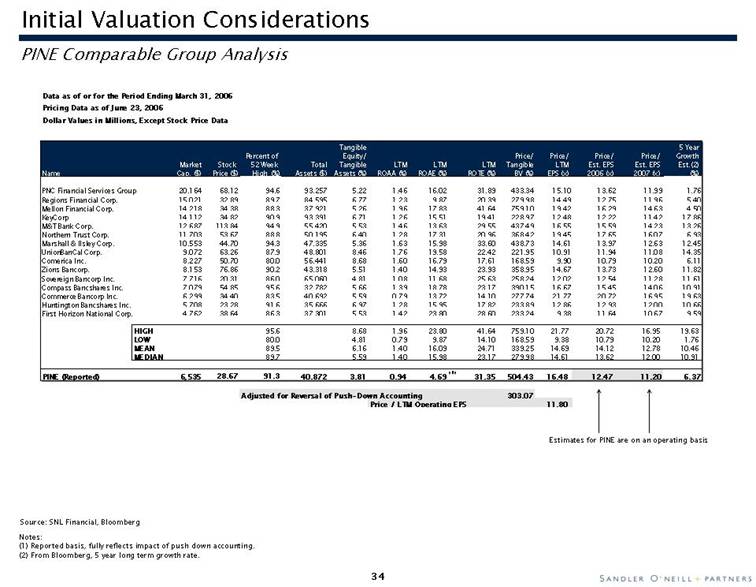

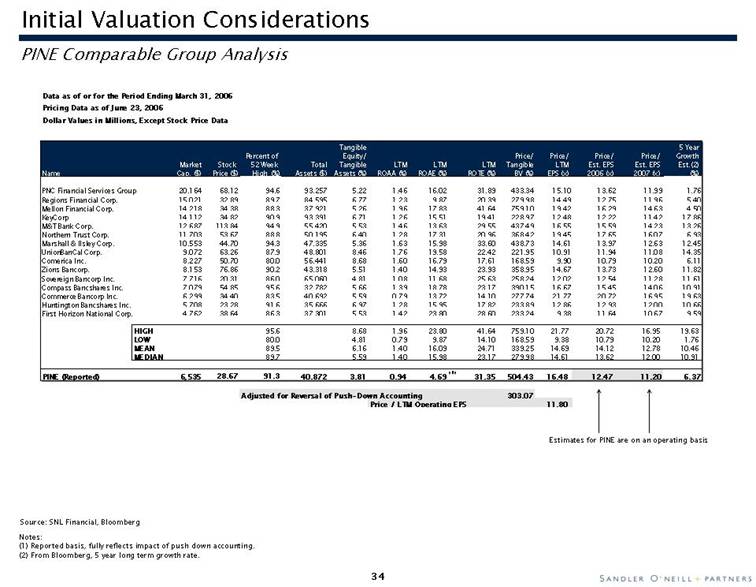

| Initial Valuation Considerations PINE Comparable Group Analysis Data as of or for the Period Ending March 31, 2006 Pricing Data as of June 23, 2006 Dollar Values in Millions, Except Stock Price Data Tangible 5 Year Percent of Equity/ Price/ Price/ Price/ Price/ Growth Market Stock 52 Week Total Tangible LTM LTM LTM Tangible LTM Est. EPS Est. EPS Est.(2) Name Cap. ($) Price ($) High (%) Assets ($) Assets (%) ROAA (%) ROAE (%) ROTE (%) BV (%) EPS (x) 2006 (x) 2007 (x) (%) PNC Financial Services Group 20,164 68.12 94.6 93,257 5.22 1.46 16.02 31.89 433.34 15.10 13.62 11.99 1.76 Regions Financial Corp. 15,021 32.89 89.7 84,595 6.77 1.23 9.87 20.39 279.98 14.49 12.75 11.96 5.40 Mellon Financial Corp. 14,218 34.38 88.3 37,921 5.26 1.96 17.83 41.64 759.10 19.42 16.29 14.63 4.50 KeyCorp 14,112 34.82 90.9 93,391 6.71 1.26 15.51 19.41 228.97 12.48 12.22 11.42 17.86 M&T Bank Corp. 12,687 113.84 94.9 55,420 5.53 1.46 13.63 29.55 437.49 16.55 15.59 14.23 13.26 Northern Trust Corp. 11,703 53.67 88.8 50,195 6.40 1.28 17.31 20.96 368.42 19.45 17.65 16.07 6.93 Marshall & Ilsley Corp. 10,553 44.70 94.3 47,335 5.36 1.63 15.98 33.60 438.73 14.61 13.97 12.63 12.45 UnionBanCal Corp. 9,072 63.26 87.9 48,801 8.46 1.76 19.58 22.42 221.95 10.91 11.94 11.08 14.35 Comerica Inc. 8,227 50.70 80.0 56,441 8.68 1.60 16.79 17.61 168.59 9.90 10.79 10.20 6.11 Zions Bancorp. 8,153 76.86 90.2 43,318 5.51 1.40 14.93 23.93 358.95 14.67 13.73 12.60 11.82 Sovereign Bancorp Inc. 7,716 20.31 86.0 65,060 4.81 1.08 11.68 25.63 258.24 12.02 12.54 11.28 11.61 Compass Bancshares Inc. 7,079 54.85 95.6 32,782 5.66 1.39 18.78 23.17 390.15 16.67 15.45 14.06 10.91 Commerce Bancorp Inc. 6,299 34.40 83.5 40,692 5.59 0.79 13.72 14.10 277.74 21.77 20.72 16.95 19.63 Huntington Bancshares Inc. 5,708 23.28 91.6 35,666 6.97 1.28 15.95 17.82 233.89 12.86 12.93 12.00 10.66 First Horizon National Corp. 4,762 38.64 86.3 37,301 5.53 1.42 23.80 28.60 233.24 9.38 11.64 10.67 9.59 HIGH 95.6 8.68 1.96 23.80 41.64 759.10 21.77 20.72 16.95 19.63 LOW 80.0 4.81 0.79 9.87 14.10 168.59 9.38 10.79 10.20 1.76 MEAN 89.5 6.16 1.40 16.09 24.71 339.25 14.69 14.12 12.78 10.46 MEDIAN 89.7 5.59 1.40 15.98 23.17 279.98 14.61 13.62 12.00 10.91 PINE (Reported) 6,535 28.67 91.3 40,872 3.81 0.94 4.69 ( 1) 31.35 504.43 16.48 12.47 11.20 6.37 Adjusted for Reversal of Push-Down Accounting 303.07 Price / LTM Operating EPS 11.80 Estimates for PINE are on an operating basis Source: SNL Financial, Bloomberg Initial Valuation Considerations Notes: (1) Reported basis, fully reflects impact of push down accounting. (2) From Bloomberg, 5 year long term growth rate. |