UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3462

The Flex-funds Trust

6125 Memorial Drive

Dublin, OH 43017

Bruce McKibben

c/o The Flex-funds Trust

6125 Memorial Drive

Dublin, OH 43017

Registrant’s telephone number, including area code: 800-325-3539

Date of fiscal year end: December 31, 2007

Date of reporting period: December 31, 2007

| Item 1. | Report to Stockholders. |

The Flex-funds

2007 ANNUAL REPORT

DECEMBER 31, 2007

| | |

| | The Flex-funds |

| | MANAGEDBY MEEDER ASSET MANAGEMENT, INC. |

| | 6125 MEMORIAL DRIVE, DUBLIN OHIO, 43017 |

| | CALL TOLL FREE 800-325-3539 | 766-7000 FAX: 614-791-2572 | WWW.FLEXFUNDS.COM |

| | EMAIL: FLEXFUNDS@MEEDERFINANCIAL.COM |

| | |

| The Flex-funds | | 2007 ANNUAL REPORT | DECEMBER 31, 2007 |

TABLE OF CONTENTS

| | | | | | |

Letter to Shareholders | | Page 1 | | The Socially Responsible Utilities Fund | | Page 16 |

The Dynamic Growth Fund | | Page 6 | | The Quantex FundTM | | Page 18 |

The Muirfield Fund® | | Page 8 | | The U.S. Government Bond Fund | | Page 20 |

The Aggressive Growth Fund | | Page 10 | | The Money Market Fund | | Page 22 |

The Defensive Growth Fund | | Page 12 | | Shareholder Expense Analysis | | Page 24 |

The Focused Growth Fund | | Page 14 | | Fund Holdings & Financial Statements | | Page 25 |

OUR MISSION STATEMENT

Every day, our mission is to exceed, with integrity, passion, and discipline, the expectations of our shareholders’ and clients’ overall investment experience.

CORE VALUES

THE CLIENT/SHAREHOLDER IS OUR #1 PRIORITY

Always remember whom we are serving. Our livelihood depends on providing a superior overall investment experience that exceeds the expectation of our shareholders and clients.

CLARITY OF PURPOSE

Our organization has a clear, well-defined vision. All of our associates are committed to and understood how they will contribute to that vision.

COMMUNICATION

We expect open and effective communication, full reporting, including good and bad news, and constructive feedback.

INTEGRITY

We insist upon honesty and adhere to the highest ethical standards.

EXCELLENCE/ INNOVATION

Our associates strive each day for excellence in the work they perform, seek innovative ways to solve problems and introduce new ideas to take advantage of opportunities. We are a “Think Outside The Box” company.

ASSOCIATE WELL-BEING

We value the success and well-being of our associates. We recognize and reward our associates’ contributions.

RESPECT FOR OTHERS

Respect all people, value the differences among them and treat them as you would like to be treated.

SEEK FIRST TO UNDERSTAND

When interacting with others, place curiosity and understanding of their perspective FIRST, setting aside preconceived opinions and quick judgment.

TEAMWORK

We are a synergistic organization that works as a team to exceed our objectives.

PROFIT

We are profitable. Profitability enhances our services and capabilities, and affords everyone the opportunity to further their financial well-being.

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

Letter To Shareholders

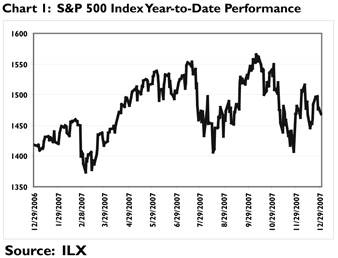

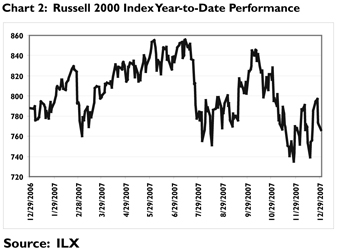

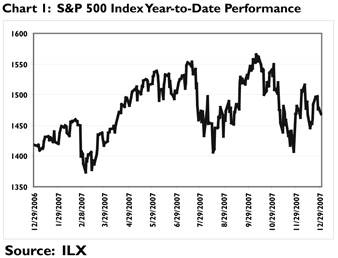

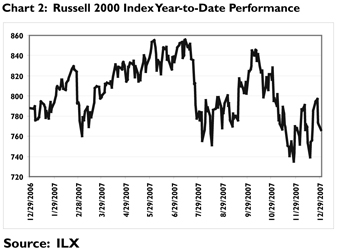

Stock prices hit record highs early in the fourth quarter, but quickly retreated and finished the quarter lower than where they began. Investors were increasingly worried that continued problems in the housing and credit markets might spill over to the broader economy and lead to a significant slowdown in economic growth. In that environment, the S&P 500 Index declined 3.33% in the fourth quarter, while the smaller cap Russell 2000 Index posted a loss of 4.58%

Despite these recent losses, the S&P 500 Index delivered a modest return for the full year. For 2007, the S&P 500 Index returned 5.49%, while the Russell 2000 Index actually declined 1.55%. (See Charts 1 & 2)

Against this backdrop, we are pleased that for the 3 months, 1 year and 3 years ending December 31, 2007, the majority of our Equity Funds outperformed their respective benchmark indices.

Positive Economic Developments

Although there has been growing concern on Wall Street about the health of the economy, recent data shows that economic conditions throughout the year remained mostly positive. Consider factors such as:

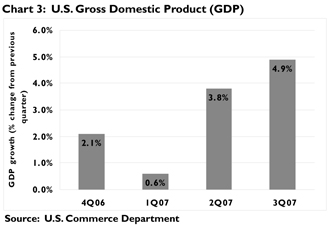

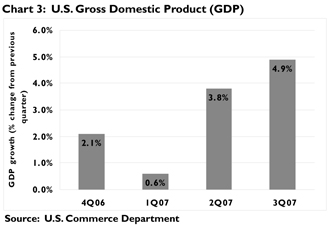

* Strong economic growth. In late November, the U.S. Commerce Department reported that the U.S. economy grew by 4.9% in the third quarter—its strongest pace in four years, and higher than analysts’ initial estimate of 3.9% (see Chart 3).

However, the Federal Reserve Board (the “Fed”) did say in its meeting on December 11, 2007 that “the pace of the economic expansion would likely slow in the near term.” In fact, Morgan Stanley recently projected only a 1% fourth quarter GDP growth. The future indicates a potential decline in economic activity.

* Impressive productivity gains. Productivity—the amount of output per hour of work—surged by 6.3% on an annualized basis during the third quarter (see Chart 4). What’s more, productivity growth has significantly outpaced several gauges of inflationary activity, helping to keep overall

| | |

| The Flex-funds 2007 Annual Report | December 31, 2007 | | Page 1 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

inflation contained. For example, unit labor costs (a barometer of inflation pressures from wages) declined by 2% during the third quarter, while the latest consumer price index data shows that consumer prices rose 0.3% in November. This data suggests that the impact on inflation from wage pressure should be muted.

* Low unemployment. The unemployment rate had been holding steady at 4.7%—quite low relative to historical levels. Additionally, employers added 60,000 jobs to their payrolls in November and another 82,000 in December, more than the market expected in either month. These positive developments suggest that the overall job market is not being hurt by the slowdown in the housing industry. The recent surge in unemployment for December to 5.0% suggests that the consumer may be at risk going forward. Though one month’s data does not constitute a trend, we continue to remain cautious.

* Robust consumer spending. The latest data shows that consumer spending—which accounts for approximately two-thirds of the economy—remains robust. Spending by consumers in November was much stronger than expected, rising at its most rapid pace since May 2004. Consumer spending increased another .2% in December which was higher than the estimated .1%.

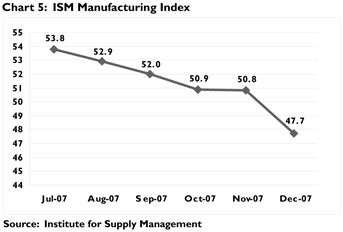

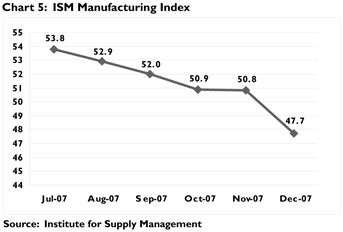

* Expanding manufacturing. While declining in December, manufacturing activity has continued to expand for the prior 10 months with only the recent month contracting, according to the Institute for Supply Management. (See Chart 5—readings above 50 indicate business expansion, while readings below 50 indicate a contraction.).

Economic Concerns Prompt Fed Action

That said, many investors worried throughout the second half of 2007 that the prolonged slump in the housing sector—and the resulting reduction in the amount of credit available to consumers and businesses—would significantly dampen economic growth. Some feared that these conditions might even lead to a recession.

These concerns were fueled in part by statements made by the Fed suggesting the potential for economic weakness. For example, Fed Chairman Ben Bernanke stated that the problems in the housing and credit markets could create “headwinds for the consumer in the months ahead” and that the Fed would need to be “exceptionally alert and flexible.” Other Fed officials made similar comments during the quarter.

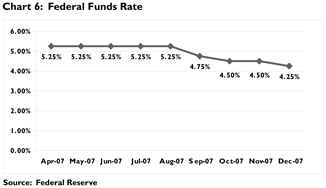

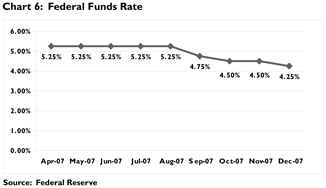

To respond to the possibility of an economic slowdown, the Fed cut a key short-term interest rate (the federal funds rate) twice during the fourth quarter. Coupled with a previous rate reduction in September, these cuts brought the federal funds rate down to 4.25% (see Chart 6). The Fed also made additional funds available to banks to help create liquidity and ensure adequate lending capabilities.

There were troubling signs during the fourth quarter and the year. Nearly every new development regarding the housing market in 2007 was negative. Some of the most recent data revealed that home foreclosure filings rose by 30% in the third quarter of 2007, new home

| | |

| Page 2 | | The Flex-funds 2007 Annual Report | December 31, 2007 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

construction in November slowed to its weakest pace in 16 years, and home prices in October fell by the largest amount since early 1991. Furthermore, numerous lenders and financial services firms reported large losses due to bad investments in the troubled mortgage sector—including Citigroup, Wachovia and Fannie Mae during the fourth quarter. These issues reinforced the belief among some investors that the risk of a recession is significant.

It is important to recognize however, that many of the negative predictions about the economy are still only potential scenarios. While we are cautious about a potential economic slowdown, we still see the current state of the economy held together by a resilient consumer. Certainly there are some potential problems at work, but rest assured, we are diligently monitoring numerous factors to help identify the direction of the economy.

Our “Fund of Funds”... A Focus on Growth

Shares of large- and mid-cap stocks outperformed small company shares during the year, as nervous investors favored the relative safety and consistency of large, financially stable companies. Our continued focus on larger companies and avoidance of small companies in our “fund of funds” (Muirfield, Dynamic Growth, Defensive Growth, Focused Growth, Aggressive Growth) assisted in the absolute and relative performance for the year.

Based on the full range of economic and market data, our investment models continued to indicate that the risk reward relationship of the stock market was positive. Indeed, every market sector except two (Financial Services and Consumer Discretionary) outperformed the broader market during the fourth quarter.

Therefore, our Defensive Equity Funds (Muirfield and Defensive Growth Funds) remained fully invested in the stock market throughout the entire year. However, we made changes to the Funds’ style allocations as market conditions developed. For example, we shifted from a somewhat defensive, value-oriented approach early in the year to a focus on growth-oriented stocks based on indications from our investment models that growth stocks offered a better trade-off between risk and return. This approach benefited our Funds as value stocks (which consist largely of Financial stocks) underperformed during much of the year.

Additionally, we increased our exposure to international stocks, which offered strong growth prospects and attractive valuations. International stocks performed well during 2007, driven in part by the falling value of the U.S. Dollar.

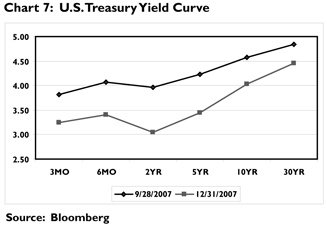

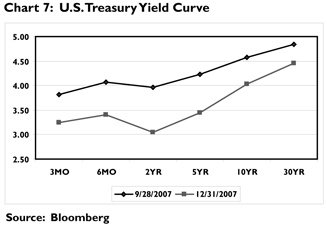

In the fixed-income markets, investors flocked to high-quality securities as they sought relative safety in the wake of concerns about the economy. Bond yields fell in that environment, pushing up prices. However, gains in the fixed-income markets were concentrated among U.S. Treasury and agency securities, as investors avoided bonds issued by firms that they feared could have exposure to the troubled mortgage sector. The yield on a 10-year Treasury note fell from 4.59% at the beginning of the fourth quarter to 4.04% by the end of the year (see Chart 7).

Our strategy for The U.S Government Bond Fund continued to focus on securities with strong credit ratings. That approach benefited the Fund as investors favored high-quality bonds during the fourth quarter. In addition, we extended the weighted average maturities from below average to above average in the Fund. This decision allowed us to lock in relatively high yields as the Fed cut interest rates during the quarter, and should allow us to continue to do so if further rate cuts occur in 2008.

The Flex-funds Money Market Fund also delivered strong performance. Once again, the Fund finished in the top 10% of all general purpose money market funds as it has for every

| | |

| The Flex-funds 2007 Annual Report | December 31, 2007 | | Page 3 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

rolling 12-month period since its inception. We accomplished this without investing in asset-backed commercial paper. Though asset-backed commercial paper now offers relatively high yields, we continue to believe that those yields do not adequately compensate investors for the significant additional risk in this type of investment. The continued concerns surrounding asset-backed securities further reinforce our belief.

Going Forward

Two key issues facing the markets as we enter 2008 are the effect of the Fed’s three recent rate cuts and the extent to which the economy might slow during the coming months.

While some investors believe that the Fed’s actions will promote a “soft landing”—strong economic growth with low inflation—others believe that the economy is more likely to slide into recession. The Fed itself has estimated that GDP for all of 2008 will grow by 1.8% to 2.5%. Still other investors worry that the rate cuts could push inflation much higher than the Fed desires, making it more difficult for the Fed to cut rates further if necessary.

As always, our job as money managers is not to simply speculate on Fed policy or the direction of the overall economy or financial markets. We base our investment decisions on facts and empirical data as they emerge, not on speculation about what might occur. As of December 31, 2007, those facts continued to indicate that the relationship between risk and reward in the stock market is, on balance, positive. Therefore, our Defensive Equity Funds remain fully invested. That said, we will continue to carefully monitor conditions in the financial markets and make adjustments to our Funds as necessary to capture additional returns while managing downside risk.

On behalf of all of the associates at Meeder Asset Management and The Flex-funds, I thank you for the continued trust and confidence you have placed in our investment management services. We look forward to working with you and helping you achieve your most important financial goals.

|

| Sincerely, |

|

|

| Robert S. Meeder, Jr. |

| President |

| The Flex-funds |

| December 31, 2007 |

| | |

| Page 4 | | The Flex-funds 2007 Annual Report | December 31, 2007 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

2007 Mutual Fund Commentary

| | |

| Fund of Funds | | |

| |

The Dynamic Growth Fund | | Page 6 |

The Muirfield Fund® | | Page 8 |

The Aggressive Growth Fund | | Page 10 |

The Defensive Growth Fund | | Page 12 |

The Focused Growth Fund | | Page 14 |

| |

| Stock Funds | | |

| |

The Socially Responsible Utilities Fund | | Page 16 |

The Quantex Fund™ | | Page 18 |

| |

| Fixed-Income Funds | | |

| |

The U.S. Government Bond Fund | | Page 20 |

The Money Market Fund | | Page 22 |

| | |

| The Flex-funds 2007 Annual Report | December 31, 2007 | | Page 5 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

The Dynamic Growth Fund

Annual Market Perspective

The Dynamic Growth Fund is one of only 6% of Growth Funds that

have outperformed the S&P 500 in each of the past 3 years.

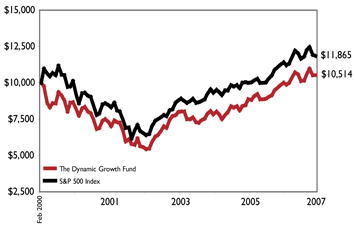

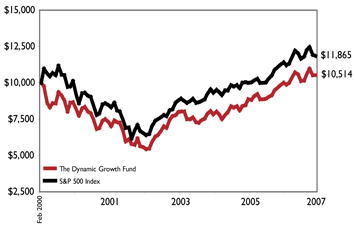

For the year ended December 31, 2007, The Dynamic Growth Fund outperformed the S&P 500 Index, with a total return of 7.06%, versus the S&P 500’s return of 5.49%. We are also pleased to report that The Dynamic Growth Fund has exceeded the S&P 500’s return for each of the last three years, a feat that, according to data from Morningstar, only 6% of growth mutual funds can claim. The Dynamic Growth Fund has an annualized return of 9.27% versus the S&P500’s 8.62% for those three years. Additionally, for the past five years, the Fund has provided an annualized return of 13.17% compared to a 12.81% return for the S&P 500.

We consistently avoided small-cap stocks throughout all of 2007, which added to Fund performance, as small-cap stocks actually declined 1.55% for the year. An over-emphasis on mid-cap value securities resulted in the Fund’s outperformance during the first half of the year. During the third quarter, growth oriented securities began to outperform and the Fund lagged for the quarter as we were still overweighted in value securities. We rotated into growth holdings late in the third quarter, which proved beneficial, as growth stocks continued to outperform throughout the fourth quarter, particularly as financial stocks struggled in light of the sub-prime issues facing the markets.

Our moderate level of developed market international holdings, which we added to during the year, also benefited the Fund’s relative performance, primarily due to currency gains from a weak U.S. dollar.

| | |

| Page 6 | | The Flex-funds 2007 Annual Report | December 31, 2007 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

Performance Perspective

Period & Average Annual Total Returns as of December 31, 2007

| | | | | | | | | | | | | | | | | | |

| | | 1

Year | | | 3

Year | | | 5

Year | | | Since

Inception1 | | | Net Expense

Ratio | | | Gross Expense

Ratio | |

The Dynamic Growth Fund | | 7.06 | % | | 9.27 | % | | 13.17 | % | | 0.64 | % | | 1.32 | % | | 1.86 | % |

S&P 500 Index2 | | 5.49 | % | | 8.62 | % | | 12.81 | % | | 2.61 | % | | — | | | — | |

1 | Inception date for The Dynamic Growth Fund is 2/29/00. |

2 | The S&P 500 Index is a widely recognized unmanaged index of common stock prices that does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

Performance quoted represents past performance. Past Performance does not guarantee future results. All performance figures represent average annual total returns for the periods ended December 31, 2007, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. Current month-end performance may be obtained at www.flexfunds.com or by calling 1.800.325.3539. Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The Dynamic Growth Fund during the periods shown above. Source for index data: Morningstar, Inc.

| | |

Growth of $10,000: 2/29/00 - 12/31/07

| | The Growth of $10,000 chart compares The Dynamic Growth Fund’s value to the S&P 500 Index. The chart is intended to give you a general idea of how the Fund performed compared to this benchmark over the period from its inception on February 29, 2000 to December 31, 2007. An understanding of the differences between the Fund and this index is important. The S&P 500 Index is a hypothetical unmanaged index of common stocks that does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. Past performance does not guarantee future results. The chart and the table above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| | |

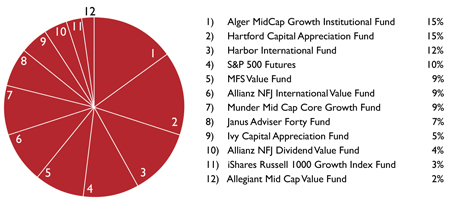

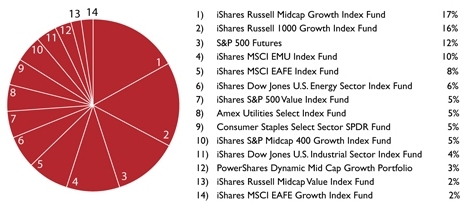

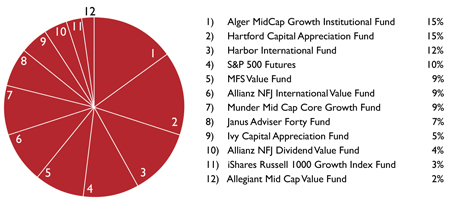

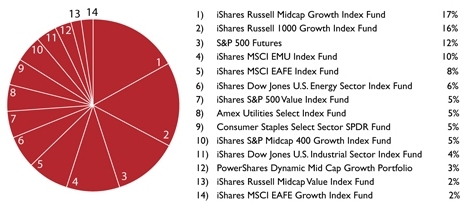

Fund Holdings as of December 31, 2007 | | Fund Holdings are subject to change. |

| | |

| The Flex-funds 2007 Annual Report | December 31, 2007 | | Page 7 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

The Muirfield Fund®

Annual Market Perspective

The Muirfield Fund strives to earn attractive returns ruring low-risk

environments and to minimize losses during high-risk environments.

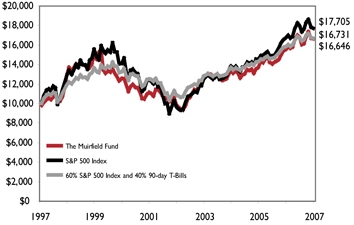

For the year ended December 31, 2007, The Muirfield Fund® returned 7.02%, which exceeded the return of the S&P 500, which returned 5.49%. Given that, as conditions warrant, The Muirfield Fund® is sometimes invested “defensively” (either partially or fully invested in cash equivalent securities), we believe the most appropriate benchmark comparison of performance is a blended index consisting of 60% of the return of the S&P 500 Index and 40% of the return of the 90-day U.S. Treasury Bill. For 2007, the blended index returned 5.32%. The Muirfield Fund® also outperformed this blended index for longer time periods, including a 3-year annualized return of 7.49% and a 5-year annualized return of 11.06%, compared to the blended index, which returned 6.99% and 8.94% for the same 3-year and 5-year periods, respectively.

Our quantitative tactical asset allocation model, which is designed to identify the risk reward relationship of the stock market, remained on balance positive throughout all of 2007. Consequently, The Muirfield Fund® maintained a 100% invested position in the stock market throughout all of 2007 even though there were declines in the S&P 500 Index of 6% in mid-February and 9% from mid-July to mid-August. Adhering to our discipline during these challenging periods was the right decision as demonstrated by the Fund’s performance relative to its benchmarks for 2007.

We consistently avoided small-cap stocks throughout all of 2007, which added to Fund performance, as small-cap stocks actually declined 1.55%, as represented by the Russell 2000 Index, for the year. An overemphasis on mid-cap value securities resulted in the fund’s outperformance during the first half of the year. During the third quarter, growth oriented securities began to outperform and the Fund lagged for the quarter as we were still overweighted in value securities. We rotated into growth holdings late in the third quarter, which proved beneficial, as growth stocks continued to outperform throughout the fourth quarter, particularly as financial stocks struggled in light of the sub-prime issues facing the markets.

Our moderate level of developed market international holdings, which we added to during the year, also benefited the Fund’s relative performance, primarily due to currency gains from a weak U.S. dollar.

| | |

| Page 8 | | The Flex-funds 2007 Annual Report | December 31, 2007 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

Performance Perspective

Period & Average Annual Total Returns as of December 31, 2007

| | | | | | | | | | | | | | | | | | |

| | | 1

Year | | | 3

Year | | | 5

Year | | | 10

Year | | | Net Expense

Ratio | | | Gross Expense

Ratio | |

The Muirfield Fund®1 | | 7.02 | % | | 7.49 | % | | 11.06 | % | | 5.23 | % | | 1.38 | % | | 1.88 | % |

60/40 Index2 | | 5.32 | % | | 6.99 | % | | 8.94 | % | | 5.30 | % | | — | | | — | |

S&P 500 Index3 | | 5.49 | % | | 8.62 | % | | 12.81 | % | | 5.90 | % | | — | | | — | |

1 | Inception date for The Muirfield Fund® is 8/10/88. |

2 | The 60/40 Index is comprised of 60% S&P 500 Index & 40% 90-day T-bills. This index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

3 | The S&P 500 Index is a widely recognized unmanaged index of common stock prices that does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

Performance quoted represents past performance. Past Performance does not guarantee future results. All performance figures represent average annual total returns for the periods ended December 31, 2007, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. Current month-end performance may be obtained at www.flexfunds.com or by calling 1.800.325.3539. Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The Muirfield Fund® during the periods shown above. Source for index data: Morningstar, Inc.

| | |

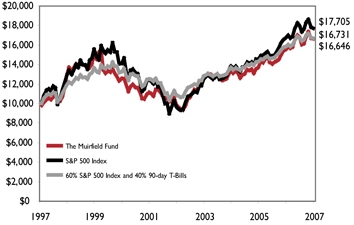

Growth Of $10,000: 12/31/97 - 12/31/07

| | The Growth of $10,000 chart compares the value of The Muirfield Fund® to the S&P 500 Index and to an index composed of 60% of the S&P 500 Index and 40% of 90-day T-bills (“the 60/40 index”). The chart is intended to give you a general idea of how the Fund performed compared to these indices over the period from December 31, 1997 to December 31, 2007. An understanding of the differences between the Fund and these indices is important. The benchmark indices are hypothetical unmanaged indices of common stocks and 90-day T-bills that do not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. Past performance does not guarantee future results. The chart and the table above do not the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| | |

| Fund Holdings as of December 31, 2007 | | Fund Holdings are subject to change. |

| | |

| The Flex-funds 2007 Annual Report | December 31, 2007 | | Page 9 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

The Aggressive Growth Fund

Annual Market Perspective

For the first time in several years, growth stocks significantly outperformed value stocks.

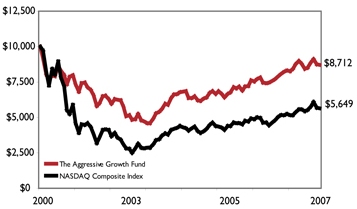

The Aggressive Growth Fund returned 6.14% in 2007. In comparison, the NASDAQ Composite Index returned 10.66% for the same period. For the 3-year period ending December 31, 2007, The Aggressive Growth Fund has outperformed its benchmark, returning an annualized 8.37%, compared to 7.65% for the NASDAQ Composite. Additionally, since its inception, The Aggressive Growth Fund has significantly outperformed the NASDAQ Composite (see page 11).

2007 was a strong year for the NASDAQ Composite. We use this as the Fund’s benchmark as it is generally considered a more aggressive target than the S&P 500. We consistently avoided small-cap stocks throughout 2007, which benefited Fund performance as small-cap stocks actually declined 1.55% for the year. For the first half of 2007, we had a fairly significant overweight in value oriented holdings. For the first half of 2007, both growth and value performed generally in line with each other. However, beginning in the third quarter, as the sub-prime issues began roiling the markets, financial stocks began to suffer and growth stocks began to outperform value holdings. Across all market cap ranges, growth stocks outperformed value stocks between 4% and 6%. In light of credit concerns, financial stocks, which make up a meaningful portion of all value stocks, were under fire, and our value holdings were not immune. As a result, we significantly underperformed the NASDAQ Composite Index in the third quarter. We rotated to growth stocks late in the third quarter and continued this position throughout the fourth quarter. As a result, the Fund essentially performed in line with the Fund’s aggressive benchmark in the fourth quarter.

We also initiated positions in the Utilities and Consumer Staples sectors, as they demonstrated relative strength compared to other domestic assets. We increased international exposure to 30%, including positions in Europe, and a 5% stake in the emerging markets. Downward pressure on the U.S. Dollar versus the Euro continued to aid performance. According to Bloomberg, the Euro appreciated 3.7% for the fourth quarter versus the U.S Dollar. With potential rate cuts going forward, the U.S. Dollar may continue to be under pressure in the coming months.

| | |

| Page 10 | | The Flex-funds 2007 Annual Report | December 31, 2007 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

Performance Perspective

Period & Average Annual Total Returns as of December 31, 2007

| | | | | | | | | | | | | | | | | | |

| | | 1

Year | | | 3

Year | | | 5

Year | | | Since

Inception1 | | | Net Expense

Ratio | | | Gross Expense

Ratio | |

The Aggressive Growth Fund | | 6.14 | % | | 8.37 | % | | 12.66 | % | | -1.74 | % | | 1.70 | % | | 1.83 | % |

Nasdaq Composite Index2 | | 10.66 | % | | 7.65 | % | | 15.46 | % | | -6.53 | % | | — | | | — | |

1 | Inception date for The Aggressive Growth Fund is 2/29/00. |

2 | The Nasdaq Composite Index is a broad-based capitalization-weighted index of all Nasdaq National Market and small-cap stocks that does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

Performance quoted represents past performance. Past Performance does not guarantee future results. All performance figures represent average annual total returns for the periods ended December 31, 2007, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. Current month-end performance may be obtained at www.flexfunds.com or by calling 1.800.325.3539. Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The Aggressive Growth Fund during the periods shown above. Source for index data: Morningstar, Inc.

| | |

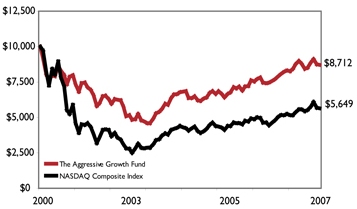

Growth of $10,000: 2/29/00 - 12/31/07

| | The Growth of $10,000 chart compares The Aggressive Growth Fund’s value to the Nasdaq Composite Index. The chart is intended to give you a general idea of how the Fund performed compared to this benchmark over the period from its inception on February 29, 2000 to December 31, 2007. An understanding of the differences between the Fund and this index is important. The Nasdaq Composite Index is a hypothetical unmanaged index of small-cap and Nasdaq National Market stocks that does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. Past performance does not guarantee future results. The chart and the table above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| | |

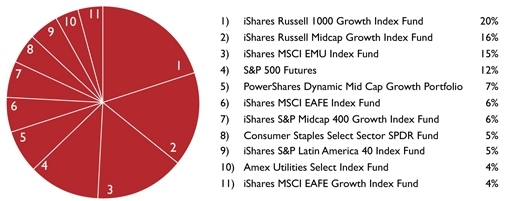

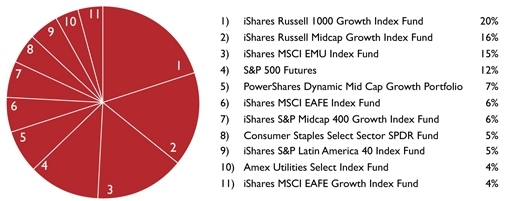

| Fund Holdings as of December 31, 2007 | | Fund holdings are subject to change. |

| | |

| The Flex-funds 2007 Annual Report | December 31, 2007 | | Page 11 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

The Defensive Growth Fund

Annual Market Perspective

We maintained a 100% equity exposure throughout all of 2007.

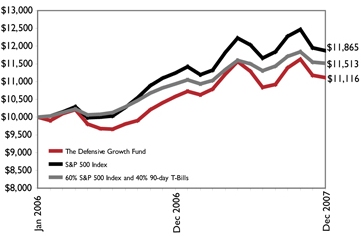

In its first full calendar year, The Defensive Growth Fund returned 5.03% for 2007. In comparison, the S&P 500 returned 5.49% for the same period. Given that, as conditions warrant, The Defensive Growth Fund is sometimes invested “defensively” (either partially or fully invested in cash equivalent securities), we believe the most appropriate benchmark comparison of performance is a blended index consisting of 60% of the return of the S&P 500 Index and 40% of the return of the 90-day U.S. Treasury Bill. For 2007, the blended index returned 5.32%.

Our quantitative tactical asset allocation model, which is designed to identify the risk reward relationship of the stock market, remained on balance positive throughout all of 2007. Consequently, The Defensive Growth Fund maintained a 100% invested position in the stock market throughout all of 2007 even though there were declines in the S&P 500 Index of 6% in mid-February and 9% from mid-July to mid-August. Adhering to our discipline during these challenging periods was the right decision.

We consistently avoided small-cap stocks throughout all of 2007, which added to Fund performance, as small-cap stocks actually declined 1.55% for the year. During the third quarter, growth oriented securities began to outperform and the Fund lagged for the quarter as we were still overweighted in value securities. We rotated into growth holdings late in the third quarter, which proved beneficial, as growth stocks continued to outperform throughout the fourth quarter, particularly as financial stocks struggled in light of the sub-prime issues facing the markets.

Our moderate level of developed market international holdings, which we added to during the year, also benefited the Fund’s relative performance, primarily due to currency gains from a weak U.S. dollar.

| | |

| Page 12 | | The Flex-funds 2007 Annual Report | December 31, 2007 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

Performance Perspective

Period & Average Annual Total Returns as of December 31, 2007

| | | | | | | | | | | | |

| | | 1

Year | | | Since

Inception1 | | | Net Expense

Ratio | | | Gross Expense

Ratio | |

The Defensive Growth Fund | | 5.03 | % | | 5.68 | % | | 1.56 | % | | 1.66 | % |

60/40 Index2 | | 5.32 | % | | 7.74 | % | | — | | | — | |

S&P 500 Index3 | | 5.49 | % | | 9.51 | % | | — | | | — | |

1 | Inception date for The Defensive Growth Fund is 1/31/06. |

2 | The 60/40 Index is comprised of 60% S&P 500 Index & 40% 90-day T-bills. This index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

3 | The S&P 500 Index is a widely recognized unmanaged index of common stock prices that does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

Performance quoted represents past performance. Past Performance does not guarantee future results. All performance figures represent average annual total returns for the periods ended December 31, 2007, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. Current month-end performance may be obtained at www.flexfunds.com or by calling 1.800.325.3539. Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The Defensive Growth Fund during the periods shown above. Source for index data: Morningstar, Inc.

| | |

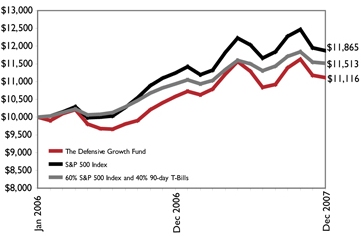

Growth of $10,000: 1/31/06 - 12/31/07

| | The Growth of $10,000 chart compares The Defensive Growth Fund’s value to the S&P 500 Index and to the 60/40 index(60% of the S&P 500 Index and 40% of 90-day T-bills ). The chart is intended to give you a general idea of how the Fund performed compared to these indices over the period from its inception on January 31, 2006 through December 31, 2007. An understanding of the differences between the Fund and these indices is important. The benchmark indices are hypothetical unmanaged indices of common stock that do not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. Past performance does not guarantee future results. The chart and the table above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| | |

| Fund Holdings as of December 31, 2007 | | Fund holdings are subject to change. |

| | |

| The Flex-funds 2007 Annual Report | December 31, 2007 | | Page 13 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

The Focused Growth Fund

Annual Market Perspective

We consistently avoided small-cap equity exposure for all of 2007.

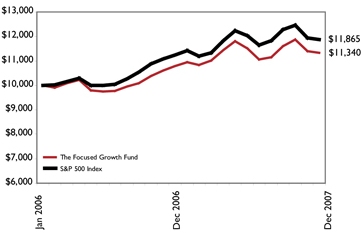

In its first full calendar year, The Focused Growth Fund returned 5.08% for the year ended December 31, 2007. In comparison, the S&P 500 Index returned 5.49% for the same period.

We consistently avoided small-cap stocks throughout all of 2007, which added to Fund performance, as small-cap stocks actually declined 1.55% for the year. An overemphasis on mid-cap value securities resulted in the Fund’s outperformance in the first quarter, but those relative gains were given up during the second quarter. During the third quarter, growth oriented securities began to outperform and the Fund lagged for the quarter as we were still overweighted in value securities. We rotated into growth holdings late in the third quarter, which proved beneficial, as growth stocks continued to outperform throughout the fourth quarter, particularly as financial stocks struggled in light of the sub-prime issues facing the markets. The Fund outperformed its benchmark by more than 1% in the fourth quarter.

Our moderate level of developed market international holdings, which we added to during the year, also benefited the Fund’s relative performance, primarily due to currency gains from a weak U.S. dollar.

| | |

| Page 14 | | The Flex-funds 2007 Annual Report | December 31, 2007 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

Performance Perspective

Period & Average Annual Total Returns as of December 31, 2007

| | | | | | | | | | | | |

| | | 1

Year | | | Since

Inception1 | | | Net Expense

Ratio | | | Gross Expense

Ratio | |

The Focused Growth Fund | | 5.08 | % | | 6.79 | % | | 1.58 | % | | 1.68 | % |

| | | | |

S&P 500 Index2 | | 5.49 | % | | 9.51 | % | | — | | | — | |

1 | Inception date for The Focused Growth Fund is 1/31/06. |

2 | The S&P 500 Index is a widely recognized unmanaged index of common stock prices that does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

Performance quoted represents past performance. Past Performance does not guarantee future results. All performance figures represent average annual total returns for the periods ended December 31, 2007, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. Current month-end performance may be obtained at www.flexfunds.com or by calling 1.800.325.3539. Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The Focused Growth Fund during the periods shown above. Source for index data: Morningstar, Inc.

| | |

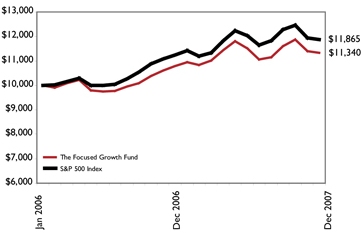

Growth of $10,000: 1/31/06 - 12/31/07

| | The Growth of $10,000 chart compares The Focused Growth Fund’s value to the S&P 500 Index. The chart is intended to give you a general idea of how the Fund performed compared to this benchmark over the period from its inception on January 31, 2006 to December 31, 2007. An understanding of the differences between the Fund and this index is important. The S&P 500 Index is a hypothetical unmanaged index of common stocks that does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. Past performance does not guarantee future results. The chart and the table above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| | |

| Fund Holdings as of December 31, 2007 | | Fund holdings are subject to change. |

| | |

| The Flex-funds 2007 Annual Report | December 31, 2007 | | Page 15 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

The Socially Responsible Utilities Fund

Annual Market Perspective

Investments for the socially responsible utilities fund are selected

on the basis of fundamental analysis. we look for companies that

have high credit ratings, above-average earnings growth, and

strong management. we will not invest in electric utilities that

generate power from Nuclear Reactors.

The Flex-funds Socially Responsible Utilities Fund returned 18.24% for the year ended December 31, 2007, compared to the Russell 3000 Utilities Index which returned 9.14% for the same period. Because of the lower volatility of this Fund, we also compare it to a blended index consisting of 60% of the Russell 3000 Utilities Index and 40% of the Lehman Brothers Long Credit Index. This benchmark returned 6.92% in 2007. Most pleasing to report is The Socially Responsible Utilities Fund has outperformed both these benchmarks for the past 3-year, 5-year, 10-year and since inception periods.

Many, but not all, of our foreign companies continued to drive the portfolio higher. We also benefited from positive movements in the more traditional domestic utilities that had been a drag in the third quarter.

Positive moves in the electric utility indices helped provide a buoyant environment for our more traditional utilities, which recovered after profit-taking in the third quarter. In the gas area, buyers produced gains in El Paso, Equitable Resources, Questar and Spectra Energy. Natural gas producers were mixed, but Kinder Morgan Energy Partners reflected both stability and strength in a Master Limited Partnership (MLP) environment that had been irrationally sold last summer.

Weak stocks were mercifully few and those that didn’t perform well were small positions. PT Telekomunikasi saw profit-taking, and demonstrated that the foreign telecom area is not monolithic. It was joined by a small decline late in the year by America Movil as well as a notable drop in NI Holdings which we had added prior to news of slowing subscriber growth.

Ever since the financial press insisted in 2002 that U.S utilities were headed for mass bankruptcy, the group, along with telecoms, has provided the best returns and the best risk-adjusted returns of any traditional domestic sector. Over the years, we have heard many investing “experts” say the sector is “too narrow,” though life as we know it cannot go on without utilities, and they always participate in long-term economic growth. Plenty of opportunities remain as the world turns toward increasing broadband, decreasing carbon and increasing reliance on both natural gas and electricity.

| | |

| Page 16 | | The Flex-funds 2007 Annual Report | December 31, 2007 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

Performance Perspective

Period & Average Annual Total Returns as of December 31, 2007

| | | | | | | | | | | | | | | | | | |

| | | 1

Year | | | 3

Year | | | 5

Year | | | 10

Year | | | Net Expense

Ratio | | | Gross Expense

Ratio | |

| | | | | | |

The Socially Responsible Utilities Fund1 | | 18.24 | % | | 17.57 | % | | 17.23 | % | | 7.52 | % | | 1.90 | % | | 2.10 | % |

| | | | | | |

Blended Index2 | | 6.92 | % | | 9.82 | % | | 11.74 | % | | 4.50 | % | | — | | | — | |

| | | | | | |

Russell 3000 Utilities Index3 | | 9.14 | % | | 13.96 | % | | 15.52 | % | | 3.11 | % | | — | | | — | |

1 | Inception date for The Socially Responsible Utilities Fund is 6/21/1995. |

2 | The blended index is comprised of 60% of the Russell 3000 Utilities Index and 40% of the Lehman Bros. Long Credit Index. One cannot invest directly in an index. |

3 | The Russell 3000 Utilities Index is a market capitalization-weighted index that is comprised of utility stocks that are included in the Russell 3000 Index. This index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

Performance quoted represents past performance. Past Performance does not guarantee future results. All performance figures represent average annual total returns for the periods ended December 31, 2007, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. Current month-end performance may be obtained at www.flexfunds.com or by calling 1.800.325.3539. Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The Socially Responsible Utilities Fund during the periods shown above. Because The Socially Responsible Utilities Fund concentrates its investments in public utility companies, the value of the Fund’s shares may fluctuate more than if invested in a greater number of industries. Changes in interest rates may also affect the value of Utility stocks, and rising interest rates can be expected to reduce the Fund’s net asset value. Source for index data: Bloomberg, LP.

| | |

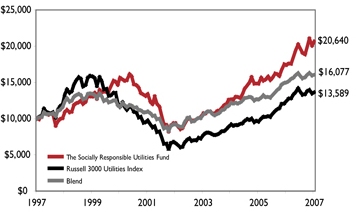

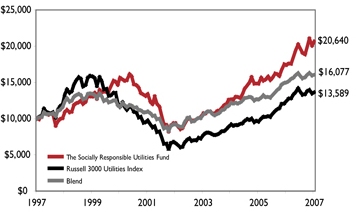

Growth of $10,000: 1/31/06 - 12/31/07

| | The Growth of $10,000 chart compares The Socially Responsible Utilities Fund’s value to the Russell 3000 Utilities Index and to the Blended Index (comprised of 60% of the Russell 3000 Utilities Index and 40% of the Lehman Bros. Long Credit Index). The chart is intended to give you a general idea of how the Fund performed compared to these benchmarks over the period from December 31, 1997 to December 31, 2007. An understanding of the differences between the Fund and these indices is important. The benchmark indices do not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. Past performance does not guarantee future results. The chart and the table above do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| | |

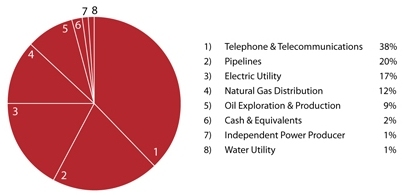

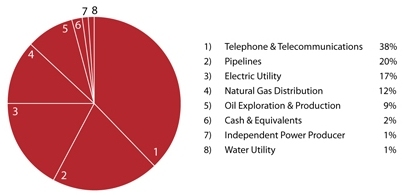

| Sector Weightings as of December 31, 2007 | | Fund holdings are subject to change. |

| | |

| The Flex-funds 2007 Annual Report | December 31, 2007 | | Page 17 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

The Quantex Fund™

Annual Market Perspective

The Quantex Fund™ employs a quantitative investment model to select

stocks of companies that have declined significantly in price and of

small, up-and-coming companies.

The Quantex Fund™ returned -7.00% for the year ended December 31, 2007. In comparison, the Russell 2000 Small-Cap Index returned -1.55%, while the S&P 400 Mid-Cap Index returned 7.93% for the same period.

The Quantex Fund™ typically owns approximately 100 stocks, which are selected using a quantitative investment model that focuses on small- and mid-cap stocks. This strategy, which we refer to as our Small to Mid Cap (SMID) discipline identifies a capitalization range from which to select stocks annually. Those stocks within this capitalization range, that are also part of a specific fund index, become the stocks that the Fund owns. These stocks are typically 1) stocks of large companies that have declined in price prior to being included in the Fund (which we refer to as “fallen angels”), or 2) stocks of small, up and coming companies (“rising stars”). We have employed this strategy since 1989 for our high net-worth individual investors, retirement plans and institutional investors with considerable success.

For the past two years, this Fund has had an overweight in value oriented stocks. Emphasizing value oriented securities added to the Fund’s performance in 2006 and the first half of 2007. However, having a value oriented emphasis detracted from performance in the last half of 2007. For the first half of the year, the Fund performed generally in line with mid caps and was 3% ahead of small caps. In the second half of the year, when growth stocks began to significantly outperform value stocks, the value holdings of the Fund lagged. An underweight in Energy stocks detracted from performance for the year, and an overweight in Consumer stocks also detracted from returns.

This investment strategy has had periods of short-term underperformance in the past. For example, in the fourth quarter of 1999 and the first quarter of 2000, the SMID strategy returned 3.8% and -6.3%, respectively, while the S&P 400 Mid-Cap Index returned 17.2% and 12.7%. However, for the subsequent 7 1/4 year period from March 31, 2000 to June 30, 2007, this strategy returned 14.4% on an annualized basis, while the S&P 400 Mid-Cap Index only returned 9.6% and the Russell 2000 Index returned 7.6%.

| | |

| Page 18 | | The Flex-funds 2007 Annual Report | December 31, 2007 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

Performance Perspective

Period & Average Annual Total Returns as of December 31, 2007

| | | | | | | | | | | | | | | | | | | | | |

| | | 1

Year | | | 4/30/05 to

12/31/07* | | | 3

Year | | | 5

Year | | | 10

Year | | | Net Expense

Ratio | | | Gross Expense

Ratio | |

The Quantex Fund™1 | | -7.00 | % | | 8.09 | % | | 5.17 | % | | 9.76 | % | | 3.46 | % | | 1.56 | % | | 2.09 | % |

Russell 2000 Index2 | | -1.55 | % | | 12.39 | % | | 6.84 | % | | 16.28 | % | | 7.17 | % | | — | | | — | |

S&P 400 Mid-Cap Index3 | | 7.93 | % | | 13.42 | % | | 10.26 | % | | 16.17 | % | | 11.18 | % | | — | | | — | |

Blended Index4 | | 3.19 | % | | 12.91 | % | | 8.55 | % | | 16.22 | % | | 9.18 | % | | — | | | — | |

1 | The inception date of The Quantex Fund TM is 3/20/1985. |

2 | The Russell 2000 Index is a market-capitalization weighted index measuring performance of the smallest 2,000 companies, on a market capitalization basis, in the Russell 3000 Index. One cannot invest directly in an index. |

3 | The S&P 400 Mid-Cap Index is an unmanaged index of common stock prices of mid-sized companies. One cannot invest directly in an index. |

4 | The Blended Index consists of 50% Russell 2000 Index and 50% S&P 400 Mid-Cap Index. One cannot invest directly in an index. |

Performance quoted represents past performance. Past Performance does not guarantee future results. All performance figures represent average annual total returns for the periods ended December 31, 2007, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. Current month-end performance may be obtained at www.flexfunds.com or by calling 1.800.325.3539. Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The Quantex Fund™ during the periods shown above. Source for index data: Morningstar, Inc.

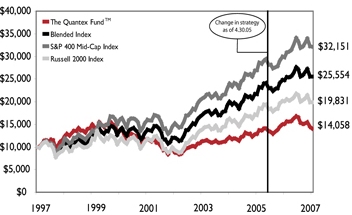

The Quantex Fund™ was previously known as The Highlands Growth Fund. On April 30, 2005, The Highlands Growth Fund changed its name to The Quantex Fund™, also changing the Fund’s investment objective and strategies. The Highlands Growth Fund focused on large-cap equities, while The Quantex Fund™ utilizes quantitative investment strategies that invest primarily in small- and mid-cap equities. Due to this change in strategies on April 30, 2005, the S&P 500 Index is a more comparative index for Fund performance prior to April 30, 2005. The Russell 2000 Index and S&P 400 Mid-Cap Index are more comparative indices for Fund performance after April 30, 2005. Source for index data: Morningstar, Inc.

| | |

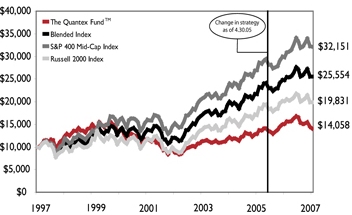

Growth of $10,000: 1/31/06 - 12/31/07

| | The Quantex Fund™ was previously known as The Highlands Growth Fund. On April 30, 2005, The Highlands Growth Fund changed its name to The Quantex Fund™, also changing the Fund’s investment objective and strategies. Due to this, the Russell 2000 Index and the S&P 400 Mid-Cap Index are more comparative indices for Fund performance. The Growth of $10,000 chart compares the value of The Quantex Fund™ to the S&P 400 Mid-Cap Index, the Russell 2000 Index, and a Blended Index (comprised of 50% Russell 2000 and 50% S&P 400 Mid-Cap). The chart is intended to show you how the Fund performed in comparison to these benchmarks from December 31, 1997 through December 31, 2007. There are important differences between the Fund and the benchmark indices. The benchmark indices are hypothetical unmanaged indices of common stock that do not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. Past performance does not guarantee future results. |

| | |

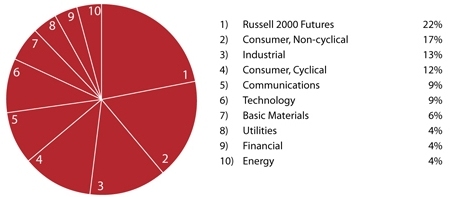

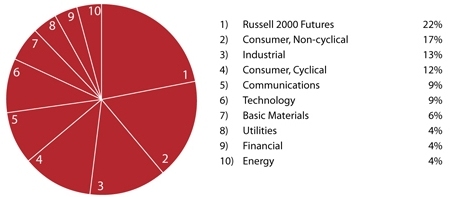

| Sector Weightings as of December 31, 2007 | | Fund holdings are subject to change. |

| | |

| The Flex-funds 2007 Annual Report | December 31, 2007 | | Page 19 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

The U.S. Government Bond Fund

Annual Market Perspective

The U.S. Government Bond Fund is one of less than 2% of intermediate - term U.S. Government Bond Funds that exceeded the Lehman Brothers Intermediate - Term Government Credit Index for each of the past 2 years.

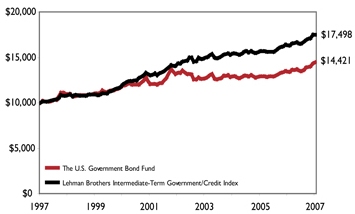

The U.S Government Bond Fund returned 7.44% for the year ended December 31, 2007. In comparison, the benchmark Lehman Brothers Intermediate-Term Government/Credit Index returned 7.39% for the same period. This was the 2nd consecutive year this fund outperformed this difficult benchmark index, a feat that can be claimed by less than 2% of all Intermediate-Term U.S Government Bond Funds, according to data from Morningstar.

Throughout the first half of 2007, our models indicated that interest rates would be relatively stable, with a slight bias towards lower rates. As a result, we maintained a slightly longer than average weighted average maturity.

The real estate story during the first half of the year turned into the sub-prime story in the third quarter. Increased foreclosures and decreased demand for asset-backed securities (largely mortgage asset-backed) took a toll on the performance of these sub-prime and asset-backed securities. Sub-prime investors ranging from large international banks and hedge funds to regional bank and money market funds struggled during the third and fourth quarters as defaults rose and liquidity all but disappeared. The lack of liquidity forced many in the sub-prime business to substantially reduce or close their operations.

As the credit markets suffered during the second half of the year, higher credit quality was rewarded more than the position on the yield curve. While we gradually increased our weighted average maturity during the second half, the Fund benefited most due to the higher credit quality holdings that the Fund owned.

| | |

| Page 20 | | The Flex-funds 2007 Annual Report | December 31, 2007 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

Performance Perspective

Period & Average Annual Total Returns as of December 31, 2007

| | | | | | | | | | | | | | | | | | |

| | | 1

Year | | | 3

Year | | | 5

Year | | | 10

Year | | | Net Expense

Ratio | | | Gross Expense

Ratio | |

The U.S. Government Bond Fund1 | | 7.44 | % | | 3.76 | % | | 1.65 | % | | 3.73 | % | | 1.01 | % | | 1.72 | % |

Lehman Bros. Intermediate-Term Government/Credit Index2 | | 7.39 | % | | 4.32 | % | | 4.06 | % | | 5.76 | % | | — | | | — | |

1 | The inception date of The U.S. Government Bond Fund is 12/31/1988. |

2 | The Lehman Brothers Intermediate-Term Government/Credit Index is an unmanaged index of fixed-rate bonds issued by the U.S. Government and its agencies that are rated investment-grade or higher, have one to ten years remaining until maturity, and at least $100 million outstanding. The Lehman Brothers Intermediate-Term Government/Credit Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

Performance quoted represents past performance. Past Performance does not guarantee future results. All performance figures represent average annual total returns for the periods ended December 31, 2007, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. Current month-end performance may be obtained at www.flexfunds.com or by calling 1.800.325.3539. Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The U.S. Government Bond Fund during the periods shown above. Source for index data: Morningstar, Inc.

| | |

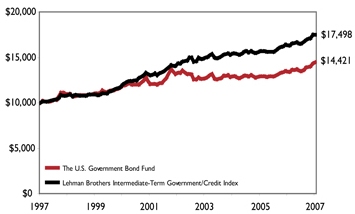

Growth of $10,000: 12/31/97 - 12/31/07

| | The Growth of $10,000 chart compares The U.S. Government Bond Fund’s value to the Lehman Brothers Intermediate-Term Government/Credit Index. The chart is intended to give you a general idea of how the Fund performed compared to this benchmark over the period from December 31, 1997 to December 31, 2007. An understanding of the differences between the Fund and this index is important. The Lehman Brothers Intermediate-Term Government/Credit Index is a hypothetical unmanaged index of fixed bonds issued by the U.S. Government and its agencies that are rated investment-grade or higher, have one to ten years remaining until maturity, and at least $100 million outstanding. This index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. Past performance does not guarantee future results. The chart and the table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| | |

| Fund Holdings as of December 31, 2007 | | Fund holdings are subject to change. |

| | |

| The Flex-funds 2007 Annual Report | December 31, 2007 | | Page 21 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

The Money Market Fund

Annual Market Perspective

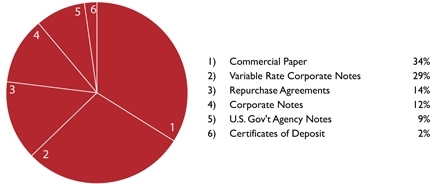

The Money Market Fund continues to provide above average returns while not investing in any asset-backed commercial paper.

“Stocks fall, bonds rise on sub-prime turmoil” – Reuters

“Bank freezes funds, markets plummet on sub-prime fears” – USA TODAY

“Credit crisis turns spotlight on money markets” – MSNBC

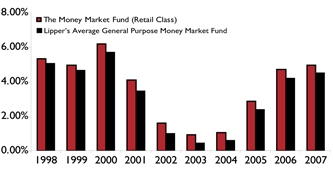

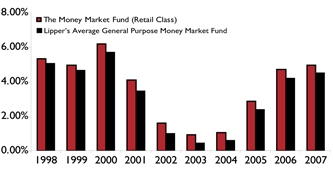

Headlines like these were abundant in the last two quarters of 2007. As the year progressed, credit concerns for corporations continued to multiply. Concerns in the market regarding asset-backed commercial paper increased, resulting in a period of abnormal volatility and liquidity. Many institutional investors from state-sponsored investment pools to sophisticated hedge fund managers were affected. Despite the far reaching nature of these events, The Flex-funds Money Market Fund was not affected. Our investments in traditional money market securities proved to be safe and timely as exotic products began to unravel in the face of uncertainty. Throughout this turmoil, we are pleased that The Flex-funds Money Market Fund Retail Class remained in the top 10% of all general purpose money market funds for the 22nd consecutive year according to iMoneyNet. This is true for every rolling 12-month period since the Fund’s inception in 1985.

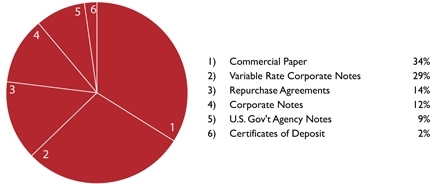

Early in the year, we maintained an overweight exposure to floating-rate instruments and overnight repurchase agreements versus conventional corporate debt securities such as notes and commercial paper. This enabled the Fund to earn a higher yield as both floating rate instruments and repurchase agreements provided a positive yield spread over corporate note and commercial paper securities.

With the possibility of lower rates looming in the future, we then made a concerted effort to maintain an above average weighted average maturity in an attempt to retain an above average yield for the Fund. Further, we continue to believe this philosophy will be suitable to defend against the potential for lower interest rates over the next several months. The Fund’s strategy shifted to reduce its position in overnight repurchase agreements and increase investments in commercial paper and fixed-term corporate notes. The credit quality of the holdings of the Fund remains high as we do not hold mortgage-backed or asset-backed type products.

| | |

| Page 22 | | The Flex-funds 2007 Annual Report | December 31, 2007 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

Performance Perspective

Period & Average Annual Total Returns as of December 31, 2007

| | | | | | | | | | | | | | | |

| | | 1

Year | | | 3

Year | | | 5

Year | | | 10

Year | | | Since

Inception | |

The Money Market Fund1 (Retail Class) | | 4.95 | % | | 4.16 | % | | 2.88 | % | | 3.65 | % | | 5.02 | %1 |

Lipper’s Average General Purpose Money Market Fund2 | | 4.49 | % | | 3.68 | % | | 2.40 | % | | 3.17 | % | | 4.65 | %2 |

Current & Effective Yields | | 7-day Compound Yield: 4.57%* | | | 7-day Simple Yield: 4.48%* | |

| | | | | |

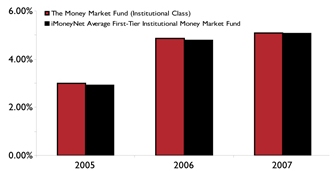

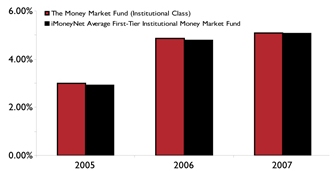

The Money Market Fund (Institutional Class)3 | | 5.09 | % | | 4.31 | % | | N/A | | | N/A | | | 4.31 | %3 |

| | | | | |

iMoneyNet Average First-Tier | | | | | | | | | | | | | | | |

Institutional Money Market Fund 4 | | 5.06 | % | | 4.24 | % | | N/A | | | N/A | | | 4.24 | %4 |

Current & Effective Yields | | 7-day Compound Yield: 4.72%* | | | 7-day Simple Yield: 4.62%* | |

1 | Inception date for the retail class of The Money Market Fund was 3/27/85. |

2 | Performance results for the Lipper Average General Purpose Money Market Fund is from 3/31/85 through 12/31/07. |

3 | Inception date for the Institutional class of The Money Market Fund was 12/28/04. |

4 | Performance results for the iMoneyNet Average First-Tier Institutional Money Market Fund is from 12/28/04 through 12/31/07. |

| * | For the seven-day period ended December 31, 2007, yield quotations more closely reflect the current earnings of The Money Market Fund than do total return quotations. |

Performance quoted represents past performance. Past Performance does not guarantee future results. All performance figures represent average annual total returns for the periods ended December 31, 2007, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. Current month-end performance may be obtained at www.flexfunds.com or by calling 1.800.325.3539. Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of both the retail class and the institutional class of The Money Market Fund during the periods shown above. Investments in The Money Market Fund are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in The Money Market Fund. Source for average general purpose money market fund data: Lipper, Inc. Source for average first-tier institutional money market fund data: iMoneyNet, Inc.

| | |

Annual Returns (Retail Class): 1998 - 2007

| | Annual Returns (Institutional Class): 2005 - 2007

|

| | |

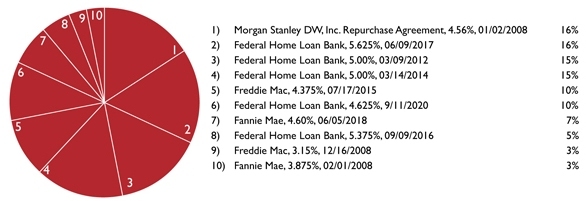

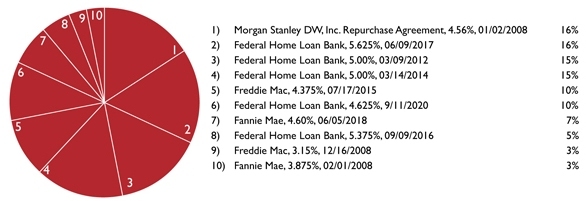

Fund Holdings as of December 31, 2007 | | Fund holdings are Subject to change. |

| | |

| The Flex-funds 2007 Annual Report | December 31, 2007 | | Page 23 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

Shareholder Expense Analysis (Unaudited)

Shareholders of mutual funds pay ongoing expenses, such as advisory fees, distribution and service fees (12b-1 fees) and other fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples below are based on an investment of $1,000 invested at the beginning of the period and held for the six-month period from June 30, 2007 to December 31, 2007.

ACTUAL EXPENSES: The first table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (e.g.: an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

| | | | | | | | | | | | |

| ACTUAL EXPENSES | | Beginning

Account Value

(6/30/2007) | | Ending

Account Value

(12/31/2007) | | Expenses Paid

During Period1

(6/30/2007 -

12/31/2007) | | Expense Ratio

(Annualized) | |

The Muirfield Fund® | | $ | 1,000.00 | | $ | 993.30 | | $ | 6.83 | | 1.36 | % |

The Dynamic Growth Fund | | | 1,000.00 | | | 994.60 | | | 6.59 | | 1.31 | % |

The Aggressive Growth Fund | | | 1,000.00 | | | 990.70 | | | 8.53 | | 1.70 | % |

The Defensive Growth Fund | | | 1,000.00 | | | 984.70 | | | 7.65 | | 1.53 | % |

The Focused Growth Fund | | | 1,000.00 | | | 984.80 | | | 7.70 | | 1.54 | % |

The Quantex Fund™ | | | 1,000.00 | | | 849.60 | | | 7.32 | | 1.57 | % |

The Socially Responsible Utilities Fund | | | 1,000.00 | | | 1,049.10 | | | 9.76 | | 1.89 | % |

The U.S. Government Bond Fund | | | 1,000.00 | | | 1,067.00 | | | 5.11 | | 0.98 | % |

The Money Market Fund - Retail Class | | | 1,000.00 | | | 1,024.10 | | | 2.45 | | 0.48 | % |

The Money Market Fund - Institutional Class | | | 1,000.00 | | | 1,024.80 | | | 1.74 | | 0.34 | % |

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES: The second table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and assumed rates of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | | | | | | | | | | | |

HYPOTHETICAL EXAMPLE (5% return before expenses) | | Beginning

Account Value

(6/30/2007) | | Ending

Account Value

(12/31/2007) | | Expenses Paid

During Period1

(6/30/2007 -

12/31/2007) | | Expense Ratio

(Annualized) | |

The Muirfield Fund® | | $ | 1,000.00 | | $ | 1,018.35 | | $ | 6.92 | | 1.36 | % |

The Dynamic Growth Fund | | | 1,000.00 | | | 1,018.60 | | | 6.67 | | 1.31 | % |

The Aggressive Growth Fund | | | 1,000.00 | | | 1,016.64 | | | 8.64 | | 1.70 | % |

The Defensive Growth Fund | | | 1,000.00 | | | 1,017.49 | | | 7.78 | | 1.53 | % |

The Focused Growth Fund | | | 1,000.00 | | | 1,017.44 | | | 7.83 | | 1.54 | % |

The Quantex Fund™ | | | 1,000.00 | | | 1,017.29 | | | 7.98 | | 1.57 | % |

The Socially Responsible Utilities Fund | | | 1,000.00 | | | 1,015.68 | | | 9.60 | | 1.89 | % |

The U.S. Government Bond Fund | | | 1,000.00 | | | 1,020.27 | | | 4.99 | | 0.98 | % |

The Money Market Fund - Retail Class | | | 1,000.00 | | | 1,022.79 | | | 2.45 | | 0.48 | % |

The Money Market Fund - Institutional Class | | | 1,000.00 | | | 1,023.49 | | | 1.73 | | 0.34 | % |

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if any transactional costs were included, your costs would have been higher.

1 | Expenses are equal to the Funds’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/365(to reflect the total number of days in the six-month period). |

| | |

| Page 24 | | The Flex-funds 2007 Annual Report | December 31, 2007 |

| | |

| The Flex-funds | | 2007 Annual Report | December 31, 2007 |

2007 Annual Report

Fund Holdings & Financial Statements

| | |

| The Flex-funds 2007 Annual Report | December 31, 2007 | | Page 25 |

Schedule of Investments

December 31, 2007

The Muirfield Fund

| | | | | |

Security Description | | Shares or

Principal

Amount ($) | | Value ($) | |

Registered Investment Companies — 93.2% | |

Alger MidCap Growth Institutional Fund — Class I | | 411,479 | | 7,859,241 | |

Allegiant Mid Cap Value Fund — Class A | | 61,235 | | 832,182 | |

Allianz NFJ Dividend Value Fund — Class D | | 129,263 | | 2,140,600 | |

Allianz NFJ International Value Fund — Class A | | 196,390 | | 5,172,925 | |

Harbor International Fund — Inst. Class | | 79,182 | | 5,650,420 | |

Hartford Capital Appreciation Fund — Class A | | 204,648 | | 8,278,001 | |

Heritage Mid Cap Stock Fund — A | | 37,896 | | 1,062,236 | |

iShares Russell 1000 Growth Index Fund | | 35,325 | | 2,147,054 | |

Ivy Capital Appreciation Fund — Class A | | 201,249 | | 2,253,991 | |

Janus Adviser Forty Fund — Class S | | 86,069 | | 3,568,409 | |

MFS Value Fund — Class A | | 151,452 | | 4,018,024 | |

Munder Mid Cap Core Growth Fund — Class A | | 132,399 | | 3,957,400 | |

| | | | | |

Total Registered Investment Companies (Cost $47,880,894) | | | | 46,940,483 | |

| | | | | |

U.S. Government Obligations — 1.2% | |

U.S. Treasury Bill, 3.64%, due 02/07/2008* | | 100,000 | | 99,635 | |

U.S. Treasury Bill, 3.03%, due 03/06/2008* | | 500,000 | | 497,241 | |

| | | | | |

Total U.S. Government Obligations

(Cost $596,900) | | | | 596,876 | |

| | | | | |

Repurchase Agreements — 5.9% | |

Morgan Stanley DW, Inc., 4.56%, 01/02/2008, (Collateralized by $3,176,798 various Certificates of Deposit, Government Agencies, Agency Strips, Commercial Papers, Treasury Notes at 2.625% — 7.25%, due 01/07/2008 — 04/15/2030, value — $3,028,380) purchase date 12/31/2007 | | 2,969,000 | | 2,969,000 | |

| | | | | |

Total Repurchase Agreements

(Cost $2,969,000) | | | | 2,969,000 | |

| | | | | |

Total Investments — 100.3%

(Cost $51,446,794)(a) | | | | 50,506,359 | |

| | | | | |

Liabilities less Other Assets — (0.3%) | | | | (132,268 | ) |

| | | | | |

Total Net Assets — 100.0% | | | | 50,374,091 | |

| | | | | |

Trustee Deferred Compensation** | |

The Flex-funds Aggressive Growth Fund | | 410 | | 3,522 | |

The Flex-funds Defensive Growth Fund | | 224 | | 2,343 | |

The Flex-funds Dynamic Growth Fund | | 2,121 | | 19,598 | |

The Flex-funds Muirfield Fund | | 5,206 | | 31,340 | |

The Flex-funds Quantex Fund | | 1,887 | | 34,570 | |

The Flex-funds Socially Responsible Utilities Fund | | 378 | | 9,881 | |

| | | | | |

Total Trustee Deferred Compensation (Cost $80,323) | | | | 101,254 | |

| | | | | |

The Muirfield Fund

| | | | |

Security Description | | Long

Contracts | | Unrealized

Appreciation

(Depreciation)($) |

Futures Contracts | | |

Standard & Poors 500 expiring March 2008, notional value $3,693,000 | | 10 | | 6,300 |

| | | | |

Total Futures Contracts | | | | 6,300 |

| | | | |

| (a) | Cost for financial reporting purposes and federal income tax purposes are the same. Cost for federal income tax purposes differs from value by net unrealized appreciation (depreciation) of securities as follows: |

| | | | |

Unrealized appreciation | | $ | 634,779 | |

Unrealized depreciation | | | (1,575,214 | ) |

| | | | |

Net unrealized appreciation (depreciation) | | $ | (940,435 | ) |

| | | | |

| * | Pledged as collateral on futures contracts. |

| ** | Assets of affiliates to The Muirfield Fund held for the benefit of the Fund’s Trustees in connection with the Trustee Deferred Compensation Plan. |

The accompanying notes are an integral part of these financial statements.

Schedule of Investments

December 31, 2007

The Dynamic Growth Fund

| | | | |

Security Description | | Shares or

Principal

Amount ($) | | Value ($) |

Registered Investment Companies — 89.6% |

Alger MidCap Growth Institutional Fund — Class I | | 151,833 | | 2,900,001 |

Allegiant Mid Cap Value Fund — Class A | | 27,512 | | 373,890 |

Allianz NFJ Dividend Value Fund — Class D | | 45,162 | | 747,877 |

Allianz NFJ International Value Fund — Class A | | 67,114 | | 1,767,793 |

Harbor International Fund — Inst. Class | | 31,116 | | 2,220,421 |

Hartford Capital Appreciation Fund — Class A | | 68,777 | | 2,782,016 |

iShares Russell 1000 Growth Index Fund | | 7,725 | | 469,526 |

Ivy Capital Appreciation Fund — Class A | | 82,054 | | 919,009 |

Janus Adviser Forty Fund — Class S | | 33,180 | | 1,375,624 |

MFS Value Fund — Class A | | 67,643 | | 1,794,563 |

Munder Mid Cap Core Growth Fund — Class A | | 59,531 | | 1,779,375 |

| | | | |

Total Registered Investment Companies (Cost $17,557,254) | | | | 17,130,095 |

| | | | |

U.S. Government Obligations — 2.1% |

U.S. Treasury Bill, 3.03%, due 03/06/2008* | | 400,000 | | 397,793 |

| | | | |

Total U.S. Government Obligations

(Cost $397,812) | | | | 397,793 |

| | | | |

Repurchase Agreements — 7.9% |

Morgan Stanley DW, Inc., 4.56%, 01/02/2008, (Collateralized by $1,614,614 various Certificates of Deposit, Government Agencies, Agency Strips, Commercial Papers, Treasury Notes at 2.625% — 7.25%, due 01/07/2008 — 04/15/2030, value — $1,539,180) purchase date 12/31/2007 | | 1,509,000 | | 1,509,000 |

| | | | |

Total Repurchase Agreements

(Cost $1,509,000) | | | | 1,509,000 |

| | | | |

Total Investments — 99.6%

(Cost $19,464,066)(a) | | | | 19,036,888 |

| | | | |

Other Assets less Liabilities — 0.4% | | | | 77,761 |

| | | | |

Total Net Assets — 100.0% | | | | 19,114,649 |

| | | | |

Trustee Deferred Compensation** |

The Flex-funds Aggressive Growth Fund | | 201 | | 1,727 |

The Flex-funds Defensive Growth Fund | | 110 | | 1,151 |

The Flex-funds Dynamic Growth Fund | | 541 | | 4,999 |

The Flex-funds Muirfield Fund | | 1,408 | | 8,476 |

The Flex-funds Quantex Fund | | 539 | | 9,874 |

The Flex-funds Socially Responsible Utilities Fund | | 82 | | 2,143 |

| | | | |

Total Trustee Deferred Compensation (Cost $24,020) | | | | 28,370 |

| | | | |

The Dynamic Growth Fund

| | | | | |

Security Description | | Long

Contracts | | Unrealized

Appreciation

(Depreciation)($) | |

Futures Contracts | | | |

Standard & Poors 500 expiring March 2008, notional value $1,846,500 | | 5 | | (4,763 | ) |

| | | | | |

Total Futures Contracts | | | | (4,763 | ) |

| | | | | |

| (a) | Cost for financial reporting purposes and federal income tax purposes are the same. Cost for federal income tax purposes differs from value by net unrealized appreciation (depreciation) of securities as follows: |

| | | | |

Unrealized appreciation | | $ | 215,802 | |

Unrealized depreciation | | | (642,980 | ) |

| | | | |

Net unrealized appreciation (depreciation) | | $ | (427,178 | ) |

| | | | |

| * | Pledged as collateral on futures contracts. |

| ** | Assets of affiliates to The Dynamic Growth Fund held for the benefit of the Fund’s Trustees in connection with the Trustee Deferred Compensation Plan. |

The accompanying notes are an integral part of these financial statements.

Schedule of Investments

December 31, 2007

The Aggressive Growth Fund

| | | | | |

Security Description | | Shares or

Principal

Amount ($) | | Value ($) | |

Registered Investment Companies — 88.5% | |

Consumer Staples Select Sector SPDR Fund | | 46,275 | | 1,332,720 | |

iShares MSCI EAFE Growth Index Fund | | 14,700 | | 1,142,337 | |

iShares MSCI EAFE Index Fund | | 23,190 | | 1,820,415 | |

iShares MSCI EMU Index Fund | | 36,455 | | 4,349,811 | |

iShares Russell 1000 Growth Index Fund | | 95,400 | | 5,798,412 | |

iShares Russell Midcap Growth Index Fund | | 41,325 | | 4,708,571 | |