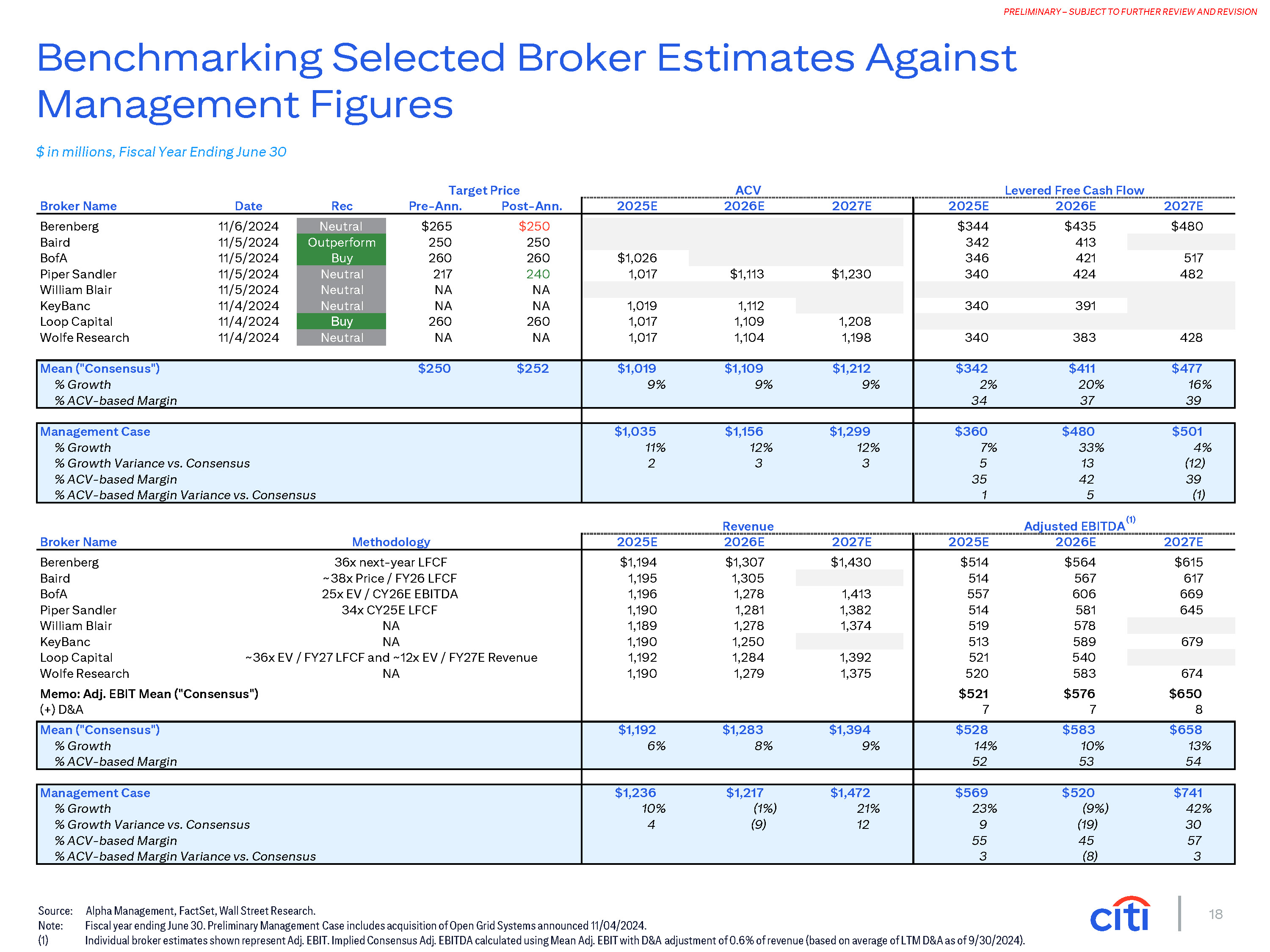

18 PRELIMINARY – SUBJECT TO FURTHER REVIEW AND REVISION Source: Alpha Management, FactSet, Wall Street Research. Note: (1) Fiscal year ending June 30. Preliminary Management Case includes acquisition of Open Grid Systems announced 11/04/2024. Individual broker estimates shown represent Adj. EBIT. Implied Consensus Adj. EBITDA calculated using Mean Adj. EBIT with D&A adjustment of 0.6% of revenue (based on average of LTM D&A as of 9/30/2024). Benchmarking Selected Broker Estimates Against Management Figures 2025E 2026E 2027E 2025E 2026E 2027E Berenberg 11/6/2024 Neutral $265 $250 $344 $435 $480 Baird 11/5/2024 Outperform 250 250 342 413 BofA 11/5/2024 Buy 260 260 $1,026 346 421 517 Piper Sandler 11/5/2024 Neutral 217 240 1,017 $1,113 $1,230 340 424 482 William Blair 11/5/2024 Neutral NA NA KeyBanc 11/4/2024 Neutral NA NA 1,019 1,112 340 391 Loop Capital 11/4/2024 Buy 260 260 1,017 1,109 1,208 Wolfe Research 11/4/2024 Neutral NA NA 1,017 1,104 1,198 340 383 428 Mean ("Consensus") $250 $252 $1,019 $1,109 $1,212 $342 $411 $477 % Growth 9% 9% 9% 2% 20% 16% % ACV-based Margin 34 37 39 Management Case $1,035 $1,156 $1,299 $360 $480 $501 % Growth 11% 12% 12% 7% 33% 4% % Growth Variance vs. Consensus 2 3 3 5 13 (12) % ACV-based Margin 35 42 39 % ACV-based Margin Variance vs. Consensus 1 5 (1) $ in millions, Fiscal Year Ending June 30 Target Price ACV Levered Free Cash Flow Broker Name Date Rec Pre-Ann. Post-Ann. Revenue Broker Name Methodology 2025E 2026E 2027E 2025E 2026E 2027E Berenberg 36x next-year LFCF $1,194 $1,307 $1,430 $514 $564 $615 Baird ~38x Price / FY26 LFCF 1,195 1,305 514 567 617 BofA 25x EV / CY26E EBITDA 1,196 1,278 1,413 557 606 669 Piper Sandler 34x CY25E LFCF 1,190 1,281 1,382 514 581 645 William Blair NA 1,189 1,278 1,374 519 578 KeyBanc NA 1,190 1,250 513 589 679 Loop Capital ~36x EV / FY27 LFCF and ~12x EV / FY27E Revenue 1,192 1,284 1,392 521 540 Wolfe Research NA 1,190 1,279 1,375 520 583 674 Memo: Adj. EBIT Mean ("Consensus") $521 $576 $650 (+) D&A 7 7 8 Mean ("Consensus") $1,192 $1,283 $1,394 $528 $583 $658 % Growth 6% 8% 9% 14% 10% 13% % ACV-based Margin 52 53 54 Management Case $1,236 $1,217 $1,472 $569 $520 $741 % Growth 10% (1%) 21% 23% (9%) 42% % Growth Variance vs. Consensus 4 (9) 12 9 (19) 30 % ACV-based Margin 55 45 57 % ACV-based Margin Variance vs. Consensus 3 (8) 3 Adjusted EBITDA(1)