| Letter to Shareholders | 1 |

The Quantex FundTM | 4 |

| The Aggressive Growth Fund | 6 |

| The Dynamic Growth Fund | 8 |

| The Strategic Growth Fund | 10 |

| The Muirfield Fund® | 12 |

| The Defensive Balanced Fund | 14 |

| The Utilities and Infrastructure Fund | 16 |

| The Total Return Bond Fund | 18 |

| The Money Market Fund | 20 |

| Shareholder Expense Analysis | 22 |

| Disclosures | 23 |

| Fund Holdings & Financial Statements | 24 |

Our Mission Statement Every day, our mission is to exceed, with integrity, passion, and discipline, the expectations of our shareholders’ and clients’ overall investment experience. Core Values The Client/Shareholder Is Our #1 Priority Always remember whom we are serving. Our livelihood depends on providing a superior overall investment experience that exceeds the expectation of our shareholders and clients. Clarity Of Purpose Our organization has a clear, well-defined vision. All of our associates are committed to and understand how they will contribute to that vision. Communication We expect open and effective communication, full reporting, including good and bad news, and constructive feedback. Integrity We insist upon honesty and adhere to the highest ethical standards. Excellence/ Innovation Our associates strive each day for excellence in the work they perform, seek innovative ways to solve problems and introduce new ideas to take advantage of opportunities. We are a “Think Outside The Box” company. Associate Well-Being We value the success and well-being of our associates. We recognize and reward our associates’ contributions. Respect For Others Respect all people, value the differences among them and treat them as you would like to be treated. Seek First To Understand When interacting with others, place curiosity and understanding of their perspective FIRST, setting aside preconceived opinions and quick judgment. Teamwork We are a synergistic organization that works as a team to exceed our objectives. Profit We are profitable. Profitability enhances our services and capabilities, and affords everyone the opportunity to further their financial well-being. |

| 2011 Annual Report | December 31, 2011 |

| Letter to Shareholders | December 31, 2011 |

The year ended December 31, 2011 proved difficult for investors in the face of renewed uncertainty. Europe drove the financial news cycle, which lead to a heightened level of volatility in the capital markets. Slow growth in the U.S. was met with negligible growth in Europe, and the possibility of a European recession is on the horizon. Tepid growth and harsh austerity measures have led to political unrest in the developed world, while the upcoming U.S. presidential election has ensured that politics will continue to play a pivotal role. Despite the presence of negative headlines, there were positive developments in 2011 as well. Corporate earnings in the U.S. reached historically high levels while the S&P 500 Index remains nearly 20% below its peak in October 2007, which creates favorable valuations. A strong jobs report at the beginning of 2012, along with a reduction in the unemployment rate to 8.5%, showed a marked improvement in the labor market. Overall, the economic picture remains clouded by uncertainty as we await resolution to the European sovereign debt crisis, which depends on the actions of policymakers.

European Debt Problems Linger

The European debt crisis entered a dangerous new phase in 2011 as Italy faced increased credit market pressure and Italian bond yields spiked even higher. Both Italy and Spain saw yields on their government bonds increase significantly throughout 2011 as investors shunned risky assets in favor of safe-havens, such as U.S. Treasuries. This development is significant since Italy is the third largest Eurozone economy and is home to the third largest bond market in the world. European leaders continue the struggle to find common ground in an effort to fight the crisis, with Germany opposed to creating “Eurobonds.” In addition, Germany remains unsupportive in calls for the European Central Bank (ECB) to make large scale bond purchases that could help contain the bond yields of countries already under pressure. As the primary creditor to European debtor nations, Germany’s actions are being followed closely. In response to these issues, the credit ratings of several European countries, including France and Spain, have been lowered.

U.S. Debt Ceiling Debate

The debate in Congress over raising the U.S. debt ceiling was fraught with conflict as a compromise between Republicans and Democrats proved elusive. For the first time, the Federal Government came perilously close to defaulting on its debt. After much public disagreement, both political parties were able to reach a compromise. Unfortunately, the package that was approved has been widely viewed as a short-term fix as opposed to a long-term solution. The agreed upon deal consists of raising the debt ceiling and simultaneously cutting spending in similar amounts, allowing the U.S. to avoid a default. The deal also delegated much of the decision making authority to a bipartisan deficit “Super Committee” consisting of 12 members

| 2011 Annual Report | December 31, 2011 |

of Congress. Unfortunately, the Super Committee was unable to reach a compromise, and any ultimate decision has again been delayed, potentially leading to automatic spending cuts in 2013.

U.S. Credit Rating Downgrade

On Friday August 5th, the credit rating agency Standard & Poor’s (S&P) downgraded the United States Government’s long-term credit rating. The rating was cut one notch, from the highest rating of AAA to AA+. The short-term debt rating was affirmed at A-1+, which is the highest short-term rating available at S&P. Rather than reflecting the immediate inability of the U.S. to meet its obligations, the downgrade was viewed as a critique of the inability of Congress to reach a long-term debt and deficit reduction deal. The downgrade of America’s credit rating sent a negative ripple into the equity markets, adding to mounting uncertainty about the global economy. Ironically, Treasury yields continued to decline following the downgrade as U.S. Treasury securities are still perceived as a safe haven asset. Despite the downgrade from S&P, the other two major rating agencies, Moody’s and Fitch, have both recently affirmed their AAA credit rating on the U.S.

Fed Remains Accommodative

Against the backdrop of lackluster economic growth and threats posed by the European sovereign debt crisis, the Federal Reserve continued down a path of easy monetary policy designed to keep interest rates extremely low. This included additional language in Fed statements that commits to low rates into 2014, as well as a program called “Operation Twist”. This consists of selling short-term treasury securities while simultaneously buying long-term treasuries, in an effort to suppress long-term interest rates. The Fed’s actions, along with elevated levels of risk and volatility around the world, combined to drive U.S. treasury yields lower in 2011. Low treasury yields impact many areas of the economy, and influence the interest rates that businesses pay for loans as well as mortgage rates for home buyers.

Economic Data Improving

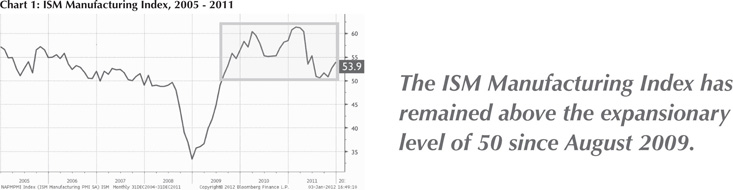

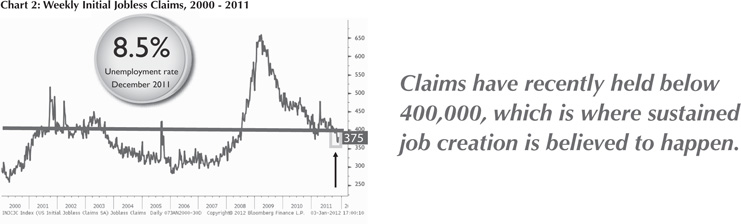

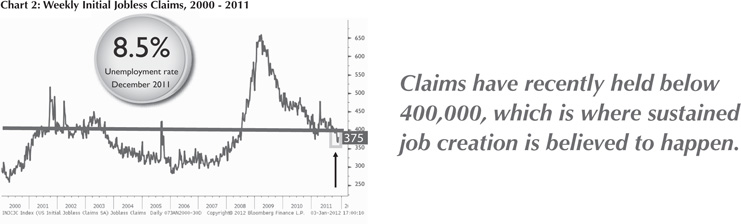

Economic data in the U.S. continues to improve, and there is evidence that consumers are feeling more optimistic as we transition into 2012. The Conference Board’s Consumer Confidence Index currently stands at 64.5, which is the highest level since April of 2011 and is significantly above the levels seen early in the recovery. Although GDP growth has been relatively anemic compared to past recoveries, we still have had eight consecutive quarters of growth. A key statistic related to manufacturing activity, the Institute for Supply Management’s (ISM) Manufacturing Index, was reported at 53.9 for December, and has remained above the expansionary level of 50 since August of 2009 (see Chart 1 on previous page). The unemployment rate declined to 8.5% for December, and is currently at the lowest level since February of 2009. Going forward, the current level of weekly initial jobless claims bodes well for the labor market. Claims have recently held below 400,000, which is a level that many economists consider significant since it is believed that sustained job creation occurs below this level (see Chart 2).

| 2011 Annual Report | December 31, 2011 |

Emerging market economies raise interest rates to stifle inflation

Since 2010, fast growing economies such as China and India have begun tightening monetary policy in an attempt to ward off rising rates of inflation. For instance, the Reserve Bank of India embarked on an interest rate tightening cycle, while The People’s Bank of China has raised rates as well. China has also raised its bank reserve requirements in an effort to decrease its money supply and fight inflation. This stands in stark contrast to developed economies, which have generally maintained interest rates at historically low levels in an effort to boost economic growth. However, as emerging market economies began tightening monetary policy, there was concern that such actions would slow their growth too much, especially against the backdrop of slowing growth in many developed economies.

Outlook for 2012

Many of the issues impacting 2011 are expected to persist well into 2012. Uncertainty is ever present as the European sovereign debt crisis continues to weigh on the capital markets, while the political landscape in both the U.S. and Europe remains volatile. Despite this, we have found several reasons to remain optimistic about the prospects for the domestic economy. Corporate earnings are strong, which also creates favorable valuations in the stock market. Job growth is showing signs of strength, which should aid the economic recovery, while manufacturing and consumer confidence

levels have both shown marked improvement since the start of the recovery. The Federal Reserve has maintained its accommodative stance, which should preserve the low interest rate environment. If European leaders can agree to a comprehensive solution to stem the sovereign debt crisis, then we believe the aforementioned factors could propel the U.S. economy to stronger than expected performance in 2012.

As we monitor the capital markets and our investment models, we will continuously evaluate our defensive position in The Muirfield Fund® and the equity portion of The Defensive Balanced Fund. We will look for opportunities to adjust portfolio weights among growth and value stocks, large-, mid-, and small-caps, and domestic and international investments in order to enhance returns and manage risk for our clients. We will also continue to proactively manage our sector exposures and will make adjustments as our investment models evolve. We will continue to select mutual funds and ETFs that we believe are best positioned to outperform. In our fixed income Funds, we will look to enhance returns by adjusting portfolio durations as well as manage credit quality.

On the following pages, you will find a review of how the The Flex-funds® Mutual Funds have performed. Please read the commentaries to learn more about the investment decisions we made during the past year. On behalf of all of the associates at Meeder Asset Management and The Flex-funds®, we thank you for the trust and confidence you have placed in our investment management services.

Robert S. Meeder

President

The Flex-funds®

December 31, 2011

| 2011 Annual Report | December 31, 2011 |

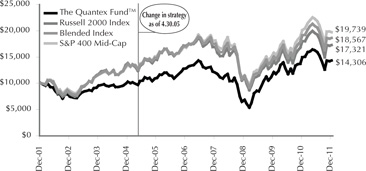

The Quantex Fund™ The Quantex FundTM outperformed both the Russell 2000 and the S&P 400 Mid-Cap indices for the three year period ended 12/31/11. |

The Flex-funds® Quantex Fund™ returned -4.05% for the year ended December 31, 2011. For the same time period, the Russell 2000 and the S&P 400 Mid-Cap Indices returned -4.17% and -1.73%, respectively. For the period ended December 31, 2011, The Quantex Fund™ has outperformed both the Russell 2000 Index and the S&P 400 Mid-Cap Index for the 3-year time period.

We have consistently employed our quantitative stock selection process since April 30, 2005 for The Quantex Fund™. We utilize rankings from our quantitative financial model to determine which securities are to be held in the Fund on an annual basis. As a result, the Fund is rebalanced annually in January. After rebalancing the Fund in January 2011, there was a strong preference for value holdings, with mid-cap value companies comprising 44% of the Fund, followed by mid-cap core with 26%, and mid-cap growth with 19%. Small-cap holdings of 11% comprise the remainder according to our allocation analysis at the beginning of 2011.

Relative to the S&P 400 Mid-Cap Index, stock selection within the energy sector provided the greatest benefit to the Fund. The largest detractor from performance was stock selection within the consumer discretionary sector, although the Fund’s overweight to the sector partially offset the negative selection impact. Stock selection in the utilities sector also contributed to performance, while selection in the financial sector detracted from returns. However, the Fund also benefited from other sector allocation decisions, including an overweight to the consumer staples and utilities sectors during 2011.

For the full year 2011, many stocks contributed positively to the performance of the Fund. The top performing stock for the year was Cabot Oil & Gas, which was up nearly 101%. Other top performers for the year include H&R Block (up 42%) and NiSource (up 40%). The largest detractors from performance during the year were First Solar (down 74%), Sears Holdings (down 57%), and E*Trade Financial (down 50%).

| 2011 Annual Report | December 31, 2011 |

Period & Average Annual Total Returns as of December 31, 2011 (Unaudited)

| | 1 | 3 | 5 | 4/30/05 to | 10 | Inception |

| | Year | Year | Year | 12/31/112 | Year | Date |

The Flex-funds® Quantex FundExpense Ratios+: Current net 1.62% Gross 2.07% | -4.05% | 28.00% | 2.09% | 5.93% | 3.65% | 3/20/85 |

Blended Index1 | -2.94% | 17.62% | 1.77% | 5.88% | 6.37% | 3/31/85 |

| Russell 2000 Index | -4.17% | 15.65% | 0.15% | 5.14% | 5.64% | 3/31/85 |

| S&P 400 Mid-Cap Index | -1.73% | 19.59% | 3.31% | 6.55% | 7.03% | 3/31/85 |

Growth of $10,000: 12/31/01 - 12/31/11

The Quantex Fund™ was previously known as The Highlands Growth Fund. On April 30, 2005, The Highlands Growth Fund changed its name to The Quantex Fund™, also changing the Fund’s investment objective and strategies. Due to this, the Russell 2000 Index and the S&P 400 Mid-Cap Index are more comparative indices for Fund performance.

The Growth of $10,000 chart compares the value of The Quantex Fund™ to the S&P 400 Mid-Cap Index and the Russell 2000 Index, the Fund’s broad-based benchmarks, and to the Blended Index, which consists of 50% of the Russell 2000 Index and 50% of the S&P 400 Mid-Cap Index. The chart is intended to give you a general idea of how the Fund performed compared to these benchmarks over the period from December 31, 2001 to December 31, 2011. An understanding of the differences between the Fund and these indices is important. The benchmark indices do not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

Past performance does not guarantee future results. The chart and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Top Ten Holdings as of December 31, 2011

| 1. | Cabot Oil & Gas Corp. | 2.1% |

| 2. | H&R Block, Inc. | 1.4% |

| 3. | Apollo Group, Inc. | 1.4% |

| 4. | NiSource, Inc. | 1.4% |

| 5. | AutoNation, Inc. | 1.4% |

| 6. | Novellus Systems, Inc. | 1.3% |

| 7. | Total System Services, Inc. | 1.3% |

| 8. | Dean Foods Co. | 1.3% |

| 9. | Tesoro Corp. | 1.3% |

| 10. | Airgas, Inc. | 1.3% |

As a percentage of total investments

Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The Quantex Fund™ during the periods shown above. + The current net expense ratio is based on average daily net assets for the year ended 12/31/11, including effect of contractual expense waivers and reimbursements. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s average daily net assets as shown in the most current Fund Prospectus. Please see additional disclosures on page 23.

| 2011 Annual Report | December 31, 2011 |

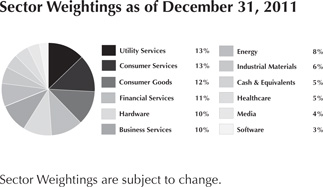

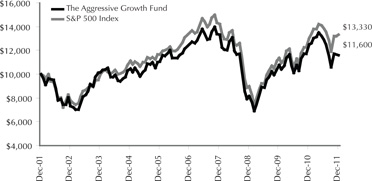

The Aggressive Growth Fund The Fund seeks growth of capital by investing in actively managed mutual funds and exchange-traded funds that invest in equity securities. |

The Flex-funds® Aggressive Growth Fund returned -7.15% for the year ended December 31, 2011. By comparison, the S&P 500 Index returned 2.11% during the same time period. Overall, our allocation to mid- and small-cap investments as well as underlying fund holdings caused the Fund to underperform its benchmark during 2011, and is discussed in more detail below.

We entered the first quarter with an overweight position among growth versus value investments, but reduced our growth overweight as the quarter progressed due to indications from our investment models. We also maintained our overweight in mid- and small-cap stocks, which benefited performance and has been a key component of our investment allocation since the stock market recovery commenced. Sector exposure was concentrated among the energy and industrial materials sectors throughout the first quarter, and our growth exposure also resulted an overweight to the technology sector. We were underweight the consumer staples and healthcare sector. We also held a direct position in emerging market securities, which detracted from performance, but continued to avoid direct exposure to developed international markets.

During the second quarter, we maintained our overweight position among growth versus value investments. We also maintained our overweight in mid- and small-cap stocks, which detracted from performance during the quarter. Our sector exposure remained consistent with the first quarter, which was characterized by an overweight position among the energy and industrial materials, and technology sector; while being underweight the consumer staples and healthcare sector. We continued to maintain a direct position in emerging market securities.

We began the third quarter with our overweight position to growth investments, and also maintained our overweight in mid- and small-cap stocks. However, we reduced the size of our overweight position as the quarter progressed due to shifting preferences in our investment models. We eliminated our direct exposure to the energy sector, but maintained our overweight to the technology sector and also became overweight to the healthcare sector. Also, we exited our direct position in emerging market securities at the beginning of the third quarter.

In the fourth quarter, we remained overweight to growth versus value investments due to ongoing preference from our investment models. We also maintained a position in mid- and small-cap stocks; however, we reduced our exposure further as the quarter progressed. We continued to overweight the healthcare and technology sectors, while avoiding the financial and energy sectors. Finally, we avoided direct exposure to all international markets.

| 2011 Annual Report | December 31, 2011 |

Period & Average Annual Total Returns as of December 31, 2011 (Unaudited)

| | 1 Year | 3 Years | 5 Years | 10 Years | Inception Date |

The Flex-funds® Aggressive Growth Fund Expense Ratios+: Current net 1.59% Gross 1.70% | -7.15% | 12.55% | -1.58% | 1.50% | 12/31/94 |

| S&P 500 Index | 2.11% | 14.13% | -0.25% | 2.92% | 2/29/00 |

Growth of $10,000: 12/31/01 - 12/31/11

The Growth of $10,000 chart compares The Aggressive Growth Fund’s value to the S&P 500 Index, the Fund’s broad-based benchmark. The chart is intended to give you a general idea of how the Fund performed compared to this benchmark over the period from December 31, 2001 to December 31, 2011. An understanding of the differences between the Fund and this index is important. The S&P 500 Index is a widely recognized unmanaged index of common stock prices that does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

Past performance does not guarantee future results. The chart and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Top Ten Holdings as of December 31, 2011 |

| 1. | Harbor Capital Appreciation Fund | 14.8% |

| 2. | Allianz NFJ Dividend Value Fund | 14.8% |

| 3. | Wells Fargo Advantage Growth Fund | 14.6% |

| 4. | T. Rowe Price Value Fund | 13.0% |

| 5. | Columbia Dividend Income Fund | 9.1% |

| 6. | RS Technology Fund | 5.5% |

| 7. | Ivy Mid Cap Growth Fund | 4.9% |

| 8. | JPMorgan Mid Cap Value Fund | 4.6% |

| 9. | Health Care Select Sector SPDR Fund | 4.6% |

| 10. | iShares Russell 2000 Index Fund | 4.4% |

As a percentage of total investments

Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The Aggressive Growth Fund during the periods shown above. This waiver is voluntary and may be terminated at any time. + The current net expense ratio is based on average daily net assets for the year ended 12/31/11, including effect of voluntary expense waivers and reimbursements. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s average daily net assets, not including acquired fund fees and expenses, as shown in the most current Fund Prospectus. Please see additional disclosures on page 23.

| 2011 Annual Report | December 31, 2011 |

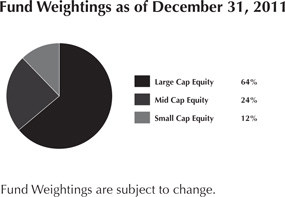

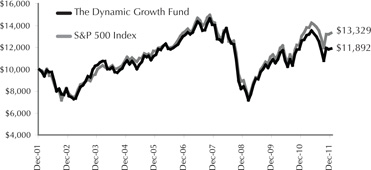

The Dynamic Growth Fund The Fund seeks growth of capital by investing in actively managed mutual funds, exchange-traded funds, and stock index futures. |

The Flex-funds® Dynamic Growth Fund returned -5.65% for the year ended December 31, 2011 compared to the S&P 500 Index return of 2.11% for the same time period. The performance of the Fund relative to the S&P 500 during 2011 was driven by numerous factors. Our allocation decisions, which consisted of our exposure to mid- and small-caps, our position in growth versus value investments, as well as our temporary emerging market exposure detracted from performance during the year. We also experienced an overall negative impact from our underlying fund holdings.

During the first quarter, we maintained our overweight allocation to growth investments versus value; however, we reduced this overweight during the quarter as our investment models began to shift toward a neutral position. Additionally, our investment models continued to maintain preference for mid- and small-cap companies, which has led us to maintain our overweight allocation to these investments. We established an overweight position in the energy sector early in the first quarter, while also overweighting the industrial materials sector. We were underweight the consumer staples and healthcare sector. On an international basis, we continued to avoid direct exposure to developed international markets, but held exposure to emerging markets.

We entered the second quarter with an overweight allocation to growth investments versus value, and we maintained this positioning throughout the quarter due to indications from our investment models. Additionally, our investment models continued to maintain preference for mid- and small-cap companies, which led us to preserve our overweight allocation to these investments. Our overweight position in the energy and industrial materials sector, which was maintained from the first quarter, detracted from performance during the second quarter. On an international basis, we continued to avoid direct exposure to developed international markets, but maintained exposure to emerging markets.

We began the third quarter with an overweight allocation to growth investments versus value, and we increased our growth positioning throughout the quarter due to indications from our investment models. However, our investment models decreased preference for mid- and small-cap companies, which led us to reduce our overweight allocation to these investments. Also during the third quarter, we were overweight to the healthcare and technology sector, while being underweight the financial and energy sectors. On an international basis, we have avoided direct exposure to the developed international markets since December of 2009, and eliminated our exposure to emerging markets at the beginning of the third quarter.

During the fourth quarter, we maintained our overweight position to growth versus value investments due to preference from our investment models. We also maintained a position in mid- and small-cap stocks; however, we reduced our exposure as the quarter progressed. We continued to overweight the healthcare and technology sectors, while avoiding the financial and energy sectors. Finally, we continued to avoid direct exposure to developed international and emerging markets.

| 2011 Annual Report | December 31, 2011 |

Period & Average Annual Total Returns as of December 31, 2011 (Unaudited)

| | 1 Year | 3 Years | 5 Years | 10 Years | Inception Date |

The Flex-funds® Dynamic Growth Fund Expense Ratios+: Current net 1.39% Gross 1.55% | -5.65% | 12.00% | -1.96% | 1.75% | 2/29/00 |

| S&P 500 Index | 2.11% | 14.13% | -0.25% | 2.92% | 2/29/00 |

Growth of $10,000: 12/31/01 - 12/31/11

The Growth of $10,000 chart compares The Dynamic Growth Fund’s value to the S&P 500 Index, the Fund’s broad-based benchmark. The chart is intended to give you a general idea of how the Fund performed compared to this benchmark over the period from December 31, 2001 to December 31, 2011. An understanding of the differences between the Fund and this index is important. The S&P 500 Index is a hypothetical unmanaged index of common stocks that does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

Past performance does not guarantee future results. The chart and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Top Ten Holdings as of December 31, 2011 |

| 1. | Allianz NFJ Dividend Value Fund | 14.9% |

| 2. | Harbor Capital Appreciation Fund | 13.2% |

| 3. | Wells Fargo Advantage Growth Fund | 13.1% |

| 4. | T. Rowe Price Value Fund | 10.2% |

| 5. | Columbia Dividend Income Fund | 9.2% |

| 6. | Alger Capital Appreciation Fund | 7.4% |

| 7. | PowerShares QQQ Trust | 6.0% |

| 8. | Health Care Select Sector SPDR Fund | 5.1% |

| 9. | Blackrock Equity Dividend Fund | 4.5% |

| 10. | Consumer Staples Select Sector SPDR Fund | 3.8% |

As a percentage of total investments

Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The Dynamic Growth Fund during the periods shown above. This waiver is voluntary and may be terminated at any time. + The current net expense ratio is based on average daily net assets for the year ended 12/31/11, including effect of voluntary expense waivers and reimbursements. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s average daily net assets, not including acquired fund fees and expenses, as shown in the most current Fund Prospectus. Please see additional disclosures on page 23.

| 2011 Annual Report | December 31, 2011 |

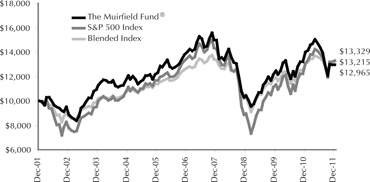

The Strategic Growth Fund The Fund seeks growth of capital by investing in actively managed mutual funds and exchange-traded funds using a targeted asset allocation structure. |

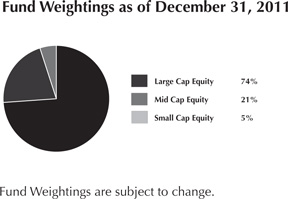

The Flex-funds® Strategic Growth Fund returned -8.34% for the year ended December 31, 2011, compared to the custom benchmark return of -1.93% for the same period. The Fund also underperformed the broader market during the year, as measured by the S&P 500 Index, which returned 2.11%. The Strategic Growth Fund is fully invested in the equity market at all times, and holds a fixed allocation across six distinct investment categories. The mix of investments selected to represent each investment category is variable and actively managed by using our strategic fund selection process. The current target allocation is comprised of the following: 25% large-cap, 20% mid-cap, 17.5% international, 12.5% small-cap, 12.5% real estate, and 12.5% commodities. Within each respective category, we seek to identify funds that will outperform their peers through an evaluation process based on valuation factors, measures of volatility, and risk-adjusted returns. Funds that fall out of favor within our models are sold and replaced with funds ranked higher by our evaluation process.

The Fund’s performance during 2011 versus the S&P 500 can be directly attributed to several of the asset allocation categories. While the S&P 500 posted a modest gain of 2.11% during the year, several of the other asset allocation categories significantly underperformed the broader market. For instance, the MSCI Emerging Markets Index declined by 20.34% in 2011, while the MSCI EAFE Index of developed international stocks declined by 12.13% during the year (be advised that one cannot invest directly in an index). The two aforementioned categories comprise approximately 17.5% of the Fund’s allocation. Furthermore, the Russell 2000 Index of small-cap stocks and the S&P 400 Mid-Cap Index of mid-cap stocks declined by 4.17% and 1.73%, respectively. These categories comprise nearly 33% of the Fund’s allocation. The only asset allocation category to outperform the S&P 500 Index during 2011 was the Dow Jones REIT Index, which increased by 9.39% during the year.

The Fund also underperformed the custom benchmark during 2011, which is the result of underperformance of underlying fund holdings against their respective benchmark indexes. For instance, our commodity holding of the Van Eck Global Hard Assets fund declined 16.62% in 2011, and underperformed its respective benchmark.

| 2011 Annual Report | December 31, 2011 |

Period & Average Annual Total Returns as of December 31, 2011 (Unaudited)

| | 1 Year | 3 Years | 8/25/08 to 12/31/114 | 5 Years | Since Inception | Inception Date |

The Flex-funds® Strategic Growth Fund Expense Ratios+: Current net 1.39% Gross 1.57% | -8.34% | 14.29% | -0.77% | -2.21% | -0.60% | 1/31/06 |

Blended Index3 | -1.93% | 15.29% | -0.42%5 | 0.11% | 1.55% | 1/31/06 |

| S&P 500 Index | 2.11% | 14.13% | 1.65%5 | -0.25% | 1.84% | 1/31/06 |

Growth of $10,000: 1/31/06 - 12/31/11

The Growth of $10,000 chart compares The Strategic Growth Fund’s value to the S&P 500 Index, the Fund’s broad-based benchmark, and the Blended Index, which consists of 25% of the S&P 500 Index, 20% of the S&P 400 Index, 12.5% of the Russell 2000 Index, 12.5% of the Dow Jones US Select REIT Index, 12.5% of the S&P GSCI Index, 12% of the MSCI EAFE Index, and 5.5% of the MSCI Emerging Markets Index. The chart is intended to give you a general idea of how the Fund performed compared to these indices over the period from its inception on January 31, 2006 to December 31, 2011. An understanding of the differences between the Fund and these indices is important. The benchmark indices are hypothetical unmanaged indices of common stock that do not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

Past performance does not guarantee future results. The chart and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Top Ten Holdings as of December 31, 2011 |

| 1. | Nuveen Real Estate Securities Fund | 12.7% |

| 2. | Wells Fargo Advantage Growth Fund | 12.5% |

| 3. | Allianz NFJ Dividend Value Fund | 11.7% |

| 4. | JPMorgan Mid Cap Value Fund | 8.6% |

| 5. | Oppenheimer International Growth Fund | 8.5% |

| 6. | Ivy Mid Cap Growth Fund | 8.3% |

| 7. | Wells Fargo Advantage Emerging Markets Equity Fund | 8.2% |

| 8. | RidgeWorth Small Cap Value Equity Fund | 6.1% |

| 9. | Lord Abbett Developing Growth Fund | 6.1% |

| 10. | Invesco Energy Fund | 5.8% |

As a percentage of total investments

Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The Strategic Growth Fund during the periods shown above. This waiver is voluntary and may be terminated at any time. + The current net expense ratio is based on average daily net assets for the year ended 12/31/11, including effect of voluntary expense waivers and reimbursements. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s average daily net assets, not including acquired fund fees and expenses, as shown in the most current Fund Prospectus. Please see additional disclosures on page 23.

| 2011 Annual Report | December 31, 2011 |

The Muirfield Fund® The Fund seeks growth of capital by investing in actively managed mutual funds and exchange-traded funds using a “Defensive Investing” strategy. |

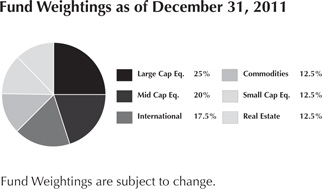

The Flex-funds Muirfield Fund® returned -7.55% for the year ended December 31, 2011. The Fund’s performance compared to the S&P 500 Index during 2011 was the result of multiple factors. Our defensive positioning detracted from performance and was the result of heightened volatility that occurred in the stock market. In the invested portion of the Fund, our exposure to mid- and small-caps as well as our temporary emerging market exposure detracted from performance during the year. We also experienced an overall negative impact from our underlying fund holdings.

In The Muirfield Fund®, we entered 2011 essentially fully-invested in the stock market. We had maintained a fully-invested position since the fourth quarter of 2010 as a result of our investment models, which continued to indicate a favorable risk/reward relationship in the stock market. However, as stock market declines materialized during the third quarter, we noted significant deterioration of the trend and technical components of our quantitative investment model. As a result, we increased our defensive posture by adopting a 20% position in fixed-income investments. Despite the stock market volatility, we noted that nearly all of the interest rate, fundamental, and valuation factors in our quantitative investment model remained positive, but we preferred to be cautious given the uncertainties present in the global capital markets. As volatility eased during the fourth quarter, we noted improvements in some of the trend and technical components of our quantitative investment model, which led us to increase our stock market exposure as the quarter progressed. As a result, we ended the year with a 10% defensive position in The Muirfield Fund®.

We managed our industry and sector exposure throughout the year and initiated changes in sector allocations in the Fund as stock market conditions progressed. During the first quarter, we continued to add to our energy position, which resulted in an overweight exposure to the sector and benefited our performance. We also remained overweight to the industrial materials sector, while being underweight the consumer staples and healthcare sectors. As the second quarter progressed, we eliminated our energy overweight and subsequently established an overweight to the healthcare sector following indications from our investment models. In addition to remaining overweight to the healthcare sector, we established an overweight to the technology sector while being underweight the financial and energy sectors in the third quarter. We maintained this sector positioning through the end of 2011, which was additive to performance during the third quarter but detracted from performance in the fourth quarter.

Throughout 2011, we maintained an overweight allocation to growth investments versus value, which benefited our performance. We also entered 2011 with an overweight exposure to mid- and small-cap investments. However, we reduced our overweight during the third quarter as these capitalization ranges underperformed large-caps following steep stock market declines. Overall, our exposure to mid- and small-cap investments detracted from performance in 2011.

Regarding international exposure, we entered 2011 with a position in emerging markets, and continued to avoid direct exposure to the developed international markets. However, we also eliminated our emerging markets position early in the third quarter, and avoided direct exposure to all international investments for the remainder of the year.

| 2011 Annual Report | December 31, 2011 |

Period & Average Annual Total Returns as of December 31, 2011 (Unaudited)

| | 1 Year | 3 Years | 5 Years | 10 Years | Inception Date |

The Flex-funds Muirfield Fund® Expense Ratios+: Current net 1.39% Gross 1.56% | -7.55% | 7.40% | -1.50% | 2.63% | 8/10/88 |

Blended Index6 | 1.55% | 8.75% | 0.80% | 2.83% | 8/10/88 |

| S&P 500 Index | 2.11% | 14.13% | -0.25% | 2.92% | 8/10/88 |

Growth of $10,000: 12/31/01 - 12/31/11

The Growth of $10,000 chart compares the value of The Muirfield Fund® to the S&P 500 Index, the Fund’s broad-based benchmark, and to an index composed of 60% of the S&P 500 Index and 40% of 90-day T-bills. The chart is intended to give you a general idea of how the Fund performed compared to these indices over the period from December 31, 2001 to December 31, 2011. An understanding of the differences between the Fund and these indices is important. The benchmark indices are hypothetical unmanaged indices of common stocks and 90-day T-bills that do not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

Past performance does not guarantee future results. The chart and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Top Ten Holdings as of December 31, 2011 |

| 1. | Allianz NFJ Dividend Value Fund | 13.4% |

| 2. | Wells Fargo Advantage Growth Fund | 12.0% |

| 3. | Harbor Capital Appreciation Fund | 11.6% |

| 4. | Caterpillar Financial Power Investment Floating Rate Demand Note, 0.60%, 1/1/12 | 11.3% |

| 5. | T. Rowe Price Value Fund | 9.0% |

| 6. | Columbia Dividend Income Fund | 8.1% |

| 7. | Alger Capital Appreciation Fund | 6.7% |

| 8. | PowerShares QQQ Trust | 5.4% |

| 9. | Health Care Select Sector SPDR Fund | 4.6% |

| 10. | Blackrock Equity Dividend Fund | 4.1% |

As a percentage of total investments

Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The Muirfield Fund® during the periods shown above. This waiver is voluntary and may be terminated at any time. + The current net expense ratio is based on average daily net assets for the year ended 12/31/11, including effect of voluntary expense waivers and reimbursements. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s average daily net assets, not including acquired fund fees and expenses, as shown in the most current Fund Prospectus. Please see additional disclosures on page 23.

| 2011 Annual Report | December 31, 2011 |

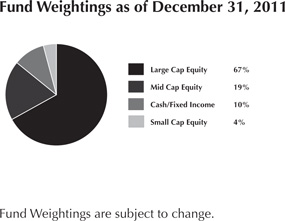

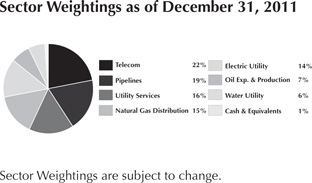

The Defensive Balanced Fund The Fund seeks income and growth of capital by investing in actively managed mutual funds and exchange-traded funds using a “Defensive Investing” strategy. |

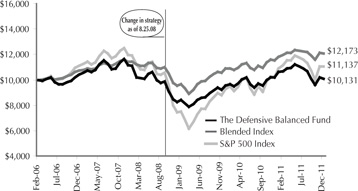

The Flex-funds® Defensive Balanced Fund returned -4.49% for the year ended December 31, 2011. The Defensive Balanced Fund will always invest at least 30% of its assets in fixed-income securities. The Fund will also hold a minimum 30% allocation in equity securities, with additional investments determined by our defensive equity discipline. The Fund’s performance lagged the S&P 500 Index during 2011, and was driven by a number of factors including our allocation decisions, defensive positioning, and underlying fund holdings.

In the equity portion of the Fund, we entered 2011 essentially fully-invested in the stock market. We had maintained a fully-invested position since the fourth quarter of 2010 as a result of our investment models, which continued to indicate a favorable risk/reward relationship in the stock market. However, as stock market declines materialized during the third quarter, we noted significant deterioration of the trend and technical components of our quantitative investment model. As a result, we increased our defensive posture by adopting a 20% position in fixed-income investments. Despite the stock market volatility, we noted that nearly all of the interest rate, fundamental, and valuation factors in our quantitative investment model remained positive, but we preferred to be cautious given the uncertainties present in the global capital markets. As volatility eased during the fourth quarter, we noted improvements in some of the trend and technical components of our quantitative investment model, which led us to increase our stock market exposure as the quarter progressed. As a result, we ended the year with a 10% defensive position.

Throughout 2011, we maintained an overweight allocation to growth investments versus value, which benefited our performance. We also entered 2011 with an overweight exposure to mid- and small-cap investments. However, we reduced our overweight during the third quarter as these capitalization ranges underperformed large-caps following steep stock market declines. Overall, our exposure to mid- and small-cap investments detracted from performance in 2011. Regarding international exposure, we entered 2011 with a position in emerging markets, and continued to avoid direct exposure to the developed international markets. However, we also eliminated our emerging markets position early in the third quarter, and avoided direct exposure to all international investments for the remainder of the year.

We also managed our industry and sector exposure throughout the year and initiated changes in sector allocations in the Fund as stock market conditions progressed. During the first quarter, we continued to add to our energy position, which resulted in an overweight exposure to the sector and benefited our performance. We also remained overweight to the industrial materials sector, while being underweight the consumer staples and healthcare sectors. As the second quarter progressed, we eliminated our energy overweight and subsequently established an overweight to the healthcare sector following indications from our investment models. In addition to remaining overweight to the healthcare sector, we established an overweight to the technology sector while being underweight in the financial and energy sectors in the third quarter. We maintained this sector positioning through the end of 2011, which was additive to performance during the third quarter but detracted from performance in the fourth quarter.

In the fixed-income portion of the Fund, the target allocation was overweight in investment grade corporate bond funds throughout 2011. During much of the past year, the environment for investing in this sector remained favorable. The financial position of bond issuers was bolstered by historically low interest rates, steady profit growth, and a recovering economy in the United States. In combination, these factors have provided for a low probability of expected issuer defaults. The duration of the fixed-income portion of the Fund was maintained mostly in line with our benchmark during 2011, consistent with readings from our fixed-income models that favored this position.

| 2011 Annual Report | December 31, 2011 |

Period & Average Annual Total Returns as of December 31, 2011 (Unaudited)

| | 1 | 3 | 8/25/08 to | 5 | Since | Inception |

| | Year | Year | 12/31/118 | Year | Inception | Date |

The Flex-funds® Defensive Balanced Fund | -4.49% | 6.32% | 1.00% | -0.87% | 0.22% | 1/31/06 |

Expense Ratios+: Current net 1.44% Gross 1.60% |

Blended Index7 | 2.91% | 7.96% | 1.63%5 | 2.45% | 3.38% | 1/31/06 |

| S&P 500 Index | 2.11% | 14.13% | 1.65%5 | -0.25% | 1.84% | 1/31/06 |

Growth of $10,000: 1/31/06 - 12/31/11

The Growth of $10,000 chart compares The Defensive Balanced Fund’s value to the S&P 500 Index, the Fund’s broad-based benchmark, and to the Blended Index, which is comprised of 42% of the S&P 500 Index, 28% of the average 90-day U.S. T-bill and 30% of the Barclays Intermediate-Term Government/Credit Index. The chart is intended to give you a general idea of how the Fund performed compared to these indices over the period from its inception on January 31, 2006 through December 31, 2011. An understanding of the differences between the Fund and these indices is important. The benchmark indices are hypothetical unmanaged indices of common stock that do not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

Past performance does not guarantee future results. The chart and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Top Ten Holdings as of December 31, 2011 |

| 1. | Allianz NFJ Dividend Value Fund | 9.2% |

| 2. | Wells Fargo Advantage Growth Fund | 8.4% |

| 3. | Harbor Capital Appreciation Fund | 8.0% |

| 4. | Caterpillar Financial Power Investment Floating Rate Demand Note, 0.60%, 1/1/12 | 6.5% |

| 5. | T. Rowe Price Value Fund | 6.4% |

| 6. | Federated Bond Fund | 6.2% |

| 7. | Prudential Total Return Bond Fund | 6.1% |

| 8. | DoubleLine Total Return Bond Fund | 6.1% |

| 9. | Putnam Income Fund | 6.0% |

| 10. | Columbia Dividend Income Fund | 5.3% |

As a percentage of total investments

Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The Defensive Balanced Fund during the periods shown above. This waiver is voluntary and may be terminated at any time. + The current net expense ratio is based on average daily net assets for the year ended 12/31/11, including effect of voluntary expense waivers and reimbursements. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s average daily net assets, not including acquired fund fees and expenses, as shown in the most current Fund Prospectus. Please see additional disclosures on page 23.

| 2011 Annual Report | December 31, 2011 |

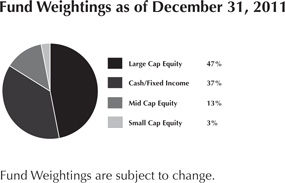

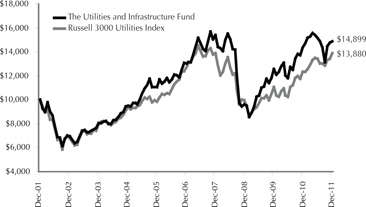

The Utilities and Infrastructure Fund (Formerly known as The Total Return Utilities Fund) The Fund outperformed the Russell 3000 Utilities benchmark for the 3-, 5-, and 10-year periods ended December 31, 2011. |

The Flex-funds® Utilities and Infrastructure Fund returned 3.93% for the year ended December 31, 2011. The Fund has outperformed the Russell 3000 Utilities benchmark for the 3- 5-, and 10-year periods ended December 31, 2011.

We experienced many opportunities across different industries during the first quarter. Natural gas companies with both production and delivery exposure performed well, despite ongoing low natural gas pricing. El Paso led our list, and was joined by Southern Union, National Fuel Gas, ONEOK, and MDU Resources. Battery and power management newcomer EnerSys hit a succession of new highs after beating expectations with a 61% earnings advance. Communications chip maker Qualcomm rose, as its chips have become extremely popular in new cellphones and tablets. Telecommunications companies were among our underperformers, despite big final-week runs in AT&T and Verizon. American Tower was negatively impacted by AT&T’s offer for T-Mobile, as investors assumed it would mean less need for towers and fewer customers.

During a volatile second quarter for equities, the utilities sector was one of the stronger performing segments of the stock market. Our best performers comprised a mix of various industries. Southern Union increased following a pair of offers, while American Water Works exceeded earnings expectations once again and raised its dividend 4.5%. We experienced a gain from Millicom International Cellular on a rally to fair value, and received a boost from dominant Canadian telecom BCE, which beat earnings expectations and raised its financial forecast. On the downside, many of our infrastructure enablers declined as a result of the poor broad market conditions that prevailed during the quarter, and included stocks like American Superconductor, GE, Cisco, driller Ensco, global engineering and construction firm Fluor, battery company EnerSys, and Veolia Environnement.

Although traditional utilities performed well in the third quarter, our exposure to more economically sensitive areas such as energy, enabling companies, and selected telecommunications companies detracted from our performance. NiSource was the strongest contributor to performance, and benefited from extensive legacy assets in the Marcellus Shale. Independent transmission company ITC Holdings announced new projects and expected success in its existing business. While the company is not the cheapest stock we own, its business is unique, monopolistic, and may expand much more than previously estimated. On the downside, National Fuel Gas fell after announcing that it had not found a partner for its Marcellus Shale properties at an acceptable price. Following a multi-year run of acquisitions, Veolia Environnement has been shedding assets. Between the general international stock-price degradation and additional difficulty of making asset sales in this cautious environment, the stock price declined significantly.

In the fourth quarter, stocks connected to corporate transactions and potential mergers and acquisitions candidates dominated portfolio news. Both Kinder Morgan and El Paso posted strong fourth quarter returns, following the former’s $38 billion offer for the latter. NiSource also performed well as investors postulated its potential as a takeover candidate. Stocks that detracted from performance for the quarter included Veolia Environnement, which is struggling to reduce debt levels from earlier expansions and NII Holdings, which suffered from heightened competition in Latin America.

| 2011 Annual Report | December 31, 2011 |

Period & Average Annual Total Returns as of December 31, 2011 (Unaudited)

| | 1 Year | 3 Years | 5 Years | 10 Years | Inception Date |

The Flex-funds Utilities and Infrastructure Fund9 Expense Ratios+: Current net 1.90% Gross 2.05% | 3.93% | 15.71% | 2.70% | 4.07% | 6/21/95 |

| Russell 3000 Utilities Index | 12.46% | 11.77% | 1.73% | 3.33% | 6/30/95 |

Growth of $10,000: 12/31/01 - 12/31/11

The Growth of $10,000 chart compares The Utilities and Infrastructure Fund’s value to the Russell 3000 Utilities Index, the Fund’s broad-based benchmark. The chart is intended to give you a general idea of how the Fund performed compared to this benchmarks over the period from December 31, 2001 to December 31, 2011. An understanding of the differences between the Fund and this index is important. The benchmark index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

Past performance does not guarantee future results. The chart and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Top Ten Holdings as of December 31, 2011 |

| 1. | NiSource, Inc. | 8.9% |

| 2. | American Water Works Co., Inc. | 5.1% |

| 3. | Questar Corp. | 4.9% |

| 4. | National Fuel Gas Co. | 4.4% |

| 5. | MDU Resources Group, Inc. | 4.1% |

| 6. | Williams Companies, Inc. | 3.9% |

| 7. | AT&T, Inc. | 3.8% |

| 8. | Enterprise Products Partners, L.P. | 3.8% |

| 9. | QUALCOMM, Inc. | 3.7% |

| 10. | National Grid PLC - ADR | 3.5% |

As a percentage of total investments

Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The Utilities and Infrastructure Fund during the periods shown above. This waiver is voluntary and may be terminated at any time. + The current net expense ratio is based on average daily net assets for the year ended 12/31/11, including effect of voluntary expense waivers and reimbursements. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s average daily net assets as shown in the most current Fund Prospectus. Please see additional disclosures on page 23.

| 2011 Annual Report | December 31, 2011 |

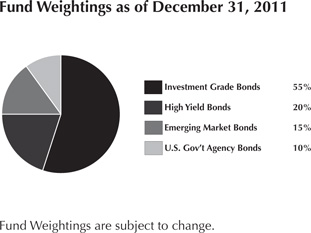

The Total Return Bond Fund The Fund seeks to maximize current income and capital growth primarily through investment in fixed-income securities or investments that provide exposure to fixed-income securities. |

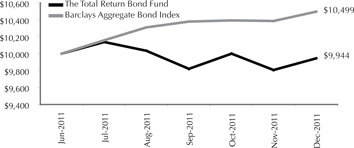

As of December 31, 2011, the Flex-funds® Total Return Bond Fund returned -0.57% since the Fund’s inception on June 30, 2011. This performance placed the Fund in the top 55% of the Fund’s peer group. Over the aforementioned time period the Fund’s benchmark, the Barclays Aggregate Bond Index, returned 4.99%. All of the Fund’s underperformance versus the benchmark was experienced during the third quarter of 2011.

During the third quarter of 2011, political, economic, and banking system risks dominated the news headlines, creating above average volatility across all fixed-income sectors. As fears over a potential European debt crisis increased, investors looked for safety in U.S. Government securities, leading to strong outperformance by these securities during the quarter. The Fund was underweight these securities relative to its benchmark which detracted from the Fund’s performance. However, the Fund did hold more U.S. Government securities than its peers, leading it to finish within the top 28% of the category for the quarter. Additionally, the Fund maintained exposure to both high yield corporate bonds and emerging market bonds throughout the quarter, which detracted from performance.

During the fourth quarter of 2011, European leaders took steps towards a solution to the developing debt crisis. This prompted fixed income investors to once again take on risk as they began buying high yield corporate bonds in search of increased yield. The Fund’s exposure to corporate bonds, both high yield and investment grade, added to its performance for the quarter, and ultimately led to outperformance versus the benchmark. The Fund did maintain some exposure to U.S. Treasury securities, which detracted from the performance of the Fund.

| 2011 Annual Report | December 31, 2011 |

Period & Average Annual Total Returns as of December 31, 2011 (Unaudited)

| | Since Inception | Inception Date |

The Flex-funds® Total Return Bond Fund Expense Ratios+: Current net 0.99% Gross 1.41% | -0.57% | 6/30/11 |

| Barclays Aggregate Bond Index | 4.99% | 6/30/11 |

Growth of $10,000: 7/31/11 - 12/31/11

The Growth of $10,000 chart compares The Total Return Bond Fund’s value to the Barclays Aggregate Bond Index, the Fund’s broad-based benchmark. The chart is intended to give you a general idea of how the Fund performed compared to this benchmark over the period from June 30, 2011 to December 31, 2011. An understanding of the differences between the Fund and this index is important. The index is a hypothetical unmanaged index that does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

Past performance does not guarantee future results. The chart and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| Top Ten Holdings as of December 31, 2011 |

| 1. | Federated Bond Fund | 11.9% |

| 2. | Prudential Total Return Bond Fund | 11.7% |

| 3. | DoubleLine Total Return Bond Fund | 11.7% |

| 4. | iShares JPMorgan Emerging Bond Fund | 9.6% |

| 5. | Putnam Income Fund | 8.0% |

| 6. | iShares iBoxx $High Yield Corporate Bond Fund | 7.3% |

| 7. | SPDR Barclays Capital High Yield Bond Fund | 7.2% |

| 8. | iShares iBoxx $Investment Grade Corporate Bond Fund | 4.6% |

| 9. | iShares Barclays Intermediate Credit Bond Fund | 4.4% |

| 10. | TCW Emerging Markets Income Fund | 3.9% |

As a percentage of total investments

Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The Total Return Bond Fund during the periods shown above. This waiver is voluntary and may be terminated at any time. + The current net expense ratio is based on average daily net assets for the year ended 12/31/11, including effect of voluntary waivers and reimbursements. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s average daily net assets, not including acquired fund fees and expenses, as shown in the most current Fund Prospectus. Please see Additional Disclosures on page 23.

| 2011 Annual Report | December 31, 2011 |

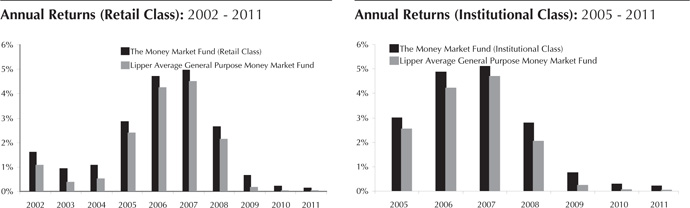

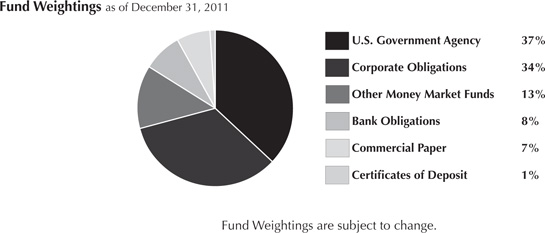

The Money Market Fund For 2011, the retail class finished the year ranked second out of 264 general purpose money market funds as measured by Lipper. The Fund has been in the top 10% of all retail money market funds every year since its inception in 1985. |

The Flex-funds ® Money Market Fund enjoyed continued success versus the competition in 2011, with both the retail and institutional share classes ranking among the top general purpose money market funds in the country. For 2011, the retail class finished the year ranked 2nd out of 264 general purpose money market funds as measured by Lipper. Equally as impressive, the Fund also ranked 2nd out of 249 general purpose money funds for the three year period ending December 31, 2011. More importantly, the Fund has been in the top 10% of all retail money market funds every year since its inception in 1985.

We entered the first quarter of 2011 in a similar market environment which has faced the Fund over the past couple of years. As it stands, an aggressively low Fed Funds target rate continued to keep yields low on eligible investment options within the money market arena, and offered no optimism that the probability of higher short-term rates would come soon. During 2011, debates escalated over the current policy; however, the target rate of 0.00% to 0.25% seems cemented based on recent Fed statements. Yield spreads of higher quality investments as compared to U.S. Treasury bills showed limited value throughout the year. At times, value was presented in longer dated offerings, with the Fund in position to take advantage of the opportunity.

During 2011, we maintained a weighted average maturity that was in line or slightly below that of our peers. Holdings in the Fund remained allocated toward investments with superior credit quality, as we believed the risk and reward relationship favored this position. Our sector allocation favored an overweight in high quality liquid investments and short-term investment grade corporate debt. At the end of 2011, the Fund’s composition was as follows: 37% U.S. Government agency securities, 34% corporate obligations, 13% in other money market funds, 8% in bank obligations, 7% in commercial paper, and 1% certificates of deposit.

As we complete the year, we believe the Fund is positioned to maintain its strong performance during a difficult environment. As we continuously monitor the markets and our strategy, we will remain vigilant and keep in mind the best interests of our shareholders.

| 2011 Annual Report | December 31, 2011 |

Period & Average Annual Total Returns as of December 31, 2011 (Unaudited)

| | 1 | 3 | 5 | 10 | Since | Inception |

| | Year | Year | Year | Year | Inception | Date |

The Flex-funds® Money Market Fund- Retail Class | 0.11% | 0.32% | 1.69% | 1.95% | 4.40% | 3/27/85 |

| Current & Effective Yields* | 7-day Compound: 0.11% 7-day Simple 0.11% |

| Lipper Average General Purpose Money Market Fund | 0.02% | 0.07% | 1.36% | 1.56% | 4.11% | 3/31/85 |

The Flex-funds® Money Market Fund- Instl Class | 0.20% | 0.41% | 1.81% | - | 2.41% | 12/28/04 |

| Current & Effective Yields* | 7-day Compound: 0.17% 7-day Simple 0.17% |

| Lipper Average General Purpose Money Market Fund | 0.02% | 0.07% | 1.36% | - | 2.07% | 12/31/04 |

Performance quoted represents past performance. Past performance does not guarantee future results. All performance figures represent average annual total returns for the periods ended December 31, 2011, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. Current month-end performance may be obtained at www.flexfunds.com or by calling 1.800.325.3539. Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of both the retail class and the institutional class of The Money Market Fund during the periods shown above. Investments in The Money Market Fund are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in The Money Market Fund. Source for average general purpose money market fund data: Lipper, Inc.

| 2011 Annual Report | December 31, 2011 |

Shareholder Expense Analysis (Unaudited)

Shareholders of mutual funds pay ongoing expenses, such as advisory fees, distribution and service fees (12b-1 fees) and other fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples below are based on an investment of $1,000 invested at the beginning of the period and held for the six-month period from June 30, 2011 to December 31, 2011.

ACTUAL EXPENSES: The first table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (e.g.: an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

| ACTUAL EXPENSES | Beginning Account Value (6/30/2011) | Ending Account Value (12/31/2011) | Expenses Paid During Period1 (6/30/2011 - 12/31/2011) | Expense Ratio (Annualized) |

| The Quantex Fund | $1,000.00 | $901.30 | $8.15 | 1.70% |

| The Aggressive Growth Fund | 1,000.00 | 898.10 | 7.80 | 1.63% |

| The Dynamic Growth Fund | 1,000.00 | 917.60 | 6.72 | 1.39% |

| The Strategic Growth Fund | 1,000.00 | 884.70 | 6.46 | 1.36% |

| The Muirfield Fund | 1,000.00 | 900.40 | 6.66 | 1.39% |

| The Defensive Balanced Fund | 1,000.00 | 932.10 | 6.77 | 1.39% |

| The Utilities and Infrastructure Fund | 1,000.00 | 982.00 | 9.64 | 1.93% |

| The Total Return Bond Fund | 1,000.00 | 994.30 | 4.98 | 0.99% |

| The Money Market Fund - Retail Class | 1,000.00 | 1,000.50 | 1.41 | 0.28% |

| The Money Market Fund - Institutional Class | 1,000.00 | 1,000.80 | 1.01 | 0.20% |

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES: The second table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and assumed rates of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

HYPOTHETICAL EXAMPLE (5% return before expenses) | Beginning Account Value (6/30/2011) | Ending Account Value (12/31/2011) | Expenses Paid During Period1 (6/30/2011- 12/31/2011) | Expense Ratio (Annualized) |

| The Quantex Fund | $1,000.00 | $1,016.64 | $8.64 | 1.70% |

| The Aggressive Growth Fund | 1,000.00 | 1,016.99 | 8.29 | 1.63% |

| The Dynamic Growth Fund | 1,000.00 | 1,018.20 | 7.07 | 1.39% |

| The Strategic Growth Fund | 1,000.00 | 1,018.35 | 6.92 | 1.36% |

| The Muirfield Fund | 1,000.00 | 1,018.20 | 7.07 | 1.39% |

| The Defensive Balanced Fund | 1,000.00 | 1,018.20 | 7.07 | 1.39% |

| The Utilities and Infrastructure Fund | 1,000.00 | 1,015.48 | 9.80 | 1.93% |

| The Total Return Bond Fund | 1,000.00 | 1,020.21 | 5.04 | 0.99% |

| The Money Market Fund - Retail Class | 1,000.00 | 1,023.79 | 1.43 | 0.28% |

| The Money Market Fund - Institutional Class | 1,000.00 | 1,024.20 | 1.02 | 0.20% |

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if any transactional costs were included, your costs would have been higher.

1 Expenses are equal to the Funds’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the total number of days in the six-month period).

| 2011 Annual Report | December 31, 2011 |

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns or current and effective yields for the periods ended December 31, 2011. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so an investor’s shares or units, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time, except for Quantex Fund TM. The Quantex Fund TM management fee waiver is contractual and can be terminated annually by the Adviser on its renewal date, April 29, 2012.

| 1 | The blended index consists of 50% of the Russell 2000 Index and 50% of the S&P 400 Mid-Cap Index. |

| 2 | The Quantex Fund™ was previously known as The Highlands Growth Fund. On April 30, 2005, The Highlands Growth Fund changed its name to The Quantex Fund™, also changing the Fund’s investment objective and strategies. The Highlands Growth Fund focused on large-cap equities, while The Quantex Fund™ utilizes quantitative investment strategies that invest primarily in small- and mid-cap equities. Due to this change in strategies on April 30, 2005, the S&P 500 Index is a more comparative index for Fund performance prior to April 30, 2005. The Russell 2000 Index and S&P 400 Mid-Cap Index are more comparative indices for Fund performance after April 30, 2005. |

| 3 | The blended index consists of 25% of the S&P 500 Index, 20% of the S&P 400 Index, 12.5% of the Russell 2000 Index, 12.5% of the Dow Jones US Select REIT Index, 12.5% of the S&P GSCI Index, 12% of the MSCI EAFE Index, and 5.5% of the MSCI Emerging Markets Index. |

| 4 | On August 25, 2008, The Focused Growth Fund became known as The Strategic Growth Fund and its investment strategy changed. This Fund will pursue its goal by investing primarily in open-end or closed-end investment companies that seek capital growth or appreciation without regard to current income. In addition, this Fund will always have set allocations to U.S. large-cap equities, U.S. mid-cap equities, U.S. small-cap equities, non-U.S./International (including emerging markets) equities, real estate equities and commodity based equities. |

| 5 | Specified index returns are calculated for the period 8/31/08 to 12/31/11. |

| 6 | The blended index is comprised of 60% of the S&P 500 Index and 40% of the average 90-day U.S. T-bill. |

| 7 | The blended index consists of 42% of the S&P 500 Index, 28% of the average 90-day U.S. T-bill and 30% of the Barclays Intermediate-Term Government/Credit Index. |

| 8 | On August 25, 2008, The Defensive Growth Fund became known as The Defensive Balanced Fund and its investment strategy changed. This Fund will always invest at least 30% and may invest up to 70% of its assets primarily in equity mutual funds. In addition, this Fund will always invest at least 30% and may invest up to 70% of its assets primarily in investment grade bonds, money market instruments, or exchange traded funds. |

| 9 | The Utilities and Infrastructure Fund was previously known as The Total Return Utilities Fund. On June 30, 2011, the Total Return Utilities Fund changed its name to The Utilities and Infrastructure Fund. Its investment objective and strategy remained unchanged. |

| + | The current net expense ratio is based on average daily net assets for the year ended 12/31/11, including effect of voluntary and/or contractual expense waivers and reimbursements. This ratio may increase or decrease depending on fluctuations in Fund net assets. Gross Expense Ratios are percentages of the Funds’ assets, not including acquired fund fees and expenses, as they are shown in the most recent Prospectus. |

| * | The current and effective yields quoted for The Money Market Fund are as of December 31, 2011. Yield quotations more closely reflect the current earnings of The Money Market Fund than do total return quotations. To obtain the current 7-day yields for The Money Market Fund, call The Flex-funds® Shareholder Services Department toll free at 800-325-3539 or 614-760-2159. Investments in The Money Market Fund (either class) are not a deposit and are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in The Money Market Fund (either class). |

To obtain a prospectus containing more information about The Flex-funds®, including other fees and expenses that apply to a continued investment in the Funds, you may call (800)325-3539, or write to P.O. Box 7177, Dublin, OH 43017. Please read the prospectus carefully before investing.

Note on comparative indices: Returns for an index do not reflect fees, brokerage commissions, or other expenses associated with investing. One cannot invest directly in an index. Source for equity index data: Bloomberg LP. Source for fixed income index data: Morningstar, Inc. Source for average general-purpose money market fund performance: Lipper, Inc.

| 2011 Annual Report | December 31, 2011 |

2011 Annual Report Fund Holdings & Financial Statements |

| 2011 Annual Report | December 31, 2011 |

Statements of Operations For the Period Ended December 31, 2011 | |

| | | | | | | |

| Investment Income | | | | | | |

| Interest | | $ | 69,247 | | | $ | 7,759 | |

| Interest from affiliates | | | 4,056 | | | | 3,188 | |

| | | 1,443,466 | | | | 1,232,118 | |

| | | 1,516,769 | | | | 1,243,065 | |

| Fund Expenses | | | | | | | | |

| Investment advisor | | | 986,465 | | | | 709,994 | |

| Transfer agent | | | 142,295 | | | | 113,607 | |

| Transfer agent - The Money Market Fund - Retail Class | | | | | | | | |

| Transfer agent - The Money Market Fund - Institutional Class | | | | | | | | |

| Fund accounting | | | 48,858 | | | | 46,467 | |

| Administrative | | | 104,862 | | | | 85,733 | |

| Trustee | | | 13,711 | | | | 10,567 | |

| Audit | | | 10,001 | | | | 9,998 | |

| Legal | | | 3,685 | | | | 3,685 | |

| Custody | | | 18,785 | | | | 16,559 | |

| Printing | | | 10,162 | | | | 7,162 | |

| Distribution plan (12b-1) | | | 237,290 | | | | 236,249 | |

| Distribution plan (12b-1) - The Money Market Fund - Retail Class | | | | | | | | |

| Distribution plan (12b-1) - The Money Market Fund - Institutional Class | | | | | | | | |

| Administrative service plan | | | 237,459 | | | | 188,981 | |

| Postage | | | 7,058 | | | | 5,475 | |

| Registration and filing | | | 24,501 | | | | 24,357 | |

| Insurance | | | 11,051 | | | | 8,919 | |

| Chief Compliance Officer | | | 4,696 | | | | 4,693 | |

| | | 14,609 | | | | 13,287 | |

Total Expenses Before Reductions | | | 1,875,488 | | | | 1,485,733 | |

| Expenses reimbursed/waived by investment advisor | | | (61,248 | ) | | | (70,019 | ) |

| Expenses paid indirectly | | | (76,821 | ) | | | (67,966 | ) |

| Distribution plan (12b-1) expenses waived | | | (24,904 | ) | | | (18,935 | ) |

| Administrative service plan expenses waived | | | (61,666 | ) | | | (10,414 | ) |

Transfer agent expenses waived | | | — | | | | — | |

| | | 1,650,849 | | | | 1,318,399 | |

| | | | | | | | |

Net Investment Income (Loss) | | | (134,080 | ) | | | (75,334 | ) |

| Realized and Unrealized Gain (Loss) from Investments | | | | | | | | |

| Net realized gains (losses) from investments | | | 7,654,168 | | | | 6,074,533 | |

| Net realized gains (losses) from futures contracts | | | 125,200 | | | | (102,743 | ) |

Distributions of long-term realized gains by other investment companies | | | 539,684 | | | | 427,284 | |

Net Realized Gains (Losses) from Investment Transactions, Futures Contracts, and Distributions of Long-term Realized Gains by Other Investment Companies | | | 8,319,052 | | | | 6,399,074 | |

Net change in unrealized appreciation (depreciation) of investments and futures contracts | | | (15,948,476 | ) | | | (13,161,740 | ) |

Net Realized and Unrealized Gain (Loss) from Investments | | | (7,629,424 | ) | | | (6,762,666 | ) |

| | | | | | | | |

Net Change in Net Assets Resulting from Operations | | $ | (7,763,504 | ) | | $ | (6,838,000 | ) |

| * | Commenced operations June 30, 2011. |

| The accompanying notes are an integral part of these financial statements. |

| 2011 Annual Report | December 31, 2011 |

| |

The Aggressive Growth Fund | | | The Defensive Balanced Fund | | | | | | | | | The Utilities and Infrastructure Fund | | | The Total Return Bond Fund* | | | | |

| | | | | | | | | | | | | | | | | | | | |

| $ | 1,006 | | | $ | 60,932 | | | $ | 9,235 | | | $ | 385 | | | $ | — | | | $ | 5,374 | | | $ | 485,555 | |

| | 2,183 | | | | 3,805 | | | | 2,876 | | | | 1,392 | | | | 1,584 | | | | 981 | | | | — | |

| | 342,973 | | | | 1,975,104 | | | | 825,045 | | | | 333,310 | | | | 842,360 | | | | 1,238,476 | | | | — | |

| | 346,162 | | | | 2,039,841 | | | | 837,156 | | | | 335,087 | | | | 843,944 | | | | 1,244,831 | | | | 485,555 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 300,255 | | | | 559,195 | | | | 615,474 | | | | 205,091 | | | | 304,084 | | | | 83,595 | | | | 445,273 | |

| | 48,041 | | | | 89,455 | | | | 98,474 | | | | 24,611 | | | | 36,490 | | | | 16,719 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | 82,530 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | 23,705 | |

| | 36,999 | | | | 43,663 | | | | 44,789 | | | | 25,509 | | | | 33,985 | | | | 17,767 | | | | 48,811 | |

| | 39,971 | | | | 69,647 | | | | 75,651 | | | | 20,509 | | | | 30,409 | | | | 20,881 | | | | 104,487 | |

| | 5,495 | | | | 10,075 | | | | 9,784 | | | | 3,615 | | | | 4,986 | | | | 4,849 | | | | 3,014 | |

| | 10,004 | | | | 10,001 | | | | 10,015 | | | | 10,016 | | | | 9,999 | | | | 10,792 | | | | 10,032 | |

| | 3,685 | | | | 3,685 | | | | 3,685 | | | | 3,685 | | | | 3,685 | | | | 1,658 | | | | 3,685 | |

| | 8,743 | | | | 15,052 | | | | 14,403 | | | | 7,506 | | | | 6,306 | | | | 6,816 | | | | 8,858 | |

| | 3,056 | | | | 7,125 | | | | 7,420 | | | | 1,605 | | | | 2,661 | | | | 4,099 | | | | 9,513 | |

| | 99,986 | | | | 186,734 | | | | 205,101 | | | | 41,082 | | | | 76,046 | | | | 52,316 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | 177,708 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | 8,914 | |

| | 79,991 | | | | 148,765 | | | | 164,013 | | | | 40,990 | | | | 60,809 | | | | 41,562 | | | | — | |

| | 2,934 | | | | 4,884 | | | | 5,998 | | | | 1,757 | | | | 5,576 | | | | 2,373 | | | | 6,159 | |

| | 21,282 | | | | 21,050 | | | | 21,861 | | | | 20,189 | | | | 19,713 | | | | 12,259 | | | | 29,836 | |

| | 3,847 | | | | 6,031 | | | | 7,107 | | | | 2,038 | | | | 2,687 | | | | — | | | | 12,347 | |

| | 4,693 | | | | 4,693 | | | | 4,693 | | | | 4,693 | | | | 4,693 | | | | 2,510 | | | | 4,694 | |

| | 10,786 | | | | 11,820 | | | | 11,024 | | | | 9,994 | | | | 13,570 | | | | 5,637 | | | | 24,636 | |

| | 679,768 | | | | 1,191,875 | | | | 1,299,492 | | | | 422,890 | | | | 615,699 | | | | 283,833 | | | | 1,004,202 | |