UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENTINVESTMENT COMPANIES

Investment Company Act file number: 811-21934

(Exact name of registrant as specified in charter)

325 North LaSalle Street, Suite 645

(Address of principal executive offices) (Zip code)

Marc L. Collins

325 North LaSalle Street, Suite 645

(Name and address of agent for service)

Registrant's telephone number, including area code: 312-832-1440

Date of fiscal year end: 09/30

Date of reporting period: 09/30/2015

| Item 1. | Reports to Stockholders. |

| RiverNorth Funds | Table of Contents |

| Shareholder Letter | 2 |

| Opportunistic Closed-End Fund Strategies | |

| Portfolio Update | 3 |

| RiverNorth Core Opportunity Fund | 7 |

| RiverNorth/DoubleLine Strategic Income Fund | 13 |

| RiverNorth Equity Opportunity Fund | 19 |

| RiverNorth/Oaktree High Income Fund | 23 |

| RiverNorth Funds Schedule of Investments and Financial Statements | |

| Disclosure of Fund Expenses | 28 |

| Schedule of Investments | |

| RiverNorth Core Opportunity Fund | 31 |

| RiverNorth/DoubleLine Strategic Income Fund | 36 |

| RiverNorth Equity Opportunity Fund | 69 |

| RiverNorth/Oaktree High Income Fund | 71 |

| Statement of Assets and Liabilities | |

| RiverNorth Core Opportunity Fund | 86 |

| RiverNorth/DoubleLine Strategic Income Fund | 88 |

| RiverNorth Equity Opportunity Fund | 90 |

| RiverNorth/Oaktree High Income Fund | 92 |

| Statement of Operations | |

| RiverNorth Core Opportunity Fund | 94 |

| RiverNorth/DoubleLine Strategic Income Fund | 95 |

| RiverNorth Equity Opportunity Fund | 96 |

| RiverNorth/Oaktree High Income Fund | 97 |

| Statements of Changes in Net Assets | |

| RiverNorth Core Opportunity Fund | 98 |

| RiverNorth/DoubleLine Strategic Income Fund | 100 |

| RiverNorth Equity Opportunity Fund | 102 |

| RiverNorth/Oaktree High Income Fund | 104 |

| Financial Highlights | |

| RiverNorth Core Opportunity Fund | 106 |

| RiverNorth/DoubleLine Strategic Income Fund | 110 |

| RiverNorth Equity Opportunity Fund | 114 |

| RiverNorth/Oaktree High Income Fund | 118 |

| Notes to Financial Statements | 122 |

| Report of Independent Registered Public Accounting Firm | 145 |

| Additional Information | 146 |

| Trustees & Officers | 147 |

| RiverNorth Funds | Shareholder Letter |

September 30, 2015 (Unaudited)

Dear Fellow Shareholders,

In the 2015 fiscal year, capital markets remained relatively calm and uneventful. We would argue too uneventful. Given the RiverNorth Funds are opportunistic closed-end fund trading strategies, volatility is typically a positive environment as discounts to net asset values fluctuate. Discounts, on average, steadily widened throughout the fiscal year, starting at 7.8% and ending at 9.8%. A discount level of 9.8% is wider than 95% of days dating back to 1996. Little volatility occurred during this period with the exception of late August as market technicals began to unravel. We believe uncertainty over the Federal Reserve's interest rate actions remains the primary culprit of stubbornly wide discounts. Although discount levels are as wide as levels seen in the financial crisis of 2008, they persist without volatility.

While we can't predict the future of asset class performance, we do know that closed-end funds across virtually all asset classes are trading at crisis levels without a crisis. Therefore, we are excited about the future, given the ability to own a diverse mix of asset classes at discount levels rarely seen. We believe it provides us with a margin of safety as well as the ability to generate excess return as compared to owning the same exposure at net asset value via an exchange traded fund or open-end fund.

Here's how Wikipedia describes features of an exchange traded fund ("ETF"):

An ETF combines the valuation feature of a mutual fund or unit investment trust, which can be bought or sold at the end of each trading day for its net asset value, with the tradability feature of a closed-end fund, which trades throughout the trading day at prices that may be more or less than its net asset value.

With the proliferation of ETFs and continuous asset growth, I increasingly scratch my head as closed-end fund discounts continue to widen and the fact that investors can buy the same asset class in the closed-end fund structure at a double-digit discount to net asset value. That said, I believe it can only be explained by the lack of knowledge about the sleepy closed-end fund universe….shhh…. let's keep it that way.

RiverNorth is uniquely positioned to offer our investors a diverse mix of funds running the gamut of asset classes: Equities, fixed income, credit and multi-asset, all of that currently implement their strategies by owning their respective asset classes at double digit discounts. At these discount levels, we believe the relationship of risk and return positively skews in favor of owning a greater percentage of closed-end funds. As a result, we have maintained above average closed-end fund exposure for much of fiscal year 2015. As market uncertainty and inefficiencies continue to persist, we believe RiverNorth's strategies are well positioned.

We are pleased to provide you with the 2015 Annual Report for the RiverNorth Funds. The report reviews our four opportunistic closed-end strategies: the RiverNorth Core Opportunity Fund (tickers: RNCIX and RNCOX), the RiverNorth/DoubleLine Strategic Income Fund (tickers: RNSIX and RNDLX), the RiverNorth Equity Opportunity Fund (tickers: RNDIX and RNEOX), and the RiverNorth/Oaktree High Income Fund (tickers: RNHIX and RNOTX).

Please visit www.rivernorth.com for additional information.

We thank you for your investment and trust in managing your assets.

Respectfully,

Patrick W. Galley, CFA

President and Chief Investment Officer

RiverNorth Funds

| 2 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

Closed-End Fund Market Overview and Outlook

Prepared by Portfolio Manager, Stephen O'Neill

Although the first closed-end funds were formed in the 1860s, our data provider started tracking closed-end funds in 1997. As such, when showing the "full history" of closed-end funds, we always start there. Over this period of time, the aggregate market capitalization of closed-end funds has doubled from $108 billion to $213 billion, but the number of funds is up only 21% (from 463 to 560). The history may be short, only 18 years, but this time period was packed with capital markets volatility, including two 50% bear markets in the S&P 500 Total Return Index (S&P 500), three periods where high yield bond spreads exceeded 10% (including the 20% spread hit in November 2008), two periods of Fed rate hikes and an inverted yield curve or two. And don't forget the Flash Crash, Taper Tantrum and PIIGS Sovereign Debt Crisis. With these events in mind, we believe the chart below, which shows the 30 day moving average discount for all closed-end funds, shows a market anomaly for closed-end fund valuation. Usually wide discounts coincide with market disorder, but today, closed-end fund discounts are exceptionally wide at a time when the broader capital markets are not priced for a crisis. Without exaggeration, the average discount today is roughly the same as it was the day Lehman Brothers filed for bankruptcy.

Discounts based on Morningstar, Inc. All CEF Index. Past performance is not a guarantee of future results.

The average closed-end fund discount was 9.8% on September 30, 2015. In the past 18 years, the average discount has been narrower 95% of the time. Either closed-end fund investors are presciently calling the next bear market or they have become too bearish about the future. Although we are guessing the latter is more likely, we don't need to know the answer because our mutual funds are not absolute return strategies. We do not attempt to time the markets. Instead we attempt to time closed-end fund discounts. When discounts are narrow, we own more exchange-traded funds or allocate more capital to our sub-advisers. When discounts are wide, as they are today, we gain more of our asset class exposure from cheap closed-end funds. Therefore, we are very excited about the relative opportunities in the closed-end fund market. They have rarely been more attractive.

| Annual Report | September 30, 2015 | 3 |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

Bond Funds

As of September 30, 2015, there were 355 U.S. domiciled closed-end bond funds with an aggregate market capitalization of $125.8 billion. Over the past twelve months, the market price total return for this category was -0.3% and the net asset value total return was 1.1%. The average discount on bond funds was 9.3% on September 30, 2015 versus 7.8% on September 30, 2014. Within the bond fund category, nearly one in five funds are trading at a discount greater than 15%.

Although discounts widened year over year, there was some opportunity to generate alpha from corporate action trades. There have been a number of proposed and/or approved liquidations or conversions of closed-end funds to open-end funds. For example, the AllianceBernstein Income Fund (ticker: ACG) announced a plan to convert to a newly formed open-end fund, the AB Income Fund. At the time of announcement, ACG was the second largest position in the RiverNorth/DoubleLine Strategic Income Fund. The discount has narrowed 600 basis points year over year and still trades 4.2% below net asset value (NAV).

We do not know when bond fund discounts will narrow, or mean revert, but we are working to optimize the portfolios in an attempt to own the funds with the most discount runway. For example, we have been buying the PIMCO Dynamic Credit Income Fund (ticker: PCI). The current discount is 15.5% compared to the one-year average of 10.9%. Since the fund's inception (January 2013), the NAV has returned 5.5% annualized. And the fund recently increased its monthly distribution by 5% to yield 10.8% on market price. We believe the fund's wide discount, strong performance and rising distribution will be very attractive to investors when they return to the closed-end fund market looking for yield. We would not be surprised to see the fund trading at a mid-to-high single digit discount in the intermediate future.

The market expects the Federal Reserve to raise interest rates in December 2015 or early 2016. Higher borrowing costs could impact the distribution rates for some levered closed-end bond funds. It depends on the funds' investment strategy, the shape of the yield curve and whether or not the fund has already hedged their borrowing costs. Investors have been worried about this risk for years and this helps to explain why discounts are wide. Although nobody likes to see their distributions decline, we would argue that closed-end fund investors have already priced in the risk of lower distributions. We have seen a number of funds cut distributions in 2015 and the discounts have not widened. They were already cheap enough. When rates finally rise, we could see discounts narrow because the fear of the future is worse than the pain of the past.

Equity Funds (including Hybrid Funds)

As of September 30, 2015, there were 199 U.S. domiciled closed-end equity funds with an aggregate market capitalization of $80.8 billion. Over the past twelve months, the market price total return for this category was -15.3% and the net asset value total return was -12.4%. The average discount on equity funds was 11.0% on September 30, 2015 versus 7.9% on September 30, 2014.

On the surface, the negative performance of equity closed-end funds is shockingly bad compared to the S&P 500, which was down less than 1% over the same time period. What gives? Well, equity closed-end funds are not a replacement for S&P 500 Index Funds. Most equity closed-end funds are not even benchmarked against an index that tracks diversified, large-cap US equities. For example, about twenty percent of the market value of equity closed-end funds comes from Master Limited Partnership (MLP) strategies. There are no MLPs in the S&P 500 Index. MLP funds were hammered over the past twelve months – down 44.3%. The contribution of MLP funds alone accounts for half the performance delta between equity closed-end funds and the S&P 500 over the past twelve months. We would also add that closed-end funds generally own stocks that pay high dividends, not growth equity. Therefore, when names like Amazon, Netflix, Google and Facebook are propelling the S&P 500 higher, you can expect equity closed-end funds to underperform.

| 4 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

In our mutual funds, we are benchmark aware, specifically to the S&P 500. We are not allocating our equity capital in proportion to the industry weightings in the closed-end fund market. In other words, we do not have 20% of our equity portfolios in MLP closed-end funds. That said, we do like the diversification of the equity closed-end fund market. Although we are overweight funds that do benchmark themselves against the S&P 500 or comparable indices, we also own global equity allocation, covered call and sector funds. As a result, the performance of our equity portfolios should be somewhere between the benchmark returns on large-cap US equities and the equity closed-end fund group.

Similar to bond funds, although discounts widened year over year, there was opportunity to generate alpha in equity closed-end funds from corporate action trades. For example, the LMP Real Estate Income Fund (ticker: RIT) announced a plan to convert to a newly formed open-end fund, the ClearBridge Real Estate Opportunities Fund. At the time of announcement, RiverNorth was one of the fund's largest shareholders. The discount has narrowed 700 basis points over the last 12 months and still trades 4.9% below net asset value.

In addition to corporate action trades, we have been focusing on equity funds with managed distribution policies. In a world where retail investors are favoring passive investment strategies with 0.05% management fees, a closed-end fund needs to have a healthy distribution yield to attract attention. Fund sponsors understand this market dynamic and are implementing higher distribution policies in an attempt to narrow discounts. For example, the Liberty All-Star Equity Fund (ticker: USA) recently increased the distribution policy from an annual rate of 6% to 8%, paid quarterly. Given the fund's discount of 14.0%, the market price yield was 11.0% on September 30, 2015. RiverNorth is one of the fund's largest shareholder and we are optimistic about the potential for this discount to narrow.

| Annual Report | September 30, 2015 | 5 |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

Definitions:

Flash Crash – The quick drop and recovery in securities prices that occurred shortly after 2:30pm Eastern Standard Time on May 6, 2010. Initial reports that the crash was caused by a mistyped order proved to be erroneous, and the causes of the flash crash remain unknown.

Taper Tantrum – the surge in US treasury yields (global government bond yields as well), in summer of 2013 when then-Fed Chairman Ben Bernanke put a spotlight on the wind down of Fed asset purchases (tapering off QE).

PIIGS Sovereign Debt Crisis – Due to the economic recession which started in 2008, several members of the European Union became historically known as PIIGS. These states include Portugal, Italy, Ireland, Greece and Spain and if combined together, they form the acronym PIIGS. The reason why these countries were grouped together is the substantial instability of their economies, which was an evident problem in 2009.

Performance Delta – the ratio comparing the change in the performance of one asset to another.

Covered Call Fund – A fund in which the strategy involves holding a long position in an asset and selling a call option on the same asset in an attempt to generate increased income from the asset.

Alpha – The measure of a fund's actual returns and expected performance, given its level of risk (as measured by beta).

Basis Points – one hundredth of one percent, used chiefly in expressing differences of interest rates.

| 6 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

RiverNorth Core Opportunity Fund

What is the Fund's investment strategy?

The RiverNorth Core Opportunity Fund ("the Fund") invests in a broad range of equity, fixed income and short‐term securities. To implement the Fund's tactical asset allocation, the adviser generally invests in closed‐end funds and exchange‐traded funds.

How did the RiverNorth Core Opportunity Fund perform relative to its benchmark during the reporting period?

For the twelve month period ending September 30, 2015, the Class I share (symbol: RNCIX) returned -7.50% and the Class R share (symbol: RNCOX) returned -7.67%. The unmanaged Blend Index returned 0.95% during the same period. The Blend Index consists of 60% S&P 500 and 40% Barclays Capital U.S. Aggregate Bond Index.

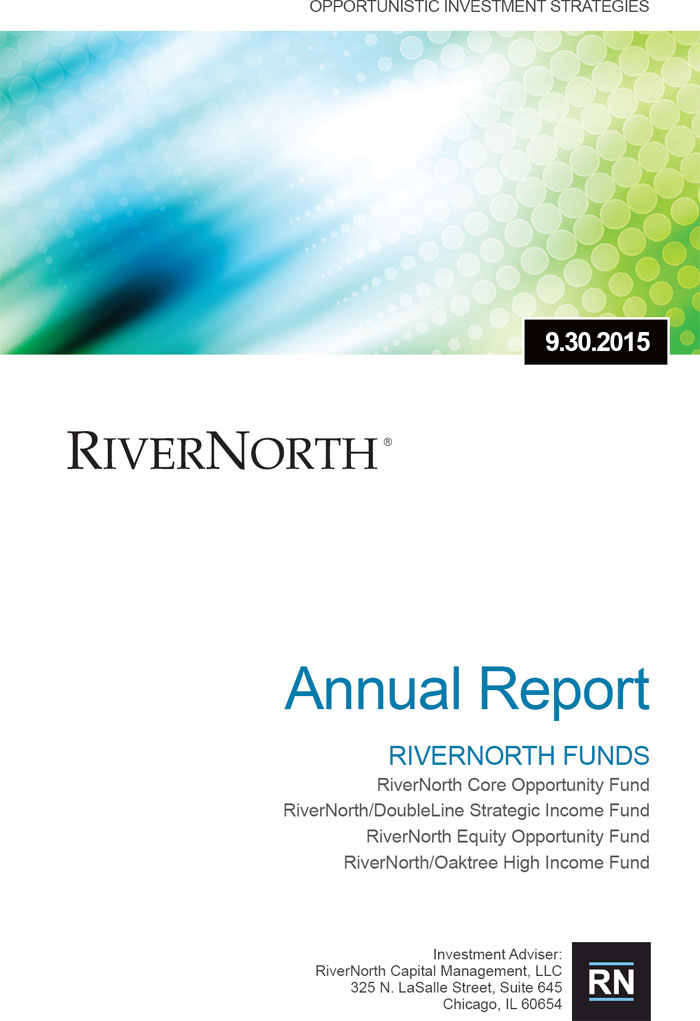

Comparison of a $10,000 Investment in the RiverNorth Core Opportunity Fund Class R, the Blend Index, and the S&P 500® Index.

| Annual Report | September 30, 2015 | 7 |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

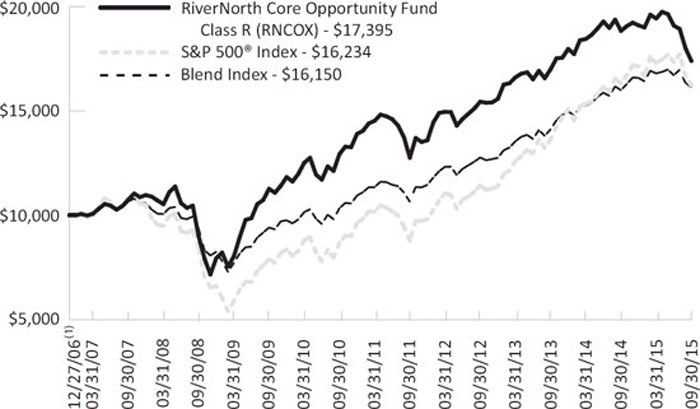

Comparison of a $10,000 Investment in the RiverNorth Core Opportunity Fund Class I, the Blend Index, and the S&P 500® Index.

Average Annual Total Returns for Periods Ending September 30, 2015

| | 1-Year | 3-Year | 5-Year | Since

Inception(1)(2) |

RiverNorth Core Opportunity Fund – Class I (RNCIX)(3) | -7.50% | 4.30% | 6.37% | 6.79% |

| RiverNorth Core Opportunity Fund – Class R (RNCOX) | -7.67% | 4.04% | 6.11% | 6.52% |

Blend Index(4) | 0.95% | 8.14% | 9.33% | 5.62% |

S&P 500® Index(4) | -0.61% | 12.40% | 13.34% | 5.69% |

| (1) | Inception date of Class R is December 27, 2006. |

(2) | Inception date of Class I is August 11, 2014. |

(3) | In presenting performance information for the newer Institutional share class of the Fund, the Fund includes, for periods prior to the offering of the Institutional share class, the operating expense ratio and performance of the Fund's Retail share class, adjusted to reflect the class-related operating expenses of the Institutional share class. Actual expense differentials across classes will vary over time. The performance of the Fund's newer Institutional share class would have been substantially similar to the performance of the Fund's Retail share class because both share classes of the Fund are invested in the same portfolio of securities and would have differed only to the extent that the classes do not have the same expenses (although differences in expenses between share classes may change over time). |

| (4) | Blend Index consists of 60% S&P 500® Index and 40% Barclays Capital U.S. Aggregate Bond Index. S&P 500® Index is a capitalization-weighted index of 500 stocks. The Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of investment-grade fixed-rate debt issues with maturities of at least one year. This unmanaged index does not reflect fees and expenses. The S&P 500® and Blend Indices are indices only and cannot be invested in directly. |

| 8 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling (888) 848-7569 or www.rivernorth.com. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Total Annual Fund Operating Expense for the Fund as disclosed in the prospectus dated January 28, 2015: 2.16% (RNCIX), 2.41% (RNCOX). In presenting expense information for the newer Institutional share class of the Fund, the Fund includes, for periods prior to the offering of the Institutional share class, the operating expense ratio of the Fund's Retail share class, adjusted to reflect the class-related operating expenses of the Institutional share class. Actual expense differentials across share classes will vary over time. The adviser has contractually agreed to defer the collection of fees and/or reimburse expenses, but only to the extent necessary to limit Total Annual Fund Operating Expenses (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividends on securities sold short; taxes; indirect expenses incurred by the underlying funds in which the Fund invests; and extraordinary expenses) to 1.35% (RNCIX) and 1.60% (RNCOX) of the average daily net assets of the Fund through January 31, 2016. The annualized net expense ratio in this annual report dated September 30, 2015 is 1.11% (RNCIX) and 1.35% (RNCOX). The expense ratio as disclosed in the Fund's annual report dated September 30, 2015 only includes the direct expenses paid by shareholders from their investment. The expense ratio as disclosed in the Fund's prospectus dated January 28, 2015 is required to include the indirect expenses of investing in underlying funds.

What contributing factors were responsible for the RiverNorth Core Opportunity Fund's relative performance during the period?

With respect to the equity portion of the portfolio, the Fund's allocation to international and emerging market equity funds detracted from relative performance. The MSCI All Country World ex USA Index was down 14.31% over the past twelve months while the S&P 500 was down only 0.61%. In addition, discount widening among equity closed-end funds detracted from performance. The Fund's exposure to real estate closed-end funds was a positive contributor

to performance.

With respect to the fixed income portion of the portfolio, our allocation to closed-end funds with lower credit quality, such as multi-sector bond, global income, and high yield funds detracted from performance. The funds in these sectors experienced net asset value (NAV) losses on average, and also experienced discount widening over the period. The Fund's exposure to municipal bond and preferred closed-end funds added to performance.

How was the RiverNorth Core Opportunity Fund positioned at the end of September 2015?

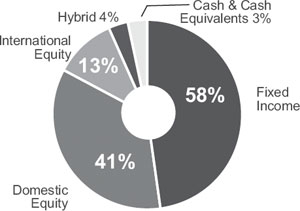

At the aggregate Fund level, we allocated 54% of the portfolio to equities, 58% to fixed income, 4% to hybrid securities (primarily preferred stocks and convertible bonds) and 3% to cash. Allocations exceed 100% due to leverage utilized by some of the closed‐end funds that we own.

| Annual Report | September 30, 2015 | 9 |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

Our equity allocation is neutral. We are 54% invested in equities; with 76% domestic and 24% international exposure. The biggest changes in our equity allocations were continued trimming of our covered call allocation and an increase in MLP funds as this sector has experienced discount widening in addition to significant losses on an NAV basis.

On the fixed income side, we have added exposure to high yield, multi-sector, and global income closed-end funds, as funds focusing on lower credit quality and emerging markets have experienced discount widening on negative NAV performance. In addition, we have decreased the Fund's exposure to municipal bond funds over the period.

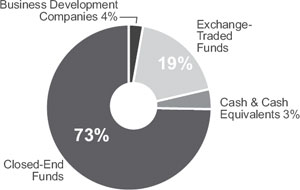

Investment Vehicle Allocation(1) (percentages are based on net assets)

Totals may not add up to 100% due to rounding.

Asset Class Allocation(1) (percentages are based on net assets)

The allocation does not add up to 100% as it reflects the estimated leverage utilized by the underlying funds and the effects of a total return swap.

| 10 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

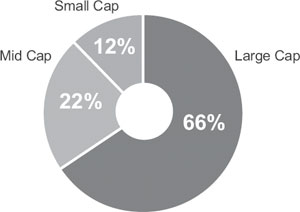

Equity Capitalization Allocation(1) (percentages are based on net assets)

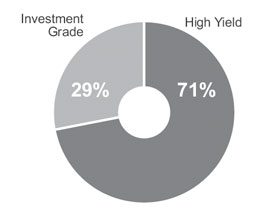

Fixed Income Allocation(1)(2) (percentages are based on net assets)

Portfolio detail statistics are estimates made by the adviser and are subject to change.

| (1) | Convertible Security Risk – the market value of convertible securities adjusts with interest rates and the value of the underlying stock. Exchange Traded Note Risk – exchange traded notes represent unsecured debt of the issuer and may be influenced by interest rates, credit ratings of the issuer or changes in value of the reference index. Fixed Income Risk – the market value of fixed income securities adjusts with interest rates and the securities are subject to issuer default. Foreign/Emerging Market Risk – foreign securities may be subject to inefficient or volatile markets, different regulatory regimes or different tax policies. These risks may be enhanced in emerging markets. Management Risk – there is no guarantee that the adviser's investment decisions will produce the desired results. Large Shareholder Purchase and Redemption Risk – The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Market Risk – economic conditions, interest rates and political events may affect the securities markets. REIT Risk – the value of REITs changes with the value of the underlying properties and changes in interest rates and are subject to additional fees. Security Risk – The value of the Fund may decrease in response to the activities and financial prospects of individual securities in the Fund's portfolio. Short Sale Risk – short positions are speculative, are subject to transaction costs and are riskier than long positions in securities. Small-Cap Risk – small-cap companies are more susceptible to failure, are often thinly traded and have more volatile stock prices. Structured Notes Risk – because of the imbedded derivative feature, structured notes are subject to more risk than investing in a simple note or bond. Swap Risk – swap agreements are subject to counterparty default risk and may not perform as intended. Underlying Fund Risk – underlying funds have additional fees, may utilize leverage, may not correlate to an intended index and may trade at a discount to their net asset values. |

| Annual Report | September 30, 2015 | 11 |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

| (2) | Credit quality allocation reflects a fixed-income portfolio weighted average of the credit breakdown of each closed-end fund as provided by the adviser of said closed-end fund. If a credit breakdown is not provided by the adviser, Bloomberg is used. Investment grade refers to a bond rated BBB- or higher by Standard & Poor's or Baa3 or higher by Moody's. High yield refers to a bond rate lower than investment grade. For more information about securities ratings, please see the Fund's Statement of Additional information at www.rivernorth.com. |

| 12 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

RiverNorth/DoubleLine Strategic Income Fund

What is the Fund's investment strategy?

The RiverNorth/DoubleLine Strategic Income ("the Fund") invests in a broad range of fixed income securities of U.S. and foreign issuers, including closed‐end funds.

Assets of the Fund are tactically managed across three distinct fixed income strategies (or sleeves). RiverNorth oversees the strategy weights and manages the Tactical Closed‐End Fund Income Strategy. The RiverNorth strategy provides diversified exposure to the fixed income market through opportunistic investments in closed‐end bond funds. Sector allocations may vary based on RiverNorth's assessment of relative value among asset classes and closed‐end funds. Jeffrey Gundlach, CEO and CIO of DoubleLine Capital, LP oversees the Opportunistic Income and Core Fixed Income Strategies. The Opportunistic Income Strategy seeks to achieve positive absolute returns and is managed without duration constraints. The Core Fixed Income Strategy – the most traditional of the three sleeves – incorporates an active asset allocation approach in an effort to mitigate risk and achieve the highest possible risk‐adjusted returns.

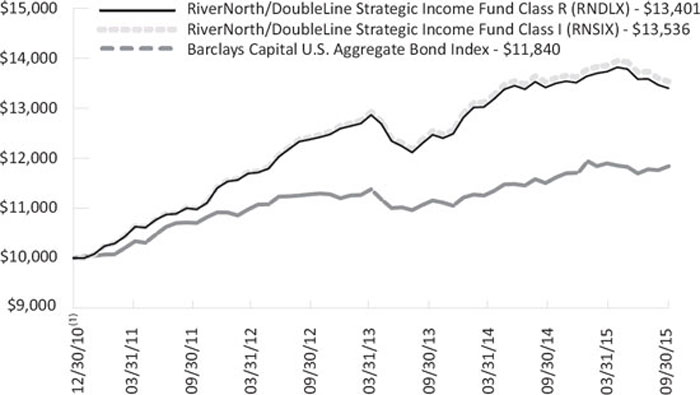

How did the RiverNorth/DoubleLine Strategic Income Fund perform relative to its benchmark during the reporting period?

For the twelve month period ending September 30, 2015, the Class I share (symbol: RNSIX) returned 0.04% and the Class R share (symbol: RNDLX) returned -0.12%. The Barclays Capital U.S. Aggregate Bond Index returned 2.94%, during the same period.

| Annual Report | September 30, 2015 | 13 |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

Comparison of a $10,000 Investment in the RiverNorth/DoubleLine Strategic Income Fund and the Barclays Capital U.S. Aggregate Bond Index

Average Annual Total Returns for Periods Ending September 30, 2015

| | 1-Year | 3-Year | Since Inception(1) |

| RiverNorth/DoubleLine Strategic Income Fund – Class I (RNSIX) | 0.04% | 3.04% | 6.58% |

| RiverNorth/DoubleLine Strategic Income Fund – Class R (RNDLX) | -0.12% | 2.80% | 6.36% |

Barclays Capital U.S. Aggregate Bond Index(2) | 2.94% | 1.71% | 3.62% |

| (1) | Inception date is December 30, 2010. |

| (2) | The Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of investment-grade fixed-rate debt issues with maturities of at least one year. The index cannot be invested in directly and does not reflect fees and expenses. |

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling (888) 848-7569 or www.rivernorth.com. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| 14 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

The Total Annual Fund Operating Expense for the Fund as disclosed in the prospectus dated January 28, 2015: 1.40% (RNSIX), 1.65% (RNDLX). The adviser has contractually agreed to defer the collection of fees and/or reimburse expenses, but only to the extent necessary to limit Total Annual Fund Operating Expenses (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividends on securities sold short; taxes; indirect expenses incurred by the underlying funds in which the Fund invests; and extraordinary expenses) to 0.95% (RNSIX) and 1.20% (RNDLX) of the average daily net assets of the Fund through January 31, 2016. The annualized net expense ratio in this annual report dated September 30, 2015 is 0.86% (RNSIX) and 1.11% (RNDLX). The expense ratio as disclosed in the Fund's annual report dated September 30, 2015 only includes the direct expenses paid by shareholders from their investment. The expense ratio as disclosed in the Fund's prospectus dated January 28, 2015 is required to include the indirect expenses of investing in underlying funds.

What contributing factors were responsible for the RiverNorth/DoubleLine Strategic Income Fund's relative performance during the period?

RiverNorth Tactical Closed‐End Fund Income Sleeve

The RiverNorth sleeve underperformed the benchmark index during the period. This was due to exposure to closed-end funds that invest in securities with lower credit quality, as well as closed-end funds that invest in emerging market fixed income, as both of these areas experienced significant volatility over the year. In addition, discount widening among fixed income closed-end funds during the period detracted from performance. The sleeve's exposure to municipal bonds and preferred securities was a positive contributor to performance.

DoubleLine Core Fixed Income Sleeve

The DoubleLine Core sleeve slightly underperformed the Barclays Capital U.S. Aggregate Bond Index's return of 2.94% over the trailing 12-month period ending September 30, 2015. The underperformance can be contributed to challenges that plagued emerging market fixed income (EMFI) and high yield (HY) sectors. Both sectors have had a challenging year with increased volatility caused by deteriorating growth, weakness in the commodities complex and a surprise currency devaluation in China that came later in that 12-month period. However, HY within the Fund outperformed the Citigroup Cash Pay High Yield Index meaningfully despite negative returns. In fact, all sectors within the portfolio, with the exception of EMFI, outperformed their respective benchmarks. With the meaningful decline in US Treasury interest rates, the government exposure and Agency RMBS sector were the best performing sectors within the portfolio. These sectors also have relatively longer durations versus other exposures within the Fund, thus benefiting from the decline in interest rates. Other sectors, such as investment grade corporate bonds, collateralized loan obligations and commercial mortgage backed securities returned modest gains to the Fund, but did experience some widening toward the latter half of the period.

DoubleLine Opportunistic Income Sleeve

The U.S. yield curve declined meaningfully over the trailing 12-months ending September 30, 2015, with the 10-year U.S. Treasury rate dropping by 45 basis points. Not surprisingly, longer duration securities outperformed shorter duration counterparts in that interest rate environment. Agency residential mortgage backed securities (RMBS), which have relatively longer durations, led the outperformance of the portfolio over fixed income indices, such as the Barclays Capital U.S. Aggregate Bond Index, with inverse floating-rate and inverse interest-only securities benefiting the most from both high price appreciation and strong interest income. Non-Agency RMBS provided healthy gains to the portfolio as well, benefiting from high coupon carry across the entire credit quality spectrum. Prime and Alt-A bonds also contributed modest price returns over the period. The Non-Agency RMBS space faced its first widening in recent history toward the last quarter of the period, but securities held in the opportunistic income portfolio maintain a healthy coupon return, which helped to offset the widening.

| Annual Report | September 30, 2015 | 15 |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

How was the RiverNorth/DoubleLine Strategic Income Fund positioned at the end of September 2015?

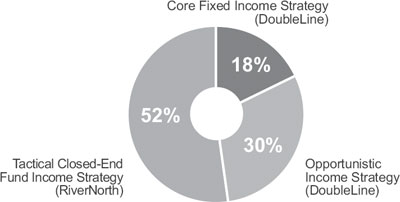

The Fund allocation was 52% RiverNorth Tactical Closed‐End Fund Income, 30% DoubleLine Opportunistic Income and 18% DoubleLine Core Fixed Income. The biggest changes over the year were increases in high yield and bank loan exposure, and decreases in the Fund's cash position and municipal bond exposure.

Strategy ("Sleeve") Allocation

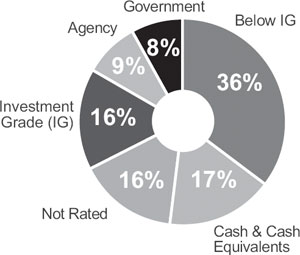

Credit Quality Distribution(1)(2) (percentages are based on net assets)

Totals may not add up to 100% due to rounding.

| 16 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

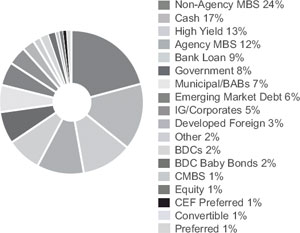

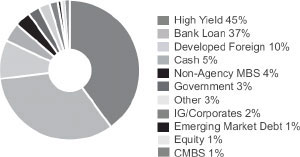

Sector Breakdown(1) (percentages are based on net assets)

The allocation does not add up to 100% as it reflects the estimated leverage utilized by the underlying funds and the effects of a total return swap.

Portfolio detail statistics are estimates made by the adviser and are subject to change.

| (1) | Asset-Backed Security Risk – the risk that the value of the underlying assets will impair the value of the security. Borrowing Risk – borrowings increase fund expenses and are subject to repayment, possibly at inopportune times. Convertible Security Risk – the market value of convertible securities adjusts with interest rates and the value of the underlying stock. Defaulted Securities Risk – defaulted securities carry the risk of uncertainty of repayment. Derivatives Risk – derivatives are subject to counterparty risk. Exchange Traded Note Risk – exchange traded notes represent unsecured debt of the issuer and may be influenced by interest rates, credit ratings of the issuer or changes in value of the reference index. Fixed Income Risk – the market value of fixed income securities adjusts with interest rates and the securities are subject to issuer default. Foreign/Emerging Market Risk – foreign securities may be subject to inefficient or volatile markets, different regulatory regimes or different tax policies. These risks may be enhanced in emerging markets. Liquidity Risk – illiquid investments may be difficult or impossible to sell. Large Shareholder Purchase and Redemption Risk – The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Management Risk – there is no guarantee that the adviser's or sub-adviser's investment decisions will produce the desired results. Market Risk – economic conditions, interest rates and political events may affect the securities markets. Mortgage-Backed Security Risk – mortgage backed securities are subject to credit risk, pre-payment risk and devaluation of the underlying collateral. Portfolio Turnover Risk – increased portfolio turnover results in higher brokerage expenses and may impact the tax status of distributions. Rating Agency Risk – rating agencies may change their ratings or ratings may not accurately reflect a debt issuer's creditworthiness. REIT Risk – the value of REITs changes with the value of the underlying properties and changes in interest rates and are subject to additional fees. Security Risk – The value of the Fund may decrease in response to the activities and financial prospects of individual securities in the Fund's portfolio. Structured Notes Risk – because of the imbedded derivative feature, structured notes are subject to more risk than investing in a simple note or bond. Swap Risk – swap agreements are subject to counterparty default risk and may not perform as intended. Underlying Fund Risk – underlying funds have additional fees, may utilize leverage, may not correlate to an intended index and may trade at a discount to their net asset values. |

| Annual Report | September 30, 2015 | 17 |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

| (2) | For the sleeve managed by RiverNorth, credit quality allocation reflects a fixed-income portfolio weighted average of the credit breakdown of each closed-end fund as provided by the advisor of said closed-end fund. If a credit breakdown is not provided by the advisor, Bloomberg is used. For the sleeves managed by DoubleLine, credit quality allocation is determined from the highest available credit rating from any Nationally Recognized Statistical Rating Organization (S&P, Moody's and Fitch). Investment grade refers to a bond rated BBB- or higher by Standard & Poor's or Baa3 or higher by Moody's. High yield refers to a bond rated lower than investment grade. For more information about securities ratings, please see the Fund's Statement of Additional Information at www.rivernorth.com. |

| 18 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

RiverNorth Equity Opportunity Fund

What is the Fund's investment strategy?

The RiverNorth Equity Opportunity Fund ("the Fund") invests primarily in equity based closed‐end funds and exchange‐traded funds.

How did the RiverNorth Equity Opportunity Fund perform relative to its benchmark during the reporting period?

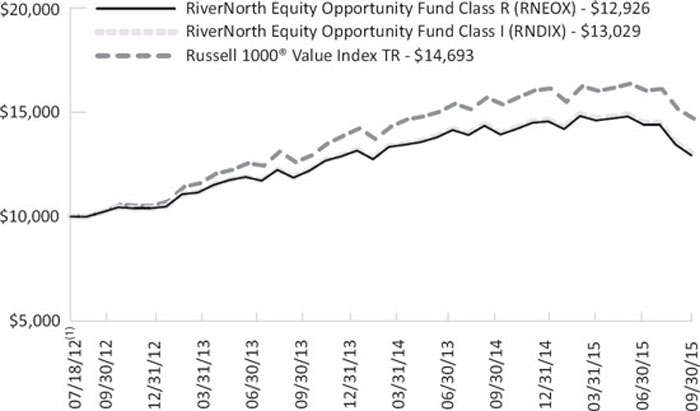

For the 12-month period ending September 30, 2015, the Class I share (symbol: RNDIX) returned

-6.99% and the Class R share (symbol: RNEOX) returned -7.20%. The Russell 1000 Value Index returned -4.42% during the same period and the S&P 500 returned -0.61%.

Comparison of a $10,000 Investment in the RiverNorth Equity Opportunity Fund and the Russell 1000 Value Index

| Annual Report | September 30, 2015 | 19 |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

Average Annual Total Returns for Periods Ending September 30, 2015

| | 1-Year | 3-Year | Since

Inception(1) |

| RiverNorth Equity Opportunity Fund - Class I (RNDIX) | -6.99% | 7.65% | 8.61% |

| RiverNorth Equity Opportunity Fund - Class R (RNEOX) | -7.20% | 7.36% | 8.34% |

Russell 1000® Value Index TR(2) | -4.42% | 11.59% | 12.77% |

| (1) | Inception date is July 18, 2012. |

| (2) | The Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® Index companies with lower price-to-book ratios and lower expected growth values. The index cannot be invested in directly and does not reflect fees and expenses. |

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling (888) 848-7569 or www.rivernorth.com. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Prior to 1/1/2014, the Fund was managed in part by a sub-adviser pursuing a different strategy.

The Total Annual Operating Expense for the Fund as disclosed in the prospectus dated January 28, 2015: 2.27% (RNDIX), 2.52% (RNEOX). The adviser has contractually agreed to defer the collection of fees and/or reimburse expenses, but only to the extent necessary to limit Total Annual Fund Operating Expenses (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividends on securities sold short; taxes; indirect expenses incurred by the underlying funds in which the Fund invests; and extraordinary expenses) to 1.35% (RNDIX) and 1.60% (RNEOX) of the average daily net assets of the Fund through January 31, 2016. The annualized net expense ratio in this annual report dated September 30, 2015 is 1.35% (RNDIX) and 1.60% (RNEOX). The expense ratio as disclosed in the Fund's annual report dated September 30, 2015 only includes the direct expenses paid by shareholders from their investment. The expense ratio as disclosed in the Fund's prospectus dated January 28, 2015 is required to include the indirect expenses of investing in underlying funds.

What contributing factors were responsible for the RiverNorth Equity Opportunity Fund's relative performance during the period?

Equity closed-end funds experienced discount widening over the year, which detracted from performance. In addition, the Fund's largest closed-end fund holding throughout the year, the Boulder Growth & Income Fund, significantly underperformed its benchmarks on a market price basis. Also, our positions in global equity closed‐end funds also detracted from relative performance. The MSCI All Country World ex USA Index was down 14.31% over the past twelve months versus the S&P 500's return of -0.61%.

How was the RiverNorth Equity Opportunity Fund positioned at the end of September 2015?

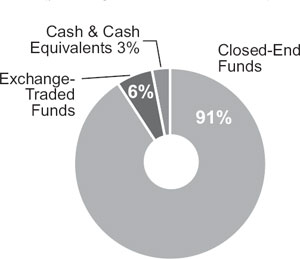

The Fund is 91% invested in closed‐end funds, 6% in ETFs and 3% in cash. The closed‐end funds are primarily general equity funds along with hybrid funds that can invest in a range of equity and fixed income securities. The large‐cap U.S. equity ETFs in the portfolio are dry powder for closed‐end fund trading opportunities. Due to what we believe are attractive discount levels, we have significantly increased the Fund's closed-end fund allocation from 74% as of September 30, 2014 to the current 91%.

| 20 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

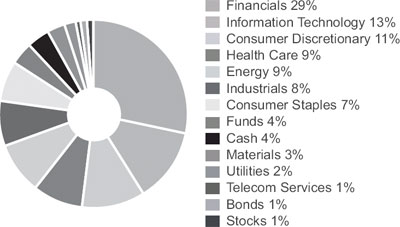

Investment Vehicle Allocation(1) (percentages are based on net assets)

Sector Breakdown(1) (percentages are based on net assets)

Totals may not add up to 100% due to rounding.

Portfolio detail statistics are estimates made by the adviser and are subject to change.

| Annual Report | September 30, 2015 | 21 |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

| (1) | Convertible Security Risk – the market value of convertible securities adjusts with interest rates and the value of the underlying stock. Currency Risk – foreign currencies will rise or decline relative to the U.S. dollar. Equity Risk – the value of equity securities changes frequently. Fixed Income Risk – the market value of fixed income securities adjusts with interest rates and the securities are subject to issuer default. Foreign/Emerging Market Risk – foreign securities may be subject to inefficient or volatile markets, different regulatory regimes or different tax policies. These risks may be enhanced in emerging markets. Investment Style Risk – investment strategies may come in and out of favor with investors and may underperform or outperform at times. Large Shareholder Purchase and Redemption Risk – The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Mid-Cap Risk – midcap companies may be more susceptible to adverse business or economic events than large-cap companies. Management Risk – there is no guarantee that the adviser's investment decisions will produce the desired results. Market Risk – economic conditions, interest rates and political events may affect the securities markets. Portfolio Turnover Risk – increased portfolio turnover results in higher brokerage expenses and may impact the tax status of distributions. Preferred Stock Risk – preferred stocks generally pay dividends, but may be less liquid than common stocks, have less priority than debt instruments and may be subject to redemption by the issuer. Security Risk – The value of the Fund may decrease in response to the activities and financial prospects of individual securities in the Fund's portfolio. Small-Cap Risk – small-cap companies are more susceptible to failure, are often thinly traded and have more volatile stock prices. Swap Risk – swap agreements are subject to counterparty default risk and may not perform as intended. Tax Risk – new federal or state governmental action could adversely affect the tax-exempt status of securities held by the Fund, resulting in higher tax liability for shareholders and potentially hurting Fund performance as well. Underlying Fund Risk – underlying funds have additional fees, may utilize leverage, may not correlate to an intended index and may trade at a discount to their net asset values. |

| 22 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

RiverNorth/Oaktree High Income Fund

What is the Fund's investment strategy?

The RiverNorth/Oaktree High Income Fund ("the Fund") invests in a broad range of income producing securities including both fixed income and equity securities.

Assets of the Fund are tactically managed across three income strategies (or sleeves). RiverNorth manages the Tactical Closed‐End Fund Strategy. This strategy is designed to provide diversified fixed income and equity income exposure through opportunistic investments in closed‐end funds. Oaktree Capital Management, LP manages the High Yield Bond and Senior Loan Strategies on a global basis. Oaktree will tactically manage the allocation between the High Yield Bond and Senior Loan Strategies based both on market opportunities and the risk and reward trade‐offs between the two asset classes.

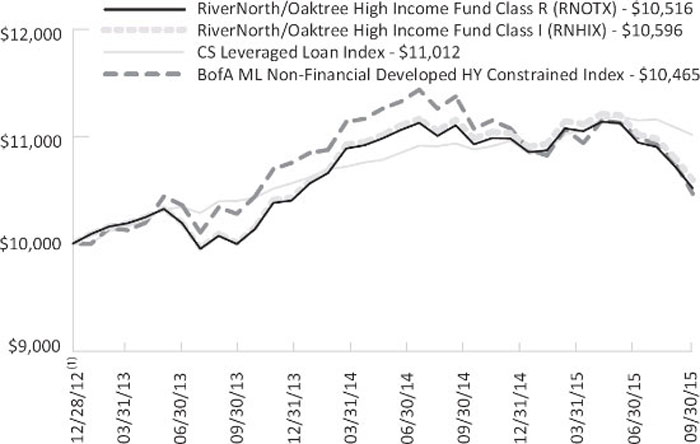

How did the RiverNorth/Oaktree High Income Fund perform relative to its benchmark during the reporting period?

For the 12-month period ending September 30, 2015, the Class I share (symbol: RNHIX) returned -3.50% and the Class R share (symbol: RNOTX) returned -3.76%. The BofA ML Non‐ Financial Developed HY Constrained Index and CS Leveraged Loan Index returned -5.48% and 1.23%, respectively, during the same period.

Comparison of a $10,000 Investment in the RiverNorth/Oaktree High Income Fund, BofA ML Non-Financial Developed HY Constrained Index and the CS Leveraged Loan Index

| Annual Report | September 30, 2015 | 23 |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

Cumulative Total Returns for the Period Ending September 30, 2015

| | 1-Year | Since Inception(1) |

| RiverNorth/Oaktree High Income Fund – Class I (RNHIX) | -3.50% | 2.12% |

| RiverNorth/Oaktree High Income Fund – Class R (RNOTX) | -3.76% | 1.84% |

BofA ML Non-Financial Developed HY Constrained Index(2) | -5.48% | 1.66% |

CS Leveraged Loan Index(2) | 1.23% | 3.56% |

| (1) | Inception date is December 28, 2012. |

| (2) | The BofA Merrill Lynch Developed Markets High Yield Constrained Index contains all securities in the BofA Merrill Lynch Global High Yield index from developed markets countries but cap issuer exposure at 2%. Developed markets is defined as an FX-G10 member, a Western European nation, or a territory of the U.S. or a Western European nation. The index tracks the performance of USD, CAD, GBP and EUR denominated below investment grade corporate debt publicly issued in the major domestic or Eurobond markets. Qualifying securities must have a below investment grade rating (based on an average of Moody's, S&P and Fitch). CS Leveraged Loan Index tracks the investable market of the U.S. dollar denominated leveraged loan market. It consists of issues rated "5B" or lower, meaning that the highest rated issues included in this index are Moody's/S&P ratings of Baa1/BB+ or Ba1/BBB+. All loans are funded term loans with a tenor of at least one year and are made by issuers domiciled in developed countries. The Bofa Merrill Lynch Developed Markets High Yield Constrained and the CS Leveraged Loan Indices are indices only and cannot be invested in directly. |

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling (888) 848-7569 or www.rivernorth.com. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions and does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Total Annual Operating Expense for the Fund as disclosed in the prospectus dated January 28, 2015: 1.80% (RNHIX), 2.05% (RNOTX). The adviser has contractually agreed to defer the collection of fees and/or reimburse expenses, but only to the extent necessary to limit Total Annual Fund Operating Expenses (excluding brokerage fees and commissions; borrowing costs, such as (a) interest and (b) dividends on securities sold short; taxes; indirect expenses incurred by the underlying funds in which the Fund invests; and extraordinary expenses) to 1.35% (RNHIX) and 1.60% (RNOTX) of the average daily net assets of the Fund through January 31, 2016. The annualized net expense ratio in this annual report dated September 30, 2015 is 1.36% (RNHIX) and 1.61% (RNOTX). The expense ratio as disclosed in the Fund's annual report dated September 30, 2015 only includes the direct expenses paid by shareholders from their investment. The expense ratio as disclosed in the Fund's prospectus dated January 28, 2015 is required to include the indirect expenses of investing in underlying funds.

What contributing factors were responsible for the RiverNorth/Oaktree High Income Fund's relative performance during the period?

RiverNorth Tactical Closed‐End Fund Sleeve

The Fund's overweighting of high yield closed-end funds compared to bank loan funds detracted from performance over the year as bank loan funds' net asset value (NAV) performance was significantly better over the period. In addition, discount widening negatively impacted both high yield and bank loan funds over the period.

| 24 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

Oaktree High Yield Bond & Senior Loan Sleeve

The twelve months ended September 30, 2015 was a challenging period for both high yield bonds and senior loans as the market suffered losses, dragged down in part by the troubled energy and metals and mining sectors. While the market default environment remained relatively benign, the energy and metals and mining sectors came under significant selling pressure, roiled by depressed commodity prices. Reflecting a flight to quality, CCC-rated bonds and loans underperformed the BB/B rated segment and first lien loans outperformed compared to second liens. European issuers outperformed their U.S. counterparts, benefiting in part from a lower exposure to the stressed energy and metals and mining sectors.

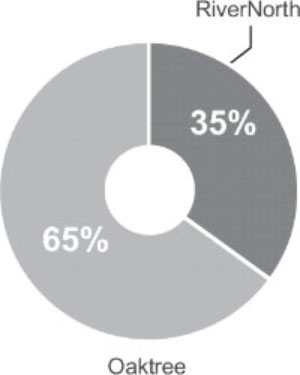

How was the RiverNorth/Oaktree High Income Fund positioned at the end of September 2015?

The Fund allocation was 35% RiverNorth Tactical Closed‐End Fund and 65% Oaktree High Yield Bond and Senior Loan.

The closed‐end fund sleeve is primarily invested in the common shares of closed‐end funds. Over the past year we have increased the Fund's allocation to high yield closed-end funds relative to bank loan closed-end funds as we have been able to purchase many high yield funds at discounts in the mid to high teens during market selloffs.

Oaktree's High Yield Bond and Senior Loan portfolios remain defensively positioned and constructed to preserve capital in the event of a market downturn. Over the years, it has been demonstrated that the key to long-term success is managing credit risk, avoiding dangerous concentrations and minimizing defaults in the portfolio.

Strategy Allocation

| Annual Report | September 30, 2015 | 25 |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

Credit Quality Distribution(1)(2) (percentages are based on net assets)

Totals may not add up to 100% due to rounding.

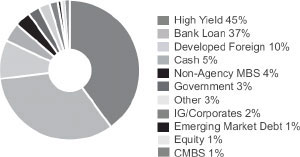

Sector Breakdown(1) (percentages are based on net assets)

The allocation does not add up to 100% as it reflects the leverage utilized by the underlying funds.

Portfolio detail statistics are estimates made by the adviser and are subject to change.

| (1) | Borrowing Risk – borrowings increase fund expenses and are subject to repayment, possibly at inopportune times. Closed-End Fund Risk – closed-end funds are exchange traded, may trade at a discount to their net asset values and may deploy leverage. Convertible Security Risk – the market value of convertible securities adjusts with interest rates and the value of the underlying stock. Credit Derivatives Risk – the use of credit derivatives is highly specialized, involves default, counterparty and liquidity risks and may not perfectly correlate to the underlying asset or liability being hedged. Currency Risk – foreign currencies will rise or decline relative to the U.S. dollar. Distressed and Defaulted Securities Risk – defaulted securities carry the risk of uncertainty of repayment. Equity Risk – equity securities may experience volatility and the value of equity securities may move in opposite directions from each other and from other equity markets generally. Fixed Income Risk – the market value of fixed income securities adjusts with interest rates and the securities are subject to issuer default. Foreign/Emerging Market Risk – foreign securities may be subject to inefficient or volatile markets, different regulatory regimes or different tax policies. These risks may be enhanced in emerging markets. Floating Interest Rate Risk – loans pay interest based on the London Interbank Offered Rate (LIBOR) and a decline in LIBOR could negatively impact the Fund's return. Investment Style Risk – investment strategies may come in and out of favor with investors and may underperform or outperform at times. Large Shareholder Purchase and Redemption Risk – The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Loans Risk – loans may be unrated or rated below investment grade and the pledged collateral may lose value. Secondary trading in loans is not fully-developed and may result in illiquidity. Management Risk – there is no guarantee that the adviser's or sub-adviser's investment decisions will produce the desired results. Market Risk – economic conditions, interest rates and political events may affect the securities markets. Portfolio Turnover Risk – increased portfolio turnover results in higher brokerage expenses and may impact the tax status of distributions. Preferred Stock Risk – preferred stocks generally pay dividends, but may be less liquid than common stocks, have less priority than debt instruments and may be subject to redemption by the issuer. Security Risk – the value of the Fund may increase or decrease in response to the prospects of the issuers of securities and loans held in the Fund. Swap Risk – swap agreements are subject to counterparty default risk and may not perform as intended. Underlying Fund Risk – underlying funds have additional fees, may utilize leverage, may not correlate to an intended index and may trade at a discount to their net asset values. Valuation Risk – Loans and fixed-income securities are traded "over the counter" and because there is no centralized information regarding trading, the valuation of loans and fixed-income securities may vary. |

| 26 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Portfolio Update |

September 30, 2015 (Unaudited)

| (2) | For the sleeve managed by RiverNorth, credit quality allocation reflects a fixed-income portfolio weighted average of the credit breakdown of each closed-end fund as provided by the advisor of said closed-end fund. If a credit breakdown is not provided by the advisor, Bloomberg is used. For the sleeves managed by Oaktree, the sub-adviser uses a proprietary credit scoring matrix to rank potential investments. This process offers a systematic way of reviewing the key quantitative and qualitative variables impacting credit quality for each investment. Investment grade refers to a bond rated BBB- or higher by Standard & Poor's or Baa3 or higher by Moody's. High yield refers to a bond rated lower than investment grade. For more information about securities ratings, please see the Fund's Statement of Additional Information at www.rivernorth.com. |

| Annual Report | September 30, 2015 | 27 |

| RiverNorth Funds | Disclosure of Fund Expenses |

September 30, 2015 (Unaudited)

Expense Example

As a shareholder of the RiverNorth Funds (the "Trust" or "Funds"), you incur two types of costs: (1) transaction costs (such as the 2% fee on redemption of Fund shares made within 90 days of purchase); and (2) ongoing costs, including management fees, distribution and service (12b-1) fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period, April 1, 2015 and held for the six months ended September 30, 2015.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on each Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not each Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line for each share class of each Fund within the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

| 28 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Funds | Disclosure of Fund Expenses |

September 30, 2015 (Unaudited)

| | | Beginning

Account Value

04/01/2015 | | | Ending

Account Value

09/30/2015 | | | Expense

Ratio(a) | | | Expenses

Paid During

Period(b) | |

| RiverNorth Core Opportunity Fund | |

| Class I Shares | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 896.00 | | | | 1.11 | % | | $ | 5.28 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.50 | | | | 1.11 | % | | $ | 5.62 | |

| | | | | | | | | | | | | | | | | |

| Class R Shares | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 895.00 | | | | 1.35 | % | | $ | 6.41 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.30 | | | | 1.35 | % | | $ | 6.83 | |

| | | | | | | | | | | | | | | | | |

| RiverNorth/DoubleLine Strategic Income Fund | |

| Class I Shares | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 976.90 | | | | 0.85 | % | | $ | 4.21 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.81 | | | | 0.85 | % | | $ | 4.31 | |

| | | | | | | | | | | | | | | | | |

| Class R Shares | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 975.70 | | | | 1.10 | % | | $ | 5.45 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.55 | | | | 1.10 | % | | $ | 5.57 | |

| | | | | | | | | | | | | | | | | |

| RiverNorth Equity Opportunity Fund | |

| Class I Shares | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 885.50 | | | | 1.35 | % | | $ | 6.38 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.30 | | | | 1.35 | % | | $ | 6.83 | |

| | | | | | | | | | | | | | | | | |

| Class R Shares | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 885.30 | | | | 1.60 | % | | $ | 7.56 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.05 | | | | 1.60 | % | | $ | 8.09 | |

| | | | | | | | | | | | | | | | | |

| RiverNorth/Oaktree High Income Fund | |

| Class I Shares | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 953.20 | | | | 1.35 | % | | $ | 6.61 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.30 | | | | 1.35 | % | | $ | 6.83 | |

| | | | | | | | | | | | | | | | | |

| Class R Shares | | | | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 951.80 | | | | 1.59 | % | | $ | 7.78 | |

| Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.10 | | | | 1.59 | % | | $ | 8.04 | |

| Annual Report | September 30, 2015 | 29 |

| RiverNorth Funds | Disclosure of Fund Expenses |

September 30, 2015 (Unaudited)

(a) | Annualized, based on the Fund's most recent fiscal half-year expenses. |

(b) | Expenses are equal to the Fund's annualized ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183), then divided by 365. Note this expense example is typically based on a six-month period. |

| 30 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Core Opportunity Fund | Schedule of Investments |

September 30, 2015

| Shares/Description | | Value | |

| CLOSED-END FUNDS - 72.86% | | | |

| | 1,609,872 | | Aberdeen Asia-Pacific Income Fund, Inc. | | $ | 7,244,424 | |

| | 247,487 | | Aberdeen Emerging Markets Smaller Company Opportunities Fund, Inc. | | | 2,650,586 | |

| | 1,711,552 | | Adams Diversified Equity Fund, Inc. | | | 21,822,288 | |

| | 134,022 | | Advent Claymore Convertible Securities and Income Fund II | | | 724,148 | |

| | 532,078 | | AllianceBernstein Global High Income Fund, Inc. | | | 5,890,103 | |

| | 336,537 | | AllianceBernstein Income Fund, Inc. | | | 2,645,181 | |

| | 700,574 | | AllianzGI Equity & Convertible Income Fund | | | 12,042,867 | |

| | 1,866,506 | | Alpine Total Dynamic Dividend Fund | | | 13,998,795 | |

| | 241,617 | | Apollo Tactical Income Fund, Inc. | | | 3,501,030 | |

| | 323,227 | | Avenue Income Credit Strategies Fund | | | 4,153,467 | |

| | 72,168 | | Babson Capital Global Short Duration High Yield Fund | | | 1,251,393 | |

| | 806,840 | | BlackRock Corporate High Yield Fund, Inc. | | | 7,963,511 | |

| | 1,450,634 | | BlackRock Credit Allocation Income Trust | | | 17,654,216 | |

| | 943,436 | | BlackRock Debt Strategies Fund, Inc. | | | 3,151,076 | |

| | 918,434 | | BlackRock Global Opportunities Equity Trust | | | 11,113,051 | |

| | 356,679 | | BlackRock Multi-Sector Income Trust | | | 5,603,427 | |

| | 305,478 | | Blackstone/GSO Long-Short Credit Income Fund | | | 4,353,061 | |

| | 500,770 | | Blackstone/GSO Strategic Credit Fund | | | 7,115,942 | |

| | 1,728,766 | | Boulder Growth & Income Fund, Inc. | | | 12,879,304 | |

| | 174,320 | | Brookfield Global Listed Infrastructure Income Fund, Inc. | | | 2,184,230 | |

| | 425,224 | | CBRE Clarion Global Real Estate Income Fund | | | 3,138,153 | |

| | 137,461 | | Central Europe, Russia and Turkey Fund, Inc. | | | 2,459,177 | |

| | 737,465 | | Central Fund of Canada Ltd. - Class A | | | 7,809,754 | |

| | 66,022 | | Central Securities Corp. | | | 1,304,595 | |

| | 576,453 | | ClearBridge American Energy MLP Fund, Inc. | | | 5,528,184 | |

| | 306,101 | | ClearBridge Energy MLP Opportunity Fund, Inc. | | | 4,413,976 | |

| | 594,509 | | ClearBridge Energy MLP Total Return Fund, Inc. | | | 8,174,499 | |

| | 274,153 | | Clough Global Allocation Fund | | | 3,583,180 | |

| | 553,130 | | Clough Global Equity Fund | | | 7,002,626 | |

| | 2,863,442 | | Clough Global Opportunities Fund(a) | | | 30,638,829 | |

| | 222,939 | | Cohen & Steers REIT and Preferred Income Fund, Inc. | | | 3,863,533 | |

| | 478,564 | | Deutsche High Income Trust | | | 3,756,727 | |

| | 51,344 | | Deutsche Strategic Income Trust | | | 527,816 | |

| | 83,769 | | Diversified Real Asset Income Fund | | | 1,347,006 | |

| | 624,067 | | Eaton Vance Limited Duration Income Fund | | | 7,913,170 | |

| | 198,976 | | Eaton Vance Short Duration Diversified Income Fund | | | 2,632,452 | |

| | 380,697 | | First Trust High Income Long/Short Fund | | | 5,364,021 | |

| | 431,555 | | Franklin Limited Duration Income Trust | | | 4,703,949 | |

| | 368,309 | | General American Investors Co., Inc. | | | 11,410,213 | |

| | 291,158 | | Global High Income Fund, Inc. | | | 2,247,740 | |

| | 503,062 | | Invesco Dynamic Credit Opportunities Fund | | | 5,317,365 | |

| | 103,532 | | Invesco Municipal Opportunity Trust | | | 1,302,433 | |

| | 283,834 | | Invesco Municipal Trust | | | 3,485,482 | |

| | 234,464 | | Ivy High Income Opportunities Fund | | | 3,040,998 | |

See Notes to Financial Statements.

| Annual Report | September 30, 2015 | 31 |

| RiverNorth Core Opportunity Fund | Schedule of Investments |

September 30, 2015

| Shares/Description | | Value | |

| | 5,165,932 | | Liberty All Star® Equity Fund | | $ | 26,242,935 | |

| | 77,932 | | LMP Capital and Income Fund, Inc. | | | 947,653 | |

| | 328,668 | | LMP Real Estate Income Fund, Inc. | | | 4,036,043 | |

| | 101,212 | | Madison Strategic Sector Premium Fund | | | 1,079,932 | |

| | 375,400 | | MFS Charter Income Trust | | | 2,909,350 | |

| | 1,204,660 | | MFS Multimarket Income Trust | | | 6,734,049 | |

| | 193,845 | | Morgan Stanley Emerging Markets Debt Fund, Inc. | | | 1,614,729 | |

| | 635,778 | | Morgan Stanley Emerging Markets Domestic Debt Fund, Inc. | | | 4,374,153 | |

| | 132,608 | | Neuberger Berman High Yield Strategies Fund, Inc. | | | 1,351,276 | |

| | 1,623,401 | | Neuberger Berman Real Estate Securities Income Fund, Inc. | | | 7,483,879 | |

| | 1,296,176 | | NexPoint Credit Strategies Fund | | | 7,414,127 | |

| | 322,166 | | Nuveen Build America Bond Fund | | | 6,330,562 | |

| | 1,177,581 | | Nuveen Credit Strategies Income Fund | | | 9,397,096 | |

| | 576,932 | | Nuveen Intermediate Duration Municipal Term Fund | | | 7,153,957 | |

| | 450,057 | | Nuveen Mortgage Opportunity Term Fund | | | 10,081,277 | |

| | 145,788 | | Nuveen Mortgage Opportunity Term Fund 2 | | | 3,165,043 | |

| | 214,967 | | Nuveen Municipal Advantage Fund, Inc. | | | 2,861,211 | |

| | 130,123 | | Nuveen Municipal Market Opportunity Fund, Inc. | | | 1,704,611 | |

| | 49,584 | | Nuveen Premier Municipal Income Fund, Inc. | | | 647,071 | |

| | 367,650 | | Nuveen Premium Income Municipal Fund 2, Inc. | | | 5,018,422 | |

| | 89,419 | | Nuveen Premium Income Municipal Fund, Inc. | | | 1,198,215 | |

| | 39,145 | | Nuveen Quality Income Municipal Fund, Inc. | | | 528,066 | |

| | 123,318 | | Nuveen Quality Preferred Income Fund 3 | | | 989,010 | |

| | 28,993 | | Nuveen Select Quality Municipal Fund, Inc. | | | 387,636 | |

| | 1,411,302 | | PIMCO Dynamic Credit Income Fund | | | 25,784,488 | |

| | 178,788 | | Prudential Global Short Duration High Yield Fund, Inc. | | | 2,465,487 | |

| | 356,869 | | Prudential Short Duration High Yield Fund, Inc. | | | 5,231,700 | |

| | 79,724 | | Royce Global Value Trust, Inc. | | | 558,865 | |

| | 1,404,999 | | Royce Value Trust, Inc. | | | 16,157,488 | |

| | 563,006 | | Sprott Focus Trust, Inc. | | | 3,327,365 | |

| | 1,124,481 | | Templeton Global Income Fund | | | 6,848,089 | |

| | 118,121 | | Tortoise MLP Fund, Inc. | | | 2,163,977 | |

| | 1,094,780 | | Tri-Continental Corp. | | | 21,348,210 | |

| | 83,331 | | Virtus Global Multi-Sector Income Fund | | | 1,191,633 | |

| | 258,024 | | Voya Emerging Markets High Income Dividend Equity Fund | | | 1,989,365 | |

| | 457,736 | | Wells Fargo Advantage Multi-Sector Income Fund | | | 5,195,304 | |

| | 395,738 | | Western Asset Emerging Markets Debt Fund, Inc. | | | 5,271,230 | |

| | 361,694 | | Western Asset Emerging Markets Income Fund, Inc. | | | 3,457,795 | |

| | 238,647 | | Western Asset Global Corporate Defined Opportunity Fund, Inc. | | | 3,777,782 | |

| | 866,223 | | Western Asset High Income Opportunity Fund, Inc. | | | 4,062,586 | |

| | 346,773 | | Western Asset Managed High Income Fund, Inc. | | | 1,550,075 | |

| | 313,775 | | Western Asset Worldwide Income Fund, Inc. | | | 3,084,408 | |

See Notes to Financial Statements.

| 32 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Core Opportunity Fund | Schedule of Investments |

September 30, 2015

| Shares/Description | | Value | |

| | 707,562 | | Zweig Total Return Fund, Inc. | | $ | 8,080,358 | |

| | | | | | | | |

TOTAL CLOSED-END FUNDS

(Cost $545,276,455) | | | 514,104,486 | |

| | | | | | | | |

| BUSINESS DEVELOPMENT COMPANIES - 3.50% | | | | |

| | 979,993 | | American Capital Ltd.(b) | | | 11,916,715 | |

| | 1,043,000 | | Fifth Street Finance Corp. | | | 6,435,310 | |

| | 855,279 | | Medley Capital Corp. | | | 6,363,276 | |

| | | | | | | | |

TOTAL BUSINESS DEVELOPMENT COMPANIES

(Cost $28,766,686) | | | 24,715,301 | |

| | | | | | | | |

| COMMON STOCKS - 0.11% | | | | |

| | 59,766 | | NexPoint Residential Trust, Inc., REIT | | | 798,474 | |

| | | | | | | | |

TOTAL COMMON STOCKS

(Cost $798,840) | | | 798,474 | |

| | | | | | | | |

| EXCHANGE-TRADED FUNDS - 17.54% | | | | |

| | 94,701 | | Guggenheim Russell Top 50® Mega Cap ETF | | | 12,578,187 | |

| | 30,000 | | iShares® Russell 2000® ETF | | | 3,276,600 | |

| | 93,567 | | iShares® S&P 100® Fund | | | 7,932,610 | |

| | 209,517 | | Market Vectors® Gold Miners ETF | | | 2,875,621 | |

| | 83,169 | | PowerShares® CEF Income Composite Portfolio | | | 1,746,549 | |

| | 521,245 | | PowerShares® FTSE RAFI Emerging Markets Portfolio | | | 7,495,503 | |

| | 240,668 | | PowerShares® FTSE RAFI US 1000 Portfolio | | | 19,953,784 | |

| | 134,759 | | SPDR® S&P 500® ETF Trust | | | 25,818,477 | |

| | 482,753 | | Vanguard® FTSE Developed Markets ETF | | | 17,205,317 | |

| | 751,375 | | Vanguard® FTSE Emerging Markets ETF | | | 24,862,998 | |

| | | | | | | | |

TOTAL EXCHANGE-TRADED FUNDS

(Cost $128,688,489) | | | 123,745,646 | |

| | | | | | | | |

| EXCHANGE-TRADED NOTES - 2.06% | | | | |

| | 372,179 | | ETRACS 2xLeveraged Long Wells Fargo Business Development Company Index ETN | | | 5,802,271 | |

| | 146,050 | | ETRACS Monthly Pay 2xLeveraged Closed-End Fund ETN | | | 2,263,775 | |

See Notes to Financial Statements.

| Annual Report | September 30, 2015 | 33 |

| RiverNorth Core Opportunity Fund | Schedule of Investments |

September 30, 2015

| Shares/Description | | Value | |

| | 211,452 | | JPMorgan Alerian MLP Index ETN | | $ | 6,426,026 | |

| | | | | | | | |

TOTAL EXCHANGE-TRADED NOTES

(Cost $17,122,466) | | | 14,492,072 | |

| | | | | | | | |

| PREFERRED STOCKS - 0.23% | | | | |

| | 61,158 | | General American Investors Co., Inc., Series B, 5.950% | | | 1,613,959 | |

| | | | | | | | |

TOTAL PREFERRED STOCKS

(Cost $1,444,152) | | | 1,613,959 | |

| | | | | | | | |

| SHORT-TERM INVESTMENTS - 3.40% | | | | |

| Money Market Fund | | | | |

| | 23,992,181 | | State Street Institutional Trust (7 Day Yield 0.00%) | | | 23,992,181 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $23,992,181) | | | 23,992,181 | |

| | | | | | | | |

TOTAL INVESTMENTS - 99.70%

(Cost $746,089,269) | | | 703,462,119 | |

| CASH SEGREGATED AT CUSTODIAN FOR TOTAL RETURN SWAP CONTRACTS - 0.06% | | | 400,000 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES - 0.24% | | | 1,732,524 | |

| NET ASSETS - 100.00% | | $ | 705,594,643 | |

(a) | Affiliated company. See Note 9 to Notes to Financial Statements. |

(b) | Non-income producing security. |

| Common Abbreviations: |

| CEF - Closed End Fund. |

| ETF - Exchange Traded Fund. |

| ETN - Exchange Traded Note. |

| FTSE - Financial Times Stock Exchange. |

| Ltd. - Limited. |

| MLP - Master Limited Partnership. |

| RAFI - Research Affiliates Fundamental Index. |

| REIT - Real Estate Investment Trust. |

| S&P - Standard & Poor's. |

| SPDR - Standard and Poor's Depositary Receipt. |

See Notes to Financial Statements.

| 34 | (888) 848-7569 | www.rivernorth.com |

| RiverNorth Core Opportunity Fund | Schedule of Investments |

September 30, 2015

TOTAL RETURN SWAP CONTRACTS (a)(b) | |

| | | | | | | | | |

| Reference Obligation | | Termination Date | | Notional Amount | | | Unrealized Appreciation | |

| ReFlow Fund, LLC* | | 12/16/2015 | | $ | 25,000,000 | | | $ | 12,046 | |

| | | | | | | | | $ | 12,046 | |

(a) | The Fund receives monthly payments based on any positive monthly return of the Reference Obligation. The Fund makes payments on any negative monthly return of such Reference Obligation. |

(b) | The floating short-term rate paid by the Fund (on the notional amount of all total return swap contracts) at September 30, 2015, was 1.94% (1 month Libor +1.75%) |

| * | See Note 4 in the Notes to Financial Statements. |

See Notes to Financial Statements.

| Annual Report | September 30, 2015 | 35 |