UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-09645 |

|

Columbia Funds Series Trust |

(Exact name of registrant as specified in charter) |

|

50606 Ameriprise Financial Center, Minneapolis, Minnesota | | 55474 |

(Address of principal executive offices) | | (Zip code) |

|

Scott R. Plummer 5228 Ameriprise Financial Center One Financial Center Minneapolis, MN 55474 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-612-671-1947 | |

|

Date of fiscal year end: | March 31 | |

|

Date of reporting period: | March 31, 2010 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia Management®

Annual Report

March 31, 2010

Columbia Asset Allocation Fund II

Not FDIC Insured n May Lose Value n No Bank Guarantee

Table of Contents

| Fund Profile | | | 1 | | |

|

| Economic Update | | | 2 | | |

|

| Performance Information | | | 4 | | |

|

| Understanding Your Expenses | | | 5 | | |

|

| Portfolio Managers' Report | | | 6 | | |

|

| Financial Statements | | | 8 | | |

|

| Report of Independent Registered Public Accounting Firm | | | 38 | | |

|

| Federal Income Tax Information | | | 39 | | |

|

| Fund Governance | | | 40 | | |

|

Board Consideration and

Re-Approval of Previous

Investment Advisory Agreement | | | 44 | | |

|

Board Consideration and

Approval of New

Investment Advisory Agreement | | | 47 | | |

|

Summary of Management

Fee Evaluation by Independent

Fee Consultant (Columbia

Management Advisors, LLC) | | | 54 | | |

|

Summary of Management

Fee Evaluation by Independent

Fee Consultant (RiverSource

Investments, LLC) | | | 60 | | |

|

| Proxy Voting Results | | | 62 | | |

|

Important Information About

This Report | | | 65 | | |

|

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific securities should not be construed as a recommendation or investment advice.

President's Message

Dear Shareholder:

On May 3, 2010, Ameriprise Financial, Inc. announced that it had completed the acquisition of the long-term asset management business of Columbia Management from Bank of America. This includes the business of managing its equity and fixed-income mutual funds. Ameriprise Financial has combined its current U.S. asset management business, RiverSource Investments, LLC, with Columbia Management. This transaction puts together two leading asset management firms to create one entity that ranks as the eighth largest manager of long-term mutual fund assets in the United States.1 This combined business will operate under the well-regarded Columbia Management brand, where we will build on the strengths of our combined investment capabilities and talent, our broad and diversified product lineup and exceptional service.

Our combined business has a new breadth and depth of investment choices. William "Ted" Truscott, CEO, U.S. asset management and president of annuities for Ameriprise Financial, leads the combined U.S. asset management business. Michael Jones serves as president, U.S. asset management. Colin Moore continues to serve as chief investment officer. I am also continuing in my role as head of mutual funds, responsible for the delivery of mutual fund products and services to investors. The Columbia funds' advisers, distributor and transfer agent are now subsidiaries of our parent company, Ameriprise Financial but operate under the Columbia Management name. You will begin to see these names used in communications and statements going forward.

| | | Service provider name | |

| Advisers | | Columbia Management Investment Advisers, LLC

Columbia Wanger Asset Management, LLC | |

|

| Distributor | | Columbia Management Investment Distributors, Inc. | |

|

| Transfer Agent | | Columbia Management Investment Services Corp. | |

|

As a valued investor in Columbia funds, please know that our goal is to ensure a smooth transition and provide the highest quality products and services. Transition teams across the organization continue their efforts to build on best practices from both legacy organizations with integration efforts including rebranding, vendor and system consolidations and client communications. Additionally, we want to assure you that the funds' portfolio managers also continue to focus on providing uninterrupted service to all fund shareholders.

Although we have a lot of work ahead of us in 2010, Columbia Management and Ameriprise Financial are excited about the opportunities for our combined organization. I share this optimism and believe it positions us as a best-in-class asset management business with the ability to deliver more for our clients than ever before.

Sincerely,

J. Kevin Connaughton

President, Columbia Funds

1Source: Ameriprise Financial, Inc., based on March 31, 2010 data from the Investment Company Institute

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus, which contains this and other important information about the funds, visit columbiamanagement.com. Read the prospectus carefully before investing.

Securities products offered through Columbia Management Investment Distributors, Inc. (formerly known as RiverSource Fund Distributors, Inc.), member FINRA. Advisory services provided by Columbia Management Investment Advisers, LLC (formerly known as RiverSource Investments, LLC).

© 2010 Columbia Management Investment Advisers, LLC. All rights reserved.

Fund Profile – Columbia Asset Allocation Fund II

Summary

g For the 12-month period that ended March 31, 2010, the fund's Class A shares returned 35.54% without sales charge.

g The fund's equity portfolio performed in line with its benchmark, the Russell 1000 Index1, which returned 51.60%. The fund's fixed-income portfolio beat its benchmark, the Barclays Capital Aggregate Bond Index2, which returned 7.69%. The average return for funds in the peer group, the Lipper Mixed-Asset Target Allocation Growth Classification3, was 40.02%.

g Stock selection drove positive performance on the equity side of the fund, while sector allocations aided fixed-income results. We believe some untimely sales and a focus on higher-quality stocks hindered performance versus the peer group.

Portfolio Management

Anwiti Bahuguna, PhD, has co-managed the fund since 2009 and has been associated with the advisor or its predecessors since 2002.

Colin Moore has co-managed the fund since 2009 and has been associated with the advisor or its predecessors since 2002.

Kent M. Peterson, PhD has co-managed the fund since 2009 and has been associated with the advisor or its predecessors since 2006.

Marie M. Schofield has co-managed the fund since 2009 and has been associated with the advisor or its predecessors since 1990.

Effective May 1, 2010, David Joy will also co-manage the fund.

Effective May 1, 2010, RiverSource Investments, LLC, a subsidiary of Ameriprise Financial, Inc., became the investment advisor to the fund and changed its name to Columbia Management Investment Advisers, LLC. Please see the fund's prospectus, as supplemented, for more information regarding the change in investment advisor and certain other changes.

The recent growth in the stock market has helped to produce short-term returns for some asset classes that are not typical and may not continue in the future. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes.

1The Russell 1000 Index tracks the performance of 1000 of the largest U.S. companies, based on market capitalization.

2The Barclays Capital Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs and total return performance of fixed-rate, publicly placed, dollar-denominated and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

3Lipper Inc., a widely respected data provider in the industry, calculates an average total return (assuming reinvestment of distributions) for mutual funds with investment objectives similar to those of the fund. Lipper makes no adjustment for the effect of sales loads.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Summary

1-year return as of 03/31/10

| | +35.54% | |

|

| |  | | | Class A shares

(without sales charge) | |

|

| | | | | +51.60% | |

|

| |  | | | Russell 1000 Index | |

|

| | | | | +7.69% | |

|

| |  | | | Barclays Capital

Aggregate Bond Index | |

|

1

Economic Update – Columbia Asset Allocation Fund II

Summary

For the 12-month period that ended March 31, 2010

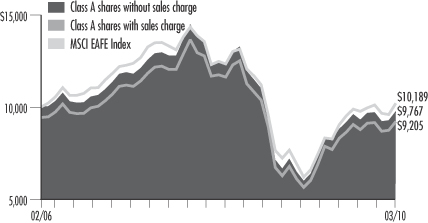

g After a sharp decline, stock markets rebounded around the world, as measured by the S&P 500 Index and the MSCI EAFE Index.

| S&P Index | | MSCI Index | |

|

| |  | |

|

g As investors grew more comfortable with risk, non-Treasury sectors of the bond market rebounded. The Barclays Capital Aggregate Bond Index delivered solid results. High-yield bonds outperformed stocks, as measured by the BofA Merrill Lynch U.S. High Yield Cash Pay Index.

Barclays

Aggregate Index | | BofA ML

Index | |

|

| |  | |

|

After a deep and difficult recession, the U.S. economy regained its footing midway through calendar year 2009. Gross domestic product (GDP) turned positive in the third quarter of 2009, rising 2.2%, and then gained 5.6% in the fourth quarter according to the estimate released by the Bureau of Economic Analysis. Growth was primarily the result of a slowdown in inventory reduction and federal government stimulus spending. Hopes for a sustained recovery now depend on a variety of factors, including continued improvement in consumer spending, an increase in revenues to keep business profits moving higher and a turnaround in the labor market.

The housing market showed some signs of stabilizing, but stopped short of meaningful improvement during the period. Home sales moved higher in 2009 as new homebuyers took advantage of a federal tax credit. However, as the tax credit was set to expire in November 2009, sales slipped—and did not revive even though the tax credit was expanded and extended through April 2010. Housing prices remained relatively flat over the past year, but that was progress compared to 2008. The average home price fell sharply in 2008; and since then distressed properties, which account for approximately 40% of all housing sales, have held prices down because they are heavily discounted.

In the beleaguered labor market, there was some good news. While businesses continued to shed jobs through most of 2009, raising the unemployment rate at the end of the period,* job data turned positive in March 2010, buoyed by a swell of temporary workers hired to conduct the national once-in-a-decade census. Consumer spending also trended higher in the second half of the period. In fact, March year-over-year sales made a significant jump upward. Despite these improvements, consumer confidence, as measured monthly by The Conference Board, an independent research organization, failed to gain much ground during the year. Consumers surveyed continue to cite uncertain business conditions and still-weak labor prospects for their concerns.

On the business side of the economy, manufacturing activity gained momentum. A key measure of the nation's manufacturing situation—the Institute for Supply Management's Index—rose above 50 in July 2009 then rose for eight consecutive months to remain well above 50 for the remainder of the period. (An index value of 50+ indicates a growing economy.) Industrial production moved higher for eleven out of the past 12 months, and durable goods orders took off, with a big jump upward in January. Manufacturing capacity utilization inched upward to 72.7%.

Stocks staged a solid comeback

Against a strengthening economic backdrop, a stock market rally that began in mid-March 2009 continued with little interruption through the end of the period. The U.S. stock market returned 49.77% for the 12-month period, as measured by the S&P 500 Index.1 Mid-cap stocks outperformed large- and small-cap stocks and value stocks outperformed growth stocks by a solid margin, as measured by their respective

*Source: U.S. Bureau of Labor Statistics

1The Standard & Poor's (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks.

2

Economic Update (continued) – Columbia Asset Allocation Fund II

Russell indices.2 Outside the United States, stock market returns were slightly stronger. The MSCI EAFE Index,3 a broad gauge of stock market performance in foreign developed markets, gained 54.44% (net of dividends, in U.S. dollars) for the period. Emerging stock markets were caught in a downdraft in 2008, but they bounced back stronger than domestic or developed world markets as their economic growth generally outpaced the developed world. The MSCI Emerging Markets Index4 returned 81.08% (net of dividends, in U.S. dollars) for the 12-month period, after giving back some gains in the first quarter of 2010.

Bond returns ranged from solid to strong

As hopes for a recovery materialized, bonds from non-Treasury sectors delivered solid returns. The Barclays Capital Aggregate Bond Index5 returned 7.69%. Municipal bonds gained more than taxable investment-grade bonds even without factoring in potential tax advantages to investors in higher income-tax brackets. The Barclays Capital Municipal Bond Index6 returned 9.69%. The high-yield bond market was even stronger than the broad stock market during the period. For the 12 months covered by this report, the BofA Merrill Lynch U.S. High Yield Cash Pay Index7 returned 55.67%.

The yield on the 10-year U.S. Treasury, a common bellwether for the bond market, rose from 2.7% to 3.8% during the 12-month period. Yet despite the pickup in economic activity, the Federal Reserve Board (the Fed) kept a key short-term interest rate—the federal funds rate—close to zero throughout the period.

Past performance is no guarantee of future results.

2The Russell 1000 Index tracks the performance of 1000 of the largest U.S. companies, based on market capitalization. The Russell MidCap Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represents approximately 25% of the total market capitalization of the Russell 1000 Index. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. The Russell 3000 Growth Index measures the performance of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The stocks in this index are also members of either the Russell 1000 Growth or the Russell 2000 Growth indexes. The Russell 3000 Value Index measures the performance of those Russell 3000 Index companies with lower price-to-book ratios and lower forecasted growth values. The stocks in this index are also members of either the Russell 1000 Value or the Russell 2000 Value indexes.

3The Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE) Index is a capitalization-weighted index that tracks the total return of common stocks in 21 developed-market countries within Europe, Australasia and the Far East.

4The Morgan Stanley Capital International Emerging Markets Index (MSCI EMI) is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of June 2009, the MSCI Emerging Markets Index consisted of the following 22 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey.

5The Barclays Capital Aggregate Bond Index is a market value-weighted index that tracks the daily price, coupon, pay-downs and total return performance of fixed-rate, publicly placed, dollar-denominated and non-convertible investment grade debt issues with at least $250 million par amount outstanding and with at least one year to final maturity.

6The Barclays Capital Municipal Bond Index is considered representative of the broad market for investment-grade, tax-exempt bonds with a maturity of at least one year.

7The BofA Merrill Lynch U.S. High Yield Cash Pay Index tracks the performance of non-investment-grade corporate bonds.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

3

Performance Information – Columbia Asset Allocation Fund II

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Annual operating expense ratio (%)*

| Class A | | | 1.35 | | |

| Class B | | | 2.10 | | |

| Class C | | | 2.10 | | |

| Class Z | | | 1.10 | | |

* The annual operating expense ratio is as stated in the fund's prospectus that is current as of the date of this report. Differences in expense ratios disclosed elsewhere in this report may result from the inclusion of fee waivers and expense reimbursements as well as the use of different time periods used in calculating the ratios.

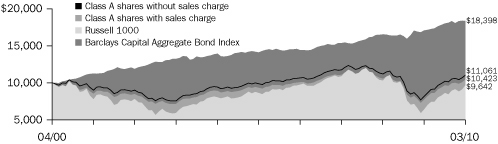

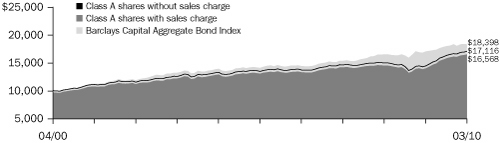

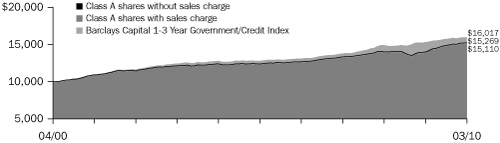

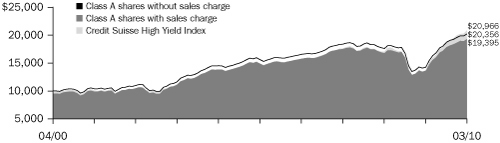

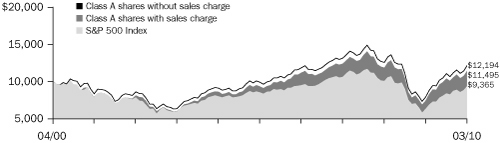

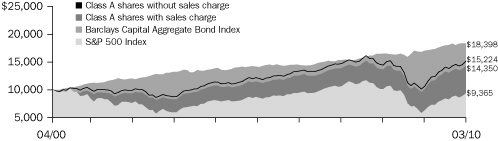

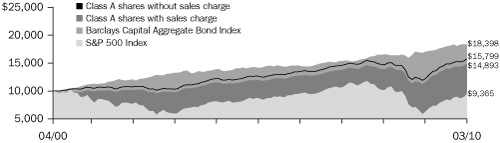

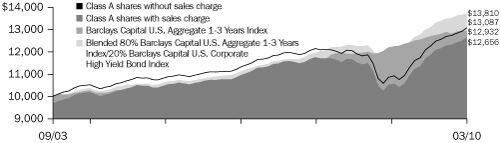

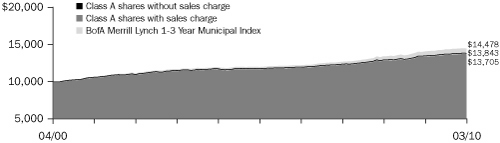

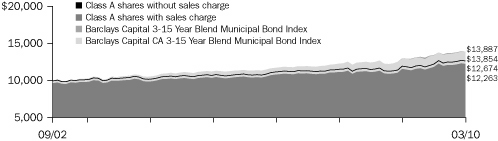

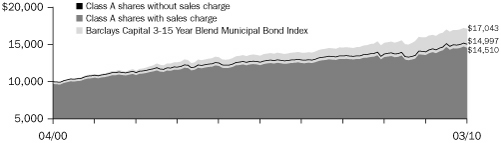

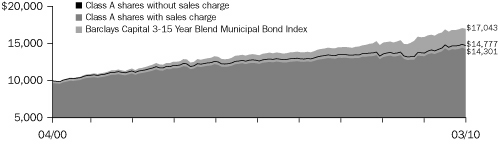

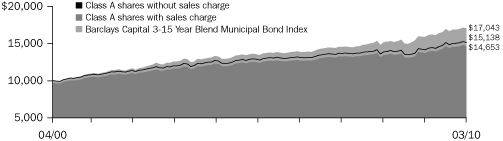

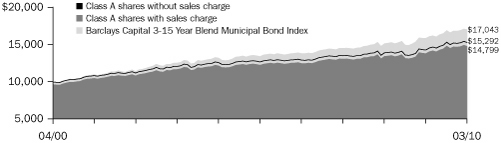

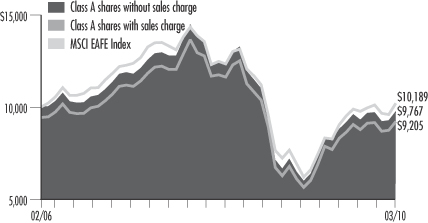

Performance of a $10,000 investment 04/01/00 – 03/31/10

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Asset Allocation Fund II during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

Performance of a $10,000 investment 04/01/00 – 03/31/10 ($)

| Sales charge | | without | | with | |

| Class A | | | 11,061 | | | | 10,423 | | |

| Class B | | | 10,247 | | | | 10,247 | | |

| Class C | | | 10,251 | | | | 10,251 | | |

| Class Z | | | 11,319 | | | | n/a | | |

Average annual total return as of 03/31/10 (%)

| Share class | | A | | B | | C | | Z | |

| Inception | | 01/18/94 | | 07/15/98 | | 11/11/96 | | 05/21/99 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | |

| 1-year | | | 35.54 | | | | 27.77 | | | | 34.52 | | | | 29.52 | | | | 34.63 | | | | 33.63 | | | | 35.90 | | |

| 5-year | | | 2.31 | | | | 1.11 | | | | 1.56 | | | | 1.18 | | | | 1.57 | | | | 1.57 | | | | 2.55 | | |

| 10-year | | | 1.01 | | | | 0.42 | | | | 0.24 | | | | 0.24 | | | | 0.25 | | | | 0.25 | | | | 1.25 | | |

The "with sales charge" returns include the maximum initial sales charge of 5.75% for Class A shares, the applicable contingent deferred sales charge of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter for Class B shares and 1.00% for Class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any fee waivers or reimbursements of fund expenses by the investment advisor and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

All results shown assume reinvestment of distributions. Class Z shares are sold at net asset value with no distribution and service (Rule 12b-1) fees. Class Z shares have limited eligibility and the investment minimum requirements may vary. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

The tables do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

4

Understanding Your Expenses – Columbia Asset Allocation Fund II

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees or exchange fees. There are also ongoing costs, which generally include investment advisory fees, distribution and service (Rule 12b-1) fees and other fund expenses. The information on this page is intended to help you understand the ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "Hypothetical" column for each share class assumes that the return each year is 5% before expenses and is calculated based on the fund's actual operating expenses. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this period.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees.

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

g For shareholders who receive their account statements from Columbia Management Services, Inc., your account balance is available online at www.columbiafunds.com or by calling Shareholder Services at 800.345.6611.

g For shareholders who receive their account statements from their financial intermediary, contact your financial intermediary to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number in the column labeled "Actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

If the value of your account falls below the minimum initial investment requirement applicable to you, your account generally will be subject to a $20 annual fee. This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

10/01/09 – 03/31/10

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,082.40 | | | | 1,018.95 | | | | 6.23 | | | | 6.04 | | | | 1.20 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,078.10 | | | | 1,015.21 | | | | 10.10 | | | | 9.80 | | | | 1.95 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,078.10 | | | | 1,015.21 | | | | 10.10 | | | | 9.80 | | | | 1.95 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,083.40 | | | | 1,020.19 | | | | 4.93 | | | | 4.78 | | | | 0.95 | | |

Expenses paid during the period are equal to the annualized expense ratio for the share class, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 365.

Had the investment advisor and/or any of its affiliates not waived fees or reimbursed a portion of expenses, account value at the end of the period would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

5

Portfolio Managers' Report – Columbia Asset Allocation Fund II

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiafunds.com for daily and most recent month-end performance updates.

Net asset value per share

as of 03/31/10 ($)

| Class A | | | 21.14 | | |

| Class B | | | 20.96 | | |

| Class C | | | 20.95 | | |

| Class Z | | | 21.09 | | |

Distributions declared per share

04/01/09 – 03/31/10 ($)

| Class A | | | 0.42 | | |

| Class B | | | 0.28 | | |

| Class C | | | 0.28 | | |

| Class Z | | | 0.47 | | |

For the 12-month period that ended March 31, 2010, the fund's Class A shares returned 35.54% without sales charge. Over the same period, the fund's benchmarks, the Russell 1000 Index and the Barclays Capital Aggregate Bond Index, returned 51.60% and 7.69%, respectively. The fund invested 60% of its assets in stocks, which performed in line with the Russell index, with the balance in fixed-income assets that nicely outpaced the Barclays benchmark. The fund outperformed a blended benchmark divided 60/40 between its two benchmarks, which gained 32.65%. The average return of the fund's peer group, the Lipper Mixed Asset Target Allocation Growth Classification, was 40.02%. We believe some untimely sales and a focus on higher-quality stocks issued by companies with strong balance sheets hindered results versus the peer group.

Stocks rebounded on improving economic news

Stocks rallied sharply, buoyed by signs that the economy was healing and the financial crisis was easing. All 10 equity sectors in the Russell index produced positive returns, with the biggest gains coming from low-quality stocks in sectors that were the weakest performers in the 2008 downturn. Financials climbed 79% as the threat of a financial system collapse subsided. Standouts in the fund included Wells Fargo, one of the largest banks in the United States; JPMorgan Chase, a diversified financial services company, and insurer Genworth Financial (0.6%, 0.8%, and 0.2% of net assets, respectively). Sectors leveraged to an economic recovery, including information technology, materials, and industrials, also led the market's charge. Overweights in several of the period's strongest performers aided relative returns. These included well-known tech companies such as Apple and Microsoft, specialty chemicals company Ashland and R.R. Do nnelley & Sons, a full-service printing company (1.2%, 1.4%, 0.3% and 0.3% of net assets, respectively).

The fund lost some ground within the consumer discretionary sector because it did not own lower-quality companies with heavy debt levels, which were among the sector's best performers. The premature sale of some lagging stocks further hindered results. Chipotle Mexican Grill, the fast food restaurant chain; Big Lots, a closeout retailer, and Carnival, the world's largest cruise operator, all scored big gains after we sold them. In industrials, the untimely sale of express delivery company FedEx further hurt performance.

Lower-quality led fixed-income rally

As the global financial crisis eased and interest rates stayed near historical lows, investors became more willing to take on added risk, shifting toward higher-yielding, lower-quality assets. The fund benefited from an underweight in Treasuries, the highest-quality and weakest-performing sector, and an increased stake in corporate bonds, which outperformed Treasuries by a wide margin. Within the corporate sector, our exposure to financial bonds was particularly helpful. Investments in certain sectors that had been very weak performers in 2008 further aided results. Standouts included commercial mortgage-backed securities (CMBS), which are bonds backed by mortgages on commercial real estate, such as shopping malls and office buildings. CMBS rallied nicely, benefiting, in part, from their inclusion in the U.S. government stimulus

6

Portfolio Managers' Report (continued) – Columbia Asset Allocation Fund II

programs. The fund also benefited from a small stake in collateralized mortgage obligations (CMOs), high-quality structured mortgage products that did quite well.

Opportunity ahead

The past 12 months were challenging for investors seeking higher-quality stocks selling at attractive valuations. Going forward, we believe the fund is well positioned for a shift in focus toward individual stock characteristics rather than macroeconomic factors. On the fixed-income side, we're optimistic that bonds will benefit as the Federal Reserve's concern for sustained economic growth helps keep inflation in check. Among the areas that interest us most are shorter-maturity CMBS, whose yields relative to Treasuries are above historical averages, and certain areas of the investment-grade corporate bond market that remain in strong demand. Conversely, we expect to keep an underweight in Treasuries, with reduced allocations to mortgage-backed securities, CMOs and government agency debt.

Portfolio characteristics and holdings are subject to change periodically and may not be representative of current characteristics and holdings. The outlook for this portfolio may differ from that presented for other Columbia Funds.

Equity securities are subject to stock market fluctuations that occur in response to economic and business developments.

Stocks of mid-cap companies pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies.

Investing in fixed-income securities may involve certain risks, including the credit quality of individual issuers, possible prepayments, market or economic developments and yields and share price fluctuations due to changes in interest rates. When interest rates go up, bond prices typically drop, and vice versa.

Investments in high-yield bonds (sometimes referred to as "junk" bonds) offer the potential for high current income and attractive total return, but involve certain risks. Changes in economic conditions or other circumstances may adversely affect a high-yield bond issuer's ability to make principal and interest payments.

Top 10 equity holdings

as of 03/31/10 (%)

| Microsoft | | | 1.4 | | |

| Exxon Mobil | | | 1.4 | | |

| Apple | | | 1.2 | | |

| General Electric | | | 1.2 | | |

International Business

Machines | | | 1.2 | | |

| Hewlett-Packard | | | 1.1 | | |

| Chevron | | | 1.0 | | |

| Intel | | | 1.0 | | |

| Procter & Gamble | | | 1.0 | | |

| Johnson & Johnson | | | 0.9 | | |

Top 5 equity sectors

as of 03/31/10 (%)

| Information Technology | | | 11.2 | | |

| Financials | | | 9.3 | | |

| Health Care | | | 7.3 | | |

| Industrials | | | 6.5 | | |

| Consumer Discretionary | | | 6.5 | | |

Portfolio structure

as of 03/31/10 (%)

| Common Stocks | | | 59.9 | | |

Corporate Fixed-Income

Bonds & Notes | | | 11.0 | | |

Government & Agency

Obligations | | | 10.8 | | |

Mortgage-Backed

Securities | | | 10.0 | | |

Commercial Mortgage-Backed

Securities | | | 5.0 | | |

Collateralized Mortgage

Obligations | | | 2.0 | | |

| Asset-Backed Securities | | | 1.0 | | |

| Short-Term Obligation | | | 1.3 | | |

Other Assets &

Liabilities, Net | | | (1.0) | | |

This fund is actively managed and the composition of its portfolio will change over time. Information provided is calculated as a percentage of net assets.

7

Investment Portfolio – Columbia Asset Allocation Fund II

March 31, 2010

| Common Stocks – 59.9% | |

| | | Shares | | Value ($) | |

| Consumer Discretionary – 6.5% | |

| Automobiles – 0.2% | |

| Ford Motor Co. (a) | | | 16,000 | | | | 201,120 | | |

| Automobiles Total | | | 201,120 | | |

| Diversified Consumer Services – 0.0% | |

| H&R Block, Inc. | | | 1,800 | | | | 32,040 | | |

| Diversified Consumer Services Total | | | 32,040 | | |

| Hotels, Restaurants & Leisure – 0.5% | |

| McDonald's Corp. | | | 5,700 | | | | 380,304 | | |

| Starbucks Corp. (a) | | | 4,400 | | | | 106,788 | | |

| Hotels, Restaurants & Leisure Total | | | 487,092 | | |

| Household Durables – 0.6% | |

| Garmin Ltd. | | | 8,700 | | | | 334,776 | | |

| Leggett & Platt, Inc. | | | 5,200 | | | | 112,528 | | |

| Stanley Black & Decker, Inc. | | | 2,700 | | | | 155,007 | | |

| Whirlpool Corp. | | | 400 | | | | 34,900 | | |

| Household Durables Total | | | 637,211 | | |

| Internet & Catalog Retail – 0.3% | |

| Amazon.com, Inc. (a) | | | 1,400 | | | | 190,022 | | |

| NetFlix, Inc. (a) | | | 200 | | | | 14,748 | | |

| Priceline.com, Inc. (a) | | | 400 | | | | 102,000 | | |

| Internet & Catalog Retail Total | | | 306,770 | | |

| Leisure Equipment & Products – 0.2% | |

| Mattel, Inc. | | | 6,400 | | | | 145,536 | | |

| Leisure Equipment & Products Total | | | 145,536 | | |

| Media – 2.0% | |

| CBS Corp., Class B | | | 3,300 | | | | 46,002 | | |

| Comcast Corp., Class A | | | 21,300 | | | | 400,866 | | |

| DIRECTV, Class A (a) | | | 9,300 | | | | 314,433 | | |

| DISH Network Corp., Class A | | | 3,600 | | | | 74,952 | | |

| Liberty Global, Inc., Class A (a) | | | 600 | | | | 17,496 | | |

| News Corp., Class A | | | 10,500 | | | | 151,305 | | |

| Time Warner, Inc. | | | 15,200 | | | | 475,304 | | |

| Viacom, Inc., Class B (a) | | | 2,900 | | | | 99,702 | | |

| Walt Disney Co. | | | 10,600 | | | | 370,046 | | |

| Media Total | | | 1,950,106 | | |

| Multiline Retail – 1.0% | |

| Dollar General Corp. (a) | | | 9,500 | | | | 239,875 | | |

| Kohl's Corp. (a) | | | 1,600 | | | | 87,648 | | |

| Macy's, Inc. | | | 2,200 | | | | 47,894 | | |

| Nordstrom, Inc. | | | 6,000 | | | | 245,100 | | |

| Sears Holdings Corp. (a) | | | 300 | | | | 32,529 | | |

| Target Corp. | | | 7,200 | | | | 378,720 | | |

| Multiline Retail Total | | | 1,031,766 | | |

| | | Shares | | Value ($) | |

| Specialty Retail – 1.5% | |

| Bed Bath & Beyond, Inc. (a) | | | 600 | | | | 26,256 | | |

| Chico's FAS, Inc. | | | 4,100 | | | | 59,122 | | |

| Gap, Inc. | | | 15,900 | | | | 367,449 | | |

| Guess?, Inc. | | | 700 | | | | 32,886 | | |

| Home Depot, Inc. | | | 11,000 | | | | 355,850 | | |

| Limited Brands, Inc. | | | 1,400 | | | | 34,468 | | |

| Ross Stores, Inc. | | | 3,400 | | | | 181,798 | | |

| Sherwin-Williams Co. | | | 200 | | | | 13,536 | | |

| Tiffany & Co. | | | 700 | | | | 33,243 | | |

| TJX Companies, Inc. | | | 8,000 | | | | 340,160 | | |

| Specialty Retail Total | | | 1,444,768 | | |

| Textiles, Apparel & Luxury Goods – 0.2% | |

| Coach, Inc. | | | 1,600 | | | | 63,232 | | |

| NIKE, Inc., Class B | | | 900 | | | | 66,150 | | |

| Polo Ralph Lauren Corp. | | | 300 | | | | 25,512 | | |

| V.F. Corp. | | | 400 | | | | 32,060 | | |

| Textiles, Apparel & Luxury Goods Total | | | 186,954 | | |

| Consumer Discretionary Total | | | 6,423,363 | | |

| Consumer Staples – 6.4% | |

| Beverages – 1.1% | |

| Brown-Forman Corp., Class B | | | 1,600 | | | | 95,120 | | |

| Coca-Cola Co. | | | 8,500 | | | | 467,500 | | |

| PepsiCo, Inc. | | | 7,500 | | | | 496,200 | | |

| Beverages Total | | | 1,058,820 | | |

| Food & Staples Retailing – 0.7% | |

| Sysco Corp. | | | 3,000 | | | | 88,500 | | |

| Wal-Mart Stores, Inc. | | | 9,000 | | | | 500,400 | | |

| Walgreen Co. | | | 3,900 | | | | 144,651 | | |

| Food & Staples Retailing Total | | | 733,551 | | |

| Food Products – 1.3% | |

| Campbell Soup Co. | | | 300 | | | | 10,605 | | |

| ConAgra Foods, Inc. | | | 1,900 | | | | 47,633 | | |

| Del Monte Foods Co. | | | 9,500 | | | | 138,700 | | |

| General Mills, Inc. | | | 3,800 | | | | 269,002 | | |

| H.J. Heinz Co. | | | 1,900 | | | | 86,659 | | |

| Hershey Co. | | | 3,900 | | | | 166,959 | | |

| Kellogg Co. | | | 1,100 | | | | 58,773 | | |

| Kraft Foods, Inc., Class A | | | 3,900 | | | | 117,936 | | |

| Sara Lee Corp. | | | 27,700 | | | | 385,861 | | |

| Food Products Total | | | 1,282,128 | | |

| Household Products – 1.3% | |

| Colgate-Palmolive Co. | | | 2,800 | | | | 238,728 | | |

| Kimberly-Clark Corp. | | | 2,200 | | | | 138,336 | | |

| Procter & Gamble Co. | | | 15,000 | | | | 949,050 | | |

| Household Products Total | | | 1,326,114 | | |

See Accompanying Notes to Financial Statements.

8

Columbia Asset Allocation Fund II

March 31, 2010

| Common Stocks (continued) | |

| | | Shares | | Value ($) | |

| Personal Products – 0.6% | |

Estée Lauder Companies, Inc.,

Class A | | | 5,700 | | | | 369,759 | | |

| Herbalife Ltd. | | | 3,800 | | | | 175,256 | | |

| Personal Products Total | | | 545,015 | | |

| Tobacco – 1.4% | |

| Altria Group, Inc. | | | 12,400 | | | | 254,448 | | |

| Lorillard, Inc. | | | 4,400 | | | | 331,056 | | |

| Philip Morris International, Inc. | | | 14,400 | | | | 751,104 | | |

| Reynolds American, Inc. | | | 900 | | | | 48,582 | | |

| Tobacco Total | | | 1,385,190 | | |

| Consumer Staples Total | | | 6,330,818 | | |

| Energy – 6.4% | |

| Energy Equipment & Services – 0.6% | |

| National Oilwell Varco, Inc. | | | 2,100 | | | | 85,218 | | |

| Oil States International, Inc. (a) | | | 1,700 | | | | 77,078 | | |

| Rowan Companies, Inc. (a) | | | 9,100 | | | | 264,901 | | |

| Schlumberger Ltd. | | | 1,800 | | | | 114,228 | | |

| Energy Equipment & Services Total | | | 541,425 | | |

| Oil, Gas & Consumable Fuels – 5.8% | |

| Alpha Natural Resources, Inc. (a) | | | 5,400 | | | | 269,406 | | |

| Anadarko Petroleum Corp. | | | 2,600 | | | | 189,358 | | |

| Apache Corp. | | | 5,500 | | | | 558,250 | | |

| Arch Coal, Inc. | | | 900 | | | | 20,565 | | |

| Chevron Corp. | | | 13,100 | | | | 993,373 | | |

| ConocoPhillips | | | 10,600 | | | | 542,402 | | |

| CONSOL Energy, Inc. | | | 900 | | | | 38,394 | | |

| Devon Energy Corp. | | | 300 | | | | 19,329 | | |

| EOG Resources, Inc. | | | 2,100 | | | | 195,174 | | |

| Exxon Mobil Corp. | | | 21,000 | | | | 1,406,580 | | |

| Hess Corp. | | | 500 | | | | 31,275 | | |

| Marathon Oil Corp. | | | 3,600 | | | | 113,904 | | |

| Massey Energy Co. | | | 1,400 | | | | 73,206 | | |

| Murphy Oil Corp. | | | 1,000 | | | | 56,190 | | |

| Peabody Energy Corp. | | | 7,600 | | | | 347,320 | | |

| Pioneer Natural Resources Co. | | | 500 | | | | 28,160 | | |

| Tesoro Corp. | | | 600 | | | | 8,340 | | |

| Valero Energy Corp. | | | 10,400 | | | | 204,880 | | |

| Whiting Petroleum Corp. (a) | | | 1,800 | | | | 145,512 | | |

| XTO Energy, Inc. | | | 11,600 | | | | 547,288 | | |

| Oil, Gas & Consumable Fuels Total | | | 5,788,906 | | |

| Energy Total | | | 6,330,331 | | |

| Financials – 9.3% | |

| Capital Markets – 1.5% | |

| Ameriprise Financial, Inc. | | | 3,100 | | | | 140,616 | | |

| Bank of New York Mellon Corp. | | | 400 | | | | 12,352 | | |

| | | Shares | | Value ($) | |

| Federated Investors, Inc., Class B | | | 500 | | | | 13,190 | | |

| Franklin Resources, Inc. | | | 2,300 | | | | 255,070 | | |

| Goldman Sachs Group, Inc. | | | 3,100 | | | | 528,953 | | |

| Jefferies Group, Inc. | | | 100 | | | | 2,367 | | |

| Morgan Stanley | | | 6,100 | | | | 178,669 | | |

| Raymond James Financial, Inc. | | | 3,800 | | | | 101,612 | | |

| T. Rowe Price Group, Inc. | | | 5,100 | | | | 280,143 | | |

| Capital Markets Total | | | 1,512,972 | | |

| Commercial Banks – 1.4% | |

| BB&T Corp. | | | 300 | | | | 9,717 | | |

| Comerica, Inc. | | | 800 | | | | 30,432 | | |

| Fifth Third Bancorp. | | | 10,700 | | | | 145,413 | | |

| Fulton Financial Corp. | | | 12,400 | | | | 126,356 | | |

PNC Financial Services

Group, Inc. | | | 4,200 | | | | 250,740 | | |

| U.S. Bancorp | | | 7,000 | | | | 181,160 | | |

| Wells Fargo & Co. | | | 20,300 | | | | 631,736 | | |

| Commercial Banks Total | | | 1,375,554 | | |

| Consumer Finance – 1.2% | |

| American Express Co. | | | 5,400 | | | | 222,804 | | |

| AmeriCredit Corp. (a) | | | 5,600 | | | | 133,056 | | |

| Capital One Financial Corp. | | | 2,300 | | | | 95,243 | | |

| Discover Financial Services | | | 24,500 | | | | 365,050 | | |

| SLM Corp. (a) | | | 30,900 | | | | 386,868 | | |

| Consumer Finance Total | | | 1,203,021 | | |

| Diversified Financial Services – 1.3% | |

| Citigroup, Inc. (a) | | | 121,100 | | | | 490,455 | | |

| JPMorgan Chase & Co. | | | 17,400 | | | | 778,650 | | |

| Diversified Financial Services Total | | | 1,269,105 | | |

| Insurance – 1.9% | |

| AFLAC, Inc. | | | 2,400 | | | | 130,296 | | |

Allied World Assurance

Holdings Ltd. | | | 9,100 | | | | 408,135 | | |

| Allstate Corp. | | | 6,100 | | | | 197,091 | | |

| Aspen Insurance Holdings Ltd. | | | 400 | | | | 11,536 | | |

Genworth Financial, Inc.,

Class A (a) | | | 11,300 | | | | 207,242 | | |

Hartford Financial Services

Group, Inc. | | | 2,000 | | | | 56,840 | | |

| Loews Corp. | | | 2,400 | | | | 89,472 | | |

| MetLife, Inc. | | | 3,000 | | | | 130,020 | | |

| Prudential Financial, Inc. | | | 5,000 | | | | 302,500 | | |

Reinsurance Group of

America, Inc. | | | 3,200 | | | | 168,064 | | |

| Transatlantic Holdings, Inc. | | | 500 | | | | 26,400 | | |

| Travelers Companies, Inc. | | | 2,600 | | | | 140,244 | | |

| Unum Group | | | 1,900 | | | | 47,063 | | |

| Insurance Total | | | 1,914,903 | | |

See Accompanying Notes to Financial Statements.

9

Columbia Asset Allocation Fund II

March 31, 2010

| Common Stocks (continued) | |

| | | Shares | | Value ($) | |

| Real Estate Investment Trusts (REITs) – 1.7% | |

Annaly Capital

Management, Inc. | | | 8,400 | | | | 144,312 | | |

| Brandywine Realty Trust | | | 6,400 | | | | 78,144 | | |

| Chimera Investment Corp. | | | 15,900 | | | | 61,851 | | |

| Equity Residential | | | 600 | | | | 23,490 | | |

| Hospitality Properties Trust | | | 12,400 | | | | 296,980 | | |

| Host Hotels & Resorts, Inc. | | | 200 | | | | 2,930 | | |

| HRPT Properties Trust | | | 59,400 | | | | 462,132 | | |

| Macerich Co. | | | 506 | | | | 19,385 | | |

| Public Storage | | | 500 | | | | 45,995 | | |

| Simon Property Group, Inc. | | | 3,900 | | | | 327,210 | | |

| SL Green Realty Corp. | | | 400 | | | | 22,908 | | |

| Ventas, Inc. | | | 3,800 | | | | 180,424 | | |

| Real Estate Investment Trusts (REITs) Total | | | 1,665,761 | | |

| Thrifts & Mortgage Finance – 0.3% | |

| Hudson City Bancorp, Inc. | | | 22,600 | | | | 320,016 | | |

| Thrifts & Mortgage Finance Total | | | 320,016 | | |

| Financials Total | | | 9,261,332 | | |

| Health Care – 7.3% | |

| Biotechnology – 0.6% | |

| Amgen, Inc. (a) | | | 7,100 | | | | 424,296 | | |

| Biogen Idec, Inc. (a) | | | 400 | | | | 22,944 | | |

| Gilead Sciences, Inc. (a) | | | 3,900 | | | | 177,372 | | |

| Biotechnology Total | | | 624,612 | | |

| Health Care Equipment & Supplies – 0.8% | |

| Baxter International, Inc. | | | 400 | | | | 23,280 | | |

| CareFusion Corp. (a) | | | 1,500 | | | | 39,645 | | |

| Hospira, Inc. (a) | | | 3,400 | | | | 192,610 | | |

| Kinetic Concepts, Inc. (a) | | | 3,700 | | | | 176,897 | | |

| Medtronic, Inc. | | | 5,900 | | | | 265,677 | | |

| Stryker Corp. | | | 1,100 | | | | 62,942 | | |

| Zimmer Holdings, Inc. (a) | | | 1,100 | | | | 65,120 | | |

| Health Care Equipment & Supplies Total | | | 826,171 | | |

| Health Care Providers & Services – 2.9% | |

| Aetna, Inc. | | | 400 | | | | 14,044 | | |

| AmerisourceBergen Corp. | | | 11,900 | | | | 344,148 | | |

| Cardinal Health, Inc. | | | 14,400 | | | | 518,832 | | |

Community Health

Systems, Inc. (a) | | | 100 | | | | 3,693 | | |

| Humana, Inc. (a) | | | 5,600 | | | | 261,912 | | |

| Lincare Holdings, Inc. (a) | | | 7,300 | | | | 327,624 | | |

| McKesson Corp. | | | 2,500 | | | | 164,300 | | |

| Medco Health Solutions, Inc. (a) | | | 8,500 | | | | 548,760 | | |

| Quest Diagnostics, Inc. | | | 600 | | | | 34,974 | | |

| | | Shares | | Value ($) | |

| Tenet Healthcare Corp. (a) | | | 200 | | | | 1,144 | | |

| UnitedHealth Group, Inc. (a) | | | 11,100 | | | | 362,637 | | |

Universal Health Services, Inc.,

Class B | | | 400 | | | | 14,036 | | |

| WellPoint, Inc. (a) | | | 4,500 | | | | 289,710 | | |

| Health Care Providers & Services Total | | | 2,885,814 | | |

| Life Sciences Tools & Services – 0.1% | |

| Thermo Fisher Scientific, Inc. (a) | | | 2,300 | | | | 118,312 | | |

| Life Sciences Tools & Services Total | | | 118,312 | | |

| Pharmaceuticals – 2.9% | |

| Abbott Laboratories | | | 9,800 | | | | 516,264 | | |

| Bristol-Myers Squibb Co. | | | 8,800 | | | | 234,960 | | |

| Eli Lilly & Co. | | | 7,300 | | | | 264,406 | | |

| Forest Laboratories, Inc. (a) | | | 3,300 | | | | 103,488 | | |

| Johnson & Johnson | | | 13,700 | | | | 893,240 | | |

| Merck & Co., Inc. | | | 9,400 | | | | 351,090 | | |

| Mylan, Inc. (a) | | | 3,900 | | | | 88,569 | | |

| Pfizer, Inc. | | | 23,300 | | | | 399,595 | | |

| Pharmaceuticals Total | | | 2,851,612 | | |

| Health Care Total | | | 7,306,521 | | |

| Industrials – 6.5% | |

| Aerospace & Defense – 1.8% | |

| General Dynamics Corp. | | | 2,000 | | | | 154,400 | | |

| Honeywell International, Inc. | | | 2,700 | | | | 122,229 | | |

| ITT Corp. | | | 2,500 | | | | 134,025 | | |

| Lockheed Martin Corp. | | | 2,400 | | | | 199,728 | | |

| Northrop Grumman Corp. | | | 1,600 | | | | 104,912 | | |

| Raytheon Co. | | | 9,600 | | | | 548,352 | | |

| United Technologies Corp. | | | 7,500 | | | | 552,075 | | |

| Aerospace & Defense Total | | | 1,815,721 | | |

| Air Freight & Logistics – 0.3% | |

| United Parcel Service, Inc., Class B | | | 4,500 | | | | 289,845 | | |

| Air Freight & Logistics Total | | | 289,845 | | |

| Commercial Services & Supplies – 0.4% | |

| R.R. Donnelley & Sons Co. | | | 12,200 | | | | 260,470 | | |

| Waste Management, Inc. | | | 4,600 | | | | 158,378 | | |

| Commercial Services & Supplies Total | | | 418,848 | | |

| Electrical Equipment – 0.7% | |

| Emerson Electric Co. | | | 12,300 | | | | 619,182 | | |

| Hubbell, Inc., Class B | | | 900 | | | | 45,387 | | |

| Rockwell Automation, Inc. | | | 300 | | | | 16,908 | | |

| Electrical Equipment Total | | | 681,477 | | |

See Accompanying Notes to Financial Statements.

10

Columbia Asset Allocation Fund II

March 31, 2010

| Common Stocks (continued) | |

| | | Shares | | Value ($) | |

| Industrial Conglomerates – 1.9% | |

| 3M Co. | | | 4,900 | | | | 409,493 | | |

| Carlisle Companies, Inc. | | | 6,900 | | | | 262,890 | | |

| General Electric Co. | | | 66,800 | | | | 1,215,760 | | |

| Industrial Conglomerates Total | | | 1,888,143 | | |

| Machinery – 0.8% | |

| Caterpillar, Inc. | | | 1,900 | | | | 119,415 | | |

| Danaher Corp. | | | 1,100 | | | | 87,901 | | |

| Dover Corp. | | | 4,700 | | | | 219,725 | | |

| Eaton Corp. | | | 800 | | | | 60,616 | | |

| Illinois Tool Works, Inc. | | | 2,700 | | | | 127,872 | | |

| Joy Global, Inc. | | | 200 | | | | 11,320 | | |

| Parker Hannifin Corp. | | | 2,800 | | | | 181,272 | | |

| Toro Co. | | | 1,000 | | | | 49,170 | | |

| Machinery Total | | | 857,291 | | |

| Professional Services – 0.1% | |

| Dun & Bradstreet Corp. | | | 700 | | | | 52,094 | | |

| Professional Services Total | | | 52,094 | | |

| Road & Rail – 0.3% | |

| Ryder System, Inc. | | | 7,400 | | | | 286,824 | | |

| Road & Rail Total | | | 286,824 | | |

| Trading Companies & Distributors – 0.2% | |

| W.W. Grainger, Inc. | | | 1,500 | | | | 162,180 | | |

| Trading Companies & Distributors Total | | | 162,180 | | |

| Industrials Total | | | 6,452,423 | | |

| Information Technology – 11.2% | |

| Communications Equipment – 0.8% | |

| Cisco Systems, Inc. (a) | | | 30,500 | | | | 793,915 | | |

| Harris Corp. | | | 700 | | | | 33,243 | | |

| Communications Equipment Total | | | 827,158 | | |

| Computers & Peripherals – 4.3% | |

| Apple, Inc. (a) | | | 5,200 | | | | 1,221,636 | | |

| Dell, Inc. (a) | | | 13,300 | | | | 199,633 | | |

| EMC Corp. (a) | | | 11,600 | | | | 209,264 | | |

| Hewlett-Packard Co. | | | 20,800 | | | | 1,105,520 | | |

International Business

Machines Corp. | | | 9,100 | | | | 1,167,075 | | |

| QLogic Corp. (a) | | | 500 | | | | 10,150 | | |

| SanDisk Corp. (a) | | | 1,000 | | | | 34,630 | | |

| Teradata Corp. (a) | | | 10,900 | | | | 314,901 | | |

| Western Digital Corp. (a) | | | 1,100 | | | | 42,889 | | |

| Computers & Peripherals Total | | | 4,305,698 | | |

| | | Shares | | Value ($) | |

| Electronic Equipment, Instruments & Components – 0.2% | |

| Amphenol Corp., Class A | | | 900 | | | | 37,971 | | |

| Corning, Inc. | | | 1,900 | | | | 38,399 | | |

Dolby Laboratories, Inc.,

Class A (a) | | | 1,500 | | | | 88,005 | | |

| Vishay Intertechnology, Inc. (a) | | | 2,700 | | | | 27,621 | | |

Electronic Equipment,

Instruments & Components Total | | | 191,996 | | |

| Internet Software & Services – 1.1% | |

| eBay, Inc. (a) | | | 14,600 | | | | 393,470 | | |

| Google, Inc., Class A (a) | | | 1,300 | | | | 737,113 | | |

| Internet Software & Services Total | | | 1,130,583 | | |

| IT Services – 0.7% | |

| Amdocs Ltd. (a) | | | 1,800 | | | | 54,198 | | |

Broadridge Financial

Solutions, Inc. | | | 1,200 | | | | 25,656 | | |

Cognizant Technology

Solutions Corp., Class A (a) | | | 3,900 | | | | 198,822 | | |

| Computer Sciences Corp. (a) | | | 800 | | | | 43,592 | | |

| Global Payments, Inc. | | | 3,100 | | | | 141,205 | | |

Hewitt Associates, Inc.,

Class A (a) | | | 400 | | | | 15,912 | | |

Lender Processing

Services, Inc. | | | 2,400 | | | | 90,600 | | |

| Western Union Co. | | | 5,800 | | | | 98,368 | | |

| IT Services Total | | | 668,353 | | |

| Office Electronics – 0.2% | |

| Xerox Corp. | | | 18,600 | | | | 181,350 | | |

| Office Electronics Total | | | 181,350 | | |

| Semiconductors & Semiconductor Equipment – 1.6% | |

| Intel Corp. | | | 44,200 | | | | 983,892 | | |

| Micron Technology, Inc. (a) | | | 5,200 | | | | 54,028 | | |

| Texas Instruments, Inc. | | | 23,400 | | | | 572,598 | | |

Semiconductors & Semiconductor

Equipment Total | | | 1,610,518 | | |

| Software – 2.3% | |

| BMC Software, Inc. (a) | | | 900 | | | | 34,200 | | |

| CA, Inc. | | | 136 | | | | 3,192 | | |

| Intuit, Inc. (a) | | | 1,700 | | | | 58,378 | | |

| Microsoft Corp. | | | 48,600 | | | | 1,422,522 | | |

| Oracle Corp. | | | 20,800 | | | | 534,352 | | |

| Sybase, Inc. (a) | | | 1,200 | | | | 55,944 | | |

| Symantec Corp. (a) | | | 2,900 | | | | 49,068 | | |

| VMware, Inc., Class A (a) | | | 1,600 | | | | 85,280 | | |

| Software Total | | | 2,242,936 | | |

| Information Technology Total | | | 11,158,592 | | |

See Accompanying Notes to Financial Statements.

11

Columbia Asset Allocation Fund II

March 31, 2010

| Common Stocks (continued) | |

| | | Shares | | Value ($) | |

| Materials – 2.4% | |

| Chemicals – 1.7% | |

| Ashland, Inc. | | | 5,700 | | | | 300,789 | | |

| Cabot Corp. | | | 7,500 | | | | 228,000 | | |

| CF Industries Holdings, Inc. | | | 200 | | | | 18,236 | | |

| Eastman Chemical Co. | | | 7,400 | | | | 471,232 | | |

| Lubrizol Corp. | | | 4,000 | | | | 366,880 | | |

| PPG Industries, Inc. | | | 4,500 | | | | 294,300 | | |

| Chemicals Total | | | 1,679,437 | | |

| Metals & Mining – 0.3% | |

| Cliffs Natural Resources, Inc. | | | 200 | | | | 14,190 | | |

Freeport-McMoRan Copper &

Gold, Inc. | | | 3,100 | | | | 258,974 | | |

| Metals & Mining Total | | | 273,164 | | |

| Paper & Forest Products – 0.4% | |

| International Paper Co. | | | 18,100 | | | | 445,441 | | |

| Paper & Forest Products Total | | | 445,441 | | |

| Materials Total | | | 2,398,042 | | |

| Telecommunication Services – 1.8% | |

| Diversified Telecommunication Services – 1.7% | |

| AT&T, Inc. | | | 28,800 | | | | 744,192 | | |

Qwest Communications

International, Inc. | | | 57,600 | | | | 300,672 | | |

| Verizon Communications, Inc. | | | 19,100 | | | | 592,482 | | |

| Diversified Telecommunication Services Total | | | 1,637,346 | | |

| Wireless Telecommunication Services – 0.1% | |

| Sprint Nextel Corp. (a) | | | 34,400 | | | | 130,720 | | |

| Wireless Telecommunication Services Total | | | 130,720 | | |

| Telecommunication Services Total | | | 1,768,066 | | |

| Utilities – 2.1% | |

| Electric Utilities – 0.8% | |

| DPL, Inc. | | | 5,600 | | | | 152,264 | | |

| Edison International | | | 4,000 | | | | 136,680 | | |

| Entergy Corp. | | | 1,000 | | | | 81,350 | | |

| Exelon Corp. | | | 3,400 | | | | 148,954 | | |

| FirstEnergy Corp. | | | 4,200 | | | | 164,178 | | |

| Pinnacle West Capital Corp. | | | 3,200 | | | | 120,736 | | |

| Electric Utilities Total | | | 804,162 | | |

| Gas Utilities – 0.5% | |

| Energen Corp. | | | 400 | | | | 18,612 | | |

| Questar Corp. | | | 10,900 | | | | 470,880 | | |

| UGI Corp. | | | 500 | | | | 13,270 | | |

| Gas Utilities Total | | | 502,762 | | |

| | | Shares | | Value ($) | |

| Independent Power Producers & Energy Traders – 0.2% | |

| AES Corp. (a) | | | 18,600 | | | | 204,600 | | |

| Mirant Corp. (a) | | | 700 | | | | 7,602 | | |

Independent Power Producers &

Energy Traders Total | | | 212,202 | | |

| Multi-Utilities – 0.6% | |

| DTE Energy Co. | | | 1,000 | | | | 44,600 | | |

| MDU Resources Group, Inc. | | | 3,900 | | | | 84,162 | | |

| NiSource, Inc. | | | 3,900 | | | | 61,620 | | |

| PG&E Corp. | | | 600 | | | | 25,452 | | |

Public Service Enterprise

Group, Inc. | | | 11,800 | | | | 348,336 | | |

| Multi-Utilities Total | | | 564,170 | | |

| Utilities Total | | | 2,083,296 | | |

Total Common Stocks

(cost of $44,726,514) | | | 59,512,784 | | |

| Corporate Fixed-Income Bonds & Notes – 11.0% | |

| | | Par ($) | | | |

| Basic Materials – 0.4% | |

| Chemicals – 0.1% | |

| EI Du Pont de Nemours & Co. | |

| 5.000% 07/15/13 | | | 85,000 | | | | 92,049 | | |

| Chemicals Total | | | 92,049 | | |

| Iron/Steel – 0.2% | |

| ArcelorMittal USA, Inc. | |

| 6.500% 04/15/14 | | | 100,000 | | | | 108,396 | | |

| Nucor Corp. | |

| 5.850% 06/01/18 | | | 100,000 | | | | 108,553 | | |

| Iron/Steel Total | | | 216,949 | | |

| Metals & Mining – 0.1% | |

| Vale Overseas Ltd. | |

| 6.250% 01/23/17 | | | 125,000 | | | | 135,524 | | |

| Metals & Mining Total | | | 135,524 | | |

| Basic Materials Total | | | 444,522 | | |

| Communications – 1.5% | |

| Media – 0.5% | |

| Comcast Cable Holdings LLC | |

| 9.875% 06/15/22 | | | 51,000 | | | | 67,225 | | |

| Comcast Corp. | |

| 7.050% 03/15/33 | | | 100,000 | | | | 107,543 | | |

| News America, Inc. | |

| 6.550% 03/15/33 | | | 125,000 | | | | 126,833 | | |

See Accompanying Notes to Financial Statements.

12

Columbia Asset Allocation Fund II

March 31, 2010

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | Par ($) | | Value ($) | |

| Time Warner, Inc. | |

| 6.200% 03/15/40 | | | 160,000 | | | | 157,955 | | |

| Viacom, Inc. | |

| 6.125% 10/05/17 | | | 60,000 | | | | 64,866 | | |

| Media Total | | | 524,422 | | |

| Telecommunication Services – 1.0% | |

| America Movil SAB de CV | |

| 5.625% 11/15/17 | | | 115,000 | | | | 121,484 | | |

| AT&T, Inc. | |

| 4.950% 01/15/13 | | | 150,000 | | | | 161,129 | | |

| British Telecommunications PLC | |

| 5.150% 01/15/13 | | | 125,000 | | | | 132,171 | | |

| Cellco Partnership/Verizon Wireless Capital LLC | |

| 5.550% 02/01/14 | | | 130,000 | | | | 142,069 | | |

| New Cingular Wireless Services, Inc. | |

| 8.750% 03/01/31 | | | 62,000 | | | | 80,055 | | |

| Telefonica Emisiones SAU | |

| 0.580% 02/04/13 (05/04/10) (b)(c) | | | 200,000 | | | | 195,652 | | |

| Vodafone Group PLC | |

| 5.750% 03/15/16 | | | 100,000 | | | | 109,116 | | |

| Telecommunication Services Total | | | 941,676 | | |

| Communications Total | | | 1,466,098 | | |

| Consumer Cyclical – 0.3% | |

| Retail – 0.3% | |

| CVS Pass-Through Trust | |

| 7.507% 01/10/32 (d) | | | 154,676 | | | | 172,003 | | |

| Wal-Mart Stores, Inc. | |

| 5.800% 02/15/18 | | | 100,000 | | | | 111,600 | | |

| Retail Total | | | 283,603 | | |

| Consumer Cyclical Total | | | 283,603 | | |

| Consumer Non-Cyclical – 1.3% | |

| Beverages – 0.6% | |

| Anheuser-Busch InBev Worldwide, Inc. | |

| 2.500% 03/26/13 (d) | | | 125,000 | | | | 125,241 | | |

| Bottling Group LLC | |

| 6.950% 03/15/14 | | | 150,000 | | | | 173,656 | | |

| Diageo Capital PLC | |

| 5.750% 10/23/17 | | | 150,000 | | | | 162,524 | | |

| Miller Brewing Co. | |

| 5.500% 08/15/13 (d) | | | 120,000 | | | | 128,478 | | |

| Beverages Total | | | 589,899 | | |

| Food – 0.3% | |

| Campbell Soup Co. | |

| 4.500% 02/15/19 | | | 60,000 | | | | 61,051 | | |

| | | Par ($) | | Value ($) | |

| ConAgra Foods, Inc. | |

| 5.875% 04/15/14 | | | 115,000 | | | | 126,257 | | |

| Kraft Foods, Inc. | |

| 5.375% 02/10/20 | | | 125,000 | | | | 127,044 | | |

| Food Total | | | 314,352 | | |

| Healthcare Services – 0.2% | |

| Roche Holdings, Inc. | |

| 6.000% 03/01/19 (d) | | | 150,000 | | | | 165,769 | | |

| Healthcare Services Total | | | 165,769 | | |

| Pharmaceuticals – 0.2% | |

| Express Scripts, Inc. | |

| 5.250% 06/15/12 | | | 80,000 | | | | 85,300 | | |

| Wyeth | |

| 5.500% 02/01/14 | | | 150,000 | | | | 165,473 | | |

| Pharmaceuticals Total | | | 250,773 | | |

| Consumer Non-Cyclical Total | | | 1,320,793 | | |

| Energy – 1.2% | |

| Oil & Gas – 0.5% | |

| Canadian Natural Resources Ltd. | |

| 5.700% 05/15/17 | | | 75,000 | | | | 80,030 | | |

| Chevron Corp. | |

| 4.950% 03/03/19 | | | 125,000 | | | | 132,093 | | |

| Nexen, Inc. | |

| 5.875% 03/10/35 | | | 150,000 | | | | 142,624 | | |

| Talisman Energy, Inc. | |

| 6.250% 02/01/38 | | | 110,000 | | | | 111,932 | | |

| Oil & Gas Total | | | 466,679 | | |

| Oil & Gas Services – 0.2% | |

| Halliburton Co. | |

| 5.900% 09/15/18 | | | 75,000 | | | | 82,415 | | |

| Weatherford International Ltd. | |

| 5.150% 03/15/13 | | | 100,000 | | | | 106,258 | | |

| Oil & Gas Services Total | | | 188,673 | | |

| Pipelines – 0.5% | |

| Enterprise Products Operating LLC | |

| 4.600% 08/01/12 | | | 70,000 | | | | 73,838 | | |

| Plains All American Pipeline LP/PAA Finance Corp. | |

| 6.650% 01/15/37 | | | 140,000 | | | | 145,172 | | |

| TransCanada Pipelines Ltd. | |

| 6.350% 05/15/67 (05/15/17) (b)(c) | | | 185,000 | | | | 176,026 | | |

| Williams Partners LP | |

| 6.300% 04/15/40 (d) | | | 100,000 | | | | 99,371 | | |

| Pipelines Total | | | 494,407 | | |

| Energy Total | | | 1,149,759 | | |

See Accompanying Notes to Financial Statements.

13

Columbia Asset Allocation Fund II

March 31, 2010

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | Par ($) | | Value ($) | |

| Financials – 4.5% | |

| Banks – 2.9% | |

| ANZ National International Ltd. | |

| 6.200% 07/19/13 (d) | | | 100,000 | | | | 110,205 | | |

| Bank of New York Mellon Corp. | |

| 5.125% 08/27/13 | | | 160,000 | | | | 174,609 | | |

| Barclays Bank PLC | |

| 6.750% 05/22/19 | | | 175,000 | | | | 193,601 | | |

| Bear Stearns Cos. LLC | |

| 7.250% 02/01/18 | | | 275,000 | | | | 317,784 | | |

| Capital One Financial Corp. | |

| 5.500% 06/01/15 | | | 125,000 | | | | 131,441 | | |

| Citigroup, Inc. | |

| 6.125% 05/15/18 | | | 215,000 | | | | 219,685 | | |

| Commonwealth Bank of Australia | |

| 3.750% 10/15/14 (d) | | | 190,000 | | | | 192,607 | | |

| Credit Suisse/New York NY | |

| 6.000% 02/15/18 | | | 100,000 | | | | 105,878 | | |

| Deutsche Bank AG London | |

| 4.875% 05/20/13 | | | 150,000 | | | | 160,744 | | |

| Goldman Sachs Group, Inc. | |

| 5.350% 01/15/16 | | | 110,000 | | | | 115,877 | | |

| Keycorp | |

| 6.500% 05/14/13 | | | 130,000 | | | | 138,828 | | |

| Merrill Lynch & Co., Inc. | |

| 6.050% 08/15/12 (e) | | | 200,000 | | | | 213,601 | | |

| Morgan Stanley | |

| 6.625% 04/01/18 | | | 125,000 | | | | 133,322 | | |

| Rabobank Nederland NV | |

| 4.750% 01/15/20 (d) | | | 200,000 | | | | 199,785 | | |

| U.S. Bank N.A. | |

| 6.300% 02/04/14 | | | 250,000 | | | | 278,804 | | |

| Wachovia Corp. | |

| 4.875% 02/15/14 | | | 150,000 | | | | 155,395 | | |

| Banks Total | | | 2,842,166 | | |

| Diversified Financial Services – 0.4% | |

| Ameriprise Financial, Inc. | |

| 7.300% 06/28/19 | | | 100,000 | | | | 115,865 | | |

| General Electric Capital Corp. | |

| 5.000% 01/08/16 | | | 225,000 | | | | 235,973 | | |

| Lehman Brothers Holdings, Inc. | |

| 5.750% 07/18/11 (f)(g) | | | 150,000 | | | | 35,437 | | |

| Diversified Financial Services Total | | | 387,275 | | |

| Insurance – 1.0% | |

| Chubb Corp. | |

| 5.750% 05/15/18 | | | 50,000 | | | | 54,059 | | |

| | | Par ($) | | Value ($) | |

| CNA Financial Corp. | |

| 5.850% 12/15/14 | | | 40,000 | | | | 40,702 | | |

| 7.350% 11/15/19 | | | 60,000 | | | | 62,708 | | |

| Lincoln National Corp. | |

| 8.750% 07/01/19 | | | 115,000 | | | | 140,619 | | |

| MetLife, Inc. | |

| 6.817% 08/15/18 | | | 150,000 | | | | 166,394 | | |

| Principal Life Income Funding Trusts | |

| 5.300% 04/24/13 | | | 125,000 | | | | 134,182 | | |

| Prudential Financial, Inc. | |

| 6.100% 06/15/17 | | | 100,000 | | | | 105,757 | | |

| Transatlantic Holdings, Inc. | |

| 8.000% 11/30/39 | | | 145,000 | | | | 148,191 | | |

| UnitedHealth Group, Inc. | |

| 5.250% 03/15/11 | | | 115,000 | | | | 119,417 | | |

| Insurance Total | | | 972,029 | | |

| Real Estate Investment Trusts (REITs) – 0.2% | |

| Duke Realty LP | |

| 8.250% 08/15/19 | | | 125,000 | | | | 139,411 | | |

| ERP Operating LP | |

| 5.200% 04/01/13 | | | 16,000 | | | | 16,607 | | |

| Simon Property Group LP | |

| 6.750% 02/01/40 | | | 80,000 | | | | 79,581 | | |

| Real Estate Investment Trusts (REITs) Total | | | 235,599 | | |

| Financials Total | | | 4,437,069 | | |

| Industrials – 0.6% | |

| Aerospace & Defense – 0.1% | |

| United Technologies Corp. | |

| 5.375% 12/15/17 | | | 120,000 | | | | 129,428 | | |

| Aerospace & Defense Total | | | 129,428 | | |

| Miscellaneous Manufacturing – 0.3% | |

| Ingersoll Rand Global Holding Co., Ltd. | |

| 9.500% 04/15/14 | | | 100,000 | | | | 121,254 | | |

| Tyco International Ltd./Tyco International Finance SA | |

| 7.000% 12/15/19 | | | 120,000 | | | | 137,718 | | |

| Miscellaneous Manufacturing Total | | | 258,972 | | |

| Transportation – 0.2% | |

| Burlington Northern Santa Fe Corp. | |

| 6.200% 08/15/36 | | | 75,000 | | | | 77,168 | | |

| Norfolk Southern Corp. | |

| 5.750% 04/01/18 | | | 100,000 | | | | 107,337 | | |

| Transportation Total | | | 184,505 | | |

| Industrials Total | | | 572,905 | | |

See Accompanying Notes to Financial Statements.

14

Columbia Asset Allocation Fund II

March 31, 2010

| Corporate Fixed-Income Bonds & Notes (continued) | |

| | | Par ($) | | Value ($) | |

| Technology – 0.2% | |

| Networking Products – 0.1% | |

| Cisco Systems, Inc. | |

| 4.950% 02/15/19 | | | 125,000 | | | | 129,992 | | |

| Networking Products Total | | | 129,992 | | |

| Software – 0.1% | |

| Oracle Corp. | |

| 6.500% 04/15/38 | | | 100,000 | | | | 110,378 | | |

| Software Total | | | 110,378 | | |

| Technology Total | | | 240,370 | | |

| Utilities – 1.0% | |

| Electric – 0.8% | |

| Commonwealth Edison Co. | |

| 5.950% 08/15/16 | | | 75,000 | | | | 82,209 | | |

| Consolidated Edison Co. of New York | |

| 5.850% 04/01/18 | | | 100,000 | | | | 109,443 | | |

| Dominion Resources, Inc. | |

| 5.200% 08/15/19 | | | 115,000 | | | | 117,705 | | |

| Indiana Michigan Power Co. | |

| 5.650% 12/01/15 | | | 100,000 | | | | 106,653 | | |

| NY State Electric & Gas Corp. | |

| 5.750% 05/01/23 | | | 18,000 | | | | 17,543 | | |

| Pacific Gas & Electric Co. | |

| 5.800% 03/01/37 | | | 100,000 | | | | 99,226 | | |

| Progress Energy, Inc. | |

| 7.750% 03/01/31 | | | 100,000 | | | | 117,922 | | |

| Southern California Edison Co. | |

| 5.000% 01/15/14 | | | 125,000 | | | | 134,968 | | |

| Electric Total | | | 785,669 | | |

| Gas – 0.2% | |

| Atmos Energy Corp. | |

| 6.350% 06/15/17 | | | 110,000 | | | | 118,298 | | |

| Sempra Energy | |

| 6.500% 06/01/16 | | | 105,000 | | | | 117,304 | | |

| Gas Total | | | 235,602 | | |

| Utilities Total | | | 1,021,271 | | |

Total Corporate Fixed-Income Bonds & Notes

(cost of $10,525,255) | | | 10,936,390 | | |

| Government & Agency Obligations – 10.8% | |

| Foreign Government Obligations – 0.6% | |

| Province of Ontario | |

| 5.450% 04/27/16 | | | 225,000 | | | | 247,986 | | |

| Province of Quebec | |

| 4.625% 05/14/18 | | | 190,000 | | | | 198,278 | | |

| | | Par ($) | | Value ($) | |

| United Mexican States | |

| 7.500% 04/08/33 | | | 151,000 | | | | 180,068 | | |

| Foreign Government Obligations Total | | | 626,332 | | |

| U.S. Government Agencies – 1.1% | |

| Federal Home Loan Mortgage Corp. | |

| 3.125% 10/25/10 (h) | | | 45,000 | | | | 45,660 | | |

| 5.500% 08/23/17 | | | 460,000 | | | | 513,897 | | |

| Federal National Mortgage Association | |

| 2.500% 05/15/14 | | | 475,000 | | | | 477,702 | | |

| U.S. Government Agencies Total | | | 1,037,259 | | |

| U.S. Government Obligations – 9.1% | |

| U.S. Treasury Bond | |

| 5.375% 02/15/31 | | | 2,351,000 | | | | 2,600,794 | | |

| U.S. Treasury Inflation Indexed Notes | |

| 3.000% 07/15/12 | | | 723,012 | | | | 778,820 | | |

| U.S. Treasury Notes | |

| 0.875% 05/31/11 | | | 635,000 | | | | 637,729 | | |

| 1.375% 10/15/12 | | | 600,000 | | | | 600,750 | | |

| 2.375% 10/31/14 | | | 2,660,000 | | | | 2,656,467 | | |

| 2.375% 02/28/15 | | | 1,800,000 | | | | 1,787,634 | | |

| U.S. Government Obligations Total | | | 9,062,194 | | |

Total Government & Agency Obligations

(cost of $10,657,881) | | | 10,725,785 | | |

| Mortgage-Backed Securities – 10.0% | |

| Federal Home Loan Mortgage Corp. | |

| 4.500% 12/01/39 | | | 595,081 | | | | 597,109 | | |

| 4.500% 01/01/40 | | | 357,551 | | | | 358,769 | | |

| 5.000% 05/01/39 | | | 242,174 | | | | 250,367 | | |

| 5.000% 07/01/39 | | | 675,549 | | | | 698,403 | | |

| 5.500% 01/01/21 | | | 91,864 | | | | 98,924 | | |

| 5.500% 07/01/21 | | | 63,974 | | | | 68,690 | | |

| 6.000% 12/01/37 | | | 822,270 | | | | 883,696 | | |

| 6.500% 07/01/29 | | | 111,744 | | | | 123,339 | | |

| 6.500% 10/01/37 | | | 231,300 | | | | 251,831 | | |

| 8.000% 09/01/25 | | | 25,131 | | | | 28,989 | | |

| Federal National Mortgage Association | |

3.199% 08/01/36

(04/01/10) (b)(c) | | | 21,957 | | | | 22,794 | | |

| 4.000% 01/01/25 | | | 749,122 | | | | 761,199 | | |

| 5.000% 10/01/20 | | | 226,967 | | | | 241,500 | | |

| 5.500% 04/01/36 | | | 117,333 | | | | 123,862 | | |

| 5.500% 11/01/36 | | | 157,014 | | | | 165,750 | | |

| 5.500% 02/01/37 | | | 238,144 | | | | 251,269 | | |

| 5.500% 03/01/37 | | | 555,000 | | | | 585,880 | | |

See Accompanying Notes to Financial Statements.

15

Columbia Asset Allocation Fund II

March 31, 2010

| Mortgage-Backed Securities (continued) | |

| | | Par ($) | | Value ($) | |

| 5.500% 05/01/37 | | | 27,151 | | | | 28,647 | | |

| 6.000% 04/01/36 | | | 122,512 | | | | 130,764 | | |

| 6.000% 06/01/36 | | | 232,198 | | | | 247,838 | | |

| 6.000% 10/01/36 | | | 441,760 | | | | 471,517 | | |

| 6.000% 11/01/36 | | | 13,351 | | | | 14,250 | | |

| 6.500% 09/01/34 | | | 8,115 | | | | 8,915 | | |

| 6.500% 01/01/37 | | | 1,624 | | | | 1,765 | | |

| 7.500% 10/01/11 | | | 11,434 | | | | 11,970 | | |

| 8.500% 08/01/11 | | | 5,151 | | | | 5,271 | | |

| 10.000% 09/01/18 | | | 36,874 | | | | 41,559 | | |

| TBA: | |

| 5.500% 04/01/40 (i) | | | 475,000 | | | | 500,605 | | |

| 6.000% 04/01/40 (i) | | | 475,000 | | | | 504,539 | | |

| Government National Mortgage Association | |

| 4.500% 04/15/39 | | | 586,284 | | | | 594,431 | | |

| 5.000% 04/15/39 | | | 1,098,092 | | | | 1,143,920 | | |

| 5.500% 02/15/37 | | | 70,123 | | | | 74,350 | | |

| 5.500% 09/15/39 | | | 535,886 | | | | 568,125 | | |

| 7.500% 12/15/23 | | | 16,404 | | | | 18,516 | | |

Total Mortgage-Backed Securities

(cost of $9,670,659) | | | 9,879,353 | | |

| Commercial Mortgage-Backed Securities – 5.0% | |

| Bear Stearns Commercial Mortgage Securities | |

5.456% 03/11/39

(04/01/10) (b)(c) | | | 400,000 | | | | 427,805 | | |

5.694% 09/11/38

(04/01/10) (b)(c) | | | 152,000 | | | | 163,594 | | |

| CS First Boston Mortgage Securities Corp. | |

5.065% 08/15/38

(04/01/10) (b)(c) | | | 300,000 | | | | 312,431 | | |

| GE Capital Commercial Mortgage Corp. | |

| 4.819% 01/10/38 | | | 150,000 | | | | 156,857 | | |

| JPMorgan Chase Commercial Mortgage Securities Corp. | |

| 4.529% 01/12/37 | | | 750,000 | | | | 761,858 | | |

| 4.659% 07/15/42 | | | 482,827 | | | | 499,967 | | |

5.201% 08/12/37

(04/01/10) (b)(c) | | | 218,547 | | | | 228,071 | | |

| 5.440% 06/12/47 | | | 400,000 | | | | 390,958 | | |

| 5.447% 05/15/45 | | | 180,000 | | | | 181,734 | | |

| 5.447% 06/12/47 | | | 287,000 | | | | 293,861 | | |

5.506% 12/12/44

(04/01/10) (b)(c) | | | 315,000 | | | | 332,820 | | |

| LB-UBS Commercial Mortgage Trust | |

| 5.403% 02/15/40 | | | 320,000 | | | | 326,481 | | |

| Merrill Lynch Mortgage Investors, Inc. | |

| I.O., | |

0.300% 12/15/30

(04/01/10) (b)(c) | | | 1,551,450 | | | | 32,131 | | |

| Morgan Stanley Capital I | |

| 5.325% 12/15/43 | | | 380,000 | | | | 402,448 | | |

| | | Par ($) | | Value ($) | |

| Wachovia Bank Commercial Mortgage Trust | |

5.090% 07/15/42

(04/01/10) (b)(c) | | | 470,000 | | | | 491,237 | | |

Total Commercial Mortgage-Backed Securities

(cost of $4,821,722) | | | 5,002,253 | | |

| Collateralized Mortgage Obligations – 2.0% | |

| Agency – 0.7% | |

| Federal Home Loan Mortgage Corp. | |

| 5.500% 09/15/33 | | | 180,000 | | | | 192,044 | | |

| Federal National Mortgage Association | |

| 5.500% 08/25/17 | | | 191,157 | | | | 203,715 | | |

| 6.000% 04/25/17 | | | 158,625 | | | | 170,711 | | |

| 7.000% 01/25/21 | | | 17,720 | | | | 19,640 | | |

| Vendee Mortgage Trust | |

| I.O.: | |

0.301% 03/15/29

(04/01/10) (b)(c) | | | 6,061,677 | | | | 58,767 | | |

0.437% 03/15/28

(04/01/10) (b)(c) | | | 4,164,132 | | | | 42,992 | | |

| Agency Total | | | 687,869 | | |

| Non-Agency – 1.3% | |

| Countrywide Alternative Loan Trust | |

| 5.500% 10/25/35 | | | 826,744 | | | | 685,175 | | |

Washington Mutual Alternative Mortgage

Pass-Through Certificates | |

| 5.500% 10/25/35 | | | 673,106 | | | | 576,037 | | |

| Non-Agency Total | | | 1,261,212 | | |

Total Collateralized Mortgage Obligations

(cost of $2,074,062) | | | 1,949,081 | | |