UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-021979

Nuveen Investment Trust V

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Kevin J. McCarthy

Nuveen Investments

333 West Wacker Drive Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: September 30

Date of reporting period: March 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

Item 1. Reports to Stockholders.

Mutual Funds

Nuveen Taxable Fixed Income Funds

For investors seeking a high level of current income and total return.

Semi-Annual Report

March 31, 2011

| | | | | | | | | | | | |

| | | Share Class / Ticker Symbol |

| | | | |

| | | Class A | | Class C | | Class R3 | | Class I |

Nuveen Preferred Securities Fund | | NPSAX | | NPSCX | | NPSTX | | NPSRX |

INVESTMENT ADVISER NAME CHANGE

Effective January 1, 2011, Nuveen Asset Management, the Fund’s investment adviser, changed its name to Nuveen Fund Advisors, Inc. (“Nuveen Fund Advisors”). Concurrently, Nuveen Fund Advisors formed a wholly-owned subsidiary, Nuveen Asset Management, LLC, to house its portfolio management capabilities.

NUVEEN INVESTMENTS COMPLETES STRATEGIC COMBINATION WITH FAF ADVISORS

On December 31, 2010, Nuveen Investments completed the strategic combination between Nuveen Asset Management, LLC, the largest investment affiliate of Nuveen Investments, and FAF Advisors. As part of this transaction, U.S. Bancorp — the parent of FAF Advisors — received cash consideration and a 9.5% stake in Nuveen Investments in exchange for the long term investment business of FAF Advisors, including investment-management responsibilities for the non-money market mutual funds of the First American Funds family.

The approximately $27 billion of mutual fund and institutional assets managed by FAF Advisors, along with the investment professionals managing these assets and other key personnel, have become part of Nuveen Asset Management, LLC. With these additions to Nuveen Asset Management, LLC, this affiliate now manages more than $100 billion of assets across a broad range of strategies from municipal and taxable fixed income to traditional and specialized equity investments.

This combination does not affect the investment objectives or strategies of this Fund. Over time, Nuveen Investments expects that the combination will provide even more ways to meet the needs of investors who work with financial advisors and consultants by enhancing the multi-boutique model of Nuveen Investments, which also includes highly respected investment teams at HydePark, NWQ Investment Management, Santa Barbara Asset Management, Symphony Asset Management, Tradewinds Global Investors and Winslow Capital. Nuveen Investments managed approximately $206 billion of assets as of March 31, 2011.

| | | | | | |

| Must be preceded by or accompanied by a prospectus. | | NOT FDIC INSURED | | MAY LOSE VALUE | | NO BANK GUARANTEE |

Table of Contents

Chairman’s

Letter to Shareholders

Dear Shareholders,

In 2010, the global economy recorded another year of recovery from the financial and economic crises of 2008, but many of the factors that caused the downturn still weigh on the prospects for continued improvement. In the U.S., ongoing weakness in housing values has put pressure on homeowners and mortgage lenders. Similarly, the strong earnings recovery for corporations and banks is only slowly being translated into increased hiring or more active lending. Globally, deleveraging by private and public borrowers has inhibited economic growth and that process is far from complete.

Encouragingly, constructive actions are being taken by governments around the world to deal with economic issues. In the U.S., the recent passage of a stimulatory tax bill relieved some of the pressure on the Federal Reserve to promote economic expansion through quantitative easing and offers the promise of sustained economic growth. A number of European governments are undertaking programs that could significantly reduce their budget deficits. Governments across the emerging markets are implementing various steps to deal with global capital flows without undermining international trade and investment.

The success of these government actions could determine whether 2011 brings further economic recovery and financial market progress. One risk associated with the extraordinary efforts to strengthen U.S. economic growth is that the debt of the U.S. government will continue to grow to unprecedented levels. Another risk is that over time there could be inflationary pressures on asset values in the U.S. and abroad, because what happens in the U.S. impacts the rest of the world economy. Also, these various actions are being taken in a setting of heightened global economic uncertainty, primarily about the supplies of energy and other critical commodities. In this challenging environment, your Nuveen investment team continues to seek sustainable investment opportunities and to remain alert to potential risks in a recovery still facing many headwinds. On your behalf, we monitor their activities to assure they maintain their investment disciplines.

As you will note elsewhere in this report, on December 31, 2010, Nuveen Investments completed a strategic combination with FAF Advisors, Inc., the manager of the First American Funds. The combination adds highly respected and distinct investment teams to meet the needs of investors and their advisors and is designed to benefit all fund shareholders by creating a fund organization with the potential for further economies of scale and the ability to draw from even greater talent and expertise to meet those investor needs.

As always, I encourage you to contact your financial consultant if you have any questions about your investment in a Nuveen Fund. On behalf of the other members of your Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Robert P. Bremner

Chairman of the Board

May 19, 2011

Portfolio Manager’s Comments

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio manager as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Any reference to credit ratings for portfolio holdings denotes the highest rating assigned by a Nationally Recognized Statistical Rating Organization (NRSRO) such as Standard & Poor’s (S&P), Moody’s or Fitch. AAA, AA, A and BBB ratings are investment grade; BB, B, CCC, CC, C and D ratings are below investment grade. Holdings and ratings may change over time.

The Nuveen Preferred Securities Fund features management by Nuveen Asset Management, LLC. Douglas Baker, CFA, has served as the Fund’s portfolio manager since its inception in 2006, and has 13 years of investment industry experience. Here Doug discusses the Fund’s performance and its investment strategy for six-month period ended March 31, 2011.

How did the Fund perform during the six-month period ended March 31, 2011?

The table in the Fund Performance section of this report provides total return performance information for the six-month, one-year and since inception periods March 31, 2011. The Fund’s Class A Shares at net asset value (NAV) outperformed the Merrill Lynch Preferred Stock Hybrid Securities Index, the Market Benchmark Index, and the Lipper Corporate Debt Funds BBB-Rated Category Average during the period.

What strategies were used to manage the Fund during the reporting period?

As has been the case for the past several quarters, the Fund continued to receive meaningful inflows during the six-month period ended March 31, 2011. Consistent with our investment process, the cash was invested in securities issued by firms that we deemed to have stable and/or improving credit profiles. These cash flows, coupled with active portfolio management, allowed us to implement strategies that helped the Fund meaningfully outperform its benchmark, such as a continued overweight to BBB-rated and BB-rated securities. Please keep in mind that these ratings are at the security level. Preferred securities are typically rated between three and five notches below the senior unsecured debt ratings of any particular issuer. As of March 31, 2011, the Fund had a 7.5% allocation to BB-rated securities, while the Blended Index has no exposure to securities rated below BBB. In general, during the reporting period lower rated investment grade and below investment grade securities outperformed higher rated investment grade securities.

During the six-month period ended March 31, 2011, the Fund held a meaningful overweight to the financial services sector versus the Market Benchmark Index, and within that overweight was another overweight to insurance companies versus banks. We believe that during this period of time, uncertainty regarding the impact of new bank regulations likely weighed on preferred/hybrid valuations for the bank sector. While the insurance sector experienced some material natural catastrophe exposure in the fourth quarter of 2010 and the first quarter of 2011, the market appeared to feel comfortable that the sector was adequately capitalized to digest these events. In addition, a few insurance companies proposed and/or executed lucrative tenders for some existing preferred/hybrid securities.

As a result, many investors thought it increasingly likely that a growing number of insurance companies would attempt to tender additional preferred/hybrid securities, especially the high coupon structures issued in 2008 and 2009.

In an effort to capitalize on the inefficiencies between the retail and institutional preferred/hybrid markets, we continued to toggle between the $25 par retail sector and the $1000 par institutional sector. Periods of market volatility often drive valuations between retail structures and institutional structures to become meaningfully bifurcated. This dynamic is primarily due to institutional investors’ ability to price risk more efficiently during periods of stress compared to retail investors. In addition, technical factors may also influence the relative valuations between $25 par retail structures and $1000 par institutional structures. For example, aggressive buying of $25 par securities by preferred security ETFs and individual retail investors drove $25 par valuations meaningfully higher compared to $1000 par structures. We used these periods of price discrepancy to rotate between $25 par and $1000 par in an attempt to improve the structure and/or yield of securities held by the Fund.

In addition to toggling between the $25 par retail structures and $1000 par institutional structures, the Fund benefited from an overweight to high equity content, non-cumulative preferred securities that materially outperformed their high debt content, cumulative counterparts. During late 2008 and early 2009, high equity content, non-cumulative security structures meaningfully underperformed high debt content, cumulative structures. Investor demand had spiked for high debt content, cumulative securities in response to menacing headlines coming from the financial services sector. We used this period of time as an opportunity to tactically increase the Fund’s allocation to high equity content, non-cumulative structures. As the severity of headlines abated, and the economy continued to demonstrate signs of stabilization, investor appetite returned for the higher-equity content preferred/hybrid securities. For the six-month period ended March 31, 2011, the Fund remained overweight to high equity content structures relative to the Market Benchmark Index. However, consistent with the past few quarterly measurement periods, we have gradually pared back the Fund’s overweight to these high equity content, non-cumulative structures in response to their increasingly richer valuations.

During the current period, we also entered into forward interest rate swap transactions to reduce the duration of the preferred stock portfolio.

Risk Considerations

Mutual fund investing involves risk; principal loss is possible. Debt or fixed income securities are subject to credit risk and interest rate risk. The value of, and income generated by debt securities will decrease or increase based on changes in market interest rates. As interest rates rise, bond prices fall. Credit risk refers to an issuer’s ability to make interest and principal payments when due. High yield or lower rated securities carry heightened credit risk and potential for default. The potential use of derivative instruments involves a high degree of financial risk, including the risk that the loss on a derivative may be greater than the principal amount invested. Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards.

Fund Performance (Unaudited)

Returns quoted represent past performance, which is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Returns without sales charges would be lower if the sales charge were included. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Returns may reflect a contractual agreement between the Fund and the investment adviser to waive certain fees and expenses; see Notes to Financial Statements, Footnote 7 — Management Fees and Other Transactions with Affiliates for more information. In addition, returns may reflect a voluntary expense limitation by the Fund’s investment adviser that may be modified or discontinued at any time without notice. For the most recent month-end performance visit www.nuveen.com or call (800) 257-8787.

Returns reflect differences in sales charges and expenses, which are primarily differences in distribution and service fees. Fund returns assume reinvestment of dividends and capital gains.

Comparative index and benchmark return information is provided for the Fund’s Class A Shares at net asset value (NAV) only.

Average Annual Total Returns as of March 31, 2011*

| | | | | | | | | | | | |

| | |

| | | Cumulative | | | Average Annual | |

| | | 6-Month | | | 1-Year | | | Since

Inception** | |

Class A Shares at NAV | | | 5.33% | | | | 15.10% | | | | 4.26% | |

Class A Shares at Offer | | | 0.31% | | | | 9.64% | | | | 3.07% | |

Merrill Lynch Preferred Stock Hybrid Securities Index*** | | | 3.22% | | | | 11.79% | | | | 1.59% | |

Market Benchmark Index*** | | | 2.81% | | | | — | | | | 3.08% | |

Lipper Corporate Debt Funds BBB-Rated Category Average*** | | | 0.80% | | | | 8.15% | | | | 5.64% | |

| | | | | | | | | | | | |

Class C Shares | | | 4.94% | | | | 14.24% | | | | 3.50% | |

Class R3 Shares | | | 5.25% | | | | 14.83% | | | | 4.01% | |

Class I Shares | | | 5.46% | | | | 15.38% | | | | 4.52% | |

Class A Shares have a maximum 4.75% sales charge. Class A Share purchases of $1 million or more are sold at net asset value without an up-front sales charge but may be subject to a contingent deferred sales charge (CDSC), also known as a back-end sales charge, if redeemed within twelve months of purchase. Class B Shares have a CDSC that begins at 5% for redemptions during the first year and declines periodically until after six years when the charge becomes 0%. Class B Shares automatically convert to Class A Shares eight years after purchase. Class C Shares have a 1% CDSC for redemptions within less than one year, which is not reflected in the one-year total return. Class R3 Shares have no sales charge and are available to only certain retirement plans. Class I Shares have no sales charge and may be purchased under limited circumstances or by specified classes of investors.

| * | Six-month returns are cumulative; all other returns are annualized. |

| ** | Since inception returns for Class A, C and I Shares are from 12/19/06; since inception return for Class R3 Shares is from 9/29/09. |

| *** | Refer to the Glossary of Terms Used in this Report for definitions. |

Yields (Unaudited) as of March 31, 2011

Dividend Yield is the most recent dividend per share (annualized) divided by the offering price per share.

The SEC 30-Day Yield is a standardized measure of the Fund’s yield that accounts for the future amortization of premiums or discounts of bonds held in the Fund’s portfolio. The SEC 30-Day Yield is computed under an SEC standardized formula and is based on the maximum offer price per share. The 30-Day Yield is computed under the same formula but is based on the net asset value (NAV) per share. Dividend Yield may differ from the SEC 30-Day Yield because the Fund may be paying out more or less than it is earning and it may not include the effect of amortization of bond premium.

The 30-Day Yield on A Shares at NAV applies only to A Shares purchased at no-load pursuant to the Fund’s policy permitting waiver of the A Share load in certain specified circumstances.

| | | | | | | | | | | | |

| | | |

| | | Dividend

Yield | | | 30-Day

Yield | | | SEC 30-Day

Yield | |

Class A Shares at NAV | | | 6.39% | | | | 5.72% | | | | — | |

Class A Shares at Offer | | | 6.08% | | | | — | | | | 5.44% | |

Class C Shares | | | 5.64% | | | | 4.95% | | | | — | |

Class R3 Shares | | | 6.13% | | | | 5.43% | | | | — | |

Class I Shares | | | 6.64% | | | | 5.95% | | | | — | |

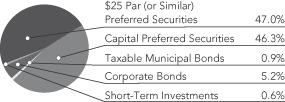

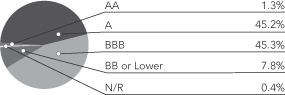

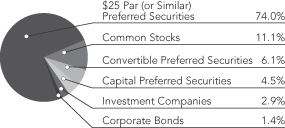

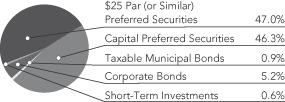

Holding Summaries (Unaudited) as of March 31, 2011

This data relates to the securities held in the Fund’s portfolio of investments. It should not be construed as a measure of performance for the Fund itself.

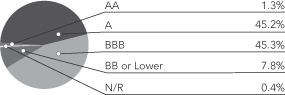

Ratings shown are the highest of Standard & Poor’s Group, Moody’s Investor Service, Inc. or Fitch, Inc. AAA includes bonds with an implied AAA rating since they are backed by U.S. Government or agency securities. AAA, AA, A and BBB ratings are investment grade; BB, B, CCC, CC, C and D ratings are below-investment grade. Holdings designated N/R are not rated by any of these national rating agencies.

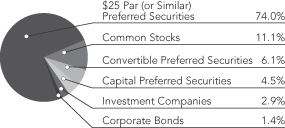

Portfolio Allocation1

| | | | |

| Top Five Issuers1 | | | |

| JP Morgan Chase & Company | | | 4.8% | |

| Wells Fargo and Company | | | 4.5% | |

| ING Groep NV | | | 4.4% | |

| CoBank Agricultural Credit Bank | | | 4.2% | |

| Aegon NV | | | 4.1% | |

Bond Credit Quality2

| | | | |

| Portfolio Composition1 | | | |

| Insurance | | | 35.7% | |

| Commercial Banks | | | 22.0% | |

| Diversified Financial Services | | | 15.5% | |

| Capital Markets | | | 9.7% | |

| U.S. Agency | | | 7.0% | |

| Short Term Investments | | | 0.6% | |

| Other | | | 9.5% | |

| 1 | As a percentage of total investments (excluding investments in derivatives) as of March 31, 2011. Holdings are subject to change. |

| 2 | As a percentage of total investments (excluding short-term investments and investments in derivatives) as of March 31, 2011. Holdings are subject to change. |

Expense Ratios (Unaudited)

The expense ratios below reflect the Fund’s total operating expenses (before fee waivers or expense reimbursements if any) as shown in the Fund’s most recent prospectus. The expense ratios include management fees and other fees and expenses.

| | | | | | | | |

| Share Class | | Gross

Expense

Ratios | | | Net

Expense

Ratios | |

| Class A | | | 1.16% | | | | 1.12% | |

| Class C | | | 1.91% | | | | 1.87% | |

| Class R3 | | | 1.42% | | | | 1.37% | |

| Class I | | | 0.91% | | | | 0.87% | |

The expense ratios shown factor in Total Annual Fund Operating Expenses including management fees and other fees and expenses. The Net Expense Ratios reflect a contractual commitment by the Fund’s investment adviser to waive fees and reimburse expenses through January 31, 2012.

Expense Examples (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including up-front and back-end sales charges (loads) or redemption fees, where applicable; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees, where applicable; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example below is based on an investment of $1,000 invested at the beginning of the period and held for the period.

The information under “Actual Performance,” together with the amount you invested, allows you to estimate actual expenses incurred over the reporting period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60) and multiply the result by the cost shown for your share class, in the row entitled “Expenses Incurred During Period” to estimate the expenses incurred on your account during this period.

The information under “Hypothetical Performance,” provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you incurred for the period. You may use this information to compare the ongoing costs of investing in the Fund and other Funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds or share classes. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Hypothetical Performance | |

| | | Actual Performance | | | (5% annualized return before expenses) | |

| | | A Shares | | | C Shares | | | Class R3 | | | I Shares | | | A Shares | | | C1 Shares | | | Class R3 | | | I Shares | |

| Beginning Account Value (10/01/10) | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

| Ending Account Value (3/31/11) | | $ | 1,053.30 | | | $ | 1,049.40 | | | $ | 1,052.50 | | | $ | 1,054.60 | | | $ | 1,020.04 | | | $ | 1,016.31 | | | $ | 1,018.80 | | | $ | 1,021.29 | |

| Expenses Incurred During Period | | $ | 5.02 | | | $ | 8.84 | | | $ | 6.29 | | | $ | 3.74 | | | $ | 4.94 | | | $ | 8.70 | | | $ | 6.19 | | | $ | 3.68 | |

For each class of the Fund, expenses are equal to the Fund’s annualized net expense ratio of .98%, 1.73%, 1.23% and .73% for Classes A, C, R3 and I, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the six month period).

Portfolio of Investments (Unaudited)

Nuveen Preferred Securities Fund

March 31, 2011

| | | | | | | | | | | | | | | | |

| | | | |

| Shares | | | Description (1) | | Coupon | | | Ratings (2) | | | Value | |

| | | | $25 PAR (OR SIMILAR) PREFERRED SECURITIES – 46.3% | | | | | | | | | | | | |

| | | | |

| | | | Capital Markets – 7.7% | | | | | | | | | | | | |

| | | | |

| | 52,752 | | | Ameriprise Financial, Inc. | | | 7.750% | | | | A | | | $ | 1,463,868 | |

| | | | |

| | 1,008 | | | BNY Capital Trust IV, Series E | | | 6.875% | | | | A1 | | | | 26,178 | |

| | | | |

| | 27,520 | | | BNY Capital Trust V, Series F | | | 5.950% | | | | A1 | | | | 693,229 | |

| | | | |

| | 1,318 | | | Credit Suisse | | | 7.900% | | | | A | | | | 35,481 | |

| | | | |

| | 75,432 | | | Deutsche Bank Capital Funding Trust I | | | 7.350% | | | | A | | | | 1,905,412 | |

| | | | |

| | 57,664 | | | Deutsche Bank Capital Funding Trust II | | | 6.550% | | | | A | | | | 1,421,994 | |

| | | | |

| | 574,651 | | | Deutsche Bank Capital Funding Trust V | | | 8.050% | | | | A | | | | 15,389,154 | |

| | | | |

| | 4,100 | | | Deutsche Bank Capital Funding Trust VIII | | | 6.375% | | | | A | | | | 98,318 | |

| | | | |

| | 325,627 | | | Deutsche Bank Contingent Capital Trust III | | | 7.600% | | | | A | | | | 8,537,940 | |

| | | | |

| | 14,100 | | | Goldman Sachs Group Inc., Series 2004–04 (SATURNS) | | | 6.000% | | | | A2 | | | | 329,517 | |

| | | | |

| | 2,179 | | | Goldman Sachs Group Inc. | | | 6.200% | | | | A– | | | | 54,279 | |

| | | | |

| | 75,000 | | | Goldman Sachs Group Inc. | | | 6.125% | | | | A1 | | | | 1,826,250 | |

| | | | |

| | 46,801 | | | Morgan Stanley Capital Trust III | | | 6.250% | | | | BBB+ | | | | 1,111,524 | |

| | | | |

| | 179,600 | | | Morgan Stanley Capital Trust IV | | | 6.250% | | | | BBB+ | | | | 4,283,460 | |

| | | | |

| | 1,900 | | | Morgan Stanley Capital Trust V | | | 5.750% | | | | BBB+ | | | | 44,099 | |

| | | | |

| | 270,010 | | | Morgan Stanley Capital Trust VI | | | 6.600% | | | | BBB+ | | | | 6,601,745 | |

| | | | |

| | 287,440 | | | Morgan Stanley Capital Trust VII | | | 6.600% | | | | BBB+ | | | | 6,979,043 | |

| | | | |

| | 126,621 | | | Morgan Stanley Capital Trust VIII | | | 6.450% | | | | BBB+ | | | | 3,065,494 | |

| | | | Total Capital Markets | | | | | | | | | | | 53,866,985 | |

| | | | Commercial Banks – 9.3% | | | | | | | | | | | | |

| | | | |

| | 195,958 | | | Banco Santander Finance | | | 10.500% | | | | A | | | | 5,575,005 | |

| | | | |

| | 4,571 | | | Banco Santander Finance | | | 6.800% | | | | A– | | | | 111,624 | |

| | | | |

| | 169,704 | | | Barclays Bank PLC | | | 8.125% | | | | A | | | | 4,461,518 | |

| | | | |

| | 71,669 | | | Barclays Bank PLC | | | 7.750% | | | | A | | | | 1,843,327 | |

| | | | |

| | 195,967 | | | Fifth Third Capital Trust V | | | 7.250% | | | | BBB | | | | 4,967,763 | |

| | | | |

| | 439,614 | | | Fifth Third Capital Trust VI | | | 7.250% | | | | BBB | | | | 11,148,611 | |

| | | | |

| | 220,819 | | | Fifth Third Capital Trust VII | | | 8.875% | | | | BBB | | | | 5,825,205 | |

| | | | |

| | 1,632 | | | Fleet Capital Trust IX | | | 6.000% | | | | BBB | | | | 38,058 | |

| | | | |

| | 500 | | | HSBC Finance Corporation | | | 6.000% | | | | A | | | | 12,575 | |

| | | | |

| | 17,633 | | | HSBC Holdings PLC | | | 8.125% | | | | A+ | | | | 481,734 | |

| | | | |

| | 222,364 | | | HSBC Holdings PLC | | | 8.000% | | | | A+ | | | | 6,066,090 | |

| | | | |

| | 60,000 | | | HSBC Holdings PLC | | | 6.200% | | | | A+ | | | | 1,449,000 | |

| | | | |

| | 6,625 | | | HSBC USA Inc. | | | 4.500% | | | | A+ | | | | 170,793 | |

| | | | |

| | 6,899 | | | KeyCorp Capital Trust V | | | 5.875% | | | | Baa3 | | | | 165,507 | |

| | | | |

| | 95,813 | | | KeyCorp Capital Trust IX | | | 6.750% | | | | BBB | | | | 2,400,116 | |

| | | | |

| | 311,531 | | | KeyCorp Capital Trust X | | | 8.000% | | | | BBB | | | | 8,137,190 | |

| | | | |

| | 170,293 | | | KeyCorp Capital VIII | | | 7.000% | | | | BBB | | | | 4,342,472 | |

| | | | |

| | 172,300 | | | National City Capital Trust II | | | 6.625% | | | | A– | | | | 4,360,913 | |

| | | | |

| | 64,863 | | | National City Capital Trust III | | | 6.625% | | | | A– | | | | 1,635,845 | |

| | | | |

| | 6,360 | | | USB Capital Trust XI | | | 6.600% | | | | A | | | | 162,434 | |

| | | | |

| | 26,547 | | | USB Capital XII | | | 6.300% | | | | A | | | | 676,949 | |

| | | | |

| | 50,000 | | | Wachovia Capital Trust IV | | | 6.375% | | | | A | | | | 1,249,000 | |

| | | | |

| | 13,031 | | | Wachovia Capital Trust IX | | | 6.375% | | | | A | | | | 326,427 | |

Portfolio of Investments (Unaudited)

Nuveen Preferred Securities Fund (continued)

March 31, 2011

| | | | | | | | | | | | | | | | |

| | | | |

| Shares | | | Description (1) | | Coupon | | | Ratings (2) | | | Value | |

| | | | Commercial Banks (continued) | | | | | | | | | | | | |

| | | | |

| | 3,392 | | | Wachovia Capital Trust X | | | 7.850% | | | | A | | | $ | 88,328 | |

| | | | |

| | 845 | | | Wells Fargo & Company | | | 8.000% | | | | A | | | | 23,728 | |

| | | | Total Commercial Banks | | | | | | | | | | | 65,720,212 | |

| | | | Consumer Finance — 1.7% | | | | | | | | | | | | |

| | | | |

| | 50,000 | | | Heller Financial Inc. | | | 6.950% | | | | A+ | | | | 5,048,440 | |

| | | | |

| | 29,250 | | | Heller Financial Inc. | | | 6.687% | | | | A+ | | | | 2,841,822 | |

| | | | |

| | 105,602 | | | HSBC Finance Corporation | | | 6.360% | | | | A | | | | 2,487,983 | |

| | | | |

| | 70,272 | | | HSBC USA Inc., Series H | | | 6.500% | | | | A+ | | | | 1,756,800 | |

| | | | Total Consumer Finance | | | | | | | | | | | 12,135,045 | |

| | | | Diversified Financial Services – 11.6% | | | | | | | | | | | | |

| | | | |

| | 29 | | | BAC Capital Trust X | | | 6.250% | | | | BBB | | | | 679 | |

| | | | |

| | 194,260 | | | Citigroup Capital Trust VII | | | 7.125% | | | | BBB | | | | 4,852,615 | |

| | | | |

| | 45,655 | | | Citigroup Capital Trust VIII | | | 6.950% | | | | BBB | | | | 1,129,505 | |

| | | | |

| | 7,847 | | | Citigroup Capital Trust XII | | | 8.500% | | | | BBB | | | | 206,612 | |

| | | | |

| | 475,000 | | | Citigroup Capital XIII | | | 7.875% | | | | BBB | | | | 13,015,000 | |

| | | | |

| | 6,165 | | | Citigroup Capital XV | | | 6.500% | | | | BBB | | | | 147,220 | |

| | | | |

| | 14,002 | | | Citigroup Capital XVI | | | 6.450% | | | | BBB | | | | 334,088 | |

| | | | |

| | 2,577 | | | Citigroup Capital XVII | | | 6.350% | | | | BBB | | | | 60,869 | |

| | | | |

| | 33,500 | | | Citigroup Capital XIX | | | 7.250% | | | | BBB | | | | 839,510 | |

| | | | |

| | 5,400 | | | Citigroup Capital XX | | | 7.875% | | | | BBB | | | | 138,672 | |

| | | | |

| | 577,524 | | | Countrywide Capital Trust III | | | 7.000% | | | | BBB | | | | 14,443,875 | |

| | | | |

| | 13,877 | | | Countrywide Capital Trust IV | | | 6.750% | | | | BBB | | | | 343,733 | |

| | | | |

| | 139,147 | | | Fleet Capital Trust VIII | | | 7.200% | | | | BBB | | | | 3,475,892 | |

| | | | |

| | 517,868 | | | ING Groep N.V. | | | 8.500% | | | | Ba1 | | | | 13,293,672 | |

| | | | |

| | 259,748 | | | ING Groep N.V. | | | 7.375% | | | | Ba1 | | | | 6,241,744 | |

| | | | |

| | 175,018 | | | ING Groep N.V. | | | 7.200% | | | | Ba1 | | | | 4,151,427 | |

| | | | |

| | 58,482 | | | ING Groep N.V. | | | 7.050% | | | | Ba1 | | | | 1,363,800 | |

| | | | |

| | 134,010 | | | ING Groep N.V. | | | 6.375% | | | | Ba1 | | | | 2,893,276 | |

| | | | |

| | 108,031 | | | ING Groep N.V. | | | 6.200% | | | | Ba1 | | | | 2,316,185 | |

| | | | |

| | 6,281 | | | ING Groep N.V. | | | 6.125% | | | | Ba1 | | | | 133,408 | |

| | | | |

| | 3,573 | | | JP Morgan Chase Capital Trust XI | | | 5.875% | | | | A2 | | | | 88,467 | |

| | | | |

| | 376 | | | JP Morgan Chase Capital Trust XIX, Series S | | | 6.625% | | | | A2 | | | | 9,532 | |

| | | | |

| | 714 | | | JP Morgan Chase Capital Trust XXIV | | | 6.875% | | | | A2 | | | | 18,478 | |

| | | | |

| | 309,016 | | | JP Morgan Chase Capital Trust XXIX | | | 6.700% | | | | A2 | | | | 7,873,728 | |

| | | | |

| | 82,803 | | | MBNA Corporation, Capital Trust D | | | 8.125% | | | | BBB | | | | 2,098,228 | |

| | | | |

| | 66,168 | | | MBNA Capital E | | | 8.100% | | | | BBB | | | | 1,697,209 | |

| | | | |

| | 3,823 | | | Merrill Lynch Capital Trust III | | | 7.375% | | | | BBB | | | | 97,066 | |

| | | | Total Diversified Financial Services | | | | | | | | | | | 81,264,490 | |

| | | | Electric Utilities – 1.4% | | | | | | | | | | | | |

| | | | |

| | 895 | | | American Electric Power | | | 8.750% | | | | Baa3 | | | | 24,720 | |

| | | | |

| | 6,228 | | | DTE Energy Trust I | | | 7.800% | | | | BBB– | | | | 164,544 | |

| | | | |

| | 100 | | | DTE Energy Trust II | | | 7.500% | | | | BBB– | | | | 2,608 | |

| | | | |

| | 25,783 | | | Entergy Texas Inc. | | | 7.875% | | | | BBB+ | | | | 723,471 | |

| | | | |

| | 8,000 | | | Georgia Power Company | | | 6.500% | | | | BBB+ | | | | 828,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Shares | | | Description (1) | | Coupon | | | Ratings (2) | | | Value | |

| | | | Electric Utilities (continued) | | | | | | | | | | | | |

| | | | |

| | 1,200 | | | NextEra Energy Inc. | | | 7.450% | | | | BBB | | | $ | 32,580 | |

| | | | |

| | 9,700 | | | NextEra Energy Inc. | | | 6.600% | | | | BBB | | | | 251,521 | |

| | | | |

| | 56,136 | | | PPL Capital Funding, Inc. | | | 6.850% | | | | BBB | | | | 1,439,888 | |

| | | | |

| | 53,000 | | | PPL Electric Utilities Corporation | | | 6.250% | | | | BB+ | | | | 1,321,688 | |

| | | | |

| | 49,000 | | | Southern California Edison Company | | | 6.500% | | | | Baa2 | | | | 4,867,846 | |

| | | | Total Electric Utilities | | | | | | | | | | | 9,656,866 | |

| | | | Insurance – 9.2% | | | | | | | | | | | | |

| | | | |

| | 48,366 | | | Aegon N.V. | | | 6.875% | | | | BBB | | | | 1,148,209 | |

| | | | |

| | 73,646 | | | Aegon N.V. | | | 6.500% | | | | BBB | | | | 1,674,710 | |

| | | | |

| | 505,699 | | | Aegon N.V. | | | 6.375% | | | | BBB | | | | 11,514,766 | |

| | | | |

| | 560,642 | | | Aegon N.V. | | | 7.250% | | | | BBB | | | | 13,870,283 | |

| | | | |

| | 845,522 | | | Allianz SE | | | 8.375% | | | | A+ | | | | 22,591,327 | |

| | | | |

| | 111,492 | | | American International Group | | | 7.700% | | | | BBB | | | | 2,779,496 | |

| | | | |

| | 12,437 | | | Arch Capital Group Limited, Series B | | | 7.875% | | | | BBB | | | | 315,651 | |

| | | | |

| | 291,912 | | | Assured Guaranty Municipal Holdings | | | 6.875% | | | | A+ | | | | 6,889,123 | |

| | | | |

| | 2,712 | | | Assured Guaranty Municipal Holdings | | | 6.250% | | | | A+ | | | | 59,257 | |

| | | | |

| | 35,588 | | | Assured Guaranty Municipal Holdings | | | 5.600% | | | | A+ | | | | 711,760 | |

| | | | |

| | 5,000 | | | Endurance Specialty Holdings Limited | | | 7.750% | | | | BBB– | | | | 127,950 | |

| | | | |

| | 2,100 | | | MetLife Inc., Series B | | | 6.500% | | | | Baa2 | | | | 52,206 | |

| | | | |

| | 1,700 | | | PLC Capital Trust III | | | 7.500% | | | | BBB | | | | 43,010 | |

| | | | |

| | 17,475 | | | PLC Capital Trust IV | | | 7.250% | | | | BBB | | | | 435,827 | |

| | | | |

| | 3,319 | | | Principal Financial Group | | | 6.518% | | | | BBB | | | | 80,486 | |

| | | | |

| | 1,250 | | | Principal Financial Group | | | 5.563% | | | | BBB | | | | 117,305 | |

| | | | |

| | 8,947 | | | Protective Life Corporation | | | 7.250% | | | | BBB | | | | 223,496 | |

| | | | |

| | 199 | | | Prudential Financial Inc. | | | 9.000% | | | | BBB+ | | | | 5,474 | |

| | | | |

| | 820 | | | Prudential PLC | | | 6.750% | | | | A– | | | | 20,533 | |

| | | | |

| | 18,187 | | | RenaissanceRe Holdings Limited, Series C | | | 6.080% | | | | BBB+ | | | | 417,392 | |

| | | | |

| | 51,390 | | | RenaissanceRe Holdings Limited, Series D | | | 6.600% | | | | BBB+ | | | | 1,262,138 | |

| | | | |

| | 14,123 | | | Selective Insurance Group | | | 7.500% | | | | Baa3 | | | | 354,487 | |

| | | | Total Insurance | | | | | | | | | | | 64,694,886 | |

| | | | Multi-Utilities – 0.3% | | | | | | | | | | | | |

| | | | |

| | 59,165 | | | Dominion Resources Inc. | | | 8.375% | | | | BBB | | | | 1,679,694 | |

| | | | |

| | 13,300 | | | Xcel Energy Inc. | | | 7.600% | | | | BBB | | | | 370,671 | |

| | | | Total Multi-Utilities | | | | | | | | | | | 2,050,365 | |

| | | | Real Estate Investment Trust – 0.9% | | | | | | | | | | | | |

| | | | |

| | 1,131 | | | Duke Realty Corporation, Series L | | | 6.600% | | | | Baa3 | | | | 26,420 | |

| | | | |

| | 220 | | | Duke Realty Corporation, Series O | | | 8.375% | | | | Baa3 | | | | 5,885 | |

| | | | |

| | 6,700 | | | Duke-Weeks Realty Corporation | | | 6.625% | | | | Baa3 | | | | 155,708 | |

| | | | |

| | 78,821 | | | Harris Preferred Capital Corporation, Series A | | | 7.375% | | | | A– | | | | 1,981,560 | |

| | | | |

| | 539 | | | Kimco Realty Corporation, Series G | | | 7.750% | | | | Baa2 | | | | 13,939 | |

| | | | |

| | 5,000 | | | PS Business Parks, Inc. | | | 7.000% | | | | BBB | | | | 124,700 | |

| | | | |

| | 63,943 | | | PS Business Parks, Inc. | | | 6.700% | | | | BBB | | | | 1,560,209 | |

| | | | |

| | 8,680 | | | Public Storage, Inc., Series K | | | 7.250% | | | | A– | | | | 221,427 | |

| | | | |

| | 30,390 | | | Public Storage, Inc., Series W | | | 6.500% | | | | BBB+ | | | | 754,888 | |

Portfolio of Investments (Unaudited)

Nuveen Preferred Securities Fund (continued)

March 31, 2011

| | | | | | | | | | | | | | | | |

| | | | |

| Shares | | | Description (1) | | Coupon | | | Ratings (2) | | | Value | |

| | | | Real Estate Investment Trust (continued) | | | | | | | | | | | | |

| | | | |

| | 9,388 | | | Vornado Realty LP | | | 7.875% | | | | BBB | | | $ | 254,321 | |

| | | | |

| | 8,930 | | | Vornado Realty Trust | | | 6.750% | | | | BBB- | | | | 218,696 | |

| | | | |

| | 32,600 | | | Wachovia Preferred Funding Corporation | | | 7.250% | | | | A– | | | | 832,930 | |

| | | | Total Real Estate Investment Trust | | | | | | | | | | | 6,150,683 | |

| | | | Thrifts & Mortgage Finance – 0.0% | | | | | | | | | | | | |

| | | | |

| | 3,623 | | | Sovereign Capital Trust V | | | 7.750% | | | | A | | | | 92,024 | |

| | | | U.S. Agency – 4.2% | | | | | | | | | | | | |

| | | | |

| | 35,000 | | | Cobank Agricultural Credit Bank, 144A | | | 7.814% | | | | A | | | | 1,650,471 | |

| | | | |

| | 465,250 | | | Cobank Agricultural Credit Bank, 144A | | | 7.000% | | | | A | | | | 21,794,078 | |

| | | | |

| | 107,000 | | | Cobank Agricultural Credit Bank, 144A | | | 11.000% | | | | A | | | | 5,965,250 | |

| | | | Total U.S. Agency | | | | | | | | | | | 29,409,799 | |

| | | | Total $25 Par (or similar) Preferred Securities (cost $281,539,571) | | | | | | | | | | | 325,041,355 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Principal

Amount (000) | | | Description (1) | | | | | Optional Call

Provisions (3) | | | Ratings (2) | | | Value | |

| | | | TAXABLE MUNICIPAL BONDS – 0.9% | | | | | | | | | | | | | | | | |

| | | | | |

| | | | California – 0.2% | | | | | | | | | | | | | | | | |

| | | | | |

| $ | 385 | | | California Municipal Finance Authority, Educational Facilities Revenue Bonds, OCEAA Project, Series 2008B, 11.000%, 10/01/14 | | | | | | | No Opt. Call | | | | N/R | | | $ | 373,904 | |

| | | | | |

| | 200 | | | California Statewide Community Development Authority, Lancer Educational Student Housing Revenue Bonds, California Baptist University, Series 2007, 9.125%, 6/01/13 | | | | | | | No Opt. Call | | | | N/R | | | | 201,354 | |

| | | | | |

| | 200 | | | Long Beach, California, Senior Airport Revenue Bonds, Federally Taxable – Build America Bonds, Series 2009C, 7.765%, 6/01/39 | | | | | | | 12/19 at 100.00 | | | | A2 | | | | 194,280 | |

| | | | | |

| | 200 | | | Southwestern Community College District, San Diego County, California, General Obligation Bonds, Election of 2008, Build America Bonds Series 2009, 7.230%, 8/01/39 | | | | | | | 8/19 at 100.00 | | | | Aa2 | | | | 201,586 | |

| | 985 | | | Total California | | | | | | | | | | | | | | | 971,124 | |

| | | | Florida – 0.3% | | | | | | | | | | | | | | | | |

| | | | | |

| | 255 | | | Miami-Dade County, Florida, Transit System Sales Surtax Revenue Bonds, Build America Bond Series 2009B, 6.910%, 7/01/39 | | | | | | | 7/19 at 100.00 | | | | AA | | | | 246,679 | |

| | | | | |

| | 190 | | | Northern Palm Beach County Improvement District, Florida, Water Control and Improvement Bonds, Development Unit 46, Series 2007B, 8.250%, 8/01/21 | | | | | | | 8/14 at 100.00 | | | | N/R | | | | 178,807 | |

| | | | | |

| | 200 | | | Orlando, Florida, Capital Improvement Special Revenue Bonds, Build America Taxable Bond Series 200C, 7.100%, 10/01/39 | | | | | | | 10/19 at 100.00 | | | | AA+ | | | | 206,034 | |

| | | | | |

| | 250 | | | Pasco County, Florida, Water and Sewer Revenue Bonds, Build America Bonds Series 2009B, 6.760%, 10/01/39 | | | | | | | No Opt. Call | | | | AA | | | | 255,995 | |

| | | | | |

| | 200 | | | Seacoast Utility Authority, Florida, Water and Sewer Utility System Revenue Bonds, Taxable Build America, Series 2009B, 6.680%, 3/01/39 | | | | | | | 3/20 at 100.00 | | | | Aa3 | | | | 201,452 | |

| | | | | |

| | 445 | | | Seminole Tribe of Florida, Special Obligation Bonds, Series 2007B, 7.804%, 10/01/20 | | | | | | | No Opt. Call | | | | BBB- | | | | 439,736 | |

| | | | | |

| | 200 | | | South Broward Hospital District, Florida, Revenue Bonds, Build America Taxable Bonds, Series 2009B, 7.278%, 5/01/44 | | | | | | | 5/19 at 100.00 | | | | AA- | | | | 203,988 | |

| | 1,740 | | | Total Florida | | | | | | | | | | | | | | | 1,732,691 | |

| | | | Hawaii – 0.0% | | | | | | | | | | | | | | | | |

| | | | | |

| | 200 | | | Honolulu City and County, Hawaii, General Obligation Bonds, Build America Bonds, Series 2009E, 6.300%, 9/01/34 | | | | | | | 9/19 at 100.00 | | | | Aa1 | | | | 201,152 | |

| | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | | Optional Call

Provisions (3) | | | Ratings (2) | | | Value | |

| | | | Idaho – 0.0% | | | | | | | | | | | | | | | | |

| | | | | |

| $ | 75 | | | Idaho Housing and Finance Association NonProfit Facilities Revenue Bonds, Liberty Charter School, Inc, Series 2008B, 7.500%, 6/01/12 | | | | | | | No Opt. Call | | | | BBB | | | $ | 74,103 | |

| | | | Louisiana – 0.0% | | | | | | | | | | | | | | | | |

| | | | | |

| | 195 | | | Carter Plantation Land Louisiana, Revenue Bonds, 9.000%, 7/01/17, 144A (4),(5) | | | | | | | 4/11 at 100.00 | | | | N/R | | | | 19,500 | |

| | | | Michigan – 0.1% | | | | | | | | | | | | | | | | |

| | | | | |

| | 200 | | | Croswell & Lexington Community Schools, Michigan, General Obligation Bonds, School Building & Site Series 2009, 6.050%, 5/01/29 | | | | | | | 5/19 at 100.00 | | | | AA– | | | | 189,276 | |

| | | | | |

| | 1,500 | | | Lansing Tax Increment Finance Authority, Michigan, Tax Increment Bonds, Capital Appreciation Refunding Series 2009, 0.000%, 5/01/31 | | | | | | | 5/19 at 38.12 | | | | AA | | | | 324,330 | |

| | 1,700 | | | Total Michigan | | | | | | | | | | | | | | | 513,606 | |

| | | | Missouri – 0.0% | | | | | | | | | | | | | | | | |

| | | | | |

| | 200 | | | Missouri Joint Municipal Electric Utility Commission, Prairie State Power Project Revenue Bond, Federally Taxable Build America Bonds – Direct Pay, Series 2009A, 6.890%, 1/01/42 | | | | | | | 1/19 at 100.00 | | | | A3 | | | | 196,488 | |

| | | | Nevada – 0.0% | | | | | | | | | | | | | | | | |

| | | | | |

| | 200 | | | Clark County, Nevada, Airport Revenue Bonds, Senior Lien Series 2009B, 6.881%, 7/01/42 | | | | | | | 7/19 at 100.00 | | | | Aa2 | | | | 199,996 | |

| | | | New Jersey – 0.1% | | | | | | | | | | | | | | | | |

| | | | | |

| | 200 | | | South Jersey Transportation Authority, New Jersey, Transportation System Revenue Bonds, Build America Bond Series 2009A-5, 7.000%, 11/01/38 | | | | | | | No Opt. Call | | | | A– | | | | 203,180 | |

| | | | Ohio – 0.1% | | | | | | | | | | | | | | | | |

| | | | | |

| | 200 | | | American Municipal Power Ohio Inc., Prairie State Energy Campus Project Revenue Bnods, Federally Taxable Issuer Subsidy Build America Bonds, Series 2009C, 6.553%, 2/15/39 | | | | | | | 2/19 at 100.00 | | | | A1 | | | | 190,728 | |

| | | | | |

| | 200 | | | Berea City School District, County, Ohio, Certificates of Participartion, Build America Bonds, Series 2009B, 7.250%, 10/01/39 | | | | | | | 10/19 at 100.00 | | | | A1 | | | | 199,522 | |

| | | | | |

| | 200 | | | Edgewood City School District, Counties of Butler and Preble, Ohio, School Improvement General Obligation Bonds, Build America Bonds, Series 2009, 7.500%, 12/01/37 | | | | | | | No Opt. Call | | | | Aa3 | | | | 206,650 | |

| | | | | |

| | 200 | | | Hamilton, Ohio, Electric System Revenue Bonds, Build America Bonds Series 2009B, 6.600%, 10/01/39 – AGC Insured | | | | | | | 10/19 at 100.00 | | | | Aa3 | | | | 195,238 | |

| | 800 | | | Total Ohio | | | | | | | | | | | | | | | 792,138 | |

| | | | Texas – 0.1% | | | | | | | | | | | | | | | | |

| | | | | |

| | 600 | | | Danbury Higher Education Authority Inc., Texas, Golden Rule Charter School Revenue Bonds, Series 2008B, 10.000%, 8/15/18 | | | | | | | No Opt. Call | | | | BB+ | | | | 561,228 | |

| | | | | |

| | 100 | | | La Vernia Education Financing Corporation, Texas, Charter School Revenue Bonds, Riverwalk Education Foundation, Series 2007B, 8.750%, 8/15/12 | | | | | | | 8/11 at 100.00 | | | | N/R | | | | 100,173 | |

| | | | | |

| | 200 | | | North Texas Tollway Authority, System Revenue Bonds, Taxble Build America Bond Series 2009B, 6.718%, 1/01/49 | | | | | | | No Opt. Call | | | | A2 | | | | 199,428 | |

| | 900 | | | Total Texas | | | | | | | | | | | | | | | 860,829 | |

| | | | Virginia – 0.0% | | | | | | | | | | | | | | | | |

| | | | | |

| | 200 | | | Metropolitan Washington DC Airports Authority, Virginia, Dulles Toll Raod Revenue Bonds, Series 2009D, 7.462%, 10/01/46 – AGC Insured | | | | | | | No Opt. Call | | | | BBB+ | | | | 196,456 | |

| | | | Washington – 0.0% | | | | | | | | | | | | | | | | |

| | | | | |

| | 520 | | | Washington State Economic Development Finance Authority, Revenue Bonds, Coeur D’Alene Fiber Fuels Inc., Series 2007H, 10.000%, 12/01/11 (4),(5) | | | | | | | No Opt. Call | | | | N/R | | | | 130,000 | |

| $ | 7,915 | | | Total Taxable Municipal Bonds (cost $6,751,890) | | | | | | | | | | | | | | | 6,091,263 | |

Portfolio of Investments (Unaudited)

Nuveen Preferred Securities Fund (continued)

March 31, 2011

| | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | | Maturity | | | Ratings (2) | | | Value | |

| | | | CORPORATE BONDS – 5.1% | | | | | | | | | | | | | | | | |

| | | | | |

| | | | Electric Utilities – 0.4% | | | | | | | | | | | | | | | | |

| | | | | |

| $ | 3,000 | | | FPL Group Capital Inc. | | | 6.650% | | | | 6/15/17 | | | | BBB | | | $ | 2,996,250 | |

| | | | Insurance – 4.7% | | | | | | | | | | | | | | | | |

| | | | | |

| | 9,310 | | | American International Group, Inc. | | | 8.175% | | | | 5/15/58 | | | | BBB | | | | 10,019,888 | |

| | | | | |

| | 2,000 | | | Nationwide Mutual Insurance Company, 144A | | | 8.250% | | | | 12/01/31 | | | | A– | | | | 2,164,818 | |

| | | | | |

| | 1,500 | | | Nationwide Mutual Insurance Company, 144A | | | 7.875% | | | | 4/01/33 | | | | A– | | | | 1,592,003 | |

| | | | | |

| | 15,210 | | | Nationwide Mutual Insurance Company, 144A | | | 9.375% | | | | 8/15/39 | | | | A– | | | | 18,496,925 | |

| | | | | |

| | 700 | | | QBE Insurance Group Limited, 144A | | | 9.750% | | | | 3/14/14 | | | | A | | | | 809,553 | |

| | 28,720 | | | Total Insurance | | | | | | | | | | | | | | | 33,083,187 | |

| $ | 31,720 | | | Total Corporate Bonds (cost $34,512,193) | | | | | | | | | | | | | | | 36,079,437 | |

Principal

Amount

(000)/Shares | | | Description (1) | | Coupon | | | Maturity | | | Ratings (2) | | | Value | |

| | | | CAPITAL PREFERRED SECURITIES – 45.6% | | | | | | | | | | | | | | | | |

| | | | | |

| | | | Capital Markets – 1.9% | | | | | | | | | | | | | | | | |

| | | | | |

| | 250 | | | BNY Institutional Capital, 144A | | | 7.780% | | | | 12/01/26 | | | | A1 | | | $ | 255,938 | |

| | | | | |

| | 6,500 | | | Goldman Sachs Group, Inc. | | | 6.345% | | | | 2/15/34 | | | | A3 | | | | 6,245,928 | |

| | | | | |

| | 6,569 | | | Schwab Capital Trust I | | | 7.500% | | | | 11/15/37 | | | | BBB+ | | | | 6,785,251 | |

| | 13,319 | | | Total Capital Markets | | | | | | | | | | | | | | | 13,287,117 | |

| | | | Commercial Banks – 12.3% | | | | | | | | | | | | | | | | |

| | | | | |

| | 3,000 | | | Abbey National Capital Trust I | | | 8.963% | | | | 6/30/30 | | | | A | | | | 3,285,000 | |

| | | | | |

| | 2,062 | | | Bank of America Corporation | | | 8.000% | | | | 1/30/18 | | | | BBB | | | | 2,217,413 | |

| | | | | |

| | 12,935 | | | Barclays Bank PLC | | | 6.278% | | | | 12/15/34 | | | | A | | | | 11,253,450 | |

| | | | | |

| | 3,135 | | | BB&T Capital Trust IV | | | 6.820% | | | | 6/12/37 | | | | Baa1 | | | | 3,119,325 | |

| | | | | |

| | 900 | | | BBVA Bancomer Texas | | | 7.250% | | | | 4/22/20 | | | | A3 | | | | 908,612 | |

| | | | | |

| | 11,705 | | | BNP Paribas, 144A | | | 7.195% | | | | 12/25/37 | | | | A | | | | 11,236,800 | |

| | | | | |

| | 950 | | | Credit Agricole, S.A | | | 9.750% | | | | 12/26/54 | | | | A | | | | 1,033,125 | |

| | | | | |

| | 5,500 | | | First Empire Capital Trust I | | | 8.234% | | | | 2/01/27 | | | | Baa2 | | | | 5,569,938 | |

| | | | | |

| | 3,000 | | | First Empire Capital Trust II | | | 8.277% | | | | 6/01/27 | | | | Baa2 | | | | 3,036,585 | |

| | | | | |

| | 3,380 | | | HVB Funding Trust III, 144A | | | 9.000% | | | | 10/22/31 | | | | BBB | | | | 3,295,500 | |

| | | | | |

| | 4,750 | | | Rabobank Nederland, 144A | | | 11.000% | | | | 6/30/19 | | | | AA– | | | | 6,186,875 | |

| | | | | |

| | 1,000 | | | Societe Generale | | | 8.750% | | | | 10/07/49 | | | | BBB+ | | | | 1,057,500 | |

| | | | | |

| | 3,500 | | | Standard Chartered PLC, 144A | | | 7.014% | | | | 7/30/37 | | | | A | | | | 3,403,855 | |

| | | | | |

| | 2,000 | | | Union State Capital Trust I | | | 9.580% | | | | 2/01/27 | | | | N/R | | | | 2,042,100 | |

| | | | | |

| | 24,619 | | | Wells Fargo & Company, Series K | | | 7.980% | | | | 9/15/99 | | | | A | | | | 26,957,804 | |

| | | | | |

| | 1,833 | | | Wells Fargo Capital Trust XIII | | | 7.700% | | | | 3/26/13 | | | | A | | | | 1,887,990 | |

| | 84,269 | | | Total Commercial Banks | | | | | | | | | | | | | | | 86,491,872 | |

| | | | Consumer Finance – 1.0% | | | | | | | | | | | | | | | | |

| | | | | |

| | 6,895 | | | Capital One Capital III Corporation | | | 7.686% | | | | 8/15/36 | | | | BBB | | | | 7,093,231 | |

| | | | Diversified Financial Services – 3.7% | | | | | | | | | | | | | | | | |

| | | | | |

| | 22,811 | | | JPMorgan Chase & Company | | | 7.900% | | | | 4/30/18 | | | | A | | | | 24,957,743 | |

| | | | | |

| | 1,000 | | | Republic New York Capital I | | | 7.750% | | | | 11/15/26 | | | | A+ | | | | 1,020,000 | |

| | 23,811 | | | Total Diversified Financial Services | | | | | | | | | | | | | | | 25,977,743 | |

| | | | Electric Utilities – 1.0% | | | | | | | | | | | | | | | | |

| | | | | |

| | 500 | | | FPL Group Capital Inc. | | | 6.350% | | | | 10/01/16 | | | | BBB | | | | 493,125 | |

| | | | | |

| | 825 | | | FPL Group Capital Inc. | | | 7.300% | | | | 9/01/17 | | | | BBB | | | | 861,094 | |

| | | | | |

| | 5,959 | | | PPL Capital Funding, Inc. | | | 6.700% | | | | 3/30/17 | | | | BB+ | | | | 5,877,064 | |

| | 7,284 | | | Total Electric Utilities | | | | | | | | | | | | | | | 7,231,283 | |

| | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000)/Shares | | | Description (1) | | Coupon | | | Maturity | | | Ratings (2) | | | Value | |

| | | | Insurance – 21.2% | | | | | | | | | | | | | | | | |

| | | | | |

| | 1,300 | | | Ace Capital Trust II | | | 9.700% | | | | 4/01/30 | | | | BBB+ | | | $ | 1,638,000 | |

| | | | | |

| | 7,010 | | | AXA SA, 144A | | | 6.379% | | | | 12/14/36 | | | | Baa1 | | | | 6,203,850 | |

| | | | | |

| | 84 | | | Axis Capital Holdings Limited | | | 7.500% | | | | 12/01/15 | | | | BBB | | | | 8,326,317 | |

| | | | | |

| | 22,154 | | | Catlin Insurance Company Limited | | | 7.249% | | | | 1/19/17 | | | | BBB+ | | | | 20,880,145 | |

| | | | | |

| | 1,900 | | | Dai-Ichi Mutual Life, 144A | | | 7.250% | | | | 7/25/61 | | | | A3 | | | | 1,878,253 | |

| | | | | |

| | 6,195 | | | Everest Reinsurance Holdings, Inc. | | | 6.600% | | | | 5/15/37 | | | | Baa1 | | | | 5,885,250 | |

| | | | | |

| | 8,000 | | | Financial Security Assurance Holdings, 144A | | | 6.400% | | | | 12/15/36 | | | | A– | | | | 5,240,000 | |

| | | | | |

| | 14,500 | | | Glen Meadows Pass Through Trust, 144A | | | 6.505% | | | | 2/15/17 | | | | BB+ | | | | 12,796,250 | |

| | | | | |

| | 2,400 | | | Hartford Financial Services Group Inc. | | | 8.125% | | | | 6/15/18 | | | | BB+ | | | | 2,628,000 | |

| | | | | |

| | 12,172 | | | Liberty Mutual Group Inc., 144A | | | 10.750% | | | | 6/15/58 | | | | Baa3 | | | | 15,823,600 | |

| | | | | |

| | 4,150 | | | Lincoln National Corporation | | | 7.000% | | | | 5/17/16 | | | | BBB | | | | 4,118,875 | |

| | | | | |

| | 3,000 | | | Lincoln National Corporation | | | 6.050% | | | | 4/20/17 | | | | BBB | | | | 2,805,000 | |

| | | | | |

| | 15,711 | | | MetLife Capital Trust X, 144A | | | 9.250% | | | | 4/08/68 | | | | BBB | | | | 18,971,033 | |

| | | | | |

| | 3,847 | | | National Financial Services Inc. | | | 6.750% | | | | 5/15/37 | | | | Baa2 | | | | 3,568,093 | |

| | | | | |

| | 5,090 | | | Prudential Financial Inc. | | | 8.875% | | | | 6/15/18 | | | | BBB+ | | | | 6,006,200 | |

| | | | | |

| | 3,000 | | | Prudential PLC | | | 7.750% | | | | 3/23/49 | | | | A– | | | | 3,037,500 | |

| | | | | |

| | 2,000 | | | Reinsurance Group of America Inc. | | | 6.750% | | | | 12/15/15 | | | | BBB– | | | | 1,954,252 | |

| | | | | |

| | 5,000 | | | StanCorp Financial Group Inc. | | | 6.900% | | | | 6/01/17 | | | | BBB | | | | 4,800,000 | |

| | | | | |

| | 9,455 | | | Swiss Re Capital I, 144A | | | 6.854% | | | | 5/25/16 | | | | A– | | | | 9,252,096 | |

| | | | | |

| | 7,900 | | | Symetra Financial Corporation, 144A | | | 8.300% | | | | 10/15/37 | | | | BBB– | | | | 7,959,250 | |

| | | | | |

| | 5,851 | | | XL Capital Ltd | | | 6.500% | | | | 10/15/57 | | | | BBB– | | | | 5,368,293 | |

| | 140,719 | | | Total Insurance | | | | | | | | | | | | | | | 149,140,257 | |

| | | | Real Estate Investment Trust – 1.7% | | | | | | | | | | | | | | | | |

| | | | | |

| | 11 | | | Sovereign Real Estate Investment Trust, 144A | | | 12.000% | | | | 10/31/50 | | | | A | | | | 12,302,960 | |

| | | | U.S. Agency – 2.8% | | | | | | | | | | | | | | | | |

| | | | | |

| | 1,650 | | | AgFirst Farm Credit Bank | | | 7.300% | | | | 12/15/53 | | | | A | | | | 1,456,010 | |

| | | | | |

| | 16 | | | Farm Credit Bank of Texas | | | 10.000% | | | | 12/15/60 | | | | A | | | | 17,930,000 | |

| | 1,666 | | | Total U.S. Agency | | | | | | | | | | | | | | | 19,386,010 | |

| | | | Total Capital Preferred Securities (cost $294,587,421) | | | | | | | | | | | | | | | 320,910,473 | |

| | | | | |

Principal

Amount (000) | | | Description (1) | | | | | Coupon | | | Maturity | | | Value | |

| | | | SHORT-TERM INVESTMENTS – 0.6% | | | | | | | | | | | | | | | | |

| | | | | |

| $ | 4,083 | | | Repurchase Agreement with State Street Bank, dated 3/31/11, repurchase price $4,083,232, collateralized by $4,120,000 U.S. Treasury Notes, 1.000%, due 4/30/12, value 4,165,993 | | | | | | | 0.010% | | | | 4/01/11 | | | $ | 4,083,231 | |

| | | | Total Short-Term Investments (cost $4,083,231) | | | | | | | | | | | | | | | 4,083,231 | |

| | | | Total Investments (cost $621,474,306) – 98.5% | | | | | | | | | | | | | | | 692,205,759 | |

| | | | Other Assets Less Liabilities – 1.5% (7) | | | | | | | | | | | | | | | 10,402,249 | |

| | | | Net Assets – 100% | | | | | | | | | | | | | | $ | 702,608,008 | |

Investments in Derivatives

Forward Swaps outstanding at March 31, 2011:

| | | | | | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Notional

Amount | | | Fund

Pay/Receive

Floating Rate | | Floating

Rate Index | | Fixed Rate

(Annualized) | | Fixed Rate

Payment

Frequency | | | Effective

Date (6) | | Termination

Date | | | Unrealized

Appreciation

(Depreciation) | |

Morgan Stanley | | $ | 28,000,000 | | | Receive | | 3-Month USD-LIBOR | | 2.970% | | | Semi-Annually | | | 11/10/11 | | | 11/10/21 | | | $ | 2,120,439 | |

Morgan Stanley | | | 12,000,000 | | | Receive | | 3-Month USD-LIBOR | | 3.488% | | | Semi-Annually | | | 10/14/11 | | | 10/14/40 | | | | 1,833,356 | |

| | | | | | | | | | | | | | | | | | | | | | | $ | 3,953,795 | |

Portfolio of Investments (Unaudited)

Nuveen Preferred Securities Fund (continued)

March 31, 2011

| | (1) | | All percentages shown in the Portfolio of Investments are based on net assets. |

| | (2) | | Ratings: Using the highest of Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investor Service, Inc. (“Moody’s”) or Fitch, Inc. (“Fitch”) rating. Ratings below BBB by Standard & Poor’s, Baa by Moody’s or BBB by Fitch are considered to be below investment grade. Holdings designated N/R are not rated by any of these national rating agencies. |

| | (3) | | Optional Call Provisions: Dates (month and year) and prices of the earliest optional call or redemption. There may be other call provisions at varying prices at later dates. Certain mortgage-backed securities may be subject to periodic principal paydowns. |

| | (4) | | For fair value measurement disclosure purposes, investment categorized as Level 3. See Notes to Financial Statements, Footnote 1 – General Information and Significant Accounting Policies, Investment Valuation for more information. |

| | (5) | | The Fund’s Adviser has concluded this issue is not likely to meet its future interest payment obligations and has directed the Fund’s custodian to cease accruing additional income on the Fund’s records. |

| | (6) | | Effective date represents the date on which both the Fund and Counterparty commence interest payment accruals on each forward swap contract. |

| | (7) | | Other Assets Less Liabilities includes Value and/or Net Unrealized Appreciation (Depreciation) of derivative instruments as listed within Investments in Derivatives. |

| | 144A | | Investment is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These investments may only be resold in transactions exempt from registration, which are normally those transactions with qualified institutional buyers. |

| | SATURNS | | Structured Asset Trust Unit Repackaging. |

| | USD-LIBOR | | United States Dollar-London Inter-Bank Offered Rate. |

See accompanying notes to financial statements.

Statement of Assets and Liabilities (Unaudited)

March 31, 2011

| | | | |

Assets | | | | |

Investments, at value (cost $621,474,306) | | $ | 692,205,759 | |

Unrealized appreciation on forward swaps | | | 3,953,795 | |

Receivables: | | | | |

Dividends | | | 1,293,151 | |

Interest | | | 6,590,476 | |

Investments sold | | | 4,636,996 | |

Shares sold | | | 3,396,556 | |

Other assets | | | 6,951 | |

Total assets | | | 712,083,684 | |

Liabilities | | | | |

Payables: | | | | |

Dividends | | | 1,818,072 | |

Investments purchased | | | 5,539,206 | |

Shares redeemed | | | 1,349,681 | |

Accrued expenses: | | | | |

Management fees | | | 329,945 | |

12b-1 distribution and service fees | | | 128,227 | |

Other | | | 310,545 | |

Total liabilities | | | 9,475,676 | |

Net assets | | $ | 702,608,008 | |

Class A Shares | | | | |

Net assets | | $ | 189,779,153 | |

Shares outstanding | | | 11,225,263 | |

Net asset value per share | | $ | 16.91 | |

Offering price per share (net asset value per share plus

maximum sales charge of 4.75% of offering price) | | $ | 17.75 | |

Class C Shares | | | | |

Net assets | | $ | 106,925,686 | |

Shares outstanding | | | 6,321,718 | |

Net asset value and offering price per share | | $ | 16.91 | |

Class R3 Shares | | | | |

Net assets | | $ | 105,516 | |

Shares outstanding | | | 6,200 | |

Net asset value and offering price per share | | $ | 17.02 | |

Class I Shares | | | | |

Net assets | | $ | 405,797,653 | |

Shares outstanding | | | 23,999,866 | |

Net asset value and offering price per share | | $ | 16.91 | |

Net Assets Consist of: | | | | |

Capital paid-in | | $ | 611,704,988 | |

Undistributed (Over-distribution of) net investment income | | | (1,258,126 | ) |

Accumulated net realized gain (loss) | | | 17,475,898 | |

Net unrealized appreciation (depreciation) | | | 74,685,248 | |

Net assets | | $ | 702,608,008 | |

Authorized shares | | | Unlimited | |

Par value per share | | $ | 0.01 | |

See accompanying notes to financial statements.

Statement of Operations (Unaudited)

Six Months Ended March 31, 2011

| | | | |

Investment Income | | | | |

Dividends | | $ | 12,391,067 | |

Interest | | | 11,791,175 | |

Total investment income | | | 24,182,242 | |

Expenses | | | | |

Management fees | | | 2,347,466 | |

12b-1 service fees – Class A | | | 222,270 | |

12b-1 distribution and service fees – Class C | | | 504,752 | |

12b-1 distribution and service fees – Class R3 | | | 196 | |

Shareholders’ servicing agent fees and expenses | | | 197,370 | |

Custodian’s fees and expenses | | | 75,809 | |

Trustees’ fees and expenses | | | 8,004 | |

Professional fees | | | 28,673 | |

Shareholders’ reports – printing and mailing expenses | | | 55,540 | |

Federal and state registration fees | | | 85,126 | |

Other expenses | | | 11,008 | |

Total expenses before custodian fee credit and expense reimbursement | | | 3,536,214 | |

Custodian fee credit | | | (157 | ) |

Expense reimbursement | | | (389,684 | ) |

Net expenses | | | 3,146,373 | |

Net investment income (loss) | | | 21,035,869 | |

Realized and Unrealized Gain (Loss): | | | | |

Net realized gain (loss) from investments | | | 18,886,257 | |

Change in net unrealized appreciation (depreciation) of: | | | | |

Investments | | | (9,598,821 | ) |

Forward swaps | | | 3,921,321 | |

Net realized and unrealized gain (loss) | | | 13,208,757 | |

Net increase (decrease) in net assets from operations | | $ | 34,244,626 | |

See accompanying notes to financial statements.

Statement of Changes in Net Assets (Unaudited)

| | | | | | | | |

| | | Six Months Ended

3/31/2011 | | | Year Ended

9/30/10 | |

Operations | | | | | | | | |

Net investment income (loss) | | $ | 21,035,869 | | | $ | 30,309,314 | |

Net realized gain (loss) from: | | | | | | | | |

Investments | | | 18,886,257 | | | | 27,616,437 | |

Futures | | | — | | | | (44,310 | ) |

Change in net unrealized appreciation (depreciation) of: | | | | | | | | |

Investments | | | (9,598,821 | ) | | | 35,553,087 | |

Forward swaps | | | 3,921,321 | | | | 32,474 | |

Futures | | | — | | | | (101,585 | ) |

Net increase (decrease) in net assets from operations | | | 34,244,626 | | | | 93,365,417 | |

Distributions to Shareholders | | | | | | | | |

From net investment income: | | | | | | | | |

Class A | | | (5,755,859 | ) | | | (8,823,737 | ) |

Class C | | | (2,889,825 | ) | | | (4,793,553 | ) |

Class R3 | | | (2,453 | ) | | | (3,823 | ) |

Class I | | | (12,817,647 | ) | | | (17,275,636 | ) |

From accumulated net realized gains: | | | | | | | | |

Class A | | | (4,508,870 | ) | | | — | |

Class C | | | (2,475,555 | ) | | | — | |

Class R3 | | | (1,530 | ) | | | — | |

Class I | | | (9,927,935 | ) | | | — | |

Decrease in net assets from distributions to shareholders | | | (38,379,674 | ) | | | (30,896,749 | ) |

Fund Share Transactions | | | | | | | | |

Proceeds from sale of shares | | | 254,541,005 | | | | 487,260,177 | |

Proceeds from shares issued to shareholders due to reinvestment of distributions | | | 19,698,958 | | | | 15,884,319 | |

| | | 274,239,963 | | | | 503,144,496 | |

Cost of shares redeemed | | | (209,217,111 | ) | | | (183,288,380 | ) |

Net increase (decrease) in net assets from Fund share transactions | | | 65,022,852 | | | | 319,856,116 | |

Net increase (decrease) in net assets | | | 60,887,804 | | | | 382,324,784 | |

Net assets at the beginning of period | | | 641,720,204 | | | | 259,395,420 | |

Net assets at the end of period | | $ | 702,608,008 | | | $ | 641,720,204 | |

Undistributed (Over-distribution of) net investment income at the end of period | | $ | (1,258,126 | ) | | $ | (828,211 | ) |

See accompanying notes to financial statements.

Financial Highlights (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Selected data for a share outstanding throughout each period: | |

| | | | | | | | |

| Class (Commencement Date) | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Investment Operations | | | Less Distributions | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | Beginning

Net

Asset

Value | | | Net

Invest-

ment

Income

(Loss)(a) | | |

Net

Realized/

Unrealized

Gain

(Loss) | | | Total | | | Net

Invest-

ment

Income | | | Capital

Gains(b) | | | Return

of

Capital | | | Total | | | Ending

Net

Asset

Value | | | Total

Return(c) | |

Class A (12/06) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended 9/30: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2011(i) | | $ | 16.99 | | | $ | .53 | | | $ | .35 | | | $ | .88 | | | $ | (.54 | ) | | $ | (.42 | ) | | $ | — | | | $ | (.96 | ) | | $ | 16.91 | | | | 5.33 | % |

2010 | | | 14.73 | | | | 1.11 | | | | 2.28 | | | | 3.39 | | | | (1.13 | ) | | | — | | | | — | | | | (1.13 | ) | | | 16.99 | | | | 23.84 | |

2009(e) | | | 11.76 | | | | .84 | | | | 3.00 | | | | 3.84 | | | | (.87 | ) | | | — | | | | — | | | | (.87 | ) | | | 14.73 | | | | 35.29 | |

Year Ended 12/31: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2008 | | | 16.98 | | | | 1.31 | | | | (5.30 | ) | | | (3.99 | ) | | | (1.08 | ) | | | — | | | | (.15 | ) | | | (1.23 | ) | | | 11.76 | | | | (24.67 | ) |

2007 | | | 20.01 | | | | 1.08 | | | | (3.03 | ) | | | (1.95 | ) | | | (1.08 | ) | | | — | | | | — | | | | (1.08 | ) | | | 16.98 | | | | (10.12 | ) |

2006(f) | | | 20.00 | | | | .03 | | | | (.02 | ) | | | .01 | | | | — | | | | — | | | | — | | | | — | | | | 20.01 | | | | .05 | |

Class C (12/06) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended 9/30: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2011(i) | | | 17.00 | | | | .47 | | | | .34 | | | | .81 | | | | (.48 | ) | | | (.42 | ) | | | — | | | | (.90 | ) | | | 16.91 | | | | 4.94 | |

2010 | | | 14.74 | | | | 1.00 | | | | 2.28 | | | | 3.28 | | | | (1.02 | ) | | | — | | | | — | | | | (1.02 | ) | | | 17.00 | | | | 22.94 | |

2009(e) | | | 11.77 | | | | .78 | | | | 3.00 | | | | 3.78 | | | | (.81 | ) | | | — | | | | — | | | | (.81 | ) | | | 14.74 | | | | 34.48 | |

Year Ended 12/31: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2008 | | | 16.96 | | | | 1.16 | | | | (5.24 | ) | | | (4.08 | ) | | | (.97 | ) | | | — | | | | (.14 | ) | | | (1.11 | ) | | | 11.77 | | | | (25.13 | ) |

2007 | | | 20.01 | | | | .93 | | | | (3.03 | ) | | | (2.10 | ) | | | (.95 | ) | | | — | | | | — | | | | (.95 | ) | | | 16.96 | | | | (10.85 | ) |

2006(f) | | | 20.00 | | | | .03 | | | | (.02 | ) | | | .01 | | | | — | | | | — | | | | — | | | | — | | | | 20.01 | | | | .05 | |

Class R3 (9/09) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended 9/30: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2011(i) | | | 17.10 | | | | .52 | | | | .35 | | | | .87 | | | | (.53 | ) | | | (.42 | ) | | | — | | | | (.95 | ) | | | 17.02 | | | | 5.25 | |

2010 | | | 14.82 | | | | 1.08 | | | | 2.30 | | | | 3.38 | | | | (1.10 | ) | | | — | | | | — | | | | (1.10 | ) | | | 17.10 | | | | 23.59 | |

2009(h) | | | 14.88 | | | | .01 | | | | (.07 | ) | | | (.06 | ) | | | — | | | | — | | | | — | | | | — | | | | 14.82 | | | | (.40 | ) |

Class I (12/06)(g) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended 9/30: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2011(i) | | | 16.99 | | | | .55 | | | | .36 | | | | .91 | | | | (.57 | ) | | | (.42 | ) | | | — | | | | (.99 | ) | | | 16.91 | | | | 5.46 | |

2010 | | | 14.72 | | | | 1.16 | | | | 2.28 | | | | 3.44 | | | | (1.17 | ) | | | — | | | | — | | | | (1.17 | ) | | | 16.99 | | | | 24.23 | |

2009(e) | | | 11.76 | | | | .86 | | | | 3.00 | | | | 3.86 | | | | (.90 | ) | | | — | | | | — | | | | (.90 | ) | | | 14.72 | | | | 35.48 | |

Year Ended 12/31: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2008 | | | 16.98 | | | | 1.19 | | | | (5.14 | ) | | | (3.95 | ) | | | (1.14 | ) | | | — | | | | (.13 | ) | | | (1.27 | ) | | | 11.76 | | | | (24.45 | ) |

2007 | | | 20.01 | | | | 1.18 | | | | (3.08 | ) | | | (1.90 | ) | | | (1.13 | ) | | | — | | | | — | | | | (1.13 | ) | | | 16.98 | | | | (9.91 | ) |

2006(f) | | | 20.00 | | | | .04 | | | | (.03 | ) | | | .01 | | | | — | | | | — | | | | — | | | | — | | | | 20.01 | | | | .05 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | |

| | | | | | | | | | | |

| Ratios/Supplemental Data | |

| | | | Ratios to Average

Net Assets Before

Reimbursement | | | Ratios to Average

Net Assets After

Reimbursement(d) | | | | |

Ending

Net

Assets

(000) | | | Expenses | | | Net

Invest-

ment

Income

(Loss) | | | Expenses | | | Net

Invest-

ment

Income

(Loss) | | | Portfolio

Turnover

Rate | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| $ | 189,779 | | | | 1.10 | * | | | 6.18 | * | | | .98 | * | | | 6.30 | * | | | 29 | |

| | 185,972 | | | | 1.16 | | | | 6.87 | | | | .95 | | | | 7.07 | | | | 72 | |

| | 93,983 | | | | 1.47 | * | | | 8.58 | * | | | .94 | * | | | 9.11 | * | | | 30 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | 22,420 | | | | 1.64 | | | | 10.32 | | | | .95 | | | | 11.02 | | | | 99 | |

| | 321 | | | | 2.50 | | | | 4.23 | | | | 1.13 | | | | 5.60 | | | | 179 | |

| | 275 | | | | 18.18 | * | | | (12.06 | )* | | | 1.23 | * | | | 4.88 | * | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | 106,926 | | | | 1.85 | * | | | 5.45 | * | | | 1.73 | * | | | 5.57 | * | | | 29 | |

| | 97,316 | | | | 1.91 | | | | 6.13 | | | | 1.70 | | | | 6.34 | | | | 72 | |

| | 48,720 | | | | 2.23 | * | | | 7.82 | * | | | 1.69 | * | | | 8.36 | * | | | 30 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | 6,429 | | | | 2.32 | | | | 8.90 | | | | 1.70 | | | | 9.52 | | | | 99 | |

| | 245 | | | | 3.29 | | | | 3.39 | | | | 1.89 | | | | 4.79 | | | | 179 | |

| | 275 | | | | 18.93 | * | | | (12.82 | )* | | | 1.99 | * | | | 4.12 | * | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | 106 | | | | 1.36 | * | | | 6.04 | * | | | 1.23 | * | | | 6.16 | * | | | 29 | |

| | 62 | | | | 1.42 | | | | 6.59 | | | | 1.20 | | | | 6.81 | | | | 72 | |

| | 50 | | | | 1.37 | * | | | 11.62 | * | | | 1.20 | * | | | 11.79 | * | | | 30 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | 405,798 | | | | .85 | * | | | 6.48 | * | | | .73 | * | | | 6.60 | * | | | 29 | |

| | 358,371 | | | | .91 | | | | 7.16 | | | | .70 | | | | 7.37 | | | | 72 | |

| | 116,643 | | | | 1.21 | * | | | 9.12 | * | | | .69 | * | | | 9.64 | * | | | 30 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | 38,697 | | | | 1.26 | | | | 7.57 | | | | .69 | | | | 8.14 | | | | 99 | |

| | 19,769 | | | | 1.80 | | | | 5.28 | | | | .78 | | | | 6.30 | | | | 179 | |

| | 4,178 | | | | 17.92 | * | | | (11.81 | )* | | | .98 | * | | | 5.13 | * | | | 0 | |

| (a) | Per share Net Investment Income (Loss) is calculated using the average daily shares method. |

| (b) | Distributions from Capital Gains include short-term capital gains, if any. |

| (c) | Total return is the combination of changes in net asset value without any sales charge, reinvested dividend income at net asset value and reinvested capital gains distributions at net asset value, if any. Total returns are not annualized. |

| (d) | After expense reimbursement from the Adviser, where applicable. Ratios do not reflect the effect of custodian fee credits earned on the Fund’s net cash on deposit with the custodian bank, where applicable. |

| (e) | For the nine months ended September 30, 2009. |

| (f) | For the period December 19, 2006 (commencement of operations) through December 31, 2006. |

| (g) | Effective May 1, 2008, Class R Shares were renamed Class I Shares. |

| (h) | For the period September 29, 2009 (commencement of operations) through September 30, 2009. |

| (i) | For the six months ended March 31, 2011. |

See accompanying notes to financial statements.

Notes to Financial Statements (Unaudited)

1. General Information and Significant Accounting Policies

General Information

The Nuveen Investment Trust V (the “Trust”) is an open-end investment company registered under the Investment Company Act of 1940, as amended. The Trust is comprised of the Nuveen Preferred Securities Fund (the “Fund”), among others. The Trust was organized as a Massachusetts business trust on September 27, 2006.