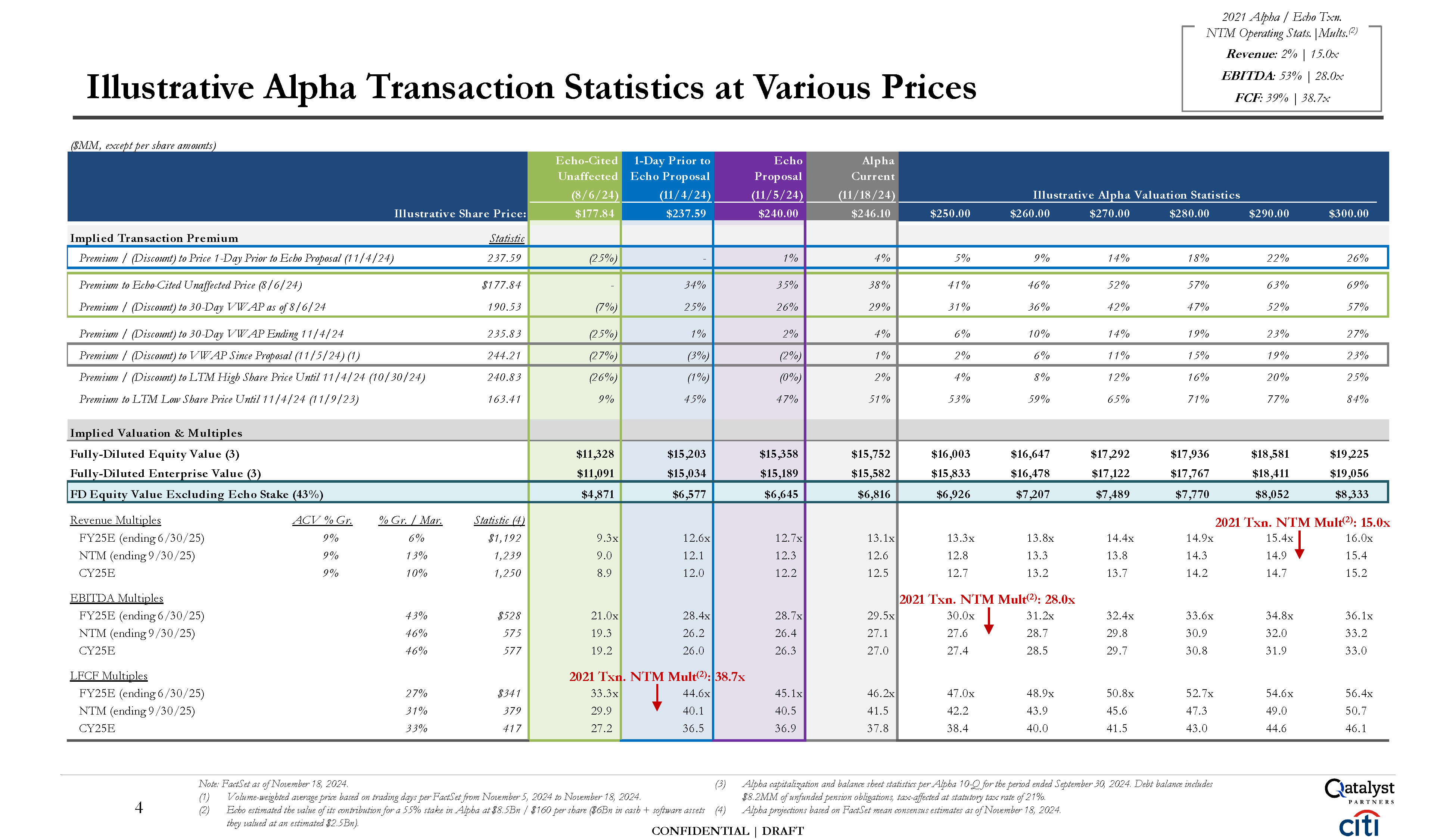

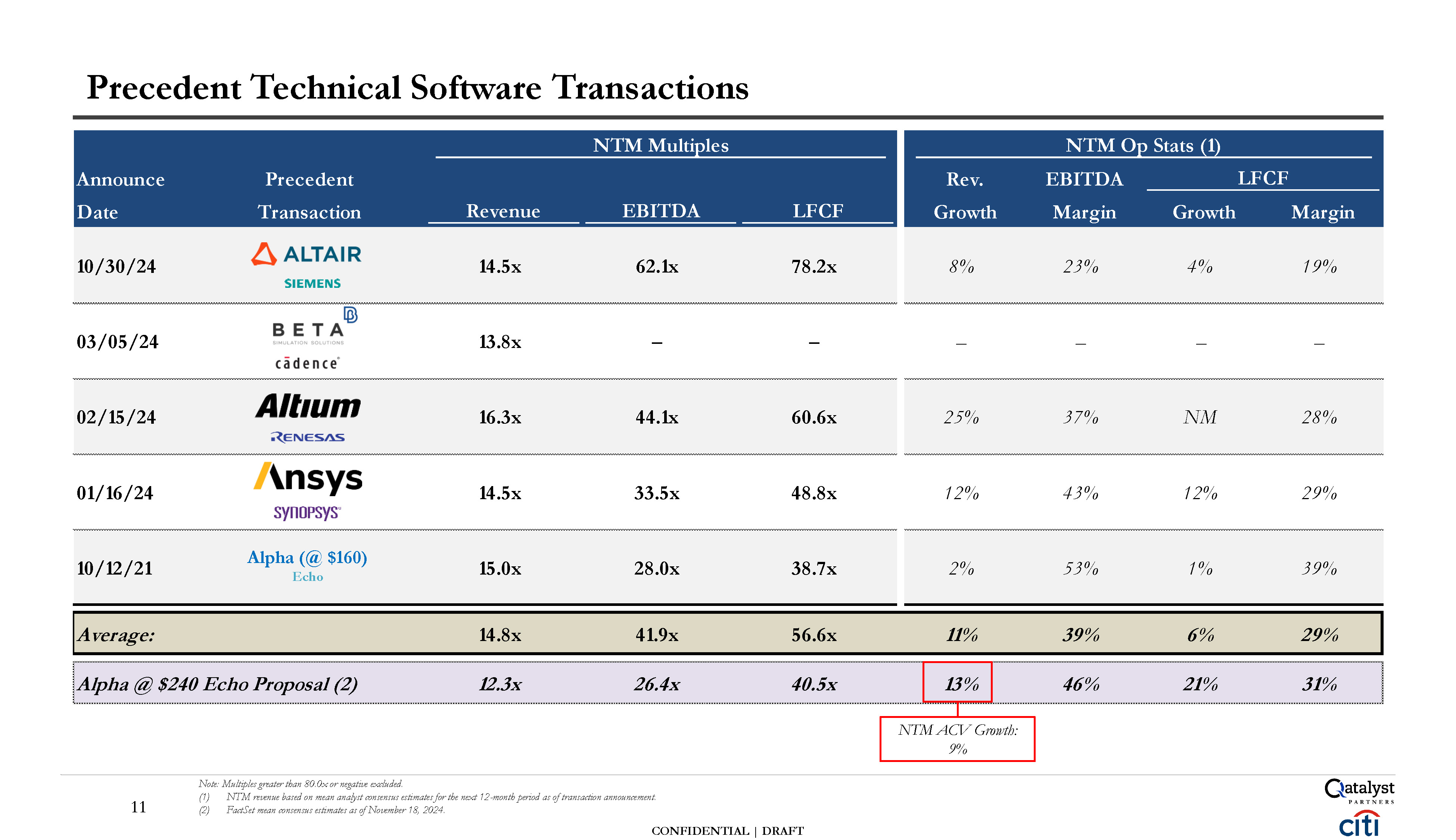

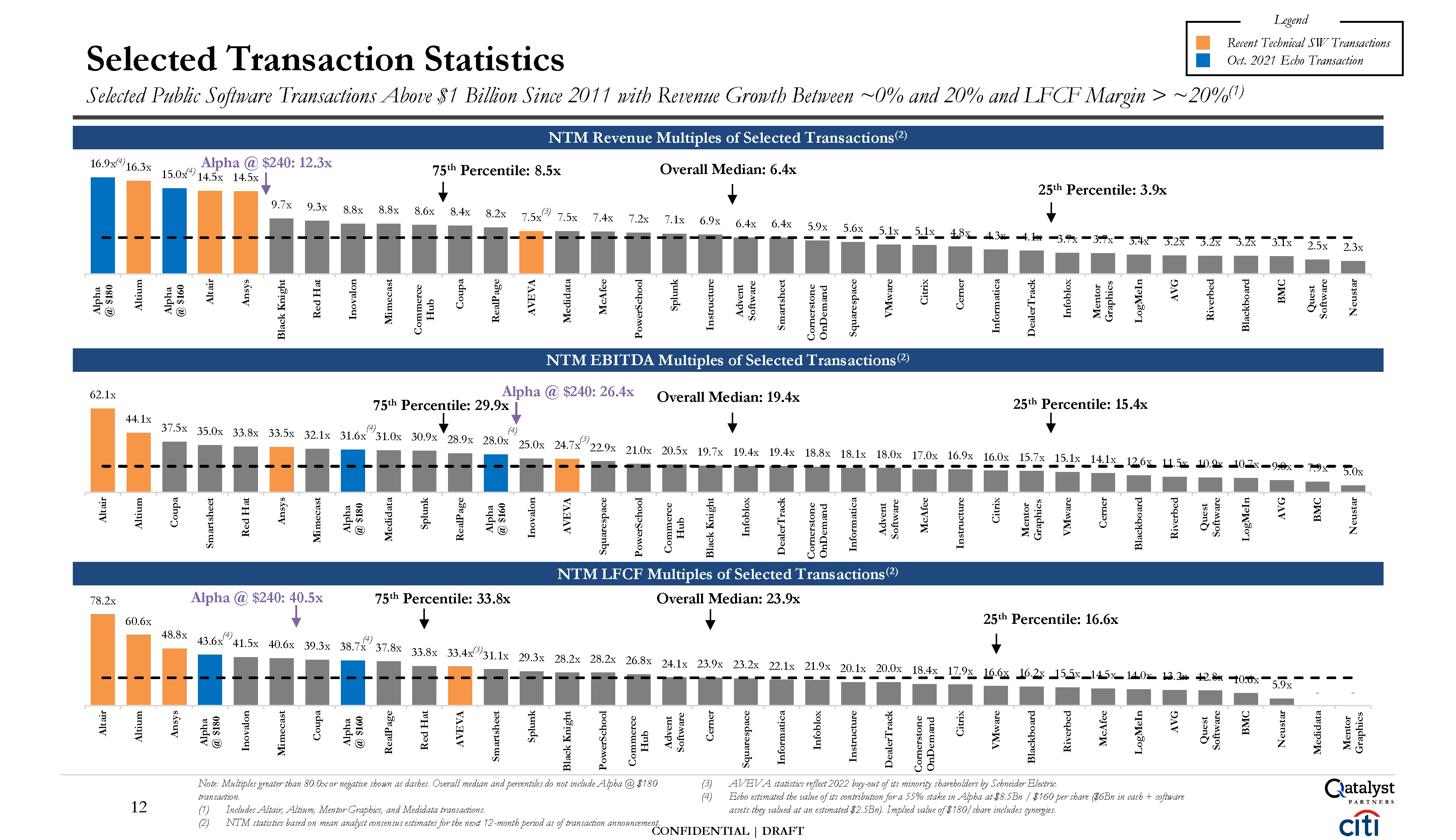

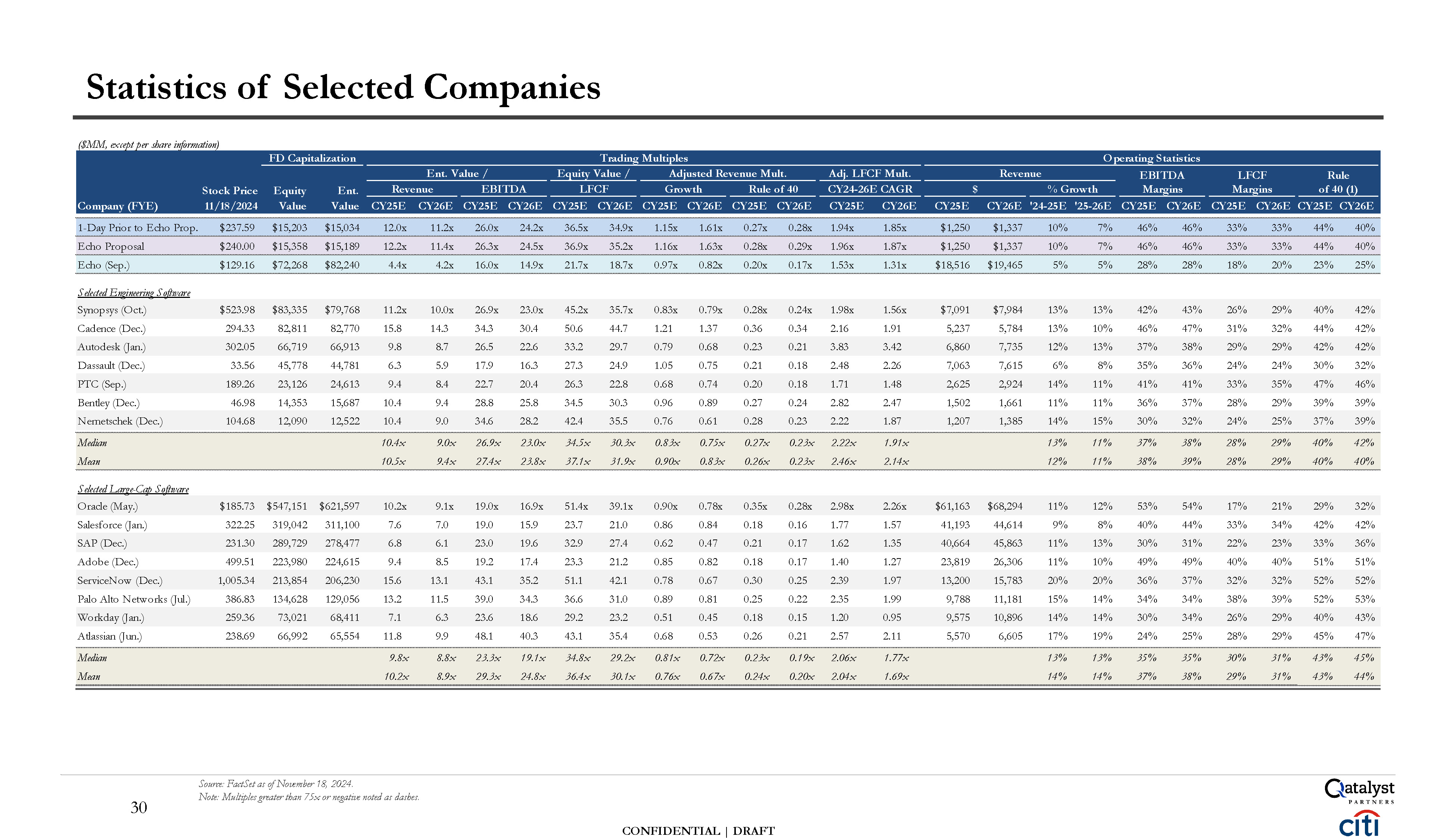

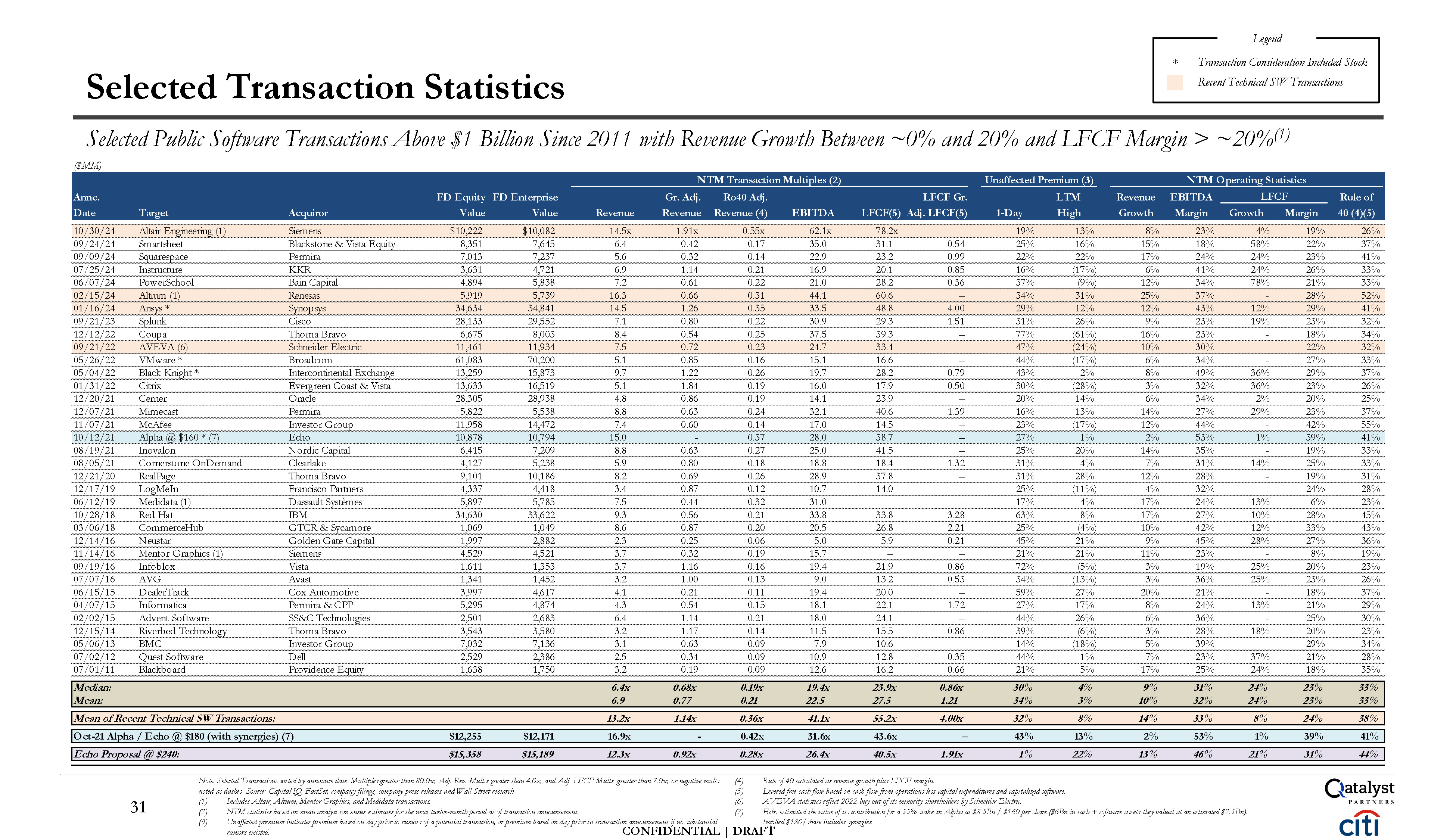

CONFIDENTIAL | DRAFT NTM Transaction Multiples (2) Unaffected Premium (3) NTM Operating Statistics Annc. FD Equity FD Enterprise Gr. Adj. Ro40 Adj. LFCF Gr. LTM Revenue EBITDA LFCF Rule of Date Target Acquiror Value Value Revenue Revenue Revenue (4) EBITDA LFCF(5) Adj. LFCF(5) 1-Day High Growth Margin Growth Margin 40 (4)(5) Mean of Recent Technical SW Transactions: 13.2x 1.14x 0.36x 41.1x 55.2x 4.00x 32% 8% 14% 33% 8% 24% 38% Oct-21 Alpha / Echo @ $180 (with synergies) (7) $12,255 $12,171 16.9x - 0.42x 31.6x 43.6x – 43% 13% 2% 53% 1% 39% 41% Echo Proposal @ $240: $15,358 $15,189 12.3x 0.92x 0.28x 26.4x 40.5x 1.91x 1% 22% 13% 46% 21% 31% 44% 10/30/24 Altair Engineering (1) Siemens $10,222 $10,082 14.5x 1.91x 0.55x 62.1x 78.2x – 19% 13% 8% 23% 4% 19% 26% 09/24/24 Smartsheet Blackstone & Vista Equity 8,351 7,645 6.4 0.42 0.17 35.0 31.1 0.54 25% 16% 15% 18% 58% 22% 37% 09/09/24 Squarespace Permira 7,013 7,237 5.6 0.32 0.14 22.9 23.2 0.99 22% 22% 17% 24% 24% 23% 41% 07/25/24 Instructure KKR 3,631 4,721 6.9 1.14 0.21 16.9 20.1 0.85 16% (17%) 6% 41% 24% 26% 33% 06/07/24 PowerSchool Bain Capital 4,894 5,838 7.2 0.61 0.22 21.0 28.2 0.36 37% (9%) 12% 34% 78% 21% 33% 02/15/24 Altium (1) Renesas 5,919 5,739 16.3 0.66 0.31 44.1 60.6 – 34% 31% 25% 37% - 28% 52% 01/16/24 Ansys * Synopsys 34,634 34,841 14.5 1.26 0.35 33.5 48.8 4.00 29% 12% 12% 43% 12% 29% 41% 09/21/23 Splunk Cisco 28,133 29,552 7.1 0.80 0.22 30.9 29.3 1.51 31% 26% 9% 23% 19% 23% 32% 12/12/22 Coupa Thoma Bravo 6,675 8,003 8.4 0.54 0.25 37.5 39.3 – 77% (61%) 16% 23% - 18% 34% 09/21/22 AVEVA (6) Schneider Electric 11,461 11,934 7.5 0.72 0.23 24.7 33.4 – 47% (24%) 10% 30% - 22% 32% 05/26/22 VMware * Broadcom 61,083 70,200 5.1 0.85 0.16 15.1 16.6 – 44% (17%) 6% 34% - 27% 33% 05/04/22 Black Knight * Intercontinental Exchange 13,259 15,873 9.7 1.22 0.26 19.7 28.2 0.79 43% 2% 8% 49% 36% 29% 37% 01/31/22 Citrix Evergreen Coast & Vista 13,633 16,519 5.1 1.84 0.19 16.0 17.9 0.50 30% (28%) 3% 32% 36% 23% 26% 12/20/21 Cerner Oracle 28,305 28,938 4.8 0.86 0.19 14.1 23.9 – 20% 14% 6% 34% 2% 20% 25% 12/07/21 Mimecast Permira 5,822 5,538 8.8 0.63 0.24 32.1 40.6 1.39 16% 13% 14% 27% 29% 23% 37% 11/07/21 McAfee Investor Group 11,958 14,472 7.4 0.60 0.14 17.0 14.5 – 23% (17%) 12% 44% - 42% 55% 10/12/21 Alpha @ $160 * (7) Echo 10,878 10,794 15.0 - 0.37 28.0 38.7 – 27% 1% 2% 53% 1% 39% 41% 08/19/21 Inovalon Nordic Capital 6,415 7,209 8.8 0.63 0.27 25.0 41.5 – 25% 20% 14% 35% - 19% 33% 08/05/21 Cornerstone OnDemand Clearlake 4,127 5,238 5.9 0.80 0.18 18.8 18.4 1.32 31% 4% 7% 31% 14% 25% 33% 12/21/20 RealPage Thoma Bravo 9,101 10,186 8.2 0.69 0.26 28.9 37.8 – 31% 28% 12% 28% - 19% 31% 12/17/19 LogMeIn Francisco Partners 4,337 4,418 3.4 0.87 0.12 10.7 14.0 – 25% (11%) 4% 32% - 24% 28% 06/12/19 Medidata (1) Dassault Systèmes 5,897 5,785 7.5 0.44 0.32 31.0 – – 17% 4% 17% 24% 13% 6% 23% 10/28/18 Red Hat IBM 34,630 33,622 9.3 0.56 0.21 33.8 33.8 3.28 63% 8% 17% 27% 10% 28% 45% 03/06/18 CommerceHub GTCR & Sycamore 1,069 1,049 8.6 0.87 0.20 20.5 26.8 2.21 25% (4%) 10% 42% 12% 33% 43% 12/14/16 Neustar Golden Gate Capital 1,997 2,882 2.3 0.25 0.06 5.0 5.9 0.21 45% 21% 9% 45% 28% 27% 36% 11/14/16 Mentor Graphics (1) Siemens 4,529 4,521 3.7 0.32 0.19 15.7 – – 21% 21% 11% 23% - 8% 19% 09/19/16 Infoblox Vista 1,611 1,353 3.7 1.16 0.16 19.4 21.9 0.86 72% (5%) 3% 19% 25% 20% 23% 07/07/16 AVG Avast 1,341 1,452 3.2 1.00 0.13 9.0 13.2 0.53 34% (13%) 3% 36% 25% 23% 26% 06/15/15 DealerTrack Cox Automotive 3,997 4,617 4.1 0.21 0.11 19.4 20.0 – 59% 27% 20% 21% - 18% 37% 04/07/15 Informatica Permira & CPP 5,295 4,874 4.3 0.54 0.15 18.1 22.1 1.72 27% 17% 8% 24% 13% 21% 29% 02/02/15 Advent Software SS&C Technologies 2,501 2,683 6.4 1.14 0.21 18.0 24.1 – 44% 26% 6% 36% - 25% 30% 12/15/14 Riverbed Technology Thoma Bravo 3,543 3,580 3.2 1.17 0.14 11.5 15.5 0.86 39% (6%) 3% 28% 18% 20% 23% 05/06/13 BMC Investor Group 7,032 7,136 3.1 0.63 0.09 7.9 10.6 – 14% (18%) 5% 39% - 29% 34% 07/02/12 Quest Software Dell 2,529 2,386 2.5 0.34 0.09 10.9 12.8 0.35 44% 1% 7% 23% 37% 21% 28% 07/01/11 Blackboard Providence Equity 1,638 1,750 3.2 0.19 0.09 12.6 16.2 0.66 21% 5% 17% 25% 24% 18% 35% Median: 6.4x 0.68x 0.19x 19.4x 23.9x 0.86x 30% 4% 9% 31% 24% 23% 33% Mean: 6.9 0.77 0.21 22.5 27.5 1.21 34% 3% 10% 32% 24% 23% 33% Selected Transaction Statistics Selected Public Software Transactions Above $1 Billion Since 2011 with Revenue Growth Between ~0% and 20% and LFCF Margin > ~20%(1) ($MM) noted as dashes. Source: Capital IQ, FactSet, company filings, company press releases and Wall Street research. (1) (2) (3) Includes Altair, Altium, Mentor Graphics, and Medidata transactions. NTM statistics based on mean analyst consensus estimates for the next twelve-month period as of transaction announcement. Unaffected premium indicates premium based on day prior to rumors of a potential transaction, or premium based on day prior to transaction announcement if no substantial rumors existed. Note: Selected Transactions sorted by announce date. Multiples greater than 80.0x, Adj. Rev. Mult.s greater than 4.0x, and Adj. LFCF Mults. greater than 7.0x, or negative mults (4) (5) (6) (7) Rule of 40 calculated as revenue growth plus LFCF margin. Levered free cash flow based on cash flow from operations less capital expenditures and capitalized software. AVEVA statistics reflect 2022 buy-out of its minority shareholders by Schneider Electric. Echo estimated the value of its contribution for a 55% stake in Alpha at $8.5Bn / $160 per share ($6Bn in cash + software assets they valued at an estimated $2.5Bn). Implied $180/share includes synergies. Legend * Transaction Consideration Included Stock Recent Technical SW Transactions 31