UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-09645 |

|

Columbia Funds Series Trust |

(Exact name of registrant as specified in charter) |

|

225 Franklin Street, Boston, Massachusetts | | 02110 |

(Address of principal executive offices) | | (Zip code) |

|

Scott R. Plummer 5228 Ameriprise Financial Center Minneapolis, MN 55474 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-612-671-1947 | |

|

Date of fiscal year end: | January 31 | |

|

Date of reporting period: | January 31, 2012 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia Masters International Equity Portfolio

Annual Report for the Period Ended January 31, 2012

Not FDIC insured • No bank guarantee • May lose value

Table of Contents

| Portfolio Profile | | | 1 | | |

|

| Performance Information | | | 2 | | |

|

| Understanding Your Expenses | | | 3 | | |

|

| Portfolio Manager's Report | | | 4 | | |

|

| Portfolio of Investments | | | 6 | | |

|

Statement of Assets and

Liabilities | | | 9 | | |

|

| Statement of Operations | | | 11 | | |

|

Statement of Changes in

Net Assets | | | 12 | | |

|

| Financial Highlights | | | 14 | | |

|

| Notes to Financial Statements | | | 19 | | |

|

Report of Independent Registered

Public Accounting Firm | | | 28 | | |

|

| Federal Income Tax Information | | | 29 | | |

|

| Fund Governance | | | 30 | | |

|

Important Information About

This Report | | | 37 | | |

|

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific securities should not be construed as a recommendation or investment advice.

President's Message

Dear Shareholders,

Americans were dispirited in the fourth quarter of 2011 by Washington's inability to reach a plan for deficit reduction and Europe's piecemeal attempt to address its own fiscal issues. Yet, there was sufficient good news to encourage risk taking, buoying both stocks and bonds to solid gains.

U.S. economic data surprised on the upside and fears of recession abated. With the bar of expectations set low, investors responded positively to the announcement that the economy had expanded by 1.8% in the third quarter. Consumer confidence improved, even though consumers remain under pressure with no real increase in disposable income and a continued decline in household net worth. Headline inflation—which tracks a broad range of consumer expenditures, including food and energy—declined. Even manufacturing held its ground.

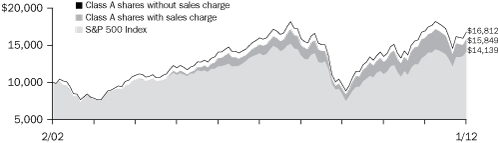

Against this backdrop, the U.S. equity markets logged solid returns. The S&P 500 Index gained 11.82%, moving into positive territory for the year with quarterly advances in all ten sectors. Mid- and small-cap stocks did even better. Value outperformed growth across all market capitalizations. Energy stocks led the market, as the price of oil moved above $100 a barrel in December. Industrials and materials stocks rose, buoyed by improving economic data. The U.S. fixed-income markets logged modest but solid returns. High-yield bonds were the best performers as the economy showed signs of improvement. Emerging market bonds were strong performers, as inflation came under control in key regions. Municipal bonds and Treasuries eked out only modest gains, as investors moved away from quality in favor of riskier assets.

While fourth quarter gains were encouraging, challenges still remain. Columbia Management, however, remains strong and steadfast. Columbia Management is the eighth largest manager of long-term mutual fund assets with $326 billion under management as of December 31, 2011. The past year has been one of considerable change for the organization as we worked diligently to align products, services and resources in the integration of Columbia Management with RiverSource Investments. The strong line-up of talent, resources and capabilities that has resulted is highlighted by the success of our products. As of December 31, 2011, Columbia Management offers 52 funds rated either 4 or 5 stars by Morningstar.*

For more information about these and other funds offered by Columbia Management, including detailed, up-to-date fund performance and portfolio information, please visit us online at columbiamanagement.com. Other information and resources available on our website include:

g timely economic analysis and market commentary

g quarterly fund commentaries

g Columbia Management Investor, a quarterly newsletter for shareholders

Thank you for your continued support of the Columbia Funds. We look forward to serving your investment needs for many years to come.

Best Regards,

J. Kevin Connaughton

President, Columbia Funds

*All ratings are based on Class Z shares as of 12/31/2011. Out of 119 Class Z share Columbia funds rated by Morningstar, 7 funds received a 5-star Overall Rating and 45 funds received a 4-star Overall Rating. The Overall Morningstar Rating for a retail mutual fund is derived from a weighted average of the performance figures associated with its 3-, 5- and 10-year (if applicable) Morningstar Rating metrics. For share classes that do not have a 3-, 5-, or 10-year actual performance history, the fund's independent Morningstar Rating metric is then compared against the retail mutual fund universe breakpoints to determine its hypothetical rating.

For each fund with at least a three-year history, Morningstar calculates a Morningstar RatingTM based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund's monthly performance (including the effects of sales charges/loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.)

The Morningstar RatingTM is for Class Z shares only; other classes may have different performance characteristics and may have different ratings. ©2012 Morningstar, Inc. All Rights Reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus, which contains this and other important information about the funds, visit columbiamanagement.com. The prospectus should be read carefully before investing.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2012 Columbia Management Investment Advisers, LLC. All rights reserved.

Portfolio Profile – Columbia Masters International Equity Portfolio

Summary

g Effective January 31, 2012, the fiscal year end of Columbia Masters International Equity Portfolio was changed from March 31 to January 31.

g For the 10-month period that ended January 31, 2012, the portfolio's Class A shares returned –9.18% without sales charge.

g In a difficult period for the world's stock markets, the portfolio held up better than its benchmark, the MSCI EAFE Index1 (Net).

g Diversification across a broad range of markets and solid performance from underlying funds generally accounted for the portfolio's advantage against its benchmark.

Portfolio Management

Fred Copper has co-managed the portfolio since May 2010 and has been associated with the advisor or its predecessors since 2005.

Colin Moore has co-managed the portfolio since February 2009 and has been associated with the advisor or its predecessors since 2002.

1The Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE) Index (Net) is a free float-adjusted market capitalization Index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. As of December 2010, the MSCI EAFE Index (Net) consisted of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

Summary

10-month (cumulative) return

as of 01/31/12

| | | | –9.18% | |

|

|  | | | Class A shares

(without sales charge) | |

|

| | | | –10.47% | |

|

|  | | | MSCI EAFE Index (Net) | |

|

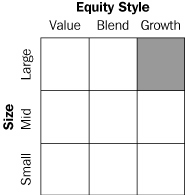

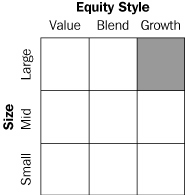

Morningstar Style BoxTM

The Morningstar Style BoxTM is based on the fund's portfolio holdings as of period end. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2012 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

1

Performance Information – Columbia Masters International Equity Portfolio

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

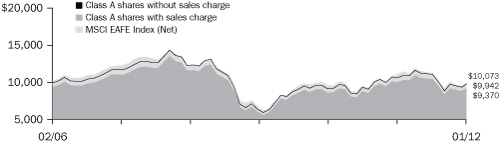

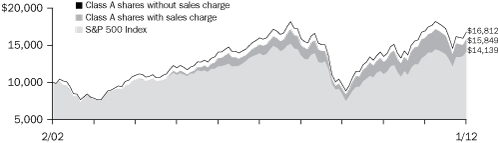

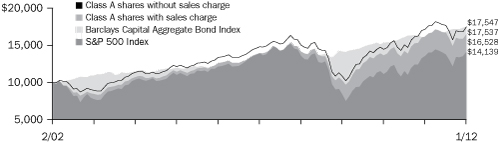

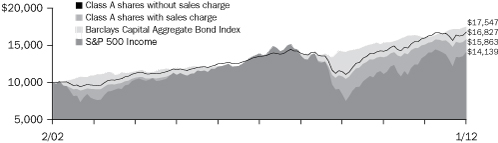

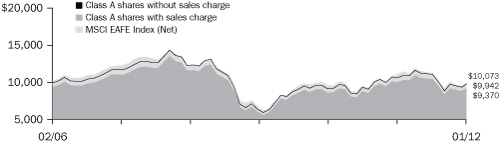

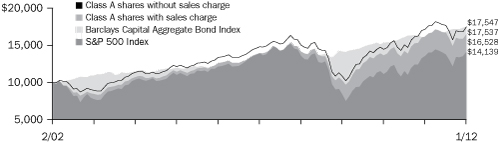

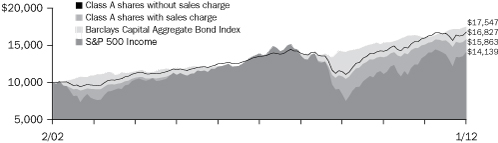

Performance of a $10,000 investment 02/15/06 – 01/31/12 ($)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Masters International Equity Portfolio during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

Performance of a $10,000 investment 02/15/06 – 01/31/12 ($)

| Sales charge | | without | | with | |

| Class A | | | 9,942 | | | | 9,370 | | |

| Class B | | | 9,510 | | | | 9,431 | | |

| Class C | | | 9,510 | | | | 9,510 | | |

| Class R | | | 9,779 | | | | n/a | | |

| Class Z | | | 10,085 | | | | n/a | | |

Average annual total return as of 01/31/12 (%)

| Share class | | A | | B | | C | | R | | Z | |

| Inception | | 02/15/06 | | 02/15/06 | | 02/15/06 | | 02/15/06 | | 02/15/06 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | without | |

| 10-mth | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (cumulative) | | | –9.18 | | | | –14.44 | | | | –9.86 | | | | –14.33 | | | | –9.75 | | | | –10.65 | | | | –9.36 | | | | –8.99 | | |

| 1-year | | | –6.84 | | | | –12.18 | | | | –7.65 | | | | –12.23 | | | | –7.54 | | | | –8.46 | | | | –7.14 | | | | –6.65 | | |

| 5-year | | | –3.38 | | | | –4.52 | | | | –4.12 | | | | –4.45 | | | | –4.10 | | | | –4.10 | | | | –3.65 | | | | –3.15 | | |

| Life | | | –0.10 | | | | –1.09 | | | | –0.84 | | | | –0.98 | | | | –0.84 | | | | –0.84 | | | | –0.37 | | | | 0.14 | | |

The "with sales charge" returns include the maximum initial sales charge of 5.75% for Class A shares, the applicable contingent deferred sales charge of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter for Class B shares and 1.00% for Class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any fee waivers or reimbursements of portfolio expenses by Columbia Management Investment Advisers, LLC (the Investment Manager) and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

All results shown assume the reinvestment of distributions. Class Z shares are sold at net asset value with no distribution and service (Rule 12b-1) fees. Class R shares are sold at net asset value with distribution (Rule 12b-1) fees. Class Z and Class R shares have limited eligibility and the investment minimum requirements may vary. Please see the portfolio's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

2

Understanding Your Expenses – Columbia Masters International Equity Portfolio

As an investor, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and service (Rule 12b-1) fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Portfolio during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the Portfolio's actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the Actual column. The amount listed in the "Hypothetical" column assumes a 5% annual rate of return before expenses (which is not the Portfolio's actual return) and then applies the Portfolio's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See "Compare with other funds" below for details on how to use the hypothetical data.

In addition to the ongoing expenses which the Portfolio bears directly, the Portfolio's shareholders indirectly bear the Portfolio's allocable share of the costs and expenses of each underlying fund in which the Portfolio invests. You can also estimate the effective expenses paid during the period, which includes the indirect fees associated with investing in the underlying funds, by using the amounts listed in the effective expenses paid during the period column.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Portfolio with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

August 1, 2011 – January 31, 2012

| | | Account value

at the beginning

of the period ($) | | Account value

at the end

of the period ($) | | Expenses

paid during

the period ($) | | Portfolio's

annualized

expense

ratio (%) | | Effective

expenses paid

during the

period ($) | | Portfolio's

effective

annualized

expense

ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 894.00 | | | | 1,024.21 | | | | 1.21 | | | | 1.29 | | | | 0.25 | % | | | 6.56 | | | | 7.01 | | | | 1.36 | % | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 890.30 | | | | 1,020.38 | | | | 4.82 | | | | 5.15 | | | | 1.00 | % | | | 10.16 | | | | 10.86 | | | | 2.11 | % | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 891.30 | | | | 1,020.38 | | | | 4.82 | | | | 5.15 | | | | 1.00 | % | | | 10.17 | | | | 10.86 | | | | 2.11 | % | |

| Class R | | | 1,000.00 | | | | 1,000.00 | | | | 892.10 | | | | 1,022.98 | | | | 2.36 | | | | 2.53 | | | | 0.49 | % | | | 7.71 | | | | 8.25 | | | | 1.60 | % | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 894.80 | | | | 1,025.48 | | | | — | | | | — | | | | 0.00 | % | | | 5.36 | | | | 5.73 | | | | 1.11 | % | |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Portfolio's most recent fiscal half year and divided by 365.

Expenses do not include fees and expenses incurred indirectly by the Portfolio from the underlying funds in which the Portfolio may invest (also referred to as "acquired funds"), including affiliated and non-affiliated pooled investments vehicles (including mutual funds and exchange traded funds).

Had Columbia Management Investment Advisers, LLC and/or any of its affiliates not waived/reimbursed a portion of fees and expenses, account value at the end of the period would have been reduced.

3

Portfolio Managers' Report – Columbia Masters International Equity Portfolio

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

Net asset value per share

as of 01/31/12 ($)

| Class A | | | 7.87 | | |

| Class B | | | 7.86 | | |

| Class C | | | 7.86 | | |

| Class R | | | 7.85 | | |

| Class Z | | | 7.87 | | |

Distributions declared per share

04/01/11 – 01/31/12 ($)

| Class A | | | 0.10 | | |

| Class B | | | 0.05 | | |

| Class C | | | 0.05 | | |

| Class R | | | 0.08 | | |

| Class Z | | | 0.11 | | |

For the 10-month period that ended January 31, 2012, the portfolio's Class A shares returned –9.18% without sales charge. In a period that was generally difficult for international stock markets, the portfolio held up better than its benchmark, the MSCI EAFE Index (Net), which returned –10.47% over the same period. The portfolio invests in shares of four Columbia funds: Columbia Acorn International, Columbia Emerging Markets Fund, Columbia Pacific/Asia Fund and Columbia European Equity Fund. We believe that the portfolio's diversification across regions and markets aided returns during this volatile period. In addition, solid performance from the portfolio's underlying funds helped cushion losses.

A volatile period for international stock markets

Fears of a global recession and continuing financial crisis plagued international stock markets throughout most of the 10-month period. In Europe, concerns were directly tied to sovereign debt issues in the peripheral countries of Greece, Italy, Spain, Portugal and Ireland. Markets also contended with lower expectations for global growth and inflation and monetary policy tightening in emerging markets. Concerns over inflation abated as the year progressed, but Europe's debt problems lingered. The combination of these factors led to a period of significant equity weakness and exceptional volatility. Yet, near the end of the period, there was sufficient good news to encourage some risk taking, buoying international stock markets in the final months of the period.

Underlying funds helped returns

Two of the four Columbia funds in the portfolio performed better than their individual benchmarks. Columbia European Equity Fund, which accounts for approximately 60% of the portfolio's assets, ended the period with close to a two percentage point advantage over its benchmark, the MSCI Europe Index (Net). The fund had less exposure than the index to Europe's troubled countries—Greece, Ireland and Italy, which helped minimize losses. Columbia Acorn International also held up better than its benchmarks, the S&P Global Ex-U.S. $500 million – $5 billion Index, the S&P Global Ex-U.S. Small Cap Index and the MSCI EAFE (Net). Notwithstanding the devastating Japanese tsunami and associated nuclear catastrophe in the spring of 2011, Japanese equities proved to be among the best performers for Columbia Acorn International. The fund's Japanese holdings fell less than 1% (in U.S.dollars), buoyed in part by an appreciating yen. Columbia Emerging Markets Fund and Columbia Pacific/Asia Fund generated returns that were generally in line with their benchmarks.

Looking ahead

We believe that several major catalysts will affect global risk and the opportunity for continued growth in international markets in 2012. In Europe, all eyes are on euro zone leaders to make real progress in solving the region's debt crisis. Until that occurs, we are reasonably cautious on Europe, given a backdrop of slower economic activity. In emerging markets, we see the potential for positive benefits from lower inflation and more favorable monetary policy. Central banks are beginning to ease policy in order to stimulate growth in domestic economies. Emerging market balance sheets are generally quite strong and should allow for further fiscal stimulus, if required, to boost

4

Portfolio Managers' Report (continued) – Columbia Masters International Equity Portfolio

growth. Favorable demographics and ongoing urbanization are also positive factors, especially in Asia. And finally, valuations are generally attractive in both developed foreign and emerging stock markets, which improves prospects for 2012.

Portfolio characteristics and holdings are subject to change periodically and may not be representative of current characteristics and holdings. The outlook for this portfolio may differ from that presented for other Columbia Funds.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns.

The portfolio is a "fund of funds."

A fund of funds bears its allocable share of the costs and expenses of the underlying funds in which it invests. Such funds are thus subject to two levels of fees and a potentially higher expense ratio than would be associated with an investment in an investment fund that invests and trades directly in financial instruments under the direction of a single manager. Risks, among others, include stock market fluctuations due to business and economic developments.

Stocks of small- and mid-cap companies may pose special risks, including possible illiquidity and greater price volatility than stocks of larger, more established companies.

Value stocks are stocks of companies that may have experienced adverse business or industry developments or may be subject to special risks that have caused the stocks to be out of favor. If the manager's assessment of a company's prospects is wrong, the price of its stock may not approach the value the manager has placed on it.

International investing involves special risks, including foreign taxation, currency risks, risks associated with possible differences in financial standards and other risks associated with future political and economic developments.

Investing in emerging markets may involve greater risks than investing in more developed countries. In addition, concentration of investments in a single region may result in greater volatility.

5

Portfolio of Investments – Columbia Masters International Equity Portfolio

January 31, 2012

(Percentages represent value of investments compared to net assets)

| | | Shares | | Value | |

| Equity Funds 100.2% | |

| International 100.2% | |

| Columbia Acorn International(a) | | | 88,499 | | | $ | 3,267,380 | | |

| Columbia Pacific/Asia Fund(a) | | | 2,072,677 | | | | 16,291,243 | | |

| Columbia Emerging Markets Fund(a)(b) | | | 672,136 | | | | 6,533,160 | | |

| Columbia European Equity Fund(a) | | | 7,121,503 | | | | 38,883,406 | | |

| Total | | | 64,975,189 | | |

Total Equity Funds

(Cost: $69,700,922) | | $ | 64,975,189 | | |

| | | Shares | | Value | |

| Money Market Funds —% | |

| Columbia Short-Term Cash Fund, 0.134%(a)(c) | | | 7 | | | $ | 7 | | |

Total Money Market Funds

(Cost: $7) | | | | | | $ | 7 | | |

Total Investments in Affiliated Funds

(Cost: $69,700,929) | | | | $ | 64,975,196 | | |

| Other Assets and Liabilities | | | | | | | (156,552 | ) | |

| Net Assets | | | | | | $ | 64,818,644 | | |

| Forward Foreign Currency Exchange Contracts Open at January 31, 2012 | |

| Counterparty | | Exchange Date | | Currency to be

Delivered | | Currency to be

Received | | Unrealized

Appreciation | | Unrealized

Depreciation | |

| HSBC Securities (USA), Inc. | | Feb. 10, 2012

| | | 6,290,000

(EUR) | | | | 8,055,623

(USD) | | | $ | —

| | | $ | (172,127

| ) | |

| Citigroup Global Markets, Inc. | | Feb. 10, 2012

| | | 382,448,000

(JPY) | | | | 4,981,444

(USD) | | | | —

| | | | (36,655

| ) | |

| Credit Suisse | | Feb. 10, 2012

| | | 4,051,000

(NZD) | | | | 3,259,374

(USD) | | | | —

| | | | (83,552

| ) | |

| Barclays Bank PLC | | Feb. 10, 2012

| | | 3,260,337

(USD) | | | | 3,118,000

(AUD) | | | | 47,019

| | | | —

| | |

| Goldman, Sachs & Co. | | Feb. 10, 2012

| | | 4,850,869

(USD) | | | | 28,999,000

(NOK) | | | | 90,349

| | | | —

| | |

| State Street Bank & Trust Company | | Feb. 10, 2012

| | | 8,086,883

(USD) | | | | 55,602,000

(SEK) | | | | 83,830

| | | | —

| | |

| Citigroup Global Markets, Inc. | | March 5, 2012

| | | 1,203,000

(BRL) | | | | 645,733

(USD) | | | | —

| | | | (37,261

| ) | |

| Citigroup Global Markets, Inc. | | March 5, 2012

| | | 842,000

(GBP) | | | | 1,303,374

(USD) | | | | —

| | | | (23,124

| ) | |

| Citigroup Global Markets, Inc. | | March 5, 2012

| | | 3,006,901,000

(IDR) | | | | 323,671

(USD) | | | | —

| | | | (9,810

| ) | |

| Citigroup Global Markets, Inc. | | March 5, 2012

| | | 35,052,000

(INR) | | | | 651,524

(USD) | | | | —

| | | | (51,955

| ) | |

| Citigroup Global Markets, Inc. | | March 5, 2012

| | | 3,010,120,000

(KRW) | | | | 2,592,696

(USD) | | | | —

| | | | (80,209

| ) | |

| Citigroup Global Markets, Inc. | | March 5, 2012

| | | 1,847,000

(MYR) | | | | 583,570

(USD) | | | | —

| | | | (22,209

| ) | |

| Citigroup Global Markets, Inc. | | March 5, 2012

| | | 14,275,000

(PHP) | | | | 322,351

(USD) | | | | —

| | | | (9,626

| ) | |

| Citigroup Global Markets, Inc. | | March 5, 2012

| | | 14,437,000

(THB) | | | | 453,994

(USD) | | | | —

| | | | (11,746

| ) | |

| Citigroup Global Markets, Inc. | | March 5, 2012

| | | 59,204,000

(TWD) | | | | 1,952,961

(USD) | | | | —

| | | | (48,944

| ) | |

| Citigroup Global Markets, Inc. | | March 5, 2012

| | | 4,287,000

(ZAR) | | | | 519,070

(USD) | | | | —

| | | | (26,503

| ) | |

| Citigroup Global Markets, Inc. | | March 5, 2012

| | | 2,907,329

(USD) | | | | 2,852,000

(AUD) | | | | 109,980

| | | | —

| | |

| Citigroup Global Markets, Inc. | | March 5, 2012

| | | 912,439

(USD) | | | | 867,000

(CHF) | | | | 29,845

| | | | —

| | |

| Citigroup Global Markets, Inc. | | March 5, 2012

| | | 219,085

(USD) | | | | 171,000

(EUR) | | | | 4,605

| | | | —

| | |

| Citigroup Global Markets, Inc. | | March 5, 2012

| | | 392,101

(USD) | | | | 1,509,000

(ILS) | | | | 10,598

| | | | —

| | |

| Citigroup Global Markets, Inc. | | March 5, 2012

| | | 6,998,899

(USD) | | | | 539,229,000

(JPY) | | | | 78,124

| | | | —

| | |

| Citigroup Global Markets, Inc. | | March 5, 2012

| | | 394,150

(USD) | | | | 2,296,000

(NOK) | | | | —

| | | | (3,290

| ) | |

| Citigroup Global Markets, Inc. | | March 5, 2012

| | | 519,205

(USD) | | | | 671,000

(SGD) | | | | 14,238

| | | | —

| | |

| Total | | | | | | | | $ | 468,588 | | | $ | (617,011 | ) | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

6

Columbia Masters International Equity Portfolio

January 31, 2012

Notes to Investments in Affiliated Funds

(a) Investment in affiliated mutual fund advised by Columbia Management Investment Advisers, LLC or one of its affiliates.

(b) Non-income producing.

(c) The rate shown is the seven-day current annualized yield at January 31, 2012.

Currency Legend

AUD Australian Dollar

BRL Brazilian Real

CHF Swiss Franc

EUR Euro

GBP Pound Sterling

IDR Indonesian Rupiah

ILS Israeli Shekel

INR Indian Rupee

JPY Japanese Yen

KRW Korean Won

MYR Malaysia Ringgits

NOK Norwegian Krone

NZD New Zealand Dollar

PHP Philippine Peso

SEK Swedish Krona

SGD Singapore Dollar

THB Thailand Baht

TWD Taiwan Dollar

USD US Dollar

ZAR South African Rand

Fair Value Measurements

Generally accepted accounting principles (GAAP) require disclosure regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or techniques. In addition, investments shall be disclosed by major category.

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund's assumptions about the information market participants would use in pricing an investment. An investment's level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset or liability's fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

• Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date (to include NAV for open-end mutual funds). Valuation adjustments are not applied to Level 1 investments.

• Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

• Level 3 — Valuations based on significant unobservable inputs (including the Fund's own assumptions and judgment in determining the fair value of investments).

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment's fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in a valuation model may include, but are not limited to, financial statement analysis, discount rates and estimated cash flows, and comparable company data.

The Accompanying Notes to Financial Statements are an integral part of this statement.

7

Columbia Masters International Equity Portfolio

January 31, 2012

Fair Value Measurements (continued)

The following table is a summary of the inputs used to value the Fund's investments as of January 31, 2012:

| | | Fair Value at January 31, 2012 | |

| Description | | Level 1

Quoted Prices

in Active

Markets for

Identical Assets(a) | | Level 2

Other

Significant

Observable

Inputs | | Level 3

Significant

Unobservable

Inputs | | Total | |

| Investments in Affilated Funds | | $ | 64,975,196 | | | $ | — | | | $ | — | | | $ | 64,975,196 | | |

| Total Investments in Affiliated Funds | | | 64,975,196 | | | | — | | | | — | | | | 64,975,196 | | |

| Derivatives(b) | |

Assets

Forward Foreign Currency Exchange Contracts | | | — | | | | 468,588 | | | | — | | | | 468,588 | | |

Liabilities

Forward Foreign Currency Exchange Contracts | | | — | | | | (617,011 | ) | | | — | | | | (617,011 | ) | |

| Total | | $ | 64,975,196 | | | $ | (148,423 | ) | | $ | — | | | $ | 64,826,773 | | |

(a) There were no significant transfers between Levels 1 and 2 during the period.

(b) Derivative instruments are valued at unrealized appreciation (depreciation).

The Accompanying Notes to Financial Statements are an integral part of this statement.

8

Statement of Assets and Liabilities – Columbia Masters International Equity Portfolio

January 31, 2012

| Assets | |

| Investments in affiliated funds, at value | |

| (identified cost $69,700,929) | | $ | 64,975,196 | | |

| Unrealized appreciation on forward foreign currency exchange contracts | | | 468,588 | | |

| Receivable for: | |

| Affiliated investments sold | | | 341,123 | | |

| Capital shares sold | | | 13,422 | | |

| Expense reimbursement due from Investment Manager | | | 1,179 | | |

| Prepaid expense | | | 3,177 | | |

| Total assets | | | 65,802,685 | | |

| Liabilities | |

| Unrealized depreciation on forward foreign currency exchange contracts | | | 617,011 | | |

| Payable for: | |

| Affiliated investments purchased | | | 125,568 | | |

| Capital shares purchased | | | 105,893 | | |

| Distribution and service fees | | | 377 | | |

| Transfer agent fees | | | 18,833 | | |

| Administration fees | | | 35 | | |

| Other expenses | | | 116,324 | | |

| Total liabilities | | | 984,041 | | |

| Net assets applicable to outstanding capital stock | | $ | 64,818,644 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

9

Statement of Assets and Liabilities (continued) – Columbia Masters International Equity Portfolio

January 31, 2012

| Represented by | |

| Paid-in capital | | $ | 161,130,430 | | |

| Undistributed net investment income | | | 450,752 | | |

| Accumulated net realized loss | | | (91,888,382 | ) | |

| Unrealized appreciation (depreciation) on: | |

| Affiliated investments | | | (4,725,733 | ) | |

| Forward foreign currency exchange contracts | | | (148,423 | ) | |

| Total — representing net assets applicable to outstanding capital stock | | $ | 64,818,644 | | |

| Net assets applicable to outstanding shares | |

| Class A | | $ | 25,068,647 | | |

| Class B | | $ | 2,027,502 | | |

| Class C | | $ | 5,485,859 | | |

| Class R | | $ | 49,182 | | |

| Class Z | | $ | 32,187,454 | | |

| Shares outstanding | |

| Class A | | | 3,187,039 | | |

| Class B | | | 257,846 | | |

| Class C | | | 698,360 | | |

| Class R | | | 6,264 | | |

| Class Z | | | 4,089,879 | | |

| Net asset value per share | |

| Class A(a) | | $ | 7.87 | | |

| Class B | | $ | 7.86 | | |

| Class C | | $ | 7.86 | | |

| Class R | | $ | 7.85 | | |

| Class Z | | $ | 7.87 | | |

(a) The maximum offering price per share for Class A is $8.35. The offering price is calculated by dividing the net asset value by 1.0 minus the maximum sales charge of 5.75%.

The Accompanying Notes to Financial Statements are an integral part of this statement.

10

Statement of Operations – Columbia Masters International Equity Portfolio

| | | Year ended

Jan. 31, 2012(a) | | Year ended

March 31, 2011 | |

| Net investment income | |

| Income: | |

| Dividend distributions from underlying affiliated funds | | $ | 886,815 | | | $ | 2,363,828 | | |

| Expenses: | |

| Distribution fees | |

| Class B | | | 15,778 | | | | 25,546 | | |

| Class C | | | 42,070 | | | | 70,263 | | |

| Class R | | | 110 | | | | 125 | | |

| Service fees | |

| Class B | | | 5,258 | | | | 8,511 | | |

| Class C | | | 14,024 | | | | 23,396 | | |

| Distribution and service fees — Class A | | | 67,829 | | | | 112,843 | | |

| Transfer agent fees | |

| Class A | | | 53,038 | | | | 67,594 | | |

| Class B | | | 4,093 | | | | 5,112 | | |

| Class C | | | 10,872 | | | | 13,973 | | |

| Class R | | | 42 | | | | 37 | | |

| Class Z | | | 70,744 | | | | 85,725 | | |

| Administration fees | | | 14,245 | | | | — | | |

| Compensation of board members | | | 9,636 | | | | 30,131 | | |

| Stockholders' meeting fees | | | 106 | | | | — | | |

| Pricing and bookkeeping fees | | | 509 | | | | 27,115 | | |

| Custodian fees | | | 5,858 | | | | 5,386 | | |

| Printing and postage fees | | | 57,197 | | | | 91,961 | | |

| Registration fees | | | 64,268 | | | | 63,004 | | |

| Professional fees | | | 60,648 | | | | 66,057 | | |

| Chief compliance officer expenses | | | 30 | | | | 1,096 | | |

| Other | | | 13,308 | | | | 6,753 | | |

| Total expenses | | | 509,663 | | | | 704,628 | | |

| Fees waived or expenses reimbursed by Investment Manager and its affiliates | | | (364,519 | ) | | | (463,944 | ) | |

| Expense reductions | | | (148 | ) | | | (1 | ) | |

| Total net expenses | | | 144,996 | | | | 240,683 | | |

| Net investment income | | | 741,819 | | | | 2,123,145 | | |

| Realized and unrealized gain (loss) — net | |

| Net realized gain (loss) on: | |

| Sales of underlying affiliated funds | | | (1,610,120 | ) | | | (32,550,340 | ) | |

| Capital gain distributions from underlying affiliated funds | | | 501,156 | | | | — | | |

| Forward foreign currency exchange contracts | | | 578,558 | | | | — | | |

| Net realized loss | | | (530,406 | ) | | | (32,550,340 | ) | |

| Net change in unrealized appreciation (depreciation) on: | |

| Investments — affiliated issuers | | | (9,300,064 | ) | | | 42,289,227 | | |

| Forward foreign currency exchange contracts | | | (148,423 | ) | | | — | | |

| Net change in unrealized appreciation (depreciation) | | | (9,448,487 | ) | | | 42,289,227 | | |

| Net realized and unrealized gain (loss) | | | (9,978,893 | ) | | | 9,738,887 | | |

| Net change in net assets resulting from operations | | $ | (9,237,074 | ) | | $ | 11,862,032 | | |

(a) For the period from April 1, 2011 to January 31, 2012.

The Accompanying Notes to Financial Statements are an integral part of this statement.

11

Statement of Changes in Net Assets – Columbia Masters International Equity Portfolio

| | | Year ended

Jan. 31, 2012(a) | | Year ended

March 31, 2011 | | Year ended

March 31, 2010 | |

| Operations | |

| Net investment income | | $ | 741,819 | | | $ | 2,123,145 | | | $ | 5,124,789 | | |

| Net realized loss | | | (530,406 | ) | | | (32,550,340 | ) | | | (22,127,081 | ) | |

| Net change in unrealized appreciation (depreciation) | | | (9,448,487 | ) | | | 42,289,227 | | | | 75,038,404 | | |

| Net increase (decrease) in net assets resulting from operations | | | (9,237,074 | ) | | | 11,862,032 | | | | 58,036,112 | | |

| Distributions to shareholders from: | |

| Net investment income | |

| Class A | | | (330,929 | ) | | | (2,202,252 | ) | | | (1,162,782 | ) | |

| Class B | | | (13,728 | ) | | | (124,341 | ) | | | (29,094 | ) | |

| Class C | | | (37,257 | ) | | | (338,096 | ) | | | (79,794 | ) | |

| Class R | | | (369 | ) | | | (1,323 | ) | | | (433 | ) | |

| Class Z | | | (487,342 | ) | | | (3,064,636 | ) | | | (1,875,064 | ) | |

| Total distributions to shareholders | | | (869,625 | ) | | | (5,730,648 | ) | | | (3,147,167 | ) | |

| Decrease in net assets from share transactions | | | (33,477,580 | ) | | | (34,562,344 | ) | | | (33,028,724 | ) | |

| Redemption fees | | | — | | | | — | | | | 938 | | |

| Total increase (decrease) in net assets | | | (43,584,279 | ) | | | (28,430,960 | ) | | | 21,861,159 | | |

| Net assets at beginning of year | | | 108,402,923 | | | | 136,833,883 | | | | 114,972,724 | | |

| Net assets at end of year | | $ | 64,818,644 | | | $ | 108,402,923 | | | $ | 136,833,883 | | |

| Undistributed net investment income | | $ | 450,752 | | | $ | — | | | $ | 3,552,388 | | |

(a) For the period from April 1, 2011 to January 31, 2012.

The Accompanying Notes to Financial Statements are an integral part of this statement.

12

Statement of Changes in Net Assets (continued) – Columbia Masters International Equity Portfolio

| | | Year ended Jan. 31, 2012(a) | | Year ended March 31, 2011 | | Year ended March 31, 2010 | |

| | | Shares | | Dollars ($) | | Shares | | Dollars ($) | | Shares | | Dollars ($) | |

| Capital stock activity | |

| Class A shares | |

| Subscriptions | | | 239,852 | | | | 1,967,901 | | | | 262,902 | | | | 2,132,786 | | | | 860,237 | | | | 6,474,067 | | |

| Distributions reinvested | | | 31,876 | | | | 235,242 | | | | 223,830 | | | | 1,698,913 | | | | 148,393 | | | | 1,091,724 | | |

| Redemptions | | | (1,782,769 | ) | | | (14,476,248 | ) | | | (2,218,381 | ) | | | (17,966,365 | ) | | | (2,688,107 | ) | | | (20,377,765 | ) | |

| Net decrease | | | (1,511,041 | ) | | | (12,273,105 | ) | | | (1,731,649 | ) | | | (14,134,666 | ) | | | (1,679,477 | ) | | | (12,811,974 | ) | |

| Class B shares | |

| Subscriptions | | | 3,611 | | | | 31,983 | | | | 8,062 | | | | 64,000 | | | | 45,790 | | | | 340,223 | | |

| Distributions reinvested | | | 953 | | | | 7,033 | | | | 12,356 | | | | 92,087 | | | | 3,423 | | | | 25,770 | | |

| Redemptions | | | (104,870 | ) | | | (855,978 | ) | | | (144,060 | ) | | | (1,173,513 | ) | | | (128,083 | ) | | | (968,770 | ) | |

| Net decrease | | | (100,306 | ) | | | (816,962 | ) | | | (123,642 | ) | | | (1,017,426 | ) | | | (78,870 | ) | | | (602,777 | ) | |

| Class C shares | |

| Subscriptions | | | 11,959 | | | | 96,428 | | | | 53,320 | | | | 427,667 | | | | 88,936 | | | | 682,997 | | |

| Distributions reinvested | | | 3,291 | | | | 24,258 | | | | 32,952 | | | | 249,551 | | | | 7,447 | | | | 56,125 | | |

| Redemptions | | | (342,370 | ) | | | (2,893,474 | ) | | | (343,277 | ) | | | (2,768,247 | ) | | | (489,572 | ) | | | (3,645,416 | ) | |

| Net decrease | | | (327,120 | ) | | | (2,772,788 | ) | | | (257,005 | ) | | | (2,091,029 | ) | | | (393,189 | ) | | | (2,906,294 | ) | |

| Class R shares | |

| Subscriptions | | | 4,508 | | | | 34,553 | | | | 1,589 | | | | 13,173 | | | | 3,559 | | | | 27,333 | | |

| Distributions reinvested | | | 48 | | | | 351 | | | | 99 | | | | 740 | | | | 58 | | | | 431 | | |

| Redemptions | | | (525 | ) | | | (1,227 | ) | | | (3,279 | ) | | | (26,273 | ) | | | (4,632 | ) | | | (35,426 | ) | |

| Net increase (decrease) | | | 4,031 | | | | 33,677 | | | | (1,591 | ) | | | (12,360 | ) | | | (1,015 | ) | | | (7,662 | ) | |

| Class Z shares | |

| Subscriptions | | | 145,916 | | | | 1,220,541 | | | | 616,761 | | | | 5,026,829 | | | | 1,509,342 | | | | 11,298,156 | | |

| Distributions reinvested | | | 5,503 | | | | 40,616 | | | | 22,151 | | | | 167,907 | | | | 14,075 | | | | 104,306 | | |

| Redemptions | | | (2,325,700 | ) | | | (18,909,559 | ) | | | (2,764,352 | ) | | | (22,501,599 | ) | | | (3,692,821 | ) | | | (28,102,479 | ) | |

| Net decrease | | | (2,174,281 | ) | | | (17,648,402 | ) | | | (2,125,440 | ) | | | (17,306,863 | ) | | | (2,169,404 | ) | | | (16,700,017 | ) | |

| Total net decrease | | | (4,108,717 | ) | | | (33,477,580 | ) | | | (4,239,327 | ) | | | (34,562,344 | ) | | | (4,321,955 | ) | | | (33,028,724 | ) | |

(a) For the period from April 1, 2011 to January 31, 2012.

The Accompanying Notes to Financial Statements are an integral part of this statement.

13

Financial Highlights – Columbia Masters International Equity Portfolio

The following tables are intended to help you understand the Portfolio's financial performance. Certain information reflects financial results for a single share of a class held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total returns assume reinvestment of all dividends and distributions. Total returns do not reflect payment of sales charges, if any, and are not annualized for periods of less than one year.

| | | Year ended

Jan. 31, | | Year ended March 31, | |

| | | 2012(a) | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

| Class A | |

| Per share data | |

| Net asset value, beginning of period | | $ | 8.78 | | | $ | 8.24 | | | $ | 5.49 | | | $ | 11.14 | | | $ | 11.69 | | | $ | 10.26 | | |

| Income from investment operations: | |

| Net investment income | | | 0.07 | | | | 0.15 | | | | 0.27 | | | | 0.05 | | | | 0.17 | | | | 0.15 | | |

| Net realized and unrealized gain (loss) | | | (0.88 | ) | | | 0.78 | | | | 2.64 | | | | (5.14 | ) | | | 0.11 | | | | 1.63 | | |

| Total from investment operations | | | (0.81 | ) | | | 0.93 | | | | 2.91 | | | | (5.09 | ) | | | 0.28 | | | | 1.78 | | |

| Less distributions to shareholders from: | |

| Net investment income | | | (0.10 | ) | | | (0.39 | ) | | | (0.16 | ) | | | — | | | | (0.13 | ) | | | (0.07 | ) | |

| Net realized gains | | | — | | | | — | | | | — | | | | (0.56 | ) | | | (0.70 | ) | | | (0.28 | ) | |

| Total distributions to shareholders | | | (0.10 | ) | | | (0.39 | ) | | | (0.16 | ) | | | (0.56 | ) | | | (0.83 | ) | | | (0.35 | ) | |

| Redemption fees: | |

| Redemption fees added to paid-in-capital | | | — | | | | — | | | | (0.00 | )(b) | | | (0.00 | )(b) | | | (0.00 | )(b) | | | (0.00 | )(b) | |

| Net asset value, end of period | | $ | 7.87 | | | $ | 8.78 | | | $ | 8.24 | | | $ | 5.49 | | | $ | 11.14 | | | $ | 11.69 | | |

| Total return | | | (9.18 | %) | | | 12.08 | % | | | 53.33 | % | | | (48.03 | %) | | | 1.76 | % | | | 17.39 | % | |

| Ratios to average net assets(c) | |

| Expenses prior to fees waived or expenses reimbursed | | | 0.76 | %(d) | | | 0.65 | % | | | 0.53 | % | | | 0.51 | % | | | 0.47 | % | | | 0.84 | % | |

| Net expenses after fees waived or expenses reimbursed(e) | | | 0.25 | %(d)(f) | | | 0.25 | %(f) | | | 0.25 | %(f) | | | 0.25 | %(f) | | | 0.25 | %(f) | | | 0.25 | %(f) | |

| Net investment income | | | 1.01 | %(d)(f) | | | 1.80 | %(f) | | | 3.50 | %(f) | | | 0.56 | %(f) | | | 1.39 | %(f) | | | 1.31 | %(f) | |

| Supplemental data | |

| Net assets, end of period (in thousands) | | $ | 25,069 | | | $ | 41,237 | | | $ | 53,013 | | | $ | 44,548 | | | $ | 119,670 | | | $ | 75,289 | | |

| Portfolio turnover | | | 3 | % | | | 95 | % | | | 2 | % | | | 20 | % | | | 3 | % | | | 1 | % | |

| Notes to Financial Highlights | |

(a) For the period from April 1, 2011 to January 31, 2012. During the period, the Portfolio's fiscal year end was changed from March 31 to January 31.

(b) Rounds to less than $0.01.

(c) In addition to the fees and expenses which the Portfolio bears directly, the Portfolio indirectly bears a pro rata share of the fees and expenses of the acquired funds in which it invests. Such indirect expenses are not included in the reported expense ratios.

(d) Annualized.

(e) The Investment Manager and certain of its affiliates agreed to waive/reimburse certain fees and expenses, if applicable.

(f) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

14

Financial Highlights (continued) – Columbia Masters International Equity Portfolio

| | | Year ended

Jan. 31, | | Year ended March 31, | |

| | | 2012(a) | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

| Class B | |

| Per share data | |

| Net asset value, beginning of period | | $ | 8.78 | | | $ | 8.20 | | | $ | 5.43 | | | $ | 11.09 | | | $ | 11.66 | | | $ | 10.26 | | |

| Income from investment operations: | |

| Net investment income (loss) | | | 0.02 | | | | 0.08 | | | | 0.21 | | | | (0.01 | ) | | | 0.07 | | | | 0.10 | | |

| Net realized and unrealized gain (loss) | | | (0.89 | ) | | | 0.79 | | | | 2.62 | | | | (5.09 | ) | | | 0.12 | | | | 1.59 | | |

| Total from investment operations | | | (0.87 | ) | | | 0.87 | | | | 2.83 | | | | (5.10 | ) | | | 0.19 | | | | 1.69 | | |

| Less distributions to shareholders from: | |

| Net investment income | | | (0.05 | ) | | | (0.29 | ) | | | (0.06 | ) | | | — | | | | (0.06 | ) | | | (0.01 | ) | |

| Net realized gains | | | — | | | | — | | | | — | | | | (0.56 | ) | | | (0.70 | ) | | | (0.28 | ) | |

| Total distributions to shareholders | | | (0.05 | ) | | | (0.29 | ) | | | (0.06 | ) | | | (0.56 | ) | | | (0.76 | ) | | | (0.29 | ) | |

| Redemption fees: | |

| Redemption fees added to paid-in-capital | | | — | | | | — | | | | (0.00 | )(b) | | | (0.00 | )(b) | | | (0.00 | )(b) | | | (0.00 | )(b) | |

| Net asset value, end of period | | $ | 7.86 | | | $ | 8.78 | | | $ | 8.20 | | | $ | 5.43 | | | $ | 11.09 | | | $ | 11.66 | | |

| Total return | | | (9.86 | %) | | | 11.18 | % | | | 52.13 | % | | | (48.35 | %) | | | 1.03 | % | | | 16.50 | % | |

| Ratios to average net assets(c) | |

| Expenses prior to fees waived or expenses reimbursed | | | 1.51 | %(d) | | | 1.40 | % | | | 1.28 | % | | | 1.26 | % | | | 1.22 | % | | | 1.59 | % | |

| Net expenses after fees waived or expenses reimbursed(e) | | | 1.00 | %(d)(f) | | | 1.00 | %(f) | | | 1.00 | %(f) | | | 1.00 | %(f) | | | 1.00 | %(f) | | | 1.00 | %(f) | |

| Net investment income (loss) | | | 0.26 | %(d)(f) | | | 1.05 | %(f) | | | 2.73 | %(f) | | | (0.18 | %)(f) | | | 0.55 | %(f) | | | 0.93 | %(f) | |

| Supplemental data | |

| Net assets, end of period (in thousands) | | $ | 2,028 | | | $ | 3,143 | | | $ | 3,950 | | | $ | 3,043 | | | $ | 7,490 | | | $ | 5,960 | | |

| Portfolio turnover | | | 3 | % | | | 95 | % | | | 2 | % | | | 20 | % | | | 3 | % | | | 1 | % | |

| Notes to Financial Highlights | |

(a) For the period from April 1, 2011 to January 31, 2012. During the period, the Portfolio's fiscal year end was changed from March 31 to January 31.

(b) Rounds to less than $0.01.

(c) In addition to the fees and expenses which the Portfolio bears directly, the Portfolio indirectly bears a pro rata share of the fees and expenses of the acquired funds in which it invests. Such indirect expenses are not included in the reported expense ratios.

(d) Annualized.

(e) The Investment Manager and certain of its affiliates agreed to waive/reimburse certain fees and expenses, if applicable.

(f) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

15

Financial Highlights (continued) – Columbia Masters International Equity Portfolio

| | | Year ended

Jan. 31, | | Year ended March 31, | |

| | | 2012(a) | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

| Class C | |

| Per share data | |

| Net asset value, beginning of period | | $ | 8.77 | | | $ | 8.19 | | | $ | 5.42 | | | $ | 11.08 | | | $ | 11.66 | | | $ | 10.25 | | |

| Income from investment operations: | |

| Net investment income (loss) | | | 0.02 | | | | 0.09 | | | | 0.21 | | | | (0.02 | ) | | | 0.07 | | | | 0.10 | | |

| Net realized and unrealized gain (loss) | | | (0.88 | ) | | | 0.78 | | | | 2.62 | | | | (5.08 | ) | | | 0.11 | | | | 1.60 | | |

| Total from investment operations | | | (0.86 | ) | | | 0.87 | | | | 2.83 | | | | (5.10 | ) | | | 0.18 | | | | 1.70 | | |

| Less distributions to shareholders from: | |

| Net investment income | | | (0.05 | ) | | | (0.29 | ) | | | (0.06 | ) | | | — | | | | (0.06 | ) | | | (0.01 | ) | |

| Net realized gains | | | — | | | | — | | | | — | | | | (0.56 | ) | | | (0.70 | ) | | | (0.28 | ) | |

| Total distributions to shareholders | | | (0.05 | ) | | | (0.29 | ) | | | (0.06 | ) | | | (0.56 | ) | | | (0.76 | ) | | | (0.29 | ) | |

| Redemption fees: | |

| Redemption fees added to paid-in-capital | | | — | | | | — | | | | (0.00 | )(b) | | | (0.00 | )(b) | | | (0.00 | )(b) | | | (0.00 | )(b) | |

| Net asset value, end of period | | $ | 7.86 | | | $ | 8.77 | | | $ | 8.19 | | | $ | 5.42 | | | $ | 11.08 | | | $ | 11.66 | | |

| Total return | | | (9.75 | %) | | | 11.19 | % | | | 52.22 | % | | | (48.39 | %) | | | 0.94 | % | | | 16.61 | % | |

| Ratios to average net assets(c) | |

| Expenses prior to fees waived or expenses reimbursed | | | 1.51 | %(d) | | | 1.40 | % | | | 1.28 | % | | | 1.26 | % | | | 1.22 | % | | | 1.59 | % | |

| Net expenses after fees waived or expenses reimbursed(e) | | | 1.00 | %(d)(f) | | | 1.00 | %(f) | | | 1.00 | %(f) | | | 1.00 | %(f) | | | 1.00 | %(f) | | | 1.00 | %(f) | |

| Net investment income (loss) | | | 0.25 | %(d)(f) | | | 1.05 | %(f) | | | 2.77 | %(f) | | | (0.19 | %)(f) | | | 0.60 | %(f) | | | 0.88 | %(f) | |

| Supplemental data | |

| Net assets, end of period (in thousands) | | $ | 5,486 | | | $ | 8,990 | | | $ | 10,506 | | | $ | 9,087 | | | $ | 27,656 | | | $ | 21,210 | | |

| Portfolio turnover | | | 3 | % | | | 95 | % | | | 2 | % | | | 20 | % | | | 3 | % | | | 1 | % | |

| Notes to Financial Highlights | |

(a) For the period from April 1, 2011 to January 31, 2012. During the period, the Portfolio's fiscal year end was changed from March 31 to January 31.

(b) Rounds to less than $0.01.

(c) In addition to the fees and expenses which the Portfolio bears directly, the Portfolio indirectly bears a pro rata share of the fees and expenses of the acquired funds in which it invests. Such indirect expenses are not included in the reported expense ratios.

(d) Annualized.

(e) The Investment Manager and certain of its affiliates agreed to waive/reimburse certain fees and expenses, if applicable.

(f) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

16

Financial Highlights (continued) – Columbia Masters International Equity Portfolio

| | | Year ended

Jan. 31, | | Year ended March 31, | |

| | | 2012(a) | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

| Class R | |

| Per share data | |

| Net asset value, beginning of period | | $ | 8.76 | | | $ | 8.22 | | | $ | 5.47 | | | $ | 11.12 | | | $ | 11.68 | | | $ | 10.26 | | |

| Income from investment operations: | |

| Net investment income | | | 0.07 | | | | 0.14 | | | | 0.28 | | | | 0.02 | | | | 0.15 | | | | 0.16 | | |

| Net realized and unrealized gain (loss) | | | (0.90 | ) | | | 0.76 | | | | 2.59 | | | | (5.11 | ) | | | 0.09 | | | | 1.59 | | |

| Total from investment operations | | | (0.83 | ) | | | 0.90 | | | | 2.87 | | | | (5.09 | ) | | | 0.24 | | | | 1.75 | | |

| Less distributions to shareholders from: | |

| Net investment income | | | (0.08 | ) | | | (0.36 | ) | | | (0.12 | ) | | | — | | | | (0.10 | ) | | | (0.05 | ) | |

| Net realized gains | | | — | | | | — | | | | — | | | | (0.56 | ) | | | (0.70 | ) | | | (0.28 | ) | |

| Total distributions to shareholders | | | (0.08 | ) | | | (0.36 | ) | | | (0.12 | ) | | | (0.56 | ) | | | (0.80 | ) | | | (0.33 | ) | |

| Redemption fees: | |

| Redemption fees added to paid-in-capital | | | — | | | | — | | | | (0.00 | )(b) | | | (0.00 | )(b) | | | (0.00 | )(b) | | | (0.00 | )(b) | |

| Net asset value, end of period | | $ | 7.85 | | | $ | 8.76 | | | $ | 8.22 | | | $ | 5.47 | | | $ | 11.12 | | | $ | 11.68 | | |

| Total return | | | (9.36 | %) | | | 11.62 | % | | | 52.81 | % | | | (48.12 | %) | | | 1.48 | % | | | 17.09 | % | |

| Ratios to average net assets(c) | |

| Expenses prior to fees waived or expenses reimbursed | | | 1.01 | %(d) | | | 0.90 | % | | | 0.78 | % | | | 0.76 | % | | | 0.72 | % | | | 1.09 | % | |

| Net expenses after fees waived or expenses reimbursed(e) | | | 0.50 | %(d)(f) | | | 0.50 | %(f) | | | 0.50 | %(f) | | | 0.50 | %(f) | | | 0.50 | %(f) | | | 0.50 | %(f) | |

| Net investment income | | | 0.98 | %(d)(f) | | | 1.75 | %(f) | | | 3.78 | %(f) | | | 0.26 | %(f) | | | 1.22 | %(f) | | | 1.46 | %(f) | |

| Supplemental data | |

| Net assets, end of period (in thousands) | | $ | 49 | | | $ | 20 | | | $ | 31 | | | $ | 26 | | | $ | 44 | | | $ | 12 | | |

| Portfolio turnover | | | 3 | % | | | 95 | % | | | 2 | % | | | 20 | % | | | 3 | % | | | 1 | % | |

| Notes to Financial Highlights | |

(a) For the period from April 1, 2011 to January 31, 2012. During the period, the Portfolio's fiscal year end was changed from March 31 to January 31.

(b) Rounds to less than $0.01.

(c) In addition to the fees and expenses which the Portfolio bears directly, the Portfolio indirectly bears a pro rata share of the fees and expenses of the acquired funds in which it invests. Such indirect expenses are not included in the reported expense ratios.

(d) Annualized.

(e) The Investment Manager and certain of its affiliates agreed to waive/reimburse certain fees and expenses, if applicable.

(f) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

17

Financial Highlights (continued) – Columbia Masters International Equity Portfolio

| | | Year ended

Jan. 31, | | Year ended March 31, | |

| | | 2012(a) | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

| Class Z | |

| Per share data | |

| Net asset value, beginning of period | | $ | 8.78 | | | $ | 8.26 | | | $ | 5.52 | | | $ | 11.16 | | | $ | 11.70 | | | $ | 10.26 | | |

| Income from investment operations: | |

| Net investment income | | | 0.09 | | | | 0.17 | | | | 0.29 | | | | 0.07 | | | | 0.23 | | | | 0.12 | | |

| Net realized and unrealized gain (loss) | | | (0.89 | ) | | | 0.78 | | | | 2.64 | | | | (5.15 | ) | | | 0.08 | | | | 1.69 | | |

| Total from investment operations | | | (0.80 | ) | | | 0.95 | | | | 2.93 | | | | (5.08 | ) | | | 0.31 | | | | 1.81 | | |

| Less distributions to shareholders from: | |

| Net investment income | | | (0.11 | ) | | | (0.43 | ) | | | (0.19 | ) | | | — | | | | (0.15 | ) | | | (0.09 | ) | |

| Net realized gains | | | — | | | | — | | | | — | | | | (0.56 | ) | | | (0.70 | ) | | | (0.28 | ) | |

| Total distributions to shareholders | | | (0.11 | ) | | | (0.43 | ) | | | (0.19 | ) | | | (0.56 | ) | | | (0.85 | ) | | | (0.37 | ) | |

| Redemption fees: | |

| Redemption fees added to paid-in-capital | | | — | | | | — | | | | (0.00 | )(b) | | | (0.00 | )(b) | | | (0.00 | )(b) | | | (0.00 | )(b) | |

| Net asset value, end of period | | $ | 7.87 | | | $ | 8.78 | | | $ | 8.26 | | | $ | 5.52 | | | $ | 11.16 | | | $ | 11.70 | | |

| Total return | | | (8.99 | %) | | | 12.28 | % | | | 53.58 | % | | | (47.84 | %) | | | 2.03 | % | | | 17.69 | % | |

| Ratios to average net assets(c) | |

| Expenses prior to fees waived or expenses reimbursed | | | 0.51 | %(d) | | | 0.40 | % | | | 0.28 | % | | | 0.26 | % | | | 0.22 | % | | | 0.59 | % | |

| Net expenses after fees waived or expenses reimbursed(e) | | | 0.00 | %(d)(f) | | | 0.00 | %(f) | | | 0.00 | %(f) | | | 0.00 | %(f) | | | 0.00 | %(f) | | | 0.00 | %(f) | |

| Net investment income | | | 1.23 | %(d)(f) | | | 2.04 | %(f) | | | 3.77 | %(f) | | | 0.83 | %(f) | | | 1.89 | %(f) | | | 0.93 | %(f) | |

| Supplemental data | |

| Net assets, end of period (in thousands) | | $ | 32,187 | | | $ | 55,013 | | | $ | 69,334 | | | $ | 58,268 | | | $ | 89,568 | | | $ | 31,029 | | |

| Portfolio turnover | | | 3 | % | | | 95 | % | | | 2 | % | | | 20 | % | | | 3 | % | | | 1 | % | |

| Notes to Financial Highlights | |

(a) For the period from April 1, 2011 to January 31, 2012. During the period, the Portfolio's fiscal year end was changed from March 31 to January 31.

(b) Rounds to less than $0.01.

(c) In addition to the fees and expenses which the Portfolio bears directly, the Portfolio indirectly bears a pro rata share of the fees and expenses of the acquired funds in which it invests. Such indirect expenses are not included in the reported expense ratios.

(d) Annualized.

(e) The Investment Manager and certain of its affiliates agreed to waive/reimburse certain fees and expenses, if applicable.

(f) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

18

Notes to Financial Statements – Columbia Masters International Equity Portfolio

January 31, 2012

Note 1. Organization

Columbia Masters International Equity Portfolio (the Portfolio), a series of Columbia Funds Series Trust (the Trust), is a diversified portfolio. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware statutory trust.

Under normal circumstances, the Portfolio invest most of its assets in Class I shares of mutual funds (underlying funds) managed by Columbia Management Investment Advisers, LLC (the Investment Manager), a wholly owned subsidiary of Ameriprise Financial, Inc. (Ameriprise Financial), or its affiliates (Columbia Funds). The financial statements of the underlying funds in which the Portfolio invests should be read in conjunction with the Portfolio's financial statements.

Fiscal Year End Change

During the period, the Portfolio changed its fiscal year end from March 31 to January 31.

Portfolio Shares

The Trust may issue an unlimited number of shares (without par value). The Portfolio offers Class A, Class B, Class C, Class R and Class Z shares. All share classes have identical voting, dividend and liquidation rights. Each share class has its own expense structure and sales charges, as applicable.

Class A shares are subject to a maximum front-end sales charge of 5.75% based on the initial investment amount. Class A shares purchased without an initial sales charge in accounts aggregating $1 million to $50 million at the time of purchase are subject to a contingent deferred sales charge (CDSC) if the shares are sold within 18 months of purchase, charged as follows: 1.00% CDSC if redeemed within 12 months of purchase, and 0.50% CDSC if redeemed more than 12, but less than 18, months after purchase.

Class B shares may be subject to a maximum CDSC of 5.00% based upon the holding period after purchase. Class B shares will generally convert to Class A shares eight years after purchase. The Portfolio no longer accepts investments by new or existing investors in the Portfolio's Class B shares, except in connection with the reinvestment of any dividend and/or capital gain distributions in Class B shares of the Portfolio and exchanges by existing Class B shareholders of certain other funds within the Columbia Family of Funds.

Class C shares are subject to a 1.00% CDSC on shares redeemed within one year of purchase.

Class R shares are not subject to sales charges and are only available to qualifying institutional investors.

Class Z shares are not subject to sales charges, and are only available to certain investors, as described in the Portfolio's prospectus.

Note 2. Summary of Significant Accounting Policies

Use of Estimates

The preparation of financial statements in accordance with U.S. generally accepted accounting principles (GAAP) requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies consistently followed by the Portfolio in the preparation of its financial statements.

Security Valuation

Investments in the underlying funds are valued at the net asset value of each class of the respective underlying fund determined as of the close of the New York Stock Exchange on the valuation date.

Derivative Instruments

The Portfolio invests in certain derivative instruments as detailed below to meet its investment objectives. Derivatives are instruments whose values depend on, or are derived from, in whole or in part, the value of one or more other assets, such as securities, currencies, commodities or indices. Derivative instruments may be used to maintain cash reserves while maintaining exposure to certain other assets, to offset anticipated declines in values of investments, to facilitate trading, to reduce transaction costs and to pursue higher investment returns. The Portfolio may also use derivative instruments to mitigate certain investment risks, such as foreign currency exchange rate risk, interest rate risk and credit risk. Derivatives may involve various risks, including the

19

Columbia Masters International Equity Portfolio, January 31, 2012

potential inability of the counterparty to fulfill its obligation under the terms of the contract, the potential for an illiquid secondary market and the potential for market movements which may expose the Portfolio to gains or losses in excess of the amount shown in the Statement of Assets and Liabilities.

The Portfolio and any counterparty are required to maintain an agreement that requires the Portfolio and that counterparty to monitor (on a daily basis) the net fair value of all derivatives entered into pursuant to the agreement between the Portfolio and such counterparty. If the net fair value of such derivatives between the Portfolio and that counterparty exceeds a certain threshold (as defined in the agreement), the Portfolio or the counterparty (as the case may be) is required to post cash and/or securities as collateral. Fair values of derivatives presented in the financial statements are not netted with the fair value of other derivatives or with any collateral amounts posted by the Portfolio or any counterparty.

Forward Foreign Currency Exchange Contracts

Forward foreign currency exchange contracts are agreements between two parties to buy and sell a currency at a set price on a future date. These contracts are intended to be used to minimize the exposure to foreign exchange rate fluctuations during the period between the trade and settlement dates of the contract. The Portfolio utilized forward foreign currency exchange contracts to hedge the currency exposure associated with some or all of the Portfolio's securities, to shift foreign currency exposure back to U.S. dollars, to shift investment exposure from one currency to another, and to shift U.S. dollar exposure to achieve a representative weighted mix of major currencies in its benchmark, and/or to recover an underweight country exposure in its portfolio.

The values of forward foreign currency exchange contracts fluctuate with changes in foreign currency exchange rates. The Portfolio will record a realized gain or loss when the forward foreign currency exchange contract is closed.

The use of forward foreign currency exchange contracts does not eliminate fluctuations in the prices of the Portfolio's securities. The risks of forward foreign currency exchange contracts include movement in the values of the foreign currencies relative to the U.S. dollar (or other foreign currencies) and the possibility that counterparties will not complete their contractual obligations, which may be in excess of the amount reflected, if any, in the Statement of Assets and Liabilities.

Effects of Derivative Transactions in the Financial Statements

The following tables are intended to provide additional information about the effect of derivatives on the financial statements of the Portfolio, including: the fair value of derivatives by risk category and the location of those fair values in the Statement of Assets and Liabilities; the impact of derivative transactions on the Portfolio's operations over the period including realized gains or losses and unrealized gains or losses. The derivative schedules following the Portfolio of Investments present additional information regarding derivative instruments outstanding at the end of the period, if any.

| Fair Values of Derivative Instruments at January 31, 2012 | |

| | | Asset derivatives | | Liability derivatives | |

| Risk Exposure Category | | Statement of Assets

and Liabilities Location | | Fair Value | | Statement of Assets

and Liabilities Location | | Fair Value | |

| Foreign exchange contracts | | Unrealized appreciation on

forward foreign currency

exchange contracts | | $ | 468,588 | | | Unrealized depreciation on

forward foreign currency

exchange contracts | | $ | 617,011 | | |

20

Columbia Masters International Equity Portfolio, January 31, 2012

Effect of Derivative Instruments in the Statement of Operations for the Year Ended January 31, 2012

Amount of Realized Gain (Loss) on Derivatives Recognized in Income

| Risk Exposure Category | | Forward Foreign

Currency Exchange

Contracts | |

| Foreign exchange contracts | | $ | 578,558 | | |

Change in Unrealized Appreciation (Depreciation) on Derivatives Recognized in Income

| Risk Exposure Category | | Forward Foreign

Currency Exchange

Contracts | |

| Foreign exchange contracts | | $ | (148,423 | ) | |

Volume of Derivative Instruments for the Year Ended January 31, 2012

| | | Contracts

Opened | |

Forward Foreign Currency

Exchange Contracts | | | 129 | | |

Security Transactions

Security transactions are accounted for on the trade date. Cost is determined and gains (losses) are based upon the specific identification method for both financial statement and federal income tax purposes.

Income Recognition

Income and capital gain distributions from the underlying funds, if any, are recorded on the ex-dividend date.

Expenses

General expenses of the Trust are allocated to the Portfolio and other funds of the Trust based upon relative net assets or other expense allocation methodologies determined by the nature of the expense. Expenses directly attributable to the Portfolio are charged to the Portfolio. Expenses directly attributable to a specific class of shares are charged to that share class.

Determination of Class Net Asset Value

All income, expenses (other than class-specific expenses, which are charged to that share class, as shown in the Statement of Operations) and realized and unrealized gains (losses) are allocated to each class of the Portfolio on a daily basis, based on the relative net assets of each class, for purposes of determining the net asset value of each class.

Federal Income Tax Status

The Portfolio intends to qualify each year as a regulated investment company under Subchapter M of the Internal Revenue Code, as amended, and will distribute substantially all of its taxable income (including net short-term capital gains), if any, for its tax year, and as such will not be subject to federal income taxes. In addition, the Portfolio intends to distribute in each calendar year substantially all of its net investment income, capital gains and certain other amounts, if any, such that the Portfolio should not be subject to federal excise tax. Therefore, no federal income or excise tax provision is recorded.

Distributions to Shareholders

Distributions from net investment income, if any, are declared and paid semi-annually. Net realized capital gains, if any, are distributed along with the income dividend. Income distributions and capital gain distributions are determined in accordance with federal income tax regulations which may differ from GAAP.

Guarantees and Indemnifications