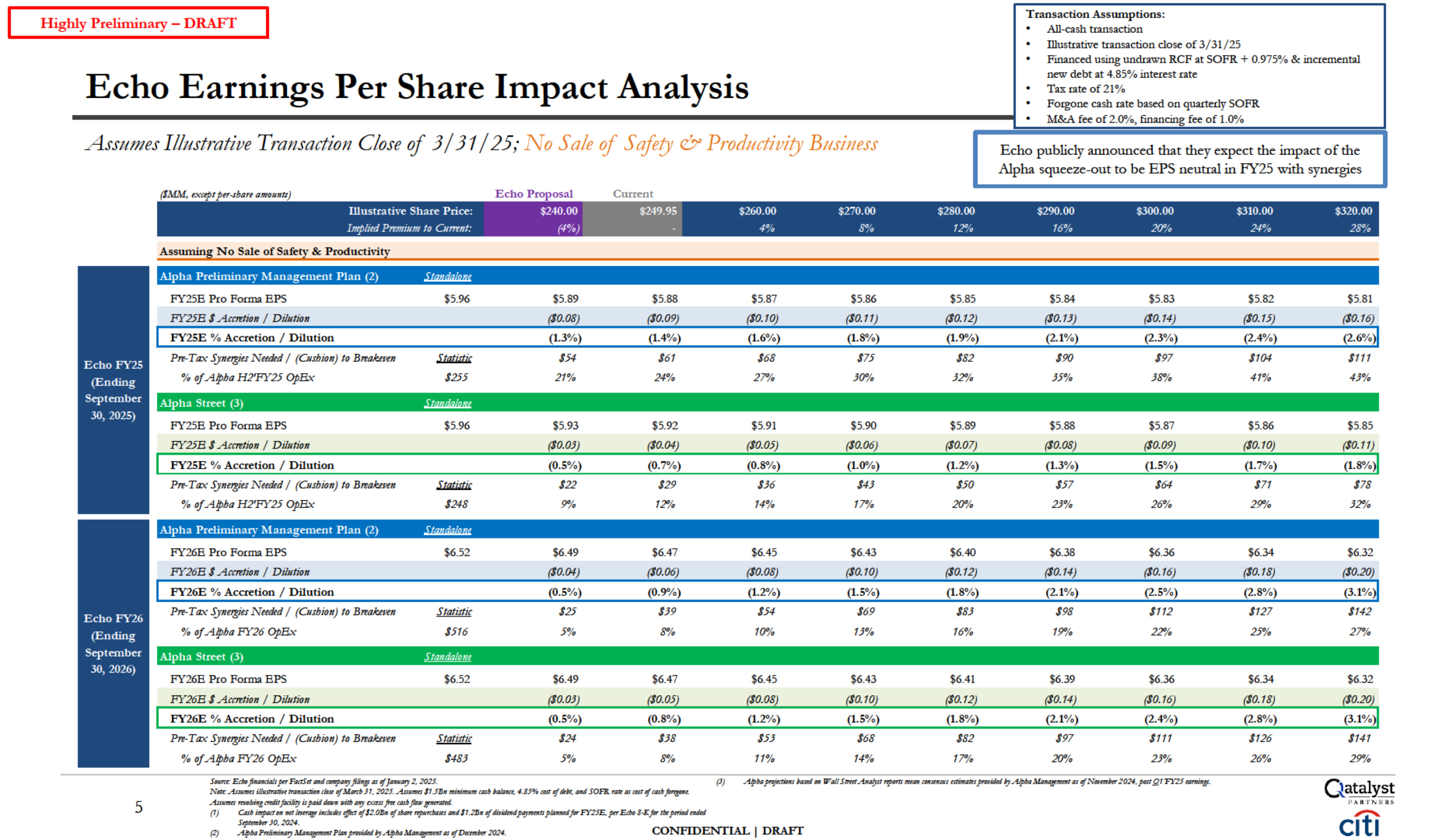

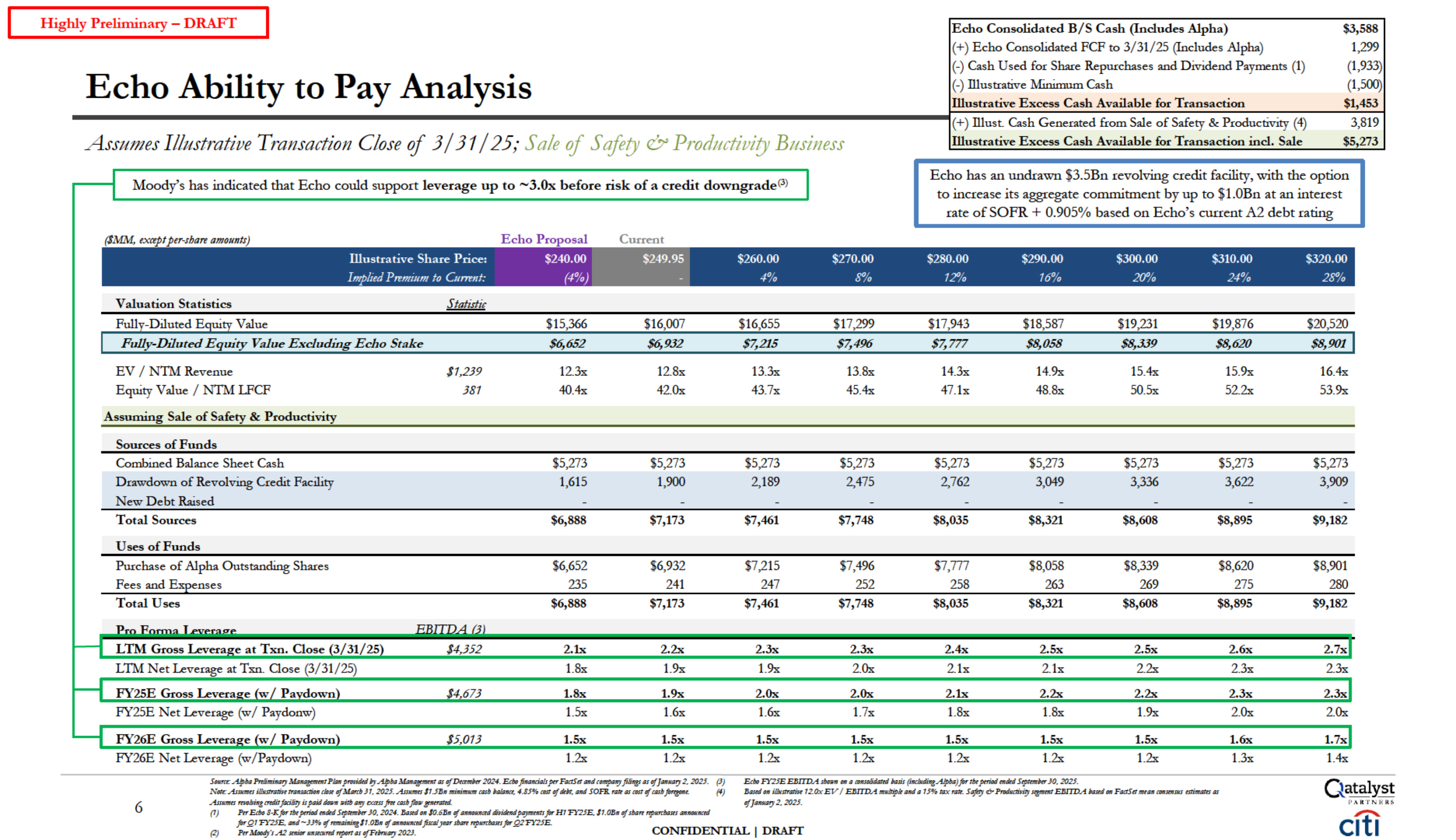

Valuation Statistics Statistic $15,366 $16,007 $16,655 $17,299 $17,943 $18,587 $19,231 $19,876 $20,520 V.-ilue Excludi Ecl10 Stake $6,652 $6,932 $7,215 $7,496 $7,777 $8,058 $8,339 $8,620 $8,901 EV / NTM Revenue 11,239 12.3x 12.Sx 13.3x 13.Sx 14.3x 14.9x 15.4x 15.9x 16.4x Equity Value / NTM LFCF 381 40.4x 42.0x 43.7x 45.4x 47.lx 48.Sx 50.5x 52.2x 53.9x Assumin No Sale of Safe!l'.& Pcoductivi!l'. Sources of Funds Combined Balance Sheet Cash $1,453 $1,453 $1,453 $1,453 $1,453 $1,453 $1,453 $1,453 $1,453 Drawdown of Revolving Credit Facility 4,500 4,500 4,500 4,500 4,500 4,500 4,500 4,500 4,500 New Debt Raised 841 1,129 1,420 1,710 1,999 2,289 2,579 2,868 3,158 Total Sources $6,794 $7,082 $7,373 $7,663 $7,953 $8,242 $8,532 $8,821 $9,111 Uses of Funds Purchase of Alpha Outstanding Shares $6,652 $6,932 $7,215 $7,496 $7,777 $8,058 $8,339 $8,620 $8,901 Fees and E enses 141 150 158 167 176 184 193 201 210 Total Uses $6,794 $7,082 $7,373 $7,663 $7,953 $8,242 $8,532 $8,821 $9,111 Pro Forina Levera e LTM Gross Leverage at Txn. Close (3/31/25) $4,121 2.8x 2.8x 2.9x 2.9x 3.0x 3.lx 3.lx 3.2x 3.3x LTM Net Leverage at Txn. Oose (3/31/25) 2.4x 2.5x 2.6x 2.6x 2.7x 2.7x 2.Sx 2.9x 2.9x FY25E Gross Levera e w/ Pa down 15,043 2.Sx 2.Sx 2.6x 2.6x 2.7x 2.8x 2.8x 2.9x 2.9x FY25E Net Leverage (w/ Paydown) 2.2x 2.2x 2.3x 2.3x 2.4x 2.5x 2.5x 2.6x 2.6x FY26E Gross Leverage (w/ Paydown) 15,397 1.8x 1.9x 1.9x 2.0x 2.lx 2.lx 2.2x 2.2x 2.3x FY26E Net Leverage (w/Paydown) 1.5x 1.6x 1.7x 1.7x 1.Sx 1.Sx 1.9x 1.9x 2.0x Highly Preliminary - DRAFT Echo Ability to Pay Analysis Echo Consolidated B/S Cash (Includes Alpha) (+) Echo Consolidated FCF to 3/31/25 (Includes Alpha) (-) Cash Used for Sha.re Repurchases and Dividend Payments (1) (-) illustrative l\finimum Cash Illustrative Excess Cash Available foe Transaction $3,588 1,299 (1,933) (1,500) $1,453 Assumes Illustrative Transaction Close of 3 / 31 / 25; No Sale of Safety & Productivity Business Moody's has indicated that Echo could support leverage up to ~3.0x before risk of a credit downgrade<2l Echo has an undrawn $3.SBn revolving credit facility, with the option to increase its aggregate commitment by up to $1.0Bn at an interest rate of SOFR + 0.905% based on Echo's current A2 debt rating ' ' . Illustrative Share Price: $240.00 Imp!ted Prrmmm lo C11m11/: (4%) E p $260.00 $270.00 $280.00 $290.00 $300.00 $310.00 $320.00 4% 8% 12% 16% 20% 24% 28% E.dJoFY25E..EBlTD.A.WH OIi a (t»l!o/ith:td Hsis(indlldin1,Alpb4)far tbt ptriodt11dtd S ttr JO, 2025. C-latalyst PAiC'rNf!U, s :A9&1PrtliJ!lti11a,yZ14o tPN11p1mid«l"7A4>lxl. asefDt(tf/1/NT2024. E.dJoft11aMiabptr FllttSttat1dtmpa,,y filii't.14sof]at111a,y2. 2025. (J) N«t:A.slN.ltffl ilhl1tmiff trrlM«1#11 f.Hl1t llfMarr.bJ1. 2025.As1U1t1115B1111tillilltlim tasb 4.85%(t)/1 efdtk. tltUi SOFR. f'fJfl asmt If wb j,r1p.t. AslUltl ftMl.biJltmditfad51J iJpaidd4WII •ilbdJ!!t:XJ:ISI fttt tasbjh:P§llffl#td. Ptr Em, 8-Kfar tbtptriodmdtd Stp1t1111NTJO, 2024. <d1»1I0.6& 'f 411Mlillad di1idmdpaymm1farH1'FY.?5.E.l1.0B11II/slwt r,p,ml,o1tsJttJIWlll(td 4 CONFIDENTIAL I DRAFI farQ,1FY2J.E. a,,d~JJ'/4ofrmtlini11gl1.0BII IfJttJMlillttd filt4lJ'tt1r1&zrtrtpli1rba1t1farQ2FY2JE. Ptr MtJodJ'1A2 fn#{J(' nltOlffli ttpon01efFtffltaty202.J. c1t1 (2)