UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

AMENDMENT NO. 2

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-173

DODGE & COX FUNDS

(Exact name of registrant as specified in charter)

555 California Street, 40th Floor

San Francisco, CA 94104

(Address of principal executive offices) (Zip code)

Thomas M. Mistele, Esq.

555 California Street, 40th Floor

San Francisco, CA 94104

(Name and address of agent for service)

Registrant’s telephone number, including area code: 415-981-1710

Date of fiscal year end: DECEMBER 31, 2014

Date of reporting period: DECEMBER 31, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following are the December 31, 2014 annual reports for the Dodge & Cox Funds, a Delaware statutory trust, consisting of six series: Dodge & Cox Stock Fund, Dodge & Cox Global Stock Fund, Dodge & Cox International Stock Fund, Dodge & Cox Balanced Fund, Dodge & Cox Income Fund, and Dodge & Cox Global Bond Fund. The reports of each series were transmitted to their respective shareholders on February 17, 2015.

| | | | |

| | | |  |

www.dodgeandcox.com

For Fund literature, transactions, and account

information, please visit the Funds’ website.

or write or call:

DODGE & COX FUNDS

c/o Boston Financial Data Services

P.O. Box 8422

Boston, Massachusetts 02266-8422

(800) 621-3979

INVESTMENT MANAGER

Dodge & Cox

555 California Street, 40th Floor

San Francisco, California 94104

(415) 981-1710

This report is submitted for the general information of the shareholders of the Fund. The report is not authorized for distribution to prospective investors in the Fund unless it is accompanied by a current prospectus.

This report reflects our views, opinions, and portfolio holdings as of December 31, 2014, the end of the reporting period. Any such views are subject to change at any time based upon market or other conditions and Dodge & Cox disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dodge & Cox Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dodge & Cox Fund.

12/14 SF AR  Printed on recycled paper

Printed on recycled paper

Annual Report

December 31, 2014

Stock Fund

ESTABLISHED 1965

TICKER: DODGX

TO OUR SHAREHOLDERS

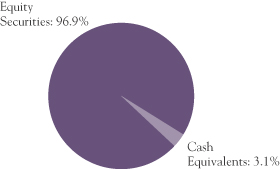

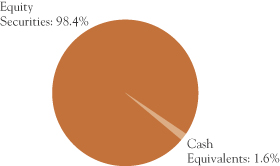

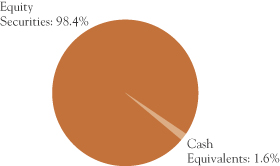

The Dodge & Cox Stock Fund had a total return of 10.4% for the year ending December 31, 2014, compared to a return of 13.7% for the S&P 500 Index. At year end, the Fund had net assets of $60.3 billion with a cash position of 1.2%.

MARKET COMMENTARY

U.S. equity markets were strong during 2014: the S&P 500 closed on December 31 near its record high. Utilities and Health Care were the best performing sectors in the S&P 500, while Energy was the weakest, and the only sector to post a negative return. Global oil prices dropped approximately 50%, due to lower-than-expected demand growth and modestly higher-than-expected supply growth. The U.S. dollar strengthened against most major currencies, allowing American companies and consumers to pay lower prices for imported foreign goods. However, in aggregate, the stronger currency dampens profitability of U.S. multinational corporations and makes U.S. exports less competitive.

After declining in the first quarter, U.S. economic activity rebounded and continued to expand at a moderate pace through December. U.S. labor market conditions improved: job gains were solid and the unemployment rate declined. While the recovery in the housing sector remained modest, household wealth and spending rose, and consumer sentiment reached a seven-year high. Corporate profitability was robust, and businesses increased investment in fixed assets. The U.S. Federal Reserve announced the end of its historic asset-purchase program, but retained an accommodative stance and signaled its intention to take a slow approach toward raising interest rates in 2015. Despite concerns about global economic growth, our long-term outlook for equities continues to be positive.

INVESTMENT STRATEGY

Our disciplined investment process combines in-depth, bottom-up research and rigorous debate of ideas among our experienced investment professionals; the Fund benefits from the collective judgment of our team. We evaluate potential investments based on a three- to five-year investment horizon and have a strict price discipline.

While individual company research is the primary factor in determining the Fund’s portfolio composition, we can identify themes that cut across many industries. Innovation is a pervasive theme in the Fund and is factored into our analysis. We highlight examples of our current investment theses within the Information Technology and Energy sectors below.(a)

Information Technology

In the Information Technology sector, investors can have limited visibility of future earnings because growth is often driven by innovation and disruption; companies are required to make significant investments in research & development (R&D) with uncertain outcomes. In addition, companies face intense competition, have short product cycles, and must combat product obsolescence. As a result, we typically look for companies with reasonable valuations that incorporate modest expectations, industry leadership (e.g., brand, distribution, market share), sustained R&D efforts, a strong intellectual property portfolio, and financial stability. We believe that these characteristics can help offset the inherent uncertainty of changes in technology.

On December 31, 2014, 23.7% of the Fund was invested in the Information Technology sector compared to 19.7% of the S&P 500.(b) Information Technology is not a homogeneous sector: the Fund holds 16 technology companies with differing business models and diversified revenue streams and geographic exposures. We evaluate each investment opportunity on a standalone basis and weigh a company’s valuation against its risks and opportunities to ascertain whether it is an attractive investment opportunity. Technology holdings ranged from Hewlett-Packard at 0.7 times sales to Google at 5.5 times sales.

Hewlett-Packard

Hewlett-Packard, a long-term holding in the Fund, is an example of how our patience, persistence, and ability to build conviction in the face of uncertainty have benefited recent performance (up 101% in 2013 and up 46% in 2014, and the largest contributor to Fund results in both years). We believe that Hewlett-Packard remains an

PAGE 1 § DODGE & COX STOCK FUND

attractive investment opportunity with strong business prospects given its large valuation discount to the overall market. As the world’s largest enterprise technology company, Hewlett-Packard has a strong, well-recognized brand and serves more than one billion end users in more than 170 countries. The company generates high, recurring free cash flow. Over our three- to five-year investment horizon, Hewlett-Packard is positioned to benefit from growth opportunities in the cloud, security, and converged network infrastructure markets. Furthermore, we believe that the competent management of the company’s operating businesses is underappreciated by the market. Current risks to the business include the possibility of expensive acquisitions, macroeconomic weakness, and competitive threats in PCs, services, and enterprise server/storage/networking. While these risks are significant, we believe that the valuation reflects an overly pessimistic outlook.

In October, the company announced plans to separate the business into two companies—Hewlett-Packard Enterprise and HP Inc.—and expects to complete the transaction by October 2015. Hewlett-Packard Enterprise will consist of technology infrastructure, software, and services, with a focus on growth opportunities from cloud, big data, security, and mobility. HP Inc. will consist of the personal computing and printing businesses, which generate strong cash flow; the new company intends to invest in innovative technologies, such as 3-D printing. We believe that the proposed separation could build long-term shareholder value. The announcement comes four years into Hewlett-Packard’s five-year turnaround strategy. Management believes that the separation will provide greater focus, flexibility, and management alignment for each new company. Additionally, we believe the proposed capital structures and capital allocation strategy would be better tailored for each company’s respective growth profile. On December 31, Hewlett-Packard was a 4.1% position in the Fund.

Google

As the most popular internet destination in the world, Google has extremely high search engine market share in both developed and emerging markets: ~70% desktop share and over 90% mobile share globally. The company is well-positioned to benefit from continued growth in its

core search business as internet penetration increases (currently at approximately 40% globally), users spend more time online, e-commerce expands, and more advertising revenue is earned online. Google also has meaningful non-search assets in display advertising (e.g., YouTube, DoubleClick), mobile (e.g., Android), and social (e.g., Google+). The company is led by a long-term, product-focused management team with significant economic ownership and a demonstrated focus on shareholders and financial returns. However, Google faces increasing competition, greater regulatory scrutiny around the world, and declining margins due to rising R&D expenses. Despite these issues, we believe that its valuation at 17 times forward estimated earnings(c) is reasonable considering its strong long-term growth prospects and cash generation potential. Recently, we added to the Fund’s position; Google was a 2.3% holding at year end.

Energy

In the Energy sector, technological innovation has improved exploration success and oil recovery, increased efficiency of energy conservation, and reduced the environmental impact of energy extraction. We have identified attractive energy investment opportunities, especially within the Energy Equipment & Services (Oil Services) industry. The Fund is overweight Oil Services compared to the S&P 500 (5.2% versus 1.4%, respectively).

To evaluate each potential energy investment, we consider scenarios using a range of oil and gas prices. Our approach tends to be contrarian: we are often more skeptical as other investors become more optimistic, and our interest increases when other investors become more pessimistic. Given the recent collapse in oil prices and lower stock prices, we have reassessed and retested our investment theses and increased positions selectively in the Energy sector with technology leaders, such as Schlumberger. We continue to assess the impact of lower commodity prices on the entire portfolio.

Schlumberger

Schlumberger, the world’s leading oil services company, is the most technologically focused company among the integrated oilfield service companies, with double the

DODGE & COX STOCK FUND §PAGE 2

R&D budget of its closest peer. We believe that its consistent spending on technology (e.g., enhanced recovery techniques, seismic interpretation, directional drilling) has provided the company with a competitive advantage that is sustainable over time. The company’s innovation efforts have enabled the industry to extract oil and gas from deepwater and shale resources that were previously cost-prohibitive or physically challenging to reach.

Schlumberger is the dominant international provider in key markets, including the Middle East and Russia. The majority of its revenues come from outside the United States, and its international business has higher margins than its U.S. operations. We believe that Schlumberger is well positioned to continue to benefit from the long-term relationships it has with international oil companies and producing nations. If the price of oil remains low, the company will face a challenging environment. Relative to competitors, its strong franchises, and solid balance sheet and cash flow should allow the company to endure an extended downturn. Weighing this risk with Schlumberger’s valuation and opportunities, we believe that the company (a 2.5% position in the Fund) remains an attractive investment opportunity.

IN CLOSING

The U.S. equity market remains reasonably valued: the S&P 500 traded at 15.2 times forward estimated earnings at year end, which was in line with its 10-year historical average of 15.4 times. We are optimistic about the long-term prospects for sales and earnings growth and believe that cash returned to shareholders can continue to increase. Balance sheets and cash flows continue to be strong for companies within our investment universe. In our opinion, the Fund’s portfolio is well positioned to benefit from long-term global growth opportunities. Acknowledging that markets can be volatile in the short term, we encourage shareholders to remain focused on the long term.

Thank you for your continued confidence in our firm. As always, we welcome your comments and questions.

For the Board of Trustees,

| | |

| |  |

Charles F. Pohl, Chairman | | Dana M. Emery, President |

January 27, 2015

| (a) | | The use of specific examples does not imply that they are more attractive investments than the Fund’s other holdings. |

| (b) | | Unless otherwise specified, all weightings and characteristics are as of December 31, 2014. |

| (c) | | Google’s consensus forward estimated earnings exclude stock-based compensation expense (they are non-GAAP earnings). |

PAGE 3 § DODGE & COX STOCK FUND

ANNUAL PERFORMANCE REVIEW

The Fund underperformed the S&P 500 by 3.3 percentage points in 2014.

Key Detractors from Relative Results

| | § | | The Fund’s holdings in the Health Care sector (up 9% compared to up 25% for the S&P 500 sector) hurt results. GlaxoSmithKline (down 16%) and Sanofi (down 13%) lagged. | |

| | § | | Returns from holdings in the Financials sector (up 13% compared to up 15% for the S&P 500 sector) hindered performance. Key detractors included AEGON (down 18%) and the Fund’s lack of holdings in the Real Estate Investment Trusts industry, which outpaced the overall market (up 31%). | |

| | § | | The Fund’s underweight position in the Utilities sector (no holdings compared to 3% for the S&P 500 sector) detracted from results as it was the best performing sector of the market (up 29%). | |

| | § | | Returns from holdings in the Industrials sector (up 4% compared to up 10% for the S&P 500 sector) hurt performance. Philips (down 19%), ADT Corp. (down 8%), and General Electric (down 7%) were weak. | |

| | § | | Selected additional detractors included Sprint (down 61%), Coach (down 31%), Apache (down 26%), and Weatherford International (down 26%). | |

Key Contributors to Relative Results

| | § | | The Fund’s holdings in the Consumer Discretionary sector (up 16% compared to up 10% for the S&P 500 sector) helped returns. CarMax (up 42%), Target (up 31% since date of purchase), and Time Warner (up 30%) were strong. | |

| | § | | Returns from holdings in the Materials sector (up 14% compared to up 6% for the S&P 500 sector) aided performance. Dow Chemical (up 22% to date of sale) and the Fund’s lack of holdings in the Metals & Mining industry, a weaker area of the market (down 14%), were relative positives. | |

| | § | | The Fund’s average underweight position in the Energy sector (9% compared to 10% for the S&P 500 sector) slightly contributed to results since the sector lagged the overall market. | |

| | § | | Selected additional contributors included Forest Laboratories (up 52% to date of sale), Hewlett-Packard (up 46%), Microsoft (up 28%), and Wells Fargo (up 24%). | |

KEY CHARACTERISTICS OF DODGE & COX

Independent Organization

Dodge & Cox is one of the largest privately owned investment managers in the world. We remain committed to independence, with a goal of providing the highest quality investment management service to our existing clients.

Over 80 Years of Investment Experience

Dodge & Cox was founded in 1930. We have a stable and well-qualified team of investment professionals, most of whom have spent their entire careers at Dodge & Cox.

Experienced Investment Team

The Investment Policy Committee, which is the decision-making body for the Stock Fund, is a nine-member committee with an average tenure at Dodge & Cox of 26 years.

One Business with a Single Research Office

Dodge & Cox manages equity (domestic, international, and global), fixed income (domestic and global), and balanced investments, operating from one office in San Francisco.

Consistent Investment Approach

Our team decision-making process involves thorough, bottom-up fundamental analysis of each investment.

Long-Term Focus and Low Expenses

We invest with a three- to five-year investment horizon, which has historically resulted in low turnover relative to our peers. We manage Funds that maintain low expense ratios.

Risks: The Fund is subject to stock market risk, meaning stocks in the Fund may decline in value for extended periods due to the financial prospects of individual companies, or due to general market and economic conditions. Please read the prospectus and summary prospectus for specific details regarding the Fund’s risk profile.

DODGE & COX STOCK FUND §PAGE 4

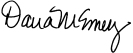

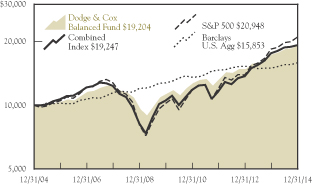

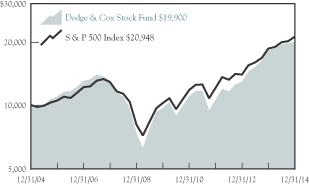

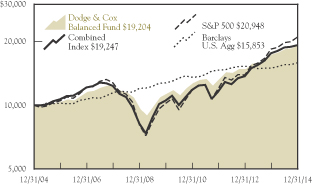

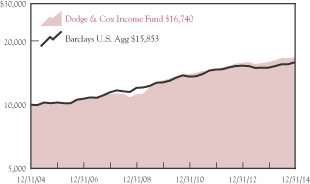

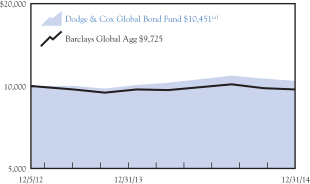

GROWTH OF $10,000 OVER 10 YEARS

FOR AN INVESTMENT MADE ON DECEMBER 31, 2004

AVERAGE ANNUAL TOTAL RETURN

FOR PERIODS ENDED DECEMBER 31, 2014

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Years | | | 10 Years | | | 20 Years | |

Dodge & Cox Stock Fund | | | 10.43 | % | | | 15.56 | % | | | 7.13 | % | | | 11.90 | % |

S&P 500 | | | 13.69 | | | | 15.46 | | | | 7.68 | | | | 9.85 | |

Returns represent past performance and do not guarantee future results. Investment return and share price will fluctuate with market conditions, and investors may have a gain or loss when shares are sold. Fund performance changes over time and currently may be significantly lower than stated. Performance is updated and published monthly. Visit the Fund’s website at www.dodgeandcox.com or call 800-621-3979 for current performance figures.

The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted for any income taxes payable by shareholders on these distributions or on Fund share redemptions. Index returns include dividends but, unlike Fund returns, do not reflect fees or expenses. The S&P 500 Index is a market capitalization-weighted index of 500 large-capitalization stocks commonly used to represent the U.S. equity market.

S&P 500® is a trademark of McGraw Hill Financial.

FUND EXPENSE EXAMPLE

As a Fund shareholder, you incur ongoing Fund costs, including management fees and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The following example shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The example assumes a $1,000 investment held for the six months indicated.

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and expenses based on the Fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON WITH OTHER MUTUAL FUNDS

Information on the second line of the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio of the Fund and an assumed 5% annual rate of return before expenses (not the Fund’s actual return). The amount under the heading “Expense Paid During the Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other mutual funds.

| | | | | | | | | | | | |

Six Months Ended

December 31, 2014 | | Beginning Account Value

7/1/2014 | | | Ending Account Value

12/31/2014 | | | Expenses Paid

During Period* | |

Based on Actual Fund Return | | $ | 1,000.00 | | | $ | 1,031.70 | | | $ | 2.65 | |

Based on Hypothetical 5% Yearly Return | | | 1,000.00 | | | | 1,022.60 | | | | 2.64 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.52%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

The expenses shown in the table highlight ongoing costs only and do not reflect any transactional fees or account maintenance fees. Though other mutual funds may charge such fees, please note that the Fund does not charge transaction fees (e.g., redemption fees, sales loads) or universal account maintenance fees (e.g., small account fees).

PAGE 5 § DODGE & COX STOCK FUND

| | | | |

| FUND INFORMATION | | | December 31, 2014 | |

| | | | |

| GENERAL INFORMATION | | | |

Net Asset Value Per Share | | | $180.94 | |

Total Net Assets (billions) | | | $60.3 | |

Expense Ratio | | | 0.52% | |

Portfolio Turnover Rate | | | 17% | |

30-Day SEC Yield(a) | | | 1.25% | |

Fund Inception | | | 1965 | |

No sales charges or distribution fees | | | | |

Investment Manager: Dodge & Cox, San Francisco. Managed by the Investment Policy Committee, whose nine members’ average tenure at Dodge & Cox is 26 years.

| | | | | | | | |

| PORTFOLIO CHARACTERISTICS | | Fund | | | S&P 500 | |

Number of Equity Securities | | | 66 | | | | 502 | |

Median Market Capitalization (billions) | | | $41 | | | | $19 | |

Weighted Average Market Capitalization (billions) | | | $115 | | | | $134 | |

Price-to-Earnings Ratio(b) | | | 14.9x | | | | 15.2x | |

Foreign Securities not in the S&P 500(c) | | | 10.5% | | | | 0.0% | |

| | | | |

| TEN LARGEST HOLDINGS (%)(d) | | Fund | |

Hewlett-Packard Co. | | | 4.1 | |

Wells Fargo & Co. | | | 4.0 | |

Capital One Financial Corp. | | | 3.9 | |

Microsoft Corp. | | | 3.8 | |

Novartis AG (Switzerland) | | | 3.2 | |

Time Warner, Inc. | | | 3.2 | |

Time Warner Cable, Inc. | | | 2.9 | |

Charles Schwab Corp. | | | 2.8 | |

Bank of America Corp. | | | 2.8 | |

Bank of New York Mellon Corp. | | | 2.7 | |

| | | | | | | | |

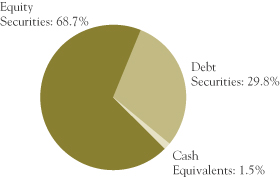

| SECTOR DIVERSIFICATION (%) | | Fund | | | S&P 500 | |

Financials | | | 23.9 | | | | 16.6 | |

Information Technology | | | 23.7 | | | | 19.7 | |

Health Care | | | 16.9 | | | | 14.2 | |

Consumer Discretionary | | | 15.2 | | | | 12.3 | |

Energy | | | 8.6 | | | | 8.4 | |

Industrials | | | 6.5 | | | | 10.4 | |

Consumer Staples | | | 2.7 | | | | 9.8 | |

Materials | | | 0.9 | | | | 3.1 | |

Telecommunication Services | | | 0.4 | | | | 2.3 | |

Utilities | | | 0.0 | | | | 3.2 | |

| (a) | SEC Yield is an annualization of the Fund’s total net investment income per share for the 30-day period ended on the last day of the month. |

| (b) | Price-to-earnings (P/E) ratios are calculated using 12-month forward earnings estimates from third-party sources. |

| (c) | Foreign securities are U.S. dollar denominated. |

| (d) | The Fund’s portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation to buy, sell, or hold any particular security and is not indicative of Dodge & Cox’s current or future trading activity. |

DODGE & COX STOCK FUND §PAGE 6

| | | | |

| PORTFOLIO OF INVESTMENTS | | | December 31, 2014 | |

| | | | | | | | |

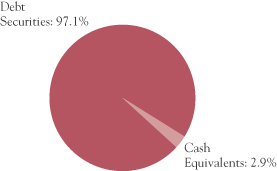

| COMMON STOCKS: 98.8% | |

| | |

| | | SHARES | | | VALUE | |

| CONSUMER DISCRETIONARY: 15.2% | |

CONSUMER DURABLES & APPAREL: 0.8% | | | | | |

Coach, Inc. | | | 10,316,700 | | | $ | 387,495,252 | |

NVR, Inc.(a) | | | 70,900 | | | | 90,420,897 | |

| | | | | | | | |

| | | | | | | 477,916,149 | |

MEDIA: 11.8% | | | | | | | | |

Comcast Corp., Class A | | | 27,569,897 | | | | 1,599,329,725 | |

DISH Network Corp., Class A(a) | | | 6,819,649 | | | | 497,084,216 | |

News Corp., Class A(a) | | | 6,326,406 | | | | 99,261,310 | |

Time Warner Cable, Inc. | | | 11,589,110 | | | | 1,762,240,067 | |

Time Warner, Inc. | | | 22,619,432 | | | | 1,932,151,881 | |

Time, Inc. | | | 4,754,341 | | | | 117,004,332 | |

Twenty-First Century Fox, Inc. | | | 28,214,826 | | | | 1,083,590,392 | |

| | | | | | | | |

| | | | | | | 7,090,661,923 | |

RETAILING: 2.6% | | | | | | | | |

CarMax, Inc.(a) | | | 4,824,050 | | | | 321,185,249 | |

Liberty Interactive Corp., Series A(a) | | | 13,101,375 | | | | 385,442,453 | |

Liberty Ventures, Series A(a) | | | 1,933,707 | | | | 72,939,428 | |

Target Corp. | | | 10,670,686 | | | | 810,011,774 | |

| | | | | | | | |

| | | | | | | 1,589,578,904 | |

| | | | | | | | |

| | | | | | | 9,158,156,976 | |

| CONSUMER STAPLES: 2.7% | | | | | |

FOOD & STAPLES RETAILING: 2.7% | | | | | |

Wal-Mart Stores, Inc. | | | 18,655,350 | | | | 1,602,121,458 | |

| |

| ENERGY: 8.6% | | | | | |

Apache Corp. | | | 18,390,028 | | | | 1,152,503,055 | |

Baker Hughes, Inc. | | | 14,018,450 | | | | 786,014,492 | |

Chevron Corp. | | | 7,792,280 | | | | 874,137,970 | |

National Oilwell Varco, Inc. | | | 8,582,900 | | | | 562,437,437 | |

Schlumberger, Ltd.(b)

(Curacao/United States) | | | 17,665,245 | | | | 1,508,788,575 | |

Weatherford International PLC(a),(b) (Ireland) | | | 24,773,700 | | | | 283,658,865 | |

| | | | | | | | |

| | | | | | | 5,167,540,394 | |

| FINANCIALS: 23.9% | | | | | | | | |

BANKS: 10.1% | | | | | | | | |

Bank of America Corp. | | | 93,511,800 | | | | 1,672,926,102 | |

BB&T Corp. | | | 17,105,244 | | | | 665,222,939 | |

JPMorgan Chase & Co. | | | 15,006,400 | | | | 939,100,512 | |

SunTrust Banks, Inc. | | | 10,250,133 | | | | 429,480,573 | |

Wells Fargo & Co. | | | 43,860,341 | | | | 2,404,423,893 | |

| | | | | | | | |

| | | | | | | 6,111,154,019 | |

DIVERSIFIED FINANCIALS: 11.8% | | | | | |

Bank of New York Mellon Corp. | | | 40,373,124 | | | | 1,637,937,641 | |

Capital One Financial Corp.(c) | | | 28,169,211 | | | | 2,325,368,368 | |

Charles Schwab Corp. | | | 56,605,900 | | | | 1,708,932,121 | |

Goldman Sachs Group, Inc. | | | 7,463,400 | | | | 1,446,630,822 | |

| | | | | | | | |

| | | | | | | 7,118,868,952 | |

| | | | | | | | |

| | |

| | | SHARES | | | VALUE | |

INSURANCE: 2.0% | | | | | | | | |

AEGON NV(b) (Netherlands) | | | 66,753,197 | | | $ | 500,648,978 | |

MetLife, Inc. | | | 12,901,700 | | | | 697,852,953 | |

| | | | | | | | |

| | | | | | | 1,198,501,931 | |

| | | | | | | | |

| | | | | | | 14,428,524,902 | |

| HEALTH CARE: 16.9% | | | | | | | | |

HEALTH CARE EQUIPMENT & SERVICES: 5.0% | |

Cigna Corp. | | | 6,144,784 | | | | 632,359,722 | |

Express Scripts Holding Co.(a) | | | 11,388,600 | | | | 964,272,762 | |

Medtronic, Inc. | | | 5,370,000 | | | | 387,714,000 | |

UnitedHealth Group, Inc. | | | 9,915,600 | | | | 1,002,368,004 | |

| | | | | | | | |

| | | | | | | 2,986,714,488 | |

PHARMACEUTICALS, BIOTECHNOLOGY &

LIFE SCIENCES: 11.9% | |

GlaxoSmithKline PLC ADR(b) (United Kingdom) | | | 11,381,400 | | | | 486,441,036 | |

Merck & Co., Inc. | | | 20,357,600 | | | | 1,156,108,104 | |

Novartis AG ADR(b) (Switzerland) | | | 21,110,700 | | | | 1,956,117,462 | |

Pfizer, Inc. | | | 28,771,064 | | | | 896,218,643 | |

Roche Holding AG ADR(b) (Switzerland) | | | 42,969,500 | | | | 1,460,533,305 | |

Sanofi ADR(b) (France) | | | 27,088,029 | | | | 1,235,485,003 | |

| | | | | | | | |

| | | | | | | 7,190,903,553 | |

| | | | | | | | |

| | | | | | | 10,177,618,041 | |

| INDUSTRIALS: 6.5% | | | | | | | | |

CAPITAL GOODS: 2.4% | | | | | | | | |

Danaher Corp. | | | 6,675,009 | | | | 572,115,022 | |

General Electric Co. | | | 23,414,475 | | | | 591,683,783 | |

Koninklijke Philips NV(b) (Netherlands) | | | 7,383,475 | | | | 214,120,775 | |

NOW, Inc.(a) | | | 2,090,700 | | | | 53,793,711 | |

| | | | | | | | |

| | | | | | | 1,431,713,291 | |

COMMERCIAL & PROFESSIONAL SERVICES: 1.6% | |

ADT Corp.(c) | | | 11,819,337 | | | | 428,214,580 | |

Tyco International PLC(b) (Ireland) | | | 12,660,975 | | | | 555,310,363 | |

| | | | | | | | |

| | | | | | | 983,524,943 | |

TRANSPORTATION: 2.5% | | | | | | | | |

FedEx Corp. | | | 8,824,299 | | | | 1,532,427,764 | |

| | | | | | | | |

| | | | | | | 3,947,665,998 | |

| | |

| PAGE 7 § DODGE & COX STOCK FUND | | See accompanying Notes to Financial Statements |

| | | | |

| PORTFOLIO OF INVESTMENTS | | | December 31, 2014 | |

| | | | | | | | |

| COMMON STOCKS (continued) | |

| | |

| | | SHARES | | | VALUE | |

| INFORMATION TECHNOLOGY: 23.7% | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT: 0.9% | |

Maxim Integrated Products, Inc.(c) | | | 16,326,840 | | | $ | 520,336,391 | |

| |

SOFTWARE & SERVICES: 11.7% | | | | | |

AOL, Inc.(a),(c) | | | 7,100,754 | | | | 327,841,812 | |

Cadence Design Systems, Inc.(a) | | | 10,099,300 | | | | 191,583,721 | |

eBay, Inc.(a) | | | 16,424,109 | | | | 921,720,997 | |

Google, Inc., Class A(a) | | | 795,200 | | | | 421,980,832 | |

Google, Inc., Class C(a) | | | 1,877,200 | | | | 988,158,080 | |

Microsoft Corp. | | | 49,217,900 | | | | 2,286,171,455 | |

Symantec Corp.(c) | | | 51,921,000 | | | | 1,332,033,255 | |

Synopsys, Inc.(a),(c) | | | 13,627,969 | | | | 592,407,813 | |

| | | | | | | | |

| | | | | | | 7,061,897,965 | |

TECHNOLOGY, HARDWARE & EQUIPMENT: 11.1% | |

Cisco Systems, Inc. | | | 18,518,211 | | | | 515,084,039 | |

Corning, Inc. | | | 34,269,300 | | | | 785,795,049 | |

EMC Corp. | | | 24,850,400 | | | | 739,050,896 | |

Hewlett-Packard Co. | | | 62,145,595 | | | | 2,493,902,727 | |

Juniper Networks, Inc. | | | 8,968,479 | | | | 200,176,451 | |

NetApp, Inc.(c) | | | 19,794,000 | | | | 820,461,300 | |

Nokia Corp. ADR(b) (Finland) | | | 18,753,500 | | | | 147,402,510 | |

TE Connectivity, Ltd.(b) (Switzerland) | | | 15,376,575 | | | | 972,568,369 | |

| | | | | | | | |

| | | | | | | 6,674,441,341 | |

| | | | | | | | |

| | | | | | | 14,256,675,697 | |

| MATERIALS: 0.9% | | | | | |

Celanese Corp., Series A(c) | | | 9,220,971 | | | | 552,889,421 | |

|

| TELECOMMUNICATION SERVICES: 0.4% | |

Sprint Corp.(a) | | | 64,778,296 | | | | 268,829,928 | |

| | | | | | | | |

TOTAL COMMON STOCKS

(Cost $40,318,283,795) | | | | | | $ | 59,560,022,815 | |

| | | | | | | | |

| SHORT-TERM INVESTMENTS: 1.2% | |

| | |

| | | PAR VALUE | | | VALUE | |

MONEY MARKET FUND: 0.1% | |

SSgA U.S. Treasury Money

Market Fund | | $ | 60,874,430 | | | $ | 60,874,430 | |

|

REPURCHASE AGREEMENT: 1.1% | |

Fixed Income Clearing Corporation(d) 0.01%, dated 12/31/14, due 1/2/15, maturity value $656,866,365 | | | 656,866,000 | | | | 656,866,000 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $717,740,430) | | | $ | 717,740,430 | |

| | | | | | | | |

TOTAL INVESTMENTS

(Cost $41,036,024,225) | | | 100.0 | % | | $ | 60,277,763,245 | |

OTHER ASSETS LESS LIABILITIES | | | 0.0 | % | | | (17,642,220 | ) |

| | | | | | | | |

| NET ASSETS | | | 100.0 | % | | $ | 60,260,121,025 | |

| | | | | | | | |

| (b) | Security denominated in U.S. dollars |

| (c) | See Note 9 regarding holdings of 5% voting securities |

| (d) | Repurchase agreement is collateralized by U.S. Treasury Note 1.00%-2.375%, 5/31/18-7/31/18. Total collateral value is $670,008,188. |

In determining a company’s country designation, the Fund generally references the country of incorporation. In cases where the Fund considers the country of incorporation to be a “jurisdiction of convenience” chosen primarily for tax purposes, the Fund uses the country designation of an appropriate broad-based market index. In that circumstance, two countries are listed - the country of incorporation and the country designated by an appropriate index, respectively.

ADR: American Depositary Receipt

| | |

| See accompanying Notes to Financial Statements | | DODGE & COX STOCK FUND §PAGE 8 |

| | | | |

STATEMENT OF ASSETS AND LIABILITIES | |

| |

| | | December 31, 2014 | |

ASSETS: | | | | |

Investments, at value | | | | |

Unaffiliated issuers (cost $36,203,044,072) | | $ | 53,378,210,305 | |

Affiliated issuers (cost $4,832,980,153) | | | 6,899,552,940 | |

| | | | |

| | | 60,277,763,245 | |

| | | | |

Receivable for Fund shares sold | | | 77,337,450 | |

Dividends and interest receivable | | | 53,846,884 | |

Prepaid expenses and other assets | | | 289,850 | |

| | | | |

| | | 60,409,237,429 | |

| | | | |

LIABILITIES: | | | | |

Payable for investments purchased | | | 13,943,690 | |

Payable for Fund shares redeemed | | | 106,826,720 | |

Management fees payable | | | 25,560,977 | |

Accrued expenses | | | 2,785,017 | |

| | | | |

| | | 149,116,404 | |

| | | | |

NET ASSETS | | $ | 60,260,121,025 | |

| | | | |

NET ASSETS CONSIST OF: | | | | |

Paid in capital | | $ | 40,545,844,119 | |

Undistributed net investment income | | | 19,383,384 | |

Undistributed net realized gain | | | 453,154,502 | |

Net unrealized appreciation | | | 19,241,739,020 | |

| | | | |

| | $ | 60,260,121,025 | |

| | | | |

Fund shares outstanding (par value $0.01 each, unlimited shares authorized) | | | 333,044,877 | |

Net asset value per share | | $ | 180.94 | |

|

STATEMENT OF OPERATIONS | |

| | | Year Ended December 31, 2014 | |

INVESTMENT INCOME: | | | | |

Dividends (net of foreign taxes of $30,137,316) | | | | |

Unaffiliated issuers | | $ | 1,107,988,550 | |

Affiliated issuers | | | 109,081,196 | |

Interest | | | 6,381 | |

| | | | |

| | | 1,217,076,127 | |

| | | | |

EXPENSES: | | | | |

Management fees | | | 284,657,421 | |

Custody and fund accounting fees | | | 1,092,587 | |

Transfer agent fees | | | 4,465,255 | |

Professional services | | | 287,794 | |

Shareholder reports | | | 1,147,414 | |

Proxy expenses | | | 1,979,172 | |

Registration fees | | | 434,294 | |

Trustees’ fees | | | 258,072 | |

Miscellaneous | | | 2,919,729 | |

| | | | |

| | | 297,241,738 | |

| | | | |

NET INVESTMENT INCOME | | | 919,834,389 | |

| | | | |

REALIZED AND UNREALIZED GAIN: | | | | |

Net realized gain | | | | |

Unaffiliated issuers | | | 2,255,513,744 | |

Affiliated issuers | | | 77,846,110 | |

Net change in unrealized appreciation/depreciation | | | 2,407,499,870 | |

| | | | |

Net realized and unrealized gain | | | 4,740,859,724 | |

| | | | |

NET INCREASE IN NET ASSETS FROM OPERATIONS | | $ | 5,660,694,113 | |

| | | | |

| | | | | | | | |

STATEMENT OF CHANGES IN NET ASSETS | |

| | |

| | | Year Ended December 31, 2014 | | | Year Ended

December 31, 2013 | |

OPERATIONS: | | | | | | | | |

Net investment income | | $ | 919,834,389 | | | $ | 691,471,816 | |

Net realized gain | | | 2,333,359,854 | | | | 2,942,196,702 | |

Net change in unrealized appreciation/depreciation | | | 2,407,499,870 | | | | 12,466,351,142 | |

| | | | | | | | |

| | | 5,660,694,113 | | | | 16,100,019,660 | |

| | | | | | | | |

| | |

DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | | | | | | |

Net investment income | | | (908,453,128 | ) | | | (688,649,453 | ) |

Net realized gain | | | (840,004,493 | ) | | | — | |

| | | | | | | | |

Total distributions | | | (1,748,457,621 | ) | | | (688,649,453 | ) |

| | | | | | | | |

| | |

FUND SHARE TRANSACTIONS: | | | | | | | | |

Proceeds from sale of shares | | | 9,175,796,977 | | | | 7,505,695,700 | |

Reinvestment of distributions | | | 1,609,896,035 | | | | 638,450,488 | |

Cost of shares redeemed | | | (9,285,324,011 | ) | | | (8,549,348,435 | ) |

| | | | | | | | |

Net increase/(decrease) from Fund share transactions | | | 1,500,369,001 | | | | (405,202,247 | ) |

| | | | | | | | |

Total increase in net assets | | | 5,412,605,493 | | | | 15,006,167,960 | |

| | |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 54,847,515,532 | | | | 39,841,347,572 | |

| | | | | | | | |

End of year (including undistributed net investment income of $19,383,384 and $8,002,123, respectively) | | $ | 60,260,121,025 | | | $ | 54,847,515,532 | |

| | | | | | | | |

| | |

SHARE INFORMATION: | | | | | | | | |

Shares sold | | | 52,472,086 | | | | 52,247,087 | |

Distributions reinvested | | | 9,034,682 | | | | 4,391,872 | |

Shares redeemed | | | (53,255,380 | ) | | | (58,685,059 | ) |

| | | | | | | | |

Net increase/(decrease) in shares outstanding | | | 8,251,388 | | | | (2,046,100 | ) |

| | | | | | | | |

| | |

| PAGE 9 § DODGE & COX STOCK FUND | | See accompanying Notes to Financial Statements |

NOTES TO FINANCIAL STATEMENTS

NOTE 1—ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Dodge & Cox Stock Fund (the “Fund”) is one of the series constituting the Dodge & Cox Funds (the “Trust” or the “Funds”). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The Fund commenced operations on January 4, 1965, and seeks long-term growth of principal and income. Risk considerations and investment strategies of the Fund are discussed in the Fund’s Prospectus.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require the use of estimates and assumptions by management. Actual results may differ from those estimates. Significant accounting policies are as follows:

Security valuation The Fund’s net assets are valued as of the close of trading on the New York Stock Exchange (NYSE), generally 4:00 p.m. Eastern Time, each day that the NYSE is open for business. Portfolio securities and other financial instruments for which market quotes are readily available are valued at market value. Listed securities are generally valued using the official quoted close price or the last sale on the exchange that is determined to be the primary market for the security. Security values are not discounted based on the size of the Fund’s position. Securities for which market quotations are not readily available are valued at fair value as determined in good faith by or under the direction of the Board of Trustees. Short-term securities less than 60 days to maturity may be valued at amortized cost if amortized cost approximates current value. All securities held by the Fund are denominated in U.S. dollars.

The Board of Trustees has delegated authority to Dodge & Cox, the Fund’s investment manager, to make fair value determinations in accordance with the Dodge & Cox Funds Valuation Policies (“Valuation Policies”), subject to Board oversight. Dodge & Cox has established a Pricing Committee that is comprised of representatives from Treasury, Legal, Compliance, and Operations. The Pricing Committee is responsible for implementing the Valuation Policies, including determining the fair value of

securities when market quotations or market-based valuations are not readily available or are deemed unreliable. The Pricing Committee considers relevant indications of value that are reasonably available to it in determining the fair value assigned to a particular security, such as the value of similar financial instruments, trading volumes, contractual restrictions on disposition, related corporate actions, and changes in economic conditions.

Valuing securities at fair value involves greater reliance on judgment than valuation of securities based on readily available market quotations. In some instances, lack of information and uncertainty as to the significance of information may lead to a conclusion that a prior valuation is the best indication of a security’s present value. When fair value pricing is employed, the prices of securities used by the Fund to calculate its net asset value may differ from quoted or published prices for the same securities.

Security transactions, investment income, expenses, and distributions Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Dividend income and corporate action transactions are recorded on the ex-dividend date, or when the Fund first learns of the dividend/corporate action if the ex-dividend date has passed. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Dividends characterized as return of capital for U.S. tax purposes are recorded as a reduction of cost of investments and/or realized gain. Interest income is recorded on the accrual basis.

Expenses are recorded on the accrual basis. Most expenses of the Trust can be directly attributed to a specific series. Expenses which cannot be directly attributed are allocated among the Funds in the Trust based on relative net assets or other expense methodologies determined by the nature of the expense.

Distributions to shareholders are recorded on the ex-dividend date.

DODGE & COX STOCK FUND §PAGE 10

NOTES TO FINANCIAL STATEMENTS

Repurchase agreements The Fund enters into repurchase agreements, secured by U.S. government or agency securities, which involve the purchase of securities from a counterparty with a simultaneous commitment to resell the securities at an agreed-upon date and price. It is the Fund’s policy that its custodian take possession of the underlying collateral securities, the fair value of which exceeds the principal amount of the repurchase transaction, including accrued interest, at all times. In the event of default by the counterparty, the Fund has the contractual right to liquidate the collateral securities and to apply the proceeds in satisfaction of the obligation.

Indemnification Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business the Trust enters into contracts that provide general indemnities to other parties. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 2—VALUATION MEASUREMENTS

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| § | | Level 1: Quoted prices in active markets for identical securities |

| § | | Level 2: Other significant observable inputs (including quoted prices for similar securities, market indices, interest rates, credit risk, etc.) |

| § | | Level 3: Significant unobservable inputs (including Fund management’s assumptions in determining the fair value of investments) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s holdings at December 31, 2014:

| | | | | | | | |

| Security Classification(a) | | LEVEL 1

(Quoted Prices) | | | LEVEL 2

(Other Significant

Observable Inputs) | |

Common Stocks(b) | | $ | 59,560,022,815 | | | $ | — | |

Short-term Investments | | | | | | | | |

Money Market Fund | | | 60,874,430 | | | | — | |

Repurchase Agreement | | | — | | | | 656,866,000 | |

| | | | | | | | |

Total | | $ | 59,620,897,245 | | | $ | 656,866,000 | |

| | | | | | | | |

| | | | | | | | | |

| (a) | There were no transfers between Level 1 and Level 2 during the year ended December 31, 2014. There were no Level 3 securities at December 31, 2014 and 2013, and there were no transfers to Level 3 during the year. |

| (b) | All common stocks held in the Fund are Level 1 securities. For a detailed break-out of common stocks by major industry classification, please refer to the Portfolio of Investments. |

NOTE 3—RELATED PARTY TRANSACTIONS

Management fees Under a written agreement approved by a unanimous vote of the Board of Trustees, the Fund pays an annual management fee of 0.50% of the Fund’s average daily net assets to Dodge & Cox, investment manager of the Fund. The agreement further provides that Dodge & Cox shall waive its fee to the extent that such fee plus all other ordinary operating expenses of the Fund exceed 0.75% of the average daily net assets for the year.

Fund officers and trustees All officers and two of the trustees of the Trust are officers or employees of Dodge & Cox. The Trust pays a fee only to those trustees who are not affiliated with Dodge & Cox.

NOTE 4—INCOME TAX INFORMATION AND DISTRIBUTIONS TO SHAREHOLDERS

A provision for federal income taxes is not required since the Fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute all of its taxable income to shareholders. Distributions are determined in accordance with income tax regulations, and such amounts may differ from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences at year end to reflect tax character.

PAGE 11 § DODGE & COX STOCK FUND

NOTES TO FINANCIAL STATEMENTS

Book/tax differences are primarily due to differing treatments of wash sales, in-kind redemptions, and net short-term realized gain (loss). During the year, the Fund recognized net realized gains of $583,544,894 from the delivery of appreciated securities in two in-kind redemption transactions. For federal income tax purposes, this gain is not recognized as taxable income to the Fund and therefore will not be distributed to shareholders. At December 31, 2014, the cost of investments for federal income tax purposes was $41,038,354,404.

Distributions during the years noted below were characterized as follows for federal income tax purposes:

| | | | | | |

| | | Year Ended December 31, 2014 | | Year Ended

December 31, 2013 | |

Ordinary income | | $908,453,128 | | | $688,649,453 | |

| | ($2.800 per share) | | | ($2.105 per share) | |

| | |

Long-term capital gain | | $840,004,493 | | | — | |

| | ($2.560 per share) | | | | |

At December 31, 2014, the tax basis components of distributable earnings were as follows:

| | | | |

Unrealized appreciation | | $ | 20,324,503,253 | |

Unrealized depreciation | | | (1,085,094,412 | ) |

| | | | |

Net unrealized appreciation | | | 19,239,408,841 | |

Undistributed ordinary income | | | 19,383,384 | |

Undistributed long-term capital gain | | | 455,484,681 | |

During 2014, the Fund utilized all of its capital loss carryforward, which amounted to $440,626,227.

Under the Regulated Investment Company Modernization Act of 2010, capital losses incurred by the Fund after January 1, 2011, are not subject to expiration. In addition, such losses must be utilized prior to the losses incurred in the years preceding enactment.

Fund management has reviewed the tax positions for open periods (three years and four years, respectively, from filing the Fund’s Federal and State tax returns) as applicable to the Fund, and has determined that no provision for income tax is required in the Fund’s financial statements.

NOTE 5—LOAN FACILITIES

Pursuant to an exemptive order issued by the Securities and Exchange Commission (SEC), the Fund may participate in

an interfund lending facility (Facility). The Facility allows the Fund to borrow money from or loan money to the Funds. Loans under the Facility are made for temporary or emergency purposes, such as to fund shareholder redemption requests. Interest on borrowings is the average of the current repurchase agreement rate and the bank loan rate. There was no activity in the Facility during the year.

All Funds in the Trust participate in a $500 million committed credit facility (Line of Credit) with State Street Bank and Trust Company, to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The maximum amount available to the Fund is $250 million. Each Fund pays an annual commitment fee on its pro-rata portion of the Line of Credit. The Fund’s commitment fee for the year ended December 31, 2014, amounted to $158,594 and is reflected as a Miscellaneous Expense in the Statement of Operations. Interest on borrowings is charged at the prevailing rate. There were no borrowings on the Line of Credit during the year.

NOTE 6—PURCHASES AND SALES OF INVESTMENTS

For the year ended December 31, 2014, purchases and sales of securities, other than short-term securities, aggregated $11,606,261,860 and $10,725,926,031, respectively.

NOTE 7—ACCOUNTING PRONOUNCEMENTS

In June 2014, the Financial Accounting Standards Board issued Accounting Standards Update (ASU) No. 2014-11, Transfers and Servicing (Topic 860), Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures. The ASU changes the accounting for certain repurchase agreements and expands disclosure requirements related to repurchase agreements and similar transactions. Management is currently evaluating the impact, if any, of applying this ASU effective January 1, 2015.

NOTE 8—SUBSEQUENT EVENTS

Fund management has determined that no material events or transactions occurred subsequent to December 31, 2014, and through the date of the Fund’s financial statements issuance, which require additional disclosure in the Fund’s financial statements.

DODGE & COX STOCK FUND §PAGE 12

NOTES TO FINANCIAL STATEMENTS

NOTE 9—HOLDINGS OF 5% VOTING SECURITIES

Each of the companies listed below was considered to be an affiliate of the Fund because the Fund owned 5% or more of the company’s voting securities during all or part of the year ended December 31, 2014. Purchase and sale transactions and dividend income earned during the period on these securities were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Shares at

Beginning of Period | | | Additions | | | Reductions | | | Shares at

End of Period | | | Dividend

Income(a) | | | Value at End of Period | |

ADT Corp. | | | 12,073,537 | | | | — | | | | (254,200 | ) | | | 11,819,337 | | | $ | 9,504,750 | | | $ | 428,214,580 | |

AOL, Inc. | | | 5,997,054 | | | | 1,550,000 | | | | (446,300 | ) | | | 7,100,754 | | | | — | (b) | | | 327,841,812 | |

Capital One Financial Corp. | | | 28,876,111 | | | | 100,000 | | | | (806,900 | ) | | | 28,169,211 | | | | 33,979,153 | | | | 2,325,368,368 | |

Celanese Corp., Series A | | | 9,419,271 | | | | — | | | | (198,300 | ) | | | 9,220,971 | | | | 8,616,826 | | | | 552,889,421 | |

Maxim Integrated Products, Inc. | | | 10,277,500 | | | | 6,301,040 | | | | (251,700 | ) | | | 16,326,840 | | | | 15,049,561 | | | | 520,336,391 | |

NetApp, Inc. | | | 14,635,500 | | | | 5,513,000 | | | | (354,500 | ) | | | 19,794,000 | | | | 11,173,496 | | | | 820,461,300 | |

Symantec Corp. | | | 50,304,000 | | | | 2,700,000 | | | | (1,083,000 | ) | | | 51,921,000 | | | | 30,757,410 | | | | 1,332,033,255 | |

Synopsys, Inc. | | | 13,596,636 | | | | 579,733 | | | | (548,400 | ) | | | 13,627,969 | | | | — | (b) | | | 592,407,813 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | 109,081,196 | | | $ | 6,899,552,940 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Net of foreign taxes, if any |

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

SELECTED DATA AND RATIOS (for a share outstanding throughout each year) | | Year Ended December 31, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | |

Net asset value, beginning of year | | | $168.87 | | | | $121.90 | | | | $101.64 | | | | $107.76 | | | | $96.14 | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 2.83 | | | | 2.11 | | | | 1.98 | | | | 1.76 | | | | 1.23 | |

Net realized and unrealized gain (loss) | | | 14.60 | | | | 46.97 | | | | 20.26 | | | | (6.13 | ) | | | 11.62 | |

| | | | |

Total from investment operations | | | 17.43 | | | | 49.08 | | | | 22.24 | | | | (4.37 | ) | | | 12.85 | |

| | | | |

Distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (2.80 | ) | | | (2.11 | ) | | | (1.98 | ) | | | (1.75 | ) | | | (1.23 | ) |

Net realized gain | | | (2.56 | ) | | | — | | | | — | | | | — | | | | — | |

| | | | |

Total distributions | | | (5.36 | ) | | | (2.11 | ) | | | (1.98 | ) | | | (1.75 | ) | | | (1.23 | ) |

| | | | |

Net asset value, end of year | | | $180.94 | | | | $168.87 | | | | $121.90 | | | | $101.64 | | | | $107.76 | |

| | | | |

Total return | | | 10.43 | % | | | 40.55 | % | | | 22.01 | % | | | (4.08 | )% | | | 13.48 | % |

Ratios/supplemental data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of year (millions) | | | $60,260 | | | | $54,848 | | | | $39,841 | | | | $36,562 | | | | $43,038 | |

Ratio of expenses to average net assets | | | 0.52 | % | | | 0.52 | % | | | 0.52 | % | | | 0.52 | % | | | 0.52 | % |

Ratio of net investment income to average net assets | | | 1.62 | % | | | 1.45 | % | | | 1.72 | % | | | 1.62 | % | | | 1.25 | % |

Portfolio turnover rate | | | 17 | % | | | 15 | % | | | 11 | % | | | 16 | % | | | 12 | % |

See accompanying Notes to Financial Statements

PAGE 13 § DODGE & COX STOCK FUND

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Trustees of Dodge & Cox Funds and Shareholders of Dodge & Cox Stock Fund

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Dodge & Cox Stock Fund (the “Fund”, one of the series constituting Dodge & Cox Funds) at December 31, 2014, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as financial statements) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2014, by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

San Francisco, California

February 17, 2015

DODGE & COX STOCK FUND §PAGE 14

SPECIAL 2014 TAX INFORMATION (unaudited)

The following information is provided pursuant to provisions of the Internal Revenue Code:

The Fund designates up to a maximum amount of $1,246,603,033 of its distributions paid to shareholders in 2014 as qualified dividends (treated for federal income tax purposes in the hands of shareholders as taxable at a maximum rate of 20%).

For shareholders that are corporations, the Fund designates 83% of its ordinary dividends paid to shareholders in 2014 as dividends from domestic corporations eligible for the corporate dividends received deduction, provided that the shareholder otherwise satisfies applicable requirements to claim that deduction.

BOARD APPROVAL OF FUNDS’ INVESTMENT MANAGEMENT AGREEMENTS AND MANAGEMENT FEES

(unaudited)

The Board of Trustees is responsible for overseeing the performance of the Dodge & Cox Funds’ investment manager and determining whether to continue the Investment Management Agreements between the Funds and Dodge & Cox each year (the “Agreements”). At a meeting of the Board of Trustees of the Trust held on December 17, 2014, the Trustees, by a unanimous vote (including a separate vote of those Trustees who are not “interested persons” (as defined in the Investment Company Act of 1940) (the “Independent Trustees”)), approved the renewal of the Agreements for an additional one-year term through December 31, 2015 with respect to each Fund other than the Dodge & Cox Global Bond Fund. The Agreement for the Dodge & Cox Global Bond Fund was not subject to renewal at this time. During the course of the year, the Board received a wide variety of materials relating to the services provided by Dodge & Cox and the performance of each of the Funds.

INFORMATION RECEIVED

In advance of the meeting, the Board, including each of the Independent Trustees, requested, received, and reviewed materials relating to the Agreements and the services provided by Dodge & Cox. The Independent Trustees retained Morningstar® to prepare an independent expense and performance summary for each Fund and

comparable funds managed by other advisers identified by Morningstar. The Morningstar materials included information regarding advisory fee rates, expense ratios, and transfer agency, custodial, and distribution expenses, as well as appropriate performance comparisons to each Fund’s peer group and an index or combination of indices. The Morningstar materials also included a comparison of expenses of various share classes offered by comparable funds.

The materials reviewed by the Board contained information concerning, among other things, Dodge & Cox’s profitability, financial results and condition, advisory fee revenue, and separate account and sub-adviser fund fee schedules. The Board additionally considered the Funds’ brokerage commissions, turnover rates, sales and redemption data and the significant investment that Dodge & Cox makes in research used in managing the Funds. The Board received and reviewed a memorandum summarizing information provided throughout the year regarding Dodge & Cox’s services to the Funds as well as information regarding (i) the different fees, services, costs, and risks associated with other accounts managed by Dodge & Cox as compared to the Dodge & Cox Funds; (ii) the differences in performance between the Funds and separately managed accounts; and (iii) Fund shares subscription and redemption activity. Throughout the process of reviewing the services provided by Dodge & Cox and preparing for the meeting, the Independent Trustees found Dodge & Cox to be open, forthright, detailed, and very helpful in answering questions about all issues.

The Board received copies of the Agreements and a memorandum from the independent legal counsel to the Independent Trustees discussing the factors generally regarded as appropriate to consider in evaluating advisory arrangements. The Trust’s Contract Review Committee, consisting solely of Independent Trustees, met with the independent legal counsel on November 3, 2014, and again on December 17, 2014, to discuss whether to renew the Agreements. The Board, including the Independent Trustees, subsequently concluded that the existing Agreements are fair and reasonable and voted to approve the Agreements.

In considering the Agreements, the Board, including the Independent Trustees, did not identify any single

PAGE 15 § DODGE & COX STOCK FUND

factor or particular information as all-important or controlling. In reaching the decision to approve the Agreements, the Board considered several factors, discussed below, to be key factors and reached the conclusions described below.

NATURE, QUALITY, AND EXTENT OF THE SERVICES

The Board considered that Dodge & Cox provides a wide range of services to the Funds in addition to portfolio management and that the quality of these services has been excellent in all respects. The extensive nature of services provided by Dodge & Cox has been documented in materials provided to the Board and in presentations made to the Board throughout the year. In particular, the Board considered the nature, quality, and extent of portfolio management, administrative, and shareholder services performed by Dodge & Cox. With regard to portfolio management services, the Board considered Dodge & Cox’s established long-term history of care and conscientiousness in the management of the Funds; its demonstrated consistency in investment approach and depth; the background and experience of the Dodge & Cox Investment Policy Committee, International Investment Policy Committee, Global Stock Investment Policy Committee, Fixed Income Investment Policy Committee, and Global Bond Investment Policy Committee, and research analysts responsible for managing the Funds; its methods for assessing the regulatory and investment climate in various jurisdictions; Dodge & Cox’s overall high level of attention to its core investment management function; and its commitment to the Funds and their shareholders.

In the area of administrative and shareholder services, the Board considered the excellent quality of Dodge & Cox’s work in areas such as compliance, legal services, trading, proxy voting, technology, oversight of the Funds’ transfer agent and custodian, tax compliance, and shareholder communication through its website and other means. The Board also noted Dodge & Cox’s diligent disclosure policy, its favorable compliance record, and its reputation as a trusted, shareholder-friendly mutual fund family.

In addition, the Board considered that Dodge & Cox manages approximately $180 billion in Fund assets with

fewer professionals than most comparable funds, and that on average these professionals have more experience and longer tenure than investment professionals at comparable funds. The Board also noted that Dodge & Cox is an investment research-oriented firm with no other business endeavors to distract management’s attention from its research efforts, and that its investment professionals adhere to a consistent investment approach across the Funds. The Board further considered the favorable stewardship and “Gold” analyst ratings awarded to each of the Funds by Morningstar. The Board concluded that it was satisfied with the nature, extent, and quality of investment management and other services provided to the Funds by Dodge & Cox.

INVESTMENT PERFORMANCE

The Board considered short-term and long-term investment performance for each Fund (including periods of outperformance or underperformance) as compared to both relevant indices and the performance of such Fund’s peer group. The Board noted that each Fund demonstrated favorable longer-term performance relative to its benchmark and peer group. The Board determined after extensive review and inquiry that Dodge & Cox’s historic, long-term, team-oriented, bottom up investment approach remains consistent and that Dodge & Cox continues to be distinguished by its integrity, transparency, and independence.

The Board considered that the performance of the Funds is the result of a team-oriented investment management process that emphasizes a long-term investment horizon, comprehensive independent research, price discipline, and focus. The Board also considered that the investment performance delivered by Dodge & Cox to the Funds appeared to be consistent with the relevant performance delivered for other clients of Dodge & Cox. The Board concluded that Dodge & Cox has delivered favorable long-term performance for Fund investors consistent with the long-term investment strategies being pursued by the Funds.

COSTS AND ANCILLARY BENEFITS

Costs of Services to Funds: Fees and Expenses. The Board considered each Fund’s management fee rate and expense ratio relative to similar mutual funds and relative

DODGE & COX STOCK FUND §PAGE 16

to management fees charged by Dodge & Cox to other clients. In particular, the Board considered that the Funds continue to be substantially below their peer group median in expense ratios and management fee rates and that many media and industry reports specifically comment on the low expense ratios of the Funds, which have been a defining characteristic of the Funds for many years. The Board also evaluated the operating structures of the Funds and Dodge & Cox, noting that the Funds do not charge front-end sales commissions or distribution fees, and Dodge & Cox bears, among other things, the significant cost of third party research, reimbursement for recordkeeping and administrative costs to third-party retirement plan administrators, and administrative and office overhead. The Board noted that expenses are well below industry averages. The Board also considered that the Funds receive numerous administrative, regulatory compliance, legal, technology and shareholder support services from Dodge & Cox without any additional administrative fee and the fact that the Funds have relatively low transaction costs and portfolio turnover rates. The Board reviewed Morningstar data showing that the few peer group funds with lower expense ratios often have other share classes with significantly higher expense ratios.

The Board reviewed information regarding the fee rates Dodge & Cox charges to separate accounts and subadvised funds that have investment programs similar to those of the Funds, including instances where separate account and sub-advised fund fees are lower than Fund fees. The Board considered differences in the nature and scope of services Dodge & Cox provides to the Funds as compared to other client accounts, differences in regulatory, litigation, and other risks as between Dodge & Cox Funds and other types of clients, and certain characteristics of the market for institutional separate account management services. The Board further noted that, with respect to non-U.S. funds sponsored and managed by Dodge & Cox that are comparable to the Funds in many respects, the fee rates charged by Dodge & Cox are the same as or higher than the fee rates charged to the Funds. After consideration of these matters, the Board concluded that the overall costs incurred by the Funds for the services they receive (including the management fee paid to Dodge & Cox) are reasonable

and that the fees are acceptable based upon the qualifications, experience, reputation, and performance of Dodge & Cox and the low overall expense ratios of the Funds.

Profitability and Costs of Services to Dodge & Cox; “Fall-out” Benefits. The Board reviewed reports of Dodge & Cox’s financial position, profitability, and estimated overall value, and considered Dodge & Cox’s overall profitability within its context as a private, employee-owned S-Corporation and relative to the favorable services provided. The Board noted in particular that Dodge & Cox’s profits are not generated by high fee rates, but reflect an extraordinarily streamlined, efficient, and focused business approach toward investment management. The Board recognized the importance of Dodge & Cox’s profitability—which is derived solely from management fees and does not include other business ventures—to maintain its independence, stability, company culture and ethics, and management continuity. The Board also considered that the compensation/profit structure at Dodge & Cox includes a return on shareholder employees’ investment in the firm, which is vital for remaining independent and facilitating retention of management and investment professionals.

The Board considered that Dodge & Cox recently recommended closing the International Stock Fund to new investors to pro-actively manage the growth of the Fund. The Stock Fund and Balanced Fund were similarly closed to new investors during periods of significant growth in the past. While these actions are intended to benefit existing shareholders, the effect is to reduce potential revenues to Dodge & Cox from new shareholders.

The Board also considered potential “fall-out” benefits (including the receipt of research from unaffiliated brokers and reputational benefits to non-U.S. funds sponsored and managed by Dodge & Cox) that Dodge & Cox might receive as a result of its association with the Funds and determined that they are not significant. The Board also noted the extent of additional administrative services performed by Dodge & Cox for the Funds, and that the magnitude of costs and risks borne by Dodge & Cox in rendering advisory services to the Funds (including risks in the regulatory compliance, securities valuation, and investment management processes) are

PAGE 17 § DODGE & COX STOCK FUND

continuing to increase. The Board concluded that the profitability of Dodge & Cox’s relationship with the Funds (including fall-out benefits) was fair and reasonable.

THE BENEFIT OF ECONOMIES OF SCALE

The Board considered whether there have been economies of scale with respect to the management of each Fund, whether the Funds have appropriately benefited from any economies of scale, and whether the management fee rate is reasonable in relation to the Fund assets and any economies of scale that may exist. In the Board’s view, any consideration of economies of scale must take account of the Funds’ low fee structure and the considerable efficiencies of the Funds’ organization and fee structure that has been realized by shareholders from the time of each Fund’s inception (i.e., from the first dollar). An assessment of economies of scale must also take into account that Dodge & Cox has capped expenses when offering new funds. In addition, the Board noted that Dodge & Cox has shared economies of scale by adding or enhancing services to the Funds over time, and that the internal costs of providing investment management, up-to-date technology, administrative, legal, and compliance services to the Funds are continuing to increase. For example, Dodge & Cox has increased its global research staff and investment resources over the years to address the increased complexity of investing in multinational and non-U.S. companies. In addition, Dodge & Cox has made substantial expenditures in other staff, technology, and infrastructure to enable it to integrate credit and equity analyses and to be able to implement its strategy in a more effective and secure manner. The Board determined that the Funds provide access for small investors to high quality investment management at a relatively low cost. The Board’s decision to renew the Agreements was made after consideration of economies of scale and review of peer group fund expense ratios and historical expense ratio patterns for the Funds. The Board concluded that the current Dodge & Cox fee structure is fair and reasonable and adequately shares economies of scale that may exist.

CONCLUSION

Based on their evaluation of all material factors and assisted by the advice of independent legal counsel to the Independent Trustees, the Board, including the Independent Trustees, concluded that the advisory fee

structure was fair and reasonable, that each Fund was paying a competitive fee for the services provided, that the scope and quality of Dodge & Cox’s services has provided substantial value for Fund shareholders over the long term, and that approval of the Agreements was in the best interests of each Fund and its shareholders.

FUND HOLDINGS

The Fund provides a complete list of its holdings four times each fiscal year, as of the end of each quarter. The Fund files the lists with the Securities and Exchange Commission (SEC) on Form N-CSR (second and fourth quarters) and Form N-Q (first and third quarters). Shareholders may view the Fund’s Forms N-CSR and N-Q on the SEC’s website at www.sec.gov. Forms N-CSR and N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling 202-551-8090 (direct) or 800-732-0330 (general SEC number). A list of the Fund’s quarter-end holdings is also available at www.dodgeandcox.com on or about 15 days following each quarter end and remains available on the website until the list is updated in the subsequent quarter.

PROXY VOTING

For a free copy of the Fund’s proxy voting policies and procedures, please call 800-621-3979, visit the Fund’s website at www.dodgeandcox.com, or visit the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ending June 30 is also available at www.dodgeandcox.com or at www.sec.gov.

HOUSEHOLD MAILINGS

The Fund routinely mails shareholder reports and summary prospectuses to shareholders and, on occasion, proxy statements. In order to reduce the volume of mail, when possible, only one copy of these documents will be sent to shareholders who are part of the same family and share the same residential address.

If you have a direct account with the Funds and you do not want the mailing of shareholder reports and summary prospectuses combined with other members in your household, contact the Funds at 800-621-3979. Your request will be implemented within 30 days.

DODGE & COX STOCK FUND §PAGE 18

DODGE & COX FUNDS—EXECUTIVE OFFICER & TRUSTEE INFORMATION

| | | | | | |

Name (Age) and

Address* | | Position with Trust (Year of Election or

Appointment) | | Principal Occupation During Past 5 Years | | Other Directorships Held by Trustees |

| INTERESTED TRUSTEES AND OFFICERS |

| Charles F. Pohl (56) | | Chairman and Trustee (Officer since 2004) | | Chairman (since 2013), Co-President (2011-2013), Senior Vice President (until 2011), and Director of Dodge & Cox; Chief Investment Officer, Portfolio Manager, Investment Analyst, and member of Investment Policy Committee (IPC), Global Stock Investment Policy Committee (GSIPC), International Investment Policy Committee (IIPC), and Fixed Income Investment Policy Committee (FIIPC) | | — |

| Dana M. Emery (53) | | President and Trustee (Trustee since 1993) | | Chief Executive Officer (since 2013), President (since 2011), Executive Vice President (until 2011), and Director of Dodge & Cox; Director of Fixed Income, Portfolio Manager, and member of FIIPC and Global Bond Investment Policy Committee (GBIPC) | | — |

| John A. Gunn (71) | | Senior Vice President (Officer since 1998) | | Chairman Emeritus (2011-2013), Chairman (until 2011), Chief Executive Officer (until 2010), and Director of Dodge & Cox; Portfolio Manager and member of IPC, GSIPC (until 2014), and IIPC | | — |