UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-09645 |

|

Columbia Funds Series Trust |

(Exact name of registrant as specified in charter) |

|

225 Franklin Street, Boston, Massachusetts | | 02110 |

(Address of principal executive offices) | | (Zip code) |

|

Scott R. Plummer

5228 Ameriprise Financial Center

Minneapolis, MN 55474 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-612-671-1947 | |

|

Date of fiscal year end: | February 28 | |

|

Date of reporting period: | February 28, 2011 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Columbia Overseas Value Fund

Annual Report for the Period Ended February 28, 2011

Not FDIC insured • No bank guarantee • May lose value

Table of Contents

| Fund Profile | | | 1 | | |

|

| Economic Update | | | 2 | | |

|

| Performance Information | | | 4 | | |

|

| Understanding Your Expenses | | | 5 | | |

|

| Portfolio Manager's Report | | | 6 | | |

|

| Investment Portfolio | | | 8 | | |

|

Statement of Assets and

Liabilities | | | 13 | | |

|

| Statement of Operations | | | 14 | | |

|

Statement of Changes in

Net Assets | | | 15 | | |

|

| Financial Highlights | | | 17 | | |

|

| Notes to Financial Statements | | | 18 | | |

|

Report of Independent Registered

Public Accounting Firm | | | 27 | | |

|

| Federal Income Tax Information | | | 28 | | |

|

| Fund Governance | | | 29 | | |

|

| Shareholder Meeting Results | | | 33 | | |

|

Important Information About

This Report | | | 37 | | |

|

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia Fund. References to specific securities should not be construed as a recommendation or investment advice.

President's Message

Dear Shareholder:

The Columbia Management story began over 100 years ago, and today, we are one of the nation's largest dedicated asset managers. The recent acquisition by Ameriprise Financial, Inc. brings together the talents, resources and capabilities of Columbia Management with those of RiverSource Investments, Threadneedle (acquired by Ameriprise in 2003) and Seligman Investments (acquired by Ameriprise in 2008) to build a best-in-class asset management business that we believe is truly greater than its parts.

RiverSource Investments traces its roots to 1894 when its then newly-founded predecessor, Investors Syndicate, offered a face-amount savings certificate that gave small investors the opportunity to build a safe and secure fund for retirement, education or other special needs. A mutual fund pioneer, Investors Syndicate launched Investors Mutual Fund in 1940. In the decades that followed, its mutual fund products and services lineup grew to include a full spectrum of styles and specialties. More than 110 years later, RiverSource continues to be a trusted financial products leader.

Threadneedle, a leader in global asset management and one of Europe's largest asset managers, offers sophisticated international experience from a dedicated U.K. management team. Headquartered in London, it is named for Threadneedle Street in the heart of the city's financial district, where British investors pioneered international and global investing. Threadneedle was acquired in 2003 and today operates as an affiliate of Columbia Management.

Seligman Investments' beginnings date back to the establishment of the investment firm J. & W. Seligman & Co. in 1864. In the years that followed, Seligman played a major role in the geographical expansion and industrial development of the United States. In 1874, President Ulysses S. Grant named Seligman as fiscal agent for the U.S. Navy—an appointment that would last through World War I. Seligman helped finance the westward path of the railroads and the building of the Panama Canal. The firm organized its first investment company in 1929 and began managing its first mutual fund in 1930. In 2008, J. & W. Seligman & Co. Incorporated was acquired and Seligman Investments became an offering brand of RiverSource Investments, LLC.

We are proud of the rich and distinctive history of these firms, the strength and breadth of products and services they offer, and the combined cultures of pioneering spirit and forward thinking. Together we are committed to providing more for our shareholders than ever before.

> A singular focus on our shareholders

Our business is asset management, so investors are our first priority. We dedicate our resources to identifying timely investment opportunities and provide a comprehensive choice of equity, fixed-income and alternative investments to help meet your individual needs.

> First-class research and thought leadership

We are dedicated to helping you take advantage of today's opportunities and anticipate tomorrow's. We stay abreast of the latest investment trends and ideas, using our collective insight to evaluate events and transform them into solutions you can use.

> A disciplined investment approach

We aren't distracted by passing fads. Our teams adhere to a rigorous investment process that helps ensure the integrity of our products and enables you and your financial advisor to match our solutions to your objectives with confidence.

When you choose Columbia Management, you can be confident that we will take the time to understand your needs and help you and your financial advisor identify the solutions that are right for you. Because at Columbia Management, we don't consider ourselves successful unless you are.

Sincerely,

J. Kevin Connaughton

President, Columbia Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus, which contains this and other important information about the funds, visit www.columbiamanagement.com. The prospectus should be read carefully before investing.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2011 Columbia Management Investment Advisers, LLC. All rights reserved.

Fund Profile – Columbia Overseas Value Fund

Summary

g For the 12-month period that ended February 28, 2011, the fund's Class Z shares returned 17.06%.

g The fund trailed its benchmark, the MSCI EAFE Value Index (Net)1, which returned 18.55%. Its return also lagged the 21.24% average return of the funds in its peer group, the Lipper International Multi-Cap Value Funds Classification.2

g Stock selection, especially a focus on more defensive companies in the consumer discretionary sector, held back performance despite strong results from holdings in the financials sector.

Portfolio Management

Fred Copper has managed the fund since 2010. From 2008 until joining Columbia Management Investment Advisers, LLC in May 2010, Mr. Copper was associated with the fund's previous investment adviser as an investment professional.

1The Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE) Value Index (Net) is a subset of the MSCI EAFE Index, and constituents of the index include securities from Europe, Australasia and the Far East. The index generally represents approximately 50% of the free float-adjusted market capitalization of the underlying MSCI EAFE Index, and consists of those securities classified by Morgan Stanley Capital International, Inc. (MSCI) as most representing the value style, such as higher book value-to-price ratios, higher forward earnings-to-price ratios, higher dividend yields and lower forecasted growth rates than securities representing the growth style.

2Lipper Inc., a widely respected data provider in the industry, calculates an average total return (assuming reinvestment of distributions) for mutual funds with investment objectives similar to those of the fund. Lipper makes no adjustment for the effect of sales loads.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

Summary

1-year return as of 02/28/11

| | | | +17.06% | |

|

|  | | | Class Z shares

(without sales charge) | |

|

| | | | +18.55% | |

|

|  | | | MSCI EAFE Value Index (Net) | |

|

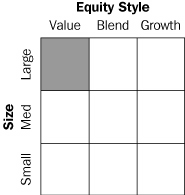

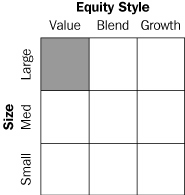

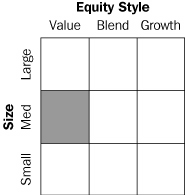

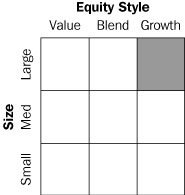

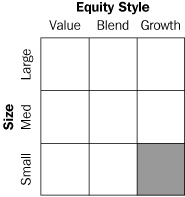

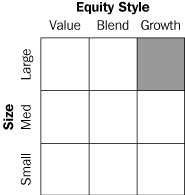

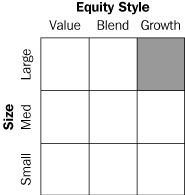

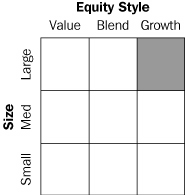

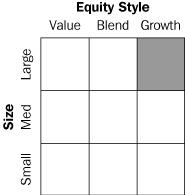

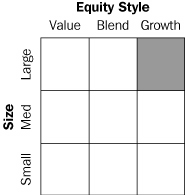

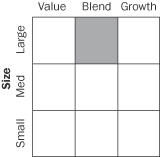

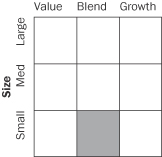

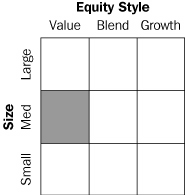

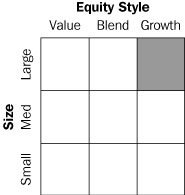

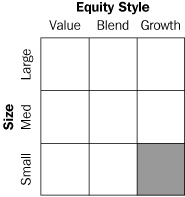

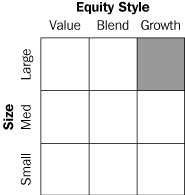

Morningstar Style BoxTM

The Morningstar Style BoxTM is based on the fund's portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend or growth). Information shown is based on the most recent data provided by Morningstar.

© 2011 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

1

Economic Update – Columbia Overseas Value Fund

Summary

For the 12-month period that ended February 28, 2011

g Despite intermittent volatility, stock markets around the world gained ground, as measured by the S&P 500 Index, the MSCI EAFE Index (Net) and the MSCI Emerging Markets Index (Net).

| S&P Index | | MSCI EAFE

Index | |

|

| |  | |

|

MSCI EM

Index | | | | | |

|

| | | |

|

As the world shed concerns that key economies might lapse back into recession, the World Bank reported that global gross domestic product (GDP) rose 3.9% in 2010. The improvement over 2009 was more notable in high-income developed economies than in emerging-market countries, which had less ground to make up. Emerging market countries expanded by an estimated 7%, contributing nearly half of all global growth in 2010. This two-speed global recovery is likely to result in slower growth in 2011, but global growth should remain solid at 3.3% to 3.6%1—higher in emerging market economies, led by China and India.

Robust expansion in the Asia Pacific region

Asian Pacific economies led the global economy in 2010 and are poised to continue in that role. Exports from markets such as Singapore and South Korea have been solid and domestic demand continues to strengthen. Labor markets are healthy, income is rising and confidence runs high across the region. Higher oil prices pose a downside risk to the current expansion, because it could erode demand for Asian exports and increase the risk of inflation. However, if growth exceeds expectations in the United States or Europe, the picture gets even better for Asia.

Austerity measures weigh on Europe

Growth in the developed world was hampered by a debt crisis in Europe's weakest nations. However, the European Union took steps to manage debt restructuring in an orderly fashion and fear subsided—at least for now. In addition, austerity measures were introduced in Greece, Ireland, Portugal and Spain. Public employment and government spending were cut back sharply. Layoffs and pay cuts have been met with resistance, but their necessity is hard to dispute.

Inflation a growing worry

As demand picked up and commodity prices began to rise across the globe, inflation has become a growing worry in both fast-growing emerging markets and slower-growth developed countries. In developed market economies, inflation is generally an external force, resulting from higher commodity prices, especially for food and energy. In emerging markets, excess demand is driving inflation concerns and policymakers have begun to shift their focus from stimulating growth to taming inflation. However, rising food prices are also a problem in Asia since food accounts for a greater percentage of household budgets than it does in more developed areas of the world.

Stocks stall, then pick up steam

Despite a period of volatility in the summer of 2010, as the world sought to digest a mounting debt crisis within euro-zone countries, it was a good year for stock markets around the world. The U.S. stock market returned 22.57% for the 12-month period, as measured by the S&P 500 Index.2 Outside the U.S., stock market returns were also strong. The MSCI EAFE Index (Net),3 a broad gauge of stock market performance in foreign developed markets, gained 20.00% (in U.S.

1World Bank estimate, January 12, 2011.

2The Standard & Poor's (S&P) 500 Index tracks the performance of 500 widely held, large-capitalization U.S. stocks.

3The Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE) Index (Net) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. As of May 27, 2010, the MSCI EAFE Index (Net) consisted of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom.

2

Economic Update (continued) – Columbia Overseas Value Fund

dollars) for the period. The MSCI Emerging Markets Index (Net)4 returned 20.91% (in U.S. dollars), led by strong performances from European and Eastern European markets. Rising inflation pressures and tighter monetary policy late in the 12-month period tempered returns.

Past performance is no guarantee of future results.

4The Morgan Stanley Capital International Emerging Markets (MSCI EM) Index (Net) is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. As of May 27, 2010, the MSCI EM Index (Net) consisted of the following 21 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand and Turkey.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the fund may not match those in an index.

3

Performance Information – Columbia Overseas Value Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

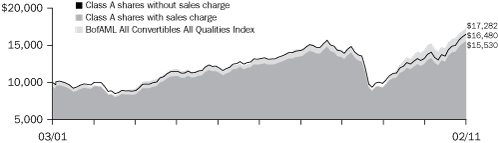

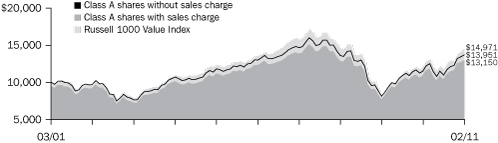

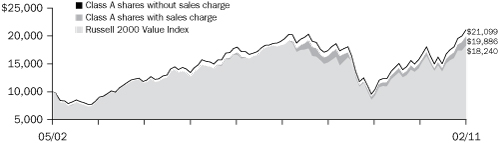

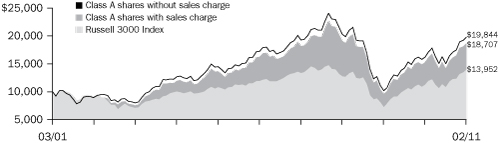

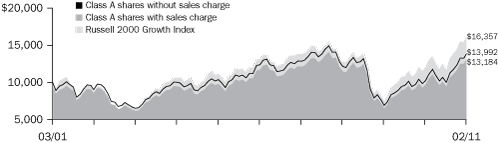

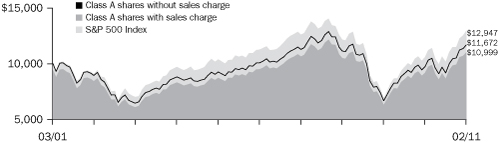

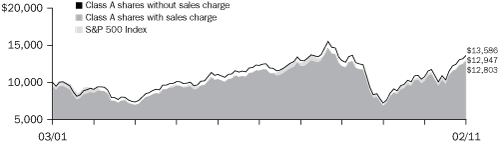

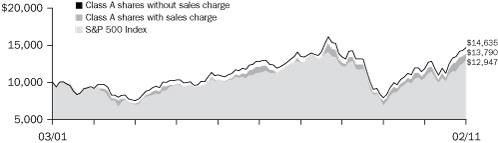

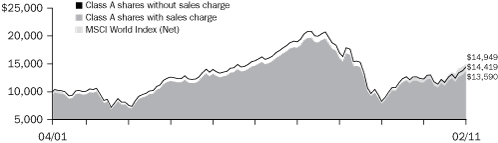

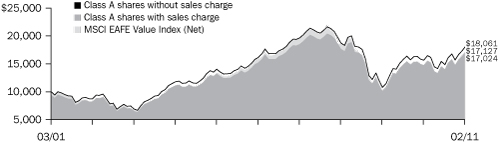

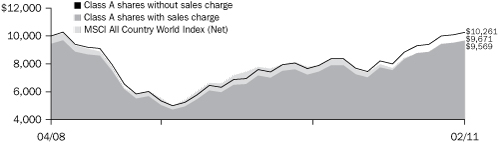

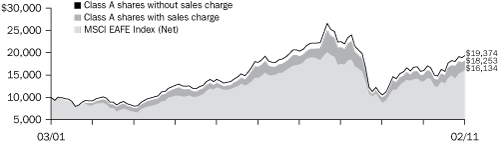

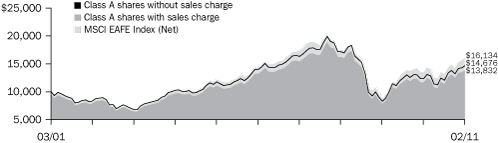

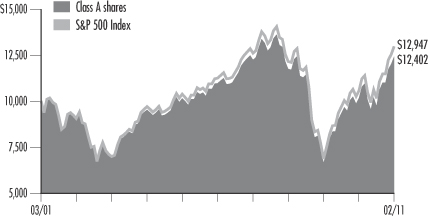

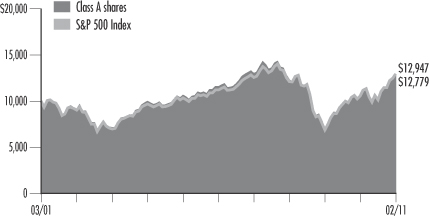

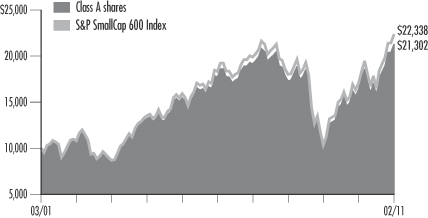

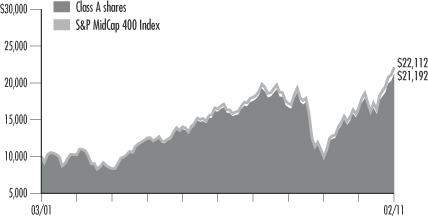

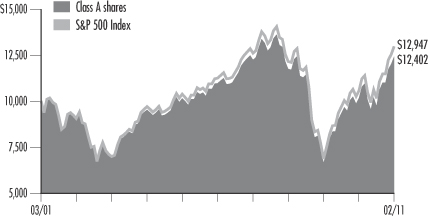

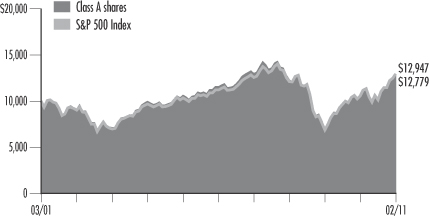

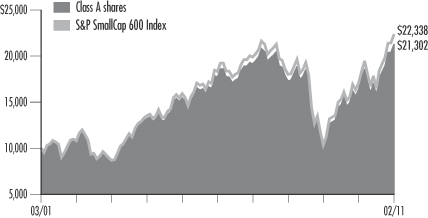

Performance of a $10,000 investment 03/31/08 – 02/28/11

The chart above shows the change in value of a hypothetical $10,000 investment in Class Z shares of Columbia Overseas Value Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

Performance of a $10,000 investment 03/31/08 – 02/28/11 ($)

| Sales charge | | without | | with | |

| Class Z | | | 8,868 | | | | n/a | | |

Average annual total return as of 02/28/11 (%)

| Share class | | Z | |

| Inception | | 03/31/08 | |

| Sales charge | | without | |

| 1-year | | | 17.06 | | |

| Life | | | –4.04 | | |

The Fund commenced operations on March 31, 2008. The returns shown do not reflect any sales charges and have not been adjusted to reflect differences in expenses. if differences in expenses were reflected, the return shown would have been lower.

All results shown assume reinvestment of distributions. Class Z shares are sold at net asset value with no distribution and service (Rule 12b-1) fees. Class Z shares have limited eligibility and the investment minimum requirements may vary. Please see the fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class.

Performance results reflect any fee waivers or reimbursements of fund expenses by the Investment Manager and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The tables do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares.

4

Understanding Your Expenses – Columbia Overseas Value Fund

As a fund shareholder, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees or exchange fees. There are also ongoing costs, which generally include investment advisory fees, distribution and service (Rule 12b-1) fees and other fund expenses. The information on this page is intended to help you understand the ongoing costs of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing your fund's expenses by share class

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class during the period. The information in the following table is based on an initial investment of $1,000, which is invested at the beginning of the period and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the fund's actual operating expenses and total return for the period. The amount listed in the "Hypothetical" column for each share class assumes that the return each year is 5% before expenses and is calculated based on the fund's actual operating expenses. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during this period.

Compare with other funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the fund with other funds. To do so, compare the 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees.

Estimating your actual expenses

To estimate the expenses that you paid over the period, first you will need your account balance at the end of the period:

g For shareholders who receive their account statements from Columbia Management Investment Services Corp., your account balance is available online at www.columbiamanagement.com or by calling Shareholder Services at 800.345.6611.

g For shareholders who receive their account statements from their financial intermediary, contact your financial intermediary to obtain your account balance.

1. Divide your ending account balance by $1,000. For example, if an account balance was $8,600 at the end of the period, the result would be 8.6.

2. In the section of the table below titled "Expenses paid during the period," locate the amount for your share class. You will find this number in the column labeled "Actual." Multiply this number by the result from step 1. Your answer is an estimate of the expenses you paid on your account during the period.

If the value of your account falls below the minimum initial investment requirement applicable to you, your account may be subject to a $20 annual fee. This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

09/01/10 – 02/28/11

| | | Account value at the

beginning of the period ($) | | Account value at the

end of the period ($) | | Expenses paid

during the period ($) | | Fund's annualized

expense ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | |

| Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 1,216.10 | | | | 1,019.09 | | | | 6.32 | | | | 5.76 | | | | 1.15 | | |

Expenses paid during the period are equal to the annualized expense ratio for the share class, multiplied by the average account value over the period, then multiplied by the number of days in the fund's most recent fiscal half-year and divided by 365.

Had the Investment Manager and/or any of its affiliates not waived fees or reimbursed a portion of expenses, account value at the end of the period would have been reduced.

It is important to note that the expense amounts shown in the table are meant to highlight only ongoing costs of investing in the fund and do not reflect any transaction costs, such as sales charges, redemption fees or exchange fees. Therefore, the hypothetical examples provided may not help you determine the relative total costs of owning shares of different funds. If these transaction costs were included, your costs would have been higher.

5

Portfolio Manager's Report – Columbia Overseas Value Fund

Performance data quoted represents past performance and current performance may be lower or higher. Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. Please visit www.columbiamanagement.com for daily and most recent month-end performance updates.

Net asset value per share

as of 02/28/11 ($)

Distributions declared per share

03/01/10 – 02/28/11 ($)

For the 12-month period that ended February 28, 2011, the fund's Class Z shares returned 17.06%. The fund's results trailed the MSCI EAFE Value Index (Net), which returned 18.55% over the same period. The average return for funds in its peer group, the Lipper International Multi-Cap Value Funds Classification, was 21.24%. Stock selection, especially in the consumer discretionary sector, generally accounted for the fund's shortfall against its benchmark and competing funds. Disappointing results from defensive consumer stocks offset strong returns from financials and from the fund's holdings in Japan.

Global recovery lifted cyclical stocks in foreign markets

We positioned the fund to take advantage of a continued rebound in the world economy, and a strong rally in international equity markets over most of the period contributed to healthy returns. However, the fund's emphasis on defensive consumer discretionary stocks held back performance relative to the index. The fund had less exposure than the index to consumer companies that were closely tied to the economy, which were strong performers as the global economy recovered and consumer demand improved. Some of the fund's consumer holdings also experienced company-specific problems. Game Group of the United Kingdom and Altek of Taiwan (0.5% and 0.6% of net assets, respectively) were two examples. A retailer of video game software, Game Group felt the effects of competition from increased on-line downloading of video games. The absence of new game hardware platforms, which typically drive software sales for video games, also hurt. Meanwhile, Altek, a camera manufacturer, was hurt by higher lens prices, which cut into profit margins. Outside the consumer group, a notable disappointment was AWE (0.5% of net assets). This Australian oil exploration and production company experienced a setback in its oil exploration program.

Financials holdings supported results

Two British financials selections posted standout results. Intermediate Capital (1.0% of net assets), a non-bank corporate lending firm, benefited from the reluctance of many banks with their own balance sheet problems to make new commercial loans. Intermediate Capital was able to provide loans on favorable terms to corporations with good credit. Brit Insurance Holdings, a property-and-casualty insurer, was acquired by a private equity firm at a premium stock price. Another takeover target that supported performance was Demag Cranes, a German industrial crane manufacturer that already did well because of increased shipping activity at the world's major ports. Demag Cranes' share price was lifted further by its acquisition. Good stock selection in Japan also helped lift results. Two strong performers were Miraca Holdings and Daiichikosho (0.8% and 1.3% of net assets, respectively). Miraca provides diagnostic testing services for the health care industry, while Daiichikosho produces a popular line of karaoke equipment.

Despite challenges, foreign equity outlook remains good

We believe the global economy should continue to recover and provide good investment opportunities in foreign equity markets, especially in developed economies where short-term interest rates remain low. We think stocks offer attractive value relative to other asset classes, especially low-yielding fixed-income investments.

6

Portfolio Manager's Report (continued) – Columbia Overseas Value Fund

Notwithstanding this optimism, there are concerns that can unsettle the markets. Political unrest in the Middle East already has had a direct impact on world markets by pushing up the price of oil. If popular unrest spreads beyond the Middle East, it could create even more uncertainty in the capital markets. On a separate note, equity investors remain unpersuaded that peripheral European nations, such as Greece, are on track to resolve their debt problems, even after receiving assistance from the European Union and the International Monetary Fund. Another European debt crisis remains a possibility.

Despite these uncertainties, we believe the current global economic recovery is sustainable, providing the potential backdrop for further gains both in corporate profits and stock prices. Given this view, we would consider any market weakness caused by Middle Eastern political unrest or European credit problems as an opportunity to buy attractive stocks at favorable prices.

Portfolio characteristics and holdings are subject to change periodically and may not be representative of current characteristics and holdings. The outlook for the fund may differ from those presented for other Columbia Funds.

Equity securities are affected by stock market fluctuations that occur in response to economic and business developments.

International investing may involve certain risks, including currency fluctuations, risks associated with possible differences in financial accounting standards and other monetary and political risks. Significant levels of foreign taxes, including potentially confiscatory levels of taxation and withholding taxes, may also apply to some foreign investments.

Investing in emerging markets may involve greater risks than investing in more developed countries. In addition, concentration of investments in a single region may result in greater volatility.

Value stocks are securities of companies that may have experienced adverse business or industry developments or may be subject to special risks that have caused the stocks to be out of favor. If the manager's assessment of a company's prospects is wrong, the price of the company's stock may not approach the value the manager has placed on it.

Top 5 sectors

as of 02/28/11 (%)

| Financials | | | 32.4 | | |

| Energy | | | 13.1 | | |

| Health Care | | | 9.6 | | |

| Consumer Discretionary | | | 9.3 | | |

| Telecommunication Services | | | 9.2 | | |

Top 10 holdings

as of 02/28/11 (%)

| Total | | | 3.4 | | |

| Royal Dutch Shell | | | 3.3 | | |

| Banco Santander | | | 2.7 | | |

Australia & New Zealand

Banking Group | | | 2.0 | | |

| Vodafone Group | | | 2.0 | | |

Sumitomo Mitsui Financial

Group | | | 2.0 | | |

| BP | | | 2.0 | | |

| Zurich Financial Services AG | | | 2.0 | | |

| Sanofi-Aventis | | | 1.9 | | |

| Enel | | | 1.7 | | |

The fund is actively managed and the composition of its portfolio will change over time. Information provided is calculated as a percentage of net assets.

7

Investment Portfolio – Columbia Overseas Value Fund

February 28, 2011

| Common Stocks – 100.6% | |

| | | Shares | | Value ($) | |

| Consumer Discretionary – 9.3% | |

| Auto Components – 1.1% | |

| Exedy Corp. | | | 1,300 | | | | 43,087 | | |

| Kongsberg Automotive Holding ASA (a) | | | 66,318 | | | | 51,513 | | |

| Auto Components Total | | | 94,600 | | |

| Automobiles – 3.4% | |

| Fuji Heavy Industries Ltd. | | | 9,000 | | | | 77,554 | | |

| Nissan Motor Co., Ltd. | | | 6,300 | | | | 64,733 | | |

| Proton Holdings Bhd | | | 28,100 | | | | 35,642 | | |

| Toyota Motor Corp. | | | 2,600 | | | | 121,491 | | |

| Automobiles Total | | | 299,420 | | |

| Household Durables – 0.5% | |

| Arnest One Corp. | | | 3,300 | | | | 41,732 | | |

| Household Durables Total | | | 41,732 | | |

| Internet & Catalog Retail – 0.9% | |

| Hyundai Home Shopping Network Corp. | | | 952 | | | | 78,888 | | |

| Internet & Catalog Retail Total | | | 78,888 | | |

| Leisure Equipment & Products – 0.6% | |

| Altek Corp. | | | 38,767 | | | | 52,958 | | |

| Leisure Equipment & Products Total | | | 52,958 | | |

| Media – 1.3% | |

| Daiichikosho Co., Ltd. | | | 5,800 | | | | 113,152 | | |

| Media Total | | | 113,152 | | |

| Specialty Retail – 1.0% | |

| Game Group PLC | | | 45,453 | | | | 45,073 | | |

| Halfords Group PLC | | | 6,584 | | | | 41,475 | | |

| Specialty Retail Total | | | 86,548 | | |

| Textiles, Apparel & Luxury Goods – 0.5% | |

| LG Fashion Corp. | | | 1,610 | | | | 40,222 | | |

| Textiles, Apparel & Luxury Goods Total | | | 40,222 | | |

| Consumer Discretionary Total | | | 807,520 | | |

| Consumer Staples – 2.6% | |

| Beverages – 0.8% | |

| Cott Corp. (a) | | | 8,794 | | | | 73,518 | | |

| Beverages Total | | | 73,518 | | |

| Food & Staples Retailing – 1.3% | |

| Koninklijke Ahold NV | | | 4,977 | | | | 66,812 | | |

| Matsumotokiyoshi Holdings Co., Ltd. | | | 1,900 | | | | 42,656 | | |

| Food & Staples Retailing Total | | | 109,468 | | |

| | | Shares | | Value ($) | |

| Food Products – 0.5% | |

| Balrampur Chini Mills Ltd. (a) | | | 26,485 | | | | 38,892 | | |

| Food Products Total | | | 38,892 | | |

| Consumer Staples Total | | | 221,878 | | |

| Energy – 13.1% | |

| Energy Equipment & Services – 1.5% | |

| Electromagnetic GeoServices AS (a) | | | 30,033 | | | | 59,527 | | |

| Shinko Plantech Co., Ltd. | | | 6,300 | | | | 67,646 | | |

| Energy Equipment & Services Total | | | 127,173 | | |

| Oil, Gas & Consumable Fuels – 11.6% | |

| AWE Ltd. (a) | | | 23,520 | | | | 39,771 | | |

| BP PLC | | | 21,266 | | | | 171,023 | | |

| ENI SpA | | | 3,814 | | | | 92,999 | | |

| Rosneft Oil Co., GDR | | | 9,416 | | | | 88,887 | | |

| Royal Dutch Shell PLC, Class B | | | 8,031 | | | | 287,027 | | |

| Total SA | | | 4,745 | | | | 290,791 | | |

| Yanzhou Coal Mining Co., Ltd., Class H | | | 13,400 | | | | 40,257 | | |

| Oil, Gas & Consumable Fuels Total | | | 1,010,755 | | |

| Energy Total | | | 1,137,928 | | |

| Financials – 32.4% | |

| Capital Markets – 4.6% | |

Credit Suisse Group AG,

Registered Shares | | | 2,047 | | | | 94,694 | | |

| Deutsche Bank AG, Registered Shares | | | 1,666 | | | | 107,087 | | |

| ICAP PLC | | | 9,188 | | | | 77,744 | | |

| Intermediate Capital Group PLC | | | 15,937 | | | | 83,268 | | |

| Tokai Tokyo Financial Holdings, Inc. | | | 11,000 | | | | 40,799 | | |

| Capital Markets Total | | | 403,592 | | |

| Commercial Banks – 13.3% | |

Australia & New Zealand Banking

Group Ltd. | | | 7,065 | | | | 174,614 | | |

| Banco Bilbao Vizcaya Argentaria SA | | | 6,651 | | | | 82,107 | | |

| Banco Santander SA | | | 18,752 | | | | 231,209 | | |

Bangkok Bank PCL, Foreign

Registered Shares | | | 10,400 | | | | 54,661 | | |

| BNP Paribas | | | 1,914 | | | | 149,440 | | |

| Commonwealth Bank of Australia | | | 1,781 | | | | 96,811 | | |

| Mitsubishi UFJ Financial Group, Inc. | | | 11,500 | | | | 63,882 | | |

| National Bank of Canada | | | 768 | | | | 59,176 | | |

| Sumitomo Mitsui Financial Group, Inc. | | | 4,600 | | | | 174,072 | | |

| Turkiye Is Bankasi, Class C | | | 12,068 | | | | 37,591 | | |

| UCO Bank | | | 15,506 | | | | 33,753 | | |

| Commercial Banks Total | | | 1,157,316 | | |

See Accompanying Notes to Financial Statements.

8

Columbia Overseas Value Fund

February 28, 2011

| Common Stocks (continued) | |

| | | Shares | | Value ($) | |

| Diversified Financial Services – 2.4% | |

| Fuyo General Lease Co., Ltd. | | | 2,200 | | | | 82,034 | | |

| ING Groep NV (a) | | | 9,747 | | | | 122,224 | | |

| Diversified Financial Services Total | | | 204,258 | | |

| Insurance – 7.8% | |

| Allianz SE, Registered Shares | | | 818 | | | | 117,847 | | |

| Baloise Holding AG, Registered Shares | | | 910 | | | | 98,336 | | |

| Hartford Financial Services Group, Inc. | | | 1,994 | | | | 59,022 | | |

| Lancashire Holdings Ltd. | | | 4,658 | | | | 45,471 | | |

Muenchener Rueckversicherungs-

Gesellschaft AG, Registered Shares | | | 565 | | | | 94,301 | | |

| Sampo Oyj, Class A | | | 3,149 | | | | 97,469 | | |

Zurich Financial Services AG,

Registered Shares | | | 583 | | | | 169,234 | | |

| Insurance Total | | | 681,680 | | |

| Real Estate Investment Trusts (REITs) – 1.6% | |

| Japan Retail Fund Investment Corp. | | | 52 | | | | 89,502 | | |

| Wereldhave NV | | | 461 | | | | 46,815 | | |

| Real Estate Investment Trusts (REITs) Total | | | 136,317 | | |

| Real Estate Management & Development – 2.7% | |

| Cheung Kong Holdings Ltd. | | | 5,500 | | | | 86,065 | | |

| Hongkong Land Holdings Ltd. | | | 11,000 | | | | 75,652 | | |

| Huaku Development Co., Ltd. | | | 11,000 | | | | 32,782 | | |

| Sinolink Worldwide Holdings Ltd. | | | 344,000 | | | | 42,125 | | |

| Real Estate Management & Development Total | | | 236,624 | | |

| Financials Total | | | 2,819,787 | | |

| Health Care – 9.6% | |

| Biotechnology – 0.7% | |

| Celgene Corp. (a) | | | 1,178 | | | | 62,552 | | |

| Biotechnology Total | | | 62,552 | | |

| Health Care Providers & Services – 0.8% | |

| Miraca Holdings, Inc. | | | 1,800 | | | | 69,640 | | |

| Health Care Providers & Services Total | | | 69,640 | | |

| Pharmaceuticals – 8.1% | |

| AstraZeneca PLC | | | 2,936 | | | | 142,996 | | |

| GlaxoSmithKline PLC | | | 6,016 | | | | 115,501 | | |

| Jazz Pharmaceuticals, Inc. (a) | | | 1,507 | | | | 37,117 | | |

| Novartis AG, Registered Shares | | | 1,777 | | | | 99,647 | | |

| Recordati SpA | | | 8,298 | | | | 77,579 | | |

| Sanofi-Aventis SA | | | 2,345 | | | | 161,799 | | |

| Santen Pharmaceutical Co., Ltd. | | | 1,700 | | | | 66,500 | | |

| Pharmaceuticals Total | | | 701,139 | | |

| Health Care Total | | | 833,331 | | |

| | | Shares | | Value ($) | |

| Industrials – 7.9% | |

| Airlines – 0.3% | |

| Turk Hava Yollari A.O. (a) | | | 9,119 | | | | 25,553 | | |

| Airlines Total | | | 25,553 | | |

| Commercial Services & Supplies – 0.8% | |

| Aeon Delight Co., Ltd. | | | 3,800 | | | | 70,147 | | |

| Commercial Services & Supplies Total | | | 70,147 | | |

| Construction & Engineering – 1.3% | |

| KHD Humboldt Wedag International AG | | | 3,458 | | | | 37,893 | | |

| Macmahon Holdings Ltd. | | | 125,790 | | | | 74,383 | | |

| Construction & Engineering Total | | | 112,276 | | |

| Industrial Conglomerates – 1.7% | |

| DCC PLC | | | 2,831 | | | | 90,829 | | |

| Tyco International Ltd. | | | 1,155 | | | | 52,368 | | |

| Industrial Conglomerates Total | | | 143,197 | | |

| Professional Services – 0.7% | |

| Teleperformance | | | 1,642 | | | | 62,357 | | |

| Professional Services Total | | | 62,357 | | |

| Trading Companies & Distributors – 3.1% | |

| ITOCHU Corp. | | | 7,300 | | | | 75,913 | | |

| Kloeckner & Co., SE (a) | | | 2,535 | | | | 82,382 | | |

| Mitsui & Co., Ltd. | | | 6,200 | | | | 113,336 | | |

| Trading Companies & Distributors Total | | | 271,631 | | |

| Industrials Total | | | 685,161 | | |

| Information Technology – 4.9% | |

| Electronic Equipment, Instruments & Components – 2.1% | |

| FUJIFILM Holdings Corp. | | | 1,400 | | | | 49,291 | | |

| Hitachi Ltd. | | | 13,000 | | | | 79,123 | | |

| Venture Corp., Ltd. | | | 8,000 | | | | 59,509 | | |

Electronic Equipment, Instruments &

Components Total | | | 187,923 | | |

| IT Services – 0.7% | |

| Groupe Steria SCA | | | 1,935 | | | | 61,041 | | |

| IT Services Total | | | 61,041 | | |

| Office Electronics – 0.8% | |

| Canon, Inc. | | | 1,400 | | | | 67,703 | | |

| Office Electronics Total | | | 67,703 | | |

See Accompanying Notes to Financial Statements.

9

Columbia Overseas Value Fund

February 28, 2011

| Common Stocks (continued) | |

| | | Shares | | Value ($) | |

| Semiconductors & Semiconductor Equipment – 1.3% | |

| Hanwha SolarOne Co., Ltd., ADR (a) | | | 4,564 | | | | 39,022 | | |

| Macronix International | | | 100,267 | | | | 73,285 | | |

Semiconductors & Semiconductor

Equipment Total | | | 112,307 | | |

| Information Technology Total | | | 428,974 | | |

| Materials – 5.4% | |

| Chemicals – 2.2% | |

| BASF SE | | | 895 | | | | 74,424 | | |

| Clariant AG, Registered Shares (a) | | | 2,595 | | | | 42,789 | | |

| Kansai Paint Co., Ltd. | | | 8,000 | | | | 76,208 | | |

| Chemicals Total | | | 193,421 | | |

| Containers & Packaging – 0.8% | |

| Smurfit Kappa Group PLC (a) | | | 5,596 | | | | 69,500 | | |

| Containers & Packaging Total | | | 69,500 | | |

| Metals & Mining – 1.5% | |

| Eastern Platinum Ltd. (a) | | | 24,000 | | | | 38,042 | | |

| First Quantum Minerals Ltd. | | | 482 | | | | 62,759 | | |

| Kobe Steel Ltd. | | | 11,000 | | | | 30,107 | | |

| Metals & Mining Total | | | 130,908 | | |

| Paper & Forest Products – 0.9% | |

| Svenska Cellulosa AB, Class B | | | 4,621 | | | | 76,389 | | |

| Paper & Forest Products Total | | | 76,389 | | |

| Materials Total | | | 470,218 | | |

| Telecommunication Services – 9.2% | |

| Diversified Telecommunication Services – 4.4% | |

| BCE, Inc. | | | 2,438 | | | | 90,389 | | |

| Tele2 AB, Class B | | | 4,184 | | | | 95,457 | | |

| Telefonica SA | | | 4,194 | | | | 106,490 | | |

| Telenor ASA | | | 5,632 | | | | 93,377 | | |

| Diversified Telecommunication Services Total | | | 385,713 | | |

| Wireless Telecommunication Services – 4.8% | |

Advanced Info Service PCL, Foreign

Registered Shares | | | 15,000 | | | | 39,002 | | |

| Freenet AG | | | 7,353 | | | | 84,827 | | |

| Softbank Corp. | | | 1,300 | | | | 53,448 | | |

| Vivo Participacoes SA, ADR | | | 1,687 | | | | 62,099 | | |

| Vodafone Group PLC | | | 61,548 | | | | 174,397 | | |

| Wireless Telecommunication Services Total | | | 413,773 | | |

| Telecommunication Services Total | | | 799,486 | | |

| | | Shares | | Value ($) | |

| Utilities – 6.2% | |

| Electric Utilities – 2.9% | |

| Enel SpA | | | 25,316 | | | | 150,848 | | |

| Fortum Oyj | | | 3,090 | | | | 95,728 | | |

| Electric Utilities Total | | | 246,576 | | |

| Independent Power Producers & Energy Traders – 0.4% | |

| Energy Development Corp. | | | 276,000 | | | | 35,627 | | |

Independent Power Producers &

Energy Traders Total | | | 35,627 | | |

| Multi-Utilities – 2.4% | |

| AGL Energy Ltd. | | | 3,570 | | | | 52,962 | | |

| Centrica PLC | | | 14,977 | | | | 82,806 | | |

| RWE AG | | | 1,091 | | | | 73,635 | | |

| Multi-Utilities Total | | | 209,403 | | |

| Water Utilities – 0.5% | |

Cia de Saneamento Basico do Estado

de Sao Paulo | | | 1,800 | | | | 44,108 | | |

| Water Utilities Total | | | 44,108 | | |

| Utilities Total | | | 535,714 | | |

Total Common Stocks

(cost of $7,884,520) | | | 8,739,997 | | |

Total Investments – 100.6%

(cost of $7,884,520) (b) | | | 8,739,997 | | |

| Other Assets & Liabilities, Net – (0.6)% | | | (49,850 | ) | |

| Net Assets – 100.0% | | | 8,690,147 | | |

Notes to Investment Portfolio:

(a) Non-income producing security.

(b) Cost for federal income tax purposes is $7,995,076.

Generally accepted accounting principles (GAAP) require disclosure regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or techniques. In addition, investments shall be disclosed by major category.

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund's assumptions about the information market participants would use in pricing an investment. An investment's level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset or liability's fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

See Accompanying Notes to Financial Statements.

10

Columbia Overseas Value Fund

February 28, 2011

Fair value inputs are summarized in the three broad levels listed below:

• Level 1—Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date (including NAV for open-end mutual funds). Valuation adjustments are not applied to Level 1 investments.

• Level 2—Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

• Level 3—Valuations based on significant unobservable inputs (including the Fund's own assumptions and judgment in determining the fair value of investments).

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment's fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy. Non-U.S. equity securities actively traded in foreign markets may be reflected in Level 2 despite the availability of closing prices, because the Fund evaluates and determines whether those closing prices reflect fair value at the close of the New York Stock Exchange (NYSE) or require adjustment, as described in Note 2 to the financial statements—Security Valuation.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

The following table is a summary of the inputs used to value the Fund's investments as of February 28, 2011:

| Description | | Quoted

Prices

(Level 1) | | Other

Significant

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | | Total | |

| Common Stocks | |

| Consumer Discretionary | | $ | — | | | $ | 807,520 | | | $ | — | | | $ | 807,520 | | |

| Consumer Staples | | | 73,518 | | | | 148,360 | | | | — | | | | 221,878 | | |

| Energy | | | 88,887 | | | | 1,049,041 | | | | — | | | | 1,137,928 | | |

| Financials | | | 118,198 | | | | 2,701,589 | | | | — | | | | 2,819,787 | | |

| Health Care | | | 99,669 | | | | 733,662 | | | | — | | | | 833,331 | | |

| Industrials | | | 52,368 | | | | 632,793 | | | | — | | | | 685,161 | | |

| Information Technology | | | 39,022 | | | | 389,952 | | | | — | | | | 428,974 | | |

| Materials | | | 100,801 | | | | 369,417 | | | | — | | | | 470,218 | | |

| Telecommunication Services | | | 152,488 | | | | 646,998 | | | | — | | | | 799,486 | | |

| Utilities | | | 44,108 | | | | 491,606 | | | | — | | | | 535,714 | | |

| Total Common Stocks | | | 769,059 | | | | 7,970,938 | | | | — | | | | 8,739,997 | | |

| Total Investments | | | 769,059 | | | | 7,970,938 | | | | — | | | | 8,739,997 | | |

Unrealized Appreciation on

Forward Foreign Currency

Exchange Contracts | | | — | | | | 18,815 | | | | — | | | | 18,815 | | |

Unrealized Depreciation on

Forward Foreign Currency

Exchange Contracts | | | — | | | | (11,771 | ) | | | — | | | | (11,771 | ) | |

| Total | | $ | 769,059 | | | $ | 7,977,982 | | | $ | — | | | $ | 8,747,041 | | |

The Fund's assets assigned to the Level 2 input category are generally valued using the market approach, in which a security's value is determined through reference to prices and information from market transactions for similar or identical assets. These assets include certain foreign securities for which a third party statistical pricing service may be employed for purposes of fair market valuation. The models utilized by the third party statistical pricing service take into account a security's correlation to available market data including, but not limited to, intraday index, ADR, and ETF movements.

The following table shows transfers between Level 1 and Level 2 of the fair value hierarchy:

| | | Transfers In | | Transfers Out | |

| | | Level 1 | | Level 2 | | Level 1 | | Level 2 | |

| | | | | $ | — | | | $ | 64,400 | | | $ | 64,400 | | | $ | — | | |

Financial assets were transferred from Level 1 to Level 2 as it was determined that the application of factors received from third party statistical services resulted in a price which was more representative of fair value for these securities as of period end.

For the year ended February 28, 2011, transactions in written option contracts were as follows:

| | | Number of

contracts | | Premium

received | |

| Options outstanding at February 28, 2010 | | | 3 | | | $ | 192 | | |

| Options written | | | 284 | | | | 10,230 | | |

Options terminated in closing purchase

transactions | | | (101 | ) | | | (5,940 | ) | |

| Options exercised | | | (60 | ) | | | (240 | ) | |

| Options expired | | | (126 | ) | | | (4,242 | ) | |

| Options outstanding at February 28, 2011 | | | — | | | $ | — | | |

Forward foreign currency exchange contracts outstanding on February 28, 2011, are:

Foreign Exchange Rate Risk

| Counterparty | | Forward

Foreign

Currency

Exchange

Contracts

to Buy | | Value | | Aggregate

Face Value | | Settlement

Date | | Unrealized

Appreciation | |

| Morgan Stanley | | | | | | | | | |

| |

| Capital | | | | | | | | | |

| |

| Services, Inc. | | AUD | | | | $ | 292,175 | | | $ | 289,318 | | | 04/28/11 | | $ | 2,857 | | |

Morgan Stanley

Capital

Services, Inc. | | EUR | | | | | 445,415 | | | | 440,294 | | | 04/28/11 | | | 5,121 | | |

Morgan Stanley

Capital

Services, Inc. | | GBP | | | | | 302,215 | | | | 300,325 | | | 04/28/11 | | | 1,890 | | |

Morgan Stanley

Capital

Services, Inc. | | JPY | | | | | 125,749 | | | | 125,584 | | | 04/28/11 | | | 165 | | |

Morgan Stanley

Capital

Services, Inc. | | SEK | | | | | 36,214 | | | | 35,355 | | | 04/28/11 | | | 859 | | |

Morgan Stanley

Capital

Services, Inc. | | SGD | | | | | 87,306 | | | | 87,120 | | | 04/28/11 | | | 186 | | |

| | | $ | 11,078 | | |

See Accompanying Notes to Financial Statements.

11

Columbia Overseas Value Fund

February 28, 2011

| Counterparty | | Forward

Foreign

Currency

Exchange

Contracts

to Sell | | Value | | Aggregate

Face Value | | Settlement

Date | | Unrealized

Appreciation

(Depreciation) | |

| Morgan Stanley | | | | | | | | | |

| |

| Capital | | | | | | | | | |

| |

| Services, Inc. | | CAD | | | | $ | 299,146 | | | $ | 293,760 | | | 04/28/11 | | $ | (5,386 | ) | |

Morgan Stanley

Capital

Services, Inc. | | CHF | | | | | 142,144 | | | | 138,915 | | | 04/28/11 | | | (3,229 | ) | |

Morgan Stanley

Capital

Services, Inc. | | KRW | | | | | 109,046 | | | | 111,046 | | | 04/28/11 | | | 2,000 | | |

Morgan Stanley

Capital

Services, Inc. | | MYR | | | | | 42,778 | | | | 43,049 | | | 04/28/11 | | | 271 | | |

Morgan Stanley

Capital

Services, Inc. | | NOK | | | | | 79,935 | | | | 77,807 | | | 04/28/11 | | | (2,128 | ) | |

Morgan Stanley

Capital

Services, Inc. | | PHP | | | | | 35,248 | | | | 34,929 | | | 04/28/11 | | | (319 | ) | |

Morgan Stanley

Capital

Services, Inc. | | THB | | | | | 66,203 | | | | 65,494 | | | 04/28/11 | | | (709 | ) | |

Morgan Stanley

Capital

Services, Inc. | | TWD | | | | | 149,671 | | | | 155,137 | | | 04/28/11 | | | 5,466 | | |

| | | $ | (4,034 | ) | |

The Fund was invested in the following countries at February 28, 2011:

Summary of Securities

by Country | | Value | | % of Total

Investments | |

| Japan | | $ | 1,773,755 | | | | 20.3 | | |

| United Kingdom | | | 1,266,781 | | | | 14.5 | | |

| France | | | 725,428 | | | | 8.3 | | |

| Germany | | | 672,397 | | | | 7.7 | | |

| Switzerland | | | 504,699 | | | | 5.8 | | |

| Australia | | | 438,541 | | | | 5.0 | | |

| Spain | | | 419,806 | | | | 4.8 | | |

| Canada | | | 323,883 | | | | 3.7 | | |

| Italy | | | 321,427 | | | | 3.7 | | |

| Netherlands | | | 235,850 | | | | 2.7 | | |

| United States | | | 211,060 | | | | 2.5 | | |

| Norway | | | 204,418 | | | | 2.3 | | |

| Hong Kong | | | 203,842 | | | | 2.3 | | |

| Finland | | | 193,197 | | | | 2.2 | | |

| Sweden | | | 171,846 | | | | 2.0 | | |

| Ireland | | | 160,329 | | | | 1.8 | | |

| Taiwan | | | 159,026 | | | | 1.8 | | |

| South Korea | | | 119,110 | | | | 1.4 | | |

| Brazil | | | 106,206 | | | | 1.2 | | |

| Thailand | | | 93,664 | | | | 1.1 | | |

| Russia | | | 88,887 | | | | 1.0 | | |

| China | | | 79,279 | | | | 0.9 | | |

| India | | | 72,645 | | | | 0.8 | | |

| Turkey | | | 63,144 | | | | 0.7 | | |

| Singapore | | | 59,508 | | | | 0.7 | | |

| Malaysia | | | 35,642 | | | | 0.4 | | |

| Philippines | | | 35,627 | | | | 0.4 | | |

| | | $ | 8,739,997 | | | | 100.0 | | |

Certain securities are listed by country of underlying exposure but may trade predominantly on another exchange.

| Acronym | | Name | |

| ADR | | American Depositary Receipt | |

|

| AUD | | Australian Dollar | |

|

| CAD | | Canadian Dollar | |

|

| CHF | | Swiss Franc | |

|

| EUR | | Euro | |

|

| GBP | | Pound Sterling | |

|

| GDR | | Global Depository Receipt | |

|

| JPY | | Japanese Yen | |

|

| KRW | | South Korean Won | |

|

| MYR | | Malaysian Ringgit | |

|

| NOK | | Norwegian Krone | |

|

| PHP | | Philippine Peso | |

|

| SEK | | Swedish Krona | |

|

| SGD | | Singapore Dollar | |

|

| THB | | Thailand Baht | |

|

| TWD | | New Taiwan Dollar | |

|

See Accompanying Notes to Financial Statements.

12

Statement of Assets and Liabilities – Columbia Overseas Value Fund

February 28, 2011

| | | | | ($) | |

| Assets | | Investments, at cost | | | 7,884,520 | | |

| | | Investments, at value | | | 8,739,997 | | |

| | | Cash | | | 13,088 | | |

| | | Foreign currency (cost of $1,452) | | | 1,412 | | |

| | | Unrealized appreciation on forward foreign currency exchange contracts | | | 18,815 | | |

| | | Receivable for: | | | |

| | | Dividends | | | 25,285 | | |

| | | Foreign tax reclaims | | | 7,243 | | |

| | | Expense reimbursement due from Investment Manager | | | 14,689 | | |

| | | Prepaid expenses | | | 25 | | |

| | | Total Assets | | | 8,820,554 | | |

| Liabilities | | Unrealized depreciation on forward foreign currency exchange contracts | | | 11,771 | | |

| | | Payable for: | | | |

| | | Investments purchased | | | 4,261 | | |

| | | Foreign capital gains taxes withheld | | | 1,059 | | |

| | | Investment advisory fee | | | 5,673 | | |

| | | Pricing and bookkeeping fees | | | 5,441 | | |

| | | Transfer agent fee | | | 83 | | |

| | | Trustees' fees | | | 18,599 | | |

| | | Audit fee | | | 34,648 | | |

| | | Legal fee | | | 20,047 | | |

| | | Custody fee | | | 8,560 | | |

| | | Reports to shareholders | | | 19,114 | | |

| | | Chief compliance officer expenses | | | 131 | | |

| | | Other liabilities | | | 1,020 | | |

| | | Total Liabilities | | | 130,407 | | |

| | | Net Assets | | | 8,690,147 | | |

| Net Assets Consist of | | Paid-in capital | | | 10,527,110 | | |

| | | Overdistributed net investment income | | | (88,280 | ) | |

| | | Accumulated net realized loss | | | (2,610,526 | ) | |

| | | Net unrealized appreciation (depreciation) on: | | | |

| | | Investments | | | 855,477 | | |

| | | Foreign currency translations and forward foreign currency exchange contracts | | | 7,425 | | |

| | | Foreign capital gains tax | | | (1,059 | ) | |

| | | Net Assets | | | 8,690,147 | | |

| Class Z | | Net assets | | $ | 8,690,147 | | |

| | | Shares outstanding | | | 1,086,879 | | |

| | | Net asset value, offering and redemption price per share | | $ | 8.00 | | |

See Accompanying Notes to Financial Statements.

13

Statement of Operations – Columbia Overseas Value Fund

For the Year Ended February 28, 2011

| | | | | ($) | |

| Investment Income | | Dividends | | | 285,405 | | |

| | | Interest | | | 3 | | |

| | | Foreign taxes withheld | | | (24,594 | ) | |

| | | Total Investment Income | | | 260,814 | | |

| Expenses | | Investment advisory fee | | | 64,261 | | |

| | | Transfer agent fee | | | 69 | | |

| | | Pricing and bookkeeping fees | | | 51,388 | | |

| | | Trustees' fees | | | 28,774 | | |

| | | Custody fee | | | 34,447 | | |

| | | Audit fee | | | 47,894 | | |

| | | Legal fees | | | 25,000 | | |

| | | Reports to shareholders | | | 30,000 | | |

| | | Chief compliance officer expenses | | | 975 | | |

| | | Other expenses | | | 3,022 | | |

| | | Total Expenses | | | 285,830 | | |

| | | Fees waived or expenses reimbursed by Investment Manager | | | (195,697 | ) | |

| | | Expense reductions | | | (10 | ) | |

| | | Net Expenses | | | 90,123 | | |

| | | Net Investment Income | | | 170,691 | | |

| Net Realized and Unrealized Gain (Loss) on Investments, Foreign Currency, Written Options and Foreign Capital Gains Tax | | Net realized gain (loss) on: | | | |

| | | Investments | | | 70,199 | | |

| | | Foreign currency transactions and forward foreign currency

exchange contracts | | | (53,057 | ) | |

| | | Written options | | | 3,241 | | |

| | | Net realized gain | | | 20,383 | | |

| | | Net change in unrealized appreciation (depreciation) on: | | | |

| | | Investments | | | 1,039,139 | | |

| | | Foreign currency translations and forward foreign currency

exchange contracts | | | 52,830 | | |

| | | Written options | | | (111 | ) | |

| | | Foreign capital gains tax | | | (1,047 | ) | |

| | | Net change in unrealized appreciation (depreciation) | | | 1,090,811 | | |

| | | Net Gain | | | 1,111,194 | | |

| | | Net Increase Resulting from Operations | | | 1,281,885 | | |

See Accompanying Notes to Financial Statements.

14

Statement of Changes in Net Assets – Columbia Overseas Value Fund

| | | | | Year Ended February 28, | |

| Increase (Decrease) in Net Assets | | | | 2011 ($) | | 2010 ($) | |

| Operations | | Net investment income | | | 170,691 | | | | 174,290 | | |

| | | Net realized gain (loss) on investments, futures contracts,

written options, foreign currency transactions and

forward foreign currency exchange contracts | | | 20,383 | | | | (354,737) | | |

| | | Net change in unrealized appreciation (depreciation)

on investments, written options, foreign capital gains tax,

foreign currency translations and forward foreign currency

exchange contracts | | | 1,090,811 | | | | 3,087,630 | | |

| | | Net increase resulting from operations | | | 1,281,885 | | | | 2,907,183 | | |

| Distributions to Shareholders | | From net investment income | | | (165,101 | ) | | | (293,672 | ) | |

| | | Net Capital Stock Transactions | | | 1,838 | | | | 293,672 | | |

| | | Total increase in net assets | | | 1,118,622 | | | | 2,907,183 | | |

| Net Assets | | Beginning of period | | | 7,571,525 | | | | 4,664,342 | | |

| | | End of period | | | 8,690,147 | | | | 7,571,525 | | |

| | | Overdistributed net investment income at end of period | | | (88,280 | ) | | | (51,714 | ) | |

See Accompanying Notes to Financial Statements.

15

Statement of Changes in Net Assets (continued) – Columbia Overseas Value Fund

| | | Capital Stock Activity | |

| | | Year Ended

February 28, 2011 | | Year Ended

February 28, 2010 | |

| | | Shares | | Dollars ($) | | Shares | | Dollars ($) | |

| Class Z | |

| Subscriptions | | | 1,067,133 | | | | 8,184,910 | | | | — | | | | — | | |

| Distributions reinvested | | | 22,767 | | | | 165,101 | | | | 40,674 | | | | 293,672 | | |

| Redemptions | | | (1,088,418 | ) | | | (8,348,173 | ) | | | — | | | | — | | |

| Net increase | | | 1,482 | | | | 1,838 | | | | 40,674 | | | | 293,672 | | |

See Accompanying Notes to Financial Statements.

16

Financial Highlights – Columbia Overseas Value Fund

Selected data for a share outstanding throughout each period is as follows:

| | | Year Ended February 28, | | Period Ended

February 28, | |

| Class Z Shares | | 2011 | | 2010 | | 2009 (a) | |

| Net Asset Value, Beginning of Period | | $ | 6.98 | | | $ | 4.46 | | | $ | 10.00 | | |

| Income from Investment Operations: | |

| Net investment income (b) | | | 0.16 | | | | 0.17 | | | | 0.27 | | |

Net realized and unrealized gain (loss) on investments, futures contracts,

written options, foreign capital gains tax and foreign currency | | | 1.01 | | | | 2.63 | | | | (5.56 | ) | |

| Total from investment operations | | | 1.17 | | | | 2.80 | | | | (5.29 | ) | |

| Less Distributions to Shareholders: | |

| From net investment income | | | (0.15 | ) | | | (0.28 | ) | | | (0.23 | ) | |

| Return of capital | | | — | | | | — | | | | (0.02 | ) | |

| Total distributions to shareholders | | | (0.15 | ) | | | (0.28 | ) | | | (0.25 | ) | |

| Net Asset Value, End of Period | | $ | 8.00 | | | $ | 6.98 | | | $ | 4.46 | | |

| Total return (c)(d) | | | 17.06 | % | | | 62.60 | % | | | (53.41 | )%(e) | |

| Ratios to Average Net Assets/Supplemental Data: | |

| Net expenses (f) | | | 1.15 | % | | | 1.14 | % | | | 1.10 | %(g) | |

| Waiver/Reimbursement | | | 2.50 | % | | | 1.88 | % | | | 2.89 | %(g) | |

| Net investment income (f) | | | 2.18 | % | | | 2.46 | % | | | 3.72 | %(g) | |

| Portfolio turnover rate | | | 48 | % | | | 62 | % | | | 66 | %(e) | |

| Net assets, end of period (000s) | | $ | 8,690 | | | $ | 7,572 | | | $ | 4,664 | | |

(a) The Fund commenced operations on March 31, 2008. Per share data and total return reflect activity from that date.

(b) Per share data was calculated using the average shares outstanding during the period.

(c) Total return at net asset value assuming all distributions reinvested.

(d) Had the Investment Manager and/or any of its affiliates not waived fees or reimbursed a portion of expenses, total return would have been reduced.

(e) Not annualized.

(f) The benefits derived from expense reductions had an impact of less than 0.01%.

(g) Annualized.

See Accompanying Notes to Financial Statements.

17

Notes to Financial Statements – Columbia Overseas Value Fund

February 28, 2011

Note 1. Organization

Columbia Overseas Value Fund (the Fund), a series of Columbia Funds Series Trust (the Trust), is a diversified fund. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware statutory trust.

After the close of business on April 30, 2010, Ameriprise Financial, Inc. (Ameriprise Financial) acquired a portion of the asset management business of Columbia Management Group, LLC (the Transaction), including the business of managing the Fund. In connection with the closing of the Transaction (the Closing), RiverSource Investments, LLC, a wholly owned subsidiary of Ameriprise Financial, became the investment manager of the Fund and changed its name to Columbia Management Investment Advisers, LLC (the Investment Manager).

Investment Objective

The Fund seeks long-term capital appreciation.

Fund Shares

The Trust has unlimited authorized shares of beneficial interest. The Fund offers Class Z shares, however at February 28, 2011, Class Z shares of the Fund were not publicly offered.

The Fund is authorized to issue Class A, Class C shares, which would be subject to sales charges and Class R shares, which would not be subject to sales charges, however these share classes are not currently offered for sale and have not commenced operations.

Class Z shares are not subject to sales charges and are available only to certain investors, as described in the Fund's prospectus.

Note 2. Summary of Significant Accounting Policies

The preparation of financial statements in accordance with U.S. generally accepted accounting principles (GAAP) requires the Investment Manager to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

Security Valuation

Equity securities are valued at the last sale price on the principal exchange on which they trade, except for securities traded on the NASDAQ, which are valued at the NASDAQ official close price. Unlisted securities or listed securities for which there were no sales during the day are valued at the closing bid price on such exchanges or over-the-counter markets.

Short-term investments maturing in 60 days or less are valued at amortized cost, which approximates market value.

Purchased options are valued at the last reported sale price, or in the absence of a sale, at the last quoted bid price. Written options are valued at the last reported sale price, or in the absence of a sale, at the last quoted ask price.

Forward foreign currency exchange contracts are valued at the prevailing forward exchange rate of the underlying currencies.

Foreign securities are generally valued at the last sale price on the foreign exchange or market on which they trade. If any foreign share prices are not readily available as a result of limited share activity, the securities are valued at the last sale price of the local shares in the principal market in which such securities are normally traded.

Generally, trading in foreign securities is substantially completed each day at various times prior to the close of the New York Stock Exchange (NYSE). The values of such securities used in computing the net asset value of the Fund's shares are determined as of such times. Foreign currency exchange rates are generally determined at 4:00 p.m. Eastern (U.S.) time. Occasionally, events affecting the values of such foreign securities may occur between the times at which they are determined and the close of the customary trading session of the NYSE, which would not be reflected in the computation of the Fund's net asset value. If events materially affecting the values of such foreign securities occur and it is determined that market quotations are not reliable, then these foreign securities will be valued at their fair value using procedures approved by the Board of Trustees.

The Fund may use a systematic fair valuation model provided by an independent third party to value securities principally traded in foreign markets in order to adjust for possible stale pricing that may occur between the close of the foreign exchanges and the time for valuation.

Investments for which market quotations are not readily available, or that have quotations which the Investment Manager believes are not reliable, are valued at fair value as determined in good faith under

18

Columbia Overseas Value Fund, February 28, 2011

consistently applied procedures established by and under the general supervision of the Board of Trustees. If a security is valued at fair value, such value is likely to be different from the last quoted market price for the security. The determination of fair value often requires significant judgment. To determine fair value, the Investment Manager may use assumptions including but not limited to future cash flows and estimated risk premiums. Multiple inputs from various sources may be used to determine value.

Foreign Currency Transactions and Translations

The values of all assets and liabilities quoted in foreign currencies are translated into U.S. dollars at that day's exchange rates. Net realized and unrealized gains (losses) on foreign currency transactions and translations include gains (losses) arising from the fluctuation in exchange rates between trade and settlement dates on securities transactions, gains (losses) arising from the disposition of foreign currency and currency gains (losses) between the accrual and payment dates on dividends, interest income and foreign withholding taxes.

For financial statement purposes, the Fund does not distinguish that portion of gains (losses) on investments which is due to changes in foreign exchange rates from that which is due to changes in market prices of the investments. Such fluctuations are included with the net realized and unrealized gains (losses) on investments on the Statement of Operations.

Derivative Instruments

The Fund may use derivative instruments including options and forward foreign currency exchange contracts in order to meet its investment objectives. The Fund employs strategies in differing combinations to permit it to increase, decrease or change the level of exposure to market risk factors. The achievement of any strategy relating to derivatives depends on an analysis of various risk factors, and if the strategies for the use of derivatives do not work as intended, the Fund may not achieve its investment objectives.

In pursuit of its investment objectives, the Fund is exposed to the following market risks, among others:

Equity Risk: Equity risk relates to change in value of equity securities such as common stocks due to general market conditions such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, or adverse investor sentiment. Equity securities generally have greater price volatility than fixed income securities.

Foreign Exchange Rate Risk: Foreign exchange rate risk relates to the change in the U.S. dollar value of a security held that is denominated in a foreign currency. The U.S. dollar value of a foreign-currency-denominated security will decrease as the dollar appreciates against the currency, while the U.S. dollar value will increase as the dollar depreciates against the currency.

The following provides more detailed information about each derivative type held by the Fund:

Forward Foreign Currency Exchange Contracts—The Fund entered into forward foreign currency exchange contracts to shift its investment exposure from one currency to another.

The Fund used forward contracts to shift its U.S. dollar exposure in order to achieve a representative weighted mix of major currencies in its benchmark and/or to recover an underweight country exposure in its portfolio.

Forward foreign currency exchange contracts are agreements to exchange one currency for another at a future date at a specified price. These contracts are used to minimize the exposure to foreign exchange rate fluctuations during the period between the trade and settlement dates of the contract. Contracts to buy generally are used to acquire exposure to foreign currencies, while contracts to sell are generally used to reduce the exposure to foreign exchange rate fluctuations. Forward foreign currency exchange contracts are valued daily at the current exchange rate of the underlying currency, resulting in unrealized gains (losses) which become realized at the time the forward foreign currency exchange contracts are closed or mature. Realized and unrealized gains (losses) arising from such transactions are included in net realized and unrealized gains (losses) on foreign currency transactions. The use of forward foreign currency exchange contracts does not eliminate fluctuations in the prices of the Fund's portfolio securities. While the maximum potential loss from such contracts is the aggregate face value in U.S. dollars at the time the contract was opened, exposure is typically limited to the change in value of the contract (in U.S. dollars) over the period it remains open. The Fund could also be exposed to risk that counterparties of the contracts may be unable to fulfill the terms of the contracts.

During the year ended February 28, 2011, the Fund entered into 272 forward foreign currency exchange contracts.

Options—The Fund had written covered call and purchased put options to decrease the Fund's exposure to equity risk and to increase return on instruments. Written covered call and purchased put options become more valuable as the price of the underlying instruments depreciates relative to the strike price.

19

Columbia Overseas Value Fund, February 28, 2011

Writing put options tends to increase the Fund's exposure to the underlying instrument. When the Fund writes a call or put option, an amount equal to the premium received is recorded as a liability and subsequently marked-to-market to reflect the current value of the option written. Premiums received from writing options which expire are treated as realized gains. Premiums received from writing options which are exercised or closed are added to the proceeds or offset against the amounts paid on the underlying security transaction to determine the realized gain or loss. The Fund, as a writer of an option, has no control over whether the underlying security may be sold (call) or purchased (put) and as a result bears the market risk of an unfavorable change in the price of the security underlying the written option. There is the risk that the Fund may not be able to enter into a closing transaction because of an illiquid market. The Fund identifies within its portfolio of investments cash or liquid portfolio securities equal to the amount of the written options contract commitment.

The Fund may also purchase put and call options. Purchasing call options tends to increase the Fund's exposure to the underlying instrument. Purchasing put options tends to decrease the Fund's exposure to the underlying instrument. The Fund may pay a premium, which is included in the Fund's Statement of Assets and Liabilities as an investment and subsequently marked-to-market to reflect the current value of the option. The risk associated with purchasing put and call options is limited to the premium paid. Premiums paid for purchasing options which expire are treated as realized losses. Premiums paid for purchasing options which are exercised are added to the amounts paid (call) or offset against the proceeds (put) on the underlying security to determine the realized gain or loss. If the Fund enters into a closing transaction, the Fund will realize a gain or loss, depending on whether the proceeds from the closing transaction are greater or less than the cost of the option.

During the year ended February 28, 2011, the Fund entered into 284 written call options contracts and 46 purchased put options contracts.

Effects of Derivative Transactions in the Financial Statements

The following table is a summary of the value of the Fund's derivative instruments as of February 28, 2011:

| Fair Value of Derivative Instruments | |

| Statement of Assets and Liabilities | |

| Assets | | Fair Value | | Liabilities | | Fair Value | |

Unrealized Appreciation on Forward Foreign

Currency Exchange Contracts | | $ | 18,815 | | | Unrealized Depreciation on Forward Foreign

Currency Exchange Contracts | | $ | 11,771 | | |