Item 1: Report to Shareholders| Institutional Core Plus Fund | May 31, 2007 |

The views and opinions in this report were current as of May 31, 2007. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

Manager’s Letter

T. Rowe Price Institutional Core Plus Fund

Dear Investor

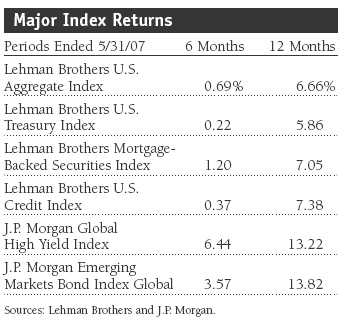

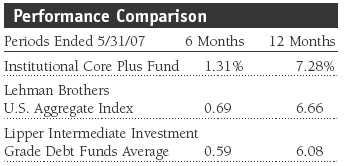

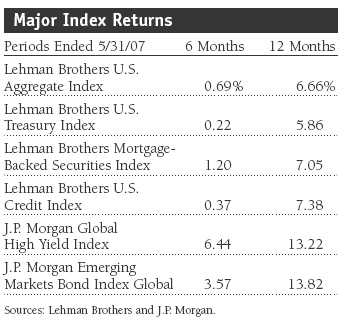

The bond market’s broad-based strength we discussed in our report to shareholders six months ago evaporated over the last six months, along with the anticipation of a short-term rate cut. All segments within the investment-grade bond universe posted muted gains for the six-month period and average results for the fiscal year ended May 31, 2007, while high-yield and emerging markets bonds fared better. We are pleased to report that your fund’s 6- and 12-month results were ahead of its Lipper peer group average and the Lehman Brothers U.S. Aggregate Index.

• All segments within the investment-grade bond universe posted muted gains for the six-month period but decent results for the year, while high-yield and emerging markets bonds fared better.

• The Institutional Core Plus Fund outperformed its Lipper peer group average and the Lehman Brothers U.S. Aggregate Index for the past six and 12 months.

• The fund’s emphasis on higher-yielding, lower-quality issues and foreign bonds boosted returns over the period, while our underweight in mortgages detracted.

• We intend to maintain our focus on lower-quality issues, but alongside an emphasis on diversification, which should minimize our exposure to company-specific problems.

Market Environment

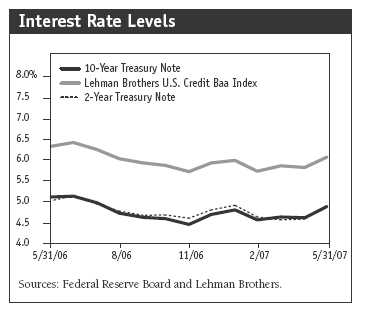

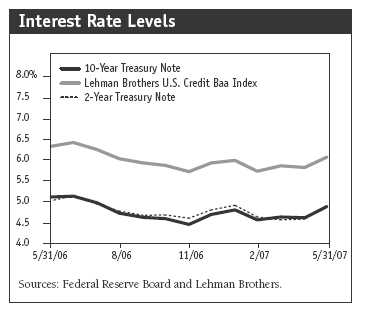

While economic growth was generally subdued over the past six months, the negative reaction of the bond market—and the enthusiastic response of the equity market—suggested that most investors believed the slowdown was only temporary. Bond prices fell and yields rose substantially around the turn of the year, when several pieces of data indicated job growth was strong, consumers were buoyant, and even the troubled housing sector might be on the verge of righting itself, as suggested by an unanticipated rise in home sales.

Bonds rallied in the first quarter of 2007 when optimism about the economy began to appear misplaced, however. Further signals from the housing sector revealed that the housing crunch was far from over. Starts of new homes declined sharply, home prices began to fall on a nationwide basis, and, in March, existing home sales saw their biggest monthly drop in nearly two decades. Indeed, a new set of housing worries emerged when default rates on subprime loans began to climb dramatically, which led in turn to the collapse of many lenders focused on the subprime market. Bond prices received a further boost from a worldwide pullback in equity prices, which sent investors to the relatively safe haven of the U.S. Treasury market. Confirmation of the slowing economy came in April in the form of official data on first-quarter growth that showed the economy was expanding at its slowest rate in several years.

Thanks perhaps to the slowdown, inflation trends appeared largely benign during the period. The glaring exception was the cost of gasoline, which rose sharply due both to refining constraints and renewed increases in oil prices. Core consumer price inflation, which excludes food and energy costs, remained more controlled. By the end of the period, core inflation gauges seemed to be trending back to a pace of increasing at a yearly rate of less than 2%, the upper end of the Fed’s generally accepted “comfort range.”

Despite the favorable data, investors concluded in April and May that the Fed was unlikely to let down its guard anytime soon. The Federal Reserve’s monetary policy committee left the federal funds rate unchanged after each of its four meetings during the period. Although Fed Chairman Ben Bernanke assured Congress that he expected inflationary pressures to ebb eventually, he also made clear that inflation remained a concern and that he anticipated the economy would regain its strength later in the year. Indeed, bond yields shot upward in May in response to signs of renewed economic vigor, including healthy manufacturing and capital spending trends.

Performance and Investment Review

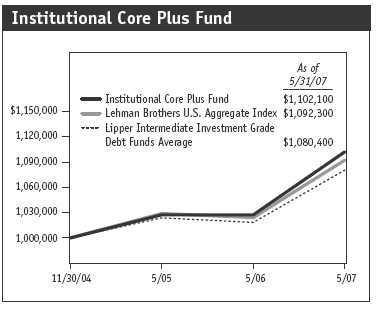

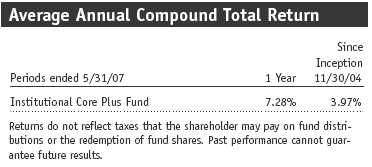

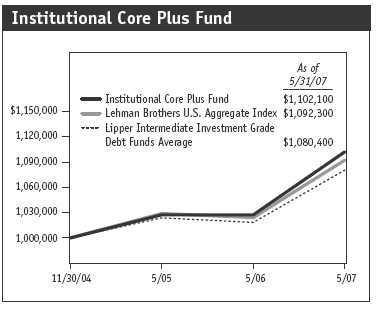

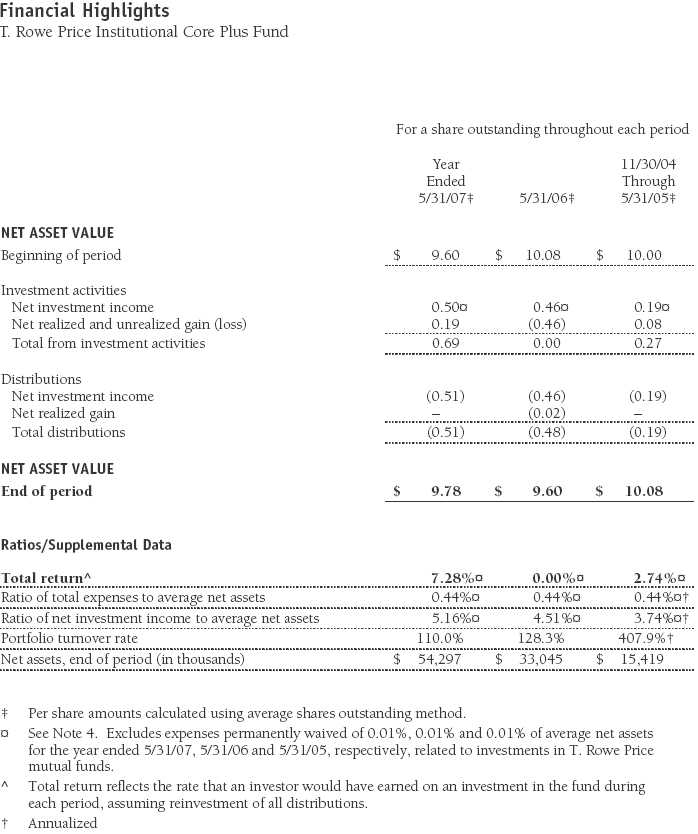

The Institutional Core Plus Fund generated a modest 1.31% return for the six-month period ended May 31, 2007, ahead of our Lipper peer group average and the Lehman Brothers U.S. Aggregate Index. Your fund’s 7.28% 12-month return also surpassed that of the Lipper average and the Lehman Brothers benchmark.

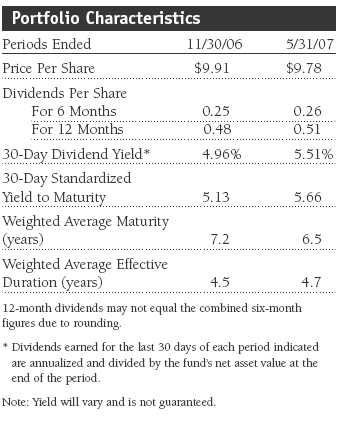

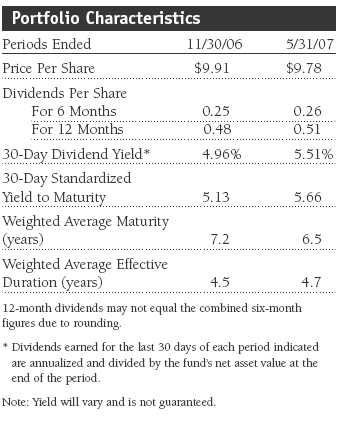

As interest rates edged higher over the past six months, the fund’s share price retreated $0.13. However, dividends rose slightly to $0.26 per share, resulting in a modest gain. Despite the rising rate trend since November, yields at the end of the reporting period were lower than one year ago, and the fund’s 12-month results comprised $0.18 of price appreciation plus dividends totaling $0.51 per share.

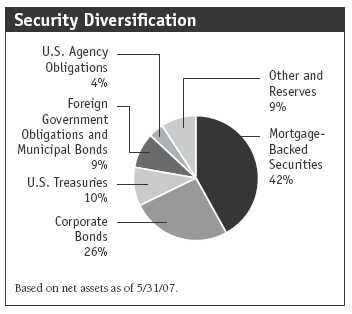

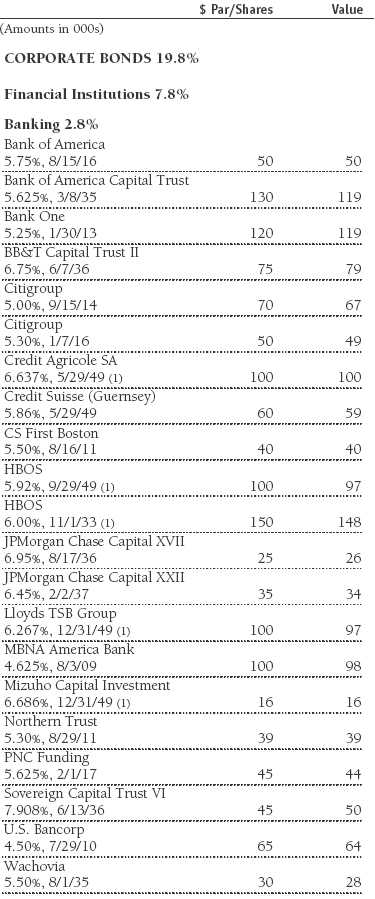

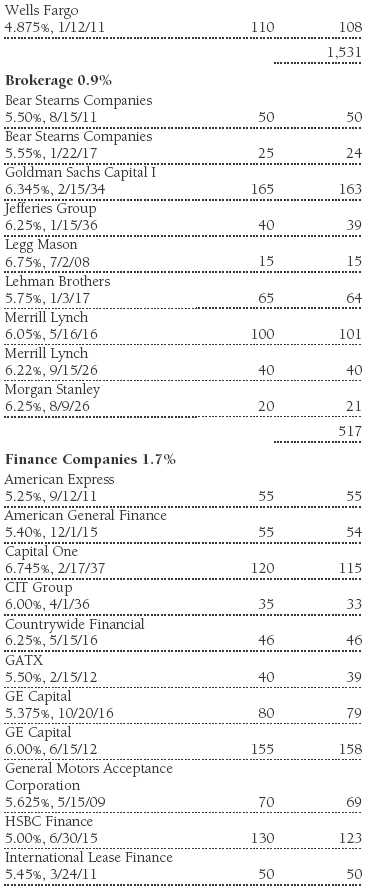

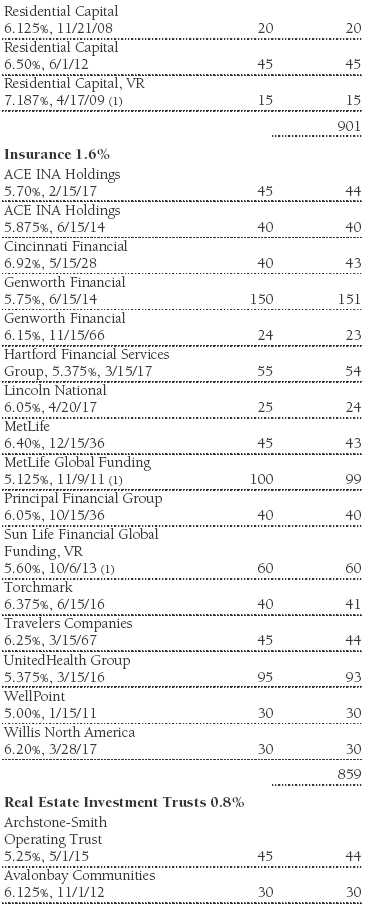

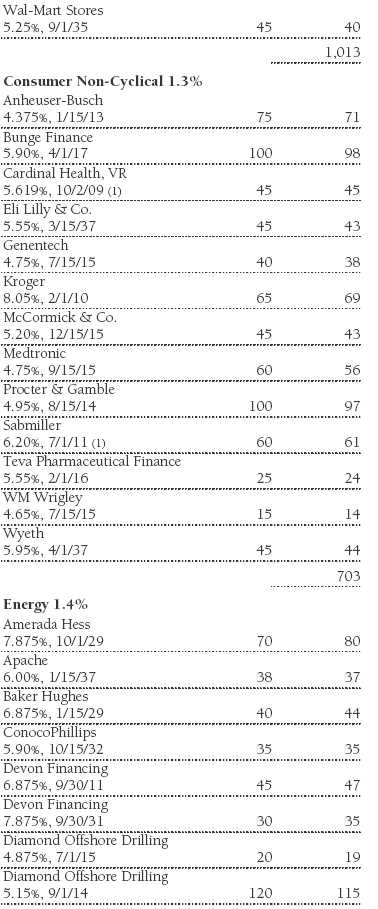

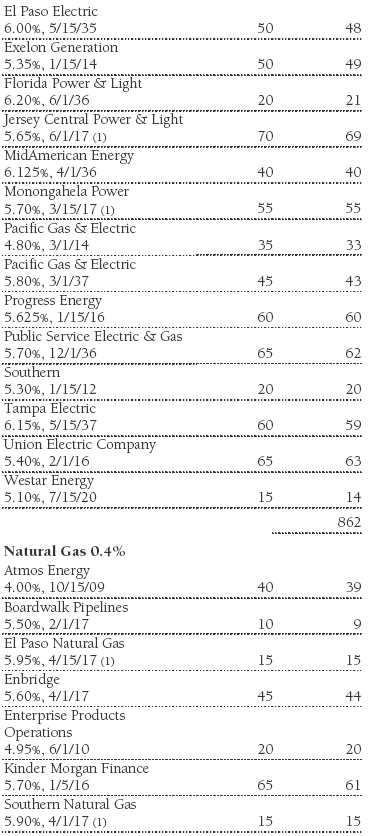

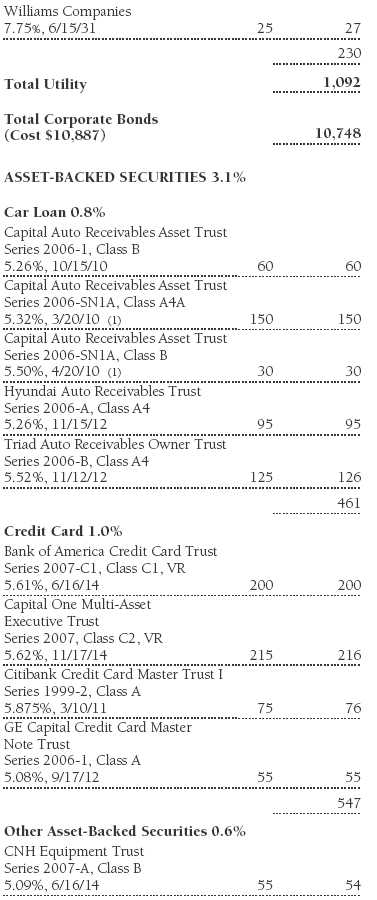

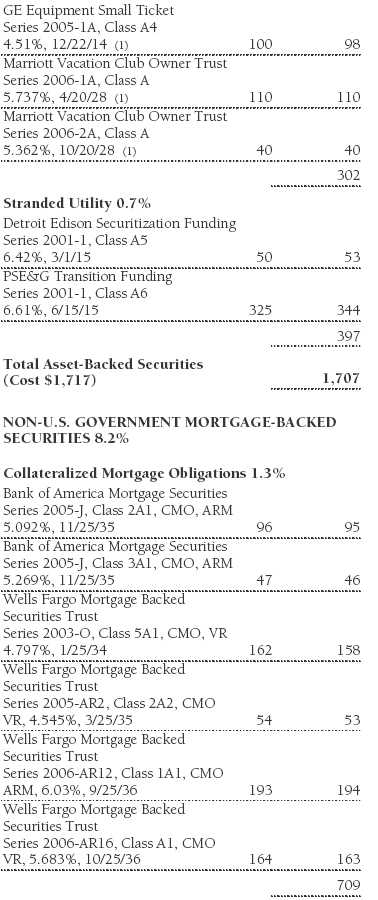

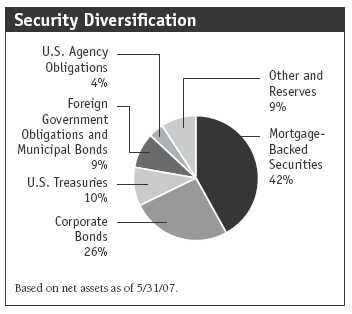

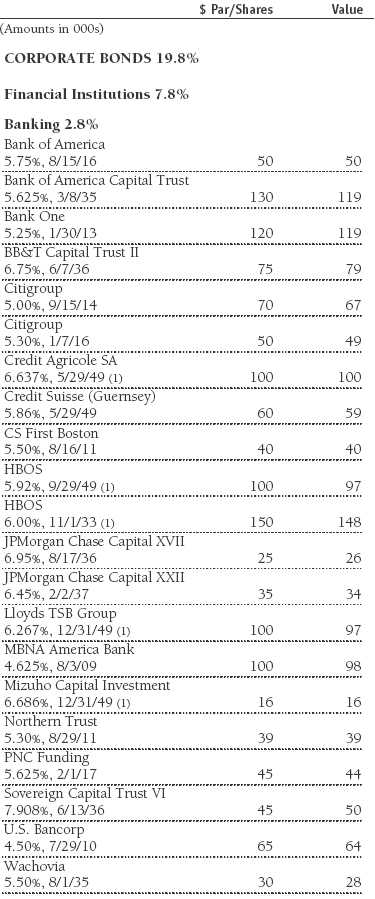

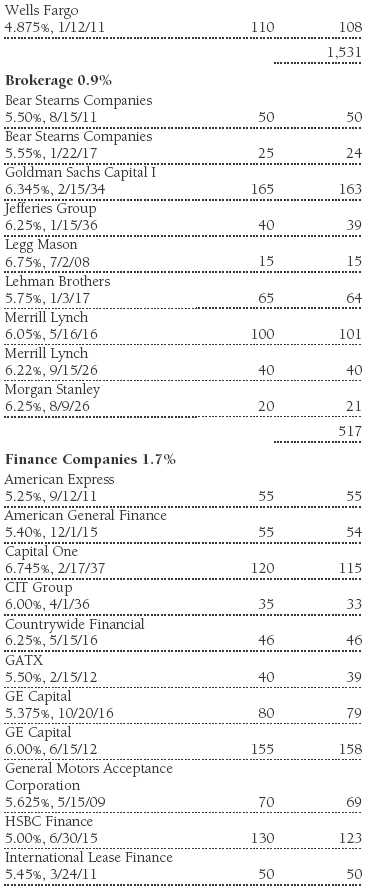

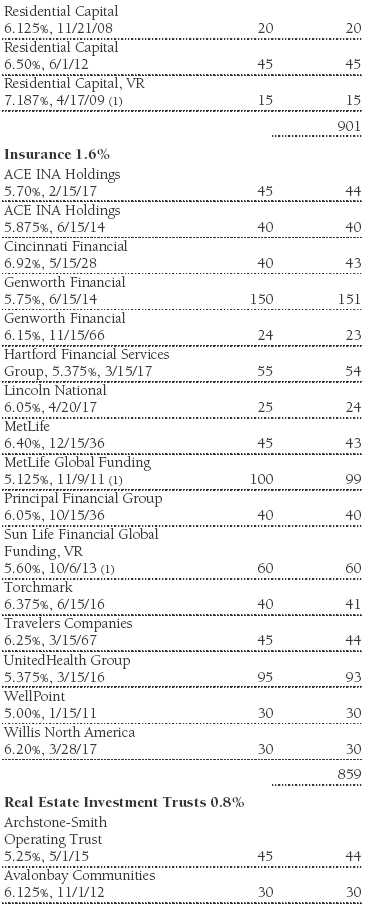

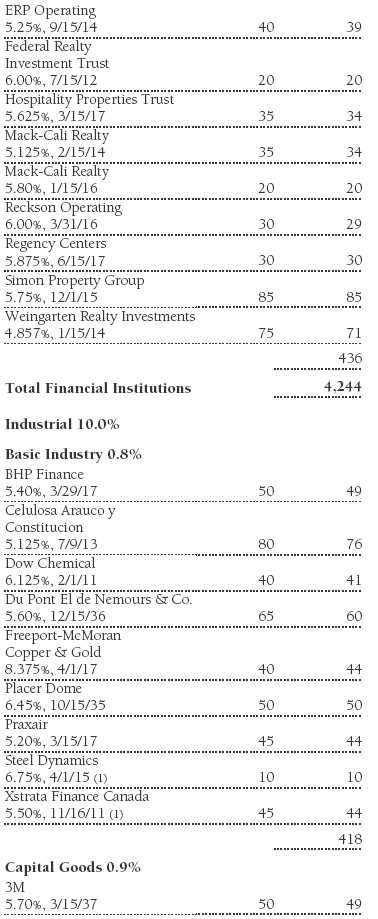

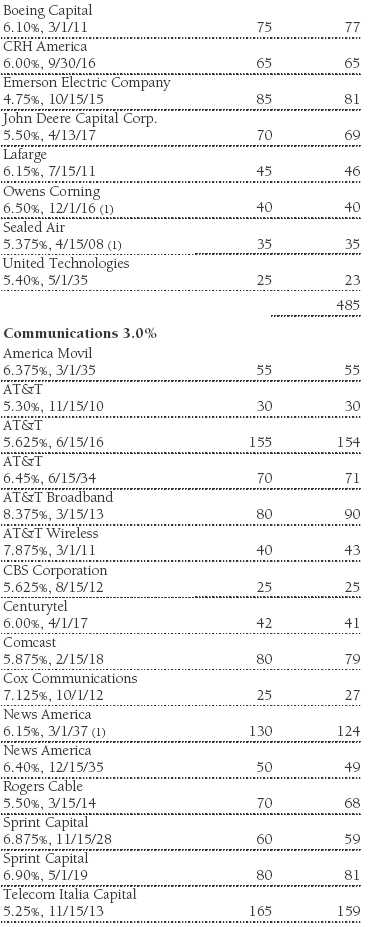

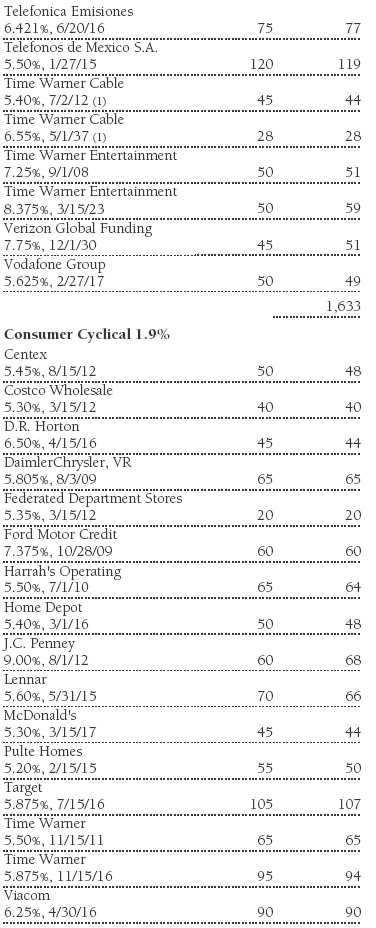

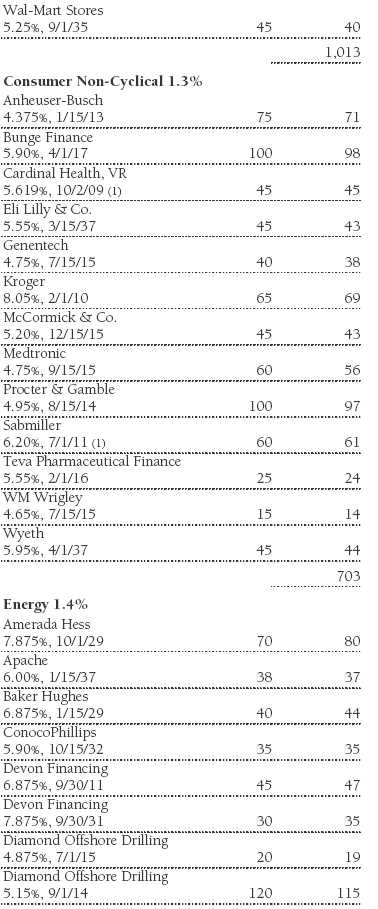

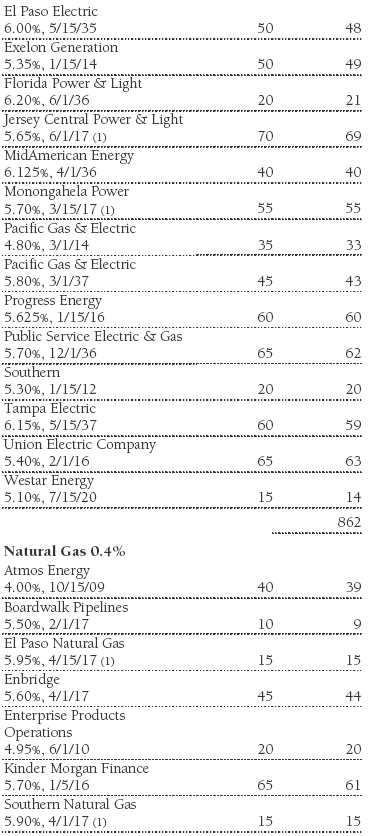

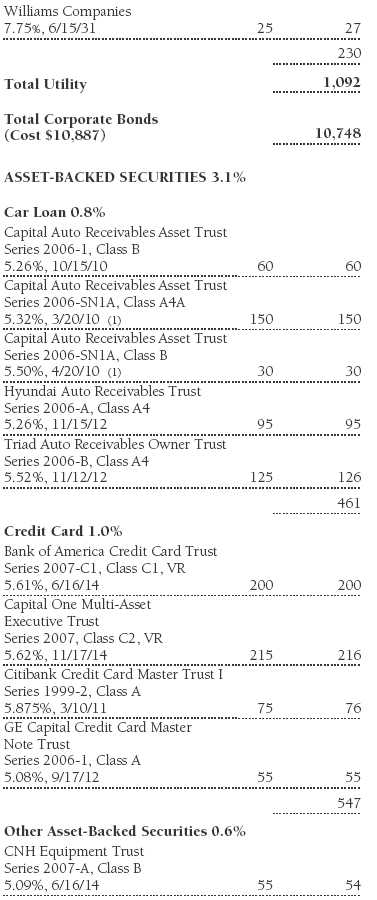

As shown in the security diversification chart, mortgage-backed bonds, corporate bonds, and U.S. Treasuries accounted for 78% of the fund’s assets at the end of the reporting period. The fund also has significant positions in foreign government obligations and municipal bonds and U.S. agency obligations. We had a noteworthy allocation to high-yield bonds, which are included in the corporate category.

The fund’s duration position, which was moderately longer than the benchmark’s, generally helped results during the past six months and year. This was especially true when yields fell steeply in the first quarter in response to worries over the housing sector and a temporary flight from equities. The fund’s duration ended the period at 4.7 years, slightly longer than six months ago, although its weighted average maturity declined somewhat.

The fund’s sector allocations had a mixed effect on performance. While we have recently trimmed our position, we remained overweight in commercial mortgage-backed securities (CMBS). Although this helped our results last year, it weighed on performance in the past few months as CMBS credit spreads widened in sympathy with swap rates and increased supply. Conversely, our allocation to Treasury inflation-protected securities (TIPS) has boosted performance recently, as rising energy prices have caused headline inflation to creep upward. TIPS fared poorly after last year’s quiet hurricane season resulted in a plunge in energy prices, which eventually pulled headline inflation below core inflation.

Our defensive position in mortgages detracted from results as the sector benefited from stable interest rates throughout much of the period while largely avoiding fallout from the housing slump and troubles in the subprime lending market. Nevertheless, we remain cautious on the sector given the potential for interest rate volatility to increase from historically low levels.

Our exposure to foreign bonds was generally beneficial in the period as investors flocked to emerging markets in search of yield and as the U.S. dollar declined against other currencies. Exposure to currencies from Asia, particularly Malaysia, India, and Indonesia, performed especially well. Bond holdings from Mexico, Brazil, Turkey, and Poland were also strong. We continue to find opportunities in global developed and emerging markets that we believe are likely to outperform the U.S. We expect Asian currencies to continue to appreciate given the strong growth in the region and the pressure being exerted on China to revalue the renminbi (yuan).

Lastly, our credit allocation boosted relative results in the period. Our exposure to high-yield bonds helped performance, as high-yield credit spreads contracted to record levels. Declining credit spreads also helped our focus on lower-rated holdings within our investment-grade allocation. We plan to maintain our emphasis on lower-quality issuers, while using a broadly diversified approach in an attempt to shield the portfolio from individual company actions that can hurt bondholders—such as leveraged buyouts, special dividends, and share buybacks.

Outlook

Global liquidity continues to tighten as many central banks increase rates, which may eventually affect credit spreads and drive up yields of riskier assets. The Fed has noted that core inflation remains stubbornly high, making the central bank likely to keep its policy on hold until officials determine if the current policy is keeping growth moderate and inflation stable. While bond returns may be generally subdued in this environment, we will continue to use our mandate to invest in lower-quality and overseas issues in an attempt to boost returns for the portfolio.

As always, we appreciate your confidence and thank you for investing with T. Rowe Price.

Respectfully submitted,

Brian J. Brennan

Chairman of the fund’s Investment Advisory Committee

June 21, 2007

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

Bonds are subject to interest rate risk, the decline in bond prices that usually accompanies a rise in interest rates, and credit risk, the chance that any fund holding could have its credit rating downgraded or that a bond issuer will default (fail to make timely payments of interest or principal), potentially reducing the fund’s income level and share price. Mortgage-backed securities are subject to prepayment risk, particularly if falling rates lead to heavy refinancing activity, and extension risk, which is an increase in interest rates that causes a fund’s average maturity to lengthen unexpectedly due to a drop in mortgage prepayments. This could increase the fund’s sensitivity to rising interest rates and its potential for price declines.

Average maturity: The average of the stated maturity dates of a bond or money market portfolio’s securities. The average maturity for a money market fund is measured in days, whereas a bond fund’s average maturity is measured in years. In general, the longer the average maturity, the greater the fund’s sensitivity to interest rate changes, which means greater price fluctuation.

Basis point: One one-hundredth of a percentage point, or 0.01%.

Duration: A measure of a bond or bond fund’s sensitivity to changes in interest rates. For example, a fund with a four-year duration would fall about 4% in response to a one-percentage-point rise in interest rates, and vice versa.

Federal funds rate: The interest rate charged on overnight loans of reserves by one financial institution to another in the United States. The Federal Reserve sets a target federal funds rate to affect the direction of interest rates.

J.P. Morgan Emerging Markets Bond Index Global: An index of U.S. dollar-denominated Brady Bonds, Eurobonds, traded loans, and local market debt instruments issued by sovereign and quasi-sovereign entities.

J.P. Morgan Global High-Yield Index: An unmanaged index that tracks the performance of the high-yield bond market.

Lehman Brothers Mortgage-Backed Securities Index: An unmanaged index that tracks the performance of the mortgage-backed pass-through securities of Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC).

Lehman Brothers U.S. Aggregate Index: An unmanaged index that tracks domestic investment-grade bonds, including corporate, government, and mortgage-backed securities.

Lehman Brothers U.S. Credit Index: An unmanaged index that tracks the performance of domestic investment-grade corporate bonds.

Lehman Brothers U.S. Treasury Index: An unmanaged index of publicly traded obligations of the U.S. Treasury.

Lipper averages: The averages of all mutual funds in a particular category as tracked by Lipper Inc.

Real interest rate: A fixed-income security’s interest rate after being adjusted for inflation. It is calculated by subtracting the inflation rate from a nominal interest rate. For example, if a 10-year Treasury note is yielding 5% and inflation is 2%, the real interest rate is 3%.

Weighted average maturity: The weighted average of the stated maturity dates of the portfolio’s securities. In general, the longer the average maturity, the greater the fund’s sensitivity to interest rate changes. A shorter average maturity usually means less interest rate sensitivity and therefore a less volatile portfolio.

Yield curve: A graphic depiction of the relationship between yields and maturity dates for a set of similar securities, such as Treasuries or municipal securities. Yield curves typically slope upward, indicating that longer maturities offer higher yields. When the yield curve is flat, there is little or no difference between the yields offered by shorter- and longer-term securities.

Performance and Expenses

T. Rowe Price Institutional Core Plus Fund

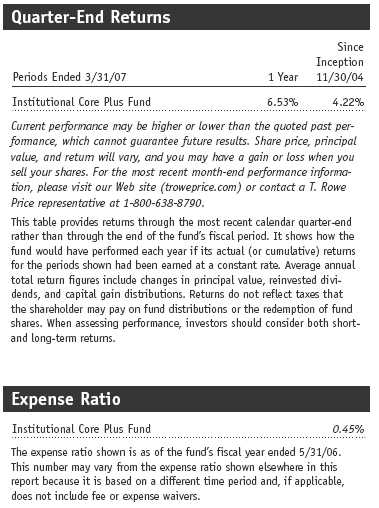

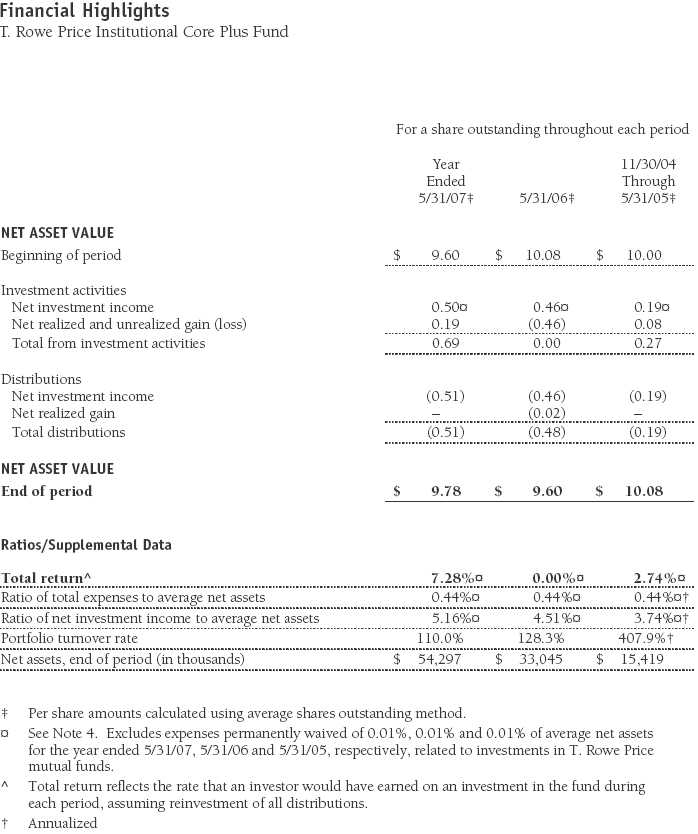

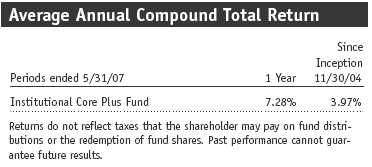

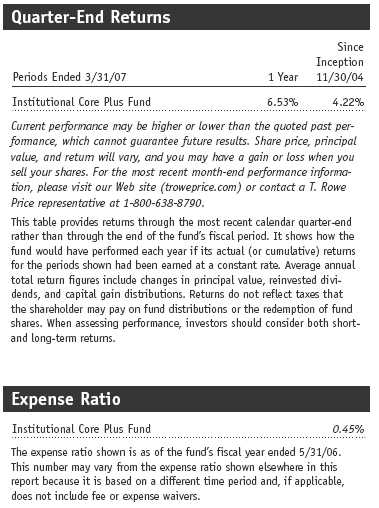

This chart shows the value of a hypothetical $1 million investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

This table shows how the fund would have performed each year if its actual (or cumulative) returns for the periods shown had been earned at a constant rate.

Fund Expense Example

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and actual expenses. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

The accompanying notes are an integral part of these financial statements.

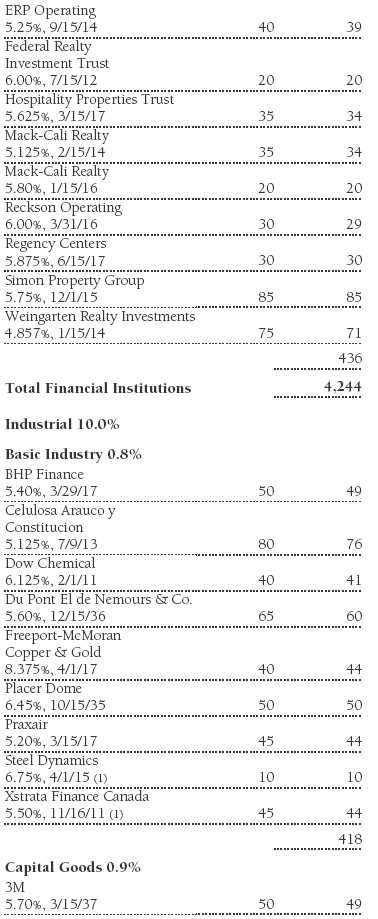

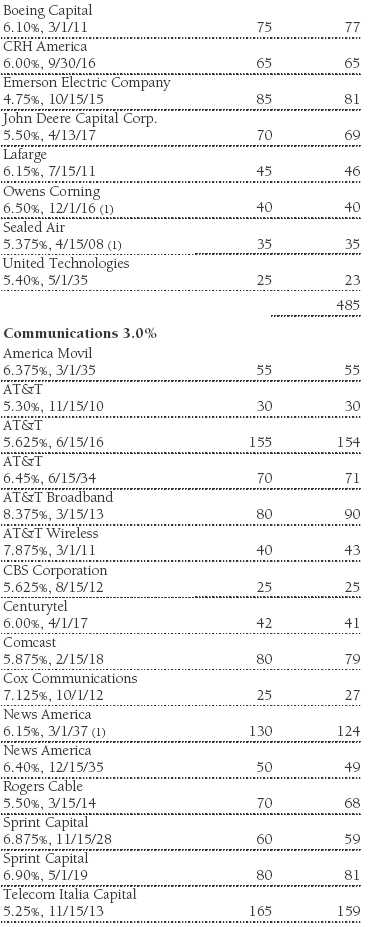

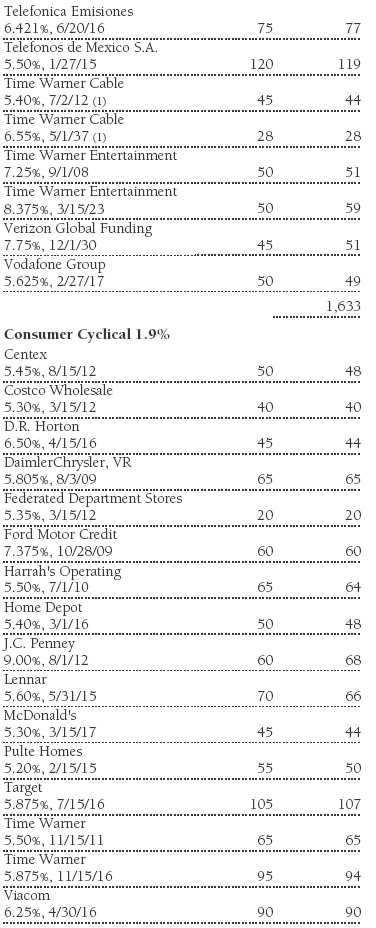

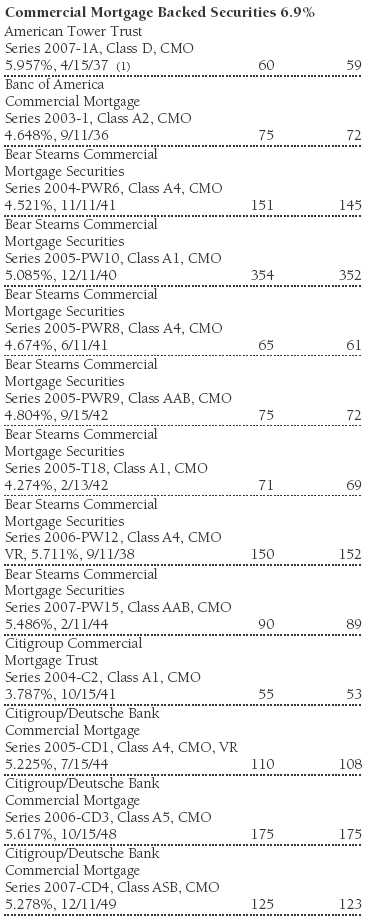

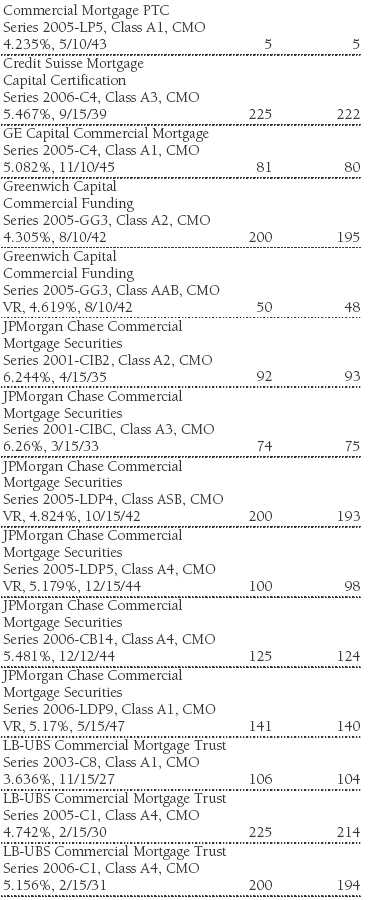

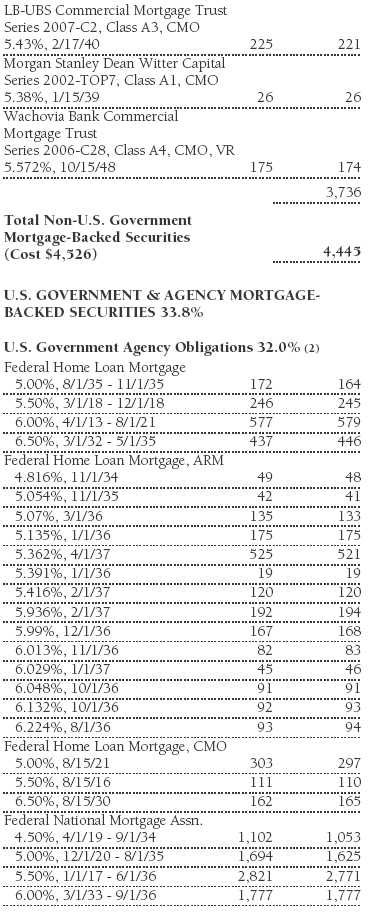

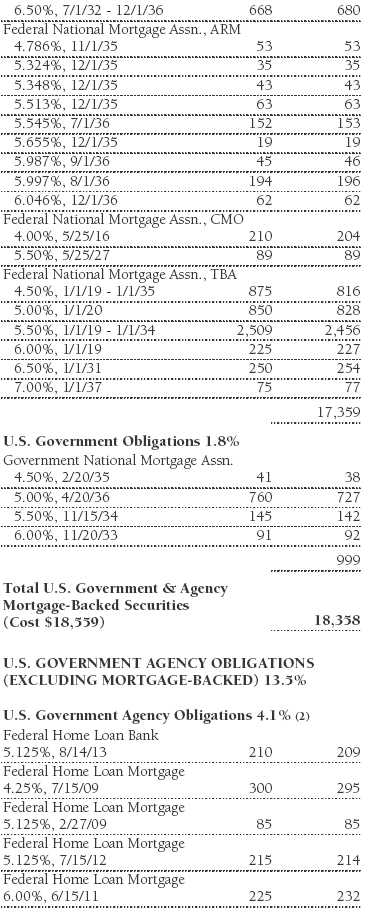

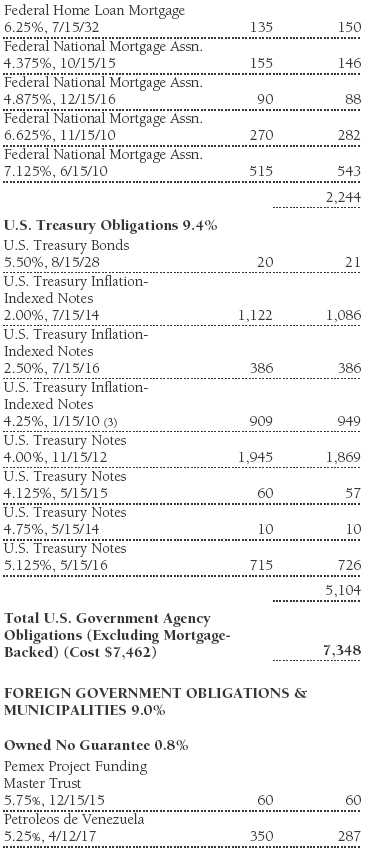

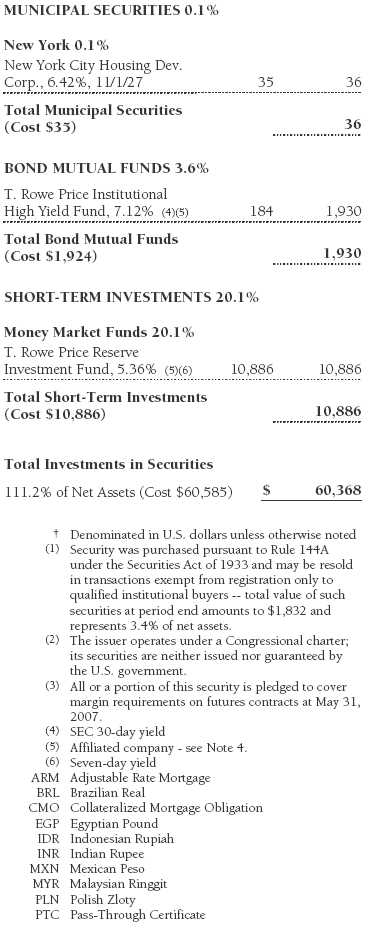

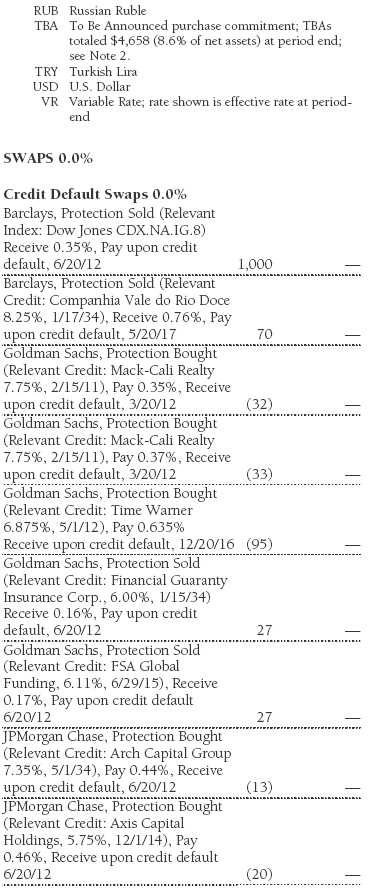

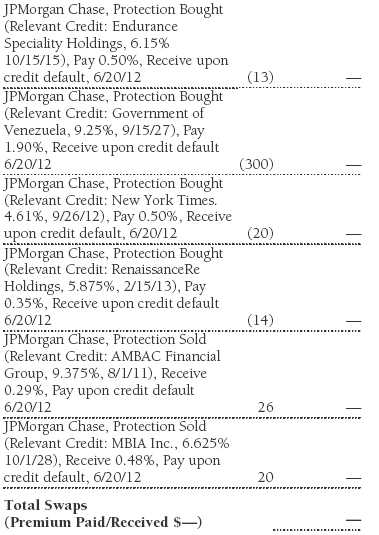

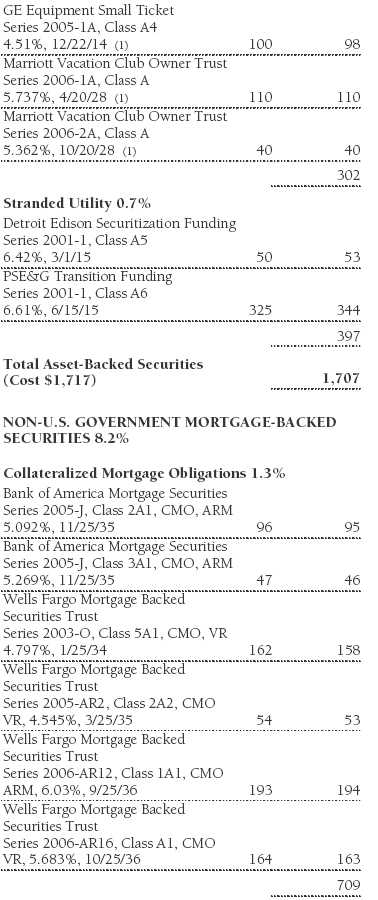

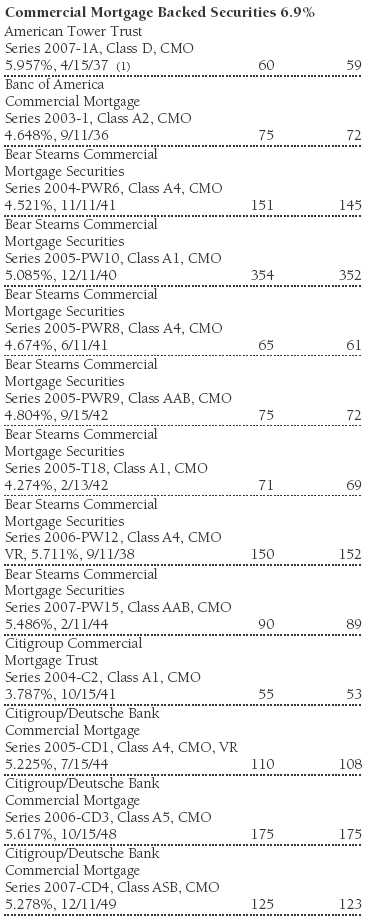

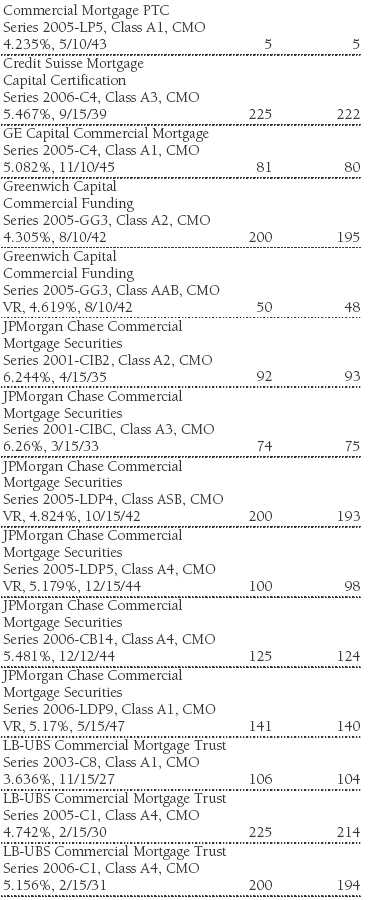

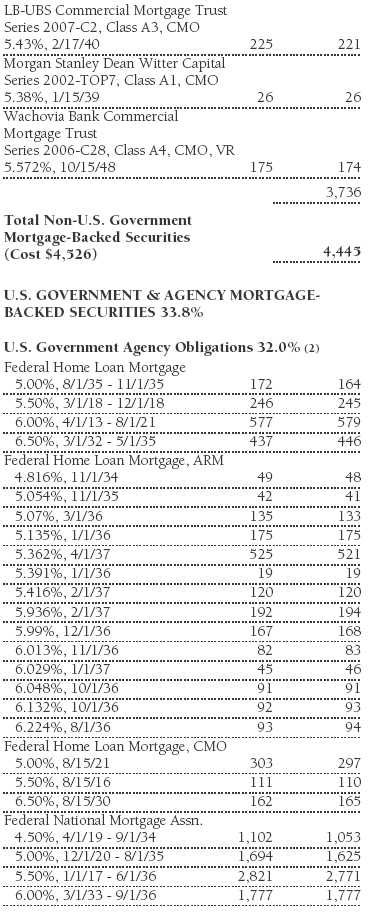

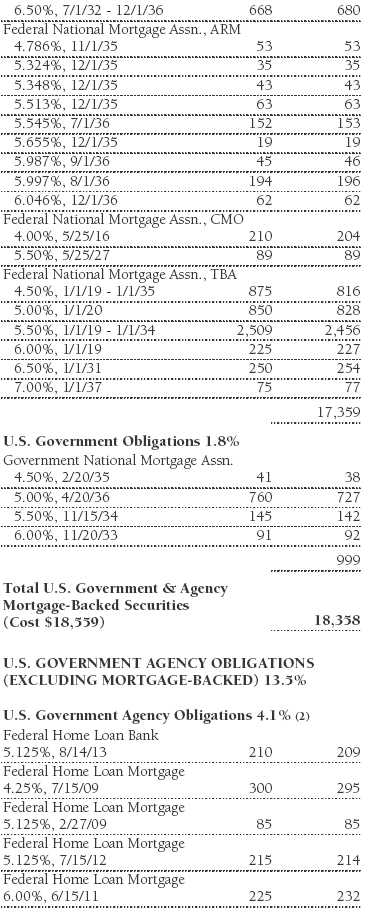

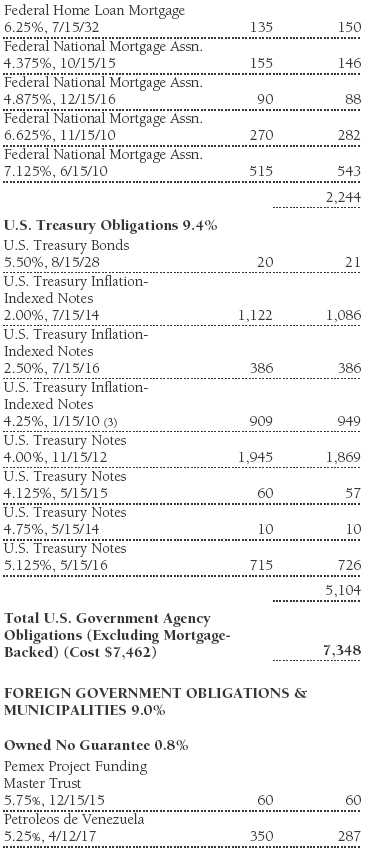

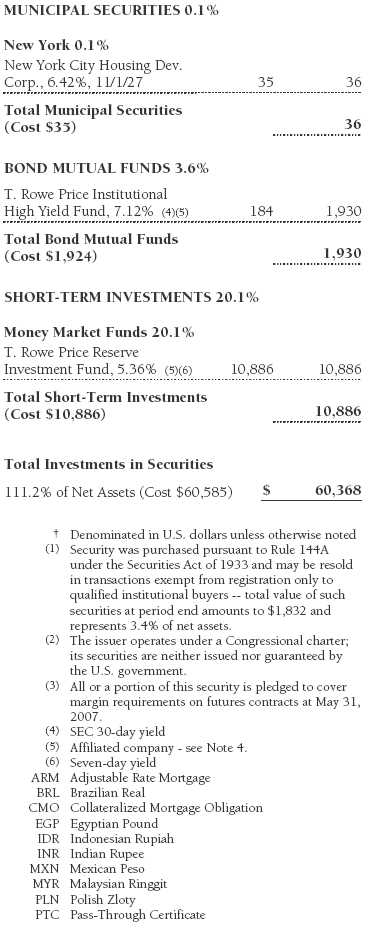

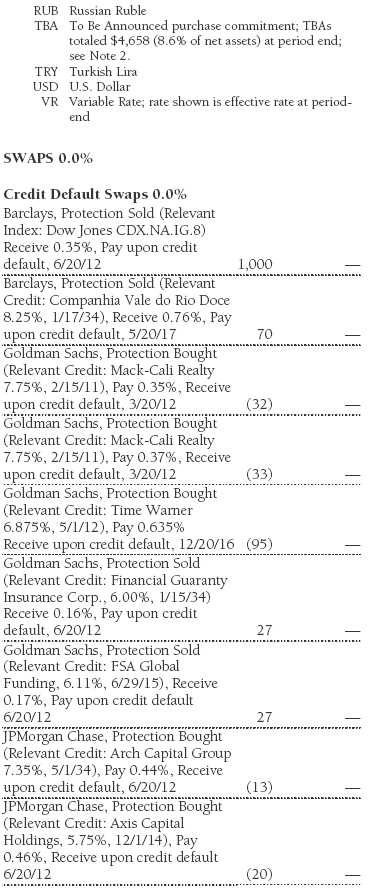

Portfolio of Investments †

T. Rowe Price Institutional Core Plus Fund

May 31, 2007

The accompanying notes are an integral part of these financial statements.

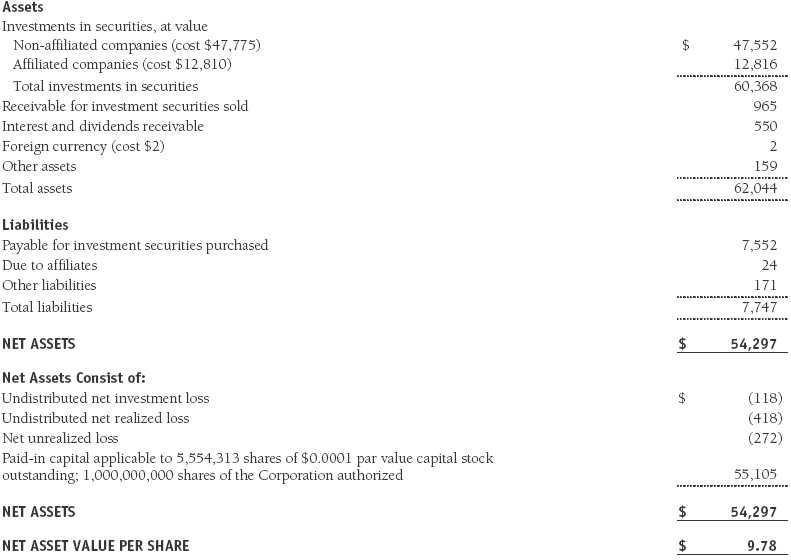

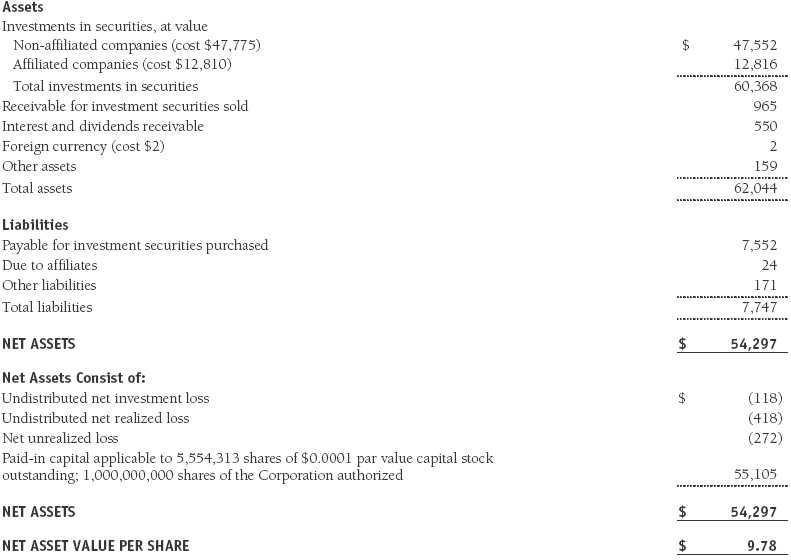

Statement of Assets and Liabilities

T. Rowe Price Institutional Core Plus Fund

May 31, 2007

(In thousands except shares and per share amounts)

The accompanying notes are an integral part of these financial statements.

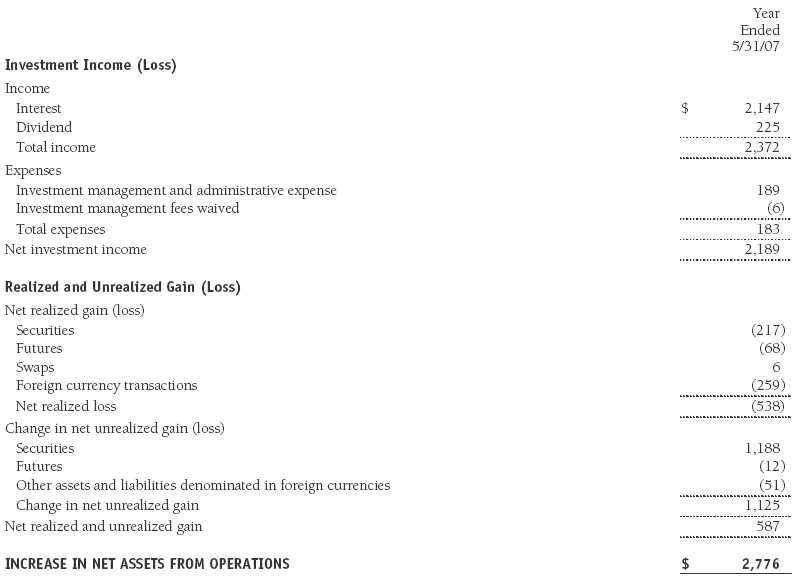

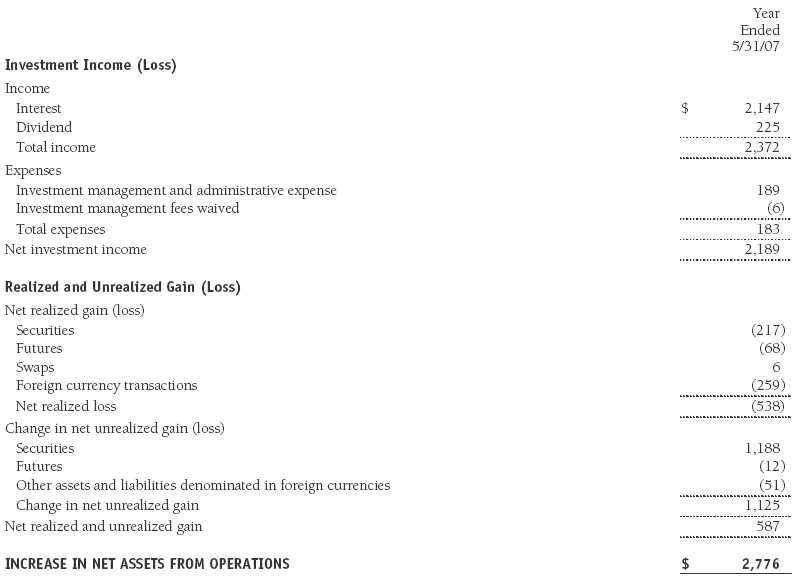

Statement of Operations

T. Rowe Price Institutional Core Plus Fund

($ 000s)

The accompanying notes are an integral part of these financial statements.

Statement of Changes in Net Assets

T. Rowe Price Institutional Core Plus Fund

($ 000s)

The accompanying notes are an integral part of these financial statements.

Notes to Financial Statements

T. Rowe Price Institutional Core Plus Fund

May 31, 2007

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

T. Rowe Price Institutional Income Funds, Inc. (the corporation), is registered under the Investment Company Act of 1940 (the 1940 Act). The Institutional Core Plus Fund (the fund), a diversified, open-end management investment company, is one portfolio established by the corporation. The fund commenced operations on November 30, 2004. The fund seeks to maximize total return through income and capital appreciation.

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, which require the use of estimates made by fund management. Fund management believes that estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the fund ultimately realizes upon sale of the securities.

Valuation The fund values its investments and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business. Debt securities are generally traded in the over-the-counter market. Securities with original maturities of one year or more are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service, which considers yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Securities with original maturities of less than one year are valued at amortized cost in local currency, which approximates fair value when combined with accrued interest.

Investments in mutual funds are valued at the mutual fund’s closing net asset value per share on the day of valuation. Options on futures contracts are valued at the last sale price. Financial futures contracts are valued at closing settlement prices. Forward currency exchange contracts are valued using the prevailing forward exchange rate. Swap agreements are valued at prices furnished by dealers who make markets in such securities.

Other investments, including restricted securities, and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors.

Most foreign markets close before the close of trading on the NYSE. If the fund determines that developments between the close of a foreign market and the close of the NYSE will, in its judgment, materially affect the value of some or all of its portfolio securities, which in turn will affect the fund’s share price, the fund will adjust the previous closing prices to reflect the fair value of the securities as of the close of the NYSE, as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors. A fund may also fair value securities in other situations, such as when a particular foreign market is closed but the fund is open. In deciding whether to make fair value adjustments, the fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. The fund uses outside pricing services to provide it with closing market prices and information used for adjusting those prices. The fund cannot predict when and how often it will use closing prices and when it will adjust those prices to reflect fair value. As a means of evaluating its fair value process, the fund routinely compares closing market prices, the next day’s opening prices in the same markets, and adjusted prices.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as quoted by a major bank. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is reflected as a component of security gains and losses.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Inflation adjustments to the principal amount of inflation-indexed bonds are reflected as interest income. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Payments (“variation margin”) made or received to settle the daily fluctuations in the value of futures contracts are recorded as unrealized gains or losses until the contracts are closed. Unsettled variation margin on futures contracts is reflected as other assets or liabilities, and unreali zed gains and losses on futures contracts are reflected as the change in net unrealized gain or loss in the accompanying financial statements. Unrealized gains and losses on forward currency exchange contracts are reflected as the change in net unrealized gain or loss in the accompanying financial statements. Net periodic receipts or payments required by swaps are accrued daily and recorded as realized gain or loss in the accompanying financial statements. Fluctuations in the fair value of swaps are reflected in the change in net unrealized gain or loss and are reclassified to realized gain or loss upon termination prior to maturity. Paydown gains and losses are recorded as an adjustment to interest income. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared on a daily basis and paid monthly. Capital gain distributions, if any, are declared and paid by the fund, typically on an annual basis.

New Accounting Pronouncements In June 2006, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation No. 48 (“FIN 48”), Accounting for Uncertainty in Income Taxes, a clarification of FASB Statement No. 109, Accounting for Income Taxes. FIN 48 establishes financial reporting rules regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. Management is evaluating the anticipated impact, if any, that FIN 48 will have on the fund upon adoption, which, pursuant to a delay granted by the U.S. Securities and Exchange Commission, is expected to be on the last business day of the fund’s semiannual period, November 30, 2007.

In September 2006, the FASB released the Statement of Financial Accounting Standard No. 157 (“FAS 157”), Fair Value Measurements. FAS 157 clarifies the definition of fair value and establishes the framework for measuring fair value, as well as proper disclosure of this methodology in the financial statements. It will be effective for the fund’s fiscal year beginning June 1, 2008. Management is evaluating the effects of FAS 157; however, it is not expected to have a material impact on the fund’s net assets or results of operations.

NOTE 2 - INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Restricted Securities The fund may invest in securities that are subject to legal or contractual restrictions on resale. Although certain of these securities may be readily sold, for example, under Rule 144A, others may be illiquid, their sale may involve substantial delays and additional costs, and prompt sale at an acceptable price may be difficult.

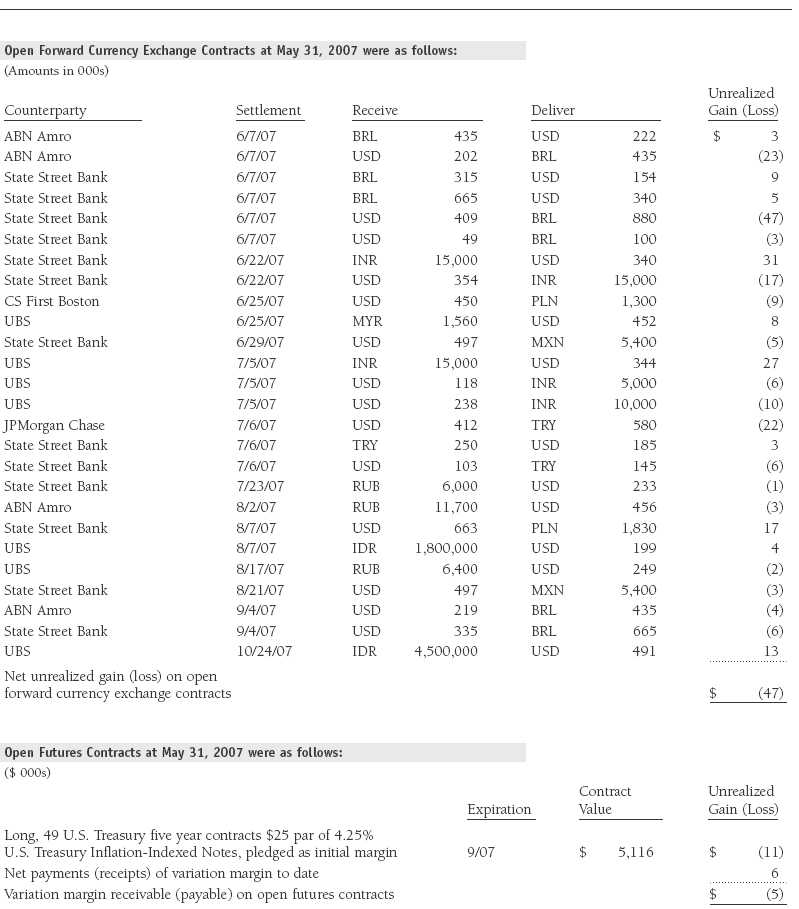

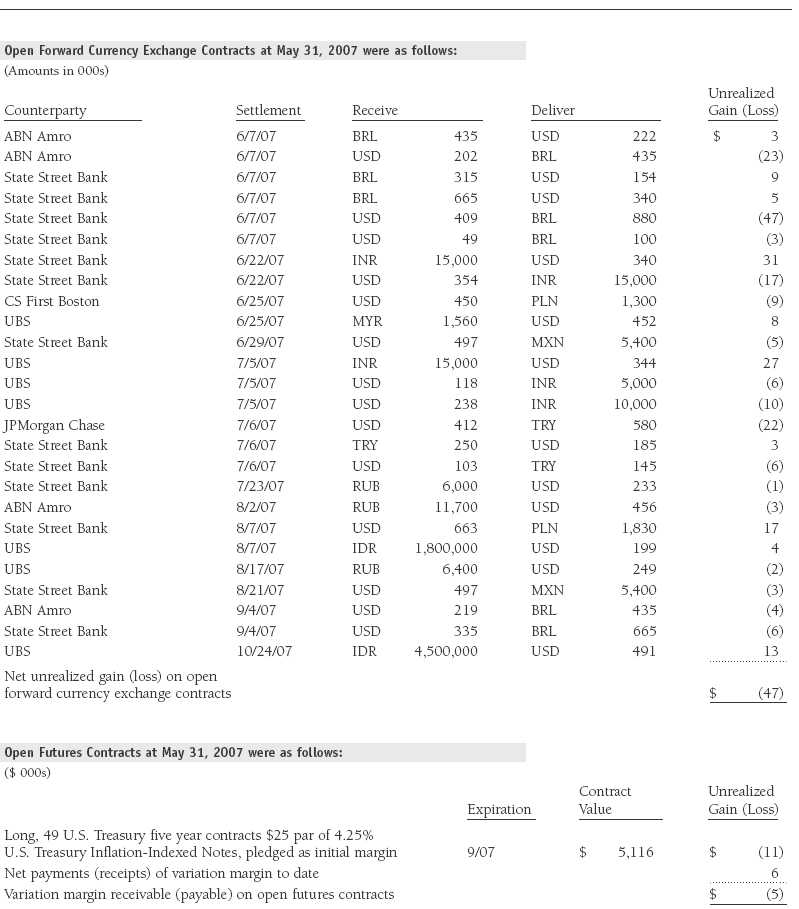

Forward Currency Exchange Contracts During the year ended May 31, 2007, the fund was a party to forward currency exchange contracts under which it is obligated to exchange currencies at specified future dates and exchange rates. Risks arise from the possible inability of counterparties to meet the terms of their agreements and from movements in currency values.

Futures Contracts During the year ended May 31, 2007, the fund was a party to futures contracts, which provide for the future sale by one party and purchase by another of a specified amount of a specific financial instrument at an agreed upon price, date, time, and place. Risks arise from possible illiquidity of the futures market and from movements in security values and/or interest rates.

Options Call and put options on futures contracts give the holder the right to purchase or sell, respectively, a particular futures contract at a specified price on a certain date. Risks arise from possible illiquidity of the options market and from movements in underlying futures prices.

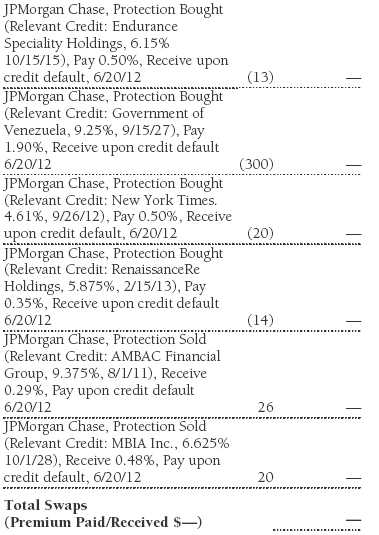

Swaps During the year ended May 31, 2007, the fund was a party to credit default swaps under which it buys or sells credit protection against a defined-issuer credit event. Upon a defined-issuer credit event, the fund is required to either deliver the notional amount of the contract in cash and take delivery of the relevant credit or deliver cash approximately equal to the notional amount of the contract less market value of the relevant credit at the time of the credit event. Risks arise from the possible inability of counterparties to meet the terms of their agreements and from changes in creditworthiness of the relevant underlying issuer.

TBA Purchase Commitments During the year ended May 31, 2007, the fund entered into to be announced (TBA) purchase commitments, pursuant to which it agrees to purchase mortgage-backed securities for a fixed unit price, with payment and delivery at a scheduled future date beyond the customary settlement period for that security. With TBA transactions, the particular securities to be delivered are not identified at the trade date; however, delivered securities must meet specified terms, including issuer, rate, and mortgage term, and be within industry-accepted “good delivery” standards. The fund generally enters into TBAs with the intention of taking possession of the underlying mortgage securities. Until settlement, the fund maintains cash reserves and liquid assets sufficient to settle its TBAs.

Other Purchases and sales of portfolio securities, other than short-term and U.S. government securities, aggregated $20,639,000 and $11,886,000, respectively, for the year ended May 31, 2007. Purchases and sales of U.S. government securities aggregated $40,958,000 and $33,153,000, respectively, for the year ended May 31, 2007.

NOTE 3 - FEDERAL INCOME TAXES

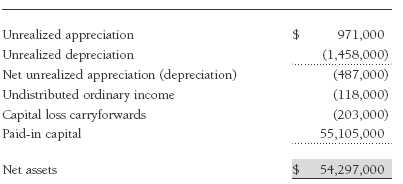

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Federal income tax regulations differ from generally accepted accounting principles; therefore, distributions determined in accordance with tax regulations may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character. Financial records are not adjusted for temporary differences.

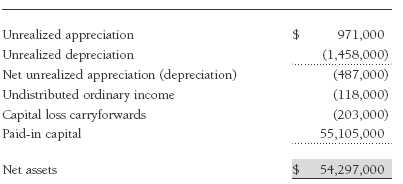

Distributions during the year ended May 31, 2007, totaled $2,202,000 and were characterized as ordinary income for tax purposes. At May 31, 2007, the tax-basis components of net assets were as follows:

Pursuant to federal income tax regulations applicable to investment companies, the fund has elected to treat net capital losses realized between November 1 and May 31 of each year as occurring on the first day of the following tax year. Consequently, $169,000 of realized losses reflected in the accompanying financial statements will not be recognized for tax purposes until 2008. Federal income tax regulations require the fund to defer recognition of capital losses realized on certain futures and forward currency exchange contract transactions; accordingly, $130,000 of realized losses reflected in the accompanying financial statements have not been recognized for tax purposes as of May 31, 2007. Federal income tax regulations require the fund to treat the gain/loss on certain open futures and/or forward currency exchange contracts as realized on the last day of the tax year; accordingly, $83,000 of unrealized losses reflected in the accompanying financial statements were realized for tax purpo ses as of May 31, 2007. The fund intends to retain realized gains to the extent of available capital loss carryforwards. As of May 31, 2007, the fund had $203,000 of capital loss carryforwards that expire in fiscal 2015.

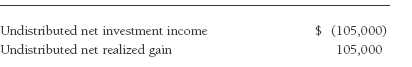

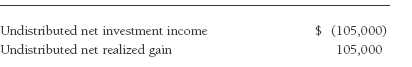

For the year ended May 31, 2007, the fund recorded the following permanent reclassifications to reflect tax character. Reclassifications between income and gain relate primarily to the character of currency gains and losses. Results of operations and net assets were not affected by these reclassifications.

At May 31, 2007, the cost of investments for federal income tax purposes was $60,883,000.

NOTE 4 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (the manager or Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. The investment management and administrative agreement between the fund and the manager provides for an all-inclusive annual fee equal to 0.45% of the fund’s average daily net assets. The fee is computed daily and paid monthly. The agreement provides that investment management, shareholder servicing, transfer agency, accounting, custody services, and directors’ fees and expenses are provided to the fund, and interest, taxes, brokerage commissions, and extraordinary expenses are paid directly by the fund.

The fund may invest in the T. Rowe Price Reserve Investment Fund and the T. Rowe Price Government Reserve Investment Fund (collectively, the T. Rowe Price Reserve Investment Funds), open-end management investment companies managed by Price Associates and affiliates of the fund. The T. Rowe Price Reserve Investment Funds are offered as cash management options to mutual funds, trusts, and other accounts managed by Price Associates and/or its affiliates, and are not available for direct purchase by members of the public. The T. Rowe Price Reserve Investment Funds pay no investment management fees.

The fund may invest in the T. Rowe Price Institutional High Yield Fund, Inc. (High Yield Fund), as a means of gaining efficient and cost-effective exposure to the high-yield bond markets. The High Yield Fund is an open-end management investment company managed by Price Associates, and is an affiliate of the fund (reflected on the Affiliated Companies table). The High Yield Fund pays an annual all-inclusive management and administrative fee to Price Associates equal to 0.50% of average daily net assets. To ensure that Institutional Core Plus does not incur duplicate fees for its assets invested in the High Yield Fund, Price Associates has agreed to reduce its management fee charged to the fund. Accordingly, the accompanying Statement of Operations includes $6,000 of management fees permanently waived pursuant to this agreement. For the year ended May 31, 2007, realized gains on sales of High Yield Fund shares were $0 and capital gain distributions from High Yield Fund totaled $0.

As of May 31, 2007, T. Rowe Price Group, Inc., and/or its wholly owned subsidiaries owned 1,690,374 shares of the fund, representing 30% of the fund’s net assets.

Report of Independent Registered Public Accounting Firm

To the Board of Directors of T. Rowe Price Institutional Income Funds, Inc. and

Shareholders of T. Rowe Price Institutional Core Plus Fund

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of T. Rowe Price Institutional Core Plus Fund (one of the portfolios comprising T. Rowe Price Institutional Income Funds, Inc., hereafter referred to as the “Fund”) at May 31, 2007, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the fiscal periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the auditing standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at May 31, 2007 by correspondence with the custodian and brokers, and by agreement to the underlying ownership records for T. Rowe Price Reserve Investment Fund and T. Rowe Price Institutional High Yield Fund, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

July 12, 2007

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s Web site, www.sec.gov. The description of our proxy voting policies and procedures is also available on our Web site, www.troweprice.com. To access it, click on the words “Company Info” at the top of our homepage for individual investors. Then, in the window that appears, click on the “Proxy Voting Policy” navigation button in the top left corner.

Each fund’s most recent annual proxy voting record is available on our Web site and through the SEC’s Web site. To access it through our Web site, follow the directions above, then click on the words “Proxy Voting Record” at the bottom of the Proxy Voting Policy page.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s Web site (www.sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| Approval of Investment Management Agreement |

On March 7, 2007, the fund’s Board of Directors (Board) unanimously approved the investment advisory contract (Contract) between the fund and its investment manager, T. Rowe Price Associates, Inc. (Manager). The Board considered a variety of factors in connection with its review of the Contract, also taking into account information provided by the Manager during the course of the year, as discussed below:

Services Provided by the Manager

The Board considered the nature, quality, and extent of the services provided to the fund by the Manager. These services included, but were not limited to, management of the fund’s portfolio and a variety of related activities, as well as financial and administrative services, reporting, and communications. The Board also reviewed the background and experience of the Manager’s senior management team and investment personnel involved in the management of the fund. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Manager.

Investment Performance of the Fund

The Board reviewed the fund’s average annual total return for the one-year and since-inception periods and compared these returns with previously agreed upon comparable performance measures and market data, including those supplied by Lipper, an independent provider of mutual fund data. On the basis of this evaluation and the Board’s ongoing review of investment results, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Manager under the Contract and other benefits that the Manager (and its affiliates) may have realized from its relationship with the fund, including research received under “soft dollar” agreements. The Board noted that soft dollars were not used to pay for third-party, non-broker research. The Board also received information on the estimated costs incurred and profits realized by the Manager and its affiliates from advising T. Rowe Price mutual funds. The Board noted that the Manager had waived its fee for the fund. The Board concluded that the Manager’s profits from advising T. Rowe Price mutual funds were reasonable in light of the services provided to the fund. The Board also considered whether the fund or other funds benefit under the fee levels set forth in the Contract from any economies of scale realized by the Manager. The Board noted that, under the Contract, the fund pays the Manager a single fee based on the fund’s assets and the Manager, in turn, pays all expenses of the fund, with certain exceptions. The Board concluded that, based on the profitability data it reviewed and consistent with this single fee structure, the Contract provided for a reasonable sharing of any benefits from economies of scale with the fund.

Fees

The Board reviewed the fund’s single-fee structure and compared the rate with fees and expenses of other comparable funds based on information and data supplied by Lipper. The information provided to the Board showed that the fund’s single fee rate was below the median management fee rate and expense ratio of comparable funds. The Board also reviewed the fee schedules for comparable privately managed accounts of the Manager and its affiliates. Management informed the Board that the Manager’s responsibilities for privately managed accounts are more limited than its responsibilities for the fund and other T. Rowe Price mutual funds that it or its affiliates advise. On the basis of the information provided, the Board concluded that the fees paid by the fund under the Contract were reasonable.

Approval of the Contract

As noted, the Board approved the continuation of the Contract. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund to approve the continuation of the Contract, including the fees to be charged for services thereunder.

| About the Fund’s Directors and Officers |

Your fund is governed by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and other business affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of Board members are independent of T. Rowe Price Associates, Inc. (T. Rowe Price), and T. Rowe Price International, Inc. (T. Rowe Price International); “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the fund directors and is available without charge by calling a T. Rowe Price representative at 1-800-225-5132.

| Independent Directors | |

| |

| Name (Year of Birth) | |

| Year Elected* | Principal Occupation(s) During Past 5 Years and Directorships of Other Public Companies |

| |

| Jeremiah E. Casey (1940) | Director, National Life Insurance (2001 to 2005); Director, The Rouse Company, real estate developers (1990 to |

| 2006 | 2004); Director, Allfirst Financial Inc. (previously First Maryland Bancorp) (1983 to 2002) |

| |

| Anthony W. Deering (1945) | Chairman, Exeter Capital, LLC, a private investment firm (2004 to present); Director, Vornado Real Estate Investment |

| 2002 | Trust (3/04 to present); Director, Mercantile Bankshares (4/03 to present); Member, Advisory Board, Deutsche Bank |

| | North America (2004 to present); Director, Chairman of the Board, and Chief Executive Officer, The Rouse Company, |

| | real estate developers (1997 to 2004) |

| |

| Donald W. Dick, Jr. (1943) | Principal, EuroCapital Advisors, LLC, an acquisition and management advisory firm; Chairman, The Haven Group, a |

| 2002 | custom manufacturer of modular homes (1/04 to present) |

| |

| David K. Fagin (1938) | Chairman and President, Nye Corporation (6/88 to present); Director, Canyon Resources Corp. (5/00 to present); |

| 2002 | Director, Golden Star Resources Ltd. (5/92 to present); Director, Pacific Rim Mining Corp. (2/02 to present) |

| |

| Karen N. Horn (1943) | Director, Federal National Mortgage Association (9/06 to present); Managing Director and President, Global Private |

| 2003 | Client Services, Marsh Inc. (1999 to 2003); Managing Director and Head of International Private Banking, Bankers |

| | Trust (1996 to 1999); Director, Georgia Pacific (5/04 to 12/05), Eli Lilly and Company, and Simon Property Group |

| |

| Theo C. Rodgers (1941) | President, A&R Development Corporation (1977 to present) |

| 2005 | |

| |

| John G. Schreiber (1946) | Owner/President, Centaur Capital Partners, Inc., a real estate investment company; Partner, Blackstone Real Estate |

| 2002 | Advisors, L.P. |

| |

| *Each independent director oversees 119 T. Rowe Price portfolios and serves until retirement, resignation, or election of a successor. |

| Inside Directors | |

| |

| Name (Year of Birth) | |

| Year Elected* [Number of | |

| T. Rowe Price Portfolios | |

| Overseen] | Principal Occupation(s) During Past 5 Years and Directorships of Other Public Companies |

| |

| Edward C. Bernard (1956) | Director and Vice President, T. Rowe Price; Vice Chairman of the Board, Director, and Vice President, T. Rowe Price |

| 2006 [119] | Group, Inc.; Chairman of the Board, Director, and President, T. Rowe Price Investment Services, Inc., and T. Rowe |

| | Price Retirement Plan Services, Inc.; Chairman of the Board and Director, T. Rowe Price Services, Inc., T. Rowe |

| | Price Savings Bank, T. Rowe Price Global Asset Management Limited, and T. Rowe Price Global Investment Services |

| | Limited; Director, T. Rowe Price International, Inc.; Chief Executive Officer, Chairman of the Board, Director, and |

| | President, T. Rowe Price Trust Company; Chairman of the Board, all funds |

| |

| Mary J. Miller, CFA (1955) | Director, T. Rowe Price Trust Company; Director and Vice President, T. Rowe Price; Vice President, T. Rowe Price |

| 2004 [37] | Group, Inc.; President, Institutional Income Fund |

| |

| *Each inside director serves until retirement, resignation, or election of a successor. |

| Officers | |

| |

| Name (Year of Birth) | |

| Title and Fund(s) Served | Principal Occupation(s) |

| |

| Connice A. Bavely, CFA (1951) | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| Vice President, Institutional Income Funds | |

| |

| David C. Beers, CFA (1970) | Assistant Vice President, T. Rowe Price; formerly, High Yield Analyst, |

| Assistant Vice President, Institutional Income Funds | Chartwell Investment Partners and Business Analyst/Software Developer, |

| | Morgan Stanley Investment Management (to 2004) |

| |

| Brian J. Brennan, CFA (1964) | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price |

| Executive Vice President, Institutional Income Funds | Trust Company |

| |

| Andrew M. Brooks (1956) | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| Vice President, Institutional Income Funds | |

| |

| Joseph A. Carrier, CPA (1960) | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., T. Rowe Price |

| Treasurer, Institutional Income Funds | Investment Services, Inc., and T. Rowe Price Trust Company |

| |

| Michael J. Conelius, CFA (1964) | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price |

| Vice President, Institutional Income Funds | International, Inc. |

| |

| Roger L. Fiery III, CPA (1959) | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., T. Rowe Price |

| Vice President, Institutional Income Funds | International, Inc., and T. Rowe Price Trust Company |

| |

| Justin T. Gerbereux, CFA (1975) | Vice President, T. Rowe Price; formerly student, Mary Washington College |

| Assistant Vice President, Institutional Income Funds | and Darden School of Business Administration, University of Virginia (to |

| | 2003); Equity Research Intern, Mellon Growth Advisors, LLC (to 2002) |

| |

| John R. Gilner (1961) | Chief Compliance Officer and Vice President, T. Rowe Price; Vice President, |

| Chief Compliance Officer, Institutional Income Funds | T. Rowe Price Group, Inc., and T. Rowe Price Investment Services, Inc. |

| |

| Gregory S. Golczewski (1966) | Vice President, T. Rowe Price and T. Rowe Price Trust Company |

| Vice President, Institutional Income Funds | |

| |

| Henry H. Hopkins (1942) | Director and Vice President, T. Rowe Price Investment Services, Inc., |

| Vice President, Institutional Income Funds | T. Rowe Price Services, Inc., and T. Rowe Price Trust Company; Vice |

| | President, T. Rowe Price, T. Rowe Price Group, Inc., T. Rowe Price |

| | International, Inc., and T. Rowe Price Retirement Plan Services, Inc. |

| |

| Paul A. Karpers, CFA (1967) | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| Vice President, Institutional Income Funds | |

| |

| Ian D. Kelson (1956) | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price |

| Vice President, Institutional Income Funds | International, Inc. |

| |

| Patricia B. Lippert (1953) | Assistant Vice President, T. Rowe Price and T. Rowe Price Investment |

| Secretary, Institutional Income Funds | Services, Inc. |

| |

| Kevin P. Loome, CFA (1967) | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| Vice President, Institutional Income Funds | |

| |

| Paul M. Massaro, CFA (1975) | Vice President, T. Rowe Price; formerly student, The Wharton Business |

| Assistant Vice President, Institutional Income Funds | School, University of Pennsylvania (to 2003); Equity Research Employee, |

| | Banc of America Securities and J.P. Morgan Chase (to 2002) |

| |

| Michael J. McGonigle (1966) | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| Vice President, Institutional Income Funds | |

| |

| Brian A. Rubin, CPA (1974) | Assistant Vice President, T. Rowe Price |

| Assistant Vice President, Institutional Income Funds | |

| |

| Daniel O. Shackelford, CFA (1958) | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price |

| Vice President, Institutional Income Funds | Trust Company |

| |

| Walter P. Stuart III, CFA (1960) | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| Vice President, Institutional Income Funds | |

| |

| Thomas E. Tewksbury (1961) | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| Vice President, Institutional Income Funds | |

| |

| David A. Tiberii, CFA (1965) | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| Vice President, Institutional Income Funds | |

| |

| Mark J. Vaselkiv (1958) | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| Executive Vice President, Institutional Income Funds | |

| |

| Julie L. Waples (1970) | Vice President, T. Rowe Price |

| Vice President, Institutional Income Funds | |

| |

| Thea N. Williams (1961) | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| Vice President, Institutional Income Funds | |

| |

| Unless otherwise noted, officers have been employees of T. Rowe Price or T. Rowe Price International for at least five years. |

Item 2. Code of Ethics.The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors/Trustees has determined that Mr. Donald W. Dick Jr. qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Dick is considered independent for purposes of Item 3 of Form N-CSR.

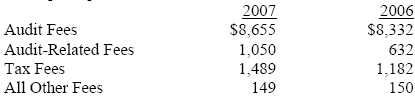

Item 4. Principal Accountant Fees and Services.

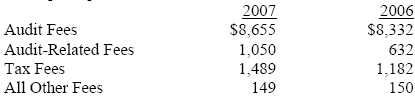

(a) – (d) Aggregate fees billed to the registrant for the last two fiscal years for professional services rendered by the registrant’s principal accountant were as follows:

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,201,000 and $883,000, respectively, and were less than the aggregate fees billed for those same periods by the registrant’s principal accountant for audit services rendered to the T. Rowe Price Funds.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Schedule of Investments.

Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is attached.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

| | |

SIGNATURES |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the |

| undersigned, thereunto duly authorized. |

| |

| T. Rowe Price Institutional Income Funds, Inc. |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | July 23, 2007 |

| |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, this report has been signed below by the following persons on behalf of |

| the registrant and in the capacities and on the dates indicated. |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | July 23, 2007 |

| |

| |

| |

| By | /s/ Joseph A. Carrier |

| | Joseph A. Carrier |

| | Principal Financial Officer |

| |

| Date | July 23, 2007 |