UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03651

Touchstone Strategic Trust

(Exact name of registrant as specified in charter)

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Address of principal executive offices) (Zip code)

Jill T. McGruder

303 Broadway, Suite 1100

Cincinnati, Ohio 45202-4203

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end: March 31

Date of reporting period: March 31, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

March 31, 2016

Annual Report

Touchstone Strategic Trust

Touchstone Flexible Income Fund

Touchstone Focused Fund

Touchstone Growth Opportunities Fund

Touchstone International Value Fund

Touchstone Mid Cap Growth Fund

Touchstone Sands Capital Emerging Markets Growth Fund

Touchstone Small Cap Growth Fund

Touchstone Sustainability and Impact Equity Fund

Table of Contents

This report identifies the Funds’ investments on March 31, 2016. These holdings are subject to change. Not all investments in each Fund performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not occur.

Letter from the President

Dear Shareholder:

We are pleased to provide you with the Touchstone Strategic Trust Annual Report. Inside you will find key financial information, as well as manager commentaries for the Funds, for the 12 months ended March 31, 2016.

Concerns about global economic growth dominated the market landscape during the period. While growth in Europe and Japan remained anemic, it was a potential slowdown in China’s economy that was most concerning. This was most directly reflected in the continued decline of commodity and crude oil prices, which in turn caused emerging market economies (such as Brazil and Russia) most levered to those markets to struggle. More broadly, China’s economy had a strong impact on investor sentiment. Weaker economic data releases were followed by sharp, but temporary sell-offs in the equity markets. Recognizing the downside risks to the global economy, central banks maintained highly accommodative monetary policies. Even in the U.S. – where economic growth had been unspectacular but stable – the U.S. Federal Reserve Board raised short-term rates by a marginal amount in December, but provided new guidance in early 2016 that indicated a more gradual path for potential future interest rate hikes.

The global growth fears resulted in mixed performance for equity markets. Domestic markets generally outperformed their non-U.S. counterparts, but still struggled. In a period of elevated market volatility, the perceived safety of large-capitalization stocks was rewarded with small gains, while smaller-capitalization companies reported losses. Growth stocks ended a multi-year run of outperformance as analysts questioned whether growth could be maintained in a weak global economy.

Despite the first interest rate hike in the U.S. in nearly a decade, monetary policy around the world remained accommodative. The increased economic uncertainty caused investors to seek the safety of bonds, and U.S. Treasury yields actually declined during the period. Reflecting the increased risk, credit spreads – particularly in energy and commodity-related sectors – widened, which favored investment grade bonds over high yield securities.

After a multi-year bull market, the volatility experienced this year provided a sober reminder of the risks of investing. It is our belief that risk must be viewed in the context of one’s long-term goals, and not seen through the prism of short-term market movements. A financial professional can help you determine your risk-return profile and create an asset allocation plan that may be suitable for the diverse market environments ahead.

We greatly appreciate your continued support. Thank you for including Touchstone as part of your investment plan.

Sincerely,

Jill T. McGruder

President

Touchstone Strategic Trust

Management’s Discussion of Fund Performance (Unaudited)

Touchstone Flexible Income Fund

Sub-Advised by ClearArc Capital, Inc.

Investment Philosophy

The Touchstone Flexible Income Fund seeks a high level of income consistent with reasonable risk and seeks capital appreciation as a secondary goal. The Fund primarily invests in income-producing securities such as debt securities, common stocks, and preferred stocks. Its investment approach seeks to maximize risk-adjusted returns through fundamental research, quantitative modeling, quantitative analysis, and capital structure analysis. In performing this research, modeling and analysis, companies are evaluated based on such factors as sales, assets, earnings, markets, and management, as well as debt-to-equity ratios. The Fund seeks returns by investing across a broader array of investments than traditional investment-grade fixed-income funds, and ClearArc believes that a low correlation between various asset classes leads to stability of expected returns.

Fund Performance

Touchstone Flexible Income Fund (Class A Shares) outperformed its benchmark, the Barclays U.S. Aggregate Bond Index, for the 12-month period ended March 31, 2016. The Fund’s total return was 2.13 percent (calculated excluding the maximum sales charge), while the total return of the benchmark was 1.96 percent.

Market Environment

The 12-month period that ended on March 31, 2016 was largely a tale of two environments. Many trends that held during the first three quarters of the period began to change during the final quarter. For much of 2015, the first increase in the U.S. Federal Funds rate since 2006 appeared to be just around the corner. This caused market volatility to increase. A false alarm about a possible interest rate hike in September caused volatility to spike in many markets. The U.S. Federal Reserve Board (Fed) finally raised rates in December. The immediate aftermath of that action was increased market volatility, as well as an equity sell-off, which subsided in March 2016 when the Fed turned dovish, citing sluggish global growth as the reason for its more cautious view.

Across global capital markets, interest rates fell over the 12-month period. The European and Japanese economies showed encouraging signs of recovery early in the period but later stagnated. U.S. corporate credit spreads, the yield premium that corporate credit offers over U.S. Treasuries of similar maturities, widened significantly, resulting in poor performance among corporate bonds. In currencies, the euro and Japanese yen both delivered strong returns. The U.S. dollar initially performed well but weakened in early 2016.

Performance of the U.S. stock market, measured by the S&P 500® Index, was slightly positive for the period while most other global equity markets generated negative returns. Emerging market equities finished the 12-month period in negative territory led by commodity producing countries.

Portfolio Review

There were a number of drivers of the Fund’s outperformance such as derivatives positions and preferred equities. The strong derivatives performance was led by short positions on the currencies of Brazil, South Africa, Colombia, South Korea and New Zealand. A Eurodollar/Euribor convergence trade expressed our view that the Fed would be dovish relative to the European Central Bank (ECB). Ultimately, the position profited when the gap narrowed between short-term forward rates in the U.S. and Europe. Finally, the Fund’s positions in equities and in the Chicago Board Options Exchange Volatility Index (VIX), which measures volatility in the S&P 500® Index, also added to the outperformance. Among preferred equities, banks remained under scrutiny and operated with much higher capital levels, so we had anticipated incremental return there. It proved to be the right move as preferreds outperformed other credit sectors.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

The Fund’s performance detractors included bond sectors the Fund did not own. Fund weights in U.S. Treasury and Agency bonds were less than the benchmark and were not quite enough to keep up with benchmark performance. As such, an underweight to U.S. Treasuries hurt as yields fell and prices increased.

Outlook

The current pulse of the macroeconomic outlook is for inflation to increase. With the weaker U.S. dollar, this may take months to play out. As a result, we prefer the Japanese and European equity markets over U.S. equities. We also like U.S. housing, which continues to recover from weak levels. Ongoing job growth and wage hikes in the U.S. should help maintain this recovery. However, we expect market volatility to remain elevated. Economic data has varied, members of the Fed are providing conflicting and evolving views, and we believe China can show some improved economic growth for a quarter or two but feel it is unsustainable longer-term. We believe the market is fairly pricing on the chance of future interest rate hikes, but this may change quickly if inflation data surprises to the upside.

Looking a little further into the future, we believe central banks may need to confront higher inflation while economic growth remains weak. This may be an unpleasant set of circumstances. We believe attempting to stimulate economic activity through lower rates is not working. Central banks may become more creative, so be prepared to hear the term “helicopter money” more as the year progresses. This is a monetary policy in which central banks distribute money to consumers in order to increase the rate of inflation. It is more of a direct approach than lowering interest rates, which has not been working well given the weak demand for credit.

We also believe the large divergence between the U.S. equity market and the Japanese and European equity markets will not be sustained. Credit market rallies are likely unsustainable, in our view. This is due to high corporate balance sheet leverage and weak growth. Finally, we believe emerging markets will relapse at some point later this year. Emerging market fundamentals are very weak and credit growth is anticipated to turn negative.

The Fund will remain defensively positioned overall, and for the next few quarters we are positioning it for the possibility of a reflationary environment. This positioning includes the move to higher quality bonds and preferred equities that we mentioned earlier. We expect the Fund’s quality to stay neutral or continue to rise versus the benchmark. The Fund’s overall duration is shorter than the benchmark’s. We manage duration for both the bond allocation and the preferred allocation, as well as at a portfolio level. We expect to maintain preferred positioning at neutral to the benchmark or slightly higher, unless risk of recession rises. The Fund’s equity exposure may increase on opportunities in Japan and Europe. Equity exposure may also rise in sectors that are a beneficiary of reflationary policies, such as Industrials or Materials.

Dividend-paying investments may not experience the same price appreciation as non-dividend paying instruments, dividend-issuing companies may choose not to pay a dividend, or the dividend may be less than what is anticipated.

Diversification neither assures a profit nor guarantees against loss in a declining market.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Flexible Income Fund - Class A* and the Barclays U.S. Aggregate Bond Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares and Institutional Class shares was April 1, 2004, October 29, 2001, September 1, 1998 and September 10, 2012, respectively. Class A shares, Class C shares and Class Y shares performance information was calculated using the historical performance of the Fifth Third/ Maxus Income Fund Investor shares, with an inception date of March 10, 1985, for periods prior to April 1, 2004, October 29, 2001 and September 1, 1998, respectively. Institutional Class shares performance information was calculated using the historical performance of Class Y shares for the periods prior to September 10, 2012. The returns have been restated for sales loads and fees applicable to Class A, Class C, Class Y and Institutional Class shares. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

Barclays U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. investment grade, fixed rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and ten years.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone Focused Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Fund seeks to invest in companies of all capitalizations that are trading below what is believed to be the estimate of their intrinsic value and have a sustainable competitive advantage or a high barrier to entry in place. The barrier(s) to entry can be created through a cost advantage, economies of scale, high customer loyalty or a government barrier (e.g. license or subsidy). Management believes that the strongest barrier to entry is the combination of economies of scale and high customer loyalty.

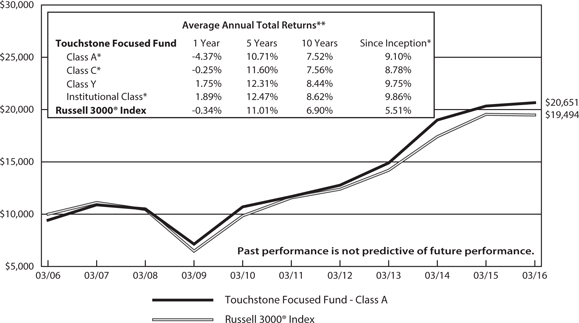

Fund Performance

The Touchstone Focused Fund (Class A Shares) outperformed its benchmark, the Russell 3000® Index, for the 12-month period ended March 31, 2016. The Fund’s total return was 1.47 percent (calculated excluding the maximum sales charge), while the total return of the benchmark was -0.34 percent.

Market Environment

For the twelve months ended March 31, 2016, domestic equity markets experienced a higher than normal level of volatility as the broader indices declined moderately in value. The first quarter of 2016 ended with positive momentum however, as the U.S. Federal Reserve Board (Fed) provided language that suggested it planned to take a more cautious approach to future interest rate increases. Also helping market sentiment was the decision by Chinese officials to bolster its economy as well as reports that Saudi Arabia was considering freezing its oil production in an attempt to establish a floor for oil prices. Top performing sectors from the past twelve months included Telecommunication Services, Utilities, Consumer Staples, Information Technology and Consumer Discretionary. Energy was the worst performing sector with Materials, Health Care and Financials also lagging. The Industrials sector finished in-line with the benchmark.

Portfolio Review

Stock selection accounted for all of the outperformance for the Touchstone Focused Fund. Sector allocation detracted from performance with cash holdings detracting slightly. The majority of the sector allocation impact was due to underweights in both the Utilities and Telecommunication Services sectors. The leading sector contributors came from overweights to the Consumer Staples and Information Technology sectors. Sector weights are mainly a function of the Fund’s stock selection process. On an absolute basis, seven of the nine sectors in which the Fund was invested outperformed the benchmark. Investments made in international companies underperformed the benchmark while domestic holdings outperformed.

Amazon.com Inc. (Consumer Discretionary sector) was the top performing stock during the past 12 months. Throughout the past year, Amazon benefited from an improving core business as well as a better than expected holiday season and positive momentum in its U.S. eCommerce and cloud businesses. Alphabet Inc. (Information Technology sector; formerly known as Google) benefited from positive momentum in its YouTube and mobile segments and an announced $5 billion buyback. SYSCO Corp. (Consumer Staples sector) benefited from the company reporting stronger than expected revenue growth following a failed attempt to acquire its largest competitor.

Stocks that detracted from performance included Joy Global Inc. (Industrials sector) which reported several weak quarters as it warned investors of continued weakness due to the impact from falling commodity prices, particularly iron ore and copper. Kennametal Inc. (Industrials sector) reduced guidance throughout the year due to general weakness in its end markets. Novartis (Health Care sector) guided earnings down for 2016 due to generic erosion of top selling drug Glivec and slowing revenue growth at its eye care division.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

During the past 12 months, we increased the Fund’s weight to the Health Care and Information Technology sectors. We also decreased the weight to Industrials, Energy, Financials and Consumer Discretionary sectors. The Fund’s cash position stood at 7.8 percent as of March 31, 2016 which is an increase from 2.2 percent a year ago.

From a market cap perspective, we exited the Fund’s remaining positions in smaller-cap stocks (companies with a market cap below $2 billion). The Fund now has no exposure to that segment, compared to the benchmark weight of 5.4 percent. The Fund remained underweight in mid-cap businesses. While we continued to increase the Fund’s exposure to larger-cap businesses (companies with a market cap above $10 billion), it remains underweight compared to the benchmark. This allocation decision added slightly to performance during the year.

Over the past twelve months, we have focused on buying high quality businesses with stable returns on capital, solid balance sheets and sustainable barriers to entry. As a result, the Fund portfolio’s weight to high barrier businesses has increased over the past year. The weighted average return on capital for the companies held in the Fund (ex Financials) is currently significantly more than the weighted average cost of capital. Overall, the Fund is fully invested in companies that we believe are sheltered by barriers to entry indicating that these businesses should continue to earn attractive returns on capital in the future.

Outlook

Due to increased concerns over the quality of the market rally and corporate earnings, along with rising concerns internationally, we have decreased the Fund’s cyclical exposure and operational leverage over the last few quarters. Additionally, exposure to financial leverage in the Fund, excluding the Financials sector (leverage is a part of the financial service business model in most cases), is below the level in the benchmark. We continue to focus on buying what we believe are high quality businesses with stable returns on capital, solid balance sheets and sustainable barriers to entry.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

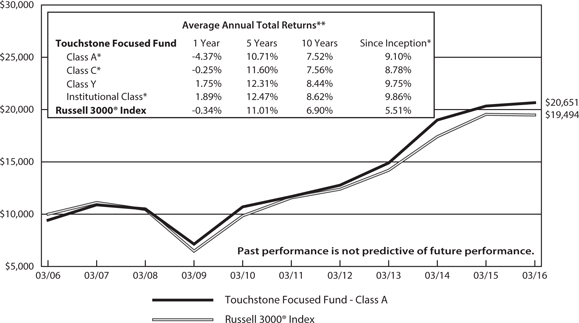

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Focused

Fund - Class A* and the Russell 3000® Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares and Institutional Class shares was September 30, 2003, April 12, 2012, February 12, 1999 and December 20, 2006, respectively. Class A shares, Class C shares and Institutional Class shares performance information was calculated using the historical performance of Class Y shares for the periods prior to September 30, 2003, April 12, 2012 and December 20, 2006, respectively. The returns have been restated for sales loads and fees applicable to Class A, Class C and Institutional Class shares. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Notes to Chart

Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

The Frank Russell Company (FRC) is the source and owner of the Index data contained or reflected in this material and all trademarks and copyrights related thereto. The material may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a Touchstone Investments presentation of the data, and FRC is not responsible for the formatting or configuration of this material or for any inaccuracy in the presentation thereof.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone Growth Opportunities Fund

Sub-Advised by Westfield Capital Management, L. P.

Investment Philosophy

The Touchstone Growth Opportunities Fund seeks long-term growth of capital by primarily investing in stocks of U.S. companies with large, medium and small market capitalizations. The Fund’s portfolio managers place focus on companies they believe to have demonstrated records of achievement with excellent prospects for earnings growth over a 1 to 3 year period. Westfield looks for companies that it believes are reasonably priced with high forecasted earnings potential.

Fund Performance

The Touchstone Growth Opportunities Fund (Class A Shares) underperformed its benchmark, the Russell 3000® Growth Index, for the 12-month period ended March 31, 2016. The Fund’s total return was -9.12 percent (calculated excluding the maximum sales charge), while the total return of the benchmark was 1.34 percent.

Market Environment

Despite several bouts with volatility, the broad U.S. equity markets finished the period nearly where they started. A consistent theme throughout the period was the oscillation of investors’ views on the global economy. Fears of a slowdown sparked sharp sell-offs, only for the market to rebound when investor sentiment improved. The period began with a steady market advance, which came to an abrupt halt in the last week of June 2015 when Greece effectively defaulted on its scheduled $1.7 billion debt payment to the International Monetary Fund (IMF). Although this European nation of 11 million people contributes less than 0.4 percent to the global Gross Domestic Product (GDP), the prospect of its economic demise undermined confidence in financial markets more broadly. Perhaps more of a concern to investors was the eroding business confidence in Germany, Europe’s economic powerhouse, and China’s large stock market sell-off. The month of August brought a broad downturn across global financial markets, triggered by China’s surprise yuan devaluation and fears that China’s cooling economy would lead to an overall slowdown in global growth. The U.S. economy, on the other hand, proved to be more resilient than earlier economic forecasts had predicted. Consumer and business spending continued to improve, the unemployment rate dropped to 5 percent, and the gradual tightening of labor markets manifested itself in modest wage growth. By year-end, headline inflation actually firmed despite further weakness in energy prices and a strong U.S. dollar. The U.S. Federal Reserve Board (Fed) expressed confidence in the prospects for the U.S. economy by taking the first step to end the extended period of its unconventional easy money policy by slightly raising the target rate for Fed Funds in December. Investor sentiment, however, continued to reflect caution in the early trading days of 2016. This reversed in mid-February, and U.S. markets turned around to finish the first quarter of 2016 and the 12-month period higher than they began.

Portfolio Review

Stock selection accounted for the majority of the underperformance with sector allocation also detracting from returns. Weakness particularly in the Health Care, Industrials, and Consumer Discretionary sectors offset moderate strength in the Materials sector.

The Health Care sector detracted from relative performance. The substantial amount of the sector’s losses stemmed from the Fund’s position in PTC Therapeutics, Inc., a developer of biopharmaceutical products. The stock traded down sharply in February after the company received a refuse to file (RTF) letter from the Food & Drug Administration. Our initial investment in PTC was predicated on our belief that the company’s Duchenne’s Muscular Dystrophy and Cystic Fibrosis drug Translarna had a multibillion dollar potential and the ability to generate significant operating leverage given the low infrastructure needs of the orphan drug space. The FDA’s

Management’s Discussion of Fund Performance (Unaudited) (Continued)

RTF letter has significantly delayed any potential roll-out of Translarna. Additionally, we found that management’s remarks around the RTF letter raised significant questions around other statements the company had made. Given these two factors, we determined that an outright sale was the most prudent course of action. Also detracting from the Fund’s relative performance was Ireland-domiciled Jazz Pharmaceuticals PLC. After reaching an all-time high at the end of July, the stock declined in August and September in tandem with its peers in the specialty pharmaceutical space. We maintain an investment in the company, which has a portfolio of products in the orphan space focused on the areas of oncology and psychiatry. Jazz’s lead asset Xyrem, which is used for the treatment of severe narcolepsy, is protected from competitive threats by multiple layers of patents and regulatory barriers. To help diversify its portfolio of products without sacrificing high growth and margin profile, Jazz has been building a commercial portfolio in pediatric oncology and rare diseases. The company’s seasoned management team and low tax infrastructure further differentiates Jazz from other firms within the specialty pharma universe, which is why we maintain a position in the stock.

The Industrials sector also detracted from relative performance. Steelcase Inc., a provider of office furniture systems, was the sector’s biggest source of weakness. Shortly after initiating a position in October, the stock traded lower following the release of the company’s quarterly results, which came in shy of Wall Street expectations. While orders in its Europe, Middle East, and Asia business segments were up 20 percent organically, Steelcase saw fewer large orders in its Americas segment due to lower business spending. As a result, the company guided fourth quarter sales and earnings down to below consensus estimates. Steelcase also declined in part due to competitor Herman Miller as well as smaller competitors, and noted that it would bring a number of new products to market in an effort to stem the market share erosion. We continue to hold the position but are monitoring it closely given the weak results. Airline operator United Continental Holdings, Inc. declined in late spring of 2015, along with all the other airlines, following a decision by Southwest Airlines Co. to raise its guidance for available seat miles (ASM). ASM is a measure of an airline flight’s passenger carrying capacity, and it is closely monitored by investors who are concerned that added seats, along with lower airfares, will pressure profit margins. The stock was sold, but we have since reinitiated a position given our belief that the company is poised to cut capacity and to execute on sequentially better PRASM (passenger revenue per available seat mile) trends going forward. Commercial vehicle dealership operator Rush Enterprises, Inc. also detracted from relative performance.

The Consumer Discretionary sector detracted from relative performance during the period. We had resisted building a position in the on-line retail phenomenon Amazon.com, Inc. given the company’s lofty valuation. We finally bought the stock in mid-July, after Amazon reported better-than-expected profits across all of its business lines. The cloud computing platform Amazon Web Services (AWS), which was launched by the company in 2006 but did not report a profitable quarter until the spring of 2015, was the greatest driver of the earnings upside. A sum of parts valuation approach, which is based on both the AWS segment and the core retail business, yielded a much more palatable entry point for us. The stock exited 2015 near its all-time highs, but moderated in early 2016 as fourth quarter earnings failed to meet consensus expectations. Despite the recent quarterly results, we remain invested in the stock due to the company driving an increasing share of all retail sales growth in the U.S. Amazon announced in February that it had authorized a $5 billion share repurchase program. Historically, the company’s repurchases have been positive signals of future outperformance. Clothing manufacturer V.F. Corp. was the Fund’s weakest performer in the Consumer Discretionary sector. The stock suffered after the company reported quarterly results shy of Wall Street expectations and lowered forward guidance in late October. Despite the weakness, we initially chose to remain invested in the stock given the company’s diversified global brands, which we believed made it less volatile than other apparel players. However, we sold the stock in February given worsening retail data points and our determination that the stock was expensive relative to its peers.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

The Materials sector contributed to relative performance, due primarily to stock selection. Vulcan Materials Company, the largest producer of construction aggregates in the U.S., was one of the sector’s top performers in 2015. The stock continued to trade higher in the first quarter of 2016. The company reported robust operational results for its fourth fiscal quarter, with higher-than-expected volumes driving sales and 80 percent incremental margins boosting profits. Management’s upbeat earnings guidance for 2016 and its confident tone during the quarterly investor call left us optimistic that there is further upside potential for the stock. A timely sale of the Fund’s investment in Monsanto Co. , a supplier of agricultural products to farmers, also benefited relative performance. This leader in the agricultural seed and traits industry traded higher in April and May, powered by investor optimism for the company’s product pipeline, organic sales growth and margin expansion. However, the stock was sold in May after evaluating Monsanto’s proposed acquisition of peer Syngenta. This sale proved to be the right decision, as the stock subsequently sold off during the summer of 2015.

Outlook

Recent economic data have shown improvement in the U.S. economy. The employment picture continues to look bright, oil prices appear to have stabilized, the service sector is expanding, industrial production is ticking up, and consumer spending is stable. Investor concerns about other global economies have also receded somewhat. China’s industrial profits have been showing signs of life this year and its consumer-driven segments have been an area of growth. The economic recovery continues in Europe, albeit at a tepid pace. Global manufacturing statistics have stabilized and emerging markets appear to be bottoming. In short, economic growth around the world is slow, but we do not think a recession is likely. We think this economic backdrop is good for domestic growth equities. We believe we have positioned the Fund to benefit from pockets of secular strength, focusing on those companies that have sustainable pricing power, a competitive edge, and attractive fundamentals.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Growth Opportunities Fund - Class A* and the Russell 3000® Growth Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares and Institutional Class shares was September 29, 1995, August 2, 1999, February 2, 2009 and February 2, 2009, respectively. Class C shares, Class Y shares and Institutional Class shares performance information was calculated using the historical performance of Class A shares for periods prior to August 2, 1999, February 2, 2009 and February 2, 2009, respectively. The returns have been restated for sales loads and fees applicable to Class C, Class Y and Institutional Class shares. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

Russell 3000® Growth Index measures the performance of those Russell 3000® companies with higher price-to-book ratios and higher forecasted growth values.

The Frank Russell Company (FRC) is the source and owner of the Index data contained or reflected in this material and all trademarks and copyrights related thereto. The material may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a Touchstone Investments presentation of the data, and FRC is not responsible for the formatting or configuration of this material or for any inaccuracy in the presentation thereof.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone International Value Fund

Sub-Advised by Barrow, Hanley, Mewhinney & Strauss, LLC

Investment Philosophy

The Touchstone International Value Fund seeks long-term capital growth by primarily investing in equity securities of non-U.S. companies believed to be undervalued and seeks companies that have price-to-earnings and price-to-book ratios below the market, enterprise-value/free-cash-flow ratios at or below the market and dividend yields above the market.

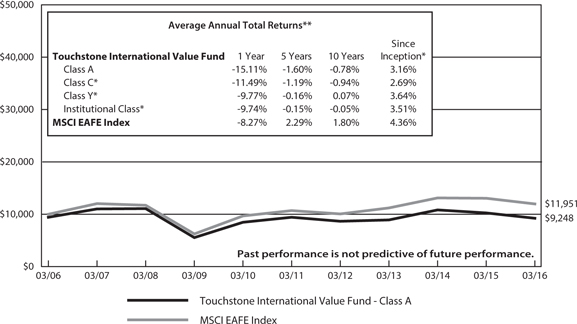

Fund Performance

The Touchstone International Value Fund (Class A Shares) underperformed its benchmark the MSCI EAFE Index, for the 12-month period ended March 31, 2016. The Fund’s total return was -9.97 percent (calculated excluding the maximum sales charge), while the total return of the benchmark was -8.27 percent.

Market Environment

At the beginning of the 12-month period, the U.S. economy led global markets as the U.S. dollar strengthened and the U.S. Federal Reserve Board (Fed) guided market expectations for higher interest rates. In sharp contrast, central banks around the world eased monetary conditions by lowering interest rates in response to weak economic growth and deflationary pressures. Despite a weak fundamental backdrop, many countries saw positive market responses as a result of accommodative monetary policy from central banks. However, in August 2015, equity markets fell sharply around the globe following China’s currency devaluation. A number of emerging market currencies collapsed in response, sparking heavy outflows from those markets. Contagion fears spread to developed markets, including Europe and the U.S., which further highlighted the risk of increased global dependence on China as a driver of global economic growth. Emerging market commodity exporters such as Russia and Brazil suffered most from China’s problems, and the decline in oil prices contributed additional uncertainty to an already volatile Middle East region. As 2015 came to a close, the U.S. economy and its policy responses continued to diverge from the rest of the world, primarily because of a stronger dollar and the likelihood of higher interest rates.

At the start of 2016, there was a strong consensus that lower oil prices and actions from the world’s central banks – aggressive monetary easing and lower interest rates – would benefit major world markets, including Europe, Japan and China. Many investors also believed that the U.S. would continue on its path toward a strengthening economy and higher interest rates, resulting in continued strength for the U.S. dollar. This consensus view proved wrong as the U.S. dollar weakened, interest rates in the U.S. did not rise and equity markets with the most aggressive monetary easing policies moved lower. By mid-February, however, economic readings – along with oil and commodity prices – stabilized, rekindling investors’ appetite and rallied equity markets. Commodity exporters saw their stock markets rise, and emerging markets overall also moved higher.

Portfolio Review

For the period, the Fund’s stock selection within the Materials, Consumer Discretionary and Consumer Staples sectors contributed most to performance, while stock selection within the Information Technology, Health Care and Telecommunication Services sectors detracted from performance.

Among the individual stocks that contributed to Fund performance during the period were Imperial Brands PLC, Dairy Crest Group PLC (both from the Consumer Staples sector), DS Smith PLC (Materials sector) and National Grid PLC (Utilities sector). Imperial Brands PLC, a U.K.-based cigarette, cigar and tobacco manufacturer, outperformed after the U.S. Federal Trade Commission (FTC) approved the merger between Reynolds American Inc. and Lorillard Inc. in June 2015. As part of that transaction, Imperial purchased five brands – KOOL,

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Salem, Winston, Maverick and blueCigs – from Reynolds and Lorillard. The transaction also included Imperial’s acquisition of Lorillard’s manufacturing facilities and its U.S. sales and marketing teams. These acquisitions drove Imperial’s U.S. market share higher. Dairy Crest Group, a U.K.-based consumer foods business, outperformed due in part to the company’s sale of its dairy business to competitor Müeller Dairy Ltd. Meanwhile, Dairy Crest’s core business also performed well, making additional market share gains in its profitable Cathedral City cheese business. Materials company DS Smith endured a volatile 12 months, but ultimately outperformed. The U.K.-based packaging company benefited from its long-term strategy of focusing on packaging solutions for fast-moving consumer packaged goods (FMCG) companies and utilizing its integrated recycled paper products as raw material inputs. Furthermore, the company reported continued market share gains, rising margins and increased volume growth. DS Smith also benefited from growth via acquisitions during the period. National Grid is a U.K.-based utility company with high quality assets and solid regulatory constructs. National Grid briefly underperformed early in the period, as income-producing equities suffered amid concerns of interest rate action by central banks. As the economic environment weakened and the risk of policy tightening subsided, the stock recovered lost ground and advanced to new highs in March 2016. National Grid’s U.K. utilities have rate structures that automatically adjust for changes in interest rates and inflation, which help to reduce earnings volatility and improve transparency. The Fund remains invested in the stock due to our belief that National Grid will continue to deliver consistent growth in earnings and dividends.

Among the stocks that detracted from Fund performance were Delta Lloyd NV (Financials sector), Casino Guichard-Perrachon SA (Consumer Staples sector), Joy Global Inc. and IHI Corp. (both from the Industrials sector). Delta Lloyd is a Netherlands-based financial services provider offering insurance products, fund management and banking products and services. A transition in the European Union’s regulatory regime has been in process for more than ten years and is scheduled to finally be implemented in January 2016. Dutch regulators have forced companies to be compliant with the new Solvency II standards at the beginning of 2016. This compressed transition period for compliance has put pressure on Dutch insurance companies like Delta Lloyd. The company attempted to address its capital issues by repositioning its investment portfolio to lower risk-weighted assets and by selling businesses it viewed as non-core, but these actions were insufficient to cover the capital shortfall in the short time the regulators allotted. As a result, Delta Lloyd announced that it would implement an equity issuance, which we believe will likely be dilutive to existing shareholders. Casino Guichard-Perrachon is a France-based company that owns and operates retail outlets in France and abroad. Latin America accounted for approximately one-third of its business, and the stock declined as the Brazilian economy weakened and investors grew concerned about the company’s Brazil-based consumer electronic retailing business, Via Varejo SA. An additional negative factor was the depreciation of the Brazilian real against the euro. Joy Global is a U.S.-based manufacturer and distributor of mining equipment for the extraction of minerals and ores. Amid the continued decline in commodity prices, Joy’s customers decreased their maintenance and capital expenditures due to declines in copper prices and the negative impact that lower natural gas prices had on coal as a substitute. The decrease in capital expenditure spending negatively impacted Joy Global, causing the company to reduce its full-year earnings outlook. Though it was only owned for a portion of the period, IHI Corp. also detracted from relative results. This Japan-based heavy equipment manufacturer generates about half of its income from aircraft engines, but also has substantial exposure to turbo chargers and power plant construction. As a Japanese company, the stock faced general headwinds due to concerns about an economic slowdown in China, a significant trading partner for Japan and its industrial companies. The stock was further pressured due to an unexpected loss provision in its power plant construction business. However, we view the stock’s declines as an overreaction and the Fund remains invested in the company. Based solely on the earnings from the turbo charger and aircraft engine segments, we estimate the company to be undervalued.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Outlook

Our view remains that many of the central banks’ initiatives are not expanding liquidity or the global economy, and that sustainable growth will likely be accompanied by more normal (i.e., higher) interest rates and a banking system that is not constricting growth. Once central bankers reach this conclusion, we believe the market should begin to reward many financial stocks for their cheapness and improving fundamentals. We believe the largest concern for investors and central banks continues to be China and its effect on developed and emerging markets. Profits in both mature and emerging markets have been decelerating for some time in response to China’s slowdown, and investors continue to watch global GDP and manufacturing for signals as to the direction of corporate profits. In March, however, many countries, including the U.S. and several in the eurozone, showed improvement in their Purchasing Manager’s Index (PMI) data, which tend to be leading indicators of global corporate profits. We believe that a continuation of this trend should boost investor confidence going forward.

Our investment discipline is driven by fundamental research, which includes analyzing and building our own appraisals of fair value one company at a time. We strive to comprise a relatively concentrated basket of companies that we believe offers a better return profile relative to the market.

Dividend-paying investments may not experience the same price appreciation as non-dividend paying instruments, dividend-issuing companies may choose not to pay a dividend, or the dividend may be less than what is anticipated.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

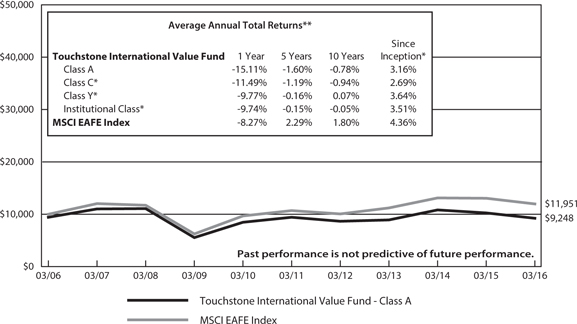

Comparison of the Change in Value of a $10,000 Investment in the Touchstone International

Value Fund - Class A* and the MSCI EAFE Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares and Institutional Class shares was August 18, 1994, April 25, 1996, October 9, 1998 and September 10, 2012, respectively. Class C shares, Class Y shares and Institutional Class shares performance information was calculated using the historical performance of Class A shares for periods prior to April 25, 1996, October 9, 1998 and September 10, 2012, respectively. The returns have been restated for sales loads and fees applicable to Class C, Class Y, and Institutional Class shares. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance excluding the U.S. and Canada.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This report is not approved or produced by MSCI.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone Mid Cap Growth Fund

Sub-Advised by Westfield Capital Management, L. P.

Investment Philosophy

The Touchstone Mid Cap Growth Fund seeks to increase the value of Fund shares by primarily investing in stocks of mid-cap U.S. companies. The Fund’s portfolio managers place focus on companies that they believe to have a demonstrated record of achievement with excellent prospects for earnings growth over a 1 to 3 year period. Westfield looks for companies that it believes are reasonably priced with high forecasted earnings potential.

Fund Performance

The Touchstone Mid Cap Growth Fund (Class A Shares) underperformed its benchmark, the Russell Midcap® Growth Index, for the 12-month period ended March 31, 2016. The Fund’s total return was -6.34 percent (calculated excluding the maximum sales charge), while the total return on the benchmark was -4.75 percent.

Market Environment

Despite several bouts with volatility, the U.S. broad equity markets finished the period nearly where they started. A consistent theme throughout the period was the oscillation of investors’ views on the global economy. Fears of a slowdown sparked sharp sell-offs, only for the market to rebound when investor sentiment improved. The period began with steady advance, which came to an abrupt halt in the last week of June 2015 when Greece effectively defaulted on its scheduled $1.7 billion debt payment to the International Monetary Fund (IMF). Although this European nation of 11 million people contributes less than 0.4 percent to the global Gross Domestic Product (GDP), the prospect of its economic demise undermined confidence in financial markets more broadly. Perhaps more of a concern to investors was the eroding business confidence in Germany, Europe’s economic powerhouse, and China’s large stock market sell-off. The month of August brought a broad downturn across global financial markets, triggered by China’s surprise yuan devaluation and fears that China’s cooling economy would lead to an overall slowdown in global growth. The U.S. economy, on the other hand, proved to be more resilient than earlier economic forecasts had predicted. Consumer and business spending continued to improve, the unemployment rate dropped to 5 percent, and the gradual tightening of labor markets manifested itself in modest wage growth. By year-end, headline inflation actually firmed despite further weakness in energy prices and a strong U.S. dollar. The U.S. Federal Reserve Board (Fed) expressed confidence in the prospects for the U.S. economy by taking the first step to end the extended period of its unconventional easy money policy by slightly raising the target rate for Fed Funds in December. Investor sentiment, however, continued to reflect caution in the early trading days of 2016. This reversed in mid-February, and U.S. markets turned around to finish the first quarter of 2016 and the 12-month period higher than they began.

Portfolio Review

Positive contributions from strong stocks election particularly within Information Technology, Consumer Discretionary and Materials was offset by an underweight to Consumer Staples and overweights to the Health Care and Energy sectors.

The Health Care sector was the biggest detractor from relative performance during the period. After a solid start to the period, AMAG Pharmaceuticals, Inc., a specialty pharmaceutical company, suffered severe losses in the second half of 2015. Investors were scared by the news that a relatively unknown company, McGruff Pharmaceuticals, had received approval for a generic drug that had the same active ingredient as AMAG’s Makena, an orphan-status product for the treatment of pre-term birth. The Fund remained invested given our belief that we were not likely to see a meaningful impact on Makena sales from the generic drug. Later in the year,

Management’s Discussion of Fund Performance (Unaudited) (Continued)

the company announced a delay for the approval of Makena. AMAG requested an expedited review by the Food & Drug Administration, and it was an encouraging sign that the request was accepted. We continue to believe that AMAG enjoys strong operating margins, strong free cash flow and that management intends to aggressively redeploy cash into new growth acquisitions. However, the Fund exited the position in February to fund the purchase of another stock with a more favorable risk/reward. Also detracting from the Fund’s relative performance was Ireland-domiciled Jazz Pharmaceuticals PLC. After reaching an all-time high at the end of July, the stock declined in August and September in tandem with its peers in the specialty pharmaceutical space. We maintain an investment in the company, which has a portfolio of products in the orphan space focused on the areas of oncology and psychiatry. Jazz’s lead asset Xyrem, which is used for the treatment of severe narcolepsy, is protected from competitive threats by multiple layers of patents and regulatory barriers. To help diversify its portfolio of products without sacrificing high growth and margin profile, Jazz has been building a commercial portfolio in pediatric oncology and rare diseases. The company’s seasoned management team and low tax infrastructure further differentiates Jazz from other firms within the specialty pharmaceutical universe, which is why we maintain a position in the stock.

Fund positions in the Energy sector detracted from relative performance. CONSOL Energy Inc., a producer of coal and gas and provider of electric services, detracted from performance during the period. Although we believed that the company’s assets could prove to be highly valued in the right economic context, the Fund sold the stock as we believed its coal exposure and financial leverage could limit the stock upside. Offsetting the poor performance in CONSOL were the Fund positions in refiners. U.S. refiners benefited late in 2015 from strong gasoline demand globally and limited access to refining capacity. However, the Fund’s exposure to refiners has trended lower recently, as slowing production growth is a headwind for earnings.

The Consumer Staples sector also detracted from relative performance. Although stock selection benefited relative returns, it could not make up for the Fund being underweight in the sector, which was the benchmark’s top performer during the period. Additionally, Mead Johnson Nutrition Company, a producer of infant and children’s nutrition products, traded down and was sold in September given the company’s heavy exposure to weakening markets in China/Brazil. The stock advanced subsequent to its sale from the Fund’s portfolio, further negatively impacting the Fund’s incremental results. Consumer Staples, in general, run contrary to the Westfield investment discipline and approach. Specifically, Consumer Staples stocks offer, on average, slower rates of growth combined with above average multiples. While exceptions exist, they are just that—exceptions, and not the rule. As fewer companies in the Consumer Staples sector meet our growth and valuation criteria, it is likely that we will continue to remain underweight the group. While this positioning can hurt relative performance at times of high market uncertainty (i.e., where visibility is highly valued, and arguably overvalued), we would expect the allocation impact to reverse as valuations revert to levels more consistent with the companies’ reported rates of growth.

The Information Technology sector contributed to relative performance. Total System Services, Inc., a provider of outsourced payment services, was the sector’s top performer. The stock enjoyed a prolonged advance through most of 2015, beating earnings expectations in each quarter of the year. We had maintained a position in the stock based on growth in the company’s card issuer processing business and generation of ample cash flow, which management uses to fund strategic mergers and acquisitions (M&A), share repurchases and dividends. However, given how much the stock had gained, we sold the stock in early January to fund the purchase of another position with a more favorable risk/reward. Splunk Inc. is a provider of a software platform that enables organizations to gain real-time operational intelligence by harnessing the value of their machine data. We purchased the stock in early February, which was a source of strength in the sector. The company continues to take market share from legacy vendors in application performance management/IT operations. Its topline growth is benefiting from increased security spending and the company continues to grow its customer base as its product evolves.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

We believe high-profile security breaches will also bolster demand. The stock traded higher into the company’s recent quarterly report, which beat Wall Street estimates.

The Materials sector was also a contributor to relative performance. Vulcan Materials Company, the largest producer of construction aggregates in the U.S., was one of the sector’s top performers in 2015. The stock continued to trade higher in the first quarter of 2016. The company reported robust operational results for its fourth fiscal quarter, with higher-than-expected volumes driving sales and 80 percent incremental margins boosting profits. Management’s upbeat earnings guidance for 2016 and its confident tone during the quarterly investor call left us optimistic that there is further upside potential for the stock. Scotts Miracle-Gro Co., a manufacturer of consumer lawn and garden products, also contributed to the Fund’s relative performance. Strong results out of home improvement retailer Home Depot, Inc.—which at more than 30 percent of sales is Scotts’ largest customer—helped Scotts advance in late February. Scotts reported better-than-expected first quarter results, and reiterated forward guidance for 2016. The company also announced a minority position in Bonnie Plants, a potted vegetable and herb company, which we view as being aligned with its strategy to grow the business through product extensions and to tap into faster-growing gardening segments. We trimmed the position in the stock given its big move to the upside but remain invested in the stock, given the company’s positive fundamental trends, including structural improvements in margins and a focus on faster-growing segments in the U.S.

The Consumer Discretionary sector also contributed to relative performance. Amusement park operator Six Flags Entertainment Corp. was the Fund’s top source of relative strength. The stock rallied strongly into the end of 2015, declined early in 2016, before rallying again to reach new highs by the end of the period. The company announced strong third and fourth quarter results. Though the fourth quarter is less significant due to park closures during the holiday season and winter months, third quarter results exhibited sales growth driven by strong attendance and a 25 percent year-over-year increase in active passes/memberships. Since bringing the company out of bankruptcy in 2010, the management team at Six Flags has focused on disciplined capital allocation and revenue growth. As a result, shareholder value has flourished. In December, the company significantly increased its dividend yield, which should offer a degree of downside protection for investors, while ongoing international park ventures offer long-term potential for further growth. Ulta Salon, Cosmetics & Fragrance, Inc., a retailer of prestige and mass beauty products, was also a driver of the sector’s outperformance. The stock advanced sharply following recent quarterly results, which were highlighted by strong gross margins due to reduced promotional activity. We believe Ulta is one of the better growth stories in traditional retail.

Outlook

Recent economic data have shown improvement in the U.S. economy. The employment picture continues to look bright, oil prices appear to have stabilized, the service sector is expanding, industrial production is ticking up and consumer spending is stable. Investor concerns about other global economies have also receded somewhat. China’s industrial profits have been showing signs of life this year and its consumer-driven segments have been an area of growth. The economic recovery continues in Europe, albeit at a tepid pace. Global manufacturing statistics have stabilized and emerging markets appear to be bottoming. In short, economic growth around the world is slow, but we do not think a recession is likely. We think this economic backdrop is good for domestic growth equities. We believe we have positioned the Fund to benefit from pockets of secular strength, focusing on those companies that have sustainable pricing power, a competitive edge and attractive fundamentals.

Dividend-paying investments may not experience the same price appreciation as non-dividend paying instruments, dividend-issuing companies may choose not to pay a dividend, or the dividend may be less than what is anticipated.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Mid Cap

Growth Fund - Class A* and the Russell Midcap® Growth Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class B shares, Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class B shares, Class C shares, Class Y shares and Institutional Class shares was October 3, 1994, May 1, 2001, October 3, 1994, February 2, 2009 and April 1, 2011. Class B shares, Class Y shares and Institutional Class shares performance information was calculated using the historical performance of Class A shares for periods prior to May 1, 2001, February 2, 2009 and April 1, 2011, respectively. The returns have been restated for sales loads and fees applicable to Class B, Class Y, and Institutional Class shares. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class B shares are subject to a contingent deferred sales charge (“CDSC”) of 5.00% in the event of a shareholder redemption within a one-year period of purchase. The CDSC will be incrementally reduced over time. After the 6th year, there is no CDSC. Class C shares are subject to a CDSC of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

Russell Midcap® Growth Index measures the performance of those Russell Midcap® companies with higher price-to-book ratios and higher forecasted growth values.

The Frank Russell Company (FRC) is the source and owner of the Index data contained or reflected in this material and all trademarks and copyrights related thereto. The material may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a Touchstone Investments presentation of the data, and FRC is not responsible for the formatting or configuration of this material or for any inaccuracy in the presentation thereof.

Management’s Discussion of Fund Performance (Unaudited)

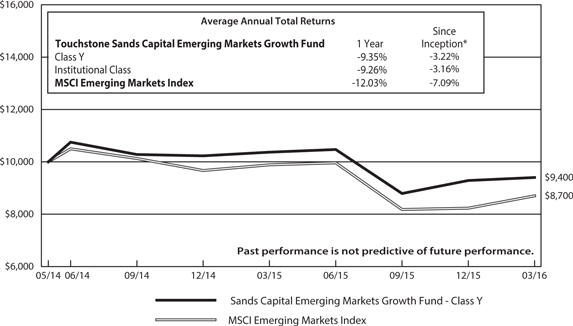

Touchstone Sands Capital Emerging Markets Growth Fund

Sub-Advised by Sands Capital Management, LLC

Investment Philosophy

The Touchstone Sands Capital Emerging Markets Growth Fund seeks long-term capital appreciation. The Fund primarily invests in companies in emerging market or frontier market countries. Sands Capital uses a “bottom-up” approach to investment selection, as opposed to sector or regional allocations that focuses on a company’s long-term business fundamentals. Therefore, the Fund may overweight certain geographies or sectors and may underweight other geographies or sectors. Sands Capital looks for companies that have sustainable above-average earnings growth, a leadership position in a promising business space, significant competitive advantages such as profitability, superior quality and distribution relative to competitors, strong brand and consumer loyalty, a clear mission in an understandable business model, financial strength and a rational valuation in relation to competitors, the market and business prospects.

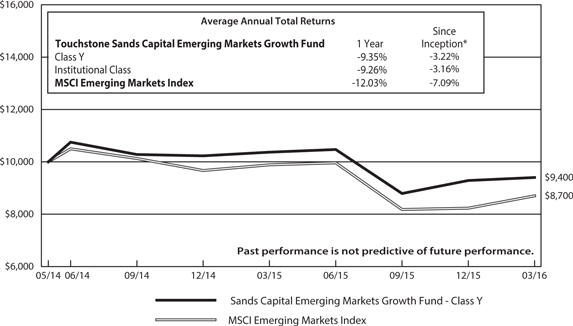

Fund Performance

The Touchstone Sands Capital Emerging Markets Growth Fund (Class Y Shares) outperformed its benchmark, the MSCI Emerging Markets Index, for the 12-month period ended March 31, 2016. The Fund’s total return was -9.35 percent, while the total return of the benchmark was -12.03 percent.

Market Environment

Investing in emerging markets has been fraught with challenges in recent years, as a confluence of macroeconomic forces has not only undermined some countries’ key growth tailwinds, but also inflated certain problematic headwinds. Overall, growth around the world appears to be slowing. It’s up for debate as to the causes of the slowdown, but there appear to be both cyclical and structural factors at work.

Despite shifting macroeconomic factors that can cause short-term challenges for investors, the emerging markets opportunity set has evolved over the past decade to include much more than just companies that engage in natural resource extraction and low-cost manufacturing. There are businesses across a variety of geographies that are benefiting from structural local demand growth instead of simply relying on export-driven business models. We believe local demand growth is more sustainable because in many developing countries, it is underpinned by long-term secular trends, including increasing productivity, growing discretionary incomes and attractive demographic profiles. We tend to find investment ideas that reflect these trends in the Information Technology, Health Care and Consumer sectors of the economy.

In our view, India remains a relative bright spot in emerging markets. India has many favorable fundamentals, including strong demographics, a relatively insulated, consumer-driven economy, improving internal and external balances and a government that is pushing toward needed reform in key growth-stoking areas, such as infrastructure and power generation. That said, the country is still recovering from a cyclical slowdown. The effects of this are apparent in relative investment results over the past 12 months, as four out of the top five detractors over the period were Indian businesses. Prime Minister Narendra Modi’s government has started the reform process, but it will take time to bear fruit. However, once initiatives to reduce bureaucracy, implement tax and permitting changes and develop major infrastructure projects kick into gear, we believe the economy will begin firing on all cylinders.

Portfolio Review

During the 12-month period, the top five contributors to relative investment results were Raia Drogasi SA, Qunar Cayman Islands Ltd., BIM Birlesik Magazalar AS, Sands China Ltd. and Mail.ru Group Ltd. At Raia Drogasil’s investor day event in December, the company increased its guidance for new store openings. Raia

Management’s Discussion of Fund Performance (Unaudited) (Continued)

is now targeting 165 gross store openings in 2016, and 195 per year thereafter. This compares to 130 new stores in 2014 and 145 in 2015. Increasing its store opening capacity has been a focus for the company and was many years in the making. Specifically, Raia has taken steps to expand its real estate development team, streamline the store opening process and invest in enhanced training and recruitment initiatives to develop a larger pool of new store managers. More importantly, as the largest retail operator in Brazil (based on the number of stores) and one of the select few that is free-cash-flow positive with a strong balance sheet, Raia has been able to secure prime real estate locations at relatively attractive prices, as many of its competitors have had to direct their own cash to meeting rising interest payments. While new stores combined with modest same-store-sales growth will drive revenue, we believe the company can also deliver meaningful margin leverage over time. We expect Raia to accomplish this by driving growth at existing stores at or above inflation, increasing generic and private label penetration and investing in productivity initiatives. We continue to view Raia as a strong operator in an attractive industry and believe it can grow for many years.

The top five detractors from relative investment results were Adani Ports & Special Economic Zone Ltd., Housing Development Finance Corp. Ltd., Jubilant Foodworks Ltd., Almarai Company Ltd. and Larsen & Toubro Ltd. Jubilant Foodworks is the master franchisee for the Domino’s Pizza Inc. brand in India, Bangladesh, Nepal and Sri Lanka and holds the exclusive rights for developing and operating Dunkin’ Donuts Brands Group Inc. restaurants in the same countries. While industry-wide pressure on consumer spending continues to weigh on the company’s near-term performance, the Fund’s long-term investment case remains intact. We believe Jubilant remains on track to build a business that will benefit from the long-term structural growth of the Indian quick service restaurant (QSR) industry. The company continues to invest in its business by building out its footprint and is on pace to open approximately 150 new stores per year for the foreseeable future.

During the past 12 months the following businesses were purchased: Amorepacific Corp., Bharat Forge Ltd., Britannia Industries Ltd., Ctrip.com International Ltd., Eicher Motors Ltd., IHH Healthcare Berhad, Medy-Tox Inc., SM Prime Holdings Inc.,Taiwan Semiconductor Manufacturing Co. Ltd. and Zee Entertainment Enterprises Ltd.

Amorepacific is the top cosmetic skincare business in Korea (based on sales) with a portfolio of 34 brands across a spectrum of price points, from mass market to prestige. Amorepacific’s continued innovation and delivery of high-quality products has helped it build consumer trust and strong brand equity, which we believe is its core competitive advantage. The company is leveraging its market-leading position in Korea to expand into China, where the cosmetics market is nearly triple the size and growing fast.

Bharat Forge is India’s largest metal forging company by capacity, with a global presence in the supply of forged and machined parts to original equipment manufacturers (OEMs) for commercial vehicles, personal vehicles and a range of non-auto verticals. Additionally, the company has made significant investments in its engineering capabilities over the past 10 years, allowing it to expand into higher margin non-auto industries, such as aerospace, rail, power, oil and gas, marine and mining. We believe the potential upside from market share gains in these new areas could be multiple times the size of its existing revenue base, providing a long tailwind for growth.

Britannia is the leading biscuit manufacturer in India with an estimated 35 percent market share. In India, biscuits are similar to cookies or crackers in the United States. The company is increasingly focused on the premium segment of the market. We believe Britannia will leverage its leadership position to achieve above-average growth by increasing penetration of its premium products and continuing to drive improved profitability. In our view, Britannia’s scale creates significant competitive advantages in terms of sourcing, manufacturing, selling and innovation.

Ctrip.com is the leading provider of online travel services in China based on gross merchandise value. Within China’s highly fragmented travel industry, the company plays an important role as an aggregator of availability information, pricing and reviews. We expect Ctrip.com to gain market share, particularly in hotels, due to its

Management’s Discussion of Fund Performance (Unaudited) (Continued)

leading position. Ctrip.com now owns stakes in both of its next closest competitors, which we believe will lessen the competitive intensity of the industry and facilitate increased pricing power and margin expansion.

Eicher Motors designs and manufactures Royal Enfield motorcycles, the leading mid-size motorcycle (200 to 800 cubic centimeter engines) brand in India. Royal Enfield is an iconic brand in India targeted toward the country’s growing middle class as an affordable luxury vehicle. The company’s brand awareness and reputation for quality have enabled it to capture over 90 percent of the mid-size motorcycle market.

IHH Healthcare is a leading premium hospital operator in Asia, with more than 6,000 licensed beds across Singapore, Malaysia and Turkey. The company focuses exclusively on the tertiary care market, which generally involves advanced procedures and complex treatments performed by highly-trained medical staff. Due to this specialized level of care, IHH benefits from reduced competitive intensity, and its revenue per patient is typically higher than hospitals that treat basic, primary care needs. IHH also treats a higher proportion of affluent and medical tourism patients who tend to be less price-sensitive. In addition, over the next three to five years, IHH plans to increase its number of beds by 50 percent, with expansion projects in both existing and new markets.

Medy-Tox is a South Korea-based biopharmaceutical company that develops and manufactures injectable products for aesthetic and therapeutic purposes. The company’s core products use botulinum bacteria, which temporarily relaxes the underlying muscle when injected beneath the skin. Medy-Tox primarily markets these products for the reduction of fine lines on the face, but there are expanding use cases in cosmetic treatments for the body, as well as medical indications.

SM Prime is the largest mall operator in the Philippines with 50 malls that have a cumulative gross square footage greater than its next two competitors combined. SM Prime pursues a mass-market strategy whereby they offer affordable shopping, quick-service restaurants, government services (e.g., driver’s licenses) and a variety of entertainment facilities. We believe this strategy is the key driver behind the company’s ability to garner over half of the average daily Philippine mall foot traffic.

Taiwan Semiconductor Manufacturing (TSMC) is the world’s largest outsourced semiconductor foundry for logic chips (as opposed to memory chips) based on production capacity. Its customers include vertically-integrated OEMs, as well as semiconductor companies that outsource their chip production. TSMC is the only large-scale, customer-dedicated foundry capable of producing leading-edge chips, which are the most advanced chips available in terms of the computing power. We believe TSMC is well-positioned within this leading-edge market.

Zee Entertainment is one of the largest pay-TV broadcasters in India with 33 channels that account for approximately 20 to 25 percent of the country’s viewership share. Zee’s content comprises all major genres, including movies, sports and general entertainment programming, both in Hindi and regional dialects. The company earns a majority of its revenue from subscriptions and advertising sales (about 40 and 50 percent, respectively).

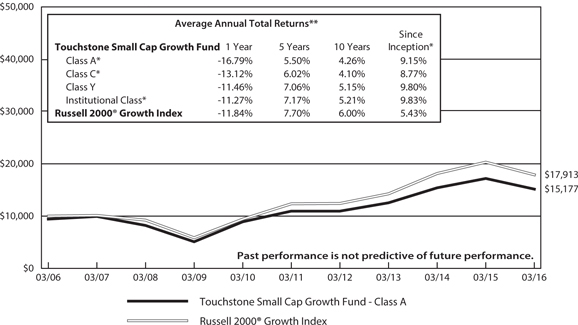

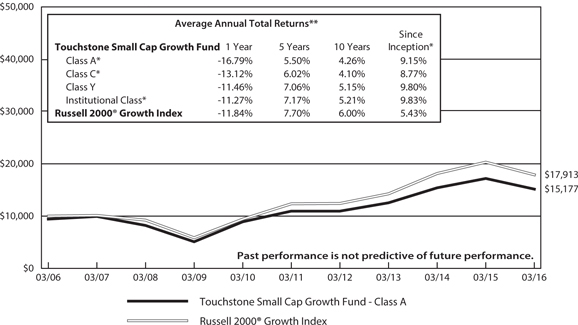

During the period, we sold Jerónimo Martins SGPS SA, Kroton Educacional SA, LARGAN Precision Co. Ltd., Mindray Medical International Ltd., Multiplus SA, Odontoprev SA, Perusahaan Gas Negara Persero Tbk TP, Qunar Cayman Islands Ltd. and Unilever Indonesia Tbk TP.