UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21934

RiverNorth Funds

(Exact name of registrant as specified in charter)

325 North LaSalle Street, Suite 645, Chicago, IL 60654

(Address of principal executive offices) (Zip code)

Patrick W. Galley

325 North LaSalle Street, Suite 645

Chicago, IL 60654

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-832-1440

Date of fiscal year end: 09/30

Date of reporting period: 09/30/2012

| Item 1. | Reports to Stockholders. |

| | |

RiverNorth Funds | | Table of Contents |

| | September 30, 2012 |

| | |

Annual Report | September 30, 2012 | | 1 |

| | |

RiverNorth Funds | | Shareholder Letter |

| | September 30, 2012 (Unaudited) |

Dear Fellow Shareholders,

We are pleased to provide you with the 2012 Annual Report for the RiverNorth Funds. This report covers the RiverNorth Core Opportunity Fund (ticker: RNCOX), the RiverNorth/DoubleLine Strategic Income Fund (tickers: RNSIX and RNDLX) and the recently launched RiverNorth/Manning & Napier Dividend Income Fund (tickers: RNDIX and RNMNX). All Funds have a fiscal year-end of September 30, 2012.

Launched in July 2012, the RiverNorth/Manning & Napier Dividend Income Fund helps round out RiverNorth’s product offering of opportunistic investment strategies focused on closed-end funds. The RiverNorth/Manning & Napier Dividend Income Fund is an equity income based strategy. The Fund combines RiverNorth’s expertise in capitalizing on the inefficiencies within the closed-end fund space, specifically equity focused closed-end funds, with Manning & Napier’s disciplined stock screening process with a focus on companies with high free cash flow yields. We believe that opportunistic, discount-based investments in closed-end fund shares can earn excess returns over the closed-end fund’s benchmark index. Therefore, tactical management of an equity closed-end fund portfolio combined with a disciplined equity manager, we believe can produce best in class risk adjusted returns. Investor sentiment continues to be negative toward equities and many equity based closed-end funds are trading at attractive discounts to net asset value. As irrefutable contrarians investing against the herd, we find the current investment opportunity in equity closed-end funds compelling.

After just fifteen months of launching, we closed our alternative fixed income fund, the RiverNorth/DoubleLine Strategic Income Fund, to new investors on March 30, 2012. Our flagship fund, the RiverNorth Core Opportunity Fund, remains closed to new investors as well. Shareholders may still purchase shares of the fund(s) in which they are currently invested. Our history of closing funds to new investors reflects our commitment to shareholders in preserving current and future trading opportunities within the closed-end fund space.

Last, we are pleased to announce the launch of the RiverNorth Dynamic Buy-Write Fund (ticker: RNBWX) in October 2012, after the date of this Annual Report. The RiverNorth Dynamic Buy-Write Fund is designed to capitalize on the inefficiencies and opportunities embedded in the options market. RiverNorth hired significant talent and expertise within the volatility and options markets to manage this new product. We at RiverNorth are very excited about the prospects of this new fund and look forward to sharing detailed information about the new fund. Please visit www.rivernorthfunds.com for information about the RiverNorth Dynamic Buy-Write Fund.

Our family of funds offers investors an alternative and prudent way to allocate to more traditional asset classes. We believe these characteristics are necessary for an investment strategy in today’s volatile and uncertain market environment.

We thank you for your investment and trust in managing your assets.

Respectfully,

Patrick W. Galley, CFA

| | |

2 | | (888) 848-7569 | www.rivernorthfunds.com |

| | |

RiverNorth Funds | | Shareholder Letter |

| | September 30, 2012 (Unaudited) |

RiverNorth Core Opportunity Fund

Portfolio Management Commentary – Patrick Galley, CFA and Stephen O’Neill, CFA

What is the Fund’s investment strategy?

The RiverNorth Core Opportunity Fund (RNCOX; the “Fund”) invests in a broad range of equity, fixed income and short-term securities. To implement the Fund’s tactical asset allocation, the Adviser generally invests in closed-end funds and exchange-traded funds.

How did the RiverNorth Core Opportunity Fund perform relative to its benchmark during the reporting period?

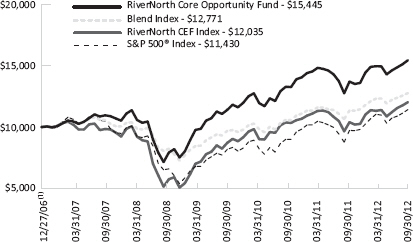

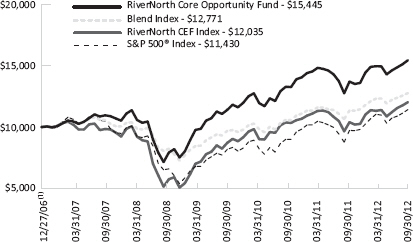

For the twelve months ended September 30, 2012, the RiverNorth Core Opportunity Fund returned 21.05%. The unmanaged Blend Index returned 19.87%, during the same period. The Blend Index consists of 60% S&P 500 Index and 40% Barclays Capital U.S. Aggregate Bond Index.

In order to compare the Fund’s performance to the overall taxable closed-end fund market, we maintain the RiverNorth Closed-end Fund Index (“RiverNorth CEF Index”). We believe the RiverNorth CEF Index provides the best representation of the taxable closed-end fund market because it is constructed without discount biases and is designed to capture the broader group’s asset class diversity. The RiverNorth CEF Index returned 24.54% during the reporting period. Please note that RNCOX owns closed-end funds opportunistically and is not benchmarked against the RiverNorth CEF Index. We recommend that shareholders view the RiverNorth CEF Index as a reference point only.

Comparison of a $10,000 Investment in the RiverNorth Core Opportunity Fund, the Blend Index, the RiverNorth CEF Index, and the S&P 500® Index.

| | |

Annual Report | September 30, 2012 | | 3 |

| | |

RiverNorth Funds | | Shareholder Letter |

| | September 30, 2012 (Unaudited) |

Average Annual Total Returns for Periods Ending September 30, 2012

| | | | | | | | |

| | | 1-Year | | 3-Year | | 5-Year | | Since

Inception(1) |

RiverNorth Core Opportunity Fund (RNCOX) | | 21.05% | | 11.07% | | 7.54% | | 7.84% |

Blend Index(2) | | 19.87% | | 10.71% | | 3.67% | | 4.34% |

S&P 500® Index(2) | | 30.20% | | 13.20% | | 1.05% | | 2.48% |

RiverNorth CEF Index(3) | | 24.54% | | 12.20% | | 3.30% | | 3.27% |

| (1) | Inception date is December 27, 2006. |

| (2) | Blend Index consists of 60% S&P 500® Index and 40% Barclays Capital U.S. Aggregate Bond Index. S&P 500® Index is a capitalization-weighted index of 500 stocks. The S&P 500® Index is designed to measure performance of the broad domestic economy based on the changing aggregate market value of these 500 stocks. The Barclays Capital US Aggregate Bond Index (formerly Lehman Brothers US Aggregate Bond Index) is a benchmark index composed of US securities in Treasury, Government-Related, Corporate, and Securitized sectors. It includes securities that are of investment-grade quality or better, have at least one year to maturity, and have an outstanding par value of at least $250 million. This unmanaged index does not reflect fees and expenses. The index cannot be invested in directly. The S&P 500 and Blend Indices are indices only and cannot be invested in directly. |

| (3) | The RiverNorth CEF Index measures the performance of the taxable closed-end fund market through a representative 75 Funds. The index rebalances every 12 months and is calculated using the total return of the underlying investments. Please see www.rivernorth.com for more information. |

The RiverNorth CEF Index is an index only and cannot be invested in directly.

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling (888) 848-7569 or www.rivernorthfunds.com. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions.

The RiverNorth Core Opportunity Fund’s Total Annual Fund Operating Expenses as disclosed in the prospectus is 2.32%. The Fund’s adviser has contractually agreed to waive management fees and/or reimburse expenses (excluding brokerage fees and commissions; borrowing costs such as (a) interest and (b) dividends on securities sold short; taxes; indirect expenses incurred by the underlying funds in which the Fund invests and extraordinary expenses) of the Fund until at least January 31, 2013 in order to maintain the Total Annual Fund Operating Expenses After Fee Waiver and/or Reimbursement at or below 1.60%. As reported in the Financial Highlights section of this Report, for the fiscal year ended September 30, 2012 the ratio of expenses to average net assets excluding fee waivers and reimbursements was 1.36%.

What contributing factors were responsible for the RiverNorth Core Opportunity Fund’s relative performance during the period?

With respect to the equity portion of the portfolio, the Fund’s allocation to international equities (in both developed and emerging markets) detracted from the Fund’s relative performance. The MSCI All Country World Index* was up 20.98% over the past twelve months; whereas the S&P 500 Index was up 30.20%. We remain committed to our international equity allocation based on the attractive discounts of global equity funds and the favorable valuation ratios on developed and emerging market indices. Overall the equity portfolio did benefit from discount narrowing in 2012.

| | |

4 | | (888) 848-7569 | www.rivernorthfunds.com |

| | |

RiverNorth Funds | | Shareholder Letter |

| | September 30, 2012 (Unaudited |

Our preference for the credit-related sectors of the bond market contributed to the outperformance of the Fund’s fixed income portfolio relative to the Barclays Capital U.S. Aggregate Bond Index*, which returned 5.12% over the last 12 months. Yields on high quality bonds (i.e. U.S. Treasury bonds and agency mortgage-backed securities) are no longer keeping pace with inflation. We believe bank loans and high yield bonds offer more attractive yields and are fundamentally compelling.

Our closed-end bond funds performed exceptionally well during the latest fiscal year. Two of the best performing funds were those formerly known as the Nuveen Multi-Strategy Income & Growth Funds I and II. In November 2011, these multi-strategy funds received shareholder approval to reposition the portfolios as single-strategy funds. Closed-end fund investors generally prefer funds that fit neatly into one investment category or style box and therefore single-strategy funds often trade narrower. Fund I converted into a preferred stock fund and Fund II converted into a bank loan fund. We owned both funds and had allocated about 5% of the portfolio to this idea. Over the past twelve months the discounts on both funds have narrowed roughly 1,000 basis points. We had similar success with the BlackRock Credit Allocation Funds II, III and IV. These funds were formerly preferred stock funds that had incurred steep losses during the credit crisis. BlackRock repositioned the portfolios in 2010 and the funds now focus on corporate bonds (investment grade and high yield). Over the past twelve months the discounts on these three funds narrowed roughly 800 basis points.

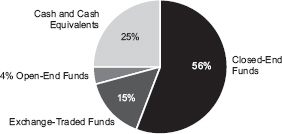

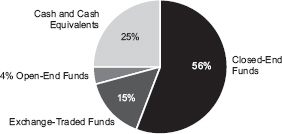

We also generated excess returns (“alpha”) for our shareholders by tactically managing the Fund’s closed-end fund exposure. From September 30, 2011 to December 31, 2011 we increased the Fund’s closed-end fund exposure from 59% to 70% of assets. We became more aggressive in response to discount volatility in October/November 2011. The trading opportunity was short-lived but the volatility enabled us to increase our exposure at very attractive discount levels. Closed-end funds went on to rally in 2012 and we sold down our positions into strength. The Fund’s current closed-end fund exposure is 56%.

What was the closed-end fund environment like for the past twelve months and current outlook?

The trailing twelve-month average discount on the RiverNorth CEF Index was 2.30% on September 30, 2012. To put this figure into perspective, the comparable averages for fiscal years 2011 and 2010 were 2.81% and 2.65%, respectively.

The range of the average discount over the past twelve months was 0.58% to 6.01%. While the discount range was fairly wide the mean-reversion trading opportunities for the Fund were limited. There were only seven trading days in the past twelve months when the average discount on the RiverNorth CEF Index closed wider than its five-year average of 4.28%. Despite multiple periods of capital markets volatility in the recent past, the closed-end fund market has simply not experienced long-lasting and broad-based discount volatility since 2009. We believe discount volatility is restrained because – 1) investors have become acclimated to the tumultuous macro-environment and 2) investors are hungry for yield and closed-end funds can offer compelling distribution rates. In other words, the absence of fear and the prevalence of greed have kept discounts relatively stable and narrow.

Though we would have preferred more discount volatility over the past twelve months, the environment was certainly favorable to long-term closed-end fund investors. Taxable bond funds were investor favorites. The average premium on the roughly 180 taxable bond funds was 3.04% on September 30, 2012; an increase of over 500 basis points in the past year. As previously mentioned, our taxable bond funds were significant contributors to the Fund’s recent outperformance. Equity funds (including general equity, covered call and hybrid funds) also

| | |

Annual Report | September 30, 2012 | | 5 |

| | |

RiverNorth Funds | | Shareholder Letter |

| | September 30, 2012 (Unaudited) |

narrowed during the reporting period. However these discounts remain wide by historical standards. The Fund’s largest equity fund positions are still trading at double-digit discounts.

Looking forward, we anticipate a slow and steady rotation out of taxable bond funds and into equity funds with attractive distribution policies. With bond yields near historic lows and bond fund premiums near historic highs, the risk of buying over-priced bonds through an over-priced investment vehicle should begin to dissuade knowledgeable investors from pushing premiums much higher. The diminished total return prospects for the bond market and the recent gains in the stock market may cause investors to warm up to equity closed-end funds. The wide discounts on these equity funds can offer investors an attractive opportunity as they wade into the equity market.

Future discount volatility should be highly correlated with U.S. interest rates. Discount volatility may intensify if/when the economy gains momentum and interest rates begin to rise. Closed-end fund investors typically over-react when the Federal Reserve’s monetary policy is in a tightening mode. Although the Federal Reserve has announced its intention to keep short-term interest rates low through at least mid-2015, we believe discount volatility on bond funds will increase when long-term interest rates begin to rise.

How was the RiverNorth Core Opportunity Fund positioned at the end of September 2012?

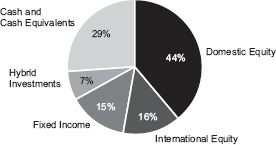

We have allocated 60% of the portfolio to equities, 15% to fixed income, 7% to hybrid securities (primarily preferred stocks and convertible bonds) and 29% to cash. The allocations exceed 100% because some of the closed-end funds we own utilize leverage.

Our equity allocation is neutral; though the equity beta is less than 1.0 (relative to the S&P 500). Beta reflects the sensitivity of a fund’s return to fluctuations in the market index. We are 60% invested in equities with roughly 73% domestic and 27% international exposure. The equity portfolio includes a large allocation to covered-call funds with exposure to domestic and foreign large cap stocks. These funds sell call options against their underlying positions to generate additional income. Therefore covered-call funds are often expected to outperform a purely passive stock index strategy in bear markets and underperform a purely passive stock index in bull markets.

Our fixed income portfolio is quite different from the Barclays Capital U.S. Aggregate Bond Index. The Fund has minimal exposure to U.S. Treasury bonds and agency mortgage-backed securities (MBS). We favor cash and corporate credit to high quality bonds with paltry yields. Our fixed income allocation of 15% (excluding cash) contains mostly leveraged loans, high yield bonds, investment grade bonds and non-agency MBS. The Fund continues to maintain a large cash position for three reasons – 1) cash as a substitute for high quality bonds, 2) cash to counterbalance the leverage from some of our closed-end fund positions and 3) cash as dry-powder for closed-end fund trading opportunities.

The Fund’s current allocation to closed-end funds is 56% of assets. Most of our closed-end fund exposure comes from traditional equity and covered-call funds. We believe these funds should generate alpha for our shareholders if/when Main Street investors return to the equity market.

*The MSCI All Country World Index is a market capitalization weighted index designed to provide a broad measure of equity-market performance throughout the world. It is maintained by Morgan Stanley Capital International, and is comprised of stocks from both developed and emerging markets. The Barclays Capital U.S. Aggregate Bond Index is a benchmark index composed of U.S. securities in Treasury, Government-Related, Corporate, and Securitized sectors. It includes securities that are of investment-grade quality or better, have at least one year to maturity, and have an outstanding par value of at least $250 million. You cannot invest directly in an index.

| | |

| | |

6 | | (888) 848-7569 | www.rivernorthfunds.com |

| | |

RiverNorth Funds | | Shareholder Letter |

| | September 30, 2012 (Unaudited) |

The charts below further highlight our positioning:

Investment Vehicle Allocation(1) (percentages are based on net assets)

Asset Class Allocation(1) (percentages are based on net assets)

The allocation does not add up to 100% as it reflects the leverage utilized by the underlying funds.

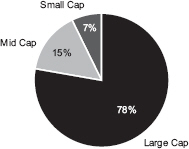

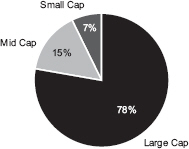

Equity Capitalization Allocation(1) (percentages are based on net assets)

| | |

| | |

Annual Report | September 30, 2012 | | 7 |

| | |

RiverNorth Funds | | Shareholder Letter |

| | September 30, 2012 (Unaudited) |

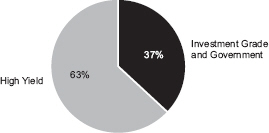

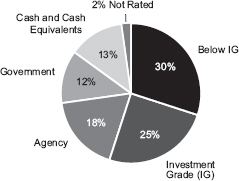

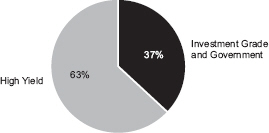

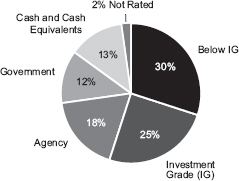

Fixed Income Allocation(1) (percentages are based on net assets)

| (1) | Convertible Security Risk – the market value of convertible securities adjust with interest rates and the value of the underlying stock. Exchange Traded Note Risk – exchange traded notes represent unsecured debt of the issuer and may be influenced by interest rates, credit ratings of the issuer or changes in value of the reference index. Fixed Income Risk – the market value of fixed income securities adjust with interest rates and are subject to issuer default. Foreign/Emerging Market Risk – foreign securities may be subject to inefficient or volatile markets, different regulatory regimes or different tax policies. These risks may be enhanced in emerging markets. Management Risk – there is no guarantee that the adviser’s or subadviser’s investment decisions will produce the desired results. Market Risk – economic conditions, interest rates and political events may affect the securities markets. Portfolio Turnover Risk – increased portfolio turnover results in higher brokerage expenses and may impact the tax status of distributions. REIT Risk – the value of REITs change with the value of the underlying properties and changes in interest rates and are subject to additional fees. Short Sale Risk – short positions are speculative, are subject to transaction costs and are riskier than long positions in securities. Small-Cap Risk – small-cap companies are more susceptible to failure, are often thinly traded and have more volatile stock prices. Structured Notes Risk – because of the imbedded derivative feature, structured notes are subject to more risk than investing in a simple note or bond. Swap Risk – swap agreements are subject to counterparty default risk and may not perform as intended. Underlying Fund Risk – underlying funds have additional fees, may utilize leverage, may not correlate to an intended index and may trade at a discount to their net asset values. |

Portfolio detail statistics are estimates made by the Adviser and are subject to change.

Information regarding closed-end fund premiums and discounts provided by Morningstar.

| | |

8 | | (888) 848-7569 | www.rivernorthfunds.com |

| | |

RiverNorth Funds | | Shareholder Letter |

| | September 30, 2012 (Unaudited) |

RiverNorth/Doubleline Strategic Income Fund

Portfolio Management Commentary – Patrick Galley, CFA, Stephen O’Neill, CFA and Jeffrey Gundlach

What is the Fund’s investment strategy?

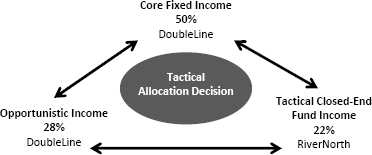

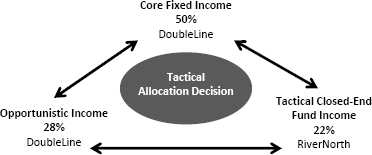

The RiverNorth/DoubleLine Strategic Income Fund (RNSIX and RNDLX; the “Fund”) invests in a broad range of fixed income securities of U.S. and foreign issuers including closed-end funds.

Assets of the Fund are tactically managed across three distinct fixed income strategies (or sleeves). RiverNorth Capital Management oversees the sleeve allocation and manages the Tactical Closed-end Fund Income Strategy. This strategy is designed to provide diversified exposure to the fixed income market through opportunistic investments in closed-end funds. Jeffrey Gundlach, Chief Investment Officer at DoubleLine Capital, oversees the Opportunistic Income and Core Fixed Income Strategies. The Opportunistic Income Strategy has a flexible mandate and is managed without duration constraints. The Core Fixed-Income Strategy, the most traditional of the three fixed income sleeves, incorporates an active asset allocation approach within the diverse fixed income universe in an effort to mitigate risk and achieve superior risk-adjusted returns.

How did the RiverNorth/DoubleLine Strategic Income Fund perform relative to its benchmark during the reporting period?

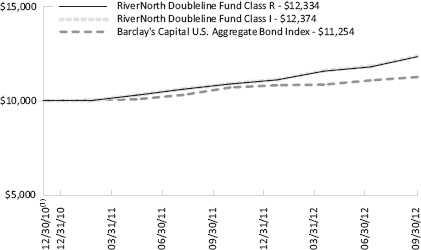

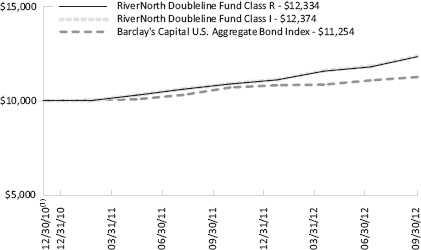

For the twelve months ended September 30, 2012, the Class I shares of the RiverNorth/DoubleLine Strategic Income Fund returned 13.56%. The Fund’s Class R shares returned 13.28% for the period. The Barclays Capital U.S. Aggregate Bond Index returned 5.16%, during the same period.

Comparison of a $10,000 Investment in the RiverNorth/Doubleline Strategic Income Fund and the Barclay’s Capital U.S. Aggregate Bond Index

| | |

Annual Report | September 30, 2012 | | 9 |

| | |

RiverNorth Funds | | Shareholder Letter |

| | September 30, 2012 (Unaudited) |

Average Annual Total Returns for Periods Ending September 30, 2012

| | | | |

| | | 1 - Year | | Since Inception(1) |

RiverNorth/Doubleline Strategic Income Fund – Class I (RNSIX) | | 13.56% | | 12.94% |

RiverNorth/Doubleline Strategic Income Fund – Class R (RNDLX) | | 13.28% | | 12.73% |

Barclays Capital U.S. Aggregate Bond Index(2) | | 5.16% | | 6.98% |

| (1) | Inception date is December 30, 2010. |

| (2) | The Barclay’s Capital U.S. Aggregate Bond Index is a benchmark index composed of U.S. securities in Treasury, Government-Related, Corporate, and Securitized sectors. It includes securities that are of investment-grade quality or better, have at least one year to maturity, and have an outstanding par value of at least $250 million. This unmanaged index does not reflect fees and expenses. The index cannot be invested in directly. |

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling (888) 848-7569 or www.rivernorthfunds.com. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions.

The RiverNorth/DoubleLine Strategic Income Fund’s Total Annual Operating Expense as disclosed in the prospectus is 1.23% for Class I Shares and 1.48% for Class R Shares. The Fund’s adviser has contractually agreed to waive management fees and/or reimburse expenses (excluding brokerage fees and commissions; borrowing costs such as (a) interest and (b) dividends on securities sold short; taxes; indirect expenses incurred by the underlying funds in (b) which the Fund invests and extraordinary expenses) of the Fund until at least January 31, 2013 in order to (c) maintain the Total Annual Fund Operating Expenses After Fee Waiver and/or Reimbursement at or below 0.95% and 1.20% for the Class I shares and Class R shares, respectively. As reported in the Financial Highlights section of this Report, for the fiscal year ended September 30, 2012 the ratio of expenses to average net assets excluding fee waivers and reimbursements for the Class I shares and Class R shares was 0.90% and 1.15%, respectively, including fee waivers and reimbursements it was 0.90% and 1.15%, respectively.

What contributing factors were responsible for the RiverNorth/DoubleLine Strategic Income Fund’s relative performance during the period?

RiverNorth Tactical Closed-End Fund Income Sleeve:

The RiverNorth sleeve benefited from the general discount narrowing on taxable bond funds. The focus on credit-related sectors of the bond market also contributed to the sleeve’s outperformance relative to the Barclays Capital U.S. Aggregate Bond Index.

DoubleLine Opportunistic Income Sleeve:

The non-agency mortgage-backed securities (MBS) sector saw a significant rally over the latter half of the fiscal year across the credit spectrum. Specifically, higher credit quality bonds, such as Prime and Alt-A securities, were the best performing benefiting from relatively high price appreciation and strong interest returns. Alt-A is a classification of mortgages where the risk profile falls between prime and subprime. Longer duration agency collateralized mortgage obligations (CMOs),

| | |

10 | | (888) 848-7569 | www.rivernorthfunds.com |

| | |

RiverNorth Funds | | Shareholder Letter |

| | September 30, 2012 (Unaudited) |

such as inverse floating-rate bonds, continue to experience strong interest income and price gains which more than offset prepayments over the period.

DoubleLine Core Fixed Income Sleeve:

Risk assets have seen a significant rally over the latter half of the year with both emerging market debt and non-agency MBS, boosting most of the performance over the period. Investment grade corporate bonds performed well versus the index while U.S. government debt was relatively flat.

What was the closed-end fund environment like for the past twelve months and current outlook?

Near zero percent policy rates and a series of quantitative easing programs have forced savers to reach for yield in the taxable bond market. Many investors have discovered closed-end bond funds in their search for attractive yield. Closed-end bond funds generally use leverage (about 30%) and therefore their distribution yields are often higher than those on open-end mutual funds and exchange-traded funds with similar investment strategies. The average closed-end fund distribution rate is currently 7.08%. The yield advantage has enticed investors into paying premiums for these bond funds. The average premium on the roughly 180 taxable bond funds was 3.04% on September 30, 2012; an increase of over 500 basis points in the past year.

We have responded by reducing the Fund’s allocation to closed-end funds. We have been selling our best performing funds into strength. The closed-end fund portfolio has become more concentrated in our best ideas. The top ten closed-end fund positions now account for over 50% of the closed-end fund portfolio. We remain bullish on our core positions and are comfortable with the weighted average discount on the portfolio, which is approximately 5%.

In our opinion, bond fund discounts will remain narrow by historical standards so long as interest rates remain low. We believe the current environment is ideal for leveraged bond funds. These funds borrow at rock-bottom short-term rates and investors pocket the spread between the interest income from the bonds and the interest expense on the debt. Although a fundamental case could be made for owning many bond funds at premium valuations, we adhere to Warren Buffett’s advice of being fearful when others are greedy and greedy when others are fearful.

What was the fixed income environment like for the past twelve months and current outlook?

For the past twelve months, U.S. Treasury rates fell with the curve flattening even further; 2-year rates were down 1 basis point on the year with the 10-year down 28 basis points to end the period at 1.63%. The riskier assets in the fixed income market outperformed over the period with emerging markets fixed income leading the way. Corporate securities and non-agency MBS also had significant outperformance over the time period. Treasuries and agency MBS returns trailed over the period given these sectors have little credit risk.

Looking forward, the key headwinds facing global markets will continue to be the European banking/debt crisis, U.S. elections/fiscal cliff and slowing Chinese growth. Despite the fact that liquidity provided by the European Central Bank (ECB), U.S. and other central banks around the world have been market supportive over the past 4 months, these issues have not been resolved and will likely weigh on global growth through the end of 2012 and into 2013. The ECB’s European Support Mechanism (ESM) and SMP 2.0 program now known as outright monetary transactions or OMTs have yet to be tested as ECB President Draghi has been successful in talking down yields in the European periphery without putting “any skin in the game”. Greek and Spanish governments still face uphill battles to find ever deeper austerity adjustments to cover increasing fiscal shortfalls as growth targets continue to be missed, and to convince coalition partners and citizens to continue forward with increasingly burdensome austerity measures. Not to be underestimated,

| | |

Annual Report | September 30, 2012 | | 11 |

| | |

RiverNorth Funds | | Shareholder Letter |

| | September 30, 2012 (Unaudited) |

“bail-out fatigue’ from Germany, Finland, Netherlands and other core European countries could escalate as the bailout costs for periphery Europe rises. Over the longer term, the eurozone’s creation of a banking union and advance toward full fiscal union should continue to proceed, albeit at a start-and stop pace.

A U.S. policy response to the fiscal crisis is not expected until after the November presidential election, or around the time the expiration of numerous tax cuts and the implementation of automatic spending cuts begin at year-end. Lastly, Chinese officials are likely to continue to provide just enough stimuli to maintain growth and avoid a hard landing, without showing any real new growth programs ahead of its leadership changes starting in October/November 2012 and ending in March 2013 with the change in Presidency and Premiership at the National People’s Congress. Another risk that remains on DoubleLine’s radar screen is the growing geopolitical tensions between Israel and Iran.

How was the RiverNorth/DoubleLine Strategic Income Fund positioned at the end of September 2012?

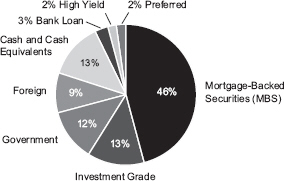

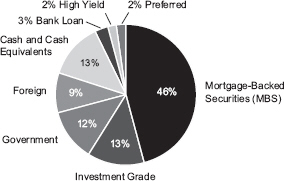

Strategy (“Sleeve”) Allocation

Credit Quality Distribution(1) (percentages are based on net assets)

| | |

| | |

12 | | (888) 848-7569 | www.rivernorthfunds.com |

| | |

RiverNorth Funds | | Shareholder Letter |

| | September 30, 2012 (Unaudited) |

Sector Breakdown(1) (percentages are based on net assets)

| (1) | Asset-Backed Security Risk – the risk that the value of the underlying assets will impair the value of the security. Borrowing Risk – borrowings increase fund expenses and are subject to repayment, possibly at inopportune times. Convertible Security Risk – the market value of convertible securities adjust with interest rates and the value of the underlying stock. Defaulted Securities Risk – defaulted securities carry the risk of uncertainty of repayment. Derivatives Risk – derivatives are subject to counterparty risk. Exchange Traded Note Risk –exchange traded notes represent unsecured debt of the issuer and may be influenced by interest rates, credit ratings of the issuer or changes in value of the reference index. Fixed Income Risk – the market value of fixed income securities adjust with interest rates and are subject to issuer default. Foreign/Emerging Market Risk – foreign securities may be subject to inefficient or volatile markets, different regulatory regimes or different tax policies. These risks may be enhanced in emerging markets. Liquidity Risk – illiquid investments may be difficult or impossible to sell. Management Risk – there is no guarantee that the adviser’s subadviser’s investment decisions will produce the desired results. Market Risk – economic conditions, interest rates and political events may affect the securities markets. Mortgage-Backed Security Risk – mortgage backed securities are subject to credit risk, pre-payment risk and devaluation of the underlying collateral. Portfolio Turnover Risk – increased portfolio turnover results in higher brokerage expenses and may impact the tax status of distributions. Rating Agency Risk – rating agencies may change their ratings or ratings may not accurately reflect a debt issuer’s creditworthiness. REIT Risk – the value of REITs change with the value of the underlying properties and changes in interest rates and are subject to additional fees. Structured Notes Risk – because of the imbedded derivative feature, structured notes are subject to more risk than investing in a simple note or bond. Swap Risk – swap agreements are subject to counterparty default risk and may not perform as intended. Underlying Fund Risk – underlying funds have additional fees, may utilize leverage, may not correlate to an intended index and may trade at a discount to their net asset values. |

Portfolio detail statistics are estimates made by the Adviser and are subject to change.

Information regarding closed-end fund premiums and discounts provided by Morningstar.

| | |

Annual Report | September 30, 2012 | | 13 |

| | |

RiverNorth Funds | | Shareholder Letter |

| | September 30, 2012 (Unaudited) |

RiverNorth/Manning & Napier Dividend Income Fund

Portfolio Management Commentary –Patrick Galley, CFA, Stephen O’Neill, CFA and Manning & Napier (team-based)

What is the Fund’s investment strategy?

The RiverNorth/Manning & Napier Dividend Income Fund (RNDIX and RNDLX; the “Fund”) invests in a broad range of dividend paying equity securities including closed-end funds. Please refer to the preceding Letter from the President for additional information about the Fund’s investment strategy.

How did the RiverNorth/Manning & Napier Dividend Income Fund perform relative to its benchmark during the reporting period?

Since inception (July 18, 2012) through September 30, 2012, the Fund returned 4.44% (RNDIX) and 4.46% (RNMNX). The Russell 1000 Value Index returned 5.73%, during the same period.

Cumulative Total Returns for the Period Ending September 30, 2012

| | |

| | | Since Inception(1) |

RiverNorth/Manning & Napier Dividend Income Fund – Class I (RNDIX) | | 4.44% |

RiverNorth/Manning & Napier Dividend Income Fund – Class R (RNMNX) | | 4.46% |

Russell 1000 Value Index(2) | | 5.73% |

| (1) | Inception date is July 18, 2012. Since Inception return is cumulative, not annualized. |

| (2) | The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 Index companies with lower price-to-book ratios and lower expected growth values. The index cannot be invested in directly and does not reflect fees and expenses. |

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling (888) 848-7569 or www.rivernorthfunds.com. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions.

The RiverNorth/Manning & Napier Dividend Income Fund’s Total Annual Operating Expense as disclosed in the prospectus is 1.66% for Class I Shares and 1.91% for Class R Shares. The Fund’s adviser has contractually agreed to waive management fees and/or reimburse expenses (excluding brokerage fees and commissions; borrowing costs such as (a) interest and (b) dividends on securities sold short; taxes; indirect expenses incurred by the underlying funds in which the Fund invests and extraordinary expenses) of the Fund until at least January 31, 2014 in order to maintain the Total Annual Fund Operating Expenses After Fee Waiver and/or Reimbursement at or below 1.35% and 1.60% for the Class I shares and Class R shares, respectively. As reported in the Financial Highlights section of this Report, for the period July 18, 2012 (inception) to September 30, 2012 the ratio of expenses to average net assets excluding fee waivers and reimbursements for the Class I shares and Class R shares was 6.16% and 6.21%, respectively, including fee waivers and reimbursements it was 1.35% and 1.60%, respectively.

| | |

| | |

14 | | (888) 848-7569 | www.rivernorthfunds.com |

| | |

RiverNorth Funds | | Shareholder Letter |

| | September 30, 2012 (Unaudited) |

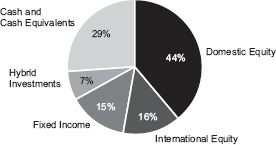

How was the RiverNorth/Manning & Napier Dividend Income Fund positioned at the end of September 2012?

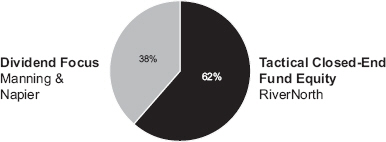

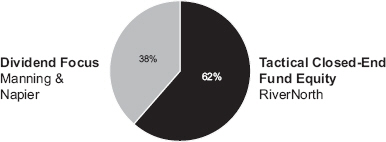

The Fund is young and we are in the process of ramping up the portfolio. The current allocation between strategies is 62% Tactical Closed-end Fund Equity and 38% Dividend Focus. For now the RiverNorth allocation includes a large exchange-traded funds (ETF) position that gives the Fund exposure to the Russell 1000 Value Index. As the Fund grows, this exposure should be reduced.

We are excited about the opportunity to own equity closed-end funds at historically wide discounts. Roughly 23% of the Fund is invested in covered-call funds managed by Eaton Vance; six funds in total with an average discount of 13%. Each fund was trading at a premium as recently as 2010. The discounts came about following a series of distribution cuts, the latest of which occurred in the first half of 2012. Investors have been fearful of additional distribution cuts and consequently the Eaton Vance covered-call funds have been amongst the widest of all closed-end funds. On October 5th, 2012, Eaton Vance announced a share-repurchase program for their covered-call funds and made clear that the firm has no current plans to alter future distributions. We believe the discounts on these covered-call funds should narrow with time. Additionally, we are finding value in general equity funds that may be susceptible to shareholder activism. Funds that trade at chronic discounts attract institutional investors that push for shareholder-friendly corporate actions (i.e. dividend increases and tender-offers).

In our opinion, equity funds present the best trading opportunities in the closed-end fund market. We look forward to fully deploying the Fund’s capital in today’s target rich environment.

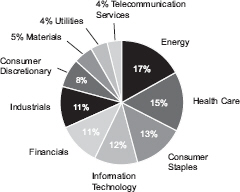

The Charts below further highlight our positioning:

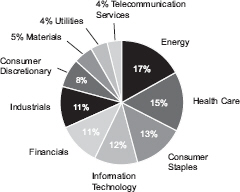

Sector Breakdown(1) (percentages are based on net assets)

| | |

Annual Report | September 30, 2012 | | 15 |

| | |

| RiverNorth Funds | | Shareholder Letter |

| | September 30, 2012 (Unaudited) |

Sleeve Weights(1) (percentages are based on net assets)

| (1) | Convertible Security Risk – the market value of convertible securities adjust with interest rates and the value of the underlying stock. Currency Risk – foreign currencies will rise or decline relative to the U.S. dollar. Equity Risk – the value of equity securities change frequently. Fixed Income Risk – the market value of fixed income securities adjust with interest rates and are subject to issuer default. Foreign/Emerging Market Risk – foreign securities may be subject to inefficient or volatile markets, different regulatory regimes or different tax policies. These risks may be enhanced in emerging markets. Investment Style Risk – investment strategies may come in and out of favor with investors and may underperform or outperform at times. Mid-Cap Risk – mid-cap companies may be more susceptible to adverse business or economic events than large-cap companies. Management Risk – there is no guarantee that the adviser’s subadviser’s investment decisions will produce the desired results. Market Risk – economic conditions, interest rates and political events may affect the securities markets. Portfolio Turnover Risk – increased portfolio turnover results in higher brokerage expenses and may impact the tax status of distributions. Preferred Stock Risk – preferred stocks generally pay dividends, but may be less liquid than common stocks, have less priority than debt instruments and may be subject to redemption by the issuer. Small-Cap Risk – small-cap companies are more susceptible to failure, are often thinly traded and have more volatile stock prices. Swap Risk – swap agreements are subject to counterparty default risk and may not perform as intended. Underlying Fund Risk – underlying funds have additional fees, may utilize leverage, may not correlate to an intended index and may trade at a discount to their net asset values. |

Portfolio detail statistics are estimates made by the Adviser and are subject to change.

| | |

16 | | (888) 848-7569 | www.rivernorthfunds.com |

| | |

RiverNorth Funds | | Disclosure of Fund Expenses |

| | September 30, 2012 (Unaudited) |

Expense Example

As a shareholder of the RiverNorth Funds, you incur two types of costs: (1) transaction costs (such as the 2% fee on redemption of Fund shares made within 90 days of purchase); and (2) ongoing costs, including management fees, distribution and service (12b-1) fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period, April 1, 2012 and held for the six months ended September 30, 2012.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not each Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line for each share class of each Fund within the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

| | |

Annual Report | September 30, 2012 | | 17 |

| | |

RiverNorth Funds | | Disclosure of Fund Expenses |

| | September 30, 2012 (Unaudited) |

| | | | | | | | |

| | | Beginning

Account Value

04/01/2012 | | Ending

Account Value

09/30/2012 | | Expense

Ratio(a) | | Expenses Paid During Period(b) |

RiverNorth Core Opportunity Fund | | | | | | | | |

Actual | | $1,000.00 | | $1,032.60 | | 1.30% | | $6.61 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,018.50 | | 1.30% | | $6.56 |

| | | | |

RiverNorth/DoubleLine Strategic Income Fund | | | | | | | | |

Class R Shares | | | | | | | | |

Actual | | $1,000.00 | | $1,066.50 | | 1.14% | | $5.89 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,019.30 | | 1.14% | | $5.76 |

| | | | |

Class I Shares | | | | | | | | |

Actual | | $1,000.00 | | $1,067.90 | | 0.89% | | $4.60 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,020.55 | | 0.89% | | $4.50 |

| | | | |

RiverNorth/Manning & Napier Dividend Income Fund(c) | | | | | | | | |

Class R Shares | | | | | | | | |

Actual | | $1,000.00 | | $1,044.60 | | 1.60% | | $3.31 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,017.00 | | 1.60% | | $8.07 |

| | | | |

Class I Shares | | | | | | | | |

Actual | | $1,000.00 | | $1,044.40 | | 1.35% | | $2.79 |

Hypothetical (5% return before expenses) | | $1,000.00 | | $1,018.25 | | 1.35% | | $6.81 |

| (a) | Annualized, based on the Fund’s most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund’s annualized ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183), then divided by 366. Note this expense example is typically based on a six-month period. |

| (c) | Note the Actual Expense Paid During the Period is based on since inception of the Share Class on July 18, 2012. |

| | |

18 | | (888) 848-7569 | www.rivernorthfunds.com |

| | |

| RiverNorth Core Opportunity Fund | | Schedule of Investments |

| | September 30, 2012 |

| | | | | | |

| Shares/Description | | Fair Value | |

CLOSED-END FUNDS - 55.75% | | | | |

1,476,089 | | Adams Express Co. | | $ | 16,738,849 | |

136,224 | | ASA Gold and Precious Metals Ltd. | | | 3,432,845 | |

681,996 | | BlackRock Credit Allocation Income Trust II, Inc. | | | 7,870,234 | |

964,545 | | BlackRock Credit Allocation Income Trust IV, Inc. | | | 13,677,248 | |

653,052 | | Boulder Growth & Income Fund, Inc. | | | 4,277,491 | |

272,671 | | Boulder Total Return Fund, Inc.(a) | | | 4,908,078 | |

68,687 | | Calamos Convertible and High Income Fund | | | 869,577 | |

91,400 | | Calamos Global Dynamic Income Fund | | | 780,556 | |

90,000 | | Central Europe and Russia Fund, Inc. | | | 3,005,100 | |

535,437 | | Clough Global Equity Fund | | | 6,907,137 | |

1,524,908 | | Clough Global Opportunities Fund | | | 17,841,424 | |

250 | | DNP Select Income Fund, Inc. | | | 2,465 | |

515,913 | | Eaton Vance Enhanced Equity Income Fund | | | 5,716,316 | |

1,153,841 | | Eaton Vance Risk-Managed Diversified Equity Income Fund | | | 12,149,946 | |

129,076 | | Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund | | | 2,553,123 | |

680,231 | | Eaton Vance Tax-Managed Buy-Write Opportunities Fund | | | 8,849,805 | |

1,542,710 | | Eaton Vance Tax-Managed Diversified Equity Income Fund | | | 14,671,172 | |

1,794,249 | | Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund | | | 19,916,164 | |

3,458,853 | | Eaton Vance Tax-Managed Global Diversified Equity Income Fund | | | 30,472,495 | |

462,315 | | Gabelli Dividend & Income Trust | | | 7,836,239 | |

408,250 | | General American Investors Co., Inc. | | | 11,863,745 | |

4,711,791 | | Liberty All Star® Equity Fund | | | 22,757,951 | |

473,714 | | Macquarie Global Infrastructure Total Return Fund, Inc. | | | 9,071,623 | |

1,782,824 | | Nuveen Credit Strategies Income Fund | | | 17,329,049 | |

44,739 | | Nuveen Energy MLP Total Return Fund | | | 843,330 | |

4,413 | | Nuveen Preferred Income Opportunities Fund | | | 43,512 | |

266,792 | | PIMCO Income Strategy Fund II | | | 3,046,765 | |

494,019 | | Royce Focus Trust, Inc. | | | 3,319,808 | |

1,717,633 | | Royce Value Trust, Inc. | | | 22,449,463 | |

718,998 | | TCW Strategic Income Fund, Inc. | | | 4,105,479 | |

120,142 | | Templeton Emerging Markets Fund | | | 2,213,016 | |

151,568 | | The Greater China Fund, Inc. | | | 1,727,875 | |

65,900 | | The New Germany Fund, Inc. | | | 958,792 | |

386,402 | | The Thai Fund, Inc. | | | 6,789,083 | |

1,022,496 | | Tri-Continental Corp. | | | 16,584,885 | |

933,097 | | Zweig Total Return Fund, Inc. | | | 11,813,008 | |

| | | | | | |

| |

TOTAL CLOSED-END FUNDS | | | | |

(Cost $268,396,402) | | | 317,393,648 | |

| | | | | | |

| |

MUTUAL FUNDS - 3.84% | | | | |

533,820 | | Calamos Convertible Fund - Class A | | | 9,571,400 | |

| | |

See Notes to Financial Statements. | | |

Annual Report | September 30, 2012 | | 19 |

| | |

| RiverNorth Core Opportunity Fund | | Schedule of Investments |

| | September 30, 2012 |

| | | | | | |

| Shares/Description | | Fair Value | |

1,111,161 | | Eaton Vance Floating-Rate Advantaged Fund | | $ | 12,267,214 | |

| | | | | | |

| |

TOTAL MUTUAL FUNDS (Cost $15,430,785) | | | 21,838,614 | |

| | | | | | |

| |

EXCHANGE-TRADED FUNDS - 14.81% | | | | |

88,563 | | Guggenheim Russell Top 50 Mega Cap ETF | | | 9,493,953 | |

176,839 | | iShares® MSCI Emerging Markets Index Fund | | | 7,307,872 | |

447,980 | | iShares® S&P 100® Index Fund | | | 29,772,751 | |

334,568 | | Powershares FTSE RAFI US 1000 Portfolio | | | 20,589,315 | |

111,000 | | SPDR® Barclays Capital Convertible Securities ETF | | | 4,393,380 | |

100,000 | | Vanguard® MSCI EAFE ETF | | | 3,288,000 | |

153,000 | | Vanguard® MSCI Emerging Markets ETF | | | 6,383,160 | |

58,957 | | WisdomTree Emerging Markets Local Debt Fund | | | 3,084,041 | |

| | | | | | |

| |

TOTAL EXCHANGE-TRADED FUNDS (Cost $71,367,614) | | | 84,312,472 | |

| | | | | | |

| |

HOLDING & INVESTMENT MANAGEMENT COMPANIES - 0.26% | | | | |

12,100 | | Affiliated Managers Group, Inc.(a) | | | 1,488,300 | |

| | | | | | |

| |

TOTAL HOLDING & INVESTMENT MANAGEMENT COMPANIES (Cost $634,253) | | | 1,488,300 | |

| | | | | | |

| |

PREFERRED STOCKS - 0.70% | | | | |

64,103 | | General American Investors Co., Inc., Series B, 5.950% | | | 1,667,319 | |

92,500 | | Kayne Anderson MLP Investment Co., Series D, 4.950% | | | 2,344,875 | |

| | | | | | |

| |

TOTAL PREFERRED STOCKS (Cost $3,825,799) | | | 4,012,194 | |

| | | | | | |

| | | | | | |

TOTAL INVESTMENTS - 75.36% (Cost $359,654,853) | | | 429,045,228 | |

CASH - 24.00% | | | 136,665,713 | |

OTHER ASSETS IN EXCESS OF LIABILITIES - 0.63% | | | 3,612,861 | |

| | | | | | |

NET ASSETS - 100.00% | | $ | 569,323,802 | |

| | | | | | |

| (a) | Non-income producing security. |

| | |

See Notes to Financial Statements. | | |

20 | | (888) 848-7569 | www.rivernorthfunds.com |

| | |

RiverNorth Core Opportunity Fund | | Schedule of Investments |

| | September 30, 2012 |

Common Abbreviations:

EAFE - Europe, Australia, and Far East.

FTSE - Financial Times Stock Exchange.

ETF - Exchange Traded Fund.

Ltd. - Limited.

MLP – Master Limited Partnership.

MSCI – Morgan Stanley Capital International.

RAFI - Research Affiliates Fundamental Index.

S&P – Standard & Poor’s.

SPDR – Standard & Poor’s Depository Receipts.

| | |

See Notes to Financial Statements. | | |

Annual Report | September 30, 2012 | | 21 |

| | |

RiverNorth/DoubleLine Strategic Income Fund | | Schedule of Investments |

| | September 30, 2012 |

| | | | | | |

| Shares/Description | | Fair Value | |

CLOSED-END FUNDS - 15.28% | | | | |

255,141 | | Advent Claymore Convertible Securities and Income Fund | | $ | 4,202,172 | |

543,636 | | Advent Claymore Convertible Securities and Income Fund II | | | 3,658,670 | |

398,296 | | Advent Claymore Enhanced Growth & Income Fund | | | 3,839,574 | |

3,035,157 | | AllianceBernstein Income Fund, Inc. | | | 26,223,757 | |

273,671 | | BlackRock Credit Allocation Income Trust I, Inc. | | | 2,909,123 | |

526,495 | | BlackRock Credit Allocation Income Trust II, Inc. | | | 6,075,752 | |

544,912 | | BlackRock Credit Allocation Income Trust III, Inc. | | | 6,598,884 | |

572,279 | | BlackRock Credit Allocation Income Trust IV, Inc. | | | 8,114,916 | |

222,822 | | BlackRock Diversified Income Strategies Fund, Inc. | | | 2,404,249 | |

161,042 | | BlackRock Income Trust, Inc. | | | 1,236,803 | |

418,191 | | Calamos Convertible and High Income Fund | | | 5,294,298 | |

210,828 | | DWS Global High Income Fund, Inc. | | | 1,856,678 | |

35,325 | | Eaton Vance Short Duration Diversified Income Fund | | | 622,427 | |

281,765 | | Federated Enhanced Treasury Income Fund | | | 4,023,604 | |

59,883 | | Global Income & Currency Fund, Inc. | | | 816,205 | |

174,771 | | Helios Strategic Income Fund, Inc. | | | 1,113,361 | |

698,784 | | ING Prime Rate Trust | | | 4,325,473 | |

699,762 | | Invesco Van Kampen Dynamic Credit Opportunities Fund | | | 8,872,982 | |

1,411,009 | | Invesco Van Kampen Senior Income Trust | | | 7,069,155 | |

198,622 | | Legg Mason BW Global Income Opportunities Fund, Inc. | | | 3,944,633 | |

296,684 | | Montgomery Street Income Securities, Inc. | | | 5,037,694 | |

302,231 | | Morgan Stanley Emerging Markets Debt Fund, Inc. | | | 3,641,884 | |

463,451 | | Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. | | | 7,633,038 | |

977,673 | | NexPoint Credit Strategies Fund | | | 6,755,720 | |

182,063 | | Nuveen Build America Bond Opportunity Fund | | | 4,014,489 | |

1,480,229 | | Nuveen Credit Strategies Income Fund | | | 14,387,826 | |

901,356 | | Nuveen Multi-Currency Short-Term Government Income Fund | | | 11,897,899 | |

533,436 | | Nuveen Preferred Income Opportunities Fund | | | 5,259,679 | |

416,772 | | PIMCO Dynamic Income Fund | | | 11,765,487 | |

52,201 | | PIMCO Income Strategy Fund | | | 690,619 | |

195,482 | | PIMCO Income Strategy Fund II | | | 2,232,404 | |

254,406 | | Putnam Master Intermediate Income Trust | | | 1,317,823 | |

350,781 | | The GDL Fund | | | 4,142,724 | |

12,063 | | Virtus Global Multi-Sector Income Fund | | | 230,162 | |

641,431 | | Wells Fargo Advantage Multi-Sector Income Fund | | | 10,461,740 | |

152,398 | | Western Asset Inflation Management Fund, Inc. | | | 2,898,183 | |

510,757 | | Western Asset/Claymore Inflation-Linked Opportunities & Income Fund | | | 6,869,682 | |

86,822 | | Western Asset/Claymore Inflation-Linked Securities & Income Fund | | | 1,152,128 | |

| | | | | | |

| |

TOTAL CLOSED-END FUNDS (Cost $185,601,781) | | | 203,591,897 | |

| | | | | | |

| | |

See Notes to Financial Statements. | | |

22 | | (888) 848-7569 | www.rivernorthfunds.com |

| | |

RiverNorth/DoubleLine Strategic Income Fund | | Schedule of Investments |

| | September 30, 2012 |

| | | | | | | | | | | | |

| Shares /Description | | | | | | | Fair Value | |

PREFERRED STOCKS - 1.44% | | | | | | | | | | |

80,225 | | Apollo Commercial Real Estate Finance, Inc., 8.625% | | | | | | | | $ | 2,053,760 | |

3,909 | | General American Investors Co., Inc., Series B, 5.950% | | | | | | | | | 101,673 | |

383,767 | | Kayne Anderson MLP Investment Co., 4.250% | | | | | | | | | 9,690,117 | |

76,371 | | The GDL Fund, Series B, 7.000%(a) | | | | | | | | | 3,852,917 | |

334,415 | | Tortoise Energy Capital Corp., 3.950% | | | | | | | | | 3,411,033 | |

| | | | | | | | | | | | |

| | | |

TOTAL PREFERRED STOCKS (Cost $19,064,085) | | | | | | | | | 19,109,500 | |

| | | | | | | | | | | | |

| | | |

| Principal Amount/Description | | Rate | | | Maturity | | Fair Value | |

FOREIGN CORPORATE BONDS - 5.88% | | | | | | | | | | |

Australia - 0.25% | | | | | | | | | | |

$2,400,000 | | Australia & New Zealand Banking Group Ltd.(b) | | | 4.88 | % | | 01/12/2021 | | | 2,764,344 | |

555,000 | | PTTEP Australia International Finance Pty. Ltd.(c) | | | 4.15 | % | | 07/19/2015 | | | 587,597 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,351,941 | |

| | | | | | | | | | | | |

| | | |

Bermuda - 0.16% | | | | | | | | | | |

600,000 | | Inkia Energy Ltd.(c) | | | 8.38 | % | | 04/04/2021 | | | 660,000 | |

1,400,000 | | Qtel International Finance Ltd.(c) | | | 3.38 | % | | 10/14/2016 | | | 1,468,600 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,128,600 | |

| | | | | | | | | | | | |

| | | |

Brazil - 0.47% | | | | | | | | | | |

1,000,000 | | Banco Bradesco SA(b) | | | 5.75 | % | | 03/01/2022 | | | 1,067,500 | |

1,200,000 | | Banco do Brasil SA(a)(c)(d) | | | 8.50 | % | | Perpetual Maturity | | | 1,432,560 | |

400,000 | | Globo Comunicacao e Participacoes SA(b)(e) | | | 5.31 | % | | 05/11/2022 | | | 439,000 | |

1,400,000 | | Globo Comunicacao e Participacoes SA(c)(e) | | | 6.25 | % | | 07/20/2049 | | | 1,526,000 | |

1,400,000 | | Itau Unibanco Holding SA(c) | | | 5.65 | % | | 03/19/2022 | | | 1,470,000 | |

300,000 | | NET Servicos de Comunicacao SA | | | 7.50 | % | | 01/27/2020 | | | 349,875 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 6,284,935 | |

| | | | | | | | | | | | |

| | | |

British Virgin Islands - 0.11% | | | | | | | | | | |

100,000 | | C10 Capital SPV Ltd.(a)(c)(d) | | | 6.72 | % | | Perpetual Maturity | | | 71,500 | |

700,000 | | CNPC General Capital Ltd.(c) | | | 2.75 | % | | 04/19/2017 | | | 725,722 | |

600,000 | | Hongkong Electric Finance Ltd. | | | 4.25 | % | | 12/14/2020 | | | 659,320 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,456,542 | |

| | | | | | | | | | | | |

| | | |

Canada - 0.44% | | | | | | | | | | |

2,875,000 | | Bank of Montreal | | | 1.40 | % | | 09/11/2017 | | | 2,893,932 | |

840,000 | | Pacific Rubiales Energy Corp.(b) | | | 7.25 | % | | 12/12/2021 | | | 991,200 | |

600,000 | | Pacific Rubiales Energy Corp.(c) | | | 7.25 | % | | 12/12/2021 | | | 708,000 | |

| | |

See Notes to Financial Statements. | | |

Annual Report | September 30, 2012 | | 23 |

| | |

RiverNorth/DoubleLine Strategic Income Fund | | Schedule of Investments |

| | September 30, 2012 |

| | | | | | | | | | |

| Principal Amount/Description | | Rate | | Maturity | | Fair Value | |

$1,350,000 | | Teck Resources Ltd. | | 5.40% | | 02/01/2043 | | $ | 1,323,661 | |

| | | | | | | | | | |

| | | | | | | | | 5,916,793 | |

| | | | | | | | | | |

| | | |

Cayman Islands - 0.55% | | | | | | | | |

200,000 | | AES Andres Dominicana Ltd.(c) | | 9.50% | | 11/12/2020 | | | 218,000 | |

500,000 | | AES Andres Dominicana Ltd. / Itabo Dominicana Ltd(b) | | 9.50% | | 11/12/2020 | | | 545,000 | |

900,000 | | EGE Haina Finance Co.(c) | | 9.50% | | 04/26/2017 | | | 949,500 | |

500,000 | | Embraer Overseas Ltd. | | 6.38% | | 01/24/2017 | | | 570,000 | |

500,000 | | Embraer Overseas Ltd. | | 6.38% | | 01/15/2020 | | | 577,500 | |

200,000 | | Grupo Aval Ltd.(b) | | 5.25% | | 02/01/2017 | | | 213,500 | |

300,000 | | Grupo Aval Ltd.(b) | | 4.75% | | 09/26/2022 | | | 296,250 | |

410,087 | | IIRSA Norte Finance Ltd.(c) | | 8.75% | | 05/30/2024 | | | 508,508 | |

250,000 | | Intercorp Retail Trust(b) | | 8.88% | | 11/14/2018 | | | 278,750 | |

1,100,000 | | Raizen Fuels Finance Ltd.(c) | | 9.50% | | 08/15/2014 | | | 1,241,625 | |

1,150,000 | | Transocean, Inc. | | 6.00% | | 03/15/2018 | | | 1,344,799 | |

600,000 | | Virgolino de Oliveira Finance Ltd.(b) | | 11.75% | | 02/09/2022 | | | 600,000 | |

| | | | | | | | | | |

| | | | | | | | | 7,343,432 | |

| | | | | | | | | | |

| | | |

Chile - 0.48% | | | | | | | | |

400,000 | | AES Gener SA | | 7.50% | | 03/25/2014 | | | 432,961 | |

200,000 | | Banco de Chile(c) | | 6.25% | | 06/15/2016 | | | 223,911 | |

1,600,000 | | Banco de Credito e Inversiones(b) | | 3.00% | | 09/13/2017 | | | 1,602,013 | |

1,110,000 | | Celulosa Arauco y Constitucion SA(c) | | 4.75% | | 01/11/2022 | | | 1,164,886 | |

200,000 | | Corp. Nacional del Cobre de Chile(c) | | 4.75% | | 10/15/2014 | | | 214,134 | |

1,200,000 | | Corp. Nacional del Cobre de Chile(c) | | 3.88% | | 11/03/2021 | | | 1,310,113 | |

200,000 | | Inversiones CMPC SA(b) | | 4.75% | | 01/19/2018 | | | 215,204 | |

500,000 | | Inversiones CMPC SA(b) | | 4.50% | | 04/25/2022 | | | 521,907 | |

100,000 | | Inversiones CMPC SA(c) | | 4.75% | | 01/19/2018 | | | 107,577 | |

500,000 | | Inversiones CMPC SA(c) | | 6.13% | | 11/05/2019 | | | 576,237 | |

| | | | | | | | | | |

| | | | | | | | | 6,368,943 | |

| | | | | | | | | | |

| | | |

China - 0.04% | | | | | | | | |

500,000 | | CNPC General Capital Ltd.(b) | | 3.95% | | 04/19/2022 | | | 534,491 | |

| | | | | | | | | | |

| | | | | | | | | 534,491 | |

| | | | | | | | | | |

| | | |

Colombia - 0.05% | | | | | | | | |

200,000 | | Banco de Bogota SA(b) | | 5.00% | | 01/15/2017 | | | 212,000 | |

400,000 | | Transportadora de Gas Internacional SA ESP(c) | | 5.70% | | 03/20/2022 | | | 432,000 | |

| | | | | | | | | | |

| | | | | | | | | 644,000 | |

| | | | | | | | | | |

| | | |

Costa Rica - 0.12% | | | | | | | | |

800,000 | | Instit Costa de Electric(b) | | 6.95% | | 11/10/2021 | | | 892,000 | |

600,000 | | Instit Costa de Electric(c) | | 6.95% | | 11/10/2021 | | | 669,000 | |

| | | | | | | | | | |

| | | | | | | | | 1,561,000 | |

| | | | | | | | | | |

| | |

See Notes to Financial Statements. | | |

24 | | (888) 848-7569 | www.rivernorthfunds.com |

| | |

RiverNorth/DoubleLine Strategic Income Fund | | Schedule of Investments |

| | September 30, 2012 |

| | | | | | | | | | |

| Principal Amount/Description | | Rate | | Maturity | | Fair Value | |

Cyprus - 0.08% | | | | | | | | |

$1,000,000 | | Alfa MTN Invest Ltd.(c) | | 9.25% | | 06/24/2013 | | $ | 1,047,500 | |

| | | | | | | | | | |

| | | | | | | | | 1,047,500 | |

| | | | | | | | | | |

| | | |

France - 0.12% | | | | | | | | |

1,450,000 | | France Telecom SA | | 2.75% | | 09/14/2016 | | | 1,523,083 | |

| | | | | | | | | | |

| | | | | | | | | 1,523,083 | |

| | | | | | | | | | |

| | | |

Great Britain - 0.38% | | | | | | | | |

1,303,000 | | BP Capital Markets PLC | | 4.75% | | 03/10/2019 | | | 1,513,565 | |

2,263,000 | | British Telecommunications PLC | | 5.95% | | 01/15/2018 | | | 2,713,755 | |

850,000 | | Diageo Capital PLC | | 1.50% | | 05/11/2017 | | | 865,918 | |

| | | | | | | | | | |

| | | | | | | | | 5,093,238 | |

| | | | | | | | | | |

| | | |

India - 0.04% | | | | | | | | |

500,000 | | Reliance Holdings USA, Inc.(b) | | 5.40% | | 02/14/2022 | | | 533,694 | |

| | | | | | | | | | |

| | | | | | | | | 533,694 | |

| | | | | | | | | | |

| | | |

Ireland - 0.06% | | | | | | | | |

700,000 | | AK Transneft OJSC Via TransCapitalInvest Ltd.(c) | | 5.67% | | 03/05/2014 | | | 744,100 | |

| | | | | | | | | | |

| | | | | | | | | 744,100 | |

| | | | | | | | | | |

| | | |

Isle Of Man - 0.05% | | | | | | | | |

700,000 | | AngloGold Ashanti Holdings PLC | | 5.13% | | 08/01/2022 | | | 714,364 | |

| | | | | | | | | | |

| | | | | | | | | 714,364 | |

| | | | | | | | | | |

| | | |

Kazakhstan - 0.00%(f) | | | | | | | | |

60,000 | | BTA Bank JSC(c)(e)(g) | | 10.75% | | 07/01/2018 | | | 11,700 | |

| | | | | | | | | | |

| | | | | | | | | 11,700 | |

| | | | | | | | | | |

| | | |

Luxembourg - 0.23% | | | | | | | | |

100,000 | | Bank of Moscow OJSC Via Kuznetski Capital(a) | | 5.97% | | 11/25/2015 | | | 103,600 | |

960,000 | | Covidien International Finance SA | | 2.80% | | 06/15/2015 | | | 1,010,833 | |

850,000 | | Covidien International Finance SA | | 6.00% | | 10/15/2017 | | | 1,046,268 | |

500,000 | | Minerva Luxembourg SA(b) | | 12.25% | | 02/10/2022 | | | 579,350 | |

286,182 | | Tengizchevoil Finance Co. SARL(c) | | 6.12% | | 11/15/2014 | | | 301,206 | |

| | | | | | | | | | |

| | | | | | | | | 3,041,257 | |

| | | | | | | | | | |

| | | |

Marshall Islands - 0.04% | | | | | | | | |

479,844 | | Nakilat, Inc.(c) | | 6.27% | | 12/31/2033 | | | 570,175 | |

| | | | | | | | | | |

| | | | | | | | | 570,175 | |

| | | | | | | | | | |

| | | |

Mexico - 0.41% | | | | | | | | |

700,000 | | Banco Mercantil del Norte SA(c) | | 4.38% | | 07/19/2015 | | | 745,500 | |

700,000 | | Banco Mercantil del Norte SA(a)(c) | | 6.86% | | 10/13/2021 | | | 761,250 | |

150,000 | | Empresas ICA SAB de CV(b) | | 8.38% | | 07/24/2017 | | | 156,750 | |

600,000 | | Empresas ICA SAB de CV(c) | | 8.90% | | 02/04/2021 | | | 633,000 | |

500,000 | | Gruma SAB de CV(c)(d) | | 7.75% | | Perpetual

Maturity | | | 513,750 | |

940,000 | | Grupo KUO SAB De CV(c) | | 9.75% | | 10/17/2017 | | | 1,005,800 | |

| | |

See Notes to Financial Statements. | | |

Annual Report | September 30, 2012 | | 25 |

| | |

RiverNorth/DoubleLine Strategic Income Fund | | Schedule of Investments |

| | September 30, 2012 |

| | | | | | | | | | |

| Principal Amount/Description | | Rate | | Maturity | | Fair Value | |

$100,000 | | Ixe Banco SA(c) | | 9.25% | | 10/14/2020 | | $ | 119,000 | |

1,000,000 | | Mexichem SAB de CV(b) | | 4.88% | | 09/19/2022 | | | 1,017,500 | |

500,000 | | Telefonos de Mexico SAB de CV | | 5.50% | | 01/27/2015 | | | 554,234 | |

| | | | | | | | | | |

| | | | | | | | | 5,506,784 | |

| | | | | | | | | | |

| | | |

Myanmar - 0.11% | | | | | | | | |

650,000 | | Axiata SPV1 Labuan Ltd. | | 5.38% | | 04/28/2020 | | | 731,892 | |

200,000 | | IOI Ventures L Bhd | | 5.25% | | 03/16/2015 | | | 213,247 | |

500,000 | | Penerbangan Malaysia Bhd(c) | | 5.63% | | 03/15/2016 | | | 566,519 | |

| | | | | | | | | | |

| | | | | | | | | 1,511,658 | |

| | | | | | | | | | |

| | | |

Netherlands - 0.14% | | | | | | | | |

266,000 | | Deutsche Telekom International Finance BV | | 8.75% | | 06/15/2030 | | | 401,498 | |

647,000 | | Koninklijke KPN NV | | 8.38% | | 10/01/2030 | | | 868,344 | |

700,000 | | WPE International Cooperatief UA(c) | | 10.38% | | 09/30/2020 | | | 602,000 | |

| | | | | | | | | | |

| | | | | | | | | 1,871,842 | |

| | | | | | | | | | |

| | | |

Norway - 0.04% | | | | | | | | |

500,000 | | Corp. Pesquera Inca SAC(c) | | 9.00% | | 02/10/2017 | | | 542,500 | |

| | | | | | | | | | |

| | | | | | | | | 542,500 | |

| | | | | | | | | | |

| | | |

Panama - 0.06% | | | | | | | | |

800,000 | | Banco Latinoamericano de Comercio Exterior SA(b) | | 3.75% | | 04/04/2017 | | | 832,000 | |

| | | | | | | | | | |

| | | | | | | | | 832,000 | |

| | | | | | | | | | |

| | | |

Peru - 0.05% | | | | | | | | |

190,000 | | Banco de Credito del Peru(c) | | 4.75% | | 03/16/2016 | | | 201,400 | |

100,000 | | Banco de Credito del Peru(a)(c) | | 9.75% | | 11/06/2069 | | | 121,000 | |

100,000 | | Banco Internacional del Peru SAA(a)(c) | | 8.50% | | 04/23/2070 | | | 106,000 | |

200,000 | | Corp. Lindley SA(b) | | 6.75% | | 11/23/2021 | | | 225,500 | |

| | | | | | | | | | |

| | | | | | | | | 653,900 | |

| | | | | | | | | | |

| | | |

Qatar - 0.12% | | | | | | | | |

839,800 | | Ras Laffan Liquefied Natural Gas Co. Ltd. II(c) | | 5.30% | | 09/30/2020 | | | 948,974 | |

500,000 | | Ras Laffan Liquefied Natural Gas Co. Ltd. III(c) | | 5.84% | | 09/30/2027 | | | 582,500 | |

| | | | | | | | | | |

| | | | | | | | | 1,531,474 | |

| | | | | | | | | | |

| | | |

Russia - 0.40% | | | | | | | | |

1,100,000 | | Gazprom OAO Via Gaz Capital SA(c) | | 8.13% | | 07/31/2014 | | | 1,216,061 | |

1,250,000 | | Gazprombank OJSC Via GPB Eurobond Finance PLC | | 7.93% | | 06/28/2013 | | | 1,309,375 | |

400,000 | | Industry & Construction Bank St. Petersburg OJSC Via Or-ICB for Industry(a) | | 5.01% | | 09/29/2015 | | | 400,000 | |

500,000 | | Russian Agricultural Bank OJSC Via RSHB Capital SA(c) | | 7.13% | | 01/14/2014 | | | 530,300 | |

| | |

See Notes to Financial Statements. | | |

26 | | (888) 848-7569 | www.rivernorthfunds.com |

| | |

RiverNorth/DoubleLine Strategic Income Fund | | Schedule of Investments |

| | September 30, 2012 |

| | | | | | | | | | |

| Principal Amount/Description | | Rate | | Maturity | | Fair Value | |

$750,000 | | Vimpel Communications Via VIP Finance Ireland Ltd. OJSC(c) | | 8.38% | | 04/30/2013 | | $ | 778,493 | |

1,000,000 | | VTB Bank OJSC Via VTB Capital SA(c) | | 6.88% | | 05/29/2018 | | | 1,078,800 | |

| | | | | | | | | | |

| | | | | | | | | 5,313,029 | |

| | | | | | | | | | |

| | | |

Singapore - 0.30% | | | | | | | | |

1,400,000 | | DBS Bank Ltd.(a)(c) | | 5.00% | | 11/15/2019 | | | 1,485,897 | |

1,600,000 | | Oversea-Chinese Banking Corp. Ltd.(a) | | 4.25% | | 11/18/2019 | | | 1,667,525 | |

800,000 | | United Overseas Bank Ltd.(a)(c) | | 5.38% | | 09/03/2019 | | | 849,556 | |

| | | | | | | | | | |

| | | | | | | | | 4,002,978 | |

| | | | | | | | | | |

| | | |

South Africa - 0.05% | | | | | | | | |

200,000 | | Transnet SOC Ltd.(b) | | 4.00% | | 07/26/2022 | | | 203,800 | |

400,000 | | Transnet SOC Ltd.(c) | | 4.50% | | 02/10/2016 | | | 425,206 | |

| | | | | | | | | | |

| | | | | | | | | 629,006 | |

| | | | | | | | | | |

| | | |

South Korea - 0.32% | | | | | | | | |

800,000 | | POSCO(b) | | 4.25% | | 10/28/2020 | | | 852,915 | |

650,000 | | POSCO(b) | | 5.25% | | 04/14/2021 | | | 743,097 | |

2,500,000 | | The Korea Development Bank | | 4.38% | | 08/10/2015 | | | 2,714,518 | |

| | | | | | | | | | |

| | | | | | | | | 4,310,530 | |

| | | | | | | | | | |

| | | |

United Arab Emirates - 0.21% | | | | | | | | |

200,000 | | Abu Dhabi National Energy Co.(b) | | 5.88% | | 12/13/2021 | | | 232,250 | |

200,000 | | Abu Dhabi National Energy Co.(c) | | 4.75% | | 09/15/2014 | | | 211,750 | |

1,000,000 | | Abu Dhabi National Energy Co.(c) | | 5.88% | | 12/13/2021 | | | 1,161,250 | |

400,000 | | Dolphin Energy Ltd.(b) | | 5.50% | | 12/15/2021 | | | 463,600 | |

640,320 | | Dolphin Energy Ltd.(c) | | 5.89% | | 06/15/2019 | | | 728,364 | |

| | | | | | | | | | |

| | | | | | | | | 2,797,214 | |

| | | | | | | | | | |

| | | |

TOTAL FOREIGN CORPORATE BONDS (Cost $75,591,272) | | | | | | | 78,372,703 | |

| | | | | | | | | | |

| | | |

| U.S. CORPORATE BONDS - 8.27% | | | | | | | | |

1,325,000 | | Alcoa, Inc. | | 6.15% | | 08/15/2020 | | | 1,464,806 | |

2,700,000 | | Altria Group, Inc. | | 2.85% | | 08/09/2022 | | | 2,700,173 | |

2,750,000 | | American Express Credit Corp. | | 2.75% | | 09/15/2015 | | | 2,899,174 | |

1,450,000 | | Arrow Electronics, Inc. | | 3.38% | | 11/01/2015 | | | 1,515,269 | |

1,050,000 | | AT&T, Inc. | | 5.35% | | 09/01/2040 | | | 1,270,336 | |

2,100,000 | | BB&T Corp. | | 1.60% | | 08/15/2017 | | | 2,140,679 | |

1,645,000 | | Becton Dickinson and Co. | | 3.13% | | 11/08/2021 | | | 1,765,736 | |

1,667,000 | | Biogen Idec, Inc. | | 6.88% | | 03/01/2018 | | | 2,053,669 | |

300,000 | | Boston Properties LP | | 5.63% | | 11/15/2020 | | | 357,802 | |

875,000 | | Boston Properties LP | | 4.13% | | 05/15/2021 | | | 950,341 | |

400,000 | | Boston Properties LP | | 3.85% | | 02/01/2023 | | | 422,279 | |

1,350,000 | | Celgene Corp. | | 3.25% | | 08/15/2022 | | | 1,366,026 | |

250,000 | | Cemex Finance LLC(c) | | 9.50% | | 12/14/2016 | | | 260,000 | |

| | |

See Notes to Financial Statements. | | |

Annual Report | September 30, 2012 | | 27 |

| | |

RiverNorth/DoubleLine Strategic Income Fund | | Schedule of Investments |

| | September 30, 2012 |

| | | | | | | | | | |

| Principal Amount/Description | | Rate | | Maturity | | Fair Value | |

$1,150,000 | | Citigroup, Inc. | | 6.00% | | 12/13/2013 | | $ | 1,220,061 | |

950,000 | | ConocoPhillips | | 6.50% | | 02/01/2039 | | | 1,373,776 | |

100,000 | | Daimler Finance North America LLC | | 6.50% | | 11/15/2013 | | | 106,485 | |

2,000,000 | | Daimler Finance North America LLC(b) | | 1.88% | | 09/15/2014 | | | 2,032,112 | |

965,000 | | Devon Energy Corp. | | 6.30% | | 01/15/2019 | | | 1,199,867 | |

1,603,000 | | Devon Energy Corp. | | 4.00% | | 07/15/2021 | | | 1,766,139 | |

1,350,000 | | DIRECTV Holdings LLC / DIRECTV Financing Co., Inc. | | 5.00% | | 03/01/2021 | | | 1,515,324 | |

1,550,000 | | Duke Energy Corp. | | 3.55% | | 09/15/2021 | | | 1,652,970 | |

1,400,000 | | Eastman Chemical Co. | | 2.40% | | 06/01/2017 | | | 1,464,110 | |

1,305,000 | | Ecolab, Inc. | | 2.38% | | 12/08/2014 | | | 1,354,205 | |

1,350,000 | | Express Scripts Holding Co.(b) | | 2.10% | | 02/12/2015 | | | 1,385,699 | |

2,175,000 | | Ford Motor Co. | | 7.45% | | 07/16/2031 | | | 2,716,031 | |

800,000 | | Freeport-McMoRan Copper & Gold, Inc. | | 2.15% | | 03/01/2017 | | | 810,048 | |

2,750,000 | | General Electric Capital Corp. | | 2.90% | | 01/09/2017 | | | 2,912,957 | |

1,436,000 | | General Mills, Inc. | | 3.15% | | 12/15/2021 | | | 1,497,647 | |

675,000 | | Halliburton Co. | | 6.15% | | 09/15/2019 | | | 842,846 | |

900,000 | | Illinois Tool Works, Inc. | | 3.38% | | 09/15/2021 | | | 969,611 | |

1,250,000 | | Intel Corp. | | 3.30% | | 10/01/2021 | | | 1,360,691 | |

1,400,000 | | International Business Machines Corp. | | 1.95% | | 07/22/2016 | | | 1,463,830 | |

1,850,000 | | JP Morgan Chase & Co. | | 4.95% | | 03/25/2020 | | | 2,116,801 | |

700,000 | | JP Morgan Chase & Co. | | 4.50% | | 01/24/2022 | | | 778,148 | |

900,000 | | Kellogg Co. | | 7.45% | | 04/01/2031 | | | 1,261,566 | |

1,600,000 | | Kinder Morgan Energy Partners LP | | 6.95% | | 01/15/2038 | | | 2,054,946 | |

1,089,000 | | Kraft Foods, Inc. | | 5.38% | | 02/10/2020 | | | 1,316,024 | |

1,500,000 | | Liberty Mutual Group, Inc.(b) | | 6.50% | | 05/01/2042 | | | 1,631,146 | |

1,243,000 | | Marathon Petroleum Corp. | | 5.13% | | 03/01/2021 | | | 1,437,137 | |

1,250,000 | | Mattel, Inc. | | 2.50% | | 11/01/2016 | | | 1,307,754 | |

825,000 | | MetLife, Inc. | | 6.38% | | 06/15/2034 | | | 1,081,197 | |

250,000 | | MetLife, Inc. | | 5.70% | | 06/15/2035 | | | 308,587 | |

350,000 | | MidAmerican Energy Holdings Co. | | 5.95% | | 05/15/2037 | | | 440,698 | |

1,499,000 | | MidAmerican Energy Holdings Co. | | 6.50% | | 09/15/2037 | | | 2,016,612 | |

1,615,000 | | Motorola Solutions, Inc. | | 6.00% | | 11/15/2017 | | | 1,930,091 | |

2,514,000 | | National Rural Utilities Cooperative Finance Corp. | | 10.38% | | 11/01/2018 | | | 3,725,600 | |

525,000 | | News America, Inc. | | 6.65% | | 11/15/2037 | | | 669,191 | |

1,250,000 | | Novartis Capital Corp. | | 4.40% | | 04/24/2020 | | | 1,476,906 | |

1,275,000 | | Omnicom Group, Inc. | | 4.45% | | 08/15/2020 | | | 1,421,718 | |

1,200,000 | | ONEOK Partners LP | | 6.13% | | 02/01/2041 | | | 1,448,342 | |

1,475,000 | | Phillips 66(b) | | 5.88% | | 05/01/2042 | | | 1,760,205 | |

150,000 | | Plains All American Pipeline LP | | 5.15% | | 06/01/2042 | | | 171,521 | |

625,000 | | PNC Funding Corp. | | 6.70% | | 06/10/2019 | | | 796,324 | |

1,300,000 | | PNC Funding Corp. | | 4.38% | | 08/11/2020 | | | 1,485,891 | |

795,000 | | Simon Property Group LP | | 5.65% | | 02/01/2020 | | | 958,213 | |

| | |

See Notes to Financial Statements. | | |

28 | | (888) 848-7569 | www.rivernorthfunds.com |

| | |