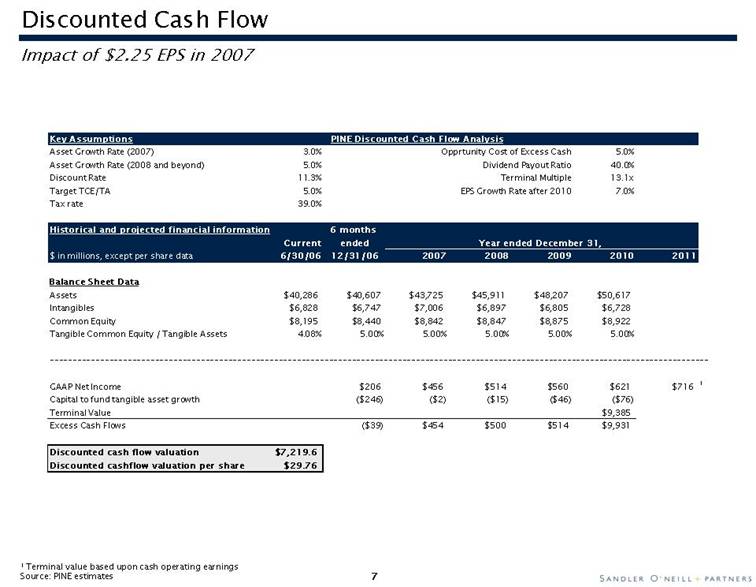

Discounted Cash Flow Impact of $2.25 EPS in 2007 Key Assumptions Asset Growth Rate (2007) 3.0% Asset Growth Rate (2008 and beyond) 5.0% Discount Rate 11.3% Target TCE/TA 5.0% Tax rate 39.0% PINE Discounted Cash Flow Analysis Opprtunity Cost of Excess Cash 5.0% Dividend Payout Ratio 40.0% Terminal Multiple 13.1x EPS Growth Rate after 2010 7.0% Historical and projected financial information 6 months Current ended Year ended December 31, $ in millions, except per share data 6/30/06 12/31/06 2007 2008 2009 2010 2011 Balance Sheet Data Assets $40,286 $40,607 $43,725 $45,911 $48,207 $50,617 Intangibles $6,828 $6,747 $7,006 $6,897 $6,805 $6,728 Common Equity $8,195 $8,440 $8,842 $8,847 $8,875 $8,922 Tangible Common Equity / Tangible Assets 4.08% 5.00% 5.00% 5.00% 5.00% 5.00% GAAP Net Income $206 $456 $514 $560 $621 $716 1 Capital to fund tangible asset growth ($246) ($2) ($15) ($46) ($76) Terminal Value $9,385 Excess Cash Flows ($39) $454 $500 $514 $9,931 Discounted cash flow valuation $7,219.6 Discounted cashflow valuation per share $29.76 1 Terminal value based upon cash operating earnings Source: PINE estimates |