UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3462

Meeder Funds Trust

6125 Memorial Drive

Dublin, OH 43017

Bruce McKibben

c/o Meeder Funds Trust

6125 Memorial Drive

Dublin, OH 43017

Registrant’s telephone number, including area code: 800-325-3539

Date of fiscal year end: December 31, 2014

Date of reporting period: December 31, 2014

Item 1. Report to Stockholders.

TABLE OF CONTENTS

| Letter to Shareholders | 1 |

| Money Market Fund | 4 |

| Total Return Bond Fund | 6 |

Quantex FundTM | 8 |

Muirfield Fund® | 10 |

| Balanced Fund | 12 |

| Dynamic Growth Fund | 14 |

| Aggressive Growth Fund | 16 |

| Strategic Growth Fund | 18 |

| Utilities and Infrastructure Fund | 20 |

| Shareholder Expense Analysis | 22 |

| Disclosures | 23 |

| Fund Holdings & Financial Statements | 24 |

Our Mission Statement Every day, our mission is to exceed, with integrity, passion, and discipline, the expectations of our clients’ overall investment experience. Core Values Integrity We hold ourselves to the highest standards, acting ethically, honestly, and with the best interests of our clients in mind. Passion We take pride in our work and believe in our strategies and our people. Discipline We employ proven processes in our pursuit for exceptional results and distinguished service. Results We are committed to accomplishing the goals of our clients and ourselves through responsible, diligent strategies. Excellence We strive to exceed expectations in everything we do and seek innovative ways to solve problems and capitalize on opportunities. |

LETTER TO SHAREHOLDERS December 31, 2014

During the opening months of 2014, a sharp drop-off in the pace of economic data sparked concern among some investors that a swoon was underway, while others maintained that the setback was temporary due to the impact of adverse weather conditions. Given the strong rebound in various economic reports received during the second quarter, it appears that those in the latter camp were correct. The year ended with elevated levels of volatility across numerous asset classes. While the S&P 500 Index managed a gain of 4.93% for the 4th quarter, the Index declined as much as 10% from its peak during October. Although that is the steepest decline that the S&P 500 has experienced since 2012, the loss paled in comparison to falling oil prices. Due primarily to a surge in supply, oil fell by 49% in the second half of 2014 to end the year around $53 per barrel. The price of gasoline tumbled as well, with the national average price coming in at $2.24 per gallon at year end compared to $3.67 on June 30th. While we expect the decline in gas to provide a boost to consumers going into 2015, we would like to highlight the positive news on the economic front throughout the year as well.

The unemployment rate now sits at 5.6%, and follows stronger than expected job creation in December. In fact, the U.S. added 2.95 million jobs in 2014, which was the strongest year for job creation since 1999. Reflecting the improving labor market conditions, the Conference Board’s measure of consumer confidence has recovered to levels last seen in 2007. Additionally, third quarter GDP was revised higher than expected, and grew by 5.0% from the prior quarter. This was the largest increase in quarterly GDP in over 10 years and stands in stark contrast to the first quarter of 2014 which saw a decline of 2.9%.

The S&P 500’s gains in the fourth quarter punctuated another strong year for the stock market, with a 13.69% gain overall as well as more record highs. While large-cap stocks fared well for the year, smaller company stocks and international markets struggled to keep pace. The Russell 2000 Index of small-cap stocks was up only 4.89% for the year, while the developed international and emerging market indexes actually fell by 4.90% and 2.19%, respectively. The fixed-income market benefited from falling yields, with the Barclays US Aggregate Bond Index up 5.97% for 2014.

The year was highlighted by several milestones and achievements for Meeder Investment Management as well, which marked the 40th year serving our clients. We have continued to expand and add new relationships with our clients across both the public and private sector, which has led our assets under management, advisement, or administration to increase to over $8.5 billion as of December 31, 2014. Our team of associates has grown as well, including the addition of two Portfolio Managers in 2014 who have both earned the CFA® designation. We are also proud of the investment results we achieved in 2014, where four of eight variable mutual funds finished in the top third of their Morningstar peer group.

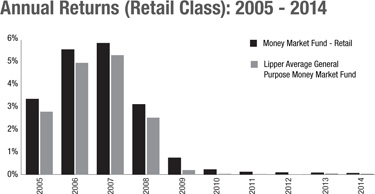

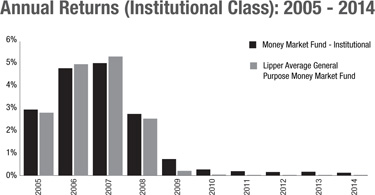

Additionally, we are pleased with the performance of our Funds on a longer-term basis. The Muirfield Fund® is in the top percentile for tactical allocation funds in the country on both a 3- and 5-year basis, while the Quantex Fund™ is in the 19th, 20th, and 10th percentile of mid-cap value funds on 3-, 5-, and 10-year basis according to Morningstar. The Balanced Fund, which is also categorized in the tactical allocation category, placed in the top 10% of its peer group over the past year, and is in the fourth percentile on a 3-year basis based on Morningstar as well. Finally, the retail class of the Money Market Fund finished the year as the top rated fund in the country on a 1- and 3-year basis according to Lipper.

Perhaps most importantly, we continued to update and evolve the quantitative investment models that are utilized in our decision-making process throughout 2014. Our investment philosophy is built on the foundation of a multi-disciplined/multi-factor method, where we construct our Funds by using a “weight of the evidence” approach that evaluates trend/technical factors, interest rate/macroeconomic factors, and valuation/fundamental metrics. Our proprietary investment models are incorporated throughout the decision-making process, from determining the risk/reward relationship of the stock market to which securities are most attractive for investment. In 2014, we

2014 Annual Report | December 31, 2014 | Page 1 |

revisited and enhanced numerous investment models, reflecting the dynamic and ever-changing nature of the capital markets.

We believe the dynamic characteristics of the capital markets necessitate the evaluation of a wide range of factors. Just as 2014 presented a number of challenges for investors, we believe 2015 will certainly be no different. For instance, while domestic stock valuations are slowly becoming expensive on an absolute basis, how do they appear when considering the inflationary and interest rate backdrop? Many international stock markets are becoming attractively valued, but how does the diverging paths of global monetary policy impact currency relationships and domestic investor returns? The Federal Reserve may be ready to raise interest rates in 2015, but what does the steepness of the yield curve say for stock returns going forward?

It is the answer to these questions and more that will determine investor outcomes for the year ahead. To address these questions, we have developed a list of primary factors and themes to monitor in 2015 that includes stock market valuations, interest rates, inflation, energy prices and the stabilization of international markets.

Stock market valuations remain a key concern for investors as we enter 2015. However, as we have noted frequently in the past, stock valuations remain somewhat attractive when considering the low inflation and interest rate backdrop. Regarding interest rates, the Fed is widely expected to raise the fed funds rate for the first time in nine years, which is leading to concerns that the economic recovery could be derailed and result in losses for bond investors. While 2015 will likely experience the first Fed rate hike, there are other factors that may limit how quickly the Fed tightens from that point. Although the labor market is improving, inflation remains exceptionally low and could see further downside pressure due to the pullback in commodity prices, most notably in the price of oil. As a result, inflation expectations and energy prices will be key variables to monitor throughout 2015 in order to anticipate the path of tighter monetary policy. Finally, international markets continued to struggle in 2014 due to decelerating growth in emerging markets and signs of deflation in Europe. We will closely follow our quantitative investment model in the year ahead to determine the stability of capital markets.

Robert S. Meeder

President

Meeder Funds®

December 31, 2014

| Page 2 | 2014 Annual Report | December 31, 2014 |

2014 Annual Report Fund Summaries |

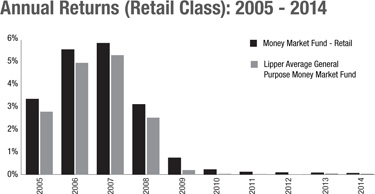

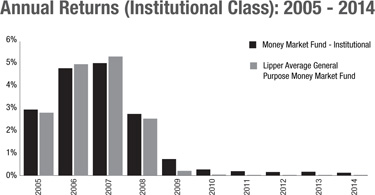

Money Market Fund The Meeder Money Market Fund enjoyed continued success versus the competition in 2014, with both the retail and institutional share classes ranking among the top general purpose money market funds in the country. Consistency continues to be extremely important when managing the Fund as it has been in the top 10% of all general purpose money market funds since its inception in 1985. The Money Market Fund industry continued to be mired in a challenging market environment during 2014. The main driver behind this was the reluctance of The Federal Reserve Open Market Committee (FOMC) to move from its policy stance of a historically low policy rate. The target rate remained locked at 0.00-0.25% for the whole year and has been unchanged since it was first implemented in December 2008. Other events facing the industry during the year were regulatory pressures, and inconsistent global economic conditions. The former came to fruition in July as the U.S. Securities and Exchange Commission adopted enhanced guidelines in an effort to improve risk controls throughout the industry. The main components included the potential for new variable NAV pricing coupled with liquidity buffers. Finally, global economic data from Europe to Asia seemed to keep investors debating whether conditions were pointing to improvement or not. In the end, the yields of money market investments were constrained for most of the year with limited opportunities. The Fund realized most of its benefit from a mix of eligible products and term structures which provided the flexibility to act on opportunities as they became available. During 2014, we maintained a weighted average maturity that was below that of our peers. Holdings in the Fund remained allocated toward investments with superior credit quality, as we believed the risk and reward relationship favored this position. Our sector allocation favored an overweight in high-quality liquid investments and short-term investment grade corporate debt. At the end of 2014, the Fund’s composition was as follows: 42% other money market funds, 15% repurchase agreements, 12% corporate obligations, 12% certificates of deposit, 10% U.S. government agency, and 9% bank obligations. As we completed 2014, our belief was that the Fund should be positioned to maintain its strong performance if the challenging environment persists. As we continuously monitor the markets and our strategy, we will remain vigilant and keep in mind the best interests of our shareholders. |

Period & Average Annual Total Returns as of December 31, 2014 (Unaudited)

| | 1 Year | 3 Year | 5 Year | 10 Year | Inception Date |

Money Market Fund - Retail Class

Expense Ratios+: Audited Net 0.16% Gross 0.90% | 0.06% | 0.08% | 0.11% | 1.62% | 3/27/85 |

| Current & Effective Yields* | 7-day Compound: 0.08% 7-day Simple: 0.08% |

| Lipper Average General Purpose Money Market Fund | 0.01% | 0.01% | 0.02% | 1.45% | 3/31/85 |

| | 1 Year | 3 Year | 5 Year | Since Inception | Inception Date |

Money Market Fund - Institutional Class

Expense Ratios+: Audited Net 0.10% Gross 0.71% | 0.11% | 0.14% | 0.18% | 1.72% | 12/28/04 |

| Current & Effective Yields* | 7-day Compound: 0.14% 7-day Simple: 0.14% |

| Lipper Average General Purpose Money Market Fund | 0.01% | 0.01% | 0.02% | 1.47% | 12/31/04 |

| |  |

| | | |

| | Top 10 Holdings |

| as of December 31, 2014 |

| 1. | Fidelity Institutional Money Market Portfolio | 42.3% |

| 2. | FICA Bank Deposit Program (StoneCastle) | 7.4% |

| 3. | GX Clarke Repo, 0.26%, 01/05/2015 | 4.9% |

| 4. | GX Clarke Repo, 0.18%, 01/02/2015 | 4.9% |

| 5. | GX Clarke Repo, 0.26%, 01/06/2015 | 4.9% |

| 6. | Caterpillar Financial Power Investment Floating Rate Demand Note, 0.45% | 4.9% |

| 7. | Federal Home Loan Bank, 0.22%, 10/07/2015 | 2.5% |

| 8. | Federal Farm Credit Bank, 0.20%, 8/03/2015 | 2.5% |

| 9. | Royal Bank of Canada, 0.23%, 6/10/2015 | 2.5% |

| 10. | Federal Farm Credit Bank, 0.13%, 2/23/2015 | 2.5% |

| | | |

| As a percentage of total net assets. |

Management fees and/or expenses were voluntarily waived and/or reimbursed in order to reduce the operating expenses of both the retail class and the institutional class of the Money Market Fund during the periods shown above. Investments in the Money Market Fund are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Money Market Fund. + The Audited Net Expense Ratio is based on average daily net assets and reflects actual expenses of the Fund paid over the one year period ended 12/31/14, including the effect of expense waivers and reimbursements. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s average daily net assets as shown in the most current Fund Prospectus. Please see additional disclosures on page 23.

2014 Annual Report | December 31, 2014 | Page 5 |

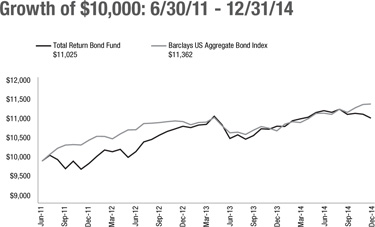

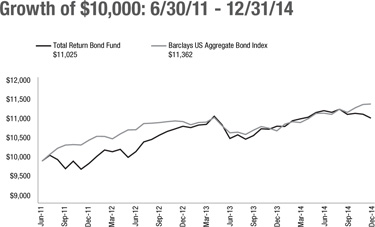

Total Return Bond Fund The Meeder Total Return Bond Fund returned 1.78% for the year ended December 31, 2014. The Fund’s benchmark, the Barclays US Aggregate Bond Index, returned 5.97% over the aforementioned time period. The main drivers contributing to the performance differential were the Fund duration and underweight allocation to U.S. Government securities versus that of the benchmark. At the beginning of the year, a majority of strategists/economists were of the belief that 2014 was the year interest rates would finally rise. The stage was set. The FOMC had instituted tapering of its bond purchase program, widely referred to as Quantitative Easing. Economic data points here in the U.S. which targeted employment remained consistent. Growth prospects for the economy were anticipated to be building momentum after a first quarter weather related setback. Economies of developed countries around the world, while not necessarily stable were dabbling with accommodative discussions in an effort to support their domestic well-being. But despite all the building blocks and positive tones, market sentiment gravitated in the opposite direction. The long end of the U.S. Treasury yield curve, the 30-year bond, appreciated in price causing a significant flattening of the yield curve (the yield difference between two points on the yield curve). The difference in yield between the 30-year bond and the 10-year note actually reached levels not seen since 2009. By the end of the year, the yield on the 30-year bond had declined by over 100 basis points. For the Total Return Bond Fund, 2014 was a tale of two halves. The first half of the year the Fund slightly underperformed the benchmark despite maintaining a significantly lower allocation to U.S. Government securities and managing the portfolio to a lower average duration. The Fund had a greater allocation to credit sensitive sectors including corporate bonds and emerging market bonds. Being invested in these sectors assisted the Fund in its ability to maintain pace with the benchmark index. What detracted most from performance in the first half of the year was the Fund’s average duration, which was approximately 3.5 years while the benchmark was approximately 5.5 years. During the second half of the year, the Fund’s underperformance versus the benchmark index escalated in response to two specific events. Volatility increased during the third quarter as credit spreads began to widen in response to geopolitical events which had been building in Eastern Europe and the Middle East. After the shock from the initial news headlines wore off, investors made moves to resume activity in credit sensitive sectors. But this was not the last we would hear of this volatility. Later in the year credit spreads widened again, with a greater ferocity. Before the end of September, geopolitical uneasiness began to penetrate the headlines again. Credit sensitive sectors again realized a widening of yield spreads versus U.S. Treasury securities. Finally, as talk of global economic uncertainty began to gain traction another perpetrator introduced itself to the markets – oil. By the end of the year oil had dropped by more than half with sources claiming oversupply and the lack of conviction from interested sovereigns to intervene and reduce production. Credit sectors again were at the mercy of excessive selling pressure. In the last quarter of the year, longer dated U.S. Treasury securities realized their greatest gain in price, dropping yields close to historical lows. As a result, the majority of performance differential of the Fund versus the benchmark was realized in the second half of 2014. Finally, at times throughout the year we incorporated the use of derivatives in the Fund, such as US Treasury futures, in order to manage the duration of the Fund. Our use of US Treasury futures during the year had a slight positive impact on the Fund’s performance. |

Period & Average Annual Total Returns as of December 31, 2014 (Unaudited)

| 1 Year | 3 Year | Since Inception | Inception Date |

Total Return Bond Fund

Expense Ratios+: Audited Net 0.99% Gross 1.53% | 1.78% | 3.50% | 2.82% | 6/30/11 |

| Barclays US Aggregate Bond Index | 5.97% | 2.66% | 3.67% | 6/30/11 |

| |  |

| | | |

The Growth of $10,000 chart compares the Total Return Bond Fund’s value to the Barclays US Aggregate Bond Index, the Fund’s broad-based benchmark. The chart is intended to give you a general idea of how the Fund performed compared to this benchmark over the period from June 30, 2011 to December 31, 2014. An understanding of the differences between the Fund and this index is important. The index is a hypothetical unmanaged index that does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. The chart and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. | | Top 10 Holdings |

| | as of December 31, 2014 |

| | 1. | Federated Bond Fund | 6.9% |

| | 2. | Fidelity® Capital & Income Fund | 6.7% |

| | 3. | DoubleLine Total Return Bond Fund | 6.6% |

| | 4. | Sentinel Total Return Bond Fund | 6.4% |

| | 5. | Vanguard Total Bond Market ETF | 6.3% |

| | 6. | Putnam Absolute Return 300 Fund | 6.2% |

| | 7. | AllianceBernstein High Income Fund | 5.7% |

| | 8. | Prudential Total Return Bond Fund | 5.7% |

| | 9. | Thompson Bond Fund | 5.5% |

| | 10. | iShares JPMorgan USD Emerging Markets Bond Fund | 5.4% |

| | | | |

| | As a percentage of total net assets. |

Management fees and/or expenses were voluntarily waived and/or reimbursed in order to reduce the operating expenses of the Total Return Bond Fund during the periods shown above. + The Audited Net Expense Ratio is based on average daily net assets and reflects actual expenses of the Fund paid over the one year period ended 12/31/14, including the effect of expense waivers and reimbursements. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s average daily net assets, including acquired fund fees and expenses, as shown in the most current Fund Prospectus. Please see additional disclosures on page 23.

2014 Annual Report | December 31, 2014 | Page 7 |

Quantex Fund™ The Meeder Quantex Fund™ returned 9.48% for the year ended December 31, 2014. For the same time period, the S&P MidCap 400 and Russell 2000 Indexes returned 9.77% and 4.89%, respectively. In addition to the 1-year period, the Quantex Fund™ outperformed the Russell 2000 Index for the 3- and 5-year periods ending December 31, 2014. It also outperformed the S&P MidCap 400 Index on a 3-year period and slightly lagged on a 5-year period ending December 31, 2014. We utilized rankings from our quantitative financial model to determine which securities were to be held in the Fund at the beginning of each year. Relative to the S&P MidCap 400 Index, stock selection within the industrials sector provided the greatest benefit to the Fund, with stock selection in the information technology sector having benefited performance as well. With the drastic drop in oil prices, it is not a surprise the largest detractor from performance was our sector overweight in energy. In addition, stock selection within the consumer staples sector detracted from performance. Stock selection in the utilities sector also contributed to performance, while our underweight allocation to financials detracted from relative returns. For the full year 2014, many stocks contributed positively to the performance of the Fund. The top performing stock for the year was Electronic Arts, which was up 105%. Other top performers for the year included Edwards Lifesciences (up 93%) and Frontier Communications (up 54%). The largest detractors from performance during the year were Cliff’s Natural Resources (down 72%), Peabody Energy (down 59%), and Denbury Resources (down 49%). Additionally, we incorporated the use of equity index derivatives, such as stock index futures, in the Fund in order to equitize cash positions. Since these derivatives are designed to track the respective stock index in question, there was no discernible impact to the Fund’s relative performance in 2014. |

Period & Average Annual Total Returns as of December 31, 2014 (Unaudited)

| | 1 Year | 3 Year | 5 Year | 4/30/05 – 12/31/142 | 10 Year | Inception Date |

Quantex Fund™

Expense Ratios+: Audited Net 1.44% Gross 1.94% | 9.48% | 21.91% | 16.46% | 10.65% | 9.66% | 3/20/85 |

Blended Index1 | 7.35% | 19.62% | 16.06% | 9.98% | 8.78% | 3/31/85 |

| Russell 2000 Index | 4.89% | 19.21% | 15.55% | 9.28% | 7.77% | 3/31/85 |

| S&P MidCap 400 Index | 9.77% | 19.99% | 16.54% | 10.67% | 9.71% | 3/31/85 |

| | Sector Concentration |

| | as of December 31, 2014 |

| | 1. | Consumer Discretionary | 18.5% |

| | 2. | Financials | 14.1% |

| | 3. | Industrials | 11.8% |

| | 4. | Materials | 10.2% |

| | 5. | Information Technology | 10.0% |

| | 6. | Healthcare | 9.6% |

| | 7. | Utilities | 7.6% |

| | 8. | Energy | 5.5% |

| | 9. | Telecommunication Services | 2.1% |

| | 10. | Consumer Staples | 1.4% |

| | 11. | Other | 9.2% |

| | | | |

| | As a percentage of total net assets. Concentrations are subject to change. The Fund has invested in stock index futures contracts in order to equitize cash balances held in the Fund. |

| |

| The Growth of $10,000 chart compares the value of the Quantex Fund™ to the S&P MidCap 400 Index and the Russell 2000 Index, the Fund’s broad-based benchmarks, and to the Blended Index, which consists of 50% of the Russell 2000 Index and 50% of the S&P MidCap 400 Index. The chart is intended to give you a general idea of how the Fund performed compared to these benchmarks over the period from December 31, 2004 to December 31, 2014. An understanding of the differences between the Fund and these indices is important. The benchmark indices do not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

The chart and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. | | Top 10 Holdings |

| | as of December 31, 2014 |

| | 1. | Electronic Arts, Inc. | 1.7% |

| | 2. | Edwards Lifesciences Corp. | 1.6% |

| | 3. | Hospira, Inc. | 1.2% |

| | 4. | Apartment Investment & Management Company | 1.2% |

| | 5. | Frontier Communications Corp. | 1.2% |

| | 6. | F5 Networks, Inc. | 1.2% |

| | 7. | Integrys Energy Group, Inc. | 1.2% |

| | 8. | Macerich Co. | 1.2% |

| | 9. | Pepco Holdings, Inc. | 1.2% |

| | 10. | Robert Half International, Inc. | 1.1% |

| | | | |

| | As a percentage of total net assets. |

The Adviser has contractually agreed to reduce its management fee by 0.25%. This agreement may be terminated by the Adviser after April 30, 2015.

+ The Audited Net Expense Ratio is based on average daily net assets and reflects actual expenses of the Fund paid over the one year period ended 12/31/14, including the effect of expense waivers and reimbursements. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s average daily net assets as shown in the most current Fund Prospectus. Please see additional disclosures on page 23.

2014 Annual Report | December 31, 2014 | Page 9 |

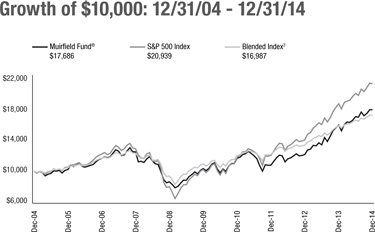

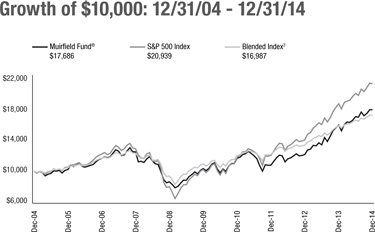

Muirfield Fund® The Meeder Muirfield Fund® returned 12.12% for the year ended December 31, 2014 compared to the Fund’s Blended Index return of 8.08% and S&P 500 Index return of 13.69%. We entered 2014 fully invested in the equity markets following output from our investment model that indicated a favorable risk/reward dynamic in the stock market. Throughout the year we opportunistically took minor defensive positions. However, none of these positions exceeded 10% at any given moment. During the first quarter, we maintained our exposure to value investments and were overweight the healthcare, technology, and consumer discretionary sectors. In addition, we were underweight consumer staples, telecom, and utilities. We also maintained exposure to mid- and small-cap investments, which had mixed results on our relative performance. Security selection in the technology sector was the most profitable for the Fund whereas security selection in the healthcare sector detracted the most from performance. We initiated a position in developed international markets following output from our investment model toward the tail end of the quarter, and continued to build this position into the next couple months. As the second quarter progressed, our investment model continued its preference for international investments which was driven by a combination of currency, valuation, and momentum factors. While emerging markets kept pace with domestic, our allocation to developed foreign markets hindered performance relative to the S&P 500 Index. In addition, our underweight to the industrials sector contributed positively to performance, while stock selection in the financials sector benefited performance as well. Overall stock selection in the healthcare sector was the largest detractor from relative performance. Our most additive stock to performance for the quarter was Hillshire Brands. During the third quarter, we continued to focus on growth sectors, including the consumer discretionary, healthcare, and technology sectors. While we continued to hold emerging markets from the previous quarter, we eliminated this position by the end of September. Relative to the S&P 500 Index, our overall sector positioning benefited performance with the strongest contribution coming from our underweight to industrials and energy. Overall, our stock selection detracted from performance although this was largely influenced by our picks within the consumer discretionary and financial sectors. Combating the underperforming picks in these sectors were beneficial picks in the consumer staple, energy, healthcare, and industrial sectors. Overall, our best performing stock for the quarter was United Therapeutics, while Aaron’s Inc. was our worst performing stock. We entered the fourth quarter with a slight tilt to large-cap securities. Toward the end of the quarter we began to move some of this allocation more toward small-cap stocks as momentum factors shifted. Throughout the quarter we were essentially fully invested which transpired from a modest allocation to cash during the prior quarter. We continued to remain focused on the consumer discretionary, technology, and healthcare sectors. Throughout the quarter, our increasing exposure to small- and mid-capitalization stocks paralleled the improvement in our investment model. Regarding relative performance, our underweight to the energy sector contributed most favorably from an allocation standpoint, while our stock choices within the technology sector generated the largest outperformance from a security selection standpoint. The largest detractor from performance for the quarter was Intercept Pharmaceuticals, while the largest individual contributors to relative performance were IBM and Becton Dickinson. The best performing held position for the period was Delta Air Lines. Additionally, we incorporated the use of equity index derivatives, such as stock index futures, in the Fund in order to equitize cash positions as well as manage the equity exposure of the Fund. With regard to equitizing cash positions, these derivatives are designed to track the respective stock index, so there was no discernible impact to the Fund’s relative performance. With regard to managing the Fund’s equity exposure, the use of stock index futures had a slight negative impact on the performance of the Fund relative to the S&P 500 Index during 2014. |

Period & Average Annual Total Returns as of December 31, 2014 (Unaudited)

| | 1 Year | 3 Year | 5 Year | 10 Year | Inception Date |

Muirfield Fund®

Expense Ratios+: Audited Net 1.22% Gross 1.62% | 12.12% | 18.02% | 11.35% | 5.87% | 8/10/88 |

Blended Index3 | 8.08% | 12.03% | 9.36% | 5.48% | 7/31/88 |

| S&P 500 Index | 13.69% | 20.41% | 15.45% | 7.67% | 7/31/88 |

| | Sector Concentration |

| | as of December 31, 2014 |

| | 1. | Information Technology | 18.9% |

| | 2. | Healthcare | 11.6% |

| | 3. | Consumer Discretionary | 9.6% |

| | 4. | Financials | 9.2% |

| | 5. | Industrials | 8.3% |

| | 6. | Consumer Staples | 7.5% |

| | 7. | Energy | 3.1% |

| | 8. | Telecommunication Services | 1.1% |

| | 9. | Materials | 1.0% |

| | 10. | Utilities | 0.6% |

| | 11. | Other | 29.1% |

| | | | |

| | As a percentage of total net assets. Concentrations are subject to change. The Fund has invested in stock index futures contracts in order to equitize cash balances held in the Fund. |

| | | | | |

The Growth of $10,000 chart compares the value of the Muirfield Fund® to the S&P 500 Index, the Fund’s broad-based benchmark, and to an index composed of 60% of the S&P 500 Index and 40% of 90-day T-bills. The chart is intended to give you a general idea of how the Fund performed compared to these benchmarks over the period from December 31, 2004 to December 31, 2014. An understanding of the differences between the Fund and these benchmarks is important. The benchmark indices are hypothetical unmanaged indices of common stocks and 90-day T-bills that do not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

The chart and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. | | Top 10 Holdings |

| | as of December 31, 2014 |

| | 1. | Apple, Inc. | 2.7% |

| | 2. | Intel Corp. | 1.7% |

| | 3. | Oracle Corp. | 1.6% |

| | 4. | Berkshire Hathaway, Inc. | 1.6% |

| | 5. | Hewlett-Packard Co. | 1.5% |

| | 6. | Exxon Mobil Corp. | 1.4% |

| | 7. | Johnson & Johnson | 1.3% |

| | 8. | American International Group, Inc. | 1.2% |

| | 9. | Archer-Daniels Midland Co. | 1.2% |

| | 10. | CVS Health Corp. | 1.1% |

| | | | |

| | As a percentage of total net assets. |

Management fees and/or expenses were voluntarily waived and/or reimbursed in order to reduce the operating expenses of the Muirfield Fund® during the periods shown above. + The Audited Net Expense Ratio is based on average daily net assets and reflects actual expenses of the Fund paid over the one year period ended 12/31/14, including the effect of expense waivers and reimbursements. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s average daily net assets, including acquired fund fees and expenses, as shown in the most current Fund Prospectus. Please see additional disclosures on page 23.

2014 Annual Report | December 31, 2014 | Page 11 |

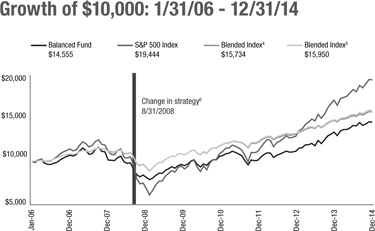

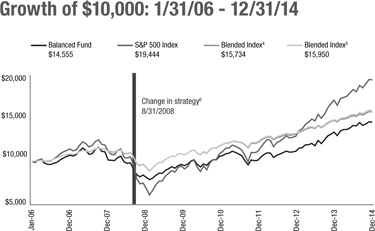

Balanced Fund The Meeder Balanced Fund returned 8.61% for the year ended December 31, 2014 compared to the Blended Index (4) return of 6.57%, the Blended Index (5) return of 7.49%, and the S&P 500 Index return of 13.69%. We entered 2014 fully invested in the stock market following output from our investment model that indicated a favorable risk/reward dynamic in the stock market. Throughout the year we opportunistically took minor defensive positions. However, none of these positions exceeded 7% at any given moment and the Fund remained essentially fully invested throughout the year. During the first quarter, we were overweight the healthcare, technology, and consumer discretionary sectors. In addition, we were underweight consumer staples, telecom, and utilities. Security selection in the technology sector was the most profitable for the Fund whereas security selection in the healthcare sector detracted the most from performance. We initiated a position in developed international markets following output from our investment model toward the tail end of the first quarter, and continued to build this position into the next quarter. Our model preference for international investments was driven by a combination of currency, valuation, and momentum factors. Our allocation to developed foreign markets hindered performance relative to the S&P 500 Index during the second quarter. In addition, our underweight to the industrials sector contributed positively to performance, while stock selection in the financials sector benefited performance as well. Overall stock selection in the healthcare sector was the largest detractor from relative performance. During the third quarter, we continued to focus on growth sectors inclusive of consumer discretionary, healthcare, and technology. While we continued to hold emerging markets from the second quarter, we eliminated this position by the end of September. Relative to the S&P 500 Index, our overall sector positioning benefited performance with the strongest contribution coming from our underweight to industrials and energy. Combating the underperforming picks in the consumer discretionary and financial sectors were beneficial picks in the consumer staple, energy, healthcare, and industrial sectors. We entered the fourth quarter with a slight tilt to large-cap securities. Toward the end of the quarter we began to move some of this allocation more toward small-cap stocks as momentum factors shifted. Throughout the quarter we were essentially fully invested. We continued to remain focused on the consumer discretionary, technology, and healthcare sectors. Regarding relative performance, our underweight to the energy sector contributed most favorably from an allocation standpoint, while our stock choices within the technology sector generated the largest outperformance from a security selection standpoint. In the fixed income portion of the Fund, we were overweight investments with greater credit risk versus that of the broader fixed income market as measured by the Barclays US Aggregate Bond Index. This portion of the Fund underperformed versus the Index due to an underweight allocation to U.S. Government securities. We maintained this portfolio stance as healthy corporate balance sheets and low default rates were supported by an underlying stable U.S. economy. We also maintained an allocation to emerging market bonds which added to relative returns. Throughout the year, duration in the fixed income portion of the Fund was held on average below that of the Index. Additionally, we incorporated the use of equity index derivatives, such as stock index futures, in the Fund in order to equitize cash positions as well as manage the equity exposure of the Fund. With regard to equitizing cash positions, these derivatives are designed to track the respective stock index, so there was no discernible impact to the Fund’s relative performance. With regard to managing the Fund’s equity exposure, the use of stock index futures had a slight negative impact on the performance of the Fund relative to the S&P 500 Index during 2014. |

Period & Average Annual Total Returns as of December 31, 2014 (Unaudited)

| | 1 Year | 3 Year | 5 Year | 8/31/2008 – 12/31/20146 | Since Inception | Inception Date |

Balanced Fund

Expense Ratios+: Audited Net 1.33% Gross 1.79% | 8.61% | 12.84% | 8.53% | 6.43% | 4.30% | 1/31/06 |

Blended Index4 | 6.57% | 8.98% | 7.70% | 5.80% | 5.28% | 1/31/06 |

Blended Index5 | 7.49% | 9.14% | 7.89% | 6.16% | 5.52% | 1/31/06 |

| S&P 500 Index | 13.69% | 20.41% | 15.45% | 10.13% | 7.70% | 1/31/06 |

| | Sector Concentration |

| | as of December 31, 2014 |

| | 1. | Information Technology | 14.3% |

| | 2. | Healthcare | 8.6% |

| | 3. | Financials | 6.7% |

| | 4. | Consumer Discretionary | 6.5% |

| | 5. | Industrials | 6.1% |

| | 6. | Consumer Staples | 5.5% |

| | 7. | Energy | 2.3% |

| | 8. | Materials | 0.8% |

| | 9. | Telecommunication Services | 0.8% |

| | 10. | Utilities | 0.4% |

| | 11. | Other | 48.0% |

| | | | |

| | As a percentage of total net assets. Concentrations are subject to change. The Fund has invested in stock index futures contracts in order to equitize cash balances held in the Fund. |

| | | | | |

| The Growth of $10,000 chart compares the Balanced Fund’s value to the S&P 500 Index, the Fund’s broad-based benchmark, to the Blended Index (4), which is comprised of 42% of the S&P 500 Index, 28% of the average 90-day U.S. T-bill and 30% of the Barclays Intermediate-Term Government/Credit Index and to the Blended Index (5) which is comprised of 2% of the S&P 500 Index, 28% of the average 90-day U.S. Treasury bill and 30% of the Barclays Aggregate Bond Index. The chart is intended to give you a general idea of how the Fund performed compared to these benchmarks over the period from its inception on January 31, 2006 through December 31, 2014. An understanding of the differences between the Fund and these indices is important. The benchmark indices are hypothetical unmanaged indices of common stock that do not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

The chart and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. | | Top 10 Holdings |

| | as of December 31, 2014 |

| | 1. | Sentinel Total Return Bond Fund | 5.2% |

| | 2. | Prudential Total Return Bond Fund | 3.3% |

| | 3. | Federated Bond Fund | 3.2% |

| | 4. | Thompson Bond Fund | 2.5% |

| | 5. | Apple, Inc. | 2.1% |

| | 6. | Vanguard Total Bond Market ETF | 2.0% |

| | 7. | Putnam Diversified Income Trust | 1.6% |

| | 8. | Ivy High Income Fund | 1.5% |

| | 9. | Intel Corp. | 1.3% |

| | 10. | Oracle Corp. | 1.3% |

| | | | |

| | | As a percentage of total net assets. |

Management fees and/or expenses were voluntarily waived and/or reimbursed in order to reduce the operating expenses of the Balanced Fund during the periods shown above. +The Audited Net Expense Ratio is based on average daily net assets and reflects actual expenses of the Fund paid over the one year period ended 12/31/14, including the effect of expense waivers and reimbursements. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s average daily net assets, including acquired fund fees and expenses, as shown in the most current Fund Prospectus. Please see additional disclosures on page 23.

2014 Annual Report | December 31, 2014 | Page 13 |

Dynamic Growth Fund The Meeder Dynamic Growth Fund returned 12.80% for the year ended December 31, 2014 compared to the S&P 500 Index return of 13.69% for the same time period. Although we entered the first quarter with a slight tilt toward small-cap investments, the fund eventually shifted focus back to large-caps as the quarter progressed. The Fund’s performance in the quarter was clearly driven by security selection within the technology sector. Specifically, there was broad based support among our stock picks in the hardware and equipment space. In addition to these picks, the Fund benefited from owning Questcor Pharmaceuticals which ultimately received a buy-out offer. We had immaterial exposure to international markets in the quarter. The largest detractors on performance included our underweight to the financials sector and our security selection within consumer staples. We began the second quarter with an overweight to the consumer discretionary, healthcare, and technology sectors. Additionally, we were underweight the energy, material, and industrial sectors. As the second quarter progressed, we maintained a focus on these sectors within the domestic allocation of the Fund. However, due to an increase in our international holdings, these overweights were brought down in-line with that of the S&P 500. We had exposure to both developed international and emerging markets throughout the quarter and although both had positive performance, the positions ultimately lagged the domestic markets. Allocation effects within the technology and financial sectors had the biggest impact on our positive performance while security selection in the consumer staples sector was the largest detractor from performance. The stock contributing the most to performance for the quarter was Xerox while Western Digital negatively impacted relative performance. Our best performing stock for the period was Conoco Phillips. Our worst performing stock was RR Donnelley & Sons. We entered the third quarter with approximately a 15% weight to emerging markets and maintained this through the end of August. Starting in September we began to trim the position and were completely out of it by the end of the quarter. In addition, during the quarter we shifted our allocation from a slight overweight to mid-cap securities to a neutral weight, adding to large-caps as we brought this exposure down. Overall, our stock picks within the energy and consumer staple sectors proved the most beneficial to the Fund. Our stock picks in the consumer discretionary sector proved to be the largest detractor on performance. Our sector allocations provided the most performance overall as our underweights to energy and industrials were positive. Also, our overweight to technology proved beneficial as well. Security selection in the consumer discretionary sector lowered performance as our retail stocks did poorly. Our best performing stock for the period was United Therapeutics, while the strongest contributor to relative performance was Gilead Sciences due to its larger weight in the Fund. Our worst performing stock for the quarter was Tenneco. We entered the fourth quarter maintaining an overweight to the technology, healthcare, and consumer discretionary sectors. Conversely, our sector underweights were the telecomm, consumer staple, and financial sectors. We began the quarter solely focused on the domestic markets and continued this focus throughout the entire quarter. Toward the end of December, we increased our exposure to momentum names in the portfolio. Our overweight to the technology sector and underweight to energy contributed positively to performance relative to the S&P 500 Index. Our individual equity selection within the healthcare sector was the largest detractor from performance. The best performing stock for the quarter was Delta Air Lines, while Visa contributed the most to performance due to its weight in the Fund. The worst performing stock for the quarter was Intercept Pharmaceuticals which was also the largest detractor relative to the S&P 500 Index. Additionally, we incorporated the use of equity index derivatives, such as stock index futures, in the Fund in order to equitize cash positions. Since these derivatives are designed to track the respective stock index in question, there was no discernible impact to the Fund’s relative performance in 2014. |

Period & Average Annual Total Returns as of December 31, 2014 (Unaudited)

| | 1 Year | 3 Year | 5 Year | 10 Year | Inception Date |

Dynamic Growth Fund

Expense Ratios+: Audited Net 1.22% Gross 1.66% | 12.80% | 19.37% | 13.14% | 6.50% | 2/29/00 |

| S&P 500 Index | 13.69% | 20.41% | 15.45% | 7.67% | 2/29/00 |

| | Sector Concentration |

| | as of December 31, 2014 |

| | 1. | Information Technology | 25.7% |

| | 2. | Healthcare | 16.2% |

| | 3. | Industrials | 11.9% |

| | 4. | Financials | 11.8% |

| | 5. | Consumer Discretionary | 10.9% |

| | 6. | Consumer Staples | 10.2% |

| | 7. | Energy | 5.9% |

| | 8. | Telecommunication Services | 1.3% |

| | 9. | Materials | 1.0% |

| | 10. | Utilities | 0.9% |

| | 11. | Other | 4.2% |

| | | | |

| | As a percentage of total net assets. Concentrations are subject to change. The Fund has invested in stock index futures contracts in order to equitize cash balances held in the Fund. |

| | | | | |

The Growth of $10,000 chart compares the Dynamic Growth Fund’s value to the S&P 500 Index, the Fund’s broad-based benchmark. The chart is intended to give you a general idea of how the Fund performed compared to this benchmark over the period from December 31, 2004 to December 31, 2014. An understanding of the differences between the Fund and this index is important. The S&P 500 Index is a hypothetical unmanaged index of common stocks that does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

The chart and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. | | Top 10 Holdings |

| | as of December 31, 2014 |

| | 1. | Apple, Inc. | 3.1% |

| | 2. | Hewlett-Packard Co. | 1.8% |

| | 3. | Berkshire Hathaway, Inc. | 1.7% |

| | 4. | PepsiCo, Inc. | 1.7% |

| | 5. | Intel Corp. | 1.6% |

| | 6. | Visa, Inc. | 1.6% |

| | 7. | Exxon Mobil Corp. | 1.6% |

| | 8. | Johnson & Johnson | 1.5% |

| | 9. | Oracle Corp. | 1.5% |

| | 10. | Gilead Sciences, Inc. | 1.3% |

| | | | |

| | As a percentage of total net assets. |

Management fees and/or expenses were voluntarily waived and/or reimbursed in order to reduce the operating expenses of the Dynamic Growth Fund during the periods shown above. + The Audited Net Expense Ratio is based on average daily net assets and reflects actual expenses of the Fund paid over the one year period ended 12/31/14, including the effect of expense waivers and reimbursements. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s average daily net assets, including acquired fund fees and expenses, as shown in the most current Fund Prospectus. Please see additional disclosures on page 23.

2014 Annual Report | December 31, 2014 | Page 15 |

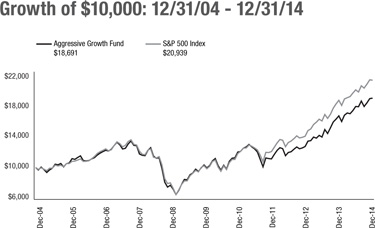

Aggressive Growth Fund The Meeder Aggressive Growth Fund returned 13.49% for the year ended December 31, 2014. By comparison, the S&P 500 Index returned 13.69% during the same time period. Although we maintained positions in mid- and small-cap stocks during the first quarter, we decreased our weight and added to large-cap stocks in accordance with our quantitative models. We also maintained an overweight exposure to the healthcare, information technology, and consumer discretionary sectors. Even though we added a position in developed international markets during the first quarter, we avoided emerging markets following output from our investment model. We began the second quarter with an overweight to the technology, healthcare, and consumer discretionary sectors, while we were underweight energy, telecomm, and utilities in the Fund. As the quarter progressed, we added a position to emerging markets and maintained this position throughout the entire quarter. Both of our international positions (developed and emerging) added to performance but lagged the S&P 500 Index for the quarter. Relative to this index, our underweight to the industrials sector benefited performance, while stock selection in the financial sector contributed to performance as well. Stock selection in the technology sector was the largest detractor from performance. Our best performing stocks in the quarter were Hillshire Brands and Protective Life, both up over 30% for the quarter. Our worst performing stocks were Brocade Communications and Unifirst Corp, both down approximately 13%. During the third quarter, we exited our international position as both developed and emerging markets lagged the S&P 500 Index. Our model that compares domestic and international markets began to favor domestic markets due to currency and momentum factors. In our domestic stock market exposure, we continued to focus on the technology, healthcare, and consumer discretionary sectors. Overall, our stock selection within the healthcare sector added the most to performance while our underweight to the energy sector helped as well. Our selection within the technology sector offset some of the positive gains made by our overweight allocation. The largest detractor to performance was our security selection within the consumer discretionary sector. Security selection within the consumer staples sector added to performance which was driven by a broad number of names contributing positively to relative returns. We began the fourth quarter with a focus on large-cap domestic equities. As the valuation and momentum metrics in our investment model changed, we began to slightly shift away from this position toward more mid- and small-cap securities. We maintained zero exposure to international markets throughout the quarter which proved beneficial as both developed and emerging markets trailed the S&P 500 Index for the quarter by more than 9%. Security selection within the technology sector had a broad base positive contribution with numerous holdings showing steady wins over the benchmark. Adding to this positive performance was our overweight allocation to the sector. This positive contribution was offset by our security selection within the financial sector as well as our underweight allocation. The biggest driver of this underperformance came from Genworth Financial (down 35% for the quarter) as the company continued to struggle with capital flexibility. Our security selection and allocation to the healthcare and consumer staples sectors detracted from performance while our selection and allocation in the energy and materials sectors added to performance. Additionally, we incorporated the use of equity index derivatives, such as stock index futures, in the Fund in order to equitize cash positions. Since these derivatives are designed to track the respective stock index in question, there was no discernible impact to the Fund’s relative performance during 2014. |

Period & Average Annual Total Returns as of December 31, 2014 (Unaudited)

| | 1 Year | 3 Year | 5 Year | 10 Year | Inception Date |

Aggressive Growth Fund

Expense Ratios+: Audited Net 1.33% Gross 1.74% | 13.49% | 19.06% | 12.63% | 6.45% | 2/29/00 |

| S&P 500 Index | 13.69% | 20.41% | 15.45% | 7.67% | 2/29/00 |

| | Sector Concentration |

| | as of December 31, 2014 |

| | 1. | Information Technology | 25.9% |

| | 2. | Healthcare | 16.5% |

| | 3. | Consumer Discretionary | 12.6% |

| | 4. | Financials | 12.0% |

| | 5. | Industrials | 11.3% |

| | 6. | Consumer Staples | 8.7% |

| | 7. | Energy | 4.4% |

| | 8. | Materials | 1.8% |

| | 9. | Utilities | 1.1% |

| | 10. | Telecommunication Services | 0.6% |

| | 11. | Other | 5.1% |

| | | | |

| | As a percentage of total net assets. Concentrations are subject to change. The Fund has invested in stock index futures contracts in order to equitize cash balances held in the Fund. |

| | | | | |

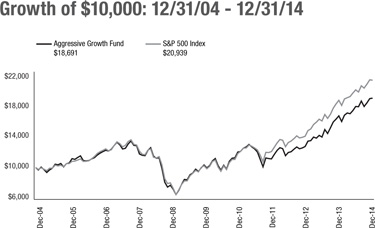

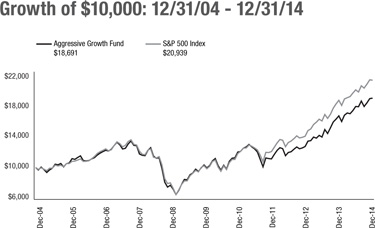

The Growth of $10,000 chart compares the Aggressive Growth Fund’s value to the S&P 500 Index, the Fund’s broad-based benchmark. The chart is intended to give you a general idea of how the Fund performed compared to this benchmark over the period from December 31, 2004 to December 31, 2014. An understanding of the differences between the Fund and this index is important. The S&P 500 Index is a widely recognized unmanaged index of common stock prices that does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

The chart and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. | | Top 10 Holdings |

| | as of December 31, 2014 |

| | 1. | Apple, Inc. | 3.2% |

| | 2. | Hewlett-Packard Co. | 2.3% |

| | 3. | Oracle Corp. | 1.9% |

| | 4. | Intel Corp. | 1.8% |

| | 5. | PepsiCo, Inc. | 1.7% |

| | 6. | Visa, Inc. | 1.6% |

| | 7. | Berkshire Hathaway, Inc. | 1.6% |

| | 8. | CVS Health Corp. | 1.5% |

| | 9. | Archer-Daniels Midland Co. | 1.4% |

| | 10. | Gilead Sciences, Inc. | 1.4% |

| | | | |

| | As a percentage of total net assets. |

Management fees and/or expenses were voluntarily waived and/or reimbursed in order to reduce the operating expenses of the Aggressive Growth Fund during the periods shown above. + The Audited Net Expense Ratio is based on average daily net assets and reflects actual expenses of the Fund paid over the one year period ended 12/31/14, including the effect of expense waivers and reimbursements. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s average daily net assets, including acquired fund fees and expenses, as shown in the most current Fund Prospectus. Please see additional disclosures on page 23.

2014 Annual Report | December 31, 2014 | Page 17 |

Strategic Growth Fund The Meeder Strategic Growth Fund returned 5.87% for the year ended December 31, 2014, compared to the custom benchmark return of 4.30% for the same period. The Fund underperformed the broader market during the year, as measured by the S&P 500 Index, which returned 13.69%. The Strategic Growth Fund is fully invested in the equity market at all times, and holds a fixed allocation across six distinct investment categories. The mix of investments selected to represent each investment category is variable and actively managed using our strategic investment selection process. The target allocation as of the end of 2014 was: 30% international, 25% large-cap, 20% mid-cap, 10% small-cap, 7.5% real estate, and 7.5% commodities. The strategic weights to each of these categories are designed to optimize the return and risk tradeoff based on our analysis. The Fund’s performance during 2014 versus the S&P 500 can be attributed to several of the asset allocation categories. While the S&P 500 posted a gain of 13.69% during the year, the international category, which comprised 30% of the Fund, lagged the performance of the S&P 500 with developed international falling 4.90% for the year while emerging markets declined by 2.19%. Additionally, the commodities category fell by 33.06%, driven by the sharp decline in oil prices. Domestically, smaller market cap ranges also underperformed the S&P 500, with the Russell 2000 Index of small-cap stocks returning 4.89%, while the S&P MidCap 400 Index gained 9.77% for 2014. The only asset allocation category in question that posted returns above the S&P 500 in 2014 was real estate investments, with the Dow Jones US Select REIT Index increasing 32.00% for the year. The Fund experienced favorable results when comparing the performance of underlying holdings against their respective benchmark indexes in several asset allocation categories. Overall, our mid-cap holdings outperformed the respective benchmark, which was partially driven by acquisition activity involving positions such as Protective Life and Hillshire Brands. We also experienced favorable relative performance in our commodity-related holdings, with Tesoro, PPG Industries, and Rock-Tenn providing positive results. Our holdings in the international and large-cap categories performed approximately in line with their respective benchmarks, while our holdings in the real estate category trailed the benchmark. Additionally, we incorporated the use of equity index derivatives, such as stock index futures, in the Fund in order to equitize cash positions and make adjustments to certain asset allocation categories. Since these derivatives are designed to track the respective stock index in question, there was no discernible impact to the Fund’s relative performance in 2014. |

Period & Average Annual Total Returns as of December 31, 2014 (Unaudited)

| | 1 Year | 3 Year | 5 Year | 8/31/2008 – 12/31/20149 | Since Inception | Inception Date |

Strategic Growth Fund

Expense Ratios+: Audited Net 1.23% Gross 1.75% | 5.87% | 14.04% | 10.28% | 5.97% | 4.10% | 1/31/06 |

Blended Index7 | 4.30% | 13.54% | 10.66% | 5.85% | 5.96% | 1/31/06 |

Blended Index8 | 3.99% | 13.43% | 10.61% | 6.01% | 6.54% | 1/31/06 |

| S&P 500 Index | 13.69% | 20.41% | 15.45% | 10.13% | 7.70% | 1/31/06 |

| | Sector Concentration |

| as of December 31, 2014 |

| 1. | Emerging Markets | 15.0% |

| 2. | Developed International | 14.8% |

| 3. | Information Technology | 13.3% |

| 4. | Financials | 13.0% |

| 5. | Energy | 8.4% |

| 6. | Consumer Discretionary | 7.8% |

| 7. | Healthcare | 7.6% |

| 8. | Consumer Staples | 6.1% |

| 9. | Industrials | 5.8% |

| 10. | Materials | 1.6% |

| 11. | Utilities | 1.4% |

| 12. | Telecommunication Services | 0.7% |

| 13. | Other | 4.5% |

| | | |

| As a percentage of total net assets. Concentrations are subject to change. The Fund has invested in stock index futures contracts in order to equitize cash balances held in the Fund. |

| | | | | |

The Growth of $10,000 chart compares the Strategic Growth Fund’s value to the S&P 500 Index, the Fund’s broad-based benchmark, a Blended Index (7), which consists of 25% of the S&P 500 Index, 20% of the S&P 400 Index, 15% of the MSCI EAFE Index, 15% of the MSCI Emerging Markets Index, 10% of the Russell 2000 Index, 7.5% of the Dow Jones US Select REIT Index and 7.5% of the S&P GSCI Index and a Blended Index (8) which consists of 25% of the S&P 500 Index, 20% of the S&P MidCap 400 Index, 12.5% of the Russell 2000 Index, 12.5% of the Dow Jones U.S. Select REIT Index, 12.5% of the S&P GSCI Index, 12% of the MSCI EAFE Index, and 5.5% of the MSCI Emerging Markets Index. The chart is intended to give you a general idea of how the Fund performed compared to these benchmarks over the period from its inception on January 31, 2006 to December 31, 2014. An understanding of the differences between the Fund and these indices is important. The benchmark indices are hypothetical unmanaged indices of common stock that do not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

The chart and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. | | Top 10 Holdings |

| as of December 31, 2014 |

| | | |

| 1. | iShares MSCI Emerging Markets ETF | 7.8% |

| 2. | iShares MSCI EAFE ETF | 7.5% |

| 3. | Ivy International Core Equity Fund | 7.3% |

| 4. | Oppenheimer Developing Markets Fund | 7.2% |

| 5. | Oracle Corp. | 1.3% |

| 6. | Diamondrock Hospitality Co. | 1.2% |

| 7. | Hewlett-Packard Co. | 1.1% |

| 8. | Exxon Mobil Corp. | 1.1% |

| 9. | Visa, Inc. | 1.0% |

| 10. | Western Digital Corp. | 1.0% |

| | | |

| As a percentage of total net assets. |

Management fees and/or expenses were voluntarily waived and/or reimbursed in order to reduce the operating expenses of the Strategic Growth Fund during the periods shown above. +The Audited Net Expense Ratio is based on average daily net assets and reflects actual expenses of the Fund paid over the one year period ended 12/31/14, including the effect of expense waivers and reimbursements. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s average daily net assets, including acquired fund fees and expenses, as shown in the most current Fund Prospectus. Please see additional disclosures on page 23.

2014 Annual Report | December 31, 2014 | Page 19 |

Utilities and Infrastructure Fund The Meeder Utilities and Infrastructure Fund returned 9.42% for the year ended December 31, 2014, compared to the Russell 3000 Utilities Index return of 16.33% for the same time period. During the first quarter, large-cap electric utilities were surprisingly strong in contrast to the negative sentiment that prevailed during the prior year. Usage was strong due to severe winter weather, while economic data was far from robust and interest rates did not provide the kind of headwind that many were expecting. In our portfolio, the year began with a timely purchase of Capstone Turbine, the world’s leading manufacturer of micro-turbines used to provide electricity to remotely located infrastructure as well as backups. Capstone is experiencing strong demand from oil, gas, and mining companies that are traveling far afield for new reserves, particularly outside North America. To fund this purchase, as well as others in the quarter, we sold Turkcell due to the volatile political environment in Turkey, and took advantage of strong prices to sell or trim ARRIS, Ensco, ITC, Corning, National Grid, Questar, NiSource, Qualcomm, and Black Hills. Strong contributions from companies producing, transporting, and processing natural gas and renewable energy drove portfolio returns in the second quarter. We initiated a position in Ormat Technologies, the world’s largest private producer of geothermal power. Ormat designs, builds, owns, and operates utility-scale generation facilities, the bulk of which are located in Nevada, California, and Hawaii. Long-time holding American Tower turned in strong performance for the quarter on better than expected earnings and an acquisition of 4,600 cell towers in Brazil. During the third quarter, investors took a moment to collectively pause and assess the market’s next turn. While the headlines provided ample fodder to keep investors on edge, the persistent underlying favorable trends among the essential service providers in this arena remained intact. During the quarter we added UIL Holdings, a decades-old electric and gas utility. UIL has operations in Massachusetts and Connecticut and is set to nearly double its customer base following its blockbuster privatization of city-owned Philadelphia Gas Works (PGW). We also added MasTec, one of North America’s leading engineering and construction firms, when an opportunistic entry point emerged. To make room for MasTec, we took partial profits in Sempra Energy, National Fuel Gas, Corning, American Tower, and Williams, and exited our position in Capstone Turbine. Utility companies had a stellar fourth quarter while energy infrastructure lagged. At the beginning of the quarter we bought OGE Energy, which owns a 50% general partner interest and 26% interest in Enable Midstream, a regional natural gas transportation MLP. Rapid growth at Enable supplements steady growth in OGE’s legacy utility businesses in eastern Oklahoma and western Arkansas. We bought AES, a global utility that is aggressively cleaning up its balance sheet, divesting nonessential businesses, and trading at a healthy discount. Lastly, on the regulated utility front we added to MDU on weakness related to its Bakken region exposure. Substantially none of MDU’s $824 million infrastructure growth backlog is at risk, and the company is exiting its oil operations. To fund these positions we sold NiSource as well as ONE Gas and Black Hills, and trimmed General Electric, American Water, and Covanta. With a unique combination of essential-service providers and their enabling industries, we believe this dynamic portfolio is well positioned going forward. |

Period & Average Annual Total Returns as of December 31, 2014 (Unaudited)

| | 1 Year | 3 Year | 5 Year | 10 Year | Inception Date |

Utilities and Infrastructure Fund10

Expense Ratios+: Audited Net 1.88% Gross 1.99% | 9.42% | 12.73% | 11.18% | 8.44% | 6/21/95 |

| Russell 3000 Utilities Index | 16.33% | 13.05% | 12.67% | 7.93% | 6/30/95 |

| | Sector Concentration |

| | as of December 31, 2014 |

| | 1. | Telecommunication Services | 23.0% |

| | 2. | Utility Services | 22.2% |

| | 3. | Pipelines | 16.1% |

| | 4. | Natural Gas Distribution | 14.1% |

| | 5. | Electric Utility | 11.8% |

| | 6. | Water Utility | 5.2% |

| | 7. | Oil Exploration & Production | 3.3% |

| | 8. | Other | 4.3% |

| | | | |

| | As a percentage of total net assets. Concentrations are subject to change. |

| | | | | |

| The Growth of $10,000 chart compares the Utilities and Infrastructure Fund’s value to the Russell 3000 Utilities Index, the Fund’s broad-based benchmark. The chart is intended to give you a general idea of how the Fund performed compared to this benchmarks over the period from December 31, 2004 to December 31, 2014. An understanding of the differences between the Fund and this index is important. The benchmark index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

The chart and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. | | Top 10 Holdings |

| | as of December 31, 2014 |

| | 1. | Kinder Morgan, Inc. | 5.3% |

| | 2. | Macquarie Infrastructure Co. LLC | 4.3% |

| | 3. | Enterprise Products Partners LP | 4.1% |

| | 4. | Corning, Inc. | 3.9% |

| | 5. | Energy Transfer Equity LP | 3.4% |

| | 6. | MDU Resources Group, Inc. | 3.3% |

| | 7. | Veolia Environnement SA ADR | 3.3% |

| | 8. | American Tower Corp. | 3.3% |

| | 9. | Telephone and Data Systems, Inc. | 3.2% |

| | 10. | Qualcomm, Inc. | 2.9% |

| | | | |

| | As a percentage of total net assets. |

Management fees and/or expenses were voluntarily waived and/or reimbursed in order to reduce the operating expenses of the Utilities and Infrastructure Fund during the periods shown above. + The Audited Net Expense Ratio is based on average daily net assets and reflects actual expenses of the Fund paid over the one year period ended 12/31/14, including the effect of expense waivers and reimbursements. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s average daily net assets as shown in the most current Fund Prospectus. Please see additional disclosures on page 23.

2014 Annual Report | December 31, 2014 | Page 21 |

Shareholder Expense Analysis (Unaudited)

Shareholders of mutual funds pay ongoing expenses, such as advisory fees, distribution and service fees (12b-1 fees) and other fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples below are based on an investment of $1,000 invested at the beginning of the period and held for the six-month period from June 30, 2014 to December 31, 2014.

ACTUAL EXPENSES: You may use actual account values and actual expenses, along with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (e.g.: an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES: Hypothetical account values and hypothetical expenses are based on the Funds’ actual expense ratios and assume rates of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | | Beginning

Account Value

(6/30/2014) | Ending

Account Value (12/31/2014) | Expenses Paid

During Period1

(6/30/2014 - 12/31/2014) | Expense Ratio

(Annualized) |

Muirfield Fund® | Actual | $1,000.00 | $1,051.60 | $6.31 | 1.22% |

| | Hypothetical | $1,000.00 | $1,019.06 | $6.21 | 1.22% |

| Utilities & Infrastructure Fund | Actual | $1,000.00 | $968.10 | $9.52 | 1.92% |

| | Hypothetical | $1,000.00 | $1,015.53 | $9.75 | 1.92% |

| Quantex Fund™ | Actual | $1,000.00 | $1,009.50 | $7.55 | 1.49% |

| | Hypothetical | $1,000.00 | $1,017.69 | $7.58 | 1.49% |

| Dynamic Growth Fund | Actual | $1,000.00 | $1,064.20 | $6.35 | 1.22% |

| | Hypothetical | $1,000.00 | $1,019.06 | $6.21 | 1.22% |

| Aggressive Growth Fund | Actual | $1,000.00 | $1,059.20 | $6.96 | 1.34% |

| | Hypothetical | $1,000.00 | $1,018.45 | $6.82 | 1.34% |

| Balanced Fund | Actual | $1,000.00 | $1,027.30 | $6.80 | 1.33% |

| | Hypothetical | $1,000.00 | $1,018.50 | $6.77 | 1.33% |

| Strategic Growth Fund | Actual | $1,000.00 | $973.10 | $6.02 | 1.21% |

| | Hypothetical | $1,000.00 | $1,019.11 | $6.16 | 1.21% |

| Total Return Bond Fund | Actual | $1,000.00 | $984.00 | $4.95 | 0.99% |

| | Hypothetical | $1,000.00 | $1,020.21 | $5.04 | 0.99% |

| Money Market Fund - Retail Class | Actual | $1,000.00 | $1,000.30 | $0.76 | 0.15% |

| | Hypothetical | $1,000.00 | $1,024.45 | $0.77 | 0.15% |

| Money Market Fund - Institutional Class | Actual | $1,000.00 | $1,000.50 | $0.40 | 0.08% |

| | Hypothetical | $1,000.00 | $1,024.80 | $0.41 | 0.08% |

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, hypothetical information is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if any transactional costs were included, your costs would have been higher.

| 1 | Expenses are equal to the Funds’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the total number of days in the six-month period). |

| Page 22 | 2014 Annual Report | December 31, 2014 |

Disclosures

Past performance is not a guarantee of future results. Investing in securities involves inherent risks, including the risk that you can lose the value of your investment. There is no assurance that the investment process will lead to successful results. Investments in foreign securities may entail unique and additional risks including political, market and currency risks. Returns for periods of one year and greater are annualized. All performance figures represent total returns and average annual total returns or current and effective yields for the periods ended December 31, 2014. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so an investor’s shares or units, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Current performance data is available at www.meederfunds.com. Management fees and/or expenses were voluntarily waived and/or reimbursed in Meeder Funds® during the periods shown to reduce expenses. Any transfer agent fee waivers are contractual. The Quantex FundTM management fee waiver is contractual and can be terminated annually by the Adviser on its renewal date, April 30, 2015.

| 1 | The blended index consists of 50% of the Russell 2000 Index and 50% of the S&P MidCap 400 Index. |

| 2 | The Quantex Fund™ was previously known as The Highlands Growth Fund. On April 30, 2005, The Highlands Growth Fund changed its name to the Quantex Fund™, also changing the Fund’s investment objective and strategies. The Highlands Growth Fund focused on large-cap equities, while the Quantex Fund™ utilizes quantitative investment strategies that invest primarily in small- and mid-cap equities. Due to this change in strategies on April 30, 2005, the S&P 500 Index is a more comparative index for Fund performance prior to April 30, 2005. The Russell 2000 Index and S&P MidCap 400 Index are more comparative indices for Fund performance after April 30, 2005. |

| 3 | The blended index is comprised of 60% of the S&P 500 Index and 40% of the average 90-day U.S. T-bill. |

| 4 | The blended index is comprised of 42% of the S&P 500 Index, 28% of the average 90-day U.S. T-bill and 30% of the Barclays Intermediate-Term Government/Credit Index. The Blended Index was used from January 1, 2010 to December 31, 2013. |

| 5 | The blended index is comprised of 42% of the S&P 500 Index, 28% of the average 90-day U.S. Treasury bill and 30% of the Barclays Aggregate Bond Index. The Blended Index was used from January 1, 2014 to December 31, 2014. |

| 6 | On August 25, 2008, The Defensive Growth Fund became known as The Defensive Balanced Fund and its investment strategy changed. In 2012, The Defensive Balanced Fund became known as the Balanced Fund. This Fund will always invest at least 30% and may invest up to 70% of its assets primarily in equity mutual funds. In addition, this Fund will always invest at least 30% and may invest up to 70% of its assets primarily in investment grade bonds, money market instruments, or exchange traded funds. |

| 7 | The blended index is comprised of 25% of the S&P 500 Index, 20% of the S&P 400 Index, 15% of the MSCI EAFE Index, 15% of the MSCI Emerging Markets Index, 10% of the Russell 2000 Index, 7.5% of the Dow Jones US Select REIT Index and 7.5% of the S&P GSCI Index. The Blended Index is representative of the average composition of the Strategic Growth Fund from January 1, 2014 to December 31, 2014. |

| 8 | The blended index is comprised of 25% of the S&P 500 Index, 20% of the S&P MidCap 400 Index, 12.5% of the Russell 2000 Index, 12.5% of the Dow Jones U.S. Select REIT Index, 12.5% of the S&P GSCI Index, 12% of the MSCI EAFE Index, and 5.5% of the MSCI Emerging Markets Index. The Blended Index is representative of the average composition of the Strategic Growth Fund from August 25, 2008 to December 31, 2013. |

| 9 | On August 25, 2008, The Focused Growth Fund became known as the Strategic Growth Fund and its investment strategy changed. This Fund will pursue its goal by investing primarily in open-end or closed-end investment companies that seek capital growth or appreciation without regard to current income. In addition, this Fund will always have set allocations to U.S. large-cap equities, U.S. mid-cap equities, U.S. small-cap equities, non-U.S./International (including emerging markets) equities, real estate equities and commodity based equities. |

| 10 | The Utilities and Infrastructure Fund was previously known as The Total Return Utilities Fund. On June 30, 2011, the Total Return Utilities Fund changed its name to the Utilities and Infrastructure Fund. Its investment objective and strategy remained unchanged. |

| * | The current and effective yields quoted for the Money Market Fund are as of December 31, 2014. Yield quotations more closely reflect the current earnings of the Money Market Fund than do total return quotations. To obtain the current 7-day yields for the Money Market Fund, call Meeder Funds® Client Services Department toll free at (800) 325-3539 or (614) 760-2159. Investments in the Money Market Fund (either class) are not a deposit and are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in Money Market Fund (either class). |