UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03651

| Touchstone Strategic Trust – June Funds |

| (Exact name of registrant as specified in charter) |

| 303 Broadway, Suite 1100 |

| Cincinnati, Ohio 45202-4203 |

| (Address of principal executive offices) (Zip code) |

| Jill T. McGruder |

| 303 Broadway, Suite 1100 |

| Cincinnati, Ohio 45202-4203 |

| (Name and address of agent for service) |

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end: June 30

Date of reporting period: June 30, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

June 30, 2016

Annual Report

Touchstone Strategic Trust

Touchstone Credit Opportunities Fund

Touchstone International Small Cap Fund

Touchstone Large Cap Fund

Touchstone Small Cap Value Opportunities Fund

Touchstone Value Fund

Table of Contents

This report identifies the Funds' investments on June 30, 2016. These holdings are subject to change. Not all investments in each Fund performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not occur.

Letter from the President

Dear Shareholder:

We are pleased to provide you with the Touchstone Strategic Trust Annual Report. Inside you will find key financial information, as well as manager commentaries, for the 12 months ended June 30, 2016.

During the fiscal year, investors warily eyed the prospects for global economic growth amid weakness in Europe and Japan and a continued slowdown in China. Concerns about the economic landscape led central bankers around the world to maintain highly accommodative monetary policies. Even in the U.S. - where growth was steady but unspectacular – the Federal Reserve Board (Fed) believed the economic outlook was sufficiently precarious as to warrant only one increase in short-term interest rates. The global environment of low growth and low inflation weighed on interest rates around the world, some of which ended the fiscal year in negative territory. The decline in rates was only exacerbated by the United Kingdom’s June 23rd vote to leave the European Union (EU), which introduced further uncertainty about the future of the EU and economic growth in that region.

U.S. equity markets were mixed during the 12-month period as larger capitalization stocks generated gains and small caps experienced losses. From a style perspective, market leadership transitioned to value-oriented stocks during the year, ending a lengthy run of outperformance by companies with growth characteristics. The relative earnings weakness exhibited outside the U.S. led to negative returns for both developed international and emerging market equities.

Though short-term interest rates rose in anticipation of the Fed’s interest rate hike in late 2015, they quickly retrenched amid concerns about the global economy. Intermediate- to long-term rates, however, continued a downward trend, providing a tailwind for investment grade bonds. The broad-based Barclays U.S. Aggregate Bond Index experienced solid gains for the year. Though they also provided positive returns, high yield bonds managed only slight gains as investors remained cautious about the potential for rising defaults due to weak energy and commodity prices.

In this kind of economic and market environment, we believe that a focus on your long-term goals remains essential to ultimately achieving investment success. The events and market fluctuations of the last year have demonstrated how quickly perceptions of risk and return can swing from bullish to bearish and back again. Consulting with your financial professional can help you determine the appropriate asset allocation to keep your long-term financial goals on track.

We greatly appreciate your continued support. Thank you for including Touchstone as part of your investment plan.

Sincerely,

Jill T. McGruder

President

Touchstone Strategic Trust

Management's Discussion of Fund Performance (Unaudited)

Touchstone Credit Opportunities Fund

Sub-Advised by Ares Capital Management II LLC

Investment Philosophy

The Touchstone Credit Opportunities Fund employs a flexible investment approach by allocating assets among core investments and opportunistic investments as credit market conditions change. It invests in several broad investment categories, including high yield bonds, bank loans, special situations, structured credit and hedges.

Fund Performance

The Touchstone Credit Opportunities Fund (Class A Shares) outperformed its benchmark, the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index, for the 10-month period ended June 30, 2016. The Fund’s total return was 2.95 percent (calculated excluding the maximum sales charge and beginning with the 8/31/2015 inception date), while the total return of the benchmark was 0.18 percent.

Market Environment

The Touchstone Credit Opportunities Fund was launched on August 31, 2015 amidst a challenging market environment where high yield bond and leveraged loan prices were coming under pressure owing largely to global growth concerns. Difficult market conditions continued throughout the fourth quarter of 2015 as elevated concerns related to slowing global growth, continued instability in the commodity sector and the U.S. Federal Reserve Board’s (Fed) first interest rate hike in seven years heightened investor apprehension and drove a widespread aversion to risk assets. Credit markets weakened as investors fled risk, highlighted by the high yield market suffering continued pressure from volatility in energy and commodity related sectors that had further extended to the broader high yield market as the year came to a close. Non-investment grade credit markets were challenged across the board as both levered loan and high yield bond indices posted their first negative performance since 2008. Despite fears around the health of China’s economy, pronounced weakness in the emerging markets and the ongoing rout in the commodities market, equity markets rallied during the fourth quarter of 2015.

The negative sentiment and volatility that prevailed in the U.S. credit markets during late 2015 continued unabated into January, which historically has been a stronger month for credit. The quarter began with a continued collapse in oil prices, concerns about China’s devaluation pace, and U.S. recession fears. Around mid-February, improvements across a number of global issues provided a more constructive macro backdrop for non-investment grade credit markets. The European Central Bank (ECB) provided a larger expansion of monetary policy than anticipated, China gave more reassurance on foreign exchange rates, the Organization Of Petroleum Exporting Countries (OPEC) and non-OPEC members held talks putting a floor under oil prices, U.S. recession concerns faded amidst better economic data and Fed narrative became more meaningfully dovish. As risk appetite resurfaced, a broader set of buyers emerged, leading to heavy inflows to high yield and the first inflows into loans following 33 consecutive weeks of outflows. Following the momentum gained in late February, capital markets firmly advanced through March as a more traditional risk rally took hold amid improving investor sentiment and accommodative central bank action and rhetoric. Leveraged loans, high yield bonds and equities all posted strong returns for the month of March, led primarily by lower rated assets and stressed industries (e.g. Energy), as strong inflows strengthened the technical picture.

U.S. credit markets posted strong results for the second quarter of 2016 despite heightened volatility at the end of June surrounding a somewhat surprising vote by the British populace to leave the European Union (Brexit). While news of this event initially rattled the markets, the subsequent rebound during the final days of June was strong as investors concluded these events should not dramatically set back the U.S. economy. While loans experienced the same reversal of sentiment at month-end, it was not to the same extent as high yield as loans ended the quarter flat. Technical conditions were favorable for the predominance of the quarter

Management's Discussion of Fund Performance (Unaudited) (Continued)

for bank loans which helped positively contribute to return during the second quarter of 2016. Equities recovered during the first two trading days after the Brexit results were announced.

Portfolio Review

Since inception, the high yield bond portion of the Fund has been the largest contributor to performance. Notably, the high yield bond investment category has been positioned more defensively in higher quality assets, which performed well during the fourth quarter of 2015 but were outpaced by lower quality assets in the first half of 2016 as the risk rally ensued. Additionally, high yield bond performance has been buoyed by a sharp rally in Treasuries as of late. Similarly, the loan segment of the Fund contributed positively to since inception performance. The Stressed/Distressed allocation had a slight drag on since inception performance as the pressure on special situations investments, particularly those within the Energy sector, during the fourth quarter of 2015 was more than offset by the rally those assets experienced in 2016.

During the latter part of 2015, the Fund was focused on getting invested, while maintaining an above average cash balance given the elevated market volatility and negative market technicals that prevailed during the fourth quarter of 2015. Over the course of the first quarter, we maintained the Fund’s defensive posture, underweight risk; however, we increased the beta1 of the Fund marginally throughout the quarter. More specifically, we steadily deployed cash to increase the Fund’s allocation to high yield bonds and bank loans as we viewed these asset classes to be relatively cheap. During the second quarter of 2016, we generally continued a barbell strategy of staying more defensively positioned, buying more high quality than high beta securities but selectively adding risk where we saw value. In addition, owing to the rally we saw in high yield bonds over the first half of 2016, we liquidated the Fund’s high yield bond position and redeployed that capital largely in bank loans. Lastly, toward the end of June 2016, we slightly increased the Fund’s cash position in anticipation of increased market volatility.

The yield curve has been flattening since inception of the Fund which has benefited the portfolio given its exposure to longer duration fixed income assets. It is our view that relative interest rates and central bank liquidity are trumping fundamentals. We think rates will be lower for longer and believe if the Fed were to raise rates it would be a curve flattening move, with the long end coming down. In June, the Fed held interest rates steady and signaled a more gradual pace of hikes than previously indicated. While the Fed doesn’t appear to be raising rates anytime soon, the yield curve has been flattening and is being pulled down because of negative interest rates globally. We think this phenomenon will be with us for an extended period of time so we are comfortable going out the curve in higher quality, longer duration assets. Regardless of interest rate direction, the Fund’s ability to toggle between fixed and floating rate assets as well as shorter and longer duration high yield bonds helps us manage interest rate risk.

Outlook

We believe heightened equity valuations, declining earnings and low cost of capital is a recipe for increased strategic mergers and acquisitions (M&A) activity. Accordingly, we have been looking for discounted senior secured paper with ample asset coverage in stressed/distressed companies that may have trouble refinancing on their own and as a result seek to be acquired.

One potential risk we see going forward is a devaluation of the Chinese yuan that surprises the market from a timing or magnitude perspective and creates volatility. In addition, we remain concerned that the Fed might decide to raise interest rates in the face of a slowing growth environment, which could create more volatility and downside in the market. Given the lack of inflationary pressure at present and slowing global growth, we believe the Fed is taking a more dovish approach than originally anticipated. Another potential cause for concern is that we are beginning to see more margin pressure at the company level in the portfolio which increases the likelihood of earnings misses and creates cause for credit spread widening.

Management's Discussion of Fund Performance (Unaudited) (Continued)

We believe the remainder of 2016 is likely to be volatile given rising global growth concerns, the upcoming U.S. presidential election and other possible exogenous shocks like a surprise devaluation of the yuan or an unforeseen geopolitical event. While the leveraged credit markets have rallied meaningfully since mid-February, we believe that the rally was primarily driven by technical factors that may soon be over-shadowed by softer company fundamentals and global recession fears. We also believe credit risk broadly is rising and anticipate default rates will rise steadily through 2016 and 2017. Economic conditions in the U.S. remain stable to positive and the global search for yield continues. In light of these factors, we are continuing to defensively position the Fund in higher quality, longer duration names and selectively adding risk where we see value. In addition, we are looking to increase the Fund’s single-name shorts in credits that have rallied recently alongside the broader market yet face potential earnings headwinds. We believe this positioning will enable the Fund to hold on to the returns generated year-to-date.

We have first focused on ramping the long side of the Fund and have been slowly layering in hedges and shorts. Following the recent rally in the market, we are actively looking to increase the Fund’s shorts, particularly as what we view to be a largely central bank driven rally collides with a weakening earnings environment.

With respect to the Fund’s positioning by investment category, it currently maintains a higher weight to high yield bonds as we are seeing good relative value opportunities in the asset class, particularly in light of the flattening yield curve. We will look to add exposure to stressed first lien loans that are potential M&A targets as noted above. Finally, owing to the recovery experienced year-to-date for structured credit, we are not currently adding exposure and would be better buyers in a more volatile market.

1 Beta is a measure of the volatility of a portfolio relative to its benchmark.

Management's Discussion of Fund Performance (Unaudited) (Continued)

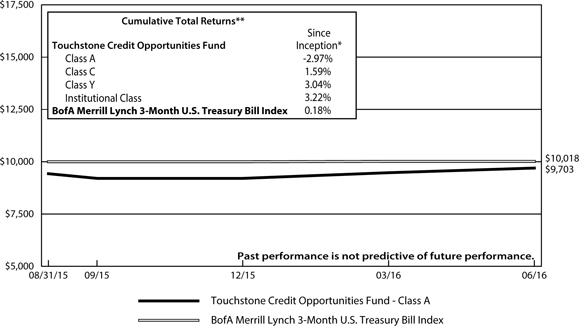

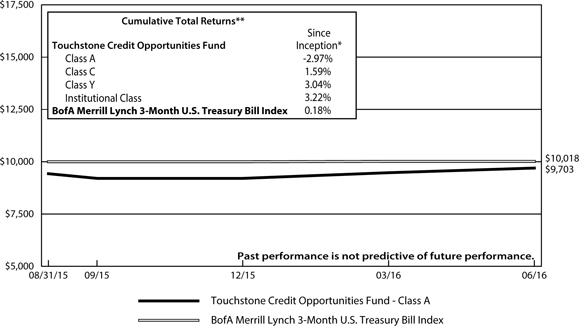

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Credit Opportunities Fund - Class A* and the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of the Fund was August 31, 2015. The returns of the index listed above are based on the inception date of the Fund. |

| ** | Not Annualized. The cumulative total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged index of Treasury securities maturing in 90 days that assumes reinvestment of all income.

Management's Discussion of Fund Performance (Unaudited)

Touchstone International Small Cap Fund

Sub-Advised by Copper Rock Capital Partners LLC

Investment Philosophy

The Touchstone International Small Cap Fund seeks capital appreciation by primarily investing in equity securities of non-U.S. small-cap companies diversified across sectors and industries. The Fund’s investment process seeks to add value through bottom-up stock selection and in-depth fundamental research and searches for companies believed to have strong management, superior earnings growth prospects and attractive relative valuations.

Fund Performance

The Touchstone International Small Cap Fund (Class A Shares) underperformed its benchmark, the S&P Developed Ex-U.S. Small Cap Index for the 12-month period ended June 30, 2016. The Fund’s total return was -8.77 percent (calculated excluding the maximum sales charge), while the total return of the benchmark was -3.80 percent.

Market Environment

The global markets posted negative results during the 12-month period, which were driven by a myriad of factors including depressed oil and commodities prices for much of 2015 and muted global growth. In particular, during the third quarter of 2015, China’s stock market suffered steep losses despite the government’s interventionist policies and devaluation of the yuan. Emerging market economies also moved significantly lower, as investors pulled out of debt and equities within those regions. Most of the decline was due to the slowdown in China, as it serves as a major importer of raw materials and commodities. The devaluation of the yuan further stoked investors’ concerns that emerging market economies would be unable to compete globally with cheaper Chinese exports. Within Europe, its Central Bank continued to provide steady stimulus actions aimed at promoting a weaker currency to support European exporters. Despite markets moving precipitously lower in the third quarter, economic data for the continent showed significant growth and global markets rebounded by the end of 2015.

The first quarter of 2016 was characterized by strong market movements caused by a combination of macroeconomic concerns. Investors worried about slowing global growth, the direction in the price of oil, declining growth in the U.S. and the possibility of a recession from poor holiday retail sales and lagging consumer confidence. The pessimism dominated most of the first half of the quarter with 2015’s best performing stocks selling off. As the quarter progressed, a turnaround in oil prices, positive U.S. economic indicators – including labor force participation and employment data – along with renewed confidence in the U.S. and European capital markets helped support an extended market rally.

The second quarter of 2016 began with a continuation of the recoveries that started after oil prices bottomed in February 2016. Cyclical, commodity-driven stocks within the Energy sector and metals and mining industries outperformed. Yield-oriented stocks also began the quarter stronger as declining sovereign interest rates within the developed markets (with some rates moving into negative territory) shifted investor attention to dividend-paying equities. There was a shift in the markets between April and May as investors eventually preferred higher quality stocks rather than deep cyclical, higher beta (a measure of an asset’s risk relative to the broader market) and lower quality stocks. In May, global capital markets began to behave in a more typical fashion as stock prices followed earnings, and strong fundamentals were the key determinants of those earnings. Global markets also began to reward companies that had ongoing expansion stories that produced cash flow. In June, the market was very mixed, exhibiting an almost indiscriminate bias in what was being rewarded. This was a reflection of the market place as commodity prices diverged while a myriad of political events occurred including the vote by the United Kingdom (U.K.) to leave the European Union (EU)(Brexit), the second-round elections in Spain and early positioning for general elections in the U.S., France and Germany. Late in the quarter, equity markets

Management's Discussion of Fund Performance (Unaudited) (Continued)

were volatile and mixed leading up to, and following Brexit. This quickly extended to other markets as investors grew concerned about a renewed slowdown in global trade and a downtick in credit quality.

Portfolio Review

Regionally, stock selection within Continental Europe contributed the most to Fund performance, while stock selection within Japan and the U.K. detracted. Stock selection within Canada and Pacific ex-Japan also detracted from returns. Individual stock selection benefited the Fund within the Consumer Staples and Financials sectors. However, overall stock selection was broadly negative across other sectors as a result of the stocks in the portfolio being out of favor for much of the period, and for the majority of the first half of 2016 in particular.

Among the individual stocks that contributed to performance during the period were Fastighets Balder AB (Financials sector), SalMar ASA, Pola Orbis Holdings Inc. (both from the Consumer Staples sector) and Recordati SpA (Health Care sector). Fastighets Balder owns and manages commercial and residential properties in Sweden. The company also operates in Helsinki and Copenhagen, as well as in the attractive Stockholm and Gothenburg markets. Fastighets Balder outperformed following a significant uptick in the third quarter of 2015. The company consistently reported stronger than expected earnings growth and expanded its valuation multiples as the quality of its portfolio improved over time. In addition, the company’s Copenhagen rental apartment portfolio increased, which also benefited the stock. SalMar is a Norway-based producer and distributor of seafood, primarily salmon and trout. The company benefited from favorable market conditions for salmon production, as supply from Chilean salmon producers came under pressure due to disease and overfarming. Consequently, this created strong demand for SalMar’s products along with an attractive pricing environment. The company also reported stronger than expected results in the first quarter of 2016, which was a catalyst to the stock’s price increase during the second quarter. Pola Orbis Holdings, a Japan-based cosmetics company, outperformed as a result of its long-running sales force conversion from direct sales to fashion retailing, as well as its strong new lineup of premium-range products. Recordati, an Italy-based pharmaceutical company, reported strong first quarter 2016 earnings and an accretive acquisition of the company Italchimici SpA, which focuses on gastrointestinal and food supplement products. The acquisition is expected to bolster Recordati’s scale in Western Europe and strengthen its portfolio of over-the-counter products.

Among the individual stocks that detracted from Fund performance were Virgin Money Holdings (U.K.) PLC, Aldermore Group PLC (both from the Financials sector), Spotless Group Holdings Ltd. and Minebea Co. Ltd. (both from the Industrials sector). Virgin Money Holdings is a U.K.-based retail-only bank, primarily focused on providing residential mortgages, savings and credit cards. The stock declined after the Brexit vote and investors grew concerned that financing new properties and consumer spending would slow as a result of businesses and employees leaving the U.K. market over the next few years. Spotless Group Holdings is an Australia-based provider of outsourced facility services including laundry and linens, catering and food management, and facilities management for customers in the healthcare, education, government, commercial and leisure segments. In December 2015, the company released an update that lowered its profit growth, citing slower than expected new-business wins and delayed benefits from an acquisition integration. Aldermore Group is a U.K.-based company that offers banking services and residential mortgages to small- and medium-sized entities and customers. The stock was sold prior to the Brexit vote, but the company had already come under pressure in late 2015 following the announcement of an increase in a stamp duty in the U.K. Minebea Co. is a Japan-based manufacturer of high-precision ball bearings for the information technology, telecommunications, aerospace, automotive and home appliance industries. Although Minebea’s operating profit increased, the company missed sales guidance in its smartphone LED backlights segment, which led to a decline in the stock during the third quarter of 2015. The stock eventually was sold in favor of other opportunities.

Management's Discussion of Fund Performance (Unaudited) (Continued)

Outlook

We believe recent volatility in the marketplace has created buying opportunities for the Fund. The market’s initial response to Brexit was one of extreme caution due to concerns about continued global expansion. While those concerns appear to have eased, we believe weakness in the British pound created investment opportunities. A lower British pound should benefit some exporters both in terms of transactions and in the translation of reported results. In fact, several U.K.-based companies that we have been analyzing have become even more attractive because of the lower pound.

Similarly, the cooperative efforts of the U.S. Federal Reserve Board (Fed), and further stimulus packages by the Bank of England, European Central Bank and Bank of Japan/Ministry of Finance have presented new areas in which to find international suppliers who can benefit from U.S. consumer demand. Going forward, we believe small- and mid-sized entrepreneurial companies can thrive in an environment where end-demand is supplied by niche companies that have access to ample low-cost capital. Finally, within emerging markets, we have continued to find opportunities in high quality, attractively valued companies that have been overlooked. Furthermore, we believe emerging markets should continue to benefit as country balance sheets improve and global interest rates remain low, further stimulating spending within the home markets.

Management's Discussion of Fund Performance (Unaudited) (Continued)

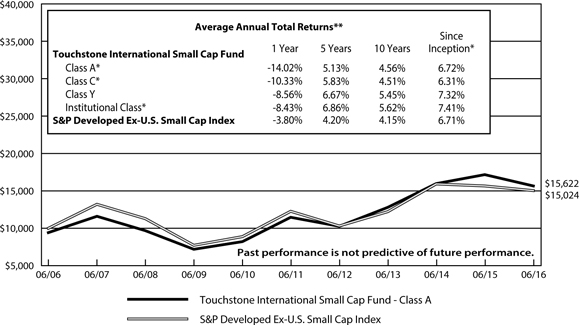

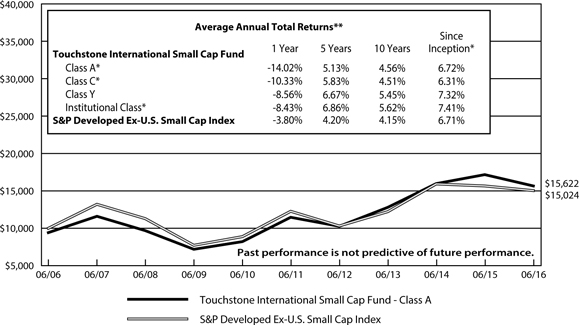

Comparison of the Change in Value of a $10,000 Investment in the Touchstone International Small Cap Fund - Class A* and the S&P Developed Ex-U.S. Small Cap Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares and Institutional Class shares was July 31, 2003, April 12, 2012, December 31, 1996 and December 20, 2006, respectively. Class A shares, Class C shares and Institutional Class shares performance was calculated using the historical performance of Class Y shares for the periods prior to July 31, 2003, April 12, 2012 and December 20, 2006, respectively. The returns have been restated for sales loads and fees applicable to Class A, Class C and Institutional Class shares. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

S&P Developed Ex-U.S. Small Cap Index is an unmanaged index of small-cap stocks from developed countries, excluding the United States.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Large Cap Fund

Sub-Advised by The London Company

Investment Philosophy

The Touchstone Large Cap Fund seeks long-term capital growth by investing primarily in common stocks of large-cap U.S. listed companies. The Fund seeks to purchase financially stable large-cap companies that it believes are consistently generating high returns on unleveraged operating capital, run by shareholder-oriented management, and trading at a discount to the company’s respective private market values.

Fund Performance

The Touchstone Large Cap Fund (Class A Shares) underperformed its benchmark, the Russell 1000® Index, for the 12-month period ended June 30, 2016. The Fund’s total return was -0.92 percent (calculated excluding the maximum sales charge), while the benchmark’s total return was 2.93 percent.

Market Environment

For the trailing twelve months, volatility was consistent but the overall market was more or less range bound. Market leadership changed hands as well, as growth stocks outperformed value stocks during the first half of the period, while value outperformed growth during the second half. Economic developments were mixed but were generally more positive than negative. Global concerns also shifted during the period, as investors focused on oil prices, China’s economy, overall debt levels, and Great Britain’s vote to leave the European Union (Brexit). All in all, global gross domestic product (GDP) growth remained tepid and low interest rates helped keep equities in favor.

Investors’ search for income heightened during the period and, as a result, bond proxy stocks outperformed, as did equities within the Utilities and Telecommunication Services sectors. Low interest rates had a significant impact on the market, which included weak performance in the Financials sector and elevated multiples within mergers and acquisitions (M&A) due to cheap financing. During the period, companies that exhibited pricing power, strong free-cash-flow generation and even a small amount of top-line growth performed relatively well. Many out-of-favor securities also outperformed.

During the period, the benchmark was led higher by the Utilities, Telecommunication Services and Consumer Staples sectors, while the Energy, Health Care and Financials sectors detracted from performance. The largest impact to performance was the significant decline in the price of oil during 2015. In addition, pockets of the Health Care sector were weak and the Financials sector was hampered by persistently low interest rates.

Portfolio Review

The Fund’s sector allocation and stock selection both detracted from relative returns during the period. From a sector perspective, the Fund’s lack of exposure to the Utilities sector detracted the most, though the Fund’s overweight to the Industrials sector and underweight to the Health Care sector helped offset this to some degree. Stock selection within the Materials, Industrials and Consumer Discretionary sectors detracted from Fund performance, while stock selection within the Consumer Staples and Health Care sectors helped offset the decline.

Among the individual stocks that contributed to performance during the period were Altria Group Inc. (Consumer Staples sector), Alleghany Corp. (Financials sector), Visa Inc. (Information Technology sector), Dollar Tree Inc. and Lowe’s Cos. Inc. (both from the Consumer Discretionary sector). Altria Group, a cigarette and tobacco company, moved higher after posting solid results including market share gains and margin improvement. The company’s pricing power was evident in the tobacco industry, and Altria continued to return cash to shareholders via dividends and share repurchases. Late last year, Altria’s shares were boosted following the acquisition of

Management's Discussion of Fund Performance (Unaudited) (Continued)

SABMiller PLC, in which Altria owns an interest. Allegheny, a company that engages in the property and casualty, and surety insurance business, moved higher as the company continued to show steady improvement in returns and book value. We remain attracted to Alleghany’s conservative underwriting policy and its long-term investment philosophy. Visa, a payments technology company, posted solid growth in its credit card business. During the second half of 2015, the company acquired the remaining portion of Visa Europe, which we believe should be positive for the long term. In addition, the company recently announced a new share repurchase plan and raised its dividend. Going forward, we believe Visa’s long-term outlook is strong, and it should benefit from its brand and global scale. Dollar Tree, a discount variety store, continued to generate industry-leading operating margins at its legacy stores, and margins at its recently acquired Family Dollar Stores Inc. improved as well. We believe there is significant room for improvement at the acquired stores. Lowe’s, a home improvement retailer, continued to post strong results as growth in its same-store sales reflected a stable to improving U.S. housing market. As Lowe’s store base matures, the company has generated greater cash flow. Capital allocation was also strong as the company aggressively repurchased shares and increased its dividend.

Among the individual stocks that detracted from returns were CarMax Inc., Scripps Networks Interactive Inc. (both from the Consumer Discretionary sector), The Mosaic Co. (Materials sector), ConocoPhillips (Energy sector) and Deere & Co. (Industrials sector). CarMax underperformed despite strength in auto sales overall. CarMax is specifically focused on used car sales, which were negatively impacted by aggressive promotions for new cars. In addition, investors were concerned about weakness in subprime customers, which further weighed on the stock. We remain attracted to the company’s best-in-class stores, strong balance sheet and significant room for square footage growth. Scripps Networks Interactive is a developer of lifestyle content for television and the Internet. The stock sold off along with its competitors as some of them began reporting weaker advertising revenue. We sold the stock during the period after the company stopped its share repurchases in order to support the substantial debt it took on to finance an acquisition. Mosaic is a producer of concentrated phosphate and potash crop nutrients, and the stock struggled all year reflecting the weak agriculture environment. During this difficult period, the company maintained its discipline and matched production with demand. Longer term, we believe the fundamentals will improve. Meantime, the company maintained strong capital allocation and increased its dividend while reducing share count. ConocoPhillips, a producer of crude oil and natural gas, was negatively impacted by the ongoing weakness in the price of oil. We subsequently sold the Fund’s position. Deere is a manufacturer of agricultural, construction and forestry machinery. The stock’s decline reflected weakness in the agriculture market. As the economic situation for farmers has deteriorated, sales at Deere have declined. Longer term, we believe the environment will eventually improve and Deere will benefit from its strong brand and global distribution.

During the period, the Fund sold its positions in Corning Inc., Intel Corp., EMC Corp. Microsoft Corp., International Business Machines Corp. (all from the Information Technology sector), Apache Corp., ConocoPhillips (both from the Energy sector), Energizer Holdings Inc. (Consumer Staples sector), Scripps Networks Interactive Inc., Bed Bath & Beyond Inc. (both from the Consumer Discretionary sector) and Pfizer Inc. (Health Care sector).

The Fund initiated positions in O’Reilly Automotive Inc. (Consumer Discretionary sector), Progressive Corp. (Financials sector), Apple Inc. (Information Technology sector), Norfolk Southern Corp. and General Electric Co. (both from the Industrials sector). O’Reilly Automotive, a high-margin, high-quality auto parts retailer with a proven domestic franchise and business model, has successfully built a widespread, dual-market network that has supported its rapid market share increase. This approach has allowed it to build barriers to entry, increase sale productivity and generate significant amounts of cash that is returned to shareholders through share buybacks. Progressive specializes in insurance products primarily related to motor vehicles. Progressive’s strong brand and conservative underwriting philosophy give the company a wide moat in the volatile insurance market. Progressive also has a low-cost-structure business, giving the company the ability to generate strong returns in competitive

Management's Discussion of Fund Performance (Unaudited) (Continued)

markets. Further, the company has returned significant amounts of capital back to shareholders through its consistent dividend and share buyback program. Apple has generated high margins and returns on capital, driven by its ability to integrate hardware, software and services into differentiated devices such as the iPhone. Apple has a strong track record of innovation and limited downside. Norfolk Southern serves as a low-cost provider with a fuel-efficient form of freight transportation. We believe the company has depressed valuation, little downside risk and high barriers to entry, and thus we have high conviction in the stock. General Electric is a technology-driven industrial and financial services company that develops and manufactures products for the generation, transmission, distribution, control and utilization of electricity. We believe the company’s plan to create a simple, more valuable company by dramatically reducing the size of its financial services businesses will result in an increase in profitability, accountability and shareholder value.

Outlook

Based on recent economic news, it appears the U.S. economy is stable with low single-digit real GDP growth. The labor market continues to expand while housing and manufacturing are improving, and interest rates are expected to remain low for a long period. Further, global growth remains tepid but margins and returns on capital are stable and attractive.

Going forward, we believe that company-specific fundamentals will drive the market, thus lowering equity correlations and creating a tailwind for Fund holdings. Specifically, we believe the Fund’s downside risk is mitigated by the Fund’s focus on those companies with pricing power, copious cash generation and prudent capital allocation. We seek companies with strong returns on capital and the flexibility to enhance shareholder value using the balance sheet. We also expect investors to reward companies that wisely deploy capital, including higher dividends, share repurchases at attractive prices and M&A transactions. Looking ahead, we believe the Fund is positioned well for a slow growth environment that rewards strong capital appreciation.

Management's Discussion of Fund Performance (Unaudited) (Continued)

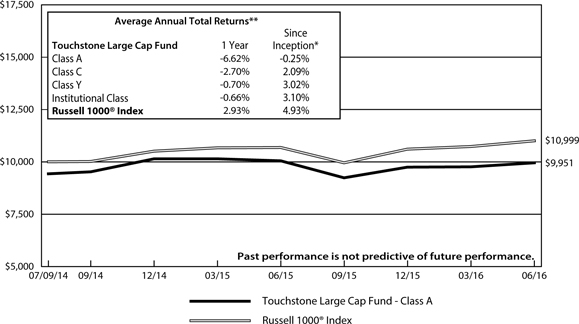

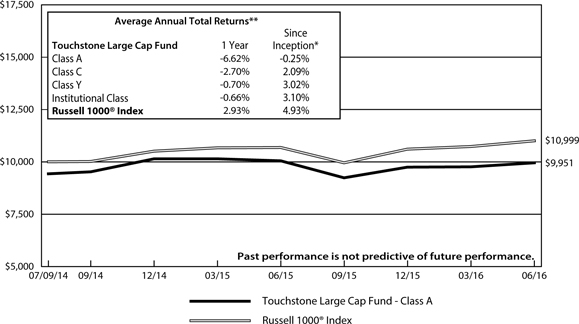

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Large Cap Fund - Class A* and the Russell 1000® Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of the Fund was July 9, 2014. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000® Index.

The Frank Russell Company (FRC) is the source and owner of the data contained or reflected in this material and all trademarks and copyrights related thereto. The material may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a Touchstone Investments presentation of the data, and FRC is not responsible for the formatting or configuration of this material or for any inaccuracy in the presentation thereof.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Small Cap Value Opportunities Fund

Sub-Advised by Thompson, Siegel & Walmsley LLC

Investment Philosophy

The Fund seeks long-term capital growth by primarily investing in equity securities of small-cap companies believed to present a value or potential worth that is not recognized by prevailing market prices or that have experienced some fundamental changes and are intrinsically undervalued by the investment community. The sub-advisor uses a combination of quantitative and qualitative methods to assess the outlook for a company.

Fund Performance

The Touchstone Small Cap Value Opportunities Fund (Class A Shares) underperformed its benchmark, the Russell 2000® Value Index, for the 12-month period ended June 30, 2016. The Fund’s total return was -13.72 percent (calculated excluding the maximum sales charge), while the total return of the benchmark was -2.58 percent.

Market Environment

Overall, equity correlations and market volatility increased as periods of rising and falling commodity prices, high yield debt and global growth concerns overwhelmed the influence of individual company fundamentals. Investors were generally risk-averse, which was highlighted by the significant outperformance of large-cap stocks over their smaller cap counterparts. Within the small-cap stock market, as represented by the Russell 2000® Index, there was a wide-divergence of returns between market sectors. The Energy sector, despite recent strong performance, lagged during the period, while generally defensive sectors such as Utilities and Consumer Staples fared the best and ended the 12-month period with double-digit returns.

Portfolio Review

There were several market factors that influenced Fund performance during the period. First, the Fund was skewed toward smaller-cap stocks compared to the benchmark, and these smaller-cap stocks underperformed the larger end of the benchmark range as global growth fears brought on a flight to more liquid and larger-cap stocks. Second, the slowdown in capital markets activity and expectations for a continuation of the U.S. Federal Reserve Board’s low interest rate policy further impacted Fund performance during the period. Lastly, the market’s risk-off focus led the Fund to be considered cheap versus the benchmark.

The most significant detractors to relative Fund performance were stock selection and positioning within the Financials sector. In particular, the Fund was negatively impacted by its bank holdings that declined because of interest rate sensitivity to the lack of rising rates. Also detracting from Fund returns was an underweight exposure to real estate investment trusts (REITs). REITs were among the top performing industry groups due to investors’ appetite for dividend-yielding securities.

Conversely, stock selection within the Consumer Staples sector was a contributor to relative performance. The Fund’s Consumer Discretionary sector was a positive contributor to relative performance as good stock selection more than offset the headwind of exposure to the struggling sector. Specifically, the Fund’s positions in children’s retail, women’s fashion, and media and sports entertainment posted positive returns during the period.

Among the individual stocks that contributed to performance during the period were Anika Therapeutics Inc. (Health Care sector), TreeHouse Foods Inc. (Consumer Staples sector) and Green Dot Corp. (Financials sector). Anika Therapeutics, an orthopedic medicines company offering therapeutic pain management solutions, moved higher as a result of the company’s single-injection product to treat joint pain, MONOVISC®, which has grown rapidly and taken market share. TreeHouse Foods, a food manufacturer servicing primarily the retail grocery and foodservice channels, rallied due to optimism around market share gains in the company’s single-serve

Management's Discussion of Fund Performance (Unaudited) (Continued)

coffee business and accretion potential from the acquisition of ConAgra Foods Inc.’s private label operations. Green Dot is a provider of prepaid debit cards and reloading services as well as a provider of GoBank, an online bank. A rumored potential takeover by PayPal Holdings Inc., combined with the introduction of an activist shareholder with a plan for the company to double earnings by 2018, drove the stock materially higher.

Among the stocks that detracted from performance during the period were Cowen Group Inc. (Financials sector), Delek US Holdings Inc. (Energy sector) and Celadon Group (Industrials sector). Cowen Group provides alternative investment management, investment banking, research, sales and trading, and prime brokerage services. Cowen Group moved lower due to the marked drop-off in capital markets activity during the first half of the year, which saw an unusually large amount of delayed mergers and acquisitions (M&A) deals. Delek US Holdings, a diversified downstream energy company, moved lower due to a narrowing of refining spreads that contributed to a decline in profitability for refiners in general. Celadon Group, a truckload carrier, declined due to overall pressure within the trucking industry as freight volumes failed to meet expectations. While freight market conditions were challenged in the near term, Celadon’s young fleet compared to its peers and multiple growth drivers via recent acquisitions are expected to benefit the company over the long term.

Outlook

Equity correlations and market volatility were once again on the rise, as the more defensive and liquid stocks rallied during the period, with global growth concerns overwhelming the influence of individual company fundamentals. We believe the market’s recent infatuation with macro and short-term events should allow our longer term, valuation-driven process to uncover stocks that we believe have been unfairly punished. At the end of the period, Consumer Discretionary remains the sector with the Fund’s largest overweight position. This is a broadly diverse group where we continue to identify companies with opportunities to exploit certain consumer trends or that have compelling business initiatives. The Fund remains underweight to the Financials sector where we believe most REIT valuations continue to be unattractive and many banks are challenged by muted loan growth and slowing reserve releases. Going forward, we believe the Fund is positioned well due to its valuation discipline and focus on sustainability of cash flows and earnings growth.

Management's Discussion of Fund Performance (Unaudited) (Continued)

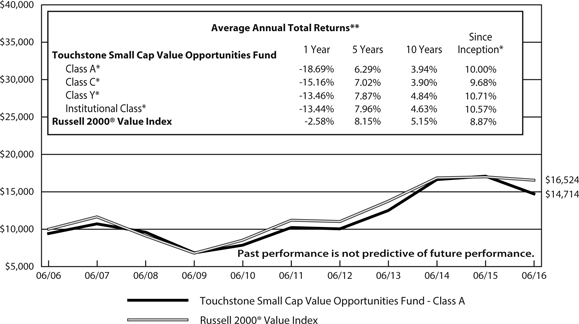

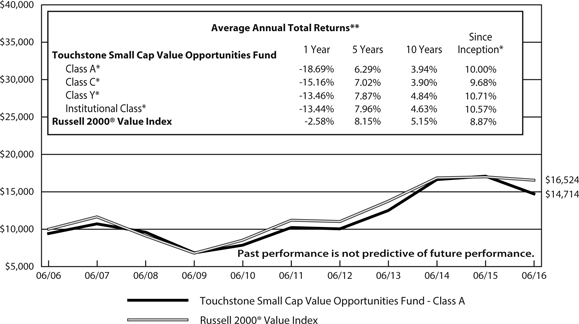

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Small Cap Value Opportunities Fund - Class A* and the Russell 2000® Value Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares and Institutional Class shares was July 31, 2003, April 12, 2012, July 25, 2003 and December 9, 2008, respectively. Performance information presented prior to July 25, 2003 for Class Y shares includes performance of a predecessor fund whose inception date was July 31, 2000. Class A shares, Class C shares and Institutional Class shares performance was calculated using the historical performance of Class Y shares for periods prior to July 31, 2003, April 12, 2012 and December 9, 2008, respectively. The returns have been restated for sales loads and fees applicable to Class A, Class C and Institutional Class shares. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

Russell 2000® Value Index measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

The Frank Russell Company (FRC) is the source and owner of the data contained or reflected in this material and all trademarks and copyrights related thereto. The material may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a Touchstone Investments presentation of the data, and FRC is not responsible for the formatting or configuration of this material or for any inaccuracy in the presentation thereof.

Management's Discussion of Fund Performance (Unaudited)

Touchstone Value Fund

Sub-Advised by Barrow, Hanley, Mewhinney & Strauss LLC

Investment Philosophy

The Touchstone Value Fund seeks long-term capital growth by primarily investing in equity securities of large- and mid-cap companies believed to be undervalued. The Fund uses traditional methods of stock selection – research and analysis – to identify companies that have price-to-earnings and price-to-book ratios below the market, that also have above-average dividend yields, and that focus on companies that are out of favor due to internal or external challenges judged to be short-term in nature. Stock selection is driven by fundamental analysis on individual companies rather than by broad market themes.

Fund Performance

The Touchstone Value Fund (Class A Shares) underperformed its benchmark, the Russell 1000® Value Index, for the 12-month period ended June 30, 2016. The Fund’s total return was -0.89 percent (calculated excluding the maximum sales charge), while the total return of the benchmark was 2.86 percent.

Market Environment

There is an old adage that “the market will do what confounds the most.” That has certainly been true, as investors’ expectations about interest rates, bond yields, oil prices, central banks and the European Union (EU), have all been upended. During the period, interest rates were pushed to record lows around the globe with much of the world’s sovereign debt now offering negative yields. Though expectations for U.S. interest rate hikes in 2016 have faded, we believe U.S. yields continue to offer a meaningful premium to the rest of the world, driving higher the demand for U.S. dollar-denominated bonds. In the face of such low absolute levels of yields, investors are desperately searching for higher income. Within U.S. equity markets, this means that investors have bid up those stocks perceived as bond proxies in sectors such as Utilities, Telecommunication Services, Consumer Staples and real estate investment trusts (REITs). Admittedly, they provide relatively high current dividend income, but many of the stocks in these sectors also trade at historically high valuations. Though the perceived safety of these stocks has become commonly accepted wisdom in the markets, we believe that the extended valuations may pose a heightened risk for investors going forward.

Portfolio Review

During the 12-month period, the Fund’s positioning in the Consumer Staples, Health Care and Telecommunication Services sectors were the largest contributors to relative performance, while the Financials sector was the leading detractor. An underweight to the (in our view) overpriced Utilities sector also detracted meaningfully from relative returns.

The decision to own stocks within the Financials sector and, more specifically bank stocks, was primarily driven by the record low valuations coming out of the 2008 financial crisis. However, the success of the Fund’s investments relied heavily on a few main drivers: higher interest rates, credit costs remaining low, declining expenses, improving capital returns and an eventual resumption in the growth of loans. While the latter four drivers played out largely as we expected, interest rates have remained at historically low levels. As a result, financial companies such as banks saw their primary revenue source – the spread they earn between loans and deposits – face a meaningful headwind.

In past economic cycles, growth following a recession reached strong enough levels that the U.S. Federal Reserve Board (Fed) committed to raising short-term interest rates to prevent inflation and general overheating of the economy. However, thus far in this economic cycle, the Fed has raised rates only once. In our view, global growth concerns have limited the Fed’s ability to return to a more traditional interest rate policy.

Management's Discussion of Fund Performance (Unaudited) (Continued)

While the Fund’s investment thesis has been delayed by unintended consequences, the valuations of many stocks that would benefit from higher interest rates have fallen to extremes. While a minor earnings revision is underway from the expected delay in Fed interest rate hikes, we do not believe earnings are on the cusp of major downward revisions. Outside of interest rates, we believe trends in credit, capital expense and loan growth remain favorable for Financials. While the past several years have been painful for investors in many Financials stocks, we feel they are now deeply discounted relative to the market and their history, offering opportunities for patient value investors.

Among the individual stocks that contributed to performance during the period were Altria Group Inc., Philip Morris International Inc. (both from the Consumer Staples sector) and Verizon Communications Inc. (from the Telecommunication Services sector). Tobacco and cigarette maker Altria Group was a strong performer during the year and added to the Fund’s relative performance. Whereas cigarette unit consumption has been steadily declining in recent years, the trends have become more positive over the past 12 months. Relatively lower gasoline prices have put more spending money into the pockets of consumers, who spent the savings on products such as cigarettes. Some consumers upgraded to premium-priced products such as Altria’s Marlboro family of brands, allowing Marlboro to continue to gain market share. Pricing continues to be rational as all three major domestic tobacco companies have supported price increases and are enjoying an expanded profit pool. The combination of stable cigarette consumption, positive pricing trends and a significantly above-average and rising cash dividend all supported Altria’s outperformance. Tobacco and cigarette maker Philip Morris International outperformed meaningfully over the past year as many of its principal markets, such as Europe, Australia and the Philippines, have stabilized. The company also gained market share in challenged geographic areas like Russia as a result of the momentum of its Marlboro (Altria sells Marlboro branded cigarettes within the U.S., while Philip Morris International sells Marlboro cigarettes overseas) and Parliament brands and its ability to raise profits through price increases. Though Philip Morris was hit hard by the strong U.S. dollar in recent years since all of its earnings are derived outside the United States, a weakening dollar towards the latter part of the first quarter in 2016 was a positive for the stock. Further, Philip Morris’ “heat-not-burn” cigarette innovation, iQOS, has achieved strong share gains in Japan, and the company expects to expand its iQOS business in Switzerland and enter six additional international markets. Verizon Communications Inc., a wireless communications service provider, posted a strong year of performance after having been weighed down by price war concerns in the domestic wireless business. However, the company has continued to invest in its networks and, relative to lower-cost competitors, achieved favorable results in third-party quality tests. The stock still trades at a discount to historical relative valuations and provides good yield support through its dividend.

Among the stocks that detracted from performance were Capital One Financial Corp., State Street Corp. and American Express Co. (all three from the Financials sector). Capital One Financial is a mix between a credit card company and a regional bank, and underperformed during the 12-month period in sympathy with private-label credit card company Synchrony Financial. In mid-June, shares of Synchrony Financial sold off after the company announced that credit losses would increase by approximately five percent over the next 12 months. The announcement heightened investors’ fears about a broader turn in consumer credit, which impacted Capital One given its exposure to subprime consumer borrowers. We believe the news was specific to Synchrony, which was supported by Capital One’s management recently re-confirming its 2016 net charge-off guidance. In addition, May 2016 delinquency data, which is generally viewed as a leading indicator for credit trends, continued to show positive developments. We continue to find Capital One’s shares attractive, trading at less than next year’s earnings. State Street is an institutional asset manager and provider of asset servicing solutions. Given its business model, State Street moved lower due to global growth concerns, as the company has an outsized international exposure relative to its peers. At current valuations, State Street trades more cheaply than a regional bank, despite taking much less balance sheet risk and having better growth prospects and higher returns. American Express also sold off during the year, and remained weak after the announcement that its branded partnership with Costco

Management's Discussion of Fund Performance (Unaudited) (Continued)

Wholesale Corp. would end. The company has committed toward working to offset the Costco loss with expense reductions and growth in its remaining loan book. We remain positive on the stock, which trades at a below-market multiple of next year’s earnings, despite a better-than-average business profile.

Outlook

The past several years have been dominated by global growth concerns, such as Greece’s default, China’s economic slowdown and, most recently, Brexit (Britain’s exit from the EU). The response from central bankers around the globe has consistently been to push interest rates to record lows in an effort to move investors out of the risk spectrum, hoping to generate risk taking and economic growth. Despite the extraordinary measures taken, investors have remained risk averse, crowding into the modest yields of U.S. Treasuries or many bond proxies in the equity market. We believe central banks have, in many cases, exacerbated the problem by buying the same bonds as the rest of the crowd, pushing rates to artificially low levels. As is often the case, these conditions have persisted long enough that the consensus has come to view this as the “new normal.” Such consensus thinking is reflected in the yield curve of the bond market, which is projecting slow growth going forward. Given these market expectations, we believe that a focus on fundamentals and valuations is key. Our active, fundamental value process is designed to avoid overvalued areas of the market and focus on companies with both improving fundamentals and the cash flow to support a continued dividend. We believe that this philosophy will benefit fund shareholders in the uncertain market environment ahead.

Dividend-paying investments may not experience the same price appreciation as non-dividend paying instruments, dividend-issuing companies may choose not to pay a dividend, or the dividend may be less than what is anticipated.

Management's Discussion of Fund Performance (Unaudited) (Continued)

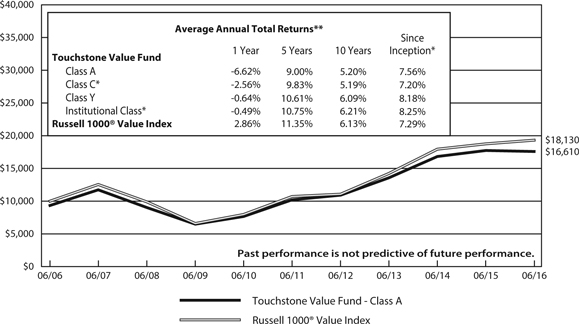

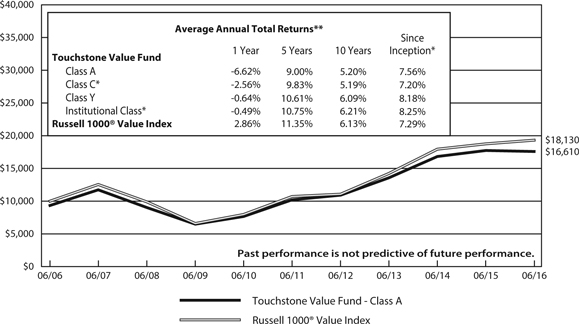

Comparison of the Change in Value of a $10,000 Investment in the Touchstone Value Fund - Class A* and the Russell 1000® Value Index

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares, Class Y shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares and Institutional Class shares was July 31, 2003, April 12, 2012, September 10, 1998 and December 20, 2006, respectively. Class A shares, Class C shares and Institutional Class shares performance was calculated using the historical performance of Class Y shares for the periods prior to July 31, 2003, April 12, 2012 and December 20, 2006, respectively. The returns have been restated for sales loads and fees applicable to Class A, Class C and Institutional Class shares. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 6.10% of the NAV (or 5.75% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Note to Chart

Russell 1000® Value Index measures those Russell 1000 companies with lower price-to-book ratios and lower expected growth values.

The Frank Russell Company (FRC) is the source and owner of the data contained or reflected in this material and all trademarks and copyrights related thereto. The material may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a Touchstone Investments presentation of the data, and FRC is not responsible for the formatting or configuration of this material or for any inaccuracy in the presentation thereof.

Tabular Presentation of Portfolios of Investments (Unaudited)

June 30, 2016

The tables below provide each Fund’s geographic allocation, credit quality or sector allocation. We hope it will be useful to shareholders as it summarizes key information about each Fund’s investments.

| Touchstone Credit Opportunities Fund | | | |

| Credit Quality* | | (% of Fixed Income Securities) | |

| BBB/Baa | | | 8.4 | % |

| BB/Ba | | | 49.1 | |

| B/B | | | 34.4 | |

| CCC | | | 2.6 | |

| CC | | | 0.1 | |

| C or Lower | | | 0.4 | |

| Not Rated | | | 5.0 | |

| | | | 100.0 | % |

| Sector Allocation** | | (% of Net Assets) | |

| Long Positions | | | | |

| Corporate Bonds | | | | |

| Consumer Discretionary | | | 19.5 | % |

| Telecommunications Services | | | 11.0 | |

| Health Care | | | 8.9 | |

| Energy | | | 8.4 | |

| Information Technology | | | 6.2 | |

| Industrials | | | 5.1 | |

| Materials | | | 4.0 | |

| Financials | | | 2.8 | |

| Consumer Staples | | | 1.5 | |

| Utilities | | | 0.3 | |

| Bank Loans | | | 24.1 | |

| Asset-Backed Securities | | | 3.9 | |

| Common Stock | | | 0.1 | |

| Purchased Call Options | | | 0.0 | |

| Investment Funds | | | 0.9 | |

| Other Assets/Liabilities (Net) | | | 4.7 | |

| | | | 101.4 | % |

| Short Positions | | | | |

| Corporate Bonds | | | (1.3 | ) |

| Common Stock | | | (0.1 | ) |

| Total | | | 100.0 | % |

| Touchstone International Small Cap Fund | | | |

| Geographic Allocation | | (% of Net Assets) | |

| Common Stocks | | | | |

| Japan | | | 22.9 | % |

| United Kingdom | | | 10.7 | |

| Sweden | | | 8.3 | |

| Canada | | | 7.8 | |

| France | | | 5.9 | |

| Australia | | | 4.2 | |

| Italy | | | 3.7 | |

| Germany | | | 3.6 | |

| Ireland | | | 3.4 | |

| South Korea | | | 3.1 | |

| Luxembourg | | | 2.3 | |

| Denmark | | | 2.1 | |

| New Zealand | | | 1.8 | |

| Austria | | | 1.6 | |

| Switzerland | | | 1.4 | |

| Isle of Man | | | 1.3 | |

| Bermuda | | | 1.2 | |

| Singapore | | | 1.2 | |

| Jersey | | | 1.1 | |

| Norway | | | 1.0 | |

| Finland | | | 1.0 | |

| Faroe Island | | | 0.9 | |

| Taiwan | | | 0.9 | |

| Thailand | | | 0.9 | |

| Portugal | | | 0.7 | |

| Netherlands | | | 0.6 | |

| Cayman Islands | | | 0.6 | |

| Exchange Traded Fund | | | 2.0 | |

| Investment Funds | | | 8.7 | |

| Other Assets/Liabilities (Net) | | | (4.9 | ) |

| Total | | | 100.0 | % |

| * | Credit quality ratings are from Standard & Poor's (“S&P”) and Moody's Investors Service (“Moody's”). If agency ratings differ, the higher rating will be used. Where no rating has been assigned, it may be for reasons unrelated to the creditworthiness of the issuer. |

| ** | Sector classifications are based upon the Global Industry Classification Standard (GICS®). |

Tabular Presentation of Portfolios of Investments (Unaudited) (Continued)

| Touchstone Large Cap Fund | | | |

| Sector Allocation* | | (% of Net Assets) | |

| Financials | | | 23.9 | % |

| Consumer Discretionary | | | 20.8 | |

| Industrials | | | 15.4 | |

| Information Technology | | | 11.2 | |

| Consumer Staples | | | 10.1 | |

| Health Care | | | 7.5 | |

| Materials | | | 5.3 | |

| Energy | | | 2.6 | |

| Telecommunication Services | | | 2.3 | |

| Investment Funds | | | 4.0 | |

| Other Assets/Liabilities (Net) | | | (3.1 | ) |

| Total | | | 100.0 | % |

| Touchstone Small Cap Value Opportunities Fund | | | |

| Sector Allocation* | | (% of Net Assets) | |

| Financials | | | 35.4 | % |

| Consumer Discretionary | | | 15.5 | |

| Industrials | | | 12.5 | |

| Information Technology | | | 7.7 | |

| Health Care | | | 6.6 | |

| Utilities | | | 6.2 | |

| Materials | | | 4.2 | |

| Consumer Staples | | | 4.1 | |

| Energy | | | 3.9 | |

| Telecommunication Services | | | 2.6 | |

| Investment Funds | | | 11.2 | |

| Other Assets/Liabilities (Net) | | | (9.9 | ) |

| Total | | | 100.0 | % |

| Touchstone Value Fund | | | |

| Sector Allocation* | | (% of Net Assets) | |

| Healthcare | | | 24.3 | % |

| Financials | | | 19.9 | |

| Energy | | | 12.1 | |

| Information Technology | | | 11.6 | |

| Industrials | | | 10.0 | |

| Consumer Staples | | | 5.6 | |

| Consumer Discretionary | | | 5.3 | |

| Materials | | | 5.1 | |

| Telecommunications Services | | | 4.6 | |

| Utilities | | | 0.9 | |

| Investment Funds | | | 0.9 | |

| Other Assets/Liabilities (Net) | | | (0.3 | ) |

| Total | | | 100.0 | % |

* Sector classifications are based upon the Global Industry Classification Standard (GICS®).

Portfolio of Investments

Touchstone Credit Opportunities Fund – June 30, 2016

| Principal | | | | | Market | |

| Amount(A) | | | | | Value | |

| | | | | | | | | |

| | | | | Corporate Bonds — 67.7% | | | | |

| | | | | | | | | |

| | | | | Consumer Discretionary — 19.5% | | | | |

| $ | 530,000 | | | Altice Luxembourg SA (Luxembourg), 144a, 7.750% 5/15/22 | | $ | 535,300 | |

| | 300,000 | | | AMC Entertainment, Inc. 5.875% 2/15/22(B) | | | 301,500 | |

| | 62,000 | | | AMC Networks, Inc. 5.000% 4/1/24 | | | 61,372 | |

| | 300,000 | | | American Builders & Contractors Supply Co., Inc., 144a, 5.625% 4/15/21 | | | 309,750 | |

| | 500,000 | | | Ashtead Capital, Inc., 144a, 6.500% 7/15/22 | | | 520,310 | |

| | 165,000 | | | Boyd Gaming Corp., 144a, 6.375% 4/1/26 | | | 172,425 | |

| | 300,000 | | | Cablevision Systems Corp. 5.875% 9/15/22 | | | 268,800 | |

| | 300,000 | | | CCO Holdings LLC / CCO Holdings Capital Corp. 5.125% 2/15/23 | | | 304,653 | |

| | 600,000 | | | Cedar Fair LP / Canada's Wonderland Co. / Magnum Management Corp. 5.375% 6/1/24 | | | 618,000 | |

| | 300,000 | | | Cinemark USA, Inc. 4.875% 6/1/23 | | | 297,000 | |

| | 439,000 | | | ClubCorp Club Operations, Inc., 144a, 8.250% 12/15/23 | | | 436,805 | |

| | 100,000 | | | CSC Holdings LLC 5.250% 6/1/24 | | | 91,000 | |

| | 600,000 | | | Dollar Tree, Inc., 144a, 5.750% 3/1/23(B) | | | 637,500 | |

| | 48,000 | | | JC Penney Corp., Inc., 144a, 5.875% 7/1/23 | | | 48,300 | |

| | 575,000 | | | L Brands, Inc. 6.875% 11/1/35 | | | 582,188 | |

| | 300,000 | | | Lamar Media Corp. 5.375% 1/15/24(B) | | | 310,500 | |

| | 100,000 | | | Lamar Media Corp., 144a, 5.750% 2/1/26 | | | 104,063 | |

| | 80,000 | | | MGM Growth Properties Operating Partnership LP / MGP Escrow Co.-Issuer, Inc., 144a, 5.625% 5/1/24 | | | 84,600 | |

| | 250,000 | | | MGM Resorts International 6.625% 12/15/21 | | | 271,875 | |

| | 800,000 | | | Numericable-SFR SAS (France), 144a, 6.250% 5/15/24 | | | 765,000 | |

| | 140,000 | | | Pinnacle Entertainment, Inc., 144a, 5.625% 5/1/24 | | | 139,650 | |

| | 533,000 | | | Reynolds Group Issuer, Inc. / Reynolds Group Issuer LLC / Reynolds Group Issuer Lu 5.750% 10/15/20 | | | 550,322 | |

| | 555,000 | | | Sabre GLBL, Inc., 144a, 5.250% 11/15/23 | | | 564,712 | |

| | 125,000 | | | Sally Holdings LLC / Sally Capital, Inc. 5.625% 12/1/25 | | | 130,938 | |

| | 300,000 | | | Sally Holdings LLC / Sally Capital, Inc. 5.750% 6/1/22 | | | 310,875 | |

| | 600,000 | | | Seminole Hard Rock Entertainment, Inc. / Seminole Hard Rock International LLC, 144a, 5.875% 5/15/21 | | | 601,500 | |

| | 300,000 | | | Sinclair Television Group, Inc., 144a, 5.625% 8/1/24 | | | 306,750 | |

| | 125,000 | | | Sinclair Television Group, Inc., 144a, 5.875% 3/15/26 | | | 127,500 | |

| | 325,000 | | | Sirius XM Radio, Inc., 144a, 4.625% 5/15/23 | | | 315,276 | |

| | 300,000 | | | Six Flags Entertainment Corp., 144a, 5.250% 1/15/21 | | | 309,375 | |

| | 300,000 | | | Virgin Media Secured Finance PLC (United Kingdom), 144a, 5.250% 1/15/26 | | | 290,250 | |

| | 250,000 | | | Ziggo Bond Finance BV (Netherlands), 144a, 5.875% 1/15/25 | | | 241,250 | |

| | | | | | | | 10,609,339 | |

| | | | | | | | | |

| | | | | Telecommunication Services — 11.0% | | | | |

| | 500,000 | | | Altice US Finance I Corp., 144a, 5.375% 7/15/23 | | | 496,250 | |

| | 97,000 | | | CenturyLink, Inc. 5.625% 4/1/20 | | | 100,638 | |

| | 400,000 | | | CenturyLink, Inc. 5.625% 4/1/25 | | | 356,000 | |

| | 575,000 | | | Charter Communications Operating LLC / Charter Communications Operating Capital, 144a, 4.908% 7/23/25(B) | | | 628,649 | |

| | 151,000 | | | CommScope, Inc., 144a, 5.500% 6/15/24 | | | 153,265 | |

| | 300,000 | | | Digicel Group Ltd. (Bermuda), 144a, 8.250% 9/30/20 | | | 250,500 | |

| | 500,000 | | | Digicel Ltd. (Bermuda), 144a, 6.000% 4/15/21 | | | 428,600 | |

| | 210,000 | | | Frontier Communications Corp. 11.000% 9/15/25 | | | 217,350 | |

| | 642,000 | | | Inmarsat Finance PLC (United Kingdom), 144a, 4.875% 5/15/22 | | | 585,825 | |

| | 50,000 | | | Intelsat Jackson Holdings SA (Luxembourg) 5.500% 8/1/23 | | | 31,750 | |

| | 60,000 | | | Intelsat Jackson Holdings SA (Luxembourg), 144a, 8.000% 2/15/24 | | | 59,100 | |

| | 500,000 | | | Level 3 Financing, Inc. 5.375% 1/15/24 | | | 501,875 | |

| | 300,000 | | | Level 3 Financing, Inc. 5.375% 5/1/25 | | | 297,750 | |

| | 100,000 | | | Neptune Finco Corp., 144a, 6.625% 10/15/25 | | | 105,000 | |

| | 335,000 | | | NeuStar, Inc. 4.500% 1/15/23 | | | 301,500 | |

| | 300,000 | | | Sprint Corp. 7.625% 2/15/25 | | | 237,375 | |

| | 500,000 | | | T-Mobile USA, Inc. 6.375% 3/1/25 | | | 522,500 | |

| | 88,000 | | | Townsquare Media, Inc., 144a, 6.500% 4/1/23 | | | 87,010 | |

| | 300,000 | | | Univision Communications, Inc., 144a, 5.125% 2/15/25 | | | 296,625 | |

| | 148,000 | | | Univision Communications, Inc., 144a, 8.500% 5/15/21 | | | 154,660 | |

| | 95,000 | | | Videotron Ltd., (Canada), 144a, 5.375% 6/15/24 | | | 96,425 | |

| | 110,000 | | | West Corp., 144a, 5.375% 7/15/22 | | | 102,300 | |

| | | | | | | | 6,010,947 | |

| | | | | | | | | |

| | | | | Health Care — 8.9% | | | | |

| | 441,000 | | | Acadia Healthcare Co., Inc. 5.625% 2/15/23 | | | 432,180 | |

| | 130,000 | | | Centene Corp., 144a, 5.625% 2/15/21 | | | 135,525 | |

Touchstone Credit Opportunities Fund (Continued)

| Principal | | | | | Market | |

| Amount(A) | | | | | Value | |

| | | | | | | |

| | | | | Corporate Bonds — 67.7% (Continued) | | | | |

| | | | | | | | | |

| | | | | Health Care — (Continued) | | | | |

| $ | 130,000 | | | Centene Corp., 144a, 6.125% 2/15/24 | | $ | 138,206 | |

| | 100,000 | | | DaVita HealthCare Partners, Inc. 5.000% 5/1/25 | | | 99,125 | |

| | 800,000 | | | DaVita HealthCare Partners, Inc. 5.125% 7/15/24 | | | 808,880 | |

| | 300,000 | | | Fresenius US Finance II, Inc., 144a, 4.500% 1/15/23 | | | 306,750 | |

| | 600,000 | | | Grifols Worldwide Operations Ltd. (Ireland) 5.250% 4/1/22 | | | 610,500 | |

| | 114,000 | | | HCA, Inc. 5.375% 2/1/25 | | | 116,850 | |

| | 620,000 | | | HealthSouth Corp. 5.750% 9/15/25 | | | 613,800 | |

| | 300,000 | | | Kinetic Concepts, Inc. / KCI USA Inc., 144a, 7.875% 2/15/21 | | | 318,936 | |

| | 500,000 | | | LifePoint Health, Inc. 5.500% 12/1/21 | | | 521,250 | |

| | 150,000 | | | Mallinckrodt International Finance SA (Luxembourg) 4.750% 4/15/23 | | | 121,500 | |

| | 100,000 | | | Mallinckrodt International Finance SA / Mallinckrodt CB LLC (Luxembourg), 144a, 5.500% 4/15/25 | | | 89,212 | |

| | 300,000 | | | Mallinckrodt International Finance SA / Mallinckrodt CB LLC (Luxembourg), 144a, 5.625% 10/15/23 | | | 279,375 | |

| | 315,000 | | | Valeant Pharmaceuticals International, Inc. (Canada), 144a, 6.125% 4/15/25 | | | 252,788 | |

| | | | | | | | 4,844,877 | |

| | | | | | | | | |

| | | | | Energy — 8.4% | | | | |

| | 214,000 | | | California Resources Corp., 144a, 8.000% 12/15/22 | | | 151,940 | |

| | 80,000 | | | Chesapeake Energy Corp., 144a, 8.000% 12/15/22 | | | 67,800 | |

| | 198,000 | | | Continental Resources, Inc. OK 4.500% 4/15/23 | | | 184,635 | |

| | 110,000 | | | Continental Resources, Inc. OK 5.000% 9/15/22 | | | 107,525 | |

| | 250,000 | | | Energy Transfer Equity LP 5.500% 6/1/27 | | | 235,000 | |