united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22153

Dunham Funds

(Exact name of registrant as specified in charter)

10251 Vista Sorrento Pkwy, Ste. 200, San Diego, CA 92121

(Address of principal executive offices) (Zip code)

Richard Malinowski

Gemini Fund Services, LLC., 80Arkay Drive Hauppauge, NY 11788

(Name and address of agent for service)

Registrant's telephone number, including area code: 631-470-2619

Date of fiscal year end: 10/31

Date of reporting period:10/31/17

Item 1. Reports to Stockholders.

This Annual Report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements also include those preceded by, followed by or that include the words “believes”, “expects”, “anticipates” or similar expressions. Such statements should be viewed with caution. Actual results or experience could differ materially from the forward-looking statements as a result of many factors. Each Fund makes no commitments to disclose any revisions to forward-looking statements, or any facts, events or circumstances after the date hereof that may bear upon forward-looking statements. In addition, prospective purchasers of the Funds should consider carefully the information set forth herein and the applicable fund’s prospectus. Other factors and assumptions not identified above may also have been involved in the derivation of these forward-looking statements, and the failure of these other assumptions to be realized may also cause actual results to differ materially from those projected.

Dear Fellow Shareholders,

Over the past fiscal year, the markets have had strong returns. While this can be attributed to a variety of factors, most of the momentum, on the surface, can be linked to optimism about the change in leadership in the United States with President Donald Trump entering the White House. Will the optimism start to fade as the passing of policy continually comes into question? Will a pro-business President be able to push through an agenda? Will the policy achieve what it is designed to do? These are just a few questions which answers will determine the path of the stock markets over the upcoming fiscal year.

During the past fiscal year, U.S. markets overall remained bullish. Even with doubts that policy can be passed into law, markets continued with a synchronized global market rally. A “risk-on” attitude has led investors to feel comfortable to chase higher returns outside of the U.S. stock market. This risk appetite combined with low volatility levels may lead to the idea that the run can continue. If central banks at some point change their course and do not remain as accommodative with low interest rates, there is a likelihood that historical volatility of international markets will return. The global upturn can also be attributed to China’s rising import demand over the past year.

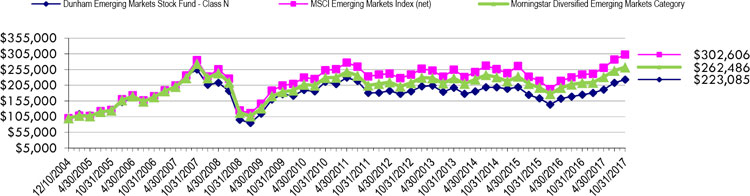

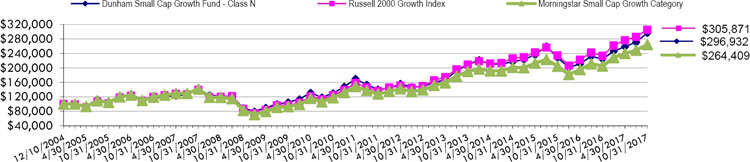

As discussed earlier, the past year has seen a global rise across all markets. For the fiscal year, the S&P 500 returned 23.6 percent while the Dow Jones Industrial Average and the tech-heavy NASDAQ Composite returned 32.1 and 31.1 percent respectively. International developed markets, as measured by the MSCI EAFE Index, returned 23.4 percent during the same time period. Doing well in its own right, emerging markets, as measured by the MSCI Emerging Markets Index, returned 26.5 percent. Both domestic and international markets had very strong overall returns.

The U.S. economy continues to show signs of growth even if the pace has slowed down since the initial excitement of a pro-business President in the White House. Strong labor markets and wage growth are keeping recession chances low. Continuing low inflation seems to have prolonged the upward cycle. Without the inflation component reaching certain levels, the Federal Reserve has had to remain cautious and has avoided tightening monetary policy too fast. U.S. markets may still have room to run as tax-cut legislation still offers an opportunity for stronger corporate earnings.

The global economy, after two years of mediocre growth, appears to have momentum to continue the upward trend. The Eurozone is doing well due to a weak currency and rising confidence and demand. Latin American countries, Canada, and Australia have all rebounded due to rising demand for commodities. While China often leads the international gains, their returns have been slowed as the local authorities try to stem financial speculation.

The oil market has stayed relatively range-bound as the Organization of Petroleum Exporting Countries (OPEC) and Russia continue to try and work on limiting production. The last twelve months has seen the price of WTI Crude bounce around from $45 per barrel and topping out near $60 per barrel. Since hitting the low point in June, the price was climbing over the course of the last four months as production cuts seemed to be working. The wild card will be if U.S. shale oil production can replace any cutback as a higher per barrel price would make domestic production more profitable. It will be important to see if the rising price and production cuts can continue.

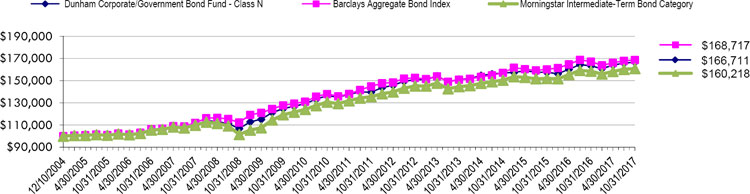

Domestic bonds had a poor year compared to the equity markets. After hitting the low of 2.04 percent at the beginning of September, the yield on the 10-year U.S. Treasury finished at 2.38 percent to end the 12-month period ended October 31, 2017. The Barclays US Aggregate Bond Index returned only 0.90 percent for the fiscal year. Global bonds also were a weak performer. The Barclays Global Aggregate Bond Index ex-US returned only 1.26 percent for the 12-month period ended October 31, 2017, which was only slightly higher compared to the broad US bond market.

Keeping with interest rates, the Federal Reserve continues to be cautious about raising the Federal Funds rate. With two hikes so far in 2017 and one more expected in December, the Fed continues to monitor targets for the dual mandate of low unemployment and a goal inflation rate. At this point, the low unemployment numbers look good, but low wage growth has led to a lower inflation number than would be expected. The pace of rate increases will be something to monitor in the upcoming fiscal year.

Meanwhile, escalating tensions in the Korean peninsula represent a potential catalyst for meaningful market risk, as the U.S. and China are the world’s 2 economies that are most central to global trade. The Fed’s unwinding of its balance sheet, and the European Central Bank’s likely tapering of asset purchases next year, could pose a liquidity challenge to markets. Overall, the global economy is in a synchronized expansion amid low inflation, with low risk of recession. Going forward, a shift toward global monetary policy normalization may boost market volatility.

We thank you for your continued trust and the confidence you have placed in us. We take that trust very seriously and look forward to servicing your investment needs for years to come.

Sincerely,

Jeffrey A. Dunham

President

Dunham & Associates Investment Counsel, Inc.

October 31, 2017

| Dunham Floating Rate Bond Fund (Unaudited) |

| Message from the Sub-Adviser (Newfleet Asset Management, LLC) |

Interest rates rose over the fiscal year, but the path was anything but direct. The yield on the 10-year Treasury began the fiscal year at 1.83 percent and hit its low for the fiscal year of 2.04 percent a few days in, trading within an 82 basis point range through the end of December. From that point, the yield began to undulate, hitting its fiscal year high of 2.63 percent in mid-March, at which point the yield began a somewhat steady decline through late June. Yields began to fluctuate again, before trending steadily upward to finish the fiscal year 55 basis points higher than they began, at 2.38 percent. The overall increase in rates aided the performance for bank loans, as measured by the S&P / LSTA Leveraged Loan Index. The path of bank loan returns generally followed the moves in U.S. Treasury yields, gaining more earlier in the fiscal year and less as the year neared its close. For the most recent fiscal year, bank loans returned 5.1 percent, after rising 6.5 percent during the previous fiscal year. Similar to U.S. Treasury yields, the London Interbank Offered Rate (“LIBOR”) increased during the fiscal year. Three-month LIBOR began the fiscal year at 0.88 percent and ended the fiscal year at 1.38 percent.

The rise in interest rates over the fiscal year coincided with an equity market increase over the same time period. At the beginning of the fiscal year, the average bank loan in the Fund had a price of $98.6. By the end of the fiscal year, the average price saw a slight increase to $98.7. At the beginning of the fiscal year, approximately 22 bank loans in the Fund had a price below $95, which represented approximately 7.2 percent of the bank loans in the Fund. By the end of the fiscal year, the Fund still held approximately 22 bank loans with a price below $95, but which represented approximately 6.9 percent of the bank loans in the Fund. The Sub-Adviser remains optimistic about the asset class’ potential as interest rates rise and investor sentiment towards the loan space allows the prices to continue to increase.

The yields on bank loans, as measured by the S&P / LSTA Leveraged Loan 100 Index, moved in similar fashion to broader Treasury yield movements during the fiscal year. Bank loans in general began the fiscal year with a yield-to-maturity of 5.1 percent, approximately 1.4 percent less than their traditional high-yield bond counterparts, as measured by the Bank of America Merrill Lynch High-Yield Bond Cash Pay Index. Bank loans underperformed traditional high-yield bonds during the fiscal year by 4.1 percent. As bank loans underperformed traditional high-yield bonds, the yield gap between bank loans and traditional high-yield bonds saw a contraction. At the end of the fiscal year, the yields on bank loans stood at 4.8 percent and traditional high-yield bonds ended at 6.0 percent. The Fund held approximately 5.7 percent of its assets in traditional high-yield bonds, which from an allocation perspective enhanced relative performance during the fiscal year.

The Sub-Adviser continued to focus on higher-rated first lien loans within the bank loan space, limiting its exposure to bank loans rated CCC and lower. The exposure to lower-rated loans, second lien loans, and traditional bonds has been limited to instances where the Sub-Adviser has determined that the additional reward is expected to significantly outweigh the additional risk. However, with the significant increase in lower-rated securities, some of the Fund’s bonds also benefited. For example, the Fund held the CCC+ rated traditional bonds issued by FTS International, Inc. (30283WAB0) (holding percentage*: 0.02 percent) for the entire fiscal year. The company is a provider of oil field services and high-pressure hydraulic fracturing, operating throughout the United States. The company’s bonds increased 77.3 percent on a total return basis over the fiscal year. An example of a CCC+ rated bond that had a challenging fiscal year was the that of Argos Merger Sub, Inc. (04021LAA8) (holding percentage*: 0.05 percent). Argos Merger Sub, Inc. is a debt issuing company that operates as a subsidiary of Argo Holdings, Inc., a private company made up of a consortium of private equity firms that acquired Petsmart, Inc. in 2015. Over the entire fiscal year, the bonds lost 19.9 percent in total return.

As the price of oil rose 16 percent over the fiscal year, from $46.86 a barrel at the beginning, to $54.38 a barrel at the end, many energy-related issuers saw increases in their bank loans. One such issuer that benefited the Fund over the fiscal year was Seadrill Partners (BL1232042) (holding percentage*: 0.31 percent). The company explores and produces oil and gas, offering crude oil, natural gas, and other oil products. The Seadrill bank loans saw a price increase of 35.9 percent over the fiscal year. A bank loan that detracted from Fund performance was from issuer Fieldwood Energy, LLC (BL1112129) (holding percentage*: 0.03 percent). The company explores, produces, and develops oil and natural gas, and acquires and develops oil and natural gas opportunity assets throughout the United States. Fieldwood’s bank loan lost 36.9 percent from its price from the beginning of the fiscal year through the end.

The Sub-Adviser remains constructive on markets but believes there are still a number of uncertainties to monitor going forward, including geopolitical tensions; energy-related volatility; and what could be signs of a flattening of the yield curve. As the supply of new money loan issuance declined in October while demand remained strong, the Sub-Adviser anticipates the supply/demand imbalance to continue in the near term, expecting the loan market to exhibit coupon-like returns for the foreseeable future. The Sub-Adviser believes that President Trump’s nomination of Jerome Powell to succeed Fed Chair Janet Yellen in February of 2018 provides some continuity to the Fed, as it is widely viewed that Mr. Powell will adopt the existing framework of gradually increasing interest rates and predictably reducing the Fed’s balance sheet. The Sub-Adviser expects the Fed to increase interest rates in December and possibly even in March of 2018. The Sub-Adviser believes the U.S. economy and its underpinnings, as well as issuers and their earnings, show continued broad-based improvement. Add to that improving global macro fundamentals and stabilized oil prices, the Sub-Adviser believes that this credit cycle should continue into 2018.

| * | Holdings percentage(s) as of 10/31/2017 |

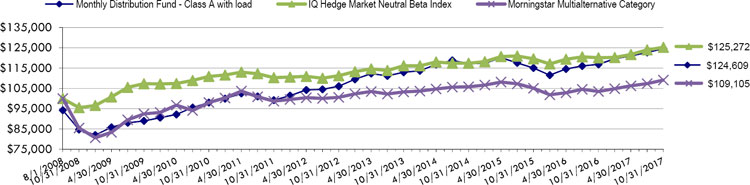

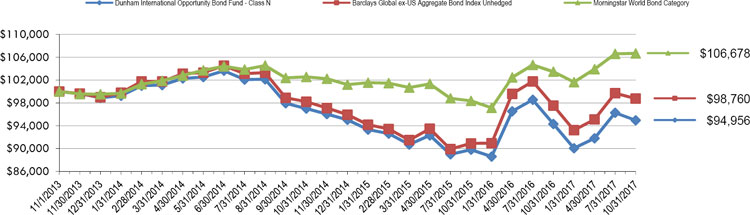

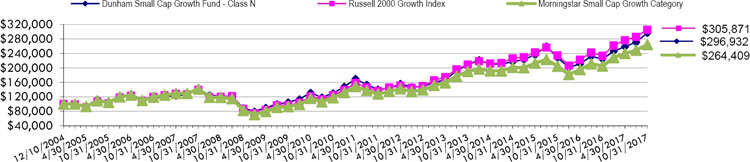

Growth of $100,000 Investment

Total Returns as of October 31, 2017

| | | Annualized | Annualized |

| | One | Three | Since Inception |

| | Year | Years | (11/1/13) |

| Class N | 3.91% | 3.04% | 2.63% |

| Class C | 3.20% | 2.27% | 1.86% |

| Class A with load of 4.50% | (1.05)% | 1.17% | 1.19% |

| Class A without load | 3.64% | 2.75% | 2.36% |

| S&P/LSTA Leveraged Loan 100 Index | 5.08% | 3.35% | 3.35% |

| Morningstar Bank Loan Category | 4.45% | 3.24% | 3.04% |

The S&P/LSTA Leveraged Loan 100 Index is designed to reflect the performance of the largest facilities in the leveraged loan market. Investors cannot invest directly in an index or benchmark.

The Morningstar Bank Loan Category is generally representative of mutual funds that primarily invest in floating-rate bank loans instead of bonds. These bank loans generally offer interest payments that typically float above a common short-term benchmark such as the London interbank offered rate, or LIBOR.

As disclosed in the Trust’s latest registration statement, the Fund’s total annual operating expenses, including cost of underlying funds, are 1.20% for Class N, 1.95% for Class C and 1.45% for Class A. Class A shares are subject to a sales load of 4.50% and a deferred sales charge of up to 0.75%. The performance data quoted here represents past performance, which is not indicative of future results. Current performance may be lower or higher than the performance data quoted. The investment return and NAV will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Total returns are calculated assuming reinvestment of all dividends and capital gains distributions, if any. The returns do not reflect the deductions of taxes a shareholder would pay on the redemption of fund shares or fund distributions. For performance information current to the most recent month-end, please call 1-800-442-4358 or visit our website www.dunham.com

| SCHEDULE OF INVESTMENTS |

| Dunham Floating Rate Bond Fund |

| October 31, 2017 |

| Security | | | | Shares | | | | | | | Value | |

| COMMON STOCKS - 0.3% | | | | | | | | | | | | | | |

| ELECTRIC - 0.1% | | | | | | | | | | | | | | |

| Vistra Energy Corp. ^ | | | | | 10,588 | | | | | | | $ | 205,831 | |

| | | | | | | | | | | | | | | |

| LODGING - 0.0% | | | | | | | | | | | | | | |

| Caesars Entertainment Corp. * ^ | | | | | 5,010 | | | | | | | | 64,879 | |

| | | | | | | | | | | | | | | |

| OIL & GAS - 0.1% | | | | | | | | | | | | | | |

| Ocean Rig UDW, Inc. * | | | | | 4,980 | | | | | | | | 133,365 | |

| | | | | | | | | | | | | | | |

| REAL ESTATE - 0.1% | | | | | | | | | | | | | | |

| Vici Properties, Inc. * | | | | | 7,261 | | | | | | | | 134,328 | |

| TOTAL COMMON STOCKS (Cost - $482,496) | | | | | | | | | | | | | 538,403 | |

| | | | | | | | | | | | | | | |

| EXCHANGE TRADED FUNDS - 2.0% | | | | | | | | | | | | | | |

| DEBT EXCHANGE TRADED FUNDS - 2.0% | | | | | | | | | | | | | | |

| PowerShares Senior Loan Portfolio | | | | | 76,935 | | | | | | | | 1,778,737 | |

| SPDR Bloomberg Barclays Short Term High Yield | | | | | 65,000 | | | | | | | | 1,814,800 | |

| TOTAL EXCHANGE TRADED FUNDS (Cost - $3,593,447) | | | | | | | | | | | | | 3,593,537 | |

| | | | | | | | | | | | | | | |

| | | Variable | | Principal | | | Interest | | Maturity | | | | |

| | | Rate | | Amount | | | Rate | | Date | | | | |

| BANK LOANS - 83.3% | | | | | | | | | | | | | | |

| CONSUMER DISCRETIONARY - 22.8% | | | | | | | | | | | | | | |

| Accuride Corp., Term Loan Retired + | | LIBOR + 7.000 | % | $ | 367,325 | | | 8.334 | % | 11/16/2023 | | | 369,161 | |

| Advantage Sales & Marketing, Inc., Term Loan + | | LIBOR + 6.500 | | | 247,000 | | | 7.877 | | 7/24/2022 | | | 208,450 | |

| Advantage Solutions, Initial Term Loan + | | LIBOR + 3.250 | | | 284,288 | | | 4.631 | | 7/24/2021 | | | 269,984 | |

| Advantage Solutions, Term B-2 Loan + | | LIBOR + 3.250 | | | 394,385 | | | 4.627 | | 7/24/2021 | | | 374,541 | |

| Affinity Gaming, Initial Term Loan + | | LIBOR + 3.500 | | | 368,359 | | | 4.834 | | 6/30/2023 | | | 371,815 | |

| American Axle & Manufacturing, Inc., Tranche B Term Loan + | | LIBOR + 2.250 | | | 281,437 | | | 3.624 | | 4/6/2024 | | | 282,406 | |

| Aristocrat Leisure Ltd., New 2017 Term Loan + | | LIBOR + 2.000 | | | 600,187 | | | 3.365 | | 10/20/2021 | | | 604,784 | |

| Aristocrat Leisure Ltd., Term B-2 Loan + | | LIBOR + 2.000 | | | 565,000 | | | 3.363 | | 10/20/2024 | | | 568,672 | |

| Bass Pro Group LLC, Initial Term Loan + | | LIBOR + 5.000 | | | 700,000 | | | 6.377 | | 9/24/2024 | | | 681,188 | |

| Cablevision, March 2017 Refinancing Term Loan + | | LIBOR + 2.250 | | | 1,783,181 | | | 3.604 | | 7/16/2025 | | | 1,784,135 | |

| Caesars, Term B-1 Loan + | | LIBOR + 3.500 | | | 147,671 | | | 4.897 | | 10/16/2022 | | | 148,066 | |

| Caesars, Term B Loan + | | LIBOR + 4.000 | | | 235,000 | | | 5.377 | | 7/8/2024 | | | 238,048 | |

| Caesars Entertainment, Inc., Term B Loan + | | LIBOR + 3.500 | | | 811,117 | | | 4.881 | | 10/12/2020 | | | 812,711 | |

| Caesars Entertainment, Inc., Term B Loan + | | LIBOR + 2.500 | | | 1,415,000 | | | 3.881 | | 10/8/2024 | | | 1,417,766 | |

| Caesars Growth Partners, 2017 Term Loan + | | LIBOR + 3.000 | | | 646,465 | | | 4.381 | | 5/8/2021 | | | 647,477 | |

| Caesars Resort Collection, Term Loan + | | LIBOR + 2.750 | | | 2,245,000 | | | 4.086 | | 10/2/2024 | | | 2,261,838 | |

| CBS Radio, Inc., Term B Loan Retired + | | LIBOR + 3.500 | | | 293,698 | | | 4.874 | | 10/16/2023 | | | 296,195 | |

| Charter Communications Operating LLC, Term E-1 Loan + | | LIBOR + 2.000 | | | 321,771 | | | 3.381 | | 6/30/2020 | | | 323,602 | |

| Charter Communications Operating LLC, Term H-1 Loan + | | LIBOR + 2.000 | | | 135,930 | | | 3.381 | | 1/16/2022 | | | 136,703 | |

| Charter Communications Operating LLC, Term I-1 Loan + | | LIBOR + 2.250 | | | 896,370 | | | 3.631 | | 1/16/2024 | | | 903,890 | |

| Cirque Du Soleil, Term B Loan + | | LIBOR + 3.750 | | | 631,838 | | | 5.084 | | 7/8/2022 | | | 637,433 | |

| CityCenter Holdings LLC, Term B Loan + | | LIBOR + 2.500 | | | 563,588 | | | 3.881 | | 4/18/2024 | | | 566,865 | |

| Cooper-Standard Automotive, Additional Term B-1 Loan + | | LIBOR + 2.250 | | | 188,074 | | | 3.584 | | 11/2/2023 | | | 189,438 | |

| Dexko Global, U.S. Dollar Term B Loan + | | LIBOR + 4.000 | | | 520,000 | | | 5.371 | | 7/24/2024 | | | 525,093 | |

| Eldorado Resorts, Inc., Term Loan + | | LIBOR + 2.250 | | | 826,471 | | | 3.647 | | 4/16/2024 | | | 829,227 | |

| FCA US LLC, Tranche D Term Loan + | | LIBOR + 6.750 | | | 1,510,000 | | | 8.084 | | 1/30/2019 | | | 1,136,962 | |

| Federal-Mogul Holdings Corp., Tranche C Term Loan + | | LIBOR + 3.750 | | | 774,024 | | | 5.119 | | 4/16/2021 | | | 782,008 | |

| Formula One, Facility B3 + | | LIBOR + 3.000 | | | 700,000 | | | 4.381 | | 1/31/2024 | | | 706,416 | |

| Gates Global LLC, Initial B-1 Dollar Term Loan Retired + | | LIBOR + 3.250 | | | 632,773 | | | 4.584 | | 3/31/2024 | | | 638,034 | |

| Gateway Casinos & Entertainment, Initial Tranche B-1 Term Loan + | | LIBOR + 3.750 | | | 164,588 | | | 5.084 | | 2/22/2023 | | | 167,288 | |

| Greektown Holdings LLC, Initial Term Loan + | | LIBOR + 3.000 | | | 169,575 | | | 4.381 | | 4/24/2024 | | | 170,571 | |

| Hilton Worldwide Finance LLC, Series B-2 Term Loan + | | LIBOR + 2.000 | | | 1,525,915 | | | 3.374 | | 10/24/2023 | | | 1,537,947 | |

| KAR Auction Services, Inc., Tranche B-4 Term Loan + | | LIBOR + 2.250 | | | 202,669 | | | 3.584 | | 3/12/2021 | | | 204,822 | |

| KAR Auction Services, Inc., Tranche B-5 Term Loan + | | LIBOR + 2.500 | | | 58,157 | | | 3.834 | | 3/8/2023 | | | 58,679 | |

| Landry’s, Inc., Initial B Term Loan + | | LIBOR + 3.250 | | | 478,790 | | | 4.628 | | 10/4/2023 | | | 484,277 | |

| Laureate International Universities, Series 2024 Term Loan + | | LIBOR + 4.500 | | | 1,042,288 | | | 5.881 | | 4/26/2024 | | | 1,049,782 | |

| Leslie’s Poolmart, Tranche B-1 Term Loan + | | LIBOR + 3.750 | | | 316,901 | | | 5.131 | | 8/16/2023 | | | 316,901 | |

See accompanying notes to financial statements.

| SCHEDULE OF INVESTMENTS |

| Dunham Floating Rate Bond Fund (Continued) |

| October 31, 2017 |

| | | Variable | | Principal | | | Interest | | Maturity | | | |

| Security | | Rate | | Amount | | | Rate | | Date | | Value | |

| BANK LOANS - 83.3% (Continued) | | | | | | | | | | | | | | |

| CONSUMER DISCRETIONARY (Continued) - 22.8% | | | | | | | | | | | | | | |

| Libbey Glass, Inc., Initial Loan + | | LIBOR + 3.000 | % | $ | 507,616 | | | 4.357 | % | 4/8/2021 | | $ | 480,966 | |

| Lionsgate, Term B Loan + | | LIBOR + 3.000 | | | 145,225 | | | 4.377 | | 12/8/2023 | | | 146,496 | |

| Masergy Communications, Refinancing Term B Loan + | | LIBOR + 2.500 | | | 852,759 | | | 3.910 | | 9/16/2023 | | | 858,959 | |

| McGraw-Hill, Term B Loan + | | LIBOR + 4.000 | | | 839,647 | | | 5.381 | | 5/4/2022 | | | 839,735 | |

| Mediacom, Tranche K Term Loan + | | LIBOR + 2.250 | | | 153,673 | | | 3.642 | | 2/16/2024 | | | 154,394 | |

| Mediacom Broadband LLC, Tranche H Term Loan + | | LIBOR + 2.500 | | | 295,114 | | | 3.880 | | 1/29/2021 | | | 295,943 | |

| Mediacom Broadband LLC, Tranche M Term Loan + | | LIBOR + 2.000 | | | 500,000 | | | 3.378 | | 1/24/2025 | | | 502,710 | |

| MGM Growth Properties, Term B Loan + | | LIBOR + 2.250 | | | 371,345 | | | 3.631 | | 4/24/2023 | | | 373,865 | |

| Michaels Stores, Inc., 2016 New Replacement Term B-1 Loan + | | LIBOR + 2.750 | | | 524,673 | | | 4.125 | | 1/30/2023 | | | 525,756 | |

| Mission Broadcasting, Inc., Term B-2 Loan + | | LIBOR + 2.500 | | | 19,805 | | | 3.885 | | 1/16/2024 | | | 19,950 | |

| Mohegan Tribal Gaming Authority, Term B Loan + | | LIBOR + 4.000 | | | 248,125 | | | 5.381 | | 10/12/2023 | | | 251,362 | |

| Neiman Marcus Group LTD, Inc., Other Term Loan + | | LIBOR + 3.250 | | | 265,179 | | | 4.647 | | 10/24/2020 | | | 209,325 | |

| Nexstar Broadcasting, Inc., Term B-2 Loan + | | LIBOR + 2.500 | | | 157,740 | | | 3.885 | | 1/16/2024 | | | 158,896 | |

| Numericable US LLC, USD TLB-11 Term Loan + | | LIBOR + 2.750 | | | 158,800 | | | 4.131 | | 8/1/2025 | | | 159,041 | |

| PetSmart, Inc., Tranche B-2 Loan + | | LIBOR + 3.000 | | | 733,715 | | | 4.380 | | 3/12/2022 | | | 629,326 | |

| Playa Resorts Holdings, Initial Term Loan + | | LIBOR + 3.000 | | | 503,938 | | | 4.380 | | 4/28/2024 | | | 506,009 | |

| Scientific Games International, Initial Term B-4 Loan + | | LIBOR + 3.250 | | | 795,000 | | | 4.594 | | 8/14/2024 | | | 805,212 | |

| Serta Simmons Bedding LLC, Initial Term Loan + | | LIBOR + 3.500 | | | 303,705 | | | 4.852 | | 11/8/2023 | | | 300,004 | |

| ServiceMaster Co. LLC, Tranche C Term Loan + | | LIBOR + 2.500 | | | 870,415 | | | 3.881 | | 11/8/2023 | | | 875,855 | |

| SFR, USD TLB-11 Term Loan + | | LIBOR + 2.750 | | | 648,375 | | | 4.131 | | 8/1/2025 | | | 648,492 | |

| SharkNinja Operating LLC, Tranche B Term Loan + | | LIBOR + 4.000 | | | 405,000 | | | 5.334 | | 9/28/2024 | | | 406,855 | |

| Sinclair Broadcasting, Tranche B Term Loan + | | LIBOR + 2.250 | | | 366,605 | | | 3.631 | | 1/4/2024 | | | 368,071 | |

| SRAM Corp., New Term Loan + | | LIBOR + 3.250 | | | 506,018 | | | 4.583 | | 3/16/2024 | | | 508,075 | |

| St. George’s University Scholastic Services, Term Loan + | | LIBOR + 4.250 | | | 213,436 | | | 5.631 | | 7/6/2022 | | | 215,570 | |

| Staples, Closing Date Term Loan + | | LIBOR + 4.000 | | | 369,000 | | | 5.319 | | 9/12/2024 | | | 348,152 | |

| Station Casinos LLC, Term B Facility Loan + | | LIBOR + 2.500 | | | 877,909 | | | 3.867 | | 6/8/2023 | | | 882,088 | |

| Suddenlink, March 2017 Refinancing Term Loan + | | LIBOR + 2.250 | | | 333,974 | | | 3.631 | | 7/28/2025 | | | 334,182 | |

| TI Group Automotive Systems LLC, Initial US Term Loan + | | LIBOR + 2.750 | | | 301,844 | | | 4.131 | | 6/30/2022 | | | 303,872 | |

| Toys R Us, Inc., DIP Term Loan + | | LIBOR + 6.750 | | | 450,000 | | | 8.127 | | 1/18/2019 | | | 452,137 | |

| Tribune Media Co., Term B Loan + | | LIBOR + 3.000 | | | 22,405 | | | 4.381 | | 12/28/2020 | | | 22,503 | |

| Tribune Media Co., Term C Loan + | | LIBOR + 3.000 | | | 279,252 | | | 4.381 | | 1/26/2024 | | | 280,300 | |

| UFC Holdings LLC, Term Loan + | | LIBOR + 3.250 | | | 601,933 | | | 4.624 | | 8/18/2023 | | | 607,739 | |

| Univision Communications, Inc., 2017 Replacement Repriced First-Lien Term Loan + | | LIBOR + 2.750 | | | 3,347,980 | | | 4.131 | | 3/16/2024 | | | 3,342,305 | |

| US Farathane LLC, Term B-4 Loan + | | LIBOR + 3.500 | | | 407,258 | | | 4.834 | | 12/24/2021 | | | 411,331 | |

| Vivid Seats, Initial Term Loan + | | LIBOR + 4.000 | | | 239,400 | | | 5.381 | | 6/30/2024 | | | 241,495 | |

| Ziggo BV, Term Loan E Facility + | | LIBOR + 2.500 | | | 890,000 | | | 3.854 | | 4/16/2025 | | | 893,035 | |

| | | | | | | | | | | | | | 41,063,181 | |

| CONSUMER STAPLES - 4.8% | | | | | | | | | | | | | | |

| Albertsons Companies LLC, 2017-1 Term B-4 Loan + | | LIBOR + 2.750 | | | 1,159,509 | | | 4.131 | | 8/24/2021 | | | 1,126,631 | |

| Albertsons Companies LLC, 2017-1 Term B-5 Loan + | | LIBOR + 3.000 | | | 250,479 | | | 4.333 | | 12/20/2022 | | | 243,079 | |

| Amplify Snack Brands, Inc., Term Loan + | | LIBOR + 5.500 | | | 157,728 | | | 6.891 | | 9/2/2023 | | | 157,038 | |

| Aramark Corp., U.S. Term B Loan + | | LIBOR + 2.000 | | | 330,489 | | | 3.381 | | 3/28/2024 | | | 332,195 | |

| Chobani LLC, New Term Loan + | | LIBOR + 3.500 | | | 332,925 | | | 4.897 | | 10/10/2023 | | | 337,364 | |

| Diversey, Inc., Initial USD Term Loan + | | LIBOR + 3.000 | | | 410,000 | | | 4.317 | | 9/6/2024 | | | 412,399 | |

| Dole Food Co, Inc., Tranche B Term Loan + | | LIBOR + 2.750 | | | 536,625 | | | 4.120 | | 4/6/2024 | | | 539,834 | |

| Hostess Brands LLC, 2017 Refinancing Term B Loan + | | LIBOR + 2.500 | | | 374,630 | | | 3.881 | | 8/4/2022 | | | 377,112 | |

| JBS USA Lux, Initial Term Loan + | | LIBOR + 2.500 | | | 1,384,825 | | | 3.854 | | 10/30/2022 | | | 1,358,867 | |

| Milk Specialties Co., New Term Loan + | | LIBOR + 4.000 | | | 339,570 | | | 5.334 | | 8/16/2023 | | | 342,894 | |

| PDC Brands, Initial Term Loan + | | LIBOR + 4.750 | | | 448,875 | | | 6.084 | | 6/30/2024 | | | 454,136 | |

| Post, Series A Incremental Term Loan + | | LIBOR + 2.250 | | | 224,438 | | | 3.631 | | 5/24/2024 | | | 225,860 | |

| Prestige Brands, Inc., Term B-4 Loan + | | LIBOR + 2.750 | | | 178,977 | | | 4.131 | | 1/26/2024 | | | 180,361 | |

| Revlon, Initial Term B Loan + | | LIBOR + 3.500 | | | 213,920 | | | 4.881 | | 9/8/2023 | | | 185,664 | |

| Reynolds Group Holdings, Inc., Incremental U.S. Term Loan + | | LIBOR + 2.750 | | | 835,147 | | | 4.131 | | 2/4/2023 | | | 841,014 | |

| Rite Aid Corp., Tranche 2 Term Loan + | | LIBOR + 3.875 | | | 430,000 | | | 5.256 | | 6/20/2021 | | | 431,972 | |

| TKC Holdings, Inc., Initial Term Loan + | | LIBOR + 4.250 | | | 606,950 | | | 5.584 | | 1/31/2023 | | | 614,409 | |

| US Foods, Inc., Initial Term Loan + | | LIBOR + 2.750 | | | 463,138 | | | 4.131 | | 6/28/2023 | | | 467,528 | |

| | | | | | | | | | | | | | 8,628,357 | |

See accompanying notes to financial statements.

| SCHEDULE OF INVESTMENTS |

| Dunham Floating Rate Bond Fund (Continued) |

| October 31, 2017 |

| | | Variable | | Principal | | | Interest | | Maturity | | | |

| Security | | Rate | | Amount | | | Rate | | Date | | Value | |

| BANK LOANS - 83.3% (Continued) | | | | | | | | | | | | | | |

| ENERGY - 2.8% | | | | | | | | | | | | | | |

| Blackhawk Mining LLC, Initial Term Loan + | | LIBOR + 9.500 | % | $ | 248,504 | | | 10.881 | % | 2/16/2022 | | $ | 229,763 | |

| Chesapeake Energy Corp., Class A Loan + | | LIBOR + 7.500 | | | 300,000 | | | 8.817 | | 8/24/2021 | | | 322,875 | |

| Chief Exploration & Development, Term Loan + | | LIBOR + 6.500 | | | 172,000 | | | 7.825 | | 5/16/2021 | | | 168,847 | |

| Contura Energy, Inc., Term Loan + | | LIBOR + 5.000 | | | 543,900 | | | 6.334 | | 3/18/2024 | | | 540,503 | |

| Fieldwood Energy LLC, Reserve Based Term Loan + | | LIBOR + 7.000 | | | 180,554 | | | 8.334 | | 9/1/2020 | | | 164,530 | |

| Fieldwood Energy LLC, FLLO Facility + | | LIBOR + 7.125 | | | 81,748 | | | 8.459 | | 9/30/2020 | | | 58,722 | |

| Fieldwood Energy LLC, Closing Date Loan + | | LIBOR + 7.125 | | | 134,102 | | | 8.459 | | 9/30/2020 | | | 50,791 | |

| Gavilan Resources LLC, Initial Term Loan + | | LIBOR + 6.000 | | | 490,000 | | | 7.357 | | 2/29/2024 | | | 477,750 | |

| MEG Energy Corp., Initial Term Loan + | | LIBOR + 3.500 | | | 591,222 | | | 4.834 | | 1/1/2024 | | | 593,995 | |

| Ocean Rig UDW, Inc., Loan | | | | | 36,488 | | | 8.000 | | 9/20/2024 | | | 37,035 | |

| Paragon Offshore Finance Co, Term Loan + | | LIBOR + 2.750 | | | 1,766 | | | 4.135 | | 7/16/2021 | | | — | |

| Peabody Energy Corp., Term Loan + | | LIBOR + 3.500 | | | 197,202 | | | 4.881 | | 4/1/2022 | | | 199,075 | |

| Seadrill Operating LP, Initial Term Loan + | | LIBOR + 3.000 | | | 807,021 | | | 4.334 | | 2/20/2021 | | | 617,012 | |

| Thermon Industries, Inc., Term B Loan + | | LIBOR + 3.750 | | | 180,000 | | | 5.128 | | 10/30/2024 | | | 181,350 | |

| Traverse Midstream Partners LLC, Advance + | | LIBOR + 4.000 | | | 580,000 | | | 5.333 | | 9/28/2024 | | | 588,773 | |

| Ultra Petroleum Corp., Loan + | | LIBOR + 3.000 | | | 260,000 | | | 4.334 | | 4/12/2024 | | | 260,423 | |

| Weatherford International, Loan + | | LIBOR + 2.300 | | | 515,000 | | | 3.681 | | 7/12/2020 | | | 503,415 | |

| | | | | | | | | | | | | | 4,994,859 | |

| FINANCIALS - 3.9% | | | | | | | | | | | | | | |

| AlixPartners, 2017 Refinancing Term Loan + | | LIBOR + 2.750 | | | 1,155,700 | | | 4.084 | | 4/4/2024 | | | 1,162,929 | |

| Asurion LLC, Amendment No. 14 Replacement B-4 Term Loan + | | LIBOR + 2.750 | | | 650,069 | | | 4.131 | | 8/4/2022 | | | 656,010 | |

| Asurion LLC, Replacement B-5 Term Loan + | | LIBOR + 3.000 | | | 338,828 | | | 4.381 | | 11/4/2023 | | | 342,191 | |

| Asurion LLC, Second Lien Replacement B-2 Term Loan + | | LIBOR + 6.000 | | | 537,456 | | | 7.381 | | 8/4/2025 | | | 556,184 | |

| Focus Financial Partners, Initial Term Loan + | | LIBOR + 3.250 | | | 435,000 | | | 4.593 | | 7/4/2024 | | | 440,438 | |

| Fortress Investment Group LLC, Initial Term Loan + | | LIBOR + 2.750 | | | 390,000 | | | 4.113 | | 7/14/2022 | | | 396,338 | |

| International Lease Finance Corp., New Loan + | | LIBOR + 2.000 | | | 300,000 | | | 3.334 | | 10/6/2023 | | | 302,625 | |

| iStar Financial, Inc., Loan + | | LIBOR + 3.000 | | | 15,664 | | | 4.381 | | 9/30/2021 | | | 15,879 | |

| Lightstone Generation LLC, Refinanced Term C Loan + | | LIBOR + 4.500 | | | 7,884 | | | 5.881 | | 1/30/2024 | | | 7,929 | |

| Lightstone Holdco LLC, Refinanced Term B Loan + | | LIBOR + 4.500 | | | 126,529 | | | 5.881 | | 1/30/2024 | | | 127,254 | |

| TransUnion LLC, 2017 Replacement Term B-3 Loan + | | LIBOR + 2.000 | | | 1,155,973 | | | 3.381 | | 4/10/2023 | | | 1,161,389 | |

| Vertafore, Inc., Term B-1 Loan + | | LIBOR + 3.250 | | | 648,550 | | | 4.631 | | 6/30/2023 | | | 653,738 | |

| Walter Investment Management Corp., Tranche B Term Loan + | | LIBOR + 3.750 | | | 1,340,546 | | | 5.131 | | 12/18/2020 | | | 1,269,611 | |

| | | | | | | | | | | | | | 7,092,515 | |

| HEALTHCARE - 8.9% | | | | | | | | | | | | | | |

| 21st Century Oncology, Inc., Tranche B Term Loan + | | LIBOR + 6.125 | | | 146,612 | | | 7.459 | | 4/30/2022 | | | 139,037 | |

| Acadia Healthcare Co, Inc., Tranche B-2 Term Loan + | | LIBOR + 2.750 | | | 302,022 | | | 4.147 | | 2/16/2023 | | | 304,147 | |

| Air Medical Resource Group, Inc., Incremental Term Loan B + | | LIBOR + 4.250 | | | 95,000 | | | 5.581 | | 9/26/2024 | | | 95,564 | |

| Akorn, Inc., Loan + | | LIBOR + 4.250 | | | 258,135 | | | 5.631 | | 4/16/2021 | | | 259,748 | |

| Amneal Pharmaceuticals LLC, Term Loan B + | | LIBOR + 3.500 | | | 328,892 | | | 4.834 | | 10/31/2019 | | | 331,513 | |

| Ardent Legacy Acquisitions, Inc., Term Loan + | | LIBOR + 5.500 | | | 189,150 | | | 6.834 | | 8/4/2021 | | | 190,096 | |

| Catalent, Inc., Dollar Term Loan + | | LIBOR + 2.250 | | | 724,492 | | | 3.631 | | 5/20/2024 | | | 732,019 | |

| Change Healthcare Holdings, Closing Date Term Loan + | | LIBOR + 2.750 | | | 990,025 | | | 4.131 | | 2/29/2024 | | | 996,831 | |

| CHG Healthcare Services, Inc., New Term Loan + | | LIBOR + 3.250 | | | 144,137 | | | 4.631 | | 6/8/2023 | | | 145,681 | |

| Community Health Systems, Inc., Incremental 2019 Term G Loan + | | LIBOR + 2.750 | | | 621,173 | | | 4.068 | | 1/1/2020 | | | 608,836 | |

| Community Health Systems, Inc., Incremental 2021 Term H Loan + | | LIBOR + 3.000 | | | 826,596 | | | 4.318 | | 1/28/2021 | | | 802,034 | |

| Concordia Healthcare Corp., Initial Dollar Term Loan + | | LIBOR + 4.250 | | | 145,688 | | | 5.631 | | 10/20/2021 | | | 121,973 | |

| DJO Finance LLC, Initial Term Loan + | | LIBOR + 3.250 | | | 564,313 | | | 4.636 | | 6/8/2020 | | | 565,784 | |

| Endo International PLC, Initial Term Loan + | | LIBOR + 4.250 | | | 503,737 | | | 5.631 | | 4/28/2024 | | | 511,231 | |

| Envision Healthcare Corp., Initial Term Loan + | | LIBOR + 3.000 | | | 759,814 | | | 4.381 | | 11/30/2023 | | | 764,206 | |

| eResearch Technology, Inc., Initial Term Loan + | | LIBOR + 3.750 | | | 398,990 | | | 5.131 | | 5/2/2023 | | | 403,145 | |

| Greatbatch Ltd., New Term B Loan + | | LIBOR + 3.500 | | | 86,051 | | | 4.857 | | 10/28/2022 | | | 86,535 | |

| Herbalife, Senior Lien Term Loan + | | LIBOR + 5.500 | | | 178,063 | | | 6.881 | | 2/16/2023 | | | 180,919 | |

| Immucor, Inc., Term B-3 Loan + | | LIBOR + 5.000 | | | 39,900 | | | 6.381 | | 6/16/2021 | | | 40,742 | |

| IMS Health, Inc., Term B-1 Dollar Loan + | | LIBOR + 2.000 | | | 320,610 | | | 3.334 | | 3/2/2024 | | | 323,359 | |

| IMS Health, Inc., Incremental Term B-2 Dollar Loan + | | LIBOR + 2.000 | | | 75,000 | | | 3.325 | | 1/16/2025 | | | 75,643 | |

| INC Research Holdings, Initial Term B Loan + | | LIBOR + 2.250 | | | 280,547 | | | 3.631 | | 7/31/2024 | | | 282,432 | |

| Kindred Healthcare, Inc., New Term Loan | | LIBOR + 3.500 | | | 169,376 | | | 4.857 | | 4/8/2021 | | | 170,277 | |

| MultiPlan, Inc., Initial Term Loan + | | LIBOR + 3.000 | | | 120,927 | | | 4.334 | | 6/8/2023 | | | 122,222 | |

See accompanying notes to financial statements.

| SCHEDULE OF INVESTMENTS |

| Dunham Floating Rate Bond Fund (Continued) |

| October 31, 2017 |

| | | Variable | | Principal | | | Interest | | Maturity | | | |

| Security | | Rate | | Amount | | | Rate | | Date | | Value | |

| BANK LOANS - 83.3% (Continued) | | | | | | | | | | | | | | |

| HEALTHCARE - 8.9% (Continued) | | | | | | | | | | | | | | |

| National Mentor Holdings, Inc., Tranche B Term Loan + | | LIBOR + 3.000 | % | $ | 262,713 | | | 4.374 | % | 2/1/2021 | | $ | 265,381 | |

| National Veterinary Associates, Term Loan + | | LIBOR + 7.000 | | | 206,174 | | | 8.334 | | 8/14/2022 | | | 208,064 | |

| NVA Holdings, Inc., Term B-2 Loan + | | LIBOR + 3.500 | | | 146,015 | | | 4.834 | | 8/14/2021 | | | 147,688 | |

| Ortho-Clinical Diagnostics, Inc., Initial Term Loan + | | LIBOR + 3.750 | | | 652,557 | | | 5.084 | | 6/30/2021 | | | 656,837 | |

| PAREXEL International, Initial Term Loan + | | LIBOR + 3.000 | | | 625,000 | | | 4.381 | | 9/28/2024 | | | 631,641 | |

| PharMerica, First Lien Term Loan + | | LIBOR + 3.500 | | | 305,000 | | | 4.831 | | 9/26/2024 | | | 307,478 | |

| PharMerica, Second Lien Term Loan + | | LIBOR + 7.750 | | | 30,000 | | | 9.081 | | 9/26/2025 | | | 30,338 | |

| Pharmaceutical Product Development, LLC, 2017 Term Loan + | | LIBOR + 2.750 | | | 547,254 | | | 4.106 | | 8/18/2022 | | | 550,931 | |

| Quorum Health Corp., Term Loan + | | LIBOR + 6.750 | | | 214,055 | | | 8.100 | | 4/28/2022 | | | 216,731 | |

| Sedgwick, Inc., Initial Loan + | | LIBOR + 5.750 | | | 125,000 | | | 7.131 | | 2/28/2022 | | | 126,719 | |

| Select Medical Group, Tranche B Term Loan + | | LIBOR + 3.500 | | | 298,500 | | | 4.851 | | 2/28/2021 | | | 302,854 | |

| Sterigenics-Nordion Holdings LLC, Incremental Term Loan + | | LIBOR + 3.000 | | | 426,984 | | | 4.381 | | 5/16/2022 | | | 427,919 | |

| Surgery Partners, Initial Term Loan + | | LIBOR + 3.250 | | | 765,000 | | | 4.631 | | 9/2/2024 | | | 760,314 | |

| Team Health, Inc., Initial Term Loan + | | LIBOR + 2.750 | | | 571,323 | | | 4.131 | | 2/6/2024 | | | 567,752 | |

| US Anesthesia Partners, Initial Term Loan + | | LIBOR + 3.250 | | | 174,563 | | | 4.631 | | 6/23/2024 | | | 175,217 | |

| US Renal Care, Inc., Initial Term Loan + | | LIBOR + 4.250 | | | 626,172 | | | 5.584 | | 12/30/2022 | | | 606,939 | |

| Valeant Pharmaceuticals International, Series F-4 Tranche B Term Loan + | | LIBOR + 4.750 | | | 1,673,858 | | | 6.107 | | 3/31/2022 | | | 1,712,783 | |

| | | | | | | | | | | | | | 15,949,560 | |

| INDUSTRIALS - 12.7% | | | | | | | | | | | | | | |

| 84 Lumber Co., Initial Term Loan Retired + | | LIBOR + 5.750 | | | 461,188 | | | 7.124 | | 10/24/2023 | | | 466,809 | |

| Accudyne Industries, Initial Term Loan + | | LIBOR + 3.750 | | | 420,000 | | | 5.084 | | 8/18/2024 | | | 423,937 | |

| ADS Waste Holdings, Inc., Additional Term Loan + | | LIBOR + 2.750 | | | 979,882 | | | 4.142 | | 11/10/2023 | | | 989,681 | |

| American Airlines, Inc., 2017 Replacement Term Loan + | | LIBOR + 2.000 | | | 426,723 | | | 3.380 | | 6/28/2020 | | | 428,628 | |

| American Airlines, Inc., 2017 Class B Term Loans + | | LIBOR + 2.000 | | | 88,110 | | | 3.377 | | 4/28/2023 | | | 88,375 | |

| American Airlines, Inc., Class B Term Loan Retired + | | LIBOR + 2.500 | | | 499,550 | | | 3.854 | | 12/14/2023 | | | 501,631 | |

| APEX Tool Group LLC, Term Loan + | | LIBOR + 3.250 | | | 548,231 | | | 4.631 | | 2/1/2020 | | | 544,560 | |

| Avantor Performance Materials, Inc., Cov-Lite Term Loan + | | LIBOR + 4.000 | | | 665,000 | | | 5.329 | | 9/20/2024 | | | 669,452 | |

| Beacon Roofing Supply, Inc., Term Loan B + | | LIBOR + 2.250 | | | 740,000 | | | 3.603 | | 10/12/2024 | | | 745,898 | |

| Brand Energy & Infrastructure Services, Initial Term Loan + | | LIBOR + 4.250 | | | 708,725 | | | 5.619 | | 6/20/2024 | | | 714,040 | |

| Brickman Group Holdings, Inc., Initial Term Loan + | | LIBOR + 3.000 | | | 669,018 | | | 4.373 | | 12/18/2020 | | | 674,313 | |

| Brickman Group Holdings, Inc., Initial Term Loan + | | LIBOR + 6.500 | | | 116,553 | | | 7.863 | | 12/16/2021 | | | 117,324 | |

| Casella Waste Systems, Inc., Term B-1 Loan + | | LIBOR + 2.750 | | | 397,000 | | | 3.857 | | 10/16/2023 | | | 400,722 | |

| CSC Service Works, Term B-1 Loan + | | LIBOR + 3.750 | | | 832,745 | | | 5.121 | | 11/14/2022 | | | 840,036 | |

| Element Materials Technology, Initial USD Term B Loan + | | LIBOR + 3.500 | | | 255,000 | | | 4.834 | | 6/28/2024 | | | 258,825 | |

| Filtration Group, Inc., Term Loan + | | LIBOR + 3.000 | | | 512,298 | | | 4.381 | | 11/24/2020 | | | 517,101 | |

| Fort Dearborn Co., Initial Term Loan + | | LIBOR + 4.000 | | | 398,627 | | | 5.347 | | 10/20/2023 | | | 400,620 | |

| Garda World Security Corp., Term B Loan + | | LIBOR + 4.000 | | | 230,667 | | | 5.390 | | 5/24/2024 | | | 233,089 | |

| Gardner Denver, Inc., Tranche B-1 Dollar Term Loan + | | LIBOR + 2.750 | | | 1,385,033 | | | 4.130 | | 7/30/2024 | | | 1,394,645 | |

| Harland Clarke Holdings Corp., Tranche B-5 Term Loan + | | LIBOR + 6.000 | | | 143,357 | | | 7.334 | | 12/31/2021 | | | 143,828 | |

| Harland Clarke Holdings Corp., Tranche B-6 Term Loan + | | LIBOR + 5.500 | | | 267,387 | | | 6.834 | | 2/9/2022 | | | 268,318 | |

| Hayward Acquisition Corp., Initial Term Loan + | | LIBOR + 3.500 | | | 280,000 | | | 4.881 | | 8/4/2024 | | | 282,975 | |

| HD Supply, Inc., Term B-3 Loan + | | LIBOR + 2.250 | | | 345,945 | | | 3.584 | | 8/12/2021 | | | 349,621 | |

| HD Supply, Inc., Term B-4 Loan + | | LIBOR + 2.500 | | | 512,130 | | | 3.834 | | 10/16/2023 | | | 518,373 | |

| Husky Injection Molding Systems Ltd., New Term Loan + | | LIBOR + 3.250 | | | 696,724 | | | 4.631 | | 6/30/2021 | | | 703,256 | |

| International Equipment Solutions LLC, Loan + | | LIBOR + 5.500 | | | 190,000 | | | 6.831 | | 8/16/2022 | | | 191,425 | |

| McJunkin Red Man Corp., 2017 Refinancing Term Loan + | | LIBOR + 3.500 | | | 400,000 | | | 4.881 | | 9/20/2024 | | | 405,750 | |

| Navistar, Inc., Tranche B Term Loan + | | LIBOR + 4.000 | | | 293,748 | | | 5.385 | | 8/7/2020 | | | 294,666 | |

| NN, Inc., 2017 Incremental Term Loan + | | LIBOR + 3.750 | | | 186,200 | | | 5.131 | | 4/2/2021 | | | 187,597 | |

| NN, Inc., Tranche B Term Loan + | | LIBOR + 4.250 | | | 216,585 | | | 5.631 | | 10/20/2022 | | | 217,668 | |

| PAE Holding Corp., Initial Term Loan + | | LIBOR + 5.500 | | | 207,486 | | | 6.881 | | 10/20/2022 | | | 209,042 | |

| Pro Mach Group, Inc., Dollar Term Loan + | | LIBOR + 3.750 | | | 618,639 | | | 5.131 | | 10/22/2021 | | | 624,825 | |

| Protection One, Inc., 2016-2 Refinancing Term B-1 Loan + | | LIBOR + 2.750 | | | 470,021 | | | 4.131 | | 5/2/2022 | | | 474,693 | |

| Quikrete Co, Inc., Initial Loan + | | LIBOR + 2.750 | | | 811,865 | | | 4.131 | | 11/16/2023 | | | 816,825 | |

| Red Ventures, Term Loan + | | LIBOR + 4.000 | | | 540,000 | | | 5.363 | | 11/8/2024 | | | 537,300 | |

| Rexnord Corp., Term B Loan Refinancing + | | LIBOR + 2.750 | | | 366,357 | | | 4.104 | | 8/20/2023 | | | 369,068 | |

| Science Applications International, Tranche B Incremental Loan + | | LIBOR + 2.500 | | | 231,946 | | | 3.903 | | 5/4/2022 | | | 234,265 | |

| Sedgwick CMS Holdings, Inc., Initial Term Loan + | | LIBOR + 2.750 | | | 666,739 | | | 4.131 | | 2/28/2021 | | | 671,046 | |

| Sedgwick CMS Holdings, Inc., New Loan + | | LIBOR + 5.750 | | | 195,000 | | | 7.068 | | 2/28/2022 | | | 198,291 | |

See accompanying notes to financial statements.

| SCHEDULE OF INVESTMENTS |

| Dunham Floating Rate Bond Fund (Continued) |

| October 31, 2017 |

| | | Variable | | Principal | | | Interest | | Maturity | | | |

| Security | | Rate | | Amount | | | Rate | | Date | | Value | |

| BANK LOANS - 83.3% (Continued) | | | | | | | | | | | | | | |

| INDUSTRIALS - 12.7% (Continued) | | | | | | | | | | | | | | |

| SiteOne Landscape Supply Holding LLC, Tranche C Term Loan + | | LIBOR + 3.500 | % | $ | 207,034 | | | 4.881 | % | 4/28/2022 | | $ | 208,457 | |

| TransDigm, Inc., Tranche D Term Loan + | | LIBOR + 3.000 | | | 80,302 | | | 4.337 | | 6/4/2021 | | | 80,905 | |

| TransDigm, Inc., Tranche E Term Loan + | | LIBOR + 3.000 | | | 390,481 | | | 4.365 | | 5/14/2022 | | | 392,753 | |

| TransDigm, Inc., Tranche F Term Loan + | | LIBOR + 3.000 | | | 1,028,377 | | | 4.365 | | 6/8/2023 | | | 1,034,028 | |

| TransDigm, Inc., Tranche G Term Loan + | | LIBOR + 3.000 | | | 749,125 | | | 4.371 | | 8/22/2024 | | | 753,867 | |

| Transplace, Inc., Closing Date Term Loan + | | LIBOR + 4.250 | | | 200,000 | | | 5.647 | | 10/8/2024 | | | 202,150 | |

| United Continental Holdings, Inc., Class B Term Loan + | | LIBOR + 2.250 | | | 492,525 | | | 3.631 | | 3/31/2024 | | | 495,665 | |

| Waste Industries USA, Inc., Initial Term Loan + | | LIBOR + 3.000 | | | 765,000 | | | 4.381 | | 9/28/2024 | | | 773,059 | |

| WEX, Inc., Term B-2 Loan + | | LIBOR + 2.750 | | | 490,758 | | | 4.131 | | 6/30/2023 | | | 496,936 | |

| Zodiac Pool Solutions, Tranche B-1 Term Loan + | | LIBOR + 4.000 | | | 322,567 | | | 5.334 | | 12/20/2023 | | | 326,600 | |

| | | | | | | | | | | | | | 22,872,938 | |

| INFORMATION TECHNOLOGY - 8.1% | | | | | | | | | | | | | | |

| Alorica, Inc., New Term B Loan + | | LIBOR + 3.750 | | | 49,821 | | | 5.131 | | 6/30/2022 | | | 50,382 | |

| Applied Systems, Inc., Initial Term Loan + | | LIBOR + 3.250 | | | 635,000 | | | 4.576 | | 9/20/2024 | | | 644,039 | |

| Applied Systems, Inc., Initial Term Loan + | | LIBOR + 7.000 | | | 105,000 | | | 8.326 | | 9/20/2025 | | | 108,577 | |

| Avaya, Inc., Term Facility + | | LIBOR + 7.500 | | | 200,000 | | | 8.870 | | 1/24/2018 | | | 201,250 | |

| Avaya, Inc., Term B-7 Loan + | | LIBOR + 5.250 | | | 183,899 | | | 6.628 | | 5/28/2020 | | | 153,365 | |

| Blackboard, Inc., Term B-4 Loan + | | LIBOR + 5.000 | | | 812,372 | | | 6.363 | | 6/30/2021 | | | 780,641 | |

| BMC Software, Inc., Initial B-1 US Term Loan + | | LIBOR + 4.000 | | | 715,839 | | | 5.381 | | 9/10/2022 | | | 721,794 | |

| Cologix, Inc., Delayed Draw Term Loan + | | LIBOR + 3.000 | | | 110,000 | | | 4.323 | | 12/16/2021 | | | 110,550 | |

| Cologix, Inc., Initial Term Loan + | | LIBOR + 3.000 | | | 218,900 | | | 4.317 | | 3/20/2024 | | | 219,402 | |

| Dell International LLC, Refinancing Term B Loan + | | LIBOR + 2.000 | | | 1,475,380 | | | 3.381 | | 9/8/2023 | | | 1,480,810 | |

| First Data Corp., 2022D New Dollar Term Loan + | | LIBOR + 2.250 | | | 1,381,406 | | | 3.621 | | 7/8/2022 | | | 1,386,766 | |

| First Data Corp., 2024 New Dollar Term Loan + | | LIBOR + 2.500 | | | 1,611,807 | | | 3.871 | | 4/26/2024 | | | 1,620,583 | |

| Global Cash Access Holdings, Inc., Term B Loan + | | LIBOR + 4.500 | | | 394,013 | | | 5.881 | | 5/8/2024 | | | 397,421 | |

| Go Daddy Operating Co. LLC, Initial Term Loan + | | LIBOR + 2.500 | | | 384,373 | | | 3.881 | | 2/16/2024 | | | 386,897 | |

| Infor US, Inc., Tranche B-6 Term Loan + | | LIBOR + 2.750 | | | 1,242,516 | | | 4.084 | | 1/31/2022 | | | 1,245,883 | |

| Kronos, Inc., Incremental Term Loan + | | LIBOR + 3.500 | | | 694,759 | | | 4.809 | | 10/31/2023 | | | 700,494 | |

| Kronos, Inc., Initial Term Loan + | | LIBOR + 8.250 | | | 120,000 | | | 9.635 | | 10/31/2024 | | | 123,994 | |

| Lockheed Martin, B Term Loan + | | LIBOR + 2.000 | | | 210,410 | | | 3.381 | | 8/16/2023 | | | 212,142 | |

| Mitchell International, Inc., Initial Term Loan + | | LIBOR + 3.500 | | | 363,804 | | | 4.881 | | 10/12/2020 | | | 367,973 | |

| North American Bancard LLC, Initial Term Loan + | | LIBOR + 3.500 | | | 583,538 | | | 4.834 | | 6/30/2024 | | | 589,008 | |

| ON Semiconductor Corp., 2017 New Replacement Term Loan + | | LIBOR + 2.250 | | | 155,376 | | | 3.631 | | 4/1/2023 | | | 156,266 | |

| Presidio, Inc., Term B Loan + | | LIBOR + 3.000 | | | 165,981 | | | 4.587 | | 2/2/2022 | | | 167,523 | |

| Rackspace Hosting, Inc., 2017 Refinancing Term B Loan + | | LIBOR + 3.250 | | | 520,775 | | | 4.392 | | 11/4/2023 | | | 521,790 | |

| RCN Corp., Closing Date Term Loan + | | LIBOR + 3.000 | | | 288,076 | | | 4.381 | | 1/31/2024 | | | 285,576 | |

| Sorenson Communications LLC, Initial Term Loan + | | LIBOR + 5.750 | | | 389,910 | | | 8.000 | | 4/30/2020 | | | 392,590 | |

| Tempo Acquisition LLC, Initial Term Loan + | | LIBOR + 3.000 | | | 558,600 | | | 4.381 | | 4/30/2024 | | | 561,220 | |

| Veritas US, Inc., New Dollar Term B Loan + | | LIBOR + 4.500 | | | 568,618 | | | 5.834 | | 1/28/2023 | | | 574,253 | |

| Western Digital Corp., U.S. Term B-2 Loan + | | LIBOR + 2.750 | | | 404,965 | | | 3.380 | | 4/28/2023 | | | 407,243 | |

| | | | | | | | | | | | | | 14,568,432 | |

| MATERIALS- 9.5% | | | | | | | | | | | | | | |

| Americna Builders Contractors Supply Co, Inc., Additional Term B-1 Loan + | | LIBOR + 2.500 | | | 586,364 | | | 3.881 | | 11/1/2023 | | | 590,794 | |

| Anchor Glass Container Corp., July 2017 Additional Term Loan + | | LIBOR + 2.750 | | | 434,605 | | | 4.092 | | 12/8/2023 | | | 437,967 | |

| Anchor Glass Container Corp., Term Loan + | | LIBOR + 7.750 | | | 244,000 | | | 9.067 | | 12/8/2024 | | | 247,355 | |

| Atotech, Initial Term B-1 Loan + | | LIBOR + 3.000 | | | 149,625 | | | 4.334 | | 2/1/2024 | | | 150,934 | |

| Berlin Packaging LLC, 2017 Replacement Term Loans + | | LIBOR + 3.250 | | | 392,565 | | | 4.615 | | 9/30/2021 | | | 396,002 | |

| Berry Plastics Group, Inc., Term K Loan + | | LIBOR + 2.250 | | | 291,526 | | | 3.607 | | 2/8/2020 | | | 293,348 | |

| Berry Plastics Group, Inc., Term L Loan + | | LIBOR + 2.250 | | | 417,785 | | | 3.607 | | 1/6/2021 | | | 420,298 | |

| Berry Plastics Group, Inc., Term M Loan + | | LIBOR + 2.250 | | | 328,143 | | | 3.622 | | 9/30/2022 | | | 330,058 | |

| Berry Plastics Group, Inc., Term N Loan + | | LIBOR + 2.250 | | | 529,350 | | | 3.607 | | 1/20/2024 | | | 531,708 | |

| BWAY Corp., Initial Term Loan + | | LIBOR + 3.250 | | | 488,775 | | | 4.607 | | 4/4/2024 | | | 492,563 | |

| CPG International, Inc., New Term Loan + | | LIBOR + 3.750 | | | 538,022 | | | 5.084 | | 5/4/2024 | | | 544,327 | |

| CPI Card Group, Term Loan + | | LIBOR + 4.500 | | | 1,008,336 | | | 5.857 | | 8/16/2022 | | | 736,085 | |

| Cypress Performance Group LLC, Initial Term Loan + | | LIBOR + 3.250 | | | 290,000 | | | 4.630 | | 11/8/2024 | | | 292,900 | |

| Cypress Performance Group LLC, Initial Term Loan + | | LIBOR + 7.500 | | | 35,000 | | | 8.880 | | 11/8/2025 | | | 35,656 | |

| H.B. Fuller Co., Commitment + | | LIBOR + 2.250 | | | 750,000 | | | 3.615 | | 10/20/2024 | | | 755,104 | |

See accompanying notes to financial statements.

| SCHEDULE OF INVESTMENTS |

| Dunham Floating Rate Bond Fund (Continued) |

| October 31, 2017 |

| | | Variable | | Principal | | | Interest | | Maturity | | | |

| Security | | Rate | | Amount | | | Rate | | Date | | Value | |

| BANK LOANS - 83.3% (Continued) | | | | | | | | | | | | | | |

| MATERIALS- 9.5% (Continued) | | | | | | | | | | | | | | |

| Huntsman International LLC, 2023 Term B Loan + | | LIBOR + 3.000 | % | $ | 221,017 | | | 4.381 | % | 3/31/2023 | | $ | 222,537 | |

| INEOS, New 2022 Dollar Term Loan + | | LIBOR + 2.750 | | | 1,203,072 | | | 4.131 | | 3/31/2022 | | | 1,205,797 | |

| INEOS, New 2024 Dollar Term Loan + | | LIBOR + 2.750 | | | 104,213 | | | 4.131 | | 3/31/2024 | | | 104,474 | |

| INEOS, New 2024 Dollar Term Loan + | | LIBOR + 2.000 | | | 1,920,000 | | | 3.378 | | 3/31/2024 | | | 1,924,608 | |

| Kloeckner Pentaplast Group, Dollar Term Loan + | | LIBOR + 4.250 | | | 875,000 | | | 5.584 | | 6/30/2022 | | | 883,566 | |

| KMG Chemicals, Inc., Initial Term Loan + | | LIBOR + 4.250 | | | 115,182 | | | 5.631 | | 6/16/2024 | | | 116,574 | |

| Kraton Corp., Dollar Replacement Term Loan + | | LIBOR + 3.000 | | | 405,832 | | | 4.381 | | 1/6/2022 | | | 412,301 | |

| New Arclin US Holdings, First Lien Term Loan + | | LIBOR + 4.250 | | | 274,313 | | | 5.584 | | 2/14/2024 | | | 276,971 | |

| Omnova Solutions, Inc., Term B-2 Loan + | | LIBOR + 4.250 | | | 573,210 | | | 5.631 | | 8/24/2023 | | | 580,375 | |

| Plastipak Holdings, Inc., Tranche B Term Loan + | | LIBOR + 2.750 | | | 150,000 | | | 4.109 | | 10/14/2024 | | | 151,331 | |

| Platform Specialty Products Corp., Tranche B-7 Term Loan + | | LIBOR + 2.500 | | | 568,912 | | | 3.881 | | 6/8/2020 | | | 574,305 | |

| PQ Corp., Second Amendment Tranche B-1 Term Loan + | | LIBOR + 3.250 | | | 91,840 | | | 4.631 | | 11/4/2022 | | | 93,093 | |

| Solenis International LP, Initial Dollar Term Loan + | | LIBOR + 3.250 | | | 346,971 | | | 4.568 | | 8/1/2021 | | | 349,139 | |

| Summit Materials, Restatement Effective Date Term Loan + | | LIBOR + 2.750 | | | 384,158 | | | 4.131 | | 7/18/2022 | | | 386,960 | |

| Tekni-Plex, Inc., Tranche B-1 Term Loan + | | LIBOR + 3.250 | | | 500,000 | | | 4.607 | | 10/16/2024 | | | 504,140 | |

| Transcendia Holdings, Inc., Initial Term Loan + | | LIBOR + 4.000 | | | 528,675 | | | 5.381 | | 5/30/2024 | | | 534,292 | |

| Tricorbraun, Inc., Delayed Draw Term Loan + | | LIBOR + 3.750 | | | 31,818 | | | 5.067 | | 11/30/2023 | | | 32,113 | |

| Tricorbraun, Inc., Closing Date Term Loan + | | LIBOR + 3.750 | | | 315,795 | | | 5.084 | | 11/30/2023 | | | 318,717 | |

| Tronox Ltd., Blocked Dollar Term Loan + | | LIBOR + 3.000 | | | 114,883 | | | 4.329 | | 9/24/2024 | | | 115,949 | |

| Tronox Ltd., Initial Dollar Term Loan + | | LIBOR + 3.000 | | | 265,117 | | | 4.329 | | 9/24/2024 | | | 267,576 | |

| Univar, Inc., Term B-2 Loan + | | LIBOR + 2.750 | | | 840,863 | | | 4.131 | | 6/30/2022 | | | 846,417 | |

| Vantage Specialty Chemicals, Inc., Closing Date Term Loan + | | LIBOR + 4.000 | | | 80,000 | | | 5.378 | | 10/28/2024 | | | 80,883 | |

| Venator Materials LLC, Initial Term Loan + | | LIBOR + 3.000 | | | 515,000 | | | 4.381 | | 8/8/2024 | | | 521,759 | |

| Zep, Inc., Initial Term Loan + | | LIBOR + 4.000 | | | 280,000 | | | 5.381 | | 8/12/2024 | | | 283,413 | |

| | | | | | | | | | | | | | 17,042,389 | |

| REAL ESTATE - 1.4% | | | | | | | | | | | | | | |

| Capital Automotive LLC, Initial Tranche B-2 Term Loan + | | LIBOR + 2.500 | | | 135,567 | | | 3.881 | | 3/24/2024 | | | 136,109 | |

| Capital Automotive LLC, Initial Tranche B Term Loan + | | LIBOR + 6.000 | | | 386,850 | | | 7.334 | | 3/24/2025 | | | 398,455 | |

| Communications Sales & Leasing, Inc., Shortfall Term Loan + | | LIBOR + 3.000 | | | 583,895 | | | 4.381 | | 10/24/2022 | | | 561,724 | |

| DTZ Bank Loan, 2015-1 Additional Term Loan + | | LIBOR + 3.250 | | | 586,500 | | | 4.587 | | 11/4/2021 | | | 590,579 | |

| Extended Stay America, Inc., Repriced Term Loan + | | LIBOR + 2.500 | | | 344,638 | | | 3.881 | | 8/30/2023 | | | 347,294 | |

| Realogy Holdings Corp., Initial Term B Loan + | | LIBOR + 2.250 | | | 450,989 | | | 3.627 | | 7/20/2022 | | | 454,726 | |

| | | | | | | | | | | | | | 2,488,887 | |

| TELECOMMUNICATION SERVICES - 5.7% | | | | | | | | | | | | | | |

| Altice Financing S.A., March 2017 Refinancing Term Loan + | | LIBOR + 2.750 | | | 417,900 | | | 4.104 | | 7/16/2025 | | | 418,640 | |

| Cable & Wireless Communications Ltd., Additional Term B-3 Loan + | | LIBOR + 3.500 | | | 215,000 | | | 4.881 | | 2/1/2025 | | | 216,226 | |

| Centurylink, Inc., Initial Term B Loan + | | LIBOR + 2.750 | | | 635,000 | | | 4.135 | | 2/1/2025 | | | 628,056 | |

| Digicel, Initial Term B Loan + | | LIBOR + 3.750 | | | 215,000 | | | 5.068 | | 5/28/2024 | | | 217,123 | |

| Frontier Communications Corp., Term B-1 Loan + | | LIBOR + 3.750 | | | 603,988 | | | 5.130 | | 6/16/2024 | | | 576,524 | |

| Global Tel Link Corp., Term Loan + | | LIBOR + 4.000 | | | 351,708 | | | 5.334 | | 5/24/2020 | | | 356,280 | |

| Level 3 Financing, Inc., Tranche B 2024 Term Loan + | | LIBOR + 2.250 | | | 1,825,000 | | | 3.617 | | 2/22/2024 | | | 1,834,289 | |

| Neustar, Inc., TLB1 + | | LIBOR + 3.250 | | | 61,740 | | | 4.660 | | 1/8/2020 | | | 62,666 | |

| Neustar, Inc., TLB2 + | | LIBOR + 3.750 | | | 235,000 | | | 5.160 | | 8/8/2024 | | | 237,791 | |

| SBA Communications Corp., Incremental Tranche B-2 Term Loan + | | LIBOR + 2.250 | | | 157,378 | | | 3.631 | | 6/10/2022 | | | 158,110 | |

| SBA Senior Finance II LLC, Incremental Tranche B-1 Term Loan + | | LIBOR + 2.250 | | | 440,237 | | | 3.631 | | 3/24/2021 | | | 442,683 | |

| Securus Technologies, Incremental 2015 Term Loan + | | LIBOR + 4.250 | | | 83,938 | | | 5.630 | | 4/17/2020 | | | 84,042 | |

| Securus Technologies, Initial Term Loan + | | LIBOR + 3.500 | | | 139,926 | | | 4.880 | | 4/17/2020 | | | 140,101 | |

| Securus Technologies, Initial Term Loan + | | LIBOR + 4.500 | | | 550,000 | | | 5.885 | | 10/31/2024 | | | 557,563 | |

| Securus Technologies, Initial Loan + | | LIBOR + 8.250 | | | 160,000 | | | 9.573 | | 6/20/2025 | | | 161,800 | |

| SFR Group SA, USD TLB-[12] Term Loan + | | LIBOR + 3.000 | | | 700,000 | | | 4.381 | | 2/1/2026 | | | 701,631 | |

| Sprint Communications, Inc., Initial Term Loan + | | LIBOR + 2.500 | | | 457,700 | | | 3.881 | | 2/2/2024 | | | 459,940 | |

| UPC Financing Partnership, Facility AR + | | LIBOR + 2.500 | | | 1,800,000 | | | 4.055 | | 1/16/2026 | | | 1,807,875 | |

| Virgin Media PLC, I Facility + | | LIBOR + 2.750 | | | 660,000 | | | 4.283 | | 2/1/2025 | | | 663,383 | |

| West Corp., Term B Loan + | | LIBOR + 4.000 | | | 450,790 | | | 5.381 | | 10/10/2024 | | | 452,305 | |

| | | | | | | | | | | | | | 10,177,028 | |

See accompanying notes to financial statements.

| SCHEDULE OF INVESTMENTS |

| Dunham Floating Rate Bond Fund (Continued) |

| October 31, 2017 |

| | | Variable | | Principal | | | Interest | | Maturity | | | |

| Security | | Rate | | Amount | | | Rate | | Date | | Value | |

| BANK LOANS - 83.3% (Continued) | | | | | | | | | | | | | | |

| UTILITIES - 2.7% | | | | | | | | | | | | | | |

| Atlantic Power Corp., Term Loan + | | LIBOR + 3.500 | % | $ | 357,734 | | | 5.584 | % | 4/12/2023 | | $ | 361,982 | |

| Calpine Construction Finance Co. LP, Term Loan + | | LIBOR + 2.750 | | | 261,688 | | | 4.084 | | 6/1/2023 | | | 263,235 | |

| Calpine Corp., Term B-1 Loan + | | LIBOR + 2.250 | | | 660,870 | | | 3.631 | | 5/4/2020 | | | 662,109 | |

| Dayton Power & Light Co., Loan + | | LIBOR + 3.250 | | | 93,295 | | | 4.631 | | 8/24/2022 | | | 94,637 | |

| Dynergy, Inc., Tranche C-1 Term Loan + | | LIBOR + 3.250 | | | 608,981 | | | 4.631 | | 2/8/2024 | | | 613,521 | |

| Energy Future Holdings Corp., Term Loan + | | LIBOR + 3.000 | | | 1,000,000 | | | 4.381 | | 6/30/2018 | | | 1,007,500 | |

| NRG Energy, Inc., Term Loan + | | LIBOR + 2.250 | | | 955,240 | | | 3.584 | | 6/30/2023 | | | 959,529 | |

| Talen Energy Supply LLC, Term B-1 Loan + | | LIBOR + 4.000 | | | 198,503 | | | 5.381 | | 7/16/2023 | | | 198,378 | |

| Talen Energy Supply LLC, Initial Term Loan + | | LIBOR + 4.000 | | | 332,990 | | | 5.381 | | 4/16/2024 | | | 332,782 | |

| Tex Operations Co. LLC, Initial Term C Loan + | | LIBOR + 2.750 | | | 53,571 | | | 4.142 | | 8/4/2023 | | | 53,806 | |

| Tex Operations Co. LLC, Initial Term Loan + | | LIBOR + 2.750 | | | 230,908 | | | 4.133 | | 8/4/2023 | | | 231,951 | |

| Vistra Operations Co., 2016 Incremental Term Loan + | | LIBOR + 2.750 | | | 119,100 | | | 4.116 | | 12/14/2023 | | | 120,109 | |

| | | | | | | | | | | | | | 4,899,539 | |

| | | | | | | | | | | | | | | |

| TOTAL BANK LOANS (Cost - $149,602,684) | | | | | | | | | | | | | 149,777,685 | |

| | | | | | | | | | | | | | | |

| BONDS & NOTES - 4.9% | | | | | | | | | | | | | | |

| AIRLINES - 0.0% | | | | | | | | | | | | | | |

| American Airlines Group, Inc. - 144A | | | | | 45,000 | | | 4.625 | | 3/1/2020 | | | 46,631 | |

| | | | | | | | | | | | | | | |

| BUILDING MATERIALS - 0.1% | | | | | | | | | | | | | | |

| Standard Industries, Inc. - 144A | | | | | 95,000 | | | 5.500 | | 2/15/2023 | | | 100,463 | |

| | | | | | | | | | | | | | | |

| CHEMICALS - 0.2% | | | | | | | | | | | | | | |

| Hexion, Inc. | | | | | 105,000 | | | 6.625 | | 4/15/2020 | | | 93,975 | |

| INEOS - 144A ^ | | | | | 200,000 | | | 5.625 | | 8/1/2024 | | | 208,500 | |

| NOVA Chemicals Corp. - 144A | | | | | 75,000 | | | 4.875 | | 6/1/2024 | | | 76,594 | |

| NOVA Chemicals Corp. - 144A | | | | | 55,000 | | | 5.000 | | 5/1/2025 | | | 56,100 | |

| | | | | | | | | | | | | | 435,169 | |

| COAL - 0.3% | | | | | | | | | | | | | | |

| Alliance Resource Operating Partners LP - 144A | | | | | 257,000 | | | 7.500 | | 5/1/2025 | | | 272,420 | |

| Peabody Energy Corp. - 144A | | | | | 15,000 | | | 6.000 | | 3/31/2022 | | | 15,506 | |

| Peabody Energy Corp. - 144A | | | | | 260,000 | | | 6.375 | | 3/31/2025 | | | 269,100 | |

| | | | | | | | | | | | | | 557,026 | |

| COMPUTERS - 0.3% | | | | | | | | | | | | | | |

| Diamond 1 & 2 Finance Corp. - 144A ^ | | | | | 570,000 | | | 5.450 | | 6/15/2023 | | | 625,314 | |

| | | | | | | | | | | | | | | |

| DIVERSIFIED FINANANCIAL SERVICES - 0.2% | | | | | | | | | | | | | | |

| International Lease Finance Corp. | | | | | 120,000 | | | 3.875 | | 4/15/2018 | | | 121,116 | |

| Springleaf Financial ^ | | | | | 250,000 | | | 6.125 | | 5/15/2022 | | | 264,375 | |

| | | | | | | | | | | | | | 385,491 | |

| ELECTRIC - 0.0% | | | | | | | | | | | | | | |

| Talen Energy Supply LLC - 144A | | | | | 18,000 | | | 4.625 | | 7/15/2019 | | | 18,270 | |

| Texas Competitive Electric Holdings Co. LLC | | | | | 635,000 | | | 11.500 | | 10/1/2020 | | | 445 | |

| | | | | | | | | | | | | | 18,715 | |

| ENTERTAINMENT - 0.1% | | | | | | | | | | | | | | |

| Scientific Games International, Inc. - 144A | | | | | 145,000 | | | 7.000 | | 1/1/2022 | | | 153,700 | |

| | | | | | | | | | | | | | | |

| FOOD - 0.1% | | | | | | | | | | | | | | |

| Dole Food Co., Inc. - 144A | | | | | 175,000 | | | 7.250 | | 6/15/2025 | | | 189,875 | |

| | | | | | | | | | | | | | | |

| HEALTHCARE-SERVICES - 0.5% | | | | | | | | | | | | | | |

| CHS/Community Health Systems, Inc. | | | | | 190,000 | | | 6.250 | | 3/31/2023 | | | 183,588 | |

| Eagle Holding Co II LLC - 144A | | | | | 90,000 | | | 7.625 | | 5/15/2022 | | | 93,037 | |

| Surgery Center Holdings, Inc. - 144A | | | | | 130,000 | | | 8.875 | | 4/15/2021 | | | 133,250 | |

| Tenet Healthcare Corp. - 144A | | | | | 405,000 | | | 4.625 | | 7/15/2024 | | | 399,938 | |

| | | | | | | | | | | | | | 809,813 | |

See accompanying notes to financial statements.

| SCHEDULE OF INVESTMENTS |

| Dunham Floating Rate Bond Fund (Continued) |

| October 31, 2017 |

| | | Variable | | Principal | | | Interest | | Maturity | | | |

| Security | | Rate | | Amount | | | Rate | | Date | | Value | |

| BONDS & NOTES - 4.9% (Continued) | | | | | | | | | | | | | | |

| HOME BUILDERS - 0.1% | | | | | | | | | | | | | | |

| TRI Pointe Group, Inc. | | | | $ | 70,000 | | | 4.375 | % | 6/15/2019 | | $ | 72,188 | |

| TRI Pointe Group, Inc. | | | | | 130,000 | | | 4.875 | | 7/1/2021 | | | 136,500 | |

| | | | | | | | | | | | | | 208,688 | |

| MEDIA - 0.7% | | | | | | | | | | | | | | |

| CCO Holdings LLC - 144A | | | | | 180,000 | | | 4.000 | | 3/1/2023 | | | 183,038 | |

| Cequel Communications Holding LLC - 144A | | | | | 34,000 | | | 6.375 | | 9/15/2020 | | | 34,769 | |

| Charter Communications Operating LLC | | | | | 225,000 | | | 4.464 | | 7/23/2022 | | | 237,862 | |

| iHeartCommunications, Inc. | | | | | 95,000 | | | 9.000 | | 12/15/2019 | | | 70,538 | |

| Numericable US LLC - 144A | | | | | 410,000 | | | 6.000 | | 5/15/2022 | | | 427,937 | |

| Sirius XM Radio, Inc. - 144A | | | | | 105,000 | | | 3.875 | | 8/1/2022 | | | 107,494 | |

| Univision Communications, Inc. - 144A | | | | | 200,000 | | | 5.125 | | 5/15/2023 | | | 203,000 | |

| | | | | | | | | | | | | | 1,264,638 | |

| OIL & GAS - 0.5% | | | | | | | | | | | | | | |

| Alta Mesa Holdings LP - 144A | | | | | 135,000 | | | 7.875 | | 12/15/2024 | | | 147,825 | |

| Carrizo Oil & Gas, Inc. ^ | | | | | 140,000 | | | 6.250 | | 4/15/2023 | | | 143,150 | |

| Chesapeake Energy Corp. | | | | | 170,000 | | | 6.625 | | 8/15/2020 | | | 175,525 | |

| Denbury Resources, Inc. | | | | | 140,000 | | | 5.500 | | 5/1/2022 | | | 88,550 | |

| EP Energy LLC / Everest Acquisition Finance, Inc. - 144A ^ | | | | | 160,000 | | | 8.000 | | 11/29/2024 | | | 164,000 | |

| MEG Energy Corp. - 144A ^ | | | | | 115,000 | | | 6.500 | | 1/15/2025 | | | 114,856 | |

| | | | | | | | | | | | | | 833,906 | |

| OIL & GAS SERVICES - 0.1% | | | | | | | | | | | | | | |

| FTS International, Inc. - 144A + | | LIBOR + 7.500 | | | 120,000 | | | 8.820 | | 6/15/2020 | | | 122,550 | |

| FTS International, Inc. | | | | | 50,000 | | | 6.250 | | 5/1/2022 | | | 48,750 | |

| | | | | | | | | | | | | | 171,300 | |

| PACKAGING & CONTAINERS - 0.5% | | | | | | | | | | | | | | |

| Ardagh Packaging Finance PLC - 144A | | | | | 235,000 | | | 6.000 | | 2/15/2025 | | | 249,981 | |

| BWAY Holding Co. - 144A | | | | | 265,000 | | | 5.500 | | 4/15/2024 | | | 276,925 | |

| Reynolds Group Holdings Ltd. | | | | | 50,000 | | | 5.750 | | 10/15/2020 | | | 50,938 | |

| Reynolds Group Holdings Ltd. - 144A + | | LIBOR + 3.500 | | | 230,000 | | | 4.859 | | 7/15/2021 | | | 235,175 | |

| | | | | | | | | | | | | | 813,019 | |

| PHARMACEUTICALS - 0.0% | | | | | | | | | | | | | | |

| Valeant Pharmaceuticals International, Inc. - 144A | | | | | 70,000 | | | 5.375 | | 3/15/2020 | | | 69,125 | |

| | | | | | | | | | | | | | | |

| PIPELINES - 0.1% | | | | | | | | | | | | | | |

| Energy Transfer Equity LP | | | | | 190,000 | | | 4.250 | | 3/15/2023 | | | 193,802 | |

| | | | | | | | | | | | | | | |

| PRIVATE EQUITY - 0.0% | | | | | | | | | | | | | | |

| Icahn Enterprises LP | | | | | 60,000 | | | 6.250 | | 2/1/2022 | | | 62,850 | |

| | | | | | | | | | | | | | | |

| REITS - 0.2% | | | | | | | | | | | | | | |

| IStar Financial, Inc. | | | | | 120,000 | | | 5.000 | | 7/1/2019 | | | 121,275 | |

| IStar Financial, Inc. | | | | | 60,000 | | | 6.000 | | 4/1/2022 | | | 62,550 | |

| IStar Financial, Inc. | | | | | 130,000 | | | 5.250 | | 9/15/2022 | | | 133,575 | |

| | | | | | | | | | | | | | 317,400 | |

| RETAIL - 0.2% | | | | | | | | | | | | | | |

| Argos Merger Sub, Inc. - 144A ^ | | | | | 140,000 | | | 7.125 | | 3/15/2023 | | | 107,100 | |

| Cumberland Farms, Inc. - 144A | | | | | 125,000 | | | 6.750 | | 5/1/2025 | | | 133,125 | |

| Ferrellgas Partners LP ^ | | | | | 200,000 | | | 6.750 | | 6/15/2023 | | | 187,000 | |

| PetSmart, Inc. - 144A | | | | | 20,000 | | | 5.875 | | 6/1/2025 | | | 17,550 | |

| | | | | | | | | | | | | | 444,775 | |

| SEMICONDUCTORS - 0.3% | | | | | | | | | | | | | | |

| Broadcom Corp.- 144A | | | | | 500,000 | | | 2.200 | | 1/15/2021 | | | 497,305 | |

| | | | | | | | | | | | | | | |

| SOFTWARE - 0.2% | | | | | | | | | | | | | | |

| First Data Corp. - 144A | | | | | 190,000 | | | 5.375 | | 8/15/2023 | | | 198,313 | |

| First Data Corp. - 144A | | | | | 90,000 | | | 5.000 | | 1/15/2024 | | | 93,825 | |

| First Data Corp. - 144A | | | | | 25,000 | | | 5.750 | | 1/15/2024 | | | 26,250 | |

| | | | | | | | | | | | | | 318,388 | |

See accompanying notes to financial statements.

| SCHEDULE OF INVESTMENTS |

| Dunham Floating Rate Bond Fund (Continued) |

| October 31, 2017 |

| | | Principal | | | Interest | | Maturity | | | |

| Security | | Amount | | | Rate | | Date | | Value | |

| BONDS & NOTES - 4.9% (Continued) | | | | | | | | | | | | |

| TELECOMMUNICATIONS - 0.2% | | | | | | | | | | | | |

| Frontier Communications Corp. | | $ | 105,000 | | | 6.250 | % | 9/15/2021 | | $ | 86,362 | |

| T-Mobile USA, Inc. | | | 205,000 | | | 6.000 | | 4/15/2024 | | | 219,862 | |

| | | | | | | | | | | | 306,224 | |

| | | | | | | | | | | | | |

| TOTAL BONDS & NOTES (Cost - $8,783,858) | | | | | | | | | | | 8,823,617 | |

| | | | | | | | | | | | | |

| ASSET BACKED SECURITIES - 1.6% | | | | | | | | | | | | |

| Drive Auto Receivables Trust | | | 450,000 | | | 2.800 | | 7/15/2022 | | | 451,582 | |

| JP Morgan Mortgage Trust - 144A | | | 836,930 | | | 2.601 | | 12/25/2046 | | | 840,304 | |

| Residential Mortgage Trust | | | 89,303 | | | 6.110 | | 6/25/2037 | | | 89,744 | |

| Santander Drive Auto Receivables Trust | | | 355,000 | | | 2.760 | | 12/15/2022 | | | 358,120 | |

| SoFi Professional Loan Program LLC - 144A | | | 535,000 | | | 2.720 | | 11/26/2040 | | | 533,987 | |

| Vericrest Opportunity Loan Trust - 144A | | | 395,652 | | | 3.500 | | 3/25/2047 | | | 399,566 | |

| Vericrest Opportunity Loan Trust - 144A | | | 282,984 | | | 3.125 | | 9/25/2047 | | | 283,072 | |

| TOTAL ASSET BACKED SECURITIES (Cost - $2,950,942) | | | | | | | | | | | 2,956,375 | |

| | | | | | | | | | | | | |

| Security | | Shares | | | | | | | Value | |

| RIGHTS - 0.0% | | | | | | | | | | | | |

| TRA Rights | | | 10,588 | | | | | | | $ | 11,201 | |

| TOTAL RIGHTS (Cost - $17,470) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | Interest | | | | | | |

| | | | | | | Rate | | | | | | |

| SHORT-TERM INVESTMENT - 17.8% | | | | | | | | | | | | |

| MONEY MARKET FUND - 17.8% | | | | | | | | | | | | |

| Fidelity Investments Money Market Fund - Class I | | | 31,968,937 | | | 0.92% | + | | | | 31,968,937 | |

| TOTAL SHORT-TERM INVESTMENT - (Cost - $31,968,937) | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| COLLATERAL FOR SECURITIES LOANED - 1.2% | | | | | | | | | | | | |

| Mount Vernon Prime Portfolio (Cost - $2,147,100) | | | 2,147,100 | | | 1.32% | + | | | | 2,147,100 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS - 111.1% (Cost - $199,546,934) | | | | | | | | | | | 199,816,855 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS - (11.1)% | | | | | | | | | | | (19,887,827 | ) |

| NET ASSETS - 100.0% | | | | | | | | | | $ | 179,929,028 | |

REITs - Real Estate Investment Trusts.

144A - Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. As of October 31, 2017 the total market value of 144A securites is $8,125,770 or 4.52% of net assets.

| * | Non-Income producing security. |

| ^ | All or a portion of these securities are on loan. Total loaned securities had a value of $2,113,114 at October 31, 2017. |

| + | Variable rate security. Interest rate is as of October 31, 2017. |

| Portfolio Composition* - (Unaudited) |

| Bank Loans | | | 75.0 | % | | Healthcare-Services | | | 0.4 | % |

| Short-Term Investment | | | 16.1 | % | | Packaging & Containers | | | 0.4 | % |

| Exchange Traded Fund | | | 1.8 | % | | Coal | | | 0.3 | % |

| Asset Backed Securities | | | 1.5 | % | | Chemicals | | | 0.2 | % |

| Other ** | | | 1.3 | % | | Diversified Financial Services | | | 0.2 | % |

| Collateral for Securities Loaned | | | 1.1 | % | | REITs | | | 0.2 | % |

| Media | | | 0.6 | % | | Retail | | | 0.2 | % |

| Oil & Gas | | | 0.5 | % | | Semiconductors | | | 0.2 | % |

| | | | | | | Total | | | 100.0 | % |

| * | Based on total value of investments as of October 31, 2017. |

| ** | Groupings less than 0.20% of holdings. |

Percentage may differ from Schedule of Investments which are based on Fund net assets.

See accompanying notes to financial statements.

| Dunham Corporate/Government Bond Fund (Unaudited) |

| Message from the Sub-Adviser (Newfleet Asset Management, LLC) |

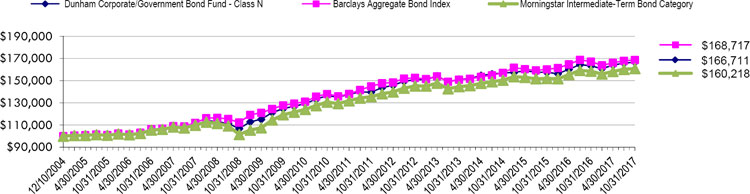

Investment-grade bonds, as measured by the Barclays Aggregate Bond Index, gained 0.9 percent in the fiscal year ended October 31, 2017, after increasing 4.4 percent over the previous fiscal year. Treasuries in the middle of the yield curve, as measured by the BofA ML Treasuries 5-7 Years Index, fell 0.8 percent, while long-term Treasuries, as measured by the BofA ML Treasuries 10+ Years Index, declined 2.2 percent over the same time period. Corporate bonds, as measured by the BofA ML U.S. Corporate Bond Master Index, outperformed intermediate-term Treasury bonds, rising 3.5 percent over the fiscal quarter. High-yield bonds, as measured by the BofA ML High-Yield Bond Cash Pay Index, had another strong fiscal year, adding 10.1 percent, outperforming all of the aforementioned indexes.

The Sub-Adviser continued to balance risk versus reward by choosing to emphasize lower duration bonds and overweighting lower credit quality securities, which benefitted the Fund for the second consecutive year. By the end of the fiscal year, the average effective duration of the Fund was 5.40 years, while the benchmark index had an average duration of 5.96 years. While the lower duration exposure did not adversely affect performance during the most recent fiscal year, the overweight to lower credit quality securities versus the benchmark contributed to the Fund’s performance. Treasury yields fluctuated within an 85 basis point range over the fiscal year. The 10-year Treasury yield went from its lowest point of 1.78 percent early in the fiscal year to its highest point of 2.63 late in the fiscal year, before settling at 2.38 percent on October 31, 2017. The overweights to corporate high-yield securities and corporate investment-grade securities were the largest contributors to performance over the fiscal year. The Sub-Adviser’s overweight to the corporate high-yield sector was slightly less at the end of the fiscal year, investing roughly 12 percent of the Fund in such securities. The index held less than 1 percent in high-yield securities. The overweight to corporate investment-grade securities was slightly higher than the overweight at the beginning of the fiscal year, equaling roughly 31 percent of the Fund’s assets, and approximately 5 percent greater than the index’s allocation to that sector.

Contributors for the fiscal quarter included Valeant Pharmaceuticals International, Inc. 5.5% due 03/01/2023 (91911KAE2) (holding percentage*: 0.06 percent). These bonds performed well in the most recent fiscal year due to a combination of factors including meeting first quarter earnings expectations and modestly raising full-year 2017 guidance, positive developments around its Xifaxin franchise extending a stay on generic litigation, and the FDA requirement of bioequivalence studying for the approval of a generic, and continued asset sales and debt pay down toward its goal of reducing $5 billion of debt by January 2018. There have also been rumors of the potential of either a debt-for-equity swap or the issuance of a convertible debt investment to de-lever the balance sheet. Another contributor over the fiscal year was the Corrections Corporation of America (CXW) 5.00% due 10/15/2022 (2202YAQ3) (holding percentage*: 0.16 percent). The company provides detention and corrections services to government agencies in the United States and United Kingdom. CXW may have been the largest beneficiary from Trump’s surprise presidential victory. The bonds had been beaten down on fears that a Clinton victory would bring further cuts to privately owned prisons. Industry trade groups supported Trump during the campaign and have benefited from Trump’s anti-illegal-immigration policies and tough-on-crime stance. In addition to the presidential elections, CXW was boosted by the conclusion of an Immigration and Customs Enforcement review of private prison usage. That review found no need/ability to reduce exposure to private prisons. The bonds rose 19.4 percent over the fiscal year.