UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-09645 |

|

Columbia Funds Series Trust |

(Exact name of registrant as specified in charter) |

|

50606 Ameriprise Financial Center Minneapolis, MN | | 55474 |

(Address of principal executive offices) | | (Zip code) |

|

Ryan Larrenaga c/o Columbia Management Investment Advisers, LLC 225 Franklin Street Boston, MA 02110 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 345-6611 | |

|

Date of fiscal year end: | January 31 | |

|

Date of reporting period: | January 31, 2016 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

ANNUAL REPORT

January 31, 2016

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

ABOUT COLUMBIA THREADNEEDLE INVESTMENTS

Columbia Threadneedle Investments is a leading global asset management group that provides a broad range of actively managed investment strategies and solutions for individual, institutional and corporate clients around the world.

With more than 2,000 people, including over 450 investment professionals based in North America, Europe and Asia, we manage $472 billion* of assets across developed and emerging market equities, fixed income, asset allocation solutions and alternatives. We are the 13th largest manager of long-term mutual fund assets in the U.S.** and the 4th largest manager of retail funds in the U.K.***

Our priority is the investment success of our clients. We aim to deliver the investment outcomes they expect through an investment approach that is team-based, performance-driven and risk-aware. Our culture is dynamic and interactive. By sharing our insights across asset classes and geographies, we generate richer perspectives on global, regional and local investment landscapes. The ability to exchange and debate investment ideas in a collaborative environment enriches our teams' investment processes. More importantly, it results in better informed investment decisions for our clients.

Columbia funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

* In U.S. dollars as of December 31, 2015. Source: Ameriprise Q4 Earnings Release. Includes all assets managed by entities in the Columbia and Threadneedle groups of companies. Contact us for more current data.

** Source: ICI as of December 31, 2015 for Columbia Management Investment Advisers, LLC.

*** Source: Investment Association as of September 2015 for Threadneedle Asset Management Limited.

© 2016 Columbia Management Investment Advisers, LLC. All rights reserved.

Not part of the shareholder report

Investment strategies to help meet investor needs

We are committed to helping investors navigate financial challenges to reach their desired outcomes. The possibilities are endless.

Your success is our priority.

Retire comfortably

Retire comfortably

Fund college or higher education

Fund college or higher education

Leave a legacy

Leave a legacy

Generate an appropriate stream of income in retirement

Traditional approaches to income may no longer be adequate — and they may no longer provide the diversification benefits they once did. Investors need to rethink how they generate retirement income.

Worried about running out of income? You are not alone.

Navigate a changing interest rate environment

Even in today's challenging interest rate environment, it's still possible to navigate markets and achieve your goals.

Make investment choices designed specifically for this market environment.

Maximize after-tax returns

In an environment where what you keep is more important than what you earn, municipal bonds can help mitigate higher taxes while providing attractive yields compared to other investment options.

You've worked too hard building your wealth to lose it to taxes.

Grow assets to achieve financial goals

Finding growth opportunities in today's complex market environment requires strong research capabilities, creative thinking and a disciplined approach.

Do your investments deliver the portfolio growth you need?

Ease the impact of volatile markets

With increasing concerns about market volatility, investors should consider diversifying their portfolios with non-traditional holdings.

Interested in turning volatility into opportunity?

To find out more, contact your financial professional, call 800.426.3750 or visit columbiathreadneedle.com/us

Not part of the shareholder report

Get the market insight you need from our investment experts and subscribe to our latest publications

Stay informed with Columbia Threadneedle Investments

Investor insight

Find economic and market commentary, investment videos, white papers, mutual fund commentary and more at columbiathreadneedle.com/us.

Subscribe to the latest information from Columbia Threadneedle. Register your information online at columbiathreadneedle.com/us/subscribe and select the publications you would like to receive, including:

n Columbia Threadneedle Investor Newsletter, highlighting the latest macro- and micro-economic trends, investment themes, products, service changes and other items of interest to our investors

n Investment Strategy Outlook, showcasing the Columbia Threadneedle Asset Allocation Team's perspective on global economic investment conditions and markets

n MarketTrack, featuring straightforward insight on current investment opportunities

n White papers that delve deep into a variety of investment topics

n Quarterly portfolio manager commentary and fund fact sheets

Update your subscriptions at any time by accessing the email subscription center.

Social media

We offer you multiple ways to access our market commentary and investment insights.

n Perspectives blog at columbiathreadneedle.com/us

Read timely posts by our investment team, including our chief investment officer, chief economist and portfolio managers.

n Twitter.com/CTinvest_US

Follow us on Twitter for quick, up-to-the-minute comments on market news and more.

n Youtube.com/CTInvestUS

View our commentaries on the economy, markets and current investment opportunities.

n Linkedin.com/company/Columbia-Threadneedle-Investments-US

Connect with us on LinkedIn for updates from our thought leaders.

Not part of the shareholder report

Dear Shareholder,

Dear Shareholder,

Today's investors are typically focused on outcomes, like living a certain retirement lifestyle, paying for college education or building a legacy. But in today's complex global investment landscape, even simple goals are not easily achieved.

At Columbia Threadneedle Investments, we aspire to help satisfy five core needs of today's investors:

n Generate an appropriate stream of income in retirement

Traditional approaches to generating income may not provide the diversification benefits they once did, and they may actually introduce unwanted risk in today's market. To seek to improve your potential to live comfortably long term, we endeavor to pursue investments that explore less traveled paths to income.

n Navigate a changing interest rate environment

Today's uncertain market environment includes the prospect of a rise in interest rates. Blending traditional investments with non-traditional or alternative products may help protect your wealth during periods of volatility. We can attempt to help strengthen your portfolio with agile products designed to take on the market's ups and downs.

n Maximize after-tax returns

In an environment where what you keep may be more important than what you earn, municipal bonds can help mitigate high tax burdens while providing potentially attractive yields. Our state and federal tax-exempt products are aimed at helping investors manage risk, minimize the fluctuation of capital and grow wealth on a more tax-efficient basis.

n Grow assets to achieve financial goals

We believe that finding and protecting growth comes from a disciplined security selection process designed to create excess return. Our goal is to provide investment solutions built to help you face today's market challenges and grow your assets at each crossroad of your journey.

n Ease the impact of volatile markets

Despite a bull market run that has benefited many investors over the past several years, it's important to remember the lessons of 2008 and the value that a well-diversified portfolio may provide through times of market volatility. We are here to help you hold onto the savings you have worked tirelessly to amass, and to provide you the best opportunity to maintain your standard of living regardless of market conditions.

Find out today how we can help you confidently invest to realize your dreams. Please visit us at blog.columbiathreadneedleus.com/our-best-ideas to learn more about our unique investment solutions.

The world is constantly changing, but our priority remains the same: to help you secure your finances, meet your goals and achieve success. Thank you for your continued investment with us.

Sincerely,

Christopher O. Petersen

President, Columbia Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free prospectus and summary prospectus, which contains this and other important information about a fund, visit columbiathreadneedle.com/us. The prospectus should be read carefully before investing.

Columbia Funds are distributed by Columbia Management Investment Distributors, Inc., member FINRA, and managed by Columbia Management Investment Advisers, LLC.

© 2016 Columbia Management Investment Advisers, LLC. All rights reserved.

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

Fund Investment Manager

Columbia Management Investment

Advisers, LLC

225 Franklin Street

Boston, MA 02110

Fund Distributor

Columbia Management Investment

Distributors, Inc.

225 Franklin Street

Boston, MA 02110

Fund Transfer Agent

Columbia Management Investment

Services Corp.

P.O. Box 8081

Boston, MA 02266-8081

For more information about any of the funds, please visit columbiathreadneedle.com/us or call 800.345.6611. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 7 p.m. Eastern time.

The views expressed in this report reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

Performance Overview | | | 3 | | |

Manager Discussion of Fund Performance | | | 5 | | |

Understanding Your Fund's Expenses | | | 7 | | |

Portfolio of Investments | | | 8 | | |

Statement of Assets and Liabilities | | | 14 | | |

Statement of Operations | | | 16 | | |

Statement of Changes in Net Assets | | | 17 | | |

Financial Highlights | | | 19 | | |

Notes to Financial Statements | | | 27 | | |

Report of Independent Registered Public Accounting Firm | | | 35 | | |

Federal Income Tax Information | | | 36 | | |

Trustees and Officers | | | 37 | | |

Important Information About This Report | | | 43 | | |

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

Performance Summary

n Columbia Global Strategic Equity Fund (the Fund) Class A shares returned -6.66% excluding sales charges for the 12-month period that ended January 31, 2016.

n While absolute returns disappointed, the Fund outperformed its benchmark, the MSCI ACWI (Net), which returned -6.80% during the period.

n We attribute the Fund's outperformance of its benchmark primarily to positioning, via underlying funds, in information technology and materials, which more than offset positioning in consumer staples, which detracted.

Average Annual Total Returns (%) (for period ended January 31, 2016)

| | | Inception | | 1 Year | | 5 Years | | 10 Years | |

Class A | | 10/15/96 | | | | | | | |

Excluding sales charges | | | | | | | -6.66 | | | | 6.04 | | | | 4.89 | | |

Including sales charges | | | | | | | -12.05 | | | | 4.79 | | | | 4.27 | | |

Class B | | 08/12/97 | | | | | | | |

Excluding sales charges | | | | | | | -7.40 | | | | 5.25 | | | | 4.11 | | |

Including sales charges | | | | | | | -10.99 | | | | 4.94 | | | | 4.11 | | |

Class C | | 10/15/96 | | | | | | | |

Excluding sales charges | | | | | | | -7.38 | | | | 5.26 | | | | 4.11 | | |

Including sales charges | | | | | | | -8.10 | | | | 5.26 | | | | 4.11 | | |

Class K* | | 03/07/11 | | | -6.59 | | | | 6.15 | | | | 4.95 | | |

Class R | | 01/23/06 | | | -6.91 | | | | 5.79 | | | | 4.63 | | |

Class R4* | | 11/08/12 | | | -6.55 | | | | 6.20 | | | | 4.97 | | |

Class R5* | | 11/08/12 | | | -6.32 | | | | 6.32 | | | | 5.03 | | |

Class Z | | 10/15/96 | | | -6.48 | | | | 6.32 | | | | 5.17 | | |

MSCI ACWI (Net) | | | | | | | -6.80 | | | | 4.45 | | | | 3.61 | | |

Returns for Class A are shown with and without the maximum initial sales charge of 5.75%. Returns for Class B are shown with and without the applicable contingent deferred sales charge (CDSC) of 5.00% in the first year, declining to 1.00% in the sixth year and eliminated thereafter. Returns for Class C are shown with and without the 1.00% CDSC for the first year only. The Fund's other classes are not subject to sales charges and have limited eligibility. Please see the Fund's prospectus for details. Performance for different share classes will vary based on differences in sales charges and fees associated with each class. All results shown assume reinvestment of distributions during the period. Returns do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. Performance results reflect the effect of any fee waivers or reimbursements of Fund expenses by Columbia Management Investment Advisers, LLC and/or any of its affiliates. Absent these fee waivers or expense reimbursement arrangements, performance results would have been lower.

The performance information shown represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by contacting your financial intermediary, visiting columbiathreadneedle.com/us or calling 800.345.6611.

*The returns shown for periods prior to the share class inception date (including returns for the Life of the Fund, if shown, which are since Fund inception) include the returns of the Fund's oldest share class. Since the Fund launched more than one share class at its inception, Class A shares were used. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedle.com/us/investment-products/mutual-funds/appended-performance for more information.

On June 1, 2015, the MSCI ACWI (Net) (the New Index) replaced the S&P 500 Index (the Former Index) as the Fund's primary benchmark. The Fund's investment manager believes that the New Index provides a more appropriate basis for comparing the Fund's performance. Information on the New Index and the Former Index will be included for a one-year transition period.

The MSCI ACWI (Net) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The index consists of 45 country indices comprising 24 developed and 21 emerging market country indices.

The S&P 500 Index, an unmanaged index, measures the performance of 500 widely held, large-capitalization U.S. stocks and is frequently used as a general measure of market performance.

Indices are not available for investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes (except the MSCI ACWI (Net), which reflects reinvested dividends net of withholding taxes) or other expenses of investing. Securities in the Fund may not match those in an index.

Annual Report 2016

3

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

PERFORMANCE OVERVIEW (continued)

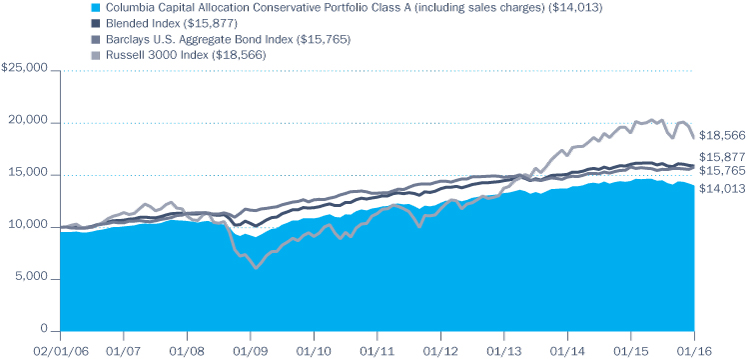

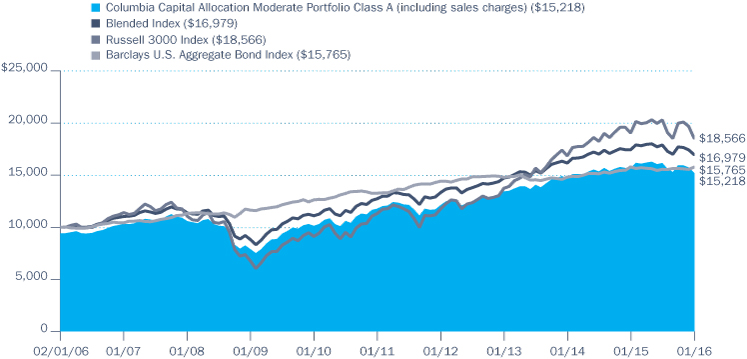

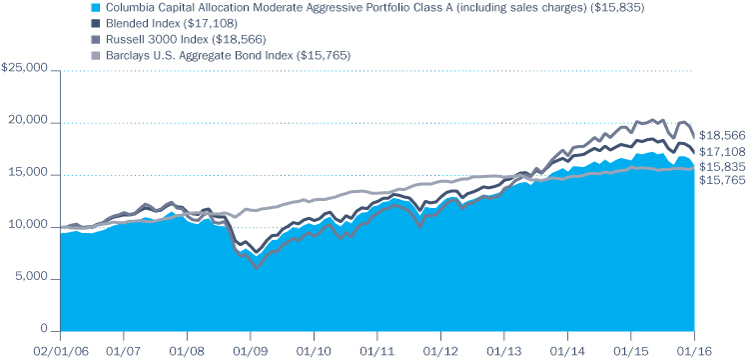

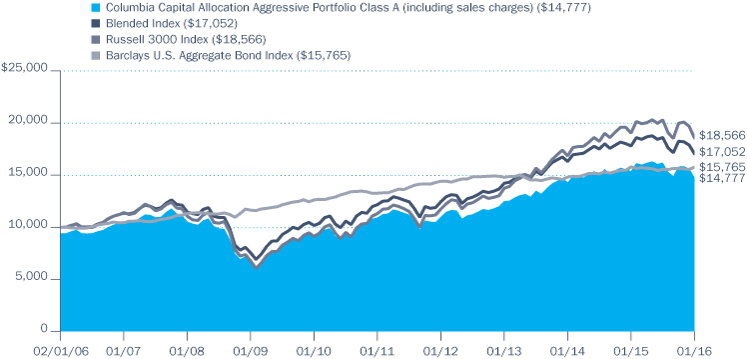

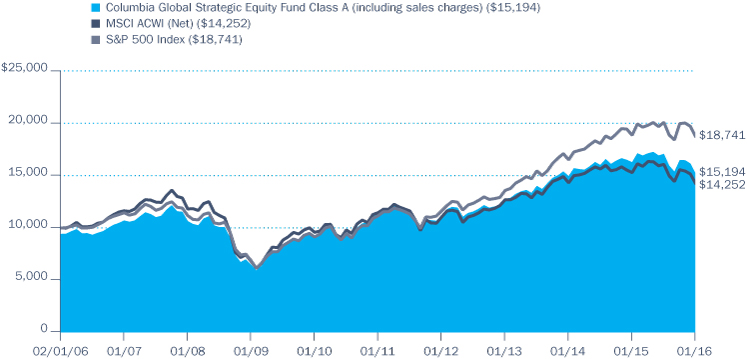

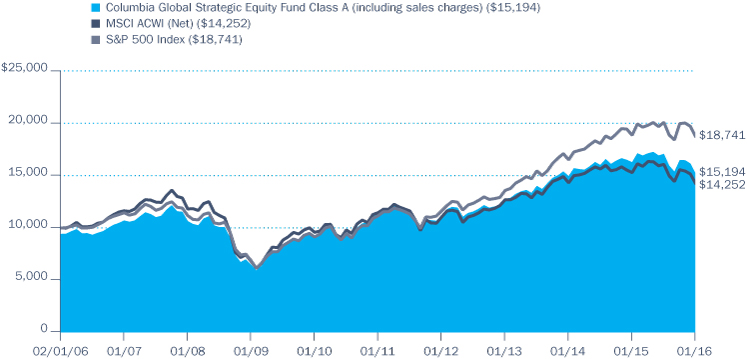

Performance of a Hypothetical $10,000 Investment (February 1, 2006 – January 31, 2016)

The chart above shows the change in value of a hypothetical $10,000 investment in Class A shares of Columbia Global Strategic Equity Fund during the stated time period, and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares.

Annual Report 2016

4

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

MANAGER DISCUSSION OF FUND PERFORMANCE

For the 12-month period that ended January 31, 2016, the Fund's Class A shares returned -6.66% excluding sales charges. While absolute returns disappointed, the Fund outperformed its benchmark, the MSCI ACWI (Net), which returned -6.80% during the period. We attribute the Fund's outperformance relative to its benchmark primarily to positioning, via underlying funds, in information technology and materials, which more than offset positioning in consumer staples, which detracted.

Global Equities Struggled Amid Low Economic Growth

The 12-month period ended January 31, 2016 was a difficult one for global equity markets. Low interest rates and low economic growth persisted across developed markets. Emerging markets were even harder hit not only by slowing economic growth but also by structural concerns, such as those seen in Greece. Most dramatically, perhaps, amid an imbalance of supply and demand, we saw plummeting commodity prices, which particularly impacted oil-producing nations and businesses. Divergent central bank policy, geopolitical risk, a strong U.S. dollar, a devaluation of China's renminbi and a broad overcapacity of industrial goods around the world further impacted global equity markets during the period.

The broad global equity market, as measured by the benchmark, underperformed the broad U.S. equity market. Within the benchmark, Denmark and Ireland were the best performers for the period, while Greece and Brazil were the biggest laggards. From a sector perspective, consumer staples was the only sector in the benchmark to post a positive absolute return during the period, as consumers benefited from savings at the gas pump. Other consumer-oriented sectors, including consumer discretionary, telecommunication services and health care, also outpaced the broad benchmark during the period. In contrast, materials and energy were the worst performers in the benchmark by a wide margin during the period, driven primarily by lower commodity prices.

Positioning In Information Technology and Materials Supported Relative Results

An overweight position in information technology and an underweight position in materials relative to the benchmark, via positions in underlying funds, contributed positively to the Fund's relative results. An overweighting allocation to Japan was the biggest regional positive contributor. Stock selection also proved effective, as the Fund's Japan sleeve, invested directly in Japanese equities, performed ahead of the relatively strong Japanese equity market. Other positive contributors included positions in underlying funds Columbia Contrarian Core Fund, Columbia Dividend Income Fund and Columbia Global Technology Growth Fund, each of which handily beat its respective underlying benchmark.

The sector that detracted most from relative results was consumer staples, as the Fund was underweight, via positions in underlying funds, the best performer in the benchmark during the period. Further, while the Fund's exposure to U.S. large-cap growth equities, via positions in Columbia Select Large Cap Growth Fund and Columbia Large Cap Growth Fund, performed well through much of the period, the significant sell-off of

Portfolio Management

Mark Burgess

Melda Mergen, CFA, CAIA*

*Effective March 9, 2016, Robert McConnaughey no longer serves as Portfolio Manager of the Fund. Melda Mergen was added as a Co-manager of the Fund.

Morningstar Style BoxTM

The Morningstar Style BoxTM is based on a fund's portfolio holdings. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

© 2016 Morningstar, Inc. All rights reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Portfolio Breakdown (%)

(at January 31, 2016) | |

Common Stocks | | | 10.2 | | |

Equity Funds | | | 83.5 | | |

Exchange-Traded Funds | | | 2.1 | | |

Fixed-Income Funds | | | 3.8 | | |

Money Market Funds | | | 0.4 | | |

Total | | | 100.0 | | |

Percentages indicated are based upon total investments. The Fund's portfolio composition is subject to change.

Annual Report 2016

5

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

MANAGER DISCUSSION OF FUND PERFORMANCE (continued)

Investment Risks

Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. Asset allocation does not assure a profit or protect against loss. The Fund's investment in other funds subjects it to the investment performance (positive or negative), risks and expenses of these underlying funds. ETFs trade like stocks, are subject to investment risk and will fluctuate in market value. Investment products, including shares of mutual funds, are not federally or FDIC-insured, are not deposits or obligations of, or guaranteed by any financial institution. The Fund may invest significantly in issuers within a particular sector, which may be negatively affected by market, economic or other conditions, making the Fund more vulnerable to unfavorable developments in the sector. International investing involves certain risks and volatility due to potential political, economic or currency instabilities and different financial and accounting standards. Investing in derivatives is a specialized activity that involves special risks, which may result in significant losses or limited gains. See the Fund's prospectus for information on these and other risks.

growth assets at year-end 2015 and early 2016 in favor of more value-oriented equities, ultimately dampened relative results for the period overall. Other notable detractors during the period were positions in underlying funds Columbia Convertible Securities Fund and Columbia Global Infrastructure Fund, which each saw surprisingly volatile asset class performance as well as relative underperformance to their respective investment universes.

Portfolio Changes

Changes within the portfolio can be driven by active trading, by directing allocations to select market segments or by market appreciation or depreciation within a given market segment, all via investments in underlying funds. During the period, the most notable changes in the Fund were driven by the change of benchmark index to the MSCI ACWI (Net). The Fund had always included significant global exposures but operated versus a U.S.-centric benchmark. To appropriately reflect this shift, we added significantly to the Fund's international exposures via underlying funds implementing global and international equity strategies.

Annual Report 2016

6

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

UNDERSTANDING YOUR FUND'S EXPENSES

(Unaudited)

As an investor, you incur two types of costs. There are transaction costs, which generally include sales charges on purchases and may include redemption fees. There are also ongoing costs, which generally include management fees, distribution and/or service fees, and other fund expenses. The following information is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to help you compare these costs with the ongoing costs of investing in other mutual funds.

Analyzing Your Fund's Expenses

To illustrate these ongoing costs, we have provided examples and calculated the expenses paid by investors in each share class of the Fund during the period. The actual and hypothetical information in the table is based on an initial investment of $1,000 at the beginning of the period indicated and held for the entire period. Expense information is calculated two ways and each method provides you with different information. The amount listed in the "Actual" column is calculated using the Fund's actual operating expenses and total return for the period. You may use the Actual information, together with the amount invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the results by the expenses paid during the period under the "Actual" column. The amount listed in the "Hypothetical" column assumes a 5% annual rate of return before expenses (which is not the Fund's actual return) and then applies the Fund's actual expense ratio for the period to the hypothetical return. You should not use the hypothetical account values and expenses to estimate either your actual account balance at the end of the period or the expenses you paid during the period. See "Compare With Other Funds" below for details on how to use the hypothetical data.

In addition to the ongoing expenses which the Fund bears directly, the Fund's shareholders indirectly bear the Fund's allocable share of the costs and expenses of each underlying fund in which the Fund invests. You can also estimate the effective expenses paid during the period, which includes the indirect fees associated with investing in the underlying funds, by using the amounts listed in the "Effective Expenses Paid During the Period" column.

Compare With Other Funds

Since all mutual funds are required to include the same hypothetical calculations about expenses in shareholder reports, you can use this information to compare the ongoing cost of investing in the Fund with other funds. To do so, compare the hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. As you compare hypothetical examples of other funds, it is important to note that hypothetical examples are meant to highlight the ongoing costs of investing in a fund only and do not reflect any transaction costs, such as sales charges, or redemption or exchange fees. Therefore, the hypothetical calculations are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If transaction costs were included in these calculations, your costs would be higher.

August 1, 2015 – January 31, 2016

| | | Account Value at

the Beginning of

the Period ($) | | Account Value at

the End of

the Period ($) | | Expenses Paid

During the

Period ($) | | Fund's Annualized

Expense Ratio (%) | | Effective Expenses

Paid During the

Period ($) | | Fund's Effective

Annualized

Expense Ratio (%) | |

| | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Hypothetical | | Actual | | Actual | | Hypothetical | | Actual | |

Class A | | | 1,000.00 | | | | 1,000.00 | | | | 889.90 | | | | 1,022.34 | | | | 2.45 | | | | 2.62 | | | | 0.52 | | | | 5.98 | | | | 6.40 | | | | 1.27 | | |

Class B | | | 1,000.00 | | | | 1,000.00 | | | | 886.40 | | | | 1,018.60 | | | | 5.97 | | | | 6.39 | | | | 1.27 | | | | 9.50 | | | | 10.17 | | | | 2.02 | | |

Class C | | | 1,000.00 | | | | 1,000.00 | | | | 886.90 | | | | 1,018.60 | | | | 5.97 | | | | 6.39 | | | | 1.27 | | | | 9.50 | | | | 10.17 | | | | 2.02 | | |

Class K | | | 1,000.00 | | | | 1,000.00 | | | | 890.30 | | | | 1,022.84 | | | | 1.98 | | | | 2.12 | | | | 0.42 | | | | 5.51 | | | | 5.90 | | | | 1.17 | | |

Class R | | | 1,000.00 | | | | 1,000.00 | | | | 889.40 | | | | 1,021.09 | | | | 3.63 | | | | 3.88 | | | | 0.77 | | | | 7.16 | | | | 7.66 | | | | 1.52 | | |

Class R4 | | | 1,000.00 | | | | 1,000.00 | | | | 890.80 | | | | 1,023.59 | | | | 1.27 | | | | 1.36 | | | | 0.27 | | | | 4.81 | | | | 5.15 | | | | 1.02 | | |

Class R5 | | | 1,000.00 | | | | 1,000.00 | | | | 891.90 | | | | 1,024.08 | | | | 0.80 | | | | 0.86 | | | | 0.17 | | | | 4.34 | | | | 4.64 | | | | 0.92 | | |

Class Z | | | 1,000.00 | | | | 1,000.00 | | | | 891.50 | | | | 1,023.59 | | | | 1.27 | | | | 1.36 | | | | 0.27 | | | | 4.81 | | | | 5.15 | | | | 1.02 | | |

Expenses paid during the period are equal to the annualized expense ratio for each class as indicated above, multiplied by the average account value over the period and then multiplied by the number of days in the Fund's most recent fiscal half year and divided by 365.

Effective expenses paid during the period and the Fund's effective annualized expense ratio include expenses borne directly to the class plus the Fund's pro rata portion of the ongoing expenses charged by the underlying funds using the expense ratio of each class of the underlying funds as of the underlying fund's most recent shareholder report.

Annual Report 2016

7

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

PORTFOLIO OF INVESTMENTS

January 31, 2016

(Percentages represent value of investments compared to net assets)

Equity Funds 83.4%

| | | Shares | | Value ($) | |

DIVIDEND INCOME 13.1% | |

Columbia Dividend Income Fund,

Class I Shares(a) | | | 1,546,484 | | | | 26,553,134 | | |

Columbia Global Dividend Opportunity

Fund, Class I Shares(a) | | | 3,659,863 | | | | 57,789,240 | | |

Total | | | | | 84,342,374 | | |

INTERNATIONAL 49.9% | |

Columbia Asia Pacific ex-Japan Fund,

Class I Shares(a) | | | 1,545,119 | | | | 13,875,173 | | |

Columbia Emerging Markets Fund,

Class I Shares(a)(b) | | | 2,109,773 | | | | 17,996,366 | | |

Columbia European Equity Fund,

Class I Shares(a) | | | 9,393,015 | | | | 57,297,390 | | |

Columbia Global Energy and Natural

Resources Fund, Class I Shares(a)(b) | | | 1,206,040 | | | | 16,884,557 | | |

Columbia Global Equity Value Fund,

Class I Shares(a) | | | 1,852,643 | | | | 19,045,170 | | |

Columbia Global Infrastructure Fund,

Class I Shares(a) | | | 2,374,594 | | | | 25,693,104 | | |

Columbia Global Technology Growth

Fund, Class I Shares(a)(b) | | | 3,012,176 | | | | 59,068,777 | | |

Columbia International Opportunities

Fund, Class I Shares(a)(b) | | | 2,134,832 | | | | 27,048,320 | | |

Columbia Overseas Value Fund,

Class I Shares(a) | | | 2,425,769 | | | | 18,702,676 | | |

Columbia Select Global Equity Fund,

Class I Shares(a) | | | 6,850,002 | | | | 65,212,022 | | |

Total | | | | | 320,823,555 | | |

U.S. LARGE CAP 16.6% | |

Columbia Contrarian Core Fund,

Class I Shares(a) | | | 1,860,167 | | | | 37,240,531 | | |

Columbia Disciplined Core Fund,

Class I Shares(a) | | | 2,393,964 | | | | 21,617,496 | | |

Columbia Large Cap Growth Fund,

Class I Shares(a)(b) | | | 1,077,990 | | | | 33,881,237 | | |

Columbia Select Large Cap Growth

Fund, Class I Shares(a)(b) | | | 923,460 | | | | 13,574,861 | | |

Total | | | | | 106,314,125 | | |

U.S. SMALL CAP 3.8% | |

Columbia Small Cap Growth Fund I,

Class I Shares(a)(b) | | | 1,590,402 | | | | 24,508,088 | | |

Total Equity Funds

(Cost: $627,618,048) | | | | | 535,988,142 | | |

Fixed-Income Funds 3.8%

| | | Shares | | Value ($) | |

CONVERTIBLE 3.8% | |

Columbia Convertible Securities Fund,

Class I Shares(a) | | | 1,623,781 | | | | 24,600,291 | | |

Total Fixed-Income Funds

(Cost: $24,360,465) | | | | | 24,600,291 | | |

Exchange-Traded Funds 2.1% | |

Financial Select Sector SPDR Fund | | | 623,746 | | | | 13,541,526 | | |

Total Exchange-Traded Funds

(Cost: $15,507,316) | | | | | 13,541,526 | | |

Common Stocks 10.2%

Issuer | | Shares | | Value ($) | |

CONSUMER DISCRETIONARY 2.0% | |

Automobiles 1.2% | |

Fuji Heavy Industries Ltd. | | | 76,300 | | | | 3,122,419 | | |

Mazda Motor Corp. | | | 95,400 | | | | 1,736,063 | | |

Toyota Motor Corp. | | | 47,500 | | | | 2,860,904 | | |

Total | | | | | 7,719,386 | | |

Household Durables 0.2% | |

Sony Corp. | | | 63,400 | | | | 1,471,471 | | |

Leisure Products 0.2% | |

Shimano, Inc. | | | 9,400 | | | | 1,499,534 | | |

Media 0.4% | |

Daiichikosho Co., Ltd. | | | 59,100 | | | | 2,382,394 | | |

Total Consumer Discretionary | | | | | 13,072,785 | | |

CONSUMER STAPLES 0.8% | |

Food & Staples Retailing 0.7% | |

San-A Co., Ltd. | | | 43,700 | | | | 2,016,833 | | |

Tsuruha Holdings, Inc. | | | 26,500 | | | | 2,199,097 | | |

Total | | | | | 4,215,930 | | |

Personal Products 0.1% | |

Kao Corp. | | | 13,300 | | | | 713,749 | | |

Total Consumer Staples | | | | | 4,929,679 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

8

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

PORTFOLIO OF INVESTMENTS (continued)

January 31, 2016

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

FINANCIALS 2.2% | |

Banks 0.8% | |

Aozora Bank Ltd. | | | 503,000 | | | | 1,684,804 | | |

Mitsubishi UFJ Financial Group, Inc. | | | 543,500 | | | | 2,787,013 | | |

Sumitomo Mitsui Financial Group, Inc. | | | 28,200 | | | | 946,071 | | |

Total | | | | | 5,417,888 | | |

Capital Markets 0.3% | |

Nihon M&A Center, Inc. | | | 45,700 | | | | 2,163,792 | | |

Diversified Financial Services 0.4% | |

ORIX Corp. | | | 189,100 | | | | 2,674,340 | | |

Insurance 0.2% | |

Tokio Marine Holdings, Inc. | | | 33,000 | | | | 1,180,728 | | |

Real Estate Investment Trusts (REITs) 0.1% | |

Invincible Investment Corp. | | | 1,111 | | | | 681,892 | | |

Real Estate Management & Development 0.4% | |

Relo Holdings, Inc. | | | 19,200 | | | | 2,298,908 | | |

Total Financials | | | | | 14,417,548 | | |

HEALTH CARE 1.6% | |

Biotechnology 0.2% | |

PeptiDream, Inc.(b) | | | 34,400 | | | | 1,116,260 | | |

Health Care Equipment & Supplies 1.0% | |

Asahi Intecc Co., Ltd. | | | 23,900 | | | | 1,101,456 | | |

CYBERDYNE, Inc.(b) | | | 35,000 | | | | 586,113 | | |

Hoya Corp. | | | 64,000 | | | | 2,470,546 | | |

Nakanishi, Inc. | | | 16,000 | | | | 625,104 | | |

Sysmex Corp. | | | 22,200 | | | | 1,429,516 | | |

Total | | | | | 6,212,735 | | |

Health Care Technology 0.2% | |

M3, Inc. | | | 58,200 | | | | 1,334,846 | | |

Pharmaceuticals 0.2% | |

Astellas Pharma, Inc. | | | 96,600 | | | | 1,337,578 | | |

Total Health Care | | | | | 10,001,419 | | |

INDUSTRIALS 2.0% | |

Construction & Engineering 0.3% | |

Raito Kogyo Co., Ltd. | | | 176,200 | | | | 1,541,127 | | |

Common Stocks (continued)

Issuer | | Shares | | Value ($) | |

Machinery 0.5% | |

Hoshizaki Electric Co., Ltd. | | | 16,200 | | | | 1,132,885 | | |

Nihon Trim Co., Ltd. | | | 28,300 | | | | 976,817 | | |

Shinmaywa Industries Ltd. | | | 161,000 | | | | 1,300,466 | | |

Total | | | | | 3,410,168 | | |

Professional Services 0.1% | |

Tanseisha Co., Ltd. | | | 104,200 | | | | 664,872 | | |

Road & Rail 0.4% | |

Central Japan Railway Co. | | | 9,100 | | | | 1,689,084 | | |

Trancom Co., Ltd. | | | 17,300 | | | | 1,033,406 | | |

Total | | | | | 2,722,490 | | |

Trading Companies & Distributors 0.7% | |

ITOCHU Corp. | | | 250,500 | | | | 2,944,109 | | |

MonotaRO Co., Ltd | | | 52,900 | | | | 1,222,897 | | |

Total | | | | | 4,167,006 | | |

Total Industrials | | | | | 12,505,663 | | |

INFORMATION TECHNOLOGY 0.5% | |

Electronic Equipment, Instruments & Components 0.5% | |

Keyence Corp. | | | 4,900 | | | | 2,312,240 | | |

Murata Manufacturing Co., Ltd. | | | 8,000 | | | | 925,343 | | |

Total | | | | | 3,237,583 | | |

Total Information Technology | | | | | 3,237,583 | | |

MATERIALS 0.1% | |

Chemicals 0.1% | |

Nitto Denko Corp. | | | 10,400 | | | | 598,044 | | |

Total Materials | | | | | 598,044 | | |

TELECOMMUNICATION SERVICES 1.0% | |

Diversified Telecommunication Services 0.5% | |

Nippon Telegraph & Telephone Corp. | | | 82,800 | | | | 3,525,013 | | |

Wireless Telecommunication Services 0.5% | |

KDDI Corp. | | | 122,000 | | | | 3,089,358 | | |

Total Telecommunication Services | | | | | 6,614,371 | | |

Total Common Stocks

(Cost: $66,612,066) | | | | | 65,377,092 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

9

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

PORTFOLIO OF INVESTMENTS (continued)

January 31, 2016

Money Market Funds 0.4%

| | | Shares | | Value ($) | |

Columbia Short-Term Cash Fund,

0.360%(a)(c) | | | 2,603,359 | | | | 2,603,359 | | |

Total Money Market Funds

(Cost: $2,603,359) | | | | | 2,603,359 | | |

Total Investments

(Cost: $736,701,254) | | | | | 642,110,410 | | |

Other Assets & Liabilities, Net | | | | | 607,255 | | |

Net Assets | | | | | 642,717,665 | | |

Notes to Portfolio of Investments

(a) As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company's outstanding voting securities, or a company which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended January 31, 2016 are as follows:

Issuer | | Beginning

Cost ($) | | Purchase

Cost ($) | | Proceeds

From

Sales ($) | | Realized

Gain

(Loss) ($) | | Ending

Cost ($) | | Capital Gain

Distributions ($) | | Dividends —

Affiliated

Issuers ($) | | Value ($) | |

Columbia Asia Pacific ex-Japan

Fund, Class I Shares | | | — | | | | 21,949,921 | | | | (1,393,614 | ) | | | (158,667 | ) | | | 20,397,640 | | | | — | | | | 3,515,442 | | | | 13,875,173 | | |

Columbia Contrarian Core Fund,

Class I Shares | | | 58,147,811 | | | | 2,325,356 | | | | (38,336,849 | ) | | | 16,438,805 | | | | 38,575,123 | | | | 1,154,229 | | | | 1,170,567 | | | | 37,240,531 | | |

Columbia Convertible Securities

Fund, Class I Shares | | | 40,390,970 | | | | 3,514,688 | | | | (26,604,769 | ) | | | 7,059,576 | | | | 24,360,465 | | | | 1,839,425 | | | | 1,673,504 | | | | 24,600,291 | | |

Columbia Disciplined Core Fund,

Class I Shares | | | 10,013,902 | | | | 11,690,872 | | | | (4,708,966 | ) | | | 1,948,994 | | | | 18,944,802 | | | | — | | | | 393,185 | | | | 21,617,496 | | |

Columbia Disciplined Growth Fund,

Class I Shares | | | 34,931,708 | | | | 2,646 | | | | (38,859,534 | ) | | | 3,925,180 | | | | — | | | | — | | | | — | | | | — | | |

Columbia Dividend Income Fund,

Class I Shares | | | 71,248,036 | | | | 3,299,532 | | | | (72,155,947 | ) | | | 22,537,108 | | | | 24,928,729 | | | | 1,477,747 | | | | 1,820,595 | | | | 26,553,134 | | |

Columbia Dividend Opportunity

Fund, Class I Shares | | | 56,281,445 | | | | 1,182,473 | | | | (64,973,739 | ) | | | 7,509,821 | | | | — | | | | — | | | | 1,175,202 | | | | — | | |

Columbia Emerging Markets Fund,

Class I Shares | | | 37,956,119 | | | | 6,081,003 | | | | (20,730,666 | ) | | | (2,388,823 | ) | | | 20,917,633 | | | | — | | | | — | | | | 17,996,366 | | |

Columbia European Equity Fund,

Class I Shares | | | — | | | | 73,941,069 | | | | (5,560,281 | ) | | | (192,249 | ) | | | 68,188,539 | | | | 1,847,384 | | | | 946,414 | | | | 57,297,390 | | |

Columbia Flexible Capital Income

Fund, Class I Shares | | | 43,272,274 | | | | 933,960 | | | | (48,849,562 | ) | | | 4,643,328 | | | | — | | | | — | | | | 914,486 | | | | — | | |

Columbia Global Dividend

Opportunity Fund, Class I Shares | | | 60,079,324 | | | | 19,640,189 | | | | (9,506,731 | ) | | | (1,825,543 | ) | | | 68,387,239 | | | | — | | | | 1,941,348 | | | | 57,789,240 | | |

Columbia Global Energy and Natural

Resources Fund, Class I Shares | | | 37,672,603 | | | | 7,806,713 | | | | (15,450,896 | ) | | | (5,983,999 | ) | | | 24,044,421 | | | | — | | | | — | | | | 16,884,557 | | |

Columbia Global Equity Value Fund,

Class I Shares | | | — | | | | 24,228,395 | | | | (1,605,442 | ) | | | (87,517 | ) | | | 22,535,436 | | | | 166,201 | | | | 315,405 | | | | 19,045,170 | | |

Columbia Global Infrastructure

Fund, Class I Shares | | | 41,606,420 | | | | 6,415,329 | | | | (5,194,323 | ) | | | (1,838,532 | ) | | | 40,988,894 | | | | 5,820,790 | | | | 591,953 | | | | 25,693,104 | | |

Columbia Global Technology

Growth Fund, Class I Shares | | | — | | | | 68,832,123 | | | | (6,871,867 | ) | | | 193,050 | | | | 62,153,306 | | | | 1,050,736 | | | | — | | | | 59,068,777 | | |

Columbia International

Opportunities Fund, Class I Shares | | | — | | | | 34,111,809 | | | | (2,838,035 | ) | | | (102,617 | ) | | | 31,171,157 | | | | — | | | | — | | | | 27,048,320 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

10

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

PORTFOLIO OF INVESTMENTS (continued)

January 31, 2016

Notes to Portfolio of Investments (continued)

Issuer | | Beginning

Cost ($) | | Purchase

Cost ($) | | Proceeds

From

Sales ($) | | Realized

Gain

(Loss) ($) | | Ending

Cost ($) | | Capital Gain

Distributions ($) | | Dividends —

Affiliated

Issuers ($) | | Value ($) | |

Columbia Large Cap Growth Fund,

Class I Shares | | | 18,786,735 | | | | 22,332,298 | | | | (8,304,476 | ) | | | 2,671,158 | | | | 35,485,715 | | | | 3,559,581 | | | | — | | | | 33,881,237 | | |

Columbia Mid Cap Growth Fund,

Class I Shares | | | 50,713,121 | | | | 17,724 | | | | (53,560,620 | ) | | | 2,829,775 | | | | — | | | | — | | | | — | | | | — | | |

Columbia Overseas Value Fund,

Class I Shares | | | — | | | | 48,021,673 | | | | (24,558,672 | ) | | | (1,840,058 | ) | | | 21,622,943 | | | | — | | | | 515,343 | | | | 18,702,676 | | |

Columbia Pacific/Asia Fund,

Class I Shares | | | 12,792,594 | | | | 104,254 | | | | (16,195,078 | ) | | | 3,298,230 | | | | — | | | | 41,554 | | | | 51,874 | | | | — | | |

Columbia Real Estate Equity Fund,

Class I Shares | | | 26,170,810 | | | | 1,301,644 | | | | (29,933,757 | ) | | | 2,461,303 | | | | — | | | | 979,351 | | | | 322,294 | | | | — | | |

Columbia Select Global Equity

Fund, Class I Shares | | | — | | | | 79,577,146 | | | | (9,686,681 | ) | | | (206,266 | ) | | | 69,684,199 | | | | — | | | | — | | | | 65,212,022 | | |

Columbia Select Large Cap Equity

Fund, Class I Shares | | | 26,594,087 | | | | 2,344,635 | | | | (26,259,516 | ) | | | (2,679,206 | ) | | | — | | | | 2,056,864 | | | | 274,901 | | | | — | | |

Columbia Select Large Cap Growth

Fund, Class I Shares | | | 56,635,538 | | | | 5,250,470 | | | | (65,128,427 | ) | | | 19,832,603 | | | | 16,590,184 | | | | 5,200,824 | | | | — | | | | 13,574,861 | | |

Columbia Short-Term Cash Fund | | | — | | | | 85,696,913 | | | | (83,093,554 | ) | | | — | | | | 2,603,359 | | | | — | | | | 2,386 | | | | 2,603,359 | | |

Columbia Small Cap Growth

Fund I, Class I Shares | | | 47,276,556 | | | | 10,441,949 | | | | (13,924,048 | ) | | | (792,369 | ) | | | 43,002,088 | | | | 10,402,467 | | | | — | | | | 24,508,088 | | |

Total | | | 730,570,053 | | | | 541,044,784 | | | | (694,286,050 | ) | | | 77,253,085 | | | | 654,581,872 | | | | 35,597,153 | | | | 15,624,899 | | | | 563,191,792 | | |

(b) Non-income producing investment.

(c) The rate shown is the seven-day current annualized yield at January 31, 2016.

Fair Value Measurements

The Fund categorizes its fair value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available. Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the Fund's assumptions about the information market participants would use in pricing an investment. An investment's level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the asset's or liability's fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

Fair value inputs are summarized in the three broad levels listed below:

> Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date (including NAV for open-end mutual funds). Valuation adjustments are not applied to Level 1 investments.

> Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

> Level 3 — Valuations based on significant unobservable inputs (including the Fund's own assumptions and judgment in determining the fair value of investments).

Inputs that are used in determining fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered by the Investment Manager, along with any other relevant factors in the calculation of an investment's fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels within the hierarchy.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

11

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

PORTFOLIO OF INVESTMENTS (continued)

January 31, 2016

Fair Value Measurements (continued)

Foreign equity securities actively traded in markets where there is a significant delay in the local close relative to the New York Stock Exchange (NYSE) are classified as Level 2. The values of these securities may include an adjustment to reflect the impact of significant market movements following the close of local trading, as described in Note 2 to the financial statements — Security Valuation.

Investments falling into the Level 3 category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and estimated cash flows, and comparable company data.

Under the direction of the Fund's Board of Trustees (the Board), the Investment Manager's Valuation Committee (the Committee) is responsible for overseeing the valuation procedures approved by the Board. The Committee consists of voting and non-voting members from various groups within the Investment Manager's organization, including operations and accounting, trading and investments, compliance, risk management and legal.

The Committee meets at least monthly to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information received from approved pricing vendors and brokers and the results of Board-approved valuation control policies and procedures (the Policies). The Policies address, among other things, instances when market quotations are or are not readily available, including recommendations of third party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale pricing, including those that are illiquid, restricted, or in default; and the effectiveness of third party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to discuss additional valuation matters, which may include the need to review back-testing results, review time-sensitive information or approve related valuation actions. The Committee reports to the Board, with members of the Committee meeting with the Board at each of its regularly scheduled meetings to discuss valuation matters and actions during the period, similar to those described earlier.

For investments categorized as Level 3, the Committee monitors information similar to that described above, which may include: (i) data specific to the issuer or comparable issuers, (ii) general market or specific sector news and (iii) quoted prices and specific or similar security transactions. The Committee considers this data and any changes from prior periods in order to assess the reasonableness of observable and unobservable inputs, any assumptions or internal models used to value those securities and changes in fair value. This data is also used to corroborate, when available, information received from approved pricing vendors and brokers. Various factors impact the frequency of monitoring this information (which may occur as often as daily). However, the Committee may determine that changes to inputs, assumptions and models are not required as a result of the monitoring procedures performed.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

12

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

PORTFOLIO OF INVESTMENTS (continued)

January 31, 2016

Fair Value Measurements (continued)

The following table is a summary of the inputs used to value the Fund's investments at January 31, 2016:

| | | Level 1

Quoted Prices in Active

Markets for Identical

Assets ($) | | Level 2

Other Significant

Observable Inputs ($) | | Level 3

Significant

Unobservable Inputs ($) | | Total ($) | |

Investments | |

Equity Funds | | | 535,988,142 | | | | — | | | | — | | | | 535,988,142 | | |

Fixed-Income Funds | | | 24,600,291 | | | | — | | | | — | | | | 24,600,291 | | |

Exchange-Traded Funds | | | 13,541,526 | | | | — | | | | — | | | | 13,541,526 | | |

Common Stocks | |

Consumer Discretionary | | | — | | | | 13,072,785 | | | | — | | | | 13,072,785 | | |

Consumer Staples | | | — | | | | 4,929,679 | | | | — | | | | 4,929,679 | | |

Financials | | | — | | | | 14,417,548 | | | | — | | | | 14,417,548 | | |

Health Care | | | — | | | | 10,001,419 | | | | — | | | | 10,001,419 | | |

Industrials | | | — | | | | 12,505,663 | | | | — | | | | 12,505,663 | | |

Information Technology | | | — | | | | 3,237,583 | | | | — | | | | 3,237,583 | | |

Materials | | | — | | | | 598,044 | | | | — | | | | 598,044 | | |

Telecommunication Services | | | — | | | | 6,614,371 | | | | — | | | | 6,614,371 | | |

Total Common Stocks | | | — | | | | 65,377,092 | | | | — | | | | 65,377,092 | | |

Money Market Funds | | | — | | | | 2,603,359 | | | | — | | | | 2,603,359 | | |

Total Investments | | | 574,129,959 | | | | 67,980,451 | | | | — | | | | 642,110,410 | | |

See the Portfolio of Investments for all investment classifications not indicated in the table.

The Fund's assets assigned to the Level 2 input category are generally valued using the market approach, in which a security's value is determined through reference to prices and information from market transactions for similar or identical assets and/or fund per share market values which are not considered publicly available. These assets include certain foreign securities for which a third party statistical pricing service may be employed for purposes of fair market valuation. The model utilized by such third party statistical pricing service takes into account a security's correlation to available market data including, but not limited to, intraday index, ADR, and exchange-traded fund movements.

There were no transfers of financial assets between levels during the period.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

13

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

STATEMENT OF ASSETS AND LIABILITIES

January 31, 2016

Assets | |

Investments, at value | |

Unaffiliated issuers (identified cost $82,119,382) | | $ | 78,918,618 | | |

Affiliated issuers (identified cost $654,581,872) | | | 563,191,792 | | |

Total investments (identified cost $736,701,254) | | | 642,110,410 | | |

Foreign currency (identified cost $347,073) | | | 340,020 | | |

Receivable for: | |

Investments sold | | | 1,415,608 | | |

Capital shares sold | | | 243,462 | | |

Dividends | | | 57,123 | | |

Foreign tax reclaims | | | 24,891 | | |

Prepaid expenses | | | 2,955 | | |

Total assets | | | 644,194,469 | | |

Liabilities | |

Payable for: | |

Investments purchased | | | 432,856 | | |

Capital shares purchased | | | 889,853 | | |

Investment management fees | | | 1,205 | | |

Distribution and/or service fees | | | 5,993 | | |

Transfer agent fees | | | 62,853 | | |

Administration fees | | | 343 | | |

Plan administration fees | | | 1 | | |

Compensation of board members | | | 24,039 | | |

Other expenses | | | 59,661 | | |

Total liabilities | | | 1,476,804 | | |

Net assets applicable to outstanding capital stock | | $ | 642,717,665 | | |

Represented by | |

Paid-in capital | | $ | 723,692,264 | | |

Undistributed net investment income | | | 21,552 | | |

Accumulated net realized gain | | | 13,602,335 | | |

Unrealized appreciation (depreciation) on: | |

Investments — unaffiliated issuers | | | (3,200,764 | ) | |

Investments — affiliated issuers | | | (91,390,080 | ) | |

Foreign currency translations | | | (7,642 | ) | |

Total — representing net assets applicable to outstanding capital stock | | $ | 642,717,665 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

14

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

STATEMENT OF ASSETS AND LIABILITIES (continued)

January 31, 2016

Class A | |

Net assets | | $ | 522,769,214 | | |

Shares outstanding | | | 46,066,953 | | |

Net asset value per share | | $ | 11.35 | | |

Maximum offering price per share(a) | | $ | 12.04 | | |

Class B | |

Net assets | | $ | 12,278,505 | | |

Shares outstanding | | | 1,232,609 | | |

Net asset value per share | | $ | 9.96 | | |

Class C | |

Net assets | | $ | 80,104,064 | | |

Shares outstanding | | | 8,136,015 | | |

Net asset value per share | | $ | 9.85 | | |

Class K | |

Net assets | | $ | 91,322 | | |

Shares outstanding | | | 7,857 | | |

Net asset value per share | | $ | 11.62 | | |

Class R | |

Net assets | | $ | 2,253,665 | | |

Shares outstanding | | | 201,489 | | |

Net asset value per share | | $ | 11.19 | | |

Class R4 | |

Net assets | | $ | 71,411 | | |

Shares outstanding | | | 6,045 | | |

Net asset value per share | | $ | 11.81 | | |

Class R5 | |

Net assets | | $ | 340,104 | | |

Shares outstanding | | | 28,757 | | |

Net asset value per share | | $ | 11.83 | | |

Class Z | |

Net assets | | $ | 24,809,380 | | |

Shares outstanding | | | 2,131,703 | | |

Net asset value per share | | $ | 11.64 | | |

(a) The maximum offering price per share is calculated by dividing the net asset value per share by 1.0 minus the maximum sales charge of 5.75%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

15

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

STATEMENT OF OPERATIONS

Year Ended January 31, 2016

Net investment income | |

Income: | |

Dividends — unaffiliated issuers | | $ | 723,186 | | |

Dividends — affiliated issuers | | | 15,624,899 | | |

Foreign taxes withheld | | | (47,126 | ) | |

Total income | | | 16,300,959 | | |

Expenses: | |

Investment management fees | | | 227,275 | | |

Distribution and/or service fees | |

Class A | | | 1,506,143 | | |

Class B | | | 202,349 | | |

Class C | | | 942,935 | | |

Class R | | | 13,112 | | |

Transfer agent fees | |

Class A | | | 964,664 | | |

Class B | | | 32,583 | | |

Class C | | | 151,024 | | |

Class K | | | 50 | | |

Class R | | | 4,201 | | |

Class R4 | | | 118 | | |

Class R5 | | | 175 | | |

Class Z | | | 67,016 | | |

Administration fees | | | 152,348 | | |

Plan administration fees | |

Class K | | | 249 | | |

Compensation of board members | | | 18,804 | | |

Custodian fees | | | 17,011 | | |

Printing and postage fees | | | 103,322 | | |

Registration fees | | | 108,069 | | |

Audit fees | | | 18,564 | | |

Legal fees | | | 11,313 | | |

Other | | | 20,057 | | |

Total expenses | | | 4,561,382 | | |

Expense reductions | | | (680 | ) | |

Total net expenses | | | 4,560,702 | | |

Net investment income | | | 11,740,257 | | |

Realized and unrealized gain (loss) — net | |

Net realized gain (loss) on: | |

Investments — unaffiliated issuers | | | (1,899,581 | ) | |

Investments — affiliated issuers | | | 77,253,085 | | |

Capital gain distributions from underlying affiliated funds | | | 35,597,153 | | |

Foreign currency translations | | | 58,487 | | |

Net realized gain | | | 111,009,144 | | |

Net change in unrealized appreciation (depreciation) on: | |

Investments — unaffiliated issuers | | | (3,200,764 | ) | |

Investments — affiliated issuers | | | (164,702,526 | ) | |

Foreign currency translations | | | (7,642 | ) | |

Net change in unrealized depreciation | | | (167,910,932 | ) | |

Net realized and unrealized loss | | | (56,901,788 | ) | |

Net decrease in net assets from operations | | $ | (45,161,531 | ) | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

16

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

STATEMENT OF CHANGES IN NET ASSETS

| | | Year Ended

January 31,

2016 | | Year Ended

January 31,

2015 | |

Operations | |

Net investment income | | $ | 11,740,257 | | | $ | 8,168,863 | | |

Net realized gain | | | 111,009,144 | | | | 101,307,403 | | |

Net change in unrealized depreciation | | | (167,910,932 | ) | | | (39,982,660 | ) | |

Net increase (decrease) in net assets resulting from operations | | | (45,161,531 | ) | | | 69,493,606 | | |

Distributions to shareholders | |

Net investment income | |

Class A | | | (13,318,216 | ) | | | (13,862,717 | ) | |

Class B | | | (319,406 | ) | | | (538,218 | ) | |

Class C | | | (1,739,569 | ) | | | (1,619,994 | ) | |

Class K | | | (2,283 | ) | | | (2,792 | ) | |

Class R | | | (53,623 | ) | | | (53,003 | ) | |

Class R4 | | | (2,177 | ) | | | (368 | ) | |

Class R5 | | | (8,879 | ) | | | (2,318 | ) | |

Class Z | | | (910,600 | ) | | | (1,303,933 | ) | |

Net realized gains | |

Class A | | | (116,440,092 | ) | | | (17,989,405 | ) | |

Class B | | | (3,762,199 | ) | | | (950,424 | ) | |

Class C | | | (20,400,096 | ) | | | (3,156,769 | ) | |

Class K | | | (19,260 | ) | | | (2,770 | ) | |

Class R | | | (511,499 | ) | | | (77,174 | ) | |

Class R4 | | | (18,379 | ) | | | (302 | ) | |

Class R5 | | | (69,949 | ) | | | (4,229 | ) | |

Class Z | | | (7,218,349 | ) | | | (1,500,258 | ) | |

Total distributions to shareholders | | | (164,794,576 | ) | | | (41,064,674 | ) | |

Increase (decrease) in net assets from capital stock activity | | | 49,111,670 | | | | (28,793,992 | ) | |

Total decrease in net assets | | | (160,844,437 | ) | | | (365,060 | ) | |

Net assets at beginning of year | | | 803,562,102 | | | | 803,927,162 | | |

Net assets at end of year | | $ | 642,717,665 | | | $ | 803,562,102 | | |

Undistributed net investment income | | $ | 21,552 | | | $ | 549,403 | | |

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

17

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | | Year Ended January 31, 2016 | | Year Ended January 31, 2015 | |

| | | Shares | | Dollars ($) | | Shares | | Dollars ($) | |

Capital stock activity | |

Class A shares | |

Subscriptions(a) | | | 4,286,880 | | | | 59,866,975 | | | | 3,389,380 | | | | 52,903,887 | | |

Distributions reinvested | | | 7,865,106 | | | | 102,836,354 | | | | 1,605,067 | | | | 25,157,919 | | |

Redemptions | | | (6,629,625 | ) | | | (96,085,087 | ) | | | (5,275,793 | ) | | | (82,891,901 | ) | |

Net increase (decrease) | | | 5,522,361 | | | | 66,618,242 | | | | (281,346 | ) | | | (4,830,095 | ) | |

Class B shares | |

Subscriptions | | | 69,249 | | | | 824,483 | | | | 41,381 | | | | 588,201 | | |

Distributions reinvested | | | 276,665 | | | | 3,245,485 | | | | 78,031 | | | | 1,106,622 | | |

Redemptions(a) | | | (1,158,577 | ) | | | (15,443,704 | ) | | | (1,366,697 | ) | | | (19,292,713 | ) | |

Net decrease | | | (812,663 | ) | | | (11,373,736 | ) | | | (1,247,285 | ) | | | (17,597,890 | ) | |

Class C shares | |

Subscriptions | | | 941,822 | | | | 11,545,927 | | | | 689,063 | | | | 9,699,013 | | |

Distributions reinvested | | | 1,431,675 | | | | 16,346,154 | | | | 246,307 | | | | 3,462,123 | | |

Redemptions | | | (1,370,592 | ) | | | (17,423,012 | ) | | | (1,062,689 | ) | | | (14,991,054 | ) | |

Net increase (decrease) | | | 1,002,905 | | | | 10,469,069 | | | | (127,319 | ) | | | (1,829,918 | ) | |

Class K shares | |

Distributions reinvested | | | 1,571 | | | | 20,967 | | | | 335 | | | | 5,350 | | |

Redemptions | | | — | | | | — | | | | (4,528 | ) | | | (73,306 | ) | |

Net increase (decrease) | | | 1,571 | | | | 20,967 | | | | (4,193 | ) | | | (67,956 | ) | |

Class R shares | |

Subscriptions | | | 46,241 | | | | 653,394 | | | | 50,504 | | | | 760,887 | | |

Distributions reinvested | | | 40,316 | | | | 523,858 | | | | 8,107 | | | | 125,764 | | |

Redemptions | | | (61,623 | ) | | | (882,713 | ) | | | (95,281 | ) | | | (1,460,159 | ) | |

Net increase (decrease) | | | 24,934 | | | | 294,539 | | | | (36,670 | ) | | | (573,508 | ) | |

Class R4 shares | |

Subscriptions | | | 15,401 | | | | 233,617 | | | | 497 | | | | 8,191 | | |

Distributions reinvested | | | 1,585 | | | | 20,033 | | | | 33 | | | | 531 | | |

Redemptions | | | (11,621 | ) | | | (154,423 | ) | | | (824 | ) | | | (13,733 | ) | |

Net increase (decrease) | | | 5,365 | | | | 99,227 | | | | (294 | ) | | | (5,011 | ) | |

Class R5 shares | |

Subscriptions | | | 8,399 | | | | 126,968 | | | | 17,775 | | | | 289,239 | | |

Distributions reinvested | | | 5,816 | | | | 78,304 | | | | 396 | | | | 6,405 | | |

Redemptions | | | (5,420 | ) | | | (76,033 | ) | | | (75 | ) | | | (1,190 | ) | |

Net increase | | | 8,795 | | | | 129,239 | | | | 18,096 | | | | 294,454 | | |

Class Z shares | |

Subscriptions | | | 420,245 | | | | 6,139,485 | | | | 565,792 | | | | 9,077,037 | | |

Distributions reinvested | | | 174,109 | | | | 2,367,369 | | | | 50,980 | | | | 814,969 | | |

Redemptions | | | (1,747,439 | ) | | | (25,652,731 | ) | | | (880,017 | ) | | | (14,076,074 | ) | |

Net decrease | | | (1,153,085 | ) | | | (17,145,877 | ) | | | (263,245 | ) | | | (4,184,068 | ) | |

Total net increase (decrease) | | | 4,600,183 | | | | 49,111,670 | | | | (1,942,256 | ) | | | (28,793,992 | ) | |

(a) Includes conversions of Class B shares to Class A shares, if any.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

18

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

The following tables are intended to help you understand the Fund's financial performance. Certain information reflects financial results for a single share of a class held for the periods shown. Per share net investment income (loss) amounts are calculated based on average shares outstanding during the period. Total return assumes reinvestment of all dividends and distributions, if any. Total return does not reflect payment of sales charges, if any. Total return and portfolio turnover are not annualized for periods of less than one year. The portfolio turnover rate is calculated without regard to purchase and sales transactions of short-term instruments and certain derivatives, if any. If such transactions were included, the Fund's portfolio turnover rate may be higher.

| | | Year Ended January 31, | | Year Ended

March 31, | |

Class A | | 2016 | | 2015 | | 2014 | | 2013 | | 2012(a) | | 2011 | |

Per share data | |

Net asset value, beginning of period | | $ | 15.35 | | | $ | 14.83 | | | $ | 12.96 | | | $ | 11.59 | | | $ | 12.25 | | | $ | 10.33 | | |

Income from investment operations: | |

Net investment income | | | 0.24 | | | | 0.17 | | | | 0.16 | | | | 0.17 | | | | 0.09 | | | | 0.08 | | |

Net realized and unrealized gain (loss) | | | (1.00 | ) | | | 1.16 | | | | 2.02 | | | | 1.42 | | | | (0.71 | ) | | | 1.91 | | |

Total from investment operations | | | (0.76 | ) | | | 1.33 | | | | 2.18 | | | | 1.59 | | | | (0.62 | ) | | | 1.99 | | |

Less distributions to shareholders: | |

Net investment income | | | (0.33 | ) | | | (0.35 | ) | | | (0.31 | ) | | | (0.22 | ) | | | (0.04 | ) | | | (0.07 | ) | |

Net realized gains | | | (2.91 | ) | | | (0.46 | ) | | | — | | | | — | | | | — | | | | — | | |

Total distributions to shareholders | | | (3.24 | ) | | | (0.81 | ) | | | (0.31 | ) | | | (0.22 | ) | | | (0.04 | ) | | | (0.07 | ) | |

Net asset value, end of period | | $ | 11.35 | | | $ | 15.35 | | | $ | 14.83 | | | $ | 12.96 | | | $ | 11.59 | | | $ | 12.25 | | |

Total return | | | (6.66 | %) | | | 8.88 | % | | | 16.86 | % | | | 13.81 | % | | | (4.98 | %) | | | 19.35 | % | |

Ratios to average net assets(b) | |

Total gross expenses | | | 0.50 | % | | | 0.48 | % | | | 0.50 | % | | | 0.53 | % | | | 0.52 | %(c) | | | 0.51 | % | |

Total net expenses(d) | | | 0.50 | %(e) | | | 0.48 | %(e) | | | 0.50 | %(e) | | | 0.48 | %(e) | | | 0.45 | %(c)(e) | | | 0.51 | % | |

Net investment income | | | 1.66 | % | | | 1.10 | % | | | 1.17 | % | | | 1.38 | % | | | 0.93 | %(c) | | | 0.72 | % | |

Supplemental data | |

Net assets, end of period (in thousands) | | $ | 522,769 | | | $ | 622,508 | | | $ | 605,625 | | | $ | 552,395 | | | $ | 539,370 | | | $ | 201,437 | | |

Portfolio turnover | | | 75 | % | | | 16 | % | | | 18 | % | | | 26 | % | | | 86 | % | | | 36 | % | |

Notes to Financial Highlights

(a) For the period from April 1, 2011 to January 31, 2012. During the period, the Fund's fiscal year end was changed from March 31 to January 31.

(b) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(c) Annualized.

(d) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

(e) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

19

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

FINANCIAL HIGHLIGHTS (continued)

| | | Year Ended January 31, | | Year Ended

March 31, | |

Class B | | 2016 | | 2015 | | 2014 | | 2013 | | 2012(a) | | 2011 | |

Per share data | |

Net asset value, beginning of period | | $ | 13.88 | | | $ | 13.48 | | | $ | 11.79 | | | $ | 10.56 | | | $ | 11.21 | | | $ | 9.48 | | |

Income from investment operations: | |

Net investment income | | | 0.09 | | | | 0.04 | | | | 0.04 | | | | 0.06 | | | | 0.00 | (b) | | | 0.00 | (b) | |

Net realized and unrealized gain (loss) | | | (0.85 | ) | | | 1.05 | | | | 1.86 | | | | 1.30 | | | | (0.63 | ) | | | 1.75 | | |

Total from investment operations | | | (0.76 | ) | | | 1.09 | | | | 1.90 | | | | 1.36 | | | | (0.63 | ) | | | 1.75 | | |

Less distributions to shareholders: | |

Net investment income | | | (0.25 | ) | | | (0.23 | ) | | | (0.21 | ) | | | (0.13 | ) | | | (0.02 | ) | | | (0.02 | ) | |

Net realized gains | | | (2.91 | ) | | | (0.46 | ) | | | — | | | | — | | | | — | | | | — | | |

Total distributions to shareholders | | | (3.16 | ) | | | (0.69 | ) | | | (0.21 | ) | | | (0.13 | ) | | | (0.02 | ) | | | (0.02 | ) | |

Net asset value, end of period | | $ | 9.96 | | | $ | 13.88 | | | $ | 13.48 | | | $ | 11.79 | | | $ | 10.56 | | | $ | 11.21 | | |

Total return | | | (7.40 | %) | | | 8.01 | % | | | 16.09 | % | | | 12.93 | % | | | (5.60 | %) | | | 18.46 | % | |

Ratios to average net assets(c) | |

Total gross expenses | | | 1.24 | % | | | 1.23 | % | | | 1.25 | % | | | 1.28 | % | | | 1.27 | %(d) | | | 1.26 | % | |

Total net expenses(e) | | | 1.24 | %(f) | | | 1.23 | %(f) | | | 1.25 | %(f) | | | 1.23 | %(f) | | | 1.20 | %(d)(f) | | | 1.26 | % | |

Net investment income (loss) | | | 0.70 | % | | | 0.27 | % | | | 0.35 | % | | | 0.55 | % | | | 0.06 | %(d) | | | (0.05 | %) | |

Supplemental data | |

Net assets, end of period (in thousands) | | $ | 12,279 | | | $ | 28,394 | | | $ | 44,368 | | | $ | 59,438 | | | $ | 82,941 | | | $ | 74,403 | | |

Portfolio turnover | | | 75 | % | | | 16 | % | | | 18 | % | | | 26 | % | | | 86 | % | | | 36 | % | |

Notes to Financial Highlights

(a) For the period from April 1, 2011 to January 31, 2012. During the period, the Fund's fiscal year end was changed from March 31 to January 31.

(b) Rounds to zero.

(c) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(d) Annualized.

(e) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

(f) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

20

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

FINANCIAL HIGHLIGHTS (continued)

| | | Year Ended January 31, | | Year Ended

March 31, | |

Class C | | 2016 | | 2015 | | 2014 | | 2013 | | 2012(a) | | 2011 | |

Per share data | |

Net asset value, beginning of period | | $ | 13.76 | | | $ | 13.36 | | | $ | 11.69 | | | $ | 10.47 | | | $ | 11.11 | | | $ | 9.40 | | |

Income from investment operations: | |

Net investment income (loss) | | | 0.12 | | | | 0.05 | | | | 0.05 | | | | 0.07 | | | | 0.00 | (b) | | | (0.00 | )(b) | |

Net realized and unrealized gain (loss) | | | (0.87 | ) | | | 1.04 | | | | 1.83 | | | | 1.28 | | | | (0.62 | ) | | | 1.73 | | |

Total from investment operations | | | (0.75 | ) | | | 1.09 | | | | 1.88 | | | | 1.35 | | | | (0.62 | ) | | | 1.73 | | |

Less distributions to shareholders: | |

Net investment income | | | (0.25 | ) | | | (0.23 | ) | | | (0.21 | ) | | | (0.13 | ) | | | (0.02 | ) | | | (0.02 | ) | |

Net realized gains | | | (2.91 | ) | | | (0.46 | ) | | | — | | | | — | | | | — | | | | — | | |

Total distributions to shareholders | | | (3.16 | ) | | | (0.69 | ) | | | (0.21 | ) | | | (0.13 | ) | | | (0.02 | ) | | | (0.02 | ) | |

Net asset value, end of period | | $ | 9.85 | | | $ | 13.76 | | | $ | 13.36 | | | $ | 11.69 | | | $ | 10.47 | | | $ | 11.11 | | |

Total return | | | (7.38 | %) | | | 8.08 | % | | | 16.06 | % | | | 12.95 | % | | | (5.56 | %) | | | 18.41 | % | |

Ratios to average net assets(c) | |

Total gross expenses | | | 1.25 | % | | | 1.23 | % | | | 1.25 | % | | | 1.28 | % | | | 1.27 | %(d) | | | 1.26 | % | |

Total net expenses(e) | | | 1.25 | %(f) | | | 1.23 | %(f) | | | 1.25 | %(f) | | | 1.23 | %(f) | | | 1.20 | %(d)(f) | | | 1.26 | % | |

Net investment income (loss) | | | 0.90 | % | | | 0.34 | % | | | 0.42 | % | | | 0.62 | % | | | 0.06 | %(d) | | | (0.04 | %) | |

Supplemental data | |

Net assets, end of period (in thousands) | | $ | 80,104 | | | $ | 98,125 | | | $ | 96,989 | | | $ | 89,630 | | | $ | 90,148 | | | $ | 70,437 | | |

Portfolio turnover | | | 75 | % | | | 16 | % | | | 18 | % | | | 26 | % | | | 86 | % | | | 36 | % | |

Notes to Financial Highlights

(a) For the period from April 1, 2011 to January 31, 2012. During the period, the Fund's fiscal year end was changed from March 31 to January 31.

(b) Rounds to zero.

(c) In addition to the fees and expenses that the Fund bears directly, the Fund indirectly bears a pro rata share of the fees and expenses of any other funds in which it invests. Such indirect expenses are not included in the Fund's reported expense ratios.

(d) Annualized.

(e) Total net expenses include the impact of certain fee waivers/expense reimbursements made by the Investment Manager and certain of its affiliates, if applicable.

(f) The benefits derived from expense reductions had an impact of less than 0.01%.

The accompanying Notes to Financial Statements are an integral part of this statement.

Annual Report 2016

21

COLUMBIA GLOBAL STRATEGIC EQUITY FUND

FINANCIAL HIGHLIGHTS (continued)

| | | Year Ended January 31, | | Year Ended

March 31, | |