UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-09645 |

|

Columbia Funds Series Trust |

(Exact name of registrant as specified in charter) |

|

225 Franklin Street, Boston, Massachusetts | | 02110 |

(Address of principal executive offices) | | (Zip code) |

|

Scott R. Plummer 5228 Ameriprise Financial Center Minneapolis, MN 55474 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-612-671-1947 | |

|

Date of fiscal year end: | March 31 | |

|

Date of reporting period: | March 31, 2012 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia Short Term Bond Fund

Annual Report for the Period Ended March 31, 2012

Not FDIC insured • No bank guarantee • May lose value

Table of Contents

| Fund Profile | | | 1 | | |

|

| Performance Information | | | 2 | | |

|

| Fund Expense Example | | | 3 | | |

|

| Portfolio Managers' Report | | | 4 | | |

|

| Portfolio of Investments | | | 7 | | |

|

Statement of Assets and

Liabilities | | | 19 | | |

|

| Statement of Operations | | | 21 | | |

|

Statement of Changes in

Net Assets | | | 22 | | |

|

| Financial Highlights | | | 24 | | |

|

| Notes to Financial Statements | | | 33 | | |

|

Report of Independent Registered

Public Accounting Firm | | | 46 | | |

|

| Fund Governance | | | 47 | | |

|

Important Information About

This Report | | | 57 | | |

|

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific securities should not be construed as a recommendation or investment advice.

President's Message

Dear Shareholders,

A stock market rally that commenced in the fourth quarter of 2011 continued into 2012 in the United States and around the world, as all major market regions generated double-digit returns for the three-month period ended March 31, 2012. Volatility declined sharply as European debt fears quieted somewhat and sentiment improved. Returns in developed countries were buoyed by strong results in Germany, Belgium, Austria and the Nordic markets of Denmark, Finland, Norway and Sweden. Under the cloud of its own mounting debt problem, Spain was the only eurozone country to deliver a negative return during the three-month period. Solid economic growth and accommodative monetary policy helped boost gains in emerging markets. The rally in U.S. equities was largely driven by an expansion in "multiples"—an increase in stock prices relative to their earnings. By the end of the first quarter of 2012, stocks no longer appeared as cheap as they were late in 2011. Bonds lagged stocks during the first quarter as investors responded to signs of an improved environment with a greater appetite for risk.

Concerns around the health of the global economy were centered in news headlines focusing on Washington D.C., Europe, China and the Middle East. In the United States, economic indicators remained mixed but generally indicated support for slow, sustainable economic growth. European policymakers have made progress in containing the eurozone debt crisis, though they still have not solved the issue of long-term solvency. The European Central Bank has lowered interest rates and flooded the financial system with liquidity that may provide breathing space for companies to restructure their balance sheets. These massive infusions of liquidity may whet the appetite for risk from investors around the world. However, it has delayed a true reckoning with the European financial situation, as concerns about Spain and Portugal continue to cloud the outlook. These structural challenges that persist in the developed world, and slowing growth in emerging market economies, leave the global economy in a fragile state. Domestic demand, combined with slowing inflationary trends, has also helped to shore up emerging market economies. Joblessness remains low and monetary conditions remain easy.

Despite the challenges and surprises of 2011, we see pockets of strength—and as a result, attractive opportunities—both here and abroad for 2012. We hope to help you capitalize on these opportunities with various articles in our 2012 Perspectives, which is available via the Market Insights tab at columbiamanagement.com. This publication showcases the strong research capabilities and experienced investment teams of Columbia Management and offers a diverse array of investment ideas based on our five key themes for 2012.

Other information and resources available at columbiamanagement.com include:

g detailed up-to-date fund performance and portfolio information

g economic analysis and market commentary

g quarterly fund commentaries

g Columbia Management Investor, our award-winning quarterly newsletter for shareholders

Thank you for your continued support of the Columbia Funds. We look forward to serving your investment needs for many years to come.

Best Regards,

J. Kevin Connaughton

President, Columbia Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus, which contains this and other important information about the funds, visit columbiamanagement.com. The prospectus should be read carefully before investing.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2012 Columbia Management Investment Advisers, LLC. All rights reserved.

Fund Profile – Columbia Short Term Bond Fund

Summary

g For the 12-month period that ended March 31, 2012, the fund's Class A shares returned 1.78% without sales charge.

g The fund performed in line with its benchmark, the Barclays 1-3 Year Government/Credit Index.1

g The fund's sector positioning benefited performance, as did its yield curve strategy. Duration positioning detracted from relative performance.

Portfolio Management

Leonard A. Aplet has co-managed the fund since 2004. From 1987 until joining Columbia Management Investment Advisers, LLC (the Investment Manager) in May 2010, Mr. Aplet was associated with the fund's previous investment adviser as an investment professional.

Gregory S. Liechty has co-managed the fund since 2010. From 2005 until joining the Investment Manager in May 2010, Mr. Liechty was associated with the fund's previous investment adviser as an investment professional.

Ronald B. Stahl has co-managed the fund since 2006. From 1998 until joining the Investment Manager in May 2010, Mr. Stahl was associated with the fund's previous investment adviser as an investment professional.

1The Barclays 1-3 Year Government/Credit Index consists of Treasury or government agency securities and investment grade corporate debt securities with maturities of one to three years.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

Summary

1-year return as of 03/31/12

| | | | +1.78% | |

|

|  | | | Class A shares

(without sales charge) | |

|

| | | | +1.78% | |

|

|  | | | Barclays 1-3 Year Government/Credit Index | |

|

1

Performance Information – Columbia Short Term Bond Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

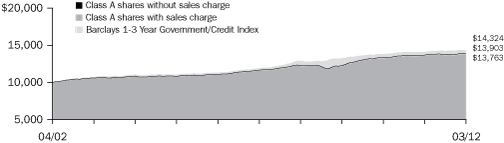

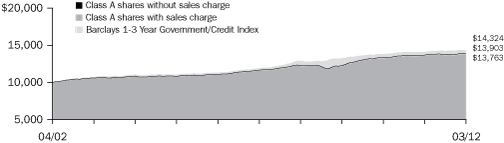

Performance of a $10,000 investment 04/01/02 – 03/31/12

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Short Term Bond Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

Performance of a $10,000 investment 04/01/02 – 03/31/12 ($)

| Sales charge | | without | | with | |

| Class A | | | 13,903 | | | | 13,763 | | |

| Class B | | | 12,903 | | | | 12,903 | | |

| Class C | | | 13,263 | | | | 13,263 | | |

| Class I* | | | 14,252 | | | | n/a | | |

| Class R* | | | 13,492 | | | | n/a | | |

| Class R4* | | | 13,988 | | | | n/a | | |

| Class W* | | | 13,857 | | | | n/a | | |

| Class Y* | | | 14,256 | | | | n/a | | |

| Class Z | | | 14,256 | | | | n/a | | |

Average annual total return as of 03/31/12 (%)

| Share class | | A | | B | | C | | I* | | R* | | R4* | | W* | | Y* | | Z | |

| Inception | | 10/02/92 | | 06/07/93 | | 10/02/92 | | 09/27/10 | | 09/27/10 | | 03/07/11 | | 09/27/10 | | 07/15/09 | | 09/30/92 | |

| Sales charge | | without | | with | | without | | with | | without | | with | | without | | without | | without | | without | | without | | without | |

| 1-year | | | 1.78 | | | | 0.77 | | | | 1.12 | | | | –1.88 | | | | 1.48 | | | | 0.48 | | | | 1.99 | | | | 1.60 | | | | 1.83 | | | | 1.89 | | | | 2.11 | | | | 2.14 | | |

| 5-year | | | 3.59 | | | | 3.39 | | | | 2.82 | | | | 2.82 | | | | 3.27 | | | | 3.27 | | | | 3.87 | | | | 3.31 | | | | 3.67 | | | | 3.59 | | | | 3.87 | | | | 3.88 | | |

| 10-year | | | 3.35 | | | | 3.25 | | | | 2.58 | | | | 2.58 | | | | 2.86 | | | | 2.86 | | | | 3.61 | | | | 3.04 | | | | 3.41 | | | | 3.32 | | | | 3.61 | | | | 3.61 | | |

The "with sales charge" returns include the maximum initial sales charge of 1.00% for Class A shares and the applicable contingent deferred sales charge of 3.00% in the first year, declining to 1.00% in the fourth year and eliminated thereafter for Class B shares and 1.00% for Class C shares for the first year only. The "without sales charge" returns do not include the effect of sales charges. If they had, returns would be lower.

Performance results reflect any fee waivers or reimbursements of fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

All results shown assume reinvestment of distributions. Class I, Class Y, Class R4 and Class Z shares are sold at net asset value with no distribution and service (Rule 12b-1) fees. Class R shares are sold at net asset value with a distribution (Rule 12b-1) fee and Class W shares are sold at net asset value with a distribution and service (Rule 12b-1) fee. Class I, Class R, Class R4, Class W, Class Y and Class Z shares have limited eligibility and the investment minimum requirements may vary. Please see the fund's prospectuses for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

The tables do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

* The returns shown for periods prior to the share class inception date (including returns since inception, which are since fund inception) include the returns of the fund's oldest share class. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiamanagement.com/mutual-funds/appended-performance for more information.

2

Fund Expense Example – Columbia Short Term Bond Fund

As an investor, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and service (Rule 12b-1) fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the Fund's actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the Actual column. The amount listed in the "Hypothetical" column assumes a 5% annual rate of return before expenses (which is not the Fund's actual return) and then applies the Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See "Compare with other funds" below for details on how to use the hypothetical data.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

10/01/11 – 03/31/12

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class A | | | 1,000.00 | | | | 1,000.00 | | | | 1,013.30 | | | | 1,020.89 | | | | 4.00 | | | | 4.02 | | | | 0.80 | | |

| Class B | | | 1,000.00 | | | | 1,000.00 | | | | 1,009.40 | | | | 1,016.96 | | | | 7.94 | | | | 7.97 | | | | 1.59 | | |

| Class C | | | 1,000.00 | | | | 1,000.00 | | | | 1,011.60 | | | | 1,019.19 | | | | 5.70 | | | | 5.72 | | | | 1.14 | | |

| Class I | | | 1,000.00 | | | | 1,000.00 | | | | 1,014.20 | | | | 1,022.82 | | | | 2.05 | | | | 2.06 | | | | 0.41 | | |

| Class R | | | 1,000.00 | | | | 1,000.00 | | | | 1,012.00 | | | | 1,019.54 | | | | 5.35 | | | | 5.37 | | | | 1.07 | | |

| Class R4 | | | 1,000.00 | | | | 1,000.00 | | | | 1,013.40 | | | | 1,020.98 | | | | 3.90 | | | | 3.92 | | | | 0.78 | | |

| Class W | | | 1,000.00 | | | | 1,000.00 | | | | 1,013.20 | | | | 1,020.84 | | | | 4.05 | | | | 4.07 | | | | 0.81 | | |

| Class Y | | | 1,000.00 | | | | 1,000.00 | | | | 1,015.10 | | | | 1,022.68 | | | | 2.20 | | | | 2.21 | | | | 0.44 | | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,014.90 | | | | 1,022.43 | | | | 2.45 | | | | 2.46 | | | | 0.49 | | |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund's most recent fiscal half year and divided by 366.

Expenses do not include fees and expenses incurred indirectly by the Fund from the underlying funds in which the Fund may invest (also referred to as "acquired funds"), including affiliated and non-affiliated pooled investments vehicles (including mutual funds and exchange traded funds).

Had Columbia Management Investment Advisers, LLC and/or certain of its affiliates not waived/reimbursed certain fees and expenses, account value at the end of the period would have been reduced.

3

Portfolio Managers' Report – Columbia Short Term Bond Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

Net asset value per share

as of 03/31/12 ($)

| Class A | | | 9.95 | | |

| Class B | | | 9.95 | | |

| Class C | | | 9.94 | | |

| Class I | | | 9.93 | | |

| Class R | | | 9.96 | | |

| Class R4 | | | 9.93 | | |

| Class W | | | 9.96 | | |

| Class Y | | | 9.93 | | |

| Class Z | | | 9.94 | | |

Distributions declared per share

04/01/11 – 03/31/12 ($)

| Class A | | | 0.17 | | |

| Class B | | | 0.09 | | |

| Class C | | | 0.14 | | |

| Class I | | | 0.20 | | |

| Class R | | | 0.14 | | |

| Class R4 | | | 0.17 | | |

| Class W | | | 0.17 | | |

| Class Y | | | 0.20 | | |

| Class Z | | | 0.19 | | |

30-day SEC yields

as of 03/31/12 (%)

| Class A | | | 1.40 | | |

| Class B | | | 0.68 | | |

| Class C | | | 1.03 | | |

| Class I | | | 1.68 | | |

| Class R | | | 1.18 | | |

| Class R4 | | | 1.32 | | |

| Class W | | | 1.44 | | |

| Class Y | | | 1.68 | | |

| Class Z | | | 1.67 | | |

The 30-day SEC yields reflect the fund's earning power, net of expenses, expressed as an annualized percentage of the public offering price per share at the end of the period. Had Columbia Management Investment Advisers, LLC and/or any of its affiliates not waived fees or reimbursed a portion of expenses, the 30-day SEC yields would have been lower.

For the 12-month period that ended March 31, 2012, the fund's Class A shares returned 1.78% without sales charge. The fund performed in line with its benchmark, the Barclays 1-3 Year Government/Credit Index, which returned 1.78%. In general, the fund's sector positioning benefited performance, as did its yield curve strategy. The fund's overweight in commercial mortgage-backed securities (CMBS), its position in auto asset-backed securities (ABS) and an overweight in corporate bonds were all favorable factors. The fund's duration was shorter than the benchmark index, which dampened results. Duration is a measure of interest rate sensitivity.

Positive sector and yield-curve stance

Against a backdrop of solid performance for structured securities, the fund's overweight in CMBS aided performance. The fund is about equally weighted between agency and non-agency CMBS, and both areas contributed significantly. During the period, we reduced the fund's exposure to agency collateralized mortgage obligations (CMO) and reallocated the proceeds primarily to CMBS and government securities, which also aided performance. CMBS was the best performing short-term investment-grade sector for the period. It benefited from improving fundamentals, limited supply and relative cheapness compared to other short-duration assets. Auto ABS was also a strong performing sector relative to Treasuries, and results benefited from the fund's holdings there, as well as in certain AAA-rated1 floating rate ABS.

The fund's overweight in corporate bonds also aided returns. Within the corporate market, the fund's exposure to finance, wireline communications, real estate investment trusts (REITs), insurance and natural gas was notably positive for performance, as these subsectors outperformed the corporate bond market overall. The remaining corporate subsectors also outperformed Treasuries, albeit to a lesser degree. The fund also benefited from an overweight in the BBB-rated segment of the market, which outperformed AA- and A-rated securities. During the period, we employed a barbell strategy to take advantage of the steep yield curve. (The yield curve charts bond yields from short to long.) This strategy aided returns as the curve flattened during the period, with five-year yields declining more than two-year yields.

Duration, quality orientation detracted from results

The fund's duration was shorter than the benchmark index, which detracted from performance as interest rates declined. The fund's higher quality orientation also dampened returns as lower quality securities outperformed across all sectors of the bond market during the period. All subsectors of the corporate market outperformed Treasuries; however, several sectors, including capital goods, sovereign and technology outperformed to a lesser degree.

1The credit quality ratings represent those of Moody's Investors Service, Inc. ("Moody's"), Standard & Poor's Corporation ("S&P") or Fitch Ratings ("Fitch") credit ratings. The ratings represent their opinions as to the quality of the securities they rate. Ratings are relative and subjective and are not absolute standards of quality. The security's credit quality does not eliminate risk.

4

Portfolio Managers' Report (continued) – Columbia Short Term Bond Fund

Looking ahead

We expect Treasury rates to rise modestly in 2012, as Federal Reserve Board policy is expected to remain highly accommodative. The odds of another monetary stimulus program in the near term have faded given supportive financial markets and better economic data. There has been some improvement in the labor market as evidenced by recent non-farm payroll reports, although the unemployment rate remains much too high. Positive data have been offset somewhat by rising energy prices, which could hamper consumer spending. We are closely watching the upcoming U.S. election as well as events in Europe and the Middle East.

Against this backdrop, the fund remains underweight in U.S. Government securities relative to the benchmark. We continue to favor U.S. agency-backed residential mortgages, including both pass-through and collateralized mortgage obligations, and CMBS, including Government National Mortgage Association (GNMA), government-backed project loans and non-agency AAA-rated CMBS. We have been adding to the fund's position in GNMA Projects, as they are expected to continue to benefit from a yield advantage over Treasuries, while having the full faith and credit guarantee from the U.S. Government.

We believe the corporate sector should continue to offer good relative returns compared to Treasuries. However, valuations are less compelling than they were at the beginning of the year. Technical market factors remain supportive, and corporate fundamentals appear positive as balance sheets and income statements are in good shape. However, we are expecting further rating downgrades of financial institutions in the second quarter of 2012. Within the corporate market, we find particular value in the wireline communication, banking, natural gas pipeline, independent energy, insurance and REIT sectors.

Portfolio characteristics and holdings are subject to change periodically and may not be representative of current characteristics and holdings. The outlook for the fund may differ from that presented for other Columbia Funds.

Investing in fixed-income securities may involve certain risks, including the credit quality of individual issuers, possible prepayments, market or economic developments and yields and share price fluctuations due to changes in interest rates. When interest rates go up, bond prices typically drop, and vice versa.

Investments in real estate securities can be subject to fluctuations in the value of the underlying properties, the effect of economic conditions on real estate values, changes in interest rates and risks related to renting properties, such as rental defaults.

Any guarantee by the U.S. Government, its agencies or instrumentalities applies only to the payment of principal and interest on the guaranteed security and does not guarantee the yield or value of that security.

Portfolio breakdown1

as of 03/31/12 (%)

Asset-Backed Securities—

Agency | | | 0.0 | * | |

Asset-Backed Securities—

Non-Agency | | | 16.7 | | |

Commercial Mortgage-Backed

Securities—Agency | | | 7.6 | | |

Commercial Mortgage-Backed

Securities—Non-Agency | | | 6.7 | | |

| Corporate Bonds & Notes | | | 30.9 | | |

Foreign Government

Obligations | | | 1.0 | | |

| Inflation-Indexed Bonds | | | 1.0 | | |

| Municipal Bonds | | | 0.5 | | |

Residential Mortgage-Backed

Securities—Agency | | | 18.5 | | |

Residential Mortgage-Backed

Securities—Non-Agency | | | 1.9 | | |

U.S. Government & Agency

Obligations | | | 2.9 | | |

| U.S. Treasury Obligations | | | 8.3 | | |

| Other2 | | | 4.0 | | |

*Rounds to less than 0.1%

1Percentages indicated are based upon total investments. The Fund's portfolio composition is subject to change.

2Includes investments in money market funds.

5

Portfolio Managers' Report (continued) – Columbia Short Term Bond Fund

Top 10 holdings3

as of 03/31/12 (%)

U.S. Treasury

2.000% 01/31/16 | | | 4.6 | | |

U.S. Treasury Note

0.375% 03/15/15 | | | 2.6 | | |

Federal Home Loan

Mortgage Corp.

3.500% 04/01/27 | | | 2.1 | | |

Federal National Mortgage

Association

0.286% 03/04/14 | | | 2.0 | | |

General Electric Capital Corp

0.734% 09/15/14 | | | 1.3 | | |

Credit Suisse First Boston

Mortgage Securities Corp.

Series 2002-CP5 Class A2

4.940% 12/15/35 | | | 0.9 | | |

U.S. Treasury

0.250% 12/15/14 | | | 0.9 | | |

Federal Home Loan Mortgage

Corp. CMO Series 3774

Class AB

3.500% 12/15/20 | | | 0.9 | | |

U.S. Treasury Inflation-Indexed

Bond

3.000% 07/15/12 | | | 0.8 | | |

Government National

Mortgage Association

CMO Series 2011-49 Class A

2.450% 07/16/38 | | | 0.8 | | |

3Percentages indicated are based upon total investments (excluding investments in money market funds).

For further detail about these holdings, please refer to the section entitled "Portfolio of Investments."

Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

Quality Breakdown4

as of 03/31/12 (%)

| AAA rating | | | 60.1 | | |

| AA rating | | | 8.9 | | |

| A rating | | | 14.8 | | |

| BBB rating | | | 16.2 | | |

4Percentages indicated are based upon total fixed income securities (excluding money market funds).

Bond ratings apply to the underlying holdings of the Fund and not the Fund itself and are divided into categories ranging from AAA (highest) to D (lowest), and are subject to change. The ratings shown are determined by using the middle rating of Moody's, S&P, and Fitch after dropping the highest and lowest available ratings. When a rating from only two agencies is available, the lower rating is used. When a rating from only one agency is available, that rating is used. When a bond is not rated by one of these agencies, it is designated as Not Rated. Credit ratings are subjective opinions and not statements of fact.

6

Portfolio of Investments – Columbia Short Term Bond Fund

March 31, 2012

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes 31.5% | |

| Aerospace & Defense 0.3% | |

| L-3 Communications Corp. | |

| 11/15/16 | | | 3.950 | % | | $ | 7,465,000 | | | $ | 7,859,801 | | |

| Banking 9.3% | |

Abbey National Treasury Services PLC

Bank Guaranteed(a) | |

| 04/25/14 | | | 2.137 | % | | | 12,000,000 | | | | 11,659,057 | | |

BB&T Corp.

Senior Unsecured(a) | |

| 04/28/14 | | | 1.253 | % | | | 10,237,000 | | | | 10,283,804 | | |

BNP Paribas SA

Bank Guaranteed(a) | |

| 01/10/14 | | | 1.482 | % | | | 11,830,000 | | | | 11,582,018 | | |

Bank of Montreal

Senior Unsecured(a) | |

| 04/29/14 | | | 1.023 | % | | | 8,195,000 | | | | 8,209,005 | | |

Bank of New York Mellon Corp. (The)

Senior Unsecured(a) | |

| 07/28/14 | | | 0.823 | % | | | 11,000,000 | | | | 10,995,502 | | |

Barclays Bank PLC

Senior Unsecured | |

| 04/07/15 | | | 3.900 | % | | | 7,325,000 | | | | 7,610,470 | | |

Capital One Financial Corp.

Senior Unsecured(a) | |

| 07/15/14 | | | 1.717 | % | | | 11,085,000 | | | | 10,975,591 | | |

Citigroup, Inc.

Senior Unsecured | |

| 06/15/16 | | | 3.953 | % | | | 19,100,000 | | | | 19,628,191 | | |

Commonwealth Bank of Australia

Senior Unsecured(b) | |

| 10/15/14 | | | 3.750 | % | | | 11,000,000 | | | | 11,527,725 | | |

| Cooperatieve Centrale Raiffeisen-Boerenleenbank BA | |

| 01/10/14 | | | 1.850 | % | | | 11,000,000 | | | | 11,097,922 | | |

Goldman Sachs Group Inc. (The)

Senior Unsecured(a) | |

| 03/22/16 | | | 0.924 | % | | | 14,175,000 | | | | 12,938,685 | | |

HSBC USA, Inc.

Senior Unsecured | |

| 02/13/15 | | | 2.375 | % | | | 13,500,000 | | | | 13,592,569 | | |

ING Bank NV

Senior Unsecured(b) | |

| 06/09/14 | | | 1.875 | % | | | 12,000,000 | | | | 11,873,184 | | |

JPMorgan Chase & Co.

Senior Unsecured | |

| 07/05/16 | | | 3.150 | % | | | 20,685,000 | | | | 21,323,422 | | |

KeyCorp

Senior Unsecured | |

| 08/13/15 | | | 3.750 | % | | | 10,000,000 | | | | 10,572,664 | | |

Lloyds TSB Bank PLC

Bank Guaranteed | |

| 01/21/16 | | | 4.875 | % | | | 11,500,000 | | | | 11,923,626 | | |

Merrill Lynch & Co., Inc.

Senior Unsecured | |

| 01/15/15 | | | 5.000 | % | | | 17,200,000 | | | | 17,943,848 | | |

Morgan Stanley

Senior Unsecured(a) | |

| 01/09/14 | | | 0.769 | % | | | 17,000,000 | | | | 16,166,830 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes (continued) | |

| Banking (cont.) | |

Toronto-Dominion Bank (The)

Senior Unsecured(a) | |

| 07/14/14 | | | 0.867 | % | | $ | 9,765,000 | | | $ | 9,801,941 | | |

U.S. Bank

Subordinated Notes(a) | |

| 04/29/20 | | | 3.778 | % | | | 14,000,000 | | | | 14,616,924 | | |

Wells Fargo & Co.

Senior Unsecured(a) | |

| 10/28/15 | | | 0.753 | % | | | 17,832,000 | | | | 17,445,242 | | |

| Total | | | 271,768,220 | | |

| Chemicals 0.3% | |

Dow Chemical Co. (The)

Senior Unsecured | |

| 02/15/15 | | | 5.900 | % | | | 6,835,000 | | | | 7,694,112 | | |

| Construction Machinery 0.4% | |

John Deere Capital Corp.

Senior Unsecured | |

| 04/03/13 | | | 4.500 | % | | | 5,151,000 | | | | 5,358,977 | | |

John Deere Capital Corp.(a)

Senior Unsecured | |

| 03/03/14 | | | 0.700 | % | | | 7,483,000 | | | | 7,502,411 | | |

| Total | | | 12,861,388 | | |

| Diversified Manufacturing 0.6% | |

| Ingersoll-Rand Global Holding Co., Ltd. | |

| 04/15/14 | | | 9.500 | % | | | 6,002,000 | | | | 6,915,709 | | |

| Tyco International Finance SA | |

| 10/15/14 | | | 4.125 | % | | | 11,220,000 | | | | 11,998,365 | | |

| Total | | | 18,914,074 | | |

| Electric 1.5% | |

| CenterPoint Energy Houston Electric LLC(b) | |

| 01/15/14 | | | 5.750 | % | | | 1,000,000 | | | | 1,080,305 | | |

Consolidated Edison Co. of New York, Inc.

Senior Unsecured | |

| 02/01/13 | | | 4.875 | % | | | 5,693,000 | | | | 5,893,616 | | |

| 04/01/14 | | | 5.550 | % | | | 265,000 | | | | 289,115 | | |

DTE Energy Co.

Senior Unsecured(a) | |

| 06/03/13 | | | 1.180 | % | | | 7,095,000 | | | | 7,121,778 | | |

Jersey Central Power & Light Co.

Senior Unsecured | |

| 05/01/16 | | | 5.625 | % | | | 2,000,000 | | | | 2,247,112 | | |

| National Rural Utilities Cooperative Finance Corp. | |

| 07/01/13 | | | 5.500 | % | | | 9,525,000 | | | | 10,097,967 | | |

| 02/02/15 | | | 1.000 | % | | | 3,815,000 | | | | 3,819,662 | | |

| Nevada Power Co. | |

| 03/15/16 | | | 5.950 | % | | | 1,000,000 | | | | 1,144,198 | | |

Ohio Power Co.

Senior Unsecured | |

| 09/01/13 | | | 5.750 | % | | | 5,870,000 | | | | 6,260,783 | | |

Progress Energy, Inc.

Senior Unsecured | |

| 03/15/14 | | | 6.050 | % | | | 2,715,000 | | | | 2,977,171 | | |

| Sierra Pacific Power Co. | |

| 09/01/13 | | | 5.450 | % | | | 1,710,000 | | | | 1,814,195 | | |

| Total | | | 42,745,902 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

7

Columbia Short Term Bond Fund

March 31, 2012

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes (continued) | |

| Food and Beverage 1.7% | |

| Anheuser-Busch InBev Worldwide, Inc.(a) | |

| 07/14/14 | | | 0.927 | % | | $ | 11,375,000 | | | $ | 11,392,279 | | |

| Bacardi Ltd.(b) | |

| 04/01/14 | | | 7.450 | % | | | 6,200,000 | | | | 6,924,048 | | |

General Mills, Inc.

Senior Unsecured(a) | |

| 05/16/14 | | | 0.848 | % | | | 13,445,000 | | | | 13,469,013 | | |

Kraft Foods, Inc.

Senior Unsecured(a) | |

| 07/10/13 | | | 1.457 | % | | | 8,800,000 | | | | 8,856,100 | | |

SABMiller PLC(b)

Senior Unsecured | |

| 08/15/13 | | | 5.500 | % | | | 4,685,000 | | | | 4,948,232 | | |

| 01/15/14 | | | 5.700 | % | | | 4,360,000 | | | | 4,710,330 | | |

| Total | | | 50,300,002 | | |

| Gas Distributors 0.4% | |

Atmos Energy Corp.

Senior Unsecured | |

| 01/15/13 | | | 5.125 | % | | | 1,960,000 | | | | 2,026,808 | | |

| 06/15/17 | | | 6.350 | % | | | 1,525,000 | | | | 1,784,116 | | |

Sempra Energy

Senior Unsecured | |

| 02/01/13 | | | 6.000 | % | | | 2,272,000 | | | | 2,371,127 | | |

| 11/15/13 | | | 8.900 | % | | | 5,230,000 | | | | 5,851,136 | | |

| Total | | | 12,033,187 | | |

| Gas Pipelines 1.6% | |

Energy Transfer Partners LP

Senior Unsecured | |

| 04/15/14 | | | 8.500 | % | | | 5,215,000 | | | | 5,893,101 | | |

| Nisource Finance Corp. | |

| 03/01/13 | | | 6.150 | % | | | 4,288,000 | | | | 4,479,374 | | |

| Plains All American Pipeline LP/Finance Corp. | |

| 09/01/12 | | | 4.250 | % | | | 8,220,000 | | | | 8,319,807 | | |

Southern Natural Gas Co.

Senior Unsecured(b) | |

| 04/01/17 | | | 5.900 | % | | | 8,530,000 | | | | 9,659,551 | | |

TransCanada PipeLines Ltd.

Senior Unsecured | |

| 06/01/15 | | | 3.400 | % | | | 7,350,000 | | | | 7,859,401 | | |

Williams Partners LP/Finance Corp.

Senior Unsecured | |

| 02/01/17 | | | 7.250 | % | | | 7,790,000 | | | | 9,374,400 | | |

| Total | | | 45,585,634 | | |

| Health Care 1.0% | |

Cardinal Health, Inc.

Senior Unsecured | |

| 06/15/15 | | | 4.000 | % | | | 8,770,000 | | | | 9,435,836 | | |

| Express Scripts Holding Co. | |

| 06/15/14 | | | 6.250 | % | | | 9,080,000 | | | | 9,963,193 | | |

Hospira, Inc.

Senior Unsecured | |

| 06/15/14 | | | 5.900 | % | | | 2,000,000 | | | | 2,158,790 | | |

| 03/30/17 | | | 6.050 | % | | | 6,287,000 | | | | 6,999,204 | | |

| Total | | | 28,557,023 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes (continued) | |

| Healthcare Insurance 0.3% | |

Cigna Corp.

Senior Unsecured | |

| 11/15/16 | | | 2.750 | % | | $ | 8,615,000 | | | $ | 8,722,455 | | |

| Independent Energy 1.4% | |

Anadarko Petroleum Corp.

Senior Unsecured | |

| 03/15/14 | | | 7.625 | % | | | 8,084,000 | | | | 9,014,355 | | |

Canadian Natural Resources Ltd.

Senior Unsecured | |

| 10/01/12 | | | 5.450 | % | | | 5,090,000 | | | | 5,208,704 | | |

Encana Corp.

Senior Unsecured | |

| 12/01/17 | | | 5.900 | % | | | 7,430,000 | | | | 8,660,222 | | |

| Southwestern Energy Co. | |

| 02/01/18 | | | 7.500 | % | | | 6,100,000 | | | | 7,349,610 | | |

| Woodside Finance Ltd.(b) | |

| 03/01/14 | | | 8.125 | % | | | 2,070,000 | | | | 2,294,620 | | |

| 11/10/14 | | | 4.500 | % | | | 7,225,000 | | | | 7,669,995 | | |

| Total | | | 40,197,506 | | |

| Integrated Energy 0.3% | |

| Phillips 66(b) | |

| 03/05/15 | | | 1.950 | % | | | 2,135,000 | | | | 2,149,768 | | |

| 05/01/17 | | | 2.950 | % | | | 6,460,000 | | | | 6,565,957 | | |

| Total | | | 8,715,725 | | |

| Life Insurance 1.1% | |

Lincoln National Corp.

Senior Unsecured | |

| 08/27/12 | | | 5.650 | % | | | 5,300,000 | | | | 5,397,435 | | |

| 02/15/14 | | | 4.750 | % | | | 3,855,000 | | | | 4,024,239 | | |

Metlife Institutional Funding II

Secured(a)(b) | |

| 04/04/14 | | | 1.368 | % | | | 11,015,000 | | | | 11,054,147 | | |

Prudential Financial, Inc.

Senior Unsecured | |

| 06/15/17 | | | 6.100 | % | | | 9,030,000 | | | | 10,427,537 | | |

| Total | | | 30,903,358 | | |

| Media Cable 0.8% | |

| Comcast Corp. | |

| 03/15/16 | | | 5.900 | % | | | 10,391,000 | | | | 11,997,708 | | |

| DIRECTV Holdings LLC/Financing Co., Inc. | |

| 02/15/16 | | | 3.125 | % | | | 10,005,000 | | | | 10,378,997 | | |

| Total | | | 22,376,705 | | |

| Media Non-Cable 0.7% | |

| News America, Inc. | |

| 12/15/14 | | | 5.300 | % | | | 10,210,000 | | | | 11,295,119 | | |

| TCM Sub LLC(b) | |

| 01/15/15 | | | 3.550 | % | | | 9,605,000 | | | | 10,163,799 | | |

| Total | | | 21,458,918 | | |

| Metals 0.4% | |

ArcelorMittal

Senior Unsecured | |

| 02/25/17 | | | 4.500 | % | | | 9,000,000 | | | | 9,022,755 | | |

| Vale Overseas Ltd | |

| 01/11/16 | | | 6.250 | % | | | 3,100,000 | | | | 3,516,519 | | |

| Total | | | 12,539,274 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

8

Columbia Short Term Bond Fund

March 31, 2012

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes (continued) | |

| Non-Captive Diversified 1.3% | |

General Electric Capital Corp.

Senior Unsecured(a) | |

| 09/15/14 | | | 0.734 | % | | $ | 37,325,000 | | | $ | 36,827,383 | | |

| Oil Field Services 0.3% | |

| Weatherford International Ltd. | |

| 03/15/13 | | | 5.150 | % | | | 139,000 | | | | 143,411 | | |

| Weatherford International, Inc. | |

| 06/15/17 | | | 6.350 | % | | | 7,530,000 | | | | 8,695,185 | | |

| Total | | | 8,838,596 | | |

| Pharmaceuticals 0.5% | |

Pfizer, Inc.

Senior Unsecured | |

| 02/15/14 | | | 4.500 | % | | | 8,830,000 | | | | 9,483,888 | | |

| Roche Holdings, Inc.(b) | |

| 03/01/14 | | | 5.000 | % | | | 3,945,000 | | | | 4,252,035 | | |

Sanofi

Senior Unsecured(a) | |

| 03/28/14 | | | 0.783 | % | | | 1,000,000 | | | | 1,005,184 | | |

| Total | | | 14,741,107 | | |

| Property & Casualty 1.3% | |

Berkshire Hathaway, Inc.

Senior Unsecured | |

| 08/15/14 | | | 1.203 | % | | | 13,390,000 | | | | 13,568,837 | | |

CNA Financial Corp.

Senior Unsecured | |

| 12/15/14 | | | 5.850 | % | | | 9,433,000 | | | | 10,167,840 | | |

Liberty Mutual Group, Inc.

Senior Unsecured(b) | |

| 03/15/14 | | | 5.750 | % | | | 6,613,000 | | | | 6,970,036 | | |

Transatlantic Holdings, Inc.

Senior Unsecured | |

| 12/14/15 | | | 5.750 | % | | | 7,240,000 | | | | 7,810,997 | | |

| Total | | | 38,517,710 | | |

| REITs 1.2% | |

Camden Property Trust

Senior Unsecured | |

| 11/30/12 | | | 5.875 | % | | | 7,660,000 | | | | 7,851,102 | | |

| 12/15/13 | | | 5.375 | % | | | 1,460,000 | | | | 1,542,332 | | |

Duke Realty LP

Senior Unsecured | |

| 02/15/15 | | | 7.375 | % | | | 7,340,000 | | | | 8,245,550 | | |

Kimco Realty Corp.

Senior Unsecured | |

| 02/01/18 | | | 4.300 | % | | | 7,300,000 | | | | 7,419,275 | | |

Simon Property Group LP

Senior Unsecured | |

| 03/01/17 | | | 5.875 | % | | | 10,000,000 | | | | 11,543,600 | | |

| Total | | | 36,601,859 | | |

| Retailers 0.3% | |

CVS Caremark Corp.

Senior Unsecured | |

| 05/18/15 | | | 3.250 | % | | | 7,500,000 | | | | 7,949,303 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Corporate Bonds & Notes (continued) | |

| Technology 1.1% | |

Cisco Systems, Inc.

Senior Unsecured(a) | |

| 03/14/14 | | | 0.724 | % | | $ | 6,600,000 | | | $ | 6,633,680 | | |

Hewlett-Packard Co.

Senior Unsecured(a) | |

| 05/30/14 | | | 0.891 | % | | | 14,775,000 | | | | 14,604,009 | | |

International Business Machines Corp.

Senior Unsecured | |

| 02/06/15 | | | 0.550 | % | | | 10,000,000 | | | | 9,947,830 | | |

| Total | | | 31,185,519 | | |

| Transportation Services 0.3% | |

| ERAC U.S.A. Finance LLC(b) | |

| 01/10/14 | | | 2.250 | % | | | 1,500,000 | | | | 1,509,631 | | |

| 05/01/15 | | | 5.600 | % | | | 7,000,000 | | | | 7,691,495 | | |

| Total | | | 9,201,126 | | |

| Wireless 0.3% | |

| America Movil SAB de CV | |

| 03/01/14 | | | 5.500 | % | | | 9,170,000 | | | | 9,897,474 | | |

| Wirelines 2.8% | |

AT&T, Inc.

Senior Unsecured | |

| 11/15/13 | | | 6.700 | % | | | 13,000,000 | | | | 14,221,116 | | |

CenturyLink, Inc.

Senior Unsecured | |

| 06/15/17 | | | 5.150 | % | | | 9,000,000 | | | | 9,279,594 | | |

| Deutsche Telekom International Finance BV | |

| 08/20/13 | | | 5.875 | % | | | 9,580,000 | | | | 10,199,836 | | |

France Telecom SA

Senior Unsecured | |

| 09/16/15 | | | 2.125 | % | | | 7,805,000 | | | | 7,953,584 | | |

| 09/14/16 | | | 2.750 | % | | | 3,335,000 | | | | 3,430,511 | | |

| Telecom Italia Capital SA | |

| 10/01/15 | | | 5.250 | % | | | 9,785,000 | | | | 10,103,012 | | |

| Telefonica Emisiones SAU | |

| 01/15/15 | | | 4.949 | % | | | 12,000,000 | | | | 12,373,980 | | |

Verizon Virginia, Inc.

Senior Unsecured | |

| 03/15/13 | | | 4.625 | % | | | 13,967,000 | | | | 14,401,009 | | |

| Total | | | 81,962,642 | | |

Total Corporate Bonds & Notes

(Cost: $903,770,945) | | $ | 918,956,003 | | |

| Residential Mortgage-Backed Securities—Agency 18.9% | |

FDIC Structured Sale Guaranteed Notes

CMO Series 2010-S1 Class 1A(a)(b)(c) | |

| 02/25/48 | | | 0.550 | % | | $ | 12,954,475 | | | $ | 12,957,545 | | |

| Federal Home Loan Mortgage Corp.(a)(c) | |

| 04/01/35 | | | 2.358 | % | | | 404,196 | | | | 425,500 | | |

| 03/01/34 | | | 2.387 | % | | | 587,659 | | | | 620,103 | | |

| 08/01/36 | | | 2.485 | % | | | 245,387 | | | | 262,443 | | |

| 01/01/37 | | | 2.489 | % | | | 719,965 | | | | 767,010 | | |

| 01/01/36 | | | 2.783 | % | | | 1,264,138 | | | | 1,353,530 | | |

| 09/01/37 | | | 5.560 | % | | | 858,292 | | | | 892,109 | | |

| 07/01/36 | | | 5.881 | % | | | 23,152 | | | | 24,908 | | |

| 12/01/36 | | | 6.044 | % | | | 463,760 | | | | 503,209 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

9

Columbia Short Term Bond Fund

March 31, 2012

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Residential Mortgage-Backed Securities—Agency (continued) | |

| CMO IO Series 3630 Class AI | | | | | | | | | | | | | |

| 03/15/17 | | | 1.931 | % | | $ | 5,698,993 | | | $ | 225,309 | | |

| Federal Home Loan Mortgage Corp.(c) | |

| 05/01/24-07/01/25 | | | 4.000 | % | | | 17,648,512 | | | | 18,646,423 | | |

| 02/01/13-05/01/25 | | | 4.500 | % | | | 13,002,863 | | | | 13,870,272 | | |

| 11/01/17-07/01/25 | | | 5.000 | % | | | 29,721,809 | | | | 32,001,732 | | |

| 05/01/17-02/01/24 | | | 5.500 | % | | | 14,965,079 | | | | 16,214,925 | | |

| 03/01/17-10/01/21 | | | 6.000 | % | | | 2,184,955 | | | | 2,372,344 | | |

| 04/01/17 | | | 6.500 | % | | | 4,209,961 | | | | 4,614,495 | | |

| 09/01/15 | | | 7.500 | % | | | 14,809 | | | | 15,620 | | |

| CMO Series 2467 Class NB | | | | | | | | | | | | | |

| 07/15/17 | | | 5.000 | % | | | 4,240,867 | | | | 4,534,433 | | |

| CMO Series 2535 Class TE | | | | | | | | | | | | | |

| 12/15/31 | | | 5.500 | % | | | 1,506,286 | | | | 1,540,835 | | |

| CMO Series 2624 Class LP | | | | | | | | | | | | | |

| 01/15/17 | | | 3.500 | % | | | 187,743 | | | | 188,247 | | |

| CMO Series 2899 Class KC | | | | | | | | | | | | | |

| 03/15/19 | | | 4.500 | % | | | 4,023,336 | | | | 4,123,540 | | |

| CMO Series 3197 Class AB | | | | | | | | | | | | | |

| 08/15/13 | | | 5.500 | % | | | 4,791 | | | | 4,798 | | |

| CMO Series 3414 Class A | | | | | | | | | | | | | |

| 07/15/22 | | | 4.500 | % | | | 7,271,056 | | | | 7,609,321 | | |

| CMO Series 3455 Class KA | | | | | | | | | | | | | |

| 10/15/34 | | | 5.000 | % | | | 1,086,560 | | | | 1,112,959 | | |

| CMO Series 3531 Class CE | | | | | | | | | | | | | |

| 01/15/39 | | | 3.000 | % | | | 1,697,587 | | | | 1,746,050 | | |

| CMO Series 3536 Class PC | | | | | | | | | | | | | |

| 05/15/39 | | | 4.500 | % | | | 5,163,310 | | | | 5,477,395 | | |

| CMO Series 3552 Class AB | | | | | | | | | | | | | |

| 10/15/36 | | | 5.000 | % | | | 8,477,384 | | | | 8,819,140 | | |

| CMO Series 3553 Class GA | | | | | | | | | | | | | |

| 07/15/19 | | | 3.200 | % | | | 6,809,734 | | | | 6,943,786 | | |

| CMO Series 3556 Class MA | | | | | | | | | | | | | |

| 07/15/37 | | | 5.000 | % | | | 5,896,080 | | | | 6,250,966 | | |

| CMO Series 3558 Class AD | | | | | | | | | | | | | |

| 08/15/19 | | | 4.750 | % | | | 9,123,252 | | | | 9,530,610 | | |

| CMO Series 3561 Class AJ | | | | | | | | | | | | | |

| 08/15/19 | | | 3.100 | % | | | 2,742,623 | | | | 2,795,851 | | |

| CMO Series 3565 Class KA | | | | | | | | | | | | | |

| 12/15/35 | | | 5.000 | % | | | 4,334,642 | | | | 4,462,574 | | |

| CMO Series 3567 Class ND | | | | | | | | | | | | | |

| 12/15/17 | | | 4.000 | % | | | 9,357,276 | | | | 9,831,682 | | |

| CMO Series 3774 Class AB | | | | | | | | | | | | | |

| 12/15/20 | | | 3.500 | % | | | 23,294,067 | | | | 24,677,725 | | |

| CMO Series 3812 Class BE | | | | | | | | | | | | | |

| 09/15/18 | | | 2.750 | % | | | 8,257,133 | | | | 8,585,114 | | |

| CMO Series 3831 Class CG | | | | | | | | | | | | | |

| 10/15/18 | | | 3.000 | % | | | 16,758,172 | | | | 17,489,887 | | |

| CMO Series 3832 Class AC | | | | | | | | | | | | | |

| 10/15/18 | | | 3.000 | % | | | 12,004,372 | | | | 12,528,521 | | |

| CMO Series 3840 Class AU | | | | | | | | | | | | | |

| 05/15/37 | | | 3.500 | % | | | 6,056,691 | | | | 6,239,655 | | |

| CMO Series 3856 Class EA | | | | | | | | | | | | | |

| 10/15/18 | | | 3.000 | % | | | 12,159,233 | | | | 12,706,725 | | |

| CMO Series 3862 Class LA | | | | | | | | | | | | | |

| 11/15/18 | | | 2.500 | % | | | 3,705,226 | | | | 3,830,925 | | |

| CMO Series R010 Class AB | | | | | | | | | | | | | |

| 12/15/19 | | | 5.500 | % | | | 3,155,712 | | | | 3,244,957 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Residential Mortgage-Backed Securities—Agency (continued) | |

| Federal Home Loan Mortgage Corp.(c)(d) | |

| 04/01/27 | | | 3.500 | % | | $ | 58,515,000 | | | $ | 61,184,747 | | |

Federal Home Loan Mortgage Corp.(c)(e)

CMO IO Series 11 Class B | | | | | | | | | | | | | |

| 01/01/20 | | | 10.000 | % | | | 3,611 | | | | 935 | | |

| Federal National Mortgage Association(a)(c) | |

| 06/01/33 | | | 1.921 | % | | | 1,229,604 | | | | 1,268,292 | | |

| 04/01/36 | | | 2.146 | % | | | 332,047 | | | | 352,900 | | |

| 11/01/34 | | | 2.173 | % | | | 379,305 | | | | 400,093 | | |

| 07/01/34 | | | 2.284 | % | | | 1,069,710 | | | | 1,137,474 | | |

| 04/01/36 | | | 2.287 | % | | | 1,406,352 | | | | 1,459,728 | | |

| 01/01/35 | | | 2.302 | % | | | 807,592 | | | | 853,458 | | |

| 04/01/34 | | | 2.313 | % | | | 967,490 | | | | 1,016,217 | | |

| 08/01/35 | | | 2.349 | % | | | 694,217 | | | | 728,989 | | |

| 06/01/34 | | | 2.500 | % | | | 771,883 | | | | 822,725 | | |

| 03/01/34 | | | 2.588 | % | | | 931,278 | | | | 993,804 | | |

| 08/01/36 | | | 4.126 | % | | | 217,672 | | | | 227,403 | | |

| 06/01/35 | | | 4.527 | % | | | 1,210,451 | | | | 1,283,235 | | |

| 07/01/33 | | | 4.952 | % | | | 1,773,003 | | | | 1,897,257 | | |

| 07/01/35 | | | 4.966 | % | | | 1,034,122 | | | | 1,100,632 | | |

| 04/01/36 | | | 5.430 | % | | | 275,864 | | | | 296,286 | | |

| 09/01/37 | | | 5.730 | % | | | 307,482 | | | | 329,060 | | |

| 07/01/36 | | | 5.757 | % | | | 26,735 | | | | 28,773 | | |

| 06/01/37 | | | 5.831 | % | | | 1,779,104 | | | | 1,887,362 | | |

| 10/01/35 | | | 6.045 | % | | | 475,685 | | | | 511,099 | | |

| 09/01/37 | | | 6.301 | % | | | 432,544 | | | | 468,673 | | |

| CMO Series 2003-W11 Class A1 | | | | | | | | | | | | | |

| 06/25/33 | | | 3.128 | % | | | 61,859 | | | | 61,839 | | |

| Federal National Mortgage Association(c) | |

| 10/01/20 | | | 3.500 | % | | | 1,296,769 | | | | 1,370,472 | | |

| 03/01/20 | | | 4.000 | % | | | 2,421,130 | | | | 2,565,974 | | |

| 10/01/13-07/01/25 | | | 4.500 | % | | | 10,910,209 | | | | 11,675,198 | | |

| 08/01/13-03/01/25 | | | 5.000 | % | | | 17,089,909 | | | | 18,474,272 | | |

| 08/01/17-01/01/25 | | | 5.500 | % | | | 54,478,131 | | | | 59,450,506 | | |

| 06/01/17-11/01/17 | | | 6.000 | % | | | 9,067,424 | | | | 9,724,183 | | |

| 08/01/14 | | | 6.500 | % | | | 92,256 | | | | 97,436 | | |

| 06/01/17-08/01/17 | | | 7.000 | % | | | 356,919 | | | | 389,153 | | |

| 08/01/15 | | | 7.500 | % | | | 13,197 | | | | 14,125 | | |

| CMO Series 2002-95 Class EB | | | | | | | | | | | | | |

| 04/25/31 | | | 5.000 | % | | | 363,988 | | | | 368,001 | | |

| CMO Series 2003-129 Class AP | | | | | | | | | | | | | |

| 01/25/19 | | | 4.000 | % | | | 2,370,559 | | | | 2,490,580 | | |

| CMO Series 2003-49 Class YC | | | | | | | | | | | | | |

| 06/25/23 | | | 4.000 | % | | | 1,831,648 | | | | 1,955,928 | | |

| CMO Series 2004-60 Class PA | | | | | | | | | | | | | |

| 04/25/34 | | | 5.500 | % | | | 1,611,847 | | | | 1,751,563 | | |

| CMO Series 2004-78 Class AC | | | | | | | | | | | | | |

| 05/25/32 | | | 5.000 | % | | | 1,538,210 | | | | 1,616,971 | | |

| CMO Series 2005-22 Class KJ | | | | | | | | | | | | | |

| 07/25/33 | | | 5.000 | % | | | 6,964,179 | | | | 7,204,265 | | |

| CMO Series 2006-106 Class PA | | | | | | | | | | | | | |

| 06/25/30 | | | 5.500 | % | | | 74,113 | | | | 74,169 | | |

| CMO Series 2006-22 Class CB | | | | | | | | | | | | | |

| 11/25/21 | | | 4.500 | % | | | 1,370,821 | | | | 1,401,742 | | |

| CMO Series 2007-35 Class DH | | | | | | | | | | | | | |

| 09/25/33 | | | 5.000 | % | | | 1,710,834 | | | | 1,769,905 | | |

| CMO Series 2008-18 Class HD | | | | | | | | | | | | | |

| 12/25/18 | | | 4.000 | % | | | 4,077,399 | | | | 4,310,000 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

10

Columbia Short Term Bond Fund

March 31, 2012

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Residential Mortgage-Backed Securities—Agency (continued) | |

| CMO Series 2008-45 Class DA | | | | | | | | | | | | | |

| 03/25/23 | | | 4.500 | % | | $ | 6,966,291 | | | $ | 7,565,253 | | |

| CMO Series 2009-70 Class NL | | | | | | | | | | | | | |

| 08/25/19 | | | 3.000 | % | | | 741,636 | | | | 774,454 | | |

| CMO Series 2009-88 Class HA | | | | | | | | | | | | | |

| 11/25/24 | | | 3.000 | % | | | 11,091,633 | | | | 11,574,364 | | |

| CMO Series 2010-9 Class PA | | | | | | | | | | | | | |

| 10/25/39 | | | 4.500 | % | | | 6,992,383 | | | | 7,075,262 | | |

| CMO Series 2011-25 Class AH | | | | | | | | | | | | | |

| 06/25/21 | | | 2.750 | % | | | 14,517,123 | | | | 15,089,040 | | |

| CMO Series 2011-3 Class EK | | | | | | | | | | | | | |

| 05/25/20 | | | 2.750 | % | | | 1,197,142 | | | | 1,243,196 | | |

| Federal National Mortgage Association(c)(d) | |

| 04/01/27 | | | 3.000 | % | | | 14,170,000 | | | | 14,668,163 | | |

Federal National Mortgage Association(c)(e)

CMO IO STRIPS Series 163 Class 2 | | | | | | | | | | | | | |

| 07/25/22 | | | 8.500 | % | | | 215,328 | | | | 31,499 | | |

| CMO IO STRIPS Series 36 Class 2 | | | | | | | | | | | | | |

| 08/01/18 | | | 9.500 | % | | | 2,198 | | | | 437 | | |

Federal National Mortgage Association(c)(f)(g)

CMO PO Series G-15 Class A | | | | | | | | | | | | | |

| 06/25/21 | | | 0.000 | % | | | 13,035 | | | | 12,482 | | |

| CMO PO Series 1993-92 Class C | | | | | | | | | | | | | |

| 05/25/23 | | | 0.000 | % | | | 570,999 | | | | 511,261 | | |

| Government National Mortgage Association(a)(c) | |

| 03/20/30 | | | 2.250 | % | | | 45,553 | | | | 47,068 | | |

| 04/20/22-06/20/29 | | | 2.375 | % | | | 1,186,327 | | | | 1,228,649 | | |

| 07/20/18 | | | 3.000 | % | | | 152,796 | | | | 159,393 | | |

| Government National Mortgage Association(c) | |

| 08/15/13-09/20/21 | | | 6.000 | % | | | 883,418 | | | | 938,216 | | |

| 09/15/13-11/15/33 | | | 6.500 | % | | | 212,627 | | | | 246,022 | | |

| 11/15/13-08/15/29 | | | 7.000 | % | | | 41,185 | | | | 47,738 | | |

| CMO Series 2008-30 Class AC | | | | | | | | | | | | | |

| 06/20/37 | | | 4.000 | % | | | 4,299,191 | | | | 4,499,560 | | |

| CMO Series 2009-33 Class NK | | | | | | | | | | | | | |

| 05/20/39 | | | 4.500 | % | | | 3,322,510 | | | | 3,569,696 | | |

| CMO Series 2010-61 Class PA | | | | | | | | | | | | | |

| 03/20/33 | | | 4.500 | % | | | 5,576,523 | | | | 5,896,213 | | |

Total Residential Mortgage-Backed Securities—Agency

(Cost: $539,237,336) | | $ | 550,236,563 | | |

| Residential Mortgage-Backed Securities—Non-Agency 1.9% | |

BCAP LLC Trust(b)(c)

CMO Series 2010-RR2 Class 5A1 | |

| 12/26/36 | | | 5.000 | % | | $ | 9,633,362 | | | $ | 9,668,117 | | |

| CMO Series 2010-RR4 Class 32A1 | | | | | | | | | | | | | |

| 01/26/37 | | | 4.000 | % | | | 9,405,079 | | | | 9,487,427 | | |

| CMO Series 2010-RR6 Class 6A1 | | | | | | | | | | | | | |

| 07/26/37 | | | 4.000 | % | | | 1,133,939 | | | | 1,135,526 | | |

Banc of America Funding Corp.

CMO Series 2010-R4 Class 4A1(a)(b)(c) | |

| 06/26/37 | | | 0.451 | % | | | 497,648 | | | | 486,429 | | |

Countrywide Alternative Loan Trust

CMO Series 2004-2CB Class 1A4(a)(c) | |

| 03/25/34 | | | 0.642 | % | | | 98,826 | | | | 94,535 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Residential Mortgage-Backed Securities—Non-Agency (continued) | |

Credit Suisse Mortgage Capital Certificates(a)(b)(c)

CMO Series 2009-12R Class 27A1 | |

| 04/27/36 | | | 2.885 | % | | $ | 915,174 | | | $ | 912,959 | | |

Credit Suisse Mortgage Capital Certificates(b)(c)

CMO Series 2009-12R Class 14A1 | |

| 11/27/35 | | | 5.500 | % | | | 2,752,591 | | | | 2,839,350 | | |

| CMO Series 2009-12R Class 19A1 | | | | | | | | | | | | | |

| 12/27/36 | | | 6.250 | % | | | 4,325,083 | | | | 4,563,655 | | |

| CMO Series 2009-12R Class 25A1 | | | | | | | | | | | | | |

| 10/27/37 | | | 4.894 | % | | | 4,490,559 | | | | 4,501,656 | | |

| CMO Series 2009-12R Class 30A1 | | | | | | | | | | | | | |

| 12/27/36 | | | 8.020 | % | | | 215,827 | | | | 217,142 | | |

| CMO Series 2009-12R Class 42A1 | | | | | | | | | | | | | |

| 06/27/37 | | | 5.000 | % | | | 1,063,908 | | | | 1,066,720 | | |

| CMO Series 2010-12R Class 12A1 | | | | | | | | | | | | | |

| 05/26/37 | | | 4.000 | % | | | 1,846,508 | | | | 1,881,019 | | |

GSR Mortgage Loan Trust

CMO Series 2005-5F Class 2A3(c) | |

| 06/25/35 | | | 5.500 | % | | | 3,861 | | | | 3,854 | | |

JPMorgan Reremic

CMO Series 2010-2 Class 2A1(a)(b)(c) | | | | | | | | | | | | | |

| 03/21/37 | | | 2.641 | % | | | 2,983,509 | | | | 2,916,917 | | |

LVII Resecuritization Trust

CMO Series 2009-3 Class A1(a)(b)(c) | |

| 11/27/37 | | | 5.600 | % | | | 154,878 | | | | 154,765 | | |

Residential Asset Mortgage Products, Inc.

Series 2005-RS2 Class M1(a)(c) | |

| 02/25/35 | | | 0.692 | % | | | 9,322,916 | | | | 8,887,256 | | |

Residential Asset Securitization Trust

CMO Series 2004-A7 Class A1(c) | |

| 10/25/34 | | | 5.500 | % | | | 617 | | | | 616 | | |

Structured Asset Securities Corp.(c)

CMO Series 2003-14 Class 1A3 | |

| 05/25/33 | | | 5.500 | % | | | 89,420 | | | | 92,566 | | |

| CMO Series 2003-21 Class 1A3 | | | | | | | | | | | | | |

| 07/25/33 | | | 5.500 | % | | | 2,906 | | | | 2,901 | | |

| CMO Series 2003-8 Class 2A7 | | | | | | | | | | | | | |

| 04/25/33 | | | 5.750 | % | | | 577,327 | | | | 595,904 | | |

Wells Fargo Mortgage Loan Trust

CMO Series 2010-RR4 Class 1A1(a)(b)(c) | |

| 12/27/46 | | | 5.262 | % | | | 6,000,507 | | | | 6,003,648 | | |

Total Residential Mortgage-Backed Securities—Non-Agency

(Cost: $55,180,247) | | $ | 55,512,962 | | |

| Commercial Mortgage-Backed Securities—Agency 7.7% | |

Federal Home Loan Mortgage Corp.(c)

Multifamily Structured Pass-Through Certificates

CMO Series K001 Class A2 | |

| 04/25/16 | | | 5.651 | % | | $ | 3,241,109 | | | $ | 3,623,680 | | |

| CMO Series K003 Class A1 | | | | | | | | | | | | | |

| 07/25/13 | | | 2.225 | % | | | 2,407,148 | | | | 2,426,203 | | |

Federal National Mortgage Association

CMO Series 2010-M4 Class A1(c) | | | | | | | | | | | | | |

| 06/25/20 | | | 2.520 | % | | | 2,442,969 | | | | 2,529,103 | | |

Government National Mortgage Association(c)

CMO Series 2007-13 Class C | |

| 06/16/40 | | | 5.020 | % | | | 6,890,461 | | | | 7,346,502 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

11

Columbia Short Term Bond Fund

March 31, 2012

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Commercial Mortgage-Backed Securities—Agency (continued) | |

| CMO Series 2009-105 Class A | | | | | | | | | | | | | |

| 12/16/50 | | | 3.456 | % | | $ | 6,903,008 | | | $ | 7,153,477 | | |

| CMO Series 2009-114 Class A | | | | | | | | | | | | | |

| 12/16/38 | | | 3.103 | % | | | 5,266,093 | | | | 5,426,849 | | |

| CMO Series 2009-63 Class A | | | | | | | | | | | | | |

| 01/16/38 | | | 3.400 | % | | | 4,019,439 | | | | 4,190,462 | | |

| CMO Series 2009-71 Class A | | | | | | | | | | | | | |

| 04/16/38 | | | 3.304 | % | | | 5,949,290 | | | | 6,169,177 | | |

| CMO Series 2009-90 Class AC | | | | | | | | | | | | | |

| 01/16/33 | | | 3.137 | % | | | 5,400,000 | | | | 5,549,515 | | |

| CMO Series 2010-102 Class AE | | | | | | | | | | | | | |

| 11/16/39 | | | 3.500 | % | | | 10,150,724 | | | | 10,661,508 | | |

| CMO Series 2010-13 Class A | | | | | | | | | | | | | |

| 08/16/22 | | | 2.461 | % | | | 3,850,940 | | | | 3,873,086 | | |

| CMO Series 2010-141 Class A | | | | | | | | | | | | | |

| 08/16/31 | | | 1.864 | % | | | 4,585,746 | | | | 4,625,633 | | |

| CMO Series 2010-159 Class A | | | | | | | | | | | | | |

| 01/16/33 | | | 2.159 | % | | | 6,889,539 | | | | 6,997,375 | | |

| CMO Series 2010-161 Class AB | | | | | | | | | | | | | |

| 05/16/35 | | | 2.110 | % | | | 15,754,784 | | | | 16,023,766 | | |

| CMO Series 2010-18 Class A | | | | | | | | | | | | | |

| 12/16/50 | | | 3.100 | % | | | 4,814,428 | | | | 5,001,324 | | |

| CMO Series 2010-22 Class AC | | | | | | | | | | | | | |

| 12/16/30 | | | 2.229 | % | | | 3,142,823 | | | | 3,179,880 | | |

| CMO Series 2010-49 Class A | | | | | | | | | | | | | |

| 03/16/51 | | | 2.870 | % | | | 1,248,698 | | | | 1,277,249 | | |

| CMO Series 2010-65 Class A | | | | | | | | | | | | | |

| 11/16/28 | | | 2.017 | % | | | 3,464,204 | | | | 3,487,649 | | |

| CMO Series 2010-83 Class A | | | | | | | | | | | | | |

| 10/16/50 | | | 2.021 | % | | | 4,203,493 | | | | 4,234,657 | | |

| CMO Series 2011-1 Class A | | | | | | | | | | | | | |

| 12/16/31 | | | 2.239 | % | | | 5,641,811 | | | | 5,738,949 | | |

| CMO Series 2011-120 Class AB | | | | | | | | | | | | | |

| 08/16/33 | | | 2.400 | % | | | 12,961,156 | | | | 13,240,378 | | |

| CMO Series 2011-143 Class AB | | | | | | | | | | | | | |

| 03/16/33 | | | 3.973 | % | | | 18,762,931 | | | | 19,786,768 | | |

| CMO Series 2011-144 Class AB | | | | | | | | | | | | | |

| 07/16/35 | | | 2.012 | % | | | 5,155,809 | | | | 5,244,747 | | |

| CMO Series 2011-149 Class A | | | | | | | | | | | | | |

| 10/16/46 | | | 3.000 | % | | | 4,603,797 | | | | 4,808,261 | | |

| CMO Series 2011-16 Class A | | | | | | | | | | | | | |

| 11/16/34 | | | 2.210 | % | | | 8,287,856 | | | | 8,426,058 | | |

| CMO Series 2011-20 Class A | | | | | | | | | | | | | |

| 04/16/32 | | | 1.883 | % | | | 7,115,053 | | | | 7,189,818 | | |

| CMO Series 2011-31 Class A | | | | | | | | | | | | | |

| 12/16/35 | | | 2.210 | % | | | 5,804,048 | | | | 5,912,398 | | |

| CMO Series 2011-49 Class A | | | | | | | | | | | | | |

| 07/16/38 | | | 2.450 | % | | | 21,240,093 | | | | 21,764,150 | | |

| CMO Series 2011-78 Class A | | | | | | | | | | | | | |

| 08/16/34 | | | 2.250 | % | | | 11,394,050 | | | | 11,589,596 | | |

| CMO Series 2012-1 Class AB | | | | | | | | | | | | | |

| 09/16/33 | | | 1.999 | % | | | 9,821,165 | | | | 9,978,438 | | |

| CMO Series 2012-22 Class AB | | | | | | | | | | | | | |

| 03/16/33 | | | 1.661 | % | | | 5,800,436 | | | | 5,843,471 | | |

| CMO Series 2012-9 Class A | | | | | | | | | | | | | |

| 05/16/39 | | | 3.220 | % | | | 2,491,467 | | | | 2,608,569 | | |

Total Commercial Mortgage-Backed Securities—Agency

(Cost: $223,473,514) | | $ | 225,908,696 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Commercial Mortgage-Backed Securities—Non-Agency 6.7% | |

Bear Stearns Commercial Mortgage Securities(c)

Series 2005-PW10 Class AAB | |

| 12/11/40 | | | 5.382 | % | | $ | 8,338,793 | | | $ | 8,656,776 | | |

| Series 2005-T20 Class AAB | | | | | | | | | | | | | |

| 10/12/42 | | | 5.129 | % | | | 11,737,689 | | | | 12,319,339 | | |

| Series 2006-PW12 Class AAB | | | | | | | | | | | | | |

| 09/11/38 | | | 5.694 | % | | | 2,961,712 | | | | 3,146,040 | | |

Citigroup Commercial Mortgage Trust(c)

Series 2004-C1 Class A3 | |

| 04/15/40 | | | 5.251 | % | | | 2,914,191 | | | | 2,985,411 | | |

| Series 2004-C2 Class A3 | | | | | | | | | | | | | |

| 10/15/41 | | | 4.380 | % | | | 517,322 | | | | 517,141 | | |

| Series 2005-C3 Class ASB | | | | | | | | | | | | | |

| 05/15/43 | | | 4.755 | % | | | 7,396,113 | | | | 7,694,990 | | |

Commercial Mortgage Pass-Through Certificates

Series 2011-STRT Class A(b)(c) | |

| 12/10/24 | | | 2.555 | % | | | 4,000,000 | | | | 4,020,752 | | |

Credit Suisse First Boston Mortgage Securities Corp.(c)

Series 2002-CP3 Class A3 | |

| 07/15/35 | | | 5.603 | % | | | 1,787,003 | | | | 1,788,358 | | |

| Series 2002-CP5 Class A2 | | | | | | | | | | | | | |

| 12/15/35 | | | 4.940 | % | | | 26,163,207 | | | | 26,518,687 | | |

| Series 2005-C2 Class AAB | | | | | | | | | | | | | |

| 04/15/37 | | | 4.681 | % | | | 8,007,162 | | | | 8,219,736 | | |

| Series 2005-C5 Class AAB | | | | | | | | | | | | | |

| 08/15/38 | | | 5.100 | % | | | 4,227,258 | | | | 4,412,944 | | |

GE Capital Commercial Mortgage Corp.

Series 2005-C1 Class AAB(c) | |

| 06/10/48 | | | 4.599 | % | | | 1,932,304 | | | | 1,992,802 | | |

GMAC Commercial Mortgage Securities, Inc.(c)

Series 2002-C3 Class A2 | |

| 07/10/39 | | | 4.930 | % | | | 8,284,142 | | | | 8,395,231 | | |

| Series 2003-C1 Class A2 | | | | | | | | | | | | | |

| 05/10/36 | | | 4.079 | % | | | 5,000,000 | | | | 5,099,260 | | |

| Series 2004-C1 Class A4 | | | | | | | | | | | | | |

| 03/10/38 | | | 4.908 | % | | | 8,095,000 | | | | 8,584,278 | | |

GS Mortgage Securities Corp. II

Series 2011-GC3 Class A1(b)(c) | |

| 03/10/44 | | | 2.331 | % | | | 13,563,992 | | | | 13,796,329 | | |

Greenwich Capital Commercial Funding Corp.(c)

Series 2003-C2 Class A3 | |

| 01/05/36 | | | 4.533 | % | | | 1,184,622 | | | | 1,189,156 | | |

| Series 2005-GG3 Class AAB | | | | | | | | | | | | | |

| 08/10/42 | | | 4.619 | % | | | 12,062,959 | | | | 12,395,932 | | |

JPMorgan Chase Commercial Mortgage Securities Corp.(c)

Series 2002-C2 Class A2 | |

| 12/12/34 | | | 5.050 | % | | | 8,274,768 | | | | 8,399,427 | | |

| Series 2005-CB11 Class ASB | | | | | | | | | | | | | |

| 08/12/37 | | | 5.201 | % | | | 8,649,310 | | | | 9,001,899 | | |

| Series 2005-LDP2 Class ASB | | | | | | | | | | | | | |

| 07/15/42 | | | 4.659 | % | | | 7,591,102 | | | | 7,931,092 | | |

| Series 2006-CB14 Class ASB | | | | | | | | | | | | | |

| 12/12/44 | | | 5.506 | % | | | 6,757,579 | | | | 7,173,501 | | |

| Series 2006-LDP7 Class ASB | | | | | | | | | | | | | |

| 04/15/45 | | | 5.871 | % | | | 2,273,774 | | | | 2,390,750 | | |

LB-UBS Commercial Mortgage Trust(c)

Series 2003-C1 Class A3 | |

| 03/15/27 | | | 4.095 | % | | | 1,563,987 | | | | 1,582,525 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

12

Columbia Short Term Bond Fund

March 31, 2012

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Commercial Mortgage-Backed Securities—Non-Agency (continued) | |

| Series 2005-C2 Class AAB | | | | | | | | | | | | | |

| 04/15/30 | | | 5.007 | % | | $ | 1,282,074 | | | $ | 1,332,536 | | |

| Series 2007-C1 Class AAB | | | | | | | | | | | | | |

| 02/15/40 | | | 5.403 | % | | | 5,306,028 | | | | 5,626,740 | | |

| Series 2008-C1 Class A1 | | | | | | | | | | | | | |

| 04/15/41 | | | 5.611 | % | | | 765,217 | | | | 776,334 | | |

Nationslink Funding Corp.

Series 1999-LTL1 Class A3(c) | |

| 01/22/26 | | | 7.104 | % | | | 6,357,513 | | | | 6,782,914 | | |

Wachovia Bank Commercial Mortgage Trust(c)

Series 2004-C12 Class A4 | |

| 07/15/41 | | | 5.317 | % | | | 10,595,000 | | | | 11,372,885 | | |

| Series 2005-C17 Class APB | | | | | | | | | | | | | |

| 03/15/42 | | | 5.037 | % | | | 1,064,583 | | | | 1,102,267 | | |

Total Commercial Mortgage-Backed Securities—Non-Agency

(Cost: $195,349,560) | | $ | 195,206,032 | | |

| Asset-Backed Securities—Agency —% | |

| Small Business Administration Pools(a) | |

| 06/25/22 | | | 0.875 | % | | $ | 134,459 | | | $ | 135,385 | | |

United States Small Business Administration

Series 2002-P10B Class 1 | |

| 08/10/12 | | | 5.199 | % | | | 176,706 | | | | 179,361 | | |

Total Asset-Backed Securities—Agency

(Cost: $311,091) | | $ | 314,746 | | |

| Asset-Backed Securities—Non-Agency 17.1% | |

Aames Mortgage Investment Trust

Series 2005-3 Class A2(a)(b) | |

| 08/25/35 | | | 0.502 | % | | $ | 16,326,667 | | | $ | 15,703,837 | | |

Access Group, Inc.(a)

Series 2004A Class A2 | |

| 04/25/29 | | | 0.820 | % | | | 8,209,246 | | | | 7,760,438 | | |

| Series 2005-1 Class A1 | | | | | | | | | | | | | |

| 06/22/18 | | | 0.554 | % | | | 17,248 | | | | 17,248 | | |

| Series 2007A Class A2 | | | | | | | | | | | | | |

| 08/25/26 | | | 0.621 | % | | | 8,515,145 | | | | 8,004,919 | | |

Ally Master Owner Trust(a)

CMO Series 2011-3 Class A1 | |

| 05/15/16 | | | 0.872 | % | | | 15,925,000 | | | | 15,867,683 | | |

| Series 2011-1 Class A1 | | | | | | | | | | | | | |

| 01/15/16 | | | 1.112 | % | | | 10,905,000 | | | | 10,921,794 | | |

| Series 2011-4 Class A1 | | | | | | | | | | | | | |

| 09/15/16 | | | 1.042 | % | | | 19,690,000 | | | | 19,689,996 | | |

| Series 2012-1 Class A1 | | | | | | | | | | | | | |

| 02/15/17 | | | 1.042 | % | | | 10,000,000 | | | | 9,999,998 | | |

Ally Master Owner Trust(b)

Series 2010-3 Class A | |

| 04/15/15 | | | 2.880 | % | | | 1,464,000 | | | | 1,490,329 | | |

AmeriCredit Automobile Receivables Trust

Series 2008-2 Class A3(a) | |

| 04/06/15 | | | 5.243 | % | | | 980,664 | | | | 1,019,255 | | |

American Credit Acceptance Receivables Trust

Series 2012-1 Class A2(b) | |

| 10/15/15 | | | 3.040 | % | | | 6,000,000 | | | | 5,998,380 | | |

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Asset-Backed Securities—Non-Agency (continued) | |

Amresco Residential Securities Mortgage Loan Trust

Series 1998-3 Class A7(a)(h) | |

| 07/25/28 | | | 0.722 | % | | $ | 14,774 | | | $ | 10,532 | | |

Arizona Educational Loan Marketing Corp.

Series 2004A Class A2(a) | |

| 12/01/23 | | | 0.708 | % | | | 7,452,632 | | | | 7,286,512 | | |

Avis Budget Rental Car Funding AESOP LLC

Series 2012-1A Class A(b) | |

| 08/20/16 | | | 2.054 | % | | | 14,200,000 | | | | 14,241,849 | | |

Bear Stearns Asset-Backed Securities Trust

Series 2006-HE9 Class 1A1(a) | |

| 11/25/36 | | | 0.292 | % | | | 153,499 | | | | 152,010 | | |

Brazos Higher Education Authority

Series 2011-1 Class A1(a) | |

| 02/25/20 | | | 0.941 | % | | | 874,767 | | | | 873,478 | | |

CIT Education Loan Trust

Series 2005-1 Class A2(a) | |

| 03/15/22 | | | 0.564 | % | | | 1,185,174 | | | | 1,179,292 | | |

CNH Wholesale Master Note Trust

Series 2011-1A Class A(a)(b) | |

| 12/15/15 | | | 1.042 | % | | | 7,000,000 | | | | 7,005,708 | | |

Capital Auto Receivables Asset Trust

Series 2007-4A Class A4 | |

| 05/15/14 | | | 5.300 | % | | | 123,048 | | | | 123,493 | | |

Capital Auto Receivables Asset Trust(b)

Series 2007-2 Class B | |

| 02/18/14 | | | 5.760 | % | | | 2,549,975 | | | | 2,557,917 | | |

Carrington Mortgage Loan Trust

Series 2006-RFC1 Class A2(a) | |

| 05/25/36 | | | 0.342 | % | | | 784,054 | | | | 766,188 | | |

Chesapeake Funding LLC(a)(b)

Series 2009-1 Class A | |

| 12/15/20 | | | 2.242 | % | | | 4,759,628 | | | | 4,768,754 | | |

| Series 2011-2A Class A | | | | | | | | | | | | | |

| 04/07/24 | | | 1.493 | % | | | 11,360,000 | | | | 11,415,717 | | |

Citigroup Mortgage Loan Trust, Inc.(a)

Series 2006-WFH4 Class A2 | |

| 11/25/36 | | | 0.342 | % | | | 262,981 | | | | 261,896 | | |

Citigroup Mortgage Loan Trust, Inc.(a)(b)

Series 2003-HE4 Class A | |

| 12/25/33 | | | 0.652 | % | | | 5,860,292 | | | | 5,703,506 | | |

Cityscape Home Equity Loan Trust(h)

Series 1997-B Class A7 | |

| 05/25/28 | | | 7.410 | % | | | 6,833 | | | | 3,433 | | |

| Series 1997-C Class A3 | | | | | | | | | | | | | |

| 07/25/28 | | | 7.380 | % | | | 607,537 | | | | 587,062 | | |

Countrywide Asset-Backed Certificates

Series 2005-11 Class 3AV3(a) | |

| 02/25/36 | | | 0.662 | % | | | 8,134,573 | | | | 8,067,512 | | |

DT Auto Owner Trust(b)

Series 2011-1A Class B | |

| 12/16/13 | | | 1.940 | % | | | 3,000,000 | | | | 3,006,283 | | |

| Series 2011-2A Class B | | | | | | | | | | | | | |

| 02/16/16 | | | 2.120 | % | | | 4,104,000 | | | | 4,107,465 | | |

| Series 2011-3A Class B | | | | | | | | | | | | | |

| 02/15/17 | | | 3.020 | % | | | 4,300,000 | | | | 4,301,054 | | |

EFS Volunteer LLC

Series 2010-1 Class A1(a)(b) | |

| 10/26/26 | | | 1.410 | % | | | 12,055,605 | | | | 12,020,713 | | |

The Accompanying Notes to Financial Statements are an integral part of this statement.

13

Columbia Short Term Bond Fund

March 31, 2012

(Percentages represent value of investments compared to net assets)

| Issuer | | Coupon

Rate | | Principal

Amount | | Value | |

| Asset-Backed Securities—Non-Agency (continued) | |

Educational Funding of the South, Inc.

Series 2011-1 Class A1(a) | |

| 10/25/21 | | | 1.110 | % | | $ | 3,570,040 | | | $ | 3,546,250 | | |

Encore Credit Receivables Trust

Series 2005-4 Class 2A4(a) | |

| 01/25/36 | | | 0.582 | % | | | 23,000,000 | | | | 21,688,172 | | |

First Alliance Mortgage Loan Trust

Series 1994-2 Class A2 (NPFGC) | |

| 06/25/25 | | | 6.680 | % | | | 33,594 | | | | 32,514 | | |

First Franklin Mortgage Loan Asset-Backed Certificates

Series 2005-FF9 Class A3(a) | |

| 10/25/35 | | | 0.522 | % | | | 11,052,905 | | | | 10,850,317 | | |

First Investors Auto Owner Trust(b)

Series 2011-1 Class A2 | |

| 03/16/15 | | | 1.470 | % | | | 3,864,899 | | | | 3,877,182 | | |

| Series 2011-2A Class A2 | | | | | | | | | | | | | |

| 08/15/17 | | | 2.600 | % | | | 8,226,790 | | | | 8,230,081 | | |

| Series 2012-1A Class A2 | | | | | | | | | | | | | |

| 11/15/17 | | | 1.960 | % | | | 5,750,000 | | | | 5,851,814 | | |

Ford Credit Floorplan Master Owner Trust

Series 2010-5 Class A1 | |

| 09/15/15 | | | 1.500 | % | | | 700,000 | | | | 704,270 | | |

| Series 2011-1 Class A1 | | | | | | | | | | | | | |

| 02/15/16 | | | 2.120 | % | | | 1,215,000 | | | | 1,242,901 | | |

Ford Credit Floorplan Master Owner Trust(a)(b)

Series 2010-1 Class A | | | | | | | | | | | | | |

| 12/15/14 | | | 1.892 | % | | | 10,000,000 | | | | 10,100,120 | | |

GE Dealer Floorplan Master Note Trust

Series 2011-1 Class A(a) | | | | | | | | | | | | | |