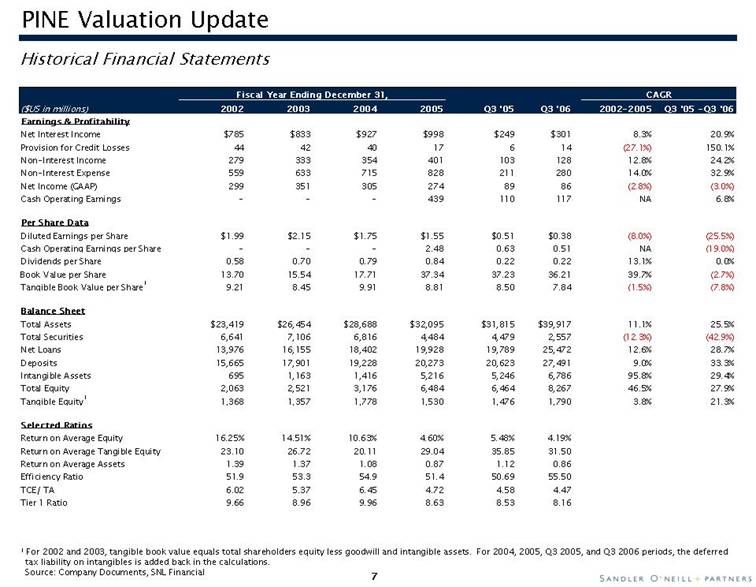

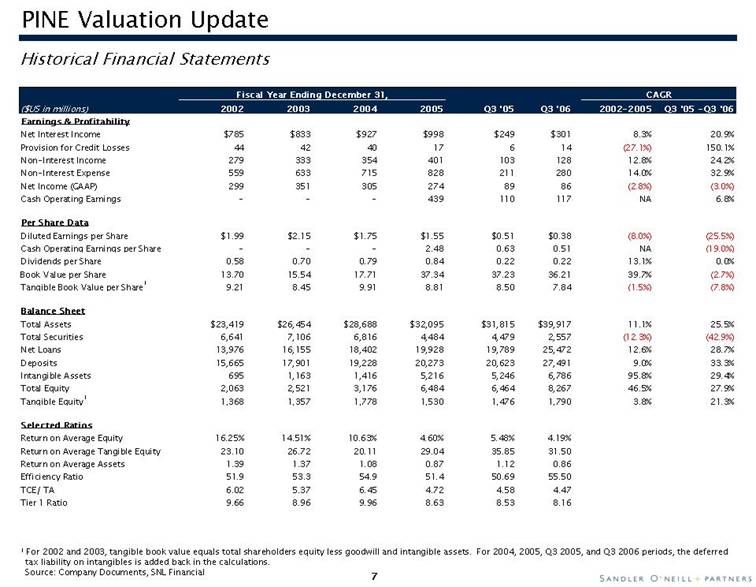

| PINE Valuation Update Historical Financial Statements ($US in millions) 2002 2003 2004 2005 Q3 ‘05 Q3 ‘06 2002-2005 Q3 ‘05 -Q3 ‘06 Earnings & Profitability Net Interest Income $785 $833 $927 $998 $249 $301 8.3% 20.9% Provision for Credit Losses 44 42 40 17 6 14 (27.1%) 150.1% Non-Interest Income 279 333 354 401 103 128 12.8% 24.2% Non-Interest Expense 559 633 715 828 211 280 14.0% 32.9% Net Income (GAAP) 299 351 305 274 89 86 (2.8%) (3.0%) Cash Operating Earnings - - - 439 110 117 NA 6.8% Per Share Data Diluted Earnings per Share $1.99 $2.15 $1.75 $1.55 $0.51 $0.38 (8.0%) (25.5%) Cash Operating Earnings per Share - - - 2.48 0.63 0.51 NA (19.0%) Dividends per Share 0.58 0.70 0.79 0.84 0.22 0.22 13.1% 0.0% Book Value per Share 13.70 15.54 17.71 37.34 37.23 36.21 39.7% (2.7%) Tangible Book Value per Share1 9.21 8.45 9.91 8.81 8.50 7.84 (1.5%) (7.8%) Balance Sheet Total Assets $23,419 $26,454 $28,688 $32,095 $31,815 $39,917 11.1% 25.5% Total Securities 6,641 7,106 6,816 4,484 4,479 2,557 (12.3%) (42.9%) Net Loans 13,976 16,155 18,402 19,928 19,789 25,472 12.6% 28.7% Deposits 15,665 17,901 19,228 20,273 20,623 27,491 9.0% 33.3% Intangible Assets 695 1,163 1,416 5,216 5,246 6,786 95.8% 29.4% Total Equity 2,063 2,521 3,176 6,484 6,464 8,267 46.5% 27.9% Tangible Equity1 1,368 1,357 1,778 1,530 1,476 1,790 3.8% 21.3% Selected Ratios Return on Average Equity 16.25% 14.51% 10.63% 4.60% 5.48% 4.19% Return on Average Tangible Equity 23.10 26.72 20.11 29.04 35.85 31.50 Return on Average Assets 1.39 1.37 1.08 0.87 1.12 0.86 Efficiency Ratio 51.9 53.3 54.9 51.4 50.69 55.50 TCE/ TA 6.02 5.37 6.45 4.72 4.58 4.47 Tier 1 Ratio 9.66 8.96 9.96 8.63 8.53 8.16 1 For 2002 and 2003, tangible book value equals total shareholders equity less goodwill and intangible assets. For 2004, 2005, Q3 2005, and Q3 2006 periods, the deferred tax liability on intangibles is added back in the calculations. Source: Company Documents, SNL Financial |