UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09253

Wells Fargo Funds Trust

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

C. David Messman

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: September 30

Registrant is making a filing for 11 of its series:

Wells Fargo Diversified Capital Builder Fund, Wells Fargo Diversified Income Builder Fund, Wells Fargo Index Asset Allocation Fund, Wells Fargo International Bond Fund, Wells Fargo Strategic Income Fund, Wells Fargo C&B Mid Cap Value Fund, Wells Fargo Common Stock Fund, Wells Fargo Discovery Fund, Wells Fargo Enterprise Fund, Wells Fargo Opportunity Fund, and Wells Fargo Special Mid Cap Value Fund.

Date of reporting period: March 31, 2018

| ITEM 1. | REPORT TO STOCKHOLDERS |

Semi-Annual Report

March 31, 2018

Wells Fargo Diversified Capital Builder Fund

Reduce clutter. Save trees.

Sign up for electronic delivery of prospectuses and shareholder reports at wellsfargo.com/advantagedelivery

Contents

The views expressed and any forward-looking statements are as of March 31, 2018, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Funds Management, LLC. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Funds Management, LLC and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

NOT FDIC INSURED ◾ NO BANK GUARANTEE ◾ MAY LOSE VALUE

| | | | |

| 2 | | Wells Fargo Diversified Capital Builder Fund | | Letter to shareholders (unaudited) |

Andrew Owen

President

Wells Fargo Funds

During the last quarter of 2017, investors enjoyed consistently rising equity values globally.

Dear Shareholder:

We are pleased to offer you this semi-annual report for the Wells Fargo Diversified Capital Builder Fund for the six-month period that ended March 31, 2018. During the last quarter of 2017, investors enjoyed consistently rising equity values globally. During the final two months of the first quarter of 2018, market volatility returned and equity markets reversed their year-to-date gains.

For the period, U.S. stocks, as measured by the S&P 500 Index,1 gained 5.84% and international stocks, as measured by the MSCI ACWI ex USA Index (Net),2 gained 3.76%. Emerging market stocks, as measured by the MSCI EM Index (Net),3 added 8.96%. In bond markets, the Bloomberg Barclays U.S. Aggregate Bond Index4 declined 1.08% and the Bloomberg Barclays Municipal Bond Index5 lost 0.37% while fixed-income investments outside the U.S. gained 5.31%, according to the Bloomberg Barclays Global Aggregate ex-USD Index.6 The ICE BofAML U.S. High Yield Index7 fell 0.51% during the period.

During the last three months of 2017, stocks advanced on synchronized global growth, which led to higher investor and consumer confidence. The first quarter of 2018 began with strong stock market gains in January. A strong January 2018 U.S. employment report and inflation concerns prompted equity volatility in February. Investor optimism for growth was supplanted with concerns over trade tensions, increased interest rates, and the prospect of new data privacy regulations.

Reactions to U.S. interest rate increases were uneven across the yield curve and globally.

The U.S. Federal Reserve (Fed) increased the federal funds rate twice during the six-month period for a combined 50 basis points (bps; 100 bps equals 1.00%). Internationally, central banks maintained low interest rates and accommodative monetary policies that supported business activity and stock values in foreign markets. A weaker U.S. dollar was generally supportive of business activity in regions around the globe. The Bank of Japan continued its accommodative monetary policies, and industrial production, retail sales, and fixed asset investment increased in China.

Globally, stocks moved higher during the last quarter of 2017. Low inflation and interest rates supported accelerating global economic growth and corporate earnings. Brief episodes of geopolitical tensions, often associated with North Korea’s advancing nuclear missile program, flaring conflicts in the Middle East, and uncertainty surrounding U.S. trade policies, did not discourage investing activity.

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure large- and mid-cap equity market performance of emerging markets. The MSCI EM Index (Net) consists of the following 24 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, the Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey, and the United Arab Emirates. You cannot invest directly in an index. |

| 4 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Barclays Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 6 | The Bloomberg Barclays Global Aggregate ex-USD Index is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S. dollar-denominated debt market. You cannot invest directly in an index. |

| 7 | The ICE BofAML U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2018. ICE Data Indices, LLC. All rights reserved. |

| | | | | | |

| Letter to shareholders (unaudited) | | Wells Fargo Diversified Capital Builder Fund | | | 3 | |

Fed officials announced in October 2017 plans to begin unwinding its $4.5 trillion portfolio of bonds and other assets accumulated during rounds of quantitative easing conducted since the 2008–2009 recession. Still, restrained inflation kept long-term bond rates steady and the flattened yield curve persisted. The Fed raised the federal funds rate target to a range of 1.25% to 1.50% in December 2017 and began selling bonds held in its portfolio.

Positive economic and market news continued as 2017 closed and 2018 began.

In January 2018, fourth-quarter 2017 U.S. gross domestic product was reported to be growing at a reported 3.2% annual rate. The unemployment rate fell to a 17-year low of 4.1%. Tax reform passed and wage growth data improved, encouraging increased business and consumer spending.

Improving business and economic data globally continued to support stocks through January 2018. Political wrangling in the U.S. over budget resolutions could not dissuade investors from buying stocks as payrolls and factory orders increased. Long-term interest rates in the U.S. trended higher as the yield curve steepened—the 10-year Treasury rate moved from 2.46% to 2.84% and the 30-year rate moved from 2.81% to 3.08% during January 2018.

Investor sentiment shifted in February as inflation concerns emerged in the U.S. when readings from the Producer Price Index in January rose 2.5% year over year. During February, the U.S. market endured a loss from January’s high of nearly 12% before recovering much of that loss. The Fed raised the federal funds rate in March 2018. Bond yields rose across the yield curve.

During January 2018, purchasing managers’ indices in China, the eurozone, India, and Japan reported data for December that indicated continued growth. Despite positive economic signals and business fundamentals, international stock values fell during February and March 2018, swept up in the selling momentum in U.S. markets.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of investment uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. To help you create a sound strategy based on your personal goals and risk tolerance, Wells Fargo Funds offers more than 100 mutual funds spanning a wide range of asset classes and investment styles. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Andrew Owen

President

Wells Fargo Funds

During February, the U.S. market endured a loss from January’s high of nearly 12% before recovering much of that loss.

For further information about your Fund, contact your investment professional, visit our website at wellsfargofunds.com, or call us directly at 1-800-222-8222.

| | | | |

| 4 | | Wells Fargo Diversified Capital Builder Fund | | Performance highlights (unaudited) |

Investment objective

The Fund seeks long-term total return, consisting of capital appreciation and current income.

Manager

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Portfolio manager

Margaret Patel

Average annual total returns (%) as of March 31, 20181

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Including sales charge | | | Excluding sales charge | | | Expense ratios2 (%) | |

| | | Inception date | | 1 year | | | 5 year | | | 10 year | | | 1 year | | | 5 year | | | 10 year | | | Gross | | | Net3 | |

| Class A (EKBAX) | | 1-20-1998 | | | 3.34 | | | | 10.57 | | | | 7.32 | | | | 9.65 | | | | 11.88 | | | | 7.96 | | | | 1.12 | | | | 1.12 | |

| Class C (EKBCX) | | 1-22-1998 | | | 7.93 | | | | 11.04 | | | | 7.15 | | | | 8.93 | | | | 11.04 | | | | 7.15 | | | | 1.87 | | | | 1.87 | |

| Administrator Class (EKBDX) | | 7-30-2010 | | | – | | | | – | | | | – | | | | 9.82 | | | | 12.07 | | | | 8.14 | | | | 1.04 | | | | 1.04 | |

| Institutional Class (EKBYX) | | 1-26-1998 | | | – | | | | – | | | | – | | | | 10.07 | | | | 12.30 | | | | 8.34 | | | | 0.79 | | | | 0.78 | |

| Diversified Capital Builder Blended Index4 | | – | | | – | | | | – | | | | – | | | | 11.36 | | | | 11.13 | | | | 9.32 | | | | – | | | | – | |

| ICE BofAML U.S. Cash Pay High Yield Index5 | | – | | | – | | | | – | | | | – | | | | 3.67 | | | | 4.98 | | | | 8.04 | | | | – | | | | – | |

| Russell 1000® Index6 | | – | | | – | | | | – | | | | – | | | | 13.98 | | | | 13.17 | | | | 9.61 | | | | – | | | | – | |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the redemption of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance shown without sales charges would be lower if sales charges were reflected. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Current month-end performance is available on the Fund’s website, wellsfargofunds.com.

Index returns do not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses, or any taxes. It is not possible to invest directly in an index.

For Class A shares, the maximum front-end sales charge is 5.75%. For Class C shares, the maximum contingent deferred sales charge is 1.00%. Performance including a contingent deferred sales charge assumes the sales charge for the corresponding time period. Administrator Class and Institutional Class shares are sold without a front-end sales charge or contingent deferred sales charge.

Balanced funds may invest in stocks and bonds. Stock values fluctuate in response to the activities of individual companies and general market and economic conditions. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for certain bonds held by the Fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest-rate changes and their impact on the Fund and its share price can be sudden and unpredictable. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). The Fund is exposed to foreign investment risk, high-yield securities risk, and smaller-company securities risk. Consult the Fund’s prospectus for additional information on these and other risks.

Please see footnotes on page 5.

| | | | | | |

| Performance highlights (unaudited) | | Wells Fargo Diversified Capital Builder Fund | | | 5 | |

| | | | |

| Ten largest holdings (%) as of March 31, 20187 | |

Adobe Systems Incorporated | | | 4.10 | |

Broadcom Limited | | | 3.38 | |

Leidos Holdings Incorporated | | | 3.22 | |

Alphabet Incorporated Class A | | | 3.19 | |

Amphenol Corporation Class A | | | 3.18 | |

Becton Dickinson & Company | | | 3.06 | |

PNC Financial Services Group Incorporated | | | 3.02 | |

LyondellBasell Industries NV Class A | | | 2.76 | |

Raytheon Company | | | 2.55 | |

Plains All American Pipeline LP | | | 2.53 | |

|

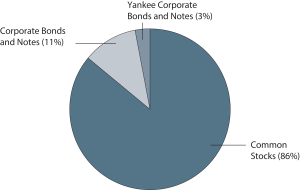

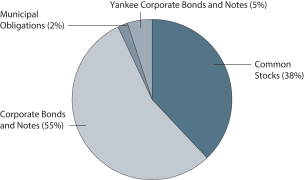

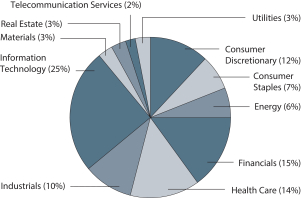

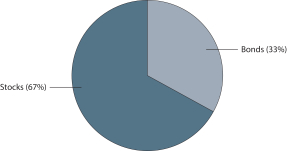

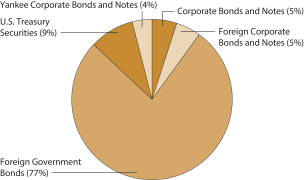

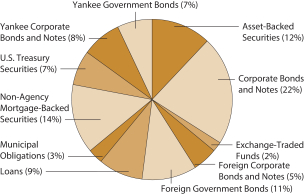

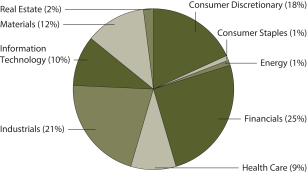

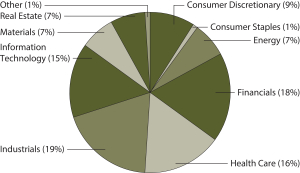

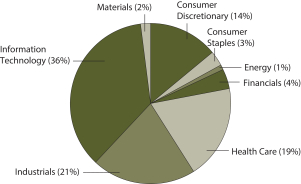

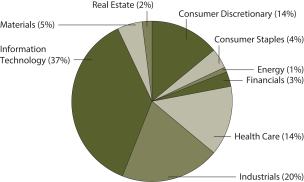

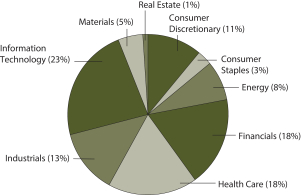

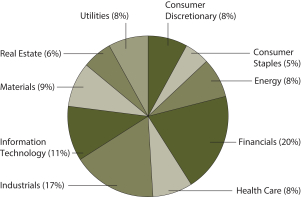

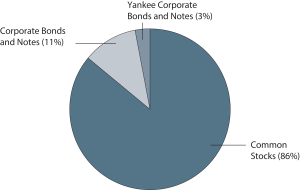

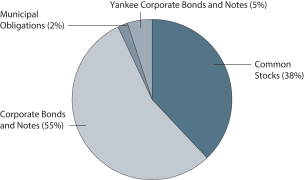

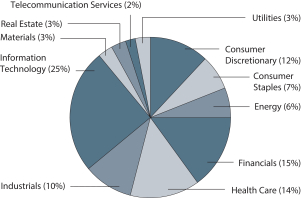

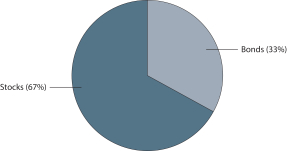

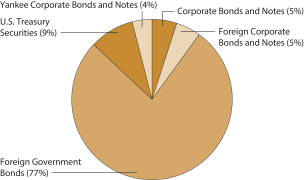

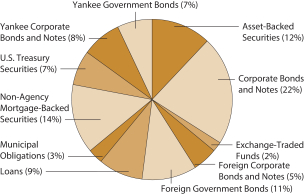

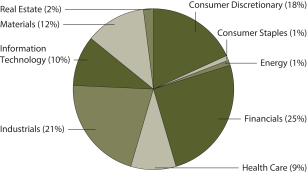

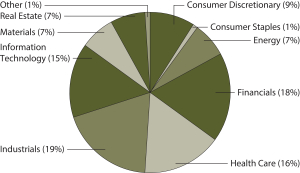

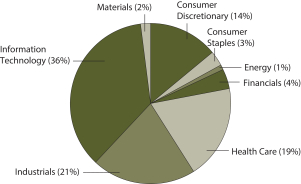

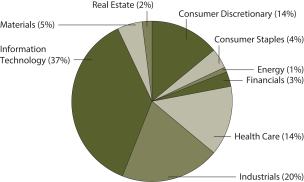

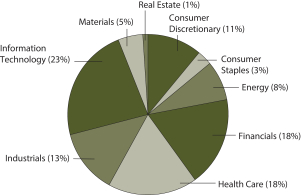

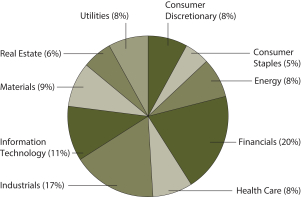

| Portfolio allocation as of March 31, 20188 |

|

|

| 1 | Historical performance shown for Administrator Class shares prior to their inception reflects the performance of Institutional Class shares and has been adjusted to reflect the higher expenses applicable to Administrator Class shares. Historical performance shown for all classes of the Fund prior to July 12, 2010, is based on the performance of the Fund’s predecessor, Evergreen Diversified Capital Builder Fund. |

| 2 | Reflects the expense ratios as stated in the most recent prospectuses. The expense ratios shown are subject to change and may differ from the annualized expense ratios shown in the financial highlights of this report. |

| 3 | The manager has contractually committed through January 31, 2019, to waive fees and/or reimburse expenses to the extent necessary to cap the Fund’s Total Annual Fund Operating Expenses After Fee Waivers at 1.20% for Class A, 1.95% for Class C, 1.05% for Administrator Class, and 0.78% for Institutional Class. After this time, the cap may be increased or the commitment to maintain the cap may be terminated only with the approval of the Board of Trustees. Brokerage commissions, stamp duty fees, interest, taxes, acquired fund fees and expenses (if any), and extraordinary expenses are excluded from the expense cap. Without this cap, the Fund’s returns would have been lower. The expense ratio paid by an investor is the net expense ratio (the total annual fund operating expenses after fee waivers) as stated in the prospectuses. |

| 4 | Source: Wells Fargo Funds Management, LLC. The Diversified Capital Builder Blended Index is composed of the Russell 1000® Index (75%) and the ICE BofAML U.S. Cash Pay High Yield Index (25%). You cannot invest directly in an index. |

| 5 | The ICE BofAML U.S. Cash Pay High Yield Index is an unmanaged market index that provides a broad-based performance measure of the non-investment grade U.S. domestic bond index. You cannot invest directly in an index. Copyright 2018. ICE Data Indices, LLC. All rights reserved. |

| 6 | The Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000® Index, which represents approximately 92% of the total market capitalization of the Russell 3000® Index. You cannot invest directly in an index. |

| 7 | The ten largest holdings, excluding cash and cash equivalents, are calculated based on the value of the investments divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

| 8 | Amounts are calculated based on the total long-term investments of the Fund. These amounts are subject to change and may have changed since the date specified. |

| | | | |

| 6 | | Wells Fargo Diversified Capital Builder Fund | | Fund expenses (unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and contingent deferred sales charges (if any) on redemptions and (2) ongoing costs, including management fees, distribution (12b-1) and/or shareholder servicing fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period from October 1, 2017 to March 31, 2018.

Actual expenses

The “Actual” line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the “Actual” line under the heading entitled “Expenses paid during period” for your applicable class of shares to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The “Hypothetical” line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and contingent deferred sales charges. Therefore, the “Hypothetical” line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

account value

10-1-2017 | | | Ending

account value

3-31-2018 | | | Expenses

paid during

the period¹ | | | Annualized net

expense ratio | |

Class A | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,041.62 | | | $ | 5.65 | | | | 1.11 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.40 | | | $ | 5.59 | | | | 1.11 | % |

Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,037.58 | | | $ | 9.45 | | | | 1.86 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,015.66 | | | $ | 9.35 | | | | 1.86 | % |

Administrator Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,041.24 | | | $ | 5.24 | | | | 1.03 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.80 | | | $ | 5.19 | | | | 1.03 | % |

Institutional Class | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,042.32 | | | $ | 3.97 | | | | 0.78 | % |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.04 | | | $ | 3.93 | | | | 0.78 | % |

| 1 | Expenses paid is equal to the annualized net expense ratio of each class multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year (to reflect the one-half-year period). |

| | | | | | |

| Portfolio of investments—March 31, 2018 (unaudited) | | Wells Fargo Diversified Capital Builder Fund | | | 7 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

Common Stocks: 85.50% | | | | | | | | | | | | | | | | |

| | | | |

Consumer Discretionary: 1.33% | | | | | | | | | | | | | | | | |

| | | | |

| Household Durables: 0.78% | | | | | | | | | | | | | | | | |

Whirlpool Corporation | | | | | | | | | | | 50,000 | | | $ | 7,655,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Specialty Retail: 0.55% | | | | | | | | | | | | | | | | |

The Home Depot Incorporated | | | | | | | | | | | 30,000 | | | | 5,347,200 | |

| | | | | | | | | | | | | | | | |

| | | | |

Consumer Staples: 0.60% | | | | | | | | | | | | | | | | |

| | | | |

| Food Products: 0.60% | | | | | | | | | | | | | | | | |

Lamb Weston Holdings Incorporated | | | | | | | | | | | 100,001 | | | | 5,822,058 | |

| | | | | | | | | | | | | | | | |

| | | | |

Energy: 11.47% | | | | | | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels: 11.47% | | | | | | | | | | | | | | | | |

Andeavor Logistics LP | | | | | | | | | | | 495,000 | | | | 22,180,950 | |

Enterprise Products Partners | | | | | | | | | | | 140,000 | | | | 3,427,200 | |

EOG Resources Incorporated | | | | | | | | | | | 35,000 | | | | 3,684,450 | |

EQT Corporation | | | | | | | | | | | 100,000 | | | | 4,751,000 | |

Kinder Morgan Incorporated | | | | | | | | | | | 1,625,000 | | | | 24,472,500 | |

ONEOK Incorporated | | | | | | | | | | | 150,000 | | | | 8,538,000 | |

Plains All American Pipeline LP | | | | | | | | | | | 1,120,000 | | | | 24,673,600 | |

The Williams Companies Incorporated | | | | | | | | | | | 810,000 | | | | 20,136,600 | |

| |

| | | | 111,864,300 | |

| | | | | | | | | | | | | | | | |

| | | | |

Financials: 4.70% | | | | | | | | | | | | | | | | |

| | | | |

| Banks: 3.43% | | | | | | | | | | | | | | | | |

PNC Financial Services Group Incorporated | | | | | | | | | | | 195,000 | | | | 29,491,800 | |

Regions Financial Corporation | | | | | | | | | | | 210,000 | | | | 3,901,800 | |

| |

| | | | 33,393,600 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Capital Markets: 1.27% | | | | | | | | | | | | | | | | |

S&P Global Incorporated | | | | | | | | | | | 65,000 | | | | 12,418,900 | |

| | | | | | | | | | | | | | | | |

| | | | |

Health Care: 11.33% | | | | | | | | | | | | | | | | |

| | | | |

| Health Care Equipment & Supplies: 5.86% | | | | | | | | | | | | | | | | |

Abbott Laboratories | | | | | | | | | | | 410,000 | | | | 24,567,200 | |

Becton Dickinson & Company | | | | | | | | | | | 137,538 | | | | 29,804,485 | |

Hologic Incorporated † | | | | | | | | | | | 50,000 | | | | 1,868,000 | |

West Pharmaceutical Services Incorporated | | | | | | | | | | | 10,000 | | | | 882,900 | |

| |

| | | | 57,122,585 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Life Sciences Tools & Services: 5.12% | | | | | | | | | | | | | | | | |

Agilent Technologies Incorporated | | | | | | | | | | | 170,000 | | | | 11,373,000 | |

Thermo Fisher Scientific Incorporated | | | | | | | | | | | 100,000 | | | | 20,646,000 | |

Waters Corporation † | | | | | | | | | | | 90,000 | | | | 17,878,500 | |

| |

| | | | 49,897,500 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 8 | | Wells Fargo Diversified Capital Builder Fund | | Portfolio of investments—March 31, 2018 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Pharmaceuticals: 0.35% | | | | | | | | | | | | | | | | |

Eli Lilly & Company | | | | | | | | | | | 45,000 | | | $ | 3,481,650 | |

| | | | | | | | | | | | | | | | |

| | | | |

Industrials: 14.13% | | | | | | | | | | | | | | | | |

| | | | |

| Aerospace & Defense: 7.07% | | | | | | | | | | | | | | | | |

Curtiss-Wright Corporation | | | | | | | | | | | 130,000 | | | | 17,559,100 | |

Huntington Ingalls Industries Incorporated | | | | | | | | | | | 65,000 | | | | 16,754,400 | |

Lockheed Martin Corporation | | | | | | | | | | | 29,000 | | | | 9,799,970 | |

Raytheon Company | | | | | | | | | | | 115,000 | | | | 24,819,300 | |

| | | | |

| | | | | | | | | | | | | | | 68,932,770 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Building Products: 0.40% | | | | | | | | | | | | | | | | |

Apogee Enterprises Incorporated | | | | | | | | | | | 90,000 | | | | 3,901,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electrical Equipment: 1.35% | | | | | | | | | | | | | | | | |

AMETEK Incorporated | | | | | | | | | | | 100,000 | | | | 7,597,000 | |

Eaton Corporation plc | | | | | | | | | | | 70,000 | | | | 5,593,700 | |

| | | | |

| | | | | | | | | | | | | | | 13,190,700 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Industrial Conglomerates: 1.39% | | | | | | | | | | | | | | | | |

Honeywell International Incorporated | | | | | | | | | | | 45,000 | | | | 6,502,950 | |

Roper Industries Incorporated | | | | | | | | | | | 25,000 | | | | 7,017,250 | |

| | | | |

| | | | | | | | | | | | | | | 13,520,200 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Machinery: 3.92% | | | | | | | | | | | | | | | | |

IDEX Corporation | | | | | | | | | | | 95,000 | | | | 13,538,450 | |

John Bean Technologies Corporation | | | | | | | | | | | 140,000 | | | | 15,876,000 | |

Oshkosh Corporation | | | | | | | | | | | 80,000 | | | | 6,181,600 | |

Parker-Hannifin Corporation | | | | | | | | | | | 15,000 | | | | 2,565,450 | |

| | | | |

| | | | | | | | | | | | | | | 38,161,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

Information Technology: 32.89% | | | | | | | | | | | | | | | | |

| | | | |

| Electronic Equipment, Instruments & Components: 6.12% | | | | | | | | | | | | | | | | |

Amphenol Corporation Class A | | | | | | | | | | | 360,000 | | | | 31,006,800 | |

Corning Incorporated | | | | | | | | | | | 670,000 | | | | 18,679,600 | |

FLIR Systems Incorporated | | | | | | | | | | | 200,000 | | | | 10,002,000 | |

| | | | |

| | | | | | | | | | | | | | | 59,688,400 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Internet Software & Services: 3.19% | | | | | | | | | | | | | | | | |

Alphabet Incorporated Class A † | | | | | | | | | | | 30,000 | | | | 31,114,200 | |

| | | | | | | | | | | | | | | | |

| | | | |

| IT Services: 3.76% | | | | | | | | | | | | | | | | |

Leidos Holdings Incorporated | | | | | | | | | | | 480,000 | | | | 31,392,000 | |

MasterCard Incorporated Class A | | | | | | | | | | | 30,000 | | | | 5,254,800 | |

| | | | |

| | | | | | | | | | | | | | | 36,646,800 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Semiconductors & Semiconductor Equipment: 11.71% | | | | | | | | | | | | | | | | |

Applied Materials Incorporated | | | | | | | | | | | 70,000 | | | | 3,892,700 | |

Broadcom Limited | | | | | | | | | | | 140,000 | | | | 32,991,000 | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—March 31, 2018 (unaudited) | | Wells Fargo Diversified Capital Builder Fund | | | 9 | |

| | | | | | | | | | | | | | | | |

| Security name | | | | | | | | Shares | | | Value | |

| | | | |

| Semiconductors & Semiconductor Equipment (continued) | | | | | | | | | | | | | | | | |

Cypress Semiconductor Corporation | | | | | | | | | | | 600,000 | | | $ | 10,176,000 | |

Microsemi Corporation † | | | | | | | | | | | 310,000 | | | | 20,063,200 | |

QUALCOMM Incorporated | | | | | | | | | | | 70,000 | | | | 3,878,700 | |

Texas Instruments Incorporated | | | | | | | | | | | 145,000 | | | | 15,064,050 | |

Versum Materials Incorporated | | | | | | | | | | | 170,000 | | | | 6,397,100 | |

Xilinx Incorporated | | | | | | | | | | | 300,000 | | | | 21,672,000 | |

| | | | |

| | | | | | | | | | | | | | | 114,134,750 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Software: 7.16% | | | | | | | | | | | | | | | | |

Adobe Systems Incorporated † | | | | | | | | | | | 185,000 | | | | 39,974,800 | |

Microsoft Corporation | | | | | | | | | | | 140,000 | | | | 12,777,800 | |

Salesforce.com Incorporated † | | | | | | | | | | | 50,000 | | | | 5,815,000 | |

Synopsys Incorporated † | | | | | | | | | | | 135,000 | | | | 11,237,400 | |

| | | | |

| | | | | | | | | | | | | | | 69,805,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Technology Hardware, Storage & Peripherals: 0.95% | | | | | | | | | | | | | | | | |

Western Digital Corporation | | | | | | | | | | | 100,000 | | | | 9,227,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Materials: 6.46% | | | | | | | | | | | | | | | | |

| | | | |

| Chemicals: 5.64% | | | | | | | | | | | | | | | | |

Ashland Global Holdings Incorporated | | | | | | | | | | | 30,000 | | | | 2,093,700 | |

Celanese Corporation Series A | | | | | | | | | | | 75,000 | | | | 7,515,750 | |

DowDuPont Incorporated | | | | | | | | | | | 110,000 | | | | 7,008,100 | |

Eastman Chemical Company | | | | | | | | | | | 45,000 | | | | 4,751,100 | |

Huntsman Corporation | | | | | | | | | | | 90,000 | | | | 2,632,500 | |

LyondellBasell Industries NV Class A | | | | | | | | | | | 255,000 | | | | 26,948,400 | |

Olin Corporation | | | | | | | | | | | 25,000 | | | | 759,750 | |

Westlake Chemical Corporation | | | | | | | | | | | 30,000 | | | | 3,334,500 | |

| | | | |

| | | | | | | | | | | | | | | 55,043,800 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Containers & Packaging: 0.82% | | | | | | | | | | | | | | | | |

Avery Dennison Corporation | | | | | | | | | | | 75,000 | | | | 7,968,750 | |

| | | | | | | | | | | | | | | | |

| | | | |

Real Estate: 0.65% | | | | | | | | | | | | | | | | |

| | | | |

| Equity REITs: 0.65% | | | | | | | | | | | | | | | | |

Saul Centers Incorporated | | | | | | | | | | | 125,000 | | | | 6,371,250 | |

| | | | | | | | | | | | | | | | |

| | | | |

Utilities: 1.94% | | | | | | | | | | | | | | | | |

| | | | |

| Electric Utilities: 0.21% | | | | | | | | | | | | | | | | |

American Electric Power Company Incorporated | | | | | | | | | | | 30,000 | | | | 2,057,700 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Gas Utilities: 1.73% | | | | | | | | | | | | | | | | |

Atmos Energy Corporation | | | | | | | | | | | 200,000 | | | | 16,848,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Common Stocks (Cost $692,815,060) | | | | | | | | | | | | | | | 833,615,613 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 10 | | Wells Fargo Diversified Capital Builder Fund | | Portfolio of investments—March 31, 2018 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

Corporate Bonds and Notes: 11.49% | | | | | | | | | | | | | | | | |

| | | | |

Consumer Discretionary: 0.50% | | | | | | | | | | | | | | | | |

| | | | |

| Hotels, Restaurants & Leisure: 0.21% | | | | | | | | | | | | | | | | |

Speedway Motorsports Incorporated | | | 5.13 | % | | | 2-1-2023 | | | $ | 2,000,000 | | | $ | 1,991,400 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Media: 0.29% | | | | | | | | | | | | | | | | |

McGraw-Hill Global Education Holdings LLC 144A« | | | 7.88 | | | | 5-15-2024 | | | | 3,000,000 | | | | 2,868,060 | |

| | | | | | | | | | | | | | | | |

| | | | |

Consumer Staples: 0.10% | | | | | | | | | | | | | | | | |

| | | | |

| Food Products: 0.10% | | | | | | | | | | | | | | | | |

Lamb Weston Holdings Incorporated 144A | | | 4.63 | | | | 11-1-2024 | | | | 1,000,000 | | | | 991,250 | |

| | | | | | | | | | | | | | | | |

| | | | |

Energy: 0.62% | | | | | | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels: 0.62% | | | | | | | | | | | | | | | | |

Plains All American Pipeline LP | | | 4.65 | | | | 10-15-2025 | | | | 6,000,000 | | | | 6,032,754 | |

| | | | | | | | | | | | | | | | |

| | | | |

Health Care: 2.46% | | | | | | | | | | | | | | | | |

| | | | |

| Health Care Equipment & Supplies: 0.26% | | | | | | | | | | | | | | | | |

Teleflex Incorporated | | | 4.88 | | | | 6-1-2026 | | | | 2,500,000 | | | | 2,475,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Health Care Providers & Services: 2.10% | | | | | | | | | | | | | | | | |

AMN Healthcare Incorporated 144A | | | 5.13 | | | | 10-1-2024 | | | | 10,512,000 | | | | 10,485,720 | |

DaVita HealthCare Partners Incorporated | | | 5.00 | | | | 5-1-2025 | | | | 1,000,000 | | | | 966,550 | |

DaVita HealthCare Partners Incorporated | | | 5.13 | | | | 7-15-2024 | | | | 1,000,000 | | | | 976,250 | |

HealthSouth Corporation | | | 5.13 | | | | 3-15-2023 | | | | 1,000,000 | | | | 1,012,500 | |

West Street Merger Sub Incorporated 144A | | | 6.38 | | | | 9-1-2025 | | | | 7,400,000 | | | | 7,048,500 | |

| | | | |

| | | | | | | | | | | | | | | 20,489,520 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Pharmaceuticals: 0.10% | | | | | | | | | | | | | | | | |

Catalent Pharma Solutions Incorporated 144A | | | 4.88 | | | | 1-15-2026 | | | | 1,000,000 | | | | 975,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Industrials: 0.98% | | | | | | | | | | | | | | | | |

| | | | |

| Aerospace & Defense: 0.52% | | | | | | | | | | | | | | | | |

TransDigm Group Incorporated | | | 6.38 | | | | 6-15-2026 | | | | 3,500,000 | | | | 3,526,250 | |

TransDigm Group Incorporated | | | 6.50 | | | | 5-15-2025 | | | | 1,500,000 | | | | 1,515,000 | |

| | | | |

| | | | | | | | | | | | | | | 5,041,250 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Commercial Services & Supplies: 0.15% | | | | | | | | | | | | | | | | |

Acco Brands Corporation 144A | | | 5.25 | | | | 12-15-2024 | | | | 1,500,000 | | | | 1,507,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Machinery: 0.10% | | | | | | | | | | | | | | | | |

SPX FLOW Incorporated 144A | | | 5.88 | | | | 8-15-2026 | | | | 1,000,000 | | | | 1,027,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Trading Companies & Distributors: 0.21% | | | | | | | | | | | | | | | | |

Wesco Distribution Incorporated | | | 5.38 | | | | 6-15-2024 | | | | 2,000,000 | | | | 2,007,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

Information Technology: 3.38% | | | | | | | | | | | | | | | | |

| | | | |

| Communications Equipment: 0.63% | | | | | | | | | | | | | | | | |

CommScope Incorporated 144A | | | 5.50 | | | | 6-15-2024 | | | | 6,000,000 | | | | 6,127,500 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Portfolio of investments—March 31, 2018 (unaudited) | | Wells Fargo Diversified Capital Builder Fund | | | 11 | |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

| Electronic Equipment, Instruments & Components: 1.70% | | | | | | | | | | | | | | | | |

Belden Incorporated 144A | | | 5.25 | % | | | 7-15-2024 | | | $ | 3,000,000 | | | $ | 3,166,200 | |

TTM Technologies Incorporated 144A | | | 5.63 | | | | 10-1-2025 | | | | 13,505,000 | | | | 13,437,473 | |

| | | | |

| | | | | | | | | | | | | | | 16,603,673 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Semiconductors & Semiconductor Equipment: 0.32% | | | | | | | | | | | | | | | | |

Versum Materials Incorporated 144A | | | 5.50 | | | | 9-30-2024 | | | | 3,000,000 | | | | 3,105,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Software: 0.73% | | | | | | | | | | | | | | | | |

Nuance Communications Company | | | 6.00 | | | | 7-1-2024 | | | | 2,000,000 | | | | 2,050,000 | |

Symantec Corporation 144A | | | 5.00 | | | | 4-15-2025 | | | | 5,000,000 | | | | 5,041,154 | |

| | | | |

| | | | | | | | | | | | | | | 7,091,154 | |

| | | | | | | | | | | | | | | | |

| | | | |

Materials: 3.00% | | | | | | | | | | | | | | | | |

| | | | |

| Chemicals: 2.68% | | | | | | | | | | | | | | | | |

Koppers Incorporated 144A | | | 6.00 | | | | 2-15-2025 | | | | 8,190,000 | | | | 8,367,723 | |

Olin Corporation | | | 5.50 | | | | 8-15-2022 | | | | 6,000,000 | | | | 6,195,000 | |

Platform Specialty Products Corporation 144A | | | 5.88 | | | | 12-1-2025 | | | | 3,000,000 | | | | 2,932,500 | |

Rayonier Advanced Materials Products Incorporated 144A | | | 5.50 | | | | 6-1-2024 | | | | 6,835,000 | | | | 6,698,300 | |

Valvoline Incorporated | | | 4.38 | | | | 8-15-2025 | | | | 2,000,000 | | | | 1,942,500 | |

| | | | |

| | | | | | | | | | | | | | | 26,136,023 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Containers & Packaging: 0.32% | | | | | | | | | | | | | | | | |

Berry Plastics Corporation | | | 5.13 | | | | 7-15-2023 | | | | 3,120,000 | | | | 3,155,194 | |

| | | | | | | | | | | | | | | | |

| | | | |

Real Estate: 0.25% | | | | | | | | | | | | | | | | |

| | | | |

| Equity REITs: 0.25% | | | | | | | | | | | | | | | | |

Iron Mountain Incorporated 144A | | | 5.38 | | | | 6-1-2026 | | | | 2,000,000 | | | | 1,912,500 | |

Iron Mountain Incorporated | | | 5.75 | | | | 8-15-2024 | | | | 500,000 | | | | 484,375 | |

| | | | |

| | | | | | | | | | | | | | | 2,396,875 | |

| | | | | | | | | | | | | | | | |

| | | | |

Utilities: 0.20% | | | | | | | | | | | | | | | | |

| | | | |

| Independent Power & Renewable Electricity Producers: 0.20% | | | | | | | | | | | | | | | | |

NRG Energy Incorporated 144A | | | 5.75 | | | | 1-15-2028 | | | | 2,000,000 | | | | 1,955,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Corporate Bonds and Notes (Cost $112,694,575) | | | | | | | | | | | | | | | 111,977,153 | |

| | | | | | | | | | | | | | | | |

| | | | |

Yankee Corporate Bonds and Notes: 2.54% | | | | | | | | | | | | | | | | |

| | | | |

Financials: 0.50% | | | | | | | | | | | | | | | | |

| | | | |

| Diversified Financial Services: 0.50% | | | | | | | | | | | | | | | | |

Tronox Finance plc 144A | | | 5.75 | | | | 10-1-2025 | | | | 5,000,000 | | | | 4,862,500 | |

| | | | | | | | | | | | | | | | |

| | | | |

Health Care: 0.24% | | | | | | | | | | | | | | | | |

| | | | |

| Pharmaceuticals: 0.24% | | | | | | | | | | | | | | | | |

Mallinckrodt plc 144A« | | | 5.50 | | | | 4-15-2025 | | | | 3,000,000 | | | | 2,328,750 | |

| | | | | | | | | | | | | | | | |

| | | | |

Industrials: 0.20% | | | | | | | | | | | | | | | | |

| | | | |

| Electrical Equipment: 0.20% | | | | | | | | | | | | | | | | |

Sensata Technologies BV 144A | | | 4.88 | | | | 10-15-2023 | | | | 2,000,000 | | | | 2,003,100 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 12 | | Wells Fargo Diversified Capital Builder Fund | | Portfolio of investments—March 31, 2018 (unaudited) |

| | | | | | | | | | | | | | | | |

| Security name | | Interest rate | | | Maturity date | | | Principal | | | Value | |

| | | | |

Information Technology: 1.60% | | | | | | | | | | | | | | | | |

| | | | |

| Technology Hardware, Storage & Peripherals: 1.60% | | | | | | | | | | | | | | | | |

Seagate HDD | | | 4.75 | % | | | 6-1-2023 | | | $ | 9,500,000 | | | $ | 9,505,911 | |

Seagate HDD | | | 4.88 | | | | 6-1-2027 | | | | 6,396,000 | | | | 6,057,668 | |

| | | | |

| | | | | | | | | | | | | | | 15,563,579 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Yankee Corporate Bonds and Notes (Cost $24,542,975) | | | | | | | | | | | | | | | 24,757,929 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Yield | | | | | | Shares | | | | |

| Short-Term Investments: 0.66% | | | | | | | | | | | | | | | | |

| | | | |

| Investment Companies: 0.66% | | | | | | | | | | | | | | | | |

Securities Lending Cash Investment LLC (l)(r)(u) | | | 1.89 | | | | | | | | 3,105,089 | | | | 3,105,400 | |

Wells Fargo Government Money Market Fund Select Class (l)(u) | | | 1.54 | | | | | | | | 3,323,641 | | | | 3,323,641 | |

| | | | |

Total Short-Term Investments (Cost $6,429,041) | | | | | | | | | | | | | | | 6,429,041 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| Total investments in securities (Cost $836,481,651) | | | 100.19 | % | | | 976,779,736 | |

Other assets and liabilities, net | | | (0.19 | ) | | | (1,819,451 | ) |

| | | | | | | | |

| Total net assets | | | 100.00 | % | | $ | 974,960,285 | |

| | | | | | | | |

| † | Non-income-earning security |

| 144A | The security may be resold in transactions exempt from registration, normally to qualified institutional buyers, pursuant to Rule 144A under the Securities Act of 1933. |

| « | All or a portion of this security is on loan. |

| (l) | The issuer of the security is an affiliated person of the Fund as defined in the Investment Company Act of 1940. |

| (r) | The investment is a non-registered investment company purchased with cash collateral received from securities on loan. |

| (u) | The rate represents the 7-day annualized yield at period end. |

Investments in Affiliates

An affiliated investment is an investment in which the Fund owns at least 5% of the outstanding voting shares of the issuer or as a result of other relationships, such as the Fund and the issuer having the same investment manager. Transactions with issuers that were either affiliated persons of the Fund at the beginning of the period or the end of the period were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shares,

beginning of

period | | | Shares

purchased | | | Shares

sold | | | Shares,

end of

period | | | Net

realized

gains

(losses) | | | Net

change in

unrealized

gains

(losses) | | | Income

from

affiliated

securities | | | Value,

end

of period | | | % of

net

assets | |

Short-Term Investments | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment Companies | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Securities Lending Cash Investment LLC | | | 8,312,789 | | | | 16,912,601 | | | | 22,120,301 | | | | 3,105,089 | | | $ | 0 | | | $ | 0 | | | $ | 8,919 | | | $ | 3,105,400 | | | | | |

Wells Fargo Government Money Market Fund Select Class | | | 6,114,337 | | | | 70,499,635 | | | | 73,290,331 | | | | 3,323,641 | | | | 0 | | | | 0 | | | | 17,501 | | | | 3,323,641 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | 0 | | | $ | 0 | | | $ | 26,420 | | | $ | 6,429,041 | | | | 0.66 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of assets and liabilities—March 31, 2018 (unaudited) | | Wells Fargo Diversified Capital Builder Fund | | | 13 | |

| | | | |

| | | | |

| |

Assets | | | | |

Investments in unaffiliated securities (including $3,040,487 of securities on loan), at value (cost $830,052,610) | | $ | 970,350,695 | |

Investments in affiliated securities, at value (cost $6,429,041) | | | 6,429,041 | |

Cash | | | 256,754 | |

Receivable for Fund shares sold | | | 1,424,994 | |

Receivable for dividends and interest | | | 2,707,734 | |

Receivable for securities lending income | | | 1,731 | |

Prepaid expenses and other assets | | | 236,910 | |

| | | | |

Total assets | | | 981,407,859 | |

| | | | |

| |

Liabilities | | | | |

Payable upon receipt of securities loaned | | | 3,103,912 | |

Payable for investments purchased | | | 1,522,847 | |

Payable for Fund shares redeemed | | | 840,531 | |

Management fee payable | | | 543,825 | |

Administration fees payable | | | 161,735 | |

Distribution fee payable | | | 82,367 | |

Trustees’ fees and expenses payable | | | 865 | |

Accrued expenses and other liabilities | | | 191,492 | |

| | | | |

Total liabilities | | | 6,447,574 | |

| | | | |

Total net assets | | $ | 974,960,285 | |

| | | | |

| |

NET ASSETS CONSIST OF | | | | |

Paid-in capital | | $ | 819,927,007 | |

Undistributed net investment income | | | 2,146,114 | |

Accumulated net realized gains on investments | | | 12,589,079 | |

Net unrealized gains on investments | | | 140,298,085 | |

| | | | |

Total net assets | | $ | 974,960,285 | |

| | | | |

| |

COMPUTATION OF NET ASSET VALUE AND OFFERING PRICE PER SHARE | | | | |

Net assets – Class A | | $ | 556,778,453 | |

Shares outstanding – Class A1 | | | 54,658,774 | |

Net asset value per share – Class A | | | $10.19 | |

Maximum offering price per share – Class A2 | | | $10.81 | |

Net assets – Class C | | $ | 123,428,838 | |

Shares outstanding – Class C1 | | | 12,142,181 | |

Net asset value per share – Class C | | | $10.17 | |

Net assets – Administrator Class | | $ | 10,911,348 | |

Shares outstanding – Administrator Class1 | | | 1,070,067 | |

Net asset value per share – Administrator Class | | | $10.20 | |

Net assets – Institutional Class | | $ | 283,841,646 | |

Shares outstanding – Institutional Class1 | | | 28,049,140 | |

Net asset value per share – Institutional Class | | | $10.12 | |

| 1 | The Fund has an unlimited number of authorized shares. |

| 2 | Maximum offering price is computed as 100/94.25 of net asset value. On investments of $50,000 or more, the offering price is reduced. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 14 | | Wells Fargo Diversified Capital Builder Fund | | Statement of operations—six months ended March 31, 2018 (unaudited) |

| | | | |

| | | | |

| |

Investment income | | | | |

Dividends | | $ | 8,129,155 | |

Interest | | | 3,999,191 | |

Income from affiliated securities | | | 26,420 | |

| | | | |

Total investment income | | | 12,154,766 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 3,065,151 | |

Administration fees | | | | |

Class A | | | 596,086 | |

Class C | | | 129,626 | |

Administrator Class | | | 7,184 | |

Institutional Class | | | 180,928 | |

Shareholder servicing fees | | | | |

Class A | | | 709,626 | |

Class C | | | 154,317 | |

Administrator Class | | | 13,816 | |

Distribution fee | | | | |

Class C | | | 462,950 | |

Custody and accounting fees | | | 24,434 | |

Professional fees | | | 22,992 | |

Registration fees | | | 32,230 | |

Shareholder report expenses | | | 21,767 | |

Trustees’ fees and expenses | | | 10,059 | |

Other fees and expenses | | | 2,599 | |

| | | | |

Total expenses | | | 5,433,765 | |

Less: Fee waivers and/or expense reimbursements | | | (261 | ) |

| | | | |

Net expenses | | | 5,433,504 | |

| | | | |

Net investment income | | | 6,721,262 | |

| | | | |

| |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | |

Net realized gains on investments | | | 12,033,435 | |

Net change in unrealized gains (losses) on investments | | | 19,780,591 | |

| | | | |

Net realized and unrealized gains (losses) on investments | | | 31,814,026 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 38,535,288 | |

| | | | |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Statement of changes in net assets | | Wells Fargo Diversified Capital Builder Fund | | | 15 | |

| | | | | | | | | | | | | | | | |

| | | Six months ended

March 31, 2018

(unaudited) | | | Year ended

September 30, 2017 | |

| | | | |

Operations | | | | | | | | | | | | | | | | |

Net investment income | | | | | | $ | 6,721,262 | | | | | | | $ | 11,582,765 | |

Net realized gains on investments | | | | | | | 12,033,435 | | | | | | | | 45,195,207 | |

Net change in unrealized gains (losses) on investments | | | | | | | 19,780,591 | | | | | | | | 48,014,577 | |

| | | | |

Net increase in net assets resulting from operations | | | | | | | 38,535,288 | | | | | | | | 104,792,549 | |

| | | | |

| | | | |

Distributions to shareholders from | | | | | | | | | | | | | | | | |

Net investment income | | | | | | | | | | | | | | | | |

Class A | | | | | | | (2,504,426 | ) | | | | | | | (7,661,442 | ) |

Class B | | | | | | | N/A | | | | | | | | (3,723 | )1 |

Class C | | | | | | | (51,669 | ) | | | | | | | (923,064 | ) |

Administrator Class | | | | | | | (56,683 | ) | | | | | | | (276,788 | ) |

Institutional Class | | | | | | | (1,936,146 | ) | | | | | | | (3,377,945 | ) |

Net realized gains | | | | | | | | | | | | | | | | |

Class A | | | | | | | (26,067,151 | ) | | | | | | | (37,599,086 | ) |

Class B | | | | | | | N/A | | | | | | | | (82,941 | )1 |

Class C | | | | | | | (5,684,959 | ) | | | | | | | (5,700,242 | ) |

Administrator Class | | | | | | | (514,874 | ) | | | | | | | (1,444,857 | ) |

Institutional Class | | | | | | | (12,827,757 | ) | | | | | | | (11,035,158 | ) |

| | | | |

Total distributions to shareholders | | | | | | | (49,643,665 | ) | | | | | | | (68,105,246 | ) |

| | | | |

| | | | |

Capital share transactions | | | Shares | | | | | | | | Shares | | | | | |

Proceeds from shares sold | | | | | | | | | | | | | | | | |

Class A | | | 2,408,871 | | | | 25,251,631 | | | | 10,742,727 | | | | 105,549,123 | |

Class B | | | N/A | | | | N/A | | | | 8,989 | 1 | | | 89,544 | 1 |

Class C | | | 1,552,258 | | | | 16,199,102 | | | | 6,100,806 | | | | 60,045,789 | |

Administrator Class | | | 187,877 | | | | 1,982,824 | | | | 1,150,741 | | | | 11,315,314 | |

Institutional Class | | | 4,468,368 | | | | 46,605,280 | | | | 15,573,690 | | | | 152,910,373 | |

| | | | |

| | | | | | | 90,038,837 | | | | | | | | 329,910,143 | |

| | | | |

Reinvestment of distributions | | | | | | | | | | | | | | | | |

Class A | | | 2,680,318 | | | | 27,306,071 | | | | 4,536,323 | | | | 43,125,024 | |

Class B | | | N/A | | | | N/A | | | | 7,409 | 1 | | | 70,848 | 1 |

Class C | | | 547,031 | | | | 5,552,022 | | | | 629,617 | | | | 5,974,204 | |

Administrator Class | | | 53,976 | | | | 550,417 | | | | 179,684 | | | | 1,707,679 | |

Institutional Class | | | 1,398,356 | | | | 14,171,619 | | | | 1,417,203 | | | | 13,422,904 | |

| | | | |

| | | | | | | 47,580,129 | | | | | | | | 64,300,659 | |

| | | | |

Payment for shares redeemed | | | | | | | | | | | | | | | | |

Class A | | | (3,931,839 | ) | | | (41,213,024 | ) | | | (8,712,586 | ) | | | (86,111,676 | ) |

Class B | | | N/A | | | | N/A | | | | (166,895 | )1 | | | (1,667,192 | )1 |

Class C | | | (1,370,802 | ) | | | (14,344,760 | ) | | | (2,103,704 | ) | | | (20,778,345 | ) |

Administrator Class | | | (162,892 | ) | | | (1,691,946 | ) | | | (2,486,279 | ) | | | (24,695,561 | ) |

Institutional Class | | | (3,459,983 | ) | | | (35,898,294 | ) | | | (3,745,131 | ) | | | (36,861,266 | ) |

| | | | |

| | | | | | | (93,148,024 | ) | | | | | | | (170,114,040 | ) |

| | | | |

Net increase in net assets resulting from capital share transactions | | | | | | | 44,470,942 | | | | | | | | 224,096,762 | |

| | | | |

Total increase in net assets | | | | | | | 33,362,565 | | | | | | | | 260,784,065 | |

| | | | |

| | | | |

Net assets | | | | | | | | | | | | | | | | |

Beginning of period | | | | | | | 941,597,720 | | | | | | | | 680,813,655 | |

| | | | |

End of period | | | | | | $ | 974,960,285 | | | | | | | $ | 941,597,720 | |

| | | | |

Undistributed (overdistributed) net investment income | | | | | | $ | 2,146,114 | | | | | | | $ | (26,224 | ) |

| | | | |

| 1 | For the period from October 1, 2016 to May 5, 2017. Effective at the close of business on May 5, 2017, Class B shares were converted to Class A shares and are no longer offered by the Fund. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 16 | | Wells Fargo Diversified Capital Builder Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

March 31, 2018

(unaudited) | | | Year ended September 30 | |

| CLASS A | | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Net asset value, beginning of period | | | $10.30 | | | | $9.96 | | | | $9.12 | | | | $9.31 | | | | $7.89 | | | | $6.93 | |

Net investment income | | | 0.07 | | | | 0.14 | 1 | | | 0.17 | | | | 0.11 | | | | 0.09 | | | | 0.12 | |

Net realized and unrealized gains (losses) on investments | | | 0.36 | | | | 1.12 | | | | 1.71 | | | | (0.20 | ) | | | 1.41 | | | | 0.96 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.43 | | | | 1.26 | | | | 1.88 | | | | (0.09 | ) | | | 1.50 | | | | 1.08 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.05 | ) | | | (0.14 | ) | | | (0.15 | ) | | | (0.10 | ) | | | (0.08 | ) | | | (0.12 | ) |

Net realized gains | | | (0.49 | ) | | | (0.78 | ) | | | (0.89 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.54 | ) | | | (0.92 | ) | | | (1.04 | ) | | | (0.10 | ) | | | (0.08 | ) | | | (0.12 | ) |

Net asset value, end of period | | | $10.19 | | | | $10.30 | | | | $9.96 | | | | $9.12 | | | | $9.31 | | | | $7.89 | |

Total return2 | | | 4.16 | % | | | 13.62 | % | | | 22.85 | % | | | (1.05 | )% | | | 19.10 | % | | | 15.75 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.11 | % | | | 1.12 | % | | | 1.14 | % | | | 1.19 | % | | | 1.21 | % | | | 1.20 | % |

Net expenses | | | 1.11 | % | | | 1.12 | % | | | 1.14 | % | | | 1.19 | % | | | 1.20 | % | | | 1.20 | % |

Net investment income | | | 1.37 | % | | | 1.43 | % | | | 1.77 | % | | | 1.17 | % | | | 1.09 | % | | | 1.66 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 17 | % | | | 54 | % | | | 73 | % | | | 69 | % | | | 82 | % | | | 70 | % |

Net assets, end of period (000s omitted) | | | $556,778 | | | | $551,272 | | | | $467,503 | | | | $402,303 | | | | $431,388 | | | | $399,535 | |

| 1 | Calculated based upon average shares outstanding. |

| 2 | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Diversified Capital Builder Fund | | | 17 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

March 31, 2018

(unaudited) | | | Year ended September 30 | |

| CLASS C | | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Net asset value, beginning of period | | | $10.28 | | | | $9.96 | | | | $9.12 | | | | $9.32 | | | | $7.90 | | | | $6.94 | |

Net investment income | | | 0.03 | | | | 0.08 | | | | 0.10 | | | | 0.05 | | | | 0.03 | | | | 0.07 | |

Net realized and unrealized gains (losses) on investments | | | 0.35 | | | | 1.11 | | | | 1.72 | | | | (0.22 | ) | | | 1.41 | | | | 0.96 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.38 | | | | 1.19 | | | | 1.82 | | | | (0.17 | ) | | | 1.44 | | | | 1.03 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.00 | )1 | | | (0.09 | ) | | | (0.09 | ) | | | (0.03 | ) | | | (0.02 | ) | | | (0.07 | ) |

Net realized gains | | | (0.49 | ) | | | (0.78 | ) | | | (0.89 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.49 | ) | | | (0.87 | ) | | | (0.98 | ) | | | (0.03 | ) | | | (0.02 | ) | | | (0.07 | ) |

Net asset value, end of period | | | $10.17 | | | | $10.28 | | | | $9.96 | | | | $9.12 | | | | $9.32 | | | | $7.90 | |

Total return2 | | | 3.76 | % | | | 12.85 | % | | | 21.96 | % | | | (1.88 | )% | | | 18.21 | % | | | 14.86 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.86 | % | | | 1.87 | % | | | 1.89 | % | | | 1.94 | % | | | 1.96 | % | | | 1.95 | % |

Net expenses | | | 1.86 | % | | | 1.87 | % | | | 1.89 | % | | | 1.94 | % | | | 1.95 | % | | | 1.95 | % |

Net investment income | | | 0.62 | % | | | 0.65 | % | | | 1.03 | % | | | 0.41 | % | | | 0.34 | % | | | 0.91 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 17 | % | | | 54 | % | | | 73 | % | | | 69 | % | | | 82 | % | | | 70 | % |

Net assets, end of period (000s omitted) | | | $123,429 | | | | $117,346 | | | | $67,630 | | | | $53,373 | | | | $45,670 | | | | $39,758 | |

| 1 | Amount is less than $0.005. |

| 2 | Total return calculations do not include any sales charges. Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 18 | | Wells Fargo Diversified Capital Builder Fund | | Financial highlights |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

March 31, 2018

(unaudited) | | | Year ended September 30 | |

| ADMINISTRATOR CLASS | | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Net asset value, beginning of period | | | $10.32 | | | | $9.97 | | | | $9.12 | | | | $9.32 | | | | $7.90 | | | | $6.94 | |

Net investment income | | | 0.08 | 1 | | | 0.16 | 1 | | | 0.18 | 1 | | | 0.14 | 1 | | | 0.12 | 1 | | | 0.14 | 1 |

Net realized and unrealized gains (losses) on investments | | | 0.34 | | | | 1.12 | | | | 1.73 | | | | (0.22 | ) | | | 1.41 | | | | 0.96 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.42 | | | | 1.28 | | | | 1.91 | | | | (0.08 | ) | | | 1.53 | | | | 1.10 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.05 | ) | | | (0.15 | ) | | | (0.17 | ) | | | (0.12 | ) | | | (0.11 | ) | | | (0.14 | ) |

Net realized gains | | | (0.49 | ) | | | (0.78 | ) | | | (0.89 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.54 | ) | | | (0.93 | ) | | | (1.06 | ) | | | (0.12 | ) | | | (0.11 | ) | | | (0.14 | ) |

Net asset value, end of period | | | $10.20 | | | | $10.32 | | | | $9.97 | | | | $9.12 | | | | $9.32 | | | | $7.90 | |

Total return2 | | | 4.12 | % | | | 13.75 | % | | | 23.14 | % | | | (0.92 | )% | | | 19.39 | % | | | 16.06 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 1.03 | % | | | 1.04 | % | | | 1.06 | % | | | 1.05 | % | | | 1.04 | % | | | 1.04 | % |

Net expenses | | | 1.03 | % | | | 1.04 | % | | | 1.03 | % | | | 0.95 | % | | | 0.95 | % | | | 0.95 | % |

Net investment income | | | 1.45 | % | | | 1.58 | % | | | 1.89 | % | | | 1.41 | % | | | 1.33 | % | | | 1.84 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 17 | % | | | 54 | % | | | 73 | % | | | 69 | % | | | 82 | % | | | 70 | % |

Net assets, end of period (000s omitted) | | | $10,911 | | | | $10,225 | | | | $21,398 | | | | $7,898 | | | | $9,411 | | | | $6,836 | |

| 1 | Calculated based upon average shares outstanding. |

| 2 | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | | | |

| Financial highlights | | Wells Fargo Diversified Capital Builder Fund | | | 19 | |

(For a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six months ended

March 31, 2018

(unaudited) | | | Year ended September 30 | |

| INSTITUTIONAL CLASS | | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

Net asset value, beginning of period | | | $10.25 | | | | $9.90 | | | | $9.07 | | | | $9.27 | | | | $7.85 | | | | $6.90 | |

Net investment income | | | 0.09 | | | | 0.19 | | | | 0.20 | | | | 0.15 | | | | 0.13 | 1 | | | 0.15 | |

Net realized and unrealized gains (losses) on investments | | | 0.34 | | | | 1.11 | | | | 1.71 | | | | (0.21 | ) | | | 1.41 | | | | 0.95 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.43 | | | | 1.30 | | | | 1.91 | | | | (0.06 | ) | | | 1.54 | | | | 1.10 | |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.07 | ) | | | (0.17 | ) | | | (0.19 | ) | | | (0.14 | ) | | | (0.12 | ) | | | (0.15 | ) |

Net realized gains | | | (0.49 | ) | | | (0.78 | ) | | | (0.89 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (0.56 | ) | | | (0.95 | ) | | | (1.08 | ) | | | (0.14 | ) | | | (0.12 | ) | | | (0.15 | ) |

Net asset value, end of period | | | $10.12 | | | | $10.25 | | | | $9.90 | | | | $9.07 | | | | $9.27 | | | | $7.85 | |

Total return2 | | | 4.23 | % | | | 14.11 | % | | | 23.28 | % | | | (0.75 | )% | | | 19.68 | % | | | 16.17 | % |

Ratios to average net assets (annualized) | | | | | | | | | | | | | | | | | | | | | | | | |

Gross expenses | | | 0.78 | % | | | 0.79 | % | | | 0.81 | % | | | 0.79 | % | | | 0.78 | % | | | 0.77 | % |

Net expenses | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % | | | 0.77 | % | | | 0.78 | % | | | 0.77 | % |

Net investment income | | | 1.70 | % | | | 1.71 | % | | | 2.14 | % | | | 1.58 | % | | | 1.52 | % | | | 2.08 | % |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 17 | % | | | 54 | % | | | 73 | % | | | 69 | % | | | 82 | % | | | 70 | % |

Net assets, end of period (000s omitted) | | | $283,842 | | | | $262,754 | | | | $122,769 | | | | $97,251 | | | | $100,160 | | | | $149,790 | |

| 1 | Calculated based upon average shares outstanding. |

| 2 | Returns for periods of less than one year are not annualized. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 20 | | Wells Fargo Diversified Capital Builder Fund | | Notes to financial statements (unaudited) |

1. ORGANIZATION

Wells Fargo Funds Trust (the “Trust”), a Delaware statutory trust organized on March 10, 1999, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). As an investment company, the Trust follows the accounting and reporting guidance in Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services – Investment Companies. These financial statements report on the Wells Fargo Diversified Capital Builder Fund (the “Fund”) which is a diversified series of the Trust.

Effective at the close of business on May 5, 2017, Class B shares were converted to Class A shares and are no longer offered by the Fund. Information for Class B shares reflected in the financial statements represents activity through May 5, 2017.

2. SIGNIFICANT ACCOUNTING POLICIES

The following significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund, are in conformity with U.S. generally accepted accounting principles which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Securities valuation

All investments are valued each business day as of the close of regular trading on the New York Stock Exchange (generally 4 p.m. Eastern Time), although the Fund may deviate from this calculation time under unusual or unexpected circumstances.

Equity securities that are listed on a foreign or domestic exchange or market are valued at the official closing price or, if none, the last sales price. If no sale occurs on the principal exchange or market that day, a fair value price will be determined in accordance with the Fund’s Valuation Procedures.

Debt securities are valued at the evaluated bid price provided by an independent pricing service or, if a reliable price is not available, the quoted bid price from an independent broker-dealer.

Investments in registered open-end investment companies are valued at net asset value. Interests in non-registered investment companies that are redeemable at net asset value are fair valued normally at net asset value.

Investments which are not valued using any of the methods discussed above are valued at their fair value, as determined in good faith by the Board of Trustees of the Fund. The Board of Trustees has established a Valuation Committee comprised of the Trustees and has delegated to it the authority to take any actions regarding the valuation of portfolio securities that the Valuation Committee deems necessary or appropriate, including determining the fair value of portfolio securities, unless the determination has been delegated to the Wells Fargo Asset Management Pricing Committee at Wells Fargo Funds Management, LLC (“Funds Management”). The Board of Trustees retains the authority to make or ratify any valuation decisions or approve any changes to the Valuation Procedures as it deems appropriate. On a quarterly basis, the Board of Trustees receives reports on any valuation actions taken by the Valuation Committee or the Wells Fargo Asset Management Pricing Committee which may include items for ratification.

Valuations of fair valued securities are compared to the next actual sales price when available, or other appropriate market values, to assess the continued appropriateness of the fair valuation methodologies used. These securities are fair valued on a day-to-day basis, taking into consideration changes to appropriate market information and any significant changes to the inputs considered in the valuation process until there is a readily available price provided on an exchange or by an independent pricing service. Valuations received from an independent pricing service or independent broker-dealer quotes are periodically validated by comparisons to most recent trades and valuations provided by other independent pricing services in addition to the review of prices by the manager and/or subadviser. Unobservable inputs used in determining fair valuations are identified based on the type of security, taking into consideration factors utilized by market participants in valuing the investment, knowledge about the issuer and the current market environment.

Securities lending

The Fund may lend its securities from time to time in order to earn additional income in the form of fees or interest on securities received as collateral or the investment of any cash received as collateral. The Fund continues to receive interest or dividends on the securities loaned. The Fund receives collateral in the form of cash or securities with a value at least equal to the value of the securities on loan. The value of the loaned securities is determined at the close of each business day and any additional required collateral is delivered to the Fund on the next business day. In a securities lending transaction, the net asset value of the Fund will be affected by an increase or decrease in the value of the securities loaned and by an increase or

| | | | | | |

| Notes to financial statements (unaudited) | | Wells Fargo Diversified Capital Builder Fund | | | 21 | |

decrease in the value of the instrument in which collateral is invested. The amount of securities lending activity undertaken by the Fund fluctuates from time to time. In the event of default or bankruptcy by the borrower, the Fund may be prevented from recovering the loaned securities or gaining access to the collateral or may experience delays or costs in doing so. In addition, the investment of any cash collateral received may lose all or part of its value. The Fund has the right under the lending agreement to recover the securities from the borrower on demand.

The Fund lends its securities through an unaffiliated securities lending agent. Cash collateral received in connection with its securities lending transactions is invested in Securities Lending Cash Investments, LLC (the “Securities Lending Fund”). The Securities Lending Fund is exempt from registration under Section 3(c)(7) of the 1940 Act and is managed by Funds Management and is subadvised by Wells Capital Management Incorporated (“WellsCap”), an affiliate of Funds Management and an indirect wholly owned subsidiary of Wells Fargo & Company (“Wells Fargo”). Funds Management receives an advisory fee starting at 0.05% and declining to 0.01% as the average daily net assets of the Securities Lending Fund increase. All of the fees received by Funds Management are paid to WellsCap for its services as subadviser. The Securities Lending Fund seeks to provide a positive return compared to the daily Fed Funds Open Rate by investing in high-quality, U.S. dollar-denominated short-term money market instruments. Securities Lending Fund investments are valued at the evaluated bid price provided by an independent pricing service. Income earned from investment in the Securities Lending Fund, if any, is included in income from affiliated securities on the Statement of Operations.

Security transactions and income recognition

Securities transactions are recorded on a trade date basis. Realized gains or losses are recorded on the basis of identified cost.

Dividend income is recognized on the ex-dividend date.

Interest income is accrued daily and bond discounts are accreted and premiums are amortized daily. To the extent debt obligations are placed on non-accrual status, any related interest income may be reduced by writing off interest receivables when the collection of all or a portion of interest has been determined to be doubtful based on consistently applied procedures and the fair value has decreased. If the issuer subsequently resumes interest payments or when the collectability of interest is reasonably assured, the debt obligation is removed from non-accrual status.

Distributions to shareholders

Distributions to shareholders are recorded on the ex-dividend date and paid from net investment income quarterly and any net realized gains are paid at least annually. Such distributions are determined in accordance with income tax regulations and may differ from U.S. generally accepted accounting principles. Dividend sources are estimated at the time of declaration. The tax character of distributions is determined as of the Fund’s fiscal year end. Therefore, a portion of the Fund’s distributions made prior to the Fund’s fiscal year end may be categorized as a tax return of capital at year end.

Federal and other taxes

The Fund intends to continue to qualify as a regulated investment company by distributing substantially all of its investment company taxable income and any net realized capital gains (after reduction for capital loss carryforwards) sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes was required.

The Fund’s income and federal excise tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal and Delaware revenue authorities. Management has analyzed the Fund’s tax positions taken on federal, state, and foreign tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability.

As of March 31, 2018, the aggregate cost of all investments for federal income tax purposes was $835,780,189 and the unrealized gains (losses) consisted of:

| | | | |

Gross unrealized gains | | $ | 165,982,107 | |

Gross unrealized losses | | | (24,982,560 | ) |

Net unrealized gains | | $ | 140,999,547 | |

Class allocations

The separate classes of shares offered by the Fund differ principally in applicable sales charges, distribution, shareholder servicing, and administration fees. Class specific expenses are charged directly to that share class. Investment income, common expenses, and realized and unrealized gains (losses) on investments are allocated daily to each class of shares based on the relative proportion of net assets of each class.

| | | | |

| 22 | | Wells Fargo Diversified Capital Builder Fund | | Notes to financial statements (unaudited) |

3. FAIR VALUATION MEASUREMENTS