United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-4017

(Investment Company Act File Number)

Federated Equity Funds

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Investors Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

John W. McGonigle, Esquire

Federated Investors Tower

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 10/31/16

Date of Reporting Period: 10/31/16

Item 1. Reports to Stockholders

Annual Shareholder Report

October 31, 2016

| Share Class | Ticker |

| A | KAUAX |

| B | KAUBX |

| C | KAUCX |

| R | KAUFX |

Federated Kaufmann Fund

Successor to the Kaufmann Fund, Inc., with performance history since February 21, 1986

A Portfolio of Federated Equity Funds

Dear Valued Shareholder,

I am pleased to present the Annual Shareholder Report for your fund covering the period from November 1, 2015 through October 31, 2016. This report includes Management's Discussion of Fund Performance, a complete listing of your fund's holdings, performance information and financial statements along with other important fund information.

In addition, our website, FederatedInvestors.com, offers easy access to Federated resources that include timely fund updates, economic and market insights from our investment strategists, and financial planning tools. We invite you to register to take full advantage of its capabilities.

Thank you for investing with Federated. I hope you find this information useful and look forward to keeping you informed.

Sincerely,

J. Christopher Donahue, President

Not FDIC Insured • May Lose Value • No Bank Guarantee

CONTENTS

| 1 |

| 5 |

| 6 |

| 13 |

| 17 |

| 19 |

| 21 |

| 22 |

| 39 |

| 40 |

| 42 |

| 48 |

| 55 |

| 55 |

Management's Discussion of Fund Performance (unaudited)

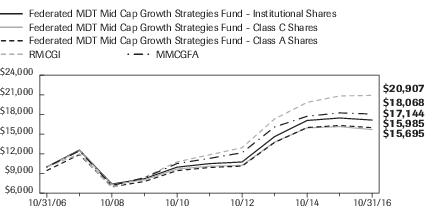

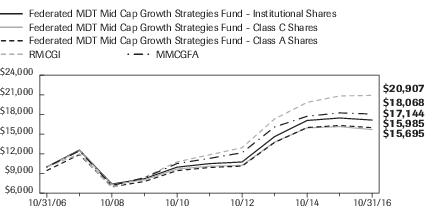

The total return of Federated Kaufmann Fund (the “Fund”), based on net asset value for the 12-month reporting period ended October 31, 2016, was 1.77% for the Class A Shares, 1.34% for the Class B Shares, 1.15% for the Class C Shares and 1.76% for the Class R Shares. The total return of the Russell Midcap® Growth Index (RMCGI),1 the Fund's broad-based securities market index, was 0.40% for the same period. The total return of the Morningstar Mid-Cap Growth Funds Average (MMCGFA),2 a peer group average for the Fund, was -0.86% for the same period. The Fund's and MMCGFA's total returns for the most recently completed fiscal year reflected actual cash flows, transaction costs and other expenses, which were not reflected in the total return of the RMCGI.

During the reporting period, the Fund's investment strategy focused on stock selection, sector exposure, international exposure3 and the effect of cash holdings. These were the most significant factors affecting the Fund's performance relative to the RMCGI.

The following discussion will focus on the performance of the Fund's Class A Shares.

Market Overview

During the reporting period, the global equity markets remained in a cautious stance while U.S. stock market was one of the few markets to maintain positive returns. The U.S. Federal Reserve (the “Fed”) raised its target rate in December 2015 for first time in nearly a decade due to positive economic data. However, concerns about global growth kept the Fed on hold for the remainder of the reporting period. Worries about global growth pressured markets during the reporting period particularly as China's economy showed signs of slowing, causing deflationary worries. Despite persistent geopolitical headwinds, e.g., Syria and the Middle East, global economies continued to grow, albeit slowly. Policymakers around the world continued to lean towards stimulus. Meanwhile, the U.S. pursued the opposite approach, a tightening strategy, which drove the strength in the U.S. Dollar Index.4

Stock Selection

The key factor affecting performance from a macroeconomic standpoint was the improving U.S. economic fundamentals, as well as accommodative monetary policies by the Fed and other central banks around the world. The monetary easing policies allowed a slow but gradual recovery of the major world economies. Profitability of many of the companies in which the Fund invested remained strong throughout the reporting period. Fund management continued to find attractive mid-cap growth investment opportunities–companies that are dominant competitors and that have strengthening fundamentals potentially delivering both near-term and long-term growth in sales and earnings.

Annual Shareholder Report

The majority of the Fund outperformance on a gross return basis versus the RMCGI was due to stock selection and sector weighting particularly in the Health Care, Consumer Discretionary and Information Technology sectors. Individual companies that most contributed to Fund performance during the reporting period were: Dyax Corp., Veeva Systems, Tesaro Inc., Corcept Therapeutics and U.S. Silica. Laggard companies that hurt relative Fund performance were: Alkermes Plc, Seres Therapeutics Inc., Dynavax Technology, Fitbit Inc. and Progenics Pharmaceuticals.

Sector Exposure

At the end of the reporting period, approximately 72% of the portfolio was invested in four large sectors: Health Care, Information Technology, Consumer Discretionary and Industrials. These sectors have historically provided good opportunities for bottom-up growth investors. Overweighting the Health Care and underweighting Energy sectors benefited relative performance versus the RMCGI. Underweighting in the Consumer Discretionary and Consumer Staples hurt relative Fund performance.

International Exposure

Stock selection of companies domiciled outside the U.S. was a positive contributor to Fund performance. Approximately 8% of the Fund's assets were invested in such companies during the reporting period.

Effect of Cash Holdings

The Fund had significant cash outflows during the reporting period which resulted in an average cash position of 11%. In a rising market, the cash holdings resulted in a modest drag on relative Fund performance.

| 1 | Please see the footnotes to the line graphs below for definitions of, and further information about, the RMCGI. |

| 2 | Please see the footnotes to the line graphs below for definitions of, and further information about, the MMCGFA. |

| 3 | International investing involves special risks including currency risk, increased volatility, political risks and differences in auditing and other financial standards. |

| 4 | The U.S. Dollar Index indicates the general international value of the U.S. dollar by averaging the exchange rates between the U.S. dollar and six major world currencies. The index is unmanaged, and it is not possible to invest directly in an index. |

Annual Shareholder Report

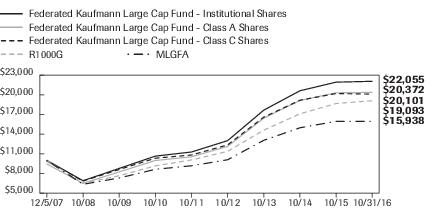

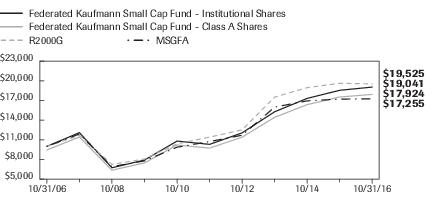

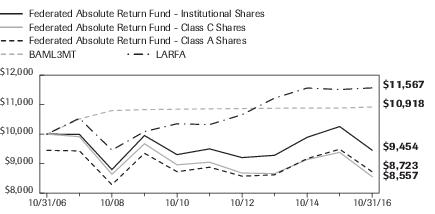

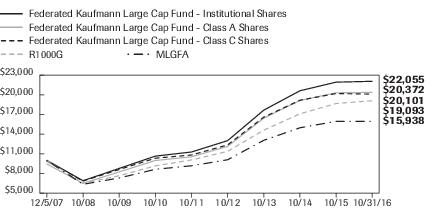

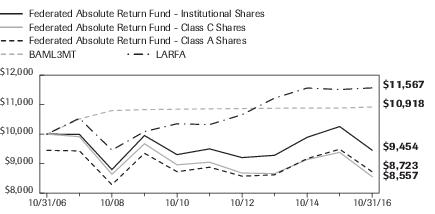

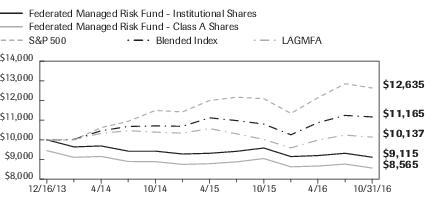

FUND PERFORMANCE AND GROWTH OF A $10,000 INVESTMENT

The graph below illustrates the hypothetical investment of $10,0001 in the Federated Kaufmann Fund (the “Fund”) from October 31, 2006 to October 31, 2016, compared to the Russell Midcap® Growth Index (RMCGI)2 and the Morningstar Mid-Cap Growth Funds Average (MMCGFA).3 The Average Annual Total Return table below shows returns for each class averaged over the stated periods.

Growth of a $10,000 Investment

Growth of $10,000 as of October 31, 2016

| Federated Kaufmann Fund - | Class R Shares | Class A Shares | RMCGI | MMCGFA |

| F | F | I | I |

| 10/31/2006 | 10,000 | 9,450 | 10,000 | 10,000 |

| 10/31/2007 | 13,107 | 12,386 | 11,972 | 12,452 |

| 10/31/2008 | 7,834 | 7,404 | 6,866 | 7,182 |

| 10/31/2009 | 8,697 | 8,201 | 8,409 | 8,348 |

| 10/31/2010 | 10,855 | 10,260 | 10,767 | 10,513 |

| 10/31/2011 | 10,217 | 9,637 | 11,852 | 11,305 |

| 10/31/2012 | 11,160 | 10,548 | 12,929 | 12,164 |

| 10/31/2013 | 15,157 | 14,306 | 17,317 | 16,089 |

| 10/31/2014 | 17,357 | 16,386 | 19,843 | 17,727 |

| 10/31/2015 | 18,447 | 17,417 | 20,823 | 18,237 |

| 10/31/2016 | 18,734 | 17,724 | 20,907 | 18,068 |

41 graphic description end -->

| ■ | Total returns shown for Class A Shares include the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450). |

| ■ | Total returns shown for Class R Shares include the redemption fee of 0.20%. |

The Fund offers multiple share classes whose performance may be greater than or less than its other share class(es) due to differences in sales charges and expenses. See the Average Annual Return table below for the returns of additional classes not shown in the line graph above.

Average Annual Total Returns for the Period Ended 10/31/2016

(returns reflect all applicable sales charges and contingent deferred sales charges as specified below in footnote #1)

| | 1 Year | 5 Years | 10 Years |

| Class A Shares | -3.83% | 11.69% | 5.89% |

| Class B Shares | -3.36% | 12.12% | 6.03% |

| Class C Shares | 0.30% | 12.34% | 5.93% |

| Class R Shares | 1.56% | 12.89% | 6.48% |

| RMCGI | 0.40% | 12.02% | 7.65% |

| MMCGFA | -0.86% | 10.20% | 6.59% |

Annual Shareholder Report

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit FederatedInvestors.com or call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

| 1 | Represents a hypothetical investment of $10,000 in the Fund after deducting applicable sales charges: For Class A Shares, the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450); for Class B Shares, the maximum contingent deferred sales charge is 5.50% on any redemption less than one year from the purchase date; for Class C Shares, the maximum contingent deferred sales charge is 1.00% on any redemption less than one year from the purchase date; for Class R Shares, the ending value reflects a 0.20% redemption fee. The Fund's performance assumes the reinvestment of all dividends and distributions. The RMCGI and MMCGFA have been adjusted to reflect reinvestment of all dividends on securities in the index and the average. |

| 2 | The RMCGI measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap® Index companies with higher price-to-book ratios and higher forecasted growth values. The RMCGI is constructed to provide a comprehensive and unbiased barometer of the mid-cap growth market and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true mid-cap growth market. The RMCGI is not adjusted to reflect sales charges, expenses or other fees that the Securities and Exchange Commission requires to be reflected in the Fund's performance. The index is unmanaged and unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index. |

| 3 | Morningstar figures represent the average of the total returns reported by all the funds designated by Morningstar as falling into the respective category indicated. They do not reflect sales charges. The Morningstar figures in the Growth of $10,000 line graph are based on historical return information published by Morningstar and reflect the return of the funds comprising the category in the year of publication. Because the funds designated by Morningstar as falling into the category can change over time, the Morningstar figures in the line graph may not match the Morningstar figures in the Average Annual Total Returns table, which reflect the return of the funds that currently comprise the category. |

Annual Shareholder Report

Portfolio of Investments Summary Table (unaudited)

At October 31, 2016, the Fund's sector composition1 was as follows:

| Sector Composition | Percentage of

Total Net Assets |

| Health Care | 30.9% |

| Information Technology | 23.6% |

| Consumer Discretionary | 8.9% |

| Industrials | 8.4% |

| Financials | 7.3% |

| Materials | 5.2% |

| Real Estate | 2.6% |

| Energy | 1.8% |

| Consumer Staples | 0.8% |

| Telecommunication Services | 0.4% |

| Securities Lending Collateral2 | 6.0% |

| Cash Equivalents3 | 11.4% |

| Other Assets and Liabilities—Net4 | (7.3)% |

| TOTAL | 100.0% |

| 1 | Except for Securities Lending Collateral, Cash Equivalents and Other Assets and Liabilities, sector classifications are based upon, and individual portfolio securities are assigned to, the classifications of the Global Industry Classification System (GICS), except that the Adviser assigns a classification to securities not classified by the GICS and to securities for which the Adviser does not have access to the classification made by the GICS. |

| 2 | Cash collateral received from lending portfolio securities, which is invested in short-term investments such as repurchase agreements or money market mutual funds. |

| 3 | Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements other than those representing securities lending collateral. |

| 4 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

Annual Shareholder Report

Portfolio of Investments

October 31, 2016

Shares or

Principal

Amount | | | Value |

| | | COMMON STOCKS—89.7% | |

| | | Consumer Discretionary—8.9% | |

| 300,000 | | Abercrombie & Fitch Co., Class A | $4,383,000 |

| 72,800 | 1 | Amazon.com, Inc. | 57,498,896 |

| 155,000 | 2 | Cracker Barrel Old Country Store, Inc. | 21,390,000 |

| 100,000 | | Ctrip.com International Ltd., ADR | 4,415,000 |

| 1,030,000 | 1 | Dave & Buster's Entertainment, Inc. | 42,590,500 |

| 1,270,000 | | Hilton Worldwide Holdings, Inc. | 28,702,000 |

| 470,000 | | Las Vegas Sands Corp. | 27,203,600 |

| 185,600 | 1 | Mohawk Industries, Inc. | 34,206,080 |

| 446,000 | | Moncler S.p.A | 7,436,108 |

| 43,580,412 | | NagaCorp Limited | 27,251,121 |

| 300,000 | 1 | Newell Brands, Inc. | 14,406,000 |

| 833,370 | 1 | One Group Hospitality, Inc./The | 1,950,086 |

| 6,738,547 | | Samsonite International SA | 21,153,438 |

| 350,000 | | Six Flags Entertainment Corp. | 19,477,500 |

| 1,330,000 | | Starbucks Corp. | 70,583,100 |

| 200,000 | | Whirlpool Corp. | 29,964,000 |

| 1,135,900 | 1 | Yoox Net-A-Porter Group | 32,754,429 |

| | | TOTAL | 445,364,858 |

| | | Consumer Staples—0.8% | |

| 1,115,000 | 1 | Blue Buffalo Pet Products, Inc. | 28,008,800 |

| 80,000 | | Constellation Brands, Inc., Class A | 13,369,600 |

| | | TOTAL | 41,378,400 |

| | | Energy—1.8% | |

| 1,367,000 | 1 | Rice Energy, Inc. | 30,197,030 |

| 1,216,400 | | US Silica Holdings, Inc. | 56,185,516 |

| | | TOTAL | 86,382,546 |

| | | Financials—7.3% | |

| 205,000 | 1 | Affiliated Managers Group | 27,195,300 |

| 1,350,000 | | American International Group, Inc. | 83,295,000 |

| 282,800 | | BlackRock, Inc. | 96,502,672 |

| 1,000,000 | | CIT Group Holdings, Inc. | 36,330,000 |

| 2,750,000 | | Chimera Investment Corp. | 43,092,500 |

| 1,935,000 | | EverBank Financial Corp. | 37,364,850 |

| 1 | 1,3,4 | FA Private Equity Fund IV LP | 523,844 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value |

| | | COMMON STOCKS—continued | |

| | | Financials—continued | |

| 6,839,360 | | FinecoBank Banca Fineco SPA | $40,031,422 |

| 1 | 1,3,4 | Infrastructure Fund | 0 |

| | | TOTAL | 364,335,588 |

| | | Health Care—30.7% | |

| 316,600 | 1,2 | Acadia Pharmaceuticals, Inc. | 7,379,946 |

| 300,000 | | Agilent Technologies, Inc. | 13,071,000 |

| 785,000 | 1 | Alkermes, Inc. | 39,571,850 |

| 1,100,000 | 1 | Amphastar Pharmaceuticals, Inc. | 19,954,000 |

| 1 | 3,4 | Apollo Investment Fund V | 323,303 |

| 1,359,250 | 1,5 | arGEN-x | 20,880,907 |

| 370,996 | 1,2 | aTyr Pharma, Inc. | 1,020,239 |

| 6,978,566 | 1,4 | BioNano Genomics, Inc. | 0 |

| 1,100,000 | 1 | Boston Scientific Corp. | 24,200,000 |

| 773,219 | 1 | Catalent, Inc. | 17,637,125 |

| 1,735,000 | 1,5 | ContraFect Corp. | 3,990,500 |

| 12,439,968 | 1,5 | Corcept Therapeutics, Inc. | 86,333,378 |

| 500,000 | | Danaher Corp. | 39,275,000 |

| 1,566,065 | 1 | Dexcom, Inc. | 122,528,926 |

| 8,829,511 | 1,2,4,5 | Dyax Corp. - CVR | 9,800,757 |

| 2,100,000 | 1,5 | Dynavax Technologies Corp. | 19,425,000 |

| 1,700,000 | 1,2,5 | Egalet Corp. | 9,537,000 |

| 250,000 | 1,2 | GW Pharmaceuticals PLC, ADR | 29,347,500 |

| 881,500 | 1 | Galapagos NV | 53,614,471 |

| 956,807 | 1,2 | Galapagos NV, ADR | 58,001,640 |

| 630,000 | 1 | Genmab A/S | 103,920,659 |

| 783,418 | 1 | Glaukos Corp. | 26,166,161 |

| 350,000 | 1 | IDEXX Laboratories, Inc. | 37,499,000 |

| 1,430,000 | 1,5 | Intersect ENT, Inc. | 20,878,000 |

| 1 | 3,4 | Latin Healthcare Fund | 424,650 |

| 175,000 | 1 | MacroGenics, Inc. | 4,145,750 |

| 436,000 | | Medtronic PLC | 35,760,720 |

| 5,319,140 | 1,2,5 | Minerva Neurosciences, Inc. | 59,308,411 |

| 1,000,000 | 1 | Nektar Therapeutics | 12,400,000 |

| 268,885 | 1,2 | Nevro Corp. | 24,715,909 |

| 2,500,000 | 1,5 | Otonomy, Inc. | 37,750,000 |

| 325,000 | 1 | Penumbra, Inc. | 21,433,750 |

| 880,000 | 1,2 | Poxel SA | 5,832,727 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value |

| | | COMMON STOCKS—continued | |

| | | Health Care—continued | |

| 11,301,600 | 1,5 | Progenics Pharmaceuticals, Inc. | $56,847,048 |

| 750,000 | 1 | Repligen Corp. | 21,427,500 |

| 1,108,000 | 1,2 | SAGE Therapeutics, Inc. | 48,242,320 |

| 2,635,000 | 1,2,5 | SCYNEXIS, Inc. | 8,458,350 |

| 1,000,000 | 1,2,5 | Seres Therapeutics, Inc. | 10,790,000 |

| 700,000 | | Shire PLC | 39,528,788 |

| 135,000 | | Shire PLC, ADR | 22,766,400 |

| 959,018 | 1,4,5 | Soteira, Inc. | 0 |

| 1,400,000 | 1,2,5 | Spark Therapeutics, Inc. | 65,814,000 |

| 1,173,832 | 1,3,5 | SteadyMed Ltd. | 4,519,253 |

| 1,317,816 | 1,5 | SteadyMed Ltd. | 5,073,592 |

| 750,000 | 1,2 | Tesaro, Inc. | 90,660,000 |

| 370,800 | 1,2 | Ultragenyx Pharmaceutical, Inc. | 21,873,492 |

| 225,000 | 1 | VCA, Inc. | 13,828,500 |

| 3,500,000 | 1 | Veeva Systems, Inc. | 135,975,000 |

| 1,080,000 | 1 | Versartis, Inc. | 11,934,000 |

| 870,000 | 1,2,5 | Zogenix, Inc. | 7,090,500 |

| | | TOTAL | 1,530,957,022 |

| | | Industrials—8.4% | |

| 350,000 | | Acuity Brands, Inc. | 78,249,500 |

| 2,175,000 | | Air Lease Corp. | 65,815,500 |

| 637,700 | 1 | Dycom Industries, Inc. | 49,058,261 |

| 281,200 | | Equifax, Inc. | 34,860,364 |

| 800,000 | | KAR Auction Services, Inc. | 34,064,000 |

| 725,000 | 1 | Rexnord Corp. | 14,420,250 |

| 57,753 | | Safran SA | 3,966,423 |

| 621,000 | | Union Pacific Corp. | 54,759,780 |

| 370,000 | 1 | Verisk Analytics, Inc. | 30,173,500 |

| 3,200,000 | 1 | ZTO Express (Cayman), Inc., ADR | 54,176,000 |

| | | TOTAL | 419,543,578 |

| | | Information Technology—23.6% | |

| 130,000 | 1 | Adobe Systems, Inc. | 13,976,300 |

| 1,465,000 | 1 | Advanced Micro Devices, Inc. | 10,591,950 |

| 530,000 | 1 | Alibaba Group Holding Ltd., ADR | 53,895,700 |

| 625,000 | | Amadeus IT Group S.A. | 29,487,523 |

| 500,000 | | Broadcom Ltd. | 85,140,000 |

| 1,000,000 | 1 | BroadSoft, Inc. | 41,550,000 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value |

| | | COMMON STOCKS—continued | |

| | | Information Technology—continued | |

| 180,000 | 1 | Check Point Software Technologies Ltd. | $15,220,800 |

| 325,000 | 1 | CoStar Group, Inc. | 60,814,000 |

| 400,000 | 1 | Coupa Software, Inc. | 10,000,000 |

| 1,059,322 | 1,3,4 | Expand Networks Ltd. | 0 |

| 690,000 | 1,2 | Fitbit, Inc. | 9,149,400 |

| 409,882 | 1 | Fleetmatics Group PLC | 24,551,932 |

| 800,000 | 1,2 | GoDaddy, Inc. | 28,632,000 |

| 150,000 | 1 | GrubHub, Inc. | 5,716,500 |

| 1,440,000 | 1 | Microsemi Corp. | 60,667,200 |

| 1,500,000 | 1,2 | Mobileye NV | 55,770,000 |

| 1,150,000 | 1 | NIC, Inc. | 26,392,500 |

| 1,015,000 | 1 | NXP Semiconductors NV | 101,500,000 |

| 320,000 | 1 | NetSuite, Inc. | 29,798,400 |

| 562,921 | 1 | Q2 Holdings, Inc. | 15,818,080 |

| 1,423,600 | 1,2 | RADWARE Ltd. | 19,232,836 |

| 500,000 | 1 | Salesforce.com, Inc. | 37,580,000 |

| 3,751 | 1,3,4 | Sensable Technologies, Inc. | 0 |

| 1,400,000 | 1 | ServiceNow, Inc. | 123,074,000 |

| 270,000 | 1 | Shopify, Inc. | 11,191,500 |

| 453,000 | 1 | Splunk, Inc. | 27,266,070 |

| 700,000 | 1 | Tyler Technologies, Inc. | 112,280,000 |

| 1,000,000 | 1 | Vantiv, Inc. | 58,360,000 |

| 1,000,000 | 1 | Workday, Inc. | 86,680,000 |

| 700,000 | 1,2 | Zillow Group, Inc. | 23,352,000 |

| | | TOTAL | 1,177,688,691 |

| | | Materials—5.2% | |

| 521,000 | | Eagle Materials, Inc. | 42,185,370 |

| 360,800 | 1,2 | Forterra, Inc. | 6,205,760 |

| 435,000 | 1 | Ingevity Corp. | 18,009,000 |

| 141,800 | | Martin Marietta Materials | 26,286,884 |

| 395,000 | | Sherwin-Williams Co. | 96,719,700 |

| 1,700,000 | 1,2 | Valvoline, Inc. | 34,680,000 |

| 300,000 | | Vulcan Materials Co. | 33,960,000 |

| | | TOTAL | 258,046,714 |

| | | Real Estate—2.6% | |

| 900,000 | 1 | CBRE Group, Inc. | 23,184,000 |

| 500,000 | | Crown Castle International Corp. | 45,495,000 |

Annual Shareholder Report

Shares or

Principal

Amount | | | Value |

| | | COMMON STOCKS—continued | |

| | | Real Estate—continued | |

| 250,000 | | Lamar Advertising Co. | $15,862,500 |

| 400,000 | | MGM Growth Properties LLC | 10,528,000 |

| 700,000 | | Ryman Hospitality Properties | 35,294,000 |

| | | TOTAL | 130,363,500 |

| | | Telecommunication Services—0.4% | |

| 530,000 | 1 | Zayo Group Holdings, Inc. | 17,055,400 |

| | | TOTAL COMMON STOCKS

(IDENTIFIED COST $3,153,487,003) | 4,471,116,297 |

| | | CORPORATE BONDS—0.1% | |

| | | Consumer Discretionary—0.0% | |

| $244,000 | 3 | Ctrip.com International Ltd., Conv. Bond, Series 144A, 1.25%, 9/15/2022 | 241,714 |

| | | Health Care—0.1% | |

| 4,600,000 | 3 | Protalix Biotherapeutics, Inc., Conv. Bond, 4.50%, 9/15/2018 | 3,059,488 |

| | | TOTAL CORPORATE BONDS

(IDENTIFIED COST $4,844,000) | 3,301,202 |

| | | PREFERRED STOCK—0.0% | |

| | | Information Technology—0.0% | |

| 679,348 | 1,3,4 | Multiplex, Inc., Pfd., Series C

(IDENTIFIED COST $5,000,001) | 0 |

| | | WARRANTS—0.1% | |

| | | Health Care—0.1% | |

| 1,735,000 | 1,5 | ContraFect Corp., 7/21/2027 | 2,161,116 |

| 848,250 | 1,5 | SCYNEXIS, Inc., 6/24/2021 | 1,638,056 |

| 1,173,832 | 1,5 | SteadyMed Ltd., 8/2/2021 | 3,006,301 |

| 7,425,000 | 1,5 | Zogenix, Inc., 7/27/2017 | 703,147 |

| | | TOTAL WARRANTS

(IDENTIFIED COST $164,079) | 7,508,620 |

| | | INVESTMENT COMPANIES—17.4% | |

| 298,168,770 | 5,6 | Federated Government Obligations Fund, Institutional Shares, 0.27%7 | 298,168,770 |

| 568,092,887 | 5 | Federated Institutional Prime Value Obligations Fund, Institutional Shares, 0.45%7 | 568,092,887 |

| | | TOTAL INVESTMENT COMPANIES

(IDENTIFIED COST $866,261,657) | 866,261,657 |

| | | TOTAL INVESTMENTS—107.3%

(IDENTIFIED COST $4,029,756,740)8 | 5,348,187,776 |

| | | OTHER ASSETS AND LIABILITIES - NET—(7.3)%9 | (361,885,532) |

| | | TOTAL NET ASSETS—100% | $4,986,302,244 |

Annual Shareholder Report

At October 31, 2016, the Fund had the following outstanding futures contracts:

| Description | Number of

Contracts | Notional

Value | Expiration

Date | Unrealized

Appreciation |

| 1S&P 500 E-Mini Index Short Futures | 371 | $39,327,855 | December 2016 | $500,444 |

| 1 | Non-income-producing security. |

| 2 | All or a portion of these securities are temporarily on loan to unaffiliated broker/dealers. |

| 3 | Denotes a restricted security that either: (a) cannot be offered for public sale without first being registered, or being able to take advantage of an exemption from registration, under the Securities Act of 1933; or (b) is subject to a contractual restriction on public sales. At October 31, 2016, these restricted securities amounted to $9,092,252, which represented 0.2% of total net assets. |

| 4 | Market quotations and price evaluations are not available. Fair value determined in accordance with procedures established by and under the general supervision of the Fund's Board of Trustees (the “Trustees”). |

| 5 | Affiliated companies and holdings. |

| 6 | All or a portion of this security is held as collateral for securities lending. |

| 7 | 7-day net yield. |

| 8 | The cost of investments for federal tax purposes amounts to $4,064,021,050. |

| 9 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

Note: The categories of investments are shown as a percentage of total net assets at October 31, 2016.

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1—quoted prices in active markets for identical securities.

Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Also includes securities valued at amortized cost.

Level 3—significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

Annual Shareholder Report

The following is a summary of the inputs used, as of October 31, 2016, in valuing the Fund's assets carried at fair value:

| Valuation Inputs | | | | |

| | Level 1—

Quoted

Prices | Level 2—

Other

Significant

Observable

Inputs | Level 3—

Significant

Unobservable

Inputs | Total |

| Equity Securities: | | | | |

| Common Stocks | | | | |

| Domestic | $3,529,383,574 | $— | $11,072,554 | $3,540,456,128 |

| International | 544,802,153 | 385,858,016 | | 930,660,169 |

| Preferred Stocks | | | | |

| Domestic | 0 | — | — | 0 |

| Debt Securities: | | | | |

| Corporate Bonds | — | 3,301,202 | — | 3,301,202 |

| Warrants | — | 7,508,620 | — | 7,508,620 |

| Investment Companies | 866,261,657 | — | — | 866,261,657 |

| TOTAL SECURITIES | $4,940,447,384 | $396,667,838 | $11,072,554 | $5,348,187,776 |

| Other Financial Instruments1 | | | | |

| Assets | $500,444 | $— | $— | $500,444 |

| Liabilities | — | — | — | — |

| TOTAL OTHER FINANCIAL INSTRUMENTS | $500,444 | $— | $— | $500,444 |

| 1 | Other financial instruments include futures contracts. |

The following acronyms are used throughout this portfolio:

| ADR | —American Depositary Receipt |

| CVR | —Contingent Value Right |

| SA | —Support Agreement |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class A Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended October 31 | 2016 | 2015 | 2014 | 2013 | 2012 |

| Net Asset Value, Beginning of Period | $6.02 | $6.60 | $6.59 | $5.28 | $4.92 |

| Income From Investment Operations: | | | | | |

| Net investment income (loss) | (0.05)1 | (0.08)1 | (0.09)1 | (0.05)1 | (0.05)1 |

| Net realized and unrealized gain on investments, futures contracts and foreign currency transactions | 0.16 | 0.46 | 0.98 | 1.78 | 0.50 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.11 | 0.38 | 0.89 | 1.73 | 0.45 |

| Less Distributions: | | | | | |

| Distributions from net realized gain on investments, futures contracts and foreign currency transactions | (0.86) | (0.96) | (0.88) | (0.42) | (0.09) |

| Net Asset Value, End of Period | $5.27 | $6.02 | $6.60 | $6.59 | $5.28 |

| Total Return2 | 1.77% | 6.29% | 14.54% | 35.63% | 9.45% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 1.95%3 | 1.95%3 | 1.95%3 | 1.95%3 | 1.95%3 |

| Net expenses excluding dividends and other expenses related to short sales | 1.95%3 | 1.95%3 | 1.95%3 | 1.95%3 | 1.95%3 |

| Net investment income (loss) | (1.00)% | (1.22)% | (1.27)% | (0.82)% | (0.97)% |

| Expense waiver/reimbursement4 | 0.06% | 0.05% | 0.15% | 0.25% | 0.28% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $1,364,222 | $1,582,916 | $1,550,663 | $1,508,534 | $1,898,465 |

| Portfolio turnover | 55% | 51% | 52% | 63% | 61% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 3 | The net expense ratio is calculated without reduction for fees paid indirectly for expense offset arrangements. The net expense ratios are 1.95%, 1.95%, 1.95%, 1.95% and 1.95%, for the years ended October 31, 2016, 2015, 2014, 2013 and 2012, respectively, after taking into account these expense reductions. |

| 4 | This expense decrease is reflected in both the net expense and the net investment income (loss) ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class B Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended October 31 | 2016 | 2015 | 2014 | 2013 | 2012 |

| Net Asset Value, Beginning of Period | $5.36 | $6.00 | $6.10 | $4.94 | $4.64 |

| Income From Investment Operations: | | | | | |

| Net investment income (loss) | (0.07)1 | (0.10)1 | (0.11)1 | (0.07)1 | (0.07)1 |

| Net realized and unrealized gain on investments, futures contracts and foreign currency transactions | 0.15 | 0.42 | 0.89 | 1.65 | 0.46 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.08 | 0.32 | 0.78 | 1.58 | 0.39 |

| Less Distributions: | | | | | |

| Distributions from net realized gain on investments, futures contracts and foreign currency transactions | (0.86) | (0.96) | (0.88) | (0.42) | (0.09) |

| Net Asset Value, End of Period | $4.58 | $5.36 | $6.00 | $6.10 | $4.94 |

| Total Return2 | 1.34% | 5.83% | 13.83% | 34.99% | 8.72% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 2.48%3 | 2.48%3 | 2.50%3 | 2.50%3 | 2.50%3 |

| Net expenses excluding dividends and other expenses related to short sales | 2.48%3 | 2.48%3 | 2.50%3 | 2.50%3 | 2.50%3 |

| Net investment income (loss) | (1.52)% | (1.74)% | (1.81)% | (1.35)% | (1.52)% |

| Expense waiver/reimbursement4 | 0.03% | 0.03% | 0.11% | 0.20% | 0.23% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $72,634 | $99,777 | $123,679 | $159,846 | $184,726 |

| Portfolio turnover | 55% | 51% | 52% | 63% | 61% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 3 | The net expense ratio is calculated without reduction for fees paid indirectly for expense offset arrangements. The net expense ratios are 2.48%, 2.48%, 2.50%, 2.50% and 2.50%, for the years ended October 31, 2016, 2015, 2014, 2013 and 2012, respectively, after taking into account these expense reductions. |

| 4 | This expense decrease is reflected in both the net expense and the net investment income (loss) ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class C Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended October 31 | 2016 | 2015 | 2014 | 2013 | 2012 |

| Net Asset Value, Beginning of Period | $5.36 | $6.00 | $6.10 | $4.94 | $4.64 |

| Income From Investment Operations: | | | | | |

| Net investment income (loss) | (0.07)1 | (0.10)1 | (0.11)1 | (0.07)1 | (0.07)1 |

| Net realized and unrealized gain on investments, futures contracts and foreign currency transactions | 0.14 | 0.42 | 0.89 | 1.65 | 0.46 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.07 | 0.32 | 0.78 | 1.58 | 0.39 |

| Less Distributions: | | | | | |

| Distributions from net realized gain on investments, futures contracts and foreign currency transactions | (0.86) | (0.96) | (0.88) | (0.42) | (0.09) |

| Net Asset Value, End of Period | $4.57 | $5.36 | $6.00 | $6.10 | $4.94 |

| Total Return2 | 1.15% | 5.86% | 13.83% | 34.99% | 8.72% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 2.48%3 | 2.48%3 | 2.50%3 | 2.50%3 | 2.50%3 |

| Net expenses excluding dividends and other expenses related to short sales | 2.48%3 | 2.48%3 | 2.50%3 | 2.50%3 | 2.50%3 |

| Net investment income (loss) | (1.52)% | (1.75)% | (1.81)% | (1.39)% | (1.52)% |

| Expense waiver/reimbursement4 | 0.03% | 0.03% | 0.11% | 0.20% | 0.23% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $343,129 | $418,926 | $427,755 | $431,327 | $392,886 |

| Portfolio turnover | 55% | 51% | 52% | 63% | 61% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 3 | The net expense ratio is calculated without reduction for fees paid indirectly for expense offset arrangements. The net expense ratios are 2.48%, 2.48%, 2.50%, 2.50% and 2.50%, for the years ended October 31, 2016, 2015, 2014, 2013 and 2012, respectively, after taking into account these expense reductions. |

| 4 | This expense decrease is reflected in both the net expense and the net investment income (loss) ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class R Shares

(For a Share Outstanding Throughout Each Period)

| Year Ended October 31 | 2016 | 2015 | 2014 | 2013 | 2012 |

| Net Asset Value, Beginning of Period | $6.03 | $6.61 | $6.60 | $5.28 | $4.93 |

| Income From Investment Operations: | | | | | |

| Net investment income (loss) | (0.05)1 | (0.08)1 | (0.08)1 | (0.05)1 | (0.05)1 |

| Net realized and unrealized gain on investments, futures contracts and foreign currency transactions | 0.16 | 0.46 | 0.97 | 1.79 | 0.49 |

| TOTAL FROM INVESTMENT OPERATIONS | 0.11 | 0.38 | 0.89 | 1.74 | 0.44 |

| Less Distributions: | | | | | |

| Distributions from net realized gain on investments, futures contracts and foreign currency transactions | (0.86) | (0.96) | (0.88) | (0.42) | (0.09) |

| Net Asset Value, End of Period | $5.28 | $6.03 | $6.61 | $6.60 | $5.28 |

| Total Return2 | 1.76% | 6.28% | 14.52% | 35.81% | 9.23% |

| Ratios to Average Net Assets: | | | | | |

| Net expenses | 1.95%3 | 1.95%3 | 1.95%3 | 1.95%3 | 1.95%3 |

| Net expenses excluding dividends and other expenses related to short sales | 1.95%3 | 1.95%3 | 1.95%3 | 1.95%3 | 1.95%3 |

| Net investment income (loss) | (1.00)% | (1.22)% | (1.27)% | (0.85)% | (0.97)% |

| Expense waiver/reimbursement4 | 0.29% | 0.29% | 0.38% | 0.48% | 0.52% |

| Supplemental Data: | | | | | |

| Net assets, end of period (000 omitted) | $3,206,317 | $3,452,182 | $3,497,459 | $3,358,658 | $2,878,476 |

| Portfolio turnover | 55% | 51% | 52% | 63% | 61% |

| 1 | Per share numbers have been calculated using the average shares method. |

| 2 | Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable. |

| 3 | The net expense ratio is calculated without reduction for fees paid indirectly for expense offset arrangements. The net expense ratios are 1.95%, 1.95%, 1.95%, 1.95% and 1.95%, for the years ended October 31, 2016, 2015, 2014, 2013 and 2012, respectively, after taking into account these expense reductions. |

| 4 | This expense decrease is reflected in both the net expense and the net investment income (loss) ratios shown above. |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Assets and Liabilities

October 31, 2016

| Assets: | | |

| Total investment in securities, at value including $283,732,210 of securities loaned, $866,261,657 of investment in affiliated holdings and $434,005,316 of investments in affiliated companies (Note 5) (identified cost $4,029,756,740) | | $5,348,187,776 |

| Restricted Cash (Note 2) | | 1,669,500 |

| Cash denominated in foreign currencies (identified cost $4,243) | | 4,212 |

| Income receivable | | 537,715 |

| Receivable for investments sold | | 46,705,862 |

| Receivable for shares sold | | 968,531 |

| Receivable for daily variation margin on futures contracts | | 68,643 |

| TOTAL ASSETS | | 5,398,142,239 |

| Liabilities: | | |

| Payable for investments purchased | $102,364,305 | |

| Payable for shares redeemed | 6,027,854 | |

| Payable for collateral due to broker for securities lending | 298,168,770 | |

| Payable to adviser (Note 5) | 173,991 | |

| Payable for administrative fees (Note 5) | 10,671 | |

| Payable for distribution services fee (Note 5) | 1,279,886 | |

| Payable for other service fees (Notes 2 and 5) | 2,687,867 | |

| Accrued expenses (Note 5) | 1,126,651 | |

| TOTAL LIABILITIES | | 411,839,995 |

| Net assets for 956,869,792 shares outstanding | | $4,986,302,244 |

| Net Assets Consist of: | | |

| Paid-in capital | | $3,260,840,527 |

| Net unrealized appreciation of investments, futures contracts and translation of assets and liabilities in foreign currency | | 1,318,931,516 |

| Accumulated net realized gain on investments, futures contracts and foreign currency transactions | | 466,260,675 |

| Distributions in excess of net investment income | | (59,730,474) |

| TOTAL NET ASSETS | | $4,986,302,244 |

Annual Shareholder Report

Statement of Assets and Liabilities–continued

| Net Asset Value, Offering Price and Redemption Proceeds Per Share | | |

| Class A Shares: | | |

| Net asset value per share ($1,364,221,692 ÷ 258,796,567 shares outstanding), no par value, unlimited shares authorized | | $5.27 |

| Offering price per share (100/94.50 of $5.27) | | $5.58 |

| Redemption proceeds per share | | $5.27 |

| Class B Shares: | | |

| Net asset value per share ($72,634,438 ÷ 15,870,411 shares outstanding), no par value, unlimited shares authorized | | $4.58 |

| Offering price per share | | $4.58 |

| Redemption proceeds per share (94.50/100 of $4.58) | | $4.33 |

| Class C Shares: | | |

| Net asset value per share ($343,129,273 ÷ 75,046,707 shares outstanding), no par value, unlimited shares authorized | | $4.57 |

| Offering price per share | | $4.57 |

| Redemption proceeds per share (99.00/100 of $4.57) | | $4.52 |

| Class R Shares: | | |

| Net asset value per share ($3,206,316,841 ÷ 607,156,107 shares outstanding), no par value, unlimited shares authorized | | $5.28 |

| Offering price per share | | $5.28 |

| Redemption proceeds per share | | $5.28 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Operations

Year Ended October 31, 2016

| Investment Income: | | | |

| Dividends (including $5,083,908 received from affiliated holdings (Note 5) and net of foreign taxes withheld of $155,997) | | | $39,019,888 |

| Interest (including income on securities loaned of $9,709,173) | | | 9,916,630 |

| TOTAL INCOME | | | 48,936,518 |

| Expenses: | | | |

| Investment adviser fee (Note 5) | | $66,546,816 | |

| Administrative fee (Note 5) | | 4,003,047 | |

| Custodian fees | | 380,776 | |

| Transfer agent fee (Note 2) | | 5,213,883 | |

| Directors'/Trustees' fees (Note 5) | | 41,450 | |

| Auditing fees | | 41,300 | |

| Legal fees | | 27,638 | |

| Portfolio accounting fees | | 188,817 | |

| Distribution services fee (Note 5) | | 23,164,904 | |

| Other service fees (Notes 2 and 5) | | 12,761,954 | |

| Share registration costs | | 134,564 | |

| Printing and postage | | 250,165 | |

| Miscellaneous (Note 5) | | 42,879 | |

| TOTAL EXPENSES | | 112,798,193 | |

Annual Shareholder Report

Statement of Operations–continued

| Waivers, Reimbursement and Reduction: | | | |

| Waiver/reimbursement of investment adviser fee (Note 5) | $(1,363,982) | | |

| Waiver of other operating expenses (Notes 2 and 5) | (8,977,942) | | |

| Fees paid indirectly from directed brokerage arrangements (Note 6) | (43,013) | | |

| TOTAL WAIVERS, REIMBURSEMENT AND REDUCTION | | $(10,384,937) | |

| Net expenses | | | $102,413,256 |

| Net investment income (loss) | | | (53,476,738) |

| Realized and Unrealized Gain (Loss) on Investments, Futures Contracts and Foreign Currency Transactions: | | | |

| Net realized gain on investments and foreign currency transactions (including realized gain of $227,548,685 on sales of investments in an affiliated company (Note 5)) | | | 488,489,348 |

| Net realized loss on futures contracts | | | (23,797) |

| Net change in unrealized appreciation of investments and translation of assets and liabilities in foreign currency | | | (358,901,784) |

| Net change in unrealized appreciation of futures contracts | | | 500,444 |

| Net realized and unrealized gain on investments, futures contracts and foreign currency transactions | | | 130,064,211 |

| Change in net assets resulting from operations | | | $76,587,473 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Statement of Changes in Net Assets

| Year Ended October 31 | 2016 | 2015 |

| Increase (Decrease) in Net Assets | | |

| Operations: | | |

| Net investment income (loss) | $(53,476,738) | $(74,032,930) |

| Net realized gain on investments, futures contracts and foreign currency transactions | 488,465,551 | 795,735,526 |

| Net change in unrealized appreciation/depreciation of investments, futures contracts and translation of assets and liabilities in foreign currency | (358,401,340) | (370,097,703) |

| CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | 76,587,473 | 351,604,893 |

| Distributions to Shareholders: | | |

| Distributions from net realized gain on investments, futures contracts and foreign currency transactions | | |

| Class A Shares | (223,507,536) | (223,114,494) |

| Class B Shares | (15,779,610) | (18,974,403) |

| Class C Shares | (66,305,492) | (67,412,650) |

| Class R Shares | (490,677,536) | (503,565,538) |

| CHANGE IN NET ASSETS RESULTING FROM DISTRIBUTIONS TO SHAREHOLDERS | (796,270,174) | (813,067,085) |

| Share Transactions: | | |

| Proceeds from sale of shares | 255,445,815 | 379,428,833 |

| Net asset value of shares issued to shareholders in payment of distributions declared | 742,894,469 | 757,424,298 |

| Cost of shares redeemed | (846,156,531) | (721,145,444) |

| CHANGE IN NET ASSETS RESULTING FROM SHARE TRANSACTIONS | 152,183,753 | 415,707,687 |

| Change in net assets | (567,498,948) | (45,754,505) |

| Net Assets: | | |

| Beginning of period | 5,553,801,192 | 5,599,555,697 |

| End of period (including distributions in excess of net investment income of $(59,730,474) and $(73,187,351), respectively) | $4,986,302,244 | $5,553,801,192 |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Notes to Financial Statements

October 31, 2016

1. ORGANIZATION

Federated Equity Funds (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. The Trust consists of 14 diversified portfolios. The financial statements included herein are only those of Federated Kaufmann Fund (the “Fund”), a diversified portfolio. The financial statements of the other portfolios are presented separately. The assets of each portfolio are segregated and a shareholder's interest is limited to the portfolio in which shares are held. Each portfolio pays its own expenses. The Fund offers four classes of shares: Class A Shares, Class B Shares, Class C Shares and Class R Shares. All shares of the Fund have equal rights with respect to voting, except on class-specific matters. The investment objective of the Fund is to provide capital appreciation.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles (GAAP).

Investment Valuation

In calculating its net asset value (NAV), the Fund generally values investments as follows:

| ■ | Equity securities listed on an exchange or traded through a regulated market system are valued at their last reported sale price or official closing price in their principal exchange or market. |

| ■ | Shares of other mutual funds or non-exchange-traded investment companies are valued based upon their reported NAVs. |

| ■ | Fixed-income securities are fair valued using price evaluations provided by a pricing service approved by the Trustees. |

| ■ | Derivative contracts listed on exchanges are valued at their reported settlement or closing price, except that options are valued at the mean of closing bid and asked quotations. |

| ■ | Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Trustees. |

| ■ | For securities that are fair valued in accordance with procedures established by and under the general supervision of the Trustees, certain factors may be considered such as: the last traded or purchase price of the security, information obtained by contacting the issuer or dealers, analysis of the issuer's financial statements or other available documents, fundamental analytical data, the nature and duration of restrictions on disposition, the movement of the market in which the security is normally traded, public trading in similar securities or derivative contracts of the issuer or comparable issuers, movement of a relevant index, or other factors including but not limited to industry changes and relevant government actions. |

If any price, quotation, price evaluation or other pricing source is not readily available when the NAV is calculated, or if the Fund cannot obtain price evaluations from a pricing service or from more than one dealer for an investment within a reasonable period of time as set forth in the Fund's valuation policies and procedures, the Fund uses the fair value of the investment determined in accordance with the procedures described below. There can be no assurance that the Fund could obtain the fair value assigned to an investment if it sold the investment at approximately the time at which the Fund determines its NAV per share.

Annual Shareholder Report

Fair Valuation and Significant Events Procedures

The Trustees have ultimate responsibility for determining the fair value of investments for which market quotations are not readily available. The Trustees have appointed a valuation committee (“Valuation Committee”) comprised of officers of the Fund, Federated Equity Management Company of Pennsylvania (“Adviser”) and certain of the Adviser's affiliated companies to assist in determining fair value and in overseeing the calculation of the NAV. The Trustees have also authorized the use of pricing services recommended by the Valuation Committee to provide fair value evaluations of the current value of certain investments for purposes of calculating the NAV. The Valuation Committee employs various methods for reviewing third-party pricing-service evaluations including periodic reviews of third-party pricing services' policies, procedures and valuation methods (including key inputs, methods, models and assumptions), transactional back-testing, comparisons of evaluations of different pricing services, and review of price challenges by the Adviser based on recent market activity. In the event that market quotations and price evaluations are not available for an investment, the Valuation Committee determines the fair value of the investment in accordance with procedures adopted by the Trustees. The Trustees periodically review and approve the fair valuations made by the Valuation Committee and any changes made to the procedures.

Factors considered by pricing services in evaluating an investment include the yields or prices of investments of comparable quality, coupon, maturity, call rights and other potential prepayments, terms and type, reported transactions, indications as to values from dealers and general market conditions. The Fund may hold securities that are valued on the basis of prices provided by a single pricing source, including dealers from whom the securities were purchased. These securities may be less liquid and the price realized upon a sale may be different than the price used to value the security. The Fund may classify these securities as having a Level 3 valuation due to a lack of observable market transactions. Some pricing services provide a single price evaluation reflecting the bid-side of the market for an investment (a “bid” evaluation). Other pricing services offer both bid evaluations and price evaluations indicative of a price between the prices bid and asked for the investment (a “mid” evaluation). The Fund normally uses bid evaluations for any U.S. Treasury and Agency securities, mortgage-backed securities and municipal securities. The Fund normally uses mid evaluations for any other types of fixed-income securities and any OTC derivative contracts. In the event that market quotations and price evaluations are not available for an investment, the fair value of the investment is determined in accordance with procedures adopted by the Trustees.

The Trustees also have adopted procedures requiring an investment to be priced at its fair value whenever the Adviser determines that a significant event affecting the value of the investment has occurred between the time as of which the price of the investment would otherwise be determined and the time as of which the NAV is computed. An event is considered significant if there is both an affirmative expectation that the investment's value will change in response to the event and a reasonable basis for quantifying the resulting change in value. Examples of significant events that may occur after the close of the principal market on which a security is traded, or after the time of a price evaluation provided by a pricing service or a dealer, include:

| ■ | With respect to securities traded principally in foreign markets, significant trends in U.S. equity markets or in the trading of foreign securities index futures contracts; |

| ■ | Political or other developments affecting the economy or markets in which an issuer conducts its operations or its securities are traded; |

Annual Shareholder Report

| ■ | Announcements concerning matters such as acquisitions, recapitalizations, litigation developments, or a natural disaster affecting the issuer's operations or regulatory changes or market developments affecting the issuer's industry. |

The Trustees have adopted procedures whereby the Valuation Committee uses a pricing service to determine the fair value of equity securities traded principally in foreign markets when the Adviser determines that there has been a significant trend in the U.S. equity markets or in index futures trading. For other significant events, the Fund may seek to obtain more current quotations or price evaluations from alternative pricing sources. If a reliable alternative pricing source is not available, the Fund will determine the fair value of the investment in accordance with the fair valuation procedures approved by the Trustees. The Trustees have ultimate responsibility for any fair valuations made in response to a significant event.

Repurchase Agreements

The Fund may invest in repurchase agreements for short-term liquidity purposes. It is the policy of the Fund to require the other party to a repurchase agreement to transfer to the Fund's custodian or sub-custodian eligible securities or cash with a market value (after transaction costs) at least equal to the repurchase price to be paid under the repurchase agreement. The eligible securities are transferred to accounts with the custodian or sub-custodian in which the Fund holds a “securities entitlement” and exercises “control” as those terms are defined in the Uniform Commercial Code. The Fund has established procedures for monitoring the market value of the transferred securities and requiring the transfer of additional eligible securities if necessary to equal at least the repurchase price. These procedures also allow the other party to require securities to be transferred from the account to the extent that their market value exceeds the repurchase price or in exchange for other eligible securities of equivalent market value.

The insolvency of the other party or other failure to repurchase the securities may delay the disposition of the underlying securities or cause the Fund to receive less than the full repurchase price. Under the terms of the repurchase agreement, any amounts received by the Fund in excess of the repurchase price and related transaction costs must be remitted to the other party.

The Fund may enter into repurchase agreements in which eligible securities are transferred into joint trading accounts maintained by the custodian or sub-custodian for investment companies and other clients advised by the Fund's Adviser and its affiliates. The Fund will participate on a pro rata basis with the other investment companies and clients in its share of the securities transferred under such repurchase agreements and in its share of proceeds from any repurchase or other disposition of such securities.

Investment Income, Gains and Losses, Expenses and Distributions

Investment transactions are accounted for on a trade-date basis. Realized gains and losses from investment transactions are recorded on an identified-cost basis. Interest income and expenses are accrued daily. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Foreign dividends are recorded on the ex-dividend date or when the Fund is informed of the ex-dividend date. Distributions of net investment income, if any, are declared and paid annually. Non-cash dividends included in dividend income, if any, are recorded at fair value. Amortization/accretion of premium and discount is included in investment income. Investment income, realized and unrealized gains and losses, and certain fund-level expenses are allocated to each class based on relative average daily net assets, except that Class A Shares, Class B Shares, Class C Shares and Class R Shares may bear distribution services fees, other service fees and transfer agent fees unique to those classes.

Annual Shareholder Report

The detail of the total fund expense waivers, reimbursement and reduction of $10,384,937 is disclosed in various locations in Note 5 and Note 6. For the year ended October 31, 2016, the Custodian reimbursed $22,460 of custody fees. For the year ended October 31, 2016, transfer agent fees for the Fund were as follows:

| | Transfer Agent

Fees Incurred |

| Class A Shares | $1,581,370 |

| Class B Shares | 92,149 |

| Class C Shares | 412,859 |

| Class R Shares | 3,127,505 |

| TOTAL | $5,213,883 |

Dividends are declared separately for each class. No class has preferential dividend rights; differences in per share dividend rates are generally due to differences in separate class expenses.

Other Service Fees

The Fund may pay other service fees up to 0.25% of the average daily net assets of the Fund's Class A Shares, Class B Shares, Class C Shares and Class R Shares to unaffiliated financial intermediaries or to Federated Shareholder Services Company (FSSC) for providing services to shareholders and maintaining shareholder accounts. Financial intermediaries may include a company affiliated with management of Federated Investors, Inc. A financial intermediary affiliated with management of Federated Investors, Inc. received $21,099 of other service fees for the year ended October 31, 2016. Subject to the terms described in the Expense Limitation note, FSSC may voluntarily reimburse the Fund for other service fees. In addition, unaffiliated third-party financial intermediaries may waive other service fees. This waiver can be modified or terminated at any time. For the year ended October 31, 2016, other service fees for the Fund were as follows:

| | Other Service

Fees Incurred |

| Class A Shares | $3,557,510 |

| Class B Shares | 207,010 |

| Class C Shares | 930,278 |

| Class R Shares | 8,067,156 |

| TOTAL | $12,761,954 |

Federal Taxes

It is the Fund's policy to comply with the Subchapter M provision of the Internal Revenue Code (the “Code”) and to distribute to shareholders each year substantially all of its income. Accordingly, no provision for federal income tax is necessary. As of and during the year ended October 31, 2016, the Fund did not have a liability for any uncertain tax positions. The Fund recognizes interest and penalties, if any, related to tax liabilities as income tax expense in the Statement of Operations. As of October 31, 2016, tax years 2013 through 2016 remain subject to examination by the Fund's major tax jurisdictions, which include the United States of America and the Commonwealth of Massachusetts.

Annual Shareholder Report

The Fund may be subject to taxes imposed by governments of countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The Fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or gains are earned.

When-Issued and Delayed-Delivery Transactions

The Fund may engage in when-issued or delayed-delivery transactions. The Fund records when-issued securities on the trade date and maintains security positions such that sufficient liquid assets will be available to make payment for the securities purchased. Securities purchased on a when-issued or delayed-delivery basis are marked to market daily and begin earning interest on the settlement date. Losses may occur on these transactions due to changes in market conditions or the failure of counterparties to perform under the contract.

Futures Contracts

The Fund purchases and sells financial futures contracts to manage cash flows and duration, enhance yield and to potentially reduce transaction costs. Upon entering into a financial futures contract with a broker, the Fund is required to deposit in a segregated account a specified amount of cash which is shown as Restricted Cash in the Statement of Assets and Liabilities. Futures contracts are valued daily and unrealized gains or losses are recorded in a “variation margin” account. Daily, the Fund receives from or pays to the broker a specified amount of cash based upon changes in the variation margin account. When a contract is closed, the Fund recognizes a realized gain or loss. Futures contracts have market risks, including the risk that the change in the value of the contract may not correlate with the changes in the value of the underlying securities. There is minimal counterparty risk to the Fund since futures are exchange traded and the exchange's clearinghouse, as counterparty to all exchange traded futures, guarantees the futures against default.

Futures contracts outstanding at period end are listed after the Fund's Portfolio of Investments.

The average notional value of long futures contracts held by the Fund throughout the period was $5,305,134. This is based on amounts held as of each month-end throughout the fiscal period.

Foreign Exchange Contracts

The Fund enters into foreign exchange contracts for the delayed delivery of securities or foreign currency exchange transactions. The Fund enters into foreign exchange contracts to protect assets against adverse changes in foreign currency exchange rates or exchange control regulations. Purchased contracts are used to acquire exposure to foreign currencies, whereas, contracts to sell are used to hedge the Fund's securities against currency fluctuations. Risks may arise upon entering into these transactions from the potential inability of counterparties to meet the terms of their commitments and from unanticipated movements in security prices or foreign exchange rates. The foreign exchange contracts are adjusted by the daily exchange rate of the underlying currency and any gains or losses are recorded for financial statement purposes as unrealized until the settlement date.

At October 31, 2016, the Fund had no outstanding foreign exchange contracts.

The average value at settlement date payable and receivable of foreign exchange contracts purchased and sold by the Fund throughout the period was $13,574 and $676, respectively. This is based on the contracts held as of each month-end throughout the fiscal period.

Annual Shareholder Report

Foreign Currency Translation

The accounting records of the Fund are maintained in U.S. dollars. All assets and liabilities denominated in foreign currencies (FCs) are translated into U.S. dollars based on the rates of exchange of such currencies against U.S. dollars on the date of valuation. Purchases and sales of securities, income and expenses are translated at the rate of exchange quoted on the respective date that such transactions are recorded. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Reported net realized foreign exchange gains or losses arise from sales of portfolio securities, sales and maturities of short-term securities, sales of FCs, currency gains or losses realized between the trade and settlement dates on securities transactions, the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund's books, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments in securities at fiscal year end, resulting from changes in the exchange rate.

Additional Disclosure Related to Derivative Instruments

| Fair Value of Derivative Instruments |

| | Asset |

| | Statement of

Assets and

Liabilities

Location | Fair

Value |

| Derivatives not accounted for as hedging instruments under ASC Topic 815 | | |

| | | |

| Equity contracts | Receivable for

daily variation margin

on futures contracts | $500,444* |

| * | Includes cumulative appreciation of futures contracts as reported in the footnotes to the Portfolio of Investments. Only the current day's variation margin is reported within the Statement of Assets and Liabilities. |

The Effect of Derivative Instruments on the Statement of Operations for the Year Ended October 31, 2016

| Amount of Realized Gain or (Loss) on Derivatives Recognized in Income |

| | Futures |

| Equity contracts | $(23,797) |

| Change in Unrealized Appreciation or (Depreciation) on Derivatives Recognized in Income |

| | Futures |

| Equity contracts | $500,444 |

Annual Shareholder Report

Securities Lending

The Fund participates in a securities lending program providing for the lending of equity securities to qualified brokers. The Fund normally receives cash collateral for securities loaned that is invested in an affiliated money market fund or in short-term securities including repurchase agreements. Collateral is maintained at a minimum level of 100% of the market value of investments loaned, plus interest, if applicable. Earnings on collateral are allocated between the borrower of the security, the securities lending agent, as a fee for its services under the program and the Fund, according to agreed-upon rates.

Securities lending transactions are subject to Master Netting Agreements which are agreements between the Fund and its counterparties that provide for the net settlement of all transactions and collateral with the Fund, through a single payment, in the event of default or termination. Amounts presented on the Portfolio of Investments and Statement of Assets and Liabilities are not net settlement amount but gross. As indicated below, the cash collateral received by the Fund exceeds the market value of the securities loaned reducing the net settlement amount to zero. The chart below identifies the amount of collateral received as well as the market value of securities on loan. Additionally, the securities lending agreement executed by the Fund includes an indemnification clause. This clause stipulates that the borrower will reimburse the Fund for any losses as a result of any failure of the borrower to return equivalent securities to the Fund.

As of October 31, 2016, securities subject to this type of arrangement and related collateral were as follows:

Market Value of

Securities Loaned | Market Value

of Collateral |

| $283,732,210 | $298,168,770 |

Restricted Securities

The Fund may purchase securities which are considered restricted. Restricted securities are securities that either: (a) cannot be offered for public sale without first being registered, or being able to take advantage of an exemption from registration, under the Securities Act of 1933; or (b) are subject to contractual restrictions on public sales. In some cases, when a security cannot be offered for public sale without first being registered, the issuer of the restricted security has agreed to register such securities for resale, at the issuer's expense, either upon demand by the Fund or in connection with another registered offering of the securities. Many such restricted securities may be resold in the secondary market in transactions exempt from registration. Restricted securities may be determined to be liquid under criteria established by the Trustees. The Fund will not incur any registration costs upon such resales. The Fund's restricted securities, like other securities, are priced in accordance with procedures established by and under the general supervision of the Trustees.

Annual Shareholder Report

Additional information on restricted securities, excluding securities purchased under Rule 144A that have been deemed liquid by the Trustees, if applicable, held at October 31, 2016, is as follows:

| Security | Acquisition Date | Cost | Market Value |

| Apollo Investment Fund V | 5/18/2001 | $0 | $323,303 |

| Ctrip.com International Ltd., Conv. Bond, Series 144A, 1.25%, 9/15/2022 | 9/7/2016 | $244,000 | $241,714 |

| Expand Networks Ltd. | 9/22/2000 | $2,500,000 | $0 |

| FA Private Equity Fund IV LP | 3/4/2002 | $66,786 | $523,844 |

| Infrastructure Fund | 8/11/2000 | $404,496 | $0 |

| Latin Healthcare Fund | 11/28/2000 | $0 | $424,650 |

| Multiplex, Inc., Pfd., Series C | 2/22/2001 | $5,000,001 | $0 |

| Protalix Biotherapeutics, Inc., Conv. Bond, 4.50%, 9/15/2018 | 9/13/2013 | $4,600,000 | $3,059,488 |

| Sensable Technologies, Inc. | 10/15/2004 | $0 | $0 |

| SteadyMed Ltd. | 7/29/2016 | $3,674,094 | $4,519,253 |

Other

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets, liabilities, expenses and revenues reported in the financial statements. Actual results could differ from those estimated. The Fund applies Investment Company accounting and reporting guidance.

3. SHARES OF BENEFICIAL INTEREST

The following tables summarize share activity:

| Year Ended October 31 | 2016 | 2015 |

| Class A Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 28,264,942 | $146,448,199 | 38,018,099 | $237,109,705 |

| Shares issued to shareholders in payment of distributions declared | 39,186,697 | 207,689,494 | 35,592,545 | 207,148,613 |

| Shares redeemed | (71,611,243) | (368,169,456) | (45,711,838) | (285,100,238) |

| NET CHANGE RESULTING FROM CLASS A SHARE TRANSACTIONS | (4,159,604) | $(14,031,763) | 27,898,806 | $159,158,080 |

| Year Ended October 31 | 2016 | 2015 |

| Class B Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 2,183,122 | $9,770,900 | 2,230,689 | $12,510,599 |

| Shares issued to shareholders in payment of distributions declared | 3,296,319 | 15,261,958 | 3,499,669 | 18,233,272 |

| Shares redeemed | (8,220,325) | (36,834,370) | (7,717,708) | (43,126,207) |

| NET CHANGE RESULTING FROM CLASS B SHARE TRANSACTIONS | (2,740,884) | $(11,801,512) | (1,987,350) | $(12,382,336) |

Annual Shareholder Report

| Year Ended October 31 | 2016 | 2015 |

| Class C Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 8,051,522 | $36,092,597 | 9,311,606 | $51,326,976 |

| Shares issued to shareholders in payment of distributions declared | 12,085,227 | 55,833,745 | 10,764,151 | 55,973,588 |

| Shares redeemed | (23,291,591) | (104,703,397) | (13,148,648) | (73,097,107) |

| NET CHANGE RESULTING FROM CLASS C SHARE TRANSACTIONS | (3,154,842) | $(12,777,055) | 6,927,109 | $34,203,457 |

| Year Ended October 31 | 2016 | 2015 |

| Class R Shares: | Shares | Amount | Shares | Amount |

| Shares sold | 12,111,531 | $63,134,119 | 12,561,731 | $78,481,553 |

| Shares issued to shareholders in payment of distributions declared | 87,402,876 | 464,109,272 | 81,658,916 | 476,068,825 |

| Shares redeemed | (64,955,611) | (336,449,308) | (51,098,433) | (319,821,892) |

| NET CHANGE RESULTING FROM CLASS R SHARE TRANSACTIONS | 34,558,796 | $190,794,083 | 43,122,214 | $234,728,486 |

| NET CHANGE RESULTING FROM TOTAL FUND SHARE TRANSACTIONS | 24,503,466 | $152,183,753 | 75,960,779 | $415,707,687 |

Redemption Fee

The Fund's Class R Shares imposes a redemption fee of 0.20% on the redemption price of the Fund's Class R Shares redeemed, if such shares were purchased after February 1, 1985. The redemption fee is applied to the Fund's Class R Shares expenses for providing redemption services, including, but not limited to: transfer agent fees, postage, printing, telephone and related employment costs. Excess fee proceeds, if any, are added to the Fund's assets. Shares acquired through employer-sponsored retirement plans will not be subject to the redemption fee. However, if shares are purchased for a retirement plan account through a broker, financial institution or other intermediary maintaining an omnibus account for the shares, the waiver may not apply. In addition, this waiver does not apply to individual retirement accounts, such as Traditional, Roth and SEP-IRAs. For the year ended October 31, 2016 and October 31, 2015, redemption fees of $527,125 and $496,244, respectively, were allocated to cover the cost of redemptions.

4. FEDERAL TAX INFORMATION

The timing and character of income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. These differences are due to differing treatments for foreign currency transactions, partnerships adjustments and net operating loss.

Annual Shareholder Report

For the year ended October 31, 2016, permanent differences identified and reclassified among the components of net assets were as follows:

| Increase (Decrease) |

| Paid-In Capital | Undistributed

Net Investment

Income (Loss) | Accumulated

Net Realized

Gain (Loss) |

| $(68,133,405) | $66,933,615 | $1,199,790 |

Net investment income (loss), net realized gains (losses), and net assets were not affected by this reclassification.

The tax character of distributions as reported on the Statement of Changes in Net Assets for the years ended October 31, 2016 and 2015, was as follows:

| | 2016 | 2015 |

| Ordinary income1 | $— | $1,624,286 |

| Long-term capital gains | $796,270,174 | $811,442,799 |

| 1 | For tax purposes, short-term capital gain distributions are considered ordinary income distributions. |

| | |

As of October 31, 2016, the components of distributable earnings on a tax-basis were as follows:

| Undistributed long-term capital gains | $487,781,555 |

| Net unrealized appreciation | $1,284,166,762 |

| Capital loss carryforwards and deferrals | $(46,486,600) |

The difference between book-basis and tax-basis net unrealized appreciation/depreciation is attributable to differing treatments for passive foreign investment company adjustments, the deferral of losses on wash sales and partnerships adjustments.

At October 31, 2016, the cost of investments for federal tax purposes was $4,064,021,050. The net unrealized appreciation of investments for federal tax purposes excluding any unrealized appreciation resulting from a) futures contracts and b) translation from FCs to U.S. dollars of assets and liabilities other than investments in securities was $1,284,166,726. This consists of net unrealized appreciation from investments for those securities having an excess of value over cost of $1,446,436,433 and net unrealized depreciation from investments for those securities having an excess of cost over value of $162,269,707.

Under current tax rules, a late-year ordinary loss may be deferred, in whole or in part, and treated as occurring on the first day of the following fiscal year. As of October 31, 2016, for federal income tax purposes, a late year ordinary loss of $46,486,600 was deferred to November 1, 2016.

5. INVESTMENT ADVISER FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Investment Adviser Fee

The advisory agreement between the Fund and the Adviser provides for an annual fee equal to 1.30% of the Fund's average daily net assets. Pursuant to the settlement of certain litigation, the Adviser has agreed, for a period continuing through June 30, 2022, to waive its investment advisory fee so that such fee will not exceed 1.275%. Also, as part of the settlement

Annual Shareholder Report

agreement, effective July 1, 2012 and continuing through June 30, 2022, the Adviser has agreed to further waive the advisory fee by an additional 0.02%, 0.04%, 0.06% or 0.07% if the Fund's net assets exceed eight, nine, ten or twelve billion dollars, respectively. Subject to the terms described in the Expense Limitation note, the Adviser may voluntarily choose to waive any portion of its fee. For the year ended October 31, 2016, the Adviser voluntarily waived $174,166 of its fee.

Certain of the Fund's assets are managed by Federated Global Investment Management Corp. (the “Sub-Adviser”). Under the terms of a sub-advisory agreement between the Adviser and the Sub-Adviser, the Sub-Adviser receives an allocable portion of the Fund's adviser fee. The fee is paid by the Adviser out of its resources and is not an incremental Fund expense. For the year ended October 31, 2016, the Sub-Adviser earned a fee of $54,568,389.

Administrative Fee

Federated Administrative Services (FAS), under the Administrative Services Agreement, provides the Fund with administrative personnel and services. For purposes of determining the appropriate rate breakpoint, “Investment Complex” is defined as all of the Federated Funds subject to a fee under the Administrative Services Agreement. The fee paid to FAS is based on the average daily net assets of the Investment Complex as specified below, plus certain out-of-pocket expenses:

| Administrative Fee | Average Daily Net Assets

of the Investment Complex |

| 0.150% | on the first $5 billion |

| 0.125% | on the next $5 billion |

| 0.100% | on the next $10 billion |

| 0.075% | on assets in excess of $20 billion |