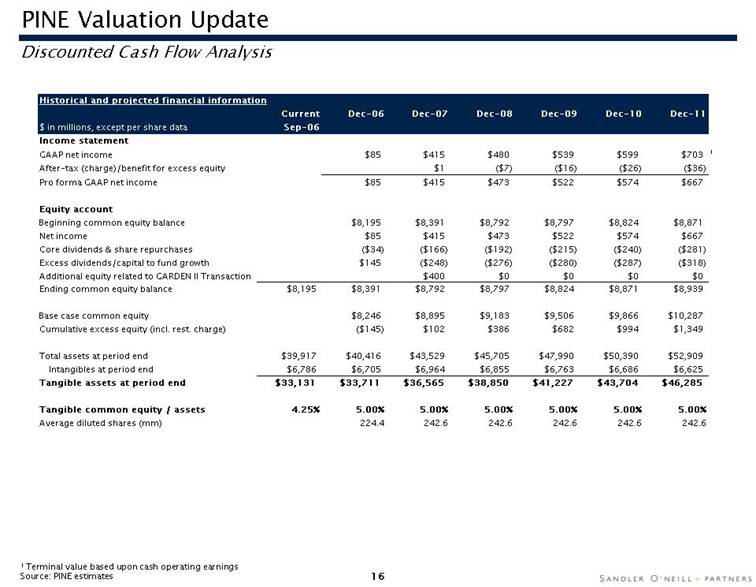

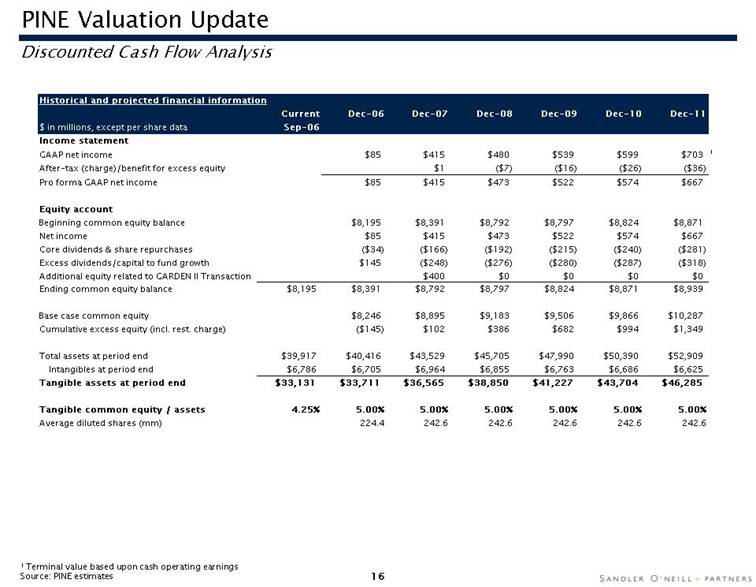

| PINE Valuation Update Discounted Cash Flow Analysis 1 Terminal value based upon cash operating earnings Source: PINE estimates Historical and projected financial information Current Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 $ in millions, except per share data Sep-06 Income statement GAAP net income $85 $415 $480 $539 $599 $703 1 After-tax (charge)/benefit for excess equity $1 ($7) ($16) ($26) ($36) Pro forma GAAP net income $85 $415 $473 $522 $574 $667 Equity account Beginning common equity balance $8,195 $8,391 $8,792 $8,797 $8,824 $8,871 Net income $85 $415 $473 $522 $574 $667 Core dividends & share repurchases ($34) ($166) ($192) ($215) ($240) ($281) Excess dividends/capital to fund growth $145 ($248) ($276) ($280) ($287) ($318) Additional equity related to GARDEN II Transaction $400 $0 $0 $0 $0 Ending common equity balance $8,195 $8,391 $8,792 $8,797 $8,824 $8,871 $8,939 Base case common equity $8,246 $8,895 $9,183 $9,506 $9,866 $10,287 Cumulative excess equity (incl. rest. charge) ($145) $102 $386 $682 $994 $1,349 Total assets at period end $39,917 $40,416 $43,529 $45,705 $47,990 $50,390 $52,909 Intangibles at period end $6,786 $6,705 $6,964 $6,855 $6,763 $6,686 $6,625 Tangible assets at period end $33,131 $33,711 $36,565 $38,850 $41,227 $43,704 $46,285 Tangible common equity / assets 4.25% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% Average diluted shares (mm) 224.4 242.6 242.6 242.6 242.6 242.6 |