UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03627

Greenspring Fund, Incorporated

(Exact name of registrant as specified in charter)

2330 West Joppa Road, Suite 110

Lutherville, MD 21093-4641

(Address of principal executive offices) (Zip code)

Mr. Charles vK. Carlson, President

2330 West Joppa Road, Suite 110

Lutherville, MD 21093-4641

(Name and address of agent for service)

(410) 823-5353

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2012

Date of reporting period: December 31, 2012

Item 1. Reports to Stockholders.

ANNUAL REPORT

DECEMBER 31, 2012

This report is intended for shareholders of the

Greenspring Fund, Incorporated and may not be

used as sales literature unless preceded or

accompanied by a current prospectus.

Greenspring Fund, Incorporated

Dear Fellow Shareholders:

During 2012, investors vacillated between optimism and pessimism as news headlines were dominated by the events unfolding within the Eurozone, the tenuous economic recovery in the United States and the prospects for economic growth in China. Equity markets started the year strongly, as investor fears about the European sovereign debt crisis lessened while politicians worked to craft plans designed to provide funds to struggling countries within the region. By mid-year, the financial crisis facing Greece and Spain intensified and investors moved to the sidelines, causing the equity markets to give back most of the gains achieved earlier in the year. By late summer, in an effort to stem investor fears and help prevent any additional adverse effects on the global economy, central banks in Europe and the United States signaled to investors that they were prepared to provide substantial liquidity to the credit markets. Markets rebounded and finished the year with strong gains as the Eurozone crisis began to fade, U.S. economic growth continued its slow march forward, corporate profits remained strong and economic growth in China appeared to be accelerating once again.

The Greenspring Fund also generated strong performance for the year, gaining 9.07% including the reinvestment of all dividends and capital gain distributions paid during the year. Gains were widespread throughout the portfolio and, reflecting the strong advance achieved by the stock market, equity returns exceeded the gains generated by the fixed income securities.

INFLUENCES on PERFORMANCE

During 2012, all asset classes within the Fund’s portfolio (common stocks, corporate bonds, convertible bonds and short term cash equivalents) produced positive returns. The gains in the common stock portfolio were widespread, with over 80% of the equity holdings delivering positive returns for the year. The Fund’s fixed income securities, including both corporate and convertible bonds, continued to provide steady positive total returns with more than 90% of the securities held in the portfolio during the year yielding positive returns.

| Greenspring Fund |

| Performance for the |

| Periods Ended December 31, 2012 |

| Quarter | | | 2.66 | % |

| 1 Year | | | 9.07 | % |

| 3 Years* | | | 6.37 | % |

| 5 Years* | | | 4.24 | % |

| 10 Years* | | | 8.27 | % |

| 15 Years* | | | 5.67 | % |

| 20 Years* | | | 8.24 | % |

| Since inception on 7/1/83* | | | 9.78 | % |

| Expense Ratio** | | | 0.93 | % |

| |

| * annualized. |

| ** as stated in Prospectus dated 5-1-12. See note on last page of letter. |

| |

| Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-366-3863 or visiting the Fund’s web site. The Fund imposes a 2.00% redemption fee for shares held 60 days or less. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced. |

The largest single influence on the Fund’s performance was the positive return produced by the Fund’s holdings in the Construction and Engineering industry group. The Fund began the year with holdings in the common stock of three companies within this industry and purchased two additional common stock investments during the year. In addition, the Fund also held a corporate bond of a company within the industry. Companies in this industry

Greenspring Fund, Incorporated

| Performance Comparison (Total Return*) |

| for Periods Ended December 31, 2012 |

| | | | 5 Years | 10 Years |

| | | 1 Year | Annualized/Cumulative | Annualized/Cumulative |

| Greenspring Fund | | 9.07% | 4.24% | 23.07% | 8.27% | 121.42% |

| Dow Jones | | 10.24% | 2.62% | 13.81% | 7.32% | 102.73% |

| S&P 500 | | 16.00% | 1.66% | 8.59% | 7.10% | 98.58% |

| NASDAQ* | | 15.91% | 2.63% | 13.85% | 8.50% | 126.09% |

| Russell 3000 | | 16.42% | 2.04% | 10.65% | 7.68% | 109.59% |

| Russell 3000 Value | | 17.55% | 0.83% | 4.20% | 7.54% | 106.78% |

| Russell 2000 | | 16.35% | 3.56% | 19.09% | 9.72% | 152.79% |

| Russell 2000 Value | | 18.05% | 3.55% | 19.03% | 9.50% | 147.87% |

| Lipper Flexible Portfolio | | 13.34% | 2.72% | 14.34% | 7.31% | 102.41% |

| |

* All data is Total Return except for NASDAQ. The Dow Jones Industrial Average, Standard and Poor’s 500 Index, NASDAQ, the Russell 3000, Russell 3000 Value, Russell 2000, Russell 2000 Value Indexes and Lipper Flexible Portfolio are unmanaged indices commonly used to measure performance of U.S. stocks. You cannot invest directly in an index. Past performance does not guarantee future results. |

profited from what we believe will be a multi-year increase in infrastructure spending related to the recent surge in the development of domestic oil and gas reserves, renewed investment in the electric transmission and distribution network, and continued upgrading and expansion of telecommunications systems. Several of the holdings also benefitted from the recovery, albeit a tepid one, in non-residential construction. All the holdings in the Construction and Engineering group produced positive returns for the year.

Within the Fund’s total portfolio, brief discussions of the five individual securities that had the largest influences (measured by dollars gained or lost) on total Fund performance for the year follow.

PartnerRe, Ltd. common stock

PartnerRe, Ltd., a global issuer of reinsurance across a wide variety of business lines, generated a total return for the Greenspring Fund of approximately 31% during 2012, driven by a return to solid underwriting results and accretive cash deployment. PartnerRe’s actions over the past year are representative of the investment characteristics we seek for the Greenspring Fund and exemplify the reasons why we have owned PartnerRe’s common stock for the last fifteen years, and why, for much of 2012, it was one of the largest positions in the Fund. Over the long term and through many different business cycles, PartnerRe’s disciplined management team has been able to consistently generate solid shareholder returns.

| | % of Net |

| Greenspring Fund | Assets |

| Top 10 Holdings | as of |

| | 12/31/12 |

| Alcatel-Lucent, Inc., 2.875%, 6/15/25 | |

| Convertible Bonds | 3.9% |

| FTI Consulting, Inc. | 3.8% |

| Republic Services, Inc. | 3.3% |

| Rosetta Resources, Inc., 9.500%, 4/15/18 | 3.2% |

| j2 Global, Inc. | 3.1% |

| PartnerRe, Ltd. | 3.0% |

| Cisco Systems, Inc. | 2.9% |

| Leucadia National Corp., 7.000%, 8/15/13 | 2.7% |

| RadioShack Corp., 2.500%, 8/1/13 | |

| Convertible Bonds - 144A | 2.7% |

| Harmonic, Inc. | 2.6% |

Greenspring Fund, Incorporated

At the start of the year, PartnerRe was coming off a disappointing 2011 performance due to losses suffered from catastrophic earthquakes and flooding in Japan, Thailand, and New Zealand and severe weather in the United States. As incurred claims from these events rose in size amid a weak reinsurance pricing market, PartnerRe’s stock price declined even though the Company had more than adequate capital to meet the loss payouts. With relatively low Wall Street expectations for the Company heading into 2012, the stock responded positively during the year for three main reasons. First, management reduced the Company’s future exposure to these types of large catastrophic events, helping to improve its ability to produce a more stable and consistent rate of return. Second, the Company used its significant excess capital to raise the dividend by more than 5% and aggressively repurchase stock below book value, generating immediate accretion to existing shareholders. Third, the reinsurance market tightened in part due to 2011’s losses, enabling PartnerRe to increase prices across many business lines for the first time in several years. As a result of these factors, along with fewer catastrophic events during 2012, the Company was able to generate a strong return for shareholders.

We reduced our position in PartnerRe during the year as the rising stock price decreased the discount to our estimate of its fair value, but we continue to be strong believers in its business model and ability to generate strong risk-adjusted total returns for shareholders in the future.

FTI Consulting, Inc. common stock

The Fund has owned shares in FTI Consulting, Inc. in varying amounts for a number of years. FTI provides high level business consulting services to large corporations, financial institutions and law firms throughout the world. FTI has five main business lines including bankruptcy/restructuring, economic consulting, litigation consulting, technology, and strategic corporate communications. With its diversified mix of business lines, FTI appears positioned to perform well in most economic climates. Its bankruptcy/restructuring operations benefitted during difficult economic times, while its pro-cyclical operations carried the load during more favorable economic conditions. FTI has historically generated a significant amount of cash flow from operations and, since it requires little capital investment to sustain its business, the majority of its cash is available to strengthen or grow the business or to be returned to shareholders through stock repurchase programs.

Early in 2012, FTI reported first quarter earnings that were below the expectations of Wall Street analysts and ultimately the Company reduced its earnings per share guidance for the full year. A number of factors were to

| Greenspring Fund |

| Ten Largest 2012 Purchases |

| Common Stocks: |

| Energen Corp. |

| GSI Group, Inc. |

| BioScrip, Inc. |

| NTELOS Holdings Corp. |

| j2 Global, Inc. |

| Bonds: |

| RadioShack Corp., 2.500%, 8/1/13 – 144A Convertible Bonds |

| PetroQuest Energy, Inc., 10.000%, 9/1/17 |

| The Scotts Miracle-Gro Co., 7.250%, 1/15/18 |

| BioScrip, Inc., 10.250%, 10/1/15 |

| MasTec, Inc., 7.625%, 2/1/17 |

| Greenspring Fund |

| Ten Largest 2012 Sales |

| Common Stocks: |

| PartnerRe, Ltd. |

| CA, Inc. |

| Prestige Brands Holdings, Inc. |

| Global Indemnity plc |

| Cisco Systems, Inc. |

| Bonds: |

| CCH II LLC, 13.500%, 11/30/16 |

| Gulfmark Offshore, Inc., 7.750%, 7/15/14 |

| Hanesbrands, Inc., 4.113%, 12/15/14 |

| Ticketmaster Entertainment, Inc., 10.750%, 8/1/16 |

| Range Resources Corp., 7.500%, 10/1/17 |

Greenspring Fund, Incorporated

blame, but the most likely cause was the sluggish economic environment that was not weak enough to allow the bankruptcy/restructuring business to thrive nor strong enough to advance the more pro-cyclical business sufficiently. The stock price declined approximately 22% during the year on fears that the earnings weakness would continue until the economic environment changes markedly. Even under current economic conditions, FTI has still been able to generate substantial free cash flow that can be used to fund growth opportunities such as acquisitions that strengthen existing business lines or add new skill sets or repurchase shares of its own common stock which should benefit future earnings per share. In any case, we believe that the long term prospects for FTI remain strong.

CA, Inc. common stock

Shares of CA, Inc., a provider of enterprise-level software products that help IT professionals more efficiently manage their networks, generated a total return of just over 33% for the Greenspring Fund during 2012 after investors applauded CA’s steady results in a choppy market environment and management unveiled a new cash deployment strategy. Customers view CA’s software as vital to running their increasingly complex IT systems, which has led to extremely high contract renewal rates and a consistent revenue stream despite limited growth in the global economy. This model, when coupled with minimal capital expenditure requirements, generates a highly profitable and very stable free cash flow stream. At the beginning of 2012, the management team found themselves in the enviable position of sitting on over $1 billion in net cash on the balance sheet and running a business that has consistently generated more than $1 billion in annual free cash flow. In January of 2012, management adopted a two year capital allocation strategy under which they plan to return 80% of the free cash flow to shareholders through a five-fold increase in the dividend and the repurchase of nearly 15% of the outstanding shares. We and other investors cheered management’s disciplined use of cash in a difficult, and hard to predict, market environment. We pared back our position in CA as the stock increased in value, but we continue to believe that the investment should generate a solid total return as evidenced by a near 4% dividend yield, continued share buybacks, and improving growth prospects as more customer contracts come up for renewal.

BioScrip, Inc. common stock

BioScrip, Inc., a specialty healthcare services provider, produced a return of just over 90% for the Greenspring Fund in 2012 as management transformed the foundation of the entire company. The May 2012 sale of its specialty pharmacy business to Walgreens not only generated $225 million in proceeds, but allowed management to better focus on the faster-growing home infusion business. With healthcare costs rising unabated, private insurance payors are looking for more cost-effective alternatives and providing infusion treatment in the home versus hospitals or skilled nursing facilities can save, on average, 50-85% per episode. Not only has BioScrip’s organic growth exceeded expectations, but the Company is using its free cash flow and proceeds from the asset sale to purchase other regional home infusion companies. BioScrip is able to quickly improve the operations of acquired businesses by introducing BioScrip’s national payor relationships to the newly acquired company. This transformation into a more focused company has resulted in accelerated growth and a healthier balance sheet, leading investors to pay a higher price for shares. While we applaud management’s accomplishments, we are watching our fair value parameters carefully as lofty growth expectations begin to be factored into the stock price.

Alcatel-Lucent, Inc. 2.875% convertible bonds

Headquartered in France, Alcatel-Lucent, Inc. is a large, diversified telecom equipment company that produces software and hardware products that enable telecommunications companies to deliver digital content worldwide. The prices of Alcatel’s common stock and bonds were depressed at the start of the year, reflecting the Company’s struggles to maintain its competitiveness in the multitude of product areas in which it competes, the negative effects of the European debt crisis on liquidity in

Greenspring Fund, Incorporated

| Greenspring Fund |

| Portfolio Allocation |

| as of December 31, 2011 |

|

| |

| Greenspring Fund |

| Portfolio Allocation |

| as of December 31, 2012 |

|

| |

the capital markets throughout Europe, and on the outlook for an economic slowdown or even a recession. During the first quarter of 2012, news out of the Eurozone improved and the capital markets began to recover. Additionally, in early February, Alcatel announced that it had completed the sale of one of its business units, raising approximately $1.5 billion. These two events led to a significant increase in the convertible bond price by the end of the first quarter. Although the maturity date of the convertible bond is June 15, 2025, the bond has a “put” feature that allows holders to sell the bond back to Alcatel on June 15, 2013 for par value. While we realize that Alcatel faces some long term challenges in its business fundamentals, we are confident that Alcatel’s short term liquidity is more than sufficient to retire the convertible bonds on the June 15, 2013 “put” date.

PORTFOLIO ACTIVITY

Allocation among the three main asset classes in the portfolio (common stocks, fixed income securities and cash equivalents) remained fairly constant throughout the year. When comparing the Fund’s portfolio year over year, the allocation to common stocks and fixed income securities both increased by 2% while cash equivalents decreased by 4%. Please refer to the Schedule of Investments in the financial statements for a complete list of portfolio holdings and the percentage of the portfolio each investment represents. We initiated positions in the common stock of five companies (Clifton Savings Bancorp, Inc., Dycom Industries, Inc., GeoEye, Inc., MYR Group, Inc., and Newpark Resources, Inc.), but as of the end of the year none of these were significant positions in the Fund’s portfolio. We made a number of additions to existing common stock holdings, with the most significant being additional purchases of Energen Corp., GSI Group, Inc., BioScrip, Inc. and NTELOS Holdings Corp.

During the year, we completely liquidated twelve of the Fund’s common stock holdings due to takeover proposals, market prices reflecting our estimate of full value, or a change in company fundamentals. The two largest positions closed during the year were the Fund’s long term holdings in Prestige Brands Holdings, Inc. and Global Indemnity plc. Other significant sales include the reduction in the Fund’s holdings in PartnerRe, Ltd., CA, Inc., and Cisco Systems, Inc.

Once again, activity in the fixed income portfolio was influenced by the maturity or redemption of many of the Fund’s holdings. With the relatively short duration of the fixed income portfolio, we expect a considerable number of holdings in the portfolio to mature on a regular basis. Furthermore, the current low interest rate environment encouraged companies to redeem or tender for existing

Greenspring Fund, Incorporated

debt that could be refinanced at lower rates, leading to additional turnover in the portfolio. As existing fixed income securities were sold, matured or redeemed, we typically reinvested the proceeds in additional fixed income securities with relatively short durations and similar financial underpinnings.

OUTLOOK

As we begin 2013, we are surrounded by political and economic uncertainty. Within this environment, we remain focused on the Greenspring Fund’s total return approach to investing by purchasing well capitalized, value-oriented common stocks and short duration high yield bonds. In the current low interest rate environment, we will maintain a relatively short expected duration in the fixed income portfolio seeking to achieve attractive total returns and buffer the potential negative impact of an increase in rates. In such an environment, a fixed income portfolio with a shorter duration should fare far better than a portfolio of longer dated securities, as the proceeds from bond redemptions or maturities can be reinvested at the higher prevailing interest rates. With respect to equity securities, we will seek out companies with solid balance sheets, shareholder friendly management teams and strong free cash flow. We continue to work on a daily basis to uncover securities that we believe have the characteristics to provide attractive returns to the Fund. We are determined to achieve our goals, and what we believe are the expectations of the Fund’s shareholders, to preserve capital during periods of market weakness and produce attractive risk adjusted returns during more favorable market conditions.

We would like to take this opportunity to extend best wishes to our shareholders for a happy, healthy and prosperous 2013, and we look forward to reporting further progress to you following the end of the first quarter.

Respectfully,

| Charles vK. Carlson | Michael J. Fusting |

| Portfolio Manager and Co-Chief Investment Officer | Co-Chief Investment Officer |

**Total Annual Fund Operating Expenses will not correlate to the Ratio of Expenses to Average Net Assets shown in the Fund’s most recent Annual Report and in the Financial Highlights section of the Prospectus, which reflects the operating expenses of the Fund and does not include acquired fund fees and expenses.

Mutual fund investing involves risk. Principal loss is possible. Small-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Investments by the Fund in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities.

Opinions expressed are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security. Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future portfolio holdings are subject to risk.

Free cash flow measures the cash generating capability of a company by adding certain non-cash charges (e.g. depreciation and amortization) to earnings and subtracting recurring capital expenditures. Duration is a commonly used measure of the potential volatility of the price of a debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration. Book value is net asset value of a company, calculated by subtracting total liabilities from total assets. Cash flow measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income. Earnings Per Share (EPS) is calculated by taking the total earnings divided by the number of shares outstanding.

Distributed by Quasar Distributors, LLC

Greenspring Fund, Incorporated

Growth of a $10,000 Investment in the Greenspring Fund

Over the Last Ten Years

Average Annual Total Returns

| | | For Periods Ended December 31, 2012 | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| Greenspring Fund | | | 9.07% | | | 6.37% | | | 4.24% | | | 8.27% |

| Russell 3000 Index | | | 16.42% | | | 11.20% | | | 2.04% | | | 7.68% |

| Lipper Flexible Portfolio Fund Index | | | 13.34% | | | 8.15% | | | 2.72% | | | 7.31% |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Greenspring Fund (the “Fund”) distributions or the redemption of Fund shares.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end is available at www.greenspringfund.com or by calling 1-800-366-3863 toll free. The Fund imposes a 2.00% redemption fee for shares held 60 days or less. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

Greenspring Fund, Incorporated

EXPENSE EXAMPLE For the Six Months Ended December 31, 2012 (Unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) redemption fees if you redeem within 60 days of purchase; and (2) ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (7/1/2012 – 12/31/2012).

Actual Expenses

The first line of the table below provides information about actual account values based on actual returns and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | Expenses Paid | |

| | | Beginning | | | Ending | | | During the Period | |

| | | Account Value | | | Account Value | | | 7/1/2012 – | |

| | | 7/1/2012 | | | 12/31/2012 | | | 12/31/2012* | |

| Actual | | | $1,000.00 | | | | $1,068.10 | | | | $4.83 | |

| Hypothetical | | | | | | | | | | | | |

| (5% annual return before expenses) | | | $1,000.00 | | | | $1,020.50 | | | | $4.72 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.93%, multiplied by the average account value over the period multiplied by 184/366 (to reflect the one-half year period). |

Greenspring Fund, Incorporated

SCHEDULE OF INVESTMENTS at December 31, 2012 |

| Shares/Principal | | Value | |

| | | | |

| COMMON STOCKS: 50.5% | | | |

| | | | |

| Business Software & Services: 1.7% | | | |

| | 514,224 | | CA, Inc. | | $ | 11,302,644 | |

| | | | | | | | |

| Commercial Banks & Thrifts: 2.7% | | | | |

| | 44,774 | | American National Bankshares, Inc. | | | 903,987 | |

| | 109,287 | | BCSB Bancorp, Inc.* | | | 1,551,875 | |

| | 65,389 | | Chicopee Bancorp, Inc.* | | | 1,039,031 | |

| | 10,271 | | Clifton Savings Bancorp, Inc. | | | 115,754 | |

| | 279,112 | | ESSA Bancorp, Inc. | | | 3,039,530 | |

| | 47,542 | | First Connecticut Bancorp, Inc. | | | 653,703 | |

| | 5,382 | | Hampden Bancorp, Inc. | | | 80,784 | |

| | 53,165 | | Heritage Financial Group, Inc. | | | 733,145 | |

| | 42,897 | | Middleburg Financial Corp. | | | 757,561 | |

| | 52,900 | | OceanFirst Financial Corp. | | | 727,375 | |

| | 110,569 | | OmniAmerican Bancorp, Inc.* | | | 2,557,461 | |

| | 85,144 | | Shore Bancshares, Inc. | | | 458,075 | |

| | 589,083 | | Southern National Bancorp of Virginiaº | | | 4,712,664 | |

| | 70,439 | | Westfield Financial, Inc. | | | 509,274 | |

| | | | | | | 17,840,219 | |

| | | | | | | | |

| Communications Equipment: 5.6% | | | | |

| | 974,759 | | Cisco Systems, Inc. | | | 19,154,014 | |

| | 3,383,952 | | Harmonic, Inc.* | | | 17,156,637 | |

| | | | | | | 36,310,651 | |

| | | | | | | | |

| Construction & Engineering: 7.3% | | | | |

| | 102,400 | | Dycom Industries, Inc.* | | | 2,027,520 | |

| | 339,375 | | EMCOR Group, Inc. | | | 11,745,769 | |

| | 578,758 | | MasTec, Inc.* | | | 14,428,437 | |

| | 647,305 | | Michael Baker Corp.º | | | 16,137,314 | |

| | 137,200 | | MYR Group, Inc.* | | | 3,052,700 | |

| | | | | | | 47,391,740 | |

| | | | | | | | |

| Electrical Equipment & Instruments: 1.2% | | | | |

| | 17,400 | | Emerson Electric Co. | | | 921,504 | |

| | 816,729 | | GSI Group, Inc.* # | | | 7,072,873 | |

| | | | | | | 7,994,377 | |

| | | | | | | | |

| Healthcare: 1.8% | | | | |

| | 1,095,989 | | BioScrip, Inc.* | | | 11,803,801 | |

| | | | | | | | |

| Insurance: 5.1% | | | | |

| | 391,825 | | Assurant, Inc. | | | 13,596,327 | |

| | 241,232 | | PartnerRe, Ltd.# | | | 19,416,764 | |

| | | | | | | 33,013,091 | |

| | | | | | | | |

| Internet Software & Services: 3.1% | | | | |

| | 650,580 | | j2 Global, Inc. | | | 19,894,736 | |

| | | | | | | | |

| Machinery: 0.2% | | | | |

| | 20,000 | | Pentair, Inc. | | | 983,000 | |

| | | | | | | | |

| Management Consulting: 3.8% | | | | |

| | 748,688 | | FTI Consulting, Inc.* | | | 24,706,704 | |

| | | | | | | | |

| Oil & Gas Equipment & Services: 0.4% | | | | |

| | 314,014 | | Newpark Resources, Inc.* | | | 2,465,010 | |

| | | | | | | | |

| Oil & Gas Exploration & Production: 7.4% | | | | |

| | 5,626 | | ConocoPhillips | | | 326,252 | |

| | 319,077 | | Energen Corp. | | | 14,387,182 | |

| | 61,905 | | EOG Resources, Inc. | | | 7,477,505 | |

| | 2,813 | | Phillips 66 | | | 149,370 | |

| | 375,296 | | Rosetta Resources, Inc.* | | | 17,023,427 | |

| | 276,575 | | Suncor Energy, Inc.# | | | 9,121,443 | |

| | | | | | | 48,485,179 | |

| | | | | | | | |

| Semiconductors: 1.8% | | | | |

| | 1,697,822 | | ON Semiconductor Corp.* | | | 11,969,645 | |

| | | | | | | | |

| Telecommunications: 1.3% | | | | |

| | 331,226 | | Lumos Networks Corp. | | | 3,318,885 | |

| | 391,432 | | NTELOS Holdings Corp. | | | 5,131,673 | |

| | | | | | | 8,450,558 | |

| | | | | | | | |

| Truck Dealerships: 1.5% | | | | |

| | 219,105 | | Rush Enterprises, Inc. - Class A* | | | 4,528,900 | |

| | 295,798 | | Rush Enterprises, Inc. - Class B* | | | 5,120,264 | |

| | | | | | | 9,649,164 | |

| Utilities: 2.3% | | | | |

| | 516,918 | | PPL Corp. | | | 14,799,362 | |

| | | | | | | | |

| Waste Management Services: 3.3% | | | | |

| | 737,658 | | Republic Services, Inc. | | | 21,635,509 | |

| | | | | | | | |

| TOTAL COMMON STOCKS | | | | |

| (cost $261,225,568) | | | 328,695,390 | |

| | | | | | | | |

| CONVERTIBLE BONDS: 15.5% | | | | |

| | | | | |

| Communications Equipment Manufacturing: 3.9% | | | | |

| | $25,098,000 | | Alcatel-Lucent, Inc., 2.875%, 6/15/25 | | | 25,317,608 | |

The accompanying notes are an integral part of these financial statements.

Greenspring Fund, Incorporated

SCHEDULE OF INVESTMENTS at December 31, 2012 (Con’t) |

| Principal | | | | Value | |

| | | | |

| CONVERTIBLE BONDS: 15.5% (Con’t) | | | |

| | | | |

| Educational: 1.8% | | | |

| | $23,182,000 | | School Specialty, Inc., 3.750%, 11/30/26 | | $ | 11,735,887 | |

| | | | | | | | |

| Entertainment: 1.3% | | | | |

| | 8,375,000 | | Live Nation Entertainment, Inc., | | | | |

| | | | 2.875%, 7/15/27 | | | 8,333,125 | |

| | | | | | | | |

| Internet Software & Services: 0.9% | | | | |

| | 5,946,000 | | Digital River, Inc., 2.000%, 11/1/30 | | | 5,882,824 | |

| | | | | | | | |

| Medical Equipment: 1.5% | | | | |

| | 9,797,000 | | Hologic, Inc., 2.000%, 12/15/37 | | | 9,815,369 | |

| | | | | | | | |

| Oil & Gas Exploration & Production: 0.6% | | | | |

| | 3,784,000 | | Bill Barrett Corp., 5.000%, 3/15/28 | | | 3,805,285 | |

| | | | | | | | |

| Retail Stores: 2.7% | | | | |

| | 18,750,000 | | RadioShack Corp., 2.500%, 8/1/13 - 144A | | | 17,296,875 | |

| | | | | | | | |

| Semiconductors & Semiconductor Equipment: 2.2% | | | | |

| | 14,447,000 | | Rambus, Inc., 5.000%, 6/15/14 | | | 14,501,176 | |

| | | | | | | | |

| Telecommunications: 0.1% | | | | |

| | 657,000 | | Cogent Communications | | | | |

| | | | Group, Inc., 1.000%, 6/15/27 | | | 638,932 | |

| | | | | | | | |

| Transportation Equipment Manufacturing: 0.5% | | | | |

| | 3,602,000 | | The Greenbrier Companies, Inc., | | | | |

| | | | 2.375%, 5/15/26 | | | 3,615,508 | |

| | | | | | | | |

| TOTAL CONVERTIBLE BONDS | | | | |

| (cost $108,000,376) | | | 100,942,589 | |

| | | | | | | | |

| CORPORATE BONDS: 28.3% | | | | |

| | | | | |

| Airlines: 0.7% | | | | |

| | 4,000,000 | | American Airlines, Inc., | | | | |

| | | | 7.500%, 3/15/16 - *144A@ | | | 4,330,000 | |

| Automotive Parts: 0.7% | | | | |

| | 3,965,000 | | TRW Automotive, Inc., | | | | |

| | | | 8.875%, 12/1/17 - 144A | | | 4,381,325 | |

| | | | | | | | |

| Coal Producers: 0.5% | | | | |

| | 3,069,000 | | CONSOL Energy, Inc., 8.000%, 4/1/17 | | | 3,337,537 | |

| | | | | | | | |

| Construction & Engineering: 2.1% | | | | |

| | 13,225,000 | | MasTec, Inc., 7.625%, 2/1/17 | | | 13,654,812 | |

| | | | | | | | |

| | | | | | | | |

| Consumer Goods: 2.7% | | | | |

| | 8,684,000 | | The Scotts Miracle-Gro Co., | | | | |

| | | | 7.250%, 1/15/18 | | | 9,378,720 | |

| | 7,738,000 | | TreeHouse Foods, Inc., 7.750%, 3/1/18 | | | 8,415,075 | |

| | | | | | | 17,793,795 | |

| Electrical Equipment & Instruments: 1.3% | | | | |

| | 8,635,000 | | Wesco Distribution, Inc., 7.500%, 10/15/17 | | | 8,770,570 | |

| | | | | | | | |

| Entertainment: 1.1% | | | | |

| | 6,239,000 | | Cinemark USA, Inc., 8.625%, 6/15/19 | | | 6,940,888 | |

| | | | | | | | |

| Healthcare: 2.5% | | | | |

| | 14,854,000 | | BioScrip, Inc., 10.250%, 10/1/15 | | | 15,930,915 | |

| | | | | | | | |

| Medical Equipment: 0.1% | | | | |

| | 325,000 | | Angiotech Pharmaceuticals, Inc., | | | | |

| | | | 9.000%, 12/1/16 | | | 328,656 | |

| | | | | | | | |

| Oil & Gas Exploration & Production: 9.2% | | | | |

| | 2,472,000 | | Bill Barrett Corp., 9.875%, 7/15/16 | | | 2,694,480 | |

| | 5,829,000 | | McMoRan Exploration Co., | | | | |

| | | | 11.875%, 11/15/14 | | | 6,229,744 | |

| | 15,667,000 | | PetroQuest Energy, Inc., 10.000%, 9/1/17 | | | 16,293,680 | |

| | 8,971,000 | | Quicksilver Resources, Inc., 8.250%, 8/1/15 | | | 8,343,030 | |

| | 100,000 | | Quicksilver Resources, Inc., 7.125%, 4/1/16 | | | 80,500 | |

| | 18,820,000 | | Rosetta Resources, Inc., 9.500%, 4/15/18 | | | 20,984,300 | |

| | 5,000,000 | | Stone Energy Corp., 8.625%, 2/1/17 | | | 5,393,750 | |

| | | | | | | 60,019,484 | |

| | | | | | | | |

| Packaging: 0.1% | | | | |

| | 140,000 | | Berry Plastics Corp., 5.090%, 2/15/15 | | | 140,560 | |

| | 268,000 | | Berry Plastics Corp., 8.250%, 11/15/15 | | | 280,730 | |

| | 50,000 | | Berry Plastics Corp., 10.250%, 3/1/16 | | | 51,688 | |

| | | | | | | 472,978 | |

| | | | | | | | |

| Publishing: 0.1% | | | | |

| | 817,000 | | Gannett Co, Inc., 9.375%, 11/15/17 | | | 908,912 | |

| | | | | | | | |

| Pulp & Paper: 1.4% | | | | |

| | 8,123,000 | | Resolute Forest Products, Inc., | | | | |

| | | | 10.250%, 10/15/18 | | | 9,341,450 | |

| | | | | | | | |

| Retail Stores: 1.2% | | | | |

| | 7,636,000 | | Albertsons, Inc., 7.250%, 5/1/13 | | | 7,740,995 | |

| | | | | | | | |

| Satellite Imagery Services: 1.3% | | | | |

| | 7,738,000 | | GeoEye, Inc., 9.625%, 10/1/15 | | | 8,589,180 | |

The accompanying notes are an integral part of these financial statements.

Greenspring Fund, Incorporated

SCHEDULE OF INVESTMENTS at December 31, 2012 (Con’t) |

| Principal | | | | Value | |

| | | | |

| CORPORATE BONDS: 28.3% (Con’t) | | | |

| | | | |

| Transportation Equipment Manufacturing: 0.4% | | | |

| $ | 2,688,000 | | Westinghouse Air Brake | | | |

| | | | Technologies Corp., 6.875%, 7/31/13 | | $ | 2,775,360 | |

| | | | | | | | |

| Wood Product Manufacturing: 2.9% | | | | |

| | 17,308,000 | | Leucadia National Corp., 7.000%, 8/15/13 | | | 17,892,145 | |

| | 1,158,000 | | Leucadia National Corp., 7.750%, 8/15/13 | | | 1,201,425 | |

| | | | | | | 19,093,570 | |

| | | | | | | | |

| TOTAL CORPORATE BONDS | | | | |

| (cost $181,304,830) | | | 184,410,427 | |

| | | | | |

| SHORT-TERM INVESTMENTS: 4.8% | | | | |

| | | | | |

| Money Market Instruments^ | | | | |

| | 25,740,000 | | AIM Liquid Assets, 0.150% | | | 25,740,000 | |

| | 5,089,039 | | AIM STIC Prime Portfolio, 0.090% | | | 5,089,039 | |

| | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | |

| (cost $30,829,039) | | | 30,829,039 | |

| | | | | |

| TOTAL INVESTMENTS IN SECURITIES | | | | |

| (cost $581,359,813): 99.1% | | | 644,877,445 | |

| Other Assets and Liabilities: 0.9% | | | 6,023,426 | |

| NET ASSETS: 100.0% | | $ | 650,900,871 | |

| * | Non-income producing security. |

| º | Investment in affiliated security (note 5). |

| # | U.S. security of foreign issuer. |

| 144A | Securities purchased pursuant to Rule 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other “qualified institutional buyers.” These securities have been deemed to be liquid by the Fund’s adviser under the supervision of the Board of Directors. As of December 31, 2012, the value of these investments was $26,008,200, or 4.0% of total net assets. |

| @ | Security is in default. |

| ^ | Rate shown is the 7-day effective yield at December 31, 2012. |

The accompanying notes are an integral part of these financial statements.

Greenspring Fund, Incorporated

STATEMENT OF ASSETS AND LIABILITIES at December 31, 2012 |

| ASSETS | | | |

| Investments in securities, at value (cost $581,359,813) | | $ | 644,877,445 | |

| Receivables: | | | | |

| Securities sold | | | 2,998,563 | |

| Fund shares sold | | | 1,222,295 | |

| Dividends and interest | | | 5,171,185 | |

| Prepaid expenses | | | 32,969 | |

| Total assets | | | 654,302,457 | |

| | | | | |

| LIABILITIES | | | | |

| Payables: | | | | |

| Due to affiliate (Note 5) | | | 403,688 | |

| Securities purchased | | | 486,221 | |

| Fund shares redeemed | | | 2,322,399 | |

| Accrued expenses | | | 189,278 | |

| Total liabilities | | | 3,401,586 | |

| | | | | |

| NET ASSETS | | $ | 650,900,871 | |

| | | | | |

| Capital shares issued and outstanding (60,000,000 shares authorized, $0.01 par value) | | | 28,017,606 | |

| | | | | |

| Net asset value, offering and redemption price per share | | $ | 23.23 | |

| | | | | |

| COMPONENTS OF NET ASSETS | | | | |

| Capital stock at par value | | $ | 280,176 | |

| Paid-in capital | | | 594,645,239 | |

| Accumulated net investment loss | | | (8,405,193 | ) |

| Undistributed net realized gain on investments | | | 863,017 | |

| Net unrealized appreciation on investments | | | 63,517,632 | |

| NET ASSETS | | $ | 650,900,871 | |

The accompanying notes are an integral part of these financial statements.

Greenspring Fund, Incorporated

STATEMENT OF OPERATIONS For the Year Ended December 31, 2012 |

| INVESTMENT INCOME | | | |

| Income | | | |

| Interest | | $ | 20,899,434 | |

| Dividends (net of foreign withholding taxes of $19,150) | | | 6,491,863 | |

| Total income | | | 27,391,297 | |

| | | | | |

| Expenses | | | | |

| Advisory fees (Note 5) | | | 5,044,432 | |

| Transfer agent fees (Note 6) | | | 771,099 | |

| Administration fees | | | 285,512 | |

| Fund accounting fees | | | 115,724 | |

| Administration fees - Corbyn (Note 5) | | | 101,838 | |

| Custody fees | | | 58,485 | |

| Reports to shareholders | | | 54,101 | |

| Blue sky fees | | | 51,696 | |

| Miscellaneous fees | | | 42,663 | |

| Directors fees | | | 39,497 | |

| Legal fees | | | 33,646 | |

| Audit fees | | | 28,300 | |

| Insurance fees | | | 28,182 | |

| Total expenses | | | 6,655,175 | |

| Net investment income | | | 20,736,122 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | | |

| Net realized gain on investments | | | 19,448,250 | |

| Change in net unrealized appreciation/depreciation on investments | | | 20,345,518 | |

| Net realized and unrealized gain on investments | | | 39,793,768 | |

| Net increase in net assets resulting from operations | | $ | 60,529,890 | |

The accompanying notes are an integral part of these financial statements.

Greenspring Fund, Incorporated

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Year Ended | | | Year Ended | |

| | | December 31, 2012 | | | December 31, 2011 | |

| INCREASE (DECREASE) IN NET ASSETS FROM: | | | | | | |

| | | | | | | |

| OPERATIONS | | | | | | |

| Net investment income | | $ | 20,736,122 | | | $ | 20,257,259 | |

| Net realized gain on investments | | | 19,448,250 | | | | 24,260,039 | |

| Change in net unrealized appreciation/depreciation on investments | | | 20,345,518 | | | | (52,118,077 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 60,529,890 | | | | (7,600,779 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (25,524,402 | ) | | | (27,706,977 | ) |

| From net realized gain | | | (17,097,170 | ) | | | (18,593,281 | ) |

| Total distributions to shareholders | | | (42,621,572 | ) | | | (46,300,258 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Net decrease in net assets derived | | | | | | | | |

| from net change in outstanding shares (a)+ | | | (105,963,365 | ) | | | (37,853,714 | ) |

| Total decrease in net assets | | | (88,055,047 | ) | | | (91,754,751 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 738,955,918 | | | | 830,710,669 | |

| End of year (including accumulated net investment | | | | | | | | |

| loss of ($8,405,193) and ($7,066,957), respectively) | | $ | 650,900,871 | | | $ | 738,955,918 | |

| (a) | A summary of capital share transactions is as follows: |

| | | Year Ended | | | Year Ended | |

| | | December 31, 2012 | | | December 31, 2011 | |

| | | Shares | | | Value | | | Shares | | | Value | |

| Shares sold | | | 4,711,945 | | | $ | 110,538,884 | | | | 11,522,484 | | | $ | 278,987,824 | |

| Shares issued in reinvestment of distributions | | | 1,827,772 | | | | 41,890,711 | | | | 2,002,046 | | | | 45,518,365 | |

| Shares redeemed+ | | | (11,075,533 | ) | | | (258,392,960 | ) | | | (15,305,772 | ) | | | (362,359,903 | ) |

| Net decrease | | | (4,535,816 | ) | | $ | (105,963,365 | ) | | | (1,781,242 | ) | | $ | (37,853,714 | ) |

| + | Net of redemption fees of $32,665 and $74,850, respectively. |

The accompanying notes are an integral part of these financial statements.

Greenspring Fund, Incorporated

FINANCIAL HIGHLIGHTS For a capital share outstanding throughout each year |

| | | Year Ended December 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| Net asset value, beginning of year | | $ | 22.70 | | | $ | 24.19 | | | $ | 22.69 | | | $ | 20.36 | | | $ | 23.59 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME (LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.67 | | | | 0.58 | | | | 0.56 | | | | 0.71 | | | | 0.43 | |

| Net realized and unrealized gain (loss) on investments | | | 1.35 | | | | (0.66 | ) | | | 1.82 | | | | 2.47 | | | | (3.18 | ) |

| Total from investment operations | | | 2.02 | | | | (0.08 | ) | | | 2.38 | | | | 3.18 | | | | (2.75 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.88 | ) | | | (0.82 | ) | | | (0.72 | ) | | | (0.83 | ) | | | (0.34 | ) |

| From net realized gain | | | (0.61 | ) | | | (0.59 | ) | | | (0.16 | ) | | | (0.02 | ) | | | (0.16 | ) |

| Total distributions | | | (1.49 | ) | | | (1.41 | ) | | | (0.88 | ) | | | (0.85 | ) | | | (0.50 | ) |

| Paid-in capital from redemption fees (Note 1) | | | — | * | | | — | * | | | — | * | | | — | * | | | 0.02 | |

| Net asset value, end of year | | $ | 23.23 | | | $ | 22.70 | | | $ | 24.19 | | | $ | 22.69 | | | $ | 20.36 | |

| Total return | | | 9.07 | % | | | (0.26 | %) | | | 10.63 | % | | | 15.83 | % | | | (11.72 | %) |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (millions) | | $ | 650.9 | | | $ | 739.0 | | | $ | 830.7 | | | $ | 528.5 | | | $ | 308.2 | |

| Ratio of expenses to average net assets | | | 0.93 | % | | | 0.91 | % | | | 0.95 | % | | | 1.03 | % | | | 1.06 | % |

| Ratio of net investment income to average net assets | | | 2.89 | % | | | 2.40 | % | | | 2.51 | % | | | 3.67 | % | | | 2.15 | % |

| Portfolio turnover rate | | | 27.67 | % | | | 58.32 | % | | | 59.99 | % | | | 46.77 | % | | | 47.11 | % |

| * | Amount less than $0.01 per share. |

The accompanying notes are an integral part of these financial statements.

Greenspring Fund, Incorporated

NOTES TO FINANCIAL STATEMENTS December 31, 2012 |

| |

| Note 1 – Significant Accounting Policies |

Greenspring Fund, Incorporated (the ���Fund”) is a diversified, open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund is organized as a Maryland corporation and commenced operations on July 1, 1983.

The preparation of the financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates. In preparing these financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued.

Investment transactions and related investment income – Investment transactions are recorded on the trade date. Dividend income is recorded on the ex-dividend date and interest income, including amortization of premiums and accretion of discounts, is recorded on the accrual basis. Dividends determined to be a return of capital are recorded as a reduction of the cost basis of the security. Realized gains and losses from investment transactions are reported on an identified cost basis.

Valuation of investments – Securities listed on a national securities exchange or the NASDAQ National Market are valued at the last reported sale price or the official closing price for certain markets on the exchange of major listing as of the close of the regular session of the New York Stock Exchange.

Securities that are traded principally in the over-the-counter market, listed securities for which no sale was reported on the day of valuation, and listed securities whose primary market is believed by Corbyn Investment Management, Inc. (“Corbyn” or the “Adviser”) to be over-the counter are valued at the mean of the closing bid and asked prices obtained from sources that the Adviser deems appropriate.

Investments in open-end management investment companies are valued at the net asset value of the shares of that investment company.

Short-term investments are valued at amortized cost, which approximates fair market value. The value of securities that mature, or have an announced call, within 60 days will be valued at market value.

Securities for which market quotations are not readily available are valued at fair value as determined in good faith by the Adviser as directed by the Fund’s Board of Directors (the “Board”).

In determining fair value, the Adviser, as directed by the Board, considers all relevant qualitative and quantitative information available. These factors are subject to change over time and are reviewed periodically. The values assigned to fair value investments are based on available information and do not necessarily represent amounts that might ultimately be realized, since such amounts depend on future developments inherent in long-term investments. Further, because of the inherent uncertainty of valuation, those estimated values may differ significantly from the values that would have been used had a ready market of the investments existed, and the differences could be material.

The Fund has adopted fair valuation accounting standards that establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various input and valuation techniques used in measuring fair value. Fair value inputs are summarized in the three broad levels listed below:

Greenspring Fund, Incorporated

NOTES TO FINANCIAL STATEMENTS December 31, 2012 (Con’t) |

| Level 1 – | Unadjusted quoted prices in active markets for identical securities that the Fund has the ability to access. |

| Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the security, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 – | Unobservable inputs for the security, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the security, and which would be based on the best information available. |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in these securities. The following is a summary of the inputs used to value the Fund’s net assets as of December 31, 2012:

| | | Quoted Prices | | | Significant Other | | | Significant | | | Carrying Value | |

| | | in Active | | | Observable | | | Unobservable | | | at December 31, | |

| | | Markets | | | Inputs | | | Inputs | | | 2012 | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 328,695,390 | | | $ | — | | | $ | — | | | $ | 328,695,390 | |

| Convertible Bonds | | | — | | | | 100,942,589 | | | | — | | | | 100,942,589 | |

| Corporate Bonds | | | — | | | | 184,410,427 | | | | — | | | | 184,410,427 | |

| Short-Term Investment | | | 30,829,039 | | | | — | | | | — | | | | 30,829,039 | |

| Total | | $ | 359,524,429 | | | $ | 285,353,016 | | | $ | — | | | $ | 644,877,445 | |

See Schedule of Investments for industry breakdown.

Transfers between levels are recognized at the end of the reporting period. During the year ended December 31, 2012, the Fund recognized no transfers between valuation levels.

Dividends and distributions to stockholders – The Fund records dividends and distributions to shareholders on the ex-dividend date.

Redemption fees – The Fund’s Board has adopted policies and procedures with respect to frequent purchases and redemptions of Fund shares by Fund shareholders. The Fund is intended for long-term investors. The Fund discourages and does not accommodate frequent purchases and redemptions of Fund shares by Fund shareholders. The Fund reserves the right to decline a purchase order for any reason.

“Market-timers” who engage in frequent purchases and redemptions over a short period can disrupt the Fund’s investment program by requiring the Fund to have excess cash on hand or to liquidate holdings to accommodate redemptions. In addition, frequent purchases and redemptions may impede efficient Fund management and create additional transaction costs that are borne by all shareholders. To the extent that the Fund invests a significant portion of its assets in small-cap securities or high-yield bonds, it may be subject to the risks of market timing more than a fund that does not. Therefore, the Fund imposes a 2% redemption fee for shares held 60 days or less. The fee is deducted from the seller’s redemption proceeds and deposited into the Fund to help offset brokerage commissions, market impact, and other costs associated with fluctuations in Fund asset levels and cash flow caused by short-term trading. All shareholders are

Greenspring Fund, Incorporated

NOTES TO FINANCIAL STATEMENTS December 31, 2012 (Con’t) |

subject to these restrictions regardless of whether you purchased your shares directly from the Fund or through a financial intermediary. However, the Fund is limited in its ability to determine whether trades placed through financial intermediaries may signal excessive trading. Accordingly, the Fund may not be able to determine whether trading in combined orders or in omnibus accounts is contrary to the Fund’s policies. The Fund reserves the right to reject combined or omnibus orders in whole or in part.

To calculate redemption fees, after first redeeming any shares associated with reinvested dividends or other distributions, the “first-in, first out” method is used to determine the holding period. Under this method, the date of redemption will be compared with the earliest purchase date of shares held in the account. If the holding period for shares purchased is 60 days or less, the fee will be charged. The redemption fee may be modified or discontinued at any time, in which case, shareholders will be notified. The redemption fee does not apply to shares acquired through the reinvestment of dividends or other distributions, or shares redeemed pursuant to a systematic withdrawal plan or a mandatory IRA distribution.

In compliance with Rule 22c-2 under the 1940 Act, Quasar Distributors, LLC, on behalf of the Fund, has entered into written agreements with each of the Fund’s financial intermediaries, under which the intermediaries must, upon request, provide the Fund with certain shareholder and identity trading information so that the Fund can enforce its frequent trading policies.

Risk of loss arising from indemnifications – In the normal course of business, the Fund enters into contracts that contain a variety of representations, which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

| Note 2 – Dividends and Distributions |

It is the Fund’s policy to declare dividends from net investment income and distributions from net realized gains as determined in accordance with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Accordingly, periodic reclassifications are made within the portfolio’s capital accounts to reflect income and gains available for distribution under income tax regulations.

On July 11, 2012 an income dividend of $0.45 per share and a long-term capital gain distribution of $0.0734 per share were declared, payable on July 12, 2012, to shareholders of record on July 10, 2012. Additionally, on December 19, 2012, an income dividend of $0.425 per share, a short-term capital gain distribution of $0.187 per share, and a long-term capital gain distribution of $0.352 per share were declared, payable on December 20, 2012 to shareholders of record on December 18, 2012. The tax character of distributions paid during the year ended December 31, 2012 and the year ended December 31, 2011 were as follows:

| Distributions paid from: | December 31, 2012 | December 31, 2011 |

| Ordinary income | $30,673,956 | $27,660,406 |

| Long-term capital gain | $11,947,616 | $18,639,852 |

These dividends are either distributed to shareholders or reinvested in the Fund as additional shares issued to shareholders. For those shareholders reinvesting the dividends, the number of shares issued is based on the net asset value per share as of the close of business on the ex-dividend date.

Greenspring Fund, Incorporated

NOTES TO FINANCIAL STATEMENTS December 31, 2012 (Con’t) |

The Fund designated as long-term capital gain dividend, pursuant to Internal Revenue Code Section 852(b)(3), the amount necessary to reduce the earnings and profits of the Fund related to net capital gain to zero for the tax year ended December 31, 2012.

| Note 3 – Purchases and Sales of Investments |

For the year ended December 31, 2012, purchases and sales of investments, other than short-term investments, aggregated $199,405,621 and $304,901,408, respectively.

| Note 4 – Federal Income Taxes |

It is the Fund’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies. Accordingly, the Fund intends to distribute substantially all of its taxable income. Therefore, no federal income tax provision is required.

As of and during the year ended December 31, 2012, the Fund did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. Tax positions not deemed to meet the “more-likely-than-not” threshold would be recorded as a tax benefit or expensed in the current year. Generally, tax authorities can examine tax returns filed for all open tax years (2009-2012).

Required Fund distributions are based on income and capital gain amounts determined in accordance with federal income tax regulations, which differ from net investment income and realized gains recognized for financial reporting purposes.

Accordingly, the composition of net assets and distributions on a tax basis may differ from those reflected in the accompanying financial statements. As of December 31, 2012, the Fund’s most recently completed year end, the components of distributable earnings on a tax basis were as follows:

| Cost of investments | | $ | 589,966,855 | |

| Gross tax unrealized appreciation | | | 85,119,085 | |

| Gross tax unrealized depreciation | | | (30,208,495 | ) |

| Net tax unrealized appreciation | | | 54,910,590 | |

| Undistributed ordinary income | | | 240,081 | |

| Undistributed long-term capital gain | | | 824,785 | |

| Total distributable earnings | | | 1,064,866 | |

| Other accumulated gains/(losses) | | | — | |

| Total accumulated earnings/(losses) | | $ | 55,975,456 | |

Accounting principles generally accepted in the United States of America require that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the year ended December 31, 2012, the Fund decreased accumulated net investment loss by $3,450,044 and decreased undistributed net realized gain on investments by $3,450,044.

Greenspring Fund, Incorporated

NOTES TO FINANCIAL STATEMENTS December 31, 2012 (Con’t) |

| Note 5 – Transactions with Affiliated Parties |

Corbyn serves as the Fund’s investment adviser. Under an agreement between the Fund and Corbyn, the Fund pays Corbyn a fee of 0.75% of the first $250 million of average daily net assets, 0.70% of average daily net assets between $250 million and $500 million and 0.65% of average daily net assets in excess of $500 million, which is computed daily and paid monthly. For the year ended December 31, 2012, the Fund incurred $5,044,432 in advisory fees.

The Fund has also entered into a Services Agreement with Corbyn to provide various administrative services. As compensation, the Fund pays Corbyn a fee of $2,500 per month plus 0.01% of average daily net assets, which is computed daily and paid monthly. For the year ended December 31, 2012, the Fund incurred $101,838 in administrative fees to Corbyn.

At December 31, 2012, investors for whom Corbyn was investment adviser held 879,620 shares of the Fund.

A company is considered to be an affiliate of the Fund under the 1940 Act if the Fund’s holdings of that company represent 5% or more of the outstanding voting securities of the company. Transactions with companies that are or were affiliates during the year ended December 31, 2012 are as follows:

| | | Beginning | | | Purchase | | | Sales | | | Ending | | | Dividend | | | | | | | |

| Issuer | | Cost | | | Cost | | | Cost | | | Cost | | | Income | | | Shares | | | Value | |

| Michael Baker Corp. | | $ | 16,353,157 | | | $ | 64,682 | | | $ | — | | | $ | 16,417,839 | | | $ | 90,623 | | | | 647,305 | | | $ | 16,137,314 | |

| Southern National | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bancorp of Virginia | | | 4,167,109 | | | | — | | | | — | | | | 4,167,109 | | | | 144,325 | | | | 589,083 | | | | 4,712,664 | |

| Note 6 – New Accounting Pronouncement |

In December 2011, the Financial Accounting Standards Board issued Accounting Standards Update (“ASU”) No. 2011-11 related to disclosures about offsetting assets and liabilities. The amendments in this ASU require an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. The ASU is effective for annual reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods. The guidance requires retrospective application for all comparative periods presented. The Adviser is currently evaluating the impact ASU No. 2011-11 will have on the financial statement disclosures.

Note 7 – Events Subsequent to the Fiscal Year End |

In preparing the financial statements as of December 31, 2012, management considered the impact of subsequent events for potential recognition or disclosure in the financial statements. On January 28, 2013, School Specialty, Inc., filed a voluntary petition under Chapter 11 in the U.S. Bankruptcy Court. Subsequent to this filing, the Fund sold its entire position in the School Specialty, Inc., 3.750% Convertible Notes due 11/30/26.

Greenspring Fund, Incorporated

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Directors and Shareholders

Greenspring Fund, Incorporated

Lutherville, Maryland

We have audited the accompanying statement of assets and liabilities of the Greenspring Fund, Incorporated (the “Fund”), including the schedule of investments, as of December 31, 2012, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2012, by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Greenspring Fund, Incorporated as of December 31, 2012, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

| | TAIT, WELLER & BAKER LLP |

| Philadelphia, Pennsylvania | |

| February 21, 2013 | |

Greenspring Fund, Incorporated

NOTICE TO SHAREHOLDERS December 31, 2012 (Unaudited) |

Tax Information

The Fund designates 17.65% of dividends declared from net investment income during the fiscal year ended December 31, 2012 as qualified income under the Jobs and Growth Tax Relief Reconciliation Act of 2003.

For corporate shareholders in the Fund, the percentage of ordinary dividend income distributed for the year ended December 31, 2012, which is designated as qualifying for the dividends-received deduction, is 17.22%.

For foreign shareholders in the Fund, for the year ended December 31, 2012, 64.98% of the ordinary distributions paid qualify as interest-related dividends under the Internal Revenue Code Section 871(k)(1)(c), and 16.79% of the ordinary income distributions are designated as short-term capital gain distributions under Internal Revenue Code Section 871(k)(2)(c).

Proxy Voting Policies and Proxy Voting Record

The Fund’s proxy voting policies and procedures, as well as its proxy voting record for the most recent 12-month period ended June 30, are available without charge, upon request, by contacting the Fund at (800) 366-3863 or info@greenspringfund.com. The Fund will send the information within three business days of receipt of the request, by first class mail or other means designed to ensure equally prompt delivery. The Fund’s proxy voting record is also available on the U.S. Securities and Exchange Commission’s website at www.sec.gov.

Form N-Q Holdings Information

The Fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at www.sec.gov and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330.

Reports and Householding

In an attempt to reduce shareholder expenses, we will mail only one copy of the Fund’s Summary Prospectus and each Annual and Semi-Annual Report to those addresses shared by two or more accounts. If you wish to receive individual copies of these documents, please call us at (800) 366-3863. We will begin sending you individual copies 30 days after receiving your request.

The Fund’s Prospectus, Statement of Additional Information, Annual Report, and Semi-Annual Report, along with its first and third quarter portfolio holdings, are available on the Fund’s website at www.greenspringfund.com.

Greenspring Fund, Incorporated

BASIC INFORMATION ABOUT FUND DIRECTORS AND OFFICERS (Unaudited) |

The Board of Directors supervises the management of the Fund. The following list summarizes information on the directors and officers of the Fund for the past five years. The address of each is 2330 West Joppa Road, Suite 110, Lutherville, MD 21093. The Fund’s Statement of Additional Information contains additional information about Fund directors and is available, without charge, upon request, by calling the Fund at (800) 366-3863, or by emailing the Fund at info@greenspringfund.com.

| | | | | Number | |

| | Position(s) Held | Term of Office and | Principal Occupation(s) | of Funds | Other |

| Name and Age | with the Fund | Length of Time Served | During the Past Five Years | Overseen | Directorship |

| | | | | | |

| | | Term of Director | | | |

| | | Indefinite | | | |

| | | Term of Officer | | | |

| | | One year | | | |

| Interested | | | | | |

| Directors/Officers | | | | | |

| Charles vK. Carlson | President | From March 1993 to present. | President and Director of the | One | None |

| 53 | Chairman of the Board | From January 1994 to present. | Fund’s Adviser. | | |

| | Chief Executive Officer | From February 1994 to present. | | | |

| | Director | From March 1987 to present. | | | |

| | | | | | |

| William E. Carlson | Director | From February 1994 to present. | President of Shapiro Sher Guinot | One | None |

| 55 | | | & Sandler (a law firm) from | | |

| | | | February 1999 to present. Partner | | |

| | | | of Shapiro Sher Guinot & Sandler | | |

| | | | from February 1990 to present. | | |

| | | | | | |

| Michael J. Fusting | Sr. Vice President | From May 1998 to present. | Sr. Vice President and Director of | One | None |

| 51 | Chief Financial Officer | From February 1994 to present. | the Fund’s Adviser. | | |

| | Director | From March 1992 to present. | | | |

| | | | | | |

| Disinterested Directors | | | | | |

| David T. Fu | Director | From May 1990 to present. | Managing Director of Kanturk | One | None |

| 56 | | | Partners, LLC (a merchant bank) | | |

| | | | from February 2004 to present. | | |

| | | | | | |

| Sean T. Furlong | Director | From March 2003 to present. | Director of Finance and | One | None |

| 47 | | | Operations at the Gilman | | |

| | | | School from June 2003 to present. | | |

| | | | | | |

Greenspring Fund, Incorporated

BASIC INFORMATION ABOUT FUND DIRECTORS AND OFFICERS (Unaudited) (Con’t) |

| | | | | Number | |

| | Position(s) Held | Term of Office and | Principal Occupation(s) | of Funds | Other |

| Name and Age | with the Fund | Length of Time Served | During the Past Five Years | Overseen | Directorship |

| | | | | | |

| | | Term of Director | | | |

| | | Indefinite | | | |

| | | Term of Officer | | | |

| | | One year | | | |

| | | | | | |

| Michael P. O’Boyle | Director | From July 2000 to present. | President and CEO of Parallon | One | None |

| 56 | | | Business Solutions, a subsidiary | | |

| | | | of Hospital Corporation of | | |

| | | | America (a provider of healthcare | | |

| | | | services) from January 2012 to | | |

| | | | present. President of UnitedHealth | | |

| | | | Networks, a division of United | | |

| | | | Healthcare (a managed health | | |

| | | | care company) from May 2008 to | | |

| | | | December 2011. Chief Operating | | |

| | | | Officer of The Cleveland Clinic | | |

| | | | Foundation (world-renowned | | |

| | | | non-profit provider of health care | | |

| | | | services, education and research) | | |

| | | | and The Cleveland Clinic Health | | |

| | | | System from July 2005 to March | | |

| | | | 2008. | | |

| | | | | | |

| Officers | | | | | |

| | | | | | |

| Elizabeth Agresta Swam | Secretary and Treasurer | From May 1998 to present. | Employee of the Fund’s Adviser | N/A | None |

| 45 | AML Officer | From July 2002 to present. | from May 1998 to present. | | |

| | Chief Compliance Officer | From July 2004 to present. | | | |

The Greenspring Fund recognizes that individuals expect an exceptional level of privacy in their financial affairs. The Fund assures the confidentiality of personal information provided to it.

The information we collect is limited to what the Fund believes is necessary or useful to conduct our business; administer your records, accounts and funds; to comply with laws and regulations; and to help us design or improve products and services. The Fund collects non-public personal information about you from information it receives from you on applications or other forms or through its website, as well as from information about your transactions with the Fund.

Some of this information may be disclosed to the Fund’s investment adviser, but not for marketing solicitation, as well as non-affiliated third parties who provide non-financial services to the Fund such as our Transfer Agent, in order to administer customer accounts and mail transaction confirmations and tax forms, and the mailing house the Fund utilizes for mailing shareholder reports. Such information may also be disclosed to a nonaffiliated third party engaged to provide fund accounting and administrative services to us. Disclosing this information enables us to meet customers’ financial needs and regulatory requirements. These third parties act on its behalf and are obligated to keep the information we provide to them confidential and to use the information only for the purposes authorized. The Fund does not disclose any non-public personal information about you or former customers to anyone, except as permitted by law.

To protect your non-public personal information, the Fund permits access to it only by authorized employees and maintains security practices to safeguard your information.

If you have any questions regarding our Privacy Policy, please contact us at 1-800-366-3863 or info@greenspringfund.com. Thank you.

Greenspring Fund, Incorporated

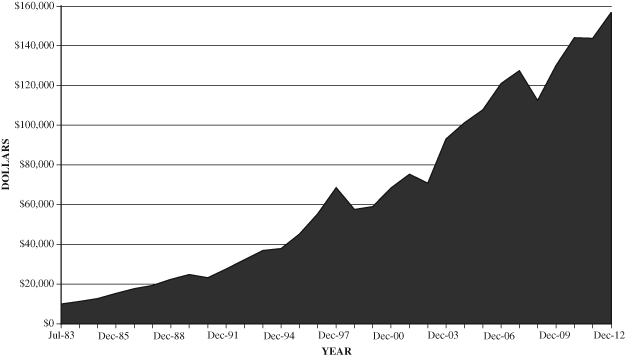

Performance Since Inception on

July 1, 1983 through December 31, 2012

(Unaudited)

| |

| HOW $10,000 INVESTED ON 7/1/83 WOULD HAVE GROWN* |

| |

|

| * | Figures include changes in principal value, reinvested dividends and capital gains distributions. Past expense limitations increased the Fund’s return. This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund since inception through December 31, 2012. The total value of $156,824 assumes the reinvestment of dividends and capital gains, but does not reflect the effect of any redemption fees. This chart does not imply any future performance. |

Average annual total returns for the one, three, five and ten year periods ended December 31, 2012 were 9.07%, 6.37%, 4.24% and 8.27%, respectively. Average annual returns for more than one year assume a compounded rate of return and are not the Fund’s year-by-year results, which fluctuated over the periods shown. Returns do not reflect taxes that shareholders may pay on Fund distributions or redemption of Fund shares.

Greenspring Fund, Incorporated

2330 West Joppa Road, Suite 110

Lutherville, MD 21093

(410) 823-5353

(800) 366-3863

www.greenspringfund.com

DIRECTORS

Charles vK. Carlson, Chairman

William E. Carlson

David T. Fu

Sean T. Furlong

Michael J. Fusting

Michael P. O’Boyle

OFFICERS

Charles vK. Carlson

President and Chief Executive Officer

Michael J. Fusting

Sr. Vice President and

Chief Financial Officer

Elizabeth Agresta Swam

Chief Compliance Officer,

Secretary, Treasurer

and AML Officer

INVESTMENT ADVISER

Corbyn Investment Management, Inc.

2330 West Joppa Road, Suite 108

Lutherville, MD 21093-7207

ADMINISTRATOR, FUND ACCOUNTANT

AND TRANSFER AGENT

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

DISTRIBUTOR

Quasar Distributors, LLC

615 East Michigan Street

Milwaukee, WI 53202

INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Tait, Weller & Baker LLP

1818 Market Street

Suite 2400

Philadelphia, PA 19103

CUSTODIAN

U.S. Bank, N.A.

1555 N. RiverCenter Dr., Suite 302

Milwaukee, WI 53212

LEGAL COUNSEL

K&L Gates LLP

1601 K Street NW

Washington, DC 20006

Symbol – GRSPX

CUSIP – 395724107