02/10/46 | | | | 103,126 | | | | 1,626,689 | |

See Notes to Financial Statements.

| | | | |

| PGIM Absolute Return Bond Fund | | | 27 | |

Schedule of Investments(continued)

as of October 31, 2019

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal Amount (000)# | | | Value | |

| | | |

COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | | | | | | | | | | | | | |

GS Mortgage Securities Trust,

Series 2014-GC20, Class XB, IO | | | 0.436 | %(cc) | | | 04/10/47 | | | | | | | | 28,307 | | | $ | 526,929 | |

Independence Plaza Trust,

Series 2018-INDP, Class E, 144A | | | 4.996 | | | | 07/10/35 | | | | | | | | 5,200 | | | | 5,529,804 | |

JPMBB Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2014-C21, Class XB, IO | | | 0.317 | (cc) | | | 08/15/47 | | | | | | | | 45,056 | | | | 712,583 | |

Series 2015-C27, Class XB, IO | | | 0.444 | (cc) | | | 02/15/48 | | | | | | | | 52,766 | | | | 1,086,763 | |

JPMorgan Chase Commercial Mortgage Securities Corp.,

Series 2018-AON, Class E, 144A | | | 4.613 | (cc) | | | 07/05/31 | | | | | | | | 25,950 | | | | 27,223,089 | |

JPMorgan Chase Commercial Mortgage Securities Trust,

Series 2013-LC11, Class XB, IO | | | 0.512 | (cc) | | | 04/15/46 | | | | | | | | 34,956 | | | | 618,736 | |

Morgan Stanley Bank of America Merrill Lynch Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2012-C05, Class XB, IO, 144A | | | 0.235 | (cc) | | | 08/15/45 | | | | | | | | 65,968 | | | | 473,980 | |

Series 2013-C08, Class XB, IO, 144A | | | 0.497 | (cc) | | | 12/15/48 | | | | | | | | 68,276 | | | | 923,296 | |

Salus European Loan Conduit DAC (United Kingdom),

Series 33A, Class A, 144A, 3 Month GBP LIBOR + 1.500%

(Cap 5.000%, Floor 0.000%) | | | 2.279 | (c) | | | 01/23/29 | | | | GBP | | | | 9,500 | | | | 12,347,665 | |

UBS-Barclays Commercial Mortgage Trust,

Series 2013-C06, Class XB, IO, 144A | | | 0.379 | (cc) | | | 04/10/46 | | | | | | | | 140,883 | | | | 1,826,210 | |

Wells Fargo Commercial Mortgage Trust, | | | | | | | | | | | | | | | | | | | | |

Series 2017-C39, Class A4 | | | 3.157 | | | | 09/15/50 | | | | | | | | 10,000 | | | | 10,518,723 | |

Series 2017-C40, Class A3 | | | 3.317 | | | | 10/15/50 | | | | | | | | 3,380 | | | | 3,591,650 | |

| | | | | | | | | | | | | | | | | | | | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(cost $193,054,179) | | | | | | | | | | | | | | | | | | | 198,532,311 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

CORPORATE BONDS 34.1% | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Advertising 0.2% | | | | | | | | | | | | | | | | | | | | |

National CineMedia LLC, | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes | | | 6.000 | | | | 04/15/22 | | | | | | | | 775 | | | | 782,828 | |

Sr. Unsec’d. Notes | | | 5.750 | | | | 08/15/26 | | | | | | | | 2,925 | | | | 2,859,187 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 3,642,015 | |

| | | | | |

Aerospace & Defense 0.7% | | | | | | | | | | | | | | | | | | | | |

Bombardier, Inc. (Canada), | | | | | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 144A | | | 7.500 | | | | 12/01/24 | | | | | | | | 9,325 | | | | 9,039,422 | |

Sr. Unsec’d. Notes, 144A | | | 7.875 | | | | 04/15/27 | | | | | | | | 6,750 | | | | 6,378,750 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 15,418,172 | |

| | | | | |

Agriculture 0.0% | | | | | | | | | | | | | | | | | | | | |

Vector Group Ltd., | | | | | | | | | | | | | | | | | | | | |

Sr. Sec’d. Notes, 144A | | | 6.125 | | | | 02/01/25 | | | | | | | | 529 | | | | 507,840 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Airlines 0.2% | | | | | | | | | | | | | | | | | | | | |

American Airlines 2013-1 Class A Pass-Through Trust,

Pass-Through Certificates(a) | | | 4.000 | % | | | 01/15/27 | | | | | | | | 2,091 | | | $ | 2,214,047 | |

Continental Airlines 2007-1 Class A Pass-Through Trust,

Pass-Through Certificates | | | 5.983 | | | | 10/19/23 | | | | | | | | 790 | | | | 836,758 | |

Continental Airlines 2012-2 Class A Pass-Through Trust,

Pass-Through Certificates | | | 4.000 | | | | 04/29/26 | | | | | | | | 87 | | | | 92,495 | |

Delta Air Lines 2007-1 Class A Pass-Through Trust,

Pass-Through Certificates | | | 6.821 | | | | 02/10/24 | | | | | | | | 593 | | | | 650,068 | |

United Airlines 2013-1 Class A, Pass-Through Trust,

Pass-Through Certificates | | | 4.300 | | | | 02/15/27 | | | | | | | | 1,844 | | | | 1,988,156 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 5,781,524 | |

| | | | | |

Apparel 0.1% | | | | | | | | | | | | | | | | | | | | |

PVH Corp.,

Sr. Unsec’d. Notes, 144A | | | 3.125 | | | | 12/15/27 | | | | EUR | | | | 2,175 | | | | 2,696,040 | |

| | | | | |

Auto Manufacturers 0.6% | | | | | | | | | | | | | | | | | | | | |

BMW US Capital LLC (Germany),

Gtd. Notes, 144A, 3 Month LIBOR + 0.410% | | | 2.411 | (c) | | | 04/12/21 | | | | | | | | 820 | | | | 821,271 | |

Ford Motor Credit Co. LLC,

Sr. Unsec’d. Notes | | | 3.350 | | | | 11/01/22 | | | | | | | | 5,685 | | | | 5,702,381 | |

General Motors Co.,

Sr. Unsec’d. Notes | | | 6.250 | | | | 10/02/43 | | | | | | | | 1,555 | | | | 1,720,288 | |

Volkswagen Group of America Finance LLC (Germany), | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 3.875 | | | | 11/13/20 | | | | | | | | 2,150 | | | | 2,189,029 | |

Gtd. Notes, 144A | | | 4.000 | | | | 11/12/21 | | | | | | | | 2,810 | | | | 2,912,304 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 13,345,273 | |

| | | | | |

Auto Parts & Equipment 0.9% | | | | | | | | | | | | | | | | | | | | |

Adient Global Holdings Ltd.,

Gtd. Notes, 144A | | | 4.875 | | | | 08/15/26 | | | | | | | | 2,700 | | | | 2,119,500 | |

Adient US LLC,

Sr. Sec’d. Notes, 144A(a) | | | 7.000 | | | | 05/15/26 | | | | | | | | 1,400 | | | | 1,473,500 | |

American Axle & Manufacturing, Inc., | | | | | | | | | | | | | | | | | | | | |

Gtd. Notes(a) | | | 6.250 | | | | 03/15/26 | | | | | | | | 3,200 | | | | 3,040,000 | |

Gtd. Notes(a) | | | 6.500 | | | | 04/01/27 | | | | | | | | 2,650 | | | | 2,510,875 | |

Cooper-Standard Automotive, Inc.,

Gtd. Notes, 144A(a) | | | 5.625 | | | | 11/15/26 | | | | | | | | 3,525 | | | | 2,996,250 | |

See Notes to Financial Statements.

| | | | |

| PGIM Absolute Return Bond Fund | | | 29 | |

Schedule of Investments(continued)

as of October 31, 2019

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| Description | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)# | | | Value | |

| | | | | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Auto Parts & Equipment (cont’d.) | | | | | | | | | | | | | | | | | | | | |

Lear Corp.,

Sr. Unsec’d. Notes | | | 5.250 | % | | | 01/15/25 | | | | | | | | 5,375 | | | $ | 5,542,271 | |

Nemak SAB de CV (Mexico),

Sr. Unsec’d. Notes(a) | | | 4.750 | | | | 01/23/25 | | | | | | | | 2,800 | | | | 2,891,000 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | 20,573,396 | |

| | | | | |

Banks 4.9% | | | | | | | | | | | | | | | | | | | | |

Banco do Brasil SA (Brazil),

Gtd. Notes | | | 3.875 | | | | 10/10/22 | | | | | | | | 3,000 | | | | 3,066,750 | |

Banco Nacional de Costa Rica (Costa Rica),

Sr. Unsec’d. Notes, 144A | | | 5.875 | | | | 04/25/21 | | | | | | | | 750 | | | | 757,500 | |

Bank of America Corp., | | | | | | | | | | | | | | | | | | | | |

Jr. Sub. Notes, Series AA | | | 6.100 | (ff) | | | — | (rr) | | | | | | | 8,820 | | | | 9,761,844 | |