UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-21113 |

| Touchstone Institutional Funds Trust |

| (Exact name of registrant as specified in charter) |

303 Broadway, Suite 1100

| Cincinnati, Ohio 45202-4203 |

(Address of principal executive offices) (Zip code)

Jill T. McGruder

303 Broadway, Suite 1100

| Cincinnati, Ohio 45202-4203 |

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end: December 31

Date of reporting period: December 31, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

December 31, 2014

Annual Report

Touchstone Institutional Funds Trust

Touchstone Sands Capital Institutional Growth Fund

Table of Contents

| | Page | |

| Letter from the President | 3 | |

| Management's Discussion of Fund Performance (Unaudited) | 4 - 7 | |

| Tabular Presentation of Portfolio of Investments (Unaudited) | 8 | |

| Portfolio of Investments: | | |

| Touchstone Sands Capital Institutional Growth Fund | 9 | |

| Statement of Assets and Liabilities | 10 | |

| Statement of Operations | 11 | |

| Statements of Changes in Net Assets | 12 | |

| Financial Highlights | 13 | |

| Notes to Financial Statements | 14 - 20 | |

| Report of Independent Registered Public Accounting Firm | 21 | |

| Other Items (Unaudited) | 22 - 26 | |

| Management of the Trust (Unaudited) | 27 - 29 | |

| Privacy Protection Policy | 31 | |

This report identifies the Fund's investments on December 31, 2014. These holdings are subject to change. Not all investments in the Fund performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not occur.

Letter from the President

Dear Shareholder:

We are pleased to provide you with the Touchstone Institutional Funds Trust Annual Report. Inside you will find key financial information, as well as manager commentaries for the Fund, for the 12 months ended December 31, 2014.

After struggling through an unusually harsh winter, the U.S. economy generated strong growth during 2014. This economic growth and an improving labor market supported the U.S. Federal Reserve Board’s actions to discontinue its Quantitative Easing program. Globally, economic weakness and lower-than-expected inflation pushed central banks outside the U.S. to further loosen monetary policy in an effort to stimulate their economies. This divergence in economic growth, monetary policy and expected interest rate paths led to a significant appreciation of the dollar.

Equity markets posted solid gains in 2014. Looking across the market capitalization spectrum, smaller- and mid-capitalization company stocks experienced greater volatility and lower returns than their large capitalization counterparts. Outside the U.S., developed and emerging market equities suffered losses as a result of the strong appreciation in the U.S. dollar.

The bond market also performed well in 2014. As yields on intermediate and long-term U.S. Treasuries declined, investment grade corporate bonds benefited from the tailwind of falling interest rates. While high yield securities also generated positive returns, the gains were limited after a lengthy period of strong performance. Non-U.S. fixed income securities faced the same currency headwinds as non-U.S. equities and recorded moderate losses during the year.

After more than five years of robust performance from U.S. stocks and bonds, we continue to believe that diversification is essential to balancing risk and return. We recommend that you work with your financial professional to employ a sound asset allocation strategy to help keep your financial strategy on course. We also believe that it is important to maintain a long-term approach to gain the full potential benefits of investing.

Touchstone is committed to helping investors achieve their financial goals by providing access to a distinctive selection of institutional asset managers who are known and respected for proficiency in their specific areas of expertise.

We greatly appreciate your continued support. Thank you for including Touchstone as part of your investment plan.

Sincerely,

Jill T. McGruder

President

Touchstone Institutional Funds Trust

Management's Discussion of Fund Performance (Unaudited)

Touchstone Sands Capital Institutional Growth Fund

Sub-Advised by Sands Capital Management LLC

Investment Philosophy

The Touchstone Sands Capital Institutional Growth Fund primarily invests in common stocks of large capitalization U.S. companies that are believed by Sands Capital to have above-average potential for revenue or earnings growth. The Fund invests in 25 to 30 companies that are generally high-quality seasoned and growing businesses, spread across an array of attractive and growing industries. Sands Capital generally seeks stocks with sustainable above average earnings growth and capital appreciation potential. In addition, Sands Capital looks for companies that have a significant competitive advantage, a leadership position or proprietary niche, a clear mission in an understandable business, financial strength, and are valued rationally in relation to comparable companies, the market and the business prospects for that particular company.

Fund Performance

The Touchstone Sands Capital Institutional Growth Fund underperformed its benchmark, the Russell 1000® Growth Index, for the 12-month period ended December 31, 2014. The Fund’s total return was 8.39 percent, while the total return of the benchmark was 13.05 percent.

Market Environment

Strong market performance during 2014 led to increased equity valuations, particularly for hyper-growth companies in the Information Technology and Biotechnology sectors. While markets extended their gains into the beginning of 2014, enthusiasm for stocks with high growth, beta,1 and/or price-to-earnings multiples began to fade as concern over potentially stretched valuations weighed on investors’ minds. The technology and biotechnology businesses held in the Fund were not immune to the selloff and contributed to absolute and relative underperformance during the second quarter. Despite negative sentiment, our conviction in the long-term growth prospects of these businesses remained intact, and we added to several positions within these sectors during the selloff.

Elevated equity valuations, combined with investors’ appetite for dividend yield in the absence of interest rate growth, also contributed to strong performance among the stocks of less expensive, slower growing mega-cap companies within the Russell 1000® Growth Index such as Microsoft Corp., Union Pacific Corp. and Home Depot Inc. Although this flight to safety had a modest negative impact on the Fund’s relative performance during the year, it had little impact on our positive view of the companies held in the Fund. Indeed, most of the businesses owned in the Fund demonstrated strong business results throughout the year. Furthermore, as concentrated growth-oriented investors with high active share, we will not own the majority of the companies contained in the benchmark. We remain disciplined in owning the small number of high-quality businesses we believe have the best earnings growth potential over a longer-term time horizon.

Finally, the performance of the Fund’s Energy sector holdings weighed on performance during the latter half of the year as the market experienced a severe drop in oil prices, which led to a broad decline in Energy sector stocks. We view the recent underperformance as a reflection of the short-term cyclicality that is inherent to the global Energy sector and continue to believe that long-term growth opportunities exist within pockets of the industry. Our focus has been on finding businesses that possess durable competitive advantages such as innovative technologies, cost-saving processes or one-of-a-kind assets that can thrive throughout the commodity cycle.

Portfolio Review

On a relative basis, the top five contributors during the period were Regeneron Pharmaceuticals Inc. and Alexion Pharmaceuticals Inc. (both Health Care sector), and Baidu Inc., Visa Inc. and Facebook Inc. (all Information Technology sector). During 2014, Regeneron reported positive data for alirocumab, its in-development treatment

Management's Discussion of Fund Performance (Unaudited) (Continued)

for high cholesterol, and the FDA approved the company’s molecule Eylea for treatment of diabetic macular edema (DME). These are two significant events, as we view alirocumab and Eylea for DME as the company’s two most important growth drivers over the next five years. We estimate alirocumab could be a multi-billion dollar opportunity given the large size of its target market, and believe Eylea for DME could generate more than $1 billion in revenues. In addition, alirocumab will diversify Regeneron’s product portfolio from a one-product business to a multi-indication, multi-product company over the next several years.

The top five relative detractors from performance were Amazon.com Inc. and Las Vegas Sands Corp. (both Consumer Discretionary sector), Southwestern Energy Co. (Energy sector) and ARM Holdings PLC and Splunk Inc. (both Information Technology sector). Early in the year, Splunk’s revenue growth appeared to be decelerating, but we believe revenues are merely becoming more seasonal as the company increases its enterprise customer base. Splunk continues to attract new customers, expand its use cases across the enterprise and increase product penetration in existing markets, which should provide a substantial runway for sustainable growth.

In the past year, we initiated positions in five businesses: Adobe Systems Inc., Alibaba Group Holding Ltd. and LendingClub Corp. (all Information Technology sector), Twenty-First Century Fox Inc.(Consumer Discretionary sector) and Whole Foods Market Inc. (Consumer Staples sector). Over the same period, we eliminated four businesses: Amazon.com Inc., Intuitive Surgical Inc. (Health Care sector) and Starbucks Corp. and Ulta Salon, Cosmetics & Fragrances Inc. (both Consumer Discretionary sector).

LendingClub Corp. is the world’s largest online marketplace-lending platform with over $6 billion in cumulative loan originations since its founding in 2006. The company disintermediates traditional bank lending by facilitating loans directly to consumer and small-business borrowers from a variety of investor-lenders, ranging from individuals to institutions. Both borrowers and investors share in LendingClub’s value proposition, which includes lower costs, increased transparency and better interest rates. LendingClub is a leader and founding member of the nascent marketplace-lending industry, which we estimate is growing in excess of 100 percent per year. Approximately 70 percent of LendingClub’s cumulative loan originations have been used for U.S. prime credit card refinancing, which is roughly a $350 billion market. We believe LendingClub has the opportunity to expand into all areas of the approximately $12 trillion U.S. consumer finance market over time. Given LendingClub’s massive addressable market, asset-light structure and opportunities for margin expansion, we believe the company can achieve annual revenue growth of over 50 percent per year, and earnings growth of over 100 percent per year for the next five years.

Amazon.com is one of the world’s most dominant retailers. Since our initial investment at the end of 2007, clients have participated in the rapid growth of the e-commerce industry by owning the business, which reported strong growth driven by innovation and solid execution. Nevertheless, in the fourth quarter of 2014, we made the decision to sell Amazon because the company’s questionable capital allocation practices and lack of detailed financial disclosures have eroded our ability to build conviction in the growth drivers necessary to support a premium valuation. We believe Amazon’s financial and operating metric disclosures do not allow us adequate visibility into the health of the core business (i.e., e-commerce and Amazon Web Services), nor do they provide needed detail about their growing non-core investments. Without proper disclosure around management’s continued allocation of capital into what we view as less attractive non-core areas (e.g., Fire phone and expansion into China), we are unable to evaluate whether these investments are achieving appropriate returns for investors. Furthermore, we believe there is a high likelihood these investments will continue, perhaps at a greater magnitude, for well longer than we had originally expected. Continued large investments in low return segments would extend the company’s timeline for realizing increased free-cash-flow and margin expansion, which is a core component of our investment case. We are also concerned about the company’s increasing use of capital leases to fund its property and equipment purchases, as this further distorts measures used to analyze the business, most notably free-cash-flow. Although we have expressed our concerns to Amazon’s management team, we do not expect an increase in disclosures in the near term. We continue to believe Amazon’s core business has

Management's Discussion of Fund Performance (Unaudited) (Continued)

strong growth potential, however, given the company’s premium valuation, we do not believe this adequately compensates our clients for the associated risks. As a result, we sold Amazon from client accounts and invested the proceeds in businesses that we believe are stronger fits with our investment criteria. If non-core investments slow, valuation becomes less demanding or we begin to see improved transparency, we may revisit our investment case for the company.

Outlook

In order for a business to possess the above-average earnings growth potential we require, it is often a key innovator or vital facilitator within a platform economy that is benefitting from positive secular change. Secular trends are distinct from short-term economic factors as they tend to persist through market cycles and can provide powerful structural tailwinds that enhance the sustainability of a business’s growth for many years. Our long-term investment horizon allows us to capture the benefit of these trends and realize the ultimate earnings power of a company while weathering volatility over shorter periods.

We have identified several powerful secular tailwinds that are present within the Fund, including the following: e-commerce and electronic payments, mobile device functionality and services, biotech and specialty pharmaceuticals, healthcare information technology and unconventional oil and gas. Excluding the systematic risk that accompanies all public equity investing, negative investment outcomes generally arise from two areas–management’s failure to execute the business properly, or our failure to accurately weigh the downside risks. Apart from management execution, downside risks may come from over- or under-estimating key elements of our investment case such as the strength of competition, rate of adoption for a product or service or the amount of capital investment needed to maintain a company’s growth trajectory. We believe our best risk mitigation tool begins with our portfolio construction process and our strict adherence to our six investment criteria.

We use our criteria in our rigorous fundamental, bottom-up research process to form investment cases that account for a range of outcomes, both positive and negative. We look for businesses that (1) have visible and sustainable growth drivers, (2) are leaders within an attractive business space, (3) possess clear competitive advantages, (4) have strong management teams, (5) have robust financial strength, and (6) are reasonably priced. We continually reassess our investment case over time as we get new information and update our assumptions and expected return accordingly. In the event that a business meaningfully underperforms our expectations and we conclude it no longer meets one or more of our criteria, we exit the investment. We believe our criteria provide a common lens to analyze and compare businesses across sectors and geographies, as well as a consistent framework to define, debate and implement the ideas generated by our globally-integrated investment research team.

We believe we own companies that are positioned to deliver strong business results and earnings growth over our three- to five-year investment horizon. Our focus on the sustainability of a business’s future earnings growth typically steers us toward companies we believe are benefiting from secular trends that should provide powerful growth tailwinds throughout economic cycles. We have high conviction in the long-term growth estimates for our portfolio companies and believe they can deliver the growth necessary to support above average relative and absolute returns over the next several years. The Fund’s sector allocations are a residual of our bottom-up, fundamental approach. Our six investment criteria typically lead us to innovative businesses that are creating new or disrupting existing markets, and/or benefiting from powerful secular tailwinds. Our approach to investment research, portfolio construction and risk management results in a concentrated portfolio of companies across industries and businesses at different stages of their respective growth lifecycles. We expect to continue to have higher weights in key growth sectors, including Consumer, Life Sciences and Information Technology, and lower weights in highly-cyclical sectors such as Energy, Materials and Financials.

1Beta is a measure of the volatility of a portfolio relative to its benchmark.

Management's Discussion of Fund Performance (Unaudited) (Continued)

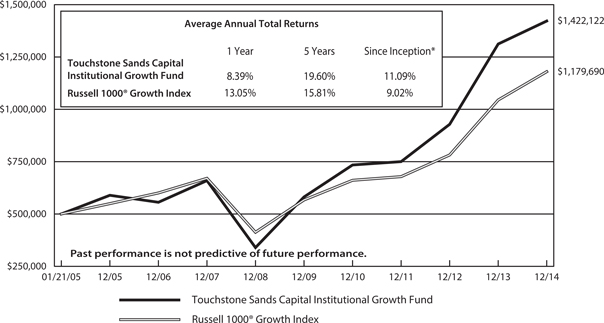

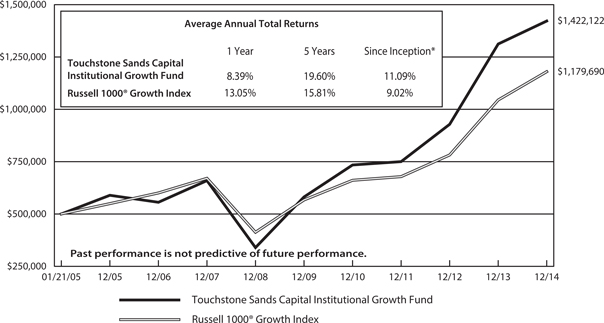

Comparison of the Change in Value of a $500,000 Investment in the

Touchstone Sands Capital Institutional Growth Fund and the Russell 1000® Growth Index

* The inception date of the Fund was January 21, 2005. The returns of the index listed above are based on the inception date of the Fund.

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

The Russell 1000® Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values.

Tabular Presentation of Portfolio of Investments (Unaudited)

December 31, 2014

The table below provides the Fund’s sector allocation. We hope it will be useful to shareholders as it summarizes key information about the Fund’s investments.

| Touchstone Sands Capital Institutional Growth Fund | |

| Sector Allocation* | (% of Net Assets) | |

| Information Technology | 43.5 | % |

| Health Care | 19.9 | |

| Consumer Discretionary | 16.9 | |

| Energy | 9.3 | |

| Materials | 3.6 | |

| Financials | 2.8 | |

| Consumer Staples | 2.5 | |

| Investment Funds | 4.8 | |

| Other Assets/Liabilities (Net) | (3.3 | ) |

| Total | 100.0 | % |

* Sector Classifications are based upon the Global Industry Classification Standard (GICS®).

Portfolio of Investments

Touchstone Sands Capital Institutional Growth Fund – December 31, 2014

| | | | | | Market | |

| | | Shares | | | Value | |

| | | | | | | |

| Common Stocks — 98.5% | | | | | | | | |

| | | | | | | | | |

| Information Technology — 43.5% | | | | | | | | |

| Adobe Systems, Inc.* | | | 1,145,000 | | | $ | 83,241,500 | |

| Alibaba Group Holding Ltd. ADR* | | | 1,628,000 | | | | 169,214,320 | |

| ARM Holdings PLC ADR | | | 2,404,000 | | | | 111,305,200 | |

| ASML Holding NV, (Netherlands) | | | 960,000 | | | | 103,516,800 | |

| Baidu, Inc. ADR* | | | 715,000 | | | | 162,998,550 | |

| Facebook, Inc. - Class A* | | | 1,930,000 | | | | 150,578,600 | |

| Google, Inc. - Class A* | | | 188,000 | | | | 99,764,080 | |

| Google, Inc. - Class C* | | | 131,000 | | | | 68,958,400 | |

| LendingClub Corp.*† | | | 1,075,000 | | | | 27,197,500 | |

| LinkedIn Corp. - Class A* | | | 664,000 | | | | 152,527,440 | |

| Salesforce.com, Inc.* | | | 2,460,626 | | | | 145,939,728 | |

| Splunk, Inc.* | | | 1,492,000 | | | | 87,953,400 | |

| Visa, Inc. - Class A | | | 1,288,000 | | | | 337,713,600 | |

| | | | | | | | 1,700,909,118 | |

| | | | | | | | | |

| Health Care — 19.9% | | | | | | | | |

| Alexion Pharmaceuticals, Inc.* | | | 659,000 | | | | 121,934,770 | |

| athenahealth, Inc.*† | | | 588,000 | | | | 85,671,600 | |

| Biogen Idec, Inc.* | | | 465,000 | | | | 157,844,250 | |

| BioMarin Pharmaceutical, Inc.* | | | 1,085,000 | | | | 98,084,000 | |

| Cerner Corp.* | | | 1,748,000 | | | | 113,025,680 | |

| Regeneron Pharmaceuticals, Inc.* | | | 493,000 | | | | 202,253,250 | |

| | | | | | | | 778,813,550 | |

| | | | | | | | | |

| Consumer Discretionary — 16.9% | | | | | | | | |

| Chipotle Mexican Grill, Inc.* | | | 248,000 | | | | 169,758,480 | |

| Las Vegas Sands Corp. | | | 1,818,000 | | | | 105,734,880 | |

| NIKE, Inc. - Class B | | | 1,329,000 | | | | 127,783,350 | |

| Priceline Group, Inc. (The)* | | | 136,000 | | | | 155,068,560 | |

| Twenty-First Century Fox, Inc.- Class A | | | 2,724,000 | | | | 104,615,220 | |

| | | | | | | | 662,960,490 | |

| | | | | | | | | |

| Energy — 9.3% | | | | | | | | |

| FMC Technologies, Inc.* | | | 1,706,000 | | | | 79,909,040 | |

| National Oilwell Varco, Inc. | | | 1,329,000 | | | | 87,089,370 | |

| Schlumberger Ltd. (Cook Islands) | | | 1,458,000 | | | | 124,527,780 | |

| Southwestern Energy Co.* | | | 2,704,000 | | | | 73,792,160 | |

| | | | | | | | 365,318,350 | |

| | | | | | | | | |

| Materials — 3.6% | | | | | | | | |

| Monsanto Co. | | | 1,169,000 | | | | 139,660,430 | |

| | | | | | | | | |

| Financials — 2.8% | | | | | | | | |

| Charles Schwab Corp. (The) | | | 3,618,000 | | | | 109,227,420 | |

| | | | | | | | | |

| Consumer Staples — 2.5% | | | | | | | | |

| Whole Foods Market, Inc. | | | 1,961,000 | | | | 98,873,620 | |

| Total Common Stocks | | | | | | $ | 3,855,762,978 | |

| | | | | | | | | |

| Investment Funds — 4.8% | | | | | | | | |

| Invesco Government & Agency | | | | | | | | |

| Portfolio, Institutional Class, 0.01%**∞Ω | | | 96,022,366 | | | $ | 96,022,366 | |

| Touchstone Institutional Money Market Fund, 0.01%^∞Ω | | | 90,273,689 | | | | 90,273,689 | |

| Total Investment Funds | | | | | | $ | 186,296,055 | |

| | | | | | | | | |

| Total Investment Securities —103.3% | | | | | | | | |

| (Cost $2,765,653,622) | | | | | | $ | 4,042,059,033 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (3.3%) | | | | | | | (127,260,144 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 3,914,798,889 | |

| * | Non-income producing security. |

| ** | Represents collateral for securities loaned. |

| ^ | Affiliated Fund. See Note 4 in Notes to Financial Statements. |

| † | All or a portion of the security is on loan. The total market value of the securities on loan as of December 31, 2014 was $92,443,177. |

| Ω | Represents the 7-day SEC yield as of December 31, 2014. |

Portfolio Abbreviations:

ADR - American Depositary Receipt

PLC - Public Limited Company

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the security valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 3,855,762,978 | | | $ | — | | | $ | — | | | $ | 3,855,762,978 | |

| Investment Funds | | | 186,296,055 | | | | — | | | | — | | | | 186,296,055 | |

| | | | | | | | | | | | | | | $ | 4,042,059,033 | |

See accompanying Notes to Financial Statements.

Statement of Assets and Liabilities

December 31, 2014

| | | Touchstone | |

| | | Sands Capital | |

| | | Institutional | |

| | | Growth | |

| | | Fund | |

| Assets | | | | |

| Investments, at cost | | $ | 2,765,653,622 | |

| Affiliated securities, at market value | | $ | 90,273,689 | |

| Non-affiliated securities, at market value | | | 3,951,785,344 | |

| Investments, at market value (A) | | $ | 4,042,059,033 | |

| Dividends and interest receivable | | | 956,880 | |

| Receivable for capital shares sold | | | 7,374,222 | |

| Receivable for investments sold | | | 6,438,764 | |

| Receivable for securities lending income | | | 12,773 | |

| Other assets | | | 34,409 | |

| Total Assets | | | 4,056,876,081 | |

| | | | | |

| Liabilities | | | | |

| Payable for return of collateral for securities on loan | | | 96,022,366 | |

| Payable for capital shares redeemed | | | 3,792,400 | |

| Payable for investments purchased | | | 39,641,526 | |

| Payable to Advisor | | | 2,557,077 | |

| Other accrued expenses and liabilities | | | 63,823 | |

| Total Liabilities | | | 142,077,192 | |

| | | | | |

| Net Assets | | $ | 3,914,798,889 | |

| | | | | |

| Net assets consist of: | | | | |

| Paid-in capital | | $ | 2,577,774,680 | |

| Accumulated net realized gains on investments | | | 60,618,798 | |

| Net unrealized appreciation on investments | | | 1,276,405,411 | |

| Net assets applicable to shares outstanding | | $ | 3,914,798,889 | |

| | | | | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 175,932,542 | |

| Net asset value, offering price and redemption price per share | | $ | 22.25 | |

| | | | | |

| (A) Includes market value of securities on loan of: | | $ | 92,443,177 | |

See accompanying Notes to Financial Statements.

Statement of Operations

For the Year Ended December 31, 2014

| | | Touchstone | |

| | | Sands Capital | |

| | | Institutional | |

| | | Growth | |

| | | Fund | |

| Investment Income | | | | |

| Dividends from affiliated securities | | $ | 7,697 | |

| Dividends from non-affiliated securities(A) | | | 17,121,692 | |

| Income from securities loaned | | | 39,826 | |

| Total Investment Income | | | 17,169,215 | |

| | | | | |

| Expenses | | | | |

| Unified management fee | | | 30,345,409 | |

| Registration fees | | | 99,213 | |

| Other expenses | | | 210,184 | |

| Net Expenses | | | 30,654,806 | |

| | | | | |

| Net Investment Loss | | | (13,485,591 | ) |

| | | | | |

| Realized and Unrealized Gains (Losses) on Investments | | | | |

| Net realized gains on investments | | | 328,303,048 | |

| Net change in unrealized appreciation (depreciation) on investments | | | (2,731,557 | ) |

| | | | | |

| Net Realized and Unrealized Gains on Investments | | | 325,571,491 | |

| | | | | |

| Change in Net Assets Resulting from Operations | | $ | 312,085,900 | |

| | | | | |

| (A) Net of foreign tax withholding of: | | $ | 224,124 | |

See accompanying Notes to Financial Statements.

Statements of Changes in Net Assets

| | | Touchstone | |

| | | Sands Capital | |

| | | Institutional | |

| | | Growth | |

| | | Fund | |

| | | For the | | | For the | |

| | | Year | | | Year | |

| | | Ended | | | Ended | |

| | | December 31, | | | December 31, | |

| | | 2014 | | | 2013 | |

| From Operations | | | | | | | | |

| Net investment loss | | $ | (13,485,591 | ) | | $ | (11,935,020 | ) |

| Net realized gains on investments | | | 328,303,048 | | | | 342,867,681 | |

| Net change in unrealized appreciation (depreciation) on investments | | | (2,731,557 | ) | | | 740,599,396 | |

| Change in Net Assets from Operations | | | 312,085,900 | | | | 1,071,532,057 | |

| | | | | | | | | |

| Distributions to Shareholders from: | | | | | | | | |

| Net investment income | | | — | | | | (167,175 | ) |

| Net realized gains | | | (321,779,018 | ) | | | (282,972,885 | ) |

| Total Distributions | | | (321,779,018 | ) | | | (283,140,060 | ) |

| | | | | | | | | |

| Share Transactions | | | | | | | | |

| Proceeds from shares sold | | | 758,742,172 | | | | 1,321,235,369 | |

| Reinvestment of distributions | | | 308,452,514 | | | | 273,516,849 | |

| Cost of shares redeemed | | | (943,347,275 | ) | | | (832,572,615 | ) |

| Change in Net Assets from Share Transactions | | | 123,847,411 | | | | 762,179,603 | |

| | | | | | | | | |

| Total Increase in Net Assets | | | 114,154,293 | | | | 1,550,571,600 | |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of period | | | 3,800,644,596 | | | | 2,250,072,996 | |

| End of period | | $ | 3,914,798,889 | | | $ | 3,800,644,596 | |

| | | | | | | | | |

| Accumulated Net Investment Income (Loss) | | $ | — | | | $ | — | |

| | | | | | | | | |

| Share Transactions | | | | | | | | |

| Shares issued | | | 33,520,873 | | | | 67,787,108 | |

| Shares reinvested | | | 14,007,834 | | | | 12,751,107 | |

| Shares redeemed | | | (41,723,970 | ) | | | (41,860,871 | ) |

| Change in Shares Outstanding | | | 5,804,737 | | | | 38,677,344 | |

See accompanying Notes to Financial Statements.

Financial Highlights

Touchstone Sands Capital Institutional Growth Fund

Selected Data for a Share Outstanding Throughout Each Period

| | | Year Ended December 31, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Net asset value at beginning of period | | $ | 22.34 | | | $ | 17.12 | | | $ | 14.36 | | | $ | 14.04 | | | $ | 11.12 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.08 | ) | | | (0.07 | ) | | | 0.01 | | | | (0.04 | ) | | | (0.03 | ) |

| Net realized and unrealized gains on investments | | | 1.93 | | | | 7.06 | | | | 3.40 | | | | 0.36 | | | | 2.95 | |

| Total from investment operations | | | 1.85 | | | | 6.99 | | | | 3.41 | | | | 0.32 | | | | 2.92 | |

| Distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | — | (A) | | | (0.01 | ) | | | — | | | | — | |

| Realized capital gains | | | (1.94 | ) | | | (1.77 | ) | | | (0.64 | ) | | | — | | | | — | |

| Total distributions | | | (1.94 | ) | | | (1.77 | ) | | | (0.65 | ) | | | — | | | | — | |

| Net asset value at end of period | | $ | 22.25 | | | $ | 22.34 | | | $ | 17.12 | | | $ | 14.36 | | | $ | 14.04 | |

| Total return | | | 8.39 | % | | | 41.28 | % | | | 23.75 | % | | | 2.28 | % | | | 26.26 | % |

| Net assets at end of period (000's) | | $ | 3,914,799 | | | $ | 3,800,645 | | | $ | 2,250,073 | | | $ | 1,490,474 | | | $ | 1,230,960 | |

| Ratio to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Net expenses | | | 0.79 | % | | | 0.80 | % | | | 0.79 | % | | | 0.80 | % | | | 0.80 | % |

| Gross expenses | | | 0.79 | % | | | 0.80 | % | | | 0.79 | % | | | 0.80 | % | | | 0.80 | % |

| Net investment income (loss) | | | (0.35 | %) | | | (0.40 | %) | | | 0.06 | % | | | (0.28 | %) | | | (0.26 | %) |

| Portfolio turnover rate | | | 27 | % | | | 37 | % | | | 31 | % | | | 18 | % | | | 41 | % |

(A) Less than $0.005 per share.

See accompanying Notes to Financial Statements.

Notes to Financial Statements

December 31, 2014

1. Organization

The Touchstone Institutional Funds Trust (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Trust was established as a Delaware statutory trust pursuant to a Declaration of Trust dated May 29, 2002. The Trust consists of one fund, the Touchstone Sands Capital Institutional Growth Fund (“Sands Capital Institutional Growth Fund” or the “Fund”), which is an open-end, non-diversified management investment company.

The Declaration of Trust permits the Trust to issue an unlimited number of shares of beneficial interest of the Fund. The Fund offers a single class of shares. The Fund’s prospectus provides a description of the Fund’s investment goals, policies, and strategies along with information on the class of shares currently being offered.

2. Significant Accounting Policies

The following is a summary of the Fund’s significant accounting policies:

Security valuation and fair value measurements— Generally accepted accounting principles in the United States (“U.S. GAAP”) defines fair value as the price the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. All investments in securities are recorded at their estimated fair value. The Fund defines the term ���market value”, as used throughout this report, as the estimated fair value. The Fund uses various methods to measure fair value of its portfolio securities on a recurring basis. U.S. GAAP fair value measurement standards require disclosure of a hierarchy that prioritizes inputs to valuation methods. These inputs are summarized in the three broad levels listed below:

| · | Level 1 – | quoted prices in active markets for identical securities |

| · | Level 2 – | other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| · | Level 3 – | significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, money market instruments are valued using amortized cost, in accordance with rules under the 1940 Act. Generally, amortized cost approximates the current fair value of a security, but since the value is not obtained from a quoted price in an active market, such securities are reflected as Level 2.

The aggregate value by input level, as of December 31, 2014, for the Fund’s investments, as well as a reconciliation of assets for which significant unobservable inputs (Level 3) were used in determining value, if applicable, is included in the Fund’s Portfolio of Investments, which also includes a breakdown of the Fund’s investments by sector allocation. The Fund did not hold any Level 3 categorized securities during the year ended December 31, 2014.

Changes in valuation techniques may result in transfers into or out of an investment’s assigned level within the hierarchy. All transfers in and out of the levels are recognized at the value at the end of the period. During the year ended December 31, 2014, there were no transfers between Levels 1, 2 and 3 for the Fund.

The Fund’s portfolio securities are valued as of the close of the regular session of trading on the New York Stock Exchange (“NYSE”) (currently 4:00 p.m., Eastern time). Portfolio securities traded on stock exchanges are valued at the last reported sale price, official close price, or last bid price if no sales are reported. Portfolio securities quoted by NASDAQ are valued at the NASDAQ Official Closing Price (“NOCP”) or from the primary exchange on which the security trades. To the extent these securities are actively traded, they are categorized

Notes to Financial Statements (Continued)

in Level 1 of the fair value hierarchy. Shares of open-end mutual funds in which the Fund invests are valued at their respective net asset values (“NAV”) as reported by the underlying funds (the “Underlying Funds”) and are categorized in Level 1. Money market instruments and other debt securities with a remaining maturity of less than 60 days are valued at amortized cost, which approximates market value and are categorized in Level 2. While this method provides consistency in valuation (and may only be used if it approximates market value), it may result in periods during which value, as determined by amortized cost, is higher or lower than the price that would be received if the Fund sold the investment.

Securities mainly traded on a non-U.S. exchange or denominated in foreign currency are generally valued according to the preceding closing values on that exchange, translated to U.S. dollars using currency exchange rates as of the close of regular trading on the NYSE, and generally categorized in Level 1. However, if an event that may change the value of a security occurs after the time that the closing value on the non-U.S. exchange was determined, but before the close of regular trading on the NYSE, the security may be priced based on fair value and generally categorized in Level 2. This may cause the value of the security, if held on the books of the Fund to be different from the closing value on the non-U.S. exchange and may affect the calculation of that Fund’s NAV. The Fund may use fair value pricing under the following circumstances, among others:

| · | If the value of a security has been materially affected by events occurring before the Fund’s pricing time but after the close of the primary markets on which the security is traded. |

| · | If the exchange on which a portfolio security is principally traded closes early or if trading in a particular portfolio security was halted during the day and did not resume prior to the Fund’s NAV calculation. |

| · | If a security is so thinly traded that reliable market quotations are unavailable due to infrequent trading. |

| · | If the validity of market quotations is not reliable. |

Securities held by the Fund that do not have readily available market quotations, significant observable inputs, or securities for which the available market quotations are not reliable, are priced at their estimated fair value using procedures approved by the Fund’s Board of Trustees and are generally categorized in Level 3.

Investment companies— The Fund may invest in securities of other investment companies, including exchange-traded funds (“ETFs”), open-end funds and closed-end funds. Open-end funds are investment companies that issue new shares continuously and redeem shares daily. Closed-end funds are investment companies that typically issue a fixed number of shares that trade on a securities exchange or over-the-counter. An ETF is an investment company that typically seeks to track the performance of an index by holding in its portfolio shares of all the companies, or a representative sample of the companies, that are components of a particular index. ETFs are traded on a securities exchange based on their market value. The risks of investment in other investment companies typically reflect the risks of the types of securities in which investment companies invest. Investments in ETFs and closed-end funds are subject to the additional risk that their shares may trade at a premium or discount to their NAV. When the Fund invests in another investment company, shareholders of the Fund indirectly bear their proportionate share of the other investment company’s fees and expenses, including operating, registration, trustee, licensing and marketing, as well as their share of the Fund’s fees and expenses.

Portfolio securities loaned— The Fund may lend its portfolio securities. Lending portfolio securities exposes the Fund to the risk that the borrower may fail to return the loaned securities or may not be able to provide additional collateral or that the Fund may experience delays in recovery of the loaned securities or loss of rights in the collateral if the borrower fails financially. To minimize these risks, the borrower must agree to maintain cash collateral with the Fund’s custodian. The loaned securities are secured by collateral valued at least equal, at all times, to the market value of the loaned securities plus accrued interest, if any. When the collateral falls below specified amounts, the lending agent will use its best effort to obtain additional collateral on the next business

Notes to Financial Statements (Continued)

day to meet required amounts under the security lending agreement. The cash collateral is reinvested by the Fund’s custodian into an approved investment vehicle. The approved investment vehicle is subject to market risk.

As of December 31, 2014, the Fund loaned securities and received collateral as follows:

| | | Market Value of | | | Market Value of | |

| | | Securities | | | Collateral | |

| Fund | | Loaned | | | Received | |

| Sands Capital Institutional Growth Fund | | $ | 92,443,177 | | | $ | 96,022,366 | |

All cash collateral is received, held, and administered by the Fund’s custodian for the benefit of the lending Fund in its custody account or other account established for the purpose of holding collateral.

By participating in securities lending, the Fund receives compensation in the form of fees. Securities lending income is derived from lending long securities from the Fund to creditworthy approved borrowers at rates that are determined based on daily trading volumes, float, short-term interest rates and market liquidity. A lending Fund retains the interest or dividends on the investment of any cash received as collateral. The lending Fund continues to receive interest or dividends on the loaned securities.

Unrealized gain or loss on the market value of the loaned securities that may occur during the term of the loan is recognized by the lending Fund. The lending Fund has the right under the lending agreement to recover the securities from the borrower on demand.

Share valuation—The NAV per share of the Fund is calculated daily by dividing the total value of the Fund’s assets, less liabilities, by its number of outstanding shares.

Investment income— Dividend income from securities is recognized on the ex-dividend date, net of foreign withholding taxes, if any, which are reduced by any amounts reclaimable by the Fund, where applicable. Interest income from securities is recorded on the basis of interest accrued, premium amortized and discount accreted.

Distributions to shareholders— The Fund intends to distribute to its shareholders substantially all of its income and capital gains. The Fund declares and distributes net investment income, if any, quarterly as a dividend to shareholders. The Fund makes distributions of capital gains, if any, at least annually, net of applicable capital loss carryforwards. Income distributions and capital gain distributions are determined in accordance with income tax regulations. Recognition of the Fund’s net investment income that invests in Underlying Funds is affected by the timing of dividend declaration by Underlying Funds.

Allocations — Expenses not directly billed to the Fund are allocated proportionally among all the Funds in the Trust, and, if applicable,Touchstone Investment Trust, Touchstone Funds Group Trust, Touchstone Tax-Free Trust, Touchstone Variable Series Trust, and Touchstone Strategic Trust, daily in relation to net assets of each Fund or another reasonable measure.

Security transactions— Security transactions are reflected for financial reporting purposes as of the trade date. Realized gains and losses on sales of portfolio securities are calculated using the identified cost basis.

Estimates— The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Expenses— The Fund pays a unified management fee to Touchstone Advisors, Inc. (“Advisor” or “Administrator”) for providing or procuring advisory, administration and other services. The Advisor is responsible for compensating any third party engaged to provide services under its supervision and is also responsible for payment of the fees of the independent Trustees, custodian, independent auditor, legal counsel (excluding costs in connection

Notes to Financial Statements (Continued)

with certain litigation or administrative actions), and the transfer and dividend disbursing agent. The Fund will pay all state registration fees, interest, taxes, dues, fees, or similar costs, brokerage or other transaction costs, and certain extraordinary expenses.

3. Investment Transactions

Investment transactions (excluding short-term investments and U.S. Government securities) were as follows for the year ended December 31, 2014:

| | | Sands Capital | |

| | | Institutional | |

| | | Growth Fund | |

| Purchases of investment securities | | $ | 1,017,182,755 | |

| Proceeds from sales and maturities | | | 1,230,290,321 | |

There were no purchases or proceeds from sales and maturities of U.S. Government securities by the Fund for the year ended December 31, 2014.

4. Transactions with Affiliates and Other Related Parties

Certain officers of the Trust are also officers of the Advisor, Touchstone Securities, Inc. (the “Underwriter”) or BNY Mellon Investment Servicing (U.S.) Inc. (“BNY Mellon”), the Sub-Administrator and Transfer Agent to the Fund. Such officers receive no compensation from the Trust. The Advisor and the Underwriter are each wholly-owned, indirect subsidiaries of Western & Southern Financial Group, Inc.

On behalf of the Fund, the Advisor pays each Independent Trustee a quarterly retainer plus additional retainers to the Lead Independent Trustee and the chairs of each standing committee. Interested Trustees do not receive compensation from the Fund. Each Independent Trustee will also receive compensation for each board meeting and committee meeting attended. Each standing committee chair will receive additional compensation for each committee meeting that he or she oversees.

MANAGEMENT & EXPENSE LIMITATION AGREEMENTS

The Advisor provides general investment supervisory services for the Fund, under terms of an advisory agreement (the “Advisory Agreement”). Under the Advisory Agreement, the Fund pays the Advisor a fee, which is computed and accrued daily and paid monthly, at an annual rate of 0.78% of the average daily net assets of the Fund. Under the Advisory Agreement, the Advisor also provides administrative services to the Trust and pays all operating expenses on the Trust’s behalf, excluding state registration fees, interest, taxes, dues, fees, or similar costs, brokerage commissions; other expenditures which are capitalized in accordance with U.S. GAAP; the cost of “Acquired Fund Fees and Expenses”, if any; and other extraordinary expenses not incurred in the ordinary course of business.

The Advisor has entered into an investment sub-advisory agreement with Sands Capital Management, LLC (the “Sub-Advisor”), a Securities and Exchange Commission (“SEC”) registered investment advisor. The Advisor, not the Fund, pays sub-advisory fees to the Sub-Advisor.

The Advisor entered into an expense limitation agreement (the “Expense Limitation Agreement”) to contractually limit operating expenses of the Fund, excluding: dividend and interest expenses on short sales; interest; taxes; brokerage commissions; other expenditures which are capitalized in accordance with U.S. GAAP; the cost of “Acquired Fund Fees and Expenses”, if any; and other extraordinary expenses not incurred in the ordinary course of business. The maximum operating expense limit in any year with respect to the Fund, as a percentage of the average daily net assets of the Fund, is 0.80%. The Advisor has agreed to waive advisory fees and reimburse

Notes to Financial Statements (Continued)

expenses in order to maintain the expense limitation for the Fund through at least April 29, 2015. During the year ended December 31, 2014, the Advisor did not waive advisory fees or reimburse any operating expenses.

Under the terms of the Expense Limitation Agreement, the Advisor is entitled to recover, subject to approval by the Fund’s Board, such amounts waived or reimbursed for a period of up to three years from the year in which the Advisor reduced its compensation or assumed expenses for the Fund. No recoupment will occur unless the Fund’s operating expenses are below the expense limitation amount in effect at the time of the waiver or reimbursement. Since the effective date, the Advisor has not waived or reimbursed any expenses, therefore there are no amounts currently eligible for recoupment.

AFFILIATED INVESTMENTS

The Fund may invest in the Touchstone Institutional Money Market Fund, subject to compliance with several conditions set forth in an exemptive order received by the Trust from the SEC. To the extent that the Fund is invested in the Touchstone Institutional Money Market Fund, the Advisor and Administrator will be paid additional fees from the Touchstone Institutional Money Market Fund that will not be waived or reimbursed.

A summary of the Fund’s investment, as applicable, in the Touchstone Institutional Money Market Fund for the year ended December 31, 2014, is as follows:

| | | Share Activity | | | | | | | |

| | | Balance | | | | | | | | | Balance | | | | | | Value | |

| | | 12/31/13 | | | Purchases | | | Sales | | | 12/31/14 | | | Dividends | | | 12/31/14 | |

| Sands Capital Institutional Growth Fund | | | 52,442,333 | | | | 974,679,531 | | | | (936,848,175 | ) | | | 90,273,689 | | | $ | 7,697 | | | $ | 90,273,689 | |

5. Federal Tax Information

Federal income tax— It is the Fund’s policy to continue to comply with the special provisions of the Internal Revenue Code applicable to regulated investment companies. As provided therein, in any fiscal year in which the Fund so qualifies and distributes at least 90% of its investment company taxable income, the Fund (but not the shareholders) will be relieved of federal income tax on the income distributed. It is the Fund’s policy to distribute all of its taxable income and accordingly, no provision for income taxes has been made.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also the Fund’s intention to declare and pay as dividends in each calendar year at least 98% of its investment company taxable income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ending October 31) plus undistributed amounts from prior years.

The tax character of distributions paid for the years ended December 31, 2014 and December 31, 2013 are as follows:

| | | Sands Capital | |

| | | Institutional | |

| | | Growth Fund | |

| | | 2014 | | | 2013 | |

| From ordinary income | | $ | — | | | $ | 165,541 | |

| From long-term capital gains | | | 321,779,018 | | | | 282,974,519 | |

| Total distributions | | $ | 321,779,018 | | | $ | 283,140,060 | |

Notes to Financial Statements (Continued)

The following information is computed on a tax basis for each item as of December 31, 2014:

| | | Sands Capital | |

| | | Institutional | |

| | | Growth Fund | |

| Tax cost of portfolio investments | | $ | 2,790,241,692 | |

| Gross unrealized appreciation | | | 1,299,665,999 | |

| Gross unrealized depreciation | | | (47,848,658 | ) |

| Net unrealized appreciation | | | 1,251,817,341 | |

| Undistributed ordinary income | | | 5,650,305 | |

| Undistributed long-term capital gains | | | 79,556,563 | |

| Accumulated earnings | | $ | 1,337,024,209 | |

The difference between the tax cost of portfolio investments and the financial statement cost is primarily due to wash sale loss deferrals.

As of December 31, 2014, the Fund did not have any capital loss carryforwards for federal income tax purposes.

Under current laws, certain capital losses realized after October 31 and ordinary losses realized after December 31 may be deferred (and certain ordinary losses after October and/or December 31 may be deferred) and treated as occurring on the first day of the following fiscal year. For the year ended December 31, 2014, the Fund did not elect to defer any losses.

The Fund has analyzed its tax positions taken on federal income tax returns for all open tax years (tax years ended December 31, 2011 through 2014) and has concluded that no provision for income tax is required in its financial statements.

Certain reclassifications, the result of permanent differences between financial statement and income tax reporting requirements, have been made to the components of capital. These reclassifications have no impact on the net assets or NAV per share of the Fund. The following reclassifications, which are primarily attributed to the tax treatment of net investment losses, have been made to the Fund for the year ended December 31, 2014.

| | | | | | Accumulated | | | Accumulated | |

| | | Paid-In | | | Net Investment | | | Net Realized | |

| Fund | | Capital | | | Income(Loss) | | | Gains(Losses) | |

| Sands Capital Institutional Growth Fund | | $ | — | | | $ | 13,485,591 | | | $ | (13,485,591 | ) |

6. Commitments and Contingencies

The Fund indemnifies the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund.

7. Risk Associated with Concentration

The Fund invests a high percentage of its assets in specific sectors of the market in order to achieve a potentially greater investment return. As a result, the Fund may be more susceptible to economic, political, and regulatory developments in a particular sector of the market, positive or negative, and may experience increased volatility on the Fund’s NAV and magnified effect on the total return.

Notes to Financial Statements (Continued)

8. Subsequent Events

Subsequent events occurring after the date of this report have been evaluated for potential impact to this report through the date the financial statements were issued. There were no subsequent events that necessitated recognition or disclosure in the Fund’s financial statements.

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders of Touchstone Institutional Funds Trust

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of Touchstone Institutional Funds Trust (comprising, Touchstone Sands Capital Institutional Growth Fund) (the “Fund”) as of December 31, 2014, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2014, by correspondence with the custodian, transfer agent, and brokers or by other appropriate auditing procedures where replies from brokers were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Touchstone Sands Capital Institutional Growth Fund at December 31, 2014, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Cincinnati, Ohio

February 20, 2015

Other Items (Unaudited)

Supplemental Tax Information

For the fiscal year ended December 31, 2014, the Fund designated $321,779,018 as long-term capital gains.

Proxy Voting Guidelines and Proxy Voting Records

The Sub-Advisor is responsible for exercising the voting rights associated with the securities purchased and held by the Fund. A description of the policies and procedures that the Sub-Advisor uses in fulfilling this responsibility is available as an appendix to the most recent Statement of Additional Information, which can be obtained without charge by calling toll free 1.800.543.0407 or by visiting the Touchstone website at www.touchstoneinvestments.com or on the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov. Information regarding how those proxies were voted during the most recent twelve-month period ended June 30 is also available without charge by calling toll free 1.800.543.0407 or on the Commission’s website at www.sec.gov.

Quarterly Portfolio Disclosure

The Trust files a complete listing of portfolio holdings for the Fund as of the end of the first and third quarters of each fiscal year on Form N-Q. The complete listing (i) is available on the Commission’s website; (ii) may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; (iii) will be made available to shareholders upon request by calling 1.800.543.0407; or (iv) can be obtained on the Touchstone website at www.touchstoneinvestments.com. Information on the operation of the Public Reference Room may be obtained by calling 1.800.SEC.0330.

Schedule of Shareholder Expenses

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including reinvested dividends or other distributions; and (2) ongoing costs, including investment advisory fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2014 through December 31, 2014).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Six Months Ended December 31, 2014” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Other Items (Unaudited) (Continued)

Schedule of Shareholder Expenses (Continued)

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table below is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | Expenses | |

| | | Net Expense | | | Beginning | | | Ending | | | Paid During | |

| | | Ratio | | | Account | | | Account | | | the Six Months | |

| | | Annualized | | | Value | | | Value | | | Ended | |

| | | December 31, | | | July 1, | | | December 31, | | | December 31, | |

| | | 2014 | | | 2014 | | | 2014 | | | 2014* | |

| Touchstone Sands Capital Institutional Growth Fund | | | | | | | | | | | | | | | | |

| Actual | | | 0.79 | % | | $ | 1,000.00 | | | $ | 1,069.10 | | | $ | 4.12 | |

| Hypothetical | | | 0.79 | % | | $ | 1,000.00 | | | $ | 1,021.22 | | | $ | 4.02 | |

| * | Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

Management and Sub-Advisory Agreement Approval Disclosure

At a meeting held on November 20, 2014, the Board of Trustees (the “Board” or “Trustees”) of the Touchstone Institutional Funds Trust (the “Trust”), and by a separate vote, the Independent Trustees of the Trust, approved the continuance of the Management Agreement between the Trust and the Advisor with respect to the Fund, and the continuance of the Sub-Advisory Agreement between the Advisor and the Sub-Advisor.

In determining whether to approve the continuation of the Management Agreement and the Sub-Advisory Agreement, the Advisor furnished information necessary for a majority of the Independent Trustees to make the determination that the continuance of the Management Agreement and the Sub-Advisory Agreement was in the best interests of the Fund and its shareholders. The information provided to the Board included: (1) industry data comparing advisory fees and expense ratios of comparable investment companies; (2) comparative performance information; (3) the Advisor’s and its affiliates’ revenues and costs of providing services to the Fund; and (4) information about the Advisor’s and Sub-Advisor’s personnel. Prior to voting, the Independent Trustees reviewed the proposed continuance of the Management Agreement and the Sub-Advisory Agreement with management and experienced independent legal counsel and received materials from such counsel discussing the legal standards for their consideration of the proposed continuation of the Management Agreement and the Sub-Advisory Agreement with respect to the Fund. The Independent Trustees also reviewed the proposed continuation of the Management Agreement and the Sub-Advisory Agreement with respect to the Fund with independent legal counsel in private sessions at which no representatives of management were present.

In approving the Fund’s Management Agreement, the Board considered various factors, among them: (1) the nature, extent and quality of services provided to the Fund, including the personnel providing such services; (2) the Advisor’s compensation and profitability; (3) a comparison of fees and performance with other advisers; (4) economies of scale; and (5) the terms of the Management Agreement. The Board’s analysis of these factors is set forth below. The Independent Trustees were advised by independent legal counsel throughout the process.

Nature, Extent and Quality of Advisor Services. The Board considered the level and depth of knowledge of the Advisor, including the professional experience and qualifications of senior personnel. In evaluating the quality of services provided by the Advisor, the Board took into account its familiarity with the Advisor’s senior management through Board meetings, discussions and reports during the preceding year. The Board also took into account the Advisor’s compliance policies and procedures. The quality of administrative and other services, including the Advisor’s role in coordinating the activities of the Fund’s other service providers, was also considered. The

Other Items (Unaudited) (Continued)

Board also considered the Advisor’s relationship with its affiliates and the resources available to them, as well as any potential conflicts of interest.

The Board discussed the Advisor’s effectiveness in monitoring the performance of the Sub-Advisor and the Advisor’s timeliness in responding to performance issues. The Board considered the Advisor’s process for monitoring the Sub-Advisor, which includes an examination of both qualitative and quantitative elements of the Sub-Advisor’s organization, personnel, procedures, investment discipline, infrastructure and performance. The Board considered that the Advisor conducts regular on-site compliance visits with the Sub-Advisor, during which the Advisor examines a wide variety of factors, such as the financial condition of the Sub-Advisor, the quality of the Sub-Advisor’s systems, the effectiveness of the Sub-Advisor’s disaster recovery programs, trade allocation and execution procedures, compliance with the Sub-Advisor’s policies and procedures, results of regulatory examinations and any other factors that might affect the quality of services that the Sub-Advisor provides to the Fund. The Board noted that the Advisor’s compliance monitoring processes also include quarterly reviews of compliance reports, and that any issues arising from such reports and the Advisor’s compliance visits to the Sub-Advisor are reported to the Board.

The Trustees concluded that they were satisfied with the nature, extent and quality of services provided to the Fund by the Advisor under the Management Agreement.

Advisor’s Compensation and Profitability. The Board took into consideration the financial condition and profitability of the Advisor and its affiliates and the direct and indirect benefits derived by the Advisor and its affiliates from the Advisor’s relationship with the Fund. The information considered by the Board included operating profit margin information for the Advisor’s business as a whole. The Board noted that the Advisor pays the Sub-Advisor’s sub-advisory fee out of the advisory fee the Advisor receives from the Fund. The Board reviewed the profitability of the Advisor’s relationship with the Fund both before and after tax expenses, and also considered whether the Advisor has the financial wherewithal to continue to provide services to the Fund, noting the ongoing commitment of the Advisor’s parent company with respect to providing support and resources as needed. The Board also noted that the Advisor derives benefits to its reputation and other benefits from its association with the Fund.

The Board recognized that the Advisor should be entitled to earn a reasonable level of profits in exchange for the level of services it provides to the Fund and the entrepreneurial risk that it assumes as Advisor. Based upon their review, the Trustees concluded that the Advisor’s level of profitability from its relationship with the Fund was reasonable and not excessive.

Expenses and Performance. The Board compared the advisory fee and total expense ratio for the Fund with various comparative data, including the median and average advisory fees and total expense ratios of the Fund’s peer group. The Board also considered, among other data, the Fund’s performance results during the six-month, twelve-month, and thirty-six month periods ended June 30, 2014, and noted that the Board reviews on a quarterly basis detailed information about the Fund’s performance results, portfolio composition and investment strategies. The Board also took into account current market conditions and their effect on the Fund’s performance.

The Board also considered the effect of the Fund’s growth and size on its performance and expenses. The Board noted that the sub-advisory fee under the Sub-Advisory Agreement was paid by the Advisor out of the advisory fee it receives from the Fund and considered the impact of such sub-advisory fee on the profitability of the Advisor. In reviewing the expense ratio and performance of the Fund, the Board also took into account the nature, extent and quality of the services provided by the Advisor and its affiliates.

The Board considered, among other data, the specific factors and related conclusions set forth below:

Touchstone Sands Capital Institutional Growth Fund. The Fund’s advisory fee and total expense ratio were above the median of its peer group. The Board took into account management’s discussion of the Fund’s expenses

Other Items (Unaudited) (Continued)

and the Fund’s advisory fee structure. The Fund’s performance for the six-month period ended June 30, 2014 was in the 5th quintile of its peer group. The Fund’s performance for the twelve- and thirty-six-month periods ended June 30, 2014 was in the 1st quintile of its peer group. The Board considered management’s discussion of the Portfolio’s recent performance and management’s continued monitoring of Fund performance. Based upon their review, the Trustees concluded that the Fund’s overall performance was satisfactory in relation to the performance of funds with similar investment objectives and relevant indices, and that the advisory fee was reasonable in light of the services received by the Fund from the Advisor and the other factors considered.

Economies of Scale. The Board considered the effect of the Fund’s current size and potential growth on its performance and expenses. The Board took into account management’s discussion of the Fund’s advisory fee structure. The Board also noted that if the Fund’s assets increased over time, the Fund might realize other economies of scale if assets increased proportionally more than certain other expenses.

Conclusion. In considering the renewal of the Fund’s Management Agreement, the Board, including the Independent Trustees, did not identify any single factor as controlling, and each Trustee may have attributed different weights to the various factors. The Board reached the following conclusions regarding the Fund’s Management Agreement with the Advisor, among others: (a) the Advisor demonstrated that it possesses the capability and resources to perform the duties required of it under the Management Agreement; (b) the Advisor maintains an appropriate compliance program; (c) the overall performance of the Fund is satisfactory in relation to the performance of funds with similar investment objectives and relevant indices; and (d) the Fund’s advisory fee is reasonable in light of the services received by the Fund from the Advisor and the other factors considered. Based on their conclusions, the Trustees determined that continuation of the Management Agreement was in the best interests of the Fund and its shareholders.

In approving the Fund’s Sub-Advisory Agreement, the Board considered various factors with respect to the Fund and its Sub-Advisory Agreement, among them: (1) the nature, extent and quality of services provided to the Fund, including the personnel providing such services; (2) the Sub-Advisor’s compensation; (3) a comparison of the sub-advisory fee and performance with other advisers; and (4) the terms of the Sub-Advisory Agreement. The Board’s analysis of these factors is set forth below. The Independent Trustees were advised by independent legal counsel throughout the process.

Nature, Extent and Quality of Services Provided; Investment Personnel. The Board considered information provided by the Advisor regarding the services provided by the Sub-Advisor, including information presented periodically throughout the previous year. The Board noted that, on a periodic basis, the Board meets with portfolio managers of the Sub-Advisor to discuss their performance and investment processes and strategies. The Board considered the Sub-Advisor’s level of knowledge and investment style. The Board reviewed the experience and credentials of the investment personnel who are responsible for managing the investment of portfolio securities for the Fund. The Board also noted the Sub-Advisor’s brokerage practices.

Sub-Advisor’s Compensation, Profitability and Economies of Scale. The Board also took into consideration the financial condition of the Sub-Advisor and any indirect benefits derived by the Sub-Advisor and its affiliates from the Sub-Advisor’s relationship with the Fund. In considering the profitability to the Sub-Advisor of its relationship with the Fund, the Board noted that the sub-advisory fee under the Sub-Advisory Agreement was paid by the Advisor out of the advisory fee that it receives under the Management Agreement and is negotiated at arms-length. As a consequence, the profitability to the Sub-Advisor of its relationship with the Fund was not a substantial factor in the Board’s deliberations. For similar reasons, the Board did not consider the potential economies of scale in the Sub-Advisor’s management of the Fund to be a substantial factor in its consideration.

Sub-Advisory Fee and Fund Performance. The Board considered that the Fund pays an advisory fee to the Advisor and that the Advisor pays the sub-advisory fee to the Sub-Advisor out of the advisory fee it receives from the Fund. The Board also compared the sub-advisory fee paid by the Advisor to fees charged by the Sub-Advisor

Other Items (Unaudited) (Continued)

to manage comparable institutional separate accounts.The Board considered the amount retained by the Advisor and the sub-advisory fee paid to the Sub-Advisor with respect to the various services provided by the Advisor and the Sub-Advisor. The Board reviewed the sub-advisory fee in relation to various comparative data, including the median and average sub-advisory fees of the Fund’s peer group, and considered the following information:

Touchstone Sands Capital Institutional Growth Fund. The Fund’s sub-advisory fee was above the median of its peer group. Based upon their review, the Trustees concluded that the sub-advisory fee was reasonable in light of the services received by the Fund from the Sub-Advisor and the other factors considered.

As noted above, the Board considered the Fund’s performance during the six-month, twelve-month, and thirty-six month periods ended June 30, 2014, as compared to the Fund’s peer group and noted that the Board reviews on a quarterly basis detailed information about the Fund’s performance results, portfolio composition and investment strategies. The Board also noted the Advisor’s expertise and resources in monitoring the performance, investment style and risk-adjusted performance of the Sub-Advisor. The Board also was mindful of the Advisor’s ongoing monitoring of the Sub-Advisor’s performance.